Form 8-K CMS ENERGY CORP For: Apr 28 Filed by: CONSUMERS ENERGY CO

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) April 28, 2016

| Commission File Number |

Registrant; State of Incorporation; Address; and Telephone Number |

IRS Employer Identification No. | ||

| 1-9513 | CMS ENERGY CORPORATION (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 |

38-2726431 | ||

| 1-5611 | CONSUMERS ENERGY COMPANY (A Michigan Corporation) One Energy Plaza Jackson, Michigan 49201 (517) 788-0550 |

38-0442310 | ||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

CMS Energy Corporation (“CMS Energy”) will hold a webcast to discuss its 2016 first quarter results and provide a business and financial outlook on April 28 at 8:30 AM (EDT). A copy of the CMS Energy presentation is furnished as Exhibit 99.1 to this report. A webcast of the presentation will be available on the CMS Energy website, www.cmsenergy.com.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 | CMS Energy presentation dated April 28, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| CMS ENERGY CORPORATION | ||||||

| Dated: April 28, 2016 | By: | /s/ Thomas J. Webb | ||||

| Thomas J. Webb | ||||||

| Executive Vice President and Chief Financial Officer | ||||||

| CONSUMERS ENERGY COMPANY | ||||||

| Dated: April 28, 2016 | By: | /s/ Thomas J. Webb | ||||

| Thomas J. Webb | ||||||

| Executive Vice President and Chief Financial Officer | ||||||

Exhibit Index

| 99.1 | CMS Energy presentation dated April 28, 2016 |

Exhibit 99.1

Exhibit 99.1

First Quarter 2016 Results & Outlook April 28, 2016

Jackson Generating Station Ludington Pumped Storage Cross Winds âEnergy Park

Among lowest acquisition cost ever Fourth largest in the world #2 in renewable sales in the Great Lakes area

This presentation is made as of the date hereof and contains “forward-looking statements” as defined in Rule 3b-6 of the

Securities Exchange Act of 1934, Rule 175 of the Securities Act of 1933, and relevant legal decisions. The forward-looking statements are subject to risks and uncertainties. All forward-looking statements should be considered in the context of the risk and other factors detailed from time to time in CMS Energy’s and Consumers Energy’s Securities and Exchange Commission filings. Forward-looking statements should be read in conjunction with “FORWARD-LOOKING STATEMENTS AND

INFORMATION” and “RISK FACTORS” sections of CMS Energy’s and Consumers Energy’s Form 10-K for the year ended

December 31, 2015 and as updated in subsequent 10-Qs. CMS Energy’s and Consumers Energy’s “FORWARD-LOOKING

STATEMENTS AND INFORMATION” and “RISK FACTORS” sections are incorporated herein by reference and discuss important factors that could cause CMS Energy’s and Consumers Energy’s results to differ materially from those anticipated in such statements. CMS Energy and Consumers Energy undertake no obligation to update any of the information presented herein to reflect facts, events or circumstances after the date hereof.

The presentation also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. A reconciliation of each of these measures to the most directly comparable GAAP measure is included in the appendix and posted on our website at www.cmsenergy.com.

CMS Energy provides historical financial results on both a reported (GAAP) and adjusted (non-GAAP) basis and provides forward-looking guidance on an adjusted basis. Management views adjusted earnings as a key measure of the company’s present operating financial performance, unaffected by discontinued operations, asset sales, impairments, regulatory items from prior years, or other items. These items have the potential to impact, favorably or unfavorably, the company’s reported earnings in future periods.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

| 1 |

|

Agenda

Overview

First Quarter Results Operational Performance

Our Model

Capital Investment Quality Improvements & Cost Reductions

Financial Results & Outlook

First Quarter; Full Year Weather Mitigation

John Russell President & CEO

Patti Poppe

Senior Vice President & Incoming CEO

Tom Webb

Executive VP & CFO

| 2 |

|

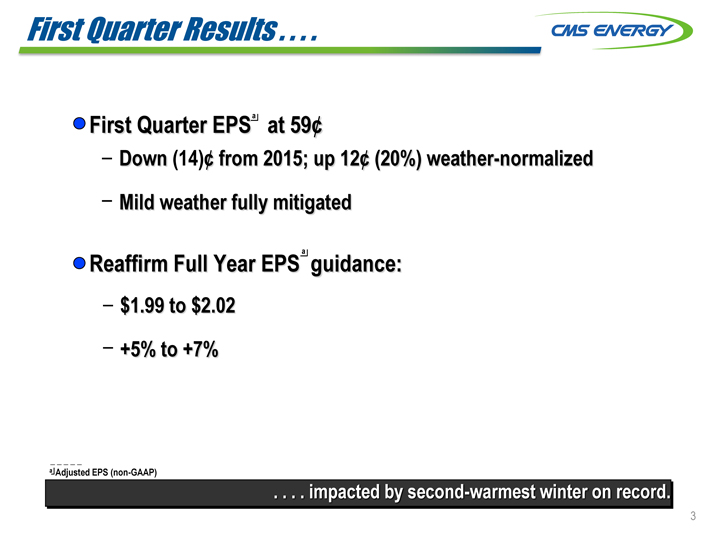

First Quarter Results . . . .

First Quarter EPSa at 59¢

Down (14)¢ from 2015; up 12¢ (20%) weather-normalized Mild weather fully mitigated

Reaffirm Full Year EPS a guidance:

$1.99 to $2.02 +5% to +7%

a Adjusted EPS (non-GAAP)

. . . . impacted by second-warmest winter on record.

3

Operational Performance

Retired 950 MW of coal plants in April

Coal mix now below 25%

Rate Cases

Settled gas rate case — $40 million

Track record demonstrates constructive regulation

Filed electric rate case at $225 million

Energy Law

Proceeding through Senate and House

Business plan based on strong 2008 Law

reflects sustainable business model.

| 4 |

|

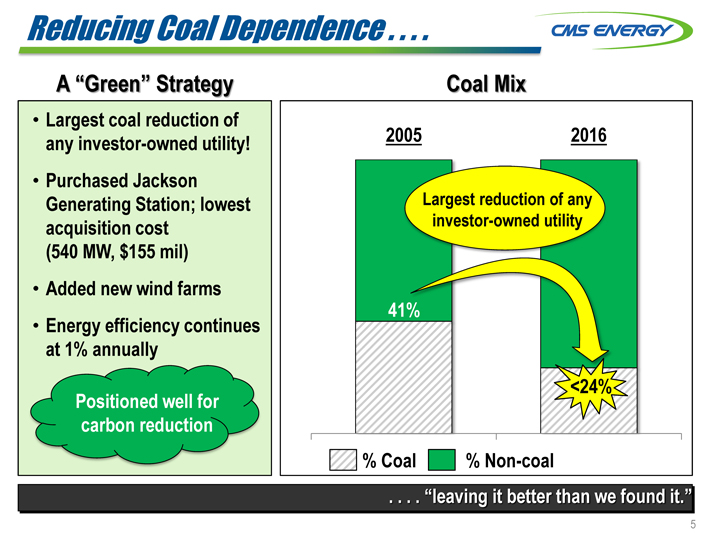

Reducing Coal Dependence . . . .

A “Green” Strategy

Largest coal reduction of any investor-owned utility! Purchased Jackson Generating Station; lowest acquisition cost (540 MW, $155 mil) Added new wind farms Energy efficiency continues at 1% annually

Positioned well for carbon reduction

Coal Mix

2005 2016

Largest reduction of any investor-owned utility

41%

<24%

% Coal % Non-coal

. . . . “leaving it better than we found it.”

| 5 |

|

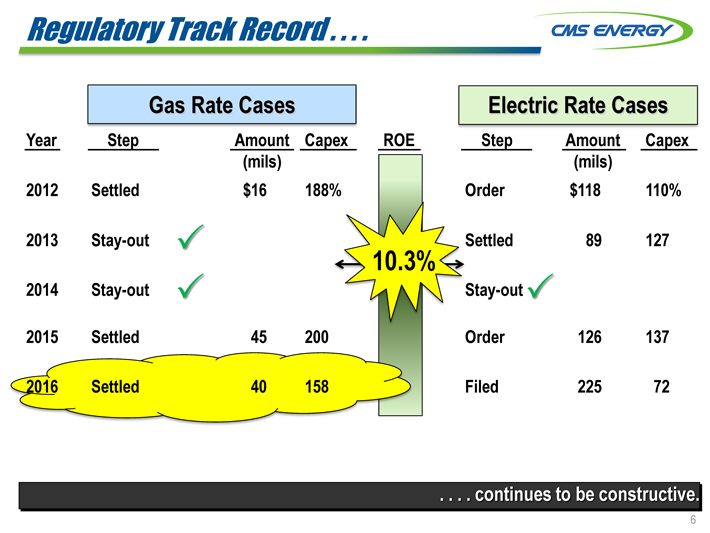

Regulatory Track Record

Gas Rate Cases Electric Rate Cases

Year Step Amount Capex ROE Step Amount Capex

(mils) (mils)

