Form 8-K CHIMERA INVESTMENT CORP For: Nov 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

____________

FORM 8-K

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 10, 2016

CHIMERA INVESTMENT CORPORATION

(Exact name of registrant as specified in its charter)

(Exact name of registrant as specified in its charter)

Maryland | 1-33796 | 26-0630461 |

(State or Other Jursidiction | (Commission | (IRS Employer |

of Incorporation) | File Number) | Identification No.) |

520 Madison Avenue, 32nd Fl | |

New York, New York | 10022 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 626-2300

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

Chimera Investment Corporation (the “Company”) hereby furnishes the information set forth in the presentation (the “Presentation”) attached hereto as Exhibit 99.1, which is incorporated herein by reference.

The Presentation is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Presentation contains statements that, to the extent they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All such forward-looking statements are intended to be subject to the safe harbor protection provided by the Reform Act. Actual outcomes and results could differ materially from those forecast due to the impact of many factors beyond the control of the Company. All forward looking statements included in the Presentation are made only as of the date of the Presentation and are subject to change without notice. Certain factors that could cause actual results to differ materially from those contained in the forward-looking statements are included in the Company’s periodic reports filed with the SEC. Copies are available on the SEC’s website at www.sec.gov. The Company disclaims any obligation to update its forward looking statements unless required by law.

Item 9.01 Financial Statements and Exhibits

(d) | Exhibits |

99.1 | Presentation by the Company |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Chimera Investment Corporation

By: /s/ Rob Colligan

Name: Rob Colligan

Title: Chief Financial Officer

Date: November 10, 2016

INVESTOR

PRESENTATION

NYSE: CIM

3rd Quarter 2016

Information is unaudited, estimated and subject to change.

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the UnitedStates Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates andprojections and, consequently, readers should not rely on these forward-looking statements as predictions of future

events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that

could cause actual results to differ materially from expected results, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31, 2015, and any subsequent Quarterly Reports on Form

10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the

state of credit markets and general economic conditions; changes in interest rates and the market value of our assets;

the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and

timing of credit losses within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to

establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target

assets; our ability to borrow to finance our assets and the associated costs; changes in the competitive landscape within

our industry; our ability to manage various operational risks and costs associated with our business; interruptions in or

impairments to our communications and information technology systems; our ability to acquire residential mortgage

loans and successfully securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-

servicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the

foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our

business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to

maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status

under the Investment Company Act of 1940.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the

date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any

forward-looking statement to reflect any change in its expectations or any change in events, conditions or

circumstances on which any such statement is based. Additional information concerning these and other risk factors is

contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written

and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its

behalf are expressly qualified in their entirety by the cautionary statements above.

This presentation may include industry and market data obtained through research, surveys, and studies conducted by

third parties and industry publications. We have not independently verified any such market and industry data from

third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or

investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This

presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of

the terms of an offer that the parties or their respective affiliates would accept.

Readers are advised that the financial information in this presentation is based on company data available at the time of

this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

Information is unaudited, estimated and subject to change. 2

CHIMERA INVESTMENT CORPORATION

We develop and manage a portfolio of leveraged mortgage investments to produce an

attractive quarterly dividend for shareholders

Business Description: Hybrid Mortgage REIT

Inception: 2007

Total Capital: $3.0 Billion

Total Portfolio: $16.7 Billion

Overall Leverage Ratio: 4.4:1 ( 1.9:1 recourse leverage)

Stock Price/Dividend Yield: $15.95 / 12.04%

Chimera Announces Internalization of

Management Structure

* Aligns shareholder and management interests

* Increase transparency

* Full Transition Completed by December 31, 2015

* Committed to expense management

* Completed a common stock repurchase of $250

million

Corporate Developments

As of September 30, 2016

5,800,000 Shares

8.00% Series A Cumulative Redeemable Preferred

Stock (Liquidation Preference $25.00 Per Share)

