Form 8-K DYNASIL CORP OF AMERICA For: Feb 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2015

------------------

Dynasil Corporation of America

------------------------------------------------------------

(Exact name of registrant as specified in its charter)

| Delaware | 000-27503 | 22-1734088 |

| ----------- | ----------- | ---------- |

| (State or other | (Commission File Number) | (IRS Employer |

| jurisdiction of incorporation) | Identification No.) |

313 Washington Street, Suite 403, Newton, MA 02458

------------------------------------------------------------

(Address of principal executive offices)

(617)-668-6855

------------------------------------------------------------

(Registrant's telephone number, including area code)

Not Applicable

______________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 7.01 | Regulation FD Disclosure |

Pursuant to Regulation FD, Dynasil Corporation of America (“Dynasil” or the “Company”) hereby furnishes slides that the Company will present to stockholders and investors on or after February 26, 2015. The slides are attached hereto as Exhibit 99.1. These slides will be available on Dynasil’s website at www.dynasil.com. The information furnished by the Company pursuant to this item, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| 99.1 | Slides presented by Dynasil Corporation of America to stockholders on or after February 26, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DYNASIL CORPORATION OF AMERICA | |||

| Date: February 26, 2015 | By: | /s/ Thomas C. Leonard | |

| Name: | Thomas C. Leonard | ||

| Title: | Chief Financial Officer | ||

EXHIBIT INDEX

| Exhibit No. | Description |

| 99.1 | Slides presented by Dynasil Corporation of America to stockholders on or after February 26, 2015. |

Exhibit 99.1

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick, Chairman, President and CEO February 26, 2015

2 Forward - Looking Statements The statements made in this presentation which are not statements of historical fact are forward looking statements within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Forward - looking statements involve known and unknown risks, uncertainties and other factors . The words “potential,” “develop,” “promising,” “believe,” “will,” “would,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “may,” “likely,” “could,” and other expressions which are predictions of or indicate future events and trends and which do not constitute historical matters identify forward - looking statements, including without limitation management’s discussion of the company’s strategic plans . Future results of operations, projections, and expectations, which may relate to this release, involve certain risks and uncertainties that could cause actual results to differ materially from the forward - looking statements . Factors that would cause or contribute to such differences include, but are not limited to, our ability to develop and commercialize the Xcede patch, including obtaining regulatory approvals, the size and growth of the potential markets for our products and our ability to serve those markets, the rate and degree of market acceptance of any of our products, our ability to obtain and maintain intellectual property protection for our products, competition, the loss of key management and technical personnel, the availability of financing sources, as well as the factors detailed in the Company's Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as in the Company's other Securities and Exchange Commission filings .

3 Corporate Objectives - Ongoing 1. Continued growth in Optics revenue through organic growth and opportunistic acquisitions to replace loss of Dynasil Products’ revenue and lower Contract Research revenue. 2. Conversion of job shop revenue stream across the Optics companies to more predictable, longer term, recurring revenue. 3. Develop technology and transfer into commercial development: • RMD scintillator technology (CLYC, CsI , Thin Film, SrI , others) • Dynasil Biomedical – Xcede Patch 4. Maintain conformity with loan covenants. Improve overall cost of capital through conversion to lower cost funding where possible. 5. Capital allocation to support the above objectives . Continued decentralized operating units with minimal core staff and expense to match operations. 6. Continued search for complementary acquisition or merger partners.

4 Financial Summary FY 2014 vs. 2013 Revenue decreased from $42.8 million in fiscal 2013 to $ 42.3 million in 2014. • Contract Research revenue remain essentially unchanged at $21.9 million. • Optics revenue increased 26%, from $15.6 million to $19.6 million. • Instruments revenue declined from $5.1 to $0.8 million as a result of the sales of the lead paint detector and gamma medical probe businesses. Net Income from Operations of $2.1 million versus net loss of $8.7 million in the prior year .

5 Fiscal Year 2014 Performance Highlights Record Revenue at all Optics Operational Units. Corporate - Completed the sales of the Instruments products in the 1 st quarter. Continued operation support for these sold products through mid - year and ultimate operational transfer to buyers by June, 2014. RMD - Managed through the government shutdown in October of 2013. Consolidation of RMD operations into one site and closing of two sites in Watertown. Maintained $33M+ backlog. Optometrics - Secured the L - 3 grating contract followed by capital and construction requirements to meet the L - 3 production demands. Complete realignment of production floor and relocation of the administrative offices. EMF - Acquired DichroTec assets in Rochester, NY. Integrated operation into EMF. Hilger – Continued support for CLYC, CsI and LYSO product development.