2012 Settled $16 188% Order $118 110%

2013 Stay-out Settled 89 127

10.3%

2014 Stay-out Stay-out

2015 Settled 45 200 Order 126 137

2016 Settled 40 158 Filed 225 72

continues to be constructive.

| 6 |

|

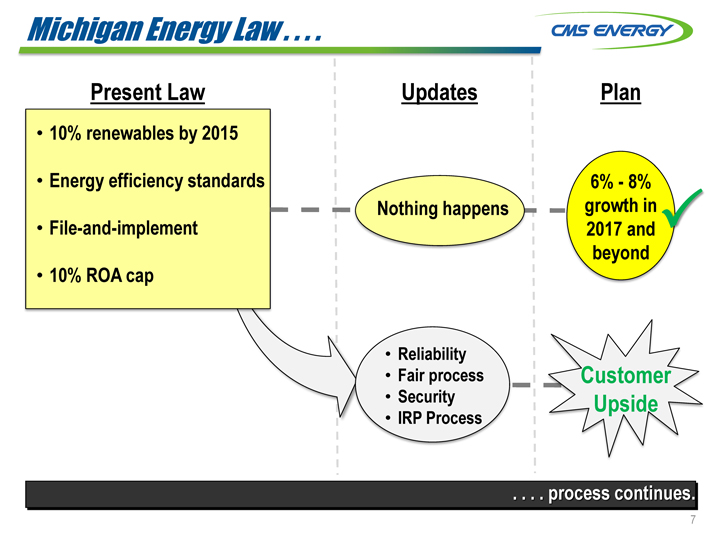

Michigan Energy Law . . . .

Present Law

10% renewables by 2015 Energy efficiency standards File-and-implement 10% ROA cap

Updates Plan

6%—8% Nothing happens growth in 2017 and beyond

Reliability

Fair process Customer

Security Upside

IRP Process

. . . . process continues.

| 7 |

|

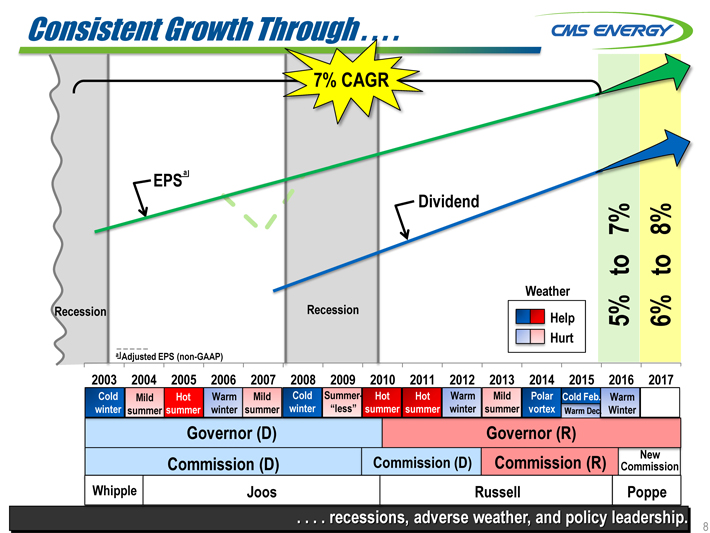

Consistent Growth Through . . . .

7% CAGR

EPSa DividendRecession Recession

a Adjusted EPS (non-GAAP)

Weather

Help

Hurt

5% to 7% 6% to 8%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Cold Feb.

Cold Mild Hot Warm Mild Cold Summer- Hot Hot Warm Mild Polar Cold Feb. Warm

winter summer summer winter summer winter “less” summer summer winter summer vortex Warm Dec. Winter

Governor (D) Governor (R)

Commission (D) Commission (D) Commission (R) Commission

Whipple Joos Russell Poppe

recessions, adverse weather, and policy leadership.

New 8

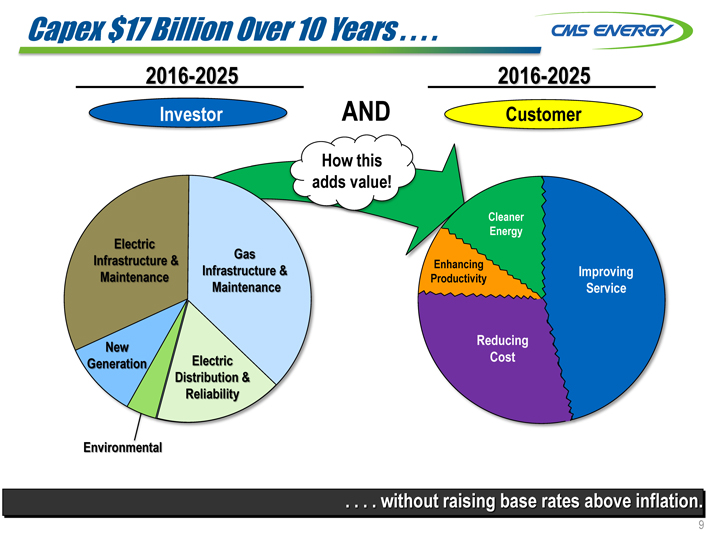

Capex $17 Billion Over 10 Years . . . .

2016-2025 2016-2025

Investor AND Customer

How this adds value!

Cleaner Energy

Electric

Gas

Infrastructure & Enhancing

Infrastructure & Improving

Maintenance Productivity

Maintenance Service

Reducing

New

Electric Cost Generation Distribution & Reliability

Environmental

. . . . without raising base rates above inflation.

9

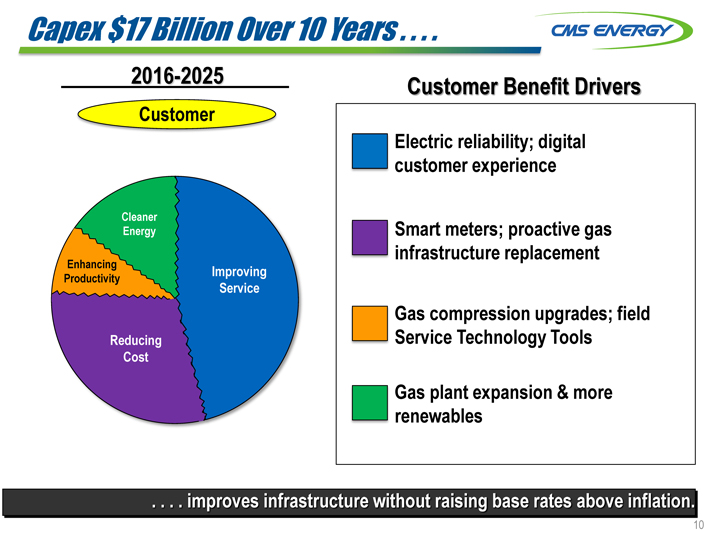

Capex $17 Billion Over 10 Years . . . .

2016-2025

Customer

Cleaner Energy

Enhancing

Improving

Productivity

Service

Reducing

Cost

Customer Benefit Drivers

Electric reliability; digital customer experience

Smart meters; proactive gas infrastructure replacement

Gas compression upgrades; field Service Technology Tools

Gas plant expansion & more renewables

. .. . . improves infrastructure without raising base rates above inflation.

