Form 8-K CMS ENERGY CORP For: May 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) May 8, 2015

|

Commission File Number |

|

Registrant; State of Incorporation; Address; and Telephone Number |

|

IRS Employer Identification No. |

|

|

|

|

|

|

|

1-9513 |

|

CMS ENERGY CORPORATION (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 |

|

38-2726431 |

|

|

|

|

|

|

|

1-5611 |

|

CONSUMERS ENERGY COMPANY (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 |

|

38-0442310 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

On May 11-12, 2015, CMS Energy Corporation’s (“CMS Energy”) management will be meeting with investors. A copy of the CMS Energy handout to be used at these meetings is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Investors and others should note that CMS Energy and Consumers Energy Company post important financial information using the investor relations section of the CMS Energy website, www.cmsenergy.com and Securities and Exchange Commission filings.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 CMS Energy handout dated May 11 & 12, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

CMS ENERGY CORPORATION |

|

|

|

|

|

Dated: May 8, 2015 |

By: |

/s/ Thomas J. Webb |

|

|

|

Thomas J. Webb |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

CONSUMERS ENERGY COMPANY |

|

|

|

|

|

Dated: May 8, 2015 |

By: |

/s/ Thomas J. Webb |

|

|

|

Thomas J. Webb |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

Exhibit 99.1

|

|

Top of Mind Capex/Capacity Customer/O&M Sales/Economy Regulatory/Law Investor Meetings May 11, 2015 Ludington Pumped Storage Ray Compressor Station Cross Winds Energy Park Fourth largest in the world #1 LDC in gas storage #2 in renewable sales in the Great Lakes area Fourth largest in the world #1 LDC in gas storage #2 in renewable sales in the Great Lakes area Ludington Pumped Storage Ray Compressor Station Cross Winds Energy Park Capital International Meeting May 12, 2015 Top of Mind Capex/Capacity Customer/O&M Sales/Economy Regulatory/Law |

|

|

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended December 31, 2014 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof. The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com. CMS Energy provides historical financial results on both a reported (Generally Accepted Accounting Principles) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company's reported earnings in future periods. Investors and others should note that CMS Energy and Consumers Energy post important financial information using the investor relations section of the CMS Energy website, www.cmsenergy.com and Securities and Exchange Commission filings. |

|

|

Our Growth Engine $15.5 Billion More “upside” $5 bil NOT yet in Plan! (2015-2024 Capex) 5% - 7% EPS growth (Investment, Sales, Cost, & DIG) (Customers, Regulators, & Policy Makers) (Value, Reliability, & Environment) 2 Why Invest in CMS Energy? a Adjusted EPS (non-GAAP) Supported By UPSIDES create headroom PARTNERS in progress PASSION to improve for customers AND owners SELF-FUNDED! Our Growth Engine $15.5 Billion More “upside” $5 bil NOT yet in Plan! (2015-2024 Capex) 5% - 7% EPS growth (Investment, Sales, Cost, & DIG) (Customers, Regulators, & Policy Makers) (Value, Reliability, & Environment) . . . . next 10 years even brighter than last 10 year record! a Based on December 31, 2014 information percent of market cap Source: 10K; actual amounts through 2014 smoothed for illustration . . . . creating an opportunity for the next ten years. |

|

|

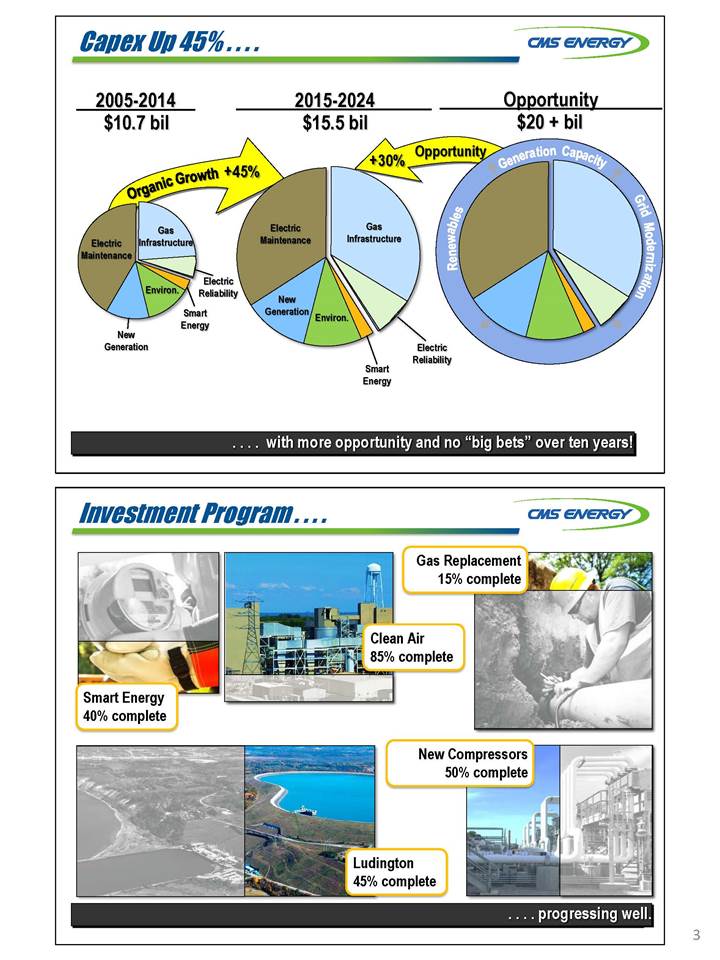

Capex Up 45% . . . . 2005-2014 2015-2024 Opportunity $10.7 bil $15.5 bil $20 + bil . . . . with more opportunity and no “big bets” over ten years! Investment Program . . . . Gas Replacement 15% complete Clean Air 85% complete Smart Energy 40% complete New Compressors 50% complete Ludington 45% complete . . . . progressing well. |

