Form 8-K BROCADE COMMUNICATIONS For: Feb 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 19, 2015

Brocade Communications Systems, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 000-25601 | 77-0409517 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||

130 Holger Way

San Jose, CA 95134-1376

(Address, including zip code, of principal executive offices)

(408) 333-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 19, 2015, Brocade Communications Systems, Inc. (the “Company”) issued a press release regarding financial results for the first quarter ended January 31, 2015. The Company also posted on its website (www.brcd.com) slides with accompanying prepared remarks regarding such financial results and forward-looking statements, including statements relating to the Company’s estimated financial results of the second quarter of fiscal year 2015. Copies of the press release and slides with accompanying prepared remarks by the Company are attached as Exhibits 99.1 and 99.2, respectively, and the information in Exhibits 99.1 and 99.2 is incorporated herein by reference.

The information in Item 2.02 and Item 9.01 in this Current Report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number | Description of Document |

99.1 | Press release, dated February 19, 2015, regarding financial results of Brocade Communications Systems, Inc. for the first quarter ended January 31, 2015. |

99.2 | Slides with accompanying prepared remarks of Brocade Communications Systems, Inc., dated February 19, 2015, regarding financial results of the first quarter ended January 31, 2015 and forward-looking statements, including statements relating to the Company’s estimated financial results of the second quarter of fiscal year 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

BROCADE COMMUNICATIONS SYSTEMS, INC. | |||||||

Date: | February 19, 2015 | By: | /s/ Daniel W. Fairfax | ||||

Daniel W. Fairfax | |||||||

Senior Vice President and Chief Financial Officer | |||||||

Exhibit 99.1

BROCADE CONTACTS | ||

Media Relations Kristy Campbell Tel: 408-333-4221 | Investor Relations Michael Iburg Tel: 408-333-0233 |  |

Brocade Reports Fiscal Q1 2015 Results

Broad-based Revenue Strength Drives Increased Profitability

SAN JOSE, Calif., February 19, 2015 — Brocade® (NASDAQ: BRCD) today reported financial results for its first fiscal quarter ended January 31, 2015. Brocade reported first quarter revenue of $576 million, up 2% both year-over-year and quarter-over-quarter. The Company reported GAAP diluted earnings per share (EPS) of $0.20, up from $0.18 in Q1 2014, and up from $0.19 in Q4 2014. Non-GAAP diluted EPS was $0.27 for Q1 2015, up from $0.24 in both Q1 2014 and Q4 2014, primarily due to higher revenue and improved gross margins.

“We delivered double-digit revenue growth in IP Networking year-over-year and one of the strongest SAN quarters in company history, resulting in increased profitability,” said Lloyd Carney, CEO of Brocade. “With a strong focus on the data center, we continue to invest strategically in disruptive technologies to build a portfolio of solutions that capitalize on the opportunities afforded to first-movers in the New IP era.”

Key Financial Metrics:

Q1 2015 | Q4 2014 | Q1 2014 | Q1 2015 vs. Q4 2014 | Q1 2015 vs. Q1 2014 | |||||||||||||

Revenue | $ | 576 | M | $ | 564 | M | $ | 565 | M | 2 | % | 2 | % | ||||

GAAP EPS—diluted | $ | 0.20 | $ | 0.19 | $ | 0.18 | 5 | % | 11 | % | |||||||

Non-GAAP EPS—diluted | $ | 0.27 | $ | 0.24 | $ | 0.24 | 14 | % | 12 | % | |||||||

GAAP gross margin | 67.6 | % | 66.8 | % | 66.0 | % | 0.8 pts | 1.6 pts | |||||||||

Non-GAAP gross margin | 68.4 | % | 67.7 | % | 67.7 | % | 0.7 pts | 0.7 pts | |||||||||

GAAP operating margin | 24.2 | % | 22.4 | % | 21.5 | % | 1.8 pts | 2.7 pts | |||||||||

Non-GAAP operating margin | 28.5 | % | 26.8 | % | 27.9 | % | 1.7 pts | 0.6 pts | |||||||||

Please see important note of explanation on non-GAAP financial measures below, including a detailed reconciliation between GAAP and non-GAAP information in the tables included herein.

Highlights:

• | SAN product revenue was $353 million, approximately flat year-over-year and up 9% sequentially. Year-over-year SAN revenue performance was led by Switch revenue, which grew 8% due to strong sales across most Gen 5 Fibre Channel switching platforms. Director and Server revenues were lower year-over-year by 2% and 24%, respectively, as customer buying patterns favored fixed configuration platforms in the quarter. The strong sequential revenue performance in the quarter was consistent with past fiscal first quarters, which aligns with many of the Company’s OEM partners’ fiscal year-ends and is typically their strongest storage quarter. All SAN product segments saw strong sequential growth with Directors up 7%, Switches up 10%, and Server products up 9%. |

• | IP Networking product revenue was $133 million, up 11% year-over-year and down 13% sequentially. The year-over-year growth was due to higher revenue from Brocade VDX® data center switches and Brocade MLX® routing products. Ethernet switch revenue increased 17% year-over-year while routing product revenue increased 14% year-over-year. Partially offsetting the gains in switches and routers was a decline in other IP product revenue related to the previously announced discontinuation of the wireless and network adapter products, and the repositioning of the Brocade ADX product line. Total IP Networking revenue was down sequentially due primarily to lower U.S. Federal revenue, which is typically lower in the fiscal first quarter. |

• | In the quarter, Brocade completed a $575 million convertible debt offering, with the majority of the proceeds being used to redeem its $300 million senior secured notes. The new convertible debt is unsecured and has a significantly lower interest rate of 1.375% compared to 6.875% on the note that has been redeemed. In conjunction with the convertible offering, the |

Page 1 of 10

Company entered into a call option hedge transaction designed to reduce the dilutive effect of the convertible notes. On the day of pricing, the Company repurchased 4.1 million shares of its common stock.

