Form 8-K DUPONT E I DE NEMOURS & For: Apr 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): April 26, 2016 (April 25, 2016)

E. I. du Pont de Nemours and Company

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 1-815 | 51-0014090 | ||

(State or Other Jurisdiction | (Commission | (I.R.S. Employer | ||

Of Incorporation) | File Number) | Identification No.) | ||

974 Centre Road

Wilmington, Delaware 19805

(Address of principal executive offices)

Registrant’s telephone number, including area code: (302) 774-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On April 25, 2016, the Registrant announced its consolidated financial results for the quarter ended March 31, 2016. A copy of the Registrant’s press release and related presentation are furnished herewith on Form 8-K as Exhibits 99.1 and 99.2, respectively. The information contained in Item 2.02, including Exhibit 99.1 and Exhibit 99.2, of this report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and it will not be incorporated by reference into any registration statement or other document filed by the Registrant under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 Press Release dated April 25, 2016

99.2 DuPont First Quarter 2016 Earnings Presentation dated April 26, 2016

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

E. I. DU PONT DE NEMOURS AND COMPANY | |

(Registrant) | |

/s/ Jeanmarie F. Desmond | |

Jeanmarie F. Desmond | |

Vice President and Controller | |

April 26, 2016

Exhibit 99.1 | |||||

|  | ||||

April 25, 2016 | Media Contact: | Dan Turner | |||

WILMINGTON, Del. | 302-996-8372 | ||||

Investor Contact: | 302-774-4994 | ||||

DuPont Reports 1Q Operating EPS1 of $1.26 and GAAP EPS of $1.39

Operating EPS1 Increased 8 Percent, Excluding Currency

Increased Full-Year 2016 Operating Earnings1 Outlook Range to $3.05 - $3.20 Per Share

First Quarter Highlights

• | First-quarter operating earnings1 were $1.26 per share, equal to the prior year. Excluding $0.10 per share of negative impact from currency, operating EPS1 increased 8 percent versus prior year. GAAP2 earnings per share were $1.39 versus $1.11 in prior year. |

• | Operating costs3 declined by approximately $135 million, a 7 percent reduction versus prior year. Corporate expenses, on an operating earnings1 basis, declined 44 percent versus prior year. |

• | Local price and product mix gains of 2 percent in Agriculture and 3 percent volume growth in Nutrition & Health were more than offset by declines in most of the other segments, resulting in sales declining 2 percent, excluding currency. Currency negatively impacted sales by an additional 4 percent. |

• | Agriculture sales reflected benefits from local price and product mix, higher corn area and a strong start to the North American corn season more than offset by negative currency impact and lower crop protection and soybean volumes. |

• | Segment pre-tax operating earnings1 of $1,717 million included approximately $110 million of negative impact from currency. Operating margins expanded in Protection Solutions, Industrial Biosciences, Nutrition & Health and Agriculture. |

• | DuPont now expects full-year 2016 operating earnings1 to be in the range of $3.05 - $3.20 per share, an increase of $0.10 per share from the previous outlook. |

WILMINGTON, Del., April 25, 2016 - DuPont (NYSE: DD), a science company that brings world-class, innovative products, materials, and services to the global marketplace, today announced first-quarter 2016 operating earnings1 of $1.26 per share compared with $1.26 per share in the prior year. GAAP2 earnings were $1.39 per share, compared with $1.11 per share in the prior year. Refer to Schedule B for details of significant items.

First-quarter sales totaled $7.4 billion, a decline of 6 percent versus prior year due to negative impacts from currency (4 percent) and volume (2 percent).

1Operating earnings and operating earnings per share are defined as earnings excluding significant items and non-operating pension/OPEB costs. See schedules A, C, and D for reconciliations of non-GAAP measures.

2Generally Accepted Accounting Principles (GAAP)

3Operating costs defined as other operating charges, selling, general & administrative, and research & development costs, excluding significant items and non-operating pension/OPEB costs. See Schedule D for reconciliation of non-GAAP measures.

E.I. du Pont de Nemours and Company

2

Today, DuPont’s board of directors approved a second-quarter dividend of $0.38 per share, the 447th consecutive quarterly dividend since the company's first dividend in the fourth quarter of 1904. The second-quarter dividend of $0.38 per share of common stock is payable on June 10, 2016, to stockholders of record at the close of business on May 13, 2016. Regular quarterly dividends of $1.125 per share on the $4.50 series preferred stock and $0.875 cents per share on the $3.50 series preferred stock also were declared, both payable on July 25, 2016, to stockholders of record as of July 8, 2016.

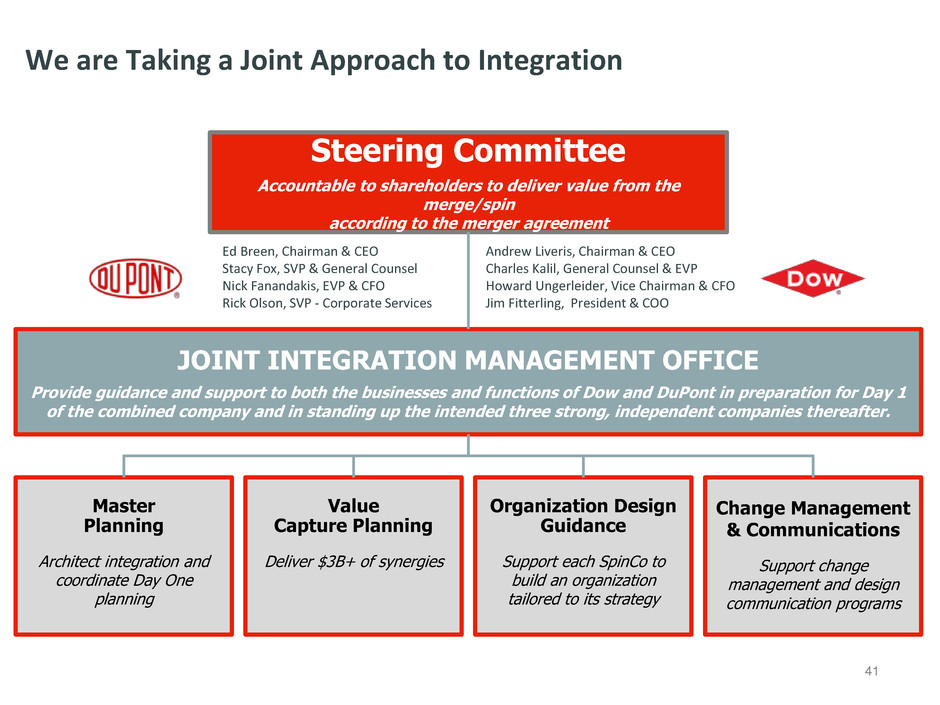

“Solid execution, local price and product mix gains, and higher corn area led to a strong start to the year for our Ag business,” said Ed Breen, Chair and CEO of DuPont. “Our other businesses generally performed well, slightly above our expectations. We made progress with our global cost savings and restructuring plan and are on track for savings of $730 million in 2016, including significant improvements in our corporate cost performance.” He added, “We also continued to achieve key milestones in our intended merger of equals with Dow and as we look ahead to the rest of the year, we remain focused on accelerating our value-creation work, investing in our core franchises, and closing the intended merger of equals.”

Global Consolidated Net Sales - 1st Quarter

Three Months Ended | |||||||||||||||||||

March 31, 2016 | Percentage Change Due to: | ||||||||||||||||||

(Dollars in millions) | $ | % Change | Local Price and Product Mix | Currency | Volume | Portfolio/Other | |||||||||||||

U.S. & Canada | $ | 3,590 | (3 | ) | (1 | ) | — | (1 | ) | (1 | ) | ||||||||

EMEA* | 2,005 | (8 | ) | 1 | (6 | ) | (3 | ) | — | ||||||||||

Asia Pacific | 1,280 | (6 | ) | (3 | ) | (2 | ) | (3 | ) | 2 | |||||||||

Latin America | 530 | (12 | ) | 7 | (17 | ) | (1 | ) | (1 | ) | |||||||||

Total Consolidated Net Sales | $ | 7,405 | (6 | ) | — | (4 | ) | (2 | ) | — | |||||||||

* Europe, Middle East & Africa | |||||||||||||||||||

3

Segment Net Sales - 1st Quarter

Three Months Ended | |||||||||||||||||||

March 31, 2016 | Percentage Change Due to: | ||||||||||||||||||

(Dollars in millions) | $ | % Change | Local Price and Product Mix | Currency | Volume | Portfolio/Other | |||||||||||||

Agriculture | $ | 3,786 | (4 | ) | 2 | (5 | ) | (1 | ) | — | |||||||||

Electronics & Communications | 452 | (13 | ) | (3 | ) | (1 | ) | (9 | ) | — | |||||||||

Industrial Biosciences | 352 | 1 | 2 | (3 | ) | 1 | 1 | ||||||||||||

Nutrition & Health | 801 | (1 | ) | — | (4 | ) | 3 | — | |||||||||||

Performance Materials | 1,249 | (10 | ) | (5 | ) | (2 | ) | (3 | ) | — | |||||||||

Protection Solutions | 729 | (8 | ) | (1 | ) | (2 | ) | (5 | ) | — | |||||||||

Other | 36 | ||||||||||||||||||

Consolidated Net Sales | $ | 7,405 | (6 | ) | — | (4 | ) | (2 | ) | — | |||||||||

