Form 8-K CLEARSIGN COMBUSTION For: Jun 28

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 28, 2016

CLEARSIGN COMBUSTION CORPORATION

(Exact name of registrant as specified in Charter)

| Washington | 001-35521 | 26-2056298 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (IRS Employee Identification No.) |

12870 Interurban Avenue South

Seattle, Washington 98168

(Address of Principal Executive Offices)

206-673-4848

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below).

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act (17 CFR 240.13(e)-4(c))

Item 7.01 Regulation FD Disclosure.

ClearSign Combustion Corporation’s Chief Financial Officer, James N. Harmon, will give a presentation to investors on June 28, 2016. A copy of the slide presentation he will use is furnished as Exhibit 99.1 to this Report, and is incorporated herein by this reference.

The information furnished herewith pursuant to Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Slide presentation dated June 28, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: June 28, 2016 | CLEARSIGN COMBUSTION CORPORATION | ||

| By: | /s/ James N. Harmon | ||

| James N. Harmon Chief Financial Officer |

|||

EXHIBIT INDEX

| Exhibit No. | Name of Exhibit |

| 99.1 | Slide presentation dated June 28, 2016 |

Exhibit 99.1

ClearSign The Future of Combustion NASDAQ: CLIR June, 2016

Important Cautions Regarding Forward - looking Statements All statements in this presentation that are not statements of historical fact are forward - looking statements, including any projections of earnings, revenue, profit margin, cash or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements regarding expectations for success in our market of the products we develop, any statements concerning proposed new products, any statements regarding future economic conditions or performance, the size of market opportunities, statements of belief and any statements of assumptions underlying any of the foregoing. These statements are based on expectations, assumptions, judgments and analysis as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties associated with these forward looking statements made in association with this presentation include, but are not limited to, our limited capital resources and limited access to financing; any unexpected, significant increase in ClearSign’s monthly cash requirements; our ability to obtain financing as and when we need it; our ability to achieve profitability; our limited operating history; competition in our industry, including alternative products, technology and pricing; general economic conditions that may have a negative impact on our business; our ability to protect our intellectual property; the possible negative effects of declining oil prices; whether field testing of ClearSign’s products will be successful; whether ClearSign will be successful in expanding the market for its products, including by licensing its technology, and other risks that are described in ClearSign’s public periodic filings with the SEC, including the discussion in the risk factors section of the 2015 annual report on Form 10 - K. Investors or potential investors should read these risks. ClearSign Combustion Corporation assumes no obligation to update these forward - looking statements to reflect future events or actual outcomes and does not intend to do so. 2

What is ClearSign Combustion (CLIR)? 3 • ClearSign designs, develops and markets technologies that aim to improve the key performance characteristics of combustion systems, including emission, operational performance, energy efficiency and overall cost effectiveness.

Transformational Technology 4 • ClearSign’s technology provides a fundamental improvement to a core energy process Energy Industry ClearSign’s Solutions

Global Energy Market: Combustion Systems • Combustion is a fundamental energy conversion process. • 2/3 of energy used in U.S. manufacturing is converted via boilers , furnaces and process heaters ¹ : our core market focus. • ClearSign’s technology provides a transformational improvement in combustion systems with respect to emissions and overall operating costs 5 1 U.S. Department of Energy, 2011

Market Drivers • Environmental Compliance : increasing regulation of NOx and other pollutants across the U.S., Canada, Europe and China • Operational Efficiency : x Energy savings x Increased throughput x Reduced maintenance and downtime 6

CLIR: Investment Highlights 7 Duplex™ Technology Electrodynamic Combustion Control™ • Large addressable market • Transformational technology

CLIR: Investment Highlights • Large addressable market • Transformational technology • Strong intellectual property • Successful commercial - scale installations: customer - validated economics • “Asset - lite” model – license or subcontract • Proven leadership team with deep industry experience 7a

Target Market Segments 8 Once - Through Steam Generators (OTSGs) used for Enhanced Oil Recovery (EOR) in California Refinery Segment • Typical applications Start - up heater, fired reboiler, cracking furnace process heater, process heater vaporizer, crude oil heater reformer • Size range: 5 to 350 MMBtu/hr Enhanced Oil Recovery (EOR) Segment • Typical applications: Once through steam generators (OTSGs) used in thermal/steam injection in oilfields • Size range: 5 to +300 MMBtu/hr Large Industrial Segment • Typical applications: Non - refinery - based heater applications, includes large chemical, cement, pulp and paper, and metals • Size range: 5 to 250 MMBtu/hr ICI Boiler Segment • Typical applications: Area source boilers in institutional, commercial, and small industrial (ICI) boilers for steam and process heat • Size range: 5 to 350 MMBtu/hr Flare Segment • Typical applications: Combustion of excess hydrocarbons in oil and gas (O&G) other applications • Size range: 20 to 10,000 MMBtu/hr

