Form 8-K CHARTER FINANCIAL CORP For: Jul 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 8-K

_____________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 23, 2015

_____________________________________

CHARTER FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

_____________________________________

Maryland | 001-35870 | 90-0947148 | ||

(State or other jurisdiction of | (Commission | (IRS Employer | ||

incorporation or organization) | File Number) | Identification No.) | ||

1233 O. G. Skinner Drive, West Point, Georgia 31833

(Address of principal executive offices) (Zip Code)

(706) 645-1391

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On July 23, 2015, Charter Financial Corporation issued an earnings release announcing its financial results for the third quarter ended June 30, 2015. The text of the press release is included as Exhibit 99.1 to this report. The information included in the press release text is considered to be “furnished” under the Securities Exchange Act of 1934.

Item 7.01. Regulation FD Disclosure.

On July 28-29, 2015, Charter Financial Corporation (the “Company”), the holding company of CharterBank, will participate in the KBW Community Bank Investor Conference (the “Conference”). The Company’s Investor Presentation attached hereto as Exhibit 99.3 will be made available to investors at the Conference. A copy of the Company’s Investor Presentation will also be posted in the Investor Relations section of the Company’s website at www.charterbk.com.

Item 8.01. Other Events

On July 23, 2015, the Board of Directors of Charter Financial Corporation declared a regular quarterly cash dividend of $0.05 per share. The dividend is payable on August 24, 2015, to stockholders of record as of August 10, 2015. A press release announcing the details of the declaration is filed herewith as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) | Exhibits. | |

Exhibit No. | Description | |

99.1 | Earnings press release dated July 23, 2015. | |

99.2 | Dividend press release dated July 23, 2015. | |

99.3 | Charter Financial Corporation Investor Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CHARTER FINANCIAL CORPORATION | ||||

(Registrant) | ||||

Date: | July 24, 2015 | By: | /s/ Curtis R. Kollar | |

Curtis R. Kollar | ||||

Senior Vice President and Chief Financial Officer | ||||

Exhibit 99.1

| ||

NEWS RELEASE

Contact: | ||

Robert L. Johnson, Chairman & CEO | At Dresner Corporate Services | |

Curt Kollar, CFO | Steve Carr | |

706-645-1391 | 312-780-7211 | |

CHARTER FINANCIAL ANNOUNCES THIRD QUARTER FISCAL

2015 EARNINGS OF $1.9 MILLION

• | Basic and diluted EPS of $0.12 for the quarter |

• | Net loan growth of 15.5% over prior year quarter, which marks the seventh consecutive year-over-year quarterly increase |

• | Flat noninterest expense |

• | Tangible book value per share of $12.44 at June 30, 2015, up $0.49 year over year |

• | Nonperforming non-covered assets at 0.55% of total non-covered assets at June 30, 2015 |

• | Repurchased 259,836 shares for an average of $12.13 per share during the quarter |

West Point, Georgia, July 23, 2015 — Charter Financial Corporation (the “Company”) (NASDAQ: CHFN) today reported net income of $1.9 million, or $0.12 per basic and diluted share, for the quarter ended June 30, 2015, compared with $1.8 million, or $0.09 per basic and diluted share, for the quarter ended June 30, 2014. Net income for the quarter increased primarily due to increases in noninterest income and net interest income, partially offset by a large negative provision for covered loans, which benefited last year's results.

Net income for the nine months ended June 30, 2015, was $5.0 million, or $0.32 and $0.30 per basic and diluted share, respectively, up from $4.9 million, or $0.23 and $0.22 per basic and diluted share, respectively, for the nine months ended June 30, 2014.

Quarterly Operating Results

Quarterly earnings for the third quarter of fiscal 2015 compared with the third quarter of fiscal 2014 were positively impacted by the following items:

• | Loan interest income, excluding accretion and amortization of loss share receivable, increased $319,000. |

• | Net interest margin, excluding accretion and amortization of loss share receivable, was 3.21% for the quarter ended June 30, 2015 compared with 2.90% for the same quarter of fiscal 2014. |

• | The cost of deposits decreased to 43 basis points for the quarter ended June 30, 2015, compared to 49 basis points for the quarter ended June 30, 2014. |

1

Exhibit 99.1

• | Deposit and bankcard fee income increased by a combined $309,000. |

• | Gain on sale of loans and loan servicing release fees increased by $137,000. |

• | Net cost of operations of real estate owned decreased by $118,000. |

The above increases to net income were partially offset by the following items:

• | Net purchase discount accretion and amortization decreased by $90,000. |

• | The average yield on loans was 5.02% for the quarter ended June 30, 2015 compared to 5.44% for the quarter ended June 30, 2014. |

• | The Company recorded a negative provision of $834,000 for the quarter ended June 30, 2014 compared to no provision in the current year quarter. |

Chairman and CEO Robert L. Johnson said, “Our net income and earnings per share for the quarter increased by 7% and 33%, respectively, compared to the prior year quarter. We are pleased with this growth and with the continued improvements in our core earnings. Our net interest margin, excluding purchase accounting, was 3.21% for the quarter ending June 30, 2015, which was significantly improved from 2.90% for the quarter ending June 30, 2014.”

Financial Condition

The Company's total assets remained relatively unchanged at $1.0 billion at June 30, 2015. Net loan growth and shares repurchased during the first three quarters of fiscal 2015 were funded by deposit growth, including brokered CDs, and utilization of the Company's cash and cash equivalents. Net loans grew $66.5 million, or 11.0%, to $672.8 million at June 30, 2015, from $606.4 million at September 30, 2014.

Mr. Johnson continued, “Our loan portfolio increased on a year-over-year basis for the seventh consecutive quarter. Continued loan portfolio growth is important to realizing increased profitability through higher operating and capital leverage.”

Total deposits were $734.2 million at June 30, 2015, compared with $717.2 million at September 30, 2014, due primarily to increases of $19.5 million and $30.8 million in core deposits and brokered deposits, respectively. Core deposits increased from $486.2 million at September 30, 2014, to $505.7 million at June 30, 2015, due primarily to an increase in transaction accounts.

Mr. Johnson added, “The rebranding of our checking products that we started last fall is having a positive impact. We reduced the number of checking products from 13 to four, enabling consumers to have free checking accounts in methods more beneficial for the bank. This is accomplished through increased interchange revenue, increased balances or reduced costs through the reduction of mailing paper statements.”

Total stockholders' equity decreased to $208.9 million at June 30, 2015, compared to $225.0 million at September 30, 2014, due predominantly to $20.8 million of share repurchases during the first three quarters of fiscal 2015.

Net Interest Income and Net Interest Margin

Net interest income increased to $8.1 million for the quarter ended June 30, 2015, compared with $7.6 million for the quarter ended June 30, 2014. Interest income increased by $358,000 due to a slight increase in loan receivable income and a $253,000 decrease in amortization of FDIC loss share receivable, aided by a $168,000, or 12.1%, decrease in total interest expense quarter over quarter. The Company's net interest margin, excluding the effects of purchase accounting, was 3.21% for the quarter ended June 30, 2015, compared with 2.90% for the quarter ended June 30, 2014. Net interest margin, including the impact of purchase accounting, increased to 3.62% for the quarter ended June 30, 2015, compared with 3.26% for the quarter ended June 30, 2014.

Net interest income for the nine months ended June 30, 2015, increased $748,000 to $23.6 million compared to the same prior year period despite a $695,000 decline in net discount accretion and amortization on acquired covered loans. Additionally, interest expense decreased by $563,000. Net interest margin, excluding the effects of purchase

2

Exhibit 99.1

accounting, improved 38 basis points to 3.22%, while net interest margin, including the impact of purchase accounting, improved 30 basis points to 3.54% for the nine months ended June 30, 2015.

Provision for Loan Losses

The Company recorded no provision for loan losses on non-covered loans for the quarters ended June 30, 2015 and 2014, due to an overall improvement in the credit quality of the non-covered loan portfolio. No provision was recorded on covered loans for the quarter ended June 30, 2015, compared to a negative provision of $834,000 for the same quarter in 2014.

There was no net provision recorded on non-covered and covered loans during the nine months ended June 30, 2015 due to our continued strong asset credit quality compared to a $300,000 provision on non-covered loans and an $886,000 negative provision on covered loans for the same prior year period.

Accounting for FDIC-Assisted Acquisitions

Mr. Johnson continued, “Earlier this year, we completed the non-single family portion of two of our FDIC assisted acquisitions. The last agreement has 14 months remaining in the loss share period. The FDIC indemnification asset is down to $4.5 million, indicating that we are approaching the completion of the resolution of the acquired troubled assets.”

Under purchase accounting rules, the Company currently expects to realize remaining discount accretion of $4.0 million and $1.7 million in amortization, netting to approximately $2.3 million of future pre-tax income impact.

Noninterest Income and Expense

Noninterest income for the quarter ended June 30, 2015 increased $581,000, or 17.9%, which was primarily due to the continued increases in gain on sale of loans, bankcard fee income and other deposit fee income. Noninterest expense for the quarter ended June 30, 2015 of $9.1 million increased slightly compared with the same period in fiscal 2014. This increase was primarily attributable to increases in salaries and employee benefits, occupancy and losses on debit card fraud, and partially offset by a $118,000 decrease in net cost of real estate owned.

