Form 8-K Colfax CORP For: Feb 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2016

Colfax Corporation

(Exact name of registrant as specified in its charter)

Delaware | 001-34045 | 54-1887631 |

(State or other jurisdiction | (Commission | (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

420 National Business Parkway, 5th Floor

Annapolis Junction, MD 20701

(Address of Principal Executive Offices) (Zip Code)

(301) 323-9000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 4, 2016, Colfax Corporation issued a press release reporting financial results for the year ended December 31, 2015. A copy of Colfax Corporation's press release is attached to this report as Exhibit 99.1 and is incorporated in this report by reference. Colfax Corporation has scheduled a conference call for 8:00 a.m. EST on February 4, 2016 to discuss its financial results, and slides for that call are attached to this report as Exhibit 99.2 and are incorporated in this report by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 | Colfax Corporation press release dated February 4, 2016, reporting financial results for the year ended December 31, 2015. |

99.2 | Colfax Corporation slides for February 4, 2016 conference call reporting financial results for the year ended December 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Colfax Corporation Date: February 4, 2016 By: /s/ C. Scott Brannan

Name: C. Scott Brannan

Title: Senior Vice President, Finance,

Chief Financial Officer and Treasurer

EXHIBIT INDEX

99.1 | Colfax Corporation press release dated February 4, 2016, reporting financial results for the year ended December 31, 2015. |

99.2 | Colfax Corporation slides for February 4, 2016 conference call reporting financial results for the year ended December 31, 2015. |

COLFAX REPORTS FOURTH QUARTER 2015 RESULTS

• | Fourth quarter net income per dilutive share of $0.36, adjusted net income per share of $0.51. |

• | Fourth quarter sales and operating profit in line with our expectations. |

• | Cost reduction programs on schedule for 2016. |

ANNAPOLIS JUNCTION, MD - February 4, 2016 - Colfax Corporation (NYSE: CFX), a leading global manufacturer of gas- and fluid-handling and fabrication technology products and services, today announced its financial results for the fourth quarter and year ended December 31, 2015.

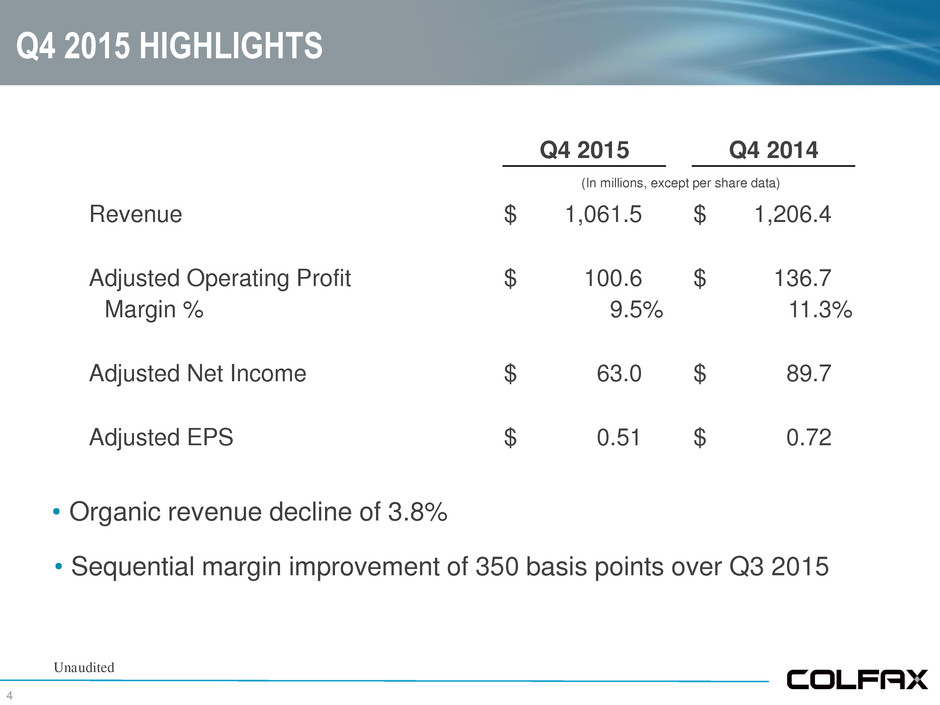

For the fourth quarter of 2015, net income was $44.2 million, or $0.36 per dilutive share. Adjusted net income (as defined below) was $63.0 million, or $0.51 per share, compared to $89.7 million for the fourth quarter of 2014, or $0.72 per share.

Net sales were $1.061 billion in the fourth quarter, a decrease of 12.0% from the prior year. Net sales decreased 3.8% organically compared to the fourth quarter of 2014. Fourth quarter operating income was $65.1 million, with adjusted operating income (as defined below) of $100.6 million. Adjusted operating income margin (as defined below) was 9.5% in the fourth quarter.