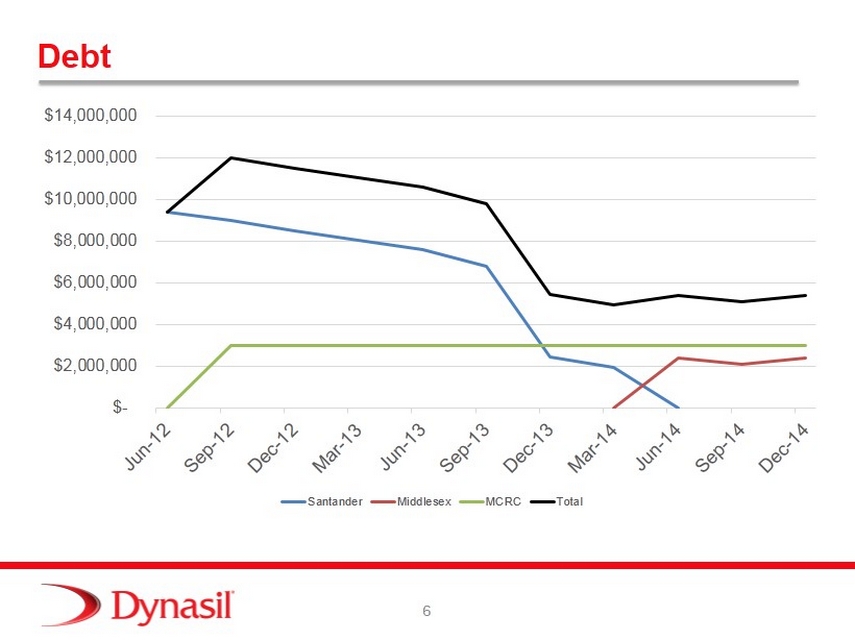

6 Debt $- $2,000,000 $4,000,000 $6,000,000 $8,000,000 $10,000,000 $12,000,000 $14,000,000 Santander Middlesex MCRC Total

7 Corporate Objectives - 2015 1. Explore options for further external funding of Xcede Technologies for ongoing development of the tissue sealant technology. 2. Yield improvements across our Optics companies. 3. Continued commercial revenue growth in the double digit range. 4. Maintenance of 18+ month backlog in our research operation – continued management diligence on matching project revenue with direct and indirect costs. 5. Capital support of specific revenue opportunities: • Chamber upgrades at both EMF sites • LYSO array fabrication and processing at Hilger • CLYC production at RMD 6. Disposition or shutdown of non - growth or none - core product lines: • Sale of SPF Instruments in 1 st quarter • Possible transfer of hard coat filters from Optometrics to EMF

8 FY 2015 1 st Quarter Financial Summary Revenue declined to $9.6 million from $ 10.7 million in the 1 st quarter of 2014: • Contract Research revenue declined $1.2 million due to continuing reductions and slowdowns in government research grant funding. • Optics revenue increased $0.8 million as a result of internal revenue growth and the DichroTec acquisition. • Instruments revenue of $0.8 million in the first quarter of 2014 eliminated as the XRF and Gamma Probe businesses were sold .

9 1 st Quarter 2015 – Performance Highlights • Optics revenue of $4.9 million exceeded Research revenue of $4.7 million for the first time since RMD acquisition in 2008 • Sale of SPF Instrument at Optometrics (Gain of $185K) • Termination of EMF Defined Benefit Pension Plan (Loss of $355K) • Capital expenditures to support EMF and Hilger • ISO 9001 designation received during quarter for Hilger Crystals

Business Sensitive RMD Highlights Dr. Kanai Shah February 2015

Business Sensitive RMD Highlights FY - 2014 11 • Celebrating 40 th year of RMD! • Closed FY14 at revenue of $21.9M • Have current backlog of ~$33 M . • Won R&D - 100 Award on Plastic Scintillators • CLYC commercial production started at RMD to support OEMs • Transferring CsI:Tl film technology to EMF • 6 Patents Awarded and 14 Applications Filed. 56 Total Patents