Noninterest income for the nine months ended June 30, 2015 increased $264,000, or 2.5%, despite a $1.1 million true-up receipt from the completion and renegotiation of a processing contract in the prior year period. Bankcard fee income and other deposit fee income increased $855,000 and gain on sale of loans increased $416,000 for the nine months ended June 30, 2015 compared to the same prior year period. Noninterest expense remained practically unchanged at $26.8 million for the nine months ended June 30, 2015 and 2014. Decreases in legal and professional fees and the net cost of real estate owned were offset by increases in salaries and employee benefits and other noninterest expense.

Asset Quality

Asset quality remained strong with nonperforming assets not covered by loss sharing agreements at 0.55% of total non-covered assets and the allowance for loan losses at 1.33% of total non-covered loans and 196.86% of nonperforming non-covered loans at June 30, 2015. The Company had net loan recoveries of $12,000 on non-covered loans for the nine months ended June 30, 2014, compared to net loan charge-offs of $283,000 on non-covered loans for the same period in fiscal 2014.

Capital Management

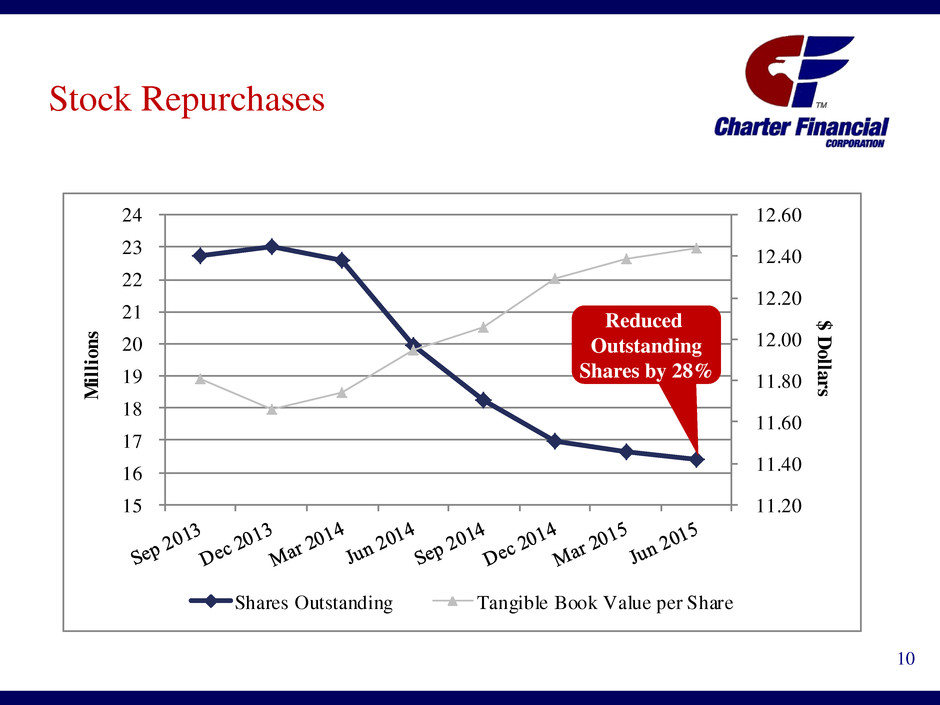

During the quarter ended June 30, 2015, the Company repurchased 259,836 shares for approximately $3.2 million, or $12.13 per share.

Mr. Johnson said, “Since December 2013, we have completed three stock buyback programs, whereby the Company

3

Exhibit 99.1

repurchased a combined 4.9 million shares at a discount to tangible book value. Additionally, through our current repurchase program announced in September 2014 and revised in March 2015, we can repurchase up to 2.6 million shares, of which 1.9 million shares have been repurchased to date. Collectively, the 6.7 million shares repurchased, or approximately 29% of our common stock, were purchased at a combined discount to tangible book value of $9.4 million.”

Mr. Johnson concluded, “Over the past two years, we have utilized our excess capital in several ways, including the repurchase of shares at a discount to tangible book value, dividends, and growing our loan portfolio. Meanwhile, we continue to explore the possibility of additional acquisitions and opportunities that would be accretive to our earnings. We are also seeking to enhance stockholder value through leverage of our expense structure and improving noninterest income.”

About Charter Financial Corporation

Charter Financial Corporation is a savings and loan holding company and the parent company of CharterBank, a full-service community bank and a federal savings institution. CharterBank is headquartered in West Point, Georgia, and operates branches in west-central Georgia, east-central Alabama, and the Florida Gulf Coast. CharterBank's deposits are insured by the Federal Deposit Insurance Corporation. Investors may obtain additional information about Charter Financial Corporation and CharterBank on the internet at www.charterbk.com under About Us.

Forward-Looking Statements

This release may contain “forward-looking statements” within the meaning of the federal securities laws. These statements may be identified by use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “seek,” and “potential.” Examples of forward-looking statements include, but are not limited to, statements regarding future growth, profitability, expense reduction, improvements in income and margins, increasing stockholder value, and estimates with respect to our financial condition and results of operation and business that are subject to various factors that could cause actual results to differ materially from these estimates. These factors include but are not limited to general and local economic conditions; changes in interest rates, deposit flows, demand for mortgages and other loans, real estate values, and competition; changes in accounting principles, policies, or guidelines; the changing exposure to credit risk; the effect of any acquisition or other strategic initiatives that we determine to pursue; changes in legislation or regulation; other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products, and services; the effect of cyberterrorism and system failures; and the effects of geopolitical instability and risks such as terrorist attacks, the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes, and the effect of any damage to our reputation resulting from developments relating to any of the factors listed herein. Any or all forward-looking statements in this release and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions we might make or known or unknown risks and uncertainties. Consequently, no forward-looking statements can be guaranteed. Except as required by law, the Company disclaims any obligation to subsequently revise or update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Additional information concerning factors that could cause actual results to differ materially from those forward-looking statements is contained from time to time in the Company's filings with the Securities and Exchange Commission. The company refers you to the section entitled “Risk Factors” contained in the company's Annual Report on Form 10-K for the fiscal year ended September 30, 2014. Copies of each filing may be obtained from the Company or the Securities and Exchange Commission.

The risks included here are not exhaustive and undue reliance should not be placed on any forward-looking statements, which are based on current expectations. All written and oral forward-looking statements attributable to the company, its management, or persons acting on their behalf are qualified in their entirety by these cautionary statements. Further, forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time unless otherwise required by law.

4

Exhibit 99.1

Charter Financial Corporation

Condensed Consolidated Statements of Financial Condition (unaudited)

June 30, 2015 | September 30, 2014 | ||||||

Assets | |||||||

Cash and amounts due from depository institutions | $ | 11,386,552 | $ | 10,996,959 | |||

Interest-earning deposits in other financial institutions | 28,564,277 | 88,465,994 | |||||

Cash and cash equivalents | 39,950,829 | 99,462,953 | |||||

Loans held for sale, fair value of $2,136,035 and $2,090,469 | 2,092,222 | 2,054,722 | |||||

Investment securities available for sale | 189,790,982 | 188,743,273 | |||||

Federal Home Loan Bank stock | 3,005,600 | 3,442,900 | |||||

Loans receivable: | |||||||

Not covered under FDIC loss sharing agreements | 636,894,866 | 546,570,720 | |||||

Covered under FDIC loss sharing agreements | 46,772,694 | 70,631,743 | |||||

Allowance for loan losses (covered loans) | (948,200 | ) | (997,524 | ) | |||

Unamortized loan origination fees, net (non-covered loans) | (1,404,319 | ) | (1,364,853 | ) | |||

Allowance for loan losses (non-covered loans) | (8,484,986 | ) | (8,473,373 | ) | |||

Loans receivable, net | 672,830,055 | 606,366,713 | |||||

Other real estate owned: | |||||||

Not covered under FDIC loss sharing agreements | 938,705 | 1,757,864 | |||||

Covered under FDIC loss sharing agreements | 2,350,797 | 5,557,927 | |||||

Accrued interest and dividends receivable | 2,579,929 | 2,459,347 | |||||

Premises and equipment, net | 19,905,672 | 20,571,541 | |||||

Goodwill | 4,325,282 | 4,325,282 | |||||

Other intangible assets, net of amortization | 492,751 | 423,676 | |||||

Cash surrender value of life insurance | 48,102,945 | 47,178,128 | |||||

FDIC receivable for loss sharing agreements | 4,473,374 | 10,531,809 | |||||

Deferred income taxes | 7,753,812 | 8,231,002 | |||||

Other assets | 6,343,250 | 9,254,001 | |||||

Total assets | $ | 1,004,936,205 | $ | 1,010,361,138 | |||

Liabilities and Stockholders’ Equity | |||||||

Liabilities: | |||||||

Deposits | $ | 734,237,570 | $ | 717,192,200 | |||

FHLB advances | 50,000,000 | 55,000,000 | |||||

Advance payments by borrowers for taxes and insurance | 1,503,405 | 1,312,283 | |||||

