Form 8-K CAPITAL SOUTHWEST CORP For: Jun 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 7, 2016

CAPITAL SOUTHWEST CORPORATION

(Exact Name Of Registrant As Specified In Charter)

|

Texas

|

814-00061

|

75-1072796

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

5400 Lyndon B. Johnson Freeway, Suite 1300

Dallas, Texas 75240

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 233-8242

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02 Results of Operations and Financial Condition.

On June 7, 2016, Capital Southwest Corporation (the “Company”) issued a press release, a copy of which has been furnished as Exhibit 99.1 hereto.

The information furnished in this Current Report on Form 8-K under Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1934, except as shall be expressly set forth by reference in a future filing.

Item 7.01 Regulation FD Disclosure.

The Company expects to hold a conference call with analysts and investors on June 8, 2016. A copy of the investor presentation slides to be used by the Company on such conference call is furnished as Exhibit 99.2 to this Form 8-K and incorporated herein by reference.

The information set forth under this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

99.1

|

Press release issued by Capital Southwest Corporation on June 7, 2016

|

|

|

99.2

|

Investor presentation slides

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 7, 2016

|

By:

|

/s/ Bowen S. Diehl

|

|

|

Name: Bowen S. Diehl

|

||

|

Title: Chief Executive Officer and President

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

Press release issued by Capital Southwest Corporation on June 7, 2016

|

||

|

Investor presentation slides

|

Exhibit 99.1

|

Lincoln Centre Tower I

5400 Lyndon B. Johnson Freeway, Suite 1300

Dallas, Texas 75240

T 214.238.5700

F 214.238.5701

|

Capital Southwest Announces Financial Results for Fourth Quarter Fiscal Year Ended March 31, 2016

CSWC Grows Portfolio to $178 million in Invested Assets

Dallas, Texas – June 7, 2016 – Capital Southwest Corporation (“Capital Southwest” or the “Company”; Nasdaq: CSWC) today announced its financial results for the fourth fiscal quarter ended March 31, 2016.

Financial Highlights

• Total Investment Portfolio: $178.4 million

◦ Total Credit Portfolio: $92.8 million

◦ Total Equity Portfolio: $49.3 million

◦ Total Investment in I-45 Senior Loan Fund (“I-45 SLF”): $36.3 million

| ✓ | I-45 SLF portfolio grew to $100 million invested in 24 credits, predominantly 1st Lien |

| ✓ | Invested $17 million in 5 credits within I-45 during Fourth Quarter Fiscal Year 2016 |

• Fourth Quarter Fiscal Year 2016 Pre-Tax Net Investment Income of $0.7 million, or $0.04 per weighted average diluted share

• Fourth Quarter Fiscal Year 2016 Dividend of $0.04 per share

• Total Cash: $96.0 million

• Total Net Assets: $272.6 million

• Net Asset Value per Share: $17.34

• Weighted Average Yield on Debt Investments: 10.7%

• No investment assets currently on non-accrual

• Subsequent to quarter end the loan to Freedom Truck Finance prepaid; proceeds to Capital Southwest totaling $6.0 MM realizing an IRR of 14.3%

• Subsequent to quarter end, increased Deutsche Bank led I-45 Senior Loan Fund Credit facility from $75 million to $100 million

• On June 7, 2016, the Company's Board of Directors declared a First Quarter Fiscal Year 2017 Dividend of $0.06 per share

In commenting on the Company's results, Bowen Diehl, President and Chief Executive Officer, stated, "During the fourth quarter, we continued to build out a diverse credit investment portfolio across the middle market. We originated transactions in the syndicated and club markets within the upper middle market as well as the directly originated lower middle market. We continue to grow our net investment income both by thoughtfully deploying capital and by effectively managing operating expenses.”