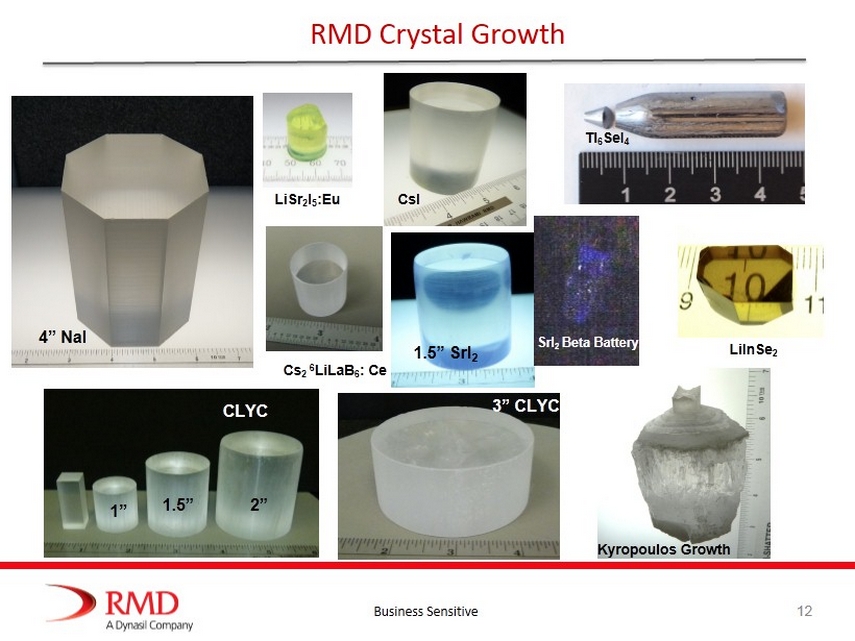

Business Sensitive 12 RMD Crystal Growth Kyropoulos Growth Cs 2 6 LiLaB 6 : Ce CsI LiSr 2 I 5 :Eu 1.5” SrI 2 1.5” 2” 1” 4” NaI CLYC Tl 6 SeI 4 LiInSe 2 SrI 2 Beta Battery 3” CLYC

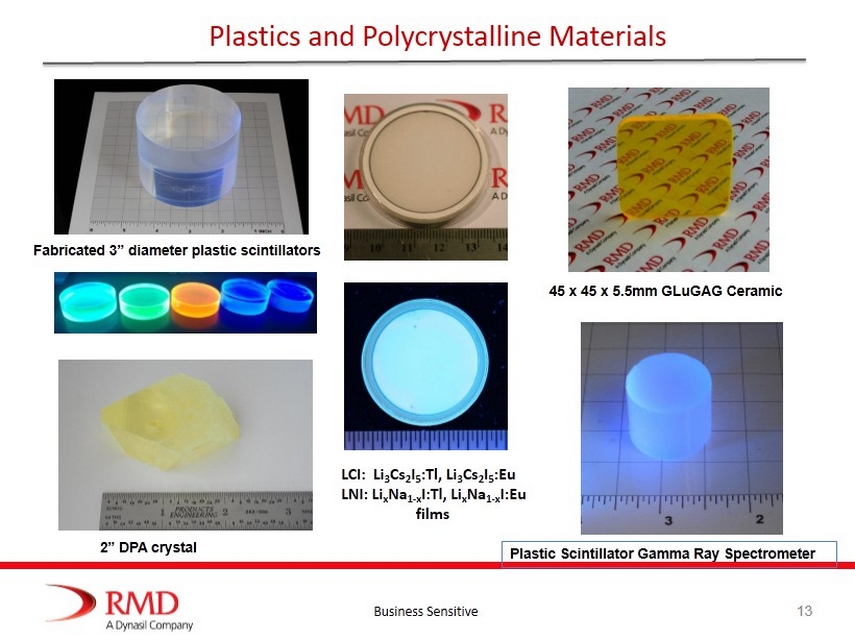

Business Sensitive 13 Plastics and P olycrystalline Materials Fabricated 3 ” diameter plastic scintillators 2” DPA crystal Plastic Scintillator Gamma Ray Spectrometer 45 x 45 x 5.5mm GLuGAG Ceramic LCI: Li 3 Cs 2 I 5 :Tl, Li 3 Cs 2 I 5 :Eu LNI: Li x Na 1 - x I:Tl, Li x Na 1 - x I:Eu f ilms

Business Sensitive 14 Nuclear and X - Ray Imaging LCI - LNI neutrons Cooling pipe in a nuclear power plant in Japan CLYC RadCam II Combined gamma - neutron RadCam image 200 400 600 800 1000 1200 1400 1600 1800 2000 200 400 600 800 1000 1200 1400 1600 1800 2000 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Braided Copper Wire IC chip NASA Mars Lander Probe

