Form 8-K CAREER EDUCATION CORP For: Nov 13

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.�20549

�

�

FORM 8-K

�

�

CURRENT REPORT

Pursuant to Section�13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November�13, 2014

�

�

Career Education Corporation

(Exact Name of Registrant as Specified in Charter)

�

�

�

| Delaware | � | 0-23245 | � | 36-3932190 |

| (State or Other Jurisdiction of Incorporation) |

� | (Commission File Number) |

� | (IRS Employer Identification No.) |

| 231 N. Martingale Rd., Schaumburg, IL | � | 60173 | ||

| (Address of Principal Executive Offices) | � | (Zip Code) | ||

Registrant�s telephone number, including area code:�(847)�781-3600

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

�

�

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

�

| � | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

�

| � | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

�

| � | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

�

| � | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

�

�

�

| Item�7.01. | Regulation FD Disclosure. |

Commencing on November�13, 2014, Career Education Corporation (the �Company�) will conduct a series of investor meetings hosted by President and CEO Scott Steffey and Chief Financial Officer Reid Simpson. A copy of the presentation materials to be used in the meetings is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The presentation materials are also available in the Investor Relations section of the Company�s website at www.careered.com. The Company disclaims any obligation to correct or update these presentation materials in the future.

The information in this report is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Items 7.01 and 9.01 of this report will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company.

Forward�Looking Statements

Statements in the presentation contain �forward-looking statements,� as defined in Section�21E of the Securities Exchange Act of 1934, as amended, that reflect the Company�s current expectations regarding its future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by, and information currently available to, the Company�s management. These statements are based on information currently available to the Company and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item�1A,�Risk Factors� of the Company�s Annual Report on Form 10-K for the year ended December�31, 2013 and its subsequent filings with the Securities and Exchange Commission, that could cause the Company�s actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances or for any other reason.

Non-GAAP Financial Measures

The presentation contains certain financial information that is presented on a non-GAAP basis. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of the presentation, and the presentation (including the reconciliation) has been posted to the Investor Relations section of the Company�s website at www.careered.com.

�

| Item�9.01. | Financial Statements and Exhibits. |

�

| (d) | Exhibits. |

�

| Exhibit Number |

�� | Description of Exhibits |

| 99.1 | �� | Investor Presentation November 2014 (furnished pursuant to Item 7.01) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

| CAREER EDUCATION CORPORATION | ||

| By: | � | /s/ Jeffrey D. Ayers |

| � | Jeffrey D. Ayers | |

| � | Senior Vice President, General Counsel and Corporate Secretary | |

Dated: November�13, 2014

Exhibit Index

�

| Exhibit Number |

�� | Description of Exhibits |

| 99.1 | �� | Investor Presentation November 2014 (furnished pursuant to Item 7.01) |

Confidential �

For Internal Use Only

Career Education

Investor Presentation

November 2014

Exhibit 99.1 |

Confidential �

For Internal Use Only

Cautionary Statements & Disclosures

1

This

presentation

contains

�forward-looking

statements,�

as

defined

in

Section

21E

of

the

Securities

Exchange

Act

of

1934, as amended, that reflect our current expectations regarding our future

growth, results of operations, cash flows, performance and business

prospects and opportunities, as well as assumptions made by, and information

currently available to, our management. We have tried to identify

forward-looking statements by using words such as �will,�

�believe,�

�moving closer to,�

�opportunities,�

�expect,�

�estimate,�

�beginning to�

and similar expressions, but these words

are not the exclusive means of identifying forward-looking statements. These

statements are based on information currently available to us and are

subject to various risks, uncertainties, and other factors, including, but not limited to,

those discussed in Item 1A,�Risk Factors�

of our Annual Report on Form 10-K for the year ended December 31, 2013 that

could cause our actual growth, results of operations, financial condition,

cash flows, performance and business prospects and opportunities to differ

materially from those expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation to update such

factors or to publicly announce the results of any of the

forward-looking statements contained herein to reflect future events, developments, or changed

circumstances or for any other reason.

Certain

financial

information

is

presented

on

a

non-GAAP

basis.

The

Company

believes

it

is

useful

to

present

non-GAAP

financial measures which exclude certain significant items as a means to understand

the performance of its core business.

As a general matter, the Company uses non-GAAP financial measures in

conjunction with results presented in accordance

with

GAAP

to

help

analyze

the

performance

of

its

core

business,

assist

with

preparing

the

annual

operating

plan,

and

measure

performance

for

some

forms

of

compensation.

