Form 8-K COCA-COLA ENTERPRISES, For: May 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 25, 2016

COCA-COLA ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-34874 | 27-2197395 | ||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(IRS Employer Identification No.) |

2500 Windy Ridge Parkway, Atlanta, Georgia 30339

(Address of principal executive offices, including zip code)

(678) 260-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

Management of the Coca-Cola Enterprises, Inc. (“CCE,” “White” or the “Company”) posted a presentation for investors on May 25, 2016. A copy of the presentation materials is included as Exhibit 99.1 to this Current Report on Form 8-K. The presentation includes information related to the combination of the businesses of the Company, Coca-Cola Iberian Partners, S.A.U. (“CCIP”), and Coca-Cola Erfrischungsgetränke GmbH (“Black”), a wholly owned subsidiary of The Coca-Cola Company (“TCCC”), including certain pro forma financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union (“IFRS EU”).

Certain pro forma financial information that is included in the presentation is contained in the unaudited pro forma condensed combined financial information included as Exhibit 99.2 to this Current Report on Form 8-K, which information is included in the European prospectus related to the listing of the ordinary shares of Coca-Cola European Partners plc (“CCEP” or “Orange”) on exchanges within the European Union.

The information in this Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 7.01, the presentation attached as Exhibit 99.1 and the financial statements attached as Exhibit 99.2 to this Current Report shall not be incorporated by reference into any filing with the SEC made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| EXHIBIT NUMBER |

DESCRIPTION | |

| 99.1 | Company Slide Presentation | |

| 99.2 | Unaudited Pro Forma Condensed Combined Financial Information of Orange | |

FORWARD-LOOKING STATEMENTS

This communication may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “plan,” “seek,” “may,” “could,” “would,” “should,” “might,” “will,” “forecast,” “outlook,” “guidance,” “possible,” “potential,” “predict” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from TCCC’s, CCE’s or CCEP’s historical experience and their respective present expectations or projections, including expectations or projections with respect to the transaction. These risks include, but are not limited to, obesity concerns; water scarcity and poor quality; evolving consumer preferences; increased competition and capabilities in the marketplace; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non-nutritive sweeteners and biotechnology-derived substances, and of other substances present in their beverage products or packaging materials; increased demand for food products and decreased agricultural productivity; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging or developing markets; fluctuations in foreign currency exchange rates; interest rate increases; an inability to maintain good relationships with their partners; a deterioration in their partners’ financial condition; increases in income tax rates, changes in income tax laws or unfavorable resolution of tax matters; increased or new indirect taxes in the United States or in other tax jurisdictions; increased cost, disruption of supply or shortage of energy or fuels; increased cost, disruption of supply or shortage of ingredients, other raw materials or packaging materials; changes in laws and regulations relating to beverage containers and packaging; significant additional labeling or warning requirements or limitations on the availability of their respective products; an inability to protect their respective information systems against service interruption, misappropriation of data or breaches of security; unfavorable general economic or political conditions in the United States, Europe or elsewhere; litigation or legal proceedings; adverse weather conditions; climate change; damage to their respective brand images and corporate reputation from negative publicity, even if unwarranted, related to product safety or quality, human and workplace rights, obesity or other issues; changes in, or failure to comply with, the laws and regulations applicable to their respective products or business operations; changes in accounting standards; an inability to achieve their respective overall long-term growth objectives; deterioration of global credit market conditions; default by or failure of one or more of their respective counterparty financial institutions; an inability to timely implement their previously announced actions to reinvigorate growth, or to realize the

2

economic benefits they anticipate from these actions; failure to realize a significant portion of the anticipated benefits of their respective strategic relationships, including (without limitation) TCCC’s relationship with Keurig Green Mountain, Inc. and Monster Beverage Corporation; an inability to renew collective bargaining agreements on satisfactory terms, or they or their respective partners experience strikes, work stoppages or labor unrest; future impairment charges; multi-employer plan withdrawal liabilities in the future; an inability to successfully manage the possible negative consequences of their respective productivity initiatives; global or regional catastrophic events; risks and uncertainties relating to the transaction, including the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected, which could result in additional demands on TCCC’s or CCEP’s resources, systems, procedures and controls, disruption of its ongoing business and diversion of management’s attention from other business concerns, the possibility that certain assumptions with respect to CCEP or the transaction could prove to be inaccurate, the failure to receive, delays in the receipt of, or unacceptable or burdensome conditions imposed in connection with, all required regulatory approvals and the satisfaction of the closing conditions to the transaction, the potential failure to retain key employees of CCE, CCIP or Black as a result of the proposed transaction or during integration of the businesses and disruptions resulting from the proposed transaction, making it more difficult to maintain business relationships; and other risks discussed in TCCC’s and CCE’s filings with the Securities and Exchange Commission (the “SEC”), including their respective Annual Reports on Form 10-K for the year ended December 31, 2015, subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which filings are available from the SEC, and the registration statement on Form F-4, file number 333-208556, that includes a proxy statement of CCE and a prospectus of CCEP, which was filed with the SEC by CCEP. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. None of TCCC, CCE, CCIP or CCEP undertakes any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. None of TCCC, CCE, CCIP or CCEP assumes responsibility for the accuracy and completeness of any forward-looking statements. Any or all of the forward-looking statements contained in this filing and in any other of their respective public statements may prove to be incorrect.

Non-GAAP Financial Measures

The presentation included in Exhibit 99.1 hereto contains non-GAAP financial measures. These non-GAAP measures are provided to allow investors to more clearly evaluate the operating performance and business trends of CCE, CCIP and Black. Management uses these non-GAAP measures to review results excluding items that are not necessarily indicative of ongoing results. The adjusted items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COCA-COLA ENTERPRISES, INC. | ||||||

| (Registrant)

| ||||||

| Date: May 25, 2016 | By: | /s/ Suzanne N. Forlidas | ||||

| Name: | Suzanne N. Forlidas | |||||

| Title: | Vice President and Secretary | |||||

4

EXHIBIT LIST

| EXHIBIT NUMBER |

DESCRIPTION | |

| 99.1 | Company Slide Presentation | |

| 99.2 | Unaudited Pro Forma Condensed Combined Financial Information of Orange | |

May 25, 2016 Exhibit 99.1

Forward-Looking Statements This communication may contain statements, estimates or projections that constitute “forward-looking statements” as defined under U.S. federal securities laws. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “plan,” “seek,” “may,” “could,” “would,” “should,” “might,” “will,” “forecast,” “outlook,” “guidance,” “possible,” “potential,” “predict” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from The Coca-Cola Company’s (“KO”), Coca-Cola Enterprises, Inc.’s (“CCE”) or Coca-Cola European Partners Limited’s (“CCEP”) historical experience and their respective present expectations or projections, including expectations or projections with respect to the transaction. These risks include, but are not limited to, obesity concerns; water scarcity and poor quality; evolving consumer preferences; increased competition and capabilities in the marketplace; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non-nutritive sweeteners and biotechnology-derived substances, and of other substances present in their beverage products or packaging materials; increased demand for food products and decreased agricultural productivity; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging or developing markets; fluctuations in foreign currency exchange rates; interest rate increases; an inability to maintain good relationships with their partners; a deterioration in their partners’ financial condition; increases in income tax rates, changes in income tax laws or unfavorable resolution of tax matters; increased or new indirect taxes in the United States or in other tax jurisdictions; increased cost, disruption of supply or shortage of energy or fuels; increased cost, disruption of supply or shortage of ingredients, other raw materials or packaging materials; changes in laws and regulations relating to beverage containers and packaging; significant additional labeling or warning requirements or limitations on the availability of their respective products; an inability to protect their respective information systems against service interruption, misappropriation of data or breaches of security; unfavorable general economic or political conditions in the United States, Europe or elsewhere; litigation or legal proceedings; adverse weather conditions; climate change; damage to their respective brand images and corporate reputation from negative publicity, even if unwarranted, related to product safety or quality, human and workplace rights, obesity or other issues; changes in, or failure to comply with, the laws and regulations applicable to their respective products or business operations; changes in accounting standards; an inability to achieve their respective overall long-term growth objectives; deterioration of global credit market conditions; default by or failure of one or more of their respective counterparty financial institutions; an inability to timely implement their previously announced actions to reinvigorate growth, or to realize the economic benefits they anticipate from these actions; failure to realize a significant portion of the anticipated benefits of their respective strategic relationships, including (without limitation) KO’s relationship with Keurig Green Mountain, Inc. and Monster Beverage Corporation; an inability to renew collective bargaining agreements on satisfactory terms, or they or their respective partners experience strikes, work stoppages or labor unrest; future impairment charges; multi-employer plan withdrawal liabilities in the future; an inability to successfully manage the possible negative consequences of their respective productivity initiatives; global or regional catastrophic events; risks and uncertainties relating to the transaction, including the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected, which could result in additional demands on KO’s or CCEP’s resources, systems, procedures and controls, disruption of its ongoing business and diversion of management’s attention from other business concerns, the possibility that certain assumptions with respect to CCEP or the transaction could prove to be inaccurate, the failure to receive, delays in the receipt of, or unacceptable or burdensome conditions imposed in connection with, all required regulatory approvals and the satisfaction of the closing conditions to the transaction, the potential failure to retain key employees of CCE, Coca-Cola Iberian Partners, S.A.U. (“CCIP”) or Coca-Cola Erfrischungsgetränke GmbH (“CCEG”) as a result of the proposed transaction or during integration of the businesses and disruptions resulting from the proposed transaction, making it more difficult to maintain business relationships; and other risks discussed in KO’s and CCE’s filings with the Securities and Exchange Commission (the “SEC”), including their respective Annual Reports on Form 10-K for the year ended December 31, 2015, subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which filings are available from the SEC, and the registration statement on Form F-4, file number 333-208556, that includes a proxy statement of CCE and a prospectus of CCEP, which was filed with the SEC by CCEP. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. None of KO, CCE, CCIP or CCEP undertakes any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. None of KO, CCE, CCIP or CCEP assumes responsibility for the accuracy and completeness of any forward-looking statements. Any or all of the forward-looking statements contained in this filing and in any other of their respective public statements may prove to be incorrect.

No Profit Forecast No Profit Forecast No statement in this announcement is intended to constitute a profit forecast for any period, nor should any statements be interpreted to mean that revenues, EBITDA, earnings per share or any other metric will necessarily be greater or less than those for the relevant preceding financial periods for CCE, CCIP, CCEG or CCEP, as appropriate. No statement in this announcement constitutes an asset valuation. Subject to its legal and regulatory obligations, neither CCEP, nor any of its agents, employees or advisors intends or has any duty or obligation to supplement, amend, update or revise any of the statements contained in this document to reflect any change in expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based. In no circumstances shall the provision of this document imply that no negative change may occur in the business of CCE, CCIP, CCEG or CCEP, as appropriate, after the date of provision of this document, or any date of amendment and/or addition thereto.