Operating Earnings (1) - 1st Quarter | ||||||||||||||||

Change vs. 2015 | ||||||||||||||||

(Dollars in millions) | 1Q16 | 1Q15 | $ | % | ||||||||||||

Agriculture | $ | 1,101 | $ | 1,138 | $ | (37 | ) | -3 | % | |||||||

Electronics & Communications | 59 | 79 | (20 | ) | -25 | % | ||||||||||

Industrial Biosciences | 63 | 54 | 9 | 17 | % | |||||||||||

Nutrition & Health | 104 | 86 | 18 | 21 | % | |||||||||||

Performance Materials | 273 | 317 | (44 | ) | -14 | % | ||||||||||

Protection Solutions | 176 | 167 | 9 | 5 | % | |||||||||||

Other | (59 | ) | (31 | ) | (28 | ) | -90 | % | ||||||||

Total segment operating earnings (2) | 1,717 | 1,810 | (93 | ) | -5 | % | ||||||||||

Exchange gains (losses) (2),(3) | (121 | ) | 142 | (263 | ) | nm | ||||||||||

Corporate expenses (2) | (86 | ) | (154 | ) | 68 | -44 | % | |||||||||

Interest expense | (92 | ) | (84 | ) | (8 | ) | 10 | % | ||||||||

Operating earnings before income taxes | 1,418 | 1,714 | (296 | ) | -17 | % | ||||||||||

Provision for income taxes on operating earnings | (303 | ) | (557 | ) | 254 | |||||||||||

Less: Net income attributable to noncontrolling interests | 6 | 4 | 2 | |||||||||||||

Operating earnings | $ | 1,109 | $ | 1,153 | $ | (44 | ) | -4 | % | |||||||

Operating earnings per share | $ | 1.26 | $ | 1.26 | $ | — | — | % | ||||||||

(1) See Schedules A, C, and D for reconciliations of non-GAAP measures. | ||||||||||||||||

(2) See Schedules B and C for listing of significant items and their impact by segment. | ||||||||||||||||

(3) See Schedule D for additional information on exchange gains and losses. | ||||||||||||||||

4

The following is a summary of business results for each of the company’s reportable segments comparing first quarter with the prior year, unless otherwise noted.

Agriculture - Operating earnings of $1,101 million decreased $37 million, or 3 percent, as local price and product mix gains and cost savings were more than offset by an $83 million negative currency impact, lower volumes and about a $40 million negative impact from the shutdown of the La Porte manufacturing facility primarily due to lost sales and inventory write-offs. Increased corn seed volume was more than offset by lower insecticide and soybean volumes. Excluding the impact of currency, operating earnings increased by 4 percent.

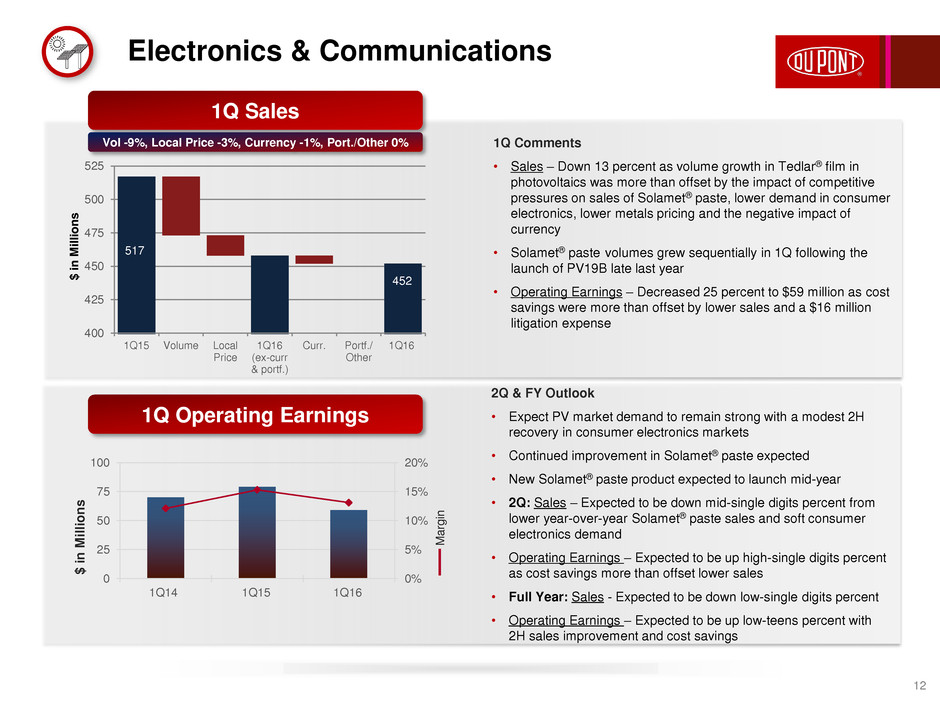

Electronics & Communications - Operating earnings of $59 million decreased $20 million, or 25 percent, as cost savings and increased demand for Tedlar® film were more than offset by competitive pressures impacting Solamet® paste, lower demand in consumer electronics, and a $16 million litigation expense.

Industrial Biosciences - Operating earnings of $63 million increased $9 million, or 17 percent, reflecting pricing gains on new product introductions in bioactives, increased demand for biomaterials, and the absence of a prior year one-time cost in CleanTech, partially offset by a $1 million negative impact from currency. Operating margins expanded by 250 basis points. Excluding the impact of currency, operating earnings increased 19 percent.

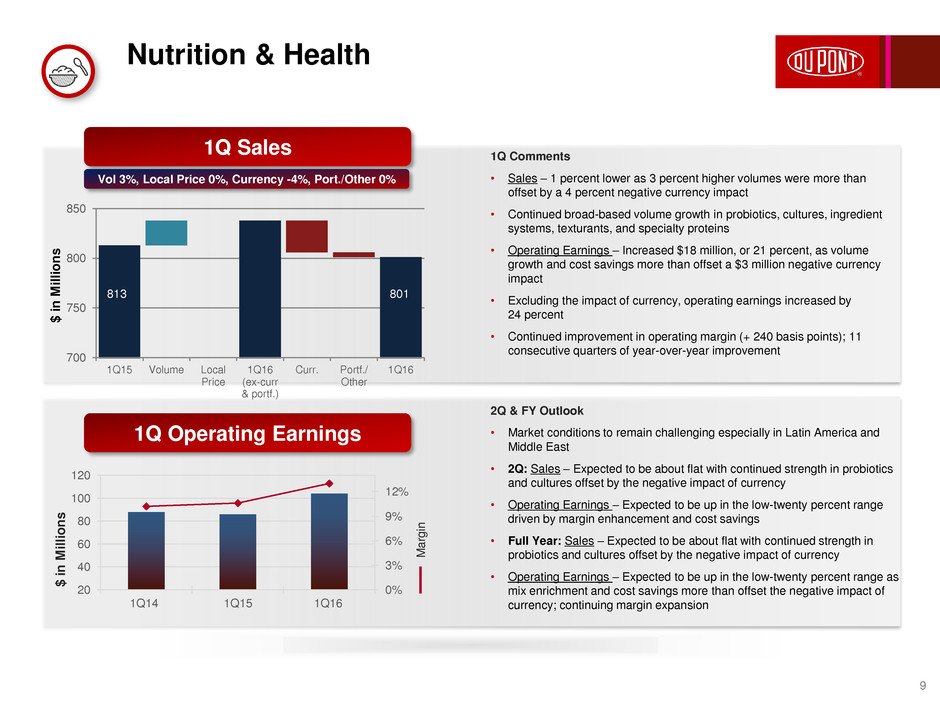

Nutrition & Health - Operating earnings of $104 million increased $18 million, or 21 percent, on broad-based volume growth in probiotics, cultures, ingredient systems, texturants, and specialty proteins, and cost savings partially offset by a $3 million negative currency impact. Operating margins expanded by 240 basis points. Excluding the impact of currency, operating earnings increased by 24 percent.

Performance Materials - Operating earnings of $273 million decreased $44 million, or 14 percent. Lower costs and increased demand in Asia Pacific automotive markets, primarily China, were more than offset by lower demand for ethylene and ethylene-based products, lower local price, and $19 million of negative impact from currency. Excluding the impact of currency, operating earnings decreased by 8 percent.

Protection Solutions - Operating earnings of $176 million increased $9 million, or 5 percent, on lower costs and improved plant utilization at the Chambers Works facility, partially offset by lower volumes and a $6 million negative currency impact. Operating margins expanded by 300 basis points. Volume declines in Nomex® thermal-resistant fiber, Kevlar® high-strength material and Tyvek® protective material were driven by weakness in the oil and gas industry, delays in military spending, and lower industrial market demand. Excluding the impact of currency, operating earnings increased by 9 percent.

2016 Outlook

The company now expects full-year 2016 operating earnings1 to be in the range of $3.05 to $3.20 per share, up from prior guidance of $2.95 to $3.10 per share, an increase of 10 to 16 percent over the prior year. The estimated negative currency impact for full year 2016 is now expected to be about $0.20 per share, versus a previously communicated estimate of $0.30 per share. The U.S. dollar has weakened against most currencies since the estimate provided on January 26, 2016. The estimated headwind from a higher base tax rate in 2016 is now expected to be about $0.10 per share. In addition, the company’s guidance includes higher corn planted area than previously forecast and a headwind from the impact of Pioneer’s transition to an agency-based route-to-market approach in the southern U.S., which will shift some sales from 2016 to the first quarter of 2017. The company continues to expect a benefit of $0.64 per share from the 2016 global cost savings and restructuring plan. For the first half 2016, the company expects operating earnings to be about flat with the prior year. Seasonal timing benefits realized through March from a stronger-than-expected start in Agriculture are anticipated to be offset in the second quarter.