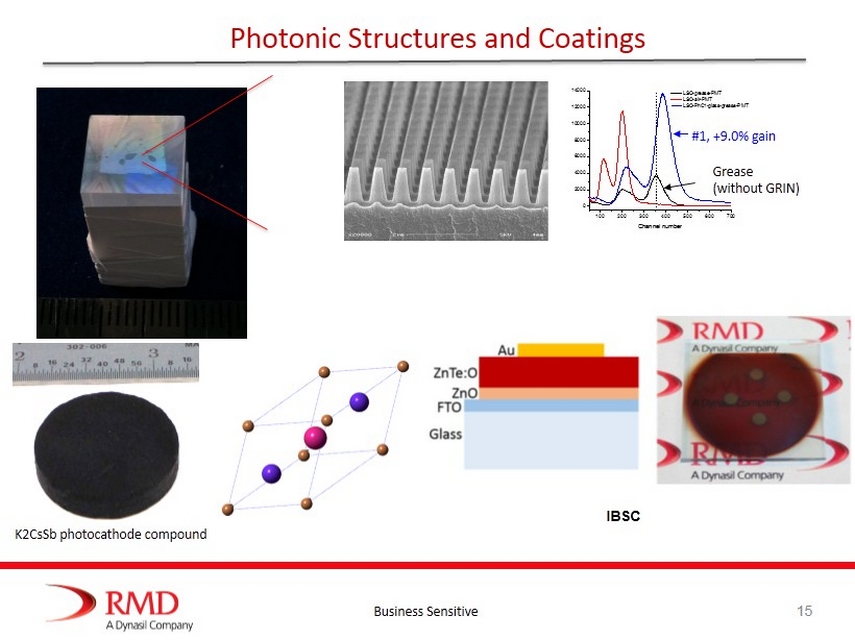

Business Sensitive 15 Photonic Structures and Coatings 100 200 300 400 500 600 700 0 2000 4000 6000 8000 10000 12000 14000 Channel number LSO-grease-PMT LSO-air-PMT LSO-PhC1-glass-grease-PMT #1, +9.0% gain Grease ( without GRIN) K2CsSb photocathode compound IBSC

Business Sensitive SrI 2 SSPM gamma ray telescope AF Space Weather 16 RMD in Space ARA - APDs Crystal growth on the International Space Station Space telescope calibrator Mars probe

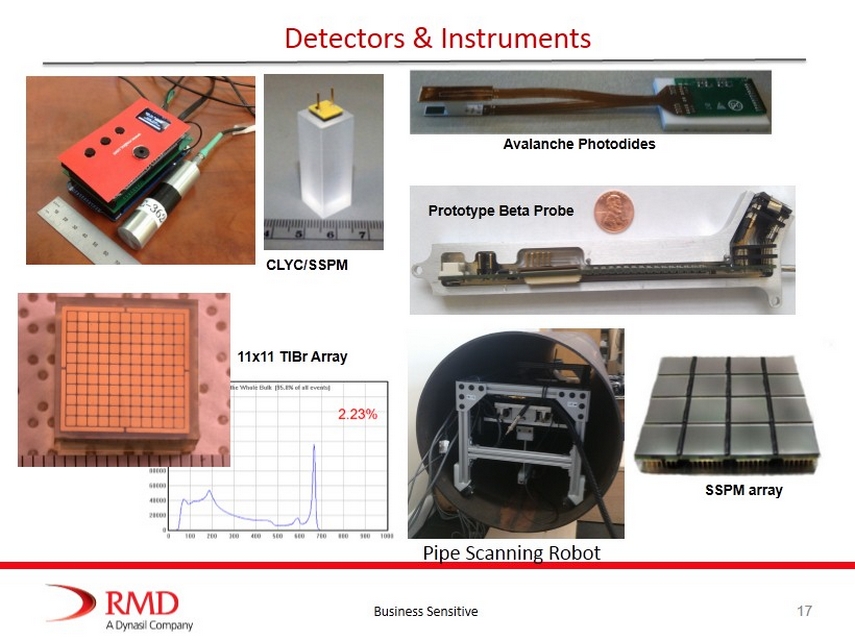

Business Sensitive 17 Detectors & Instruments 11x11 TlBr Array SSPM array CLYC/SSPM Avalanche Photodides Prototype B eta Probe Pipe Scanning Robot