EU Prospectus Directive Disclosures/ Non-GAAP Financial Measures This document is not a prospectus for the purposes of the Prospectus Directive. A prospectus prepared pursuant to the Prospectus Directive is intended to be published, which, when published, will be available from CCEP at its registered office. Investors should not subscribe for any securities referred to in this document except on the basis of information contained in the prospectus. The expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including Directive 2010/73/EU, to the extent implemented in any relevant Member State) and includes any relevant implementing measure in the relevant Member State. Any offer of securities to the public that may be deemed to be made pursuant to this communication in any member states of the European Economic Area (“EEA Member States”) that has implemented the Prospectus Directive is addressed solely to qualified investors (within the meaning of the Prospectus Directive) in that Member State. The information contained in this document is directed solely at persons (1) outside the United Kingdom, (2) within the United Kingdom (i) having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Market Act (Financial Promotion) Order 2005 (the “Order”) and (ii) to persons of a kind described in Article 49(2) (a) to (d) of the Order and (3) in EEA Member States to persons who are “qualified investors” within the meaning of Article 2(1)(e) of the Prospectus Directive (all such persons together being referred to as “Relevant Persons”). Any investment activity to which this document relates is only available to, and will only be engaged in with, Relevant Persons. This document and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other person. Persons who are not Relevant Persons must not rely on or act upon the information contained in this document. This document is not intended to form the basis of any investment activity or decision and does not constitute, may not be construed as, or form part of, an offer to sell or issue, or a solicitation of an offer or invitation to purchase or subscribe for, any securities or other interests in CCEP or any other investments of any description, a recommendation regarding the issue or the provision of investment advice by any party. No information set out in this document or referred to herein is intended to form the basis of any contract of sale, investment decision or any decision to purchase securities in CCEP. No reliance may be placed for any purposes whatsoever on this document (including, without limitation, any illustrative modeling information contained herein), or its completeness. This document should not form the basis of any investment decision and the contents do not constitute advice relating to legal, taxation or investment matters on which recipients of this document must always consult their own independent professional advisers on the merits and risks involved. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. These non-GAAP measures are provided to allow investors to more clearly evaluate the operating performance and business trends of CCE, CCIP, and CCEG. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

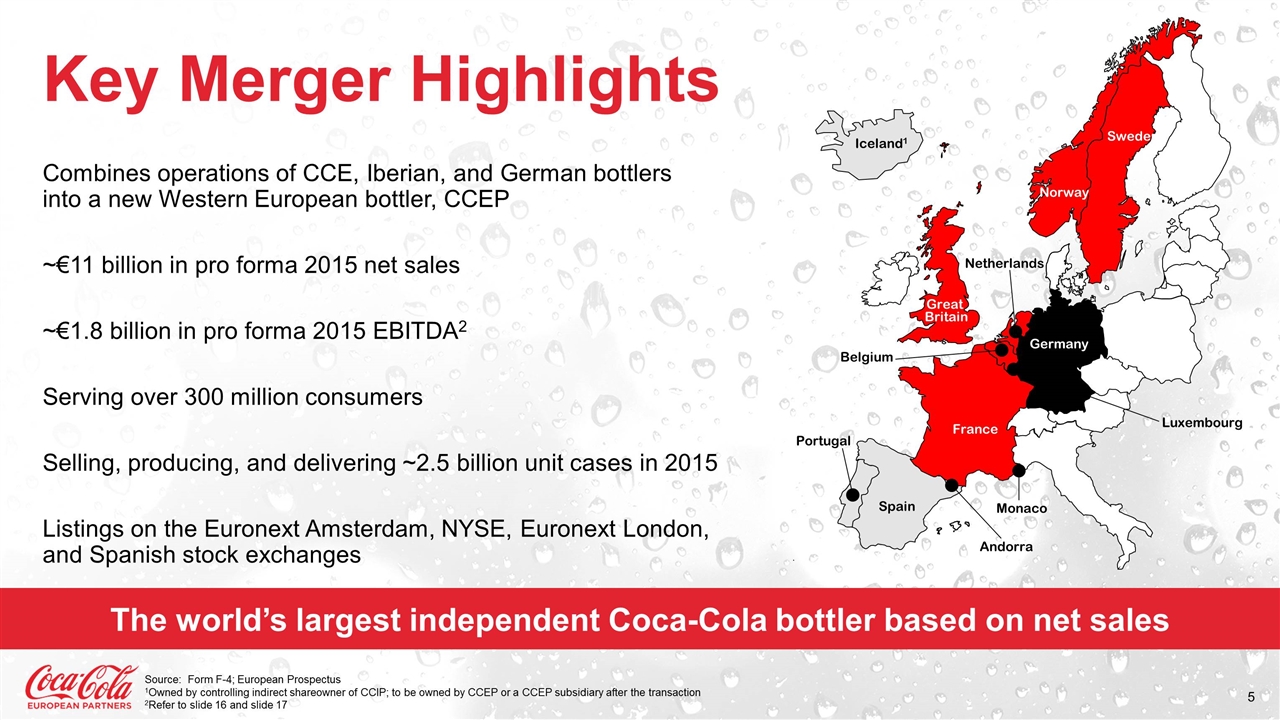

Key Merger Highlights Combines operations of CCE, Iberian, and German bottlers into a new Western European bottler, CCEP ~€11 billion in pro forma 2015 net sales ~€1.8 billion in pro forma 2015 EBITDA2 Serving over 300 million consumers Selling, producing, and delivering ~2.5 billion unit cases in 2015 Listings on the Euronext Amsterdam, NYSE, Euronext London, and Spanish stock exchanges Source: Form F-4; European Prospectus 1Owned by controlling indirect shareowner of CCIP; to be owned by CCEP or a CCEP subsidiary after the transaction 2Refer to slide 16 and slide 17 Norway Sweden Netherlands Germany France Great Britain Iceland1 Spain Portugal Andorra Luxembourg Monaco Belgium The world’s largest independent Coca-Cola bottler based on net sales

The Right Merger, At The Right Time New level of partnership with The Coca-Cola Company (TCCC) and a shared vision to drive growth Shared best practices to drive efficiency and enhance commercial effectiveness Solid platform for value creation Leverage scale and realize synergy benefits to improve operating model A winning combination

Significant Opportunities for Profitable Growth Grow CCEP’s share in ~€50B still segments1 Connect with more customers, more often Drive value growth in ~€45B sparkling segments1 Increase efficiency and effectiveness of ~€6.6B COGS and ~€2.9B SD&A annual spend2 Increase return on annual capex investment Realize synergies of creating CCEP 12015 Euromonitor; rounded 2European Prospectus, pro forma, including items impacting comparability; SD&A includes selling and distribution expenses and general and administrative expenses

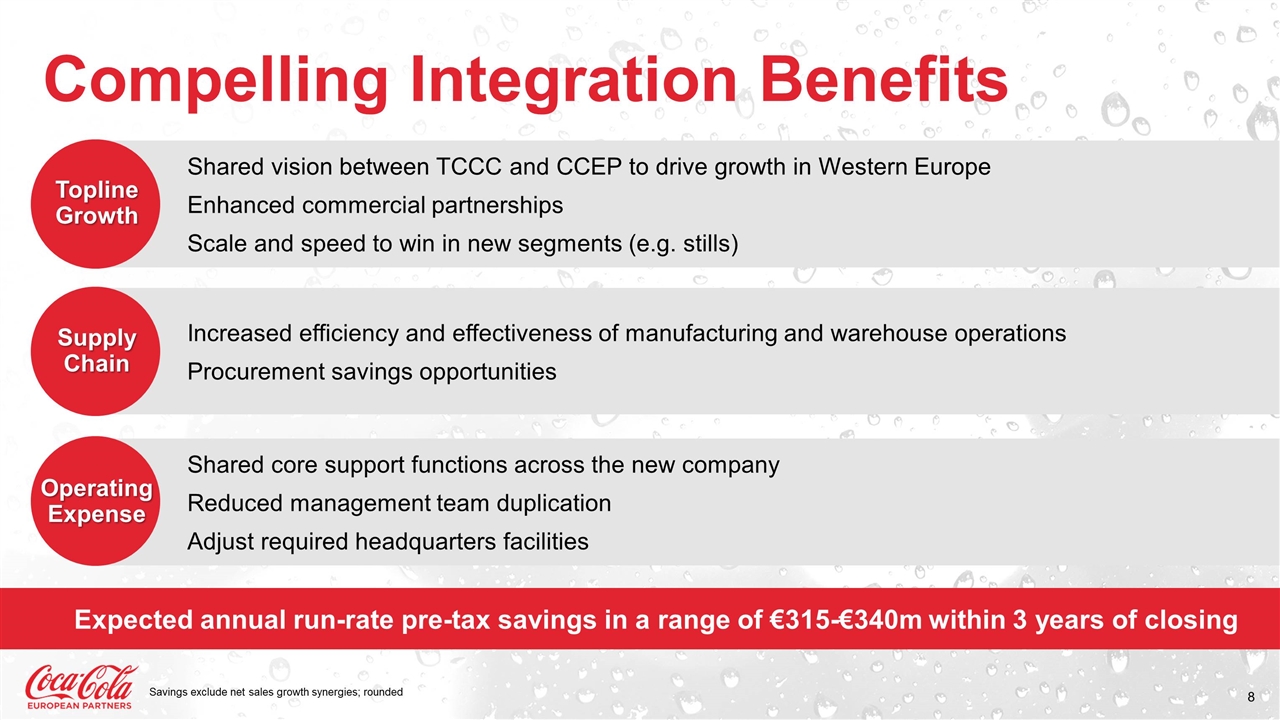

Topline Growth Supply Chain Operating Expense Shared vision between TCCC and CCEP to drive growth in Western Europe Enhanced commercial partnerships Scale and speed to win in new segments (e.g. stills) Compelling Integration Benefits Increased efficiency and effectiveness of manufacturing and warehouse operations Procurement savings opportunities Shared core support functions across the new company Reduced management team duplication Adjust required headquarters facilities Expected annual run-rate pre-tax savings in a range of €315-€340m within 3 years of closing Savings exclude net sales growth synergies; rounded

Financial Approach Maintain optimal capital structure Pursue disciplined investment Grow Free Cash Flow Deliver shareowner value A continued focus on driving strong financial returns and shareowner value

Outlook Near To Mid-Term: FMCG operating environment to remain challenging Operating Income growth driven primarily by synergies FY16 Net Sales expected to grow in a modest low single-digit range1 Mid To Long-Term: Invest for profitable topline growth Invest in restructuring to capture synergies Plan to achieve long-term objectives Focused on both near-term and long-term financial objectives 1Comparable and currency neutral

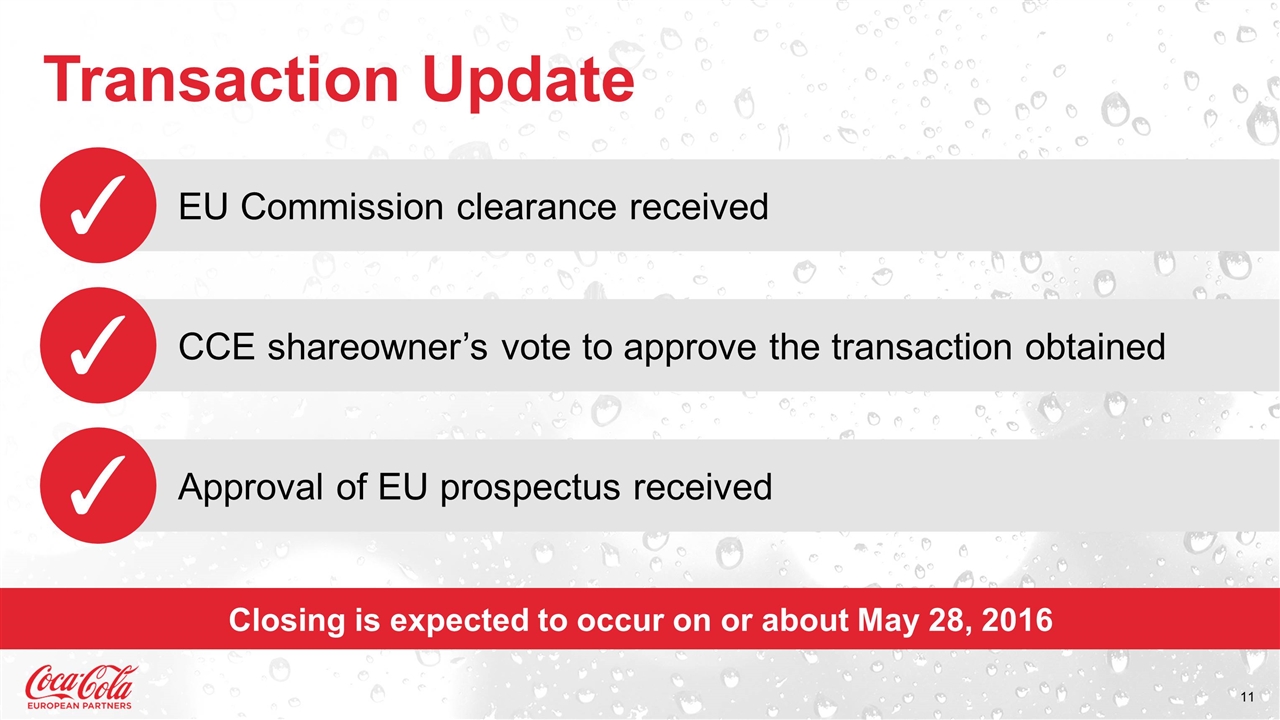

Transaction Update EU Commission clearance received ✓ Closing is expected to occur on or about May 28, 2016 CCE shareowner’s vote to approve the transaction obtained ✓ Approval of EU prospectus received ✓

