Form 8-K BOYD GAMING CORP For: Apr 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): April 21, 2016

____________________________________________________________________

Boyd Gaming Corporation

(Exact Name of Registrant as Specified in its Charter)

____________________________________________________________________

Nevada | 001-12882 | 88-0242733 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||

3883 Howard Hughes Parkway, Ninth Floor

Las Vegas, Nevada 89169

(Address of Principal Executive Offices, Including Zip Code)

(702) 792-7200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. | Entry into a Material Definitive Agreement. |

On April 21, 2016, Boyd Gaming Corporation (“Boyd”) announced it has entered into a definitive agreement to acquire ALST Casino Holdco, LLC (“ALST”), the holding company of Aliante Gaming, LLC (“Aliante”), the owner and operator of the Aliante Casino + Hotel + Spa, an upscale, resort-style casino and hotel situated in North Las Vegas and offering premium accommodations, gaming, dining, entertainment and retail.

Boyd will acquire ALST pursuant to an Agreement and Plan of Merger (the “Merger Agreement”), entered into on April 21, 2016, by and among, Boyd, Boyd TCII Acquisition, LLC, a wholly-owned subsidiary of Boyd (“Merger Sub”), and ALST. The Merger Agreement provides that, pursuant to the terms and subject to the conditions set forth therein, Merger Sub will merge (the “Merger”) with and into ALST, and ALST will be the surviving entity in the Merger, such that following the Merger, ALST and Aliante will be wholly-owned subsidiaries of Boyd.

Upon the terms and subject to the conditions of the Merger Agreement, which was unanimously approved by the board of directors of Boyd, unanimously approved by the board of managers of ALST, and approved by the holders of not less than 66-2/3% of the outstanding units of ALST, Boyd will acquire ALST for $400 million in cash, net of indebtedness and transaction expenses (for total estimated net cash consideration of $380 million). Boyd will fund the transaction with cash on hand.

The completion of the Merger is subject to customary conditions and the receipt of all required regulatory approvals, including, among others, approval by the Nevada Gaming Commission and the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. Subject to the satisfaction or waiver of conditions in the Merger Agreement, Boyd currently expects the transaction to close during the third quarter of 2016.

The Merger Agreement contains customary representations, warranties and covenants. ALST has also agreed, during the period between the execution of the Merger Agreement and the consummation of the Merger, (i) to operate its business in the ordinary course and substantially in accordance with past practice and (ii) not to solicit proposals regarding alternate transactions and not to engage in discussions concerning, furnish non-public information in connection with or enter into any agreement with any third party concerning such alternative transactions.

The Merger Agreement contains certain termination rights for both Boyd and ALST and further provides that, in connection with the termination of the Merger Agreement under specified circumstances, Boyd may be required to pay ALST a termination fee of $30 million.

Item 7.01. Regulation FD Disclosure.

On April 21, 2016, Boyd issued a press release announcing the transaction and will hold a conference call and simultaneous presentation to investors at 5:00 p.m. EDT to discuss the transaction. The press release is attached hereto as Exhibit 99.1 and the investor presentation is attached hereto as Exhibit 99.2, and each are incorporated herein in their entirety by reference.

Limitation on Incorporation by Reference. The information furnished in this Item 7.01, including the press release and the investor presentation attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Number | Description | |

99.1 | Press Release. | |

99.2 | Investor Presentation. | |

# # # #

Important Information Regarding Forward-Looking Statements

This Current Report on Form 8-K contains, or may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and include (without limitation) statements regarding the transactions contemplated by the Merger Agreement, Boyd’s expectations regarding the timing of closing, the potential benefits to be achieved from the acquisition of the Aliante business, including the potential long-term growth of Aliante and benefits from the development of the area in which Aliante is located, expectations regarding timing for Aliante to be cash flow positive and accretive to Boyd’s earnings, the expected cost synergies at the property, and any statements or assumptions underlying any of the foregoing. These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the possibility that the transactions contemplated by the definitive agreement will not close on the expected terms (or at all), or that Boyd is unable to successfully integrate the acquired assets or realize the expected synergies or that the properties will be cash flow positive or accretive to Boyd’s earnings as anticipated; litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the closing; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd’s Annual Report on Form 10-K for the year ended December 31, 2015, and in Boyd’s other current and periodic reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd as of the date hereof, and Boyd assumes no obligation to update any forward-looking statement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: | April 21, 2016 | Boyd Gaming Corporation |

