Form 8-K CONAGRA FOODS INC /DE/ For: Nov 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 18, 2015

CONAGRA FOODS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1-7275 | 47-0248710 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| One ConAgra Drive Omaha, Nebraska |

68102-5001 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (402) 240-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

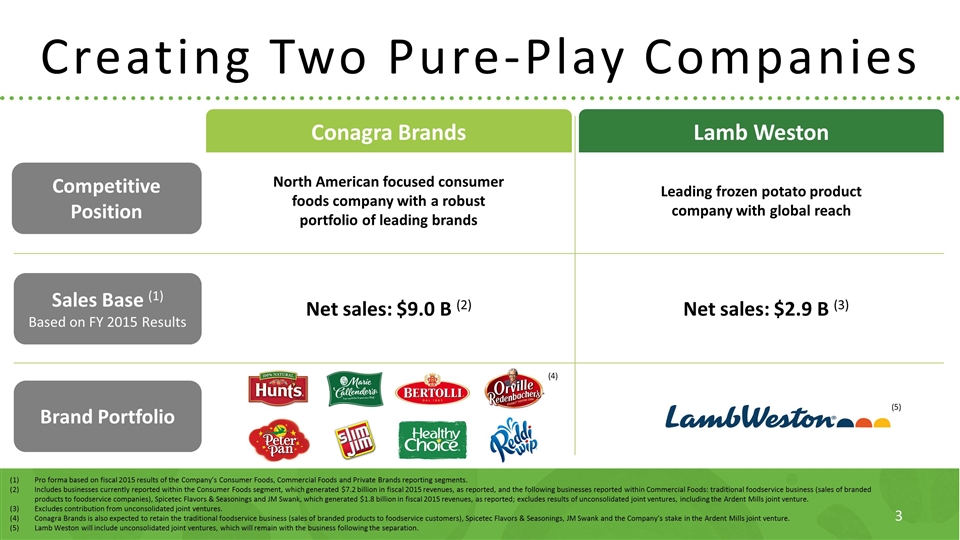

On November 18, 2015, ConAgra Foods, Inc. (the “Company” or “ConAgra Foods”), announced plans to pursue the separation of the Company into two independent public companies: one comprising its robust consumer portfolio of diverse and leading brands; and the other comprising its market leading foodservice portfolio of innovative frozen potato products. The consumer brands business will be renamed Conagra Brands, Inc. (“Conagra Brands”) and the frozen potato business will operate under the Lamb Weston name. Immediately following the transaction (the “Spin-off”), which is expected to be completed in the fall of 2016, ConAgra Foods’ shareholders will own shares of both independent companies. The transaction is expected to be structured as a spin-off of the Lamb Weston business, tax-free to the Company and its shareholders. Also on November 18, 2015, the Company held a conference call to discuss the proposed Spin-off. The Company’s presentation material for the conference call is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Act of 1933, or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such a filing.

| Item 8.01 | Other Events. |

In connection with the proposed Spin-off, the Company also announced that, if the Spin-off is completed, Conagra Brands will be led by Sean Connolly, the Company’s current Chief Executive Officer, and will be headquartered in Chicago. The completion of the Spin-off is subject to final approval by the Company’s Board of Directors, receipt of an opinion from tax counsel on the tax-free nature of the Spin-off and other customary approvals. The Company’s press release announcing the proposed Spin-off is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These risks and uncertainties include, among other things: ConAgra Foods’ ability to successfully complete the spin-off of its Lamb Weston business on a tax-free basis, within the expected time frame or at all; ConAgra Foods’ ability to successfully complete the pending sale of its private brands operations, within the expected time frame or at all; ConAgra Foods’ ability to execute its operating and restructuring plans and achieve its targeted operating efficiencies, cost-saving initiatives, and trade optimization programs; ConAgra Foods’ ability to successfully execute its long-term value creation strategy; ConAgra Foods’ ability to realize the synergies and benefits contemplated by the Ardent Mills joint venture; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; the availability and prices of raw materials, including any negative effects caused by inflation or weather conditions; the effectiveness of ConAgra Foods’ product pricing efforts, whether through pricing actions or changes in promotional strategies; the ultimate outcome of litigation, including litigation related to the lead paint and pigment matters; future economic circumstances; industry conditions; the effectiveness of ConAgra Foods’ hedging activities, including volatility in commodities that could negatively impact ConAgra Foods’ derivative positions and, in turn, ConAgra Foods’ earnings; the success of ConAgra Foods’ innovation and marketing investments; the competitive environment and related market conditions; the ultimate impact of any ConAgra Foods’ product recalls; access to capital; actions of governments and regulatory factors affecting ConAgra Foods’ businesses, including the Patient Protection and Affordable Care Act; the amount and timing of repurchases of ConAgra Foods’ common stock and debt, if any; the costs, disruption and diversion of management’s attention associated with campaigns commenced by activist investors; and other risks described in ConAgra Foods’ reports filed with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Investors and security holders are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. ConAgra Foods disclaims any obligation to update or revise statements contained in this report to reflect future events or circumstances or otherwise.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit |

Description | |

| 99.1 | Investor Presentation | |

| 99.2 | Press Release dated November 18, 2015 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CONAGRA FOODS, INC. | ||

| By: | /s/ Colleen Batcheler | |

| Name: | Colleen Batcheler | |

| Title: | Executive Vice President, General Counsel and Corporate Secretary | |

Date: November 18, 2015

Exhibit Index

| Exhibit |

Description | |

| 99.1 | Investor Presentation | |

| 99.2 | Press Release dated November 18, 2015 | |

Creating Two, Independent Pure-Play

Public Companies to Drive Value

Investor Presentation

November 18, 2015

Exhibit 99.1 |

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These risks and uncertainties include, among other things: ConAgra Foods’ ability to successfully complete the spin-off of its Lamb Weston business on a tax-free basis, within the expected time frame or at all; ConAgra Foods’ ability to successfully complete the pending sale of its private brands operations, within the expected time frame or at all; ConAgra Foods’ ability to execute its operating and restructuring plans and achieve its targeted operating efficiencies, cost-saving initiatives, and trade optimization programs; ConAgra Foods’ ability to successfully execute its long-term value creation strategy; ConAgra Foods’ ability to realize the synergies and benefits contemplated by the Ardent Mills joint venture; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; the availability and prices of raw materials, including any negative effects caused by inflation or weather conditions; the effectiveness of ConAgra Foods’ product pricing efforts, whether through pricing actions or changes in promotional strategies; the ultimate outcome of litigation, including litigation related to the lead paint and pigment matters; future economic circumstances; industry conditions; the effectiveness of ConAgra Foods’ hedging activities, including volatility in commodities that could negatively impact ConAgra Foods’ derivative positions and, in turn, ConAgra Foods’ earnings; the success of ConAgra Foods’ innovation and marketing investments; the competitive environment and related market conditions; the ultimate impact of any ConAgra Foods’ product recalls; access to capital; actions of governments and regulatory factors affecting ConAgra Foods’ businesses, including the Patient Protection and Affordable Care Act; the amount and timing of repurchases of ConAgra Foods’ common stock and debt, if any; the costs, disruption and diversion of management’s attention associated with campaigns commenced by activist investors; and other risks described in ConAgra Foods’ reports filed with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Investors and security holders are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. ConAgra Foods disclaims any obligation to update or revise statements contained in this document to reflect future events or circumstances or otherwise.

Creating Two Pure-Play Companies Lamb Weston Conagra Brands Net sales: $9.0 B (2) Net sales: $2.9 B (3) Leading frozen potato product company with global reach North American focused consumer foods company with a robust portfolio of leading brands Pro forma based on fiscal 2015 results of the Company’s Consumer Foods, Commercial Foods and Private Brands reporting segments. Includes businesses currently reported within the Consumer Foods segment, which generated $7.2 billion in fiscal 2015 revenues, as reported, and the following businesses reported within Commercial Foods: traditional foodservice business (sales of branded products to foodservice companies), Spicetec Flavors & Seasonings and JM Swank, which generated $1.8 billion in fiscal 2015 revenues, as reported; excludes results of unconsolidated joint ventures, including the Ardent Mills joint venture. Excludes contribution from unconsolidated joint ventures. Conagra Brands is also expected to retain the traditional foodservice business (sales of branded products to foodservice customers), Spicetec Flavors & Seasonings, JM Swank and the Company’s stake in the Ardent Mills joint venture. Lamb Weston will include unconsolidated joint ventures, which will remain with the business following the separation. Sales Base (1) Based on FY 2015 Results Competitive Position Brand Portfolio (4) (5)