10

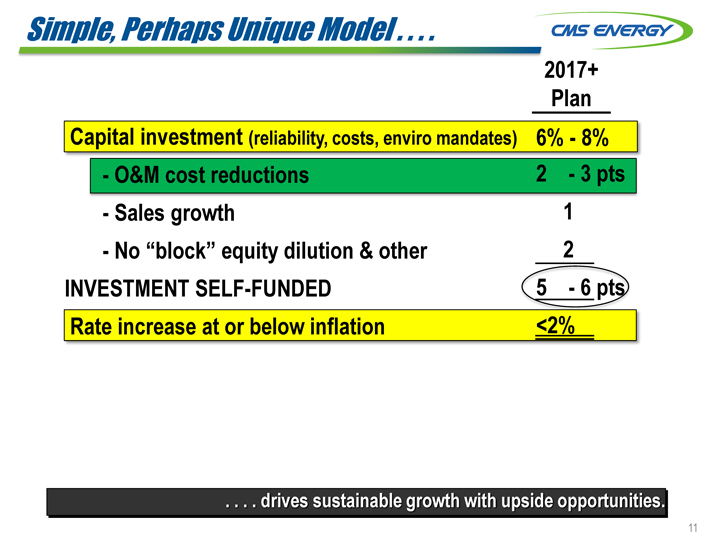

Simple, Perhaps Unique Model

2017+

Plan

Capital investment (reliability, costs, enviro mandates) 6%—8%

- O&M cost reductions 2—3 pts

- Sales growth 1

- No “block” equity dilution & other 2

INVESTMENT SELF-FUNDED 5—6 pts

Rate increase at or below inflation <2%

drives sustainable growth with upside opportunities.

11

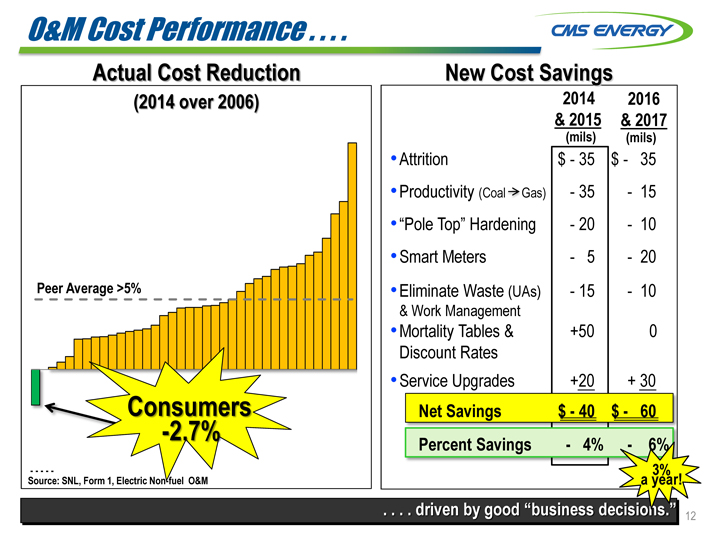

O&M Cost Performance . . . .

Actual Cost Reduction

(2014 over 2006)

Peer Average >5%

Consumers -2.7%

Source: — —— SNL, Form 1, Electric Non-fuel O&M

New Cost Savings

2014 2016

& 2015 & 2017

(mils) (mils)

Attrition $—35 $—35

Productivity (Coal Gas)—35 —15

“Pole Top” Hardening—20 —10

Smart Meters —5 —20

Eliminate Waste (UAs)—15 —10

& Work Management

Mortality Tables & +50 0

Discount Rates

Service Upgrades +20 + 30

Net Savings $—40 $—60

Percent Savings—4% —6%

3%

a year!

driven by good “business decisions.”

12

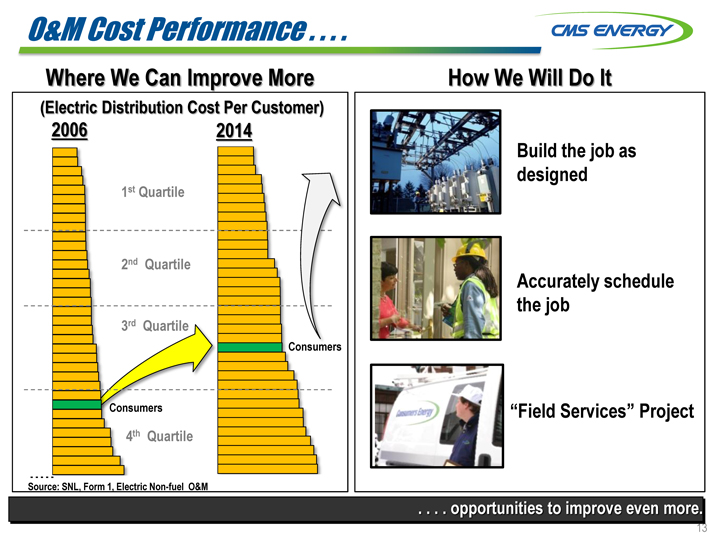

O&M Cost Performance . . . .

Where We Can Improve More

(Electric Distribution Cost Per Customer)

2006 2014

1st Quartile

2nd Quartile

3rd Quartile

4th Quartile

Consumers Consumers Source: — —— SNL, Form 1, Electric Non-fuel O&M

How We Will Do It

Build the job as designed

Accurately schedule the job

“Field Services” Project

. . . . opportunities to improve even more.

13

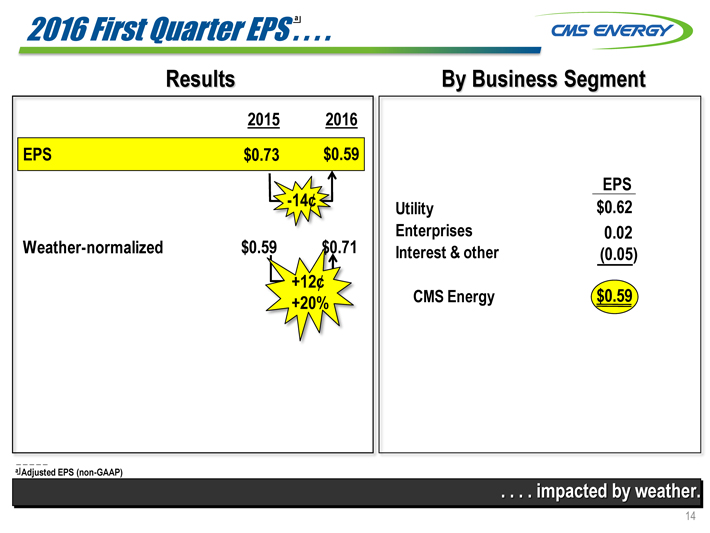

2016 First Quarter EPS . a . .

Results

2015 2016 EPS $0.73 $0.59

-14¢

Weather-normalized $0.59 $0.71

+12¢ +20%

a Adjusted EPS (non-GAAP)

By Business Segment

EPS

$0.62

0.02 (0.05)

$0.59

. . . . impacted by weather.

Utility Enterprises Interest & other

CMS Energy14

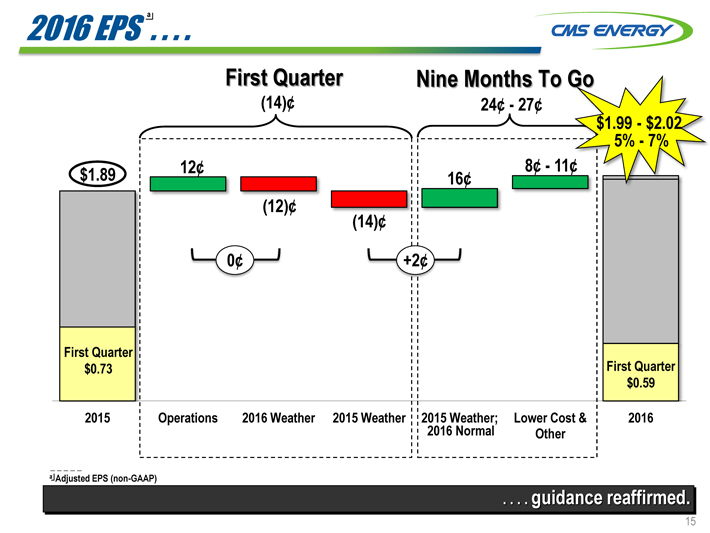

2016 EPS a .. . . .

First Quarter Nine Months To Go

| (14)¢ |

|

24¢—27¢ |

$1.99—$2.02

5%—7% 12¢ 8¢—11¢

$1.89 16¢ (12)¢ (14)¢

0¢ +2¢

First Quarter

$0.73 First Quarter

$0.59

2015 Operations 2016 Weather 2015 Weather 2015 2016 Weather; Normal Lower Cost & 2016 Other

a Adjusted EPS (non-GAAP)

. . . . guidance reaffirmed.

