Form 8-K COCA COLA BOTTLING CO For: Feb 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2016

COCA-COLA BOTTLING CO. CONSOLIDATED

(Exact name of registrant as specified in its charter)

| Delaware | 0-9286 | 56-0950585 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 4100 Coca-Cola Plaza, Charlotte, North Carolina | 28211 | |

| (Address of principal executive offices) | (Zip Code) |

| (704) 557-4400 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01. | Other Events. |

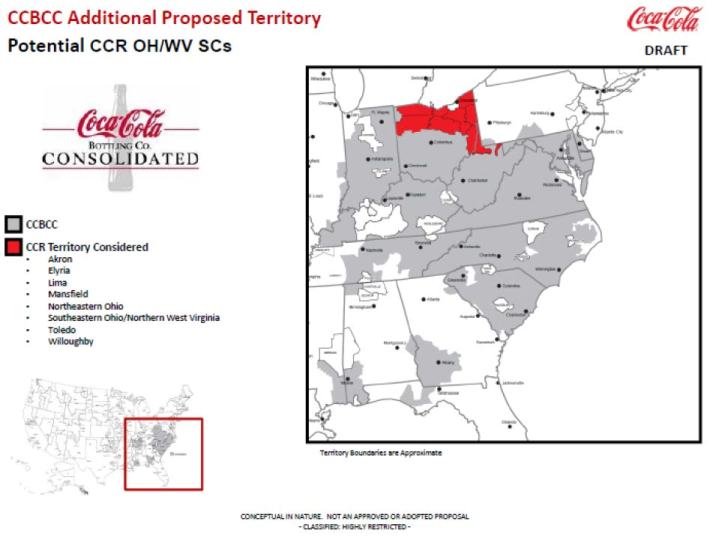

February 2016 Letter of Intent. On February 8, 2016, Coca-Cola Bottling Co. Consolidated (the “Company”) and The Coca-Cola Company entered into a non-binding letter of intent (the “February 2016 LOI”) pursuant to which Coca-Cola Refreshments USA, Inc., a wholly-owned subsidiary of The Coca-Cola Company (“CCR”), will grant the Company certain exclusive rights for the distribution, promotion, marketing and sale of The Coca-Cola Company-owned and –licensed products in certain territories currently served by CCR in northern Ohio and northern West Virginia (the “February 2016 LOI Territories”) and sell to the Company a regional manufacturing facility located in Twinsburg, Ohio (the “Twinsburg Facility”) and related manufacturing assets (collectively, the “Twinsburg Facility Transaction”). The major markets that would be served as part of the expansion contemplated by the February 2016 LOI include Akron, Elyria, Toledo, Willoughby and Youngstown County, Ohio. A copy of the Company’s news release, dated February 9, 2016, announcing the February 2016 LOI Territories transactions and the Twinsburg Facility Transaction is filed as Exhibit 99.1 hereto.

The expansion of the Company’s distribution territory and the acquisition of the Twinsburg Facility contemplated by the February 2016 LOI represent the latest contemplated series of territory expansion transactions and manufacturing facility acquisitions between the Company, CCR and The Coca-Cola Company.

The exclusive rights for the distribution, promotion, marketing and sale of The Coca-Cola Company-owned and -licensed products in the February 2016 LOI Territories will be granted to the Company by CCR pursuant to a comprehensive beverage agreement (the “CBA”) substantially in the form attached as Exhibit 1.1 to the territory conversion agreement entered into by the Company, CCR and The Coca-Cola Company on September 23, 2015, as described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 28, 2015 (the “September 2015 Form 8-K”) and filed as Exhibit 10.1 thereto.

