Form 8-K DOVER Corp For: Jan 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2016

________________________________

DOVER CORPORATION

(Exact name of registrant as specified in its charter)

________________________________

State of Delaware | 1-4018 | 53-0257888 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3005 Highland Parkway | ||

Downers Grove, Illinois | 60515 | |

(Address of principal executive offices) | (Zip Code) | |

(630) 541-1540

(Registrant’s telephone number, including area code)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On January 26, 2016, Dover Corporation (i) issued the Press Release attached hereto as Exhibit 99.1 announcing its results of operations for the quarter and year ended December 31, 2015; and (ii) posted on its website at

http://www.dovercorporation.com the presentation slides attached hereto as Exhibit 99.2 for the quarter and year ended December 31, 2015.

The information in this Current Report on Form 8-K, including exhibits, is being furnished to the Securities and Exchange Commission (the “SEC”) and shall not be deemed to be incorporated by reference into any of Dover’s filings with the SEC under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this report:

99.1 Dover Corporation Press Release dated January 26, 2016.

99.2 Presentation Slides posted on Dover Corporation’s website at http://www.dovercorporation.com.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

Date: | January 26, 2016 | DOVER CORPORATION | ||

(Registrant) | ||||

By: | /s/ Ivonne M. Cabrera | |||

Ivonne M. Cabrera | ||||

Senior Vice President, General Counsel & Secretary | ||||

EXHIBIT INDEX

Number | Exhibit | |

99.1 | Press Release of Dover Corporation dated January 26, 2016 | |

99.2 | Presentation Slides posted on Dover Corporation’s website at http://www.dovercorporation.com | |

Exhibit 99.1

Investor Contact: | Media Contact: | |

Paul Goldberg | Adrian Sakowicz | |

Vice President - Investor Relations | Vice President - Communications | |

(212) 922-1640 | (630) 743-5039 | |

DOVER REPORTS FOURTH QUARTER AND FULL YEAR 2015 RESULTS

AND REAFFIRMS 2016 EPS GUIDANCE

• | Reports quarterly revenue of $1.7 billion, a decrease of 14% from the prior year |

• | Delivers quarterly diluted earnings per share from continuing operations of $0.87, including $0.06 of discrete tax benefits |

• | Generates $274 million in free cash flow in the fourth quarter of 2015, and $795 million for the full year |

• | Adjusts full year 2016 revenue forecast to reflect weaker oil & gas markets; now expects full year organic revenue to decline 1% to 4%, one point lower than the previous forecast |

• | Reaffirms 2016 full year diluted earnings per share from continuing operations to be in the range of $3.85 to $4.05 |

Downers Grove, Illinois, January 26, 2016 — Dover (NYSE: DOV) announced today that for the fourth quarter ended December 31, 2015, revenue was $1.7 billion, a decrease of 14% from the prior year. The decrease in revenue was driven by an organic revenue decline of 12% and an unfavorable impact from foreign exchange of 4%, partially offset by 2% growth from acquisitions. Earnings from continuing operations were $136.6 million, a decrease of 21% as compared to $171.8 million for the prior year period. Diluted earnings per share from continuing operations ("EPS") for the fourth quarter ended December 31, 2015 were $0.87, compared to $1.03 EPS in the prior year period, representing a decrease of 16%. EPS from continuing operations for the fourth quarter of 2015 included discrete tax benefits of $0.06, compared to $0.02 EPS in the prior year period. Excluding these items, adjusted EPS from continuing operations for the fourth quarter of 2015 was $0.81, a decrease of 20% over an adjusted EPS of $1.01 in the prior year period. EPS for the fourth quarter ended December 31, 2015 and December 31, 2014 includes restructuring costs of $0.08 EPS and $0.16 EPS, respectively.

Revenue for the year ended December 31, 2015 was $7.0 billion, a decrease of 10% over the prior year, reflecting an organic revenue decline of 10% and an unfavorable impact from foreign exchange of 4%, offset by 4% growth from acquisitions. Earnings from continuing operations for the year ended December 31, 2015 were $595.9 million, a decrease of 23% as compared to $778.1 million for the prior year period. Diluted EPS for the year ended December 31, 2015 was $3.74, compared to $4.61 EPS in the prior year period, representing a decrease of 19%. EPS from continuing operations for the year ended December 31, 2015 included discrete tax benefits of $0.11, compared to $0.07 EPS in the prior year period. Excluding these items, adjusted EPS from continuing operations decreased 20% to $3.63 from an adjusted EPS of $4.54 in the prior year period. EPS for the year ended December 31, 2015 and 2014 includes restructuring costs of $0.25 EPS and $0.19 EPS, respectively.

Robert A. Livingston, Dover's President and Chief Executive Officer, said, "Fourth quarter and full year results continued to be impacted by tough business conditions, particularly in oil & gas markets. In this environment, we delivered fourth quarter adjusted EPS of $0.81, driven by solid execution, as our teams continued to pursue customer wins, cost actions and productivity initiatives.

“During 2015, we increased our efforts around operating efficiencies through our Dover Excellence program. One key element of this program focuses on free cash flow generation, which increased to $795 million for the year. This program also supports our ongoing investment in product innovation and customer expansion activities. Additionally, during the year we took multiple steps to right-size our businesses to reflect difficult market conditions, especially in our Energy segment. These initiatives will remain a focus as we move into 2016.

“Regarding 2016, we are reaffirming EPS to be in the range of $3.85 to $4.05. This guidance reflects a lower revenue forecast driven by weaker oil & gas markets, essentially offset by an improved tax rate. In total, our full-year revenue growth, on an adjusted basis, is now anticipated to be in the range of 1% to 4%, comprising an organic revenue decline of (4%) to (1%), one point below our prior forecast. Acquisition growth of 7% and a 2% impact from FX remain unchanged from our prior forecast.”

Net earnings for the fourth quarter ended December 31, 2015, were $141.8 million, or $0.91 EPS, which included earnings from discontinued operations of $5.3 million, compared to net earnings of $169.3 million, or $1.02 EPS, for the same period of 2014, which included a loss from discontinued operations of $2.5 million, or $0.02 EPS.

Net earnings for the year ended December 31, 2015, were $869.8 million, or $5.46 EPS, which included earnings from discontinued operations of $273.9 million, or $1.72 EPS, compared to net earnings of $775.2 million, or $4.59 EPS, for the same period of 2014, which included a loss from discontinued operations of $2.9 million, or $0.02 EPS. 2015 earnings from discontinued operations included gains of $265.6 million, or $1.67 EPS, resulting from the disposition of two businesses held for sale.

Dover will host a webcast of its fourth quarter 2015 conference call at 10:00 A.M. Eastern Time (9:00 A.M. Central Time) on Tuesday, January 26, 2016. The webcast can be accessed on the Dover website at www.dovercorporation.com. The conference call will also be made available for replay on the website. Additional information on Dover’s fourth quarter results and its operating segments can also be found on the Company’s website.

About Dover:

Dover is a diversified global manufacturer with annual revenues of approximately $7 billion. We deliver innovative equipment and components, specialty systems and support services through four major operating segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment. Dover combines global scale with operational agility to lead the markets we serve. Recognized for our entrepreneurial approach for 60 years, our team of 26,000 employees takes an ownership mindset, collaborating with customers to redefine what’s possible. Headquartered in Downers Grove, Illinois, Dover trades on the New York Stock Exchange under “DOV.” Additional information is available at www.dovercorporation.com.