In

addition,

the

Company

believes

that

non-GAAP

financial information is used by analysts and others in the investment community to

analyze the Company's historical results and to provide estimates of future

performance and that failure to report non-GAAP measures could result in a

misplaced

perception

that

the

Company's

results

have

underperformed

or

exceeded

expectations.

The

most

directly

comparable GAAP information and a reconciliation between the non-GAAP and GAAP

figures are provided at the end of this presentation, and this presentation

(including the reconciliation) has been posted to our website. |

Confidential �

For Internal Use Only

Key Investment Highlights

2

�

Diverse business model with both online and campus based portfolio

of assets.

�

Turnaround strategy in place with execution progressing.

�

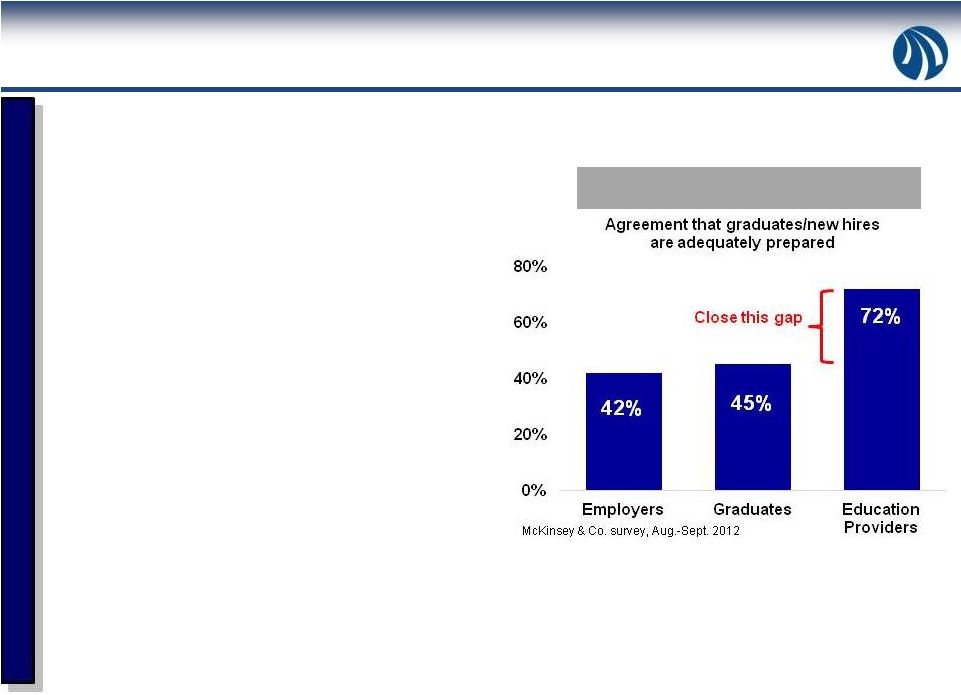

Favorable industry dynamics in terms of market size and employer

demand for skilled workers.

�

Strong balance sheet and cash position with clear path to profitability.

�

Dedicated management team with extensive industry experience.

|

Confidential �

For Internal Use Only

U.S. Macro Education Market Drivers

3

(1)

Source:� Bureau of Labor Statistics

�

U.S. population has low level of

educational attainment.

�

Approximately 3 million jobs are

unfilled due to a worker skills gap

(1)

.

�

Proprietary segment serves an under

served demographic with a higher

concentration of minority students and

older students than attend traditional

schools.

�

Due to student dependency on tuition

assistance (Title IV funds), the

proprietary segment is highly

regulated by the Department of

Education, Accreditors and States.

�The Skill Gap� |

Confidential �

For Internal Use Only

Earnings Power of Postsecondary Education

4

�

Meaningful correlation between post secondary education and lifetime

earnings. �

For-profit college students that earned a Bachelor�s degree earn an

average salary greater

than

those

students

that

earned

their

degrees

from

public

and

private

colleges

(2)

.

(2

) National Center for Education Statistics issued a report in July 2014 which

included data from students who earned a Bachelor�s Degree in

2007-2008.� The data from the report was derived from surveys conducted approximately four year�s post graduation.