Pursuant to the February 2016 LOI, CCR will also sell, transfer and assign to the Company exclusive rights for the distribution, promotion, marketing and sale in the February 2016 LOI Territories of various cross-licensed brands currently distributed by CCR in the February 2016 LOI Territories, subject to the consent of the third-party brand owners. CCR will also sell to the Company certain of CCR’s distribution assets and the working capital associated therewith, as may be necessary to distribute, promote, market and sell both The Coca-Cola Company-owned and -licensed products and the cross-licensed branded products in the February 2016 LOI Territories. The Company will pay to CCR at each closing for February 2016 LOI Territories a cash amount that reflects the agreed value of the exclusive rights to distribute, promote, market and sell in the February 2016 LOI Territories the cross-licensed branded products and the net book value of the distribution assets and working capital associated with the distribution, promotion, marketing and sale of both The Coca-Cola Company-owned and -licensed products and the cross-licensed brands in the February 2016 LOI Territories. The Company will also agree in each CBA entered into at a closing for February 2016 LOI Territories to make periodic sub-bottling payments to CCR on a continuing basis after closing for the grant of exclusive rights in the applicable territory for The Coca-Cola Company-owned and -licensed products.

The rights for the manufacture, production and packaging of Covered Beverages (as such term is defined in the CBA) using cold-fill technology at the Twinsburg Facility will be granted to the Company by The Coca-Cola Company pursuant to a final form of regional manufacturing agreement (the “Final RMA”) substantially in the form included as Schedule 9.4 to the initial regional manufacturing agreement entered into by the Company and The Coca-Cola Company on January 29, 2016 (the “Initial RMA”). An earlier form draft of the Final RMA was included as Schedule 9.4 to an earlier form draft Initial RMA included as Exhibit B to the non-binding letter of intent entered into by the Company and The Coca-Cola Company on September 23, 2015 (the “September 2015 LOI”) and filed as Exhibit 99.2 to the September 2015 Form 8-K. The Final RMA attached to the Initial RMA, while in large part similar to the form agreement included as Schedule 9.4 to the form initial regional manufacturing agreement attached to the September 2015 LOI, contains certain updates and negotiated changes to that form agreement. The Company will file the Initial RMA as an exhibit to its next Quarterly Report on Form 10-Q.

The Company will pay to CCR at the closing of the Twinsburg Facility Transaction a cash amount that reflects the agreed value of the rights to manufacture, produce and package the cross-licensed branded products at the Twinsburg Facility and the net book value of the manufacturing assets and working capital associated with the manufacture, production and packaging of both The Coca-Cola Company-owned and –licensed products and the cross-licensed brands at the Twinsburg Facility, subject to a cost of goods adjustment and additional adjustments and true-up processes to be agreed upon by the parties.

The February 2016 LOI addresses several other matters related to the ongoing expansion of the Company’s distribution territories, the acquisition of the Twinsburg Facility and the implementation of the national product supply system, including the current intentions of the Company and The Coca-Cola Company with respect to (i) the form of finished goods supply agreement for finished goods sourced from the Twinsburg Facility, (ii) the form of finished goods supply agreement to govern the supply of finished goods from CCR for the February 2016 LOI Territories, (iii) an information technology platform they plan to implement throughout the February 2016 LOI Territories, (iv) a binding system governance they expect to become fully effective during 2016 throughout all of the geographic territories served by the Company, and (v) the process pursuant to which the Company will be provided

opportunities to participate economically in the existing business of The Coca-Cola Company in the United States involving non-direct store delivery of products and future non-direct store delivery of products and/or business models developed by The Coca-Cola Company.

The proposed transactions described in the February 2016 LOI will be subject to the terms of a definitive purchase and sale agreement with respect to the distribution territory transactions and a definitive purchase and sale agreement with respect to the Twinsburg Facility Transaction. The Company anticipates that these definitive agreements will be executed by the end of 2016 and that the closings of the transactions will be completed in 2017. The Company’s expectations are subject to change, however, based on the parties’ discussions, changing business conditions and other future events and uncertainties. In addition to the negotiation and execution of the definitive agreements, the February 2016 LOI sets forth certain customary conditions to closings of the transactions described in the February 2016 LOI, as well as a number of other conditions that the Company and The Coca-Cola Company currently intend to be satisfied prior to such closings and/or to be addressed in the definitive agreements.

The foregoing description of the February 2016 LOI is a summary thereof and is qualified in its entirety by the February 2016 LOI (including any exhibits thereto), which is filed as Exhibit 99.2 hereto and incorporated herein by reference.