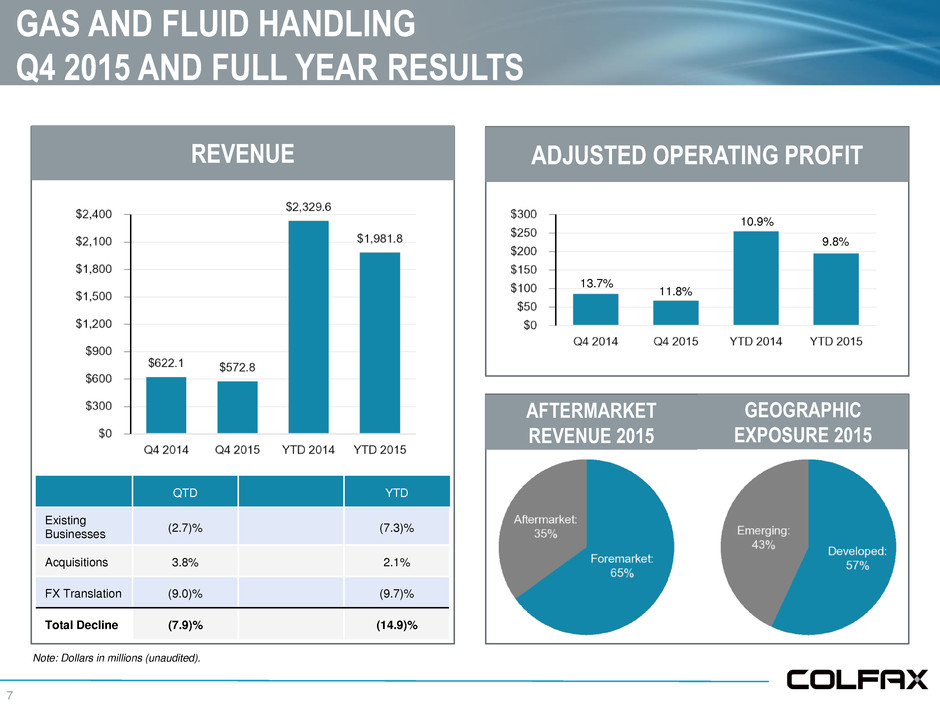

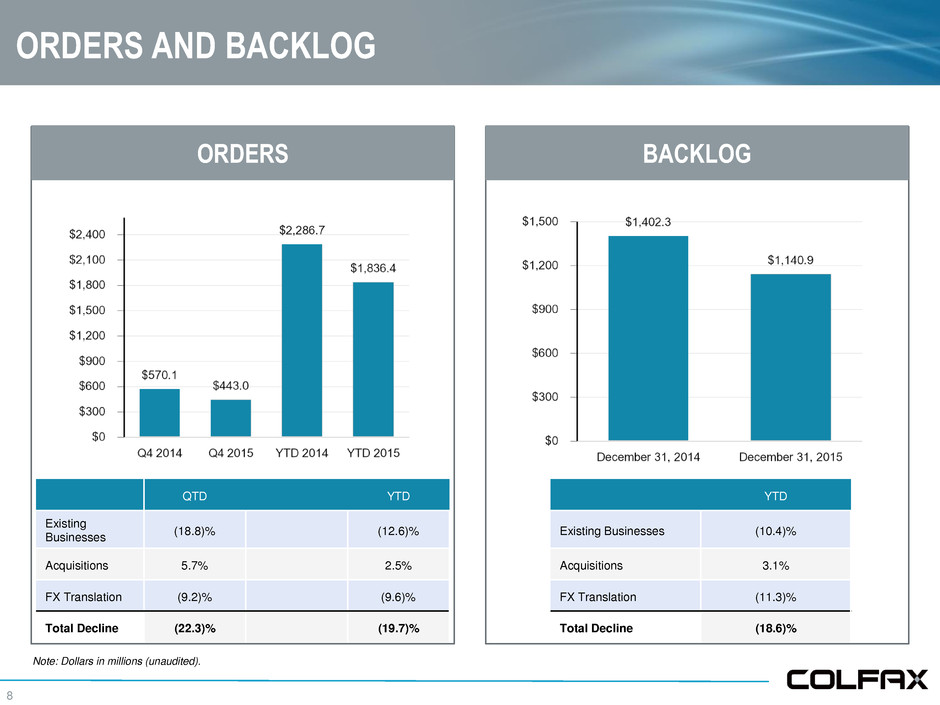

Fourth quarter gas- and fluid-handling orders decreased by 22.3% to $443.0 million compared to orders of $570.1 million for the fourth quarter of 2014, an organic order decline of 18.8%. Gas- and fluid-handling finished the period with backlog of $1,140.9 million.

For the year ended December 31, 2015 net income was $167.7 million, or $1.34 per dilutive share. Adjusted net income (as defined below) was $200.1 million, or $1.60 per share. Net sales for the year ended December 31, 2015 were $3.967 billion, a decrease of 14.2% compared to net sales for the year ended December 31, 2014. Operating income for the year ended December 31, 2015 was $284.6 million, with adjusted operating income (as defined below) of $345.8 million. Adjusted operating income margin (as defined below) for the year ended December 31, 2015 was 8.7%.

Adjusted net income, adjusted net income per share, adjusted operating income, adjusted operating income margin, organic sales decrease and organic order decrease are not financial measures calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). See below for a description of the measures' usefulness and a reconciliation of these measures to their most directly comparable GAAP financial measures.

Matthew Trerotola, President and Chief Executive Officer, stated, “We are pleased to deliver fourth quarter sales and operating profit in line with our expectations. While the demand environment remains weak in both business segments, we are on track to deliver the $100 million in cost reductions from our 2014 cost base by the end of 2016. Execution of cash conversion management was outstanding in the quarter as we closed out 2015 with a strong balance sheet and $131 million less debt than we began the quarter. We are confident we will continue to deliver on the performance goals we outlined at our recent Investor Day."

Non-GAAP Financial Measures and Other Adjustments

Colfax has provided in this press release financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted net income, adjusted net income per share, adjusted operating income, adjusted operating income margin, organic sales decrease and organic order decrease. Adjusted net income, adjusted net income per share, adjusted operating income and adjusted operating income margin exclude Restructuring and other related charges. Adjusted net income and adjusted net income per share exclude the write-off of certain deferred financing fees and original issue discount associated with the refinancing of Colfax's credit agreement for the year ended December 31, 2015, and the preferred stock conversion inducement payment for the year ended December 31, 2014. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 25.1% and 27.5% for the three months and year ended December 31, 2015, respectively. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 24.5% and 27.8% for the three months and year ended December 31, 2014, respectively. Organic sales decrease and organic order decrease exclude the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of restructuring and other related charges, write-off of certain deferred financing fees and original issue discount, and the preferred stock conversion inducement payment.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures. A reconciliation of non-GAAP financial measures presented above to GAAP results has been provided in the financial tables included in this press release.

Conference Call and Webcast

Colfax will host a conference call to provide details about its results on Thursday, February 4, 2016 at 8:00 a.m. EST. The call will be open to the public through 877-303-7908 (U.S. callers) or 678-373-0875 (international callers) and referencing the conference ID number 37611950, or through webcast via Colfax's website at www.colfaxcorp.com under the “Investors” section. Access to a supplemental slide presentation can also be found at the Colfax website under the same heading. Both the audio of this call and the slide presentation will be archived on the website later today and will be available until the next quarterly call.

About Colfax Corporation

Colfax Corporation is a diversified global manufacturing and engineering company that provides gas- and fluid-handling and fabrication technology products and services to commercial and governmental customers around the world under the Howden, Colfax Fluid Handling and ESAB brands. Colfax believes that its brands are among the most highly recognized in each of the markets that it serves. Colfax is traded on the NYSE under the ticker "CFX." Additional information about Colfax is available at www.colfaxcorp.com.