By: | /s/ Josh Hirsberg | |

Josh Hirsberg | ||

Executive Vice President, Chief Financial Officer and Treasurer | ||

EXHIBIT INDEX

Exhibit Number | Description | |

99.1 | Press Release. | |

99.2 | Investor Presentation. | |

Exhibit 99.1

Financial Contact:

Josh Hirsberg

(702) 792-7234

Media Contact:

David Strow

(702) 792-7386

BOYD GAMING TO ACQUIRE ALIANTE CASINO, HOTEL AND SPA,

EXPANDING PRESENCE IN HIGH-GROWTH LAS VEGAS LOCALS MARKET

Company Entering Growing North Las Vegas Market with Premier Asset

Cash Flow Positive, Accretive to Earnings Per Share in First Full Year

Conference Call at 5 p.m. ET Today; (888) 317-6003, Passcode 8970354

LAS VEGAS - APRIL 21, 2016 - Boyd Gaming Corporation (“Boyd Gaming”) (NYSE: BYD) today announced that it has entered into a definitive agreement to acquire ALST Casino Holdco, LLC, the holding company of Aliante Casino, Hotel and Spa (“Aliante”) for total net cash consideration of $380 million.

Opened in 2008 at a cost of more than $660 million, Aliante is an upscale, resort-style casino and hotel offering premium accommodations, gaming, dining, entertainment and retail. Strategically located on the 215 Beltway within the master-planned community of Aliante, the property is well-positioned to benefit from future planned development throughout the city of North Las Vegas.

“Aliante is an asset without rival in the North Las Vegas market, strategically positioned to benefit from substantial future growth across the northern part of the Las Vegas Valley,” said Keith Smith, President and Chief Executive Officer of Boyd Gaming. “With significant residential and industrial developments moving forward in the area, Aliante’s long-term potential is compelling. In addition, there are significant synergy opportunities at the property, allowing us to immediately improve its operating and financial performance. This acquisition will further strengthen and diversify our robust Las Vegas portfolio, the fastest-growing segment of our business.”

Aliante Chief Executive Officer Soohyung Kim said, “It has been an honor to be part of the rebirth of Aliante Casino from a difficult restructuring to this excellent outcome for all stakeholders. We recognize that it would not have been possible but for the dedication of each and every team member, led by Terry Downey. These efforts have resulted in Aliante becoming the leader in our market. We are confident that Boyd Gaming will take Aliante to the next level and help it fulfill its ultimate potential. The future of North Las Vegas is brighter than ever, and we expect that Aliante will continue to be mainstay of our community.”