Compelling Strategic Rationale Creates two vibrant pure-play companies, each well positioned for focused growth Enhances strategic focus and flexibility Allows shareholders to value the two companies based on their particular operational and financial characteristics and invest accordingly Drives value for shareholders while delivering benefits to employees, customers and other key stakeholders Best positions each company to compete, grow and win over the long term while driving value for shareholders

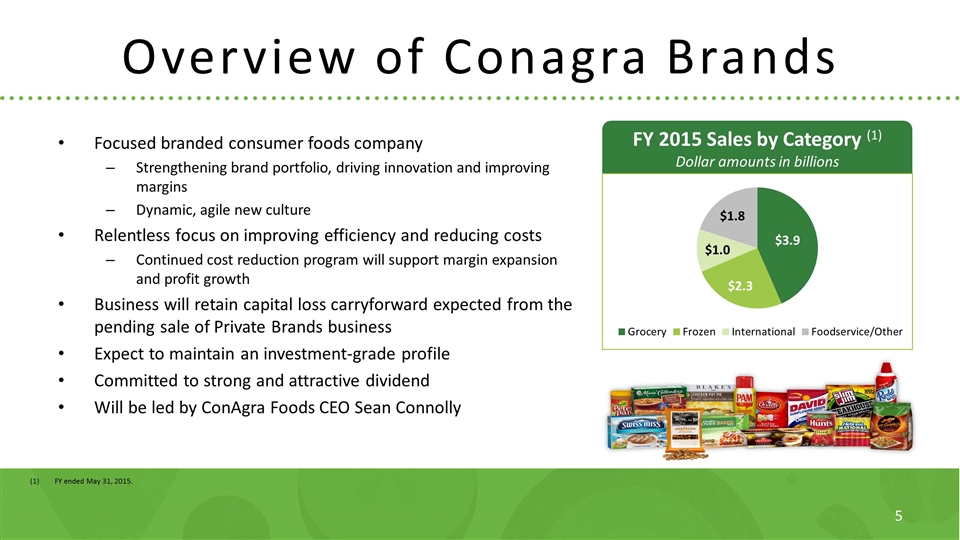

Overview of Conagra Brands Focused branded consumer foods company Strengthening brand portfolio, driving innovation and improving margins Dynamic, agile new culture Relentless focus on improving efficiency and reducing costs Continued cost reduction program will support margin expansion and profit growth Business will retain capital loss carryforward expected from the pending sale of Private Brands business Expect to maintain an investment-grade profile Committed to strong and attractive dividend Will be led by ConAgra Foods CEO Sean Connolly FY 2015 Sales by Category (1) Dollar amounts in billions FY ended May 31, 2015.

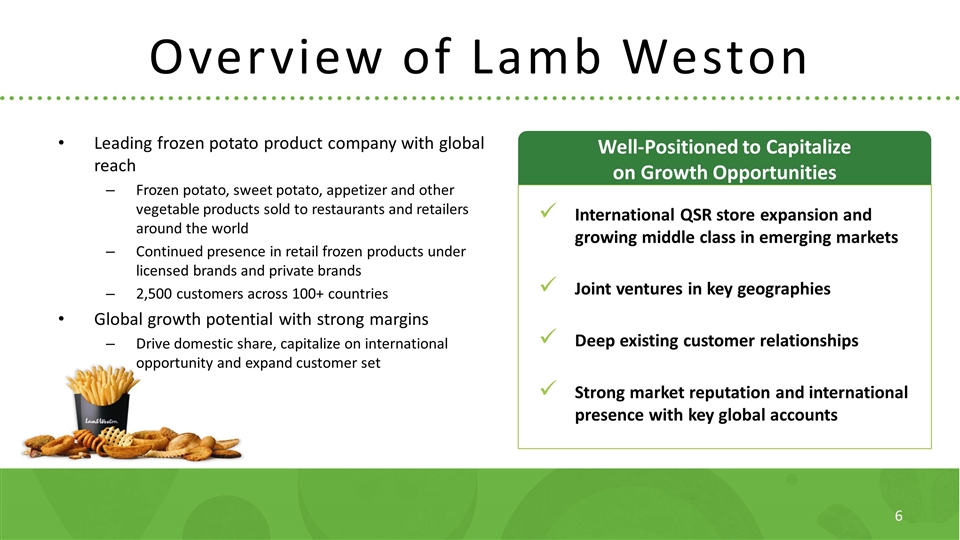

Overview of Lamb Weston Leading frozen potato product company with global reach Frozen potato, sweet potato, appetizer and other vegetable products sold to restaurants and retailers around the world Continued presence in retail frozen products under licensed brands and private brands 2,500 customers across 100+ countries Global growth potential with strong margins Drive domestic share, capitalize on international opportunity and expand customer set Well-Positioned to Capitalize on Growth Opportunities International QSR store expansion and growing middle class in emerging markets Joint ventures in key geographies Deep existing customer relationships Strong market reputation and international presence with key global accounts