15

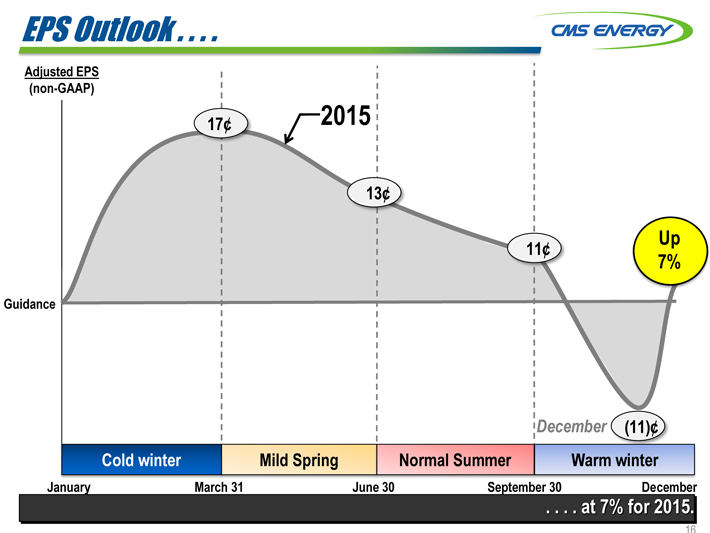

EPS Outlook . . . .

Adjusted EPS (non-GAAP)

17¢ 2015

13¢

Up

11¢

7%

Guidance

December (11)¢

Cold winter Mild Spring Normal Summer Warm winter

January March 31 June 30 September 30 December

. . . . at 7% for 2015.

16

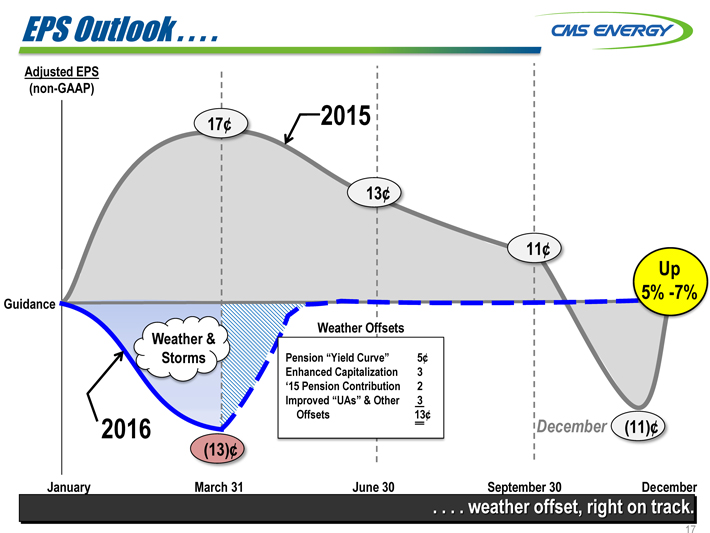

EPS Outlook . . . .

Adjusted EPS (non-GAAP)

17¢ 2015

13¢

11¢

Up

5% -7%

Guidance

Weather Offsets

Weather &

Storms Pension “Yield Curve” 5¢

Enhanced Capitalization 3

‘15 Pension Contribution 2 Improved “UAs” & Other 3 Offsets 13¢

2016 December (11)¢

| (13)¢ |

|

January March 31 June 30 September 30 December

. . . . weather offset, right on track.

17

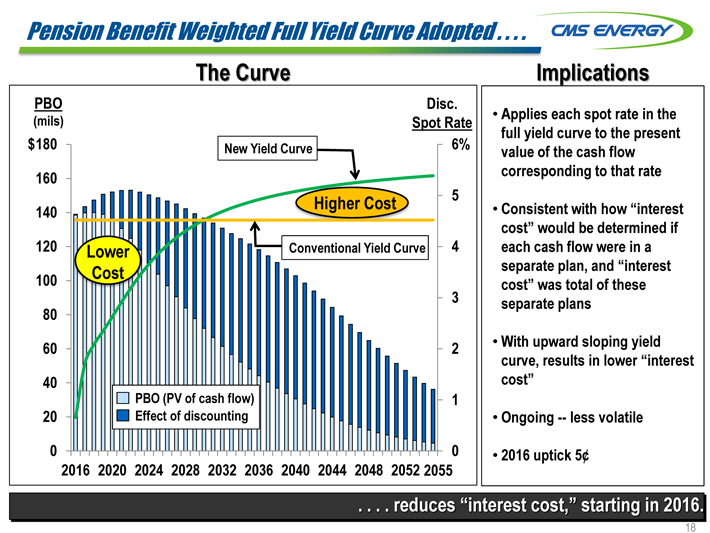

Pension Benefit Weighted Full Yield Curve Adopted . . . .

The Curve

PBO Disc. (mils) Spot Rate $ 180 6%

New Yield Curve

160

Higher Cost

140

120 Lower Conventional Yield Curve

100 Cost

80

60

40

PBO (PV of cash flow)

20 Effect of discounting

0

2016 2020 2024 2028 2032 2036 2040 2044 2048 2052 2055

5 4 3 2 1 0

Implications

Applies each spot rate in the full yield curve to the present value of the cash flow corresponding to that rate

Consistent with how “interest cost” would be determined if each cash flow were in a separate plan, and “interest cost” was total of these separate plans

With upward sloping yield curve, results in lower “interest cost”

Ongoing — less volatile

2016 uptick 5¢

. . . . reduces “interest cost,” starting in 2016.

18

Managing Work Every Year . . . .

Adjusted 2011 2012 2013 2014 2015

EPS $2.10

Mild 2.00 +17¢ Summer

+7%

1.90 +18¢

1.80 Offsets

Ice Storm -13¢

+7% Reinvestment

old RECORD

Cost WARM 1.70 Winter Savings +13¢ +7¢ +7% Reinvestment 1.60 Hot Mild Vortex Winter Summer +7% -9¢ 1.50 +1¢ old Reinvestment 2013 – 2015 Winter ICE

+7% Reinvestment Customer Reinvestment =

Hot STORM

1.40 Summer $238 million

Storms

-13¢

. . . . maximizes benefits for customers AND investors.

19

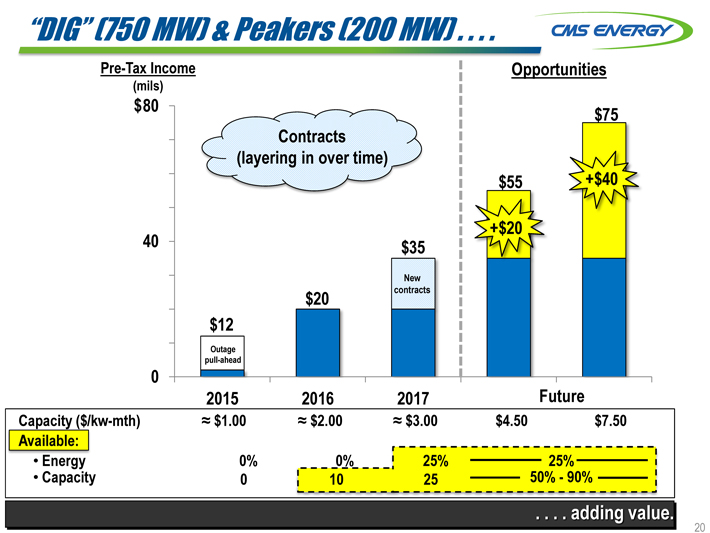

“DIG” (750 MW) & Peakers (200 MW)

Pre-Tax Income Opportunities

(mils)

$ 80 $75

Contracts

(layering in over time)

$55 +$40

+$20

40 $35

New

$20 contracts

$12

Outage

pull-ahead

0

2015 2016 2017 Future

Capacity ($/kw-mth) $1.00 $2.00 $3.00 $4.50 $ 7.50

Available:

Energy 0% 0% 25% 25%

Capacity 0 10 25 50%—90%

adding value.