A Responsible & Sustainable Business Internal reports CCEP is expected to adopt CCE’s commitment to sustainability History of community involvement and investment 2015 Dow Jones Sustainability Index ~90% of our drinks are produced and marketed locally Strong alignment with TCCC

Summary & Key Takeaways Creating the leading independent Coca-Cola bottler and a major European consumer packaged goods company A compelling business combination A unique opportunity for profitable growth Realistic about the consumer environment A commitment to driving shareowner value

May 25, 2016 Appendix – IFRS and U.S. GAAP Condensed Income Statements

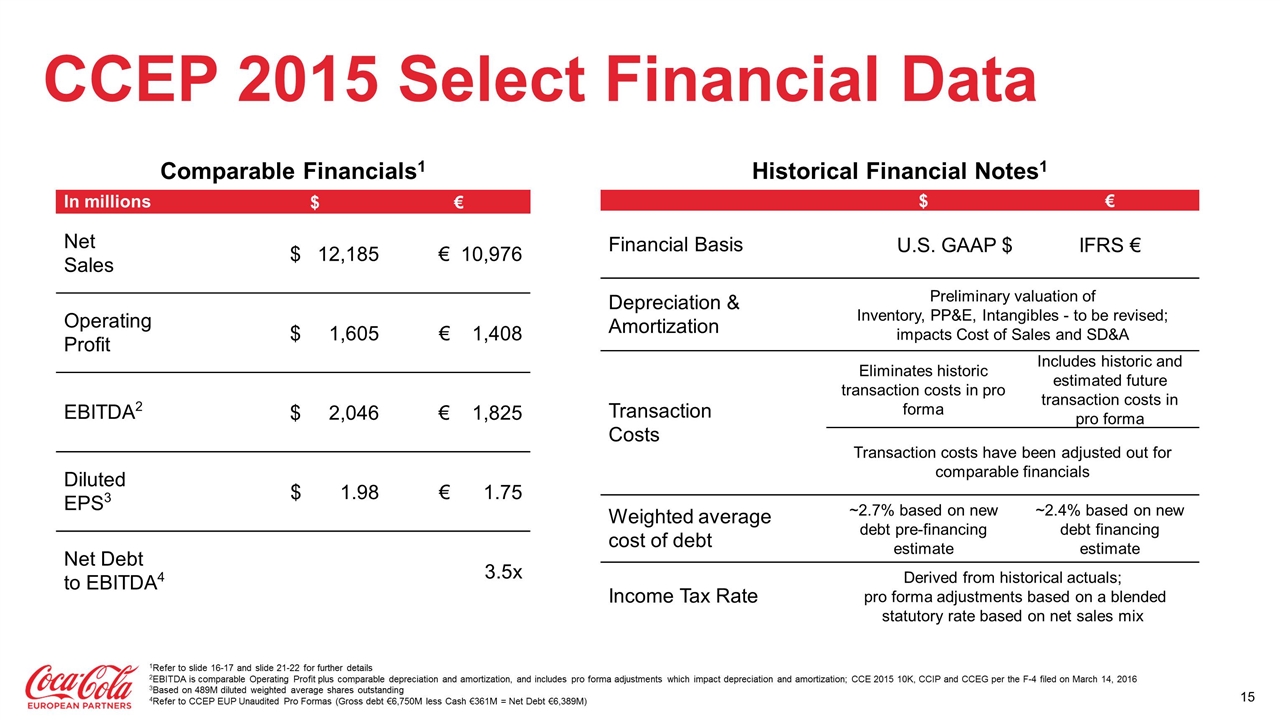

Comparable Financials1 In millions $ € Net Sales $ 12,185 € 10,976 Operating Profit $ 1,605 € 1,408 EBITDA2 $ 2,046 € 1,825 Diluted EPS3 $ 1.98 € 1.75 Net Debt to EBITDA4 3.5x CCEP 2015 Select Financial Data 1Refer to slide 16-17 and slide 21-22 for further details 2EBITDA is comparable Operating Profit plus comparable depreciation and amortization, and includes pro forma adjustments which impact depreciation and amortization; CCE 2015 10K, CCIP and CCEG per the F-4 filed on March 14, 2016 3Based on 489M diluted weighted average shares outstanding 4Refer to CCEP EUP Unaudited Pro Formas (Gross debt €6,750M less Cash €361M = Net Debt €6,389M) Historical Financial Notes1 $ € Financial Basis U.S. GAAP $ IFRS € Depreciation & Amortization Preliminary valuation of Inventory, PP&E, Intangibles - to be revised; impacts Cost of Sales and SD&A Transaction Costs Eliminates historic transaction costs in pro forma Includes historic and estimated future transaction costs in pro forma Transaction costs have been adjusted out for comparable financials Weighted average cost of debt ~2.7% based on new debt pre-financing estimate ~2.4% based on new debt financing estimate Income Tax Rate Derived from historical actuals; pro forma adjustments based on a blended statutory rate based on net sales mix

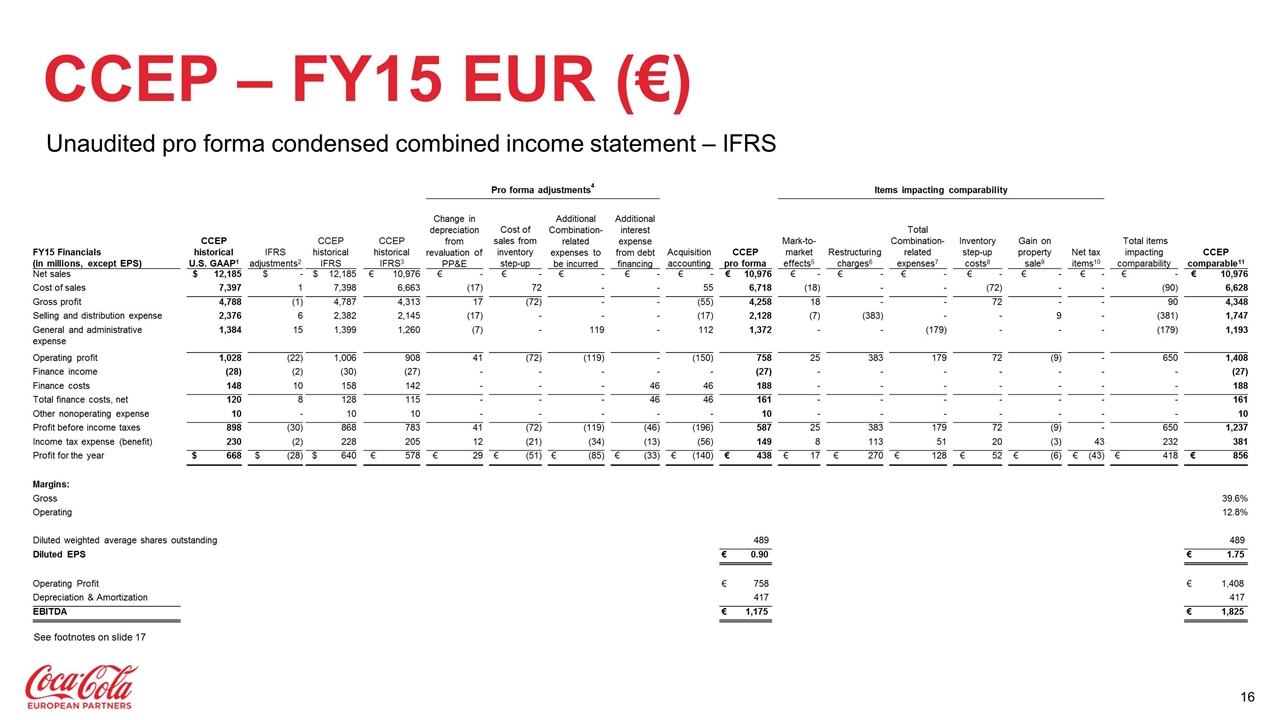

CCEP – FY15 EUR (€) Presentation Title Unaudited pro forma condensed combined income statement – IFRS See footnotes on slide 17 Pro forma adjustments4 Items impacting comparability FY15 Financials (in millions, except EPS) CCEP historical U.S. GAAP1 IFRS adjustments2 CCEP historical IFRS CCEP historical IFRS3 Change in depreciation from revaluation of PP&E Cost of sales from inventory step-up Additional Combination-related expenses to be incurred Additional interest expense from debt financing Acquisition accounting CCEP pro forma Mark-to-market effects5 Restructuring charges6 Total Combination-related expenses7 Inventory step-up costs8 Gain on property sale9 Net tax items10 Total items impacting comparability CCEP comparable11 Net sales $ 12,185 $ - $ 12,185 € 10,976 € - € - € - € - € - € 10,976 € - € - € - € - € - € - € - € 10,976 Cost of sales 7,397 1 7,398 6,663 (17) 72 - - 55 6,718 (18) - - (72) - - (90) 6,628 Gross profit 4,788 (1) 4,787 4,313 17 (72) - - (55) 4,258 18 - - 72 - - 90 4,348 Selling and distribution expense 2,376 6 2,382 2,145 (17) - - - (17) 2,128 (7) (383) - - 9 - (381) 1,747 General and administrative expense 1,384 15 1,399 1,260 (7) - 119 - 112 1,372 - - (179) - - - (179) 1,193 Operating profit 1,028 (22) 1,006 908 41 (72) (119) - (150) 758 25 383 179 72 (9) - 650 1,408 Finance income (28) (2) (30) (27) - - - - - (27) - - - - - - - (27) Finance costs 148 10 158 142 - - - 46 46 188 - - - - - - - 188 Total finance costs, net 120 8 128 115 - - - 46 46 161 - - - - - - - 161 Other nonoperating expense 10 - 10 10 - - - - - 10 - - - - - - - 10 Profit before income taxes 898 (30) 868 783 41 (72) (119) (46) (196) 587 25 383 179 72 (9) - 650 1,237 Income tax expense (benefit) 230 (2) 228 205 12 (21) (34) (13) (56) 149 8 113 51 20 (3) 43 232 381 Profit for the year $ 668 $ (28) $ 640 € 578 € 29 € (51) € (85) € (33) € (140) € 438 € 17 € 270 € 128 € 52 € (6) € (43) € 418 € 856 Margins: Gross 39.6% Operating 12.8% Diluted weighted average shares outstanding 489 489 Diluted EPS € 0.90 € 1.75 Operating Profit € 758 € 1,408 Depreciation & Amortization 417 417 EBITDA € 1,175 € 1,825

CCEP – FY15 EUR (€) Presentation Title Unaudited pro forma condensed combined income statement – IFRS Source: Unaudited pro forma condensed combined financial information of CCEP for the year ended December 31, 2015 in the European Prospectus published on May 25, 2016 (“CCEP EUP Unaudited Pro Formas”) 1Derived by combining CCE, CCIP, and CCEG historical financial information presented in the unaudited pro forma condensed combined financial information of CCEP for the year ended December 31, 2015 in the CCEP registration statement on Form F-4 filed on April 11, 2016 (“CCEP F-4 Unaudited Pro Formas”). For purposes of financial reporting, the local currency results were translated into USD using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€, 1.5291 $/£, 0.1240 $/NOK and 0.1185 $/SEK for CCE, 1.1111 $/€ for CCEG, and 1.1102 $/€ for CCIP as stated in the F-4. 2Refer to Note 5 and Note 7 of the CCEP EUP Unaudited Pro Formas for more information on the IRFS adjustments for CCE and CCEG, respectively. 3Amounts translated to EUR from USD using a simple 2015 annual average of 1.1102 $/€. 4Refer to Note 8 of the CCEP EUP Unaudited Pro Formas for a description of adjustments which are prepared under IFRS 3 “Business Combinations” under IFRS and Annex II of the Prospectus Directive Regulation. 5Amounts represent the net out-of-period mark-to-market impact of non-designated commodity hedges. 6Amounts represent nonrecurring restructuring charges. 7Amounts represent expenses associated with the pending merger with CCE, CCIP, and CCEG as described in Note 8 of the CCEP EUP Unaudited Pro Formas. 8Amounts represent cost of sales impact from preliminary inventory step-up as described in Note 8 of the CCEP EUP Unaudited Pro Formas. 9Amounts represent gains associated with the sale of a distribution facility in Great Britain. 10Amounts represent the deferred tax impact related to income tax rate or law changes in the United Kingdom and Norway. 11CCEP comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Items impacting comparability are derived from the Operating and Financial Review (“OFR”) for CCIP and CCEG in the European Prospectus, CCEP EUP Unaudited Pro Formas, and CCE FY15 earnings release issued on February 11, 2016. Note: For purposes of financial reporting, the USD results were translated into EUR using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€.