CAUTIONARY NOTE CONCERNING FORWARD LOOKING STATEMENTS:

This press release may contain forward-looking statements, including forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions and other statements that are not historical or current fact. Forward-looking statements are based on Colfax's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current expectations include, but are not limited to factors detailed in Colfax's reports filed with the U.S. Securities and Exchange Commission including its 2014 Annual Report on Form 10-K under the caption “Risk Factors.” In addition, these statements are based on a number of assumptions that are subject to change. This press release speaks only as of the date hereof. Colfax disclaims any duty to update the information herein.

The term “Colfax” in reference to the activities described in this press release may mean one or more of Colfax's global operating subsidiaries and/or their internal business divisions and does not necessarily indicate activities engaged in by Colfax Corporation.

Contact:

Terry Ross, Vice President of Investor Relations

Colfax Corporation

301-323-9054

Colfax Corporation

Consolidated Statements of Income

Dollars in thousands, except per share data

(Unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, 2015 | December 31, 2014 | December 31, 2015 | December 31, 2014 | ||||||||||||

Net sales | $ | 1,061,464 | $ | 1,206,356 | $ | 3,967,053 | $ | 4,624,476 | |||||||

Cost of sales | 728,039 | 814,509 | 2,715,279 | 3,145,631 | |||||||||||

Gross profit | 333,425 | 391,847 | 1,251,774 | 1,478,845 | |||||||||||

Selling, general and administrative expense | 232,843 | 255,119 | 905,952 | 1,011,171 | |||||||||||

Restructuring and other related charges | 35,519 | 29,387 | 61,177 | 58,121 | |||||||||||

Operating income | 65,063 | 107,341 | 284,645 | 409,553 | |||||||||||

Interest expense(1) | 10,593 | 10,424 | 47,743 | 51,305 | |||||||||||

Income before income taxes | 54,470 | 96,917 | 236,902 | 358,248 | |||||||||||

Provision for (benefit from) income taxes(2) | 5,941 | 11,128 | 49,724 | (62,025 | ) | ||||||||||

Net income | 48,529 | 85,789 | 187,178 | 420,273 | |||||||||||

Less: income attributable to noncontrolling interest, net of taxes | 4,332 | 5,655 | 19,439 | 28,175 | |||||||||||

Net income attributable to Colfax Corporation | 44,197 | 80,134 | 167,739 | 392,098 | |||||||||||

Dividends on preferred stock | — | — | — | 2,348 | |||||||||||

Preferred stock conversion inducement payment | — | — | — | 19,565 | |||||||||||

Net income available to Colfax Corporation common shareholders | $ | 44,197 | $ | 80,134 | $ | 167,739 | $ | 370,185 | |||||||

Net income per share- basic | $ | 0.36 | $ | 0.65 | $ | 1.35 | $ | 3.06 | |||||||

Net income per share- diluted | $ | 0.36 | $ | 0.64 | $ | 1.34 | $ | 3.02 | |||||||

__________

(1) Includes noncash charges of $4.7 million, associated with the write-off of original issue discount and deferred costs in connection with the refinancing of our primary credit facility on June 5, 2015.

(2) Provision for income taxes for the three months ended December 31, 2015 and 2014, was favorably impacted by the enactment of the U.S. tax extenders packages related to the exemption from taxation of certain foreign income in the United States. Benefit from income taxes for the year ended December 31, 2014 was significantly impacted by the reassessment of the realizability of certain deferred tax assets as a result of the effect of the Victor Acquisition on expected future income which resulted in a decrease in the Company's valuation allowance against U.S. deferred tax assets.

Colfax Corporation

Reconciliation of GAAP to Non-GAAP Financial Measures

In thousands, except per share data

(Unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, 2015 | December 31, 2014 | December 31, 2015 | December 31, 2014 | ||||||||||||

Adjusted Operating Income | |||||||||||||||

Operating income | $ | 65,063 | $ | 107,341 | $ | 284,645 | $ | 409,553 | |||||||

Restructuring and other related charges | 35,519 | 29,387 | 61,177 | 58,121 | |||||||||||

Adjusted operating income | $ | 100,582 | $ | 136,728 | $ | 345,822 | $ | 467,674 | |||||||

Adjusted operating income margin | 9.5 | % | 11.3 | % | 8.7 | % | 10.1 | % | |||||||

Three Months Ended | Year Ended | ||||||||||||||

December 31, 2015 | December 31, 2014 | December 31, 2015 | December 31, 2014 | ||||||||||||

Adjusted Net Income | |||||||||||||||

Net income attributable to Colfax Corporation | $ | 44,197 | $ | 80,134 | $ | 167,739 | $ | 392,098 | |||||||

Restructuring and other related charges | 35,519 | 29,387 | 61,177 | 58,121 | |||||||||||

Debt extinguishment charges- Refinancing of credit agreement | — | — | 4,731 | — | |||||||||||

Tax adjustment(1) | (16,678 | ) | (19,790 | ) | (33,549 | ) | (177,944 | ) | |||||||

Adjusted net income | $ | 63,038 | $ | 89,731 | $ | 200,098 | $ | 272,275 | |||||||

Adjusted net income margin | 5.9 | % | 7.4 | % | 5.0 | % | 5.9 | % | |||||||

Adjusted Net Income Per Share | |||||||||||||||

Net income available to Colfax Corporation common shareholders | $ | 44,197 | $ | 80,134 | $ | 167,739 | $ | 370,185 | |||||||

Restructuring and other related charges | 35,519 | 29,387 | 61,177 | 58,121 | |||||||||||

Debt extinguishment charges- Refinancing of credit agreement | — | — | 4,731 | — | |||||||||||

Preferred stock conversion inducement payment(2) | — | — | — | 19,565 | |||||||||||

Tax adjustment(1) | (16,678 | ) | (19,790 | ) | (33,549 | ) | (177,944 | ) | |||||||

Adjusted net income available to Colfax Corporation common shareholders | 63,038 | 89,731 | 200,098 | 269,927 | |||||||||||

Dividends on preferred stock(2) | — | — | — | 2,348 | |||||||||||

$ | 63,038 | $ | 89,731 | $ | 200,098 | $ | 272,275 | ||||||||

Weighted-average shares outstanding - diluted | 124,102,455 | 125,156,755 | 124,869,649 | 124,033,702 | |||||||||||

$ | 0.51 | $ | 0.72 | $ | 1.60 | $ | 2.20 | ||||||||

Net income per share— diluted (in accordance with GAAP) | $ | 0.36 | $ | 0.64 | $ | 1.34 | $ | 3.02 | |||||||

__________

(1) The effective tax rates used to calculate adjusted net income and adjusted net income per share are 25.1% and 27.5% for the fourth quarter and full year ended December 31, 2015, respectively, and 24.5% and 27.8% for the fourth quarter and full year ended December 31, 2014, respectively.