20

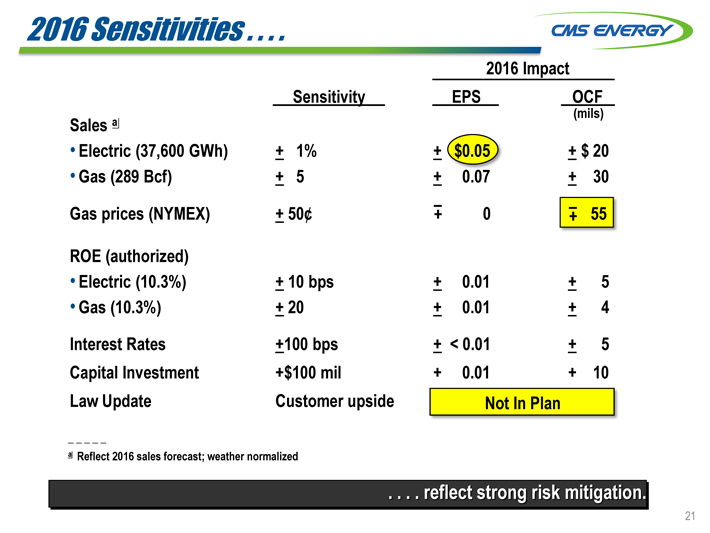

2016 Sensitivities

2016 Impact

Sensitivity EPS OCF

(mils)

Sales a

Electric (37,600 GWh) + 1% + $0.05 + $ 20

Gas (289 Bcf) + 5 + 0.07 + 30

Gas prices (NYMEX) + 50¢ + – 0 + – 55

ROE (authorized)

Electric (10.3%) + 10 bps + 0.01 + 5

Gas (10.3%) + 20 + 0.01 + 4

Interest Rates +100 bps + < 0.01 + 5

Capital Investment +$100 mil + 0.01 + 10

_ Law Update Customer upside Not In Plan

a Reflect 2016 sales forecast; weather normalized

reflect strong risk mitigation.

21

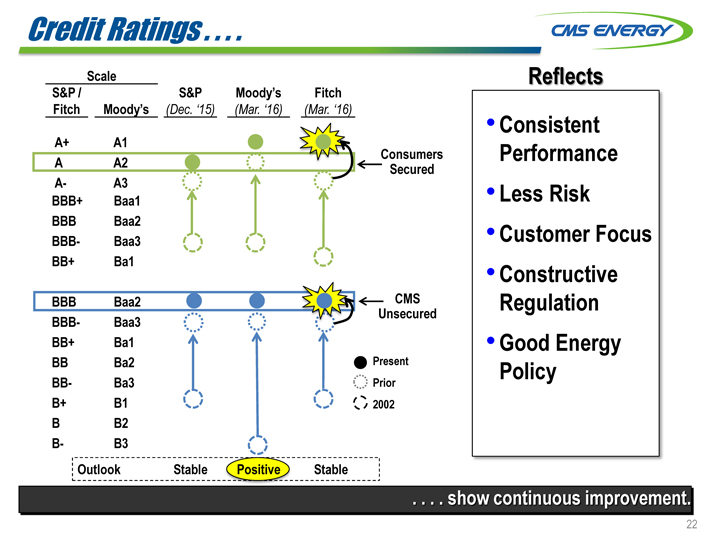

Credit Ratings . . . .

Scale Reflects

S&P / S&P Moody’s Fitch

Fitch Moody’s (Dec. ‘15) (Mar. ‘16) (Mar. ‘16)

Consistent

A+ A1

Consumers Performance

A A2 Secured

A- A3 • Less Risk BBB+ Baa1

BBB Baa2

BBB- Baa3 • Customer Focus

BB+ Ba1 •

Constructive

BBB Baa2 CMS Regulation

Unsecured BBB- Baa3

BB+ Ba1 Good Energy

BB Ba2 Present Policy BB- Ba3 Prior B+ B1 2002

B B2

B- B3

Outlook Stable Positive Stable

. . . . show continuous improvement.

22

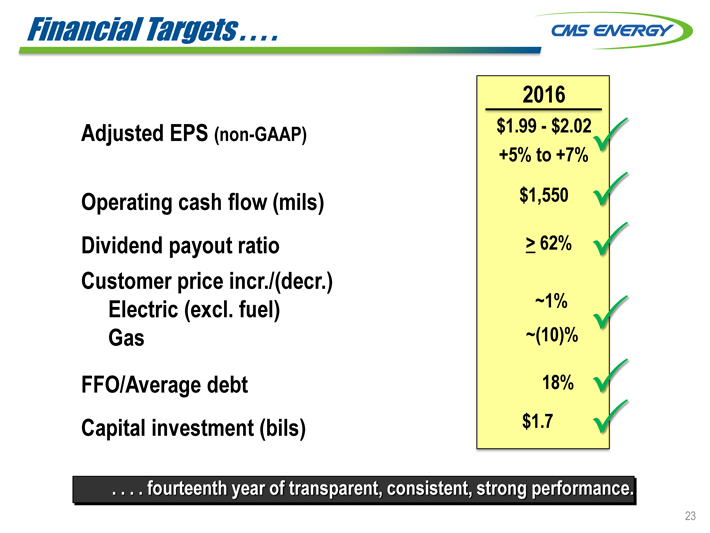

Financial Targets . . . .

Adjusted EPS (non-GAAP)

Operating cash flow (mils) Dividend payout ratio Customer price incr./(decr.) Electric (excl. fuel) Gas

FFO/Average debt Capital investment (bils)

2.02 +7% 62% 18% 2016

$1.99—$ +5% to $1,550

>

~1% ~(10)%

$1.7

. . . . fourteenth year of transparent, consistent, strong performance.

23

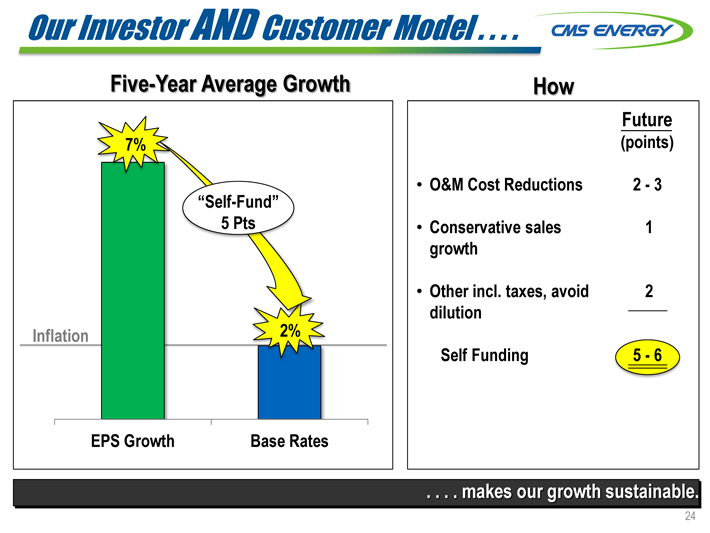

Our Investor AND Customer Model . . . .

Five-Year Average Growth

7%

“Self-Fund”

5 Pts Inflation 2% EPS Growth Base Rates

How

Future

(points)

O&M Cost Reductions 2—3

Conservative sales 1 growth

Other incl. taxes, avoid 2 dilution

Self Funding 5—6

. . . . makes our growth sustainable.

24

Q & A

Appendix

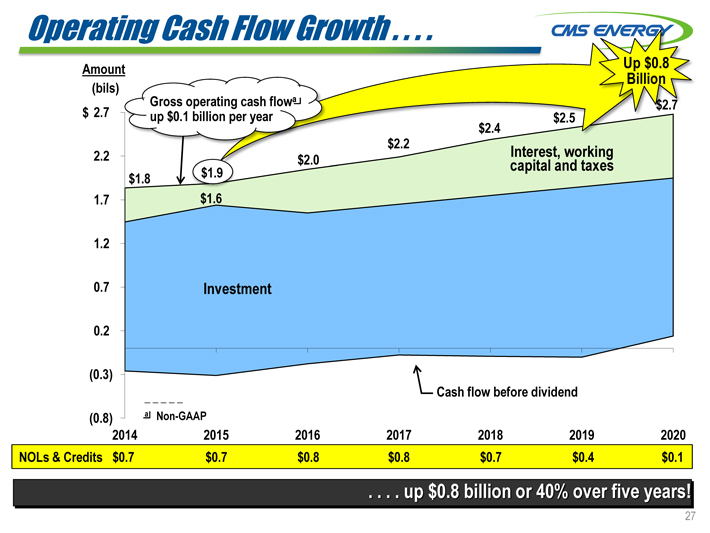

Operating Cash Flow Growth

Amount Up $0.8

(bils) Billion

Gross operating cash flowa

$ 2.7 up $0.1 billion per year $2.5

2.2

$1.8 $1.9

1.7 $1.6

1.2

0.7 Investment

0.2

(0.3)

Cash flow before dividend

(0.8) a Non-GAAP

2014 2015 2016 2017 2018 2019 2020

NOLs & Credits $0.7 $0.7 $0.8 $0.8 $0.7 $0.4 $0.1

up $0.8 billion or 40% over five years!