• | Subsequent to the end of the fiscal first quarter, Brocade announced its intent to acquire the SteelApp business from Riverbed Technology in an all-cash asset purchase. The transaction is expected to close in Brocade’s fiscal second quarter of 2015. The SteelApp product line is a leading virtual Application Delivery Controller and will extend Brocade’s New IP software portfolio to enable more advanced solutions for the Company’s data center and service provider customers. |

Board Declares Dividend:

• | The Brocade Board of Directors has declared a quarterly cash dividend of $0.035 per share of the Company’s common stock. The dividend payment will be made on April 2, 2015, to stockholders of record at the close of market on March 10, 2015. |

Brocade management will host a conference call to discuss the fiscal first quarter results and the fiscal second quarter outlook today at 2:30 p.m. PT (5:30 p.m. ET). To access the webcast, please go to www.brcd.com/events.cfm. A replay of the conference call, prepared comments and slides, as well as a written transcript, will be available at www.brcd.com.

Other Q1 2015 product, customer, and partner announcements are available at http://newsroom.brocade.com/.

Brocade (www.brocade.com)

130 Holger Way, San Jose, CA 95134

T. 408.333.8000 F. 408.333.8101

Page 2 of 10

Financial Highlights and Additional Financial Information

Q1 2015 | Q4 2014 | Q1 2014 | ||||||

Routes to market as a % of total net revenues: | ||||||||

OEM revenues | 67 | % | 63 | % | 70 | % | ||

Channel/Direct revenues | 33 | % | 37 | % | 30 | % | ||

10% or greater customer revenues | 44 | % | 44 | % | 57 | % | ||

Geographic split as a % of total net revenues (1): | ||||||||

Domestic revenues | 58 | % | 61 | % | 57 | % | ||

International revenues | 42 | % | 39 | % | 43 | % | ||

Segment split as a % of total net revenues: | ||||||||

SAN product revenues | 61 | % | 58 | % | 63 | % | ||

IP Networking product revenues | 23 | % | 27 | % | 21 | % | ||

Global Services revenues | 16 | % | 15 | % | 16 | % | ||

SAN business revenues (2) | 71 | % | 67 | % | 73 | % | ||

IP Networking business revenues (2) | 29 | % | 33 | % | 27 | % | ||

IP Networking product revenues by use category (3): | ||||||||

Data Center (4) | 53 | % | 58 | % | 59 | % | ||

Enterprise Campus | 34 | % | 34 | % | 34 | % | ||

Carrier Network (MAN/WAN) | 13 | % | 8 | % | 7 | % | ||

Additional information: | Q1 2015 | Q4 2014 | Q1 2014 | ||||||||

GAAP net income | $ | 87 | M | $ | 83 | M | $ | 81 | M | ||

Non-GAAP net income | $ | 118 | M | $ | 104 | M | $ | 109 | M | ||

GAAP operating income | $ | 139 | M | $ | 127 | M | $ | 121 | M | ||

Non-GAAP operating income | $ | 164 | M | $ | 151 | M | $ | 158 | M | ||

EBITDA | $ | 159 | M | $ | 147 | M | $ | 160 | M | ||

Effective GAAP tax provision rate | 23.1 | % | 29.1 | % | 27.1 | % | |||||

Effective Non-GAAP tax provision rate | 23.1 | % | 26.6 | % | 26.1 | % | |||||

Cash and cash equivalents | $ | 1,359 | M | $ | 1,255 | M | $ | 999 | M | ||

Restricted cash (5) | $ | 312 | M | $ | — | $ | — | ||||

Deferred revenues | $ | 310 | M | $ | 312 | M | $ | 298 | M | ||

Capital expenditures | $ | 17 | M | $ | 14 | M | $ | 13 | M | ||

Total debt, net of discount (6) | $ | 1,084 | M | $ | 597 | M | $ | 599 | M | ||

Cash, net of senior debt, convertible debt and capitalized leases (7) | $ | 483 | M | $ | 653 | M | $ | 395 | M | ||

Cash provided by operations | $ | 10 | M | $ | 158 | M | $ | 109 | M | ||

Days sales outstanding | 39 days | 36 days | 35 days | ||||||||

Employees at end of period | 4,305 | 4,161 | 4,077 | ||||||||

SAN port shipments | 1.1 | M | 1.1 | M | 1.2 | M | |||||

Share repurchases (8) | $ | 132.4 | M | $ | 32.8 | M | $ | 140.4 | M | ||

Please see important note of explanation on non-GAAP financial measures below, including a detailed reconciliation between GAAP and non-GAAP information in the tables included herein.

(1) | Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end users, the percentage of international revenues based on end-user location would likely be higher. |

(2) | SAN and IP Networking business revenues include product, support, and services revenues. |

(3) | Product revenue by use category is estimated based on analysis of the information the Company collects in its sales management system. The estimated percentage of revenue by use category may fluctuate quarter-to-quarter due to seasonality and the timing of large customer orders. |

(4) | Data Center includes enterprise, service provider, and government data center revenues. |

(5) | Q1 2015 restricted cash was used to redeem the $300 million principal of the 2020 senior secured notes, and pay for the associated call premium and interest earned on February 13, 2015. |

Page 3 of 10

(6) | Q1 2015 total debt, net of discount, includes the debt discount recorded for the conversion feature that is required to be separately accounted for as equity for the $575 million convertible debt, thereby reducing the carrying value of the 2020 convertible notes. The unamortized debt discount for the conversion feature was $80 million as of January 31, 2015. |

(7) | Q1 2015 Cash, net of senior debt, convertible debt and capitalized leases excludes restricted cash of $312 million and the 2020 senior secured notes of $300 million that have been called and were redeemed on February 13, 2015. |

(8) | $3.5 million of the $132.4 million in shares repurchases in Q1 2015 were pending cash settlement as of January 31, 2015. |

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures. In evaluating Brocade’s performance, management uses certain non-GAAP financial measures to supplement consolidated financial statements prepared under GAAP.

