Form 8-K CAPITAL SOUTHWEST CORP For: Sep 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 23, 2015

CAPITAL SOUTHWEST CORPORATION

(Exact Name Of Registrant As Specified In Charter)

|

Texas

|

814-00061

|

75-1072796

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

5400 Lyndon B. Johnson Freeway, Suite 1300

Dallas, Texas 75240

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 233-8242

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

Item 7.01

|

Regulation FD Disclosure.

|

Capital Southwest Corporation (“Capital Southwest”) will make a series of presentations to the investment community outlining Capital Southwest’s operations and strategy following its spin-off of CSW Industrials, Inc., currently a wholly owned subsidiary of Capital Southwest. The slides to be used in connection with such presentations are furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished under this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

99.1

|

CSWC Presentation

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: September 23, 2015

|

|||

|

By:

|

/s/ Joseph B. Armes

|

||

|

Name:

|

Joseph B. Armes

|

||

|

Title:

|

Chairman of the Board,

|

||

|

Chief Executive Officer and President

|

|||

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

CSWC Presentation

|

Exhibit 99.1

Capital Southwest CorporationInvestor PresentationNASDAQ: CSWC 5400 Lyndon B. Johnson Freeway, Suite 1300 | Dallas, Texas 75240 | 972.233.8242 | capitalsouthwest.com September 2015

This presentation contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 relating to, among other things the business, financial condition and results of operations of Capital Southwest, the anticipated investment strategies and investments of Capital Southwest, future market demand, and the expected completion of the proposed spin-off of CSW Industrials, Inc. Any statements preceded or followed by or that include the words "believe," "expect," "intend," "plan," "should" or similar words, phrases or expressions or the negative thereof, are intended to identify forward-looking statements. These statements are made on the basis of the current beliefs, expectations and assumptions of the management of Capital Southwest. There are a number of risks and uncertainties that could cause Capital Southwest’s actual results to differ materially from the forward-looking statements included in this presentation. In light of these risks, uncertainties, assumptions, and other factors inherent in forward-looking statements, actual results may differ materially from those discussed in this presentation. Other unknown or unpredictable factors could also have a material adverse effect on Capital Southwest’s actual future results, performance, or achievements. For a further discussion of these and other risks and uncertainties applicable to Capital Southwest and its business, see Capital Southwest’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015 and its subsequent filings with the Securities and Exchange Commission. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Capital Southwest does not assume any obligation to update these forward-looking statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law. Forward-Looking Statements

CSWC was formed in 1961, as an SBIC, and became a BDC in 1988Publicly-traded on Nasdaq under CSWC tickerInternally-managed BDC with RIC status for tax purposesIn December 2014, announced split into two separate companies with spin-off of industrial growth company (“CSW Industrials”; Nasdaq: CSWI) to be completed September 30th, 2015CSWC has refocused its investment strategy to become a lender to middle-market companies across the capital structureManagement transition over the last two years has resulted in a new Chairman (Joe Armes), CEO (Bowen Diehl) and CFO (Michael Sarner) of CSWC following completion of the spin-offDivested over $210 MM in equity investments, realizing $181 MM in capital gains over past 15 monthsInvested in 8 middle market credit’s representing $42 MM of invested capital over the past 9 monthsAnnounced a joint venture in September 2015 with Main Street Capital to form I-45 SLF for the purpose of investing in upper middle market syndicated loans Overview of Capital Southwest (CSWC)

Internally-managed BDC with no legacy issues and significant investable dry powderCredit investment strategy focused on middle-market lending opportunitiesPortfolio construction designed with granularity and diversity among asset classes to support attractive and sustainable dividendHigh-quality origination platform supported by strong relationships and proprietary deal flowProven investment team led by seasoned investment professionals with deep financial and BDC experience Investment Highlights

Long History of Value Creation CSWC was formed in 1961 with an initial equity investment of $14.9 MM, representing the only equity capital raisedCSWC grew net asset value to $769 MM as of June 30, 2015 From that initial investment through June 30, 2015, CSWC generated $348.5 MM of distributions to shareholders:June 30, 2015 NAV plus distributions to that date represented shareholder value creation of over $1.1 B …Though Assets Undervalued by Market Significant Value Creation… Note: Numbers and calculations above are shown on a consolidated basis for CSWC and exclude any impact from items related to the pending spin-off transaction(1) Average P/NAV from 1/2/08 to 12/2/14 (announce date of the spin-off)