Other liabilities | 10,275,898 | 11,901,786 | |||||

Total liabilities | 796,016,873 | 785,406,269 | |||||

Stockholders’ equity: | |||||||

Common stock, $0.01 par value; 16,403,912 shares issued and outstanding at June 30, 2015 and 18,261,388 shares issued and outstanding at September 30, 2014 | 164,039 | 182,614 | |||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized at June 30, 2015 and September 30, 2014 | — | — | |||||

Additional paid-in capital | 99,755,617 | 119,586,164 | |||||

Unearned compensation – ESOP | (5,551,193 | ) | (5,984,317 | ) | |||

Retained earnings | 114,576,694 | 111,924,543 | |||||

Accumulated other comprehensive loss | (25,825 | ) | (754,135 | ) | |||

Total stockholders’ equity | 208,919,332 | 224,954,869 | |||||

Total liabilities and stockholders’ equity | $ | 1,004,936,205 | $ | 1,010,361,138 | |||

__________________________________

(1) | Financial information as of September 30, 2014 has been derived from audited financial statements. |

5

Exhibit 99.1

Charter Financial Corporation

Condensed Consolidated Statements of Income (unaudited)

Three Months Ended June 30, | Nine Months Ended June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Interest income: | |||||||||||||||

Loans receivable | $ | 8,988,725 | $ | 8,833,596 | $ | 26,832,782 | $ | 25,564,268 | |||||||

Mortgage-backed securities and collateralized mortgage obligations | 735,230 | 871,899 | 2,359,001 | 2,794,019 | |||||||||||

Federal Home Loan Bank stock | 35,316 | 35,601 | 109,001 | 102,778 | |||||||||||

Other investment securities available for sale | 176,342 | 18,286 | 374,216 | 56,314 | |||||||||||

Interest-earning deposits in other financial institutions | 25,611 | 97,321 | 85,459 | 266,816 | |||||||||||

Amortization of FDIC loss share receivable | (596,691 | ) | (849,919 | ) | (2,387,205 | ) | (1,596,310 | ) | |||||||

Total interest income | 9,364,533 | 9,006,784 | 27,373,254 | 27,187,885 | |||||||||||

Interest expense: | |||||||||||||||

Deposits | 672,525 | 790,011 | 2,063,898 | 2,479,856 | |||||||||||

Borrowings | 545,368 | 595,829 | 1,725,750 | 1,872,357 | |||||||||||

Total interest expense | 1,217,893 | 1,385,840 | 3,789,648 | 4,352,213 | |||||||||||

Net interest income | 8,146,640 | 7,620,944 | 23,583,606 | 22,835,672 | |||||||||||

Provision for loan losses, not covered under FDIC loss sharing agreements | — | — | — | 300,000 | |||||||||||

Provision for covered loan losses | — | (834,086 | ) | — | (885,664 | ) | |||||||||

Net interest income after provision for loan losses | 8,146,640 | 8,455,030 | 23,583,606 | 23,421,336 | |||||||||||

Noninterest income: | |||||||||||||||

Service charges on deposit accounts | 1,663,324 | 1,463,698 | 4,758,276 | 4,263,639 | |||||||||||

Bankcard fees | 1,015,719 | 906,013 | 2,956,880 | 2,596,743 | |||||||||||

Gain (loss) on investment securities available for sale | — | 200,704 | (27,209 | ) | 200,704 | ||||||||||

Bank owned life insurance | 321,102 | 278,487 | 924,817 | 925,467 | |||||||||||

Gain on sale of loans and loan servicing release fees | 435,055 | 298,405 | 1,153,636 | 737,236 | |||||||||||

Brokerage commissions | 210,563 | 124,128 | 567,349 | 452,479 | |||||||||||

FDIC receivable for loss sharing agreements accretion | 19,711 | 68,400 | 94,230 | 61,533 | |||||||||||

Other | 150,933 | (104,205 | ) | 405,086 | 1,330,929 | ||||||||||

Total noninterest income | 3,816,407 | 3,235,630 | 10,833,065 | 10,568,730 | |||||||||||

Noninterest expenses: | |||||||||||||||

Salaries and employee benefits | 5,034,540 | 4,969,325 | 15,126,581 | 14,522,114 | |||||||||||

Occupancy | 1,926,645 | 1,863,131 | 5,640,356 | 5,629,280 | |||||||||||

Legal and professional | 352,116 | 369,360 | 978,025 | 1,309,946 | |||||||||||

Marketing | 305,991 | 339,774 | 938,461 | 976,048 | |||||||||||

Federal insurance premiums and other regulatory fees | 189,089 | 199,167 | 564,535 | 701,428 | |||||||||||

Net (benefit) cost of operations of real estate owned | (29,675 | ) | 87,846 | 54,573 | 374,538 | ||||||||||

Furniture and equipment | 229,105 | 225,753 | 603,306 | 550,200 | |||||||||||

Postage, office supplies and printing | 222,151 | 239,874 | 686,783 | 646,500 | |||||||||||

Core deposit intangible amortization expense | 64,009 | 94,454 | 206,405 | 300,514 | |||||||||||

Other | 756,546 | 646,682 | 2,050,328 | 1,805,148 | |||||||||||

Total noninterest expenses | 9,050,517 | 9,035,366 | 26,849,353 | 26,815,716 | |||||||||||

Income before income taxes | 2,912,530 | 2,655,294 | 7,567,318 | 7,174,350 | |||||||||||

Income tax expense | 1,000,796 | 870,116 | 2,547,849 | 2,261,294 | |||||||||||

Net income | $ | 1,911,734 | $ | 1,785,178 | $ | 5,019,469 | $ | 4,913,056 | |||||||

Basic net income per share | $ | 0.12 | $ | 0.09 | $ | 0.32 | $ | 0.23 | |||||||

Diluted net income per share | $ | 0.12 | $ | 0.09 | $ | 0.30 | $ | 0.22 | |||||||

Weighted average number of common shares outstanding | 15,559,917 | 20,746,759 | 15,858,186 | 21,486,082 | |||||||||||

Weighted average number of common and potential common shares outstanding | 16,210,424 | 21,300,951 | 16,508,693 | 22,040,274 | |||||||||||

6

Exhibit 99.1

Charter Financial Corporation

Supplemental Financial Data (unaudited)

in thousands except per share data

Quarter to Date | Year to Date | |||||||||||||||||||||||||||

6/30/2015 | 3/31/2015 | 12/31/2014 | 9/30/2014 | 6/30/2014 | 6/30/2015 | 6/30/2014 | ||||||||||||||||||||||

Consolidated balance sheet data: | ||||||||||||||||||||||||||||

Total assets | $ | 1,004,936 | $ | 1,010,645 | $ | 979,777 | $ | 1,010,361 | $ | 1,040,237 | $ | 1,004,936 | $ | 1,040,237 | ||||||||||||||

Cash and cash equivalents | 39,951 | 64,564 | 48,732 | 99,463 | 149,269 | 39,951 | 149,269 | |||||||||||||||||||||

Loans receivable, net | 672,830 | 656,212 | 627,740 | 606,367 | 582,403 | 672,830 | 582,403 | |||||||||||||||||||||

Non-covered loans receivable, net | 627,006 | 607,118 | 560,724 | 536,732 | 511,176 | 627,006 | 511,176 | |||||||||||||||||||||

Covered loans receivable, net | 45,824 | 49,094 | 67,016 | 69,635 | 71,227 | 45,824 | 71,227 | |||||||||||||||||||||

Other real estate owned | 3,290 | 4,487 | 5,508 | 7,316 | 9,345 | 3,290 | 9,345 | |||||||||||||||||||||

Non-covered other real estate owned | 939 | 1,144 | 954 | 1,758 | 1,331 | 939 | 1,331 | |||||||||||||||||||||

Covered other real estate owned | 2,351 | 3,343 | 4,554 | 5,558 | 8,014 | 2,351 | 8,014 | |||||||||||||||||||||

Securities available for sale | 189,791 | 182,982 | 191,995 | 188,743 | 185,040 | 189,791 | 185,040 | |||||||||||||||||||||

Transaction accounts | 328,961 | 328,012 | 310,891 | 314,201 | 312,962 | 328,961 | 312,962 | |||||||||||||||||||||

Total deposits | 734,238 | 736,803 | 701,475 | 717,192 | 729,609 | 734,238 | 729,609 | |||||||||||||||||||||

Borrowings | 50,000 | 50,000 | 55,000 | 55,000 | 55,000 | 50,000 | 55,000 | |||||||||||||||||||||

Total stockholders’ equity | 208,919 | 211,246 | 213,186 | 224,955 | 243,414 | 208,919 | 243,414 | |||||||||||||||||||||

Consolidated earnings summary: | ||||||||||||||||||||||||||||

Interest income | $ | 9,365 | $ | 9,040 | $ | 8,969 | $ | 8,460 | $ | 9,007 | $ | 27,373 | $ | 27,188 | ||||||||||||||