Balance of Proposed Territory Expansion. The Company also continues working towards closing the remainder of the distribution territory expansion transactions contemplated by the definitive asset purchase agreement entered into on September 23, 2015, as described in the September 2015 Form 8-K and filed as Exhibit 2.1 thereto and the remainder of the manufacturing facility acquisitions contemplated by the definitive asset purchase agreement entered into on October 30, 2015, as described in the Company’s Current Report on Form 8-K filed with the SEC on November 2, 2015 and filed as Exhibit 2.1 thereto. In addition, the Company is continuing to work towards definitive agreements with The Coca-Cola Company and CCR for the remainder of the proposed distribution territory expansion transactions described in the non-binding letter of intent entered into on May 12, 2015, as described in the Company’s Current Report on Form 8-K filed with the SEC on May 13, 2015 and filed as Exhibit 99.1 thereto, including remaining distribution territories in central and southern Ohio, northern Kentucky and parts of Indiana and Illinois, and for the remainder of the proposed manufacturing facility acquisitions contemplated by the September 2015 LOI, as described in the September 2015 Form 8-K, including three regional manufacturing facilities located in Indianapolis and Portland, Indiana and Cincinnati, Ohio. There is no assurance, however, that the parties will enter into such definitive agreements.

Relationship between the Parties. The business of the Company consists primarily of the production, marketing and distribution of nonalcoholic beverage products of The Coca-Cola Company in the territories the Company currently serves. Accordingly, the Company engages routinely in various transactions with The Coca-Cola Company, CCR and their affiliates.

The Coca-Cola Company also owns approximately 35% of the outstanding common stock of the Company, which represents approximately 5.0% of the total voting power of the Company’s common stock and class B common stock voting together. The Coca-Cola Company also has a designee serving on the Company’s Board of Directors. For more information about the relationship between the Company and The Coca-Cola Company, see the description thereof included under “Related Person Transactions” in the Company’s Notice of Annual Meeting and Proxy Statement for the Company’s 2015 Annual Meeting of Stockholders filed with the SEC on March 30, 2015.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. |

Description |

Incorporated By Reference To | ||

| 99.1 | News Release, dated February 9, 2016. | Filed herewith. | ||

| 99.2 | Letter of Intent, dated February 8, 2016, by and between The Coca-Cola Company and Coca-Cola Bottling Co. Consolidated. | Filed herewith. | ||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COCA-COLA BOTTLING CO. CONSOLIDATED | ||||||

| (REGISTRANT) | ||||||

| Date: February 9, 2016 |

By: | /s/ James E. Harris | ||||

| James E. Harris Senior Vice President, Shared Services and Chief Financial Officer | ||||||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

EXHIBITS

CURRENT REPORT

ON

FORM 8-K

| Date of Earliest Event Reported: February 8, 2016 |

Commission File No: 0-9286 |

COCA-COLA BOTTLING CO. CONSOLIDATED

EXHIBIT INDEX

| Exhibit No. |

Description |

Incorporated By Reference To | ||

| 99.1 | News Release, dated February 9, 2016. | Filed herewith. | ||

| 99.2 | Letter of Intent, dated February 8, 2016, by and between The Coca-Cola Company and Coca-Cola Bottling Co. Consolidated. | Filed herewith. | ||

Exhibit 99.1

Coca-Cola Bottling Co. Consolidated, 4100 Coca-Cola Plaza, Charlotte, NC 28211

|

News Release | |||

|

Media Contact: |

Kimberly Kuo Senior Vice President of Public Affairs, Communications and Communities 704-763-3245 | |||

|

Investor Contact: |

James E. Harris Senior Vice President, Shared Services & CFO 704-557-4582 | |||

| FOR IMMEDIATE RELEASE | Symbol: COKE | |

| February 9, 2016 | Quoted: The NASDAQ Stock Market (Global Select Market) |

Coca-Cola Consolidated Signs Letter of Intent

For Expansion of Distribution Territories and Acquisition of Manufacturing Facility

| • | New markets in Ohio and West Virginia |

| • | Acquisition of manufacturing facility in Twinsburg, Ohio |

CHARLOTTE, NC — Coca-Cola Bottling Co. Consolidated (NASDAQ: COKE) (the “Company”) today announced that it has signed a non-binding letter of intent with The Coca-Cola Company to expand the Company’s distribution territory in parts of Ohio and West Virginia and to purchase and operate a manufacturing facility in Twinsburg, Ohio (“February 2016 Letter of Intent”). The transactions proposed in the February 2016 Letter of Intent would provide exclusive distribution rights for the Company in territories located within northern Ohio and northern West Virginia, including the following major markets: Akron, Elyria, Toledo, Willoughby, and Youngstown County in Ohio. Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly owned subsidiary of The Coca-Cola Company, currently serves these territories and owns and operates the Twinsburg manufacturing facility.

