Form 8-K COMERICA INC /NEW/ For: May 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 31, 2016

COMERICA INCORPORATED

(Exact name of registrant as specified in its charter)

Delaware ------------ | 1-10706 ---------- | 38-1998421 --------------- |

(State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

Comerica Bank Tower

1717 Main Street, MC 6404

Dallas, Texas 75201

--------------------------------------------------------------------

(Address of principal executive offices) (zip code)

(214) 462-6831

------------------------------------------------------------------------

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 | REGULATION FD DISCLOSURE. |

Comerica Incorporated (“Comerica”) previously announced that Ralph W. Babb Jr., Chairman and Chief Executive Officer of Comerica, will make a presentation at the Deutsche Bank 2016 Global Financial Services Investor Conference on Wednesday, June 1, 2016. David E. Duprey, executive vice president and Chief Financial Officer; Peter W. Guilfoile, executive vice president and Chief Credit Officer; and Darlene P. Persons, director of Investor Relations, also will participate. Comerica's presentation will begin at 1:20 p.m. ET. To access the live audio webcast, visit the “Investor Relations” area of Comerica's website at www.comerica.com. Replays will be available at the same location following the conference. A copy of the presentation slides, which will be discussed at that conference, is attached hereto as Exhibit 99.1. From time to time, Comerica may also use this presentation in conversations with investors and analysts.

The information in Items 7.01 and 9.01 of this report (including Exhibit 99.1 hereto) is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

99.1 Deutsche Bank 2016 Global Financial Services Investor Conference Presentation Slides

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COMERICA INCORPORATED | ||

By: | /s/ David E. Duprey | |

Name: | David E. Duprey | |

Title: | Executive Vice President and Chief Financial Officer | |

Date: May 31, 2016

EXHIBIT INDEX

Exhibit No. | Description |

99.1 | Deutsche Bank 2016 Global Financial Services Investor Conference Presentation Slides |

Comerica Incorporated Deutsche Bank Global Financial Services Conference June 1, 2016 Pete GuilfoileExecutive Vice President and Chief Credit Officer Ralph W. Babb, Jr.Chairman and Chief Executive Officer David DupreyExecutive Vice President and Chief Financial Officer Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries, estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes in monetary and fiscal policies, including changes in interest rates; changes in regulation or oversight; Comerica's ability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or other changes in the businesses or industries of Comerica's customers, in particular the energy industry; unfavorable developments concerning credit quality; operational difficulties, failure of technology infrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; factors impacting noninterest expenses which are beyond Comerica's control; changes in the financial markets, including fluctuations in interest rates and their impact on deposit pricing; reductions in Comerica's credit rating; whether Comerica may achieve opportunities for revenue enhancements and efficiency improvements; the interdependence of financial service companies; the implementation of Comerica's strategies and business initiatives; damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; changes in customer behavior; any future strategic acquisitions or divestitures; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; the impact of legal and regulatory proceedings or determinations; the effectiveness of methods of reducing risk exposures; the effects of terrorist activities and other hostilities; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; changes in accounting standards and the critical nature of Comerica's accounting policies. Comerica cautions that the foregoing list of factors is not exclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2015 and “Item 1A. Risk Factors” beginning on page 54 of Comerica’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2016. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

3 Comerica: A Brief Overview 3/31/16 ● 1Consists of Other Markets ($7.6B) & Finance/ Other ($0.3B) Comerica Strengths Strong capital position,Prudent credit underwriting CONSERVATIVE Complemented by Retail Bank and Wealth Management PRIMARILY A BUSINESS BANK Strong presence in Texas, California, & Michigan ATTRACTIVE FOOTPRINT Products & services of a large bank with the culture of a ‘Main Street’ bank NIMBLE SIZE$69B IN ASSETS Founded 166 years ago LONG HISTORY Trusted Advisor approach RELATIONSHIP BANKING STRATEGY Loans by Geography($ in billons; 1Q16 average) Michigan$12.826% California$17.336% Texas$10.822% Other Markets$7.516% Michigan$21.7 37% Deposits by Geography($ in billions; 1Q16 average) California$16.7 30% Texas$10.419% Other1$7.914% Total $48.4 Total $56.7 4 3/31/16 ● Outlook as of 5/31/16 Comerica: Our Focus GROWING REVENUE REDUCINGEXPENSES RISK MANAGEMENT MANAGING CAPITAL POSITIONED FOR RISING RATES • Positioned in faster growing markets and industries to drive loan growth• Focus on cross-sell to drive fee income • Undertaking deep-dive review of expenses• Continue making necessary investments • Strong Capital base; Basel III Common Equity Tier 1 Capital: 10.58%• Continued share buyback & increased dividend for 2Q • Strong credit culture leads to solid credit metrics• Weathered cycle well relative to peers • Fed’s 25 bps December rate increase expected to increase 2016 net interest income by ~$90MM

0.7 0.9 1.7 1.9 3.1 3.3 3.9 4.1 4.8 5.0 6.2 12.8 EntertainmentEnvironmental Services Mortgage BankerRetail Banking EnergyTech. & Life Sciences Small BusinessCorporate Banking Commercial Real EstatePrivate Banking National DealerGeneral Middle Market 5 Footprint Balances Loan Portfolio, Reducing Risk Diverse Total CMA Loan Portfolio($ in billions; 1Q16 average) Total Loans$48.4Total Middle Market $27.0 Texas Loan Portfolio($ in billions; 1Q16 average) California Loan Portfolio($ in billions; 1Q16 average) Michigan Loan Portfolio($ in billions; 1Q16 average) General Middle Market 22% Energy29% Small Business 15% Total$10.8 General Middle Market24% National Dealer23% Tech. & Life Sciences13% Total$17.3 General Middle Market49% Small Business11% Private Banking13% Total$12.8 Average Deposits($ in billions) 6 Second Quarter UpdateLoans & deposits grow 2Q16 average balances though 5/20/16 are preliminary and subject to change ● 1Comparisons to 1Q16, through 5/20 ● 2Interest costs on interest-bearing deposits Average Loans($ in billions) 2% increase in average loans Commercial Real Estate growth continued Mortgage Banker & National Dealer seasonally higher Energy declines, as expected Stable average deposits Retail seasonal increase Business Bank declined modestly, primarily Municipalities & Large Corporate April & May Trends1 48.8 49.0 48.5 48.4 49.3 3.20 3.17 3.24 3.38 2Q15 3Q15 4Q15 1Q16 2Q16 Thru5/20/16 Loan Yields 57.4 59.1 59.7 56.7 56.8 0.14 0.14 0.14 0.14 2Q15 3Q15 4Q15 1Q16 2Q16 Thru5/20/16 Deposit Rates 2

