Form 8-K DIODES INC /DEL/ For: Feb 16

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2016

DIODES INCORPORATED

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 002-25577 | 95-2039518 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 4949 Hedgcoxe Road, Suite 200, Plano, TX |

75024 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrant’s Telephone Number, Including Area Code: (972) 987-3900

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 16, 2016, Dr. Keh-Shew Lu, President and Chief Executive Officer of Diodes Incorporated, (the “Company”), as well as Richard D. White, Chief Financial Officer, Mark King, Senior Vice President of Sales and Marketing, and Laura Mehrl, Director of Investor Relations, participated in a conference call to discuss the Company’s fourth quarter and full year 2015 financial results. A recording of the conference call has been posted on the Company’s website at www.diodes.com, and copy of a transcript of the conference call is furnished as Exhibit 99.1 to this report.

In the earnings conference call, the Company utilizes financial measures and terms not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) in order to provide investors with an alternative method for assessing the Company’s operating results in a manner that enables investors to more thoroughly evaluate its current performance as compared to past performance. The Company also believes these non-GAAP measures provide investors with a more informed baseline for modeling the Company’s future financial performance. Management uses these non-GAAP measures for the same purpose. The Company believes that investors should have access to the same set of tools that management uses in analyzing results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results and may differ from similar measures used by other companies. For a description, and reconciliation with GAAP, of these non-GAAP measures see the Company’s press release dated February 16, 2016 announcing the Company’s fourth quarter and full year 2015 financial results, a copy of which was furnished as Exhibit 99.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on February 16, 2016.

| Item 7.01 |

Regulation FD Disclosure. |

The transcript of the earnings conference call furnished as Exhibit 99.1 also provides an update on the Company’s business outlook, that is intended to be within the safe harbor provided by the Private Securities Litigation Reform Act of 1995 (the “Act”) as comprising forward looking statements within the meaning of the Act.

| Item 8.01 |

Other Events. |

From time to time, the Company may give corporate presentations to its customers, suppliers and other related interested parties. A copy of the Company’s updated corporate presentation slides is attached herewith as Exhibit 99.2.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Description | |

| 99.1 |

Transcript of earnings conference call held on February 16, 2016. | |

| 99.2 |

Corporate presentation slides | |

The information in this Form 8-K and the exhibits furnished hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DIODES INCORPORATED | ||||||

| Dated: February 22, 2016 |

By |

/s/ Richard D. White | ||||

| RICHARD D. WHITE | ||||||

| Chief Financial Officer | ||||||

EXHIBIT INDEX

| Exhibit Number |

Description | |

| 99.1 |

Transcript of earnings conference call held on February 16, 2016 | |

| 99.2 |

Corporate presentation slides | |

EXHIBIT 99.1

Diodes, Inc. Fourth Quarter and Full Year 2015 Financial Results Script

Tuesday, February 16 @ 4:00pm CST / 2:00pm PST

FINAL As Recorded

Call Participants: Dr. Keh-Shew Lu, Richard White, Mark King and Laura Mehrl

Operator:

Good afternoon and welcome to Diodes Incorporated’s fourth quarter and full year 2015 financial results conference call. At this time, all participants are in a listen only mode. At the conclusion of today’s conference call, instructions will be given for the question and answer session. If anyone needs assistance at any time during the conference call, please press the star key followed by the zero on your touchtone phone.

As a reminder, this conference call is being recorded today, Tuesday, February 16, 2016. I would now like to turn the call over to Leanne Sievers of Shelton Group Investor Relations. Leanne, please go ahead.

Introduction: Leanne Sievers, EVP of Shelton Group

Good afternoon and welcome to Diodes’ fourth quarter and full year 2015 financial results conference call. I’m Leanne Sievers, executive vice president of Shelton Group, Diodes’ investor relations firm.

Joining us today are Diodes’ President and CEO, Dr. Keh-Shew Lu; Chief Financial Officer, Rick White; Senior Vice President of Sales and Marketing, Mark King; and Director of Investor Relations, Laura Mehrl.

Page 2 of 27

Before I turn the call over to Dr. Lu, I would like to remind our listeners that the results announced today are preliminary, as they are subject to the Company finalizing its closing procedures and customary quarterly review by the Company’s independent registered public accounting firm. As such, these results are subject to revision until the Company files its Annual Report on Form 10-K for the fiscal year 2015. In addition, management’s prepared remarks contain forward-looking statements, which are subject to risks and uncertainties, and management may make additional forward-looking statements in response to your questions.

Therefore, the Company claims the protection of the safe harbor for forward-looking statements that is contained in the Private Securities Litigation Reform Act of 1995. Actual results may differ from those discussed today, and therefore we refer you to a more detailed discussion of the risks and uncertainties in the Company’s filings with the Securities and Exchange Commission.

In addition, any projections as to the Company’s future performance represent management’s estimates as of today, February 16, 2016. Diodes assumes no obligation to update these projections in the future as market conditions may or may not change.

Additionally, the Company’s press release and management’s statements during this conference call will include discussions of certain measures and financial information in GAAP and non-GAAP terms. Included in the Company’s press release are definitions and reconciliations of GAAP to non-

Page 3 of 27

GAAP items, which provide additional details. Also, throughout the Company’s press release and management’s statements during this conference call, we refer to “net income attributable to common stockholders” as “GAAP net income.”

For those of you unable to listen to the entire call at this time, a recording will be available via webcast for 60 days in the Investors section of Diodes’ website at www.diodes.com.

And now I will turn the call over to Diodes’ President and CEO, Dr. Keh-Shew Lu. Dr. Lu, please go ahead.

Dr. Keh-Shew Lu, President and CEO

Thank you, Leanne. Welcome everyone, and thank you for joining us today.

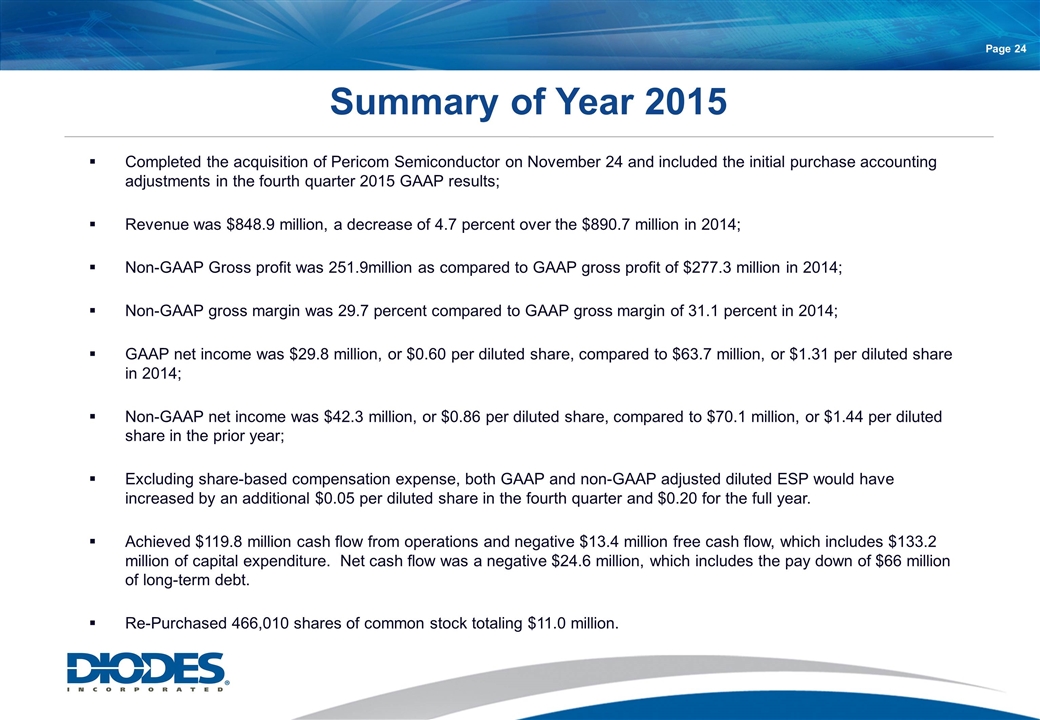

Diodes closed 2015 with increased market share, the achievement of our 25th consecutive year of profitability as well as the successful completion of the Pericom Semiconductor acquisition. The market share gains we achieved were exclusive of Pericom, and we expect to continue to increase our market share in the coming year.

Pericom is well-aligned with our acquisition strategy and expands our analog footprint, while also adding a strong mixed-signal connectivity offering that will drive expanded product content in target applications. Over the past two months since closing the acquisition, we have been diligently working on the integration efforts to maximize sales, design, operations, and administrative

Page 4 of 27

efficiencies for 2016. As expected, this transaction is accretive to our margins and non-GAAP earnings per share. Also during the quarter, we implemented the share buyback program approved by our board last quarter, repurchasing 466,000 shares and allowing us to return approximately $11 million to our shareholders.

When looking back over this past year, 2015 was characterized by weaker demand across several key end markets and geographies. The softer environment impacted loading and utilization at our manufacturing facilities, but yet also provided some unique opportunities in terms of market share gains at key customers. Gross margins were under pressure especially in the second half of the year. From a market perspective first quarter 2016 is shaping up to be a difficult quarter, but excluding Pericom and a specific sector of our communications market, our first quarter revenue is expected to be up slightly, in contrast to our normal first quarter seasonality. In addition, I believe we are well positioned for margin expansion in 2016 based on improvements in product mix and manufacturing performance as well as the benefit from previous cost reductions. Similar to past cycles, our flexible business model enabled us to respond quickly to the changing conditions in order to preserve revenue and gross profit.

Looking forward to the coming year, we remain focused on fully integrating the Pericom acquisition to capitalize on the margin expansion opportunities as well as cross-selling synergies for expanded content across targeted and emerging applications

Page 5 of 27

With that, I will now turn the call over to Rick to discuss our fourth quarter financial results as well as first quarter guidance in more detail.

Rick White, CFO

Thanks, Dr. Lu, and good afternoon everyone.

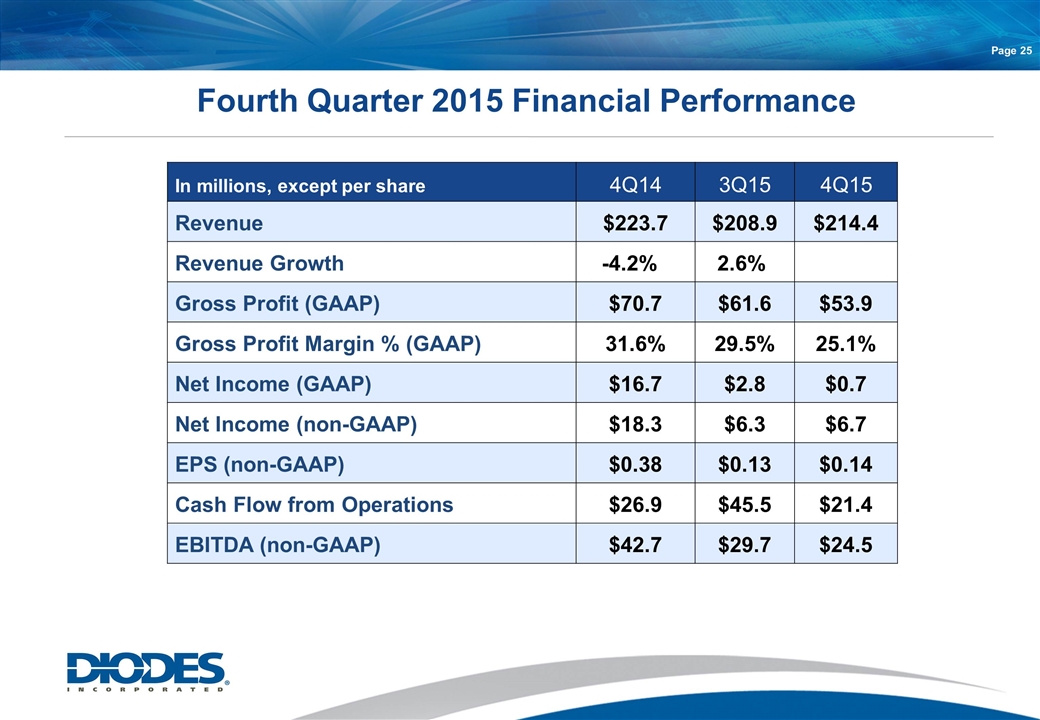

Revenue for the fourth quarter 2015 was $214.4 million, which included approximately $14.6 million of revenue from Pericom, and compares to $208.9 million in the third quarter 2015 and $223.7 million in the fourth quarter 2014. Excluding the revenue contribution from Pericom, revenue for the quarter was down 4.3 percent sequentially due primarily to weakness in the computing market, weak domestic demand in China as well as normal seasonality. For the full year 2015, revenue was $848.9 million, a decrease of 4.7 percent over $890.7 million in 2014.