Structure and Strategy Misaligned Portfolio Composition Impediment to Value Creation Historical All-Equity Investment Strategy Challenges All Surmountable Strategy Misaligned with BDC / RIC Structure CSWC’s strategy was to invest solely in equity and hold almost indefinitely Certain investments have been held for many decadesLarger control assets had a very low cost basis, a large embedded capital gain and a significant tax due upon divestiture Value creation almost exclusively from equity appreciation rather than investment incomeLack of investment income = insignificant and inconsistent shareholder dividendsBDC/RIC designation restricts investments in control companies and asset concentrationsFinancial and operating performance of large industrial assets shrouded by investment company accounting method used by CSWC Vast majority of portfolio value in strong companies100% owned industrial assets are now large enough to stand alone outside of BDC portfolio Seller’s market favorable to the divestiture of minority equity positionsManagement relationships would facilitate team augmentation with credit experience 12/31/2013 Portfolio All equityLarge concentrationsLarge public company holdingsEmbedded gains

Separate Two Business Models: Better Fit and Focus CSWCShareholders CSW Industrials(C-Corp) CSWC(BDC / RIC) CSVC(SBIC) RectorSeal Whitmore Jet-Lube Smoke Guard Balco CapStar Anticipated unlevered asset base (NAV) of ~$275 MM ($17.65/Share)(2) CSWC CSW Industrials Chief Executive Officer – Bowen Diehl Chief Executive Officer – Joe Armes Strathmore Tax Free Spin-off Total cash of $173 MM, inclusive of $68 MM in cash committed to I-45Assumes 15,583,332 shares outstanding Chairman of the Boards – Joe Armes

Corporate Transformation Well Underway 2015 2013 2014 June 2013 Joe Armes appointed as CEO January 2014 Joe Armes appointed as Chairman and David Brooks and William Thomas elected to the Board March 2014 Bowen Diehl hired as CIO and to-be-CEO of CSWC post- spin July 2014 Jack Furst elected to the Board August 2014 Adopted executive comp plan to align with strategic objectives of CSWC November 2014 Completed divestiture of public holdings (ALG, WIRE) December 2014Spin-off of CSWI announced July 2015Michael Sarner hired as SVP and to-be-CFO of CSWC post-spin September 2015I-45 SLF with Main Street Capital announced January 2015Credit strategy launched

Portfolio Rotation Focused on Credit 6/30/2014 (1) PF 9/30/2015(2) Since June 2014, CSWC has made significant strides towards its strategy of simplifying its structure and focusing on middle-market creditExited 8 portfolio companies for $210 MM in proceedsInvested $42 MM in 8 middle-market credit investments Structured a joint venture with Main Street Capital (I-45 SLF) 6/30/2014 portfolio mix is pro forma for the spin off of the CSW Industrials companiesI-45 included at full capital commitment of $68 MM to SLF

Commentary Overall structure similar to other SSLFsSPE created to house loan investments CSWC and MAIN commit capital to SPESPE “Lender” lends money alongside capital from CSWC and MAINFund capital (CSWC + MAIN + Lender) used to purchase large market first lien loansAdministrative “back office” matters are managed by a third party firm (“Admin Agent”) including transaction clearing, accounting, reporting, etc CSWC MAIN Capital Contribution:$68 MM (80%) Capital Contribution:$17 MM (20%) Distributions:Return of Capital: 20.0%Return on Capital: 24.4% Distributions:Return of Capital: 80.0%Return on Capital: 75.6% Lender Underlying Loans Admin Agent SPE Principal, interest and fees $ $ Principal & Interest Fee Services I-45 SLF Overview Allows CSWC to generate substantial income from a relatively safe asset class and reasonable leverage as a complement to Lower Middle Market lendingCovers overhead and gives CSWC a head start in building income to support a dividendEarning assets accumulated on an accelerated timeline (approx. 12 months)Delivers attractive risk-adjusted returns Transaction Rationale