“We are excited about this opportunity to expand our Company into additional markets,” said Frank Harrison, Chairman and CEO. “We are continuing to integrate recently acquired distribution territories and look forward to serving new customers, consumers, communities and employees in Ohio and West Virginia.”

The Company has recently expanded its distribution territory in parts of Tennessee, Kentucky, Indiana, Virginia, Delaware and Maryland and is working to close a series of transactions for additional distribution territory covered by the previously announced definitive agreement with The Coca-Cola Company from September 2015. The Company also is continuing to work towards a definitive agreement with The Coca-Cola Company for the remainder of the proposed territory expansion described in the previously announced letter of intent from May 2015, including distribution territories in parts of Ohio, Indiana, Illinois and Kentucky.

The Company has recently completed the acquisition of a manufacturing facility in Sandston, Virginia and is working to close a series of transactions for two additional manufacturing facilities in Silver Spring, Maryland and Baltimore, Maryland covered by the previously announced definitive agreement with The Coca-Cola Company from October 2015. The Company is continuing to work towards a definitive agreement with The Coca-Cola Company for the remainder of the manufacturing facility acquisitions described in the previously announced letter of intent from September 2015, including manufacturing facilities located in Indianapolis, Indiana; Portland, Indiana and Cincinnati, Ohio.

The transactions proposed in the February 2016 Letter of Intent are subject to the parties reaching definitive agreements, with transaction closings expected to occur in 2017. There is no assurance, however, that any definitive agreement will be reached or that the closings of the transactions contemplated by the February 2016 Letter of Intent will occur. The Company will file a report on Form 8-K with the Securities and Exchange Commission with additional information regarding the proposed territory expansion and acquisition of manufacturing assets and certain other matters addressed in the February 2016 Letter of Intent that will be available on the Commission’s website at http://www.sec.gov and on the Company’s website at http://www.cokeconsolidated.com.

Headquartered in Charlotte, North Carolina, Coca-Cola Bottling Co. Consolidated is the nation’s largest independent Coca-Cola bottler.

Cautionary Information Regarding Forward-Looking Statements

Included in this news release and other information that we make publicly available from time to time are forward-looking management comments and other statements that reflect management’s current outlook for our performance in future periods and management’s expectations for completing the proposed territory expansions and manufacturing facility acquisitions. The words “believe,” “expect,” “project,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking statements. These statements include, among others, statements regarding the time frame for completing the proposed territory expansions and manufacturing facility acquisitions and other potential opportunities for profitably growing our business as well as our plans for continuing to innovate and evolve packaging and marketing strategies to respond to ever-changing consumer tastes.