|

|

Upside Capacity Opportunities . . . . Capacity Growth Over Next Ten Years . . . . adding value to our “DIG” plant. $2.00 $4.50 $7.50 Capacity price ($ kW per month) Was (mils) Future Scenarios (mils) $55 $35 New Business Long-term Energy 250 MW at $4.00 per kWm (6/14) 250 MW = $5.75 per kWm (4/15) Recent Capacity Long-term > $3.30 Near-term = $4.50 Upside: Capacity and energy contracts layered in over time 7 (CONE) Now (mils) $15 = $5 (Prior) (Forecast) Capacity Energy $65 $40 + $25 – $50 more < $0.50 . . . . emerging incrementally with replacements not yet in plan! 5,000 7,500 10,000 Today Jackson Plant Replaces Classic Seven ROA Customers Return? Palisades PPA Expires 2022 MCV PPA Expires 2025 Future ~800 MW 1,240 MW MW PPA 2,600 capacity ~30% ~8,600 MW 540 MW 410 MW Owned Shortfall 6,000 780 MW ~9,400 MW |

|

|

Consumers Appears . . . Carbon Tonnage Reduction Million Tons (Preliminary) Projected emission level . . . . to be in a good carbon position. 13 15 17 19 21 23 25 2005 Baseline Million Tons of CO2 Consumers Energy 2014 2020 2025 2029 2030 Generation Strategy: New Supply Sources . . . . 0 5 10 15 20 25 Coal Nuclear . . . . combined cycle gas is the most attractive new source of supply. Levelized cost of new build (¢/kWh) Gas price= $3.00 $4.50 $6.00 W/ tax credit W/o tax credit W/ emission controls Today $3.00 per watt 5¢ 6¢ 7¢ 6¢ 9¢ 10¢ 12¢ 22¢ 8¢ Back -up 11¢ Back -up 6¢ Combined Cycle Gas Plant Wind Residential Solar 15¢ Future $2.00 per |

|

|

Electric Customer Prices . . . . Residential Bills Industrial Rates . . . . competitive for residential and improving for industrial customers. Customer Satisfaction . . . . Electric Gas . . . . continues to improve rapidly |

|

|

“Reinvestment” Helps Customers . . . . Increase forestry Accelerate “DIG” Outage to 2015 – $8 mil cost in 2015; $10 mil benefit in 2016 – Capacity increase 38 MW . . . . AND provides sustainable, premium growth for INVESTORS O&M Cost Savings . . . . O&M Trend vs Peers 2014 Actual Plan O&M Cost Savings 2014 & 2015 2014 2018 (mils) (mils) Attrition $ - 35 $ - 75 Productivity (Coal Gas) - 35 - 50 “Pole Top” Hardening - 30 - 30 Smart Meters - 5 - 25 Eliminate Waste (UA’s) - 15 - 20 Mortality Tables & Discount Rates +50 + 50 Service Upgrades +10 + 50 Net Savings $ - 60 $ - 100 Percent Savings - 6% - 10% FAST START! . . . . accelerated; funding investment and reducing risk. |

|

|

O&M Cost Reductions . . . . . . . . providing more headroom for customer benefits. O&M Cost Reductions . . . . Coal to Gas Switching (Zeeland) Smarter benefit plans Productivity/Attrition Coal to Gas Switching (Jackson) “Pole Top” Hardening Productivity/Smart Energy . . . . provide more headroom for more capital investment. |

|

|

Sales Growth . . . . Economic Indicators Annual Electric Sales a Grand Rapids Michigan U.S Building Permits* +32% +4% +7% GDP 2010 2013 15 11 8 Population 2011 2014 3 0 2 Unemployment (3/15) 3.9 5.6 5.5 *Annualized numbers thru February 2015 Industrial Total 8.7% 5.0% 1.0% 2.8% 3% 1% Conservative 2% ½% -2.5% -5.0% 2008-2009 Recession 2010-2013 Recovery 2014 2015 Future 2016 - 2019 a Weather normalized vs. prior year . . . . suggests upside to conservative plan. Economic Growth . . . . Examples of New Business Industries Electric Gas Combination Announcemen Plasan Carbon Composites High performance auto body parts 620 new jobs $29 million investment Phased in next 3 years Announcement Dicastal North America, Inc. World’s largest maker of alloy wheels 300 new jobs $140 million investment Production begins in 2015 Continental Dairy Magna-Cosma Betz Post Enbridge Durolast Roofing GM Assembly Dart MSU FRIB WKW Denso Brembo MACI Auto MW 50 Food 7 Manufacturing 21 Metal 20 Petroleum 19 Plastics 19 Others 19 Total Up 155 . . . . another 2.5% of sales growth. |