U.S. Target Market for Duplex™ 9 ClearSign Duplex Technology in a California OTSG Refinery Segment • 10 yr Serviceable Available Market: • up to $826M ¹ Enhanced Oil Recovery (EOR) Segment • 10 yr Serviceable Available Market: • up to $124M ² Large Industrial Segment • 10 yr Serviceable Available Market: • up to $802M ¹ ICI Boiler Segment • 10 yr Serviceable Available Market: • up to $1,723M ¹ Flare Segment • 10 yr Serviceable Available Market: • up to $201M ¹ 10 Year U.S. Serviceable Available Market of up to $3.6 Billion ¹ Frost & Sullivan Market Assessment Report, June 2016 ² The EOR Segment includes Western Canada 10 yr SAM estimate by ClearSign of $45M as well as the U.S. market SAM of $79M determined by Frost & Sullivan Market Assessment Report, June 2016

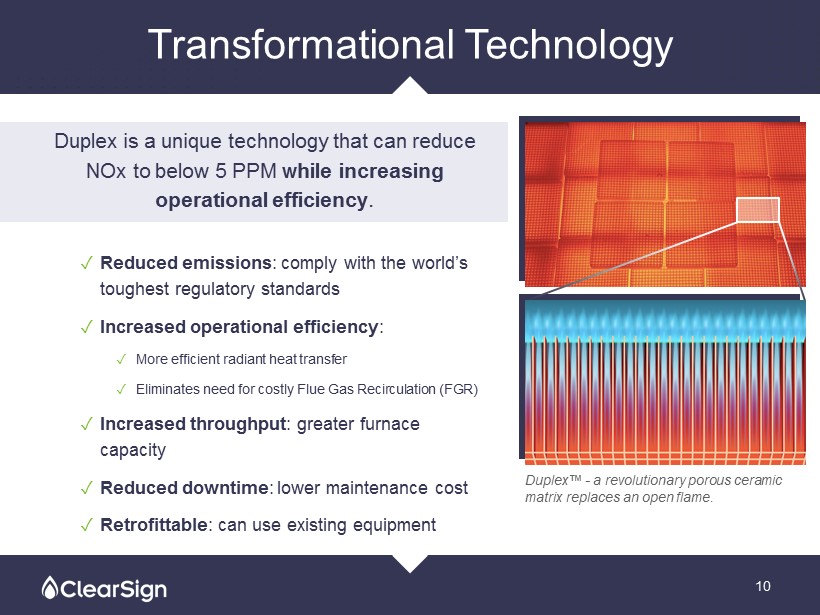

Transformational Technology 10 Duplex is a unique technology that can reduce NOx to below 5 PPM while increasing operational efficiency . ✓ Reduced emissions : comply with the world’s toughest regulatory standards ✓ Increased operational efficiency : ✓ More efficient radiant heat transfer ✓ Eliminates need for costly Flue Gas Recirculation (FGR) ✓ Increased throughput : greater furnace capacity ✓ Reduced downtime : lower maintenance cost ✓ Retrofittable : can use existing equipment Duplex™ - a revolutionary porous ceramic matrix replaces an open flame.

Duplex™ Technology 11

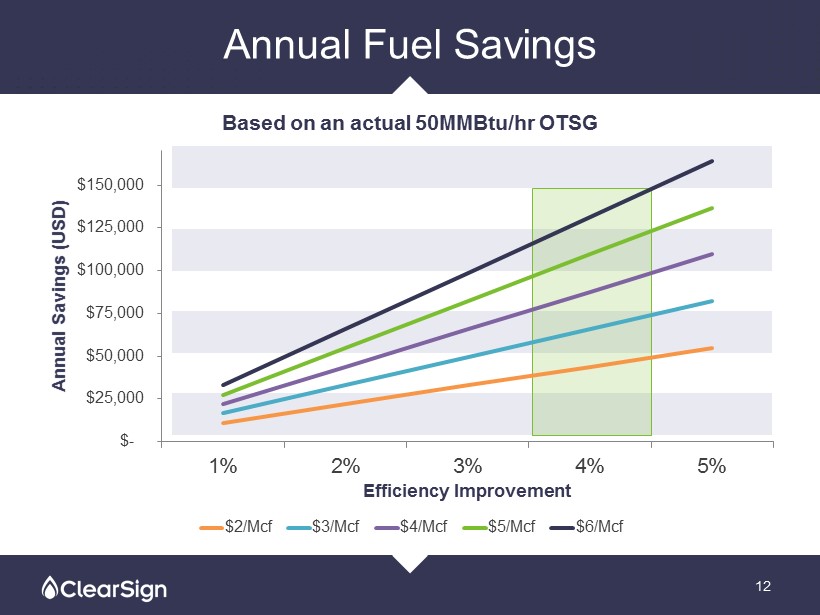

Annual Fuel Savings 12 $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 1% 2% 3% 4% 5% Annual Savings (USD) Efficiency Improvement Based on an actual 50MMBtu/hr OTSG $2/Mcf $3/Mcf $4/Mcf $5/Mcf $6/Mcf