Mr. Diehl joined Capital Southwest in 2014 and leads the firm's investment activities. He brings almost 20 years of experience in sourcing, structuring, and managing investments in a variety of industries. Mr. Diehl came to Capital Southwest from American Capital, Ltd., which he joined in 2001 and was a Managing Director since 2007. He has closed investments in 15 platform companies and numerous add-on acquisitions, representing over $1.1 billion of invested capital. Mr. Diehl’s investments have been in a variety of industries including industrial manufacturing, healthcare, business services, and consumer finance. Mr. Diehl earned a Bachelor of Engineering degree, with majors in Environmental/Geotechnical Engineering and Economics, from Vanderbilt University and a Masters of Business Administration from the University of Texas at Austin. Bowen Diehl Chief Investment Officer (to be named President & Chief Executive Officer post spinoff) Investment Team Led by Seasoned Professionals Mr. Sarner joined Capital Southwest in July 2015 as Senior Vice President, bringing to Capital Southwest over 20 years of accounting, financial, and treasury experience, including most recently 15 years at American Capital, Ltd. At American Capital, Ltd, Mr. Sarner served in a variety of financial roles, most recently as Senior Vice President, Treasury. Michael will assume the role of Chief Financial Officer of Capital Southwest, post spinoff of CSW Industrials, Inc. Mr. Sarner received a B.B.A. in Business Administration/Accounting from James Madison University, an M.B.A. in Finance from George Washington University's School of Business and Public Management and is a Certified Public Accountant. Mr. Sarner lives in Dallas with his wife and three sons. Michael Sarner Senior Vice President (to be named Chief Financial Officer post spinoff) Mr. Kelley joined Capital Southwest in 2015 to help direct the firm's credit-focused investment activities and coverage of the private equity community. He previously spent over ten years at American Capital, Ltd. where he was a Managing Director in its sponsor finance practice and managed junior debt and equity investments in middle market companies representing over $800 million in risk capital. He has extensive experience sourcing, executing, managing, and restructuring transactions across industry sectors and investment structures, including unirate, second lien, mezzanine, and equity co-investment securities. Prior to American Capital, Mr. Kelley was an investment banking professional with J.P. Morgan, the Beacon Group, and Credit Suisse First Boston. Mr. Kelley holds a BBA degree in Business Honors and Engineering Route to Business, and a MBA degree from the McCombs School at The University of Texas at Austin. Douglas Kelley Managing Director

Over the past 12 months, CSWC has rebuilt the investment team by bringing in both junior and senior team members with strong credit expertise in both the direct lending and syndicated markets Investment Team Name Title Years Experience Year Joined CSWC Relevant Experience Joe Armes Chairman, President, CEO(to-be Chairman) 20 2013 COO of Hicks Holdings LLCEVP & General Counsel of Suiza Foods (now Dean Foods)General Counsel of The Morningstar GroupAttorney for Weil, Gotshal & Manges Bowen Diehl CIO (to-be President and CEO) 20 2014 Managing Director at American CapitalMerrill Lynch Investment BankingChase Securities Investment Banking Michael Sarner SVP(to-be CFO) 20 2015 SVP, Treasury at American Capital Bill Ashbaugh SVP & Managing Director 38 2001 Managing Director in Corporate Finance at Hoak, Principal and Southwest SecuritiesVP of Corporate Finance at Rauscher Pierce Refsnes (now RBC Dain Rauscher) Douglas Kelley SVP & Managing Director 18 2015 Managing Director in Sponsor Finance at American CapitalInvestment banking at J.P. Morgan, The Beacon Group, Credit Suisse First Boston Josh Weinstein Principal 15 2015 Principal at H.I.G. WhiteHorseVP at WhiteHorse Capital PartnersAnalyst at Morgan Stanley and Citigroup Ryan Kelly Senior Associate 8 2010 Analyst at Houlihan Lokey Bryan Bailey Senior Associate 8 2012 Financial analyst in telecommunications industry Spencer Klein Associate 2 2015 Analyst at J.P. Morgan in corporate client banking Michael Knapp Associate 3 2015 Analyst at Jefferies

Potential Earning Assets Under Management Potential Investable Assets CSWC’s current equity capital base is expected to translate into earning AUM of $600 MM-$650 MM once the balance sheet is fully ramped with appropriate leverageBalance sheet anticipated to support $200 MM - $250 MM of leverageDebt / equity target will be approximately .75x Actual total cash of $173 MM, inclusive of $68 MM in cash committed to I-45CSWC maintains its original SBIC license at its wholly-owned subsidiary, Capital Southwest Venture Corporation (“CSVC”). CSVC currently has no SBA debentures outstanding. CSVC expects to seek approval for SBA leverage during calendar year 2016Assuming 2.0x leverage at the SLF