5

DuPont will hold a conference call and webcast on Tuesday, April 26, 2016, at 8:00 AM EDT to discuss this news release. The webcast and additional presentation materials can be accessed by visiting the company’s investor website (Events & Presentations) at www.investors.dupont.com. A replay of the conference call webcast will be available for 90 days by calling 1-630-652-3042, Passcode 7861619#. For additional information see the investor center at http://www.dupont.com.

Use of Non-GAAP Measures

Management believes that certain non-GAAP measurements are meaningful to investors because they provide insight with respect to ongoing operating results of the company. Such measurements are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. Reconciliations of non-GAAP measures to GAAP are provided in schedules A, C and D.

About DuPont

DuPont (NYSE: DD) has been bringing world-class science and engineering to the global marketplace in the form of innovative products, materials, and services since 1802. The company believes that by collaborating with customers, governments, NGOs, and thought leaders we can help find solutions to such global challenges as providing enough healthy food for people everywhere, decreasing dependence on fossil fuels, and protecting life and the environment. For additional information about DuPont and its commitment to inclusive innovation, please visit http://www.dupont.com.

Forward Looking Statements: This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology and, in general, for products for the agriculture industry; outcome of significant litigation and environmental matters, including realization of associated indemnification assets, if any; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could affect demand as well as availability of products for the agriculture industry; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses; and risks related to the agreement entered on December 11, 2015, with The Dow Chemical Company pursuant to which the companies have agreed to effect an all-stock merger of equals, including the completion of the proposed transaction on anticipated terms and timing, the ability to fully and timely realize the expected benefits of the proposed transaction and risks related to the intended business separations contemplated to occur after the completion of the proposed transaction. Important risk factors relating to the proposed transaction and intended business separations include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the merger, (ii) the ability of Dow and DuPont to integrate the business successfully and to achieve anticipated synergies, risks and costs and pursuit and/or implementation of the potential separations, including anticipated timing, any changes to the configuration of businesses included in the potential separation if implemented, (iii) the intended separation of the agriculture, material science and specialty products businesses of the combined company post-mergers in one or more tax efficient transactions on anticipated terms and timing, including a number of conditions which could delay, prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances, disruptions in the financial markets or other potential barriers, (iv) potential litigation relating to the proposed transaction that could be instituted against Dow, DuPont or their respective directors, (v) the risk that disruptions from the proposed transaction will harm

6

Dow’s or DuPont’s business, including current plans and operations, (vi) the ability of Dow or DuPont to retain and hire key personnel, (vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger, (viii) uncertainty as to the long-term value of DowDuPont common stock, (ix) continued availability of capital and financing and rating agency actions, (x) legislative, regulatory and economic developments, (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that could affect Dow’s and/or DuPont’s financial performance, (xii) certain restrictions during the pendency of the merger that may impact Dow’s or DuPont’s ability to pursue certain business opportunities or strategic transactions and (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed merger, are more fully discussed in the joint proxy statement/prospectus included in the preliminary registration statement on Form S-4 filed with the SEC in connection with the proposed merger. While the list of factors presented here is, and the list of factors presented in the preliminary registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Dow nor DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements regarding the proposed transaction and intended business separations, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. The company undertakes no duty to publicly revise or update any forward-looking statements as a result of future developments, or new information or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

# # #

4/25/16

7

E.I. du Pont de Nemours and Company

Consolidated Income Statements

(Dollars in millions, except per share amounts)

SCHEDULE A | |||||||

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Net sales | $ | 7,405 | $ | 7,837 | |||

Cost of goods sold | 4,242 | 4,516 | |||||

Other operating charges (1) | 185 | 148 | |||||

Selling, general and administrative expenses (1) | 1,128 | 1,220 | |||||

Research and development expense | 418 | 479 | |||||

Other income, net (1) | (372 | ) | (199 | ) | |||

Interest expense | 92 | 84 | |||||

Employee separation / asset related charges, net (1) | 77 | 38 | |||||

Income from continuing operations before income taxes | 1,635 | 1,551 | |||||

Provision for income taxes on continuing operations (1) | 406 | 530 | |||||

Income from continuing operations after income taxes | 1,229 | 1,021 | |||||

Income from discontinued operations after income taxes | 3 | 14 | |||||

Net income | 1,232 | 1,035 | |||||

Less: Net income attributable to noncontrolling interests | 6 | 4 | |||||

Net income attributable to DuPont | $ | 1,226 | $ | 1,031 | |||

Basic earnings per share of common stock: | |||||||

Basic earnings per share of common stock from continuing operations | $ | 1.40 | $ | 1.12 | |||

Basic earnings per share of common stock from discontinued operations | — | .01 | |||||

Basic earnings per share of common stock (2) | $ | 1.40 | $ | 1.13 | |||

Diluted earnings per share of common stock: | |||||||

Diluted earnings per share of common stock from continuing operations | $ | 1.39 | $ | 1.11 | |||

Diluted earnings per share of common stock from discontinued operations | — | .01 | |||||

Diluted earnings per share of common stock (2) | $ | 1.39 | $ | 1.13 | |||

Dividends per share of common stock | $ | 0.38 | $ | 0.47 | |||

Average number of shares outstanding used in earnings per share (EPS) calculation: | |||||||

Basic | 873,546,000 | 906,835,000 | |||||

Diluted | 877,251,000 | 913,819,000 | |||||

Reconciliation of Non-GAAP Measures | ||||||||||

Summary of Earnings Comparison | ||||||||||

Three Months Ended March 31, | ||||||||||

2016 | 2015 | % Change | ||||||||

Income from continuing operations after income taxes (GAAP) | $ | 1,229 | $ | 1,021 | 20 | % | ||||

Less: Significant items benefit (charge) included in income from continuing operations after income taxes (per Schedule B) | 160 | (57 | ) | |||||||

Non-operating pension/OPEB costs included in income from continuing operations after income taxes (3) | (46 | ) | (79 | ) | ||||||

Net income attributable to noncontrolling interest from continuing operations | 6 | 4 | ||||||||

Operating earnings (Non-GAAP) | $ | 1,109 | $ | 1,153 | (4 | )% | ||||

Earnings per share from continuing operations (GAAP) | $ | 1.39 | $ | 1.11 | 25 | % | ||||

Less: Significant items benefit (charge) included in EPS (per Schedule B) | 0.18 | (0.06 | ) | |||||||

Non-operating pension/OPEB costs included in EPS (3) | (0.05 | ) | (0.09 | ) | ||||||

Operating EPS (Non-GAAP) | $ | 1.26 | $ | 1.26 | — | % | ||||

8

E.I. du Pont de Nemours and Company

Condensed Consolidated Balance Sheets

(Dollars in millions, except per share amounts)

SCHEDULE A (continued) | ||||||||

March 31, 2016 | December 31, 2015 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash and cash equivalents | $ | 4,166 | $ | 5,300 | ||||

Marketable securities | 623 | 906 | ||||||

Accounts and notes receivable, net | 6,917 | 4,643 | ||||||

Inventories | 5,482 | 6,140 | ||||||

Prepaid expenses | 677 | 398 | ||||||

Total current assets | 17,865 | 17,387 | ||||||

Property, plant and equipment, net of accumulated depreciation (March 31, 2016- $14,621; December 31, 2015 - $14,346) | 9,649 | 9,784 | ||||||

Goodwill | 4,256 | 4,248 | ||||||

Other intangible assets | 4,071 | 4,144 | ||||||

Investment in affiliates | 689 | 688 | ||||||

Deferred income taxes | 4,142 | 3,799 | ||||||

Other assets | 1,129 | 1,116 | ||||||

Total | $ | 41,801 | $ | 41,166 | ||||

Liabilities and Equity | ||||||||

Current liabilities | ||||||||

Accounts payable | $ | 2,773 | $ | 3,398 | ||||

Short-term borrowings and capital lease obligations | 1,625 | 1,165 | ||||||

Income taxes | 171 | 173 | ||||||

Other accrued liabilities | 4,386 | 5,580 | ||||||

Total current liabilities | 8,955 | 10,316 | ||||||

Long-term borrowings and capital lease obligations | 8,126 | 7,642 | ||||||

Other liabilities | 13,700 | 12,591 | ||||||

Deferred income taxes | 422 | 417 | ||||||

Total liabilities | 31,203 | 30,966 | ||||||

Commitments and contingent liabilities | ||||||||

Stockholders' equity | ||||||||

Preferred stock | 237 | 237 | ||||||

Common stock, $0.30 par value; 1,800,000,000 shares authorized; Issued at March 31, 2016 - 960,450,000; December 31, 2015 - 958,388,000 | 288 | 288 | ||||||

Additional paid-in capital | 11,140 | 11,081 | ||||||

Reinvested earnings | 15,400 | 14,510 | ||||||

Accumulated other comprehensive loss | (9,951 | ) | (9,396 | ) | ||||

Common stock held in treasury, at cost (87,041,000 shares at March 31, 2016 and December 31, 2015) | (6,727 | ) | (6,727 | ) | ||||

Total DuPont stockholders' equity | 10,387 | 9,993 | ||||||

Noncontrolling interests | 211 | 207 | ||||||

Total equity | 10,598 | 10,200 | ||||||

Total | $ | 41,801 | $ | 41,166 | ||||

9

E.I. du Pont de Nemours and Company

Condensed Consolidated Statement of Cash Flows

(Dollars in millions)

SCHEDULE A (continued) | |||||||

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Total Company | |||||||

Net income | $ | 1,232 | $ | 1,035 | |||

Adjustments to reconcile net income to cash used for operating activities: | |||||||