Portfolio and Investment Activities

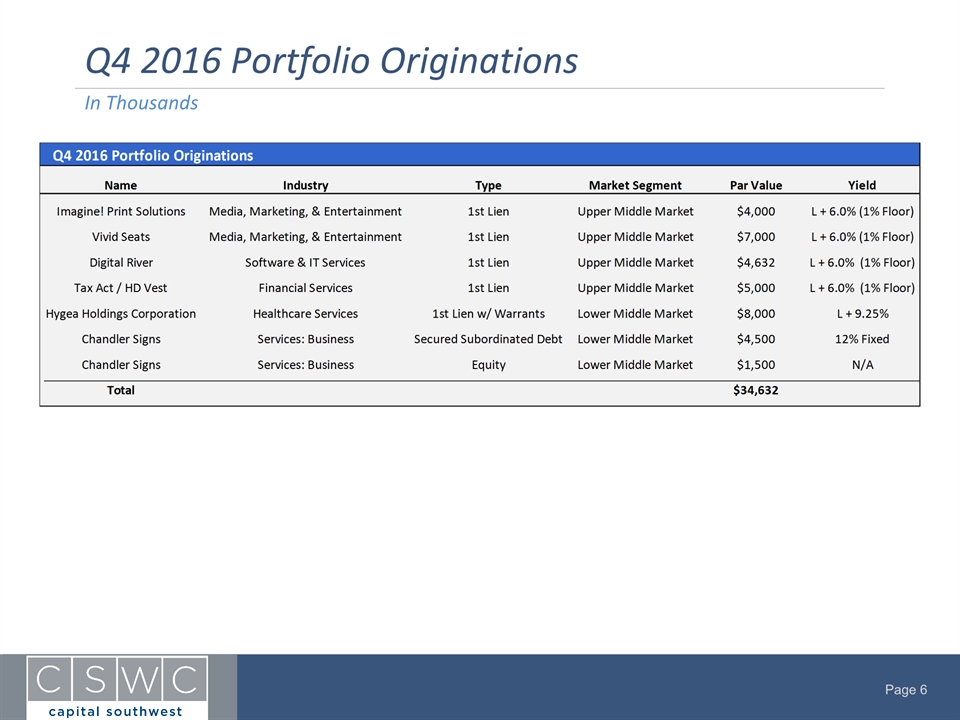

During the quarter ended March 31, 2016, the Company originated six investments totaling $34.6 million. Subsequent to quarter end, the company received $6 million in proceeds related to the repayment of the senior loan to Freedom Truck Finance, generating an IRR of 14.3%. New investment transactions which occurred during the quarter ended March 31, 2016 are summarized as follows:

Chandler Signs, L.P., $6.0 million Senior Secured Subordinated Debt and Equity: Chandler Signs is a national, vertically integrated provider of exterior on-premise signs for multi-site companies in a wide variety of end markets.

TaxAct, Inc., $5.0 million 1st Lien Senior Secured Debt: TaxAct, Inc. is a US provider of internet-enabled tax solutions for consumers, tax professionals, and small business owners.

Digital River Inc., $4.6 million 1st Lien Senior Secured Debt: Digital River is a leading provider of mission-critical, end-to-end outsourced e-commerce solutions to tier 1 and tier 2 enterprises across many industry verticals.

Hygea Holdings Corp., $8.0 million 1st Lien Senior Secured Debt and Equity Warrants: Hygea is a diversified healthcare company that owns physician practices, ancillary services companies, independent physician associations, and other medical service entities.

Vivid Seats LLC, $7.0 million 1st Lien Senior Secured Debt: Vivid Seats is an independent full-service provider of an online secondary ticket marketplace for a broad range of sporting, music and other events.

Imagine! Print Solutions, Inc., $4.0 million 1st Lien Senior Secured Debt: Imagine! is the leading provider of in-store marketing solutions in North America.

Fourth Fiscal Quarter 2016 Operating Results

For the quarter ended March 31, 2016, Capital Southwest reported total investment income of $3.8 million, compared to $3.3 million in the prior quarter. The increase in investment income was attributable to an increase in debt investments outstanding.

For the quarter ended March 31, 2016, total expenses (excluding tax expense) were $3.1 million, compared to $3.9 million in the prior quarter. The decrease in expenses was primarily due to one-time expenses related to the spin-off of CSW Industrials, Inc. (Nasdaq: CSWI) in the prior quarter.

For the quarter ended March 31, 2016, there was a tax benefit of $0.8 million recorded compared to a benefit of $0.6 million in the prior quarter. The tax benefit recorded this quarter was due to a change in the valuation allowance related to our deferred tax asset at Capital Southwest Management Company, a wholly-owned management company subsidiary.

For the quarter ended March 31, 2016, total pre-tax net investment income was $0.7 million compared to a loss of ($0.6) million in the prior quarter.

During the quarter ended March 31, 2016, Capital Southwest recorded net realized and unrealized gains on investments of $1.0 million. The net increase in net assets resulting from operations was $2.5 million, compared to a decrease of ($1.1) million in the prior quarter.

The company’s net asset value, or NAV, at March 31, 2016 was $17.34 per share, as compared to $17.22 at December 31, 2015. The increase in NAV was primarily due to appreciation of $1.0 million in the investment portfolio and an increase in the deferred tax asset of $0.8 million.