The Board of Directors of Chimera raised the fourth quarter cash dividend

to $0.50 per common share, totaling a $1.94 regular dividend for 2016*

*Excludes $0.50 special dividend paid 3/31/2016

Information is unaudited, estimated and subject to change. 3

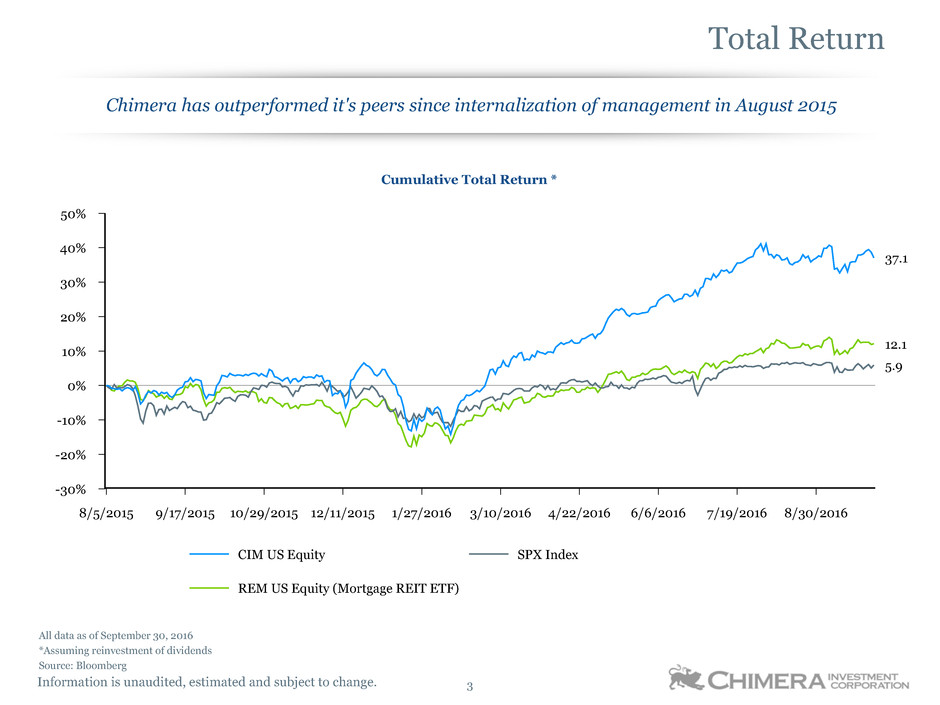

Total Return

Chimera has outperformed it's peers since internalization of management in August 2015

CIM US Equity SPX Index

REM US Equity (Mortgage REIT ETF)

Cumulative Total Return *

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

8/5/2015 9/17/2015 10/29/2015 12/11/2015 1/27/2016 3/10/2016 4/22/2016 6/6/2016 7/19/2016 8/30/2016

37.1

5.9

12.1

All data as of September 30, 2016

*Assuming reinvestment of dividends

Source: Bloomberg

Information is unaudited, estimated and subject to change. 4

PORTFOLIO COMPOSITION

Residential

Mortgage Credit

Portfolio

Agency MBS

Portfolio Total Portfolio

Gross Asset Yield: 7.6% 3.2% 6.5%

Financing Cost(2): 3.5% 1.4% 2.9%

Net Interest

Spread: 4.1% 1.8% 3.6%

Net Interest

Margin: 4.6% 1.9% 3.9%

Portfolio Yields and Spreads(1)

13

12

11

10

9

8

7

6

5

4

3

2

1

0

B

ill

io

ns

$2.5

$0.6

$2.4

$3.4

$7.6

Non-Recourse

(Securitization)

Recourse (Repo)

Recourse (Repo)

Equity

Equity

Agency MBS Portfolio

Total Assets: 4.4 billion(1)

Residential Mortgage

Credit Portfolio

Total Assets: 12.3 billion(1)

