Form 8-K DLH Holdings Corp. For: Aug 10

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): August 10, 2016

DLH Holdings Corp.

(Exact name of registrant as specified in its charter)

COMMISSION FILE NUMBER: 0-18492

New Jersey 22-1899798

(State or other jurisdiction of incorporation or

organization)

(I.R.S. Employer Identification No.)

3565 Piedmont Road, NE, Bldg. 3, Suite 700

Atlanta, GA 30305

(Address and zip code of principal executive offices)

(866) 952-1647

(Registrant's telephone number, including area code)

CHECK THE APPROPRIATE BOX BELOW IF THE FORM 8-K FILING IS INTENDED TO SIMULTANEOUSLY

SATISFY THE FILING OBLIGATION OF THE REGISTRANT UNDER ANY OF THE FOLLOWING PROVISIONS:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

2

Item 7.01 Regulation FD Disclosure

On August 2, 2016, DLH Holdings Corp. (“DLH”) announced its participation in the Canaccord Genuity

36th Annual Growth Conference in Boston, Massachusetts on August 10, 2016 at 12:30 p.m., eastern time.

At the conference, DLH’s management intends to discuss the information described in the presentation

materials attached to this Current Report as Exhibit 99.1. A copy of DLH’s presentation materials will also

be available on DLH’s website under the “Presentations” tab on the investor relations page at

http://www.dlhcorp.com/investor-relations.aspx.

The slide presentation furnished as Exhibit 99.1 to this Current Report includes “safe harbor” language

pursuant to the Private Securities Litigation Reform Act of 1995, as amended, indicating that certain

statements contained in the slide presentation or in the press release are “forward-looking” rather than

historical.

The information in this Current Report shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The

information in this Current Report shall not be incorporated by reference into any registration statement or

other document pursuant to the Securities Act of 1933, except as shall be expressly set forth by specific

reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibit is attached to this Current Report on Form 8-K:

Exhibit

Number

Exhibit Title or Description

99.1 Presentation Materials of DLH Holdings Corp. to be discussed on August 10, 2016

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused

this report to be signed on its behalf by the undersigned, hereunto duly authorized.

DLH Holdings Corp.

By: /s/ Kathryn M. JohnBull

Name: Kathryn M. JohnBull

Title: Chief Financial Officer

Date: August 10, 2016

4

EXHIBIT INDEX

Exhibit

Number

Exhibit Title or Description

99.1 Presentation Materials of DLH Holdings Corp. to be discussed on August 10, 2016

Integrity & Trust | Performance Excellence | Inclusion & Diversity | Agility

Investor Presentation

August, 2016

Zachary Parker | President & Chief Executive Officer

Kathryn JohnBull | Chief Financial Officer

2

Forward Looking Statement

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements relate to future events or DLH`s future financial performance. Any statements that are not

statements of historical fact (including without limitation statements to the effect that the Company or its management

"believes", "expects", "anticipates", "plans", “intends” and similar expressions) should be considered forward looking

statements that involve risks and uncertainties which could cause actual events or DLH`s actual results to differ

materially from those indicated by the forward-looking statements. For a discussion of such risks and uncertainties, see

“Risk Factors” in the company’s periodic reports filed with the SEC, including our Annual Report on Form 10-K for the

fiscal year ended September 30, 2015. In light of the risks and uncertainties inherent in the forward-looking statements

included herein, the inclusion of such statements should not be regarded as a representation by the Company or any

other person that the objectives and plans of the Company will be achieved. The forward-looking statements contained

in this presentation are made as of the date hereof and may become outdated over time. The Company does not assume

any responsibility for updating any forward-looking statements.

This presentation contains non-GAAP financial information. Management uses this information in its internal analysis of

results and believes that this information may be informative to investors in gauging the quality of our financial

performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures

should be used in conjunction with, rather than instead of, their comparable GAAP measures. A reconciliation of non-

GAAP measures to the comparable GAAP measures presented in this document is contained at the end of this

presentation and in the Company’s most quarterly earnings press releases for the relevant periods indicated in this

presentation.