(1)

Georgetown University Center on Education and the Workforce (June 2010).

|

Confidential �

For Internal Use Only

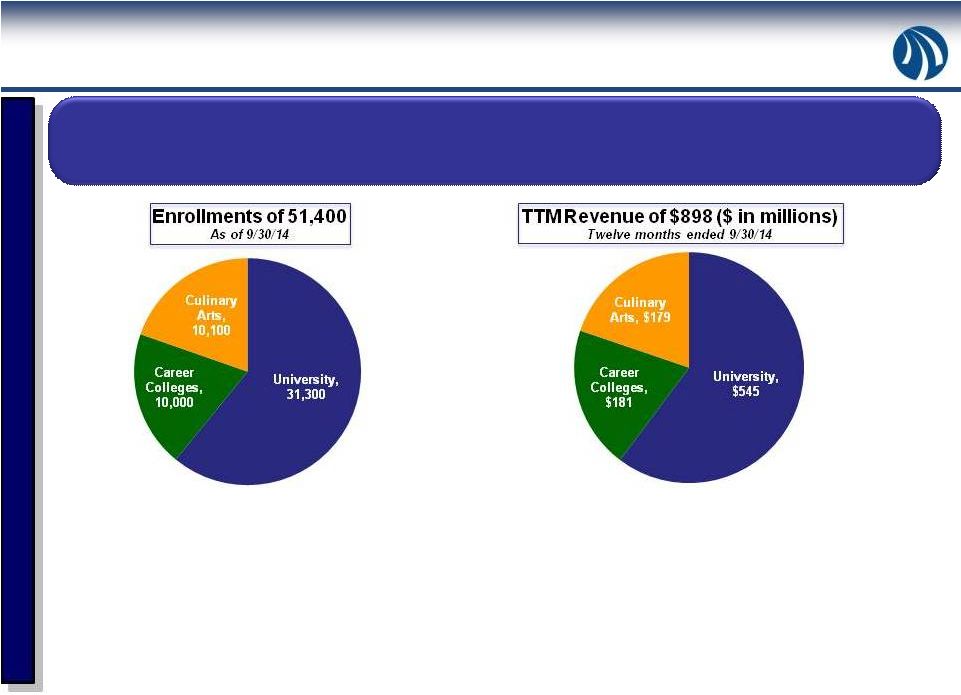

Business Overview

5

Dynamic educational services company committed to quality, career-focused

learning to a diverse student population through online, on-ground and hybrid

learning program offerings.

�

Approximately 30,250 students, or 63% of total enrollments, are online

students. �

Focus on improving the educational experiences and outcomes of students and

helping bridge the gap between learners seeking new skills and

employers looking for talent to

help them succeed.

�

Turnaround process underway, led by seasoned executive management team with

extensive industry experience. |

Confidential �

For Internal Use Only

Segment Geographic and Strategy Overview

6 |

Confidential �

For Internal Use Only

A Summary of Career Education�s History

7

�

Company founded in 1994 and went public in 1998.

�

Business built through a series of acquisitions.

�

Company

and

industry

have

experienced

two

market

downturns

�

the

most

recent

one

being more severe. |

Confidential �

For Internal Use Only

Key Investor Objectives to Turnaround Strategy

8

�

Strengthen Academic Outcomes, Enhance Regulatory Compliance

and Simplify Business Model.

�

Generate Modest University Total Student Enrollment Growth.

�

Neutralize Negative Impact of Career Schools as Soon as Practical.

�

Reduce Organizational Cost Structure.

�

Successfully Complete the Teach Out of Transitional Schools.

We

also

regularly

evaluate

the

Company�s

assets

to

determine

where

best

to

deploy

our

capital

and

structure

our

organization

to

provide

the

greatest

opportunity

for

long-term,

sustainable

shareholder

growth. |

Confidential �

For Internal Use Only

Improving Academic Outcomes, Enhanced Regulatory

Compliance and Simplification

9

�

IntelliPath is a competitive differentiator.

�

For the 2014 cohort, 100% of our 32 nationally-accredited ACICS

schools (that are not in teach out) achieved a campus placement rate

that met or exceeded ACICS�

compliance benchmark.

�

HLC acted to continue their regional accreditation of AIU and CTU in

2014 and 2013, respectively.