Interest expense | 1,218 | 1,236 | 1,336 | 1,378 | 1,386 | 3,789 | 4,352 | |||||||||||||||||||||

Net interest income | 8,147 | 7,804 | 7,633 | 7,082 | 7,621 | 23,584 | 22,836 | |||||||||||||||||||||

Provision for loan losses on non-covered loans | — | — | — | — | — | — | 300 | |||||||||||||||||||||

Provision for loan losses on covered loans | — | (4 | ) | 4 | (127 | ) | (834 | ) | — | (885 | ) | |||||||||||||||||

Net interest income after provision for loan losses | 8,147 | 7,808 | 7,629 | 7,209 | 8,455 | 23,584 | 23,421 | |||||||||||||||||||||

Noninterest income | 3,816 | 3,451 | 3,566 | 3,708 | 3,236 | 10,833 | 10,569 | |||||||||||||||||||||

Noninterest expense | 9,050 | 9,064 | 8,735 | 9,394 | 9,036 | 26,850 | 26,816 | |||||||||||||||||||||

Income tax expense | 1,001 | 761 | 786 | 481 | 870 | 2,548 | 2,261 | |||||||||||||||||||||

Net income | $ | 1,912 | $ | 1,434 | $ | 1,674 | $ | 1,042 | $ | 1,785 | $ | 5,019 | $ | 4,913 | ||||||||||||||

Per share data: | ||||||||||||||||||||||||||||

Earnings per share – basic | $ | 0.12 | $ | 0.09 | $ | 0.10 | $ | 0.06 | $ | 0.09 | $ | 0.32 | $ | 0.23 | ||||||||||||||

Earnings per share – fully diluted | $ | 0.12 | $ | 0.09 | $ | 0.10 | $ | 0.06 | $ | 0.09 | $ | 0.30 | $ | 0.22 | ||||||||||||||

Cash dividends per share | $ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.05 | $ | 0.15 | $ | 0.15 | ||||||||||||||

Weighted average basic shares | 15,560 | 15,835 | 16,175 | 17,936 | 20,747 | 15,858 | 21,486 | |||||||||||||||||||||

Weighted average diluted shares | 16,210 | 16,376 | 16,710 | 18,446 | 21,301 | 16,509 | 22,040 | |||||||||||||||||||||

Total shares outstanding | 16,404 | 16,664 | 16,963 | 18,261 | 19,960 | 16,404 | 19,960 | |||||||||||||||||||||

Book value per share | $ | 12.74 | $ | 12.68 | $ | 12.57 | $ | 12.32 | $ | 12.20 | $ | 12.74 | $ | 12.20 | ||||||||||||||

Tangible book value per share | $ | 12.44 | $ | 12.39 | $ | 12.29 | $ | 12.06 | $ | 11.95 | $ | 12.44 | $ | 11.95 | ||||||||||||||

__________________________________

(1) | Financial information as of September 30, 2014 has been derived from audited financial statements. |

7

Exhibit 99.1

Charter Financial Corporation

Supplemental Information (unaudited)

dollars in thousands

Quarter to Date | Year to Date | |||||||||||||||||||||||||||

6/30/2015 | 3/31/2015 | 12/31/2014 | 9/30/2014 | 6/30/2014 | 6/30/2015 | 6/30/2014 | ||||||||||||||||||||||

Not covered by loss share agreements | ||||||||||||||||||||||||||||

Loans receivable: (1) | ||||||||||||||||||||||||||||

1-4 family residential real estate | $ | 174,824 | $ | 172,131 | $ | 157,340 | $ | 152,811 | $ | 139,803 | $ | 174,824 | $ | 139,803 | ||||||||||||||

Commercial real estate | 356,950 | 340,172 | 313,658 | 300,556 | 284,591 | 356,950 | 284,591 | |||||||||||||||||||||

Commercial | 30,078 | 29,432 | 27,844 | 24,760 | 21,172 | 30,078 | 21,172 | |||||||||||||||||||||

Real estate construction | 70,189 | 70,758 | 67,196 | 63,485 | 58,459 | 70,189 | 58,459 | |||||||||||||||||||||

Consumer and other | 4,854 | 4,560 | 4,625 | 4,959 | 17,010 | 4,854 | 17,010 | |||||||||||||||||||||

Total non-covered loans receivable | $ | 636,895 | $ | 617,053 | $ | 570,663 | $ | 546,571 | $ | 521,035 | $ | 636,895 | $ | 521,035 | ||||||||||||||

Allowance for loan losses: | ||||||||||||||||||||||||||||

Balance at beginning of period | $ | 8,463 | $ | 8,494 | $ | 8,473 | $ | 8,606 | $ | 8,431 | $ | 8,473 | $ | 8,189 | ||||||||||||||

Charge-offs | (54 | ) | (59 | ) | (88 | ) | (342 | ) | (238 | ) | (202 | ) | (399 | ) | ||||||||||||||

Recoveries | 76 | 28 | 109 | 209 | 13 | 214 | 116 | |||||||||||||||||||||

Provision | — | — | — | — | — | — | 300 | |||||||||||||||||||||

Transfer (2) | — | — | — | — | 400 | — | 400 | |||||||||||||||||||||

Balance at end of period | $ | 8,485 | $ | 8,463 | $ | 8,494 | $ | 8,473 | $ | 8,606 | $ | 8,485 | $ | 8,606 | ||||||||||||||

Nonperforming assets: (3) | ||||||||||||||||||||||||||||

Nonaccrual loans | $ | 4,310 | $ | 3,410 | $ | 3,274 | $ | 3,508 | $ | 4,243 | $ | 4,310 | $ | 4,243 | ||||||||||||||

Loans delinquent 90 days or greater and still accruing | — | — | 64 | 736 | 238 | — | 238 | |||||||||||||||||||||

Total nonperforming non-covered loans | 4,310 | 3,410 | 3,338 | 4,244 | 4,481 | 4,310 | 4,481 | |||||||||||||||||||||

Other real estate owned | 939 | 1,144 | 954 | 1,758 | 1,331 | 939 | 1,331 | |||||||||||||||||||||

Total nonperforming non-covered assets | $ | 5,249 | $ | 4,554 | $ | 4,292 | $ | 6,002 | $ | 5,812 | $ | 5,249 | $ | 5,812 | ||||||||||||||

Troubled debt restructuring: | ||||||||||||||||||||||||||||

Troubled debt restructurings - accruing | $ | 6,105 | $ | 6,064 | $ | 6,094 | $ | 6,154 | $ | 7,352 | $ | 6,105 | $ | 7,352 | ||||||||||||||

Troubled debt restructurings - nonaccrual | 1,790 | 1,673 | 1,673 | 1,674 | 2,094 | 1,790 | 2,094 | |||||||||||||||||||||

Total troubled debt restructurings | $ | 7,895 | $ | 7,737 | $ | 7,767 | $ | 7,828 | $ | 9,446 | $ | 7,895 | $ | 9,446 | ||||||||||||||

Covered by loss sharing agreements | ||||||||||||||||||||||||||||

Nonperforming assets: | ||||||||||||||||||||||||||||

Other real estate owned | $ | 2,351 | $ | 3,343 | $ | 4,554 | $ | 5,558 | $ | 8,014 | $ | 2,351 | $ | 8,014 | ||||||||||||||

Covered loans 90+ days delinquent (4) | 1,248 | 2,638 | 5,434 | 5,315 | 3,156 | 1,248 | 3,156 | |||||||||||||||||||||

Total nonperforming covered assets | $ | 3,599 | $ | 5,981 | $ | 9,988 | $ | 10,873 | $ | 11,170 | $ | 3,599 | $ | 11,170 | ||||||||||||||

__________________________________

(1) | Includes previously acquired loans in the amount of $20.2 million and $20.8 million at June 30, 2015 and March 31, 2015, respectively, related to the Neighborhood Community Bank and McIntosh Commercial Bank non single-family loss sharing agreements with the FDIC that expired in June 2014 and March 2015, respectively. Additionally, $8.2 million, $8.6 million and $9.1 million of previously acquired loans related to Neighborhood Community Bank are included at December 31, 2014, September 30, 2014 and June 30, 2014, respectively. |

(2) | Transfer of allowance related to acquired Neighborhood Community Bank non-single family loans upon expiration of the non-single family loss sharing agreement with the FDIC in June 2014. |

(3) | Previously acquired loans that are no longer covered under the commercial loss sharing agreement with the FDIC are excluded from this table. Due to the recognition of accretion income established at the time of acquisition, acquired loans that are greater than 90 days delinquent or designated nonaccrual status are regarded as accruing loans for reporting purposes. |

(4) | Covered loans contractually past due greater than ninety days are reported as accruing loans because of accretable discounts established at the time of acquisition. |

8

Exhibit 99.1

Charter Financial Corporation

Supplemental Information (unaudited)

Quarter to Date | Year to Date | ||||||||||||||||||||

6/30/2015 | 3/31/2015 | 12/31/2014 | 9/30/2014 | 6/30/2014 | 6/30/2015 | 6/30/2014 | |||||||||||||||