(2) Adjusted net income per share for the period prior to February 12, 2014 was calculated under the if-converted method in accordance with GAAP. On February 12, 2014, the Series A Perpetual Convertible Preferred Stock were converted to Common stock and the Company paid a $19.6 million conversion inducement to the holders of the Series A Perpetual Convertible Preferred Stock.

Colfax Corporation

Change in Sales, Orders and Backlog

Dollars in millions

(Unaudited)

Net Sales | Orders | |||||||||||||||||||

$ | % | $ | % | |||||||||||||||||

For the three months ended December 31, 2014 | $ | 1,206.4 | $ | 570.1 | ||||||||||||||||

Components of Change: | ||||||||||||||||||||

Existing Businesses | (45.3 | ) | (3.8 | )% | (107.0 | ) | (18.8 | )% | ||||||||||||

Acquisitions(1) | 23.7 | 2.0 | % | 32.3 | 5.7 | % | ||||||||||||||

Foreign Currency Translation | (123.3 | ) | (10.2 | )% | (52.4 | ) | (9.2 | )% | ||||||||||||

Total | (144.9 | ) | (12.0 | )% | (127.1 | ) | (22.3 | )% | ||||||||||||

For the three months ended December 31, 2015 | $ | 1,061.5 | $ | 443.0 | ||||||||||||||||

Net Sales | Orders | Backlog at Period End | ||||||||||||||||||

$ | % | $ | % | $ | % | |||||||||||||||

As of and for the year ended December 31, 2014 | $ | 4,624.5 | $ | 2,286.7 | $ | 1,402.3 | ||||||||||||||

Components of Change: | ||||||||||||||||||||

Existing Businesses | (304.5 | ) | (6.6 | )% | (287.1 | ) | (12.6 | )% | (145.4 | ) | (10.4 | )% | ||||||||

Acquisitions(2) | 171.2 | 3.7 | % | 57.9 | 2.5 | % | 43.3 | 3.1 | % | |||||||||||

Foreign Currency Translation | (524.1 | ) | (11.3 | )% | (221.1 | ) | (9.6 | )% | (159.3 | ) | (11.3 | )% | ||||||||

Total | (657.4 | ) | (14.2 | )% | (450.3 | ) | (19.7 | )% | (261.4 | ) | (18.6 | )% | ||||||||

As of and for the year ended December 31, 2015 | $ | 3,967.1 | $ | 1,836.4 | $ | 1,140.9 | ||||||||||||||

(1) Represents the incremental sales and orders as a result of our acquisitions of RootsTM blowers and compressors and Simsmart Technologies.

(2) Represents the incremental sales, orders and order backlog as a result of our acquisitions of RootsTM blowers and compressors and Simsmart Technologies, and incremental sales as a result of our acquisition of Victor Technologies Holdings Inc.

Colfax Corporation

Consolidated Balance Sheets

Dollars in thousands, except share amounts

(Unaudited)

December 31, | |||||||

2015 | 2014 | ||||||

ASSETS | |||||||

CURRENT ASSETS: | |||||||

Cash and cash equivalents | $ | 197,469 | $ | 305,448 | |||

Trade receivables, less allowance for doubtful accounts of $39,505 and $27,256 | 888,166 | 1,029,150 | |||||

Inventories, net | 420,386 | 442,732 | |||||

Other current assets | 253,744 | 296,948 | |||||

Total current assets | 1,759,765 | 2,074,278 | |||||

Property, plant and equipment, net | 644,536 | 727,435 | |||||

Goodwill | 2,817,687 | 2,873,023 | |||||

Intangible assets, net | 995,712 | 1,043,583 | |||||

Other assets | 515,219 | 493,198 | |||||

Total assets | $ | 6,732,919 | $ | 7,211,517 | |||

LIABILITIES AND EQUITY | |||||||

CURRENT LIABILITIES: | |||||||

Current portion of long-term debt | $ | 5,792 | $ | 9,855 | |||

Accounts payable | 718,893 | 780,287 | |||||

Accrued liabilities | 391,659 | 489,983 | |||||

Total current liabilities | 1,116,344 | 1,280,125 | |||||

Long-term debt, less current portion | 1,411,755 | 1,526,955 | |||||

Other liabilities | 948,264 | 1,051,993 | |||||

Total liabilities | 3,476,363 | 3,859,073 | |||||

Equity: | |||||||

Common stock, $0.001 par value; 400,000,000 shares authorized; 123,486,425 and 123,730,578 issued and outstanding | 123 | 124 | |||||

Additional paid-in capital | 3,199,267 | 3,200,832 | |||||

Retained earnings | 557,300 | 389,561 | |||||

Accumulated other comprehensive loss | (686,715 | ) | (443,691 | ) | |||

Total Colfax Corporation equity | 3,069,975 | 3,146,826 | |||||

Noncontrolling interest | 186,581 | 205,618 | |||||

Total equity | 3,256,556 | 3,352,444 | |||||

Total liabilities and equity | $ | 6,732,919 | $ | 7,211,517 | |||

Colfax Corporation

Consolidated Statements of Cash Flows

Dollars in thousands

(Unaudited)

Year Ended December 31, | |||||||

2015 | 2014 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 187,178 | $ | 420,273 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation, amortization and impairment charges | 154,542 | 174,724 | |||||

Stock-based compensation expense | 16,321 | 17,580 | |||||

Non-cash interest expense | 10,101 | 9,094 | |||||

Deferred income tax (benefit) provision | (22,717 | ) | (139,488 | ) | |||

Changes in operating assets and liabilities, net of acquisitions: | |||||||

Trade receivables, net | 64,048 | (19,916 | ) | ||||

Inventories, net | (390 | ) | 57,847 | ||||

Accounts payable | (11,184 | ) | (54,666 | ) | |||

Changes in other operating assets and liabilities | (94,086 | ) | (79,690 | ) | |||