|

|

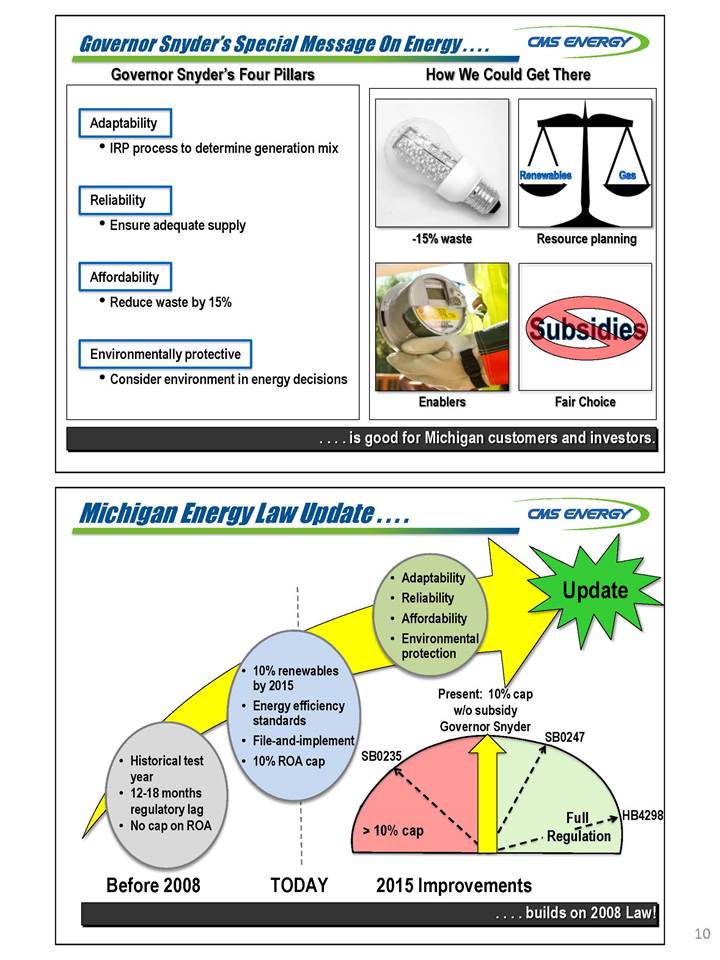

Governor Snyder’s Special Message On Energy . . . . Governor Snyder’s Four Pillars How We Could Get There Adaptability IRP process to determine generation mix Reliability Ensure adequate supply Affordability Reduce waste by 15% Environmentally protective Consider environment in energy decisions -15% waste Resource planning Enablers Fair Choice . . . . is good for Michigan customers and investors. Michigan Energy Law Update . . . . Adaptability Reliability Affordability Environmental protection Before 2008 TODAY 2015 Improvements . . . . builds on 2008 Law! Update 10% renewables by 2015 Energy efficiency standards File-and-implement 10% ROA cap Historical test year 12-18 months regulatory lag No cap on ROA Present: 10% cap w/o subsidy Governor Snyder SB0235 SB0247 > 10% cap Full Regulation HB4298 Before 2008 TODAY 2015 Improvements . . . . builds on 2008 Law! |

|

|

Experienced Policy Makers . . . . Governor Rick Snyder Commission Powering Michigan’s Comeback John Quackenbush (R), Chairman Term Ends: July 2, 2017 Consistent Leadership! Energy Committee Chairs Sally Talberg (I) Term Ends: July 2, 2019 Senator Mike Nofs House Rep. Aric Nesbitt Greg White (I) Term Ends: July 2, 2015 . . . . provide stability 2015 Gas And Electric Rate Cases . . . . 2014 2015 2016 Filed $88 M 7/01 . . . . primarily for customer improvement with large O&M offsets. ELECTRIC GAS Our View Our View Filed $163 M 12/05 Securitization Surcharge Ends $80 M 2014 2015 2016 Jackson Plant in rate base Investment recovery and cost reductions New Rate Design A) B) C) Settled $45 M Final Order New Rate Design Jackson Plant Classic 7 Decommissioned Selfimplement B) C) A) Settled $45 million |