Interest, working capital and taxes

$2.0 $2.2 $2.4 $2.7 27

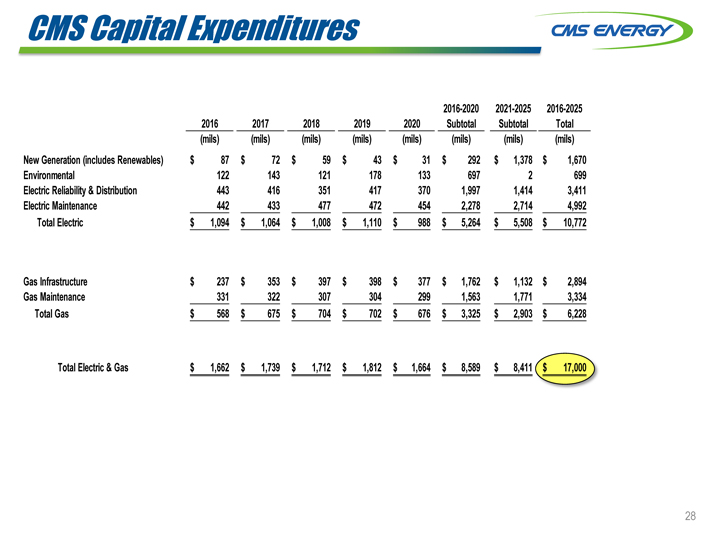

CMS Capital Expenditures

2016-2020 2021-2025 2016-2025

2016 2017 2018 2019 2020 Subtotal Subtotal Total

(mils) (mils) (mils) (mils) (mils) (mils) (mils) (mils)

New Generation (includes Renewables) $ 87 $ 72 $ 59 $ 43 $ 31 $ 292 $ 1,378 $ 1,670

Environmental 122 143 121 178 133 697 2 699

Electric Reliability & Distribution 443 416 351 417 370 1,997 1,414 3,411

Electric Maintenance 442 433 477 472 454 2,278 2,714 4,992

Total Electric $ 1,094 $ 1,064 $ 1,008 $ 1,110 $ 988 $ 5,264 $ 5,508 $ 10,772

Gas Infrastructure $ 237 $ 353 $ 397 $ 398 $ 377 $ 1,762 $ 1,132 $ 2,894

Gas Maintenance 331 322 307 304 299 1,563 1,771 3,334

Total Gas $ 568 $ 675 $ 704 $ 702 $ 676 $ 3,325 $ 2,903 $ 6,228

Total Electric & Gas $ 1,662 $ 1,739 $ 1,712 $ 1,812 $ 1,664 $ 8,589 $ 8,411 $ 17,000

28

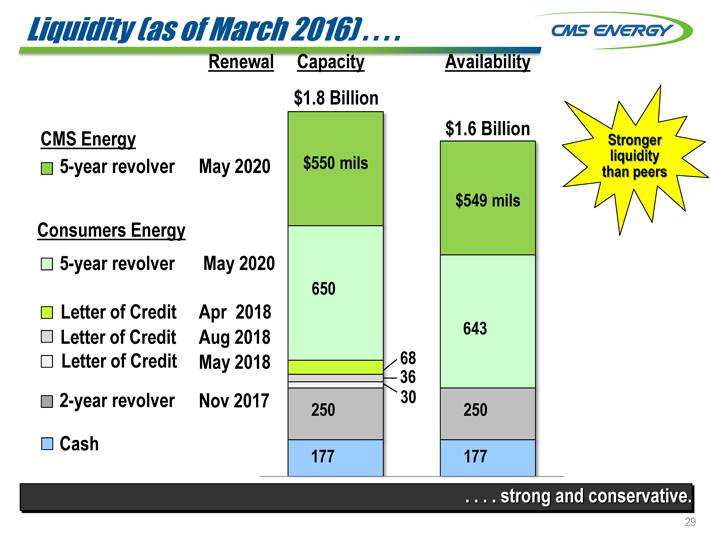

Liquidity (as of March 2016) . . . .

Renewal Capacity Availability

CMS Energy

5-year revolver May 2020

Consumers Energy

5-year revolver May 2020

Letter of Credit Apr 2018 Letter of Credit Aug 2018 Letter of Credit May 2018

2-year revolver Nov 2017 Cash

$1.8 Billion

$1.6 Billion

Stronger $550 mils liquidity than peers

$549 mils

650

643 68

36 30

250 250

177 177

. . . . strong and conservative.

29

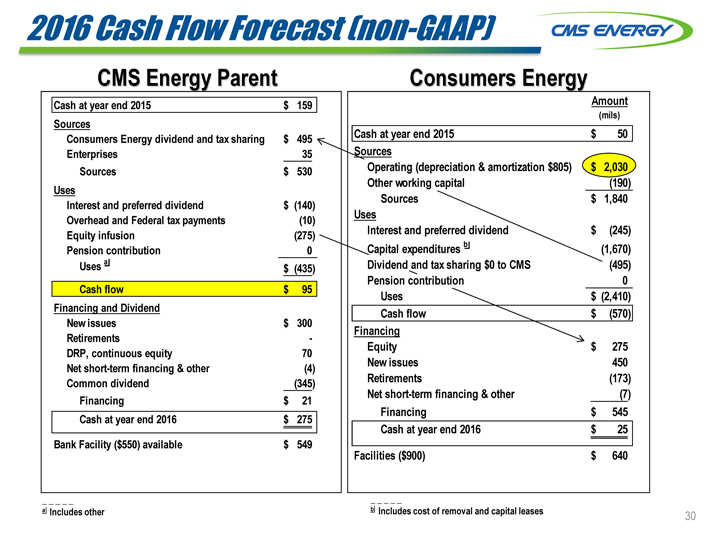

2016 Cash Flow Forecast (non-GAAP)

CMS Energy Parent

Cash at year end 2015 $ 159

Sources

Consumers Energy dividend and tax sharing $ 495

Enterprises 35

Sources $ 530

Uses

Interest and preferred dividend $ (140)

Overhead and Federal tax payments (10)

Equity infusion (275)

Pension contribution 0

Uses a $ (435)

Cash flow $ 95

Financing and Dividend

New issues $ 300

Retirements -

DRP, continuous equity 70

Net short-term financing & other (4)

Common dividend (345)

Financing $ 21

Cash at year end 2016 $ 275

Bank Facility ($550) available $ 549

a Includes other

Consumers Energy

Amount

(mils)

Cash at year end 2015 $ 50

Sources

Operating (depreciation & amortization $805) $ 2,030

Other working capital (190)

Sources $ 1,840

Uses

Interest and preferred dividend $ (245)

Capital expenditures b (1,670)

Dividend and tax sharing $0 to CMS (495)

Pension contribution 0

Uses $ (2,410)

Cash flow $ (570)

Financing

Equity $ 275

New issues 450

Retirements (173)

Net short-term financing & other (7)

Financing $ 545

Cash at year end 2016 $ 25

Facilities ($900) $ 640

b Includes cost of removal and capital leases 30

GAAP Reconciliation

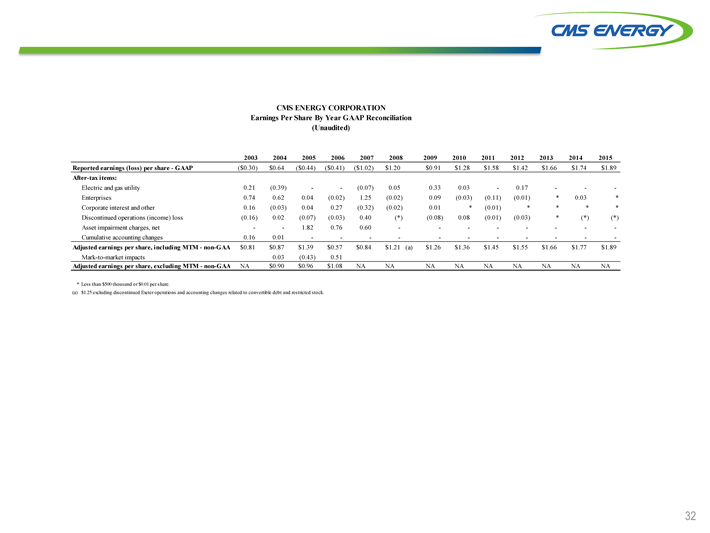

CMS ENERGY CORPORATION

Earnings Per Share By Year GAAP Reconciliation

(Unaudited)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Reported earnings (loss) per share—GAAP ($0.30) $0.64 ($0.44) ($0.41) ($1.02) $1.20 $0.91 $1.28 $1.58 $1.42 $1.66 $1.74 $1.89

After-tax items:

Electric and gas utility 0.21 (0.39) — (0.07) 0.05 0.33 0.03—0.17 ——

Enterprises 0.74 0.62 0.04 (0.02) 1.25 (0.02) 0.09 (0.03) (0.11) (0.01) * 0.03 *

Corporate interest and other 0.16 (0.03) 0.04 0.27 (0.32) (0.02) 0.01 * (0.01) * * * *

Discontinued operations (income) loss (0.16) 0.02 (0.07) (0.03) 0.40 (*) (0.08) 0.08 (0.01) (0.03) * (*) (*)

Asset impairment charges, net — 1.82 0.76 0.60 — — — —

Cumulative accounting changes 0.16 0.01 — — — — ——

Adjusted earnings per share, including MTM—non-GAA $0.81 $0.87 $1.39 $0.57 $0.84 $1.21 (a) $1.26 $1.36 $1.45 $1.55 $1.66 $1.77 $1.89

Mark-to-market impacts 0.03 (0.43) 0.51

Adjusted earnings per share, excluding MTM—non-GAA NA $0.90 $0.96 $1.08 NA NA NA NA NA NA NA NA NA

* Less than $500 thousand or $0.01 per share.