Net cash provided by operating activities | 303,813 | 385,758 | |||||

Cash flows from investing activities: | |||||||

Purchases of fixed assets | (69,877 | ) | (84,458 | ) | |||

Acquisitions, net of cash received | (196,007 | ) | (948,800 | ) | |||

Other, net | 18,927 | 3,115 | |||||

Net cash used in investing activities | (246,957 | ) | (1,030,143 | ) | |||

Cash flows from financing activities: | |||||||

Borrowings under term credit facility | 750,000 | 150,000 | |||||

Payments under term credit facility | (1,232,872 | ) | (15,542 | ) | |||

Proceeds from borrowings on revolving credit facilities and other | 1,498,039 | 1,370,626 | |||||

Repayments of borrowings on revolving credit facilities and other | (1,104,055 | ) | (1,414,146 | ) | |||

Proceeds from issuance of common stock, net | 6,052 | 613,927 | |||||

Repurchases of common stock | (27,367 | ) | — | ||||

Acquisition of shares held by noncontrolling interest | — | (10,338 | ) | ||||

Preferred stock conversion inducement payment | — | (19,565 | ) | ||||

Payments of dividend on preferred stock | — | (3,853 | ) | ||||

Other | (21,066 | ) | (21,060 | ) | |||

Net cash (used in) provided by financing activities | (131,269 | ) | 650,049 | ||||

Effect of foreign exchange rates on Cash and cash equivalents | (33,566 | ) | (11,517 | ) | |||

Decrease in Cash and cash equivalents | (107,979 | ) | (5,853 | ) | |||

Cash and cash equivalents, beginning of period | 305,448 | 311,301 | |||||

Cash and cash equivalents, end of period | $ | 197,469 | $ | 305,448 | |||

Supplemental Disclosure of Cash Flow Information: | |||||||

Interest payments | $ | 36,363 | $ | 42,041 | |||

Income tax payments, net | $ | 79,540 | $ | 82,694 | |||

FOURTH QUARTER 2015 | EARNINGS CONFERENCE CALL

2 FORWARD-LOOKING STATEMENTS The following information contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions and other statements that are not historical or current facts. Forward-looking statements are based on Colfax's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current expectations include, but are not limited to, factors detailed in Colfax's reports filed with the U.S. Securities and Exchange Commission including its 2014 Annual Report on Form 10-K under the caption “Risk Factors”. In addition, these statements are based on a number of assumptions that are subject to change. This presentation speaks only as of this date. Colfax disclaims any duty to update the information herein.

Q4 2015 RESULTS

4 Q4 2015 HIGHLIGHTS • Organic revenue decline of 3.8% • Sequential margin improvement of 350 basis points over Q3 2015 Q4 2015 Q4 2014 (In millions, except per share data) Revenue $ 1,061.5 $ 1,206.4 Adjusted Operating Profit $ 100.6 $ 136.7 Margin % 9.5 % 11.3 % Adjusted Net Income $ 63.0 $ 89.7 Adjusted EPS $ 0.51 $ 0.72 Unaudited

5 FULL YEAR 2015 HIGHLIGHTS • Organic revenue decline of 6.6% • Margin decline of 140 basis points Unaudited Year Ended December 31, 2015 2014 (In millions, except per share data) Revenue $ 3,967.1 $ 4,624.5 Adjusted Operating Profit $ 345.8 $ 467.7 Margin % 8.7 % 10.1 % Adjusted Net Income $ 200.1 $ 272.3 Adjusted EPS $ 1.60 $ 2.20

GAS AND FLUID HANDLING

7 GAS AND FLUID HANDLING Q4 2015 AND FULL YEAR RESULTS REVENUE QTD YTD Existing Businesses (2.7)% (7.3)% Acquisitions 3.8% 2.1% FX Translation (9.0)% (9.7)% Total Decline (7.9)% (14.9)% Note: Dollars in millions (unaudited). ADJUSTED OPERATING PROFIT 13.7% 11.8% 10.9% 9.8% AFTERMARKET REVENUE 2015 GEOGRAPHIC EXPOSURE 2015

8 ORDERS QTD YTD Existing Businesses (18.8)% (12.6)% Acquisitions 5.7% 2.5% FX Translation (9.2)% (9.6)% Total Decline (22.3)% (19.7)% Note: Dollars in millions (unaudited). BACKLOG ORDERS AND BACKLOG YTD Existing Businesses (10.4)% Acquisitions 3.1% FX Translation (11.3)% Total Decline (18.6)%

9 Q4 2015 SALES AND ORDERS BY END MARKET SALES: $572.8 million Total (Decline) Growth Organic (Decline) Growth Power Generation (24.6)% (17.8)% Oil, Gas & Petrochemical 22.7% 23.6% Marine 7.8% 18.0% Mining (52.1)% (35.5)% General Industrial & Other (2.6)% (1.0)% Total (7.9)% (2.7)% ORDERS: $443.0 million Total Decline Organic (Decline) Growth Power Generation (17.4)% (9.8)% Oil, Gas & Petrochemical (32.2)% (33.9)% Marine (5.9)% 4.2% Mining (21.8)% (0.6)% General Industrial & Other (23.3)% (23.7)% Total (22.3)% (18.8)%