GAAP gross profit for the fourth quarter 2015 was $53.9 million, including a $3.1 million inventory valuation adjustment related to the Pericom purchase, or 25.1 percent of revenue. Non-GAAP gross profit, excluding the $3.1 million inventory adjustment was $56.9 million, or 26.5 percent, compared to the third quarter 2015 GAAP gross profit of $61.6 million, or 29.5 percent of revenue, and the fourth quarter 2014 GAAP gross profit of $70.7 million, or 31.6 percent of revenue. The sequential decline in gross profit margin was due to lower capacity utilization, product mix and pricing.

Page 6 of 27

For the full year, non-GAAP gross profit was $251.9 million, or 29.7 percent of revenue, compared to GAAP gross profit of $277.3 million, or 31.1 percent of revenue, in the prior year.

GAAP operating expenses for the fourth quarter 2015 were $52.8 million, or 24.6 percent of revenue, including $1.6 million for the Pericom purchase accounting adjustment. Excluding the $1.6 million purchase accounting adjustment, non-GAAP operating expenses were $51.2 million, or 23.9 percent compared to GAAP operating expenses of $51.7 million, or 24.7 percent of revenue, in the third quarter 2015 and $48.6 million, or 21.7 percent of revenue, in the fourth quarter 2014.

Looking specifically at Selling, General and Administrative expenses for the quarter, SG&A was approximately $34.7 million for the fourth quarter, or 16.2 percent of revenue, compared to $34.7 million, or 16.6 percent of revenue, in the third quarter 2015 and $34.2 million, or 15.3 percent of revenue, for the fourth quarter 2014.

Investment in Research and Development for the fourth quarter was approximately $15.0 million, or 7.0 percent of revenue, compared to $13.7 million, or 6.6 percent of revenue, last quarter and $12.6 million, or 5.6 percent of revenue, in the fourth quarter 2014.

Combined, SG&A plus R&D was $49.7 million, or 23.2 percent of revenue, compared to $48.4 million, or 23.2 percent of revenue, in the third quarter 2015. The increase on a dollar basis primarily reflects the one month of expenses from Pericom. For the full year, SG&A plus R&D was 22.2 percent of revenue.

Page 7 of 27

Total Other Expense amounted to approximately $81,000 for the quarter.

Income Before Taxes and Noncontrolling Interest in the fourth quarter 2015 amounted to $1.0 million, compared to income of $10.2 million in the third quarter 2015 and $23.2 million in the fourth quarter 2014.

Turning to income taxes, our effective income tax rate for the fourth quarter and full year 2015 was approximately 26.8 percent and 33.9 percent, respectively.

GAAP net income for the fourth quarter 2015 was $0.7 million, or $0.01 (cent) per diluted share, compared to third quarter 2015 of $2.8 million, or $0.06 (cents) per diluted share, and fourth quarter 2014 of $16.7 million, or $0.34 (cents) per diluted share. The share count used to compute GAAP diluted EPS for the fourth quarter 2015 was 49.5 million shares. GAAP net income for the full year 2015 was $29.8 million, or $0.60 (cents) per diluted share, compared to $63.7 million, or $1.31 per diluted share, in 2014. 2015 represented our 25th consecutive year of profitability.

Fourth quarter 2015 non-GAAP adjusted net income was $6.7 million, or $0.14 per diluted share, which excluded, net of tax, $4.1 million of Pericom purchase accounting adjustments, $1.5 million of additional non-cash, acquisition related intangible asset amortization costs and $0.4 million of

Page 8 of 27

other non-acquisition related severance costs. This compares to non-GAAP adjusted net income of $6.3 million, or $0.13 (cents) per diluted share, in the third quarter 2015 and $18.3 million, or $0.38 (cents) per diluted share, in the fourth quarter 2014. Non-GAAP net income for the year was $42.3 million, or $0.86 (cents) per diluted share, which excluded, net of tax, $4.9 million of Pericom acquisition related costs, $6.0 million of other non-cash acquisition-related intangible asset amortization costs, $1.3 million of asset impairment costs and $0.4 million of non-acquisition related severance costs. That was compared to $70.1 million, or $1.44 per diluted share, in 2014.

We have included in our earnings release a reconciliation of GAAP net income to non-GAAP net income, which provides additional details. Included in the fourth quarter and full year 2015 GAAP and non-GAAP adjusted net income was approximately $2.5 million and $10.1 million, respectively, net of tax, non-cash share-based compensation expense. Excluding share based compensation expense, both GAAP and non-GAAP adjusted diluted EPS would have increased by an additional $0.05 per diluted share in the fourth quarter and $0.20 for the full year.

Cash flow generated from operations was $21.4 million for the fourth quarter and $119.8 million for the full year 2015.

Free cash flow was a negative $16.9 million for the fourth quarter, which included $38.2 million of capital expenditures primarily for the Chengdu site expansion and free cash flow was a negative $13.4 million for 2015, which included approximately $133.2 million of capital expenditures.

Page 9 of 27

Net cash flow for the quarter was a positive $29.7 million, including the pay-down of approximately $18.8 million of long-term debt and the $11 million share repurchase. Net cash flow was a negative $24.6 million for the year, which includes the pay-down of approximately $66 million of long-term debt and the $11 million share repurchase.

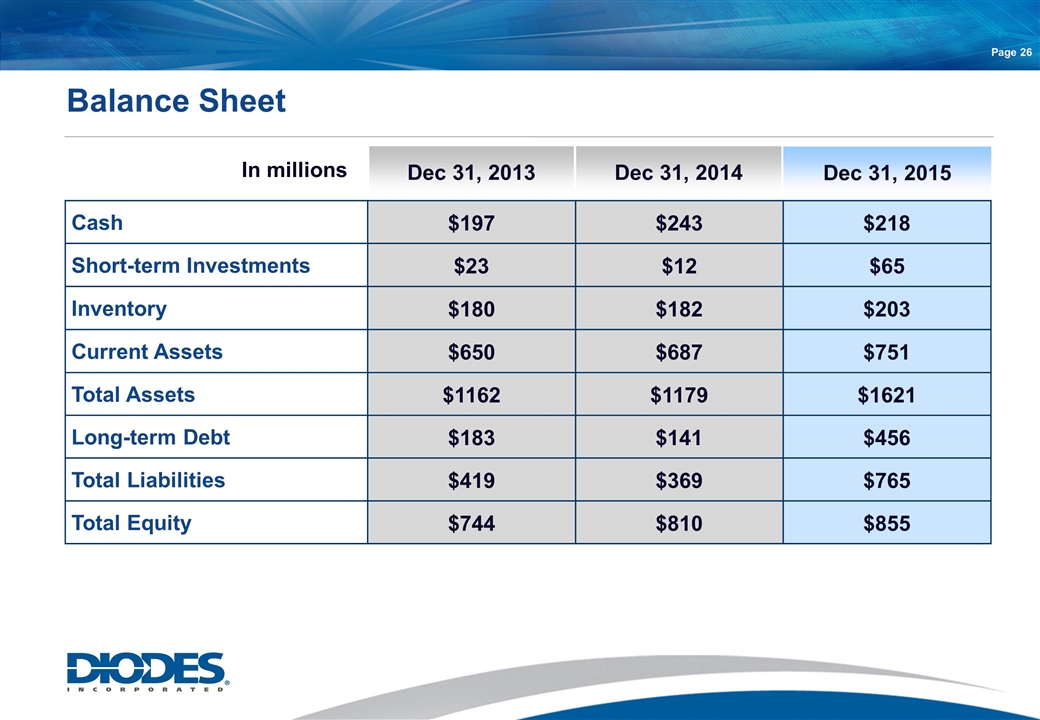

Turning to the balance sheet, at the end of the fourth quarter, cash and cash equivalents totaled approximately $218 million and short-term investment totaled $65 million. Working capital was approximately $571 million.

At the end of the fourth quarter, inventory increased by approximately $5 million from the end of third quarter 2015 to approximately $203 million including Pericom’s inventory and purchase accounting adjustments of approximately $18 million. Excluding these items, Diodes’ inventory is down approximately $13 million with decreases in finished goods, work in process and raw materials. Inventory days were 115 in the quarter, compared to 123 days last quarter.

At the end of the fourth quarter, Accounts Receivable was approximately $218 million, an increase of $16 million from the third quarter. A/R days were 90, flat to last quarter.

Page 10 of 27

Our long term debt totaled approximately $466 million, which includes $391 million borrowed for the acquisition of Pericom.

Capital expenditures for the fourth quarter were $38.2 million, or 17.8 percent of revenue, which includes the expansion of our Chengdu site. On a cash basis capital expenditures for the full year totaled $133.2 million, or 15.7 percent of revenue. Capital expenditures excluding the Chengdu site expansion totaled 8.9 percent of total revenue. For the full year 2016, we expect our capital expenditures to be 5 to 9 percent of revenue.

Depreciation and amortization expense for the fourth quarter was $22.1 million, and $80.1 million for the year.

Now, turning to our Outlook…

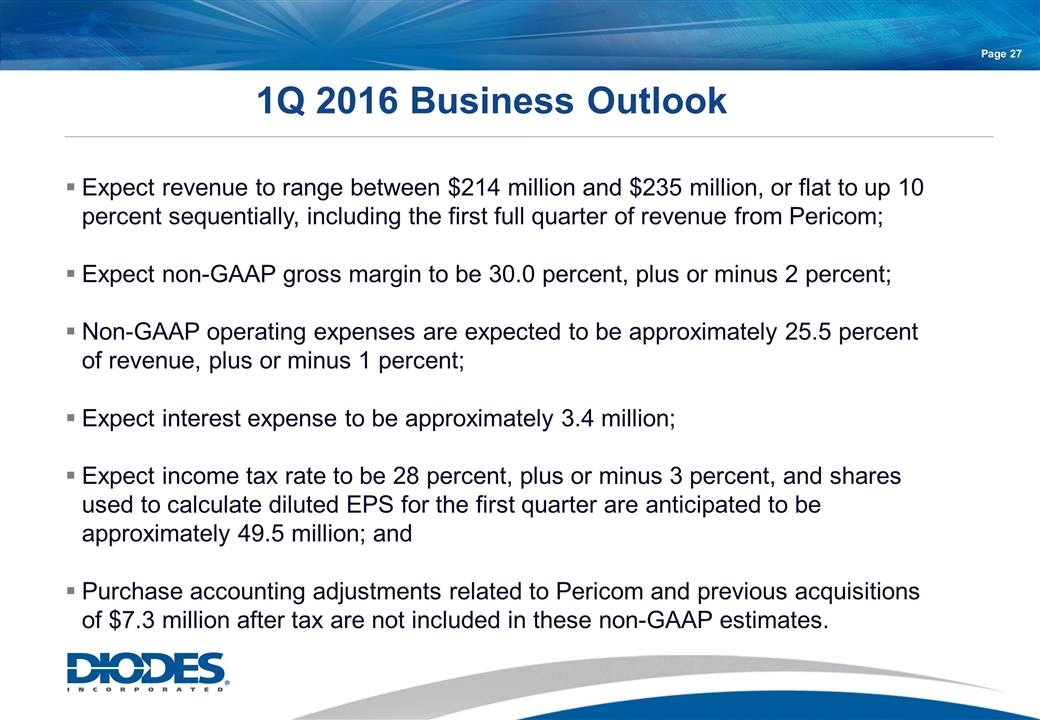

For the first quarter of 2016, we expect revenue to range between $214 million and $235 million, or flat to up 10 percent sequentially, including the first full quarter of revenue from Pericom. We expect non-GAAP gross margin to be 30.0 percent, plus or minus 2 percent. Non-GAAP operating expenses are expected to be approximately 25.5 percent of revenue, plus or minus 1 percent. Interest expense is expected to be approximately $3.4 million and we expect our income tax rate to be 28 percent, plus or minus 3 percent. Shares used to calculate diluted EPS for the first quarter are anticipated to be approximately 49.5 million. Please note that purchase accounting adjustments for Pericom and the previous acquisitions of $7.3 million after tax, are not included in these non-GAAP estimates.

Page 11 of 27

With that said, I will now turn the call over to Mark King.

Mark King, Senior VP of Sales and Marketing

Thank you, Rick, and good afternoon.

For purposes of my comments, all figures and comments will be in reference to Diodes’ core business performance during the quarter, excluding Pericom, except where noted.