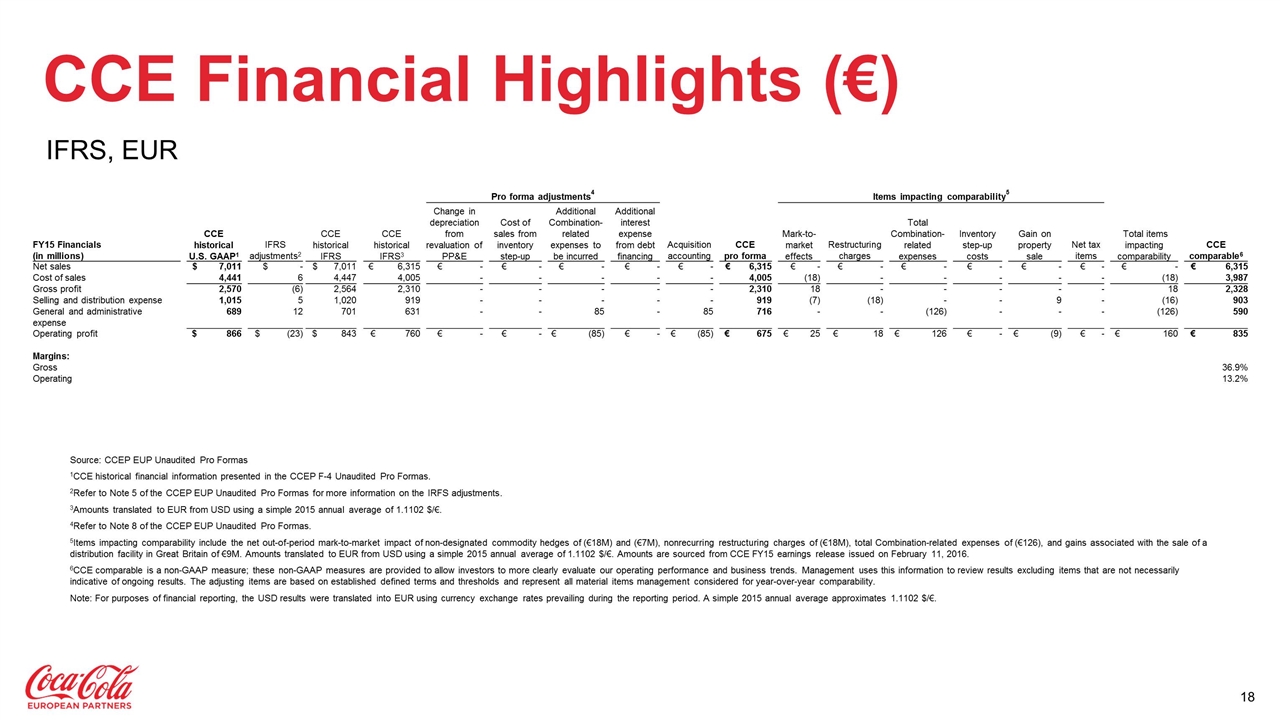

CCE Financial Highlights (€) Presentation Title IFRS, EUR Source: CCEP EUP Unaudited Pro Formas 1CCE historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 5 of the CCEP EUP Unaudited Pro Formas for more information on the IRFS adjustments. 3Amounts translated to EUR from USD using a simple 2015 annual average of 1.1102 $/€. 4Refer to Note 8 of the CCEP EUP Unaudited Pro Formas. 5Items impacting comparability include the net out-of-period mark-to-market impact of non-designated commodity hedges of (€18M) and (€7M), nonrecurring restructuring charges of (€18M), total Combination-related expenses of (€126), and gains associated with the sale of a distribution facility in Great Britain of €9M. Amounts translated to EUR from USD using a simple 2015 annual average of 1.1102 $/€. Amounts are sourced from CCE FY15 earnings release issued on February 11, 2016. 6CCE comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the USD results were translated into EUR using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€. Pro forma adjustments4 Items impacting comparability5 FY15 Financials (in millions) CCE historical U.S. GAAP1 IFRS adjustments2 CCE historical IFRS CCE historical IFRS3 Change in depreciation from revaluation of PP&E Cost of sales from inventory step-up Additional Combination-related expenses to be incurred Additional interest expense from debt financing Acquisition accounting CCE pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Inventory step-up costs Gain on property sale Net tax items Total items impacting comparability CCE comparable6 Net sales $ 7,011 $ - $ 7,011 € 6,315 € - € - € - € - € - € 6,315 € - € - € - € - € - € - € - € 6,315 Cost of sales 4,441 6 4,447 4,005 - - - - - 4,005 (18) - - - - - (18) 3,987 Gross profit 2,570 (6) 2,564 2,310 - - - - - 2,310 18 - - - - - 18 2,328 Selling and distribution expense 1,015 5 1,020 919 - - - - - 919 (7) (18) - - 9 - (16) 903 General and administrative expense 689 12 701 631 - - 85 - 85 716 - - (126) - - - (126) 590 Operating profit $ 866 $ (23) $ 843 € 760 € - € - € (85) € - € (85) € 675 € 25 € 18 € 126 € - € (9) € - € 160 € 835 Margins: Gross 36.9% Operating 13.2%

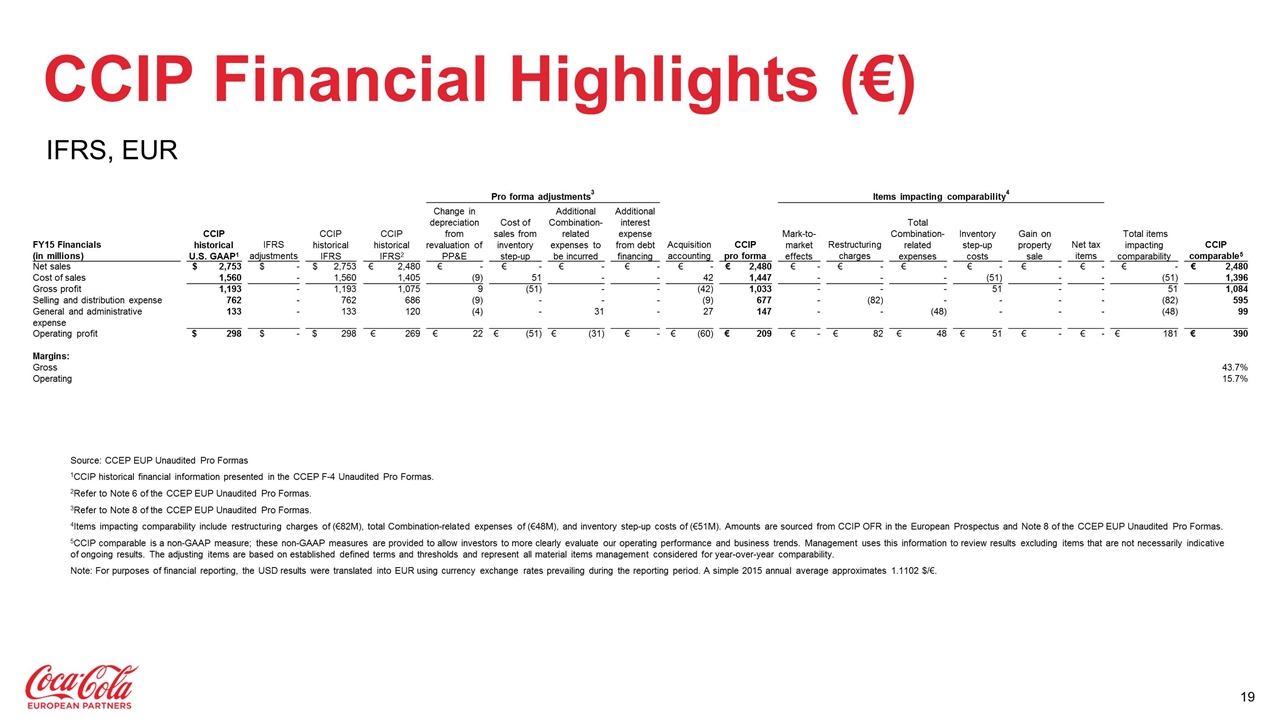

CCIP Financial Highlights (€) Presentation Title IFRS, EUR Source: CCEP EUP Unaudited Pro Formas 1CCIP historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 6 of the CCEP EUP Unaudited Pro Formas. 3Refer to Note 8 of the CCEP EUP Unaudited Pro Formas. 4Items impacting comparability include restructuring charges of (€82M), total Combination-related expenses of (€48M), and inventory step-up costs of (€51M). Amounts are sourced from CCIP OFR in the European Prospectus and Note 8 of the CCEP EUP Unaudited Pro Formas. 5CCIP comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the USD results were translated into EUR using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€. Pro forma adjustments3 Items impacting comparability4 FY15 Financials (in millions) CCIP historical U.S. GAAP1 IFRS adjustments CCIP historical IFRS CCIP historical IFRS2 Change in depreciation from revaluation of PP&E Cost of sales from inventory step-up Additional Combination-related expenses to be incurred Additional interest expense from debt financing Acquisition accounting CCIP pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Inventory step-up costs Gain on property sale Net tax items Total items impacting comparability CCIP comparable5 Net sales $ 2,753 $ - $ 2,753 € 2,480 € - € - € - € - € - € 2,480 € - € - € - € - € - € - € - € 2,480 Cost of sales 1,560 - 1,560 1,405 (9) 51 - - 42 1,447 - - - (51) - - (51) 1,396 Gross profit 1,193 - 1,193 1,075 9 (51) - - (42) 1,033 - - - 51 - - 51 1,084 Selling and distribution expense 762 - 762 686 (9) - - - (9) 677 - (82) - - - - (82) 595 General and administrative expense 133 - 133 120 (4) - 31 - 27 147 - - (48) - - - (48) 99 Operating profit $ 298 $ - $ 298 € 269 € 22 € (51) € (31) € - € (60) € 209 € - € 82 € 48 € 51 € - € - € 181 € 390 Margins: Gross 43.7% Operating 15.7%