3

Investor Highlights

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

• “Pure Play” government services provider

• Leading position in growing healthcare markets,

with long-term contracts at attractive federal

agencies

– VA, DoD, HHS, CDC

• Completed transformational acquisition of Danya

– Brings leading contract vehicles, strong margins

– Increases Company revenue base by 50% and aligns with

core end markets

• Strong cash flow and improving balance sheet

• Disciplined management has overhauled company

• Well positioned for higher growth and financial

performance going forward

4© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Who We Are & What We Do

Primary DLH Markets and Offerings

Health Services for

Active Duty Military

and Veterans

• Clinical device research and

development

• Medication Therapy

Management (pharma)

• Access to care (Behavioral and

Medications)

• Case management tools and

services

• Lifecycle management of

medical devices

• Analytics and decision support

systems

• Supply chain and inventory

management

Human

Services &

Solutions

Public Health

and Life

Sciences

5© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

(1) A reconciliation of third quarter fiscal 2016 Adjusted EBITDA, a non-GAAP measure, can be found at the end of this presentation. Historical information can be

found in the quarterly and annual reports filed with the Securities and Exchange Commission, located on the Company website at www.dlhcorp.com/sec-filings.aspx.

DLH Has Dramatically Changed in Six Years

FY2010-2012: Changed Corporate Leadership

FY2011: Long Range Strategic Plan (LRSP) Developed

FY2012: Create Stability and Backlog

FY2013: Project L.E.A.N. Cost Realignment

FY2014-15: Financial Health and Business Development

FY2016: Technology leverage and Acquisition of Danya

6

Transformative Acquisition: Danya – May 2016

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Highly complementary businesses with common core capabilities for complex, nationally

dispersed programs, operational synergies, and new business opportunities

Portfolio Diversification

• Expands DLH’s market opportunity and diversifies its portfolio of healthcare and

human services contracts and programs to four top federal agencies

– Department of Veterans Affairs (“VA”)

– Department of Health and Human Services (“HHS”)

– Department of Defense (“DoD”)

– Centers for Disease Control and Prevention (“CDC”)

Deep Domain Expertise

• Recognized professional subject matter experts and management teams tackling

critical long-term national issues and trends in public health, healthcare delivery,

systems migrations, and compliance monitoring

Corporate Culture

• Common set of values delivered to customers and throughout the workforce:

– Integrity & Trust

– Inclusion & Diversity

7

LTM Trading Performance Relative to Industry (1)

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Government Services: SAIC, BAH, LDOS, CACI, MANT, KEYW, ICFI,

EGL, VSEC, NCIT, VEC, CSRA

Defense Primes: LMT, GD, RTN, BA., NOC, LLL (1) As of August 4, 2016 per S&P Capital IQ

50

70

90

110

130

150

170

190

210

230

Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16

In

de

xe

d Pric

e

82.8%

50

7

90

11

30

15

70

19

210

3

Mar-15 Apr-15 Jun-15 Jul-15 Sep-15 Oct-15 Dec-15 Jan-16 Mar-16

Indexed Price

DLH Government Services Defense Primes Russell 2000

8

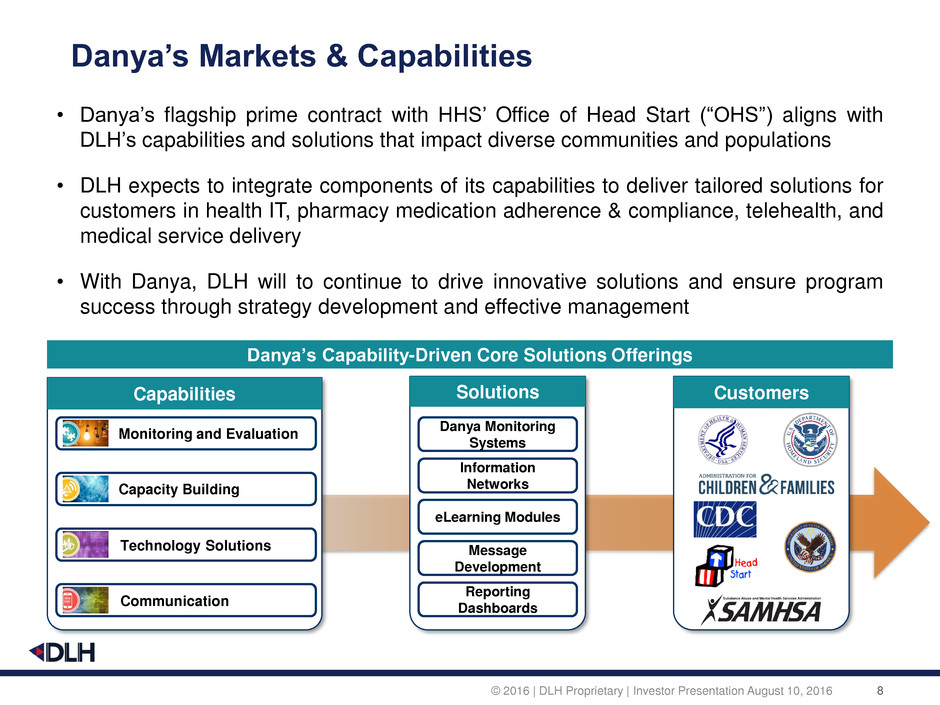

Danya’s Markets & Capabilities

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

• Danya’s flagship prime contract with HHS’ Office of Head Start (“OHS”) aligns with