�

Consolidation of brands and programs in career schools.

|

Confidential �

For Internal Use Only

Generate Modest University Total Student Enrollment Growth

10

Change in Total Student Enrollments vs. Prior Year Quarter

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014 |

Confidential �

For Internal Use Only

Neutralize Negative Impact of Career Schools as Soon

as Practical

11

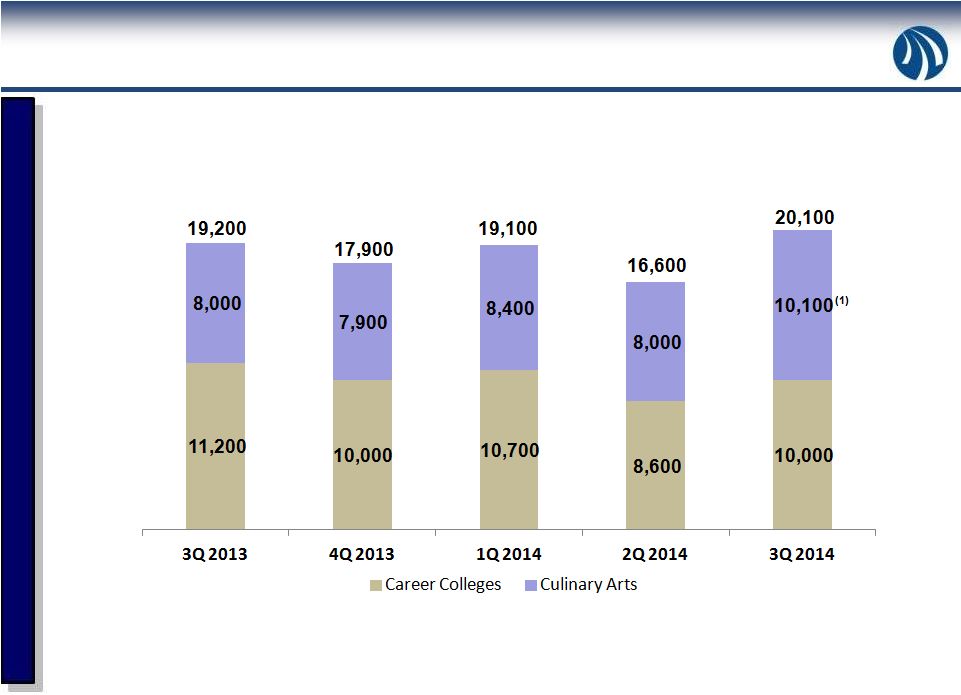

Total Student Enrollments �

Career Schools

(1) Culinary Arts had a shift in start dates as compared to the prior year,

therefore Q3 2014 had an additional start which was reflected in Q4 2013 in

the prior year. |

Confidential �

For Internal Use Only

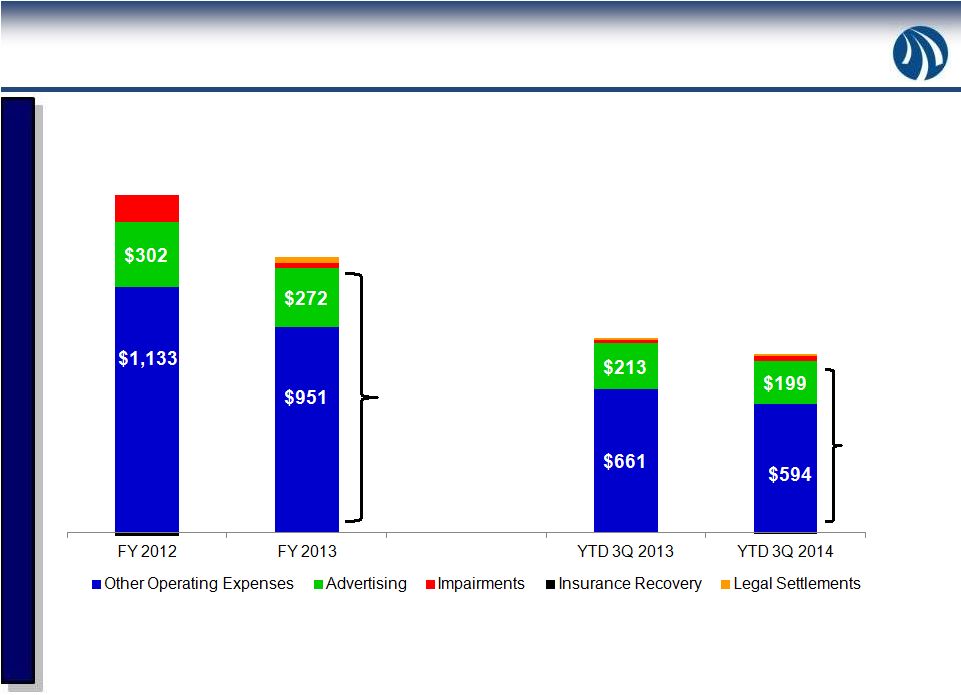

Operating Expenses ($ millions)