81% of Chimera's equity capital is allocated to mortgage credit

All data as of September 30, 2016

(1) Reflects third quarter 2016 average assets, yields, and spreads

(2) Includes the interest incurred on interest rate swaps

All data as of September 30, 2016

(1) Financing excludes unsettled trades

Information is unaudited, estimated and subject to change. 5

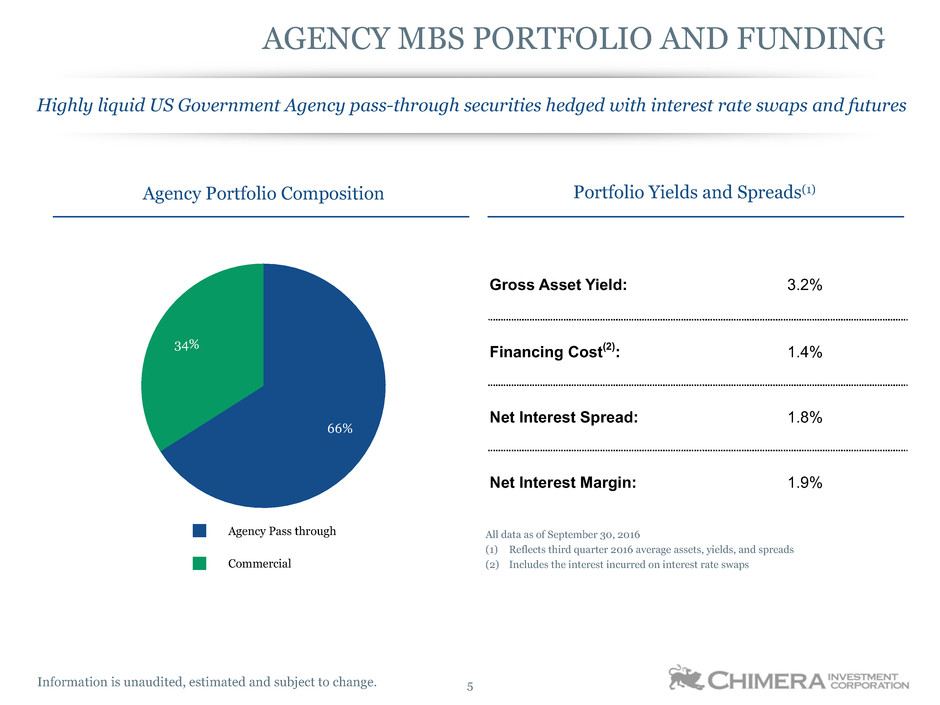

Agency Portfolio Composition

All data as of September 30, 2016

(1) Reflects third quarter 2016 average assets, yields, and spreads

(2) Includes the interest incurred on interest rate swaps

AGENCY MBS PORTFOLIO AND FUNDING

Highly liquid US Government Agency pass-through securities hedged with interest rate swaps and futures

Gross Asset Yield: 3.2%

Financing Cost(2): 1.4%

Net Interest Spread: 1.8%

Net Interest Margin: 1.9%

Agency Pass through

Commercial

66%

34%

Portfolio Yields and Spreads(1)