|

|

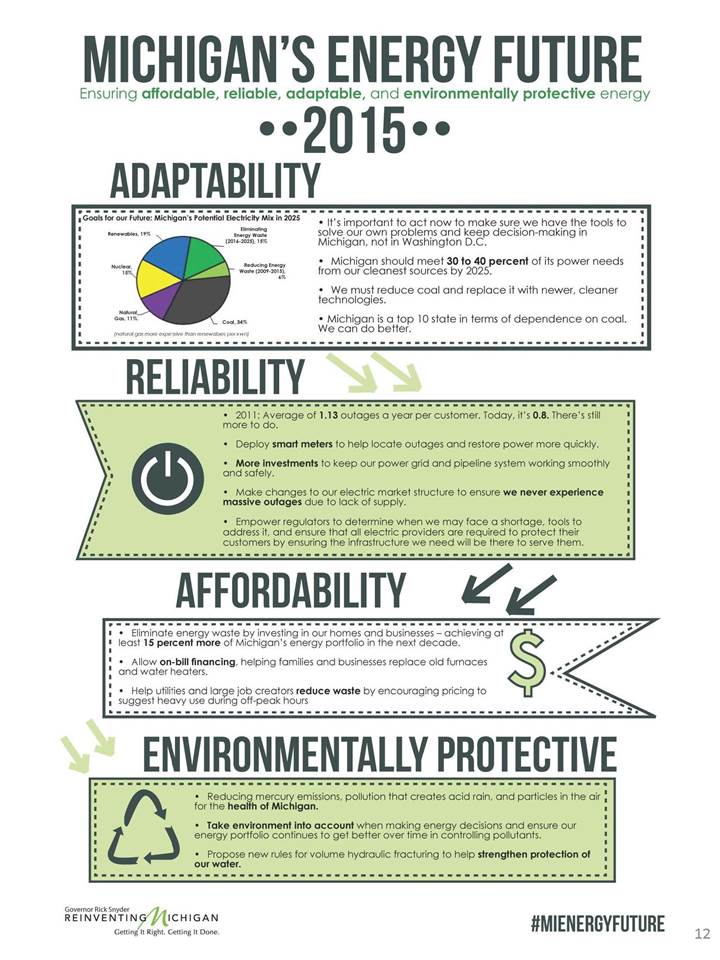

MICHIGAN'S ENERGY FUTURE Ensuring affordable, reliable,adaptable, and environmentally protective energy 2015 ADAPTABILITY Goals for our Future: Michigan's Potential Electricity Mix in 2025 It's important to act now to make sure we have the tools to solve our own problems and keep decision making in Michigan, not 1n Washington D.C. Michigan should meet 30 to 40 percent of its power needs from our cleanest sources by 2025. We must reduce coal and replace it with newer, cleaner technologies. Michigan is a top 10 state in terms of dependence on coal. We can do better. RELIABILITY 2011: Average of 1.13 outages a year per customer. Today,it's 0.8. There's still more to do. Deploy smart meters to help locate outages and restore power more quickly. More Investments to keep our power grid and pipeline system working smoothly and safely. Make changes to our electric market structure to ensure we never experience massive outages due to lack of supply. Empower regulators to determine when we may face a shortage, tools to address it, and ensure that all electric providers are required to protect their customers by ensuring the infrastructure we need will be there to serve them. Allow on-bill financing,helping families and businesses replace old furnaces and water heaters. Help utilities and lare job creators reduce waste by encouraging pricing to suggest heavy use dunng off-peak hours ENVIRONMENTA LLY PROTECTIVE Reducing mercury emissions,pollution that creates acid rain, and particles in the air for the health of Michigan. Take environment Into account when making energy decisions and ensure our energy portfolio continues to get better over time in controlling pollutants. Propose new rules for volume hydraulic fracturing to help strengthen protection of our water. #MIENERGVFUTURE |

|

|

CMS Energy Consistent Growth Future Shines Bright a $3.50 +7% /year +5% to +7% year Peers =3% / yr Last 7 Years Next 5 Years a Adjusted EPS (non-GAAP) Sustainable Future Growth Past Performance Investment (bills) $64.6 O&M Reduction (2006-2014) (10)% Sales Growth (2010-2014) +1% Energy Policy 2008 Law Next 5 Years $7.6 Capicity Opl Conserv ative (7)% +1/2 % Conservative Improved Law .... even easier, with lots of upsides. 13 |

|

|

Capital Expenditures 2015-2019 2020-2024 2015-2024 2015 2016 2017 2018 2019 Subtotal Subtotal Total (mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils) New Generation (includes Renewables) $ 70 $ 224 $ 52 $ 64 $ 134 $ 544 $ 612 $ 1,156 Environmental 254 98 136 153 212 853 139 992 Gas Infrastructure 237 216 200 159 138 950 1,454 2,404 Smart Energy 130 177 164 43 22 536 - 536 Electric Reliability & Distribution 196 198 208 262 255 1,119 1,575 2,694 Maintenance (Electric & Gas) 714 700 650 774 786 3,624 4,094 7,718 Total $ 1,601 $ 1,613 $ 1,410 $ 1,455 $ 1,547 $ 7,626 $ 7,874 $ 15,500 Electric $ 1,088 $ 1,116 $ 911 $ 983 $ 1,073 $ 5,171 $ 4,704 $ 9,875 Gas 513 497 499 472 474 2,455 3,170 5,625 Total $ 1,601 $ 1,613 $ 1,410 $ 1,455 $ 1,547 $ 7,626 $ 7,874 $ 15,500 Capacity Diversity . . . . Coal . . . . evolving to cleaner generation while becoming more cost competitive |