Reduce Organizational Cost Structure �

Progress Underway

12

$1,542

$1,272

$899

$814

Reduced by

$212 million

Reduced by

$80 million

FY 2012 & FY 2013 data as reported in the Company�s 2013 10-K and

based on schools that were in continuing operations at 12/31/13.� YTD

3Q 2013 and YTD 3Q 2014 data as reported in the Company�s 3Q 2014 10-Q and based on schools that were

in continuing operations at 9/30/14.� |

Confidential �

For Internal Use Only

3Q 2014

% of

Revenue

YTD 3Q

2014

% of

Revenue

Total Revenue

$227,452

$697,391

OPERATING EXPENSES

���� Educational services and facilities

$82,892

36.4%

$243,690

34.9%

���� General & Administrative

��������������

Advertising $70,897

31.2%

$198,780

28.5%

��������������

Admissions $30,625

13.5%

$94,258

13.5%

��������������

Administrative $53,596

23.6%

$195,546

28.0%

�������������� Bad

Debt $6,779

3.0%

$19,023

2.7%

�������������� Total

G&A $161,897

71.2%

$507,607

72.8%

Reduce Organizational Cost Structure �

Additional Opportunities

13

�

Educational services & facilities

-

Additional opportunity to optimize real estate

footprint.

�

Advertising

�

Generate efficiencies / lower lead generator volumes.

�

Administrative expenses

-

As a percentage of revenue, Career Education

administrative expenses are approximately 30%.

�

While industry comparisons can fluctuate in terms of classification of expenses,

the industry average is closer to 20%-22%.

�

Management has targeted at least $40 million in operating expense reductions in

2015. |

Confidential �

For Internal Use Only

Successfully Complete Teach Out of Transitional Schools

14

�

Transitional Schools operating losses in FY 2013 were approximately ($77) million

which was primarily cash outflow.

�

This fiscal year (through September 2014), we closed 16 campuses, divested one

campus and are scheduled to close an additional 4 campuses by the end of

this year. �

The 17 campuses that have been closed or divested as of September 2014 generated

approximately ($43) million of operating losses in FY 2013.

(1) Taught out 3 campuses and announced 3 additional campuses for teach-out

during 3Q 2014 |

Confidential �

For Internal Use Only

Financial Overview �

Profitable University Segment

15

�

CTU financially strong with trailing twelve month operating margin of 20.0%.

�

AIU moving closer to break-even performance.

University Revenue & Operating Income -

(in $000)

Trailing 12-Months

Revenue and

Operating Income

$545,188

$134,299

$138,469

Quarter Operating

Income

$55,381

$6,504

$3,685

Quarter Revenue |

Confidential �

For Internal Use Only

Future Real Estate Lease Obligations are Declining

(1)

Lease obligations are inclusive of rent payments but exclude operating

expenses. (2)

Amounts provided are for the full year of 2014.

(3)

Amounts provided are for executed sublease agreements.

16

2014

(2)

2015

2016

2017

2018

2019

2020

&

Thereafter

Total

Gross operating lease obligations

(1)

Ongoing operations

61,024

$����

60,148

$����

55,194

$����

46,199

$����

45,203

$����

35,389

$����

43,985

$��������

347,142

$�����

Transitional & Discontinued operations

38,024

31,541

24,045

21,357

14,122

6,516

2,863

138,468

Total gross operating lease obligations

99,048

$����

91,689

$����

79,239

$����

67,556

$����

59,325

$����

41,905

$����

46,848

$��������

485,610

$�����

Sublease income

(3)