Forward-Looking Statements:

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such statements relate to, among other things, operating and strategic plans, income, earnings, cash flows, foreign exchange, changes in operations, acquisitions, industries in which Dover businesses operate, anticipated market conditions and our positioning, global economies, and operating improvements. Forward-looking statements may be indicated by words or phrases such as “anticipates,” “expects,” “believes,” “suggests,” “will,” “plans,” “should,” “would,” “could,” and “forecast”, or the use of the future tense and similar words or phrases. Forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from current expectations, including, but not limited to, oil and natural gas demand, production growth, and prices; changes in exploration and production spending by Dover’s customers and changes in the level of oil and natural gas exploration and development; changes in customer demand and capital spending; economic conditions generally and changes in economic conditions globally and in markets served by Dover businesses, including well activity and U.S. industrials activity; Dover's ability to achieve expected savings from integration and other cost-control initiatives, such as lean and productivity programs as well as efforts to reduce sourcing input costs; the impact of interest rate and currency exchange rate fluctuations; the ability of Dover's businesses to expand into new geographic markets; Dover's ability to identify and successfully consummate value-adding acquisition opportunities or planned divestitures; the impact of loss of a significant customer, or loss or non-renewal of significant contracts; the ability of Dover's businesses to develop and launch new products, timing of such launches and risks relating to market acceptance by customers; the relative mix of products and services which impacts margins and operating efficiencies; increased competition and pricing pressures; the impact of loss of a single-source manufacturing facility; short-term capacity constraints; increases in the cost of raw materials; domestic and foreign governmental and public policy changes or developments, including environmental regulations, conflict minerals disclosure requirements, tax policies, and export/import laws; protection and validity of patent and other intellectual property rights; the impact of legal matters and legal compliance risks; conditions and events affecting domestic and global financial and capital markets; and a downgrade in Dover's credit ratings which, among other matters, could make obtaining financing more difficult and costly. Dover refers you to the documents that it files from time to time with the Securities and Exchange Commission, such as its reports on Form 10-K, Form 10-Q and Form 8-K, for a discussion of these and other risks and uncertainties that could cause its actual results to differ materially from its current expectations and from the forward-looking statements contained herein. Dover undertakes no obligation to update any forward-looking statement, except as required by law.

INVESTOR SUPPLEMENT - FOURTH QUARTER AND FULL YEAR 2015

DOVER CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(unaudited)(in thousands, except per share data)

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Revenue | $ | 1,694,600 | $ | 1,977,947 | $ | 6,956,311 | $ | 7,752,728 | |||||||

Cost of goods and services | 1,080,791 | 1,254,079 | 4,388,167 | 4,778,479 | |||||||||||

Gross profit | 613,809 | 723,868 | 2,568,144 | 2,974,249 | |||||||||||

Selling and administrative expenses | 414,365 | 460,377 | 1,647,382 | 1,758,765 | |||||||||||

Operating earnings | 199,444 | 263,491 | 920,762 | 1,215,484 | |||||||||||

Interest expense, net | 31,249 | 31,332 | 127,257 | 127,179 | |||||||||||

Other (income) expense, net | (1,295 | ) | 1,172 | (7,105 | ) | (5,902 | ) | ||||||||

Earnings before provision for income taxes and discontinued operations | 169,490 | 230,987 | 800,610 | 1,094,207 | |||||||||||

Provision for income taxes | 32,916 | 59,152 | 204,729 | 316,067 | |||||||||||

Earnings from continuing operations | 136,574 | 171,835 | 595,881 | 778,140 | |||||||||||

Earnings (loss) from discontinued operations, net | 5,251 | (2,541 | ) | 273,948 | (2,905 | ) | |||||||||

Net earnings | $ | 141,825 | $ | 169,294 | $ | 869,829 | $ | 775,235 | |||||||

Basic earnings per common share: | |||||||||||||||

Earnings from continuing operations | $ | 0.88 | $ | 1.04 | $ | 3.78 | $ | 4.67 | |||||||

Earnings (loss) from discontinued operations, net | 0.03 | (0.02 | ) | 1.74 | (0.02 | ) | |||||||||

Net earnings | 0.92 | 1.03 | 5.52 | 4.65 | |||||||||||

Weighted average shares outstanding | 154,986 | 164,589 | 157,619 | 166,692 | |||||||||||

Diluted earnings per common share: | |||||||||||||||

Earnings from continuing operations | $ | 0.87 | $ | 1.03 | $ | 3.74 | $ | 4.61 | |||||||

Earnings (loss) from discontinued operations, net | 0.03 | (0.02 | ) | 1.72 | (0.02 | ) | |||||||||

Net earnings | 0.91 | 1.02 | 5.46 | 4.59 | |||||||||||

Weighted average shares outstanding | 156,254 | 166,467 | 159,172 | 168,842 | |||||||||||

Dividends paid per common share | $ | 0.42 | $ | 0.40 | $ | 1.64 | $ | 1.55 | |||||||

DOVER CORPORATION

QUARTERLY SEGMENT INFORMATION

(unaudited)(in thousands)

2015 | 2014 | ||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | FY 2015 | Q1 | Q2 | Q3 | Q4 | FY 2014 | ||||||||||||||||||||||

REVENUE | |||||||||||||||||||||||||||||||

Energy | $ | 430,423 | $ | 366,044 | $ | 363,872 | $ | 323,341 | $ | 1,483,680 | $ | 478,773 | $ | 481,016 | $ | 507,334 | $ | 550,116 | $ | 2,017,239 | |||||||||||

Engineered Systems | |||||||||||||||||||||||||||||||

Printing & Identification | 230,181 | 229,934 | 227,992 | 255,563 | 943,670 | 231,679 | 252,354 | 257,282 | 247,569 | 988,884 | |||||||||||||||||||||

Industrials | 343,015 | 363,157 | 351,404 | 341,667 | 1,399,243 | 335,995 | 361,467 | 355,019 | 344,600 | 1,397,081 | |||||||||||||||||||||

573,196 | 593,091 | 579,396 | 597,230 | 2,342,913 | 567,674 | 613,821 | 612,301 | 592,169 | 2,385,965 | ||||||||||||||||||||||

Fluids | 340,236 | 351,511 | 352,018 | 355,508 | 1,399,273 | 345,009 | 346,275 | 361,797 | 377,485 | 1,430,566 | |||||||||||||||||||||

Refrigeration & Food Equipment | 372,097 | 448,115 | 492,460 | 418,758 | 1,731,430 | 411,493 | 522,357 | 528,807 | 458,532 | 1,921,189 | |||||||||||||||||||||

Intra-segment eliminations | (451 | ) | (133 | ) | (164 | ) | (237 | ) | (985 | ) | (379 | ) | (833 | ) | (664 | ) | (355 | ) | (2,231 | ) | |||||||||||

Total consolidated revenue | $ | 1,715,501 | $ | 1,758,628 | $ | 1,787,582 | $ | 1,694,600 | $ | 6,956,311 | $ | 1,802,570 | $ | 1,962,636 | $ | 2,009,575 | $ | 1,977,947 | $ | 7,752,728 | |||||||||||