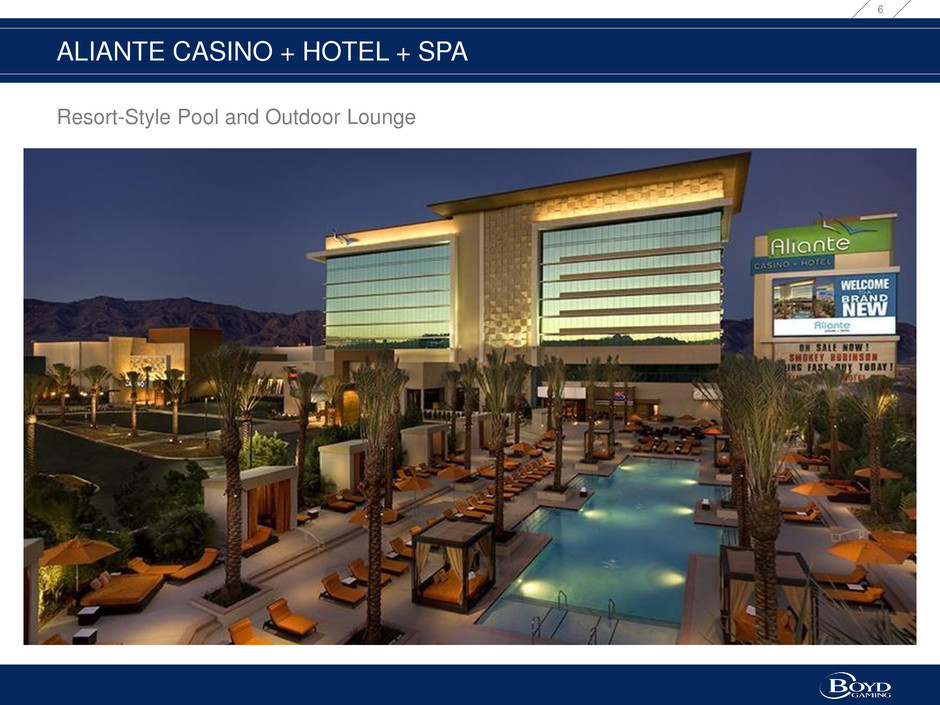

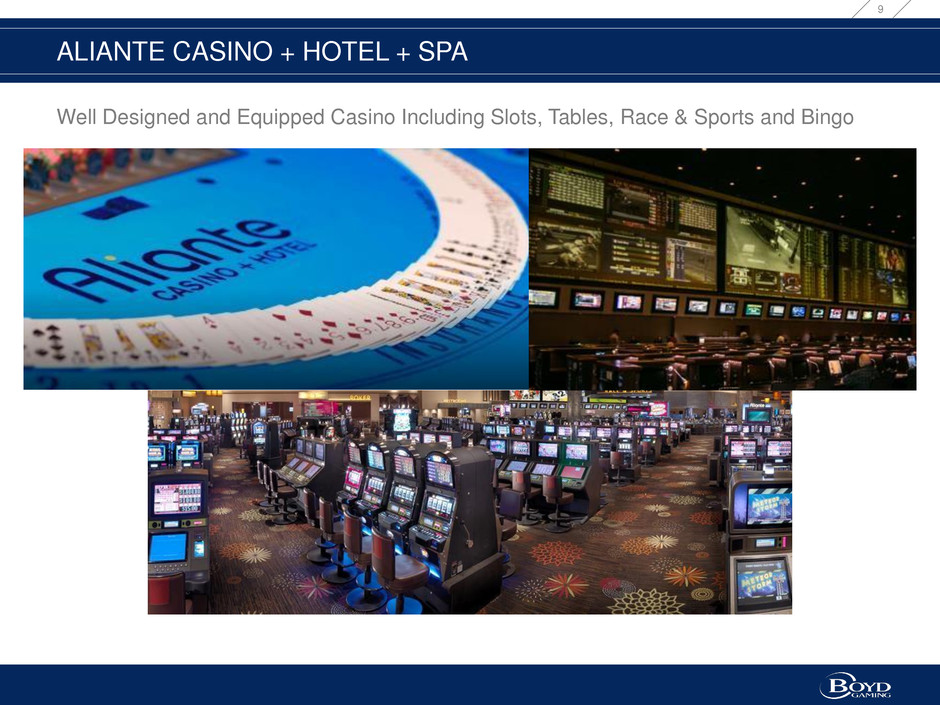

Aliante is the premiere gaming asset in North Las Vegas, featuring an 82,000-square-foot gaming floor and more than 200 luxury hotel rooms and suites. The property’s upscale amenities include five signature restaurants, an ultra-modern, 170-seat race and sports book, a 16-screen movie theater complex, 14,000 square feet of event and banquet space, a luxury spa and an expansive, resort-style pool and outdoor lounge area. Aliante is situated on approximately 40 acres within the 1,905-acre Aliante master-planned community, and is adjacent to an 18-hole championship golf course.

Aliante will be Boyd Gaming’s first property in North Las Vegas, and its 10th property in southern Nevada, one of the fastest-growing gaming markets in the United States. The Company’s current Nevada portfolio includes The Orleans and Gold Coast, both located just west of the Las Vegas Strip; Suncoast, located just south of the master-planned community of Summerlin in northwest Las Vegas; Sam’s Town, on the east side of Las Vegas on Boulder Highway; Eldorado and Jokers Wild, both located in Henderson; and California Hotel and Casino, Fremont Hotel and Casino, and Main Street Station, all in downtown Las Vegas.

The Company expects the transaction to be cash flow positive and accretive to earnings per share during its first full year of ownership.

The transaction is expected to close during the third quarter, subject to the satisfaction of customary closing conditions and the receipt of all required regulatory approvals, including approval by the Nevada Gaming Commission and the Federal Trade Commission. The transaction will be funded with cash on hand.

Morrison & Foerster LLP served as legal advisor to Boyd Gaming for the transaction. Akin Gump Strauss Hauer & Feld LLP served as legal advisor and Houlihan Lokey served as financial advisor to Aliante.

Boyd Gaming will host a conference call to discuss the transaction today, April 21, at 5:00 p.m. Eastern. The conference call number is (888) 317-6003, passcode 8970354. Please call up to 15 minutes in advance to ensure you are connected prior to the start of the call.