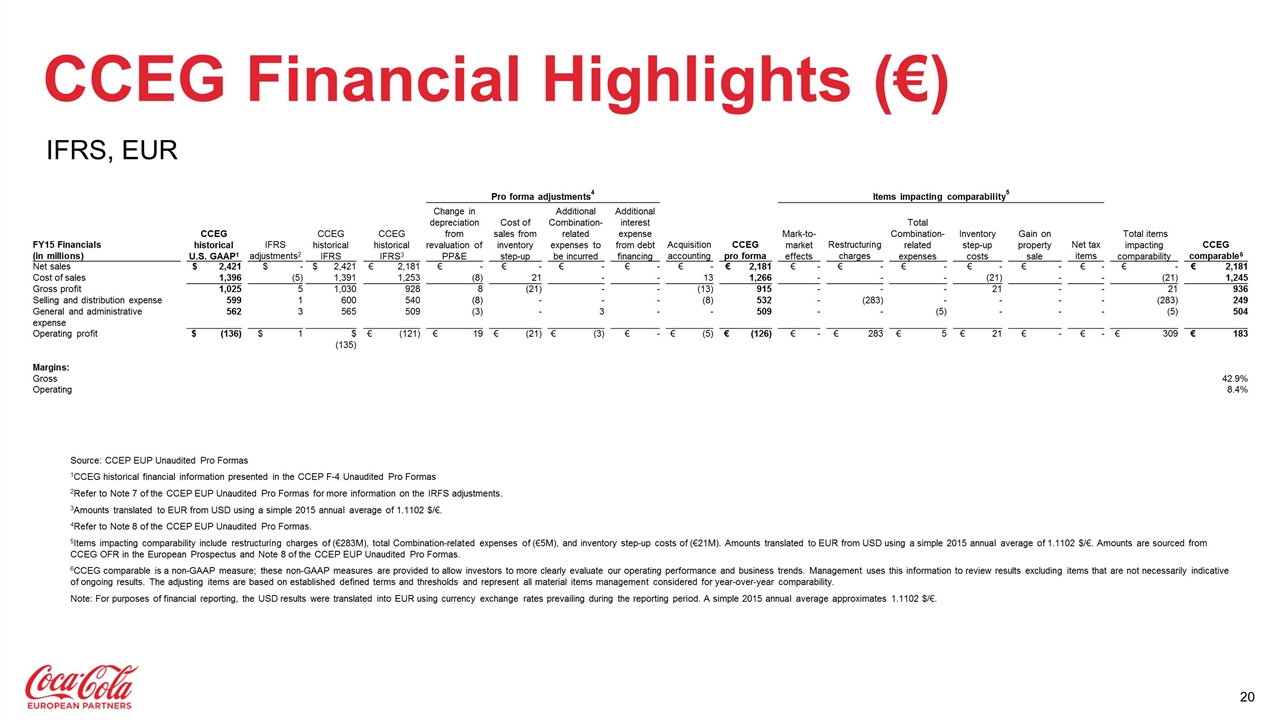

CCEG Financial Highlights (€) Presentation Title IFRS, EUR Source: CCEP EUP Unaudited Pro Formas 1CCEG historical financial information presented in the CCEP F-4 Unaudited Pro Formas 2Refer to Note 7 of the CCEP EUP Unaudited Pro Formas for more information on the IRFS adjustments. 3Amounts translated to EUR from USD using a simple 2015 annual average of 1.1102 $/€. 4Refer to Note 8 of the CCEP EUP Unaudited Pro Formas. 5Items impacting comparability include restructuring charges of (€283M), total Combination-related expenses of (€5M), and inventory step-up costs of (€21M). Amounts translated to EUR from USD using a simple 2015 annual average of 1.1102 $/€. Amounts are sourced from CCEG OFR in the European Prospectus and Note 8 of the CCEP EUP Unaudited Pro Formas. 6CCEG comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the USD results were translated into EUR using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€. Pro forma adjustments4 Items impacting comparability5 FY15 Financials (in millions) CCEG historical U.S. GAAP1 IFRS adjustments2 CCEG historical IFRS CCEG historical IFRS3 Change in depreciation from revaluation of PP&E Cost of sales from inventory step-up Additional Combination-related expenses to be incurred Additional interest expense from debt financing Acquisition accounting CCEG pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Inventory step-up costs Gain on property sale Net tax items Total items impacting comparability CCEG comparable6 Net sales $ 2,421 $ - $ 2,421 € 2,181 € - € - € - € - € - € 2,181 € - € - € - € - € - € - € - € 2,181 Cost of sales 1,396 (5) 1,391 1,253 (8) 21 - - 13 1,266 - - - (21) - - (21) 1,245 Gross profit 1,025 5 1,030 928 8 (21) - - (13) 915 - - - 21 - - 21 936 Selling and distribution expense 599 1 600 540 (8) - - - (8) 532 - (283) - - - - (283) 249 General and administrative expense 562 3 565 509 (3) - 3 - - 509 - - (5) - - - (5) 504 Operating profit $ (136) $ 1 $ (135) € (121) € 19 € (21) € (3) € - € (5) € (126) € - € 283 € 5 € 21 € - € - € 309 € 183 Margins: Gross 42.9% Operating 8.4%

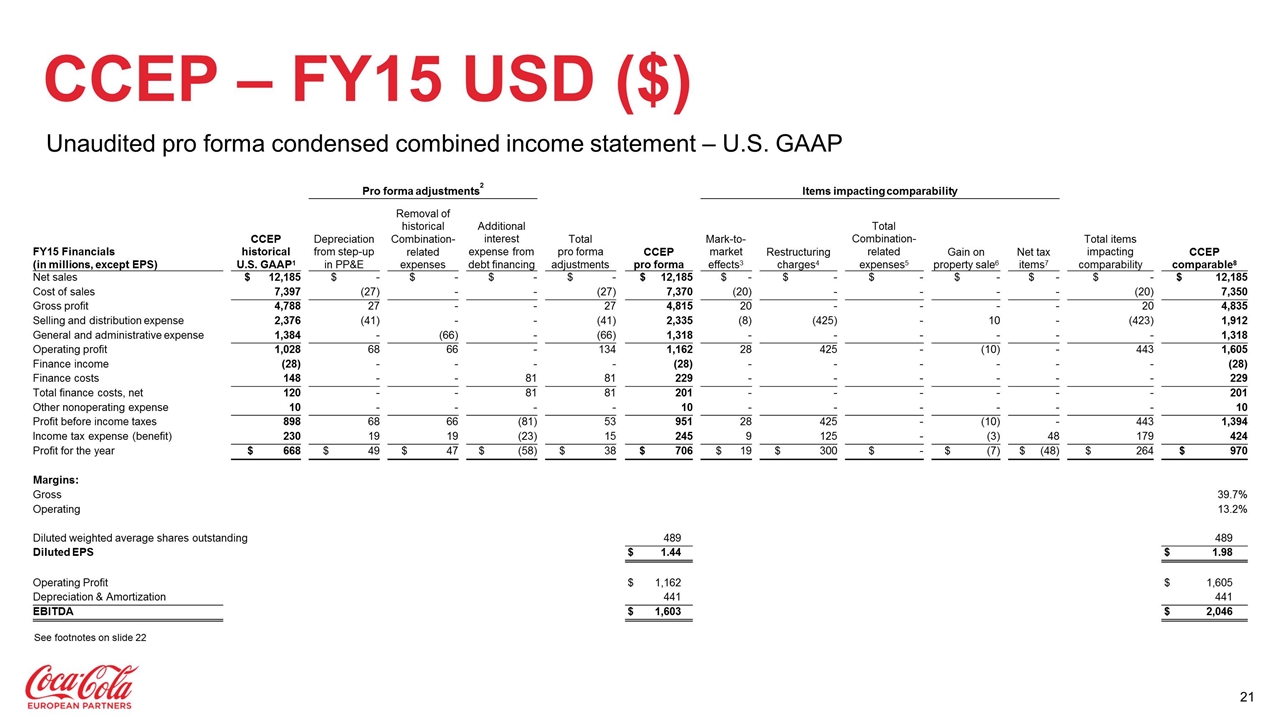

CCEP – FY15 USD ($) Presentation Title Unaudited pro forma condensed combined income statement – U.S. GAAP See footnotes on slide 22 Pro forma adjustments2 Items impacting comparability FY15 Financials (in millions, except EPS) CCEP historical U.S. GAAP1 Depreciation from step-up in PP&E Removal of historical Combination-related expenses Additional interest expense from debt financing Total pro forma adjustments CCEP pro forma Mark-to-market effects3 Restructuring charges4 Total Combination-related expenses5 Gain on property sale6 Net tax items7 Total items impacting comparability CCEP comparable8 Net sales $ 12,185 $ - $ - $ - $ - $ 12,185 $ - $ - $ - $ - $ - $ - $ 12,185 Cost of sales 7,397 (27) - - (27) 7,370 (20) - - - - (20) 7,350 Gross profit 4,788 27 - - 27 4,815 20 - - - - 20 4,835 Selling and distribution expense 2,376 (41) - - (41) 2,335 (8) (425) - 10 - (423) 1,912 General and administrative expense 1,384 - (66) - (66) 1,318 - - - - - - 1,318 Operating profit 1,028 68 66 - 134 1,162 28 425 - (10) - 443 1,605 Finance income (28) - - - - (28) - - - - - - (28) Finance costs 148 - - 81 81 229 - - - - - - 229 Total finance costs, net 120 - - 81 81 201 - - - - - - 201 Other nonoperating expense 10 - - - - 10 - - - - - - 10 Profit before income taxes 898 68 66 (81) 53 951 28 425 - (10) - 443 1,394 Income tax expense (benefit) 230 19 19 (23) 15 245 9 125 - (3) 48 179 424 Profit for the year $ 668 $ 49 $ 47 $ (58) $ 38 $ 706 $ 19 $ 300 $ - $ (7) $ (48) $ 264 $ 970 Margins: Gross 39.7% Operating 13.2% Diluted weighted average shares outstanding 489 489 Diluted EPS $ 1.44 $ 1.98 Operating Profit $ 1,162 $ 1,605 Depreciation & Amortization 441 441 EBITDA $ 1,603 $ 2,046

CCEP – FY15 USD ($) Presentation Title Unaudited pro forma condensed combined income statement – U.S. GAAP Source: Unaudited pro forma condensed combined financial information of CCEP for the year ended December 31, 2015 in the CCEP registration statement on Form F-4 filed on April 11, 2016 (“CCEP F-4 Unaudited Pro Formas”) 1Derived by combining CCE, CCIP, and CCEG historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 7 to the CCEP F-4 Unaudited Pro Formas for a description of adjustments which are prepared under Accounting Standards Codification 805 “Business Combinations” under U.S. GAAP and Article 11 of Regulation S-X. 3Amounts represent the net out-of-period mark-to-market impact of non-designated commodity hedges. 4Amounts represent nonrecurring restructuring charges. 5Amounts represent expenses associated with the pending merger with CCE, CCIP, and CCEG. 6Amounts represent gains associated with the sale of a distribution facility in Great Britain. 7Amounts represent the deferred tax impact related to income tax rate or law changes in the United Kingdom and Norway. 8CCEP comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Items impacting comparability derived from the MD&A for CCIP and from the MD&A for CCEG in the F-4, and CCE FY15 earnings release issued on February 11, 2016. Note: For purposes of financial reporting, the local currency results were translated into USD using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€, 1.5291 $/£, 0.1240 $/NOK and 0.1185 $/SEK for CCE, 1.1111 $/€ for CCEG, and 1.1102 $/€ for CCIP as stated in the F-4.