|

|

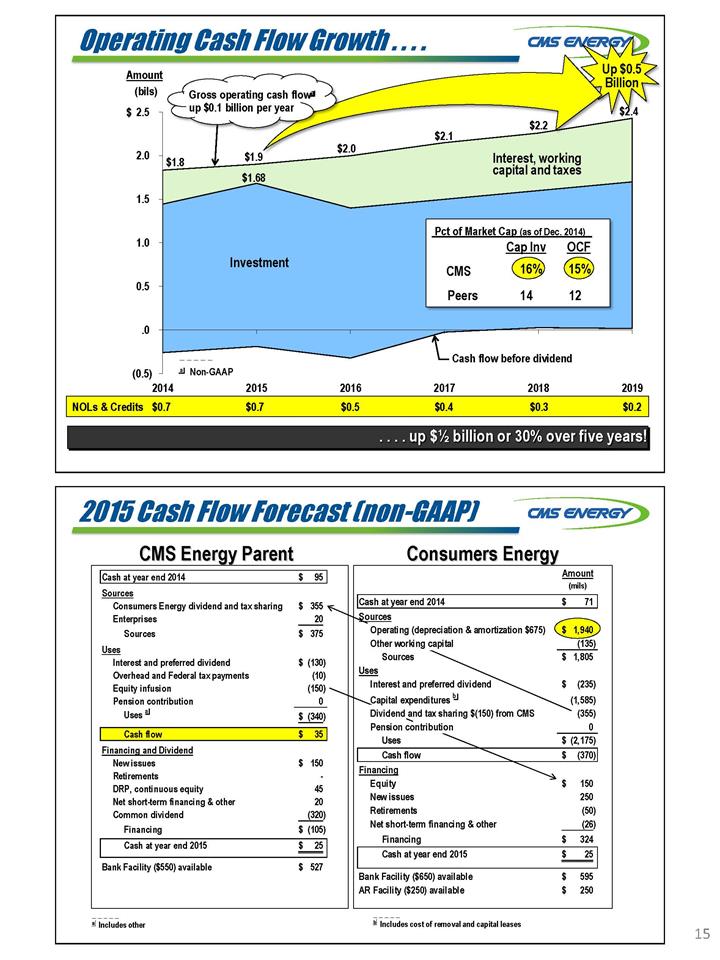

Operating Cash Flow Growth . . . . Gross operating cash flowa up $0.1 billion per year Interest, working capital and taxes Pct of Market Cap (as of Dec. 2014) Cap Inv OCF CMS 13% 15% Peers 14 12 NOLs & Credits $0.7 $0.7 $0.5 $0.4 $0.3 $0.2 . . . . up $½ billion or 30% over five years! 2015 Cash Flow Forecast (non-GAAP) CMS Energy Parent Cash at year end 2014 $ 95 Sources Consumers Energy dividend and tax sharing $ 355 Enterprises 20 Sources $ 375 Uses Interest and preferred dividend $ (130) Overhead and Federal tax payments (10) Equity infusion (150) Pension contribution 0 Uses a $ (340) Cash flow $ 35 Financing and Dividend New issues $ 150 Retirements - DRP, continuous equity 45 Net short-term financing & other 20 Common dividend (320) Financing $ (105) Cash at year end 2015 $ 25 Bank Facility ($550) available $ 527 Consumers Energy Amount (mils) Cash at year end 2014 $ 71 Sources Operating (depreciation & amortization $675) $ 1,940 Other working capital (135) Sources $ 1,805 Uses Interest and preferred dividend $ (235) Capital expenditures b (1,585) Dividend and tax sharing $(150) from CMS (355) Pension contribution 0 Uses $ (2,175) Cash flow $ (370) Financing Equity $ 150 New issues 250 Retirements (50) Net short-term financing & other (26) Financing $ 324 Cash at year end 2015 $ 25 Bank Facility ($650) available $ 595 AR Facility ($250) available $ 250 a Includes other b Includes cost of removal and capital leases |