NET EARNINGS | |||||||||||||||||||||||||||||||

Segment Earnings: | |||||||||||||||||||||||||||||||

Energy | $ | 52,305 | $ | 40,909 | $ | 48,726 | $ | 31,250 | $ | 173,190 | $ | 118,968 | $ | 114,991 | $ | 122,738 | $ | 105,118 | $ | 461,815 | |||||||||||

Engineered Systems | 88,149 | 96,702 | 102,866 | 89,244 | 376,961 | 83,227 | 101,766 | 108,800 | 93,205 | 386,998 | |||||||||||||||||||||

Fluids | 54,634 | 70,168 | 74,911 | 62,404 | 262,117 | 57,942 | 63,112 | 67,559 | 63,026 | 251,639 | |||||||||||||||||||||

Refrigeration & Food Equipment | 36,150 | 65,732 | 76,665 | 42,752 | 221,299 | 44,862 | 84,926 | 78,012 | 30,934 | 238,734 | |||||||||||||||||||||

Total Segments | 231,238 | 273,511 | 303,168 | 225,650 | 1,033,567 | 304,999 | 364,795 | 377,109 | 292,283 | 1,339,186 | |||||||||||||||||||||

Corporate expense / other | 34,526 | 20,382 | 25,881 | 24,911 | 105,700 | 30,734 | 29,287 | 27,815 | 29,964 | 117,800 | |||||||||||||||||||||

Net interest expense | 32,037 | 31,988 | 31,983 | 31,249 | 127,257 | 32,655 | 31,961 | 31,231 | 31,332 | 127,179 | |||||||||||||||||||||

Earnings from continuing operations before provision for income taxes | 164,675 | 221,141 | 245,304 | 169,490 | 800,610 | 241,610 | 303,547 | 318,063 | 230,987 | 1,094,207 | |||||||||||||||||||||

Provision for income taxes | 47,485 | 65,507 | 58,821 | 32,916 | 204,729 | 71,569 | 92,966 | 92,380 | 59,152 | 316,067 | |||||||||||||||||||||

Earnings from continuing operations | 117,190 | 155,634 | 186,483 | 136,574 | 595,881 | 170,041 | 210,581 | 225,683 | 171,835 | 778,140 | |||||||||||||||||||||

Earnings (loss) from discontinued operations, net | 92,320 | 176,762 | (385 | ) | 5,251 | 273,948 | (9,903 | ) | 3,378 | 6,161 | (2,541 | ) | (2,905 | ) | |||||||||||||||||

Net earnings | $ | 209,510 | $ | 332,396 | $ | 186,098 | $ | 141,825 | $ | 869,829 | $ | 160,138 | $ | 213,959 | $ | 231,844 | $ | 169,294 | $ | 775,235 | |||||||||||

SEGMENT OPERATING MARGIN | |||||||||||||||||||||||||||||||

Energy | 12.2 | % | 11.2 | % | 13.4 | % | 9.7 | % | 11.7 | % | 24.8 | % | 23.9 | % | 24.2 | % | 19.1 | % | 22.9 | % | |||||||||||

Engineered Systems | 15.4 | % | 16.3 | % | 17.8 | % | 14.9 | % | 16.1 | % | 14.7 | % | 16.6 | % | 17.8 | % | 15.7 | % | 16.2 | % | |||||||||||

Fluids | 16.1 | % | 20.0 | % | 21.3 | % | 17.6 | % | 18.7 | % | 16.8 | % | 18.2 | % | 18.7 | % | 16.7 | % | 17.6 | % | |||||||||||

Refrigeration & Food Equipment | 9.7 | % | 14.7 | % | 15.6 | % | 10.2 | % | 12.8 | % | 10.9 | % | 16.3 | % | 14.8 | % | 6.7 | % | 12.4 | % | |||||||||||

Total Segment | 13.5 | % | 15.6 | % | 17.0 | % | 13.3 | % | 14.9 | % | 16.9 | % | 18.6 | % | 18.8 | % | 14.8 | % | 17.3 | % | |||||||||||

DEPRECIATION AND AMORTIZATION EXPENSE | |||||||||||||||||||||||||||||||

Energy | $ | 34,427 | $ | 32,740 | $ | 31,858 | $ | 42,754 | $ | 141,779 | $ | 25,575 | $ | 25,807 | $ | 27,145 | $ | 33,429 | $ | 111,956 | |||||||||||

Engineered Systems | 14,526 | 14,392 | 14,503 | 16,493 | 59,914 | 15,850 | 15,982 | 15,334 | 14,780 | 61,946 | |||||||||||||||||||||

Fluids | 13,848 | 13,648 | 13,367 | 15,215 | 56,078 | 16,366 | 15,308 | 14,019 | 15,210 | 60,903 | |||||||||||||||||||||

Refrigeration & Food Equipment | 16,458 | 16,406 | 16,609 | 16,601 | 66,074 | 17,212 | 17,451 | 17,073 | 16,965 | 68,701 | |||||||||||||||||||||

Corporate | 923 | 841 | 837 | 643 | 3,244 | 870 | 1,000 | 910 | 902 | 3,682 | |||||||||||||||||||||

$ | 80,182 | $ | 78,027 | $ | 77,174 | $ | 91,706 | $ | 327,089 | $ | 75,873 | $ | 75,548 | $ | 74,481 | $ | 81,286 | $ | 307,188 | ||||||||||||

DOVER CORPORATION

QUARTERLY SEGMENT INFORMATION

(continued)

(unaudited)(in thousands)

2015 | 2014 | ||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | FY 2015 | Q1 | Q2 | Q3 | Q4 | FY 2014 | ||||||||||||||||||||||

BOOKINGS | |||||||||||||||||||||||||||||||

Energy | $ | 416,628 | $ | 345,079 | $ | 351,557 | $ | 315,996 | $ | 1,429,260 | $ | 478,469 | $ | 477,162 | $ | 526,134 | $ | 534,646 | $ | 2,016,411 | |||||||||||

Engineered Systems | |||||||||||||||||||||||||||||||

Printing & Identification | 235,617 | 224,203 | 226,756 | 250,639 | 937,215 | 250,416 | 245,429 | 249,288 | 248,071 | 993,204 | |||||||||||||||||||||

Industrials | 337,070 | 336,173 | 338,744 | 357,451 | 1,369,438 | 370,949 | 363,773 | 342,687 | 374,438 | 1,451,847 | |||||||||||||||||||||

572,687 | 560,376 | 565,500 | 608,090 | 2,306,653 | 621,365 | 609,202 | 591,975 | 622,509 | 2,445,051 | ||||||||||||||||||||||

Fluids | 339,310 | 333,695 | 357,032 | 321,154 | 1,351,191 | 362,943 | 375,009 | 350,853 | 345,553 | 1,434,358 | |||||||||||||||||||||

Refrigeration & Food Equipment | 419,659 | 486,793 | 430,681 | 379,967 | 1,717,100 | 493,731 | 542,810 | 459,099 | 367,567 | 1,863,207 | |||||||||||||||||||||

Intra-segment eliminations | (628 | ) | (417 | ) | (385 | ) | (486 | ) | (1,916 | ) | (506 | ) | (1,089 | ) | (737 | ) | (644 | ) | (2,976 | ) | |||||||||||