DLH’s capabilities and solutions that impact diverse communities and populations

• DLH expects to integrate components of its capabilities to deliver tailored solutions for

customers in health IT, pharmacy medication adherence & compliance, telehealth, and

medical service delivery

• With Danya, DLH will to continue to drive innovative solutions and ensure program

success through strategy development and effective management

Danya’s Capability-Driven Core Solutions Offerings

Solutions

Danya Monitoring

Systems

Information

Networks

eLearning Modules

Message

Development

Reporting

Dashboards

Capabilities

Monitoring and Evaluation

Capacity Building

Technology Solutions

Communication

Customers

9

DLH Broad Healthcare Delivery Solutions

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

10

Breadth and Depth in Pharmacy

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Coverage ranging from single clinic to operating in high-volume

automated prescription production and distribution system environments.

• Virtual / Tele-pharmacy services

• Pharmacy systems automation (including robotics),

implementation, and testing

• Bio-hazards management; Med/Surg systems and

equipment

• Cold storage systems; Specialty-meds

• Controlled substance management

• Prescription servicing and Quality Assurance (out-

patient and in-patient)

• Medical warehouse supply chain management

11

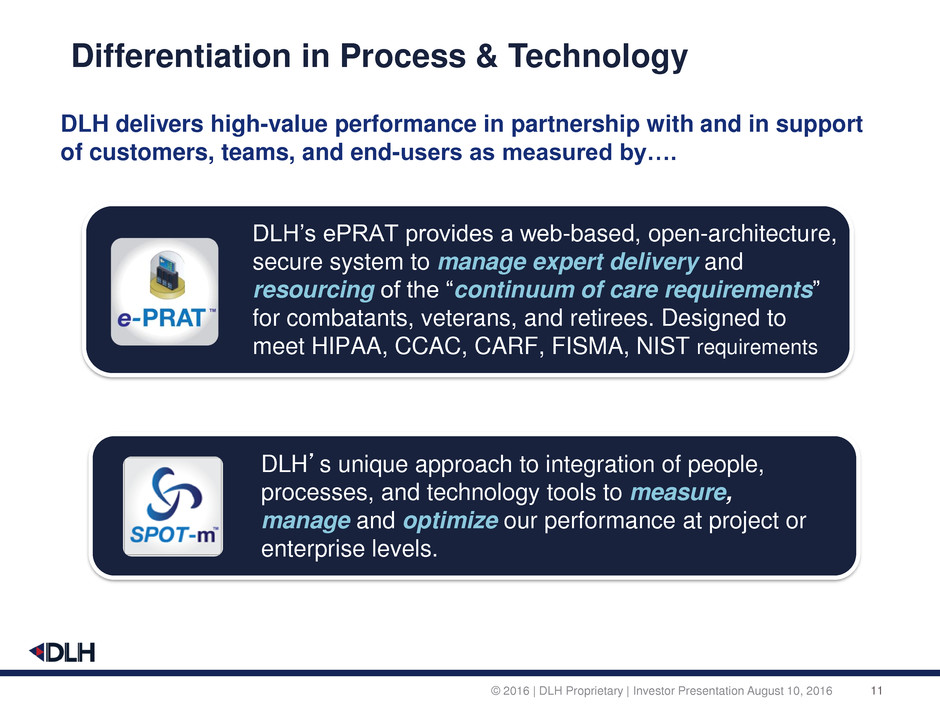

Differentiation in Process & Technology

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

DLH delivers high-value performance in partnership with and in support

of customers, teams, and end-users as measured by….

DLH’s ePRAT provides a web-based, open-architecture,

secure system to manage expert delivery and

resourcing of the “continuum of care requirements”

for combatants, veterans, and retirees. Designed to

meet HIPAA, CCAC, CARF, FISMA, NIST requirements

DLH’s unique approach to integration of people,

processes, and technology tools to measure,

manage and optimize our performance at project or

enterprise levels.