(a) $1.25 excluding discontinued Exeter operations and accounting changes related to convertible debt and restricted stock.

32

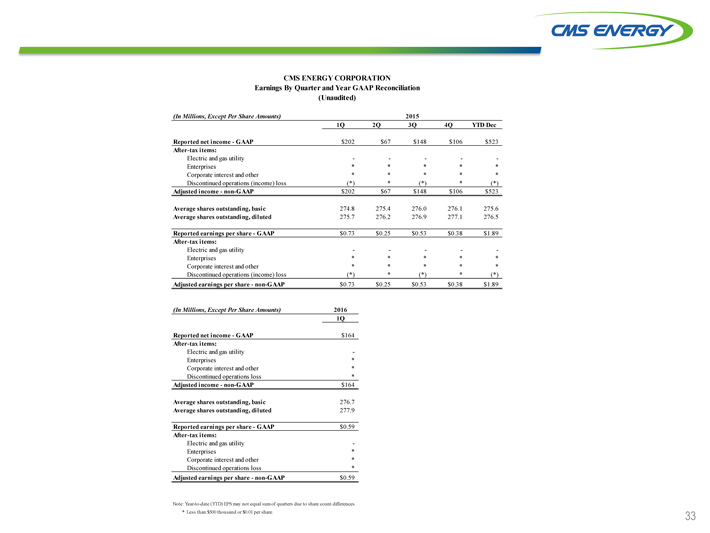

CMS ENERGY CORPORATION

Earnings By Quarter and Year GAAP Reconciliation

(Unaudited)

(In Millions, Except Per Share Amounts) 2015

1Q 2Q 3Q 4Q YTD Dec

Reported net income—GAAP $202 $67 $148 $106 $523

After-tax items:

Electric and gas utility — ——

Enterprises * * * * *

Corporate interest and other * * * * *

Discontinued operations (income) loss (*) * (*) * (*)

Adjusted income—non-GAAP $202 $67 $148 $106 $523

Average shares outstanding, basic 274.8 275.4 276.0 276.1 275.6

Average shares outstanding, diluted 275.7 276.2 276.9 277.1 276.5

Reported earnings per share—GAAP $0.73 $0.25 $0.53 $0.38 $1.89

After-tax items:

Electric and gas utility — ——

Enterprises * * * * *

Corporate interest and other * * * * *

Discontinued operations (income) loss (*) * (*) * (*)

Adjusted earnings per share—non-GAAP $0.73 $0.25 $0.53 $0.38 $1.89

(In Millions, Except Per Share Amounts) 2016

1Q

Reported net income—GAAP $164

After-tax items:

Electric and gas utility—

Enterprises *

Corporate interest and other *

Discontinued operations loss *

Adjusted income—non-GAAP $164

Average shares outstanding, basic 276.7

Average shares outstanding, diluted 277.9

Reported earnings per share—GAAP $0.59

After-tax items:

Electric and gas utility—

Enterprises *

Corporate interest and other *

Discontinued operations loss *

Adjusted earnings per share—non-GAAP $0.59

Note: Year-to-date (YTD) EPS may not equal sum of quarters due to share count differences.

* Less than $500 thousand or $0.01 per share. 33

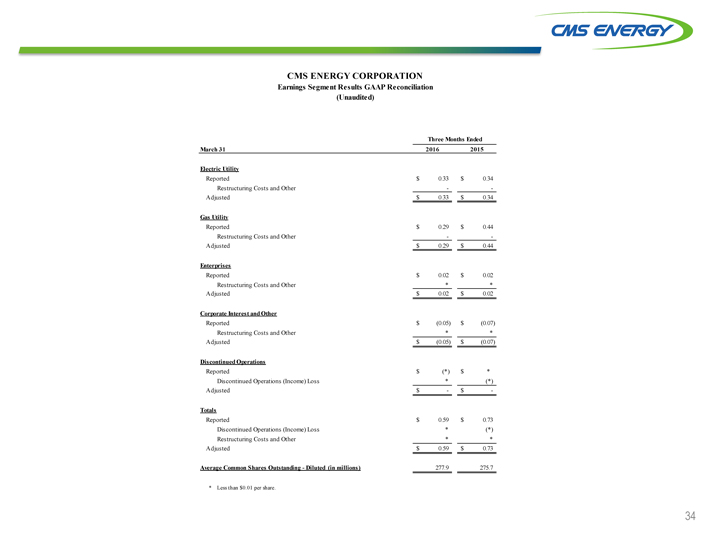

CMS ENERGY CORPORATION

Earnings Segment Results GAAP Reconciliation

(Unaudited)

Three Months Ended

March 31 2016 2015

Electric Utility

Reported $ 0.33 $ 0.34

Restructuring Costs and Other ——

Adjusted $ 0.33 $ 0.34

Gas Utility

Reported $ 0.29 $ 0.44

Restructuring Costs and Other ——

Adjusted $ 0.29 $ 0.44

Enterprises

Reported $ 0.02 $ 0.02

Restructuring Costs and Other * *

Adjusted $ 0.02 $ 0.02

Corporate Interest and Other

Reported $ (0.05) $ (0.07)

Restructuring Costs and Other * *

Adjusted $ (0.05) $ (0.07)

Discontinued Operations

Reported $ (*) $ *

Discontinued Operations (Income) Loss * (*)

Adjusted $—$—

Totals

Reported $ 0.59 $ 0.73

Discontinued Operations (Income) Loss * (*)

Restructuring Costs and Other * *

Adjusted $ 0.59 $ 0.73

Average Common Shares Outstanding—Diluted (in millions) 277.9 275.7

* Less than $0.01 per share.

34

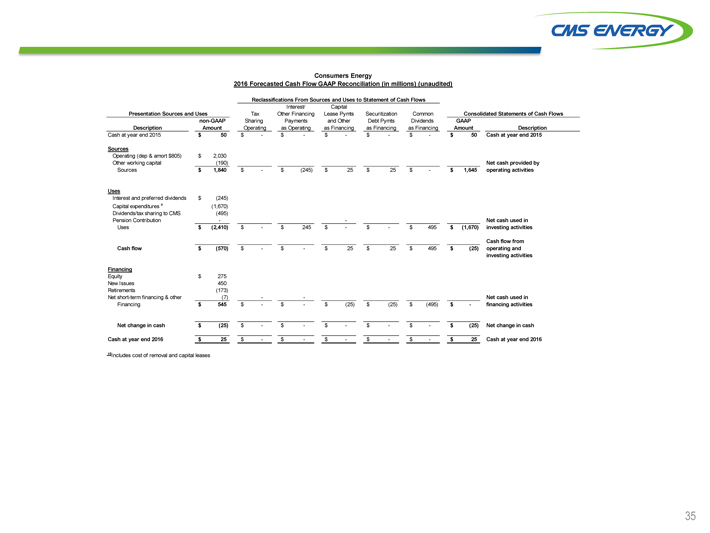

Consumers Energy

2016 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Interest/ Capital

Presentation Sources and Uses Tax Other Financing Lease Pymts Securitization Common Consolidated Statements of Cash Flows

non-GAAP Sharing Payments and Other Debt Pymts Dividends GAAP

Description Amount Operating as Operating as Financing as Financing as Financing Amount Description

Cash at year end 2015 $ 50 $—$—$—$—$—$ 50 Cash at year end 2015

Sources

Operating (dep & amort $805) $ 2,030

Other working capital (190) Net cash provided by

Sources $ 1,840 $—$ (245) $ 25 $ 25 $—$ 1,645 operating activities

Uses

Interest and preferred dividends $ (245)