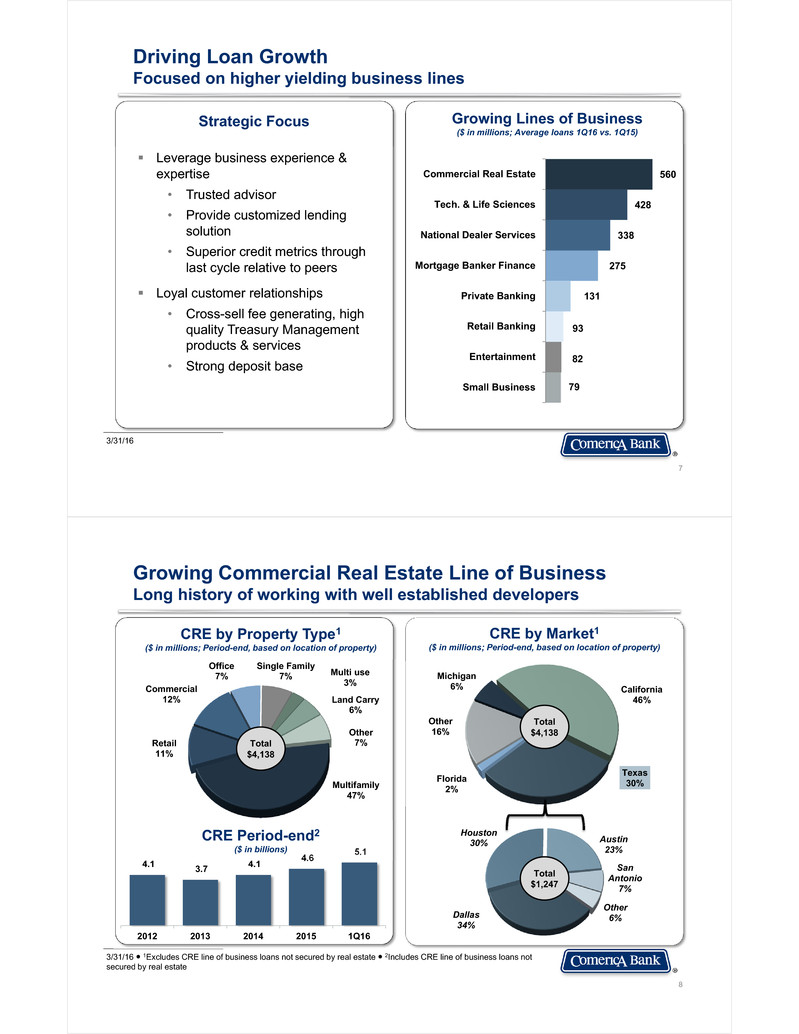

79 82 93 131 275 338 428 560 Small Business Entertainment Retail Banking Private Banking Mortgage Banker Finance National Dealer Services Tech. & Life Sciences Commercial Real Estate 7 Driving Loan GrowthFocused on higher yielding business lines Growing Lines of Business($ in millions; Average loans 1Q16 vs. 1Q15)Strategic Focus Leverage business experience & expertise• Trusted advisor• Provide customized lending solution• Superior credit metrics through last cycle relative to peers Loyal customer relationships • Cross-sell fee generating, high quality Treasury Management products & services• Strong deposit base 3/31/16 4.1 3.7 4.1 4.6 5.1 2012 2013 2014 2015 1Q16 CRE Period-end2($ in billions) Multifamily47% Retail11% Commercial12% Office7% Single Family7% Multi use3% Land Carry6% Other7% Dallas 34% Houston 30% Austin 23% San Antonio7% Other 6% Growing Commercial Real Estate Line of BusinessLong history of working with well established developers 3/31/16 ● 1Excludes CRE line of business loans not secured by real estate ● 2Includes CRE line of business loans not secured by real estate CRE by Property Type1($ in millions; Period-end, based on location of property) Michigan6% California46% Texas30%Florida2% Other16% CRE by Market1($ in millions; Period-end, based on location of property) Total$4,138 Total$4,138 Total$1,247 8