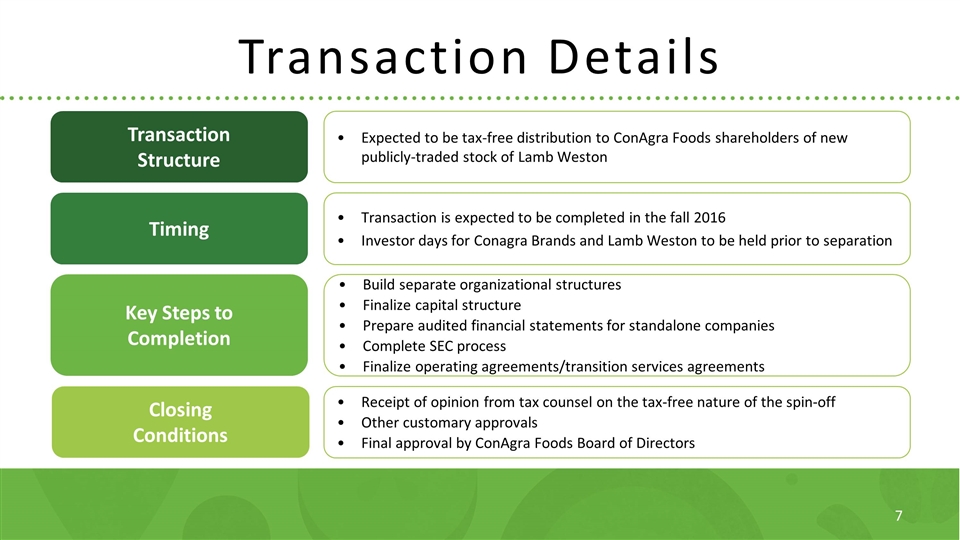

Transaction Details Transaction Structure Expected to be tax-free distribution to ConAgra Foods shareholders of new publicly-traded stock of Lamb Weston Timing Transaction is expected to be completed in the fall 2016 Investor days for Conagra Brands and Lamb Weston to be held prior to separation Key Steps to Completion Build separate organizational structures Finalize capital structure Prepare audited financial statements for standalone companies Complete SEC process Finalize operating agreements/transition services agreements Closing Conditions Receipt of opinion from tax counsel on the tax-free nature of the spin-off Other customary approvals Final approval by ConAgra Foods Board of Directors

Summary Creates two pure-play companies with unique and compelling growth prospects and investment opportunities Underscores ConAgra Foods’ commitment to take decisive action to drive long-term shareholder value Optimizes performance of each business and provides flexibility to pursue value-creating opportunities Drives value for shareholders and delivers benefits to employees, customers and other key stakeholders Enables both businesses to drive sustainable, profitable growth and deliver attractive shareholder value over the long term

Exhibit 99.2

| News Release

For more information, please contact: MEDIA: Jon Harris 630-857-1440

INVESTORS: Chris Klinefelter 402-240-4154 |

FOR IMMEDIATE RELEASE

CONAGRA FOODS ANNOUNCES PLANS TO SEPARATE INTO TWO

INDEPENDENT PUBLIC COMPANIES

Conagra Brands Will be a Diverse Portfolio of Leading Brands

Lamb Weston Will Be a Leading Foodservice Supplier of Frozen Potatoes

Company Plans Tax-Free Distribution of New Publicly Traded Stock in Lamb Weston

OMAHA, Neb. — November 18, 2015 — ConAgra Foods, Inc. (NYSE: CAG) (the “Company”) today announced plans to pursue the separation of the Company into two independent public companies: one comprising its robust consumer portfolio of diverse and leading brands and the other comprising its market leading foodservice portfolio of innovative frozen potato products. The consumer brands business will be renamed Conagra Brands, Inc. (“Conagra Brands”) and the frozen potato business will operate under the Lamb Weston name. Immediately following the transaction, which is expected to be completed in the fall of 2016, ConAgra Foods shareholders will own shares of both independent companies. The transaction is expected to be structured as a spin-off of the Lamb Weston business, tax-free to the Company and its shareholders.