Ongoing operations

2,245

$������

4,227

$������

2,936

$������

2,812

$������

2,466

$������

1,821

$������

1,068

$����������

17,575

$�������

Transitional & Discontinued operations

1,145

4,737

4,510

4,190

145

-

-

14,727

Total sublease income

3,390

$������

8,964

$������

7,446

$������

7,002

$������

2,611

$������

1,821

$������

1,068

$����������

32,302

$�������

Net operating lease obligations

Ongoing operations

58,779

$����

55,921

$����

52,258

$����

43,387

$����

42,737

$����

33,568

$����

42,917

$��������

329,567

$�����

Transitional & Discontinued operations

36,879

26,804

19,535

17,167

13,977

6,516

2,863

123,741

Total net contractual lease obligations

95,658

$����

82,725

$����

71,793

$����

60,554

$����

56,714

$����

40,084

$����

45,780

$��������

453,308

$����� |

Confidential �

For Internal Use Only

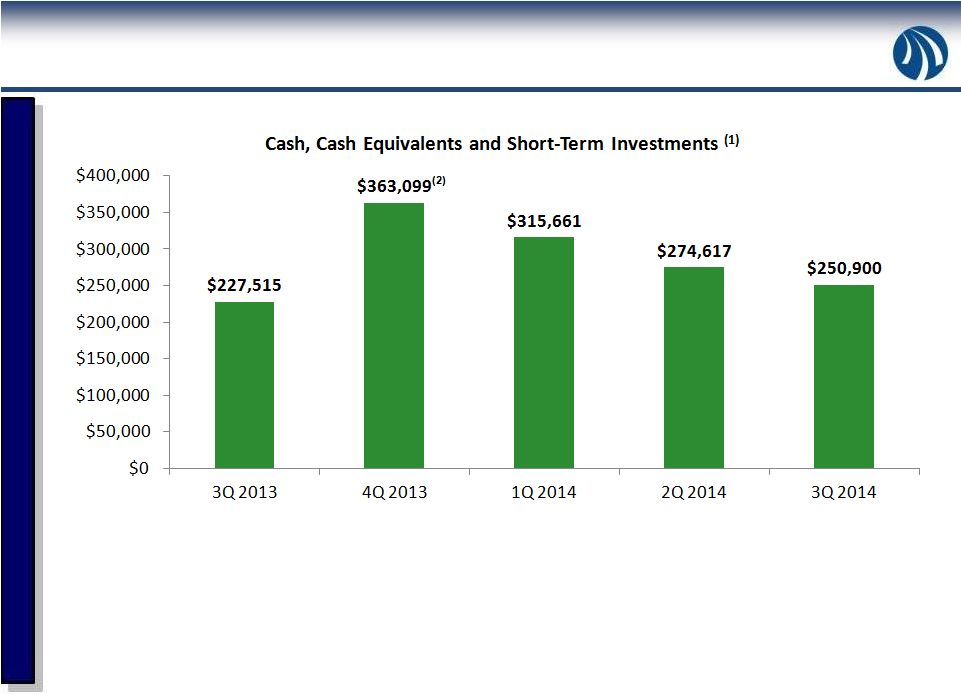

Financial Overview �

Strong Cash Position

17

(In 000�s)

(1)� Balances presented above are quarter end balances and include both Continuing and

Discontinued Operations. (2)� The increase in 4Q 2013 is attributed to proceeds

from the sale of the Company�s International segment. �

Recently increased the borrowing capacity under the company�s existing

revolving facility from $70 million to $120 million.

|

Confidential �

For Internal Use Only

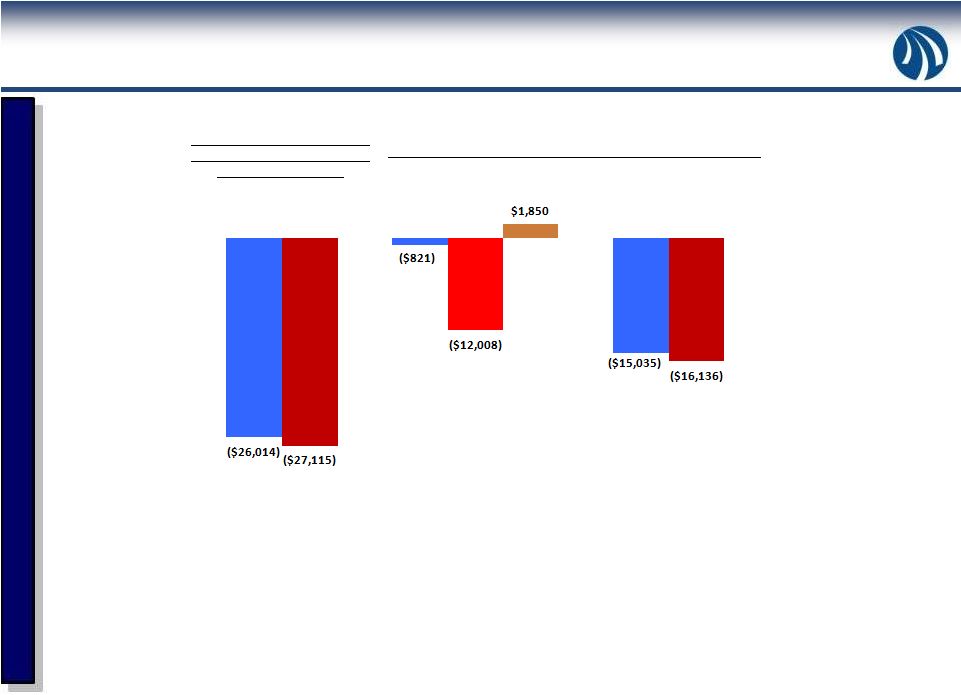

Trailing Twelve Month (TTM)