Depreciation | 238 | 306 | |||||

Amortization of intangible assets | 122 | 140 | |||||

Net periodic pension benefit cost | 146 | 147 | |||||

Contributions to pension plans | (88 | ) | (124 | ) | |||

Gain on sale of businesses and other assets | (374 | ) | — | ||||

Other operating activities - net | 258 | (1 | ) | ||||

Change in operating assets and liabilities - net | (3,378 | ) | (3,626 | ) | |||

Cash used for operating activities | (1,844 | ) | (2,123 | ) | |||

Investing activities | |||||||

Purchases of property, plant and equipment | (357 | ) | (565 | ) | |||

Investments in affiliates | (1 | ) | (45 | ) | |||

Proceeds from sale of businesses and other assets - net | 193 | 25 | |||||

Net decrease in short-term financial instruments | 282 | — | |||||

Foreign currency exchange contract settlements | (78 | ) | 442 | ||||

Other investing activities - net | (12 | ) | 3 | ||||

Cash provided by (used for) investing activities | 27 | (140 | ) | ||||

Financing activities | |||||||

Dividends paid to stockholders | (334 | ) | (429 | ) | |||

Net increase (decrease) in borrowings | 958 | (309 | ) | ||||

Repurchase of common stock | — | (282 | ) | ||||

Proceeds from exercise of stock options | 51 | 170 | |||||

Other financing activities - net | (12 | ) | (1 | ) | |||

Cash provided by (used for) financing activities | 663 | (851 | ) | ||||

Effect of exchange rate changes on cash | 20 | (174 | ) | ||||

Decrease in cash and cash equivalents | (1,134 | ) | (3,288 | ) | |||

Cash and cash equivalents at beginning of period | 5,300 | 6,910 | |||||

Cash and cash equivalents at end of period | $ | 4,166 | $ | 3,622 | |||

Reconciliation of Non-GAAP Measure | |||||||

Calculation of Free Cash Flow - Total Company | |||||||

Three Months Ended March 31, | |||||||

2016 | 2015 | ||||||

Cash used for operating activities (GAAP) | $ | (1,844 | ) | $ | (2,123 | ) | |

Purchases of property, plant and equipment | (357 | ) | (565 | ) | |||

Free cash flow (Non-GAAP) | $ | (2,201 | ) | $ | (2,688 | ) | |

(1) See Schedule B for detail of significant items. | |||||||

(2) The sum of the individual earnings per share amounts from continuing operations and discontinued operations may not equal the total company earnings per share amounts due to rounding. | |||||||

(3) First quarter 2015 non-operating pension/OPEB costs includes an after-tax exchange loss on foreign pension balances of $23. | |||||||

10

E.I. du Pont de Nemours and Company

Schedule of Significant Items from Continuing Operations

(Dollars in millions, except per share amounts)

SCHEDULE B | ||||||||||||||||||||||||

SIGNIFICANT ITEMS | ||||||||||||||||||||||||

Pre-tax | After-tax | ($ Per Share) | ||||||||||||||||||||||

2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||

1st Quarter | ||||||||||||||||||||||||

Transaction costs (1) | $ | (24 | ) | $ | (12 | ) | $ | (21 | ) | $ | (11 | ) | $ | (0.02 | ) | $ | (0.01 | ) | ||||||

Customer claims adjustment/recovery (2) | 23 | 35 | 15 | 22 | 0.02 | 0.02 | ||||||||||||||||||

Gain on sale of entity (3) | 369 | — | 214 | — | 0.24 | — | ||||||||||||||||||

Restructuring charges, net (4) | (77 | ) | — | (48 | ) | — | (0.06 | ) | — | |||||||||||||||

Asset impairment charge (5) | — | (37 | ) | — | (30 | ) | — | (0.03 | ) | |||||||||||||||

Ukraine devaluation (6) | — | (40 | ) | — | (38 | ) | — | (0.04 | ) | |||||||||||||||

1st Quarter - Total | $ | 291 | $ | (54 | ) | $ | 160 | $ | (57 | ) | $ | 0.18 | $ | (0.06 | ) | |||||||||

(1) | First quarter 2016 included charges of $(24) recorded in selling, general and administrative expenses related to costs associated with the planned merger with the Dow Chemical Company and related activities. | |||||||||||

First quarter 2015 included charges of $(12) recorded in other operating charges associated with transaction costs related to the separation of the Performance Chemicals segment. | ||||||||||||

(2) | First quarter 2016 included a benefit of $23 in other operating charges for reduction in accrual for customer claims related to the use of the Agriculture segment's Imprelis® herbicide. At March 31, 2016, the company had an accrual balance of $16 which represents the company’s best estimate associated with resolving the remaining claims for this matter. | |||||||||||

The company recorded insurance recoveries of $35 in other operating charges, in the first quarter 2015 in the Agriculture segment, for recovery of costs for customer claims related to the use of the Imprelis® herbicide. | ||||||||||||

(3) | First quarter 2016 included a gain of $369 recorded in other income, net associated with the sale of the DuPont (Shenzhen) Manufacturing Limited entity, which held certain buildings and other assets. The gain is reflected as a Corporate item. | |||||||||||

(4) | First quarter 2016 included a $(2) restructuring charge recorded in employee separation/asset related charges, net associated with the 2016 Global Cost Savings and Restructuring Program. This charge was primarily due to the identification of additional projects in certain segments, offset by reduction in severance and related benefit costs due to workforce reductions achieved through non-severance programs. The net charge impacted segment earnings as follows: Agriculture - $(21), Electronics & Communications - $7, Industrial Biosciences - $1, Nutrition & Health - $1, Performance Materials - $(4), Protection Solutions - $3, Other - $(3), and Corporate expenses - $14. | |||||||||||

First quarter 2016 included a $(75) restructuring charge recorded in employee separation/asset related charges, net related to the decision to not re-start the Agriculture segment's insecticide manufacturing facility at the La Porte site located in La Porte, Texas. The charge included $(41) of asset related charges, $(18) of contract termination costs, and $(16) of employee severance and related benefit costs. | ||||||||||||

(5) | During first quarter of 2015, a $(37) pre-tax impairment charge was recorded in employee separation / asset related charges, net for a cost basis investment within the Other segment. The assessment resulted from the venture's revised operating plan reflecting underperformance of its European wheat based ethanol facility and deteriorating European ethanol market conditions. One of the primary investors has communicated they would not fund the revised operating plan of the investee. As a result, the carrying value of our 6% equity investment in this venture exceeds its fair value. | |||||||||||

(6) | First quarter 2015 included a charge of $(40) in other income, net associated with remeasuring the company’s Ukrainian hryvnia net monetary assets. Ukraine’s central bank adopted a decision to no longer set the indicative hryvnia exchange rate. The hryvnia became a free-floating exchange rate and lost approximately a third of its value through the quarter. | |||||||||||

11

E.I. du Pont de Nemours and Company

Consolidated Segment Information

(Dollars in millions)

SCHEDULE C | |||||||

Three Months Ended March 31, | |||||||

SEGMENT NET SALES (1) | 2016 | 2015 | |||||

Agriculture | $ | 3,786 | $ | 3,937 | |||

Electronics & Communications | 452 | 517 | |||||

Industrial Biosciences | 352 | 350 | |||||

Nutrition & Health | 801 | 813 | |||||

Performance Materials | 1,249 | 1,381 | |||||

Protection Solutions | 729 | 790 | |||||

Other | 36 | 49 | |||||

Consolidated net sales | $ | 7,405 | $ | 7,837 | |||

Three Months Ended March 31, | |||||||

SEGMENT OPERATING EARNINGS (1) | 2016 | 2015 | |||||

Agriculture | $ | 1,101 | $ | 1,138 | |||

Electronics & Communications | 59 | 79 | |||||

Industrial Biosciences | 63 | 54 | |||||

Nutrition & Health | 104 | 86 | |||||

Performance Materials | 273 | 317 | |||||

Protection Solutions | 176 | 167 | |||||

Other | (59 | ) | (31 | ) | |||

Total segment operating earnings | 1,717 | 1,810 | |||||

Corporate expenses | (86 | ) | (154 | ) | |||

Interest expense | (92 | ) | (84 | ) | |||

Operating earnings before income taxes and exchange (losses) gains | 1,539 | 1,572 | |||||

Net exchange (losses) gains (2) | (121 | ) | 142 | ||||

Operating earnings before income taxes (Non-GAAP) | $ | 1,418 | $ | 1,714 | |||

Non-operating pension/OPEB costs (3) | (74 | ) | (109 | ) | |||

Total significant items before income taxes | 291 | (54 | ) | ||||

Income from continuing operations before income taxes (GAAP) | $ | 1,635 | $ | 1,551 | |||