Liquidity and Capital Resources

At March 31, 2016, Capital Southwest had unrestricted cash and money market balances of approximately $96.0 million, total assets of approximately $284.5 million, and net assets of approximately $272.6 million. As of March 31, 2016, Capital Southwest had no borrowings outstanding on its balance sheet. Subsequent to quarter end, Capital Southwest increased its off balance sheet I-45 Senior Loan Fund Credit Facility from $75 million to $100 million.

Remarking on the Company's liquidity position, Michael S. Sarner, Chief Financial Officer of the Company, stated, "We are pleased with the interest we have drawn from financial institutions interested in joining the I-45 credit facility. As we continue to originate assets and fund our equity commitment to I-45, we will look to grow the facility toward our goal of maintaining two times leverage. From an on balance sheet perspective, we are currently in negotiations toward originating a revolving credit facility and hope to have financing in place sometime this summer”.

First Quarter Fiscal Year 2017 Dividend of $0.06 Per Share Declared

On June 7, 2016, the Company's Board of Directors declared a regular quarterly dividend of $0.06 per share for the first quarter of Fiscal Year 2017 payable on July 1, 2016 to stockholders of record as of June 20, 2016.

When declaring dividends the Board of Directors reviews estimates of taxable income available for distribution, which may differ from net investment income under generally accepted accounting principles. The final determination of taxable income for each year, as well as the tax attributes for dividends in such year, will be made after the close of the tax year.

Capital Southwest maintains a dividend reinvestment plan ("DRIP") that provides for the reinvestment of dividends on behalf of its registered stockholders who hold their shares with Capital Southwest’s transfer agent and registrar, American Stock Transfer and Trust Company. Under the DRIP, if the Company declares a dividend, registered stockholders who have opted in to the DRIP by the dividend record date will have their dividend automatically reinvested into additional shares of Capital Southwest common stock.

Share Repurchase Program

On January 25th, 2016, Capital Southwest announced that its Board of Directors authorized the repurchase of up to $10 million of its common stock at prices below the Company's net asset value per share as reported in its most recent financial statements. The Board authorized the plan because it believes that the Company’s common stock may be undervalued from time to time due to market volatility. As of March 31, 2016, no shares have been purchased under the plan.

Fourth Fiscal Quarter 2016 Financial Results Conference Call and Webcast

Capital Southwest has scheduled a conference call on Wednesday, June 8, 2016, at 11:00 a.m. Eastern Time to discuss the fourth fiscal quarter 2016 financial results. You may access the call by dialing (855)-835-4076 and using the passcode 20891958 at least 10 minutes before the call. The call can also be accessed using the Investor Relations section of Capital Southwest's website at www.capitalsouthwest.com, or by using http://edge.media-server.com/m/p/jum6awy6.

A telephonic replay will be available through June 15, 2016 by dialing (855)-859-2056 and using the passcode 20891958. An audio archive of the conference call will also be available on the Investor Relations section of Capital Southwest’s website.

For a more detailed discussion of the financial and other information included in this press release, please refer to the Capital Southwest Form 10-K for the period ended March 31, 2016 to be filed with the Securities and Exchange Commission and Capital Southwest’s Fourth Fiscal Quarter 2016 Investor Presentation to be posted on the Investor Relations section of Capital Southwest’s website at www.capitalsouthwest.com.

About Capital Southwest

Capital Southwest Corporation (Nasdaq: CSWC) is a Dallas, Texas-based publicly traded business development company, with approximately $273 million in net assets as of March 31, 2016. On September 30, 2015, Capital Southwest completed the spin-off to shareholders of its industrial businesses, CSW Industrials, Inc. Capital Southwest is a middle market lender focused on supporting the acquisition and growth of middle market businesses with investments from $5 to $20 million across the capital structure, including first lien, unitranche, second lien and subordinated debt, as well as non-control equity co-investments. Since Capital Southwest's formation in 1961, it has always sought to invest in companies with strong management teams and sound financial performance. As a public company with a permanent capital base, Capital Southwest is fortunate to have the flexibility to be creative in its financing solutions and to invest to support the growth of its portfolio companies over long periods of time.

Forward-Looking Statements

This press release contains historical information and forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 with respect to the business and investments of Capital Southwest. Forward-looking statements are statements that are not historical statements and can often be identified by words such as "will," "believe," "expect" and similar expressions, and variations or negatives of these words. These statements are based on management's current expectations, assumptions and beliefs. They are not guarantees of future results and are subject to numerous risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. These risks include risks related to changes in the markets in which Capital Southwest invests, changes in the financial and lending markets and general economic and business conditions.