Operating Expense Framework CSWC Operating Expenses LTM 6/30/15 Operating Expenses / Average Assets CSWC’s run-rate operating expenses reflect $9 MM of recurring costs (or 3.3% of its post spin asset base of $275 MM)Management is targeting a long term operating expense ratio of ~2.5% of assetsTarget level is in-line with internally managed BDCs and significantly lower than externally managed BDCs reflecting a higher efficiency business modelA target of 2.5% of assets would imply that approximately $3 MM of incremental expenses could be available to invest in resources to originate and manage the investment portfolio Includes MAIN, KCAP, TCAP, TAXI and HTGCIncludes 18 BDCs with $200 - $800 MM of assets as of 6/30/15 (1) (2)

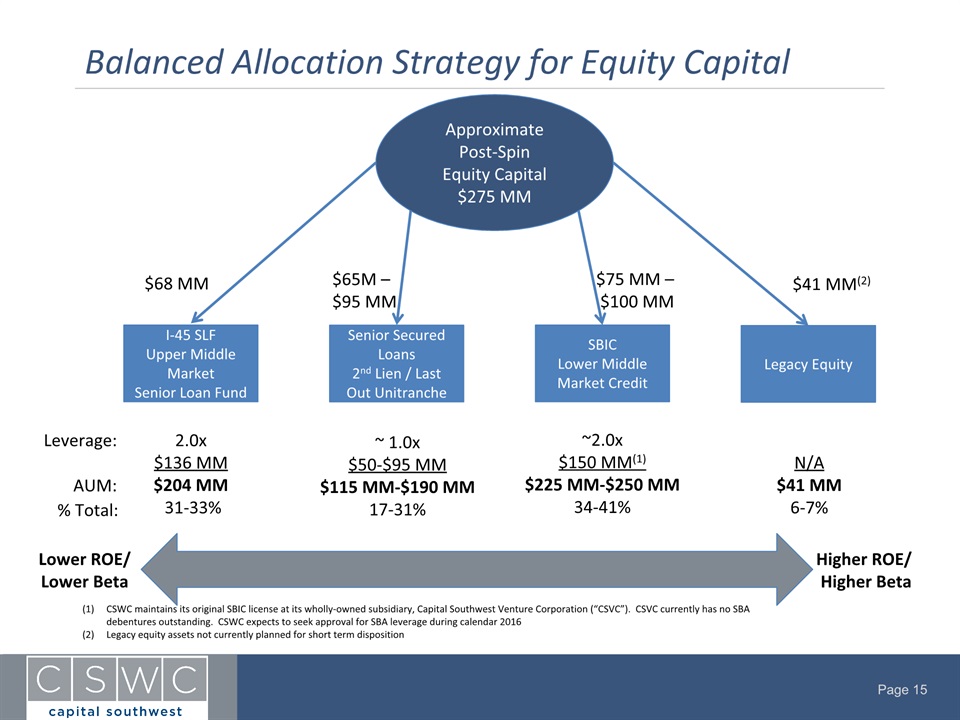

Balanced Allocation Strategy for Equity Capital ApproximatePost-Spin Equity Capital$275 MM I-45 SLFUpper Middle MarketSenior Loan Fund Senior Secured Loans2nd Lien / Last Out Unitranche SBICLower Middle Market Credit Legacy Equity $68 MM $65M – $95 MM $75 MM – $100 MM Leverage: 2.0x$136 MM$204 MM 31-33% ~ 1.0x$50-$95 MM$115 MM-$190 MM17-31% ~2.0x$150 MM(1)$225 MM-$250 MM34-41% AUM: % Total: $41 MM(2) N/A$41 MM6-7% Lower ROE/Lower Beta Higher ROE/ Higher Beta CSWC maintains its original SBIC license at its wholly-owned subsidiary, Capital Southwest Venture Corporation (“CSVC”). CSVC currently has no SBA debentures outstanding. CSWC expects to seek approval for SBA leverage during calendar 2016Legacy equity assets not currently planned for short term disposition