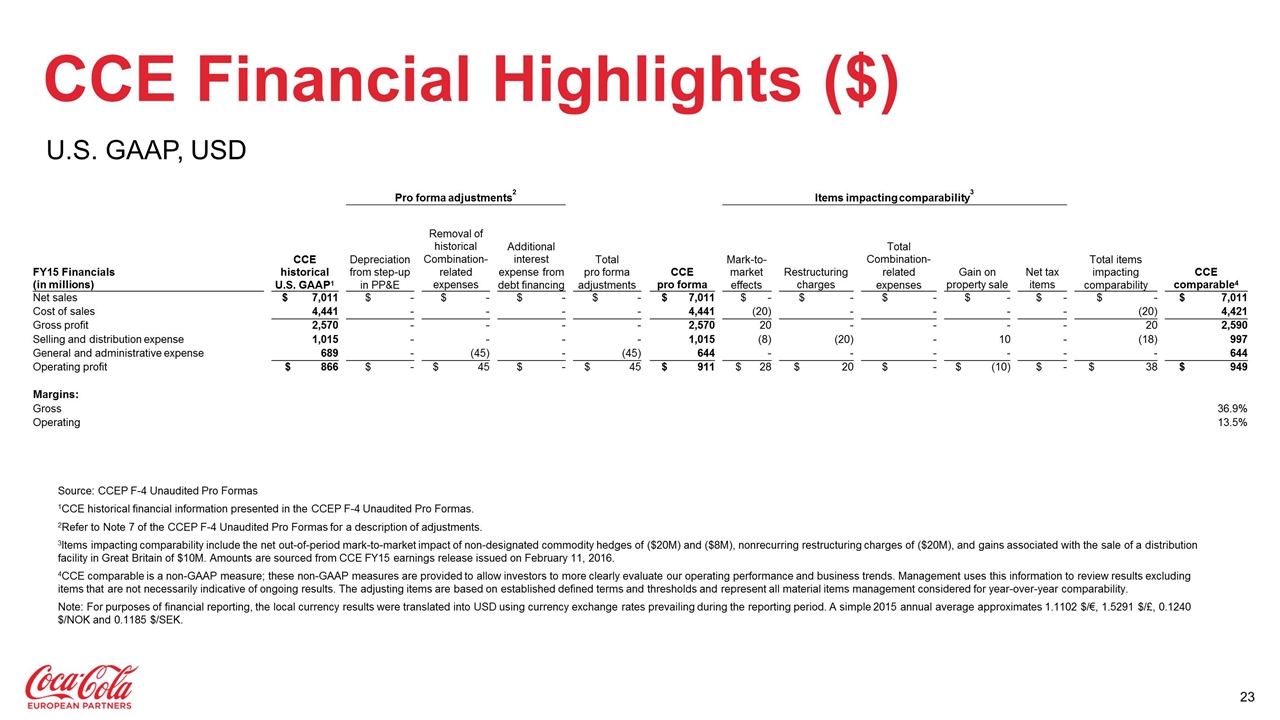

CCE Financial Highlights ($) Presentation Title U.S. GAAP, USD Source: CCEP F-4 Unaudited Pro Formas 1CCE historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 7 of the CCEP F-4 Unaudited Pro Formas for a description of adjustments. 3Items impacting comparability include the net out-of-period mark-to-market impact of non-designated commodity hedges of ($20M) and ($8M), nonrecurring restructuring charges of ($20M), and gains associated with the sale of a distribution facility in Great Britain of $10M. Amounts are sourced from CCE FY15 earnings release issued on February 11, 2016. 4CCE comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the local currency results were translated into USD using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€, 1.5291 $/£, 0.1240 $/NOK and 0.1185 $/SEK. Pro forma adjustments2 Items impacting comparability3 FY15 Financials (in millions) CCE historical U.S. GAAP1 Depreciation from step-up in PP&E Removal of historical Combination-related expenses Additional interest expense from debt financing Total pro forma adjustments CCE pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Gain on property sale Net tax items Total items impacting comparability CCE comparable4 Net sales $ 7,011 $ - $ - $ - $ - $ 7,011 $ - $ - $ - $ - $ - $ - $ 7,011 Cost of sales 4,441 - - - - 4,441 (20) - - - - (20) 4,421 Gross profit 2,570 - - - - 2,570 20 - - - - 20 2,590 Selling and distribution expense 1,015 - - - - 1,015 (8) (20) - 10 - (18) 997 General and administrative expense 689 - (45) - (45) 644 - - - - - - 644 Operating profit $ 866 $ - $ 45 $ - $ 45 $ 911 $ 28 $ 20 $ - $ (10) $ - $ 38 $ 949 Margins: Gross 36.9% Operating 13.5%

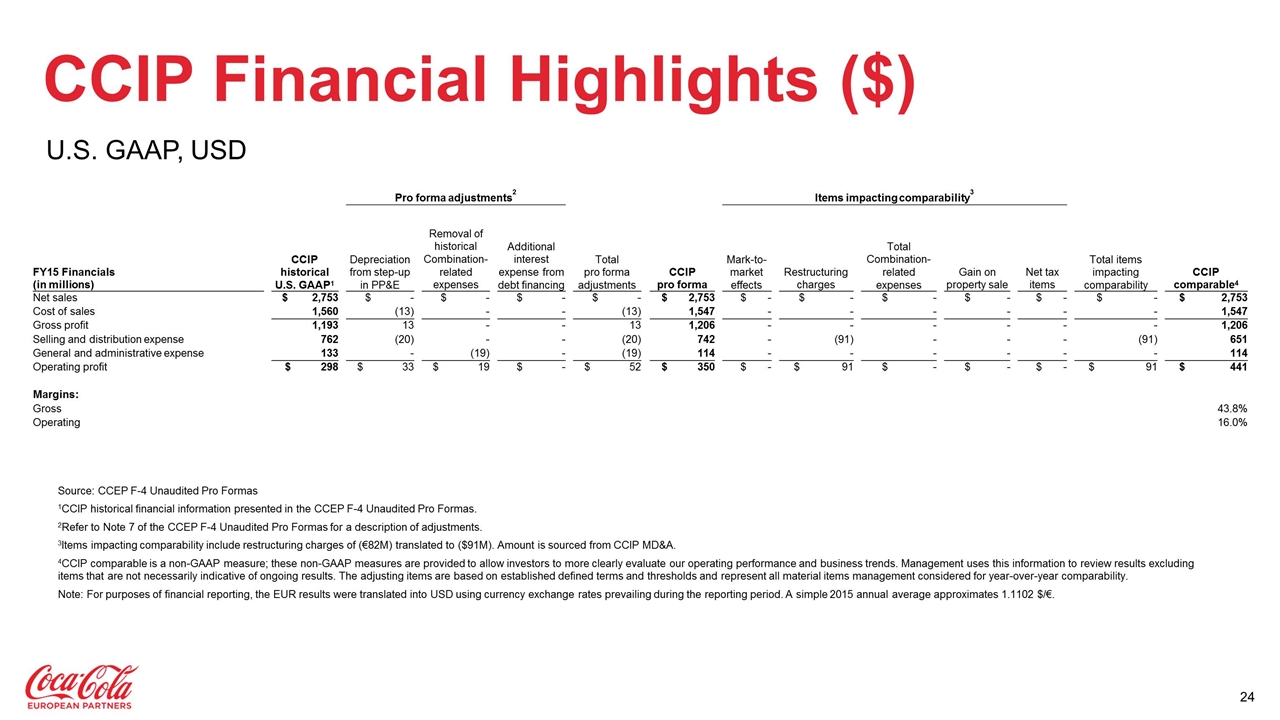

CCIP Financial Highlights ($) Presentation Title U.S. GAAP, USD Source: CCEP F-4 Unaudited Pro Formas 1CCIP historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 7 of the CCEP F-4 Unaudited Pro Formas for a description of adjustments. 3Items impacting comparability include restructuring charges of (€82M) translated to ($91M). Amount is sourced from CCIP MD&A. 4CCIP comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the EUR results were translated into USD using currency exchange rates prevailing during the reporting period. A simple 2015 annual average approximates 1.1102 $/€. Pro forma adjustments2 Items impacting comparability3 FY15 Financials (in millions) CCIP historical U.S. GAAP1 Depreciation from step-up in PP&E Removal of historical Combination-related expenses Additional interest expense from debt financing Total pro forma adjustments CCIP pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Gain on property sale Net tax items Total items impacting comparability CCIP comparable4 Net sales $ 2,753 $ - $ - $ - $ - $ 2,753 $ - $ - $ - $ - $ - $ - $ 2,753 Cost of sales 1,560 (13) - - (13) 1,547 - - - - - - 1,547 Gross profit 1,193 13 - - 13 1,206 - - - - - - 1,206 Selling and distribution expense 762 (20) - - (20) 742 - (91) - - - (91) 651 General and administrative expense 133 - (19) - (19) 114 - - - - - - 114 Operating profit $ 298 $ 33 $ 19 $ - $ 52 $ 350 $ - $ 91 $ - $ - $ - $ 91 $ 441 Margins: Gross 43.8% Operating 16.0%

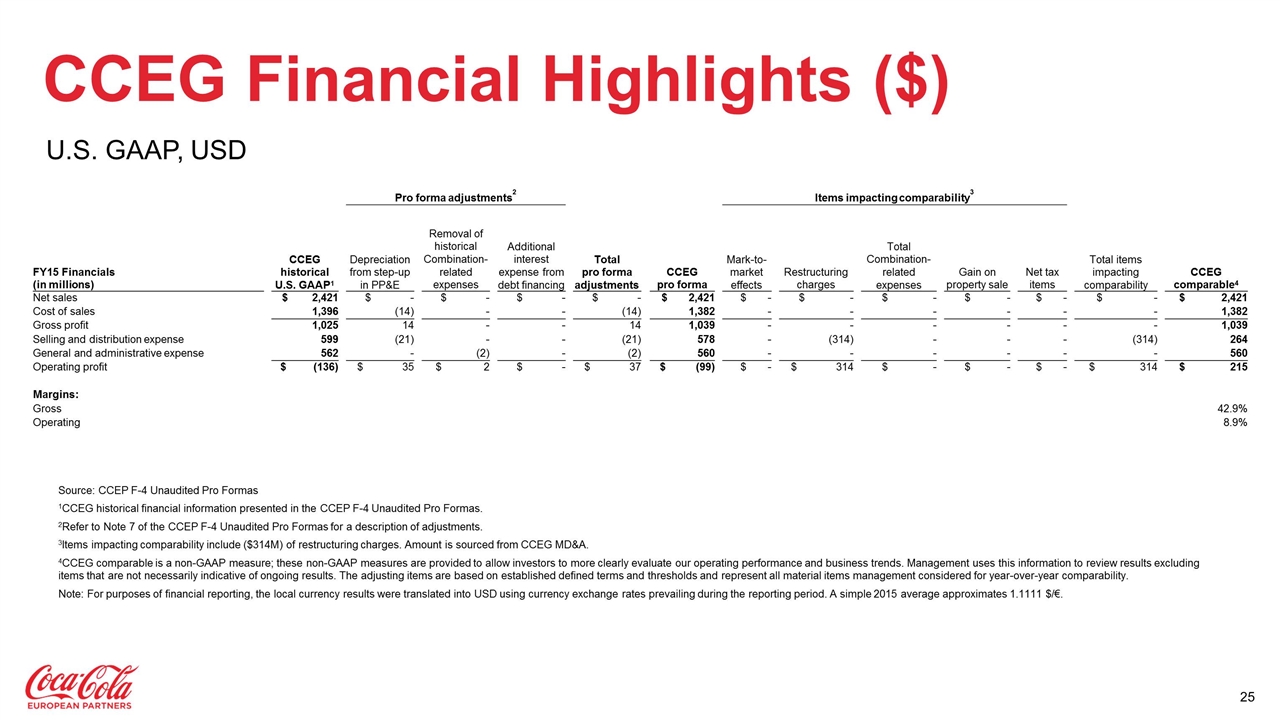

CCEG Financial Highlights ($) Presentation Title U.S. GAAP, USD Source: CCEP F-4 Unaudited Pro Formas 1CCEG historical financial information presented in the CCEP F-4 Unaudited Pro Formas. 2Refer to Note 7 of the CCEP F-4 Unaudited Pro Formas for a description of adjustments. 3Items impacting comparability include ($314M) of restructuring charges. Amount is sourced from CCEG MD&A. 4CCEG comparable is a non-GAAP measure; these non-GAAP measures are provided to allow investors to more clearly evaluate our operating performance and business trends. Management uses this information to review results excluding items that are not necessarily indicative of ongoing results. The adjusting items are based on established defined terms and thresholds and represent all material items management considered for year-over-year comparability. Note: For purposes of financial reporting, the local currency results were translated into USD using currency exchange rates prevailing during the reporting period. A simple 2015 average approximates 1.1111 $/€. Pro forma adjustments2 Items impacting comparability3 FY15 Financials (in millions) CCEG historical U.S. GAAP1 Depreciation from step-up in PP&E Removal of historical Combination-related expenses Additional interest expense from debt financing Total pro forma adjustments CCEG pro forma Mark-to-market effects Restructuring charges Total Combination-related expenses Gain on property sale Net tax items Total items impacting comparability CCEG comparable4 Net sales $ 2,421 $ - $ - $ - $ - $ 2,421 $ - $ - $ - $ - $ - $ - $ 2,421 Cost of sales 1,396 (14) - - (14) 1,382 - - - - - - 1,382 Gross profit 1,025 14 - - 14 1,039 - - - - - - 1,039 Selling and distribution expense 599 (21) - - (21) 578 - (314) - - - (314) 264 General and administrative expense 562 - (2) - (2) 560 - - - - - - 560 Operating profit $ (136) $ 35 $ 2 $ - $ 37 $ (99) $ - $ 314 $ - $ - $ - $ 314 $ 215 Margins: Gross 42.9% Operating 8.9%

Exhibit 99.2

The unaudited pro forma condensed combined financial information provided below has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union (“IFRS EU”) and has been included in the European prospectus related to the listing of the ordinary shares of Coca-Cola European Partners plc (“CCEP” or “Orange”) on exchanges in the European Union in connection with the combination of the businesses of CCE, Coca-Cola Iberian Partners, S.A.U. (“Olive”), and Coca-Cola Erfrischungsgetränke GmbH (“Black”), a wholly owned subsidiary of The Coca-Cola Company (“TCCC”).