12

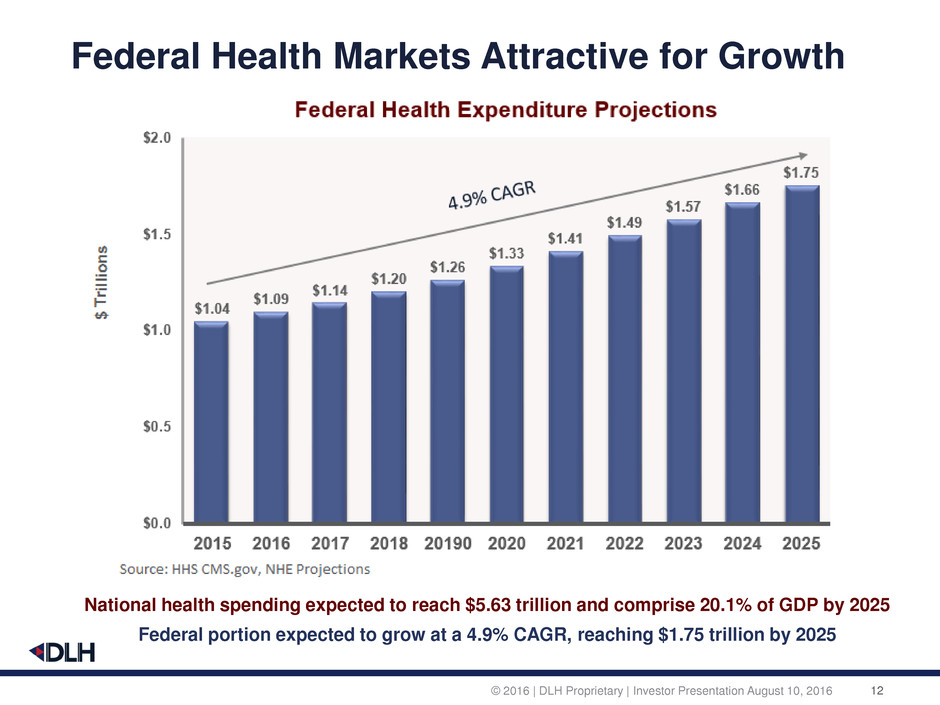

Federal Health Markets Attractive for Growth

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

National health spending expected to reach $5.63 trillion and comprise 20.1% of GDP by 2025

Federal portion expected to grow at a 4.9% CAGR, reaching $1.75 trillion by 2025

13

Buying Behavior: FY2015 HHS Spending

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Source: Federal Procurement Data System, GovWin IQ