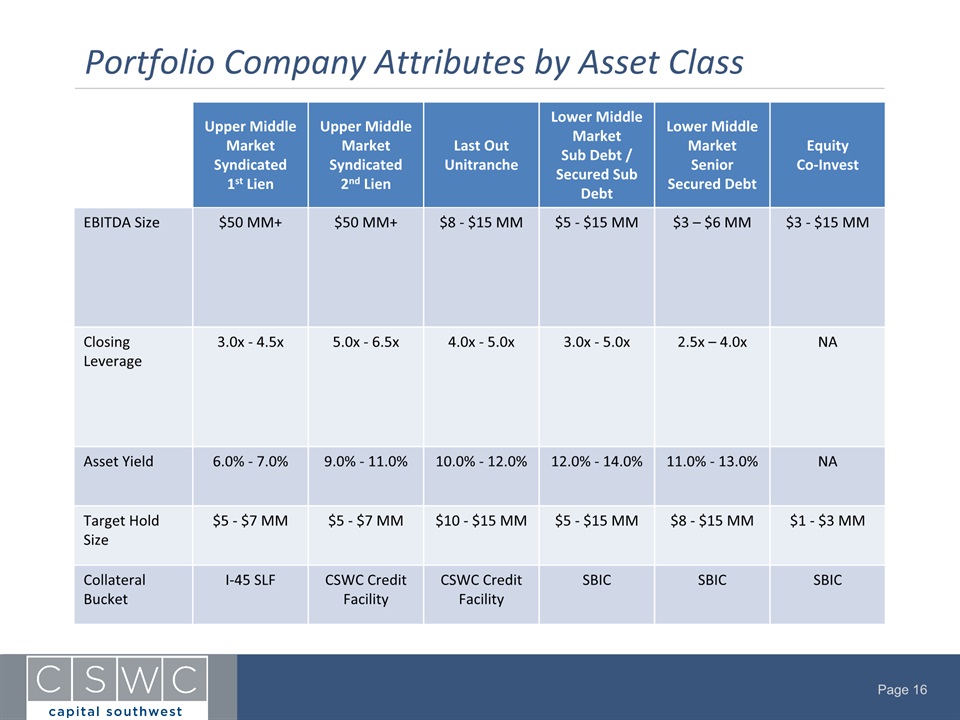

Portfolio Company Attributes by Asset Class Upper Middle Market Syndicated 1st Lien Upper Middle Market Syndicated 2nd Lien Last Out Unitranche Lower Middle Market Sub Debt / Secured Sub Debt Lower Middle Market Senior Secured Debt EquityCo-Invest EBITDA Size $50 MM+ $50 MM+ $8 - $15 MM $5 - $15 MM $3 – $6 MM $3 - $15 MM Closing Leverage 3.0x - 4.5x 5.0x - 6.5x 4.0x - 5.0x 3.0x - 5.0x 2.5x – 4.0x NA Asset Yield 6.0% - 7.0% 9.0% - 11.0% 10.0% - 12.0% 12.0% - 14.0% 11.0% - 13.0% NA Target Hold Size $5 - $7 MM $5 - $7 MM $10 - $15 MM $5 - $15 MM $8 - $15 MM $1 - $3 MM Collateral Bucket I-45 SLF CSWC Credit Facility CSWC Credit Facility SBIC SBIC SBIC

Growing Pipeline Across Multiple Origination Channels Deal Flow Deal Flow by Source Total: 3Q15-2Q16 December 2014 March 2015 June 2015 September 2015 [Estimated]

CSWC Taps Into a Broad Network of Deal Sources Intermediaries and Lending Partners Private Equity