Three Months Ended March 31, | |||||||

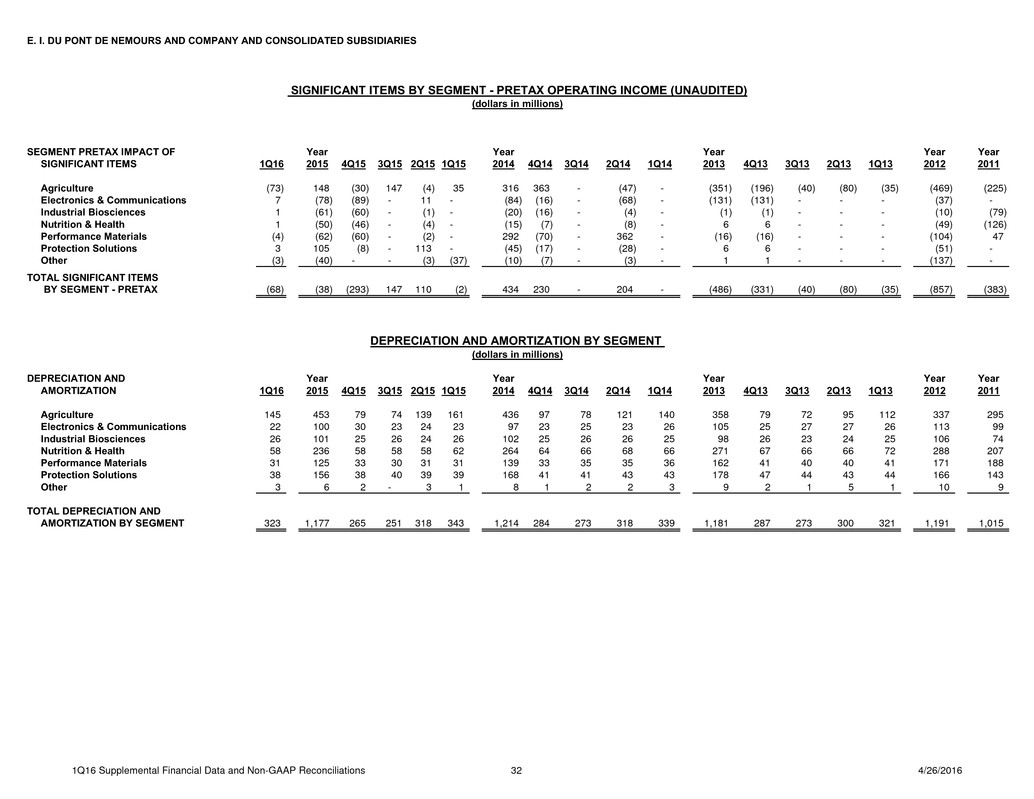

SIGNIFICANT ITEMS BY SEGMENT (PRE-TAX) (1)(4) | 2016 | 2015 | |||||

Agriculture | $ | (73 | ) | $ | 35 | ||

Electronics & Communications | 7 | — | |||||

Industrial Biosciences | 1 | — | |||||

Nutrition & Health | 1 | — | |||||

Performance Materials | (4 | ) | — | ||||

Protection Solutions | 3 | — | |||||

Other | (3 | ) | (37 | ) | |||

Total significant items by segment | (68 | ) | (2 | ) | |||

Corporate expenses | 359 | (12 | ) | ||||

Interest expense | — | — | |||||

Net exchange gains (losses) | — | (40 | ) | ||||

Total significant items before income taxes | $ | 291 | $ | (54 | ) | ||

12

E.I. du Pont de Nemours and Company

Consolidated Segment Information

(Dollars in millions)

SCHEDULE C (continued) | |||||||||||||||||||

Reconciliation of Segment Operating Earnings and Operating Earnings EPS excluding the impact of currency (Non-GAAP) | |||||||||||||||||||

Segment operating earnings and operating earnings per share excluding the impact of currency assumes current operating earnings results using foreign currency exchange rates in effect for the comparable prior-year period. | |||||||||||||||||||

Three Months Ended March 31, 2015 | Three Months Ended March 31, 2016 | ||||||||||||||||||

Segment Operating Earnings | Segment Operating Earnings | Impact of Currency | Segment Operating Earnings Excluding Currency | % Change | |||||||||||||||

Agriculture | $ | 1,138 | $ | 1,101 | $ | (83 | ) | $ | 1,184 | 4 | % | ||||||||

Electronics & Communications | 79 | 59 | — | 59 | (25 | ) | |||||||||||||

Industrial Biosciences | 54 | 63 | (1 | ) | 64 | 19 | |||||||||||||

Nutrition & Health | 86 | 104 | (3 | ) | 107 | 24 | |||||||||||||

Performance Materials | 317 | 273 | (19 | ) | 292 | (8 | ) | ||||||||||||

Protection Solutions | 167 | 176 | (6 | ) | 182 | 9 | |||||||||||||

Other | (31 | ) | (59 | ) | (1 | ) | (58 | ) | (87 | ) | |||||||||

Total segment operating earnings | $ | 1,810 | $ | 1,717 | $ | (113 | ) | $ | 1,830 | 1 | % | ||||||||

Three Months Ended March 31, 2015 | Three Months Ended March 31, 2016 | ||||||||||||||||||

Operating Earnings per share (Non-GAAP) (5) | Operating Earnings per share (Non-GAAP) (5) | Impact of Currency | Operating Earnings per share excluding currency (Non-GAAP) (5) | % Change | |||||||||||||||

Operating Earnings per share (Non-GAAP) (5) | $ | 1.26 | $ | 1.26 | $ | (0.10 | ) | $ | 1.36 | 8 | % | ||||||||

(1) DuPont Sustainable Solutions, previously within the company's Safety & Protection segment (now Protection Solutions) was comprised of two business units: Clean Technologies (CleanTech) and Consulting Solutions. Effective January 1, 2016, the CleanTech business is reported in the Industrial Biosciences segment and the Consulting Solutions business unit is reported within Other. Reclassifications of prior year data have been made to conform to current year classifications. | |||||||||||||||||||

(2) See Schedule D for additional information on exchange gains and losses. Three months ended March 31, 2015 exchange gains, on an operating earnings basis (Non-GAAP), excludes the impact of a $23 exchange loss on non-operating pension. | |||||||||||||||||||

(3) First quarter 2015, non-operating pension/OPEB costs includes a $23 exchange loss on foreign pension balances. | |||||||||||||||||||

(4) See Schedule B for detail of significant items. | |||||||||||||||||||

(5) See Schedule A for reconciliation of operating earnings per share. | |||||||||||||||||||

13

E.I. du Pont de Nemours and Company

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

SCHEDULE D | |||||||||

Reconciliations of Adjusted EBIT / EBITDA to Consolidated Income Statements | |||||||||

Three Months Ended March 31, | |||||||||

2016 | 2015 | ||||||||

Income from continuing operations before income taxes (GAAP) | $ | 1,635 | $ | 1,551 | |||||

Add: Significant items (benefit) charge before income taxes | (291 | ) | 54 | ||||||

Add: Non-operating pension/OPEB costs (1) | 74 | 109 | |||||||

Operating earnings before income taxes (Non-GAAP) | $ | 1,418 | $ | 1,714 | |||||

Less: Net income attributable to noncontrolling interests from continuing operations | 6 | 4 | |||||||

Add: Interest expense | 92 | 84 | |||||||

Adjusted EBIT from operating earnings (Non-GAAP) | 1,504 | 1,794 | |||||||

Add: Depreciation and amortization | 360 | 383 | |||||||

Adjusted EBITDA from operating earnings (Non-GAAP) | $ | 1,864 | $ | 2,177 | |||||

Reconciliation of Operating Costs to Consolidated Income Statement Line Items | |||||||||||||||||||||||||

Operating costs is defined as other operating charges, selling, general and administrative expenses, and research and development costs, excluding significant items and non-operating pension/OPEB costs. | |||||||||||||||||||||||||

Three months ended March 31, 2016 | Three months ended March 31, 2015 | ||||||||||||||||||||||||

As Reported (GAAP) | Less: Significant Items (2) | Less: Non-Operating Pension/OPEB Costs | Operating Costs (Non-GAAP) | As Reported (GAAP) | Less: Significant Items (2) | Less: Non-Operating Pension/OPEB Costs | Operating Costs (Non-GAAP) | ||||||||||||||||||

Other operating charges | $ | 185 | $ | (23 | ) | $ | — | $ | 208 | $ | 148 | $ | (23 | ) | $ | — | $ | 171 | |||||||

Selling, general and administrative expenses | 1,128 | 24 | 30 | 1,074 | 1,220 | — | 34 | 1,186 | |||||||||||||||||

Research and development expense | 418 | — | 11 | 407 | 479 | — | 13 | 466 | |||||||||||||||||

Total | $ | 1,731 | $ | 1 | $ | 41 | $ | 1,689 | $ | 1,847 | $ | (23 | ) | $ | 47 | $ | 1,823 | ||||||||

Reconciliation of Operating Earnings Per Share (EPS) Outlook | ||||||||

The reconciliation below represents the company's outlook on an operating earnings basis, defined as earnings excluding significant items and non-operating pension/OPEB costs. | ||||||||

Year Ended December 31, | ||||||||

2016 Outlook | 2015 Actual | |||||||

Operating EPS (Non-GAAP) | $ 3.05 - 3.20 | $ | 2.77 | |||||

Significant items (2) | ||||||||

Transaction costs (3) | (0.40 | ) | (0.07 | ) | ||||

Gain on sale of entity | 0.24 | — | ||||||

Restructuring charges, net | (0.06 | ) | (0.58 | ) | ||||

Customer claims adjustment/recovery | 0.02 | 0.23 | ||||||

Litigation settlement | — | 0.10 | ||||||

Asset impairment charge | — | (0.03 | ) | |||||

Ukraine devaluation | — | (0.04 | ) | |||||

Non-operating pension/OPEB costs - estimate (4) | (0.24 | ) | (0.29 | ) | ||||

EPS from continuing operations (GAAP) | $ 2.61 - 2.76 | $ | 2.09 | |||||

14

E.I. du Pont de Nemours and Company

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

SCHEDULE D (continued) | ||||||||

Exchange Gains/Losses on Operating Earnings (2) | ||||||||

The company routinely uses forward exchange contracts to offset its net exposures, by currency, related to the foreign currency denominated monetary assets and liabilities of its operations. The objective of this program is to maintain an approximately balanced position in foreign currencies in order to minimize, on an after-tax basis, the effects of exchange rate changes. The net pre-tax exchange gains and losses are recorded in other income, net and the related tax impact is recorded in provision for (benefit from) income taxes on the Consolidated Income Statements. | ||||||||