|

|

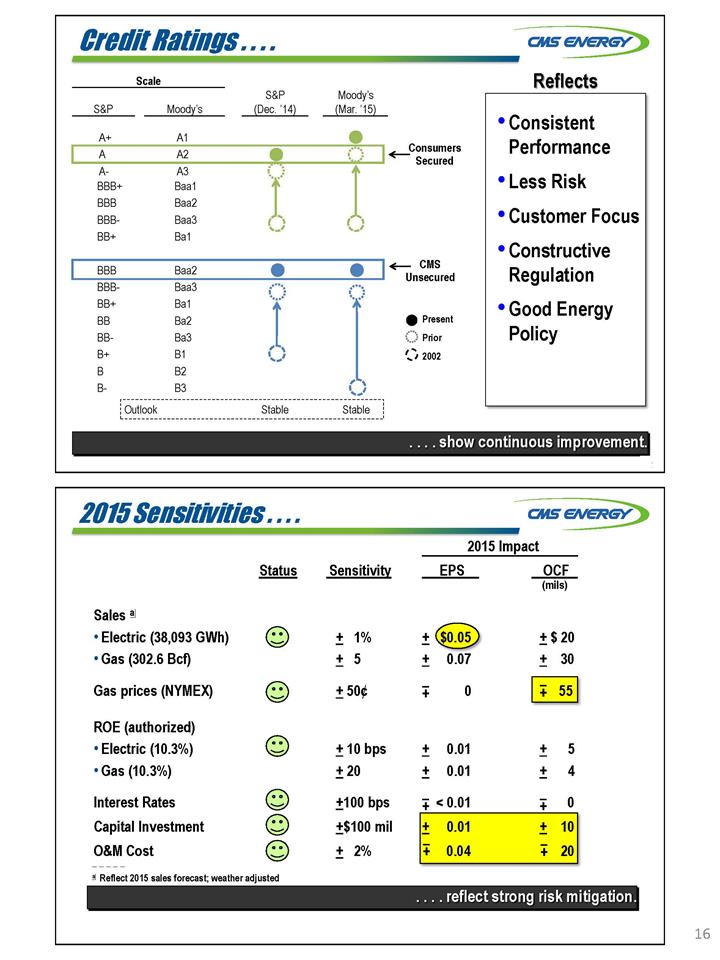

Credit Ratings . . . . Scale S&P Moody’s S&P (Dec. ‘14) Moody’s (Mar. ‘15) A+ A1 A A2 A- A3 BBB+ Baa1 BBB Baa2 BBB- Baa3 BB+ Ba1 BBB Baa2 BBB- Baa3 BB+ Ba1 BB Ba2 BB- Ba3 B+ B1 B B2 B- B3 Outlook Stable Stable Consumers Secured CMS Unsecured Present Prior 2002 Reflects Consistent Performance Less Risk Customer Focus Constructive Regulation Good Energy Policy . . . . show continuous improvement 2015 Sensitivities . . . . 2015 Impact Status Sensitivity EPS OCF (mils) Sales a Electric (38,093 GWh) Gas (302.6 Bcf) + 1% + 5 + $0.05 + 0.07 + $ 20 + 30 Gas prices (NYMEX) + 50¢ – – 55 ROE (authorized) Electric (10.3%) Gas (10.3%) + 10 bps + 20 + 0.01 + 5 + 0.01 + 4 Interest Rates +100 bps – < 0.01 – Capital Investment O&M Cost _ _ _ _ _ a Reflect 2015 sales forecast; weather adjusted +$100 mil + 2% + 0.01 – 0.04 + 10 – 20 . . . . reflect strong risk mitigation. |

|

|

Electric Customer Base Diversified . . . . Top Ten Customers (2014 Ranked by Deliveries) Hemlock Semiconductor General Motors Nexteer Automotive Corporation Gerdau MacSteel Denso International Packaging Corporation of America Meijer State of Michigan Spectrum Health AT&T Percentage of electric gross margin is 2.4% 2014 Electric Gross Margin Commercial 33% Residential 50% Industrial 8% Auto 5% Other 4% $2.3 Billion Michigan’s Energy Future . . . . Michigan’s Electricity Mix a 2015 Consumers Energy 2025 Michigan Potential Mix Michigan Gas Cheaper Wind Cheaper Renewables 10% 9% 9% 19% Energy Optimization 2009 – 2015 6 7 6 6 Energy Optimization 2016 – 2025 15 15 Clean Sources 16% 16% 30% 40% Natural Gas 25 13 20 11 Coal 43 54 34 34 Nuclear 16 17 16 15 Total 100% 100% 100% 100% a Percent of expected retail sales (kWh) . . . . a leader in clean, affordable and reliable power |