These statements and expectations are based on currently available competitive, financial and economic data along with our operating plans and are subject to future events and uncertainties that could cause anticipated events not to occur or actual results to differ materially from historical or anticipated results. Among the events or uncertainties which could adversely affect future periods are: lower than expected selling pricing resulting from increased marketplace competition; changes in how significant customers market or promote our products; changes in our top customer relationships; changes in public and consumer preferences related to nonalcoholic beverages; unfavorable changes in the general economy; miscalculation of our need for infrastructure investment; our inability to meet requirements under beverage agreements; material changes in the performance requirements for marketing funding support or our inability to meet such requirements; decreases from historic levels of marketing funding support; changes in The Coca-Cola Company’s and other beverage companies’ levels of advertising, marketing and spending on brand innovation; the inability of our aluminum can or plastic bottle suppliers to meet our purchase requirements; our inability to offset higher raw material costs with higher selling prices, increased bottle/can sales volume or reduced expenses; consolidation of raw material suppliers could impact our profitability; increased purchases of finished goods subject us to incremental risks that could impact our profitability; sustained increases in fuel costs or our inability to secure adequate supplies of fuel; sustained increases in workers’ compensation, employment practices and vehicle accident claims costs; sustained increases in the cost of employee benefits; product liability claims or product recalls; technology failures; changes in interest rates; the impact of debt levels on operating flexibility and access to capital and credit markets; adverse changes in our credit rating (whether as a result of our operations or prospects or as a result of those of The Coca-Cola Company or other bottlers in the Coca-Cola system); changes in legal contingencies; legislative changes affecting our distribution and packaging; adoption of significant product labeling or warning requirements; additional taxes resulting from tax audits; natural disasters and unfavorable weather; global climate change or legal or regulatory responses to such change; issues surrounding labor relations; bottler system disputes; our use of estimates and assumptions; changes in accounting standards; impact of obesity and health concerns on product demand; public policy challenges regarding the sale of soft drinks in schools; the impact of volatility in the financial markets on access to the credit markets; the impact of acquisitions or dispositions of bottlers by their franchisors; and the concentration of our capital stock ownership. The forward-looking statements in this news release should be read in conjunction with the more detailed descriptions of the above factors located in our Annual Report on Form 10-K for the year ended December 28, 2014 under Part I, Item 1A “Risk Factors” and our Quarterly Report on Form 10-Q for the quarterly period ended September 27, 2015 under Part II, Item 1A “Risk Factors,” as well as those additional factors we may describe from time to time in other filings with the Securities and Exchange Commission. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements contained in this release as a result of new information or future events or developments.

—Enjoy Coca-Cola—

Exhibit 99.2

COCA-COLA PLAZA

ATLANTA, GEORGIA

|

J. ALEXANDER M. DOUGLAS, JR. PRESIDENT, COCA-COLA NORTH AMERICA |

P. O. Box 1734 Atlanta, GA 30301 ____

404 676-4421 Fax 404-598-4421 |

February 8, 2016

J. Frank Harrison III

Chairman and Chief Executive Officer

Coca-Cola Bottling Co. Consolidated

4100 Coca-Cola Plaza

Charlotte, NC 28211

Dear Frank,

This letter (“Letter of Intent”) sets forth the general terms and conditions pursuant to which Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly owned subsidiary of The Coca-Cola Company (“TCCC”), or one of its affiliates, will grant certain exclusive territory rights and sell certain distribution and manufacturing assets to Coca-Cola Bottling Co. Consolidated (“Bottler”), as further described below:

1. Grant of Exclusive Territory Rights for TCCC Beverages & Comprehensive Beverage Agreement. As part of the transactions described herein (the “Transaction”), CCR will grant Bottler certain exclusive rights for the distribution, promotion, marketing and sale in the geographic area described in Exhibit A (the “Sub-Bottling Territory”) of TCCC-owned and -licensed beverage products. Such rights will be granted via a Comprehensive Beverage Agreement (the “CBA”) among TCCC, CCR and Bottler in substantially the form attached to the Territory Conversion Agreement dated September 23, 2015 between TCCC, CCR and Bottler, as amended by the First Amendment to Territory Conversion Agreement dated February 8, 2016.

2. Sale of Exclusive Territory Rights for Certain Cross-Licensed Brands. CCR will also sell, transfer and assign to Bottler certain exclusive territory rights for the distribution, promotion, marketing and sale in the Sub-Bottling Territory of the cross-licensed brands (if any) then distributed by CCR in the Sub-Bottling Territory (the “Cross-Licensed Brands”). Such sale, transfer and assignment will be via such agreements as are mutually agreed by the parties, including the Distribution APA (as defined below), and will be subject to the consent of third party brand owners.

Classified - Confidential

3. Sale of Distribution Assets and Working Capital. In connection with the grant of the exclusive territory rights referred to in the two preceding sections, CCR will sell, transfer and assign to Bottler certain distribution assets and the working capital associated therewith, all as may be necessary to distribute, promote, market and sell the Covered Beverages (as defined in the CBA), Related Products (as defined in the CBA) and Cross-Licensed Brands in the Sub-Bottling Territory and as will be more particularly described in the Distribution APA (as defined below). The parties anticipate that the sale of distribution assets and working capital and of the exclusive territory rights for Cross-Licensed Brands described above will be documented in a definitive agreement (the “Distribution APA”) in substantially the same form as similar agreements entered into by the parties in past transactions.