Readers should not place undue reliance on any forward-looking statements and are encouraged to review Capital Southwest's Annual Report on Form 10-K for the year ended March 31, 2016 and subsequent fillings with the Securities and Exchange Commission for a more complete discussion of the risks and other factors that could affect any forward-looking statements. Except as required by the federal securities laws, Capital Southwest does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changing circumstances or any other reason after the date of this press release.

Investor Relations Contact:

Michael S. Sarner, Chief Financial Officer

214-884-3829

Capital Southwest CorporationQ4 2016 Earnings Presentation 5400 Lyndon B. Johnson Freeway, Suite 1300 | Dallas, Texas 75240 | 214.238.5700 | capitalsouthwest.com June 8, 2016

This presentation contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 relating to, among other things the business, financial condition and results of operations of Capital Southwest, the anticipated investment strategies and investments of Capital Southwest, and future market demand. Any statements preceded or followed by or that include the words "believe," "expect," "intend," "plan," "should" or similar words, phrases or expressions or the negative thereof, or any other statements that are not historical statements are forward-looking statements. These statements are made on the basis of the current beliefs, expectations and assumptions of the management of Capital Southwest. There are a number of risks and uncertainties that could cause Capital Southwest’s actual results to differ materially from the forward-looking statements included in this presentation. In light of these risks, uncertainties, assumptions, and other factors inherent in forward-looking statements, actual results may differ materially from those discussed in this presentation. Other unknown or unpredictable factors could also have a material adverse effect on Capital Southwest’s actual future results, performance, or achievements. For a further discussion of these and other risks and uncertainties applicable to Capital Southwest and its business, see Capital Southwest’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015 and its subsequent filings with the Securities and Exchange Commission. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Capital Southwest does not assume any obligation revise or to update these forward-looking statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law. Forward-Looking Statements

Bowen S. DiehlPresident and Chief Executive OfficerMichael S. SarnerChief Financial OfficerChris RehbergerVP Finance / Treasurer Conference Call Participants

CSWC has refocused its investment strategy to become a lender to middle-market companies across the capital structureCSWC was formed in 1961, and became a BDC in 1988Publicly-traded on Nasdaq under CSWC tickerInternally-managed BDC with RIC status for tax purposesManagement transition over the last two years has resulted in a new Chairman, CEO, CFO, and credit teamIn December 2014, announced split into two separate companies with spin-off of industrial growth company (“CSW Industrials”; Nasdaq: CSWI) which was completed September 30th, 2015Over the past 18 months, CSWC has made significant strides towards rotating its investment portfolio from equity to credit CSWC Company Overview

Portfolio Rotation Focused on Credit 6/30/2014 (excl. CSWI Companies) 3/31/2016 Investable Assets Since June 2014, CSWC has made significant strides towards rotating its investment assets from equity to creditExited 21 legacy portfolio companies for $222 MM in proceedsInvested $91 MM in 17 middle-market credit investmentsInvested $100 MM in 24 credits within I-45 Senior Loan Fund (“I-45”), a joint venture with Main Street CapitalBelow is a depiction of the asset rotation of the CSWC portfolio, excluding the businesses that were spun-off as CSW Industrials 1% of Total Assets Generating Recurring Income 59% of Total Assets Generating Recurring Income