Dynasil Corporation of America Xcede – February 2015

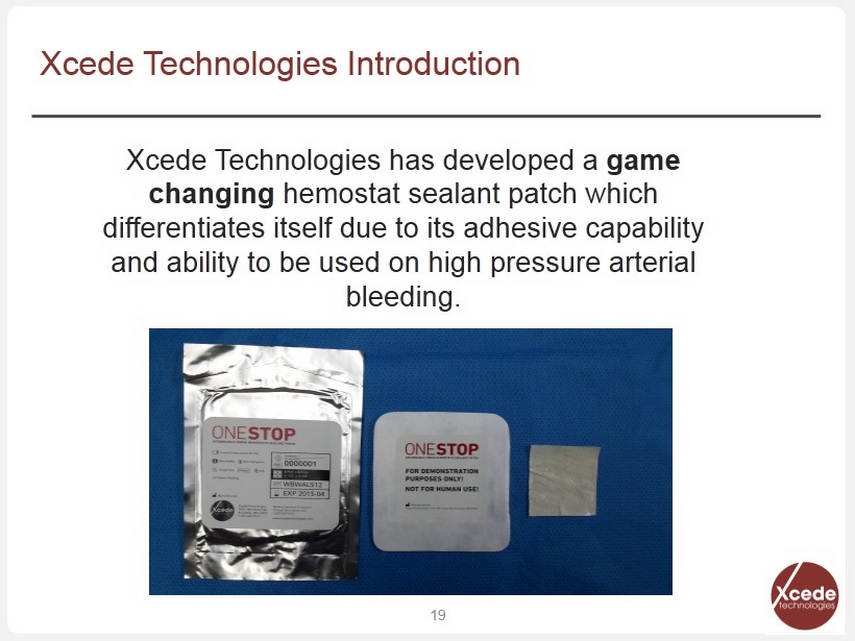

Xcede Technologies has developed a g ame changing hemostat sealant patch which differentiates itself due to its adhesive capability and ability to be used on high pressure arterial bleeding. Xcede Technologies Introduction 19

• Superior technology • Large and growing market - $5.5 Billion • Extremely low manufacturing costs • Alone in i ts ability t o b e u sed o n v ery h igh p ressure bleeding • Predictable and known development pathway • Partnership with Mayo Clinic • Industry with acquisition momentum Xcede Technologies’ Value Proposition 20

Our Solution: The Xcede Patch Significant research and development has resulted in multiple formations of the patch (version 1.0 and version 2.0) resulting in its present configuration of a preformed 4”x4 ” two layer patch consisting of a fibrin mesh with proprietary adhesive backing. 21 Version 2.0 ▪ Hemostat + sealant in one ▪ High burst strength ▪ F ast - acting (hold times as short as 15 seconds) ▪ Resorbable

Current Xcede Technologies’ Team Management Dave Talen - CEO ▪ 20 years of marketing, sales and general management experience in the Medical Device Industry. ▪ Management positions at Scimed Life Systems, Integ , Urologix , Spinetech and Timm Medical Dr. Daniel Ericson PhD. - CTO ▪ Inventor, entrepreneur, developed and transferred 7 medical technologies to AveCor , BSC, and Medtronic ▪ 40+ patents Kyle Brandy – Senior Scientist ▪ Biochemistry and engineering background ▪ 8 years in early stage technology development Shareholders Dynasil biomedical Mayo Foundation for Education and Research Board of Directors Vic Schmitt Peter Sulick Sarah Combs Thomas Leonard Dr. Michael Joyner Advisory Board Dr. Sam Asirvatham ▪ Invasive Cardiology, Mayo Clinic Dr. Steve Cassivi ▪ Thoracic Surgery, Mayo Clinic Dr. Gianrico Farrugia ▪ Gastroenterology, Mayo Clinic ▪ CEO of Mayo Clinic Jacksonville campus 22

• Launch the Xcede patch first in Europe and then in the US with initial indication for General Surgery in mild to moderate bleeding. • First in Human Clinical trial and Pilot Data • FDA Pivotal Trials • Partner with large, established company for distribution outside the US • In house direct sales team for sales inside the US • Development of products for Secondary Indications and completion of associated clinical trials. • Look to expand indicated use through post market studies Strategy 23