Information is unaudited, estimated and subject to change. 6

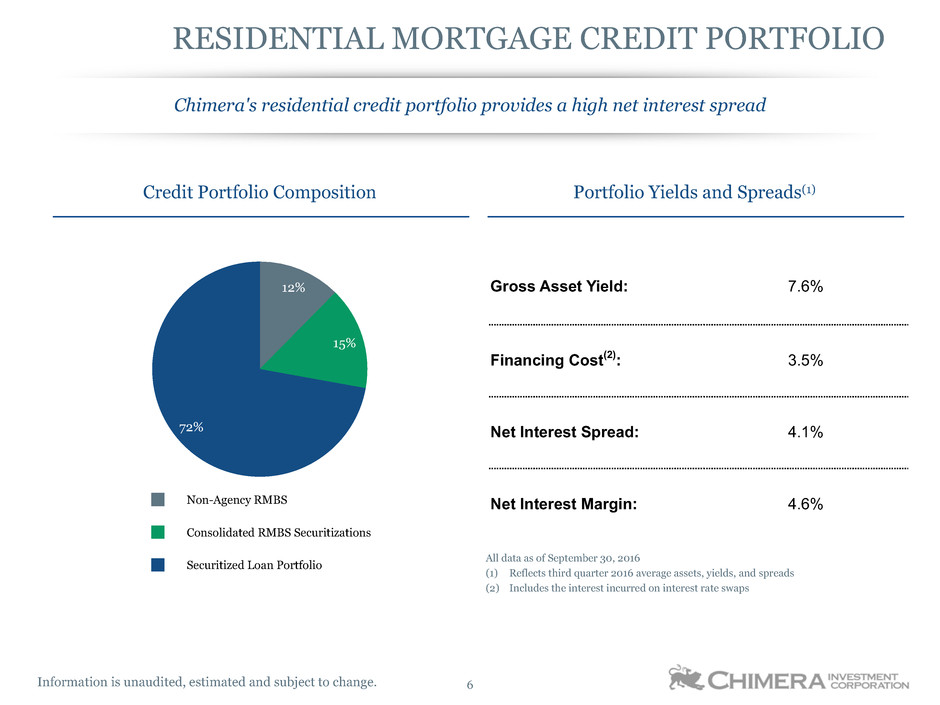

Non-Agency RMBS

Consolidated RMBS Securitizations

Securitized Loan Portfolio

12%

15%

72%

RESIDENTIAL MORTGAGE CREDIT PORTFOLIO

Chimera's residential credit portfolio provides a high net interest spread

Gross Asset Yield: 7.6%

Financing Cost(2): 3.5%

Net Interest Spread: 4.1%

Net Interest Margin: 4.6%

Portfolio Yields and Spreads(1)Credit Portfolio Composition

All data as of September 30, 2016

(1) Reflects third quarter 2016 average assets, yields, and spreads

(2) Includes the interest incurred on interest rate swaps

Information is unaudited, estimated and subject to change. 7

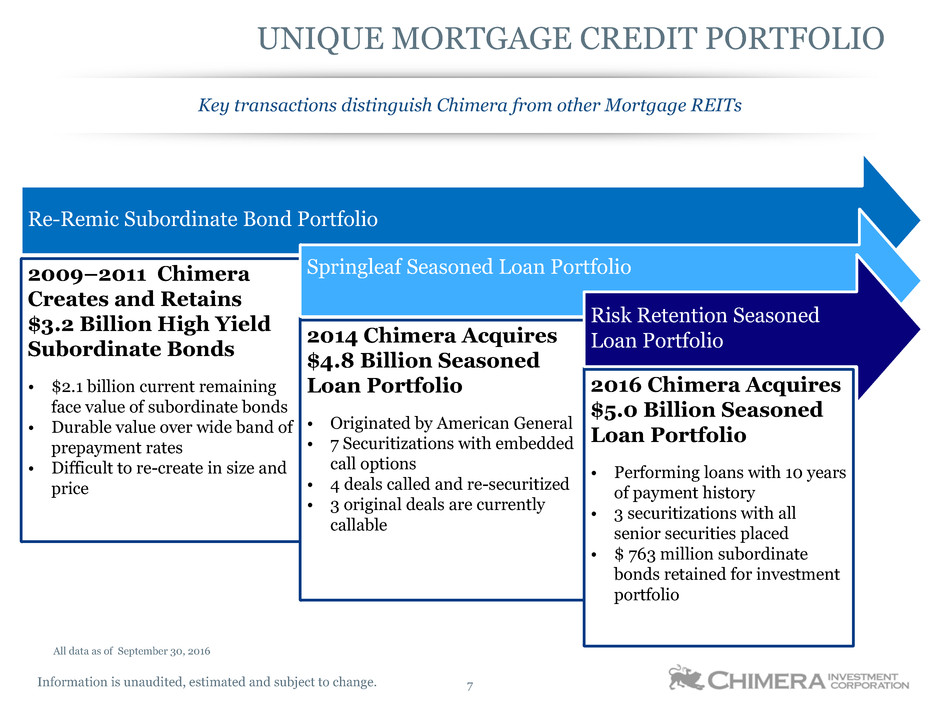

2016 Chimera Acquires

$5.0 Billion Seasoned

Loan Portfolio

• Performing loans with 10 years

of payment history

• 3 securitizations with all

senior securities placed

• $ 763 million subordinate

bonds retained for investment

portfolio

2014 Chimera Acquires

$4.8 Billion Seasoned

Loan Portfolio

• Originated by American General

• 7 Securitizations with embedded

call options

• 4 deals called and re-securitized

• 3 original deals are currently

callable

2009–2011 Chimera

Creates and Retains

$3.2 Billion High Yield

Subordinate Bonds

• $2.1 billion current remaining

face value of subordinate bonds

• Durable value over wide band of

prepayment rates

• Difficult to re-create in size and

price

UNIQUE MORTGAGE CREDIT PORTFOLIO

Key transactions distinguish Chimera from other Mortgage REITs

Re-Remic Subordinate Bond Portfolio

Springleaf Seasoned Loan Portfolio

Risk Retention Seasoned

Loan Portfolio

All data as of September 30, 2016

Information is unaudited, estimated and subject to change. 8

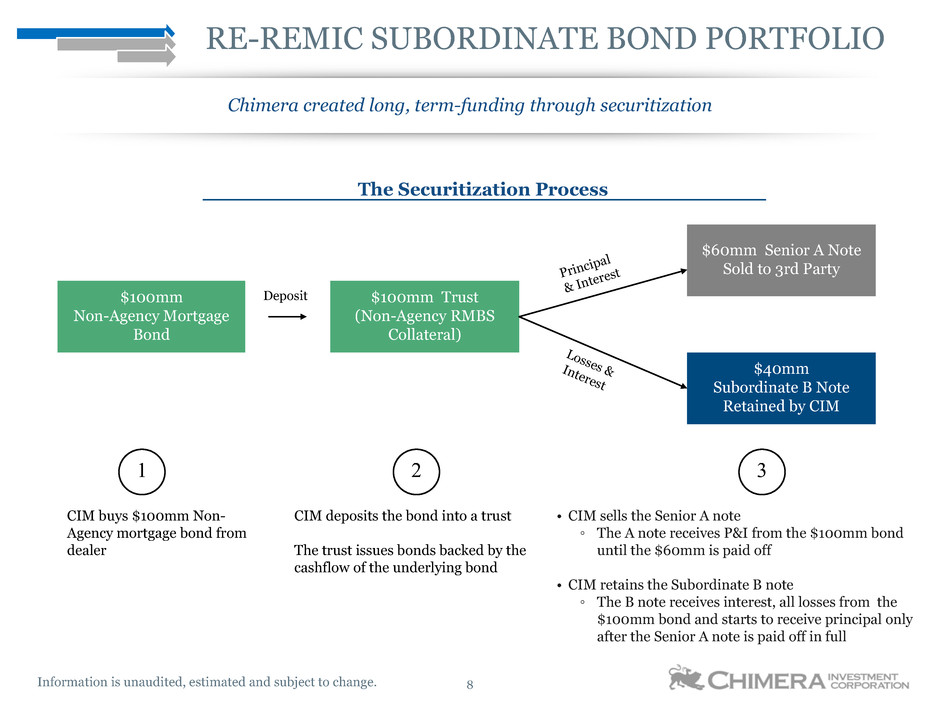

RE-REMIC SUBORDINATE BOND PORTFOLIO

Chimera created long, term-funding through securitization

The Securitization Process

$100mm

Non-Agency Mortgage

Bond

$100mm Trust

(Non-Agency RMBS

Collateral)

Deposit

$60mm Senior A Note

Sold to 3rd Party

$40mm

Subordinate B Note

Retained by CIM

CIM buys $100mm Non-

Agency mortgage bond from

dealer

CIM deposits the bond into a trust