|

|

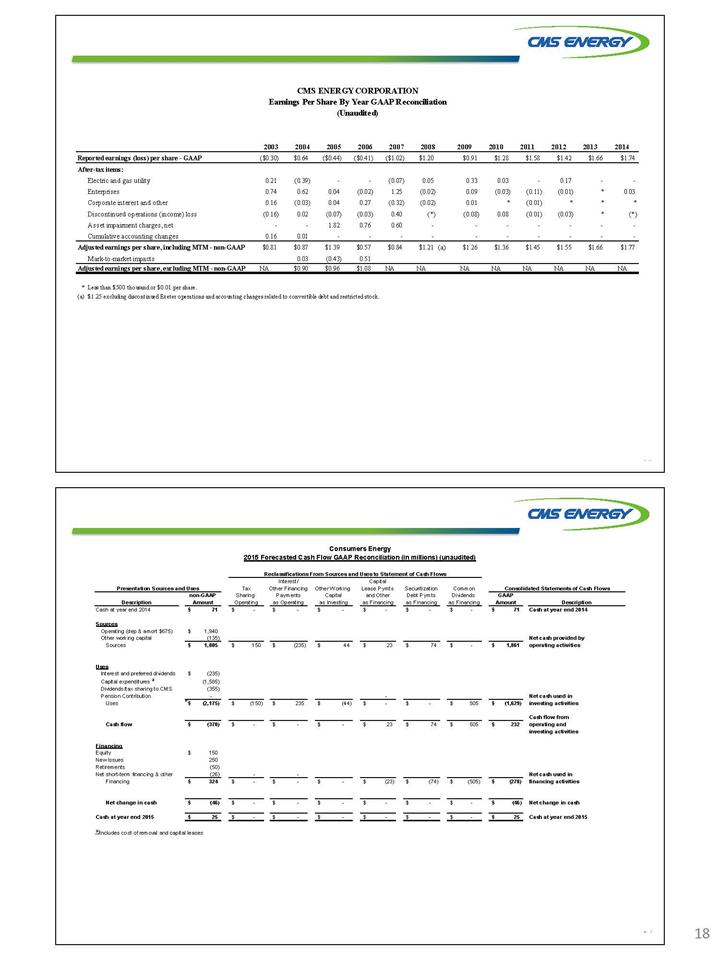

CMS ENERGY CORPORATION Earnings Per Share By Year GAAP Reconciliation (Unaudited 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Reported earnings (loss) per share - GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74 After-tax items: Electric and gas utility 0.21 (0.39) - - (0.07) 0.05 0.33 0.03 - 0.17 - - Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11) (0.01) * 0.03 Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01) * * * Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03) * (*) Asset impairment charges, net - - 1.82 0.76 0.60 - - - - - - - Cumulative accounting changes 0.16 0.01 - - - - - - - - - - Adjusted earnings per share, including MTM - non-GAAP $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77 Mark-to-market impacts 0.03 (0.43) 0.51 Adjusted earnings per share, excluding MTM - non-GAAP NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA NA * Less than $500 thousand or $0.01 per share. (a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and rest ricted stock. Consumers Energy 2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited) Presentation Sources and Uses Reclassifications From Sources ad Uses to Statement of Cash Flows Interest/Capital Tax Other Financing Other Working Lease Payments Securitization Common Consolidated Statements of Cash Flows non-GAAP Sharing Payments Capital and Other Debt Payments Dividends GAAP Description Amount Operating as Operating as Investing as Financing as Financing as Financing Amount Description Cash at year end 2014 $ 71 $ - $ - $ - $ - $ - $ - $ 71 Cash at year end 2014 Sources Operating (dep & amort $675) $ 1,940 Other working capital (135) Net cash provided by Sources $ 1,805 $ 150 $ (235) $ 44 $ 23 $ 74 $ - $ 1,861 operating activities Uses Interest and preferred dividends $ (235) Capital expenditures a (1,585) Dividends/tax sharing to CMS (355) Pension Contribution - - Net cash used in Uses $ (2,175) $ (150) $ 235 $ (44) $ - $ - $ 505 $ (1,629) investing activities Cash flow from Cash flow $ (370) $ - $ - $ - $ 23 $ 74 $ 505 $ 232 operating and investing activities Financing Equity $ 150 New Issues 250 Retirements (50) Net short-term financing & other (26) - - Net cash used in Financing $ 324 $ - $ - $ - $ (23) $ (74) $ (505) $ (278) financing activities Net change in cash $ (46) $ - $ - $ - $ - $ - $ - $ (46) Net change in cash Cash at year end 2015 $ 25 $ - $ - $ - $ - $ - $ - $ 25 Cash at year end 2015 a Includes cost of removal and capital leases |