Total consolidated bookings | $ | 1,747,656 | $ | 1,725,526 | $ | 1,704,385 | $ | 1,624,721 | $ | 6,802,288 | $ | 1,956,002 | $ | 2,003,094 | $ | 1,927,324 | $ | 1,869,631 | $ | 7,756,051 | |||||||||||

BACKLOG | |||||||||||||||||||||||||||||||

Energy | $ | 212,060 | $ | 194,819 | $ | 156,631 | $ | 155,586 | $ | 210,846 | $ | 206,415 | $ | 232,739 | $ | 233,347 | |||||||||||||||

Engineered Systems | |||||||||||||||||||||||||||||||

Printing & Identification | 108,151 | 103,403 | 100,476 | 98,288 | 131,298 | 128,912 | 115,352 | 110,359 | |||||||||||||||||||||||

Industrials | 276,598 | 248,592 | 236,298 | 250,725 | 266,517 | 268,680 | 254,612 | 282,598 | |||||||||||||||||||||||

384,749 | 351,995 | 336,774 | 349,013 | 397,815 | 397,592 | 369,964 | 392,957 | ||||||||||||||||||||||||

Fluids | 259,504 | 240,389 | 236,608 | 243,459 | 328,617 | 348,508 | 323,424 | 277,834 | |||||||||||||||||||||||

Refrigeration & Food Equipment | 337,084 | 373,193 | 307,351 | 247,352 | 431,298 | 450,065 | 376,141 | 282,507 | |||||||||||||||||||||||

Intra-segment eliminations | (595 | ) | (354 | ) | (598 | ) | (808 | ) | (374 | ) | (211 | ) | (302 | ) | (431 | ) | |||||||||||||||

Total consolidated backlog | $ | 1,192,802 | $ | 1,160,042 | $ | 1,036,766 | $ | 994,602 | $ | 1,368,202 | $ | 1,402,369 | $ | 1,301,966 | $ | 1,186,214 | |||||||||||||||

DOVER CORPORATION

QUARTERLY EARNINGS PER SHARE

(unaudited)(in thousands, except per share data*)

2015 | 2014 | ||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | FY 2015 | Q1 | Q2 | Q3 | Q4 | FY 2014 | ||||||||||||||||||||||

Basic earnings (loss) per common share: | |||||||||||||||||||||||||||||||

Continuing operations | $ | 0.72 | $ | 0.98 | $ | 1.20 | $ | 0.88 | $ | 3.78 | $ | 1.00 | $ | 1.26 | $ | 1.36 | $ | 1.04 | $ | 4.67 | |||||||||||

Discontinued operations | 0.57 | 1.11 | — | 0.03 | 1.74 | $ | (0.06 | ) | $ | 0.02 | $ | 0.04 | $ | (0.02 | ) | $ | (0.02 | ) | |||||||||||||

Net earnings | 1.30 | 2.10 | 1.20 | 0.92 | 5.52 | $ | 0.94 | $ | 1.29 | $ | 1.40 | $ | 1.03 | $ | 4.65 | ||||||||||||||||

Diluted earnings (loss) per common share: | |||||||||||||||||||||||||||||||

Continuing operations | $ | 0.72 | $ | 0.97 | $ | 1.19 | $ | 0.87 | $ | 3.74 | $ | 0.99 | $ | 1.25 | $ | 1.34 | $ | 1.03 | $ | 4.61 | |||||||||||

Discontinued operations | 0.57 | 1.10 | — | 0.03 | 1.72 | $ | (0.06 | ) | $ | 0.02 | $ | 0.04 | $ | (0.02 | ) | $ | (0.02 | ) | |||||||||||||

Net earnings | 1.28 | 2.07 | 1.19 | 0.91 | 5.46 | $ | 0.93 | $ | 1.27 | $ | 1.38 | $ | 1.02 | $ | 4.59 | ||||||||||||||||

Adjusted diluted earnings per common share (calculated below): | |||||||||||||||||||||||||||||||

Continuing operations | $ | 0.72 | $ | 0.97 | $ | 1.14 | $ | 0.81 | $ | 3.63 | $ | 0.97 | $ | 1.25 | $ | 1.31 | $ | 1.01 | $ | 4.54 | |||||||||||

Net earnings (loss) and average shares used in calculated earnings (loss) per share amounts are as follows: | |||||||||||||||||||||||||||||||

Net earnings (loss): | |||||||||||||||||||||||||||||||

Continuing operations | $ | 117,190 | $ | 155,634 | $ | 186,483 | $ | 136,574 | $ | 595,881 | $ | 170,041 | $ | 210,581 | $ | 225,683 | $ | 171,835 | $ | 778,140 | |||||||||||

Discontinued operations | 92,320 | 176,762 | (385 | ) | 5,251 | 273,948 | (9,903 | ) | 3,378 | 6,161 | (2,541 | ) | (2,905 | ) | |||||||||||||||||

Net earnings | 209,510 | 332,396 | 186,098 | 141,825 | 869,829 | 160,138 | 213,959 | 231,844 | 169,294 | 775,235 | |||||||||||||||||||||

Average shares outstanding: | |||||||||||||||||||||||||||||||

Basic | 161,650 | 158,640 | 155,300 | 154,986 | 157,619 | 169,750 | 166,474 | 166,021 | 164,589 | 166,692 | |||||||||||||||||||||

Diluted | 163,323 | 160,398 | 156,560 | 156,254 | 159,172 | 172,013 | 168,857 | 168,343 | 166,467 | 168,842 | |||||||||||||||||||||

Note: | |||||||||||||||||||||||||||||||

Earnings from continuing operations are adjusted by discrete tax items to derive adjusted earnings from continuing operations and adjusted diluted earnings per common share as follows: | |||||||||||||||||||||||||||||||

2015 | 2014 | ||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | FY 2015 | Q1 | Q2 | Q3 | Q4 | FY 2014 | ||||||||||||||||||||||

Adjusted earnings from continuing operations: | |||||||||||||||||||||||||||||||

Earnings from continuing operations | $ | 117,190 | $ | 155,634 | $ | 186,483 | $ | 136,574 | $ | 595,881 | $ | 170,041 | $ | 210,581 | $ | 225,683 | $ | 171,835 | $ | 778,140 | |||||||||||

Gains (losses) from discrete and other tax items | — | — | 8,131 | 9,382 | 17,513 | 2,541 | (635 | ) | 5,524 | 3,860 | 11,290 | ||||||||||||||||||||

Adjusted earnings from continuing operations | $ | 117,190 | $ | 155,634 | $ | 178,352 | $ | 127,192 | $ | 578,368 | $ | 167,500 | $ | 211,216 | $ | 220,159 | $ | 167,975 | $ | 766,850 | |||||||||||

Adjusted diluted earnings per common share: | |||||||||||||||||||||||||||||||

Earnings from continuing operations | $ | 0.72 | $ | 0.97 | $ | 1.19 | $ | 0.87 | $ | 3.74 | $ | 0.99 | $ | 1.25 | $ | 1.34 | $ | 1.03 | $ | 4.61 | |||||||||||

Gains (losses) from discrete and other tax items | — | — | 0.05 | 0.06 | 0.11 | 0.01 | — | 0.03 | 0.02 | 0.07 | |||||||||||||||||||||