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Subsidiary Monetary Position Gain (Loss) | ||||||||

Pre-tax exchange gains (losses) | $ | 33 | $ | (116 | ) | |||

Local tax benefits (expenses) | 13 | (118 | ) | |||||

Net after-tax impact from subsidiary exchange gains (losses) | $ | 46 | $ | (234 | ) | |||

Hedging Program Gain (Loss) | ||||||||

Pre-tax exchange (losses) gains | $ | (154 | ) | $ | 258 | |||

Tax benefits (expenses) | 55 | (93 | ) | |||||

Net after-tax impact from hedging program exchange (losses) gains | $ | (99 | ) | $ | 165 | |||

Total Exchange Gain (Loss) | ||||||||

Pre-tax exchange (losses) gains (5) | $ | (121 | ) | $ | 142 | |||

Tax benefits (expenses) | 68 | (211 | ) | |||||

Net after-tax exchange losses | $ | (53 | ) | $ | (69 | ) | ||

As shown above, the "Total Exchange Gain (Loss)" is the sum of the "Subsidiary Monetary Position Gain (Loss)" and the "Hedging Program Gain (Loss)." | ||||||||

Reconciliation of Base Income Tax Rate to Effective Income Tax Rate | ||||||||

Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), as defined above, significant items and non-operating pension/OPEB costs. | ||||||||

Three Months Ended March 31, | ||||||||

2016 | 2015 | |||||||

Income from continuing operations before income taxes (GAAP) | $ | 1,635 | $ | 1,551 | ||||

Add: Significant items - (benefit) charge (2) | (291 | ) | 54 | |||||

Non-operating pension/OPEB costs (1) | 74 | 109 | ||||||

Less: Net exchange (losses) gains (5) | (121 | ) | 142 | |||||

Income from continuing operations before income taxes, significant items, exchange gains (losses), and non-operating pension/OPEB costs (Non-GAAP) | $ | 1,539 | $ | 1,572 | ||||

Provision for income taxes on continuing operations (GAAP) | $ | 406 | $ | 530 | ||||

Add: Tax expenses on significant items | (131 | ) | (3 | ) | ||||

Tax benefits on non-operating pension/OPEB costs | 28 | 30 | ||||||

Tax benefits (expenses) on exchange gains/losses | 68 | (211 | ) | |||||

Provision for income taxes on continuing earnings, excluding exchange gains (losses) (Non-GAAP) | $ | 371 | $ | 346 | ||||

Effective income tax rate (GAAP) | 24.8 | % | 34.2 | % | ||||

Significant items and non-operating pension/OPEB costs effect | (3.4 | ) | (1.7 | ) | ||||

Tax rate, from continuing operations before significant items and non-operating pension/OPEB costs | 21.4 | % | 32.5 | % | ||||

Exchange gains (losses) effect | 2.7 | (10.5 | ) | |||||

Base income tax rate from continuing operations (Non-GAAP) | 24.1 | % | 22.0 | % | ||||

(1) First quarter 2015, non-operating pension/OPEB costs includes a $23 exchange loss on foreign pension balances. | ||||||||

(2) See Schedule B for detail of significant items. | ||||||||

(3) The 2016 outlook for significant items includes the current estimate for full year 2016 transaction costs associated with the planned merger with The Dow Chemical Company and related activities. | ||||||||

(4) The 2016 estimate for non-operating pension/OPEB costs does not include additional settlements and curtailments expected during the remainder of the year as a result of actions associated with the 2016 global cost savings and restructuring plan. | ||||||||

(5) First quarter 2015 exchange gains, on an operating earnings basis (Non-GAAP), excludes a $23 exchange loss on non-operating pension. | ||||||||

Conference Call DuPont First Quarter 2016 Earnings April 26, 2016

1 Regulation G The attached charts include company information that does not conform to generally accepted accounting principles (GAAP). Management believes that an analysis of this data is meaningful to investors because it provides insight with respect to ongoing operating results of the company. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consistent with similar measures provided by other companies. This data should be read in conjunction with previously published company reports on Forms 10-K, 10-Q, and 8-K. These reports, along with reconciliations of non-GAAP measures to GAAP are available on the Investor Center of www.dupont.com under Filings and Reports – Reconciliations and Other Data. Reconciliations of non-GAAP measures to GAAP are also included with this presentation. Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology and, in general, for products for the agriculture industry; outcome of significant litigation and environmental matters, including realization of associated indemnification assets, if any; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could affect demand as well as availability of products for the agriculture industry; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses; and risks related to the agreement entered on December 11, 2015, with The Dow Chemical Company pursuant to which the companies have agreed to effect an all-stock merger of equals, including the completion of the proposed transaction on anticipated terms and timing, the ability to fully and timely realize the expected benefits of the proposed transaction and risks related to the intended business separations contemplated to occur after the completion of the proposed transaction. Important risk factors relating to the proposed transaction and intended business separations include, but are not limited to, (i) the completion of the proposed

2 to the proposed transaction and intended business separations include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the merger, (ii) the ability of Dow and DuPont to integrate the business successfully and to achieve anticipated synergies, risks and costs and pursuit and/or implementation of the potential separations, including anticipated timing, any changes to the configuration of businesses included in the potential separation if implemented, (iii) the intended separation of the agriculture, material science and specialty products businesses of the combined company post-mergers in one or more tax efficient transactions on anticipated terms and timing, including a number of conditions which could delay, prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances, disruptions in the financial markets or other potential barriers, (iv) potential litigation relating to the proposed transaction that could be instituted against Dow, DuPont or their respective directors, (v) the risk that disruptions from the proposed transaction will harm Dow’s or DuPont’s business, including current plans and operations, (vi) the ability of Dow or DuPont to retain and hire key personnel, (vii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger, (viii) uncertainty as to the long-term value of DowDuPont common stock, (ix) continued availability of capital and financing and rating agency actions, (x) legislative, regulatory and economic developments, (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that could affect Dow’s and/or DuPont’s financial performance, (xii) certain restrictions during the pendency of the merger that may impact Dow’s or DuPont’s ability to pursue certain business opportunities or strategic transactions and (xiii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed merger, are more fully discussed in the joint proxy statement/prospectus included in the preliminary registration statement on Form S-4 filed with the SEC in connection with the proposed merger. While the list of factors presented here is, and the list of factors presented in the preliminary registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Dow nor DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements regarding the proposed transaction and intended business separations, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. The company undertakes no duty to publicly revise or update any forward-looking statements as a result of future developments, or new information or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Developing Markets Total developing markets is comprised of Developing Asia, Developing Europe, Middle East & Africa, and Latin America. A detailed list of all developing countries is available on the Earnings News Release link on the Investor Center website at www.dupont.com.

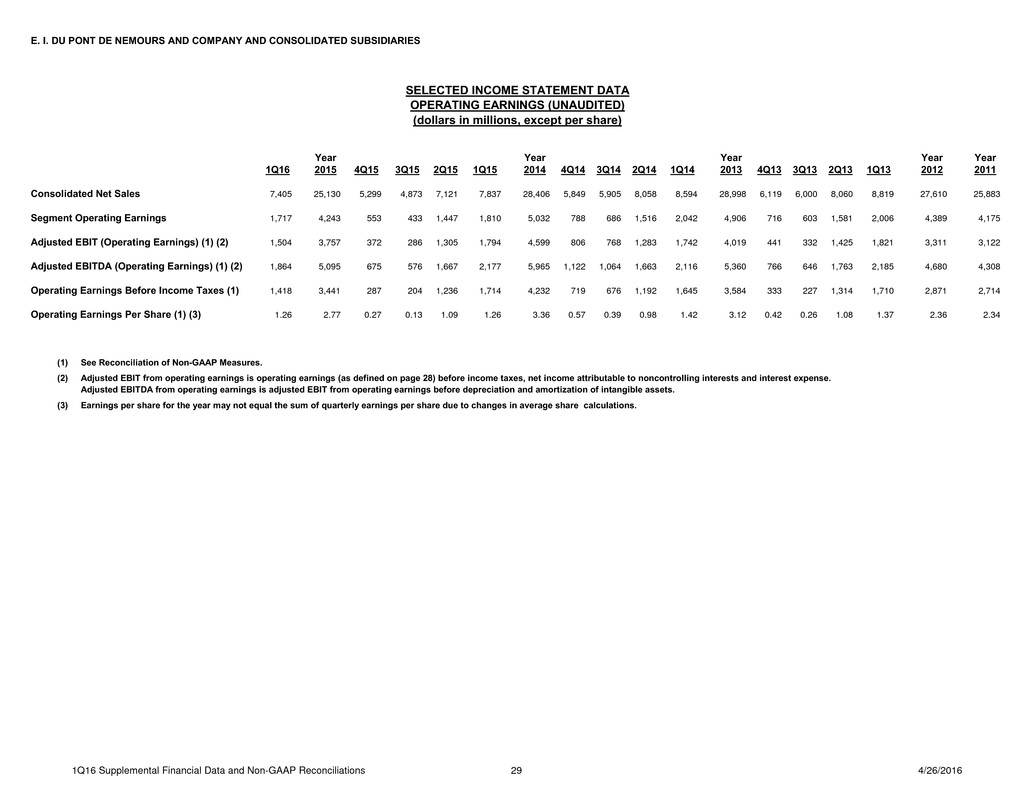

1Q 2016 Financial Results $ in millions, except EPS 3 1Q16 vs. 1Q15 EPS Operating earnings* $1.26 0% Operating earnings, ex currency* $1.36 8% GAAP earnings $1.39 25% Segment Operating Earnings* $1,717 (5%) 1Q16 vs. 1Q15 Consolidated Net Sales $7,405 (6%) Currency Impact (4%) Portfolio - Local Price & Product Mix - Volume (2%) * See appendix for reconciliations of non-GAAP measures