Management believes that non-GAAP financial measures used in this press release allow management to gain a better understanding of Brocade’s comparative operating performance both from period to period, and relative to its competitors’ operating results. Management also believes these non-GAAP financial measures help with the determination of Brocade’s baseline performance before gains, losses or charges that are considered by management to be outside ongoing operating results. Accordingly, management uses these non-GAAP financial measures for planning and forecasting of future periods and in making decisions regarding operations and the allocation of resources. Management believes these non-GAAP financial measures, when read in conjunction with Brocade’s GAAP financials, provide useful information to investors by offering:

• | the ability to make more meaningful period-to-period comparisons of Brocade’s ongoing operating results; |

• | the ability to make more meaningful comparisons of Brocade’s operating performance against its industry and competitor companies; |

• | the ability to better identify trends in Brocade’s underlying business and to perform related trend analysis; |

• | a better understanding of how management plans and measures Brocade’s underlying business; and |

• | an easier way to compare Brocade’s most recent results of operations against investor and analyst financial models. |

Management excludes certain gains or losses and benefits or costs in determining non-GAAP net income that are the result of infrequent events or events that arise outside the ordinary course of Brocade’s continuing operations. Management believes that it is appropriate to evaluate Brocade’s operating performance by excluding those items that are not indicative of ongoing operating results or limit comparability. Such items include, but are not limited to: (i) legal provision or recovery associated with certain pre-acquisition litigation, (ii) call premium cost and write-off of debt discount and debt issuance costs related to lenders that did not participate in refinancing, (iii) settlement gain associated with certain pre-acquisition-related litigation, (iv) restructuring, goodwill impairment, and other related costs, (v) gain on sale of network adapter business, (vi) gain on sale of non-marketable equity investment, and (vii) specific non-cash and non-recurring tax benefits or detriments.

Management also excludes the following non-cash charges in determining non-GAAP net income (i) stock-based compensation expense, (ii) amortization of purchased intangible assets, and (iii) non-cash interest expense related to the convertible debt. Because of varying use of valuation methodologies, subjective assumptions and the variety of award types, management believes that the exclusion of stock-based compensation allows for more accurate comparisons of our operating results to our peer companies. Management also believes that the exclusion of expense associated with the amortization of acquisition-related intangible assets is appropriate because a significant portion of the purchase price for acquisitions may be allocated to intangible assets that have short lives and the exclusion of amortization expense allows comparisons of operating results that are consistent over time for Brocade’s newly acquired and long-held businesses. In connection with the convertible debt, under the relevant accounting guidance, a non-cash interest expense is recognized for the convertible debt as an imputed interest expense for the conversion feature. Management believes excluding the non-cash interest expense from its non-GAAP measures is useful for investors because the expense does not represent a cash outflow and is not indicative of ongoing operating performance.

Finally, management believes that it is appropriate to exclude the tax effects of the items noted above in order to present a more meaningful measure of non-GAAP net income.

Limitations These non-GAAP financial measures have limitations, however, because they do not include all items of income and expense that impact the company. Management compensates for these limitations by also considering Brocade’s GAAP results. The non-GAAP financial measures that Brocade uses are not prepared in accordance with, and should not be considered an alternative to measurements required by GAAP, such as operating income, net income and net income per share, and should not be considered measurements of Brocade’s liquidity. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. In addition, these non-GAAP financial measures may not be comparable to similar measurements reported by other companies.

Page 4 of 10

Cautionary Statement

This press release contains statements that are forward-looking in nature, including statements regarding Brocade’s strategy, operational performance and prospects for revenue growth. These statements are based on current expectations on the date of this press release and involve a number of risks and uncertainties which may cause actual results to differ significantly from such estimates. The risks include, but are not limited to, the ability to close the SteelApp transaction, changes in IT spending levels in one or more of our target markets, Brocade’s ability to execute on its sale strategy, and the effect of increasing market competition and changes in the industry. Certain of these and other risks are set forth in more detail in “Item 1A. Risk Factors” in Brocade’s Annual Report on Form 10-K for the fiscal year ended November 1, 2014. Brocade does not assume any obligation to update or revise any such forward-looking statements, whether as the result of new developments or otherwise.

About Brocade

Brocade (NASDAQ: BRCD) networking solutions help the world’s leading organizations transition smoothly to a world where applications and information reside anywhere. (www.brocade.com)

ADX, Brocade, Brocade Assurance, the B-wing symbol, DCX, Fabric OS, HyperEdge, ICX, MLX, MyBrocade, OpenScript, The Effortless Network, VCS, VDX, Vplane, and Vyatta are registered trademarks, and Fabric Vision and vADX are trademarks of Brocade Communications Systems, Inc., in the United States and/or in other countries. Other brands, products, or service names mentioned may be trademarks of others.

© 2015 Brocade Communications Systems, Inc. All Rights Reserved.