The trust issues bonds backed by the

cashflow of the underlying bond

• CIM sells the Senior A note

◦ The A note receives P&I from the $100mm bond

until the $60mm is paid off

• CIM retains the Subordinate B note

◦ The B note receives interest, all losses from the

$100mm bond and starts to receive principal only

after the Senior A note is paid off in full

Principa

l

& Interes

t

Losses

&Interes

t

1 2 3

Information is unaudited, estimated and subject to change. 9

($ in thousands) At Issuance / Acquisition September 30, 2016

Vintage Deal Total OriginalFace

Total of

Tranches

Sold

Total of

Tranches

Retained

Total Remaining

Face

Remaining

Face of

Tranches

Sold

Remaining Face

of Tranches

Retained

2014 CSMC 2014-4R(1) 367,271 — 367,271 263,888 — 263,888

2010 CSMC 2010-1R 1,730,581 691,630 1,038,951 647,347 14,160 633,187

2010 CSMC 2010-11R 566,571 338,809 227,762 270,438 61,775 208,663

2009 CSMC 2009-12R 1,730,698 915,566 815,132 587,546 117,863 469,683

2009 JPMRR 2009-7 1,522,474 856,935 665,539 543,907 164,661 379,246

2009 JMAC 2009-R2 281,863 192,500 89,363 98,633 39,469 59,164

TOTAL 6,199,458 2,995,440 3,204,018 2,411,759 397,928 2,013,831

% of origination remaining 39% 13% 63%

CONSOLIDATED RMBS SECURITIZATIONS

▪ Re-Remic subordinate bonds have had slow prepayments considering the low interest rate environment

▪ Chimera expects the subordinate bond portfolio to have meaningful impact on earnings for the foreseeable future

All data as of September 30, 2016

(1) Contains collateral from CSMC 2010-12R Trust.

(2) Projected Balances are estimated based on future cash flows and changes in prepayment speeds

Significant outstanding balances

remain under a number of

prepayment projections

Total Remaining Face - Projected Balances (2)

Change in CPR (%) September 30,2017

September 30,

2018

September 30,

2019

-50% 2,118,331 1,881,698 1,689,471

Unchanged 2,039,847 1,748,545 1,518,721

+50% 1,962,878 1,622,360 1,363,216

Information is unaudited, estimated and subject to change. 10

SPRINGLEAF SEASONED LOAN PORTFOLIO

Chimera acquired $4.8 Billion Seasoned Loan Portfolio previously securitized by Springleaf Financial