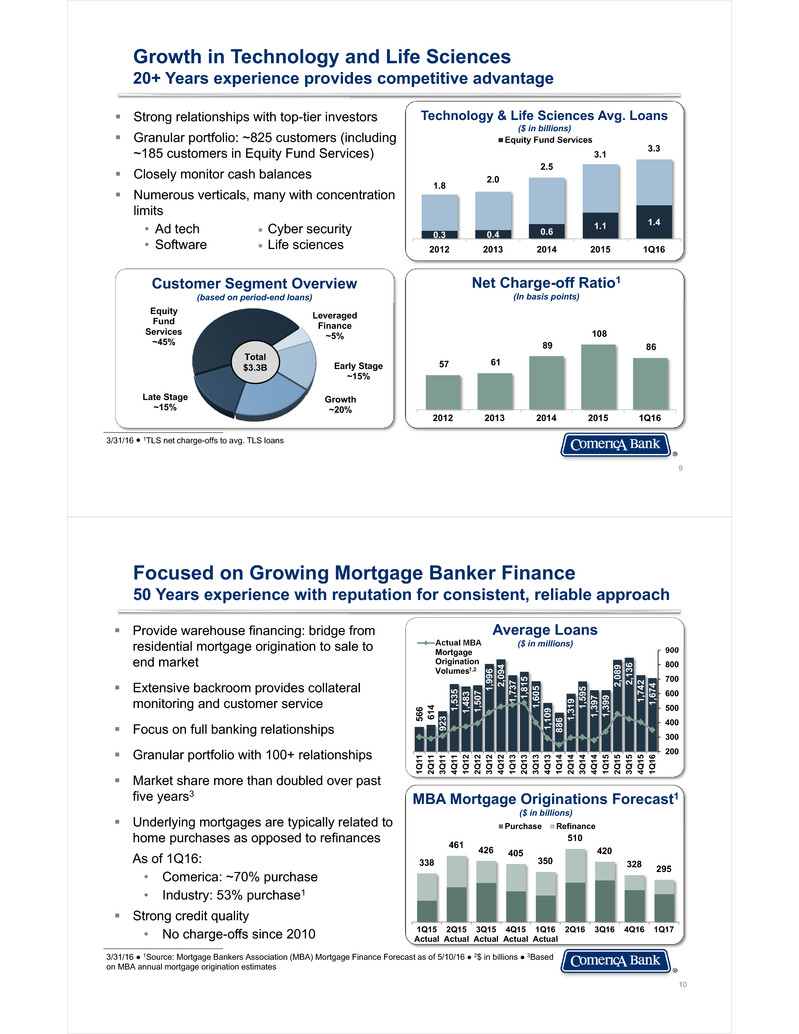

0.3 0.4 0.6 1.1 1.4 1.8 2.0 2.5 3.1 3.3 2012 2013 2014 2015 1Q16 Equity Fund Services 9 Growth in Technology and Life Sciences20+ Years experience provides competitive advantage Technology & Life Sciences Avg. Loans($ in billions) Customer Segment Overview(based on period-end loans) Strong relationships with top-tier investors Granular portfolio: ~825 customers (including ~185 customers in Equity Fund Services) Closely monitor cash balances Numerous verticals, many with concentration limits• Ad tech ● Cyber security• Software ● Life sciences Net Charge-off Ratio1(In basis points) Total $3.3B 57 61 89 108 86 2012 2013 2014 2015 1Q16 Early Stage~15% Growth~20%Late Stage~15% Equity Fund Services~45% Leveraged Finance~5% l . 3/31/16 ● 1TLS net charge-offs to avg. TLS loans 10 3/31/16 ● 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 5/10/16 ● 2$ in billions ● 3Based on MBA annual mortgage origination estimates 566 614 923 1,53 5 1,48 3 1,50 7 1,9 96 2,09 4 1,73 7 1,81 5 1,60 5 1,10 9 886 1 ,319 1, 595 1,39 7 1,39 9 2 ,089 2,13 6 1,74 2 1,67 4 200 300 400 500 600 700 800 900 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 1Q1 6 Actual MBAMortgageOriginationVolumes Average Loans($ in millions) Focused on Growing Mortgage Banker Finance50 Years experience with reputation for consistent, reliable approach MBA Mortgage Originations Forecast1($ in billions) 338 461 426 405 350 510 420 328 295 1Q15Actual 2Q15Actual 3Q15Actual 4Q15Actual 1Q16Actual 2Q16 3Q16 4Q16 1Q17 Purchase Refinance 1,2 Provide warehouse financing: bridge from residential mortgage origination to sale to end market Extensive backroom provides collateral monitoring and customer service Focus on full banking relationships Granular portfolio with 100+ relationships Market share more than doubled over past five years3 Underlying mortgages are typically related to home purchases as opposed to refinancesAs of 1Q16: • Comerica: ~70% purchase • Industry: 53% purchase1 Strong credit quality• No charge-offs since 2010

11 Energy Line of Business Cyclical Reduction 30+ Years industry experience As of 3/31/16 unless otherwise noted ● 2Q16 balances are preliminary and subject to change ● 1As of 5/12/16 ● 2Commitments totaling ~$200MM Oil40% Mixed18% Maintain granular portfolio: ~200 customers $2.9B in loans as of 5/20/16 Focus on larger, middle market companies• Develop full relationships• Access to diverse financial sources• Sophisticated, use hedging strategies 70% E&P companies 95% of loans have security Spring redeterminations 49% complete1• Borrowing bases declined ~22% on average Collateral deficiencies1:• 9 relationships2 totaling ~$40MM 59% criticized; Appropriately downgrading loans based on expected cash flow with continued low energy prices 535 463 481 479 509535 530 513 480 426 2,496 2,316 2,249 2,111 2,162 3,566 3,309 3,243 3,070 3,097 1Q15 2Q15 3Q15 4Q15 1Q16 Midstream Services Exploration & Production Energy Business Line Loans ($ in millions; Period-end) 6,930 6,624 6,541 6,134 5,573 50% 48% 48% 49% 54% 1Q15 2Q15 3Q15 4Q15 1Q16 Total Commitments Utilization Rate Net Interest Income Growing($ in millions) 12 Net Interest Income Increased 3%NIM expands 23 bps 413 421 422 433 447 2.64 2.65 2.54 2.58 2.81 1Q15 2Q15 3Q15 4Q15 1Q16 NIM 1 2 2 6 6 6 6 8 11 12 15 23 BOK F HBA N KEY FITB FHN MTB ST I BBT RF ZIO N CFR CMA Greatest 1Q16 NIM Growth1(In basis points) 1Q16 compared to 4Q15 ● 1Source: SNL Financial

49.5 51.7 54.8 58.3 56.7 0.25 0.19 0.15 0.14 0.14 2012 2013 2014 2015 1Q16 Deposit Rates 13 Maintain Strong Deposit BaseLow cost, relationship-oriented 3/31/16 ● 1Interest costs on interest-bearing deposits ● 2Source: SNL Financial ● 31Q16 interest incurred on deposits as a percentage of average deposits 28% 28% 30% 31 % 32% 35 % 35% 36% 39 % 40% 44 % 50% STI FHN HBA N BBT MTB FITB KEY R F BOK F CFR ZIO N CMA Highest Noninterest-Bearing as aPercent of Total Deposits2(Period-end) 34 30 27 26 25 24 24 22 18 17 14 5 BOK F FITB KEY MTB BB T FHN HBA N STI RF ZIO N CMA CFR One of the Lowest Cost of Deposits2,3(In basis points) Strong Deposit Base($ in billions; Average) 1 Why is Comerica Asset Sensitive? 14 3/31/16 ● 1Estimated outlook as of 5/31/16 based on simulation modeling. This analysis incorporates a dynamic balance sheet assuming historical relationships for all other variables. ● 2As of 2/29/16 Interest Rate Sensitivity Significant upside in rising rate scenario Additional Annual Net Interest Income1Estimated Increase From Movement in Fed Rates Deposit Beta ($ in millions) 0% 25% 50% 75% +25 bps ~$85 ~$70 ~$55 ~$40 +50 bps ~165 ~135 ~105 ~75 +100 bps ~325 ~270 ~215 ~155 ~$90MM expected benefit to FY16 from 12/15 rate rise, if deposit prices remain at current levels Predominately floating rate loans • <2% have floors2 Fixed rate securities < 20% of earning assets Large non-maturity deposit base Abnormally low interest rate environment Fixed Rate~15% Libor-Based~65%Prime-Based~20% Loan Portfolio ($ in billions, Period-end) Total $49.4B