Revenue for the quarter was down 4.3 percent sequentially due to the distributor inventory adjustments we mentioned last quarter, predominately in Europe, combined with normal seasonal trends. OEM sales were down 5.4 percent, while distributor POP was down 3.6 percent and POS was down 8.0 percent after an extremely strong Q3. Distributor inventory declined 5.3 percent.

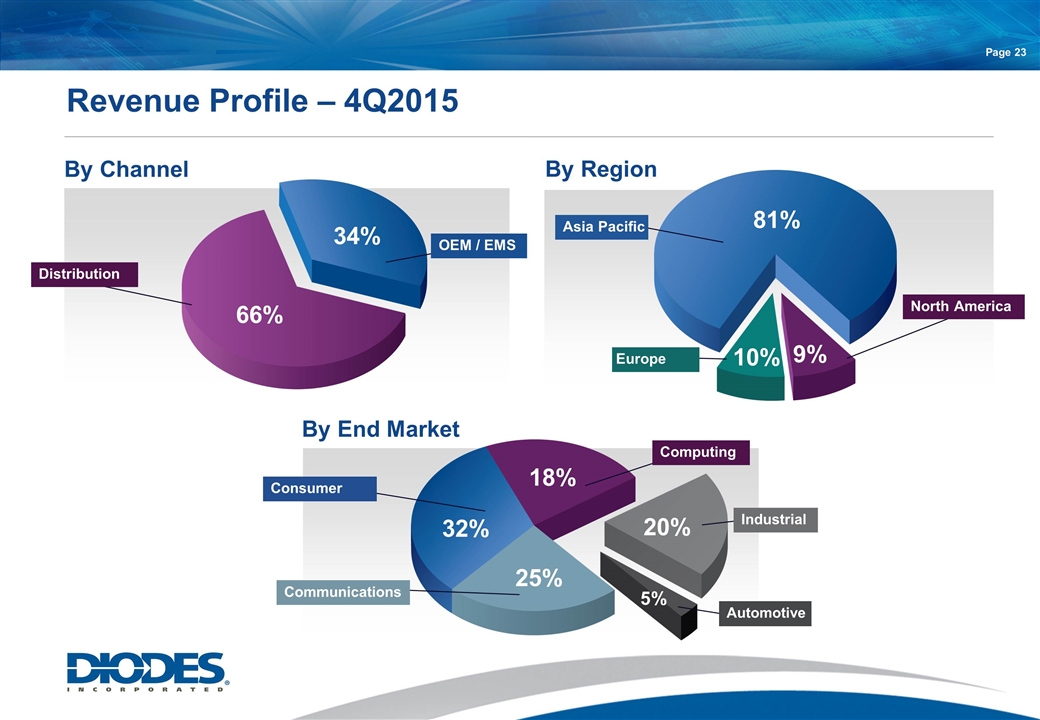

Turning to Global Sales, Asia represented 81 percent of revenue, Europe 10 percent and North America 9 percent.

In terms of our end markets, consumer represented 32 percent of revenue, communications 25, industrial 20 percent, computing 18, and automotive was 5 percent. The computing market remained soft in the quarter along with the consumer market due to weak domestic demand in China. On the positive side, we continued to make progress on our automotive and industrial initiatives.

Page 12 of 27

Despite the overall soft market, customer activity remained strong across regions. Design activity remains at high levels and design wins are solid. We continue to penetrate our key customer base with a deeper product line and see significant customer synergies with our recent acquisition of Pericom. From a product perspective, we saw strong revenue momentum for LED lighting, sensors, CMOS LDOs and MOSFETs.

Let me now talk about our business in more detail within each of our end markets.

For the consumer market, we released several devices to support large consumer electronics, such as digital TVs and set-top boxes. For the portable space, we released a high efficiency class-D audio power amplifier that can drive up to 4W through a 4 Ohm speaker with a power supply as low as 2.8V. In terms of design wins, we secured 9 significant wins for our audio and DC-DC lines for products such as sound bars, set-top boxes and Bluetooth speakers.

In the communications market, we released a family of current mode PWM controllers. When used in conjunction with our protocol decoder and secondary side controller, these devices offer a high performance solution for mobile phone chargers/adapters that is compatible with the Qualcomm Quick Charge 2.0 protocol. For cell phone battery packs, we released several new protection solutions for single cell lithium-ion and lithium-polymer rechargeable batteries. We obtained a number of new design wins across several mobile phone charger and adapter applications, including several in

Page 13 of 27

support of the high-growth India market. We also saw continued success for our CMOS LDOs and Hall Sensors in mobile phone handsets, with 11 significant wins.

For mobile communication applications including portable device charging, Diodes’ innovative Active Rectifier platform was used to develop our first device suited to quick-charging applications, such as the USB Type-C for 15W chargers. This technology embeds a low RDSon MOSFET together with a controller in a small footprint solution, delivering high power efficiency. Also aimed at efficiency for chargers and adapters, Diodes also launched several new SBR devices in a range of small packages with industry-leading Vf and leakage performance.

For the computing market, we continued to gain share in this space with our load switches and secured 12 new wins across 7 leading manufacturers. Other wins included CMOS LDOs and logic devices in notebooks and servers. Additionally, our Pericom team released several new products, including a 16-bit I/O expander for I2C bus applications, a redriver with AUX listener, a new clock generator family, and a plug-in detector for use with the emerging USB Type-C connector.

In the industrial market, Diodes released a family of new products for entry into the High Voltage Gate Driver market, offering a mix of 600V half bridge drivers as well as High side/ low side drivers. These products complement Diodes growing MOSFET technology base and strengthen the ability to address motor drive and power supply applications in the near- term, with the potential to migrate to electronic vehicles in the future.

Page 14 of 27

We also released a family of single-chip motor driver ICs with integrated H-bridge switches and high-sensitivity Hall sensors for driving low-profile, single-coil brushless DC motors and cooling fans. For general illumination applications, we released a family of LED drivers for dimmable retrofit lamps that can operate in either buck or buck-boost architectures with output power up to 12W. During the quarter, we secured 16 new industrial and smart lighting design wins, including wins for large scale industrial equipment as well as standard linear in e-metering and white good applications.

And finally in Automotive, we had a another strong quarter of new product releases, including a family of automotive precision shunt references as well as medium voltage LED drivers. We also extended our range of automotive-qualified MOSFET’s with 10 new products from our 175 degree C-rated portfolio featuring our Shielded Gate technology. These products are 100% avalanche tested for ruggedness, and suitable for under-hood and other high temperature applications. Thirteen other automotive qualified MOSFET’s were released in the quarter, bringing the total of Automotive MOSFET releases to 79 for the year. In terms of design wins, our wins in the quarter were dominated by LED sockets for daytime running lamps and emergency lighting.

In summary, despite the weaker environment throughout this past year, we remained focused on achieving continued market share gains as we capitalized on our expanding product portfolio and design win success across

Page 15 of 27

our end markets. We believe there are significant opportunities in the coming year as we integrate the Pericom acquisition and further broaden our content at customers and end market penetration. We continue to place a strong emphasis on the portable and wearable space as well as the automotive market, where we continue to maintain strong momentum going into the new year.

With that, I’ll open the floor to questions - Operator?

+++ q-and-a

Operator^ (Operator Instructions) Steve Smigie, Raymond James.

Steve Smigie^ Great. Thanks a lot, guys, and good execution in a pretty soft macro here. Dr. Lu, I was hoping you could follow up on gross margin. To your point, it looks like Pericom is definitely coming in and driving some gross margin accretion there. Can you talk about as we look out to 2016, is there a chance that even in this weak environment, maybe exiting 2016, you guys could get up to a mid-30s gross margin? Or would that be topping a soft macro?

Keh-Shew Lu^ Well, I think we give the accretive forecast on the gross margin here (inaudible) 1Q, we focused on 30%, and that really is better than third quarter of past year and fourth quarter of the last years. So we know typically 1Q is the lowest one. And if the revenue continued going back, our reorganization will continue going up, then that 30% will continue to improve from there.

So, since we’re not really talking about what would be the gross margins, but we believe (inaudible) should be the lowest one if the market continued to improve from 1Q. And we’re looking at if utilization gets better, our (inaudible) costs go down, then our (inaudible) will continue to improve.

Page 16 of 27

Steve Smigie^ Great. Thanks. And then just curious, any first thoughts (technical difficulty) of having Pericom acquired? And any positive surprises? And what kind of growth are you thinking about long-term in that business?

Keh-Shew Lu^ Well, the Pericom acquisition — so far, we don’t see any negatives. Now, we do see some spots are greater than expected, but I do not really want to go through the details because it seems too early to say. But so far, we could not find any surprise from the next start.

Steve Smigie^ Okay, great. And last question, is there a concern out there about China? And I was just curious if — how you’re thinking about the China local market at this point. Is that stabilizing at all, or is it still pretty soft?

Keh-Shew Lu^ Well, I think it’s stabilized. I would say it’s still very soft. So you are hitting on both right. We don’t see yet extent of improvement, but it still is quite stable now. Right now, they just finished the Chinese New Year. And we — right now, we don’t see any signs yet, but we’re hoping after Chinese New Year and (inaudible) from March, that we would hope to see some improvement. But right now, I won’t say definitely. It’s good. I’m still thinking first half is still quite weak.

Steve Smigie^ Okay, great. Thanks. Well, congratulations on closing Pericom and the good execution there. Thank you.

Operator^ Gary Mobley, Benchmark.

Gary Mobley^ Wanted to ask about seasonality for Diodes as the year unfolds. Should we think that, for any reason, 2016 will be any different in that Q2 and Q3 are typically the strongest two quarters, Q4 is typically flattish on a sequential basis? And with the contribution of Pericom — and I know it’s a small percentage of the overall revenue — would you expect that seasonality to be muted a little bit? Just because I was — Pericom’s revenue isn’t quite as seasonal as yours.

Keh-Shew Lu^ Well, typically 2Q is much stronger, 3Q is even stronger and then 4Q slow down (inaudible) in 2015 that 3Q actually going down from 2Q, and then 4Q even further down. So if you look at — I think I’m talking about the past. If the seasonality is correct, then 40% to 45% in one half and 55% in second half. Last year, sure enough, it’s not happened to that kind of pattern.

Page 17 of 27

In 2016, there is no sign of telling which way will go. Because so far we think the first half is still quite weak. You can see from 1Q, 1Q is very (technical difficulty) and 1Q is quite weak. And even Diodes is (inaudible) of slightly better (inaudible) without the Pericom acquisition. But the market in general, 1Q is weak. And so far, we don’t know the second Q yet. So it’s even — I cannot really tell this year what the patents is going to look like.

Gary Mobley^ And, Mark, related to that, I think you mentioned in your prepared remarks that distributor inventory was down over 5% sequentially. If I’m not mistaken, distributors — probably about half of your revenue, and you probably don’t have detailed insight into shipment directly to OEMs as far as inventory goes. But what is your sense as you sit here today in terms of distributor and customer inventories relative to where they have been over the past 12 or 18 months?

Mark King^ I think the customer inventories — I think customers take their product as they need it. I don’t think customers — we all have agreements that we have to ship just in time, so I don’t really see a great deal of inventory build at the customer. I think the channel is getting in pretty good shape. I think we will expect to see some channel build for us in North America and Europe in the first quarter. Asia may be a little bit flattish in the first quarter because I think they expected a little bit better fourth quarter than they got. And thus, the inventory levels stayed a little higher than we thought they would in the fourth quarter.

But I think everything is in line. There is not too big of an inventory hangover, so I think we will be in pretty good shape to regain some POP and position ourselves for the second and third quarter.

Gary Mobley^ Okay. And Rick, I know Q1 will be the first full quarter with Pericom results and business integration. I don’t know what the plans are specifically with respect to OpEx synergies and whatnot with Pericom. But would you expect Q1 to represent the high mark for non-GAAP operating expenses for the full year, or should we model roughly flattish trends off of that Q1 base?

Page 18 of 27

Rick White^ Yes, basically what’s going to happen in the first quarter is we have another purchase accounting inventory adjustment equal to the one that we had in the fourth quarter. (Multiple speakers). No, no, it’s the same as what we had in the fourth quarter. We took half in the fourth quarter, half in the first quarter and then that goes away. And then the rest of the year will be just the acquisition-related intangible asset acquisitions.

Gary Mobley^ Okay. What about on a non-GAAP basis? Do you foresee some cost synergies to be wrung out from the acquisition?

Rick White^ Well, I think if — as we move through time, not only the non-GAAP, but the GAAP expenses will go down just because we will be getting rid of double the costs that we had. For example, forward costs and things like that. So I think both GAAP and non-GAAP expenses will go down.

Gary Mobley^ Okay. All right, that’s it for me. Thanks, guys.

Operator^ Christopher Longiaru, Sidoti and Company.