Adjusted earnings from continuing operations | $ | 0.72 | $ | 0.97 | $ | 1.14 | $ | 0.81 | $ | 3.63 | $ | 0.97 | $ | 1.25 | $ | 1.31 | $ | 1.01 | $ | 4.54 | |||||||||||

* Per share data may not add due to rounding. | |||||||||||||||||||||||||||||||

DOVER CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

December 31, 2015 | December 31, 2014 | ||||||

Assets: | |||||||

Cash and cash equivalents | $ | 362,185 | $ | 681,581 | |||

Receivables, net of allowances | 1,120,490 | 1,186,746 | |||||

Inventories, net | 802,895 | 863,737 | |||||

Other current assets | 135,209 | 101,905 | |||||

Property, plant and equipment, net | 854,269 | 837,069 | |||||

Goodwill | 3,737,389 | 3,491,557 | |||||

Intangible assets, net | 1,413,223 | 1,369,520 | |||||

Deferred taxes and other assets | 194,103 | 171,005 | |||||

Assets of discontinued operations | — | 327,171 | |||||

Total assets | $ | 8,619,763 | $ | 9,030,291 | |||

Liabilities and Stockholders' Equity: | |||||||

Notes payable and current maturities of long-term debt | $ | 151,122 | $ | 777,956 | |||

Payables and accrued expenses | 1,216,060 | 1,260,893 | |||||

Deferred taxes and other non-current liabilities | 990,664 | 986,958 | |||||

Long-term debt | 2,617,342 | 2,253,041 | |||||

Liabilities of discontinued operations | — | 50,718 | |||||

Stockholders' equity | 3,644,575 | 3,700,725 | |||||

Total liabilities and stockholders' equity | $ | 8,619,763 | $ | 9,030,291 | |||

DOVER CORPORATION

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited)(in thousands)

Years Ended December 31, | |||||||

2015 | 2014 | ||||||

Operating activities: | |||||||

Net earnings | $ | 869,829 | $ | 775,235 | |||

(Earnings) loss from discontinued operations, net | (273,948 | ) | 2,905 | ||||

Depreciation and amortization | 327,089 | 307,188 | |||||

Stock-based compensation | 30,697 | 31,628 | |||||

Contributions to employee benefit plans | (21,942 | ) | (24,232 | ) | |||

Net change in assets and liabilities | 17,334 | (142,560 | ) | ||||

Net cash provided by operating activities of continuing operations | 949,059 | 950,164 | |||||

Investing activities: | |||||||

Additions to property, plant and equipment | (154,251 | ) | (166,033 | ) | |||

Acquisitions (net of cash and cash equivalents acquired) | (567,843 | ) | (802,254 | ) | |||

Proceeds from the sale of property, plant and equipment | 14,604 | 14,373 | |||||

Proceeds from the sale of businesses | 689,314 | 191,348 | |||||

Settlement of net investment hedge | (17,752 | ) | — | ||||

Other | 1,350 | (19,991 | ) | ||||

Net cash used in investing activities of continuing operations | (34,578 | ) | (782,557 | ) | |||

Financing activities: | |||||||

Cash received from Knowles Corporation, net of cash distributed | — | 359,955 | |||||

Change in notes payable, net | (327,000 | ) | 251,500 | ||||

Net increase in debt | 94,252 | (6,566 | ) | ||||

Dividends to stockholders | (257,969 | ) | (258,487 | ) | |||

Purchase of common stock | (600,164 | ) | (601,077 | ) | |||

Net proceeds from exercise of share-based awards | (1,005 | ) | (814 | ) | |||

Net cash used in financing activities of continuing operations | (1,091,886 | ) | (255,489 | ) | |||

Net cash (used in) provided by discontinued operations | (115,930 | ) | 6,007 | ||||

Effect of exchange rate changes on cash | (26,061 | ) | (40,426 | ) | |||

Net decrease in cash and cash equivalents | (319,396 | ) | (122,301 | ) | |||

Cash and cash equivalents at beginning of period | 681,581 | 803,882 | |||||

Cash and cash equivalents at end of period | $ | 362,185 | $ | 681,581 | |||

DOVER CORPORATION

QUARTERLY FREE CASH FLOW

(unaudited)(in thousands)

2015 | 2014 | ||||||||||||||||||||||||||||||

Q1 | Q2 | Q3 | Q4 | FY 2015 | Q1 | Q2 | Q3 | Q4 | FY 2014 | ||||||||||||||||||||||

Cash flow from operating activities | $ | 131,332 | $ | 218,911 | $ | 282,213 | $ | 316,603 | $ | 949,059 | $ | 28,361 | $ | 185,013 | $ | 292,012 | $ | 444,778 | $ | 950,164 | |||||||||||

Less: Additions to property, plant and equipment | (27,956 | ) | (43,807 | ) | (39,516 | ) | (42,972 | ) | (154,251 | ) | (32,695 | ) | (42,550 | ) | (33,532 | ) | (57,256 | ) | (166,033 | ) | |||||||||||

Free cash flow | $ | 103,376 | $ | 175,104 | $ | 242,697 | $ | 273,631 | $ | 794,808 | $ | (4,334 | ) | $ | 142,463 | $ | 258,480 | $ | 387,522 | $ | 784,131 | ||||||||||

Free cash flow as a percentage of earnings from continuing operations | 88.2 | % | 112.5 | % | 130.1 | % | 200.4 | % | 133.4 | % | (2.5 | )% | 67.7 | % | 114.5 | % | 225.5 | % | 100.8 | % | |||||||||||

Free cash flow as a percentage of revenue | 6.0 | % | 10.0 | % | 13.6 | % | 16.1 | % | 11.4 | % | (0.2 | )% | 7.3 | % | 12.9 | % | 19.6 | % | 10.1 | % | |||||||||||

ADDITIONAL INFORMATION

FOURTH QUARTER AND FULL YEAR 2015

Acquisitions

During the fourth quarter of 2015, the Company completed three acquisitions across the Fluids segment and the Printing & Identification platform of the Engineered Systems segment. For the full year 2015, Dover made a total of four acquisitions for consideration totaling $567.8 million.

Discontinued Operations

For the fourth quarter of 2015, the Company recognized a gain from discontinued operations of $5.3 million, or $0.03 EPS. On a full-year basis, the Company generated net earnings of $273.9 million, or $1.72 EPS. Included in this amount is a $87.8 million gain on sale of Datamax O'Neil, which was sold in the first quarter of 2015 and a $177.8 million gain on sale of Sargent Aerospace, which was sold in the second quarter of 2015. Also included in the results of discontinued operations is $6.3 million of earnings, or $0.04 EPS, attributable to the operations of Datamax O'Neil and Sargent Aerospace.

Restructuring and Other Costs

During the quarter, the Company took actions to adjust our costs and streamline our businesses, resulting in $16.5 million, or $0.08 EPS, of restructuring charges. These charges were incurred primarily at each of our business segments, including $4.2 million in Energy, $4.5 million in Engineered Systems, $1.3 million in Fluids, and $6.3 million in Refrigeration & Food Equipment. For full year, restructuring costs totaled $55.2 million, or $0.25 EPS, of which primarily $30.8 million was incurred in Energy, $13.3 million in Engineered Systems, $4.9 million in Fluids, and $5.8 million in Refrigeration and Food Equipment.