Page 5 of 10

BROCADE COMMUNICATIONS SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

Three Months Ended | |||||||

January 31, 2015 | January 25, 2014 | ||||||

(In thousands, except per share amounts) | |||||||

Net revenues: | |||||||

Product | $ | 486,238 | $ | 475,205 | |||

Service | 90,001 | 89,330 | |||||

Total net revenues | 576,239 | 564,535 | |||||

Cost of revenues: | |||||||

Product | 149,926 | 153,627 | |||||

Service | 36,630 | 38,238 | |||||

Total cost of revenues | 186,556 | 191,865 | |||||

Gross margin | 389,683 | 372,670 | |||||

Operating expenses: | |||||||

Research and development | 85,231 | 87,156 | |||||

Sales and marketing | 140,238 | 132,665 | |||||

General and administrative | 24,671 | 20,143 | |||||

Amortization of intangible assets | 138 | 9,883 | |||||

Restructuring and other related costs | — | 6,217 | |||||

Gain on sale of network adapter business | — | (4,884 | ) | ||||

Total operating expenses | 250,278 | 251,180 | |||||

Income from operations | 139,405 | 121,490 | |||||

Interest expense | (25,424 | ) | (9,196 | ) | |||

Interest income and other loss, net | (559 | ) | (1,336 | ) | |||

Income before income tax | 113,422 | 110,958 | |||||

Income tax expense | 26,155 | 30,074 | |||||

Net income | $ | 87,267 | $ | 80,884 | |||

Net income per share—basic | $ | 0.20 | $ | 0.18 | |||

Net income per share—diluted | $ | 0.20 | $ | 0.18 | |||

Shares used in per share calculation—basic | 428,536 | 440,573 | |||||

Shares used in per share calculation—diluted | 439,156 | 453,549 | |||||

Cash dividends declared per share | $ | 0.035 | $ | — | |||

Page 6 of 10

BROCADE COMMUNICATIONS SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

Three Months Ended | |||||||

January 31, 2015 | January 25, 2014 | ||||||

(In thousands) | |||||||

Net income | $ | 87,267 | $ | 80,884 | |||

Other comprehensive income and loss, net of tax: | |||||||

Unrealized gains (losses) on cash flow hedges: | |||||||

Change in unrealized gains and losses | (1,774 | ) | (924 | ) | |||

Net gains and losses reclassified into earnings | 603 | (31 | ) | ||||

Net unrealized losses on cash flow hedges | (1,171 | ) | (955 | ) | |||

Foreign currency translation adjustments | (4,221 | ) | (823 | ) | |||

Total other comprehensive loss | (5,392 | ) | (1,778 | ) | |||

Total comprehensive income | $ | 81,875 | $ | 79,106 | |||

Page 7 of 10

BROCADE COMMUNICATIONS SYSTEMS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

January 31, 2015 | November 1, 2014 | ||||||

(In thousands, except par value) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 1,359,365 | $ | 1,255,017 | |||

Restricted cash | 311,918 | — | |||||

Accounts receivable, net of allowances for doubtful accounts of $107 and $80 at January 31, 2015, and November 1, 2014, respectively | 249,127 | 224,913 | |||||

Inventories | 40,275 | 38,718 | |||||

Deferred tax assets | 99,691 | 92,692 | |||||

Prepaid expenses and other current assets | 43,498 | 46,665 | |||||

Total current assets | 2,103,874 | 1,658,005 | |||||

Property and equipment, net | 442,644 | 445,433 | |||||

Goodwill | 1,567,718 | 1,567,723 | |||||

Intangible assets, net | 33,633 | 26,658 | |||||

Other assets | 35,612 | 35,856 | |||||

Total assets | $ | 4,183,481 | $ | 3,733,675 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 88,198 | $ | 93,705 | |||

Accrued employee compensation | 96,598 | 169,018 | |||||

Deferred revenue | 236,322 | 239,993 | |||||

Current portion of long-term debt | 300,778 | 1,826 | |||||

Other accrued liabilities | 84,134 | 82,766 | |||||

Total current liabilities | 806,030 | 587,308 | |||||

Long-term debt, net of current portion | 783,597 | 595,450 | |||||

Non-current deferred revenue | 73,227 | 71,746 | |||||

Non-current income tax liability | 47,451 | 39,647 | |||||

Non-current deferred tax liabilities | 19,302 | 27,153 | |||||

Other non-current liabilities | 4,289 | 4,310 | |||||

Total liabilities | 1,733,896 | 1,325,614 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.001 par value, 5,000 shares authorized, no shares issued and outstanding | — | — | |||||

Common stock, $0.001 par value, 800,000 shares authorized: | |||||||

Issued and outstanding: 423,622 and 431,470 shares at January 31, 2015, and November 1, 2014, respectively | 424 | 431 | |||||

Additional paid-in capital | 1,748,959 | 1,774,197 | |||||

Accumulated other comprehensive loss | (24,206 | ) | (18,814 | ) | |||

Retained earnings | 724,408 | 652,247 | |||||

Total stockholders’ equity | 2,449,585 | 2,408,061 | |||||

Total liabilities and stockholders’ equity | $ | 4,183,481 | $ | 3,733,675 | |||

Page 8 of 10

BROCADE COMMUNICATIONS SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended | |||||||

January 31, 2015 | January 25, 2014 | ||||||

(In thousands) | |||||||

Cash flows from operating activities: | |||||||

Net income | $ | 87,267 | $ | 80,884 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Excess tax benefits from stock-based compensation | (16,102 | ) | (14,335 | ) | |||