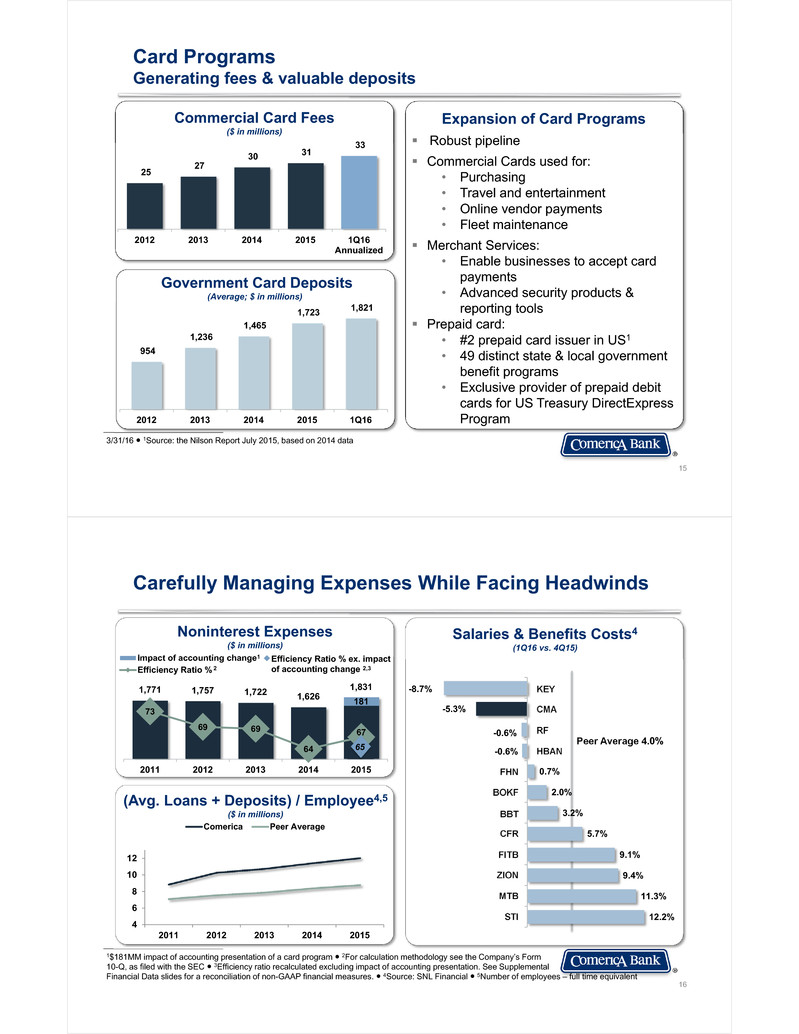

15 Card ProgramsGenerating fees & valuable deposits 3/31/16 ● 1Source: the Nilson Report July 2015, based on 2014 data 954 1,236 1,465 1,723 1,821 2012 2013 2014 2015 1Q16 Government Card Deposits(Average; $ in millions) Robust pipeline Commercial Cards used for:• Purchasing• Travel and entertainment• Online vendor payments• Fleet maintenance Merchant Services: • Enable businesses to accept card payments • Advanced security products & reporting tools Prepaid card: • #2 prepaid card issuer in US1• 49 distinct state & local government benefit programs• Exclusive provider of prepaid debit cards for US Treasury DirectExpressProgram Commercial Card Fees ($ in millions) Expansion of Card Programs 25 27 30 31 33 2012 2013 2014 2015 1Q16Annualized 1811,771 1,757 1,722 1,626 1,831 73 69 69 64 67 2011 2012 2013 2014 2015 Impact of accounting changeEfficiency Ratio % Noninterest Expenses($ in millions) 1 16 Carefully Managing Expenses While Facing Headwinds 1$181MM impact of accounting presentation of a card program ● 2For calculation methodology see the Company’s Form 10-Q, as filed with the SEC ● 3Efficiency ratio recalculated excluding impact of accounting presentation. See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures. ● 4Source: SNL Financial ● 5Number of employees – full time equivalent 4 6 8 10 12 2011 2012 2013 2014 2015 Comerica Peer Average (Avg. Loans + Deposits) / Employee4,5($ in millions) 65 Efficiency Ratio % ex. impact of accounting change 2,32 Salaries & Benefits Costs4(1Q16 vs. 4Q15) Peer Average 4.0% KEY CMA STI RF HBAN FHN BOKF BBT FITB CFR ZION MTB 12.2% 11.3% 9.4% 9.1% 5.7% 3.2% 2.0% 0.7% -0.6% -0.6% -5.3% -8.7%

17 Engaged Boston Consulting Group Committed to completing review quickly, comprehensively & effectively• Deploy tactics to increase revenue• Increase sales productivity• Assess management structure• Optimize infrastructure & operating base• Further leverage technology to improve product delivery & drive efficiency Plan to provide information around opportunities identified on 2Q16 earnings call Not waiting or relying on rising rates to drive efficiency ratio lower & move towards double digit return on equity ~7,600 ~6,000 2010 2015 5,989 5,545 5,423 5,350 5,184 2011 2012 2013 2014 2015 Reducing Real Estate Sq Ft (Sq ft in thousands) -13% Vendor Optimization(Vendor Count) -21% GEAR Up!Growth in Efficiency And Revenue Focus on Operating More Efficiently Actions Taken to Offset Headwinds 18 Active Capital ManagementContinued to reduce share count through repurchase & raised dividend 1Shares & warrants repurchased under equity repurchase program ● 2Payable July 1, 2016, to common stock shareholders of record on June 15, 2016 ● 3See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ● 4LTM = last twelve months Equity repurchases1: Pace of buyback linked to financial performance & balance sheet movement • 2Q16: nearly complete as of 5/27~1.4MM shares for ~$63MM • 1Q16: 1.2MM shares for $42MM• 4Q15: 1.5MM shares for $65MM• 3Q15: 1.2MM shares for $59MM• 2Q15: 1.0MM shares & 500k warrants for $59MMDividend increased 5% to $0.22/share2 $31.40 $33.36 $35.64 $37.72 $39.33 $39.96$34.79 $39.86 $39.22 $41.35 $43.03 $43.66 2011 2012 2013 2014 2015 1Q16 Tangible Book Value Book ValueTangible Book Value Per Share3 Dividends Per Share Growth 0.40 0.55 0.68 0.79 0.83 0.84 2011 2012 2013 2014 2015 LTM1Q16 197 188 182 179 176 175 2011 2012 2013 2014 2015 1Q16 Common Shares Outstanding(in millions) 4 CAGR+16%CAGR+5% CAGR-2%