Chimera consolidated the loans on its balance sheet and worked to re-securitize the

portfolio in order to reduce financing costs and lower equity commitment

Springleaf Acquisition

◦ $ 4.8 billion seasoned loans

◦ 7 original securitizations

◦ $775 million equity commitment

from Chimera

◦ Performing loans with 10 years

of payment history

◦ Loans originated for American

General portfolio

Springleaf Optimization

◦ Chimera calls 4 of the 7

Springleaf deals

◦ Chimera re-issues new debt

◦ Lowered financing costs by over

100 basis points

◦ Reduced equity commitment by

$155 million

Springleaf Pipeline

◦ Three original Springleaf deals

remain to be called

◦ All new Chimera securitizations

have 3-year call rights

2014 2015 2016

All data as of September 30, 2016

Information is unaudited, estimated and subject to change. 11

RISK RETENTION LOAN PORTFOLIO

Risk Retention Rule creates an opportunity for Mortgage REITs who have permanent capital

Risk Retention Rule

▪ All new mortgage securitizations

must have an equity sponsor

▪ Deal Sponsor to have meaningful

“skin in the game” investment

amount

▪ Deal Sponsor must have the

ability to hold the investment for

a minimum of 5 years

Chimera sponsors three securitizations

▪ $763 million new investments

▪ Performing seasoned loans with more

than 10 years of payment history

▪ Attractive risk-adjusted portfolio

returns

▪ Increased returns available with

recourse leverage

▪ Partially funded by reduction in

Agency MBS allocation

2016 Chimera

securitizes

$5.0 Billion

under the

new risk

retention rule

Chimera 2.0

Chimera has historically retained the equity interests in its securitizations

Information is unaudited, estimated and subject to change. 12

▪ $5.0 Billion loan portfolio and securitization

is consolidated on balance sheet

▪ Chimera retained $763 Million subordinate

bonds for investment

▪ Chimera funded purchased interests through

combination of available cash, sale of

approximately $1.9 Billion Agency MBS, and

recourse financing

▪ Approximately $13 Million deal expenses

incurred in Q2 2016

◦ Chimera expects high single digit yields on portfolio

without leverage

◦ Chimera expects to achieve mid-to-high teen yields

with added recourse leverage

◦ Deals are callable in 4 years

RISK RETENTION PORTFOLIO

CIM 2016-1 CIM 2016-2 CIM 2016-3

Loan Portfolio $1.4 Billion $1.7 Billion $1.7 Billion

Weighted average coupon of mortgage 7.41% 7.41% 7.41%

Average loan age 131 Months 131 Months 131 Months

Average loan balance $107 Thousand $106 Thousand $105 Thousand

Senior class sold with initial coupon 70%, 2.95% 70%, 2.94% 70%, 2.94%

Retained Securities $226 Million $270 Million $267 Million

All data as of September 30, 2016

Information is unaudited, estimated and subject to change. 13

SMALL BALANCE RESIDENTIAL LOAN PORTFOLIO

Chimera has one of the largest seasoned, performing, small balance residential loan