Tax Rate

The effective tax rate on continuing operations was 19.4% and 25.6% for the fourth quarters of 2015 and 2014, respectively. On a full year basis, the effective tax rates on continuing operations for 2015 and 2014 were 25.6% and 28.9%, respectively. The 2015 and 2014 rates were favorably impacted by discrete and other items, as shown in the reconciliation for quarterly earnings per share included herein. After adjusting for discrete and other items, the fourth quarter effective tax rates were 25.0% and 27.3% for 2015 and 2014, respectively, and the full year rates were 27.8% and 29.9% for 2015 and 2014, respectively. The reduction in the effective tax rate year over year is principally due to a change in the geographic mix of earnings as well as restructuring of foreign operations.

Free Cash Flow

The following table is a reconciliation of free cash flow (a non-GAAP measure) from cash flow provided by operating activities:

Three Months Ended December 31, | Years Ended December 31, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Free Cash Flow (dollars in thousands) | |||||||||||||||

Cash flow provided by operating activities | $ | 316,603 | 444,778 | $ | 949,059 | $ | 950,164 | ||||||||

Less: Capital expenditures | (42,972 | ) | (57,256 | ) | (154,251 | ) | (166,033 | ) | |||||||

Free cash flow | $ | 273,631 | $ | 387,522 | $ | 794,808 | $ | 784,131 | |||||||

Free cash flow as a percentage of revenue | 16.1 | % | 19.6 | % | 11.4 | % | 10.1 | % | |||||||

Free cash flow as a percentage of earnings from continuing operations | 133.4 | % | 100.8 | % | |||||||||||

The fourth quarter 2015 decrease in free cash flow reflects lower earnings relative to the prior year driven by lower volume and product mix.

Revenue Growth Factors

2015 | |||||||||||||||

Q1 | Q2 | Q3 | Q4 | Full Year | |||||||||||

Organic | (6 | )% | (10 | )% | (10 | )% | (12 | )% | (10 | )% | |||||

Acquisitions | 5 | % | 4 | % | 3 | % | 2 | % | 4 | % | |||||

Currency translation | (4 | )% | (4 | )% | (4 | )% | (4 | )% | (4 | )% | |||||

(5 | )% | (10 | )% | (11 | )% | (14 | )% | (1) | (10 | )% | (1) | ||||

(1) Includes a decline in revenue in Q4 within the Refrigeration & Food Equipment segment due to the divestiture of a product line.

Share Repurchases

In January 2015, the Board of Directors approved a new standing share repurchase authorization, whereby the Company may repurchase up to 15 million shares of its common stock over the following three years. This plan replaced the Company's $1.0 billion share repurchase program, which it completed in 2014. During the year ended December 31, 2015, the Company purchased a total of approximately 8.2 million shares of its common stock in the open market at a total cost of $600.2 million, or $72.94 per share. As of December 31, 2015, the approximate number of shares still available for repurchase under the January 2015 share repurchase authorization was 6.8 million.

Capitalization

The following table provides a summary reconciliation of total debt and net debt to net capitalization to the most directly comparable GAAP measures:

Net Debt to Net Capitalization Ratio (in thousands) | December 31, 2015 | December 31, 2014 | ||||||

Current maturities of long-term debt | $ | 122 | $ | 299,956 | ||||

Commercial paper | 151,000 | 478,000 | ||||||

Long-term debt | 2,617,342 | 2,253,041 | ||||||

Total debt | 2,768,464 | 3,030,997 | ||||||

Less: Cash and cash equivalents | (362,185 | ) | (681,581 | ) | ||||

Net debt | 2,406,279 | 2,349,416 | ||||||

Add: Stockholders' equity | 3,644,575 | 3,700,725 | ||||||

Net capitalization | $ | 6,050,854 | $ | 6,050,141 | ||||

Net debt to net capitalization | 39.8 | % | 38.8 | % | ||||

Non-GAAP Information:

These Investor Supplement tables contain non-GAAP measures of adjusted earnings from continuing operations used in calculating adjusted diluted earnings per common share, as management believes this information is useful to investors to better understand the company’s ongoing profitability and facilitates easier comparisons of the company’s profitability to prior and future periods and to its peers. The company has also disclosed herein a number of non-GAAP measures related to free cash flow and the ratio of net debt to net capitalization. Management believes these metrics are important measures of the company's operating performance and liquidity. Free cash flow information provides both management and investors a measurement of cash generated from operations that is available to fund acquisitions, pay dividends, repay debt and repurchase common stock, while the net debt to net capitalization ratio is helpful in evaluating the company's capital structure and the amount of leverage employed.

Earnings Conference Call Fourth Quarter 2015 January 26, 2016 – 9:00am CT

2 Forward looking statements and non-GAAP measures We want to remind everyone that our comments may contain forward-looking statements that are inherently subject to uncertainties and risks. We caution everyone to be guided in their analysis of Dover Corporation by referring to the documents we file from time to time with the SEC, including our Form 10-K for 2014, for a list of factors that could cause our results to differ from those anticipated in any such forward-looking statements. We would also direct your attention to our website, www.dovercorporation.com, where considerably more information can be found. This document contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or Dover’s earnings release and investor supplement for the fourth quarter and full year 2015, which are available on our website. 2

3 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 Q1* Q2 Q3* Q4* Q1 Q2 Q3* Q4* Q4 2015 Performance Adjusted Earnings Per Share* (continuing operations) Q4 Q4/Q4 * Excludes discrete & other tax benefits of $0.01 in Q1 2014, $0.03 in Q3 2014, $0.02 in Q4 2014, $0.05 in Q3 2015 and $0.06 in Q4 2015 (b) See Press Release for free cash flow reconciliation 3 Quarterly Comments 2014 2015 Revenue impacted by weak global macros, FX, and tough oil & gas markets, partially offset by acquisition growth US activity declined, largely driven by oil & gas markets and tough comps in retail refrigeration. Asian and European activity softened on reduced capex spending Segment margin impacted by lower volume and acquisition- related costs, partially offset by productivity and the net benefits of prior period restructuring Bookings decline largely driven by oil & gas exposure and FX Book-to-bill of 0.96 Note: Q4 2014 includes restructuring and other costs of $0.17; includes restructuring costs of $0.10 in Q1 2015, $0.01 in Q2 2015, $0.05 in Q3 2015 and $0.08 in Q4 2015 Revenue $1.7B -14% $7.0B -10% Adj. EPS (cont.) $0.81 -20% $3.63 -20% Bookings $1.6B -13% $6.8B -12% Seg. Margin 13.3% -150 bps 14.9% -240 bps Adj. Seg. Margin (a) 14.3% -230 bps 15.7% -220 bps Organic Rev. -12% -10% Acq. Growth 2% 4% FCF (b) $274M -29% $795M 1% FY FY/FY (a) Adjusted for $16.5 million of restructuring in Q4 2015 and $55.2 million for FY 2015, and $37.1 million in Q4 2014 and $44.8 million for FY 2014

4 Revenue Q4 2015 Energy Engineered Systems Fluids Refrigeration & Food Equip Total Organic -40% 4% -6% -6% -12% Acquisitions - 3% 5% 1% 2% Currency -1% -6% -5% -2% -4% Total -41% 1% -6% -7% (a) -14% (a) FY 2015 Energy Engineered Systems Fluids Refrigeration & Food Equip Total Organic -34% 3% 1% -8% -10% Acquisitions 9% 1% 2% 1% 4% Currency -1% -6% -5% -2% -4% Total -26% -2% -2% -9% (a) -10% (a) (a) Adjusted for the impact of the disposition of a product line in Refrigeration & Food Equipment in Q4 2015