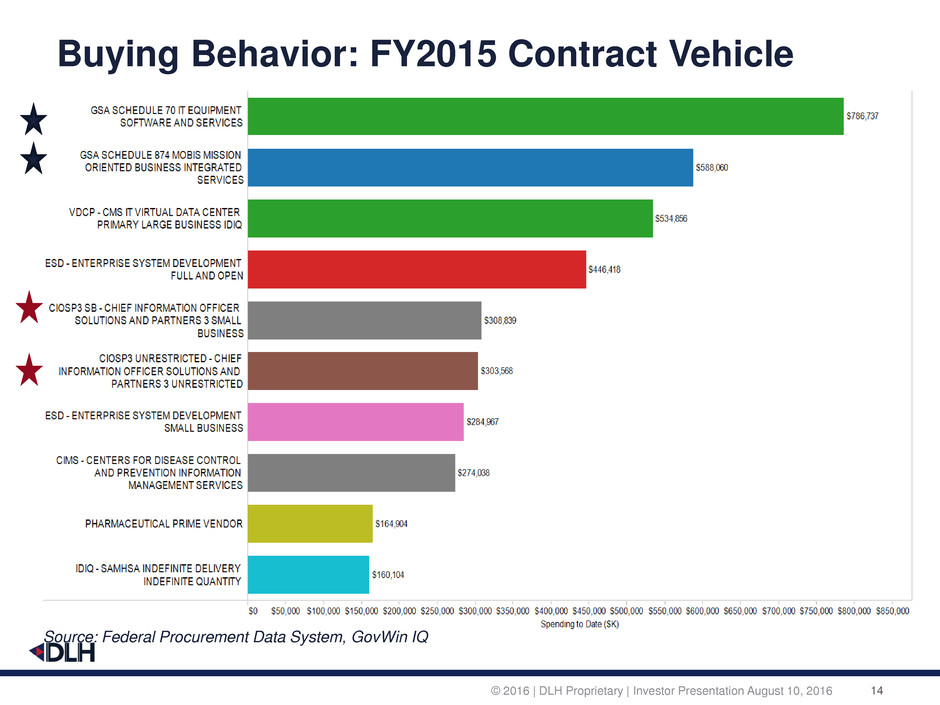

14© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

Buying Behavior: FY2015 Contract Vehicle

Source: Federal Procurement Data System, GovWin IQ

15© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

S

T

RA

T

E

G

IC

MODE

L

P

O

S

IT

IO

NING

K

E

Y

S

DRIVE PRFORMANCE

EXCELLENCE

BUILD UPON CURRENT

DIFFERENTIATORS

BUILD POWERHOUSE

MARKETING POSITION

DEPLOY CAPITAL

FOR GROWTH

NAVIGATE POLITICAL

ENVIRONMENT ISSUES

DLH

P

L

A

Y

B

O

O

K

Organic Growth Acquisitions Margin Expansion Shareholder Value

Leverage outstanding performance track record that has resulted

JD Power award for Veterans Affairs client to expand within the

VA and adjacent federal health oriented markets (including DoD)

GAMEPLAN

GROWTH

Build upon current

market leading

customer satisfaction

Instill continuous

improvement culture

throughout operations

Accelerate technology

refresh cycle time

Prioritize healthcare

COTS solutions where

feasible

Deliver strategically

aligned and robust

“Qualified NB Pipeline”

Expand and align

business development

resources

Make acquisitions

consistent with growth

strategy

Solidify financing

capacity

Ensure adequate and

scaled “Deal Flow”

Increase connectivity

to market “Shapers”

Engage trade

associations & capital

market affiliations

Align composition of

board of directors to fit

Focus growth where government decision makers prioritize “best

value” over “lowest and cheapest price”

Shape new business pursuits around greater complexity work

requirements which typically yield higher gross margins

Use dramatically improved company financial health posture to

add appropriately scaled acquisition to the DLH playbook

16

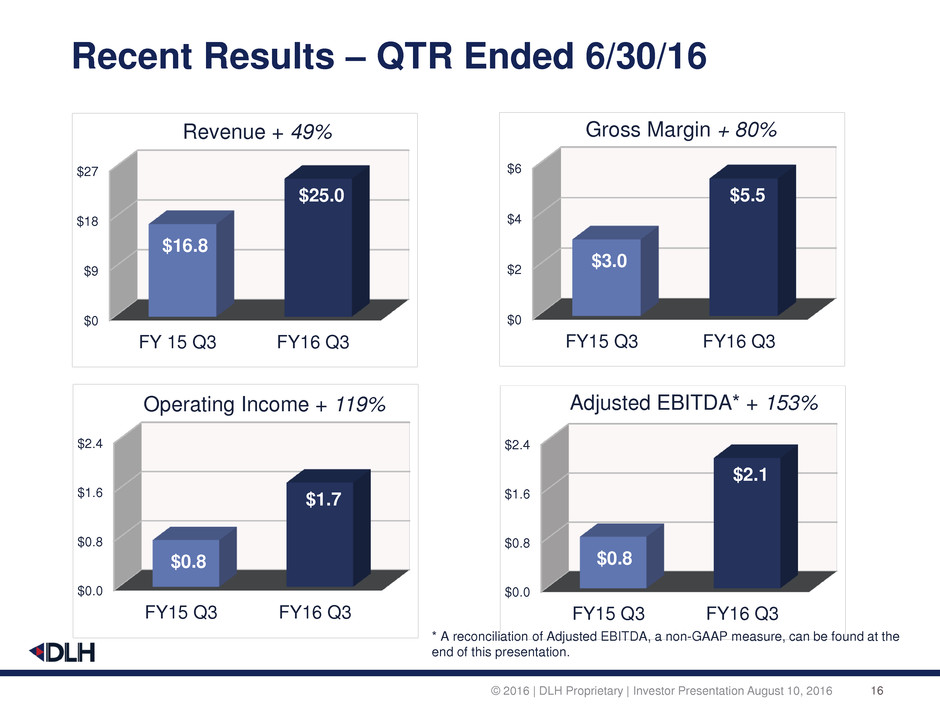

Recent Results – QTR Ended 6/30/16

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

$0

$9

$18

$27

FY 15 Q3 FY16 Q3

$16.8

$25.0

Revenue + 49%

$0

$2

$4

$6

FY15 Q3 FY16 Q3

$3.0

$5.5

Gross Margin + 80%

$0.0

$0.8

$1.6

$2.4

FY15 Q3 FY16 Q3

$0.8

$1.7

Operating Income + 119%

$0.0

$0.8

$1.6

$2.4

FY15 Q3 FY16 Q3

$0.8

$2.1

Adjusted EBITDA* + 153%

* A reconciliation of Adjusted EBITDA, a non-GAAP measure, can be found at the

end of this presentation.