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION OF ORANGE

The unaudited pro forma condensed combined statement of net assets as of 31 December 2015, the unaudited pro forma condensed combined income statement for the year ended 31 December 2015 and the related notes thereto set out in this “Unaudited Pro Forma Condensed Combined Financial Information of Orange” (together the “Unaudited Pro Forma Condensed Combined Financial Information”) have been prepared on the basis of the notes set out below to illustrate the effects of (1) the Combination and (2) the Debt Financing resulting from the incurrence of indebtedness by Orange in the amount of €3.2 billion in connection with the financing of the Cash Consideration (the “Debt Financing” and, together with the Combination, the “Transactions”).

The Unaudited Pro Forma Condensed Combined Financial Information has been prepared in accordance with Annex II of the Prospectus Directive Regulation. It is presented in millions of Euros and in a manner consistent with the accounting policies to be adopted by Orange, as outlined in Note 9, when preparing its audited consolidated financial statements for the year ending 31 December 2016. The historical audited consolidated financial information of White and Black is prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and presented in U.S. dollars. Historical data of White and Black reflected in the Unaudited Pro Forma Condensed Combined Financial Information, therefore, was derived from the audited consolidated financial statements of White and Black prepared in accordance with U.S. GAAP and has been adjusted to IFRS EU to be adopted by Orange and translated into Euros. Historical data of Olive reflected in the Unaudited Pro Forma Condensed Combined Financial Information was derived from the audited consolidated financial statements of Olive prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IFRS IASB”) and presented in Euros and has been adjusted to IFRS EU to be adopted by Orange. For purposes of the Unaudited Pro Forma Condensed Combined Financial Information, Orange has elected to present a statement of net assets. Orange intends to present a full balance sheet when preparing its audited consolidated financial statements for the year ending 31 December 2016.

The Unaudited Pro Forma Condensed Combined Financial Information does not constitute financial statements within the meaning of section 434 of the Companies Act 2006.

Introduction

The Unaudited Pro Forma Condensed Combined Financial Information has been prepared in order to illustrate the effects of the Transactions on the financial position and results of operations of Orange. On 6 August 2015, Orange, White, Coca-Cola European Partners Holdings US, Inc. (“US HoldCo”) and Orange Merge Co LLC (“MergeCo”) entered into the Merger Agreement and White, Orange, MergeCo, US HoldCo, European Refreshments (“Red 1”), Coca-Cola Gesellschaft mit beschränkter Haftung (“Red 2”) and Vivaqa Beteiligungs GmbH & Co. KG (“Red 3” and, together with Red 1 and Red 2, “Red”) and Olive entered into the Master Agreement. At the Completion, White, Olive Partners, S.A. (“Olive HoldCo”) and Red will combine their NARTD beverage bottling businesses in western Europe by combining White, Olive and Black through the Olive Contribution, the Black Contribution and the Merger. Based on the terms of the Combination, White, Olive and Black will converge under the common control of Orange, a newly incorporated company based in the United Kingdom, which will be listed on the NYSE, the ASE and the Spanish Stock Exchanges and listed and admitted to trading on Euronext London and Euronext Amsterdam, in each case under the symbol “CCE.”

The Unaudited Pro Forma Condensed Combined Financial Information is based on information and assumptions that Orange believes are reasonable, including assumptions regarding the terms of the Combination. The Unaudited Pro Forma Condensed Combined Financial Information has been prepared for illustrative purposes only and because of its nature, addresses a hypothetical situation. It does not intend to represent what Orange’s financial position or results of operations actually would have been if the Transactions had been completed on the dates indicated, nor does it intend to represent, predict or estimate the results of operations for any future period or financial position at any future date. In addition, the Unaudited Pro Forma Condensed Combined Financial Information does not reflect ongoing cost savings that Orange expects to achieve as a result of the Combination or the costs necessary to achieve these cost savings or synergies.

The unaudited pro forma condensed combined statement of net assets as of 31 December 2015 gives effect to the Transactions as if they had occurred on 31 December 2015. The unaudited pro forma condensed combined income statement for the year ended 31 December 2015 is presented as if the Transactions had taken place on 1 January 2015. In particular, as pro forma information is prepared to illustrate retrospectively the effects of transactions that will occur in the future, there are limitations that are inherent to the nature of pro forma information. As such, had the Transactions taken place on the dates assumed above, the actual effects would not necessarily have been the same as those presented in the Unaudited Pro Forma Condensed Combined Financial Information.

The Unaudited Pro Forma Condensed Combined Financial Information excludes the impact of the acquisition of Vifilfell hf. from Cobega for no more than €35 million, which is expected to occur shortly after the Completion but is not expected to have a significant impact on the Combination, the statement of net assets, or the income statement of Orange.

Unaudited Pro Forma Condensed Combined Financial Information

This section presents the unaudited pro forma condensed combined statement of net assets as of 31 December 2015, the unaudited pro forma condensed combined income statement for the year ended 31 December 2015 and the related explanatory notes.

2

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF NET ASSETS OF ORANGE

AS OF 31 DECEMBER 2015

(€ in millions)

| Historical IFRS EU | ||||||||||||||||||||||

| White – Reclassified and Adjusted (Note 1) |

Olive – Reclassified (Note 2) |

Black – Reclassified and Adjusted (Note 3) |

Acquisition Accounting (Note 4) |

Orange Pro Forma |

||||||||||||||||||

| ASSETS |

||||||||||||||||||||||

| Non-current: |

||||||||||||||||||||||

| Intangible assets, net |

€ | 3,186 | € | 26 | € | 500 | € | 7,136 | (A) | € | 10,848 | |||||||||||

| Goodwill |

81 | 816 | 742 | 1,752 | (B) | 3,391 | ||||||||||||||||

| Property, plant and equipment, net |

1,708 | 656 | 1,087 | 705 | (C) | 4,156 | ||||||||||||||||

| Non-current derivative assets |

22 | — | — | — | 22 | |||||||||||||||||

| Deferred tax assets |

81 | 90 | — | — | 171 | |||||||||||||||||

| Other non-current assets |

35 | 4 | 9 | — | 48 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-current assets |

5,113 | 1,592 | 2,338 | 9,593 | 18,636 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Current: |

||||||||||||||||||||||

| Current derivative assets |

19 | — | — | — | 19 | |||||||||||||||||

| Current tax assets |

14 | 144 | 16 | — | 174 | |||||||||||||||||

| Inventories |

370 | 144 | 169 | 72 | (D) | 755 | ||||||||||||||||

| Amounts receivable from TCCC |

52 | 8 | 35 | — | 95 | |||||||||||||||||

| Trade accounts receivable, net |

1,210 | 380 | 374 | — | 1,964 | |||||||||||||||||

| Cash and cash equivalents |

157 | 214 | 118 | (128 | ) | (E) | 361 | |||||||||||||||

| Assets classified as held for distribution to shareholder |

— | 107 | — | (107 | ) | (F) | — | |||||||||||||||

| Other current assets |

61 | 54 | 41 | — | 156 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

1,883 | 1,051 | 753 | (163 | ) | 3,524 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

€ | 6,996 | € | 2,643 | € | 3,091 | € | 9,430 | € | 22,160 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES |

||||||||||||||||||||||

| Non-current: |

||||||||||||||||||||||

| Borrowings, less current portion |

€ | 3,122 | € | 31 | € | 108 | € | 3,054 | (G) | € | 6,315 | |||||||||||

| Employee benefit liabilities |

148 | — | 99 | — | 247 | |||||||||||||||||

| Non-current provisions |

14 | 12 | — | — | 26 | |||||||||||||||||

| Non-current derivative liabilities |

21 | — | — | — | 21 | |||||||||||||||||

| Deferred tax liabilities |

768 | 32 | 47 | 2,222 | (H) | 3,069 | ||||||||||||||||

| Other non-current liabilities |

52 | — | 4 | 5 | (I) | 61 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-current liabilities |

4,125 | 75 | 258 | 5,281 | 9,739 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Current: |

||||||||||||||||||||||

| Current portion of borrowings |

418 | 5 | 74 | (62 | ) | (G) | 435 | |||||||||||||||

| Current provisions |

536 | — | 199 | — | 735 | |||||||||||||||||

| Current derivative liabilities |

46 | — | — | — | 46 | |||||||||||||||||

| Current tax liabilities |

44 | 32 | 1 | — | 77 | |||||||||||||||||

| Amounts payable to TCCC |

94 | 17 | 73 | 73 | (J) | 257 | ||||||||||||||||

| Trade and other payables |

866 | 386 | 431 | 20 | (K) | 1,703 | ||||||||||||||||

| Liabilities classified as held for distribution to shareholder |

— | 16 | — | (16 | ) | (F) | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

2,004 | 456 | 778 | 15 | 3,253 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

6,129 | 531 | 1,036 | 5,296 | 12,992 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET ASSETS |

€ | 867 | € | 2,112 | € | 2,055 | € | 4,134 | € | 9,168 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3

NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF NET

ASSETS OF ORANGE

NOTE 1 – WHITE’S RECLASSIFIED AND ADJUSTED STATEMENT OF NET ASSETS

The Unaudited Pro Forma Condensed Combined Financial Information includes information of White that was derived from the historical audited consolidated financial statements as of and for the year ended 31 December 2015 prepared in accordance with U.S. GAAP, contained in its Annual Report on Form 10-K for the year ended 31 December 2015, which has been filed by CCE with the SEC. The historical audited consolidated balance sheet has been adjusted to (1) present White’s balance sheet as a statement of net assets, (2) align with the presentation format to be adopted by Orange, (3) reflect White’s historical audited consolidated balance sheet on a basis consistent with the accounting policies to be adopted by Orange under IFRS EU and (4) translate from U.S. Dollars to Euros, which will be the presentation currency of Orange. For the purpose of adjusting White’s financial information from U.S. GAAP to IFRS EU, White has adopted IFRS EU with a transition date of 1 January 2014 (“Transition Date”). The order of the line items in the table below presents White’s historical audited consolidated balance sheet prepared in accordance with U.S. GAAP, which differs from the order of line items of Orange’s unaudited pro forma condensed combined statement of net assets under IFRS EU. The reconciliation is as follows (which is unaudited, in millions):

| White’s U.S. GAAP Statement of Net Assets Line Items |

As of 31 December 2015 (Audited) USD ($) |

Line Item Reclassifications Under Orange’s Presentation(B) USD ($) |

IFRS EU Accounting Adjustments and Reclassifications USD ($) |

White’s IFRS EU Reclassified and Adjusted Statement of Net Assets USD ($) |

White’s IFRS EU Reclassified and Adjusted Statement of Net Assets(A) EUR (€) |

|||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||

| Current: |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 170 | $ | — | $ | — | $ | 170 | € | 157 | ||||||||||||||

| Trade accounts receivable, less allowances |

1,314 | (1,314 | ) | — | — | — | ||||||||||||||||||

| Trade accounts receivable, net |

— | 1,314 | — | 1,314 | 1,210 | |||||||||||||||||||

| Amounts receivable from TCCC |

56 | — | — | 56 | 52 | |||||||||||||||||||

| Inventories |

336 | — | 66 | (D) | 402 | 370 | ||||||||||||||||||

| Other current assets |

170 | (39 | ) | (65 | ) | (D)(F)(H) | 66 | 61 | ||||||||||||||||

| Current derivative assets |

— | 23 | (2 | ) | (E) | 21 | 19 | |||||||||||||||||

| Current tax assets |

— | 16 | — | 16 | 14 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total current assets |