Return on equity (annualized) | 3.62 | % | 2.69 | % | 3.09 | % | 1.78 | % | 2.71 | % | 3.13 | % | 2.42 | % | |||||||

Return on assets (annualized) | 0.76 | % | 0.58 | % | 0.68 | % | 0.41 | % | 0.67 | % | 0.67 | % | 0.61 | % | |||||||

Net interest margin (annualized) | 3.62 | % | 3.54 | % | 3.47 | % | 3.14 | % | 3.26 | % | 3.54 | % | 3.24 | % | |||||||

Net interest margin, excluding the effects of purchase accounting (1) | 3.21 | % | 3.31 | % | 3.14 | % | 2.95 | % | 2.90 | % | 3.22 | % | 2.84 | % | |||||||

Bank tier 1 leverage ratio (2) | 16.70 | % | 16.73 | % | 18.31 | % | 17.67 | % | 19.51 | % | 16.70 | % | 19.51 | % | |||||||

Bank total risk-based capital ratio | 22.88 | % | 23.42 | % | 26.46 | % | 27.90 | % | 32.93 | % | 22.88 | % | 32.93 | % | |||||||

Effective tax rate | 34.36 | % | 34.67 | % | 31.96 | % | 31.58 | % | 32.77 | % | 33.67 | % | 31.52 | % | |||||||

Yield on loans | 5.02 | % | 4.95 | % | 5.14 | % | 5.05 | % | 5.44 | % | 5.04 | % | 5.47 | % | |||||||

Cost of deposits | 0.43 | % | 0.43 | % | 0.48 | % | 0.49 | % | 0.49 | % | 0.45 | % | 0.50 | % | |||||||

Ratios of non-covered assets: | |||||||||||||||||||||

Allowance for loan losses as a % of total loans | 1.33 | % | 1.37 | % | 1.49 | % | 1.55 | % | 1.65 | % | 1.33 | % | 1.65 | % | |||||||

Allowance for loan losses as a % of nonperforming loans | 196.86 | % | 248.17 | % | 254.47 | % | 199.64 | % | 192.06 | % | 196.86 | % | 192.06 | % | |||||||

Nonperforming assets as a % of total loans and REO | 0.82 | % | 0.74 | % | 0.75 | % | 1.09 | % | 1.11 | % | 0.82 | % | 1.11 | % | |||||||

Nonperforming assets as a % of total assets | 0.55 | % | 0.48 | % | 0.48 | % | 0.65 | % | 0.62 | % | 0.55 | % | 0.62 | % | |||||||

Net charge-offs as a % of average loans (annualized) | (0.01 | )% | 0.02 | % | (0.01 | )% | 0.10 | % | 0.18 | % | — | % | 0.08 | % | |||||||

__________________________________

(1) | Net interest income excluding accretion and amortization of loss share loans receivable divided by average net interest earning assets excluding average loan accretable discounts in the amount of $3.9 million, $5.1 million, $5.5 million, $6.1 million, and $5.5 million, for the quarters ended June 30, 2015, March 31, 2015, December 31, 2014, September 30, 2014, and June 30, 2014, respectively. |

(2) | During the quarter ended March 31, 2015, an upstream of capital was made between the bank and the holding company in the amount of $17.5 million to be used primarily for the repurchase of the Company's outstanding shares. |

9

Exhibit 99.1

Charter Financial Corporation

Average Balances, Interest Rates and Yields (unaudited)

dollars in thousands

Quarter to Date | |||||||||||||||||||||

6/30/2015 | 6/30/2014 | ||||||||||||||||||||

Average Balance | Interest | Average Yield/Cost (10) | Average Balance | Interest | Average Yield/Cost (10) | ||||||||||||||||

Assets: | |||||||||||||||||||||

Interest-earning assets: | |||||||||||||||||||||

Interest-earning deposits in other financial institutions | $ | 44,748 | $ | 26 | 0.23 | % | $ | 151,348 | $ | 97 | 0.26 | % | |||||||||

FHLB common stock and other equity securities | 3,006 | 35 | 4.70 | 3,443 | 36 | 4.14 | |||||||||||||||

Mortgage-backed securities and collateralized mortgage obligations available for sale | 155,280 | 735 | 1.89 | 176,194 | 872 | 1.98 | |||||||||||||||

Other investment securities available for sale (1) | 28,218 | 176 | 2.50 | 18,290 | 18 | 0.40 | |||||||||||||||

Loans receivable (1)(2)(3)(4) | 668,329 | 7,508 | 4.49 | 586,797 | 7,189 | 4.90 | |||||||||||||||

Accretion and amortization of loss share loans receivable (5) | 885 | 0.53 | 795 | 0.54 | |||||||||||||||||

Total interest-earning assets | 899,581 | 9,365 | 4.16 | 936,072 | 9,007 | 3.85 | |||||||||||||||

Total noninterest-earning assets | 103,728 | 123,453 | |||||||||||||||||||

Total assets | $ | 1,003,309 | $ | 1,059,525 | |||||||||||||||||

Liabilities and Equity: | |||||||||||||||||||||

Interest-bearing liabilities: | |||||||||||||||||||||

Interest bearing checking | $ | 175,641 | $ | 53 | 0.12 | % | $ | 178,771 | $ | 51 | 0.11 | % | |||||||||

Bank rewarded checking | 49,743 | 25 | 0.20 | 48,429 | 29 | 0.24 | |||||||||||||||

Savings accounts | 50,409 | 2 | 0.02 | 48,482 | 2 | 0.02 | |||||||||||||||

Money market deposit accounts | 123,392 | 62 | 0.20 | 120,903 | 65 | 0.21 | |||||||||||||||

Certificate of deposit accounts | 231,077 | 531 | 0.92 | 247,197 | 643 | 1.04 | |||||||||||||||

Total interest-bearing deposits | 630,262 | 673 | 0.43 | 643,782 | 790 | 0.49 | |||||||||||||||

Borrowed funds | 50,000 | 545 | 4.36 | 55,000 | 596 | 4.33 | |||||||||||||||

Total interest-bearing liabilities | 680,262 | 1,218 | 0.72 | 698,782 | 1,386 | 0.79 | |||||||||||||||

Noninterest-bearing deposits | 99,138 | 85,061 | |||||||||||||||||||

Other noninterest-bearing liabilities | 12,417 | 11,979 | |||||||||||||||||||

Total noninterest-bearing liabilities | 111,555 | 97,040 | |||||||||||||||||||

Total liabilities | 791,817 | 795,822 | |||||||||||||||||||

Total stockholders' equity | 211,492 | 263,703 | |||||||||||||||||||

Total liabilities and stockholders' equity | $ | 1,003,309 | $ | 1,059,525 | |||||||||||||||||

Net interest income | $ | 8,147 | $ | 7,621 | |||||||||||||||||

Net interest earning assets (6) | $ | 219,319 | $ | 237,290 | |||||||||||||||||

Net interest rate spread (7) | 3.44 | % | 3.06 | % | |||||||||||||||||

Net interest margin (8) | 3.62 | % | 3.26 | % | |||||||||||||||||

Net interest margin, excluding the effects of purchase accounting (9) | 3.21 | % | 2.90 | % | |||||||||||||||||

Ratio of average interest-earning assets to average interest-bearing liabilities | 132.24 | % | 133.96 | % | |||||||||||||||||

__________________________________

(1) | Tax exempt or tax-advantaged securities and loans are shown at their contractual yields and are not shown at a tax equivalent yield. |

(2) | Includes net loan fees deferred and accreted pursuant to applicable accounting requirements. |

(3) | Interest income on loans is interest income as recorded in the income statement and, therefore, does not include interest income on nonaccrual loans. |

(4) | Interest income on loans excludes discount accretion and amortization of the indemnification asset. |

(5) | Accretion of accretable purchase discount on loans acquired in FDIC-assisted acquisitions and amortization of the overstatement of FDIC indemnification asset. |

(6) | Net interest-earning assets represent total average interest-earning assets less total average interest-bearing liabilities. |

(7) | Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities. |

(8) | Net interest margin represents net interest income as a percentage of average interest-earning assets. |

(9) | Net interest margin, excluding the effects of purchase accounting represents net interest income excluding accretion and amortization of loss share loans receivable as a percentage of average net interest earning assets excluding loan accretable discounts in the amount of $3.9 million and $5.5 million for the quarters ended June 30, 2015 and June 30, 2014, respectively. |

(10) | Annualized. |

10

Exhibit 99.1

Charter Financial Corporation

Average Balances, Interest Rates and Yields (unaudited)

dollars in thousands

Fiscal Year to Date | |||||||||||||||||||||

6/30/2015 | 6/30/2014 | ||||||||||||||||||||

Average Balance | Interest | Average Yield/Cost (10) | Average Balance | Interest | Average Yield/Cost (10) | ||||||||||||||||