|

|

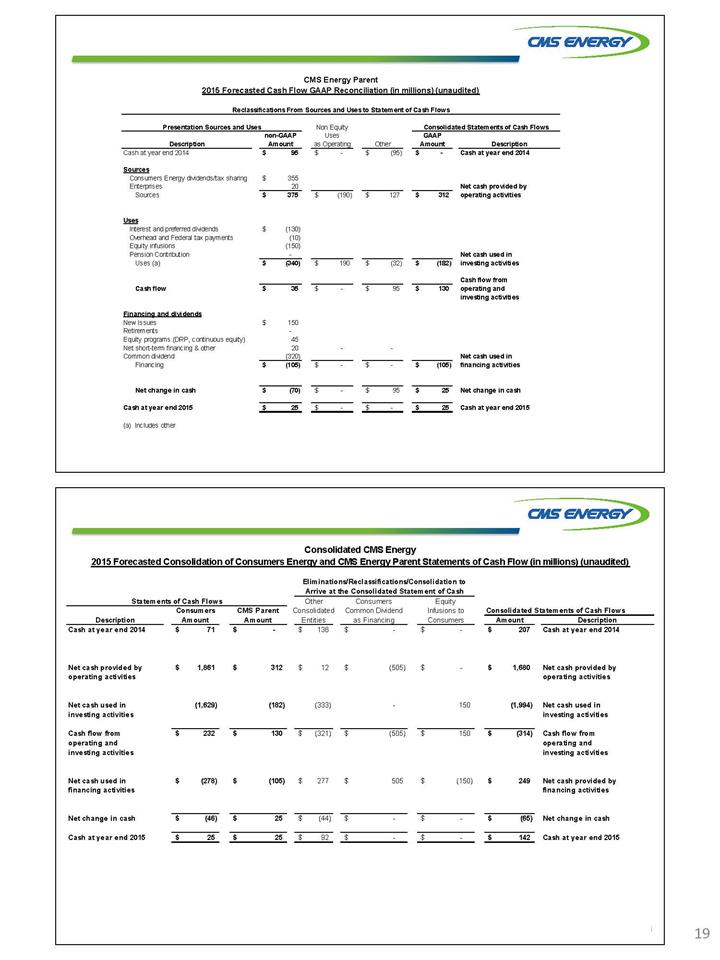

CMS Energy Parent 2015 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited) Reclassifications From Sources and Uses to Statement of Cash Flows Presentation Sources and Uses Consolidated Statements of Cash Flows Description Non Equity non-GAAP Uses GAAP Amount as Operating Other Amount Description Cash at year end 2014 $ 95 $ - $ (95) $ - Cash at year end 2014 Sources Consumers Energy dividends/tax sharing $ 355 Enterprises 20 Net cash provided by Sources $ 375 $ (190) $ 127 $ 312 operating activities Uses Interest and preferred dividends $ (130) Overhead and Federal tax payments (10) Equity infusions (150) Pension Contribution - Net cash used in Uses (a) $ (340) $ 190 $ (32) $ (182) investing activities Cash flow from Cash flow $ 35 $ - $ 95 $ 130 operating and investing activities Financing and dividends New Issues $ 150 Retirements - Equity programs (DRP, continuous equity) 45 Net short-term financing & other 20 - - Common dividend (320) Net cash used in Financing $ (105) $ - $ - $ (105) financing activities Net change in cash $ (70) $ - $ 95 $ 25 Net change in cash Cash at year end 2015 $ 25 $ - $ - $ 25 Cash at year end 2015 (a) Includes other Consolidated CMS Energy 2015 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited) Eliminations/Reclassifications/Consolidation to Arrive at the Consolidated Statement of Cash Statements of Cash Flows Other Consumers Equity Consolidated Statements of Cash Flows Consumers CMS Parent Consolidated Common Dividend Infusions to Description Amount Amount Entities as Financing Consumers Amount Description Cash at year end 2014 $ 71 $ - $ 136 $ - $ - $ 207 Cash at year end 2014 Net cash provided by $ 1,861 $ 312 $ 12 $ (505) $ - $ 1,680 Net cash provided by operating activities operating activities Net cash used in (1,629) (182) (333) - 150 (1,994) Net cash used in investing activities investing activities Cash flow from $ 232 $ 130 $ (321) $ (505) $ 150 $ (314) Cash flow from operating and operating and investing activities investing activities Net cash used in $ (278) $ (105) $ 277 $ 505 $ (150) $ 249 Net cash provided by financing activities financing activities Net change in cash $ (46) $ 25 $ (44) $ - $ - $ (65) Net change in cash Cash at year end 2015 $ 25 $ 25 $ 92 $ - $ - $ 142 Cash at year end 2015 |

|

|

CMS Energy Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities (unaudited) (mils) 2014 2015 2016 2017 2018 2019 Consumers Operating Income + Depreciation & Amortization $ 1,813 $ 1,940 $ 1,955 $ 2,081 $ 2,194 $ 2,358 Enterprises Project Cash Flows 20 20 28 50 52 55 Gross Operating Cash Flow Other operating activities including taxes, interest payments and $ 1,833 $ 1,960 $ 1,983 $ 2,131 $ 2,246 $ 2,413 working capital (386) (280) (583) (631) (646) (713) Net cash provided by operating activities $ 1,447 $ 1,680 $ 1,400 $ 1,500 $ 1,600 $ 1,700 |

|

|

May 2015 OUR MODEL; OUR PLAN INVESTOR INFORMATION CMS Energy Corporation Phil McAndrews Investor Relations Department Travis Uphaus One Energy Plaza, Jackson, MI 49201 www.cmsenergy.com CUSTOMERS INVESTORS High-end EPS (and dividend) growth - 12 year track record - Repeatable Capex -- 100% organic (no “big bets”) Self-funded -- No block equity dilution! (5 years!) World-class cost performance Solid sales growth (under promise/over deliver) World-class regulation and law OUTPERFORMED FOR A DECADE: NEXT DECADE EVEN BRIGHTER . . . . continues to improve rapidly . . . . AND provides sustainable, premium growth for INVESTORS. |

|

|

Adjusted EPS Gross OCF Dividend CapEx CMS O&M Cost Electric Sales (Ind. /Total ) Energy Policy 10% 11 16% 15 21% Energy efficiency standards File and implement 10% renewables by 2015 10% ROA cap Adaptability Reliability Affordability Environmentally protective 2015 Update 2008 Law +$100 mil $1 bil capex = +1% sales = $20 mil OCF = 5¢ EPS Self-funded (No block equity dilution) + $0.6 $1.8 $2.4 Base Rates < 2% 2005 - 2014 $10.7 B 2015 - 2024 $15.5 B Opportunity $16.5 + B +30% +45% Down 10% Down 7% -5% -2.5% 5% 1% 3% 1% 2% ½% $1.1 $0.9 $1.3 > 2% < 2% $1.77 Conservative Organic Growth Opportunity Generation capacity Gas conversion Grid modernization No “Big Bets” Gas Infrastructure Electric Reliability Smart Energy Environmental New Generation Electric Maintenance 2006 2014 2019 Residential Bills Industrial Rates National Avg Midwest Avg +10¢ (bils) (bils) % of Mkt Cap % % Peers New capacity Gas combined cycle -- $700 million Renewables -- $1 billion New Energy Efficiency Incentive/ rate base Decoupling Eliminate ROA subsidy = $150 million $20 + B Upside Peers up 42% Actual Plan Upsides NOT in Plan +5% - +7% Int’l Sale $1.0 2.8% 8.7% 7% /year + $0.5 This placemat contains “forward-looking statements”; please refer to our SEC filings for information regarding the risks and uncertainties that could cause our results to differ materially. It also contains non-GAAP measures. Reconciliations to most directly comparable GAAP measures are found in the accompanying handout or on our website at www.cmsenergy.com a a a Non-GAAP 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2008 - 2009 Recession 2010 - 2013 Recovery 2014 2015 2016 - 2019 Future OCF 20¢ 36¢ 50¢ 66¢ 84¢ 96¢ $1.02 $1.08 $1.15 $0.81 $0.90 $0.96 $1.08 $0.84 $1.21 $1.26 $1.36 $1.45 $1.55 $1.66 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Future -20 -10 0 10 20 2013 2014 2015 2016 -30 -20 -10 0 10 20 30 2013 2014 2015 2016 EPS |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CMS Energy (CMS) PT Raised to $66 at KeyBanc

- Standard Lithium Successfully Commissions First Commercial-Scale DLE Column in North America

- CMS Energy (CMS) PT Raised to $57 at Morgan Stanley

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share