Depreciation and amortization | 19,575 | 38,754 | |||||

Loss on disposal of property and equipment | 444 | 2,348 | |||||

Gain on sale of network adapter business | — | (4,884 | ) | ||||

Amortization of debt issuance costs and debt discount | 1,056 | 281 | |||||

Call premium cost and write-off of debt discount and debt issuance costs related to lenders that did not participate in refinancing | 15,122 | — | |||||

Provision for doubtful accounts receivable and sales allowances | 2,403 | 1,567 | |||||

Non-cash stock-based compensation expense | 24,082 | 18,588 | |||||

Changes in assets and liabilities, net of acquisitions: | |||||||

Restricted cash | (11,918 | ) | — | ||||

Accounts receivable | (26,616 | ) | 29,771 | ||||

Inventories | 1,155 | 2,097 | |||||

Prepaid expenses and other assets | 3,614 | 3,486 | |||||

Deferred tax assets | 494 | 95 | |||||

Accounts payable | (8,776 | ) | (8,077 | ) | |||

Accrued employee compensation | (77,033 | ) | (39,208 | ) | |||

Deferred revenue | (2,190 | ) | (5,414 | ) | |||

Other accrued liabilities | (1,423 | ) | 10,455 | ||||

Restructuring liabilities | (761 | ) | (6,939 | ) | |||

Net cash provided by operating activities | 10,393 | 109,469 | |||||

Cash flows from investing activities: | |||||||

Purchases of property and equipment | (16,514 | ) | (12,966 | ) | |||

Purchase of intangible assets | (7,750 | ) | — | ||||

Proceeds from collection of note receivable | 250 | 250 | |||||

Proceeds from sale of network adapter business | — | 9,995 | |||||

Net cash used in investing activities | (24,014 | ) | (2,721 | ) | |||

Cash flows from financing activities: | |||||||

Payment of debt issuance costs related to debt | (409 | ) | — | ||||

Payment of principal related to capital leases | (1,154 | ) | (608 | ) | |||

Common stock repurchases | (128,966 | ) | (140,380 | ) | |||

Proceeds from issuance of common stock | 21,036 | 32,410 | |||||

Payment of cash dividends to stockholders | (15,106 | ) | — | ||||

Proceeds from convertible notes | 565,656 | — | |||||

Purchase of convertible hedge | (86,135 | ) | — | ||||

Proceeds from issuance of warrants | 51,175 | — | |||||

Excess tax benefits from stock-based compensation | 16,102 | 14,335 | |||||

Increase in restricted cash | (300,000 | ) | — | ||||

Net cash provided by (used in) financing activities | 122,199 | (94,243 | ) | ||||

Effect of exchange rate fluctuations on cash and cash equivalents | (4,230 | ) | (815 | ) | |||

Net increase in cash and cash equivalents | 104,348 | 11,690 | |||||

Cash and cash equivalents, beginning of period | 1,255,017 | 986,997 | |||||

Cash and cash equivalents, end of period | $ | 1,359,365 | $ | 998,687 | |||

Page 9 of 10

BROCADE COMMUNICATIONS SYSTEMS, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(Unaudited)

Three Months Ended | |||||||||||

January 31, 2015 | November 1, 2014 | January 25, 2014 | |||||||||

(In thousands, except per share amounts) | |||||||||||

Non-GAAP adjustments | |||||||||||

Stock-based compensation expense included in cost of revenues | $ | 3,816 | $ | 4,225 | $ | 3,142 | |||||

Amortization of intangible assets expense included in cost of revenues | 637 | 600 | 6,462 | ||||||||

Total gross margin impact from non-GAAP adjustments | 4,453 | 4,825 | 9,604 | ||||||||

Stock-based compensation expense included in research and development | 4,933 | 5,527 | 4,336 | ||||||||

Stock-based compensation expense included in sales and marketing | 9,843 | 8,832 | 6,765 | ||||||||

Stock-based compensation expense included in general and administrative | 5,490 | 5,116 | 4,345 | ||||||||

Amortization of intangible assets expense included in operating expenses | 138 | 135 | 9,883 | ||||||||

Restructuring, goodwill impairment, and other related costs | — | 229 | 6,217 | ||||||||

Gain on sale of network adapter business | — | — | (4,884 | ) | |||||||

Total operating income impact from non-GAAP adjustments | 24,857 | 24,664 | 36,266 | ||||||||

Call premium cost and write-off of debt discount and debt issuance costs related to lenders that did not participate in refinancing | 15,122 | — | — | ||||||||

Convertible debt interest | 678 | — | — | ||||||||

Income tax effect of non-tax adjustments | (9,499 | ) | (3,587 | ) | (8,366 | ) | |||||

Total net income impact from non-GAAP adjustments | $ | 31,158 | $ | 21,077 | $ | 27,900 | |||||

Gross margin reconciliation | |||||||||||

GAAP gross margin | $ | 389,683 | $ | 377,118 | $ | 372,670 | |||||

Total gross margin impact from non-GAAP adjustments | 4,453 | 4,825 | 9,604 | ||||||||

Non-GAAP gross margin | $ | 394,136 | $ | 381,943 | $ | 382,274 | |||||

GAAP gross margin, as a percent of total net revenues | 67.6 | % | 66.8 | % | 66.0 | % | |||||

Non-GAAP gross margin, as a percent of total net revenues | 68.4 | % | 67.7 | % | 67.7 | % | |||||

Operating income reconciliation | |||||||||||

GAAP operating income | $ | 139,405 | $ | 126,530 | $ | 121,490 | |||||

Total operating income impact from non-GAAP adjustments | 24,857 | 24,664 | 36,266 | ||||||||

Non-GAAP operating income | $ | 164,262 | $ | 151,194 | $ | 157,756 | |||||

GAAP operating income, as a percent of total net revenues | 24.2 | % | 22.4 | % | 21.5 | % | |||||