Assets: | |||||||||||||||||||||

Interest-earning assets: | |||||||||||||||||||||

Interest-earning deposits in other financial institutions | $ | 50,140 | $ | 85 | 0.23 | % | $ | 146,869 | $ | 267 | 0.24 | % | |||||||||

FHLB common stock and other equity securities | 3,276 | 109 | 4.44 | 3,748 | 103 | 3.66 | |||||||||||||||

Mortgage-backed securities and collateralized mortgage obligations available for sale | 163,857 | 2,359 | 1.92 | 184,775 | 2,794 | 2.02 | |||||||||||||||

Other investment securities available for sale (1) | 23,029 | 374 | 2.17 | 19,126 | 56 | 0.39 | |||||||||||||||

Loans receivable (1)(2)(3)(4) | 647,306 | 22,422 | 4.62 | 584,630 | 21,249 | 4.85 | |||||||||||||||

Accretion and amortization of loss share loans receivable (5) | 2,024 | 0.41 | 2,719 | 0.62 | |||||||||||||||||

Total interest-earning assets | 887,608 | 27,373 | 4.11 | 939,148 | 27,188 | 3.86 | |||||||||||||||

Total noninterest-earning assets | 107,218 | 134,998 | |||||||||||||||||||

Total assets | $ | 994,826 | $ | 1,074,146 | |||||||||||||||||

Liabilities and Equity: | |||||||||||||||||||||

Interest-bearing liabilities: | |||||||||||||||||||||

Interest bearing checking | $ | 169,518 | $ | 157 | 0.12 | % | $ | 175,754 | $ | 149 | 0.11 | % | |||||||||

Bank rewarded checking | 48,730 | 77 | 0.21 | 48,342 | 87 | 0.24 | |||||||||||||||

Savings accounts | 49,270 | 7 | 0.02 | 48,243 | 8 | 0.02 | |||||||||||||||

Money market deposit accounts | 124,565 | 196 | 0.21 | 127,567 | 211 | 0.22 | |||||||||||||||

Certificate of deposit accounts | 226,293 | 1,627 | 0.96 | 256,980 | 2,025 | 1.05 | |||||||||||||||

Total interest-bearing deposits | 618,376 | 2,064 | 0.45 | 656,886 | 2,480 | 0.50 | |||||||||||||||

Borrowed funds | 53,077 | 1,725 | 4.33 | 57,956 | 1,872 | 4.31 | |||||||||||||||

Total interest-bearing liabilities | 671,453 | 3,789 | 0.75 | 714,842 | 4,352 | 0.81 | |||||||||||||||

Noninterest-bearing deposits | 97,598 | 77,572 | |||||||||||||||||||

Other noninterest-bearing liabilities | 11,807 | 11,459 | |||||||||||||||||||

Total noninterest-bearing liabilities | 109,405 | 89,031 | |||||||||||||||||||

Total liabilities | 780,858 | 803,873 | |||||||||||||||||||

Total stockholders' equity | 213,968 | 270,273 | |||||||||||||||||||

Total liabilities and stockholders' equity | $ | 994,826 | $ | 1,074,146 | |||||||||||||||||

Net interest income | $ | 23,584 | $ | 22,836 | |||||||||||||||||

Net interest earning assets (6) | $ | 216,155 | $ | 224,306 | |||||||||||||||||

Net interest rate spread (7) | 3.36 | % | 3.05 | % | |||||||||||||||||

Net interest margin (8) | 3.54 | % | 3.24 | % | |||||||||||||||||

Net interest margin, excluding the effects of purchase accounting (9) | 3.22 | % | 2.84 | % | |||||||||||||||||

Ratio of average interest-earning assets to average interest-bearing liabilities | 132.19 | % | 131.38 | % | |||||||||||||||||

__________________________________

(1) | Tax exempt or tax-advantaged securities and loans are shown at their contractual yields and are not shown at a tax equivalent yield. |

(2) | Includes net loan fees deferred and accreted pursuant to applicable accounting requirements. |

(3) | Interest income on loans is interest income as recorded in the income statement and, therefore, does not include interest income on nonaccrual loans. |

(4) | Interest income on loans excludes discount accretion and amortization of the indemnification asset. |

(5) | Accretion of accretable purchase discount on loans acquired in FDIC-assisted acquisitions and amortization of the overstatement of FDIC indemnification asset. |

(6) | Net interest-earning assets represent total average interest-earning assets less total average interest-bearing liabilities. |

(7) | Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities. |

(8) | Net interest margin represents net interest income as a percentage of average interest-earning assets. |

(9) | Net interest margin, excluding the effects of purchase accounting represents net interest income excluding accretion and amortization of loss share loans receivable as a percentage of average net interest earning assets excluding loan accretable discounts in the amount of $4.8 million and $4.5 million for the three months ended June 30, 2015 and June 30, 2014, respectively. |

(10) | Annualized. |

11

Exhibit 99.2

| ||

NEWS RELEASE

Contact: | ||

Robert L. Johnson, Chairman & CEO | At Dresner Corporate Services | |

Curt Kollar, CFO | Steve Carr | |

706-645-1391 | 312-780-7211 | |

CHARTER FINANCIAL DECLARES REGULAR

QUARTERLY CASH DIVIDEND

West Point, Georgia, July 23, 2015 – Charter Financial Corporation (NASDAQ: CHFN) today announced that its board of directors has declared a regular quarterly cash dividend of $0.05 per share. The dividend is payable on August 24, 2015, to stockholders of record as of August 10, 2015.

Charter Financial Corporation is a savings and loan holding company and the parent company of CharterBank, a full-service community bank and a federal savings institution. CharterBank is headquartered in West Point, Georgia, and operates branches in west-central Georgia, east-central Alabama, and the Florida Gulf Coast. CharterBank's deposits are insured by the Federal Deposit Insurance Corporation. Investors may obtain additional information about Charter Financial Corporation and CharterBank on the internet at www.charterbk.com under About Us.

1

Forward-Looking Statement 2 This presentation may contain certain forward-looking statements regarding our prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the Safe Harbor Provision for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of said safe harbor provision. Forward- looking statements can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and words of similar meaning. These forward-looking statements include, but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the asset quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward-looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: general economic conditions, either nationally or in our market areas, that are worse than expected; competition among depository and other financial institutions; changes in the interest rate environment that reduce our margins or reduce the fair value of financial instruments; adverse changes in the securities markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate acquired entities; our incurring higher than expected loan charge-offs with respect to assets acquired in FDIC-assisted acquisitions; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies and the Financial Accounting Standards Board; and changes in our organization, compensation and benefit plans. Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date of this presentation. Except as required by applicable law or regulation, we do not undertake, and specifically disclaim any obligation to update any forward-looking statements that may be made from time to time by or on behalf of the Company. Please see “Risk Factors” beginning on page 19 of the Company’s Prospectus dated February 11, 2013.

Market Profile 3 NASDAQ: CHFN Recent Price1 (07/20/2015): $12.33 Shares Outstanding (06/30/2015): 16.4 Million Market Capitalization2: $202.3 Million Price/Tangible Book Value3: 99.1% Dividend Yield: 1.62% Total Assets (06/30/2015): $1.0 Billion 1- Source: Bloomberg 2- Based on July 20, 2015 closing market price and June 30, 2015 shares outstanding. 3- Based on July 20, 2015 closing market price, June 30, 2015 shares outstanding and June 30, 2015 tangible book value.

Corporate Profile 4 Headquartered in West Point, Georgia Founded in 1954 as First Federal Savings and Loan Association Organic & acquisitive growth Three FDIC-assisted acquisitions (June 2009, March 2010, Sept 2011) Approximately 274 FTE’s servicing over 48,000 checking accounts 15 Branches along I-85 & I-20 in GA/AL and NW Florida June 30, 2015: Total Assets: $1.0 Billion Total Net Loans: $672.8 Million Total Deposits: $734.2 Million Total Capital: $208.9 Million

Overview of Management Team 5 Focus on Growing Atlanta MSA Presence Conservative Credit M&A Experience … 5 Transactions Both Assisted & Unassisted Full Conversion From Mutual Thrift – Established Strong Capital Position Transformed Balance Sheet From Traditional Thrift to Commercial Bank Top Executives NAME POSITION (Banking/CharterBank) EXPERIENCE Robert Lee Johnson Chairman & CEO 33/31 Lee Washam President, CharterBank 31/15 Curtis R. Kollar Senior VP & CFO 28/24

6 Market Conditions Auto Industry is Strong on I-85 Corridor Most of Our Markets have Significant Manufacturing, University or Military Influences Lending Opportunities in Metro Markets Gradual Recovery in Non-Metro Markets Active Regional M&A Market

7 Recent Accomplishments EPS Growth Improving Operating Leverage Flat Expenses and Core NIM Expansion Annualized Loan Growth 14.6% in Three Quarters Continued Growth in Checking Accounts and Bank Card Fees Accretive Impact of Stock Repurchases Good Credit Quality –Non Performing Assets 0.55% of Assets Reduced Shares Outstanding by 28% in the Last 2 Years All Purchased Below Tangible Book Value