Q4 2016 Portfolio Originations In Thousands

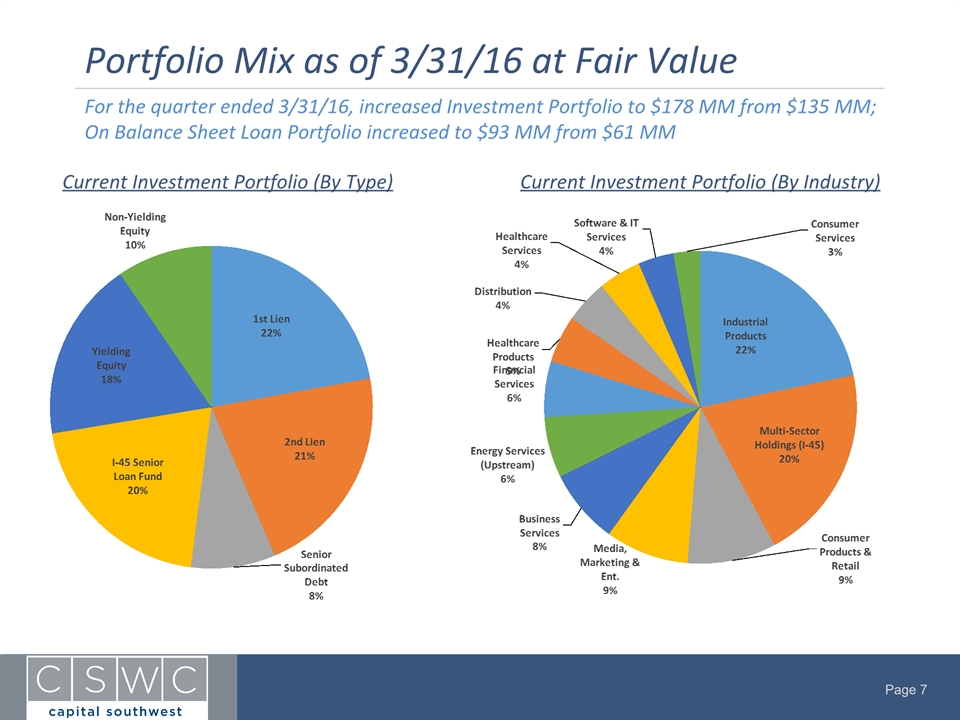

Portfolio Mix as of 3/31/16 at Fair Value Current Investment Portfolio (By Type) Current Investment Portfolio (By Industry) For the quarter ended 3/31/16, increased Investment Portfolio to $178 MM from $135 MM; On Balance Sheet Loan Portfolio increased to $93 MM from $61 MM

I-45 Senior Loan Fund Portfolio Current I-45 Portfolio (By Type) Current I-45 Portfolio (By Industry) Invested $8 MM additional equity to fund I-45 loan portfolio growth to $100 MM

Financial HighlightsGrew investment portfolio to $178 MM from $135 MM Q4 2016 Pre-Tax Net Investment Income of $708 K or $0.04 per weighted average diluted sharePaid quarterly dividend of $0.04 per shareNo non-accruals or watch list companies within debt investment portfolio$96 MM in cash available for investment activityKey UpdatesDeclared $0.06 dividend per share for Q1 2017Continue to ramp I-45 Senior Loan Fund I-45 distributed $1.1 MM dividend to CSWC during the quarter Increased Deutsche Bank Credit Facility to $100 MM from $75 MMExited Freedom Truck Finance loan, generating a 14.3% IRR Q4 2016 Highlights

Key Highlights 1 CSWC utilizes an internal 1 - 4 investment rating system in which 1 represents material outperformance and 4 represents material underperformance. All new investments are initially set to 2.2 Excludes CSWC equity investment in I-45 Senior Loan Fund Quarter Ended 9/30/2015 Quarter Ended 12/31/2015 Quarter Ended 3/31/2016 Financial Highlights Pre-Tax Net Investment Income / (Loss) Per Wtd. Avg. Diluted Share ($0.59) ($0.04) $0.04 Dividends Per Share $0.00 $0.00 $0.04 NAV Per Share $17.68 $17.22 $17.34 Cash & Cash Equivalents $184,111 $143,680 $95,969 Debt to Equity 0.0x 0.0x 0.0x Shares Outstanding 15,583 15,725 15,726 Weighted Average Shares Outstanding (Diluted) 15,680 15,751 15,795 Portfolio Statistics Fair Value of Debt Investments $45,115 $60,929 $92,832 Average Debt Investment Hold Size $5,013 $5,077 $5,157 Fair Value of Debt Investments as a % of Cost 100% 100% 99% % of Debt Portfolio on Non-Accrual (at Fair Value) 0.3% 0.0% 0.0% Weighted Average Investment Rating1 N/A 2.0 2.0 Weighted Average Yield on Debt Investments 10.11% 10.31% 10.67% Total Fair Value of Portfolio Investments $93,339 $134,935 $178,436 Weighted Average Yield on all Portfolio Investments 4.37% 10.82% 9.46% Investment Mix (Debt vs. Equity)2 47% / 53% 57% / 43% 65% / 35% Investment Mix (Yielding vs. Non-Yielding) 80% / 20% 89% / 11% 90% / 10%