portfolios in the Mortgage REIT Industry

$5.0 Billion 2016

Risk Retention

Seasoned Loan

Portfolio

$4.8 Billion

Springleaf Portfolio All data as of September 30, 2016

Total Current Unpaid Balance $8.4 Billion

Total Number of Loans 92,430

Weighted Average Loan Size $91,257

Weighted Average Coupon 7.23%

Average Loan Age 128 Months

Information is unaudited, estimated and subject to change. 14

SMALL BALANCE RESIDENTIAL LOAN PORTFOLIO

Positive pay history

Prepay experience

Relatively low

mortgage payment

• While loans were subprime at origination, average loan age shows

homeowners ability to pay

• Homeowner pay history is a good predictor of future behavior

• Borrowers with low loan balances and moderate FICO scores

generally have lower prepayment speeds

• Prepay experience has been moderate

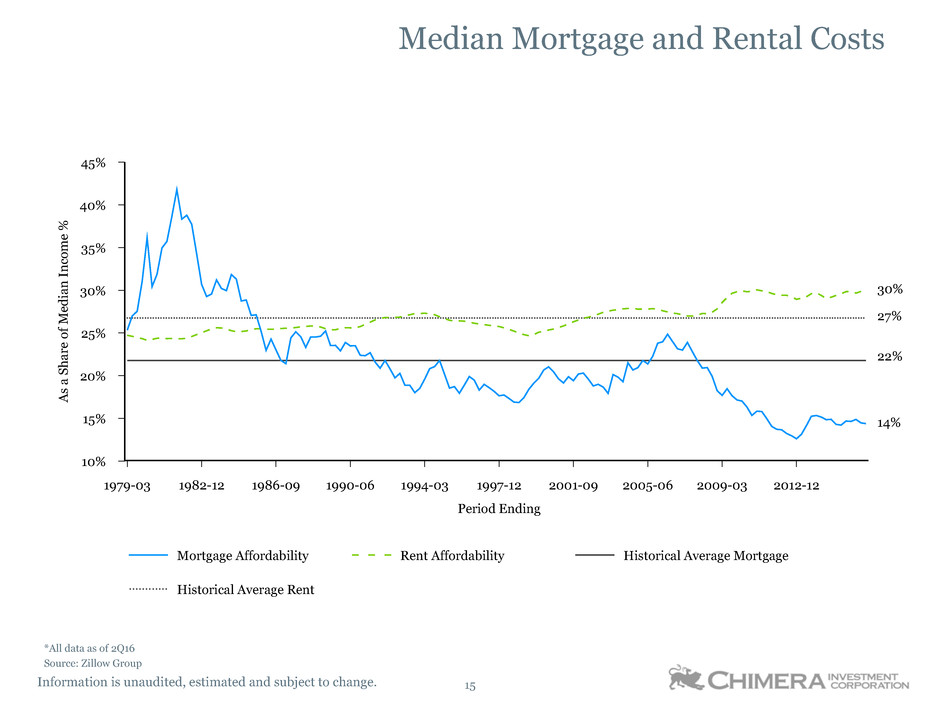

• Average monthly mortgage payment is approximately $800

• Mortgage is cheaper than rent in most areas

Stable and improving

housing market

• Home prices are stable to increasing nationally

• No supply issues

• More stringent lending standards

Information is unaudited, estimated and subject to change. 15

Median Mortgage and Rental Costs

Mortgage Affordability Rent Affordability Historical Average Mortgage

Historical Average Rent

45%

40%

35%

30%

25%

20%

15%

10%

As

aS

ha

re

of

M

ed

ia

n

In

co

m

e%

1979-03 1982-12 1986-09 1990-06 1994-03 1997-12 2001-09 2005-06 2009-03 2012-12

Period Ending

*All data as of 2Q16

Source: Zillow Group

30%

27%

22%

14%

Information is unaudited, estimated and subject to change. 16

New Foreclosures and Mortgages in Foreclosure

Consumers with New Foreclosures (thousands) % of mortgages in foreclosure

700

600

500

400

300

200

100

0

Co

ns

um

er

sw

ith

N

ew

Fo

re

clo

su

re

s

6%

5%

4%

3%

2%

1%

0%

%

of

M

or

tg

ag

es

in

Fo

rc

lo

su

re

March 2003 March 2005 March 2007 March 2009 March 2011 March 2013 March 2015

Period Ending

*All data as of 2Q16

Source: Bloomberg; NY Federal Reserve

1.6%

82.8

Information is unaudited, estimated and subject to change. 17

SUMMARY

Chimera has a unique portfolio of high yielding

assets, created through securitization, which would be

difficult to recreate in size and scale

Upward trending macro economic conditions for

energy prices and the housing market are positive for

the credit of Chimera's mortgage portfolio

New risk retention rules present an attractive

opportunity for companies like Chimera to sponsor

mortgage securitizations

Chimera has assembled a portfolio of unique mortgage

assets with a goal to provide high and durable income to

shareholders

Opportunity for

Permanent

Capital

Positive Macro

Economic

Environment

Franchise

Mortgage Assets

Information is unaudited, estimated and subject to change.

Appendix

Information is unaudited, estimated and subject to change. 19

Agency Securities – As of September 30, 2016 Repo Days to Maturity – As of September 30, 2016

Security

Type Coupon

(1) Current

Face

Weighted

Average

Market Price

Weighted

Average CPR

Agency

Pass-

through

3.50% $1,085,704 105.6 15.0

4.00% 1,271,630 107.7 20.4

4.50% 314,759 109.6 22.8

Commercial 3.6% 1,273,235 105.6 0.1

Agency IO 0.9% N/M(2) 4.5 8.3

Total $3,945,328

Maturity PrincipalBalance

Weighted

Average Rate

Weighted

Average Days

Within 30 days $1,553,423 0.82%

30 to 59 days 332,006 0.78%

60 to 89 days 827,670 0.83%

90 to 360 days 665,480 0.79%

Over 360 days — —

Total $3,378,579 0.81% 49 Days

The majority of Chimera's Agency Portfolio consists of highly liquid pass-through securities