Non-GAAP operating income, as a percent of total net revenues | 28.5 | % | 26.8 | % | 27.9 | % | |||||

Net income and net income per share reconciliation | |||||||||||

Net income on a GAAP basis | $ | 87,267 | $ | 83,419 | $ | 80,884 | |||||

Total net income impact from non-GAAP adjustments | 31,158 | 21,077 | 27,900 | ||||||||

Non-GAAP net income | $ | 118,425 | $ | 104,496 | $ | 108,784 | |||||

Non-GAAP net income per share—basic | $ | 0.28 | $ | 0.24 | $ | 0.25 | |||||

Non-GAAP net income per share—diluted | $ | 0.27 | $ | 0.24 | $ | 0.24 | |||||

Shares used in non-GAAP per share calculation—basic | 428,536 | 431,843 | 440,573 | ||||||||

Shares used in non-GAAP per share calculation—diluted | 439,156 | 441,649 | 453,549 | ||||||||

Page 10 of 10

|

Q1 FY 2015 Earnings

Prepared Comments and Slides

February 19, 2015

Michael Iburg

Investor Relations

Phone: 408-333-0233

Kristy Campbell

Media Relations

Phone: 408-333-4221

NASDAQ: BRCD

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Michael Iburg, Investor Relations

Thank you for your interest in Brocade’s Q1 Fiscal 2015 earnings presentation, which includes prepared remarks, safe harbor, slides, and a press release detailing fiscal first quarter 2015 results. The press release, along with these prepared comments and slides, has been furnished to the SEC on Form 8-K and has been made available on the Brocade Investor Relations website at www.brcd.com. The press release will be issued subsequently via Marketwired.

© 2015 Brocade Communications Systems, Inc. Page 2 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 3 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Today’s prepared comments include remarks by Lloyd Carney, Brocade CEO, regarding the company’s quarterly results, its strategy, and a review of operations, as well as industry trends and market/technology drivers related to its business; and by Dan Fairfax, Brocade CFO, who will provide a financial review.

A management discussion and live question and answer conference call will be webcast at

2:30 p.m. PT on February 19 at www.brcd.com and will be archived on the Brocade Investor Relations website.

© 2015 Brocade Communications Systems, Inc. Page 4 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Lloyd Carney, CEO

© 2015 Brocade Communications Systems, Inc. Page 5 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Brocade continued to execute well across a number of key metrics in Q1. We outperformed our SAN expectations for the quarter and achieved double-digit growth in our IP Networking business over the same period a year ago, resulting in increased profitability.

We have a clear strategic vision that has three essential components: expanding our presence in the data center, building a portfolio of open, software-driven solutions for both storage networking and IP networking, and executing within a financial model that delivers shareholder value and enables us to invest prudently in our future growth.

We continue to extend our leadership in New IP-based technologies. We are delivering on an aggressive product roadmap, recently announcing several innovative products to enable increasingly open, agile, and user-centric networks.

We are leveraging our strong financial position to make thoughtful, strategic acquisitions that add value to our technology portfolio. Earlier this month, we announced our intent to acquire the virtual application delivery controller business from Riverbed. This acquisition enhances our position in this rapidly growing market and expands the capability of our software offerings.

During the quarter, we completed a $575 million convertible notes offering, which reduces the interest rate on our debt and provides additional resources to meet our financial objectives and drive our strategic vision. The demand for these notes was high and a clear recognition by the market of the company’s financial strength and business direction.

© 2015 Brocade Communications Systems, Inc. Page 6 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Q1 15 was one of the best quarters in Brocade history for SAN revenue. A key driver of our performance continues to be the strong adoption of our industry-leading Gen 5 Fibre Channel portfolio. With the rapid migration to high-density server virtualization, Fibre Channel technology offers tremendous advantages, providing highly-deterministic, reliable, low-latency performance.

In addition, with the exponential growth of storage capacity in the data center, we continue to see an opportunity to leverage our differentiated storage networking solution to deliver the most reliable and easy-to-scale data center storage fabrics. The adoption of new technologies, such as all-flash arrays and hybrid flash arrays, is growing at a faster rate than many leading analysts had predicted. The network truly matters in these high performance deployments and Fibre Channel continues to be the best network protocol to attach these technologies.

While block storage is served more efficiently with Fibre Channel, we see increasing interest in dedicated IP-based Flash storage for unstructured data, creating an emerging use case for our IP Storage product line. With our extensive expertise in mission-critical storage networking, and an industry-leading portfolio of Ethernet fabric solutions and storage network management tools, this is a natural fit for Brocade.

We were pleased to announce an expanded OEM relationship with EMC for the industry’s first IP-based storage networking switch, the EMC Connectrix VDX-6740B. This solution leverages the Brocade VDX®switch and Brocade VCS fabric technology to provide the reliability, performance, and scalability that customers expect from their storage network.

© 2015 Brocade Communications Systems, Inc. Page 7 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

IP Networking revenue grew 17% year-over-year on an adjusted basis. Strength was broad based, with growth across service provider and federal markets. In particular, the Brocade VDX family grew 44% over the prior year, demonstrating our continued strength in data center deployments and execution of our strategy. Brocade offers one of the strongest product portfolios in the industry to support emerging New IP technologies and we continue to expand our capabilities through product innovation and strategic acquisitions.

Our recently launched security products for the Brocade MLXe router enable comprehensive in-flight data privacy for campus, data center, and wide area networks. These enhancements, leveraging wire-speed IPSec and MACsec encryption, allow customers to deploy pervasive data security across their network while offloading their appliances, improving performance, and increasing their overall IT security profile.