Christopher Longiaru^ My question has to do with — you talked about you’re in a position to expand your gross margins. And there is usually a lot of pieces to that. You have the addition of Pericom, they had some high interest margins so there’s a mix feature there. Automotive and industrial, some higher-margin products for you guys. But also utilization is a big part of that. So can you give us a little granularity into how to expect that to play out relatively over the next couple of quarters and where you see opportunity first and where you see opportunity later?

Keh-Shew Lu^ Well, if you look at 2015 (inaudible) 2013, the rating actually went down, and that costs more under (inaudible) sale okay, especially second half. If you look at second half revenue really going down instead of growth. So then looking for this year, 1Q, and the revenue (inaudible) well, revenue-wise we can see gradually improvements. And so if utilization should be (inaudible) especially the expert — you can see we had (inaudible) we have been working on how to improve that utilization of the (inaudible) by move some of the product inside — into the SVAD2 and convert SVAD2 into the age. So all the new products we (inaudible) and have used. Still the important majority is used in the SVAD, so if (inaudible) in products start to (inaudible) SVAD2 loading continues to improve.

Page 19 of 27

Just so I could — based — back to 2016 — based on 2016, I believe SVAD2 loading will significantly improve, just because the new product started in this year. And so in general, I believe this year the underutilizations will be improved. And we have some (inaudible) which I do on the revenue growth in this year (inaudible) alone excluding (inaudible). I think that improved the utilization rate from both (inaudible) and that will give us a better (inaudible) and improve on the GP. But (inaudible) asking for GP for this year I expect 30% in 1Q. I hope it’s the lowest one. And while the revenue started going up in second quarter and hopefully in the third quarter, then utilization will get better, GP will getting better.

Mark King^ (multiple speakers) This is Rick. There’s another factor that, in case you didn’t mention, which was CAT, our Chengdu assembly site. The last couple of years, it has kind of been getting going. And in 2016, as you can see, we spent quite a bit of money there to get the equipment in, get the buildings ready to go, and so we’re hoping that it can be fully efficient this year. So in addition to the wafer fabs issue that Keh-Shu talked about, CAT is going also improve, we think.

Christopher Longiaru^ And would I be right in saying that if I stood at Pericom from the number, it would look like your Diodes (technical difficulty) was about flattish from (technical difficulty) up to the March quarter or through the year guidance, which is much better than typical seasonality? Is that fair to say?

Mark King^ Yes, I think what Keh-Shu said in his speech was that if you take out Pericom, you take out a certain sector of the communications business, we are actually slightly up if you just look at those two pieces of Diodes from fourth quarter to first quarter.

Christopher Longiaru^ So, looking at kind of the exclusion of Pericom from a mix perspective, utilization-wise you probably are around the same levels (technical difficulty). That’s going to blur the gross margin improvement was from the mix addition of Pericom unless that went (technical difficulty). That’s all upside (inaudible) kind of gross margin run rate around 30%. Is that a fair thing to say?

Page 20 of 27

Mark King^ Yes, I think that’s fair. As you move through time, the Diodes piece — because you have to remember that Pericom is basically outsourced to both wafers and assembly tests. And so their — if you say that their revenue and margin are stable, then the improvement would come from Diodes’ utilization of our manufacturing facilities.

Christopher Longiaru^ And the only part of Pericom that’s not outsourced is the frequency control products part. Correct?

Mark King^ Yes, that’s true. That’s true.

Keh-Shew Lu^ It is (inaudible) an inflection point wafer for the system and for the packaging — oscillator.

Mark King^ Oscillators using the crystals, right.

Christopher Longiaru^ Okay. That’s all I have today. Thanks for taking my questions.

Operator^ Suji Desilva, Topeka.

Suji Desilva^ Could we talk about the debt reduction plans here post the merger, and whether the priority is debt reduction or buybacks?

Mark King^ Yes, as we’ve always tried to do, as we did in 2015, we’re going to try and pay the debt back as quickly as we can.

Suji Desilva^ (technical difficulty) that Diodes level?

Mark King^ What was that?

Suji Desilva^ (technical difficulty) the EBITDA level there.

Mark King^ Yes, that’s right.

Keh-Shew Lu^ Yes. Our agreement with banks is that it’s a [3X], and we need to continue to bring down that 3X down to 2.5.

Page 21 of 27

Mark King^ Yes, so the coverage ratio or the leverage ratio is — the maximum is 3, and we can stay there for a year. And then in the fourth quarter, it has to go down to 2.5. And so that is what we’re going to achieve.

Suji Desilva^ Okay, great. And then Dr. Lu, you talked about key customers and share gains that were happening in this environment. Can you elaborate on why that is occurring in this environment? Thanks.

Keh-Shew Lu^ I don’t think we want to talk too much about this. So I prefer — since, in the speech our (inaudible) result — Pericom, without that, we are still — in 1Q, we are actually slightly better than 4Q. And I think we should just stop there.

Suji Desilva^ Fair enough, Dr. Lu. Maybe last question on the quick charge functionality in smart phones. What kind of attach rate do you expect that to go to this year versus last year, and what kind of share do you think you can get in that market? It seems to be a very hot topic into Barcelona for the Mobile World Congress.

Mark King^ Yes, I don’t think we really have a way to document that now. Actually, Pericom has had a lot of progress in that area, and we are continuing to win significant design wins. So we think the attach rate is — it’s still slow, but the type C is a big focus for them. Diodes also has some products in that range, so we plan to participate strongly in that marketplace.

Suji Desilva^ Okay, great. Thanks, guys.

Operator^ Harsh Kumar, Stephens.

Unidentified Participant^ Hey, guys. This is Richard in for Harsh. Thanks for taking my question, and congratulations.

Wanted to start with pricing. I think you had a comment in the prepared remarks that pricing was a little challenging. Is this more than normal ASP pressure, or what are you seeing from that perspective?

Keh-Shew Lu^ Well, it’s at the high end of our normal pricing ASP (inaudible). I think if you remember, I’ve been talking about ASP in our

Page 22 of 27

mobile is 1.5% to 2% a quarter. So — and right now in the 4Q, it’s at the high end of that. So it’s just somewhere around 2% or slightly worse. It’s not really significantly higher, but it said that — I should say at the high end of our model.

Unidentified Participant^ Got you. That is very helpful, Dr. Lu. Thank you for that. And then in terms of utilization, can you point where you are there? And then in terms of Pericom, are you seeing any opportunities to bring some of that outsourced wafer or assembly and tests in-house? And what’s the plan there from a manufacturing consolidation footprint?

Keh-Shew Lu^ Okay, let me answer the outsourcing and Pericom first. Pericom from a wafer point of view, we cannot (inaudible) because the majority of their wafer for almost other than the crystal and crystal sedater, all their products is somewhere at 80-inch and is the fun geometry type of the wafers. BCD, 8-inch, so we cannot — we have no capability of the wafer point of view to bring that inside.

From a packaging point of view, I will say half of the packaging, we do not — half of the packaging, we do not (technical difficulty). And, again, the daily (inaudible) we picked the time because a lot of them is key (inaudible) it takes time to bring those in. So Pericom has good CP. For me, it’s not trying to bring inside, get the CP high. For me, is spend more effort to quickly (inaudible) more markets. It basically is already in somewhere around 40-something, 50%. My focus on Pericom products is open up more channels, open up more customers, do more design wins to [eodize] the sales legacy — more cycle sales who have Pericom sales team to sell Diodes products, and Diodes sales teams sell more Pericom products. This is more important than trying to spend an effort bringing them inside (technical difficulty) the CP. I think I get more benefit by gross sales.

Suji Desilva^ Got you. That’s extremely helpful. Thank you, Doctor, and good luck.

Operator^ (multiple speakers)

Page 23 of 27

Keh-Shew Lu^ Well, I didn’t answer your utilization questions. Utilization —

Mark King^ Yes, so just let me quickly say that in the — from a fab standpoint, fabs were in the fourth quarter in 50% to 60% utilized range except for maybe OFAB, which was higher than that. And we actually slowed down our assembly test in Shanghai because we were trying to reduce the inventory, which we successfully did in the fourth quarter. So, maybe not quite as high in Shanghai as it has been over the last three quarters, four quarters, but still fairly well-utilized.

Unidentified Participant^ Got you. Thank you, again.

Operator^ Shawn Harrison, Longbow Research.

Shawn Harrison^ Maybe some basic questions. Sorry, I want to level set expectations on Pericom in terms of what was the annualized run rate of sales for the business exiting 2015. Because if I take the December quarter run rate, it implies a healthy step up from where it was. So maybe if you could just give us the run rate of sales annualized and maybe a range of contributions for the March quarter, that would be very helpful in setting expectations.

Keh-Shew Lu^ I think if you look at their revenue, somewhere around [130] in (technical difficulty) (inaudible), that would be $33 million. That’s about their run rate. And right now for 1Q, we look at about $33 million. Now, the reason in December is higher, is typically October is low, November is low, and the third month is higher. That’s why December is $14 million from Pericom. But typically, each quarter is about $33 million.

Shawn Harrison^ That’s very helpful. (multiple speakers) Very, very helpful. I guess one more follow-up on that. The — if I remember correctly, the gross margin on a non-GAAP basis for Pericom was in the mid to upper 40s, and the EBIT margin was maybe in the low to mid teens. Is that the right ratio to think of the business currently?

Mark King^ We don’t do our non-GAAP margins the same way they did. So if you look at their GAAP margins, they are between 45% and 50%.

Shawn Harrison^ Okay.

Keh-Shew Lu^ But that margin is 75% to [50%] (multiple speakers).

Page 24 of 27

Rick White^ Right. And that does include the purchase accounting adjustments that we made on the books.

Shawn Harrison^ Got you. And the OpEx is kind of high — that it was in the high 30s?

Keh-Shew Lu^ Yes, their OpEx as much higher than Diodes’ because their GPs are higher, their RMBs are higher. And even SG&A, since it’s a small Company, is higher.

Rick White^ Yes, that’s probably right. OpEx is in the low to mid 30s.

Shawn Harrison^ Okay, very helpful, Rick. I guess as a follow-up, in terms of just thinking about the markets where there could be growth for 2016, it sounds like you are very positive on auto and industrial. Would you expect any turnaround in the consumer electronics or computing markets? And I guess within communications, do you believe this is more of just a temporary inventory correction pause versus the market turning over?

Mark King^ I think it’s really hard to say right now what we’re going to expect in the consumer electronics and the computer market. I think they have been kind of both struggling a little bit. So I think we are optimistic but unsure of where they are going. We have a lot of new products going in. We’re still continuing to add products and penetrate further into the same customer, so we hope to be able to squeak out some growth.

I think the communication sector between Diodes and Pericom — I think we have some decent opportunities to grow in those markets in the coming quarter. So I think the combined force of the two Companies gives us a strong position in that market. I think it gives us a strong position in the computer market also. I’m just not as sure the computer market is going to be as strong as we need it to be to get the kind of growth that we would like.

We still see significant amount of opportunities; there’s just a certain level of overall demand that we can’t control. So we are excited about the opportunity. We are excited about the cross-selling. We are excited about the customers that they are strong on, and bringing our products into those

Page 25 of 27

customers. And we are pretty excited about being able to take them into some of our strongholds. So we think there’s a significant amount of opportunity for us, and we are very excited about it.

Keh-Shew Lu^ Yes, (inaudible) the computer market on the deal. 2016 is probably either flat or slightly colder — the computer market. From the cell phone market, we’re total cell phone, probably flat. But virtually it’s smart phone (inaudible) have some growth and that’s smart phone areas. But Diodes plus Pericom, we’re not looking for the market — obviously if markets trended to good, we would like it and we would move forward. But we are more focused on cross-selling, market share gains, to help us to grow. So, 2016 are still hoping we can continue to gain market share and hope in 2016 we will have better growth than 2015 into that market share gain.

Mark King^ Just to add, the one — another advantage of the Pericom for Diodes is they’re a little bit more upstream in the design cycles. So we think that they can help drive us farther along with our analog product lines in some of these areas and get us a little sooner look at some of these products. So we have already started to see some examples of that, and so I think that they give us — they are giving us a little bit visibility in different areas that we haven’t had in the past earlier.

Shawn Harrison^ That’s very fair, Mark. Thanks so much.

Operator^ Justin Lee, Robert W. Baird.

Justin Lee^ The first question is in China, what end markets do you have residual excess inventories?

Mark King^ I had trouble understanding you on that. Where do we have residual inventory?

Justin Lee^ Right. So in China, what end markets — what end markets do you have excessive inventories?