The conference call will also be available at www.boydgaming.com, or at: https://www.webcaster4.com/Webcast/Page/964/14826

Following the call’s completion, a replay will be available by dialing (877) 344-7529 today, April 21, beginning at 7:00 p.m. Eastern and continuing through Friday, April 29, at 11:59 p.m. Eastern. The conference number for the replay will be 10085163. The replay will also be available at www.boydgaming.com.

The Company will also provide a presentation detailing the transaction at:

http://boydgaming.investorroom.com.

About Boyd Gaming

Headquartered in Las Vegas, Boyd Gaming Corporation (NYSE: BYD) is a leading diversified owner and operator of 22 gaming entertainment properties located in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi and New Jersey. Boyd Gaming press releases are available at www.prnewswire.com. Additional news and information on Boyd Gaming can be found at www.boydgaming.com.

About Aliante

ALST Casino Holdco, LLC (“ALST”) was formed in 2011 to acquire the equity interests of Aliante Gaming, LLC (“AG LLC”) under a joint plan of reorganization under Chapter 11 of the United States Bankruptcy Code. AG LLC is the owner and operator of the Aliante Casino + Hotel + Spa (the “Hotel”), located within the Aliante master-planned community in the City of North Las Vegas. The Hotel features a full-service Scottsdale-modern, desert-inspired casino and resort with more than 200luxury hotel rooms and suites and approximately 82,000 square feet of gaming space, including slot machines, gaming tables, a bingo room and a 170 seat race and sports book. The Hotel’s non-gaming amenities include a 16-screen movie theater complex, a 650-seat showroom, an entertainment lounge, a spa and a resort style pool and six full-service restaurants and 14,000 square feet of event space. Aliante is situated on approximately 40 acres within the 1,905-acre Aliante master-planned community, and is adjacent to an 18-hole championship golf course. Additional news and information on Aliante can be found at www.aliantegaming.com.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and include (without limitation) statements regarding the transactions contemplated by the definitive agreement, Boyd Gaming’s expectations regarding the timing of closing, the potential benefits to be achieved from the acquisition of the Aliante business, including the potential long-term growth of Aliante and benefits from the development of the area in which Aliante is located, expectations regarding timing for Aliante to be cash flow positive and accretive to Boyd Gaming’s earnings, the expected cost synergies at the property, and any statements or assumptions underlying any of the foregoing. These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the possibility that the transactions contemplated by the definitive agreement will not close on the expected terms (or at all), or that Boyd Gaming is unable to successfully integrate the acquired assets or realize the expected synergies or that the properties will be cash flow positive or accretive to Boyd Gaming’s earnings as anticipated; litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the closing; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd Gaming’s Annual Report on Form 10-K for the year ended December 31, 2015, and in Boyd Gaming’s other current and periodic reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd Gaming as of the date hereof, and Boyd Gaming assumes no obligation to update any forward-looking statement.