Adjusted EBITDA �

Ongoing

Operations (in $000)

Quarterly Adjusted EBITDA �

Ongoing Operations (in $000)

TTM 2Q

2014

1Q 2014

2Q 2014

Financial Overview �

Improving Adjusted EBITDA

18

�

Ongoing Adjusted EBITDA exhibits seasonality fluctuations due to

higher advertising

investments in 1Q and 3Q.

�

Adjusted EBITDA from ongoing operations is expected to be positive for Q4 2014 and

exiting 2015 on a TTM basis.

4Q 2013

(1) Numbers exclude significant items (including Transitional Schools) as disclosed

in the Non-GAAP reconciliation at the end of these slides.

TTM 3Q

2014

3Q 2014

3Q 2013 |

Confidential �

For Internal Use Only

Adjusted EBITDA �

Transitional & Discontinued Operations

Trailing Twelve Months Adjusted EBITDA� ($ in millions)

(1) Numbers exclude significant items (including International segment) as

disclosed in the Non-GAAP reconciliation at the end of these

slides.

19

Projected

�

Negative Adjusted EBITDA from Transitional and Discontinued Operations continues

to decline. |

Confidential �

For Internal Use Only

Key Investment Highlights

20

�

Diverse business model with both online and campus based portfolio

of assets.

�

Turnaround strategy in place with execution progressing.

�

Favorable industry dynamics in terms of market size and employer

demand for skilled workers.

�

Strong balance sheet and cash position with clear path to profitability.

�

Dedicated management team with extensive industry experience.

|

Confidential �

For Internal Use Only

Reconciliation of GAAP to Non-GAAP Items

21

Adjusted EBITDA

Q3 2014

Q2 2014

Q1 2014

Q4 2013

Q3 2013

Ongoing Operations:

Pre-tax loss from continuing operations

(44,787)

$��������

(31,984)

$��������

(39,930)

$��������

(43,458)

$��������

(54,989)

$��������

Transitional Schools operating loss

11,390

9,642

8,259

12,944

10,099

Interest (income) expense, net

(120)

(177)

(25)

65

15

Loss (gain) on sale of business

-

-

-

(68)

39

Depreciation and amortization

(3)

11,950

12,554

13,029

13,661

13,990

Stock-based compensation

(3)

950

1,020

1,341

1,580

1,713

Legal settlements

(3) (4)

-

1,600

5,850

17,000

300

14,396

7,403

74

3,050

11,513

(226)

(879)

(606)

(2,924)

1,184

(8,588)

-

-

-

-

Adjusted EBITDA�Ongoing Operations

(2)

(15,035)

$��������

(821)

$������������

� (12,008)

$��������

1,850

$�����������

(16,136)

$��������

Adjusted EBITDA per diluted share

(0.22)

$������������

(0.01)

$������������

(0.18)

$������������

0.03

$������������

� (0.24)

$������������

Memo: Advertising Expenses

(3)

69,875

$���������

56,224

$���������

69,379

$���������

56,077

$���������

70,936

$���������

Transitional Schools and Discontinued Operations:

Pre-tax (loss) income from discontinued operations

(2,065)

$����������

(12,726)

$��������

(17,993)

$��������

117,272

$�������

(21,712)

$��������

Transitional Schools operating loss

(11,390)

(9,642)

(8,259)

(12,944)

(10,099)

Loss (gain) on sale of business

(8)

-

311

-

(130,109)

-

International Schools operating (income) loss

(7)

-

-

-

(11,434)

7,608

Interest (income) expense, net

-

-

-

(51)

(21)

Depreciation and amortization

(8)

1,191

1,840

2,402

2,765

2,961

Legal settlements

(8)

225

-

-

-

-

89

51

(7)

3,933

72

(3,485)

1,436

3,099

5,766

(3,092)