19 3/31/16 ● Outlook as of 5/31/16 Intensely Focused on Enhancing Shareholder Value GROWING REVENUE REDUCINGEXPENSES RISK MANAGEMENT MANAGING CAPITAL POSITIONED FOR RISING RATES • Positioned in faster growing markets and industries to drive loan growth• Focus on cross-sell to drive fee income • Undertaking deep-dive review of expenses• Continue making necessary investments • Strong Capital base; Basel III Common Equity Tier 1 Capital: 10.58%• Continued share buyback & increased dividend for 2Q • Strong credit culture leads to solid credit metrics• Weathered cycle well relative to peers • Fed’s 25 bps December rate increase expected to increase 2016 net interest income by ~$90MM 20 Appendix

21 Financial Summary 1Q16 4Q15 1Q15 Diluted income per common share $0.34 $0.64 $0.73 Net interest income $447 $433 $413 Net interest margin 2.81% 2.58% 2.64% Provision for credit losses 148 60 14 Net credit-related charge-offs to average loans 0.49% 0.42% 0.07% Noninterest income 246 268 252 Noninterest expenses 460 484 456 Net income 60 116 134 Total average loans $48,392 $48,548 $48,151 Total average deposits 56,708 59,736 56,990 Basel III common equity Tier 1 capital ratio 10.58% 10.54% 10.40% Average diluted shares (millions) 176 179 182 $ in millions, except per share data 22 First Quarter 2016 Results $ in millions, except per share data ● 1Q16 compared to 4Q15 ● 1EPS based on diluted income per share ● 2See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ● 31Q16 repurchases under the equity repurchase program ● 4Net credit-related charge-offs 1Q16 Change From4Q15 1Q15Total average loans $48,392 (156) 241 Total average deposits 56,708 (3,028) (282) Net interest income 447 14 34 Provision for credit losses 148 88 134 Net credit-related charge-offs 58 7 50 Noninterest income 246 (22) (6) Noninterest expenses 460 (24) 4 Net income 60 (56) (74) Earnings per share (EPS)1 0.34 (0.30) (0.39) Book Value Per Share 43.66 0.63 1.54 Tangible Book Value Per Share2 39.96 0.63 1.49 Equity repurchases3 1.2MM sharesor $42MM Key QoQ Performance Drivers • Loans relatively stable • Deposits declined with purposeful pricing & LCR strategy • Net interest income up 3% with rise in rates • Provision reflected reserve build for energy & net charge-offs4 of 49 bps • Noninterest income lower due to decline in commercial loan fees following strong 4Q15 • Expenses decreased 5% with lower salaries/benefits & reductions in several other categories • TBV increased 2%, to $39.962

Net Interest Income($ in millions) 23 Net Interest Income Increased 3%NIM expands 23 bps 1Q16 compared to 4Q15 413 421 422 433 447 2.64 2.65 2.54 2.58 2.81 1Q15 2Q15 3Q15 4Q15 1Q16 NIM Net Interest Income and Rate NIM $433MM 4Q15 2.58% +20MM+ 1MM- 3MM- 2MM- 4MM - 1MM Loan impacts:+ higher short-term rates+ portfolio dynamics- nonaccrual interest- fees in the margin- one fewer day- lower volume +0.13 - 0.02- 0.01 + 6MM Higher securities balance - 5MM+ 3MM Fed balances:- lower balances+ higher rate +0.13 - 1MM Higher wholesale funding cost $447MM 1Q16 2.81% 24 Interest Rate SensitivityRemain well positioned for rising rates 3/31/16 ● For methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis Estimated Net Interest Income: Annual (12 month) SensitivitiesBased on Various AssumptionsAdditional Scenarios are Relative to 1Q16 Standard Model($ in millions) ~100 ~160 ~180 ~190 ~200 ~240 ~300 Up 100bps Addl.$3BDepositDecline Addl.20%Increasein Beta Addl.$1BDepositDecline 1Q16StandardModel Addl.~3%LoanGrowth Up 300bps 0.1 Interest Rates 200 bps gradual, non-parallel rise Loan Balances Modest increase Deposit Balances Moderate decrease Deposit Pricing (Beta) Historical price movements with short-term rates Securities Portfolio Increased for LCR compliance Loan Spreads Held at current levels MBS Prepayments Third-party projections and historical experience Hedging (Swaps) No additions modeled Standard Model Assumptions

25 Noninterest Income LowerFollowing strong commercial loan fees in 4Q15 1Q16 compared to 4Q15 ●1Excludes impact of deferred compensation of $(5)MM, $2MM, $(4)MM, in 1Q16, 4Q15 & 3Q15, respectively & $1MM in both 2Q15 & 1Q15, which is offset in noninterest expense. The Corporation believes this information will assist investors, regulators, management and others in comparing quarter over quarter results. 252 257 262 268 246 1Q15 2Q15 3Q15 4Q15 1Q16 Noninterest Income ($ in millions) Noninterest income - $10MM Commercial Lending fees (Syndication & Credit Line fees) - $ 7MM Deferred comp (returns on plan assets offset in noninterest expense) - $ 2MM Securities losses - $ 2MM Bank owned life insurance (BOLI) Total Noninterest Income excluding Deferred Comp1 251 256 266 266 251 26 Noninterest Expenses Declined 5%Continued focus on expense control 1Q16 compared to 4Q15 ● 1Excludes impact of deferred compensation of $(5)MM, $2MM, $(4)MM, in 1Q16, 4Q15 & 3Q15, respectively & $1MM in both 2Q15 & 1Q15, which is offset in noninterest income. The Corporation believes this information will assist investors, regulators, management and others in comparing quarter over quarter results. Noninterest expenses - $14MM Salaries & Benefits expense - $8MM Pension expense- $7MM Deferred comp (offset in noninterest income) - Technology-related contract labor- One fewer day+ Annual stock compensation - $3MM Occupancy - $3MM Advertising - $3MM Consultant Fees (other expense) 456 432 459 484 460 1Q15 2Q15 3Q15 4Q15 1Q16 Noninterest Expenses($ in millions) Total Noninterest Expense excluding Deferred Comp1 455 431 463 482 465