2,046 | — | (1 | ) | 2,045 | 1,883 | ||||||||||||||||||

| Non-current: |

||||||||||||||||||||||||

| Property, plant and equipment, net |

1,920 | — | (65 | ) | (G) | 1,855 | 1,708 | |||||||||||||||||

| Franchise license intangible assets, net |

3,383 | (3,383 | ) | — | — | — | ||||||||||||||||||

| Intangible assets, net |

— | 3,383 | 65 | (G) | 3,461 | 3,186 | ||||||||||||||||||

| 13 | (C) | |||||||||||||||||||||||

4

| White’s U.S. GAAP Statement of Net Assets Line Items |

As of 31 December 2015 (Audited) USD ($) |

Line Item Reclassifications Under Orange’s Presentation(B) USD ($) |

IFRS EU Accounting Adjustments and Reclassifications USD ($) |

White’s IFRS EU Reclassified and Adjusted Statement of Net Assets USD ($) |

White’s IFRS EU Reclassified and Adjusted Statement of Net Assets(A) EUR (€) |

|||||||||||||||||||

| Goodwill |

88 | — | — | 88 | 81 | |||||||||||||||||||

| Other noncurrent assets |

174 | (174 | ) | — | — | — | ||||||||||||||||||

| Non-current derivative assets |

— | 24 | — | 24 | 22 | |||||||||||||||||||

| Deferred tax assets |

— | 46 | 42 | (H)(I) | 88 | 81 | ||||||||||||||||||

| Other non-current assets |

— | 104 | (53 | ) | (D)(K) | 38 | 35 | |||||||||||||||||

| (13 | ) | (C) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total non-current assets |

5,565 | — | (11 | ) | 5,554 | 5,113 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total assets |

$ | 7,611 | $ | — | $ | (12 | ) | $ | 7,599 | € | 6,996 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| LIABILITIES |

||||||||||||||||||||||||

| Current: |

||||||||||||||||||||||||

| Accounts payable and accrued expenses |

$ | 1,601 | $ | (1,601 | ) | $ | — | $ | — | € | — | |||||||||||||

| Trade and other payables |

— | 919 | 22 | (J)(L) | 941 | 866 | ||||||||||||||||||

| Current provisions |

— | 582 | — | 582 | 536 | |||||||||||||||||||

| Current derivative liabilities |

— | 52 | (2 | ) | (E) | 50 | 46 | |||||||||||||||||

| Current tax liabilities |

— | 48 | — | 48 | 44 | |||||||||||||||||||

| Amounts payable to TCCC |

102 | — | — | 102 | 94 | |||||||||||||||||||

| Current portion of debt |

454 | (454 | ) | — | — | — | ||||||||||||||||||

| Current portion of borrowings |

— | 454 | — | 454 | 418 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total current liabilities |

2,157 | — | 20 | 2,177 | 2,004 | |||||||||||||||||||

| Non-current: |

||||||||||||||||||||||||

| Debt, less current portion |

3,407 | (3,407 | ) | — | — | — | ||||||||||||||||||

| Borrowings, less current portion |

— | 3,407 | (16 | ) | (K) | 3,391 | 3,122 | |||||||||||||||||

| Other noncurrent liabilities |

236 | (180 | ) | — | 56 | 52 | ||||||||||||||||||

| Employee benefit liabilities |

— | 142 | 19 | (L) | 161 | 148 | ||||||||||||||||||

| Non-current provisions |

— | 15 | — | 15 | 14 | |||||||||||||||||||

| Non-current derivative liabilities |

— | 23 | — | 23 | 21 | |||||||||||||||||||

| Noncurrent deferred income tax liabilities |

854 | (854 | ) | — | — | — | ||||||||||||||||||

| Deferred tax liabilities |

— | 854 | (20 | ) | (H)(I) | 834 | 768 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total non-current liabilities |

4,497 | — | (17 | ) | 4,480 | 4,125 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total liabilities |

6,654 | — | 3 | 6,657 | 6,129 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| NET ASSETS |

$ | 957 | $ | — | $ | (15 | ) | $ | 942 | € | 867 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (A) | Conversion rates – The historical financial information of White has been translated from U.S. Dollars to Euros at the exchange rate at 31 December 2015 of 0.9206. |

| (B) | Certain line items of White’s historical audited consolidated balance sheet prepared under U.S. GAAP have been reclassified to be presented in conformity with Orange’s financial statement presentation. |

5

The following reclassification was made to align the accounting policies of White to the accounting policies of Orange:

| (C) | Customer relationships - Adjustment reflects a reclassification of US$13 million of customer relationships from other non-current assets to intangible assets. |

The following adjustments represent the differences between U.S. GAAP and IFRS EU to present White’s historical audited consolidated balance sheet in accordance with IFRS EU:

| (D) | Spare parts - Adjustment reflects the reclassification of US$29 million of spare parts from other current assets and US$37 million of spare parts from other non-current assets to inventories as of 31 December 2015. |

| (E) | Cross-currency swaps - Under U.S. GAAP, interest on cross-currency swap agreements is presented on a gross basis. Under IFRS EU, interest on these instruments is presented on a net basis. This adjustment reduces current derivative assets and liabilities by US$2 million each as of 31 December 2015. |

| (F) | Prepaid taxes - Adjustment reflects a US$1 million decrease to other current assets to remove certain prepaid taxes that are immediately expensed under IFRS EU as of 31 December 2015. |

| (G) | Software - Adjustment reflects the reclassification of US$65 million in software from property, plant and equipment, net (“PP&E”) to intangible assets, net as of 31 December 2015. |

| (H) | Deferred tax assets and liabilities classification - Under U.S. GAAP, deferred tax assets and liabilities must be classified on the balance sheet as current and non-current, consistent with the classification of the related asset or liability. Under IFRS EU, deferred tax assets and liabilities are classified on the balance sheet as non-current. This adjustment reflects the reclassification of US$35 million from other current assets as an increase to deferred tax assets of US$19 million and a decrease to deferred tax liabilities of US$16 million as of 31 December 2015, based on the relevant tax jurisdictions in which White operates. White had no current deferred tax liabilities recorded within its historical U.S. GAAP balance sheet as of 31 December 2015. |

| (I) | Valuation of deferred taxes - With respect to White’s deferred tax position, under IFRS EU (1) certain of White’s historical U.S. GAAP assets and liabilities are not recognised as a temporary difference; (2) deferred taxes on share-based payment awards are valued based on changes in an award’s intrinsic value rather than its grant date fair value and (3) deferred taxes on defined benefit pension plans are based on different actuarial valuations than U.S. GAAP. |

The net impact of these differences results in an increase of US$23 million to deferred tax assets and a decrease of US$4 million to deferred tax liabilities as of 31 December 2015.

| (J) | Share-based compensation plans - Under U.S. GAAP, share-based payment awards subject to a net settlement arrangement are classified as equity-settled if the amount withheld does not exceed the minimum statutory withholding. Under IFRS EU, awards with a net settlement arrangement must be bifurcated between equity-settled and cash-settled, with the portion of an award withheld for taxes treated as cash-settled. This adjustment reflects an increase to trade and other payables of US$25 million as of 31 December 2015. |

| (K) | Debt issuance costs - Under U.S. GAAP, debt issuance costs are presented on the balance sheet on a gross basis separate from the underlying debt instrument; however under IFRS EU these costs are presented on a net basis and reduce the carrying value of the debt instrument. This adjustment reflects a reclassification of US$16 million of debt issuance costs from other non-current assets to borrowings, less current portion as of 31 December 2015. |

| (L) | Defined benefit pension plans - With respect to defined benefit pension plans, under U.S. GAAP (1) actuarial gains and losses and prior service cost are initially deferred in equity and subsequently recognised as part of net periodic benefit cost; (2) discount rates are calculated using high-quality corporate bond yields; (3) interest cost is determined using the discount rate; (4) expected return on assets is judgmental and estimated |

6

| based on asset allocation and expected performance over time and (5) contribution taxes are not included in the calculation of the defined benefit obligation. Under IFRS EU, (1) actuarial gains and losses are permanently deferred in equity; (2) discount rates are calculated using government bond yields; (3) net interest cost (including return on assets) is based on market yields of high-quality long-term corporate bonds; (4) prior service costs are immediately recognised in net periodic benefit cost and (5) taxes payable by the plan on contributions are included in the calculation of the defined benefit obligation. Further, White elected as part of its IFRS EU adoption to reset to zero all pension adjustments deferred in reserves at White’s Transition Date as allowed under IFRS 1. |

The net impact of these differences resulted in an increase of US$16 million to employee benefit liabilities as of 31 December 2015. Additionally, US$3 million was reclassified from trade and other payables to employee benefit liabilities as of 31 December 2015.

7

NOTE 2 – OLIVE’S RECLASSIFIED STATEMENT OF NET ASSETS

The Unaudited Pro Forma Condensed Combined Financial Information includes information of Olive that was derived from the historical audited consolidated financial statements as of and for the year ended 31 December 2015 prepared in accordance with IFRS IASB. The historical audited consolidated balance sheet has been adjusted to present Olive’s balance sheet as a statement of net assets and to align with the presentation format and the accounting policies to be adopted by Orange. The reconciliation is as follows (which is unaudited, in millions):

| Olive’s IFRS IASB Statement of Net Assets Line Items |

As of 31 December 2015 (Audited) EUR (€) |

Line Item Reclassifications under Orange’s Presentation(A) EUR (€) |

Accounting Policy Alignment Reclassifications EUR (€) |

Olive’s IFRS EU Reclassified Statement of Net Assets EUR (€) |

||||||||||||||

| ASSETS |

||||||||||||||||||

| Non-current: |

||||||||||||||||||

| Goodwill |

€ | 816 | € | — | € | — | € | 816 | ||||||||||

| Intangible assets |

26 | — | — | 26 | ||||||||||||||

| Property, plant and equipment |

652 | 2 | 2 | (B) | 656 | |||||||||||||

| Investment properties |

2 | (2 | ) | — | — | |||||||||||||

| Non-current investments |

4 | (4 | ) | — | — | |||||||||||||

| Other non-current assets |

— | 4 | — | 4 | ||||||||||||||

| Deferred tax assets |

90 | — | — | 90 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-current assets |

1,590 | — | 2 | 1,592 | ||||||||||||||

| Current: |

||||||||||||||||||

| Inventories |

144 | — | — | 144 | ||||||||||||||

| Trade and other receivables |

532 | (532 | ) | — | — | |||||||||||||

| Trade accounts receivable, net |

— | 380 | — | 380 | ||||||||||||||

| Current tax assets |

— | 144 | — | 144 | ||||||||||||||

| Amounts receivable from TCCC |

— | 8 | — | 8 | ||||||||||||||

| Cash and cash equivalents |

214 | — | — | 214 | ||||||||||||||

| Current investments |

52 | (52 | ) | — | — | |||||||||||||

| Prepayments for current assets |

2 | (2 | ) | — | — | |||||||||||||

| Assets classified as held for distribution to shareholder |

107 | — | — | 107 | ||||||||||||||

| Other current assets |

— | 54 | — | 54 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

1,051 | — | — | 1,051 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

€ | 2,641 | € | — | € | 2 | € | 2,643 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES |

||||||||||||||||||

| Non-current: |

||||||||||||||||||

| Non-current provisions |

€ | 12 | € | — | € | — | € | 12 | ||||||||||

| Interest-bearing loans and borrowings |

31 | (31 | ) | — | — | |||||||||||||

| Borrowings, less current portion |

— | 31 | — | 31 | ||||||||||||||

| Deferred tax liabilities |

32 | — | — | 32 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total non-current liabilities |

75 | — | — | 75 | ||||||||||||||

8

| Olive’s IFRS IASB Statement of Net Assets Line Items |

As of 31 December 2015 (Audited) EUR (€) |

Line Item Reclassifications under Orange’s Presentation(A) EUR (€) |

Accounting Policy Alignment Reclassifications EUR (€) |

Olive’s IFRS EU Reclassified Statement of Net Assets EUR (€) |

||||||||||||

| Current: |

||||||||||||||||

| Interest-bearing loans and borrowings |

5 | (5 | ) | — | — | |||||||||||

| Current portion of borrowings |

— | 5 | — | 5 | ||||||||||||

| Trade and other payables |

434 | (48 | ) | — | 386 | |||||||||||

| Current tax liabilities |

— | 32 | — | 32 | ||||||||||||

| Current accruals |

1 | (1 | ) | — | — | |||||||||||

| Amounts payable to TCCC |

— | 17 | — | 17 | ||||||||||||

| Liabilities classified as held for distribution to shareholder |

16 | — | — | 16 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

456 | — | — | 456 | ||||||||||||

|

|

|

|

|

|

|

|

|