4. Sale of Manufacturing Assets. As part of the Transaction, CCR will also sell, transfer and assign to Bottler the manufacturing facilities and related assets identified on Exhibit B (the “Manufacturing Assets”). The parties anticipate that this sale of Manufacturing Assets will be documented in a separate definitive agreement (the “Manufacturing APA”) in substantially same form as similar agreements entered into by the parties in past transactions.

5. Grant of Manufacturing Rights for TCCC Beverages. In connection with the Closing or Closings (as defined below) under the Manufacturing APA, Bottler and TCCC will execute at each such Closing a regional manufacturing agreement (an “RMA”), in substantially the form attached as Schedule 9.4 to the Initial Regional Manufacturing Agreement dated January 29, 2016 by and between TCCC and Bottler, or an amendment to Bottler’s then-existing RMA, that will govern the terms and conditions of Bottler’s use of the Manufacturing Assets to manufacture TCCC brands, including such terms as product quality, trademark licensing provisions, and the participation of Bottler in the National Product Supply Group (“NPSG”) Board formed by the parties (which shall include governance activities as reflected in the NPSG Governance Agreement previously executed by the parties). The parties intend that the RMA (and/or other documentation to be mutually agreed by the parties) will support the business and operational arrangements among the parties and other RPBs with regard to the NPSG and the operation of the Manufacturing Assets by Bottler after the Closing.

6. Product Supply Arrangements. Bottler (as supplier) will enter into finished goods supply agreements (“FGSAs”) with CCR and other Regional Producing Bottlers (“RPBs”), Expanding Participating Bottlers (“EPBs”) and other participating bottlers (“PBs”) for finished goods that are sourced from the Manufacturing Assets. Supply arrangements for U.S. Coca-Cola Bottlers (as defined in the CBA) that are not RPBs, EPBs or PBs will be covered by a separate agreement, similar to the existing Agency Sales Agreement, in a form to be mutually agreed by the parties. The FGSAs to be entered into by Bottler hereunder and by the other RPBs will be in substantially the same form as the FGSAs in effect as of the date hereof in Bottler’s distribution territories granted by CCR in prior transactions between the parties, but will incorporate certain changes in order to reflect the NPSG governance process described in the NPSG Governance Agreement previously executed by the parties and, to the extent applicable, to conform to the RMA. The Service Level Agreements attached to each RPB’s FGSAs (including Bottler’s FGSAs) may also incorporate certain changes to reflect the operating capabilities of such RPB and its customers. CCR and Bottler will also enter into an FGSA at each Closing under the Distribution APA to govern the supply to Bottler of finished goods that are sourced from CCR.

Classified - Confidential

2

Any FGSA referred to in this paragraph will be in a form to be agreed between the parties and consistent with the ongoing discussions between CCR, Bottler and other U.S. Coca-Cola Bottlers and consistent with the NPSG Governance Agreement.

7. Implementation of CONA and Anticipated Formation of New IT Services Entity. As part of the Transaction, Bottler and CCR intend to implement the CONA information technology platform in the Sub-Bottling Territory. The parties anticipate that Bottler’s implementation of CONA will be consistent with their ongoing discussions on this topic and will include Bottler’s continued participation in and part ownership of a new IT services entity named “CONA Services LLC” (“CONA LLC”). The parties anticipate that CONA LLC will provide IT services to Bottler, CCR and its other bottler owners/members on mutually acceptable terms, which terms are consistent with their discussions to date.

8. Participation in System Governance Activities. Bottler and CCR/TCCC intend to implement binding System governance with effect throughout all of Bottler’s distribution territories for Coca-Cola products, to become fully effective in Bottler’s existing distribution territories during 2016. The parties anticipate that their ongoing implementation of System governance will be consistent with their ongoing discussions on this topic, and will include a detailed joint plan for transitioning from current System governance routines and mechanisms to future System governance routines and mechanisms.

9. Economic Participation. As part of the Transaction, Bottler, CCR and TCCC intend to implement arrangements under which Bottler will be provided opportunities to participate economically in (a) the U.S. existing non-DSD businesses, and (b) future non-DSD products and/or business models. The parties currently anticipate that their implementation of such arrangements will be consistent with their ongoing discussions of the topic with such improvements as the parties may mutually agree.