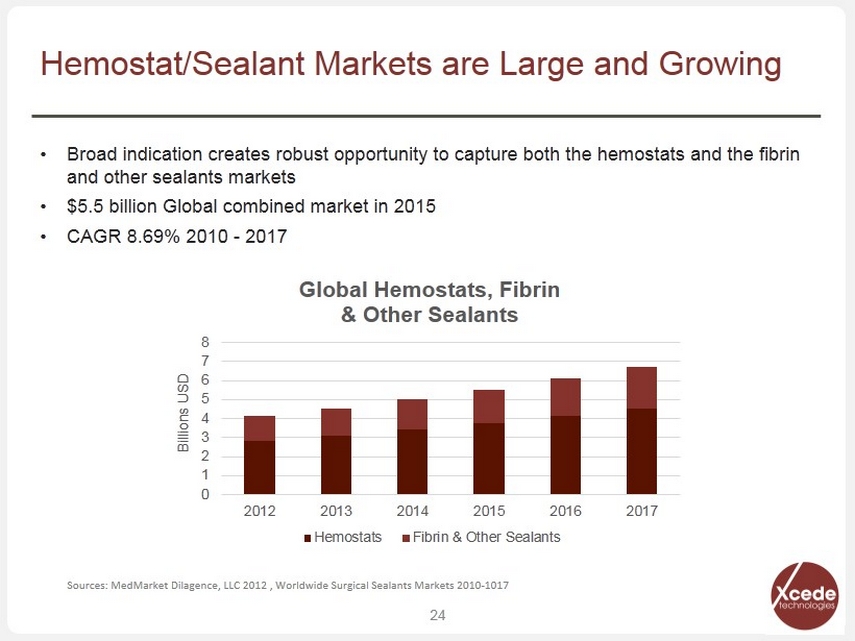

• Broad indication creates robust opportunity to capture both the hemostats and the fibrin and other sealants markets • $5.5 billion Global combined market in 2015 • CAGR 8.69% 2010 - 2017 24 Hemostat/Sealant Markets are Large and Growing 0 1 2 3 4 5 6 7 8 2012 2013 2014 2015 2016 2017 Billions USD Global Hemostats, Fibrin & Other Sealants Hemostats Fibrin & Other Sealants Sources: MedMarket Dilagence, LLC 2012 , Worldwide Surgical Sealants Markets 2010 - 1017

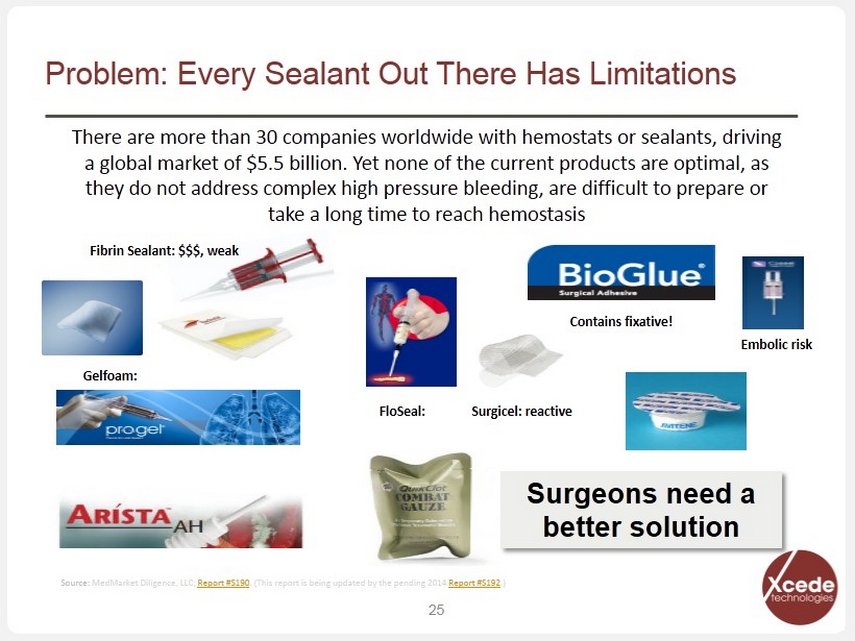

Problem: Every Sealant Out There Has Limitations 25 Gelfoam: Contains fixative! Surgicel: reactive FloSeal: Fibrin Sealant: $$$, weak Embolic risk There are more than 30 companies worldwide with hemostats or sealants, driving a global market of $5.5 billion. Yet none of the current products are optimal, as they do not address complex high pressure bleeding, are difficult to prepare or take a long time to reach hemostasis Surgeons need a better solution Source: MedMarket Diligence, LLC; Report #S190 . (This report is being updated by the pending 2014 Report #S192 .)