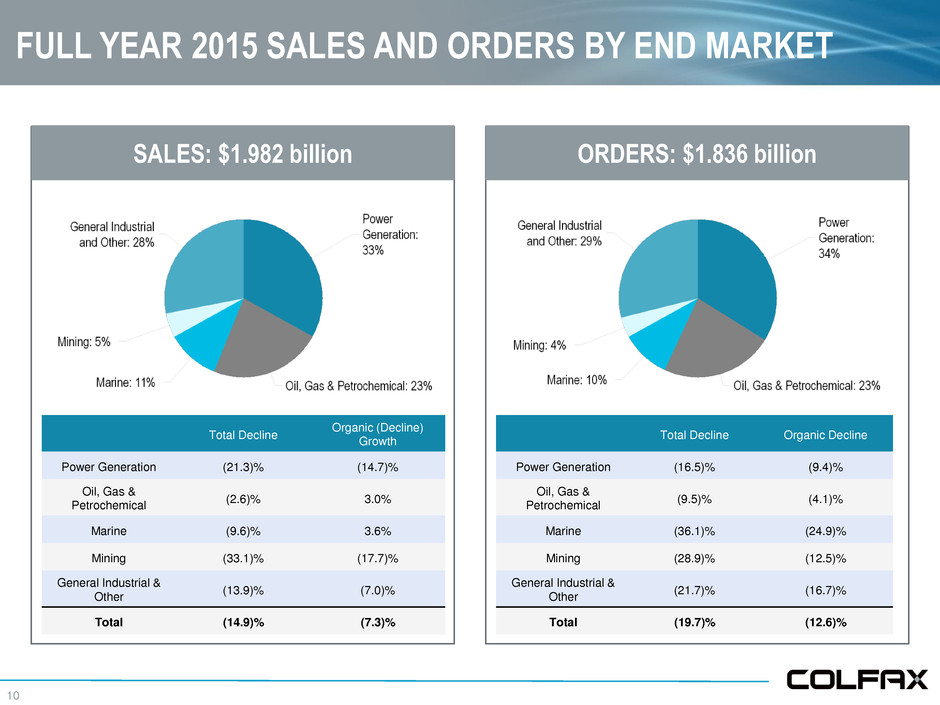

10 FULL YEAR 2015 SALES AND ORDERS BY END MARKET SALES: $1.982 billion Total Decline Organic (Decline) Growth Power Generation (21.3)% (14.7)% Oil, Gas & Petrochemical (2.6)% 3.0% Marine (9.6)% 3.6% Mining (33.1)% (17.7)% General Industrial & Other (13.9)% (7.0)% Total (14.9)% (7.3)% ORDERS: $1.836 billion Total Decline Organic Decline Power Generation (16.5)% (9.4)% Oil, Gas & Petrochemical (9.5)% (4.1)% Marine (36.1)% (24.9)% Mining (28.9)% (12.5)% General Industrial & Other (21.7)% (16.7)% Total (19.7)% (12.6)%

11 POWER GENERATION MARKET PERSPECTIVE SALES & ORDERS DECLINE • Served by both Howden and Colfax Fluid Handling • Sales decline primarily due to SCR projects in China completed in 2014 • Chinese air quality standards will augment 2016 sales and orders • Outlook for new power construction and aftermarket products stable for 2016 YTD 2015 SALES SPLIT YTD 2015 ORDERS SPLIT HIGHLIGHTS Q4 2015 vs. Q4 2014 YTD 2015 vs. YTD 2014 Total Organic Total Organic Sales (24.6)% (17.8)% (21.3)% (14.7)% Orders (17.4)% (9.8)% (16.5)% (9.4)% 33% 34%

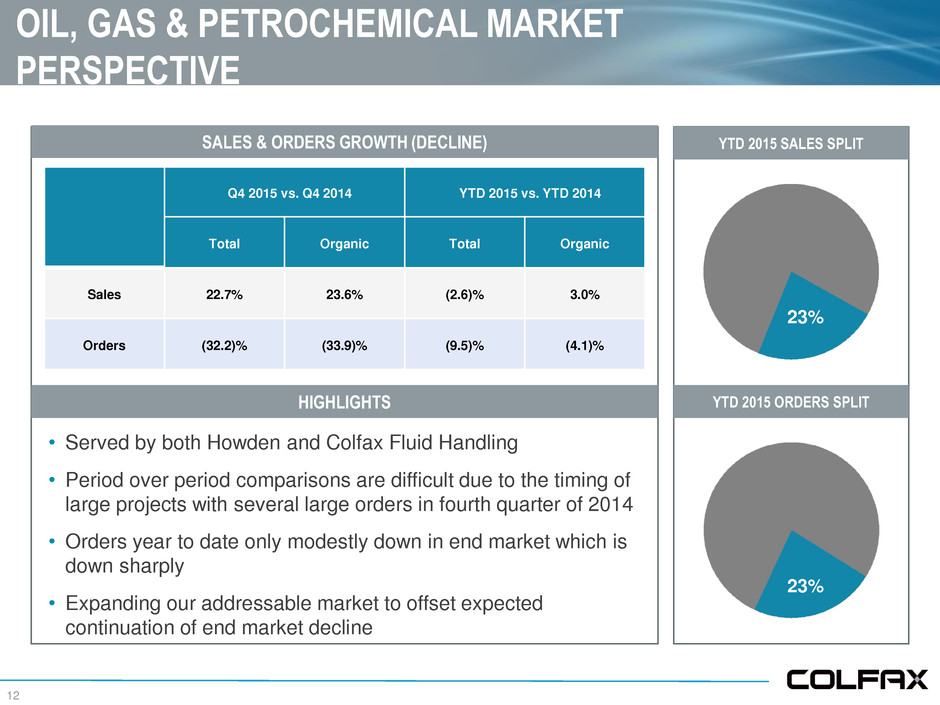

12 OIL, GAS & PETROCHEMICAL MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) • Served by both Howden and Colfax Fluid Handling • Period over period comparisons are difficult due to the timing of large projects with several large orders in fourth quarter of 2014 • Orders year to date only modestly down in end market which is down sharply • Expanding our addressable market to offset expected continuation of end market decline YTD 2015 SALES SPLIT YTD 2015 ORDERS SPLIT HIGHLIGHTS Q4 2015 vs. Q4 2014 YTD 2015 vs. YTD 2014 Total Organic Total Organic Sales 22.7% 23.6% (2.6)% 3.0% Orders (32.2)% (33.9)% (9.5)% (4.1)% 23% 23%

13 MARINE MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) • Primarily served by Colfax Fluid Handling • Fourth quarter growth reflects stabilizing new shipbuilding activity and scope of product expanding with key customers • Full year order decline primarily due to large, multi-year defense orders received in 2014 • Continued focus on aftermarket growth and expansion of product line YTD 2015 SALES SPLIT YTD 2015 ORDERS SPLIT HIGHLIGHTS Note: Marine market comprised of commercial marine and government, or defense, customers Q4 2015 vs. Q4 2014 YTD 2015 vs. YTD 2014 Total Organic Total Organic Sales 7.8% 18.0% (9.6)% 3.6% Orders (5.9)% 4.2% (36.1)% (24.9)% 11% 10%

14 MINING MARKET PERSPECTIVE SALES & ORDERS DECLINE • Primarily served by Howden • Remains a depressed market; focused on winning targeted projects YTD 2015 SALES SPLIT YTD 2015 ORDERS SPLIT HIGHLIGHTS Q4 2015 vs. Q4 2014 YTD 2015 vs. YTD 2014 Total Organic Total Organic Sales (52.1)% (35.5)% (33.1)% (17.7)% Orders (21.8)% (0.6)% (28.9)% (12.5)% 5% 4%