1Q 2016 Operating EPS* Variance 4 * See appendix for details of significant items and reconciliation of non-GAAP measures Corporate and interest expense, net contributed $0.05 per share in the quarter primarily due to cost savings Lower average shares outstanding were a $0.05 per share benefit in the quarter primarily due to the $2 billion share repurchase program in 2015. Net after-tax exchange gains (losses) added $0.02 per share to the quarter. A higher tax rate as a result of a shift in the geographic mix of earnings negatively impacted results by $0.04 per share. Segment results declined $0.08 per share, including a $0.10 per share negative impact from currency. Key Factors $0.05 $0.02 ($0.08) $0.05 ($0.04) 1Q15 Corp Exp & Interest Lower Shares EG&L Tax Rate Segment Results 1Q16 Operating EPS* $1.26 Operating EPS* $1.26 Currency ($0.10)

1Q 2016 Segment Operating Earnings* Variance ($ in millions) 5 * See appendix for details of significant items and reconciliation of non-GAAP measures Nutrition & Health increased on broad-based volume growth in probiotics, cultures, ingredient systems, texturants, and specialty proteins and cost savings partially offset by a negative currency impact. Industrial Biosciences growth reflected pricing gains on new product introductions in bioactives, increased demand for biomaterials, and the absence of a prior year one-time cost in CleanTech, partially offset by a negative currency impact. Protection Solutions results increased on lower costs and improved plant utilization at the Chambers Works facility, partially offset by lower volumes and a negative currency impact. Electronics & Communications operating earnings declined as cost savings and increased demand in Tedlar® film were more than offset by competitive pressures in Solamet® paste, lower demand in consumer electronics and a $16 million litigation expense. Other reflects increased costs associated with discontinued businesses and lower earnings in consulting solutions. Increases in local price and product mix and cost savings in Agriculture were more than offset by the negative impact of currency, lower volumes and about a $40 million negative impact from the LaPorte shutdown primarily due to lost sales and inventory write-offs. In Performance Materials, lower costs and increased demand in Asia Pacific automotive markets were more than offset by lower demand for ethylene and ethylene-based products, lower local price, and negative currency impact. Key Factors $18 $9 ($37) $9 ($44) ($28) ($20) 1Q15 N&H IB PS E&C Other Ag PM 1Q16 $1,810 Segment Operating Earnings* $1,717 Segment Operating Earnings*

Balance Sheet and Cash March 31, 2016 6 Free Cash Flow • Reflects normal seasonal cash outflow • Year over year improvement of ~$500 million Absence of Chemours net cash outflow of ~$200 million Lower working capital and capex spend Balance Sheet • $5.0 billion in net debt** • Increase since year end due to normal seasonal working capital requirements Expected Uses of Cash for 2016 • $1.3 billion for normal dividends • Capex spend est. $1.1 billion for FY 2016 • $2 billion share repurchase program (2nd half 2016 as trading window opens) -3.0 -2.0 -1.0 0.0 2015 2016 $ B il li o n s 0 4 8 12 16 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 $ B ill io n s Gross Debt Cash Net Debt** Free Cash Flow* Cash and Debt * Free Cash Flow is cash used for operating activities of ($1,844MM) and ($2,123MM) less purchases of plant, property and equipment of $357MM and $565MM for the year ended March 31, 2016, and 2015, respectively. ** See appendix for reconciliation of non-GAAP measures.

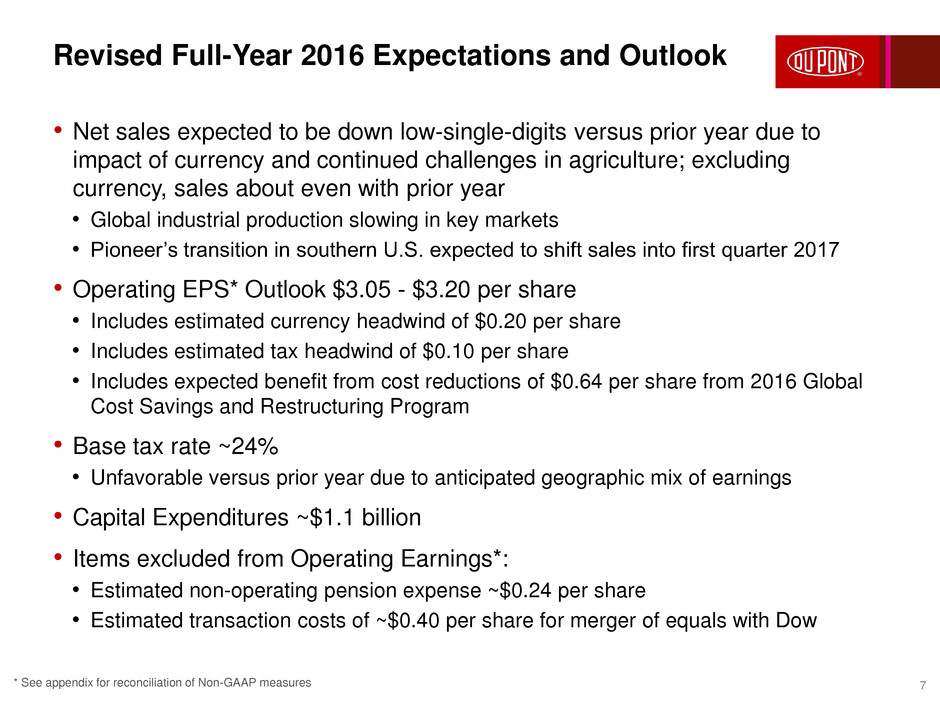

Revised Full-Year 2016 Expectations and Outlook 7 • Net sales expected to be down low-single-digits versus prior year due to impact of currency and continued challenges in agriculture; excluding currency, sales about even with prior year • Global industrial production slowing in key markets • Pioneer’s transition in southern U.S. expected to shift sales into first quarter 2017 • Operating EPS* Outlook $3.05 - $3.20 per share • Includes estimated currency headwind of $0.20 per share • Includes estimated tax headwind of $0.10 per share • Includes expected benefit from cost reductions of $0.64 per share from 2016 Global Cost Savings and Restructuring Program • Base tax rate ~24% • Unfavorable versus prior year due to anticipated geographic mix of earnings • Capital Expenditures ~$1.1 billion • Items excluded from Operating Earnings*: • Estimated non-operating pension expense ~$0.24 per share • Estimated transaction costs of ~$0.40 per share for merger of equals with Dow * See appendix for reconciliation of Non-GAAP measures

2013 Highlights Other Highlights 8 • 2016 Global Cost Savings and Restructuring Plan to generate $1.0B in cost savings on a run-rate basis by yearend 2016, which represents about $730 million in cost reductions in 2016 versus prior year - In the first quarter 2016, operating costs1 declined by approximately $135 million, 7 percent versus prior year - Selling, general & administrative costs, on an operating earnings1 basis, declined approximately $110 million, 9 percent versus prior year - Corporate expenses, on an operating earnings1 basis, declined 44 percent versus prior year • Announced second-quarter 2016 dividend of $0.38 per share 1Operating costs defined as other operating charges, selling, general & administrative, and research & development costs, excluding significant items and non-operating pension/OPEB costs. See appendix for reconciliation of non-GAAP measures.

Nutrition & Health 9 1Q14 1Q15 1Q16 0% 3% 6% 9% 12% 20 40 60 80 100 120 M a rg in $ i n M il li o n s 1Q Comments • Sales – 1 percent lower as 3 percent higher volumes were more than offset by a 4 percent negative currency impact • Continued broad-based volume growth in probiotics, cultures, ingredient systems, texturants, and specialty proteins • Operating Earnings – Increased $18 million, or 21 percent, as volume growth and cost savings more than offset a $3 million negative currency impact • Excluding the impact of currency, operating earnings increased by 24 percent • Continued improvement in operating margin (+ 240 basis points); 11 consecutive quarters of year-over-year improvement 2Q & FY Outlook • Market conditions to remain challenging especially in Latin America and Middle East • 2Q: Sales – Expected to be about flat with continued strength in probiotics and cultures offset by the negative impact of currency • Operating Earnings – Expected to be up in the low-twenty percent range driven by margin enhancement and cost savings • Full Year: Sales – Expected to be about flat with continued strength in probiotics and cultures offset by the negative impact of currency • Operating Earnings – Expected to be up in the low-twenty percent range as mix enrichment and cost savings more than offset the negative impact of currency; continuing margin expansion 1Q Operating Earnings 1Q Sales Vol 3%, Local Price 0%, Currency -4%, Port./Other 0% 700 750 800 850 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 $ in M ill io n s 813 801