Capital expenditures a (1,670)

Dividends/tax sharing to CMS (495)

Pension Contribution — — Net cash used in

Uses $ (2,410) $—$ 245 $—$—$ 495 $ (1,670) investing activities

Cash flow from

Cash flow $ (570) $—$—$ 25 $ 25 $ 495 $ (25) operating and

investing activities

Financing

Equity $ 275

New Issues 450

Retirements (173)

Net short-term financing & other (7) —— Net cash used in

Financing $ 545 $—$—$ (25) $ (25) $ (495) $—financing activities

Net change in cash $ (25) $—$—$—$—$—$ (25) Net change in cash

Cash at year end 2016 $ 25 $—$—$—$—$—$ 25 Cash at year end 2016

a Includes cost of removal and capital leases

35

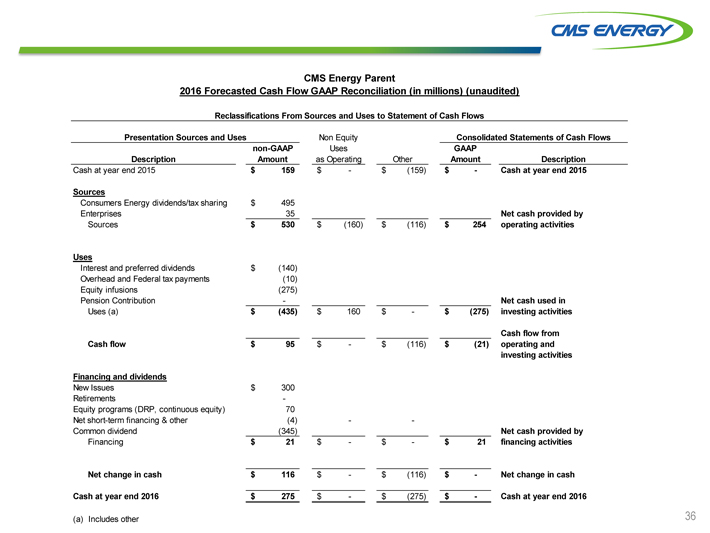

CMS Energy Parent

2016 Forecasted Cash Flow GAAP Reconciliation (in millions) (unaudited)

Reclassifications From Sources and Uses to Statement of Cash Flows

Presentation Sources and Uses Non Equity Consolidated Statements of Cash Flows

non-GAAP Uses GAAP

Description Amount as Operating Other Amount Description

Cash at year end 2015 $ 159 $—$ (159) $—Cash at year end 2015

Sources

Consumers Energy dividends/tax sharing $ 495

Enterprises 35 Net cash provided by

Sources $ 530 $ (160) $ (116) $ 254 operating activities

Uses

Interest and preferred dividends $ (140)

Overhead and Federal tax payments (10)

Equity infusions (275)

Pension Contribution — Net cash used in

Uses (a) $ (435) $ 160 $—$ (275) investing activities

Cash flow from

Cash flow $ 95 $—$ (116) $ (21) operating and

investing activities

Financing and dividends

New Issues $ 300

Retirements —

Equity programs (DRP, continuous equity) 70

Net short-term financing & other (4) ——

Common dividend (345) Net cash provided by

Financing $ 21 $—$—$ 21 financing activities

Net change in cash $ 116 $—$ (116) $—Net change in cash

Cash at year end 2016 $ 275 $—$ (275) $—Cash at year end 2016

(a) Includes other 36

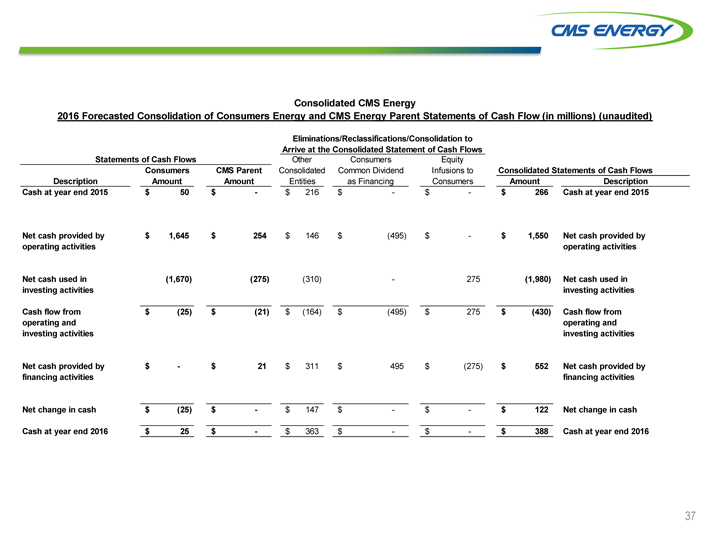

Consolidated CMS Energy

2016 Forecasted Consolidation of Consumers Energy and CMS Energy Parent Statements of Cash Flow (in millions) (unaudited)

Eliminations/Reclassifications/Consolidation to

Arrive at the Consolidated Statement of Cash Flows

Statements of Cash Flows Other Consumers Equity

Consumers CMS Parent Consolidated Common Dividend Infusions to Consolidated Statements of Cash Flows

Description Amount Amount Entities as Financing Consumers Amount Description

Cash at year end 2015 $ 50 $—$ 216 $—$—$ 266 Cash at year end 2015

Net cash provided by $ 1,645 $ 254 $ 146 $ (495) $—$ 1,550 Net cash provided by

operating activities operating activities

Net cash used in (1,670) (275) (310) — 275 (1,980) Net cash used in

investing activities investing activities

Cash flow from $ (25) $ (21) $ (164) $ (495) $ 275 $ (430) Cash flow from

operating and operating and

investing activities investing activities

Net cash provided by $—$ 21 $ 311 $ 495 $ (275) $ 552 Net cash provided by

financing activities financing activities

Net change in cash $ (25) $—$ 147 $—$—$ 122 Net change in cash

Cash at year end 2016 $ 25 $—$ 363 $—$—$ 388 Cash at year end 2016

37

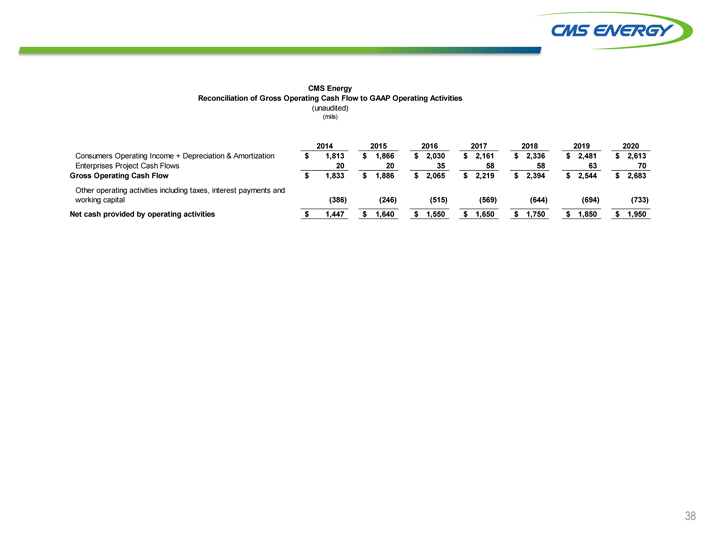

CMS Energy

Reconciliation of Gross Operating Cash Flow to GAAP Operating Activities

(unaudited)

(mils)

2014 2015 2016 2017 2018 2019 2020

Consumers Operating Income + Depreciation & Amortization $ 1,813 $ 1,866 $ 2,030 $ 2,161 $ 2,336 $ 2,481 $ 2,613

Enterprises Project Cash Flows 20 20 35 58 58 63 70

Gross Operating Cash Flow $ 1,833 $ 1,886 $ 2,065 $ 2,219 $ 2,394 $ 2,544 $ 2,683

Other operating activities including taxes, interest payments and

working capital (386) (246) (515) (569) (644) (694) (733)

Net cash provided by operating activities $ 1,447 $ 1,640 $ 1,550 $ 1,650 $ 1,750 $ 1,850 $ 1,950

38

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CMS Energy (CMS) PT Raised to $66 at KeyBanc

- CMS Energy (CMS) PT Raised to $57 at Morgan Stanley

- Crypto Hub Announces Partnership with Areon Network, Becoming the First Official Areon Launchpad

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share