###

BOYD GAMING’S ACQUISITION OF ALIANTE CASINO + HOTEL + SPA APRIL 2016

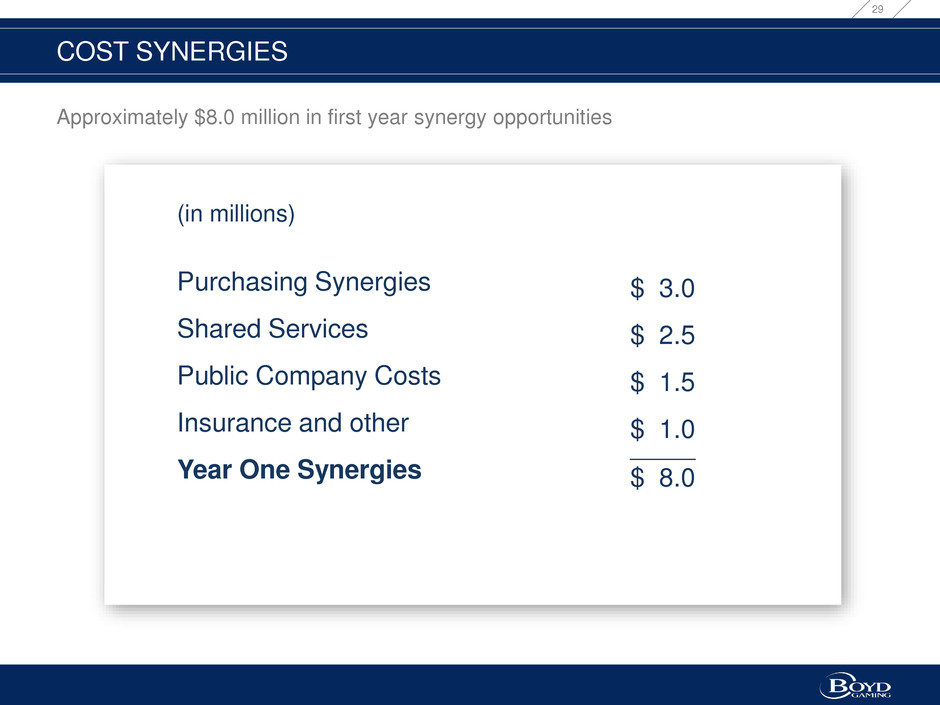

TRANSACTION OVERVIEW Aliante Casino + Hotel + Spa • Built in 2008 at an original cost of over $660 million • Initial entry into the North Las Vegas market • Positioned to benefit from significant future development in northern part of Las Vegas valley Total net purchase price: $380 million • Approximately $8.0 million of year one synergies plus operational improvements • Combination of synergies, operational improvements and market growth expected to generate EBITDA of more than $40.0 million in three to five years • Generates free cash flow and is EPS accretive in first full year Cash on Hand Third Quarter 2016; subject to customary closing conditions and required regulatory approvals 2 ACQUISITION TRANSACTION VALUE FINANCING EXPECTED CLOSING

STRATEGIC RATIONALE • High quality asset • Originally built at a cost of over $660 million • Full suite of premium amenities that align with our non-gaming investment strategy • Las Vegas economy strengthening and positioned for continued growth • North Las Vegas projected to have significant growth in jobs and housing • Aliante ideally located to capture growth in the northern part of the Las Vegas valley • Access to new customers in a market where we have limited exposure today • Benefits from participation in brand and segment wide promotions • B Connected program to drive increased loyalty of existing customers • Approximately $8.0 million of year one cost synergies plus operational improvement opportunities • Significant long-term revenue and EBITDA growth opportunities 3 PREMIUM ASSET HIGH GROWTH MARKET REVENUE ENHANCEMENTS COST SYNERGIES & FUTURE GROWTH

ALIANTE CASINO + HOTEL + SPA Built in 2008 at an original cost of over $660 million 4

ALIANTE CASINO + HOTEL + SPA AAA Four Diamond Hotel 5

ALIANTE CASINO + HOTEL + SPA Resort-Style Pool and Outdoor Lounge 6

ALIANTE CASINO + HOTEL + SPA Modern and Attractive Food & Beverage Offerings Consistent with Our Non-Gaming Strategy 7

ALIANTE CASINO + HOTEL + SPA High Quality Entertainment and Meeting Venues 8

ALIANTE CASINO + HOTEL + SPA Well Designed and Equipped Casino Including Slots, Tables, Race & Sports and Bingo 9

ALIANTE CASINO + HOTEL + SPA • 82,000-sq. ft. gaming floor that offers 1,837 slots, 30 table games and a 200-seat bingo room • 202-room hotel (including suites) • Covered and surface parking lot offering 4,800 parking spaces • Diversified restaurant offerings, including five signature restaurants • Ultra-modern, 170-seat race and sports book with sports bar and viewing patio • 16-screen movie theater complex • 650-seat showroom • 14,000 sq. ft. of event and banquet space, including four ballrooms and six meeting/conference rooms • Luxury spa and massage area • Expansive, resort-style pool and outdoor lounge area with cabanas • Modern fitness center 10

1.8 1.9 2.0 2.1 2.2 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Mi lli on s THE LAS VEGAS LOCALS MARKET 11 Population growth ranks among the top in the country 3rd of the Top 30 US Metros Source: Clark County Comprehensive Planning; U.S. Census M ill io n s