“The decision to separate into two pure-play companies reflects our ongoing commitment to implementing bold changes in order to deliver sustainable growth and enhanced shareholder value,” said Sean Connolly, president and chief executive officer, ConAgra Foods. “We carefully considered a variety of strategic alternatives, and believe that the separation of our Lamb Weston specialty potato business from our consumer brands business is the best way to drive shareholder value. The separation will enable each company to sharpen its strategic focus and provide

flexibility to capitalize on the unique growth opportunities in its respective market. Shareholders will gain direct exposure to more focused consumer and commercial foods businesses, each with distinct customer bases and investment profiles. We are confident that this separation will best position each company to compete and win while creating compelling long-term value for shareholders and delivering benefits to employees, customers and other key stakeholders.”

The two businesses operate in distinct markets and possess unique and compelling growth prospects and investment requirements. In addition, ConAgra Foods believes that the separation will result in other material benefits to the standalone companies, including:

| • | Greater management focus on the distinct businesses of consumer brands and foodservice frozen potato products; |

| • | Increased flexibility, agility and resources to capitalize on their respective long-term opportunities and growth strategies; |

| • | Tailored capital structures and financial policies and targets appropriate for each company’s unique business profile; and |

| • | The ability for investors to value the two companies based on their particular operational and financial characteristics and invest accordingly. |

Conagra Brands

Conagra Brands will be comprised primarily of the operations currently reported as the Company’s Consumer Foods segment, which generated approximately $7.2 billion in fiscal 2015 revenues, as reported. The Consumer Foods segment consists of popular leading brands such as Marie Callender’s, Hunt’s, RO*TEL, Reddi-wip, Slim Jim, PAM, Chef Boyardee, Orville Redenbacher’s, P.F. Chang’s and Healthy Choice.

Conagra Brands is also expected to include several businesses currently reported within the Commercial Foods segment, including the traditional foodservice business (sales of branded products to foodservice companies), Spicetec Flavors & Seasonings and JM Swank, as well as certain private label operations which were moved to the Consumer Foods reporting segment in the first quarter of fiscal 2016. These businesses generated approximately $1.8 billion in fiscal 2015 revenues, as reported. Conagra Brands is also expected to retain the Company’s stake in the Ardent Mills joint venture.

2

Conagra Brands’ core strategy will focus on further strengthening its consumer and foodservice portfolios, driving innovation and improving margins. Conagra Brands will remain committed to its plans to optimize operational efficiency to provide additional resources to invest in the business and pursue strategic acquisitions while also returning capital to shareholders. Conagra Brands expects to maintain an investment-grade profile following the separation, and to remain committed to a strong and attractive dividend.

Conagra Brands will be led by CEO Sean Connolly and will be headquartered in Chicago.

Lamb Weston

Following the separation, Lamb Weston’s portfolio will consist of frozen potato, sweet potato, appetizer and other vegetable products, as well as a continued presence in retail frozen products under licensed brands and private brands. For fiscal 2015, Lamb Weston generated revenues of approximately $2.9 billion, as reported, and accounted for the significant majority of the Commercial Foods segment’s fiscal 2015 operating profit of approximately $570 million.

Lamb Weston is a leading frozen potato products provider to the foodservice industry on a global basis. The Company’s interests in several joint ventures, including Lamb Weston / Meijer in Europe, are integral to the execution of its global strategy and are expected to remain with the business following separation. With distinct competitive advantages in key geographies, Lamb Weston will leverage this strong foundation to build upon its proven track record of growth. The Company will focus on opportunities to expand share domestically and accelerate international growth, particularly within fast-growing emerging markets.

Capital structure and capital allocation policy for Lamb Weston have not yet been finalized. The Lamb Weston management team will be announced at a later date.

Separation Details

The separation is expected to be tax-free to ConAgra Foods shareholders for federal income tax purposes. The transaction is currently targeted to be completed in the fall of 2016, subject to final approval by the Company’s Board of Directors, other customary approvals and receipt of an opinion

3

from tax counsel on the tax-free nature of the spin-off to the Company and its shareholders. Throughout the separation process, ConAgra Foods management will remain highly focused on driving strong business performance, and delivering on its previously announced $300 million efficiency plan.