15 GENERAL INDUSTRIAL & OTHER MARKET PERSPECTIVE SALES & ORDERS DECLINE • Includes both Howden and Colfax Fluid Handling • Weak demand for industrial capital equipment driver of sales and order declines • Relatively stronger fourth quarter sales levels driven by project timing, not improved market conditions • Market headwinds expected to continue in 2016 YTD 2015 SALES SPLIT YTD 2015 ORDERS SPLIT HIGHLIGHTS Q4 2015 vs. Q4 2014 YTD 2015 vs. YTD 2014 Total Organic Total Organic Sales (2.6)% (1.0)% (13.9)% (7.0)% Orders (23.3)% (23.7)% (21.7)% (16.7)% 28% 29%

FABRICATION TECHNOLOGY

17 FABRICATION TECHNOLOGY Q4 2015 AND FULL YEAR RESULTS REVENUE Note: Dollars in millions (unaudited). ADJUSTED OPERATING PROFIT 10.7% 9.1% 11.6% 10.0% AFTERMARKET REVENUE 2015 GEOGRAPHIC EXPOSURE 2015 QTD YTD Volume (1.3)% (2.4)% Price/ Mix (3.5)% (3.4)% Acquisitions —% 5.4% FX Translation (11.6)% (13.1)% Total Decline (16.4)% (13.5)%

RESULTS OF OPERATIONS

19 INCOME STATEMENT SUMMARY (unaudited) Refer to Appendix for Non-GAAP reconciliation and footnotes. Note: Dollars in millions, except per share amounts. Three Months Ended Year Ended December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Net sales $ 1,061.5 $ 1,206.4 $ 3,967.1 $ 4,624.5 Gross profit $ 333.4 $ 391.8 $ 1,251.8 $ 1,478.8 % of sales 31.4 % 32.5 % 31.6 % 32.0 % SG&A expense $ 232.8 $ 255.1 $ 906.0 $ 1,011.2 % of sales 21.9 % 21.1 % 22.8 % 21.9 % Adjusted operating income $ 100.6 $ 136.7 $ 345.8 $ 467.7 % of sales 9.5 % 11.3 % 8.7 % 10.1 % Adjusted net income $ 63.0 $ 89.7 $ 200.1 $ 272.3 % of sales 5.9 % 7.4 % 5.0 % 5.9 % Adjusted net income per share $ 0.51 $ 0.72 $ 1.60 $ 2.20

APPENDIX

21 DISCLAIMER Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted net income, adjusted net income per share, adjusted operating income, adjusted operating income margin, organic sales growth (decline) and organic order growth (decline). Adjusted net income, adjusted net income per share, adjusted operating income and adjusted operating income margin exclude the impact of Restructuring and other related charges. Adjusted net income and adjusted net income per share for the full year ended December 31, 2015 exclude the impact of the write-off of certain deferred financing fees and original issue discount associated with the refinancing of Colfax's credit agreement. Adjusted net income and adjusted net income per share for the full year ended December 31, 2014 exclude the impact of the preferred stock conversion inducement payment. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 25.1% and 27.5% for the fourth quarter and full year ended December 31, 2015, respectively, and 24.5% and 27.8% for the fourth quarter and full year ended December 31, 2014, respectively. Organic sales growth (decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of restructuring and other related charges, write-off of certain deferred financing fees and original issue discount and the preferred stock conversion inducement payment. Sales and order information by end market are estimates. We periodically update our customer groupings order to refine these estimates.

22 NON-GAAP RECONCILIATION (unaudited) _____________________ Note: Dollars in thousands. Year Ended December 31, 2015 Year Ended December 31, 2014 Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Net sales $ 1,981,816 $ 1,985,237 $ — $ 3,967,053 $ 2,329,598 $ 2,294,878 $ — $ 4,624,476 Operating income (loss) 162,942 8.2 % 168,687 8.5 % (46,984 ) 284,645 7.2 % 227,707 9.8 % 234,225 10.2 % (52,379 ) 409,553 8.9 % Restructuring and other related charges 31,527 29,650 — 61,177 26,533 31,588 — 58,121 Adjusted operating income (loss) $ 194,469 9.8 % $ 198,337 10.0 % $ (46,984 ) $ 345,822 8.7 % $ 254,240 10.9 % $ 265,813 11.6 % $ (52,379 ) $ 467,674 10.1 % Three Months Ended December 31, 2015 Three Months Ended December 31, 2014 Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Corporate and Other Total Colfax Corporation Net sales $ 572,824 $ 488,640 $ — $ 1,061,464 $ 622,059 $ 584,297 $ — $ 1,206,356 Operating income (loss) 47,407 8.3 % 29,148 6.0 % (11,492 ) 65,063 6.1 % 70,375 11.3 % 48,239 8.3 % (11,273 ) 107,341 8.9 % Restructuring and other related charges 19,965 15,554 — 35,519 14,916 14,471 — 29,387 Adjusted operating income (loss) $ 67,372 11.8 % $ 44,702 9.1 % $ (11,492 ) $ 100,582 9.5 % $ 85,291 13.7 % $ 62,710 10.7 % $ (11,273 ) $ 136,728 11.3 %

23 NON-GAAP RECONCILIATION (unaudited) (1) The effective tax rates used to calculate adjusted net income and adjusted net income per share are 25.1% and 27.5% for the fourth quarter and full year ended December 31, 2015, respectively, and 24.5% and 27.8% for the fourth quarter and full year ended December 31, 2014, respectively. (2) Adjusted net income per share for the period prior to February 12, 2014 was calculated under the if-converted method in accordance with GAAP. On February 12, 2014, the Series A Perpetual Convertible Preferred Stock were converted to Common stock and the Company paid a $19.6 million conversion inducement to the holders of the Series A Perpetual Convertible Preferred Stock. _____________________ Note: Dollars in thousands, except per share amounts. Three Months Ended Year Ended December 31, 2015 December 31, 2014 December 31, 2015 December 31, 2014 Adjusted Net Income Net income attributable to Colfax Corporation $ 44,197 $ 80,134 $ 167,739 $ 392,098 Restructuring and other related charges 35,519 29,387 61,177 58,121 Debt extinguishment charges- Refinancing of credit agreement — — 4,731 — Tax adjustment(1) (16,678 ) (19,790 ) (33,549 ) (177,944 ) Adjusted net income $ 63,038 $ 89,731 $ 200,098 $ 272,275 Adjusted net income margin 5.9 % 7.4 % 5.0 % 5.9 % Adjusted Net Income Per Share Net income available to Colfax Corporation common shareholders $ 44,197 $ 80,134 $ 167,739 $ 370,185 Restructuring and other related charges 35,519 29,387 61,177 58,121 Debt extinguishment charges- Refinancing of credit agreement — — 4,731 — Preferred stock conversion inducement payment(2) — — — 19,565 Tax adjustment(1) (16,678 ) (19,790 ) (33,549 ) (177,944 ) Adjusted net income available to Colfax Corporation common shareholders 63,038 89,731 200,098 269,927 Dividends on preferred stock(2) — — — 2,348 $ 63,038 $ 89,731 $ 200,098 $ 272,275 Weighted-average shares outstanding - diluted 124,102,455 125,156,755 124,869,649 124,033,702 Adjusted net income per share $ 0.51 $ 0.72 $ 1.60 $ 2.20 Net income per share— diluted (in accordance with GAAP) $ 0.36 $ 0.64 $ 1.34 $ 3.02