27 Loans Relatively StableYields increase; maintaining pricing and structure discipline 1Q16 compared to 4Q15 ● 1Utilization of commercial commitments as a percentage of total commercial commitments at period-end Total Loans($ in billions) 48.2 48.8 49.0 48.5 48.4 49.1 49.4 3.19 3.20 3.17 3.24 3.38 1Q15 2Q15 3Q15 4Q15 1Q16 4Q15 1Q16 Loan Yields Average Balances Period-end Average loans decreased $156MM - General Middle Market - Energy- Mortgage Banker Finance+ Commercial Real Estate+ National Dealer Services Period-end loans increased $293MM + Commercial Real Estate- Corporate BankingLoan yields +14 bps Average 30-day LIBOR rose ~23 bpsCommitments down ~3% to $54.4B Line utilization1 increased to 51%Loan pipeline increased 28 Loans by Business and Market Average $ in billions ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 1Q16 4Q15 1Q15 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $12.83.16.20.73.30.9 $13.03.26.20.73.30.9 $13.53.75.90.62.91.0 Total Middle Market $27.0 $27.3 $27.6 Corporate BankingUS BankingInternational 2.41.7 2.41.7 2.71.9 Mortgage Banker Finance 1.7 1.7 1.4 Commercial Real Estate 4.8 4.6 4.2 BUSINESS BANK $37.6 $37.7 $37.7 Small Business 3.9 3.9 3.7 Retail Banking 1.9 1.9 1.9 RETAIL BANK $5.8 $5.8 $5.6 Private Banking 5.0 5.0 4.8 WEALTH MANAGEMENT 5.0 5.0 $4.8 TOTAL $48.4 $48.5 $48.2 By Market 1Q16 4Q15 1Q15 Michigan $12.8 $13.0 $13.3 California 17.3 17.0 16.2 Texas 10.8 10.9 11.5 Other Markets1 7.5 7.6 7.2 TOTAL $48.4 $48.5 $48.2

29 Deposit Decline Reflects Purposeful Pricing & LCR StrategyDeposits costs stable 1Q16 compared to 4Q15 ● 1Interest costs on interest-bearing deposits ● 2At 3/31/16 Average Balances Period-end Total Deposits($ in billions) 57.0 57.4 59.1 59.7 56.7 59.9 56.4 0.15 0.14 0.14 0.14 0.14 1Q15 2Q15 3Q15 4Q15 1Q16 4Q15 1Q16 Deposit Rates 1 Average deposits decreased - Corporate Banking- Financial Services Division- Municipalities About 2/3 of total deposits are commercial Loan to Deposit Ratio2 of 87% Interest-bearing50% Noninterest-bearing50% Deposits: Large Proportion NIB($ in billions, Period-end) Total$56.4 30 Deposits by Business and Market Average $ in billions ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets ● 2Finance/ Other includes items not directly associated with the geographic markets or the three major business segments Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 1Q16 4Q15 1Q15 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $14.90.60.30.26.20.1 $16.00.70.30.16.30.2 $15.60.70.20.16.10.2 Total Middle Market $22.3 $23.6 $22.9 Corporate BankingUS BankingInternational $2.22.3 $3.32.4 2.62.0 Mortgage Banker Finance 0.6 0.6 0.6 Commercial Real Estate 1.7 1.8 2.1 BUSINESS BANK $29.1 $31.7 $30.2 Small Business 3.1 3.2 2.9 Retail Banking 20.0 20.0 19.5 RETAIL BANK $23.1 $23.2 $22.4 Private Banking 4.2 4.4 4.0 WEALTH MANAGEMENT $4.2 $4.4 $4.0 Finance/ Other2 0.3 0.4 0.4 TOTAL $56.7 $59.7 $57.0 By Market 1Q16 4Q15 1Q15 Michigan $21.7 $22.1 $21.7 California 16.7 18.5 16.8 Texas 10.4 10.8 11.1 Other Markets1 7.6 7.9 7.0 Finance/ Other2 0.3 0.4 0.4 TOTAL $56.7 $59.7 $57.0