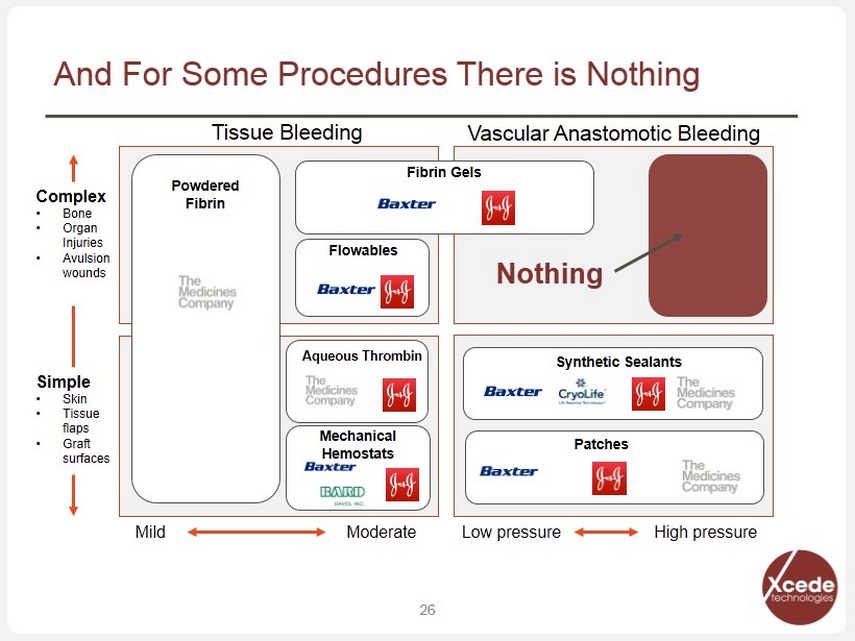

And For Some Procedures There is Nothing 26 Complex • Bone • Organ Injuries • Avulsion wounds Simple • Skin • Tissue flaps • Graft surfaces Mild Moderate Low pressure High pressure Tissue Bleeding Vascular Anastomotic Bleeding Nothing Powdered Fibrin Fibrin Gels Flowables Aqueous Thrombin Synthetic Sealants Patches Mechanical Hemostats

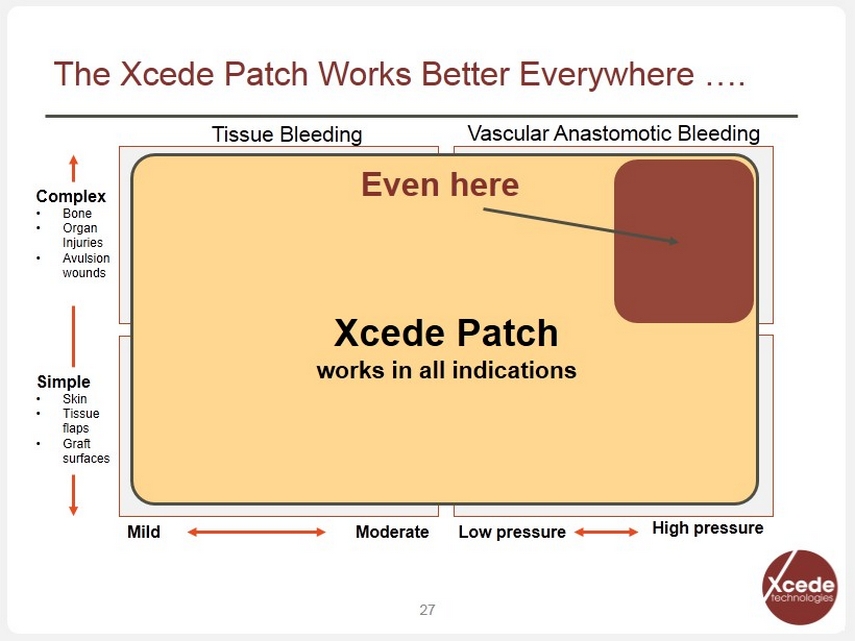

The Xcede Patch Works Better Everywhere …. 27 Complex • Bone • Organ Injuries • Avulsion wounds Simple • Skin • Tissue flaps • Graft surfaces Mild Moderate Low pressure High pressure Tissue Bleeding Vascular Anastomotic Bleeding Xcede Patch w orks in all indications Even here