Capital Management Strategies 8 TCE of 20.31% at June 30, 2015 Uses of Capital Disciplined Approach to Growth Organic Balance Sheet Growth Metro Markets Lender Lift Outs Whole Bank Acquisitions Branch Purchases Stock Repurchases and Dividends

Growth Strategies 9 Focus on Whole Bank Targets Providing High EPS Accretion Reasonable Tangible Book Value Earn-Back Metro Institution With Loan Growth Potential Interstate or Franchise Add-On for Income Accretion and Funding Lender Lift-out in Key Markets

11.20 11.40 11.60 11.80 12.00 12.20 12.40 12.60 15 16 17 18 19 20 21 22 23 24 $ DollarsM ill ion s Shares Outstanding Tangible Book Value per Share Stock Repurchases 10 Reduced Outstanding Shares by 28%

Financial Information

Fiscal YTD 2015 (9 Months) Results and Developments 12 Total Loans, Net Tangible Common Equity/Total Assets Net Income $5.0 million Fully Diluted EPS** $0.30 Loan Loss Reserves $8.5 million (Non-covered) ALL / Non-covered NPLs – 196.86% ALL as a % of Total Non-covered Loans - 1.33% Continued advances in core profitability Nonperforming Assets / Assets 0.55%* Superior asset quality 20.31% $673 million 5 consecutive quarters of total loan growth * For non-covered assets. **Diluted net income per share for the nine months ended June 30, 2015 was computed by dividing net income by weighted average shares outstanding plus potential common shares resulting from dilutive stock options and unvested restricted shares, determined using the treasury stock method. ROAA 0.67% Improved Basic EPS over Fiscal YTD 2014 (9 Months) by 39.1% June Qtr. Basic EPS $0.12 June Qtr. ROA 0.76% Well capitalized & protective of book value per share Actively repurchasing common shares Basic EPS $0.32

Balance Sheet Highlights 13 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. [1] Includes FDIC Acquisition of Neighborhood Community Bank. [2] Includes FDIC Acquisition of McIntosh Commercial Bank. [3] Includes FDIC Acquisition of First National Bank of Florida. [4] Core deposits consist of transaction accounts, money market accounts, and savings accounts. [5] Incremental capital raise of approximately $30 million (net). [6] Second step conversion and reorganization resulted in $142.9 million in gross offering proceeds. (Dollars in $000's) 2009 [1] 2010 [2] 2011 [3] 2012 2013 2014 Q3 2015 Total Assets $936,880 $1,186,082 $1,171,710 $1,032,220 $1,089,406 $1,010,361 $1,004,936 Loans, net 552,550 599,370 655,028 593,904 579,854 606,367 672,830 Non Covered 462,786 451,231 419,979 427,676 470,863 536,732 627,006 Covered 89,764 148,138 235,050 166,228 108,991 69,635 45,824 Securities 206,061 133,183 158,737 189,379 215,118 188,743 189,791 Total Liabilities $838,623 $1,052,746 $1,032,294 $889,699 $815,628 $785,406 $796,017 Retail Deposits 463,566 739,691 883,389 779,397 745,900 717,192 703,471 Core [4] 216,902 313,170 447,176 456,292 475,426 486,248 505,721 Time 246,664 426,521 436,213 323,105 270,475 230,944 228,517 Total Borrowings 227,000 212,000 110,000 81,000 60,000 55,000 50,000 Total Equity $98,257 $135,788 [5] $139,416 $142,521 $273,778 [6] $224,955 $208,919

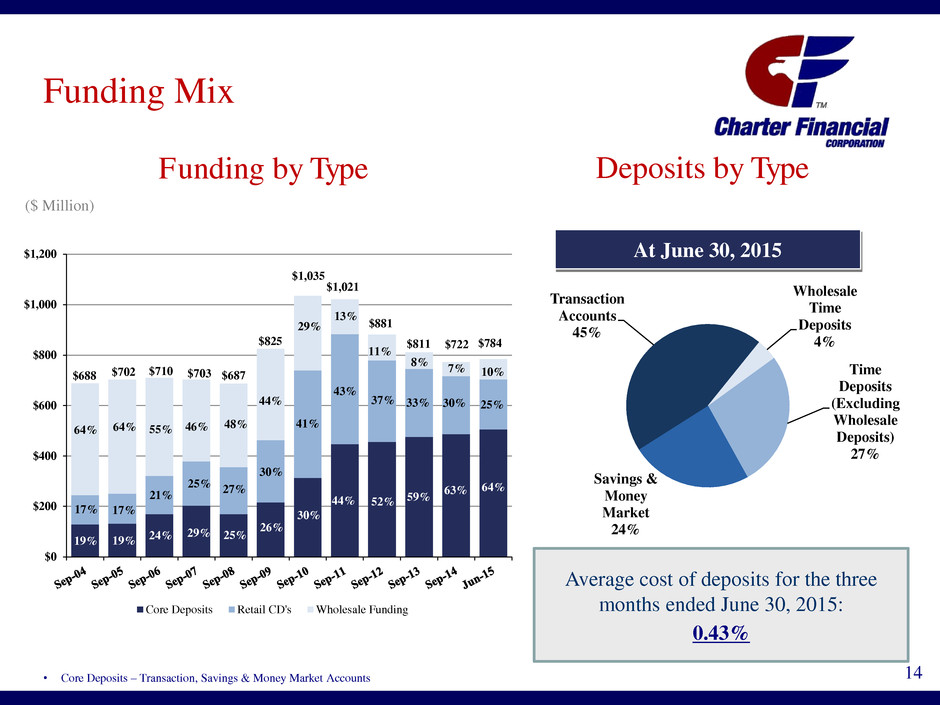

Funding Mix 14 32.1% At June 30, 2015 Average cost of deposits for the three months ended June 30, 2015: 0.43% Deposits by Type • Core Deposits – Transaction, Savings & Money Market Accounts Funding by Type ($ Million) $0 $200 $400 $600 $800 $1,000 $1,200 Core Deposits Retail CD's Wholesale Funding 55% 21% 24% 46% 25% 29% 64% 17% 19% 48% 27% 25% 26% 30% 44% 30% 41% 29% 43% 13% 44% $710 $703 $1,021 $825 $1,035 $881 11% 37% 52% $811 8% 59% 33% $702$688 $687 19% 17% 64% $784 10% 25% 64% $722 7% 30% 63%Time Deposits (Excluding Wholesale Deposits) 27% Savings & Money Market 24% Transaction Accounts 45% Wholesale Time Deposits 4%

Loans Outstanding at June 30, 2015 15 1-4 Family 26% Comm RE - Owner Occupied 12% Comm RE - Non Owner Occupied - Other 35% Comm RE - Hotels 5% Comm RE - Multifamily 6% Commercial & Industrial 5% Consumer & Other 1% Real Estate Construction 10% Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. At 2009 2010 2011 2012 2013 2014 6/30/15 Non-Covered NPAs / Total Non-Covered Assets (%) 2.16% 2.33% 1.99% 0.69% 0.49% 0.65% 0.55% on- overed COs / Average Non-Covered Loans (%) 0.71 0.90 0.48 0.86 0.32 0.08 --- ALLL Non-Covered Loans / Non-Covered NPLs (x) 0.70x 0.84x 0.80x 2.38x 2.80x 2.00x 1.97x Non-Covered Allowance / Total Non-Covered oans (%) 1.97% 2.12% 2.19% 1.87% 1.70% 1.55% 1.33%

$564.3 $579.9 $576.6 $572.0 $582.4 $606.4 $627.7 $656.2 $672.8 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0 $600.0 $650.0 $700.0 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Net Loans Outstanding Trend ($ Million) 16