.

17

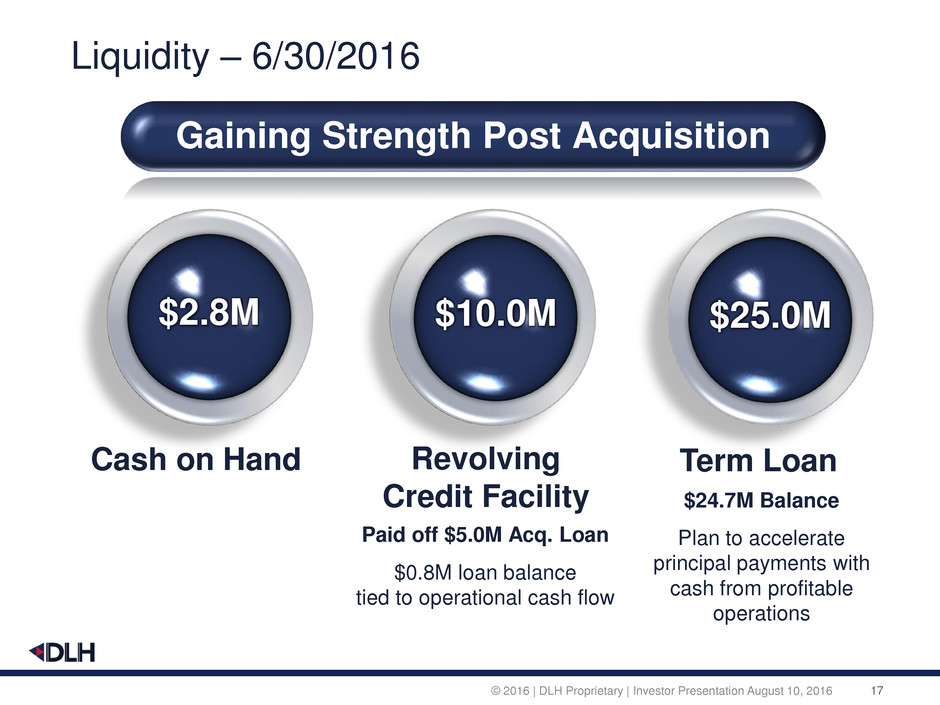

Liquidity – 6/30/2016

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

$25.0M$2.8M $10.0M

Gaining Strength Post Acquisition

Cash on Hand Term LoanRevolving

Credit Facility

Paid off $5.0M Acq. Loan

$0.8M loan balance

tied to operational cash flow

$24.7M Balance

Plan to accelerate

principal payments with

cash from profitable

operations

18

Investor Highlights

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

• “Pure Play” government services provider

• Leading position in growing healthcare markets,

with long-term contracts at attractive federal

agencies

– VA, DoD, HHS, CDC

• Completed transformational acquisition of Danya

– Brings leading contract vehicles, strong margins

– Increases Company revenue base by 50% and aligns with

core end markets

• Strong cash flow and improving balance sheet

• Disciplined management has overhauled company