10. Definitive Agreements. The transactions described in this Letter of Intent will be subject to the terms of the Distribution APA (in the case of the distribution aspect of the Transaction) and the Manufacturing APA (in the case of the manufacturing aspect of the Transaction) as described above (collectively the “Definitive Agreements”). For ease of transition and to manage resources effectively, the parties may mutually agree pursuant to the Definitive Agreements to implement the distribution and manufacturing aspects of the Transaction via a series of separate closings and transitions (each, a “Closing” and, collectively, the “Closings”).

11. Economic Consideration for Transaction: Distribution Assets. In exchange for the grant of exclusive territory rights for the Covered Beverages and Related Products, the sale of distribution rights for the Cross-Licensed Brands, and the sale of the distribution assets and working capital as described above, Bottler will pay to CCR: (a) a cash amount that reflects (i) the agreed value of the exclusive territory rights for the Cross-Licensed Brands (including the distribution assets and working capital applicable thereto), and (ii) the net book value of the other distribution assets and working capital, which amount will be payable to CCR at the Closing; and (b) sub-bottling payments for the grant of exclusive rights for the distribution, promotion, marketing and sale of Covered Beverages and Related Products in the Sub-Bottling Territory, which payments will be made to CCR on a regular basis after the Closing. The calculation of

Classified - Confidential

3

such amounts to be paid, and any adjustments to those amounts, will be determined in the same manner as in the most recently executed definitive agreements between the parties for similar transactions.

12. Economic Consideration for Transaction: Manufacturing Assets. In exchange for the sale of the Manufacturing Assets, at the time of the Closing, Bottler will pay to CCR a cash amount that reflects: (a) the agreed value of the manufacturing rights for the Cross-Licensed Brands (including the Manufacturing Assets and working capital applicable thereto); (b) CCR’s net book value of the other Manufacturing Assets and working capital applicable thereto; and (c) an adjustment that reflects the difference in actual COGS to produce such Cross-Licensed Brands at such facilities as compared to “national average” COGS for such Cross-Licensed Brands, which amount shall be payable to CCR at the Closing, which purchase price shall be subject to adjustment and true-up processes as set forth in the Manufacturing APA.

13. Conditions to Closing. CCR and Bottler each intend to include Closing conditions in the Distribution APA and Manufacturing APA that include, without limitation, the parties’ completion of customary transition activities, the expiration or termination of the applicable waiting period (and any extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (to the extent applicable), execution of the CBA (in the case of the Distribution APA), execution of the applicable FGSA or FGSAs, the grant of applicable third party consents, the parties’ execution of the RMA (in the case of the Manufacturing APA), the consummation of the transactions contemplated by the Distribution APA with respect to the portions of the Sub-Bottling Territory served by a production facility listed on Exhibit B hereto (in the case of the Manufacturing APA) and the completion of such other legal agreements as are necessary for the consummation of such transactions. In addition and consistent with past practice in similar transactions, the Definitive Agreements will contain mutually agreeable covenants regarding the satisfactory conduct of due diligence activities prior to the Closing.

14. Anticipated Schedule. The parties anticipate that, shortly after their execution of this Letter of Intent, there may be a joint public announcement by the parties of the Transaction and, subject to applicable regulatory requirements, detailed due diligence and joint integration planning and change management activities will then begin. The parties further anticipate that the Definitive Agreements and other formal legal agreements will be executed on or before December 31, 2016. The parties also anticipate that the Closing (and/or Closings) pursuant to the Definitive Agreements will be completed during 2017. Notwithstanding the foregoing, the parties acknowledge and agree that the before mentioned dates are estimates only, and are subject to change based on the parties’ discussions, changing business conditions, and other matters.

15. Board Approvals. This Letter of Intent is subject to the approval processes of the respective parties, including approval of each of their Boards of Directors.

16. Transition Planning Period and Activities. The parties anticipate that, in order to ensure a smooth transition of the distribution business in the Sub-Bottling Territory and the manufacturing facilities to Bottler and subject to applicable regulatory requirements, beginning on the date of execution of this Letter of Intent and continuing until the earlier of the termination of this Letter of Intent, execution of the Definitive Agreements, or the final Closing (as

Classified - Confidential

4

applicable), they will engage in a number of joint integration planning and change management activities.