24 CHANGE IN SALES, ORDERS AND BACKLOG (unaudited) _____________________ Note: Dollars in millions. (1) Represents the incremental sales and orders as a result of our acquisitions of RootsTM blowers and compressors and Simsmart Technologies. (2) Represents the incremental sales, orders and order backlog as a result of our acquisitions of RootsTM blowers and compressors and Simsmart Technologies, and incremental sales as a result of our acquisition of Victor Technologies Holdings Inc. Net Sales Orders Backlog at Period End $ % $ % $ % As of and for the year ended December 31, 2014 $ 4,624.5 $ 2,286.7 $ 1,402.3 Components of Change: Existing Businesses (304.5 ) (6.6 )% (287.1 ) (12.6 )% (145.4 ) (10.4 )% Acquisitions(2) 171.2 3.7 % 57.9 2.5 % 43.3 3.1 % Foreign Currency Translation (524.1 ) (11.3 )% (221.1 ) (9.6 )% (159.3 ) (11.3 )% Total (657.4 ) (14.2 )% (450.3 ) (19.7 )% (261.4 ) (18.6 )% As of and for the year ended December 31, 2015 $ 3,967.1 $ 1,836.4 $ 1,140.9 Net Sales Orders $ % $ % For the three months ended December 31, 2014 $ 1,206.4 $ 570.1 Components of Change: Existing Businesses (45.3 ) (3.8 )% (107.0 ) (18.8 )% Acquisitions(1) 23.7 2.0 % 32.3 5.7 % Foreign Currency Translation (123.3 ) (10.2 )% (52.4 ) (9.2 )% Total (144.9 ) (12.0 )% (127.1 ) (22.3 )% For the three months ended December 31, 2015 $ 1,061.5 $ 443.0

25 BALANCE SHEETS (unaudited) _____________________ Note: Dollars in thousands. December 31, 2015 2014 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 197,469 $ 305,448 Trade receivables, less allowance for doubtful accounts of $39,505 and $27,256 888,166 1,029,150 Inventories, net 420,386 442,732 Other current assets 253,744 296,948 Total current assets 1,759,765 2,074,278 Property, plant and equipment, net 644,536 727,435 Goodwill 2,817,687 2,873,023 Intangible assets, net 995,712 1,043,583 Other assets 515,219 493,198 Total assets $ 6,732,919 $ 7,211,517 LIABILITIES AND EQUITY CURRENT LIABILITIES: Current portion of long-term debt $ 5,792 $ 9,855 Accounts payable 718,893 780,287 Accrued liabilities 391,659 489,983 Total current liabilities 1,116,344 1,280,125 Long-term debt, less current portion 1,411,755 1,526,955 Other liabilities 948,264 1,051,993 Total liabilities 3,476,363 3,859,073 Equity: Common stock, $0.001 par value; 400,000,000 shares authorized; 123,486,425 and 123,730,578 issued and outstanding 123 124 Additional paid-in capital 3,199,267 3,200,832 Retained earnings 557,300 389,561 Accumulated other comprehensive loss (686,715 ) (443,691 ) Total Colfax Corporation equity 3,069,975 3,146,826 Noncontrolling interest 186,581 205,618 Total equity 3,256,556 3,352,444 Total liabilities and equity $ 6,732,919 $ 7,211,517

26 STATEMENTS OF CASH FLOWS (unaudited) _____________________ Note: Dollars in thousands. Year Ended December 31, 2015 2014 Cash flows from operating activities: Net income $ 187,178 $ 420,273 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment charges 154,542 174,724 Stock-based compensation expense 16,321 17,580 Non-cash interest expense 10,101 9,094 Deferred income tax (benefit) provision (22,717 ) (139,488 ) Changes in operating assets and liabilities, net of acquisitions: Trade receivables, net 64,048 (19,916 ) Inventories, net (390 ) 57,847 Accounts payable (11,184 ) (54,666 ) Changes in other operating assets and liabilities (94,086 ) (79,690 ) Net cash provided by operating activities 303,813 385,758 Cash flows from investing activities: Purchases of fixed assets (69,877 ) (84,458 ) Acquisitions, net of cash received (196,007 ) (948,800 ) Other, net 18,927 3,115 Net cash used in investing activities (246,957 ) (1,030,143 ) Cash flows from financing activities: Borrowings under term credit facility 750,000 150,000 Payments under term credit facility (1,232,872 ) (15,542 ) Proceeds from borrowings on revolving credit facilities and other 1,498,039 1,370,626 Repayments of borrowings on revolving credit facilities and other (1,104,055 ) (1,414,146 ) Proceeds from issuance of common stock, net 6,052 613,927 Repurchases of common stock (27,367 ) — Acquisition of shares held by noncontrolling interest — (10,338 ) Preferred stock conversion inducement payment — (19,565 ) Payments of dividend on preferred stock — (3,853 ) Other (21,066 ) (21,060 ) Net cash (used in) provided by financing activities (131,269 ) 650,049 Effect of foreign exchange rates on Cash and cash equivalents (33,566 ) (11,517 ) Decrease in Cash and cash equivalents (107,979 ) (5,853 ) Cash and cash equivalents, beginning of period 305,448 311,301 Cash and cash equivalents, end of period $ 197,469 $ 305,448 Supplemental Disclosure of Cash Flow Information: Interest payments 36,363 42,041 Income tax payments, net 79,540 82,694

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Blockchain + AI , Former OpenAI Member Ishant Singh was Appointed as BitYuan Blockchain CEO

- Oxurion Receives Transparency Notification from Atlas Special Opportunities LLC

- Radiotherapy Market Size to Grow by USD 10.19 billion from 2024 to 2031- SNS Insider

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share