Adjusted EBITDA�Transitional and Discontinued Operations

(2)

(15,435)

$��������

(18,730)

$��������

(20,758)

$��������

(24,802)

$��������

(24,283)

$��������

Adjusted EBITDA per diluted share

(0.23)

$������������

(0.28)

$������������

(0.31)

$������������

(0.37)

$������������

(0.36)

$������������

Asset impairments

(3) (5)

Unused space charges

(3) (6)

Asset impairments

(8)

Unused space charges

(6) (8)

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS

(1)

(In thousands, except per share amounts)

Insurance recovery |

Confidential �

For Internal Use Only

22

Reconciliation of GAAP to Non-GAAP Items �

con�t

Q3 2014

Q2 2014

Q1 2014

Q4 2013

Q3 2013

CTU

-

$�����������

���� -

$�����������

���� (900)

$�����������

�� 1,300

$�����������

-

$�����������

���� Career Colleges

-

-

-

200

300

Culinary Arts

-

2,000

3,000

15,500

-

Corporate & Other

-

(400)

3,750

-

-

Total

-

$������������

��� 1,600

$�����������

5,850

$�����������

17,000

$���������

300

$������������

�� (1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

The Company believes it is useful to present non-GAAP financial

measures which exclude certain significant items as a means to understand the performance of its ongoing operations.� As a

general matter, the Company uses non-GAAP financial measures in

conjunction with results presented in accordance with GAAP to help analyze the performance of its ongoing operations,

assist with preparing the annual operating plan, and measure

performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used

by analysts and others in the investment community to analyze the

Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures

could result in a misplaced perception that the Company's results have

underperformed or exceeded expectations.� We believe

Adjusted EBITDA allows us to compare our current operating results with corresponding historical periods and with the operational performance of other companies in our

industry because it does not give effect to potential differences

caused by items we do not consider reflective of underlying operating performance. We also present Adjusted EBITDA

because we believe it is frequently used by securities analysts,

investors and other interested parties as a measure of performance. In evaluating Adjusted EBITDA, investors should be aware

that in the future we may incur expenses similar to the adjustments

presented above. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will

be unaffected by expenses that are unusual, non-routine or

non-recurring. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute

for net income (loss), operating income (loss), or any other

performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or

as a measure of our liquidity.�

Non-GAAP financial measures when viewed in a reconciliation to

corresponding GAAP financial measures, provides an additional way of viewing the Company's results of operations and

the factors and trends affecting the Company's business. Non-GAAP

financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding

financial results presented in accordance with GAAP.�

Management assesses results of operations for ongoing operations,

which excludes Transitional Schools, separately from Transitional Schools. As schools within the Transitional Schools

segment are fully taught-out, these schools will be recast as

components of Discontinued Operations. As a result, management views adjusted EBITDA from ongoing operations separately

from Transitional Schools and Discontinued Operations to assess results

and make decisions.� Accordingly, Transitional Schools operating loss is added back to pre-tax loss from continuing

operations and subtracted from pre-tax loss from discontinued

operations. Quarterly amounts relate to ongoing operations,

which excludes Transitional Schools. Legal settlement amounts

are net of insurance recoveries and are recorded within the following segments:�

Asset

impairments

primarily

relate

to

impairment

charges

within

Culinary

Arts

of

$1.5

million,

$7.4

million

and

$10.7

million

which

were

recorded

during

the

third

quarter

of

2014,

second

quarter

of

2014

and

third

quarter

of

2013,

respectively,

and

within

Career

Colleges

of

$12.8

million

and

$2.9

million

recorded

during

the

third

quarter

of

2014

and

fourth

quarter

of

2013,

respectively.

Unused

space

charges

represent

the

net

present

value

of

remaining

lease

obligations

less

an

estimated

amount

for

sublease

income

as

well

as

the

subsequent

accretion

of

these

charges.

The

International

Schools

segment

was

sold

during

the

fourth

quarter

of

2013.

As

such,

management

excludes

operations

from

the

International

Schools

when

assessing

results

and

trends

of

Transitional

Schools

and

Discontinued

Operations.

Quarterly

amounts

relate

to

Transitional

Schools

and

Discontinued

Operations,

excluding

International. |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CECO Environmental to Release First Quarter Earnings and Host Conference Call on April 30

- Tesla (TSLA) Issues Letter to Shareholders, Seeks Approval to Reincorporate to Texas

- Intra-Cellular Therapies Prices Public Offering of Common Stock

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share