We also introduced the Brocade VDX 6940 switch and enhancements to Brocade VCS fabric technology. This expanded offering enables customers to easily scale their network to fit demand, while the addition of SDN and cloud orchestration capabilities allows customers to seamlessly integrate a Brocade VDX network infrastructure with the rest of their open data center ecosystem.

Earlier this month, we announced our intention to acquire the SteelApp division of Riverbed. SteelApp, an early innovator in the rapidly-growing virtual application delivery control (vADC) market, is currently the #3 vendor in the vADC market and is ranked by Gartner as a visionary in this space. This is highly strategic to our software-based networking portfolio, expands our leadership in NFV and New IP architectures, and drives new sales in the data center and service provider markets.

The value of our growing technology portfolio and success in achieving market recognition as an industry leader was underscored in Q1 15 when AT&T selected Brocade for participation in the Domain 2.0 supplier program. This highly selective program seeks the most innovative suppliers to help enable AT&T’s vision of an open, virtualized, customer-centric, cloud-based architecture. Only nine suppliers have been named to the program since its inception and we are very pleased to have been selected to contribute to this visionary initiative.

© 2015 Brocade Communications Systems, Inc. Page 8 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

We achieved solid revenue results in Q1 with broad-based strength across our portfolio of next-generation networking solutions. With a healthy financial position, we are prudently employing our resources to build an industry-leading portfolio of next-generation technologies that will accelerate growth and deliver shareholder value.

© 2015 Brocade Communications Systems, Inc. Page 9 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Dan Fairfax, CFO

© 2015 Brocade Communications Systems, Inc. Page 10 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Fiscal Q1 15 followed normal quarterly seasonal patterns, with strong sequential SAN revenue partially offset by lower sequential IP Networking revenue. Fiscal Q1 is typically our strongest SAN quarter as it aligns with the fiscal year-end of certain OEM partners and is usually their strongest storage quarter. IP Networking revenue is typically down sequentially due to lower U.S. Federal sales. The following commentary focuses on year-over-year comparisons.

Q1 15 revenue of $576M was up 2% Yr./Yr. driven by increased IP Networking revenue. SAN revenue was approximately flat Yr./Yr. as switch sales grew 8% offset by declines in Director and Server revenues of 2% and 24%, respectively, as customer buying patterns favored fixed configuration platforms in the quarter. IP Networking revenue was up 11% Yr./Yr. primarily due to stronger U.S. Federal sales and better sales execution in both service provider and enterprise markets.

Non-GAAP gross margin was 68.4% in Q1 15, up 70 basis points year-over-year due to higher revenues, lower manufacturing overhead costs, and a mix shift towards higher margin SAN products. Non-GAAP operating margin was 28.5% in Q1 15, up 60 basis points from Q1 14 primarily due to higher revenue and gross margin.

Q1 15 non-GAAP diluted EPS was $0.27, up from $0.24 in Q1 14 primarily due to higher revenue and gross margin.

Operating cash flow and adjusted free cash flow were below the forecasted ranges for the quarter due to an increase in DSOs of three days, as well as the impact of the early redemption fee associated with calling the 2020 secured notes prior to maturity.

Inventory turns were relatively flat at 19 times and the cash conversion cycle extended to 16 days, consistent with the increase in DSOs.

The Q1 15 effective non-GAAP tax rate was 23.1%, down 300 basis points year-over-year due to the benefit of the federal R&D tax credit catch-up for calendar 2014 that was approved by the U.S. Congress in Q1 15. Although the R&D tax credit was approved by Congress retroactively for 2014, it has not been approved for 2015.

© 2015 Brocade Communications Systems, Inc. Page 11 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

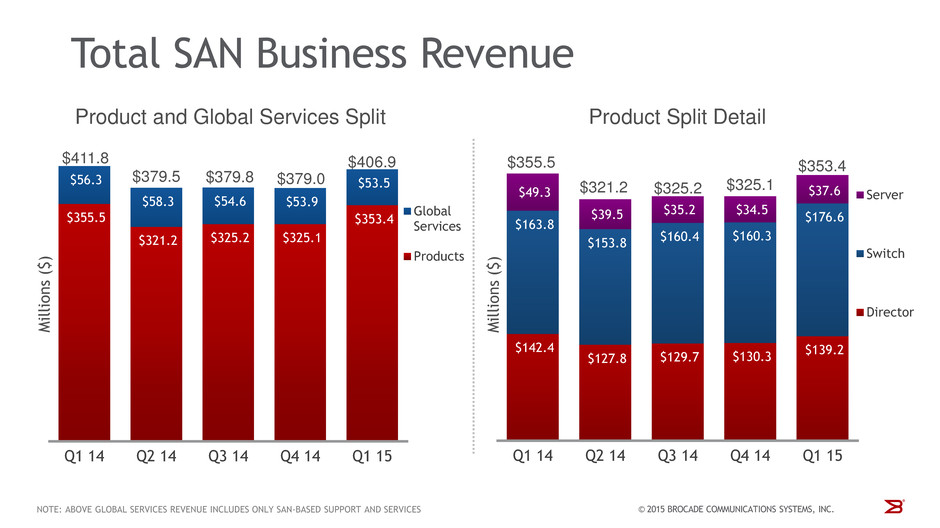

Revenue from our total SAN business, including hardware products and SAN-based support and services, in Q1 15 was $407M, down 1% from Q1 14 primarily due to a 5% decline in support and services revenue attributed to the timing of out-of-warranty repair services.