28 And Outperforms the Competition Characteristic Xcede Patch Evarrest ™ Tachosil ™ Surgeon hold time 15 seconds 3 minutes 3 minutes Stops severe arterial bleeding XX No Thrombin XX Flexible to fit complex wounds X Long shelf life at room temp X X X Effective on junctional wounds X X High burst resistance XXX X Not dependent on patient coagulation XXX No animal - derived components X High adhesion to tissue 6x 1x 1x Preparation time None None <1 min

Video 29 https://app.box.com/s/8d9eny1nrz1bpn0g2jpt3dlzo8wrm5qb

Animal Studies ▪ 65 acute animals; ▪ 18 survival animals: vascular sealing, intramuscular and subcutaneous implant Preclinical studies have shown superior performance in many applications: ▪ Spleen and liver hemostasis ▪ Partial nephrectomy hemostasis ▪ Lung sealing ▪ Intestinal sealing ▪ Vascular sealing ▪ Cancellous bone hemostasis ▪ Topical skin application ▪ Skin flap anchoring (two - sided patch) 30 Xcede Patch Pre - Clinical Work to Date

Patent name Summary Status Filing date Tissue Patch Composition – components of patch and primer Allowed 10/4/2012 Systems and Methods for the fabrication of tissue patches Engineering – steps to make patch and primer Published 10/4/2012 Systems and kits for the fabrication of tissue patches Kit - commercial concept of putting elements needed to make patch bedside into a kit Published 10/4/2012 Tissue patches and associated systems, kits and methods PCT International filing combining above 3 claim sets Published 2/1/2013 Adhesive compositions and patches, and associated systems, kits and methods Patch 2.0 - composition Provisional 8/8/2014 Minimally Invasive surgery, including vascular closure and associated sealants Vascular access use Published 1/31/2014 US and PCT 31 Intellectual Property Portfolio – Protection from Competition

Company/Product Partner Date Status at acquisition Acquisition Amount RecoThrom The Medicines Company 2012/ 2014 FDA approved $105 million collaboration fee, $10 million option with purchase price based on Net Revenue Tenaxis Medical The Medicines Company 2014 FDA approved but not launched, No sales $58 upfront (up to $112 more upon milestones) Medafor , Arista Davol 2013 FDA approval Established sales $200 million at closing, ($80 million more upon milestones) Coviden Duraseal Integra 2013 FDA approval $235 million at closing ($30 million more upon milestones) Profibrix , Fibrocaps The Medicines Company 2013 Pre - CE mark $90 million ($140 million upon milestones) Neomend , Progel Davol 2012 FDA approval No sales $140 million at closing ($25 million more upon milestones) Nerities Corp Kensey Nash 2011 Patent Only $20 million for patent Synovis Life Tech Baxter Health Care 2011 Synovis reported $82.4M in sales for 2011 $325 Million (note: 3 technologies including Veritias Collagen sealant) Omrix (renamed Evarrest ) J&J 2009 Not FDA approved at time of acquisition . Approved in 2012 $438 million. 32 An Industry with Momentum - Hemostat/Sealant Market is Flush with Acquisition Activity

Xcede Technologies’ Funding History 2011 – 2013 Dynasil Biomedical (DBM) funds Tissue Sealant technology 2013 Xcede Technologies formed. Mayo becomes a shareholder 2014 Angel funding of $2 million in the form of convertible notes 2015 Explore options for further external funding 33

Dynasil’s Strategic Objectives for Xcede • Attract long - term biotech investors to Xcede to fund its future. • Preserve Dynasil’s equity position/investment in Xcede, so that Dynasil’s stockholders share in the upside. • De - consolidate Xcede from Dynasil so Xcede’s losses are no longer on Dynasil’s financial statements. • Minimize any adverse tax consequences to Dynasil and its shareholders. 34

• Xcede has game changing technology with unique hemostatic and sealant properties • Superb team and partners • Partnership with Mayo Clinic • Experienced management • Large and growing market • Robust IP position • Active acquisition landscape in Hemostat and Sealant market 35 Summary

36 Questions

Dynasil Corporation of America Annual Meeting of Stockholders Peter Sulick Chairman, President and CEO February 26, 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Viktor Knurov Joins Headwall Partners

- Michigan-Based Business Leads the Pack With a Healthier Dog Food Option and Delivery Across Michigan and Around It

- Trane Technologies Recognized as One of Europe’s Climate Leaders by Financial Times

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share