• Well positioned for higher growth and financial

performance going forward

Integrity & Trust | Performance Excellence | Inclusion & Diversity | Agility

Backup Slides

45

20

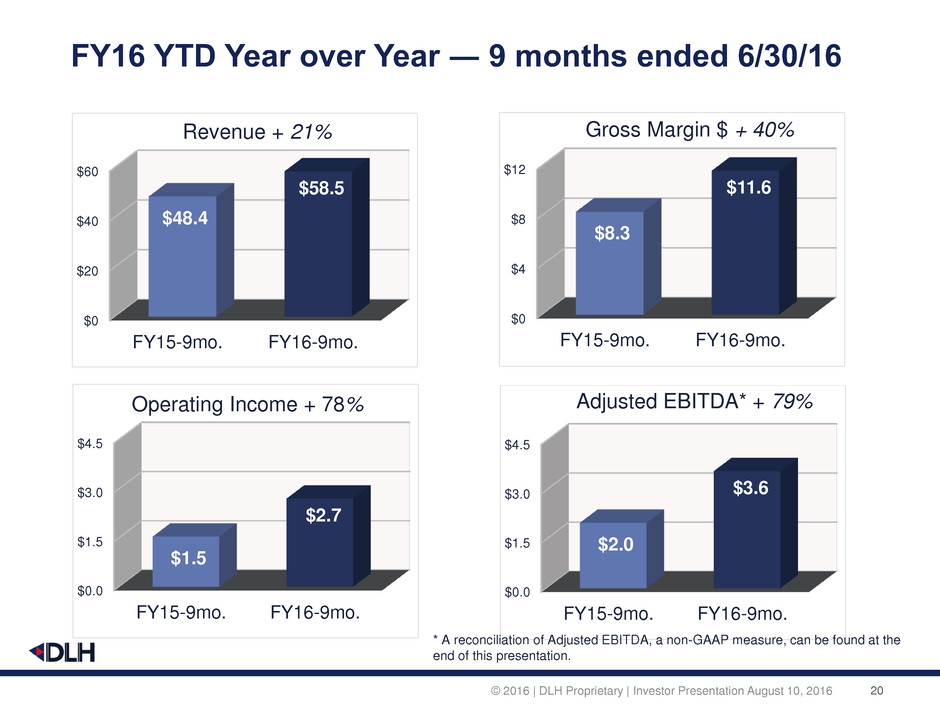

FY16 YTD Year over Year ― 9 months ended 6/30/16

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

$0

$20

$40

$60

FY15-9mo. FY16-9mo.

$48.4

$58.5

Revenue + 21%

$0

$4

$8

$12

FY15-9mo. FY16-9mo.

$8.3

$11.6

Gross Margin $ + 40%

$0.0

$1.5

$3.0

$4.5

FY15-9mo. FY16-9mo.

$1.5

$2.7

Operating Income + 78%

$0.0

$1.5

$3.0

$4.5

FY15-9mo. FY16-9mo.

$2.0

$3.6

Adjusted EBITDA* + 79%

* A reconciliation of Adjusted EBITDA, a non-GAAP measure, can be found at the

end of this presentation.

21

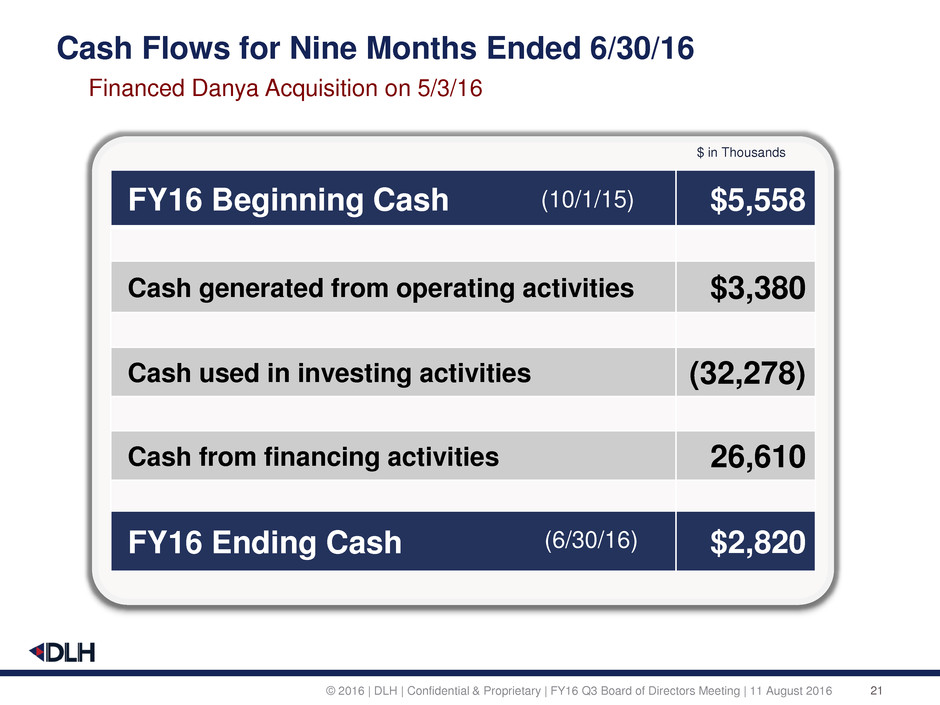

Cash Flows for Nine Months Ended 6/30/16

© 2016 | DLH | Confidential & Proprietary | FY16 Q3 Board of Directors Meeting | 11 August 2016