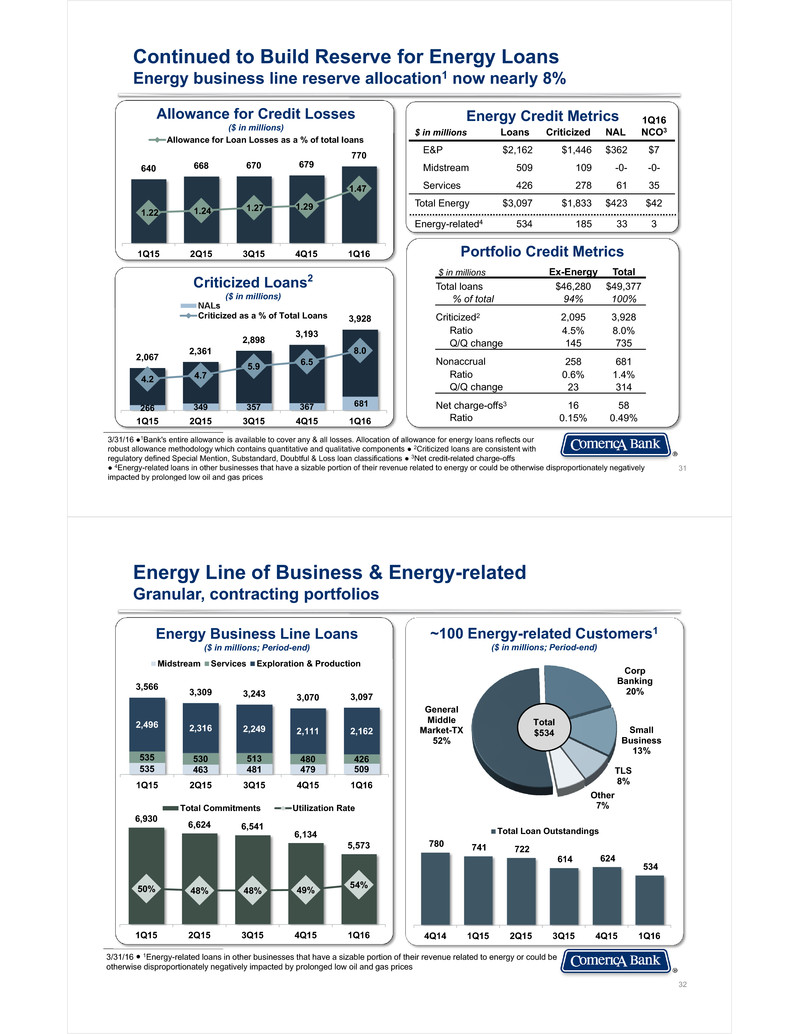

266 349 357 367 681 2,067 2,361 2,898 3,193 3,928 4.2 4.7 5.9 6.5 8.0 1Q15 2Q15 3Q15 4Q15 1Q16 NALsCriticized as a % of Total Loans Criticized Loans2($ in millions) 31 Continued to Build Reserve for Energy LoansEnergy business line reserve allocation1 now nearly 8% 3/31/16 ●1Bank's entire allowance is available to cover any & all losses. Allocation of allowance for energy loans reflects ourrobust allowance methodology which contains quantitative and qualitative components ● 2Criticized loans are consistent withregulatory defined Special Mention, Substandard, Doubtful & Loss loan classifications ● 3Net credit-related charge-offs ● 4Energy-related loans in other businesses that have a sizable portion of their revenue related to energy or could be otherwise disproportionately negatively impacted by prolonged low oil and gas prices Allowance for Credit Losses($ in millions) 640 668 670 679 770 1.22 1.24 1.27 1.29 1.47 1Q15 2Q15 3Q15 4Q15 1Q16 Allowance for Loan Losses as a % of total loans $ in millions Ex-Energy TotalTotal loans $46,280 $49,377% of total 94% 100% Criticized2 2,095 3,928Ratio 4.5% 8.0%Q/Q change 145 735 Nonaccrual 258 681Ratio 0.6% 1.4%Q/Q change 23 314 Net charge-offs3 16 58Ratio 0.15% 0.49% $ in millions Loans Criticized NAL 1Q16 NCO3 E&P $2,162 $1,446 $362 $7 Midstream 509 109 -0- -0- Services 426 278 61 35 Total Energy $3,097 $1,833 $423 $42 Energy-related4 534 185 33 3 Energy Credit Metrics Portfolio Credit Metrics 32 Energy Line of Business & Energy-relatedGranular, contracting portfolios 3/31/16 ● 1Energy-related loans in other businesses that have a sizable portion of their revenue related to energy or could be otherwise disproportionately negatively impacted by prolonged low oil and gas prices Natural Gas 13% Oil40% 535 463 481 479 509535 530 513 480 426 2,496 2,316 2,249 2,111 2,162 3,566 3,309 3,243 3,070 3,097 1Q15 2Q15 3Q15 4Q15 1Q16 Midstream Services Exploration & Production Energy Business Line Loans ($ in millions; Period-end) Mixed18% ~100 Energy-related Customers1($ in millions; Period-end) General Middle Market-TX52% Corp Banking20% Small Business13% TLS8%Other7% Total$534 780 741 722 614 624 534 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 Total Loan Outstandings6,930 6,624 6,541 6,134 5,573 50% 48% 48% 49% 54% 1Q15 2Q15 3Q15 4Q15 1Q16 Total Commitments Utilization Rate

33 National Dealer Services65+ years of floor plan lending Toyota/Lexus16% Honda/Acura 14% Ford 11% GM 8% Chrysler 10% Mercedes 3% Nissan/ Infiniti 6% Other European 12% Other Asian 12% Other18% Franchise Distribution(Based on period-end loan outstandings) Geographic DispersionCalifornia 64% Texas 7%Michigan 18% Other 11% Average Loans($ in billions) Top tier strategy Focus on “Mega Dealer” (five or more dealerships in group) Strong credit quality Robust monitoring of company inventory and performance 1.9 1.7 1.3 1.5 1.9 2.3 2.3 2.5 2.8 3.1 2.9 3.2 3.2 3.5 3.2 3.4 3.5 3.6 3.5 3.7 3.8 3.8 3.6 3.1 3.4 3.8 4.3 4.3 4.6 4.9 5.1 4.9 5.3 5.3 5.7 5.5 5.7 5.9 6.0 6.0 6.2 6.2 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 1Q1 6 Floor Plan Total $6.4B 3/31/16 ● 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) 34 Shared National Credit (SNC) Relationships At 3/31/16 ● SNCs are not a line of business. The balances shown above are included in the line of business balances. ● SNCs are facilities greater than $20 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level SNC loans increased $387MM, over 4Q15, led by a $172MM increase in Tech. & Life Sciences & $102MM increase in General Middle Market SNC relationships included in business line balances Approximately 780 borrowers Comerica is agent for approx. 20% Strategy: Pursue full relationships with ancillary business Adhere to same credit underwriting standards as rest of loan book Period-end Loans($ in billions) Commercial Real Estate$0.7 7% Corporate Banking$2.4 22% General$2.1 20%National Dealer Services$0.5 5% Energy$2.9 28% Entertainment$0.4 3% Environmental Services$0.3 3% Tech. & Life Sciences$0.9 8% Mortgage Banker$0.4 4% = Total Middle Market (67%) Total$10.6