Mark King^ I don’t think we really have any excessive inventory. I think generally the end market and the market in China in the fourth quarter was soft. So we would probably just have general inventory issues there. I would say the most — most of the softness we saw was in the consumer sector during the fourth quarter. But I can’t say whether that’s where our residual inventory is. A lot of our products is an overlapping sector.

Page 26 of 27

Justin Lee^ I see —

Keh-Shew Lu^ Are you talking about the (inaudible) talking about the hub inventory? Because we don’t — it’s so — we have a — the (technical difficulty) customer or OEM customer and the hub inventory. I don’t think we have excess inventory.

Justin Lee^ Okay, that’s good. Thanks. The next question is could you provide an update on the opportunities you see with Pericom acquisition? And what is the estimated accretion for 2016?

Keh-Shew Lu^ Well, we are thinking about that, let me answer the previous question. If you look at our inventory, it actually went up. Our inventory went up because Pericom portion. If you pick up the Pericom portion of the inventory, our Diodes inventory actually went down. And that’s including our hub inventory. So hub inventory is a part of Diodes inventory. And Diodes inventory without Pericom actually went down. So to answer your question, we don’t really see an excess of inventory in China.

Justin Lee^ Right, Dr. Lu. So could you provide an accretion update for the Pericom acquisition in 2016?

Mark King^ Yes, I haven’t really done that because we’ve got all these purchase accounting adjustments. I would say it’s probably — this is a swag, but maybe $0.05 to $0.08, something like that?

Justin Lee^ Okay. Thank you. The next question is, given the potential combination of ON Semi and Fairchild, would you see any effects with — to Diodes?

Keh-Shew Lu^ Yes, probably (multiple speakers) —

Mark King^ We think that consolidation offers opportunity. It narrows the playing field down, and it opens up spaces for Cliff to enter his accounts that maybe they were — already, all the spaces were full. We have already seen a lot of opportunity emerge for us due to the IR Infineon acquisition, and we

Page 27 of 27

would expect to see similar or possibly more opportunity coming out of the Fairchild and ON acquisition. That’s a big acquisition, a lot of. So, again, I think that’s a big effort to consolidate. So we’re excited about it.

Keh-Shew Lu^ It opened up the second source opportunity for us, especially at the standard (inaudible) and order (inaudible) which is — Fairchild has been focused on. And now Fairchild owns (inaudible). Then you open up good opportunity for second source. And we have new products (inaudible) with Fairchild, so it’s a good opportunity for us.

Justin Lee^ All right. Thank you so much. That’s all about my questions.

Operator^ Thank you. And that concludes our question-and-answer session for today. I would like to turn the conference back to Dr. Lu for any closing comments.

Keh-Shew Lu^ Thank you for your participation today. Operator, you may now disconnect.

Operator^ Thank you. Ladies and gentlemen, thank you for your participation in this conference. This does conclude the program, and you may now log off and disconnect. Everyone have a good evening.

Upon Completion of the Q&A…

Dr. Lu: Thank you for your participation today. Operator, you may now disconnect.

Investor Relations Presentation February, 2016 EXHIBIT 99.2

Safe Harbor Statement Page Any statements set forth herein that are not historical facts are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding update to Diodes Incorporated’s first quarter 2016 business outlook as of February 16, 2016, which includes the following: expect revenue to range between $214 million and $235 million, or flat to up 10 percent sequentially, including the first full quarter of revenue from Pericom; expect non-GAAP gross margin to be 30.0 percent, plus or minus 2 percent; non-GAAP operating expenses are expected to be approximately 25.5 percent of revenue, plus or minus 1 percent; expect interest expense to be approximately 3.4 million; expect income tax rate to be 28 percent, plus or minus 3 percent, and shares used to calculate diluted EPS for the first quarter are anticipated to be approximately 49.5 million; purchase accounting adjustments related to Pericom and previous acquisitions of $7.3 million after tax are not included in these non-GAAP estimates; and other statements identified by words such as “estimates,” “expects,” “projects,” “plans,” “will” and similar expressions. Potential risks and uncertainties include, but are not limited to, such factors as: the risk that such expectations may not be met: the risk that the expected benefits of acquisitions may not be realized; Diodes’ business and growth strategy; the introduction and market reception to new product announcements; fluctuations in product demand and supply; prospects for the global economy; continued introduction of new products; Diodes’ ability to maintain customer and vendor relationships; technological advancements; impact of competitive products and pricing; growth in targeted markets; successful integration of acquired companies and/or assets; Diodes’ ability to successfully make additional acquisitions; risks of domestic and foreign operations, including excessive operation costs, labor shortages, higher tax rates and joint venture prospects; unfavorable currency exchange rates; availability of tax credits; Diodes’ ability to maintain its current growth strategy or continue to maintain its current performance and loadings in manufacturing facilities; our future guidance may be incorrect; the global economic weakness may be more severe or last longer than Diodes currently anticipate; breaches of our information technology systems; and other information, including the “Risk Factors,” detailed from time to time in filings with the United States Securities and Exchange Commission. This presentation also contains non-GAAP measures. See the Company’s press release on February 16, 2016 titled, “Diodes Incorporated Reports fourth Quarter and Fiscal 2015 Financial Results” for detailed information related to the Company’s non-GAAP measures and a reconciliation of GAAP net income to non-GAAP net income.

Management Representative Page Dr. Keh-Shew Lu President and CEO Diodes Incorporated Since 2005 Texas Instruments 27 years Experience: Senior Vice President of TI Worldwide Analog and Logic President of Texas Instruments – Asia Education: Master's Degree and Doctorate in Electrical Engineering Texas Tech University Bachelor's Degree in Engineering National Cheng Kung University - Taiwan

Company Representative Page Laura Mehrl Director of Investor Relations Since May 2010 Experience: Director of Investor Relations, Diodes Incorporated, Plano, Texas Senior Business Development Manager, STMicroelectronics, Carrollton, Texas Sales Director for Analog Devices Inc., Shanghai, China Product Marketing Manager at Texas Instruments (TI), Dallas, Texas Senior Engineer at Lattice Semiconductor Inc., Hillsboro, Oregon Wafer fab design engineer and product engineer at TI, Lubbock, Texas Education: MBA with concentration in International Marketing, Texas Tech University BS in Electrical and Computer Engineering, University of Iowa

Page A leading global manufacturer and supplier of high-quality application specific, standard products within the broad discrete, logic and analog markets, serving the consumer, computing, communications, Industrial and automotive segments. About Diodes Incorporated

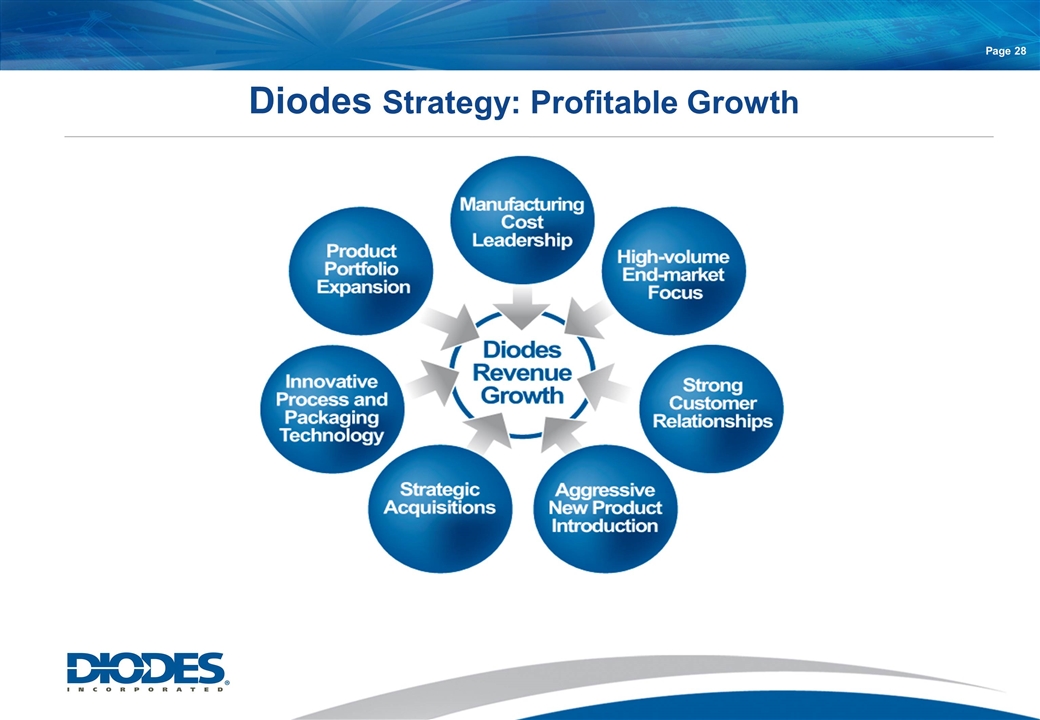

Business Objective To consistently achieve above-market profitable growth, utilizing our innovative and cost-effective packaging and silicon technology, suited for high volume, high growth markets by leveraging process expertise and design excellence to deliver high quality semiconductor products. Page

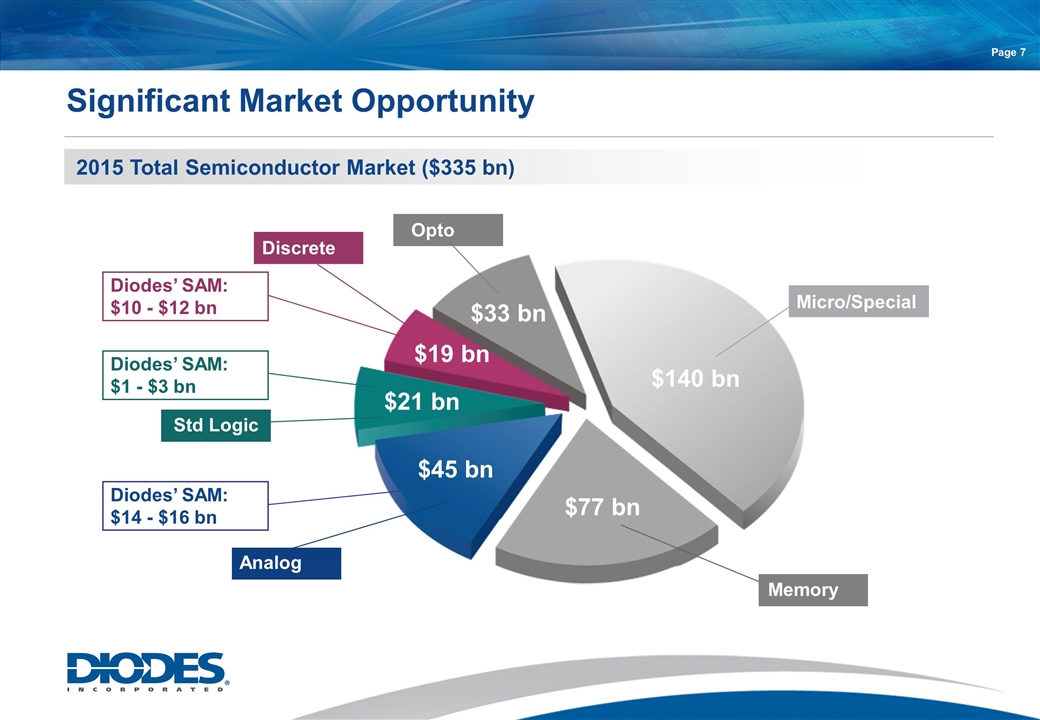

2015 Total Semiconductor Market ($335 bn) Significant Market Opportunity Page $140 bn $33 bn $77 bn $45 bn $21 bn Diodes’ SAM: $10 - $12 bn Diodes’ SAM: $14 - $16 bn Opto $19 bn Std Logic Analog Discrete Micro/Special Memory Diodes’ SAM: $1 - $3 bn