5 Printing & ID Industrial $339 $357 $352 $316 $227 $251 $357 $321 $406 $365 $0 $200 $400 $600 $800 DE Q3 DE Q4 DES Q3 DES Q4 DF Q3 DF Q4 DRE Q3 DRE Q4 Sequential Results – Q3 2015 → Q4 2015 5 $351 $342 $364 $323 $228 $255 $352 $356 $459 $402 $0 $200 $400 $600 $800 DE Q3 DE Q4 DES Q3 DES Q4 DF Q3 DF Q4 DRE Q3 DRE Q4 Revenue -11% -10%* -12%* -10% +1% +8% +3% -10% Bookings * Adjusted for the impact of the disposition of a product line in Refrigeration & Food Equipment in Q4 2015 * * * *

6 Energy Revenue decline driven by significantly lower North American oil & gas markets – Middle East markets holding up well – Bearings & Compression’s energy-related markets remain weak on slower OEM build rates Adjusted margin of 10.8% reflects negative product mix and price pressure, partially offset by the benefits of restructuring Bookings decline of 41% driven by macro oil & gas trends Book-to-bill at 0.98 6 Q4 2015 Q4 2014 % Change Revenue $323 $550 -41% Earnings $ 31 $105 -70% Margin 9.7% 19.1% -940 bps Adj. Earnings* $ 35 $111 -68% Adj. Margin* 10.8% 20.2% -940 bps Bookings $316 $535 -41% Revenue by End-Market % of Q4 Revenue Y / Y Growth Drilling & Production 68% -45% Bearings & Compression 21% -23% Automation 11% -41% $ in millions * Q4 2015 and Q4 2014 earnings adjusted for $4M and $6M in restructuring costs, respectively

7 Engineered Systems Solid organic revenue growth, partially offset by impact of FX – 8% organic growth in Printing & Identification reflects strong digital printing markets and solid NA marking and coding markets – Industrial’s organic growth of 1% was led by Environmental Solutions Adjusted margin of 15.7% reflects the impact of a business consolidation, offset by the benefits of completed restructuring Bookings decline primarily reflects impact of FX, up 1% organically Book-to-bill of 1.02 7 Q4 2015 Q4 2014 % Change Revenue $597 $592 1% Earnings $ 89 $ 93 -4% Margin 14.9% 15.7% -80 bps Adj. Earnings* $ 94 $ 97 -3% Adj. Margin* 15.7% 16.4% -70 bps Bookings $608 $623 -2% Revenue by End-Market % of Q4 Revenue Y / Y Growth Printing & Identification 43% 3% Industrial 57% -1% $ in millions * Q4 2015 and Q4 2014 earnings adjusted for $5M and $4M in restructuring costs, respectively

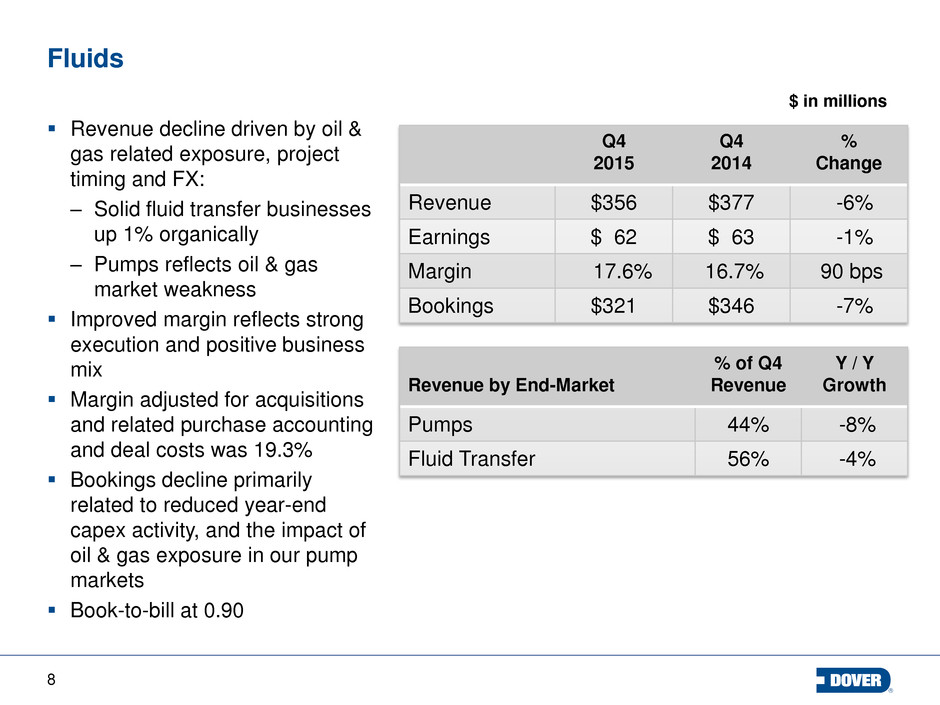

8 Fluids Revenue decline driven by oil & gas related exposure, project timing and FX: – Solid fluid transfer businesses up 1% organically – Pumps reflects oil & gas market weakness Improved margin reflects strong execution and positive business mix Margin adjusted for acquisitions and related purchase accounting and deal costs was 19.3% Bookings decline primarily related to reduced year-end capex activity, and the impact of oil & gas exposure in our pump markets Book-to-bill at 0.90 8 Q4 2015 Q4 2014 % Change Revenue $356 $377 -6% Earnings $ 62 $ 63 -1% Margin 17.6% 16.7% 90 bps Bookings $321 $346 -7% Revenue by End-Market % of Q4 Revenue Y / Y Growth Pumps 44% -8% Fluid Transfer 56% -4% $ in millions