FY16 Beginning Cash $5,558

Cash generated from operating activities $3,380

Cash used in investing activities (32,278)

Cash from financing activities 26,610

FY16 Ending Cash $2,820

(10/1/15)

(6/30/16)

$ in Thousands

Financed Danya Acquisition on 5/3/16

22

F3Q16 Financials

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

(unaudited) (unaudited)

Three Months Ended Nine Months Ended

June 30, June 30,

2016 2015 2016 2015

Revenue $ 24,989 $ 16,781 $ 58,482 $ 48,357

Direct expenses 19,533 13,743 46,885 40,055

Gross margin 5,456 3,038 11,597 8,302

General and administrative expenses 3,374 2,270 8,402 6,719

Depreciation and amortization expense 414 5 456 45

Income from operations 1,668 763 2,739 1,538

Total other income (expense), net (374 ) (34 ) (1,076 ) (723 )

Income before income taxes 1,294 729 1,663 815

Income tax expense(benefit) 518 292 666 326

Net income $ 776 $ 437 $ 997 $ 489

Net income per share - basic $ 0.08 $ 0.05 $ 0.10 $ 0.05

Net income per share - diluted $ 0.07 $ 0.04 $ 0.09 $ 0.05

Weighted average common shares outstanding

Basic 10,154 9,552 9,812 9,580

Diluted 11,311 9,956 10,855 9,990

23

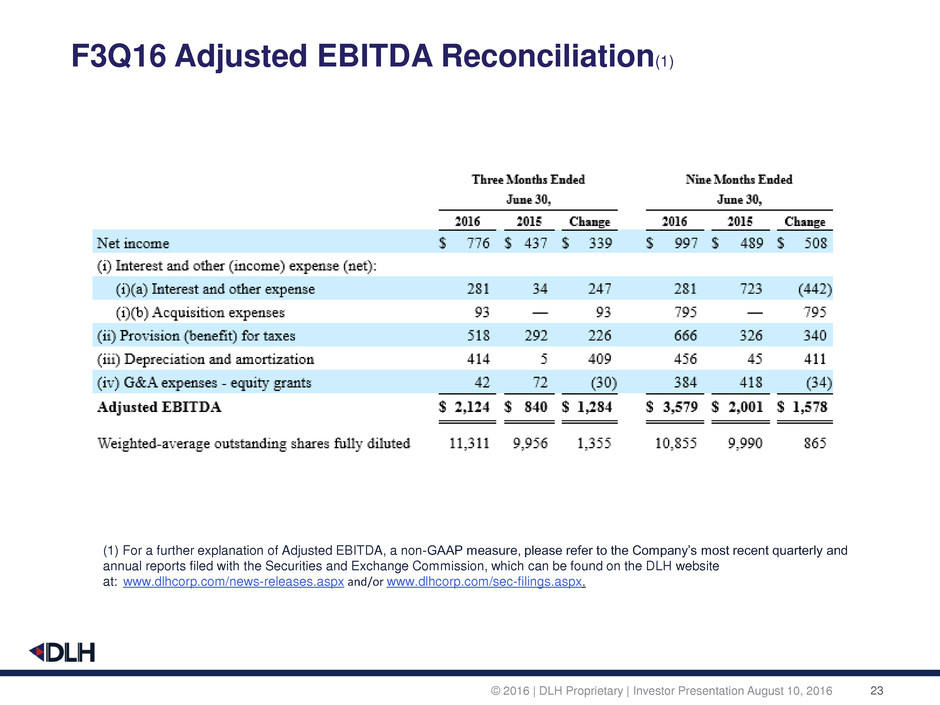

F3Q16 Adjusted EBITDA Reconciliation(1)

© 2016 | DLH Proprietary | Investor Presentation August 10, 2016

(1) For a further explanation of Adjusted EBITDA, a non-GAAP measure, please refer to the Company’s most recent quarterly and

annual reports filed with the Securities and Exchange Commission, which can be found on the DLH website

at: www.dlhcorp.com/news-releases.aspx and/or www.dlhcorp.com/sec-filings.aspx.

© 2016 | DLH | Proprietary24

Corporate Headquarters:

3565 Piedmont Rd NE

Building 3, Suite 700

Atlanta, GA 30305

National Capital Region Office:

8737 Colesville Road

Suite 1100

Silver Spring, MD 20910

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ContextLogic Completes Sale of Substantially All Operating Assets and Liabilities Associated with Wish to Qoo10

- NV Gold Announces Secured Loan Terms

- Statement on behalf of the Maher Family

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share