AGENCY MBS PORTFOLIO AND FUNDING

All data as of September 30, 2016

(1) Coupon is a weighted average for Commercial and Agency IO

(2) Notional Agency IO was $3.5 billion as of September 30, 2016

Information is unaudited, estimated and subject to change. 20

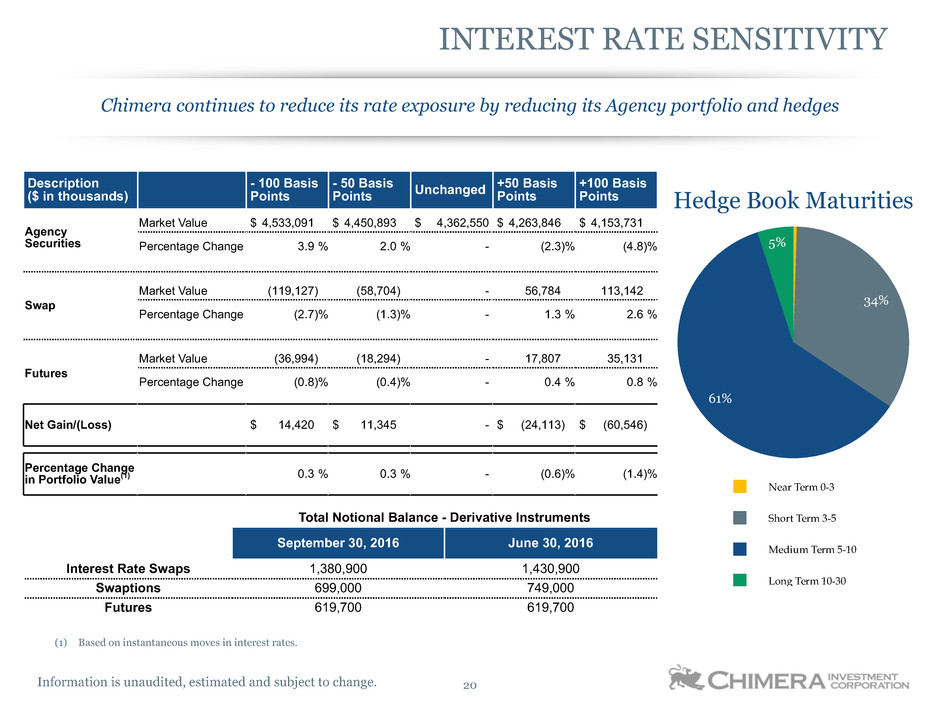

Description

($ in thousands)

- 100 Basis

Points

- 50 Basis

Points Unchanged

+50 Basis

Points

+100 Basis

Points

Agency

Securities

Market Value $ 4,533,091 $ 4,450,893 $ 4,362,550 $ 4,263,846 $ 4,153,731

Percentage Change 3.9 % 2.0 % - (2.3)% (4.8)%

Swap

Market Value (119,127) (58,704) - 56,784 113,142

Percentage Change (2.7)% (1.3)% - 1.3 % 2.6 %

Futures

Market Value (36,994) (18,294) - 17,807 35,131

Percentage Change (0.8)% (0.4)% - 0.4 % 0.8 %

Net Gain/(Loss) $ 14,420 $ 11,345 - $ (24,113) $ (60,546)

Percentage Change

in Portfolio Value(1) 0.3 % 0.3 % - (0.6)% (1.4)% Near Term 0-3

Short Term 3-5

Medium Term 5-10

Long Term 10-30

Hedge Book Maturities

34%

61%

5%

INTEREST RATE SENSITIVITY

Chimera continues to reduce its rate exposure by reducing its Agency portfolio and hedges

Total Notional Balance - Derivative Instruments

September 30, 2016 June 30, 2016

Interest Rate Swaps 1,380,900 1,430,900

Swaptions 699,000 749,000

Futures 619,700 619,700

(1) Based on instantaneous moves in interest rates.

chimerareit.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Suzano Ventures invests up to US$5 million into Bioform Technologies to further develop bio-based plastic alternatives

- Perceptyx Launches Activate, HR’s Missing Link Between Employee Insight and Impact

- HANDSHAKE SPEAKEASY IN MEXICO CITY NAMED AS THE BEST BAR IN NORTH AMERICA AS RANKING OF NORTH AMERICA'S 50 BEST BARS IS REVEALED AT THIRD ANNUAL AWARDS CEREMONY

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share