17. Due Diligence; Pre-Closing Activities. The parties anticipate that prior to execution of the Definitive Agreements and continuing until the applicable Closing, Bottler will perform such due diligence on the distribution business and manufacturing facilities as is customary for a transaction of this nature and complexity including, without limitation, in the areas of finance, operations, environmental, legal, tax, and employment, and CCR will provide reasonable and customary access in this regard.

18. Expenses. Except as otherwise expressly agreed by the parties, each party will bear its own fees and expenses incurred in connection with the Transaction, including with respect to any due diligence, negotiation, preparation of documentation, the Closing and legal, accounting, consulting, travel and other similar fees or expenses, whether or not Definitive Agreements are reached.

19. Termination. This Letter of Intent may be terminated: (a) by mutual written consent of CCR and Bottler; or (b) upon written notice by CCR or Bottler to the other party if the Definitive Agreements have not been executed on or prior to October 1, 2017.

20. Non-Binding. This Letter of Intent expresses the present intent of the parties to enter into each Definitive Agreement and supporting operating agreements based on the principal terms and conditions set forth herein. Notwithstanding anything to the contrary contained herein, this Letter of Intent shall not be binding on the parties hereto except as to the captioned sections “Expenses”, “Termination”, “Non-Binding”, “Assignment”, “Amendment; Modification; Waiver”, “Counterparts”, “Confidentiality” and “Governing Law”, which shall be binding and expressly survive any termination hereof.

21. Assignment. This Letter of Intent and the rights and obligations set forth herein shall not be assignable by any party hereto without the prior written consent of the other party hereto. Subject to the preceding sentence, the binding provisions of this Letter of Intent (as noted in the “Non-Binding” section above) shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

22. Amendment; Modification; Waiver. This Letter of Intent may not be amended or terminated or any provision hereof waived or modified except by an instrument in writing signed by each of the parties hereto.

23. Counterparts. This Letter of Intent may be executed in counterparts, each of which shall be an original and all of which, when taken together, shall constitute one agreement, and delivery of an executed signature page by facsimile transmission or other electronic transmission shall be as effective as delivery of a manually executed counterpart.

24. Confidentiality. This Letter of Intent is strictly confidential and is covered by the parties’ Confidentiality Agreement – Bottler Discussions relating to System Operational Design Project. Neither this Letter of Intent nor any of its contents may be disclosed by TCCC, CCR or Bottler or any of their respective directors, officers, employees, agents, advisors or

Classified - Confidential

5

representatives, except as permitted in such agreement, and each of the parties will cause such persons not to make any such disclosure.

25. Governing Law. This Letter of Intent will be governed by the laws of the State of Georgia.

Frank, we appreciate your team’s efforts and dedication in our System of the Future work to date. We look forward to continuing to work closely with your team to finalize the Definitive Agreements, close this transaction and move forward with our joint work.

Please acknowledge your acceptance of the terms and conditions of this Letter of Intent by signing where indicated below and returning it to us.

[Remainder of page intentionally left blank; signature page follows]

Classified - Confidential

6

| Very truly yours, | ||

| /s/ J. Alexander M. Douglas, Jr. | ||

Agreed to and Accepted

as of the date first written above:

| COCA-COLA BOTTLING CO. CONSOLIDATED | ||||

| By: | /s/ J. Frank Harrison III | |||

| Name: | J. Frank Harrison III | |||

| Title: | Chairman & Chief Executive Officer | |||

Exhibit A

Sub-Bottling Territories

Classified - Confidential

Exhibit B

Manufacturing Facilities

Twinsburg, OH

Classified - Confidential

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Coca-Cola Consolidated, Inc. To Release First Quarter 2024 Results

- Stockholder Alert: Robbins LLP Informs Investors of the Class Action Filed Against Sharecare, Inc. (SHCR)

- ROSEN, RECOGNIZED INVESTOR COUNSEL, Encourages CI&T Inc Investors to Inquire About Securities Class Action Investigation – CINT

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share