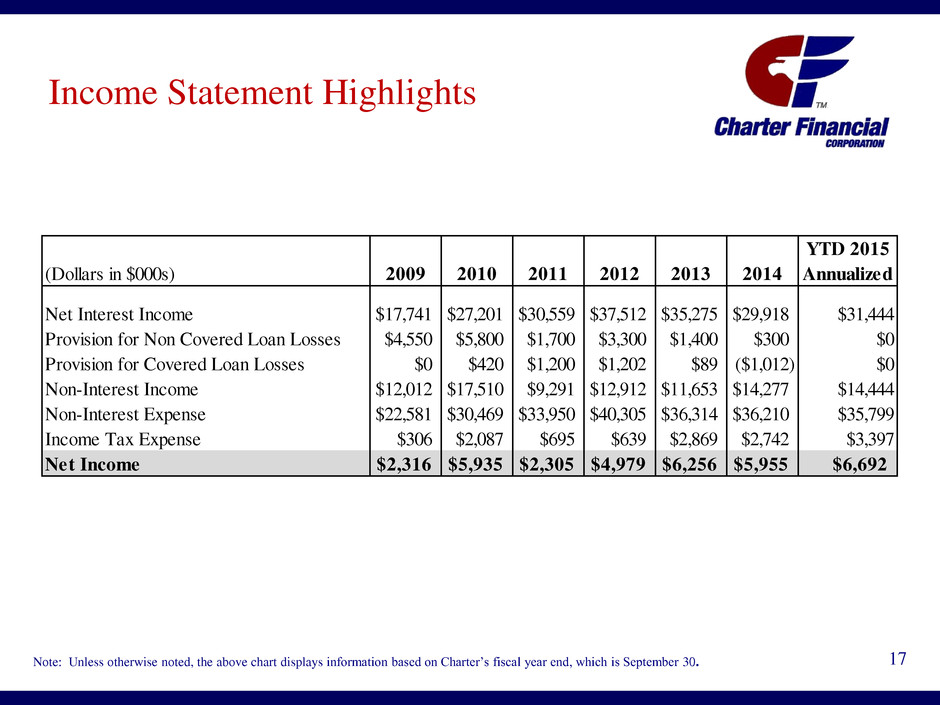

Income Statement Highlights 17 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. YTD 2015 (Dollars in $000s) 2009 2010 2011 2012 2013 2014 Annualized Net Interest Income $17,741 $27,201 $30,559 $37,512 $35,275 $29,918 $31,444 Provision for Non Covered Loan Losses $4,550 $5,800 $1,700 $3,300 $1,400 $300 $0 Provision for Covered Loan Losses $0 $420 $1,200 $1,202 $89 ($1,012) $0 Non-Interest Income $12,012 $17,510 $9,291 $12,912 $11,653 $14,277 $14,444 Non-Interest Expense $22,581 $30,469 $33,950 $40,305 $36,314 $36,210 $35,799 Income Tax Expense $306 $2,087 $695 $639 $2,869 $2,742 $3,397 Net Income $2,316 $5,935 $2,305 $4,979 $6,256 $5,955 $6,692

Return on Average Assets 18 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. 0.27% 0.56% 0.22% 0.46% 0.58% 0.56% 0.67% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015

5.24% 5.64% 5.38% 5.35% 4.61% 3.83% 4.07% 4.10% 4.16% 3.22% 2.55% 1.85% 1.23% 0.95% 0.81% 0.80% 0.74% 0.72% 2.35% 3.19% 3.59% 4.17% 3.82% 3.22% 3.47% 3.54% 3.62% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 Q1 2015 Q2 2015 Q3 2015 Yield on Interest Earning Assets Cost of Interest Bearing Liabilities Net Interest Margin Net Interest Margin Trends 19 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. 2.90% 2.95% 3.14% 3.31% 3.21% 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 3.40% Q3 2014 Q4 2014 Q1 2015 Q2 2 15 Q3 2015 Net Interest Margin Excluding the effects of Purchase Accounting

Operating Leverage 20 ($ Million) *Adjusted Net Operating Revenue = Net Interest Income + Non-Interest Income – Net Purchase Accounting Loan Accretion **Efficiency Ratio = Non-Interest Expense / (Net Interest Income + Non-Interest Income – Net Purchase Accounting Loan Accretion) $28.1 $37.0 $31.6 $41.4 $38.0 $41.1 $43.2 80% 82% 107% 97% 96% 88% 83% 76% 79% 85% 80% 77% 82% 78% 60% 70% 80% 90% 100% 110% 120% $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Adjusted Net Operating Revenue* Bargain Purchase Gain Adjusted Efficiency Ratio** Efficiency Ratio

Operating Leverage 21 ($ Million) $20 $25 $30 $35 $40 $45 $50 $55 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Net Operating Revenue Adjusted Net Operating Revenue* Expenses *Adjusted Net Operating Revenue excludes Net Purchase Accounting Loan Accretion

Noninterest Expense 22 Note: Unless otherwise noted, the above chart displays information based on Charter’s fiscal year end, which is September 30. ($ Million) $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 YTD 2015 Annualized Marketing Professional Services Occupancy & Furn. and Equip. Other Salaries and Benefits $35.8 $30.5 21.7% 22.8% $22.6 $34.0 $40.3 $36.3 22.4% 17.9% 50.8%48.0% 21.7% 21.6% 46.4% 21.1% 21.5% 45.3% 44.5% 26.0% 20.5% 54.6% 14.1% 22.7% $36.2 56.3% 13.3% 23.3%

Investment Merits Positioned to be opportunistic…. Favorable credit quality, robust capital position & profitable Trading at 99.1% of tangible book value Implemented consecutive stock repurchase plans Disciplined acquisition approach/Actively seeking opportunities Existing infrastructure can support a larger balance sheet Track record of returns to shareholders with annualized total return since: 2013 stock conversion of 12% 2010 stock offering of 15% 23

Robert L. Johnson Chairman and Chief Executive Officer [email protected] (706) 645-3249 Lee W. Washam President [email protected] (706) 645-3630 Curtis R. Kollar Senior Vice President and Chief Financial Officer [email protected] (706) 645-3237 24 Investor Contacts 1233 O. G. Skinner Drive West Point, Georgia 31833 1-800-763-4444 www.charterbk.com

Appendix

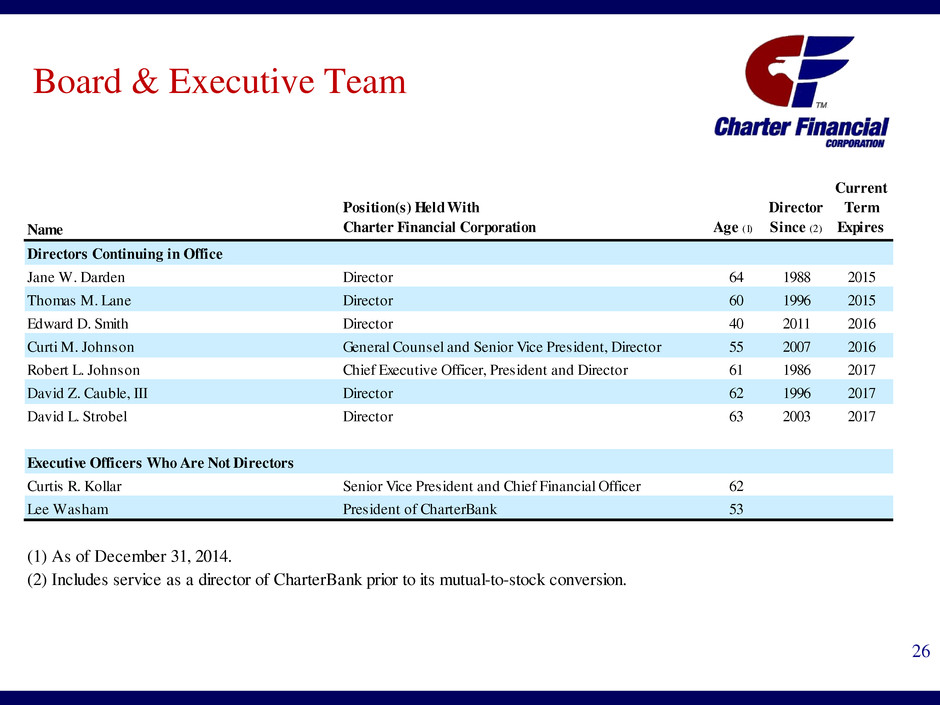

Board & Executive Team 26 Name Position(s) Held With Charter Financial Corporation Age (1) Director Since (2) Current Term Expires Directors Continuing in Office Jane W. Darden Director 64 1988 2015 Thomas M. Lane Director 60 1996 2015 Edward D. Smith Director 40 2011 2016 Curti M. Johnson General Counsel and Senior Vice President, Director 55 2007 2016 Robert L. Johnson Chief Executive Officer, President and Director 61 1986 2017 David Z. Cauble, III Director 62 1996 2017 David L. Strobel Director 63 2003 2017 Executive Officers Who Are Not Directors Curtis R. Kollar Senior Vice President and Chief Financial Officer 62 Lee Washam President of CharterBank 53 (1) As of December 31, 2014. (2) Includes service as a director of CharterBank prior to its mutual-to-stock conversion.

__________________________________ (1) Assumes an instantaneous uniform change in interest rates at all maturities. (2) NPV is the difference between the present value of an institution’s assets and liabilities. (3) Present value of assets represents the discounted present value of incoming cash flows on interest- earning assets. (4) NPV Ratio represents NPV divided by the present value of assets. Net Portfolio Value 27 At June 30, 2015 Change in Interest Rates (bp) (1) Estimated NPV (2) Estimated Increase (Decrease) in NPV Percentage Change in NPV NPV Ratio as a Percent of Present Value of Assets ( 3 ) ( 4 ) Increase (Decrease) in NPV Ratio as a Percent of Present Value of Assets ( 3 ) ( 4 ) (dollars in thousands) 300 $208,412 $1,286 0.6% 20.8% 0.2% 200 $208,487 $1,361 0.7% 20.8% 0.2% 100 $208,122 $997 0.5% 20.7% 0.1% — $207,126 — — 20.6% — (100) $199,612 ($7,514) (3.6%) 19.9% (0.7%)

End of Presentation

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Jaxon Announces Resignation of CFO

- Business growth stunted by manual tasks, Tipalti study finds

- Final Week of Containing Luxury's StartEngine Crowdfunding Campaign

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share