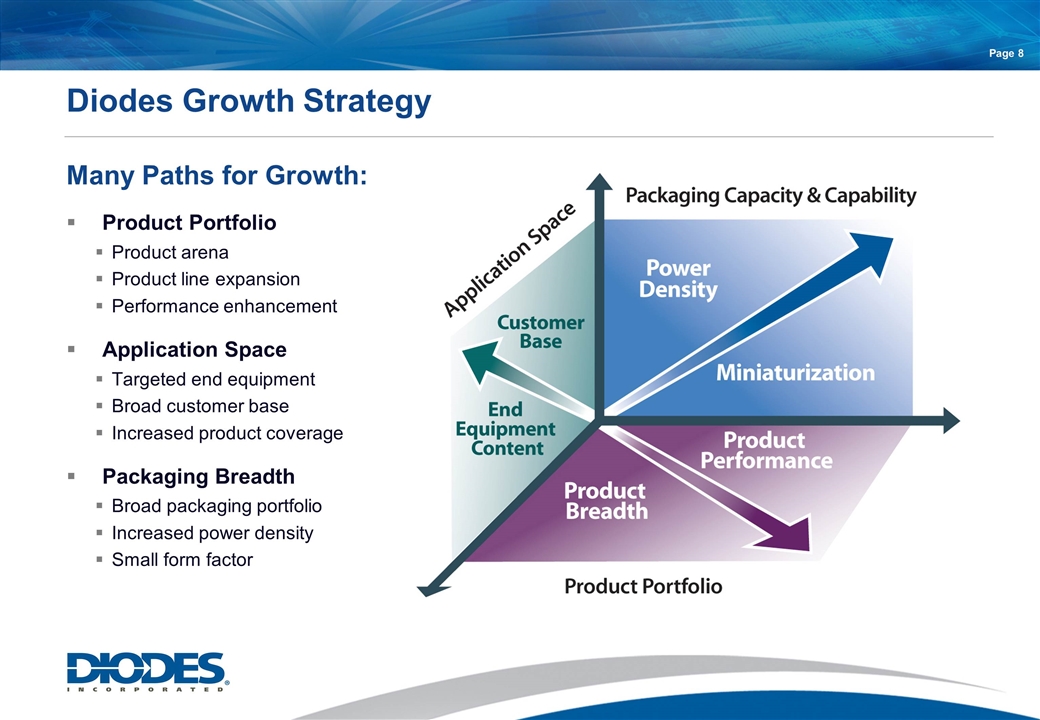

Diodes Growth Strategy Page Many Paths for Growth: Product Portfolio Product arena Product line expansion Performance enhancement Application Space Targeted end equipment Broad customer base Increased product coverage Packaging Breadth Broad packaging portfolio Increased power density Small form factor

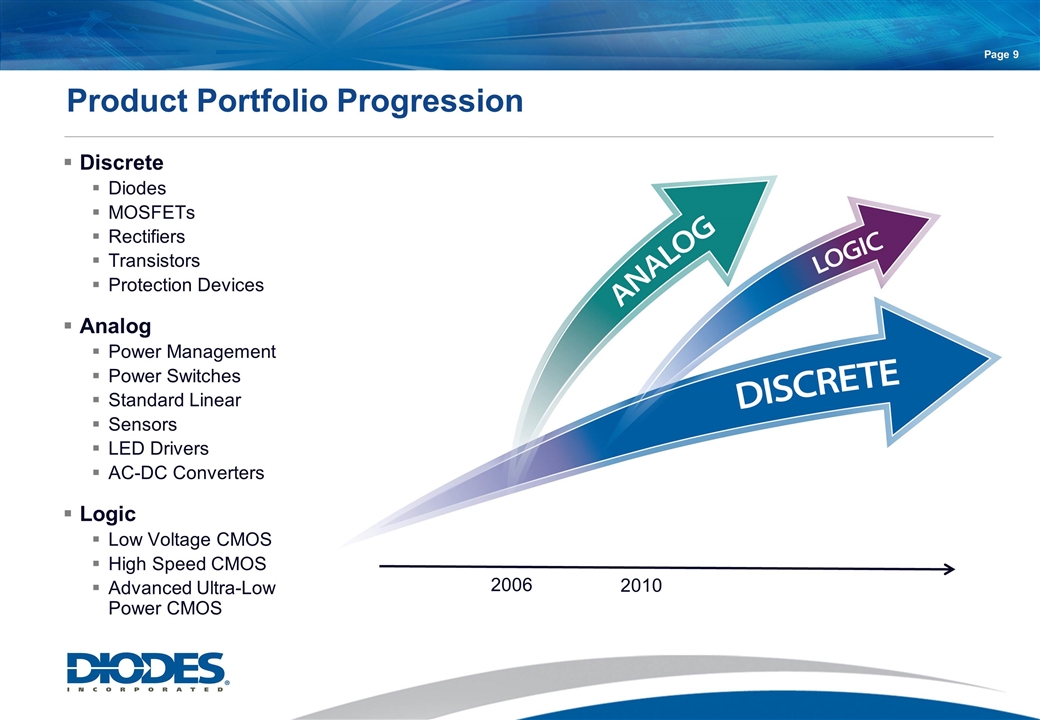

2006 2010 Product Portfolio Progression Page Discrete Diodes MOSFETs Rectifiers Transistors Protection Devices Analog Power Management Power Switches Standard Linear Sensors LED Drivers AC-DC Converters Logic Low Voltage CMOS High Speed CMOS Advanced Ultra-Low Power CMOS

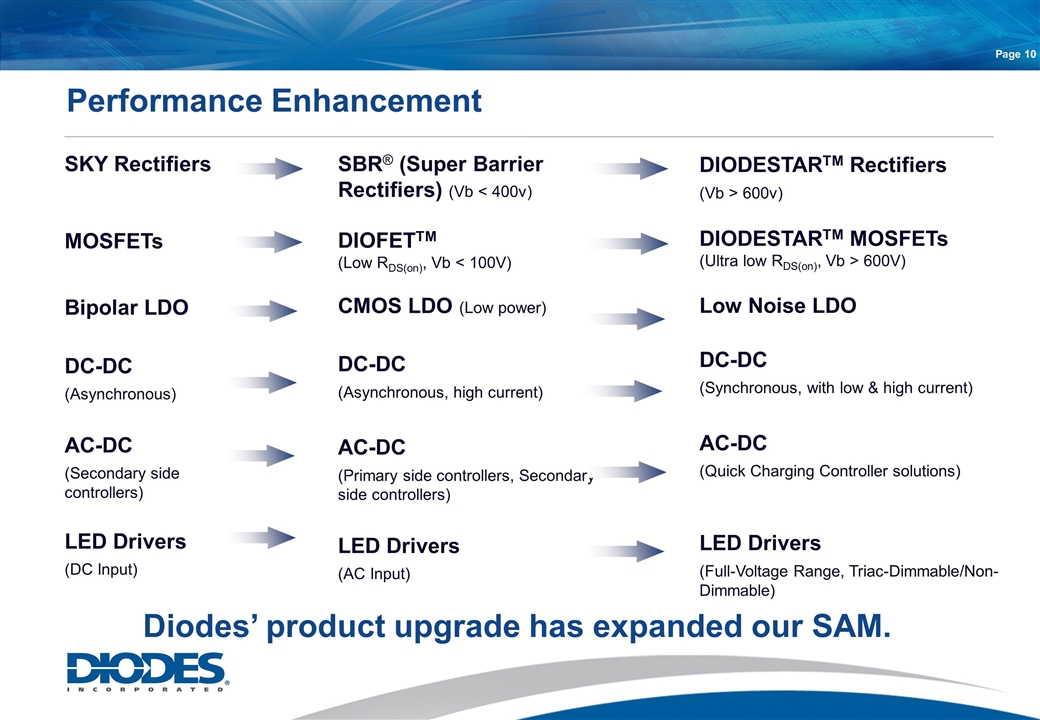

SKY Rectifiers MOSFETs Bipolar LDO DC-DC (Asynchronous) AC-DC (Secondary side controllers) LED Drivers (DC Input) Performance Enhancement Page Diodes’ product upgrade has expanded our SAM. SBR® (Super Barrier Rectifiers) (Vb < 400v) DIOFETTM (Low RDS(on), Vb < 100V) CMOS LDO (Low power) DC-DC (Asynchronous, high current) AC-DC (Primary side controllers, Secondary side controllers) LED Drivers (AC Input) DIODESTARTM Rectifiers (Vb > 600v) DIODESTARTM MOSFETs (Ultra low RDS(on), Vb > 600V) Low Noise LDO DC-DC (Synchronous, with low & high current) AC-DC (Quick Charging Controller solutions) LED Drivers (Full-Voltage Range, Triac-Dimmable/Non-Dimmable)

Efficiency, Functionality and Control for Smartphones Page LED Backlighting LED Drivers Boost Converters Schottky Diodes LCD / OLED Display Bias LCD Bias ICs OLED Bias ICs Schottky Diodes LED Flash Module Camera Flash Drivers ZXMN series MOSFETs Keypad Backlighting LED Drivers Boost Converters Schottky Diodes System Voltage Conversion Low Dropout Regulators DC-DC Converters Schottky Diodes Low-Saturation Bipolar Transistors GPS Antenna Detection Current Monitors Battery Power Management USB Power Switches Current Monitors Charger ICs Low-Saturation Bipolar Transistors ZXMP series MOSFETs RF Power Amplifier Low Dropout Regulators Audio Amplifier Class D Amplifier System Interface USB Power Switches Zener and TVS Arrays

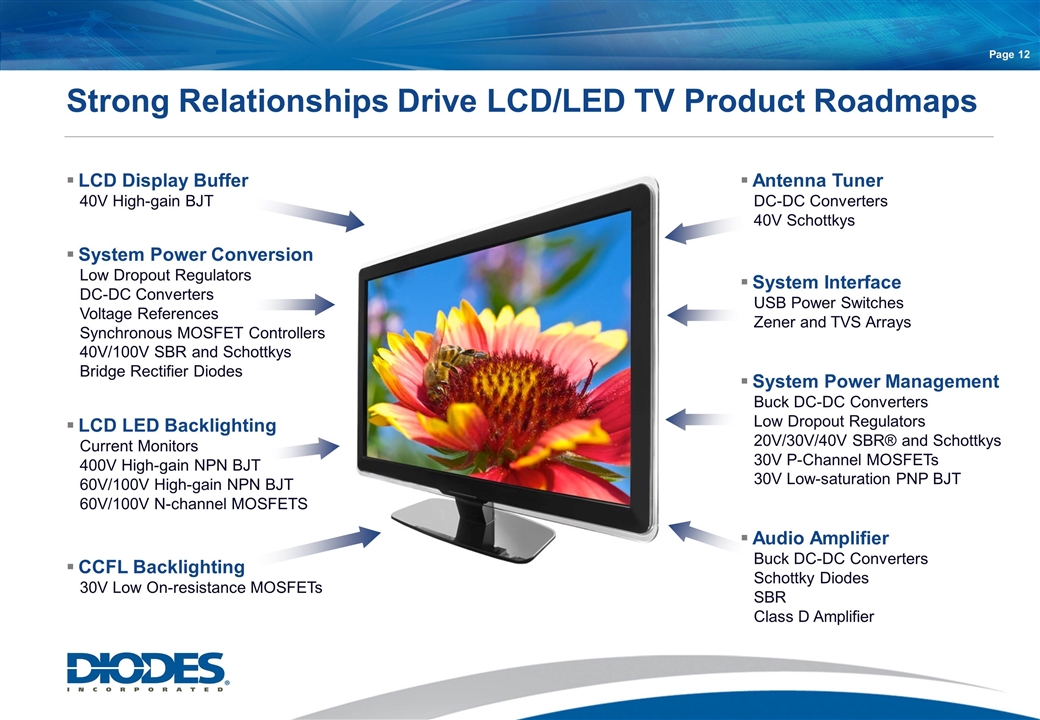

Page Strong Relationships Drive LCD/LED TV Product Roadmaps LCD Display Buffer 40V High-gain BJT System Power Conversion Low Dropout Regulators DC-DC Converters Voltage References Synchronous MOSFET Controllers 40V/100V SBR and Schottkys Bridge Rectifier Diodes LCD LED Backlighting Current Monitors 400V High-gain NPN BJT 60V/100V High-gain NPN BJT 60V/100V N-channel MOSFETS CCFL Backlighting 30V Low On-resistance MOSFETs System Interface USB Power Switches Zener and TVS Arrays System Power Management Buck DC-DC Converters Low Dropout Regulators 20V/30V/40V SBR® and Schottkys 30V P-Channel MOSFETs 30V Low-saturation PNP BJT Antenna Tuner DC-DC Converters 40V Schottkys Audio Amplifier Buck DC-DC Converters Schottky Diodes SBR Class D Amplifier

Page Product Breadth and Performance for Computing Platforms LCD / LED Backlighting LED Drivers Boost Converters Schottky Diodes Battery Power Management Current Monitors Load Switches Low-Saturation BJT ZXMP series MOSFETs System Voltage Conversion Low Dropout Regulators DC-DC Converters Schottky Diodes Low-Saturation BJT Open / Close Detection Hall Effect Sensors Hall Effect Drivers System Power Management Buck DC-DC Converters Low Dropout Regulators Super Barrier Rectifiers Schottky Diodes P-Channel MOSFETs Low-Saturation BJT System Interface USB Power Switches Zener and TVS Arrays Audio Amplifier Buck DC-DC Converters Schottky Diodes Super Barrier Rectifiers Class D Amplifier Wireless Connectivity DC-DC Converters Low Dropout Regulators