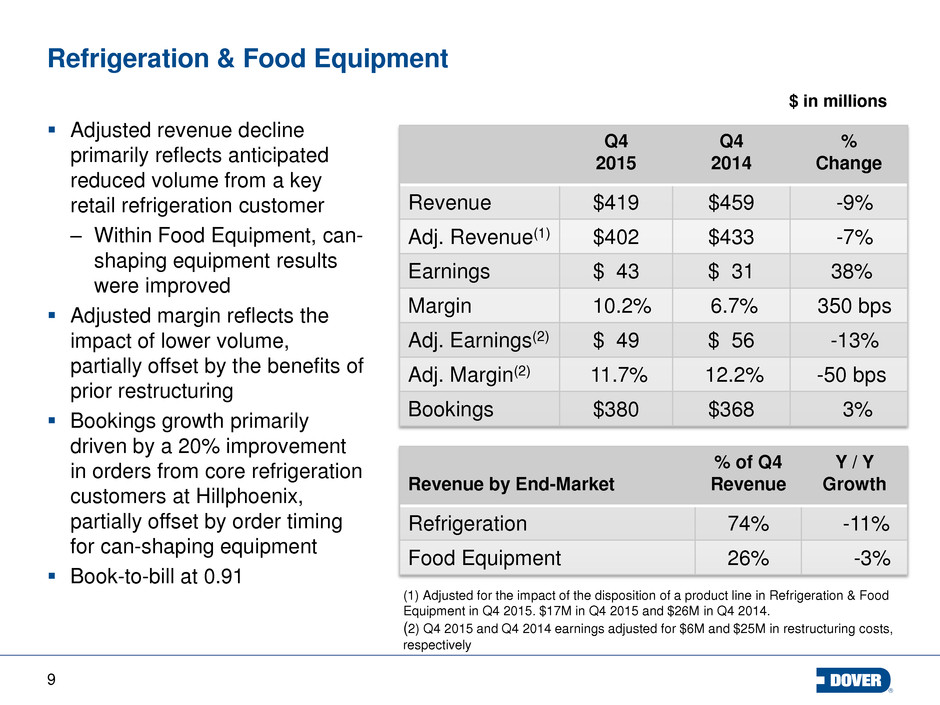

9 Refrigeration & Food Equipment Adjusted revenue decline primarily reflects anticipated reduced volume from a key retail refrigeration customer – Within Food Equipment, can- shaping equipment results were improved Adjusted margin reflects the impact of lower volume, partially offset by the benefits of prior restructuring Bookings growth primarily driven by a 20% improvement in orders from core refrigeration customers at Hillphoenix, partially offset by order timing for can-shaping equipment Book-to-bill at 0.91 9 Q4 2015 Q4 2014 % Change Revenue $419 $459 -9% Adj. Revenue(1) $402 $433 -7% Earnings $ 43 $ 31 38% Margin 10.2% 6.7% 350 bps Adj. Earnings(2) $ 49 $ 56 -13% Adj. Margin(2) 11.7% 12.2% -50 bps Bookings $380 $368 3% Revenue by End-Market % of Q4 Revenue Y / Y Growth Refrigeration 74% -11% Food Equipment 26% -3% $ in millions (2) Q4 2015 and Q4 2014 earnings adjusted for $6M and $25M in restructuring costs, respectively (1) Adjusted for the impact of the disposition of a product line in Refrigeration & Food Equipment in Q4 2015. $17M in Q4 2015 and $26M in Q4 2014.

10 Q4 2015 Overview 10 Q4 2015 Net Interest Expense $31 million, in-line with forecast Corporate Expense $25 million, down $5 million from last year; reflects continuing cost management initiatives Effective Tax Rate (ETR) Q4 rate was 25.0%, excluding discrete tax benefits of $0.06 cents. Rate reflects the benefits from passage of the Tax Relief Extension Act Capex $43 million, generally in-line with expectations Share Repurchases No activity

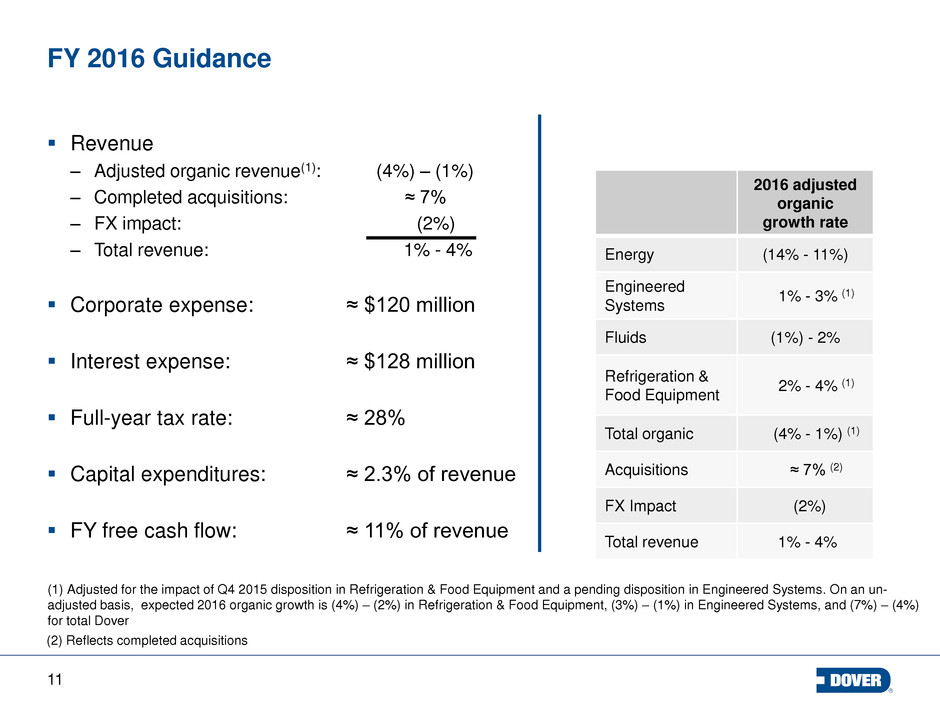

11 FY 2016 Guidance Revenue – Adjusted organic revenue(1): (4%) – (1%) – Completed acquisitions: ≈ 7% – FX impact: (2%) – Total revenue: 1% - 4% Corporate expense: ≈ $120 million Interest expense: ≈ $128 million Full-year tax rate: ≈ 28% Capital expenditures: ≈ 2.3% of revenue FY free cash flow: ≈ 11% of revenue 2016 adjusted organic growth rate Energy (14% - 11%) Engineered Systems 1% - 3% (1) Fluids (1%) - 2% Refrigeration & Food Equipment 2% - 4% (1) Total organic (4% - 1%) (1) Acquisitions ≈ 7% (2) FX Impact (2%) Total revenue 1% - 4% (2) Reflects completed acquisitions (1) Adjusted for the impact of Q4 2015 disposition in Refrigeration & Food Equipment and a pending disposition in Engineered Systems. On an un- adjusted basis, expected 2016 organic growth is (4%) – (2%) in Refrigeration & Food Equipment, (3%) – (1%) in Engineered Systems, and (7%) – (4%) for total Dover

12 2016F EPS Guidance – Bridge 2015 EPS – Continuing Ops (GAAP) $ 3.74 – Less 2015 tax items(1): (0.11) – Less dispositions(2): (0.08) 2015 Adjusted EPS $ 3.55 – Net restructuring(3): 0.15 - 0.17 – Performance including restructuring benefits(4): 0.26 - 0.40 – Compensation & investment: (0.28 - 0.26) – Acquisitions(5): ≈ 0.18 – Shares(6): ≈ 0.08 – Interest / Corp. / Tax rate / Other (net): (0.09 - 0.07) 2016F EPS – Continuing Ops $3.85 - $4.05 (1) $0.05 in Q3 2015 and $0.06 in Q4 2015 (5) Deals completed (6) Based on carryover benefit from 2015 share repurchase activity (3) Includes restructuring costs of $0.25 in FY 2015 and approximately $0.08 - $0.10 in FY 2016 (4) Includes restructuring benefits of $0.23- $0.24 (2) Reflecting the Q4 2015 disposition of a product line in Refrigeration & Food Equipment and the pending disposition of a business in Engineered Systems

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Beacon Appoints Prithvi Gandhi as Executive Vice President and Chief Financial Officer

- Ookla® Ranks Optimum Fiber as Fastest and Most Reliable Internet Speeds in New York and New Jersey

- Markem-Imaje Unveils Multipurpose Ink for Clear Coding on Cable and Other Extruded Products

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share