ConAgra Foods today also reiterated its plans to utilize the net proceeds from the pending sale of its Private Brands business primarily for debt reduction.

ConAgra Foods will hold investor days for Conagra Brands and Lamb Weston prior to the execution of the separation.

Goldman Sachs and Centerview Partners are serving as financial advisors and Jones Day and Davis Polk & Wardwell LLP are serving as legal advisors to ConAgra Foods.

Conference Call

ConAgra Foods will host a conference call regarding this announcement at 8:30 a.m. EST today. Following the Company’s remarks, the call will include a question-and-answer session with the investment community. Domestic and international participants may access the conference call toll-free by dialing 1-888-819-8045 and 1-913-981-5578, respectively, and entering pass code 7012484. This conference call also can be accessed live on the Internet at http://investor.conagrafoods.com.

A rebroadcast of the conference call will be available after 10:30 a.m. EST today. To access the digital replay, a pass code number will be required. Domestic participants should dial 1-888-203-1112, and international participants should dial 1-719-457-0820 and enter pass code 7012484. A rebroadcast also will be available on the Company’s website.

About ConAgra Foods

ConAgra Foods, Inc., (NYSE: CAG) is one of North America’s largest packaged food companies with branded and private label food found in 99 percent of America’s households, as well as a strong commercial foods business serving restaurants and foodservice operations globally. Consumers can find recognized brands such as Marie Callender’s®, Healthy Choice®, Slim Jim®, Hebrew National®, Orville Redenbacher’s®, Peter Pan®, Reddi-wip®, PAM®, Snack Pack®,

4

Banquet®, Chef Boyardee®, Egg Beaters®, Hunt’s® and many other ConAgra Foods brands, along with food sold by ConAgra Foods under private labels, in grocery, convenience, mass merchandise, club and drug stores. Additionally, ConAgra Foods supplies frozen potato and sweet potato products as well as other vegetable, spice, and bakery products to commercial and foodservice customers. ConAgra Foods operates ReadySetEat.com, an interactive recipe website that provides consumers with easy dinner recipes and more. For more information, please visit us at www.conagrafoods.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. These risks and uncertainties include, among other things: ConAgra Foods’ ability to successfully complete the spin-off of its Lamb Weston business on a tax-free basis, within the expected time frame or at all; ConAgra Foods’ ability to successfully complete the pending sale of its private brands operations, within the expected time frame or at all; ConAgra Foods’ ability to execute its operating and restructuring plans and achieve its targeted operating efficiencies, cost-saving initiatives, and trade optimization programs; ConAgra Foods’ ability to successfully execute its long-term value creation strategy; ConAgra Foods’ ability to realize the synergies and benefits contemplated by the Ardent Mills joint venture; risks and uncertainties associated with intangible assets, including any future goodwill or intangible assets impairment charges; the availability and prices of raw materials, including any negative effects caused by inflation or weather conditions; the effectiveness of ConAgra Foods’ product pricing efforts, whether through pricing actions or changes in promotional strategies; the ultimate outcome of litigation, including litigation related to the lead paint and pigment matters; future economic circumstances; industry conditions; the effectiveness of ConAgra Foods’ hedging activities, including volatility in commodities that could negatively impact ConAgra Foods’ derivative positions and, in turn, ConAgra Foods’ earnings; the success of ConAgra Foods’ innovation and marketing investments; the competitive environment and related market conditions; the ultimate impact of any ConAgra Foods’ product recalls; access to capital; actions of governments and regulatory factors affecting ConAgra Foods’ businesses, including the Patient Protection and Affordable Care Act; the amount and timing of repurchases of ConAgra Foods’ common stock and debt, if any; the costs, disruption and diversion of management’s

5

attention associated with campaigns commenced by activist investors; and other risks described in ConAgra Foods’ reports filed with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Investors and security holders are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. ConAgra Foods disclaims any obligation to update or revise statements contained in this document to reflect future events or circumstances or otherwise.

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ConAgra (CAG) PT Raised to $34 at Barclays

- Temporal Surpasses 1,000 Active Customers Milestone in Just Over a Year

- Picton Mahoney Asset Management Announces Monthly Distribution for Picton Mahoney Fortified Income Alternative Fund Exchange Traded Fund Units, Picton Mahoney Fortified Special Situations Alternative

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share