Page Automotive Networking ESD Protection TVS Protection Seat Control Module Hall Sensor SBR IntelliFET® Voltage Reference Body Control Module Bipolar Transistors Shunt Regulator Voltage Reference IntelliFET MOSFETs Hall Sensor Braking Control Unit Voltage Reference IntelliFETs MOSFETs Hall Sensor Powertrain MOSFET Hall Sensor Super Barrier Rectifier® (SBR) Daytime Running Lights LED Drivers Schottky Diodes MOSFETs Bipolar Transistors Interior Light LED Drivers Schottky Diodes MOSFETs Bipolar Transistors SBR and IntelliFET are registered trademarks of Diodes Incorporated Automotive Quality for Demanding Automotive Applications

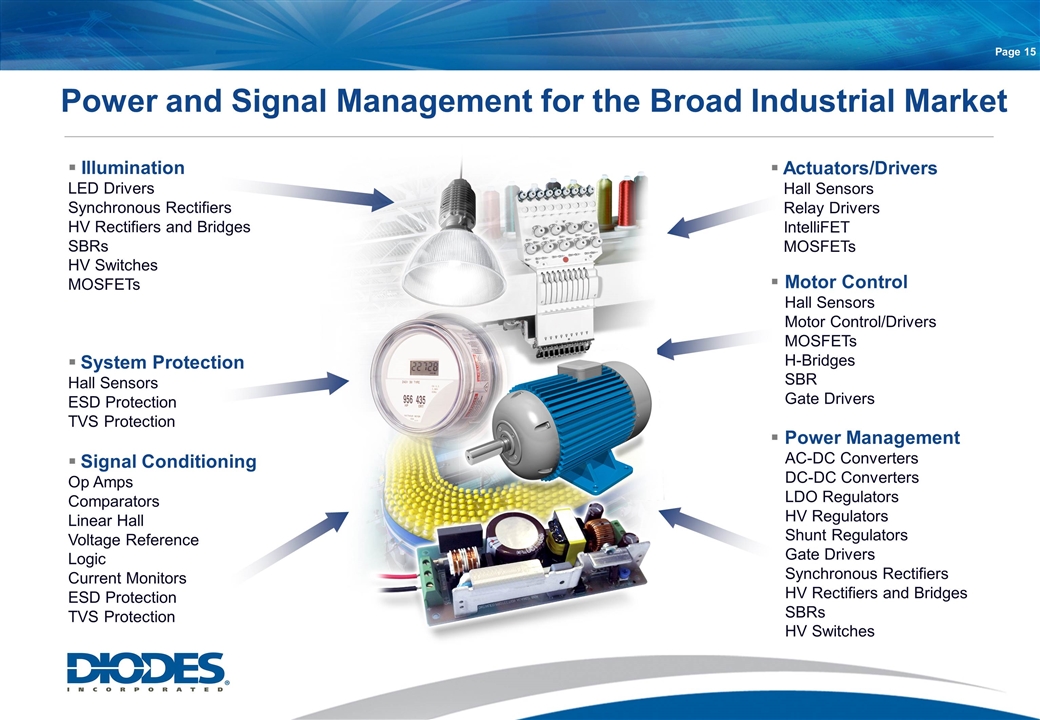

Page Power and Signal Management for the Broad Industrial Market Power Management AC-DC Converters DC-DC Converters LDO Regulators HV Regulators Shunt Regulators Gate Drivers Synchronous Rectifiers HV Rectifiers and Bridges SBRs HV Switches Signal Conditioning Op Amps Comparators Linear Hall Voltage Reference Logic Current Monitors ESD Protection TVS Protection Illumination LED Drivers Synchronous Rectifiers HV Rectifiers and Bridges SBRs HV Switches MOSFETs System Protection Hall Sensors ESD Protection TVS Protection Motor Control Hall Sensors Motor Control/Drivers MOSFETs H-Bridges SBR Gate Drivers Actuators/Drivers Hall Sensors Relay Drivers IntelliFET MOSFETs

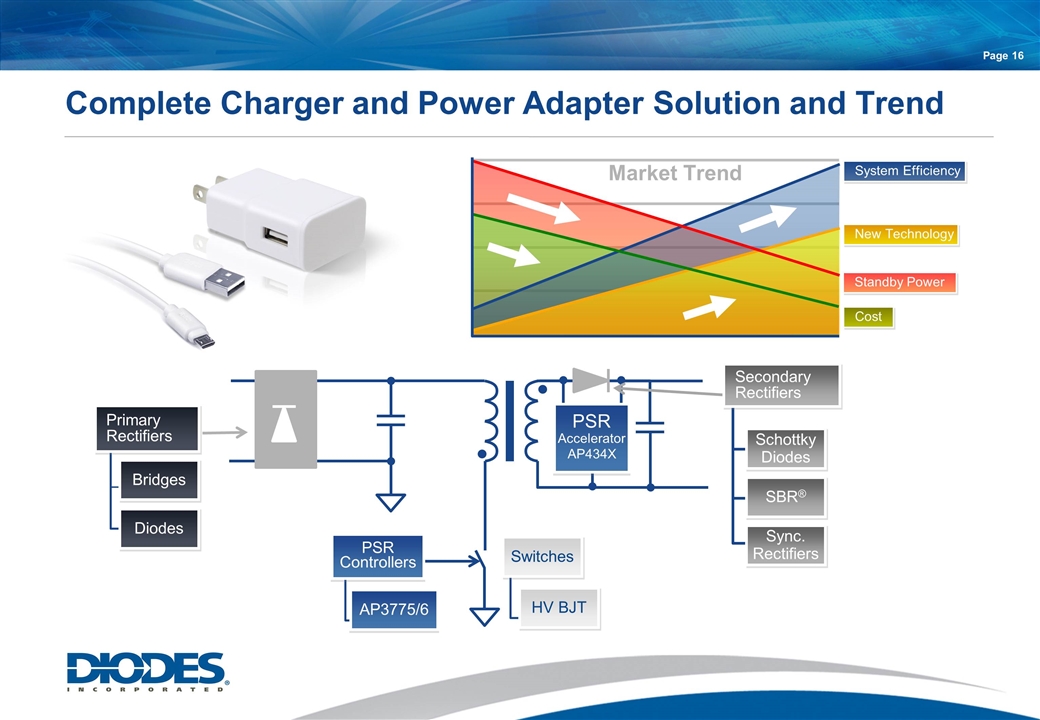

Page Market Trend Complete Charger and Power Adapter Solution and Trend Primary Rectifiers Bridges Diodes Switches HV BJT PSR Controllers AP3775/6 Secondary Rectifiers Schottky Diodes SBR® Sync. Rectifiers Standby Power Cost System Efficiency New Technology PSR Accelerator AP434X

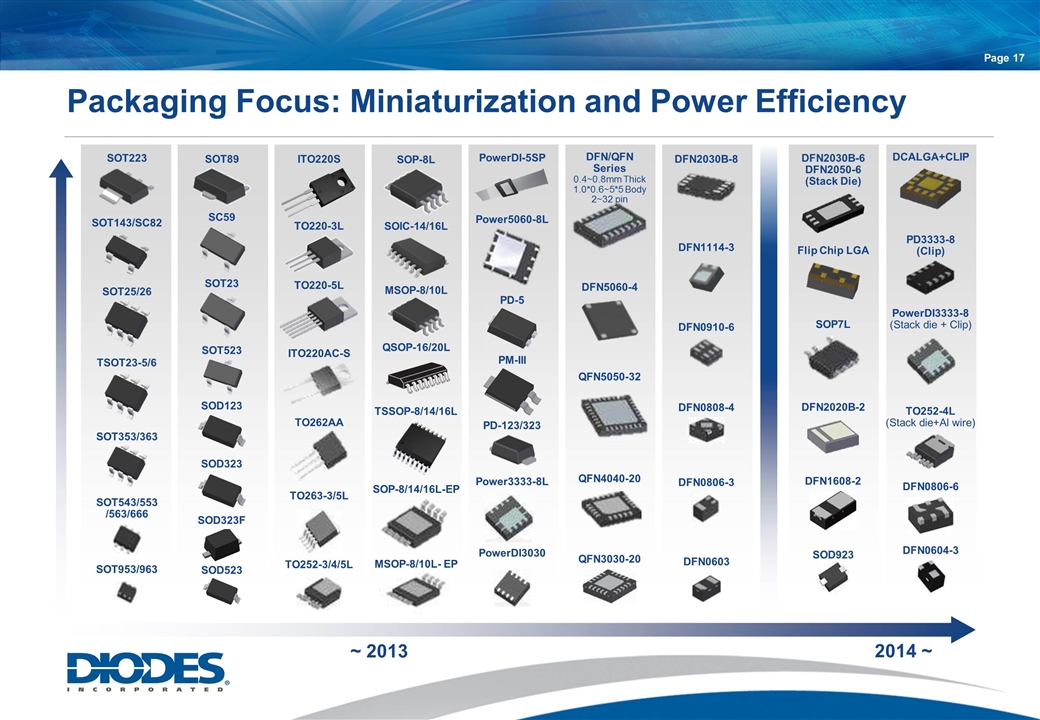

TSSOP-8/14/16L SOT89 SC59 SOD323 SOT353/363 SOT143/SC82 SOT543/553 /563/666 PM-III SOT223 ~ 2013 SOT953/963 QSOP-16/20L TSOT23-5/6 DFN0603 PowerDI-5SP Power5060-8L ITO220AC-S DFN1114-3 DFN5060-4 Power3333-8L DFN0808-4 DFN0806-3 PD-123/323 PowerDI3030 MSOP-8/10L TO263-3/5L TO220-3L DFN/QFN Series 0.4~0.8mm Thick 1.0*0.6~5*5 Body 2~32 pin DFN0910-6 DFN2030B-8 SOP-8/14/16L-EP MSOP-8/10L- EP TO252-3/4/5L SOD523 SOD323F SOIC-14/16L TO220-5L ITO220S TO262AA QFN5050-32 SOP-8L QFN4040-20 PD-5 SOT23 SOT523 SOT25/26 PowerDI3333-8 (Stack die + Clip) DFN2030B-6 DFN2050-6 (Stack Die) DFN0604-3 SOD923 PD3333-8 (Clip) SOP7L DFN2020B-2 2014 ~ TO252-4L (Stack die+Al wire) DCALGA+CLIP Flip Chip LGA SOD123 QFN3030-20 DFN1608-2 DFN0806-6 Packaging Focus: Miniaturization and Power Efficiency Page

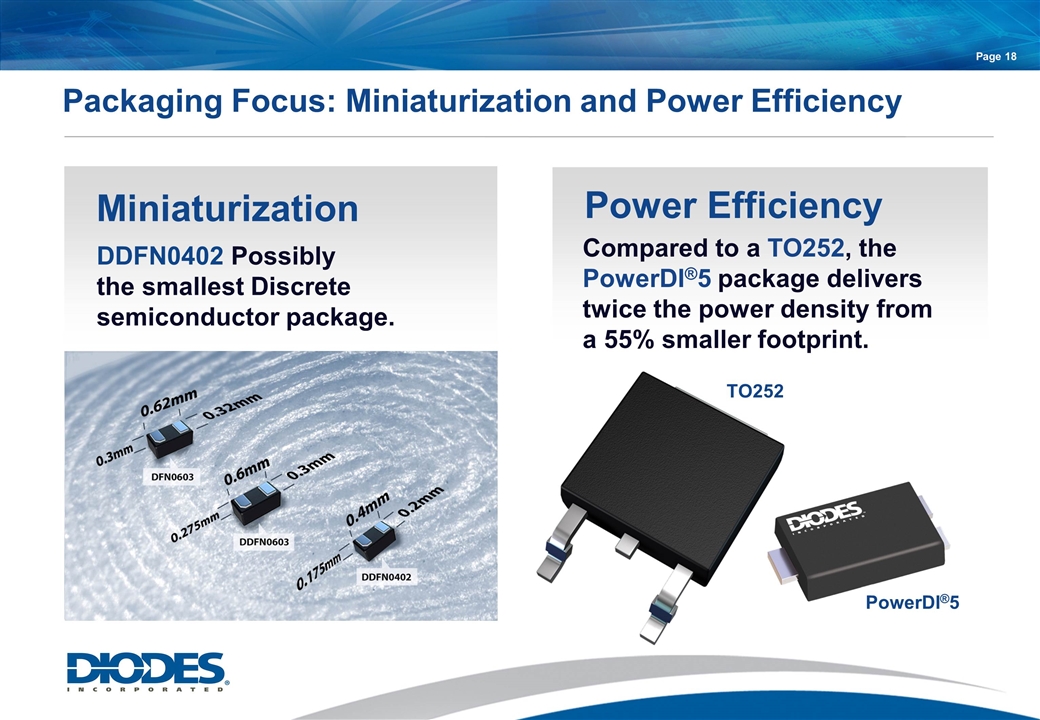

Page Packaging Focus: Miniaturization and Power Efficiency Power Efficiency Miniaturization DDFN0402 Possibly the smallest Discrete semiconductor package. Compared to a TO252, the PowerDI®5 package delivers twice the power density from a 55% smaller footprint. PowerDI®5 TO252