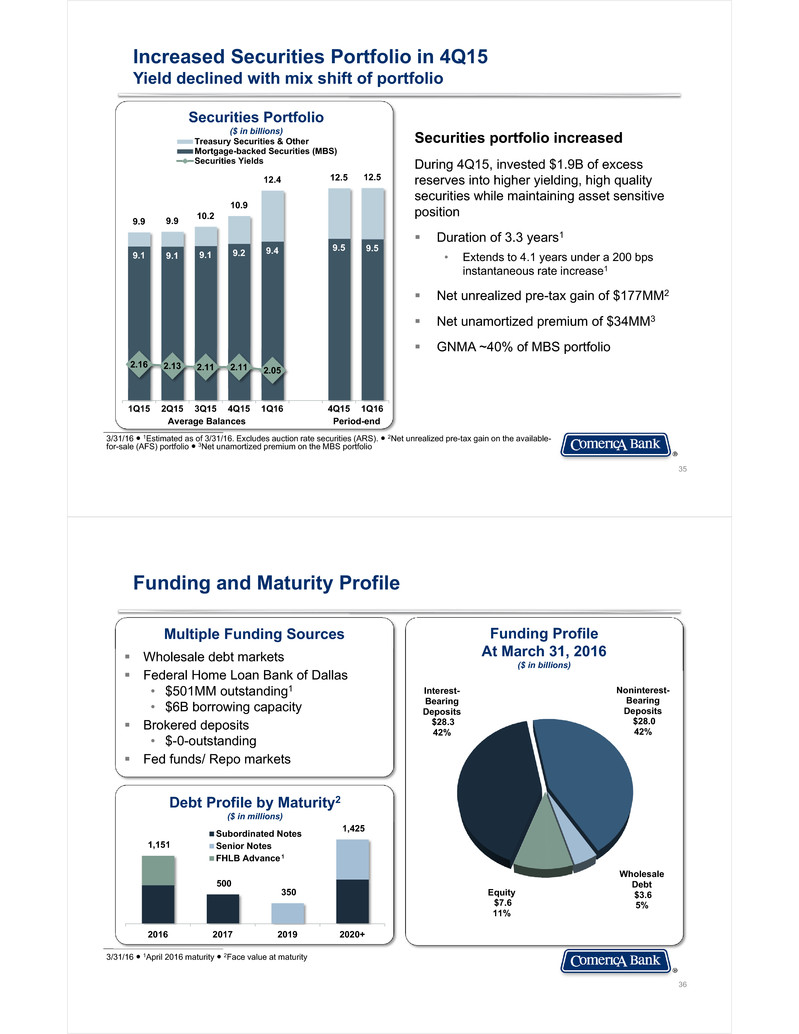

Securities Portfolio($ in billions) 35 3/31/16 ● 1Estimated as of 3/31/16. Excludes auction rate securities (ARS). ● 2Net unrealized pre-tax gain on the available-for-sale (AFS) portfolio ● 3Net unamortized premium on the MBS portfolio Securities portfolio increased During 4Q15, invested $1.9B of excess reserves into higher yielding, high quality securities while maintaining asset sensitive position Duration of 3.3 years1 • Extends to 4.1 years under a 200 bps instantaneous rate increase1 Net unrealized pre-tax gain of $177MM2 Net unamortized premium of $34MM3 GNMA ~40% of MBS portfolio 9.1 9.1 9.1 9.2 9.4 9.5 9.5 9.9 9.9 10.2 10.9 12.4 12.5 12.5 2.16 2.13 2.11 2.11 2.05 1Q15 2Q15 3Q15 4Q15 1Q16 4Q15 1Q16 Treasury Securities & OtherMortgage-backed Securities (MBS)Securities Yields Average Balances Period-end Increased Securities Portfolio in 4Q15Yield declined with mix shift of portfolio Equity$7.6 11% Interest-Bearing Deposits$28.3 42% Noninterest-Bearing Deposits$28.0 42% Wholesale Debt$3.6 5% 36 Funding and Maturity Profile 3/31/16 ● 1April 2016 maturity ● 2Face value at maturity Wholesale debt markets Federal Home Loan Bank of Dallas• $501MM outstanding1• $6B borrowing capacity Brokered deposits• $-0-outstanding Fed funds/ Repo markets Multiple Funding Sources Debt Profile by Maturity2($ in millions) 1,151 500 350 1,425 2016 2017 2019 2020+ Subordinated NotesSenior NotesFHLB Advance Funding ProfileAt March 31, 2016($ in billions) 1

Senior Unsecured/Long-Term Issuer Rating Moody’s S&P Fitch BB&T A2 A- A+ Cullen Frost A3 A- -- M&T Bank A3 A- A BOK Financial Corporation A3 BBB+ A Comerica A3 BBB+ A Zions Bancorporation Ba1 BBB- BBB- Huntington Baa1 BBB A- Fifth Third Baa1 BBB+ A KeyCorp Baa1 BBB+ A- SunTrust Baa1 BBB+ A- First Horizon National Corp Baa3 BB+ BBB- Regions Financial Baa3 BBB BBB U.S. Bancorp A1 A+ AA Wells Fargo & Company A2 A AA- PNC Financial Services Group A3 A- A+ JP Morgan A3 A- A+ Bank of America Baa1 BBB+ A 37 Holding Company Debt Rating As of 5/26/16 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities Pee r Ba nks Larg e Ba nks 38 The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets. Tangible common equity per share of common stock removes the effect of intangible assets from common shareholders equity per share of common stock.● The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) 03/31/16 12/31/15 03/31/15 12/31/14 12/31/13 12/31/12 12/31/11Common shareholders’ equityLess: GoodwillLess: Other intangible assets $7,64463513 $7,56063514 $7,50063515 $7,40263515 $7,15063517 $6,93963522 $6,86563532 Tangible common equity $6,966 $6,911 $6,850 $6,752 $6,498 $6,282 $6,198 Total assetsLess: GoodwillLess: Other intangible assets $69,00763513 $71,87763514 $69,33363515 $69,18663515 $65,22463517 $65,06663522 $61,00563532 Tangible assets $68,359 $71,228 $68,683 $68,536 $64,572 $64,409 $60,338Common equity ratio 11.08% 10.52% 10.82 10.70% 10.97% 10.67% 11.26%Tangible common equity ratio 10.23 9.70 9.97 9.85 10.07 9.76 10.27 Common shareholders’ equity $7,644 $7,560 $7,500 $7,402 $7,150 $6,939 $6,865Tangible common equity 6,996 6,911 6,850 6,752 6,498 6,282 6,198Shares of common stock outstanding (in millions) 175 176 178 179 182 188 197Common shareholders’ equity per share of common stock $43.66 $43.03 $42.12 $41.35 $39.22 $36.86 $34.79Tangible common equity per share of common stock 39.96 39.33 38.47 37.72 35.64 33.36 31.40

39 The efficiency ratio, as adjusted removes the impact of a change in accounting presentation. The Corporation believes this information will assist investors, regulators, management & others in comparing results to prior periods. 12/31/15 Noninterest expenses – GAAPLess: Impact of accounting presentation of a card program $1,831 181 Noninterest expenses – as adjusted $1,650Net interest income plus noninterest income – GAAP $2,728Plus: Tax-equivalency 4Plus: Net securities losses 2Less: Impact of accounting presentation of a card program 181Net interest income plus noninterest income – as adjusted $2,553Efficiency ratio 67%Efficiency ratio – as adjusted 65% Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) 40

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Comerica (CMA) PT Lowered to $60 at Truist Securities

- SHAREHOLDER ACTION ALERT: The Schall Law Firm Encourages Investors in Autodesk, Inc. with Losses to Contact the Firm

- Corporación Financiera de Desarrollo S.A. (COFIDE) Announces Early Tender Results, Early Settlement Date and the Extension of the Early Tender Date of its Cash Tender Offer for Any and All of its Out

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share