Balance Sheet Highlights (In Thousands, except per share amounts) Quarter Ended 9/30/2015 Quarter Ended 12/31/2015 Quarter Ended 3/31/2016 Assets Portfolio Investments $93,339 $134,935 $178,436 Cash & Cash Equivalents $184,111 $143,680 $95,969 Deferred Tax Asset $1,649 $1,544 $2,342 Other Assets $6,551 $6,421 $7,746 Total Assets $285,650 $286,580 $284,493 Liabilities Payable for Unsettled Transaction $0 $4,850 $3,940 Income Tax Payable $0 $2,948 $0 Other Liabilities $10,059 $7,997 $7,918 Total Liabilities $10,059 $15,795 $11,858 Shareholders Equity Net Asset Value $275,591 $270,785 $272,635 Shares Outstanding at Period End 15,583 15,725 15,726 NAV per Share $17.68 $17.22 $17.34 Debt to Equity 0.0x 0.0x 0.0x

Income Statement Highlights (In Thousands, except per share amounts) Quarter Ended 9/30/15 Quarter Ended 12/31/15 Quarter Ended 3/31/16 Investment Income Interest Income $945 $1,415 $2,110 Dividend Income $0 $1,612 $1,578 Fees and Other Income $133 $280 $123 Total Investment Income $1,078 $3,307 $3,811 Expenses Cash Compensation $3,411 $1,675 $1,403 Share Based Compensation $370 $195 $257 General & Administrative $1,070 $1,354 $1,192 Spin-off Related Expenses $5,474 $710 $251 Total Expenses $10,325 $3,934 $3,103 Pre-Tax Net Investment Income / (Loss) ($9,247) ($627) $708 Taxes and Gain / (Loss) Income Tax Benefit (Expense) ($88) $607 $788 Net realized gain (loss) on investments ($3,396) ($8,170) $12 Net increase (decrease) in unrealized appreciation of investments $3,783 $7,060 $1,001 Net increase (decrease) in net assets resulting from operations ($8,948) ($1,130) $2,509 Weighted Average Shares Outstanding 15,680 15,751 15,795 Pre-Tax Net Investment Income Per Weighted Average Share ($0.59) ($0.04) $0.04 Dividends Per Share $0.00 $0.00 $0.04

Investment Income Detail Constructing a portfolio of investments with recurring cash yield (In Thousands) Quarter Ended 9/30/2015 Quarter Ended 12/31/2015 Quarter Ended 3/31/2016 Investment Income Breakdown Cash Interest $930 $1,392 $2,063 Cash Dividends $0 $1,612 $1,578 Management Fees $133 $275 $115 Amortization of purchase discounts and fees $15 $23 $47 Other Income (non-recurring) $0 $5 $8 Total Investment Income $1,078 $3,307 $3,811 Key Metrics Cash Income as a % of Investment Income 98.6% 99.3% 98.8% % of Total Investment Income that is Recurring 100.0% 99.8% 99.8%

Interest Rate Sensitivity Debt Portfolio Composition Impact of Base Rate Changes on Net Investment Income Note: Illustrative change in NII is based on a projection of our existing debt investments as of 3/31/16, adjusted only for changes in Base Rates. The results of this analysis include the I-45 Senior Loan Fund, which is comprised of 100% floating rate assets and liabilities. Change in Base Interest Rates Illustrative NII Change ($'s) Illustrative NII Change (Per Share) 50 bps $43,267 $0.00 100bps $598,027 $0.04 150bps $1,185,873 $0.08 200bps $1,773,720 $0.11

Corporate Information Board of Directors Senior Management Fiscal Year End Inside Directors March 31 Joseph B. Armes Bowen S. Diehl Bowen S. Diehl President & Chief Executive Officer Independent Auditor Grant Thornton Dallas, TX Independent Directors Michael S. Sarner John H. Wilson Chief Financial Officer, Secretary & Treasurer William R. Thomas T. Duane Morgan Corporate Counsel David R. Brooks Investor Relations Thompson & Knight / Jones Day Dallas, TX Jack D. Furst Michael S. Sarner Capital Southwest Corporate Offices & Website 214-884-3829 5400 LBJ Freeway [email protected] Transfer Agent 13th Floor American Stock Transfer & Trust Company, LLC Dallas, TX 75240 Securities Listing 800-937-5449 http://www.capitalsouthwest.com NASDAQ: CSWC www.amstock.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Oragenics, Inc. Announces Notification of Noncompliance with Additional NYSE American Continued Listing Standards

- Elevate Textiles Names Jeffrey P. Pritchett Chief Executive Officer and Director of the Board

- Implementing AIOps: Blueprint for Enhanced IT Operations and Business Efficiency Published by Info-Tech Research Group

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share