Industrial Biosciences 10 1Q14 1Q15 1Q16 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 0 20 40 60 80 M a rg in $ in M ill io n s 1Q Comments • Sales – Up 1 percent, reflecting pricing and volume gains in enzymes and biomaterials that were offset by the negative currency impact and declines in CleanTech offerings • New product introductions in bioactives and increased demand for biomaterials drove the price and volume gains. CleanTech sales declined on weak demand from sulfuric acid producers. • Operating Earnings – Increased 17 percent due to pricing gains on new products, volume growth and the absence of a prior year one- time cost, partly offset by currency. Operating margins expanded 250 basis points. Excluding a $1 million negative currency impact, operating earnings increased by 19 percent. 2Q & FY Outlook • 2Q: Sales: About flat due to volume and pricing growth in bioactives offset by CleanTech declines • Operating Earnings – Expected to be up by mid-teens percent due to mix enrichment and cost savings • Full Year: Sales – Expected to be flat on stronger volume in bioactives, pricing and portfolio offset by CleanTech declines and currency; bioactives volumes expected to benefit from new product introductions • Operating Earnings – Expected to be up low-teens percent due to mix enrichment and cost savings Note: DuPont Sustainable Solutions, previously reported within the company’s Safety & Protection segment (now Protection Solutions), was comprised of two business units: clean technologies (CleanTech) and consulting solutions. Effective January 1, 2016, the clean technologies business unit became part of Industrial Biosciences and the consulting business unit became part of Other. 1Q Operating Earnings 1Q Sales Vol 1%, Local Price 2%, Currency -3%, Port./Other 1% 275 300 325 350 375 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 $ in M ill io n s 350 352

Protection Solutions 11 1Q14 1Q15 1Q16 0% 5% 10% 15% 20% 25% 0 50 100 150 200 M a rg in $ in M ill io n s 1Q Comments • Sales – Declined 8 percent, driven primarily by volume weakness and currency • Demand from the oil and gas industry and the military remained soft, impacting sales of Nomex® thermal-resistant fiber and Kevlar® high- strength materials. Lower demand for Tyvek® from industrial markets also affected sales growth. Sales in surfaces were even with prior year. • Operating Earnings – Rose 5 percent, reflecting lower costs and improved plant utilization at the Chambers Works facility, partly offset by lower volumes and a $6 million negative currency impact. Operating margin expanded by 300 bps. Excluding the impact of currency, operating earnings increased by 9 percent. 2Q & FY Outlook • 2Q: Sales – Volume contraction (driven by continued weakness in oil and gas and military tenders) and pressure from pricing are expected to result in sales declines in the low-single digits percent • Operating Earnings – Down low-single digits percent as cost savings are expected to be more than offset by lower volumes • Full Year: Sales – Expected to be even with last year due to volume growth offset by price and currency • Operating Earnings – Up high-single digits percent. Lower costs anticipated to drive operating margin expansion 1Q Operating Earnings 1Q Sales Vol -5%, Local Price -1%, Currency -2%, Port./Other 0% Note: DuPont Sustainable Solutions, previously reported within the company’s Safety & Protection segment (now Protection Solutions), was comprised of two business units: clean technologies (CleanTech) and consulting solutions. Effective January 1, 2016, the clean technologies business unit became part of Industrial Biosciences and the consulting business unit became part of Other. 600 650 700 750 800 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 (ex-curr & portf.) 790 729 $ in M ill io n s

Electronics & Communications 12 1Q14 1Q15 1Q16 0% 5% 10% 15% 20% 0 25 50 75 100 M a rg in $ in M ill io n s 1Q Comments • Sales – Down 13 percent as volume growth in Tedlar® film in photovoltaics was more than offset by the impact of competitive pressures on sales of Solamet® paste, lower demand in consumer electronics, lower metals pricing and the negative impact of currency • Solamet® paste volumes grew sequentially in 1Q following the launch of PV19B late last year • Operating Earnings – Decreased 25 percent to $59 million as cost savings were more than offset by lower sales and a $16 million litigation expense 2Q & FY Outlook • Expect PV market demand to remain strong with a modest 2H recovery in consumer electronics markets • Continued improvement in Solamet® paste expected • New Solamet® paste product expected to launch mid-year • 2Q: Sales – Expected to be down mid-single digits percent from lower year-over-year Solamet® paste sales and soft consumer electronics demand • Operating Earnings – Expected to be up high-single digits percent as cost savings more than offset lower sales • Full Year: Sales - Expected to be down low-single digits percent • Operating Earnings – Expected to be up low-teens percent with 2H sales improvement and cost savings 1Q Operating Earnings 1Q Sales Vol -9%, Local Price -3%, Currency -1%, Port./Other 0% 400 425 450 475 500 525 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 $ i n M il li o n s 517 452

Agriculture Pioneer, Crop Protection 13 1Q14 1Q15 1Q16 20.0% 25.0% 30.0% 35.0% 40.0% 0 500 1,000 1,500 M a rg in $ in M ill io n s 2Q & FY Outlook • Expect continued weakness in the agriculture sector; Currency impact moderating in 2H • Planned rapid introduction of Leptra® corn hybrids for Brazil summer season; Crop protection portfolio growing in Asia with the Zorvec™ launch and growth in Cyazypyr® and Rynaxypyr® • 2Q: Sales – Expected to be down low-single digits percent as currency remains a headwind. Volume gains in corn seed and in crop protection are offset by lower soybean seed sales • Operating Earnings – Expected to be about flat as cost savings are offset by the negative impact of currency • Full Year: Sales – Expect to be down low-single digits percent as local price and product mix gains are more than offset by the negative impact of currency; Higher corn seed volumes offset by lower insecticide and soybean seed volumes • Operating Earnings – Expected to be up mid-single digits percent as cost savings and local price and product mix gains more than offset the negative impact of currency; up low-teens percent excluding currency 1Q Comments • Continued weakness in agricultural markets and strong currency headwinds • Sales – 4 percent lower as 2 percent higher local price and product mix were more than offset by a 5 percent negative currency impact and 1 percent lower volumes • Net local prices were higher from pricing actions to mitigate currency impacts in Europe and Brazil and new product mix in North America corn seed • Increased corn seed volumes in North America due to higher expected acreage and in Brazil from higher Safrinha season sales, and higher sunflower volumes were more than offset by lower insecticide volumes, including the impact of the LaPorte shutdown, and lower soybean seed volumes • Operating Earnings – 3 percent lower as local price increases and cost savings were more than offset by an $83 million negative currency impact, lower volumes and about a $40 million negative impact from the LaPorte shutdown primarily due to lost sales and inventory write-offs • Excluding the impact of currency, operating earnings would have increased by 4 percent 1Q Operating Earnings 1Q Sales Vol -1%, Local Price 2%, Currency -5%, Port./Other 0% 3,000 3,200 3,400 3,600 3,800 4,000 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 (ex-curr & portf.) 3,937 $ in M ill io n s 3,786

Performance Materials 14 1Q14 1Q15 1Q16 0% 6% 12% 18% 24% 30% 0 80 160 240 320 M a rg in $ in M ill io n s 1Q Comments • Sales – Down 10 percent on lower local price, volume and negative currency impact; currency reduced sales by 2 percent • Price was down 5 percent, driven by lower ethylene prices as average spot prices were down approximately 50 percent year over year and competitive pressure in commoditized product lines • Increased demand in Asia Pacific automotive markets, primarily China, was more than offset by lower volumes in ethylene and ethylene-based products • Operating Earnings – Down 14 percent as lower costs and improved automotive demand in Asia Pacific were more than offset by lower demand for ethylene and ethylene-based products, lower local price, and $19 million of negative currency impact. Excluding the impact of currency, operating earnings decreased 8 percent. 1Q Operating Earnings 1Q Sales Vol -3%, Local Price -5%, Currency -2%, Port./Other 0% $ in M ill io n s 1,381 1100 1200 1300 1400 1Q15 Volume Local Price 1Q16 (ex-curr & portf.) Curr. Portf./ Other 1Q16 1,249 2Q & FY Outlook • 2Q: Sales – Expected to be about flat as continued improvement in global automotive market demand and increased ethylene volume due to a prior year unplanned outage will be offset by lower local price • Operating Earnings – Expected to be about flat with prior year as volume growth will be offset by lower local price and the negative impact of currency • Full Year: Sales – Expected to be about flat as volume growth will be offset by lower local price • Operating Earnings – Expected to be down mid-single digits as volume growth will be more than offset by lower local price and negative currency impact

APPENDIX 1: FIRST QUARTER 2016 SEGMENT COMMENTARY This data should be read in conjunction with the Company’s first quarter earnings news release dated April 26, 2016, DuPont’s 1Q 2016 Earnings Conference Call presentation materials and reconciliations of non-GAAP to GAAP measures included in the presentation materials and posted on the DuPont Investor Center website at www.dupont.com. 4/25/2016 15

. Segment Commentary First Quarter Earnings 2016 16 Nutrition & Health In Nutrition & Health, the business continued to deliver strong results, despite headwinds from currency. Sales were 1 percent lower as broad-based volume growth of 3 percent -- led by probiotics, cultures, texturants and ingredient systems, and specialty proteins -- was more than offset by a 4 percent negative impact from currency. Growth in probiotics was 30 percent as our productivity efforts have freed up capacity to enable growth. Volume was also strong in developing markets, despite economic challenges, including continued double-digit growth in China. Operating earnings increased $18 million, or 21 percent, as volume growth and costs savings more than offset a $3 million negative currency impact. Excluding the impact of currency, operating earnings increased by 24 percent. The business delivered 240 basis points of operating margin improvement and has grown operating margins year-over-year for eleven consecutive quarters. Looking to the outlook for the remainder of 2016, market conditions are expected to remain challenging, particularly in Latin America and the Middle East. In the second quarter, we expect sales to be about flat with continued strength in probiotics and cultures offset by the negative impact of currency. Operating earnings are expected to be up in the low-twenty percent range benefitting from mix enrichment and cost savings. For the full year, we expect sales to be about flat with continued strength in probiotics and cultures offset by the negative impact of currency. Operating earnings are expected to be up in the low-twenty percent range, with continued operating margin expansion, as mix enrichment and cost savings more than offset the negative impact of currency.