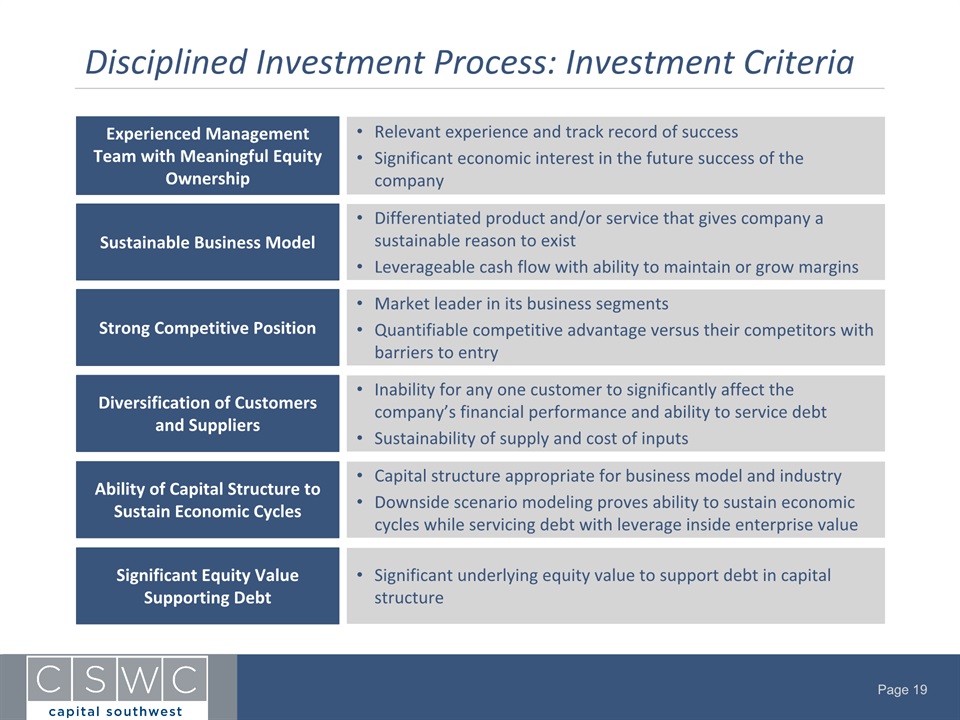

Disciplined Investment Process: Investment Criteria Experienced Management Team with Meaningful Equity Ownership Relevant experience and track record of successSignificant economic interest in the future success of the company Strong Competitive Position Sustainable Business Model Diversification of Customers and Suppliers Ability of Capital Structure to Sustain Economic Cycles Significant Equity Value Supporting Debt Market leader in its business segmentsQuantifiable competitive advantage versus their competitors with barriers to entry Differentiated product and/or service that gives company a sustainable reason to existLeverageable cash flow with ability to maintain or grow margins Inability for any one customer to significantly affect the company’s financial performance and ability to service debtSustainability of supply and cost of inputs Capital structure appropriate for business model and industryDownside scenario modeling proves ability to sustain economic cycles while servicing debt with leverage inside enterprise value Significant underlying equity value to support debt in capital structure

Disciplined Investment Process: Focus on Capital Preservation Extensive network of long standing private equity, intermediary, and co-lender relationshipsTeam effort led by senior membersSystematic CRM-driven relationship trackingEmphasis on partnership-centric approachStructural and size flexibility important to maintain relevance to sourcing network Sourcing Review deal tear-sheets outlining investment theses and risks on weekly basis Quick, thoughtful financing read to deal sourceRigorous analysis of opportunity with emphasis on downside scenarioMeet with managementPresent credit case to IC; 12-20 page memoAdvance detailed term sheet Continuous testing of investment theses and risk mitigatesLead or piggyback third party diligence work on accounting, legal, operations, industry, key management, and projectionsVisit key locations30-50 page final IC memo memorializes work and findingsDiligence reputations of transaction partnersPresent to IC for final approval Emphasis on covenants, voting rights, cash flow recapture, and incremental debt provisionsOverly borrower-friendly credit agreements will kill a dealTeam credit cycle experience critical to understanding how legal provisions are used during restructuringsContinuous communication on deal, no surprises Monthly meeting to review all portfolio positionsProactive dialogue with sponsor, credit facility agent, management, and industry relationshipsBoard seat or observer rights on lower middle market namesQuarterly portfolio valuations and covenant reviews Consistent, Downside-Focused, Risk-Return Centric Credit Approach InitialEvaluation Due Diligence &Underwriting Documentation &Closing PortfolioManagement

Maintaining Investment Discipline as Pipeline Grows Total Deals Reviewed265 Indicative Terms Submitted62 Initial IC Review15 Diligence Final ICApproval8 8 Portfolio Companies$42 MM Invested LTM September 2015