Our SAN product revenue was $353M in the quarter, essentially flat year-over-year. Switch sales were up 8% Yr./Yr., offset by Director and Server sales, which were down 2% and 24% respectively, as customer buying patterns favored fixed configuration platforms in the quarter. Switch revenue of $177M was a record for the company.

All product segments saw strong sequential growth with Directors up 7%, Switches up 10%, and Server products up 9%, consistent with normal seasonal demand.

From a total revenue perspective, including SAN and IP Networking, our channels to market remained relatively stable year-over-year with OEM revenue dropping slightly from 70% to 67% of total revenue, while revenue sold through channel/direct routes increased from 30% to 33%.

© 2015 Brocade Communications Systems, Inc. Page 12 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Revenue from our total IP Networking business, including hardware and IP-based support and services, was $169M, up 11% Yr./Yr.

Q1 15 IP Networking product revenue was $133M, up 11% year-over-year. The revenue improvement was broad-based across all geographies and all continuing product lines. Geographically, we saw double digit growth year-over-year in the Americas (up 12%), EMEA (up 20%), and Japan (up 20%), with mid-single digit growth in APAC (up 6%). From a product perspective, we experienced strong year-over-year growth in both switches (up 17%) and routers (up 14%) while only the repositioned Brocade ADX® and discontinued hardware (wireless and network adapter cards) were down year-over-year. Contributing to the strong performance in switches, Brocade VDX revenue was up 44% Yr./Yr. and we shipped our one millionth VDX port in the quarter.

IP-based Global Services revenue was $36.5M, up 11% year-over-year due to the timing of large support renewals.

The split of our IP Networking business based on customer use cases is an important measurement of the progress we are making to grow our data center business. Although it is difficult to identify all end-users and their specific network deployments due to our two-tier distribution channel, we are providing estimates of the split of our IP Networking business. Our data center customers represented approximately 53% of IP Networking revenue in Q1 15, compared to 59% in Q1 14 and 58% in Q4 14. Although the Q1 15 percentage of Data Center IP Networking was lower year-over-year, the absolute dollars were higher in Q1 15 compared to Q1 14. The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter-to-quarter due to the timing of large data center customer transactions, minor changes to classification from improved visibility of actual customer deployments, as well as the seasonality of the public sector, including Federal. Other use cases, such as enterprise campus and carrier networks (MAN/WAN) represent the balance of the business.

As an additional breakdown of our IP Networking revenue based on ship-to location, the Americas region (excluding U.S. Federal) was 53% of total IP Networking revenue, a decrease of 1% Yr./Yr. Federal was 10% of total IP Networking revenue, an increase of 2% Yr./Yr. International was 37% of total IP Networking revenue, essentially flat Yr./Yr. as a percentage of total IP Networking revenue.

© 2015 Brocade Communications Systems, Inc. Page 13 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Looking forward to Q2 15, we considered a number of factors, including the following, in setting our outlook:

• | Although we are unsure when the SteelApp transaction will close during the quarter, we have included $2M to $3M of SteelApp revenue and $3M to $4M of additional operating expense in the Q2 15 Outlook shown above. |

• | SteelApp revenue historically included certain license agreements which will not transfer to Brocade at the completion of the acquisition. As a result, the anticipated full-quarter baseline revenue is expected to be in the range of $5M to $7M for 2H FY15. At the same time, we expect incremental operating expenses associated with SteelApp to be approximately $7M per quarter for 2H FY15. |

• | For Q2 15, we expect SAN revenue to be down 8% to 11% Qtr./Qtr. and down 2% to up 1% Yr./Yr. |

• | We expect our Q2 15 IP Networking revenue to be up 3% to 11% Qtr./Qtr. and up 13% to 21% Yr./Yr. |

• | We expect our Global Services revenue to be down 2% Qtr./Qtr. and down 7% Yr./Yr. as Q2 of 2014 included a 14th week of amortized revenue. |

• | We expect Q2 15 non-GAAP gross margin to be between 66.2% to 67.2%, and non-GAAP operating margin to be between 21.0% to 23.0% primarily due to the seasonally lower revenue and increased operating expenses. Although we will be below our FY15-16 operating margin range in fiscal Q2, we will manage our operating expense base to be at the low-end of the target range for fiscal year 2015. |

• | At the end of Q1 15, OEM inventory was approximately 1.3 weeks of supply based on SAN business revenue. We expect inventory to be between one to two weeks in Q2 15. |

© 2015 Brocade Communications Systems, Inc. Page 14 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Prepared comments provided by Steve Coli, Investor Relations

That concludes Brocade’s prepared comments. At 2:30 p.m. Pacific Time on February 19, Brocade will host a webcast conference call at www.brcd.com.

Thank you for your interest in Brocade.

© 2015 Brocade Communications Systems, Inc. Page 15 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 16 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 17 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

Additional Financial Information:

Q1 14 | Q4 14 | Q1 15 | ||||

GAAP product gross margin | 67.7 | % | 68.3 | % | 69.2 | % |

Non-GAAP product gross margin | 69.4 | % | 68.9 | % | 69.7 | % |

GAAP services gross margin | 57.2 | % | 58.6 | % | 59.3 | % |

Non-GAAP services gross margin | 58.9 | % | 61.0 | % | 61.4 | % |

© 2015 Brocade Communications Systems, Inc. Page 18 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 19 of 20

Brocade Q1 FY 2015 Earnings 2/19/2015

|

© 2015 Brocade Communications Systems, Inc. Page 20 of 20

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CONDITIONS FOR SALE OF RIKSBANK CERTIFICATES

- SHARE CAPITAL REDUCTION

- European Firms Seek New Ways to Modernize Mainframes

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share