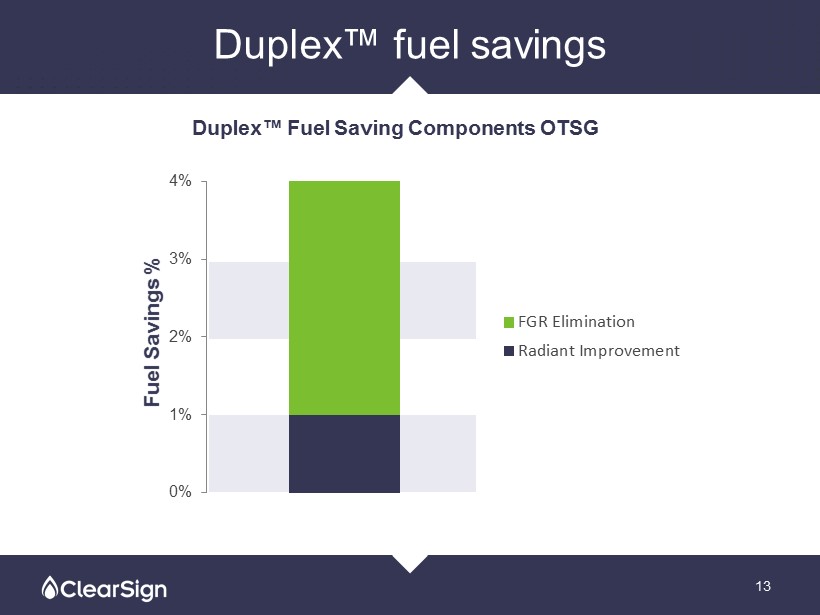

Duplex™ fuel savings 13 0% 1% 2% 3% 4% Fuel Savings % Duplex™ Fuel Saving Components OTSG FGR Elimination Radiant Improvement

Computer Controller Power Amplifier Combustion System ELECTRODES A high - voltage pulsed electrical field is introduced directly into the combustion region: x Improves efficiency x Reduces or eliminates pollution at the source x Suitable for a wide range of fuel types (solid, liquid, Gas) Electrodynamic Combustion Control™ + 10v + 40,000v 14

Strong Intellectual Property • We believe our technologies represent a greenfield opportunity • We believe we have complete freedom to practice • Patent portfolio is expanding rapidly 15 Duplex ™ May 2016 42 Patents Pending 1 Patent Granted or NOA ECC ™ May 2016 72 Patents Pending 12 Patents Granted or NOA

Commercialization Milestones Commercial pipeline - > ongoing deal flow Commercial acceptance as an industry game - changer Multiple installations build market confidence Field validation at commercial scale Lab - scale testing and proof of concept Research and experimentation 16 < - ECC Duplex - > 2015 2016 Inception - 2014 2017 2018

An “Asset - Lite” Business Model • Unique value proposition provides strong potential margins (> 50%) • “Asset – lite” minimum working capital and CapEx requirements • Simple, cost - effective designs • Designs allow subcontracting through existing regional partners trusted by customers • Patented technology can be licensed through existing channel participants: ✓ Major players become partners not competitors ✓ Sales accelerate through existing channel infrastructure 17

Go - to - Market Strategy • Flexible design meets customer needs, allowing immediate entry into the value chain • Well - suited to licensing of technology to existing channels • Or sub - contracting through established and proven value chain 18

Commercial Installations Eight customers in California, Texas and Alberta • Enhanced Oil Recovery : Oil Production (OTSG) Three producers with four OTSGs with max firing rates of: 1. 62.5 MMBtu/h & 85 MMBtu/h 2. 25 MMBtu/h 3. 250 MMBtu/hr • Refinery : Process Heat Two small refiners and two major national operators: 4. Asphalt refinery heater 5. Petrochemical refinery (diesel) 6. Refinery heater 7. Coker heater • Flare : Oil field enclosed flaring for a large Southern California oil producer 8. Enclosed Flare 19

Experienced Leadership Team Steve Pirnat Chief Executive Officer • CEO, John Zink, div. Koch Ind. • Managing Dir. EMEA, Quest Integrity Group Andrew Lee SVP Business Development • Chief Revenue Officer Adapx, Inc. • SVP Sales Microvision, Inc. Joe Colannino Chief Technology Officer • Head of R&D, IP, and Learning for John Zink and Coen Combustion Companies Jim Harmon Chief Financial Officer • CFO of Sabey Corporation • CPA at Price Waterhouse Roberto Ruiz, Ph.D. Chief Operating Officer • VP Commercial Development, John Zink • COO of Onquest, Inc. Donald Kendrick, Ph.D. SVP Technology • CTO, Lean Flame Inc. • Operations Manager, UTC (Pratt & Whitney) 20

CLIR: Key Takeaways 21 Petrochemical Refinery • Large addressable market • Transformational technology • Strong intellectual property • Successful commercial - scale installations: customer - validated economics • “Asset - lite” model – license or subcontract • Proven leadership team with deep industry experience

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ClearSign Technologies (CLIR) Appoints David Maley to its Board

- Sisecam’s $1.1 Billion Eurobond Issues Receive Over $3.5 Billion in Demand

- Penns Woods Bancorp, Inc. Reports First Quarter 2024 Earnings

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share