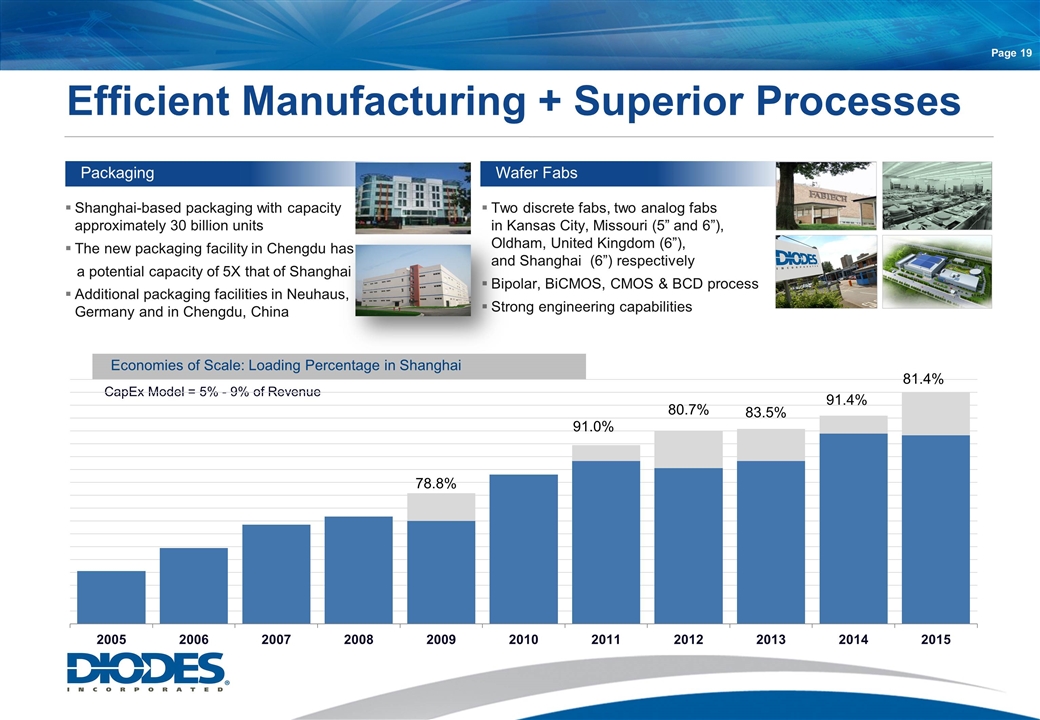

Page Shanghai-based packaging with capacity approximately 30 billion units The new packaging facility in Chengdu has a potential capacity of 5X that of Shanghai Additional packaging facilities in Neuhaus, Germany and in Chengdu, China Two discrete fabs, two analog fabs in Kansas City, Missouri (5” and 6”), Oldham, United Kingdom (6”), and Shanghai (6”) respectively Bipolar, BiCMOS, CMOS & BCD process Strong engineering capabilities CapEx Model = 5% - 9% of Revenue Packaging Wafer Fabs Economies of Scale: Loading Percentage in Shanghai Efficient Manufacturing + Superior Processes

Collaborative Customer Relationships Page Quanta

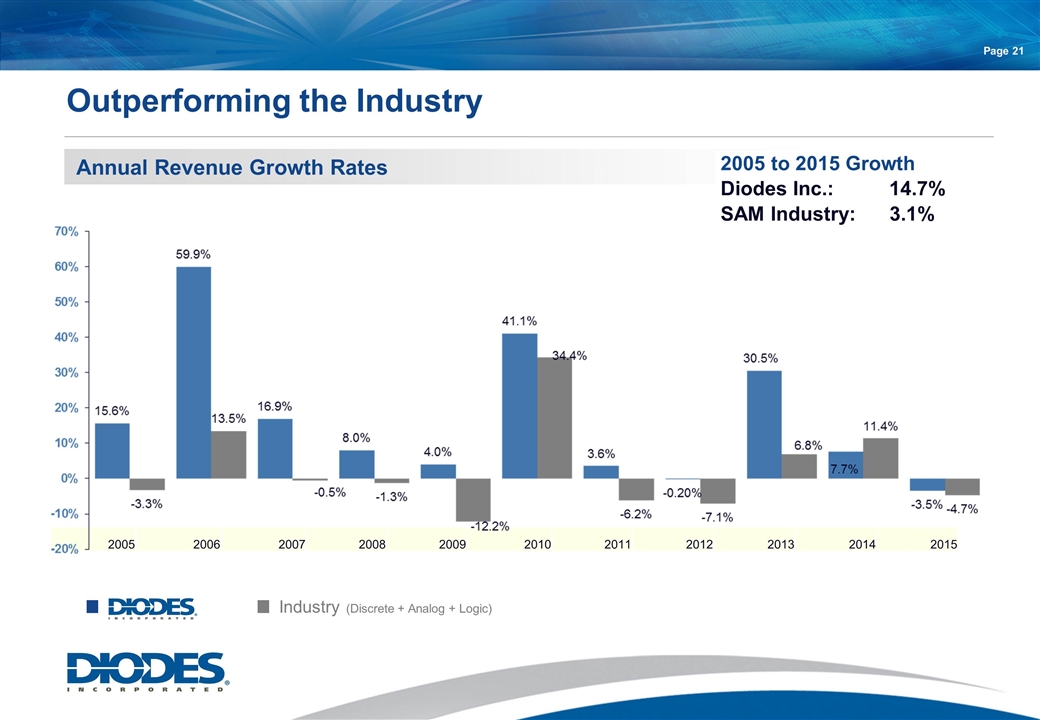

Annual Revenue Growth Rates Outperforming the Industry Page Industry (Discrete + Analog + Logic) 2005 to 2015 Growth Diodes Inc.: 14.7% SAM Industry: 3.1% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

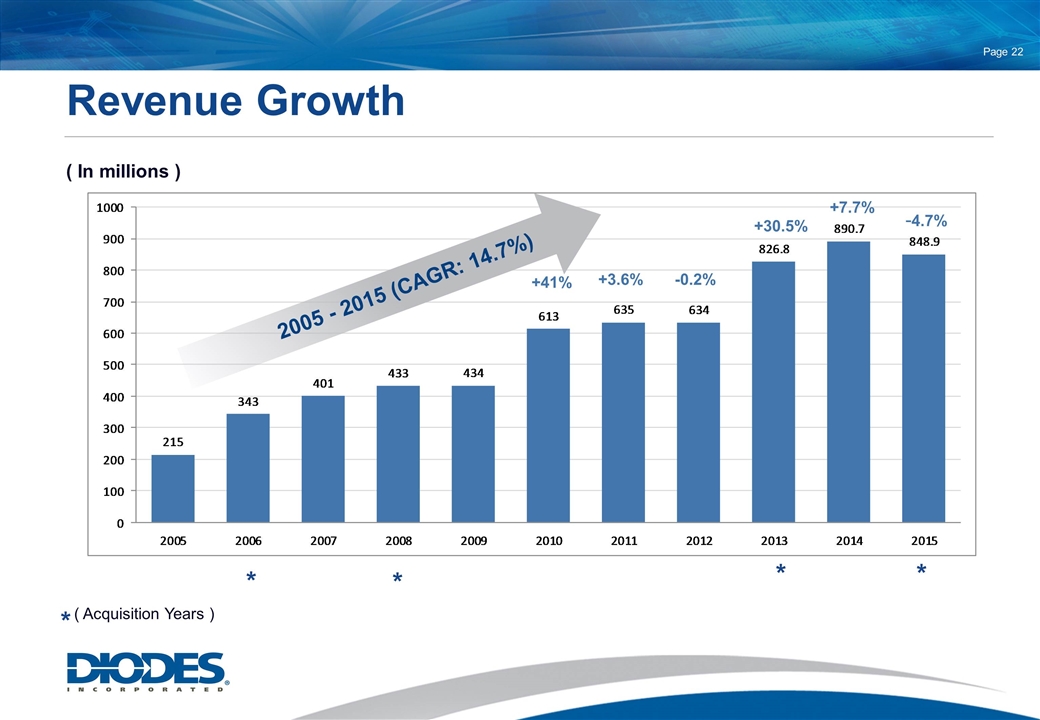

Revenue Growth ( In millions ) +41% +3.6% -0.2% +7.7% ( Acquisition Years ) * * * * * +30.5% -4.7% Page

Revenue Profile – 4Q2015 By Channel By Region By End Market Page 9% 81% 10% Asia Pacific Europe North America 66% 34% Distribution OEM / EMS 18% 20% 25% 32% 5% Industrial Consumer Communications Automotive Computing

Page Summary of Year 2015 Completed the acquisition of Pericom Semiconductor on November 24 and included the initial purchase accounting adjustments in the fourth quarter 2015 GAAP results; Revenue was $848.9 million, a decrease of 4.7 percent over the $890.7 million in 2014; Non-GAAP Gross profit was 251.9million as compared to GAAP gross profit of $277.3 million in 2014; Non-GAAP gross margin was 29.7 percent compared to GAAP gross margin of 31.1 percent in 2014; GAAP net income was $29.8 million, or $0.60 per diluted share, compared to $63.7 million, or $1.31 per diluted share in 2014; Non-GAAP net income was $42.3 million, or $0.86 per diluted share, compared to $70.1 million, or $1.44 per diluted share in the prior year; Excluding share-based compensation expense, both GAAP and non-GAAP adjusted diluted ESP would have increased by an additional $0.05 per diluted share in the fourth quarter and $0.20 for the full year. Achieved $119.8 million cash flow from operations and negative $13.4 million free cash flow, which includes $133.2 million of capital expenditure. Net cash flow was a negative $24.6 million, which includes the pay down of $66 million of long-term debt. Re-Purchased 466,010 shares of common stock totaling $11.0 million.

Fourth Quarter 2015 Financial Performance Page In millions, except per share 4Q14 3Q15 4Q15 Revenue $223.7 $208.9 $214.4 Revenue Growth -4.2% 2.6% Gross Profit (GAAP) $70.7 $61.6 $53.9 Gross Profit Margin % (GAAP) 31.6% 29.5% 25.1% Net Income (GAAP) $16.7 $2.8 $0.7 Net Income (non-GAAP) $18.3 $6.3 $6.7 EPS (non-GAAP) $0.38 $0.13 $0.14 Cash Flow from Operations $26.9 $45.5 $21.4 EBITDA (non-GAAP) $42.7 $29.7 $24.5

Balance Sheet Page Dec 31, 2014 Cash $197 $243 $218 Short-term Investments $23 $12 $65 Inventory $180 $182 $203 Current Assets $650 $687 $751 Total Assets $1162 $1179 $1621 Long-term Debt $183 $141 $456 Total Liabilities $419 $369 $765 Total Equity $744 $810 $855 Dec 31, 2015 In millions Dec 31, 2013

Page Expect revenue to range between $214 million and $235 million, or flat to up 10 percent sequentially, including the first full quarter of revenue from Pericom; Expect non-GAAP gross margin to be 30.0 percent, plus or minus 2 percent; Non-GAAP operating expenses are expected to be approximately 25.5 percent of revenue, plus or minus 1 percent; Expect interest expense to be approximately 3.4 million; Expect income tax rate to be 28 percent, plus or minus 3 percent, and shares used to calculate diluted EPS for the first quarter are anticipated to be approximately 49.5 million; and Purchase accounting adjustments related to Pericom and previous acquisitions of $7.3 million after tax are not included in these non-GAAP estimates. 1Q 2016 Business Outlook

Diodes Strategy: Profitable Growth Page

Thank you Company Contact: Diodes Incorporated Laura Mehrl Director of Investor Relations P: 972-987-3959 E: [email protected] Investor Relations Contact: Shelton Group Leanne K. Sievers EVP, Investor Relations P: 949-224-3874 E: [email protected] www.diodes.com Diodes was named one of the 10 Best Stocks of the Past 20 Years March 2012

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Diodes Incorporated to Announce First Quarter 2024 Financial Results on May 9, 2024

- Glow Announces Late Filing of Financial Statements

- Grape Law Announces Feature in Manage HR Magazine's "Top 10 Rising Immigration Law Firms in America" List

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share