Company Date Invested Type Cost Fair Value Interest Rate Effective Yield Business Description Debt 3/18/15 2nd Lien $6.9 MM $7.0 MM L+875(1) 10.6% Provides data collection through online and mobile surveys using proprietary consumer and business panels 4/17/15 2nd Lien $6.8 MM $7.0 MM L+925(1) 11.5% Global manufacturer and supplier of high performance, custom fabricated sealing and energy management solutions. 6/1/15 Secured Sub Debt $7.9 MM $8.1 MM 11.0% 12.2% Distributes fasteners, chemicals, tools and a wide variety of other products to customers in the industrial maintenance and repair and automotive aftermarket 7/7/15 2nd Lien $1.0 MM $1.0 MM L+750(1) 9.0% A global, pure-play manufacturer of high-value specialty adhesives and sealants 7/22/15 2nd Lien $4.8 MM $5.0 MM L+800(1) 11.1% A furniture retailer that offers a variety of living room furniture, bedroom furniture, dining room furniture, mattresses / foundations, etc. 8/3/15 2nd Lien $5.0 MM $5.0 MM L+775(1) 9.2% Provides payroll services and workers’ compensation solutions to the television, film, live entertainment and digital media markets 9/9/15 2nd Lien $3.3 MM $3.3 MM L+900(2) 11.1% Provider of subscription-based legal and identity theft plans 9/21/15 Last Outs Senior Debt $5.2 MM $5.2 MM 13.0% 13.0% Secondary loan finance company, specializing in the acquisition and management of sub-prime truck loans to finance the purchase of commercial, heavy-duty rigs by independent owner operators Total $40.9 MM $41.6 MM 11.2% Current CSWC Credit Portfolio 1.00% LIBOR floor (2) 1.25% LIBOR floor

Company Date Invested Type Cost Fair Value Business Description Legacy Equity Assets 11/4/97 Equity $5.4 MM $30.1 MM Impact, tilt monitoring and temperature sensing devices to detect mishandling shipments 6/29/12 Equity & Debt $6.0 MM $8.7 MM Manufactures, installs and rents spill containment system for oilfield applications. LP FundHoldings 2001 - 2006 Partnership Interests $8.9 MM $6.7 MM LP Interests held in six equity-focused investment funds 8/19/05 - 6/15/08 Equity $5.0 MM $4.0 MM Developer and supporter of software used by the oil and gas industry 4/10/07 Equity $3.0 MM $3.8 MM Holding company of Atlantic Capital Bank, a full service commercial bank 4/9/13 Equity $8.0 MM $2.5 MM Full-service corrosion control company providing the oil and gas industry with expertise in cathodic protection and asset integrity management 3/19/15 Equity $0.8 MM $2.3 MM Provides a comprehensive set of solutions to improve the transportation validation, accounting, payment and information management process 3/24/15 Equity $0.4 MM $1.9 MM Provides single-use and scalable bioprocessing solutions in the area of recombinant therapeutics, cell therapy, and vaccine manufacturing 7/10/09 -11/3/14 Equity & Debt $6.4 MM $0.2 MM Enables online video and photo sharing and DVD creation for home movies recorded in analog and new digital format Total $43.9 MM $60.2 MM Current CSWC Legacy Equity Portfolio

Strategic Decision to Retain Investment in MRI Historical Financial Results Overview of MRI Future Growth Prospects CSWC-Guided Transformation 2011 – Divested equipment monitoring product line of ShockWatch2013 – Divested DPC division2013 – ShockWatch acquired ShockLog 2014 – Divested DataSpan division2015 – New CEO and CFO management to guide transition Continued evolution and improvement of the existing product offeringDevelop a robust real-time monitoring solutionExpand presence in the cold chain sectorMaximize channel and geographic go to market strategyStrategic acquisitions and/or partnerships Media Recovery, Inc. (MRI) is a holding company of ShockWatch, Inc., a manufacturer of devices used to monitor and manage in-transit inventory CSWC originally invested in MRI in 1997 and owns ~98% of the company today. MRI historically consisted of three distinct businesses (see below for more details)ShockWatch’s products include indicators and recording devices that measure impact, tilt and temperatureHeadquartered in Dallas, TX with a manufacturing facility in Graham, TX Revenue by Product Revenue by Geography

Internally-managed BDC with no legacy issues and significant investable dry powderCredit investment strategy focused on middle-market lending opportunitiesPortfolio construction designed with granularity and diversity among asset classes to support attractive and sustainable dividendHigh-quality origination platform supported by strong relationships and proprietary deal flowProven investment team led by seasoned investment professionals with deep financial and BDC experience Investment Highlights

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- J.S. Held Celebrates Scientific and Technical Experts on World Laboratory Day

- Red Light Holland Initiates Psilocybin Extraction Phase with PharmAla Following Successful Testing and Preparation by CCrest Labs

- Yerbaé Expands Distribution Network with Two New Partnerships

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share