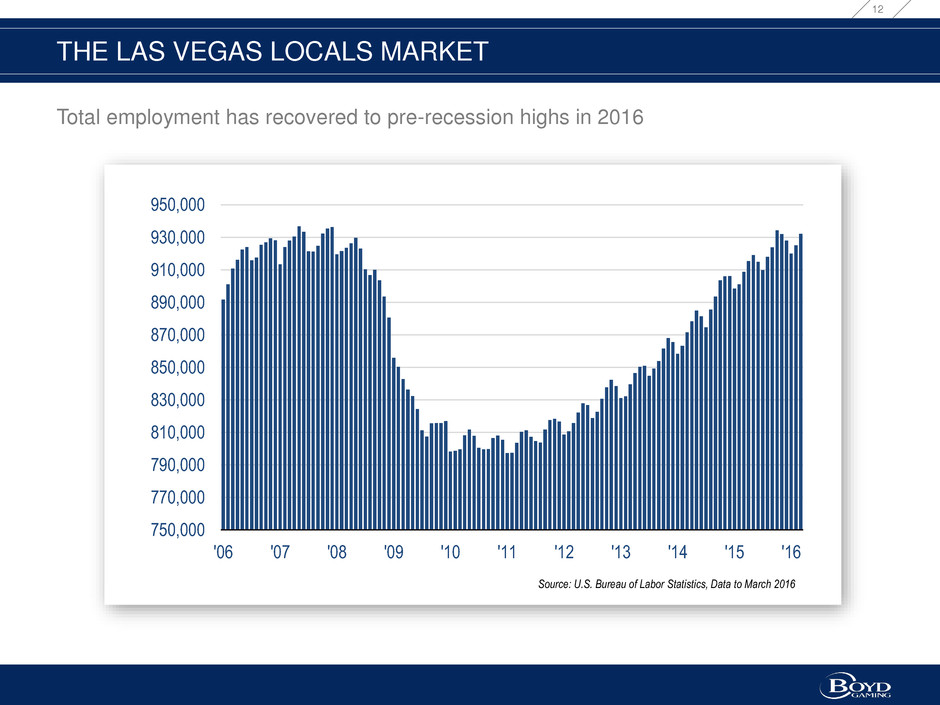

750,000 770,000 790,000 810,000 830,000 850,000 870,000 890,000 910,000 930,000 950,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 THE LAS VEGAS LOCALS MARKET 12 Total employment has recovered to pre-recession highs in 2016 Source: U.S. Bureau of Labor Statistics, Data to March 2016

0% 2% 4% 6% 8% 10% 12% 14% 16% '10 '11 '12 '13 '14 '15 '16 THE LAS VEGAS LOCALS MARKET 13 Unemployment fell below 6 percent in 2016 Source: U.S. Bureau of Labor Statistics, Data to February 2016

THE LAS VEGAS LOCALS MARKET 14 Tourism continues to expand 33 34 35 36 37 38 39 40 41 42 43 '06'07'08'09'10'11'12'13'14'15 Mi lli on s Visitor volume reaches new heights Convention travel is growing Hotel occupancy rates are rising 74% 76% 78% 80% 82% 84% 86% 88% 90% 92% '06'07'08'09'10'11'12'13'14'15 0 1 2 3 4 5 6 7 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Mi lli on s

THE LAS VEGAS LOCALS MARKET The Site Selectors Guild awarded the Governor’s Office of Economic Development with The Excellence in Economic Development Award for three key wins. Beyond tourism: Nevada is recognized for its economic development wins 15

BROADENING OUR LAS VEGAS FOOTPRINT TO THE HIGH GROWTH MARKET OF NORTH LAS VEGAS 16

190,000 195,000 200,000 205,000 210,000 215,000 220,000 225,000 230,000 235,000 240,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Population NORTH LAS VEGAS MARKET 17 The North Las Vegas market is positioned to yield significant population growth Source: Clark County Comprehensive Planning Population

80,000 85,000 90,000 95,000 100,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Employment NORTH LAS VEGAS MARKET 18 The North Las Vegas market is positioned to yield the highest level of growth in the Las Vegas Valley Source: United States Bureau of Labor Statistics Employment

60,000 62,000 64,000 66,000 68,000 70,000 72,000 74,000 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 Occupied Housing Units NORTH LAS VEGAS MARKET 19 As a result of growth in population, jobs and industrial development, housing in this part of Las Vegas is projected to be robust Source: Clark County Comprehensive Planning Occupied Housing Units

NORTH LAS VEGAS MARKET 20 Las Vegas Locals gaming revenues continue to improve led by strong performance in North Las Vegas Source: Nevada Gaming Commission • On an LTM basis as of February 2016, the North Las Vegas Market outpaced the remainder of the Las Vegas Locals Market North Las Vegas Gaming Revenue Total Boulder Strip & Balance of County Gaming Revenue Growth % 5.35% 3.91%

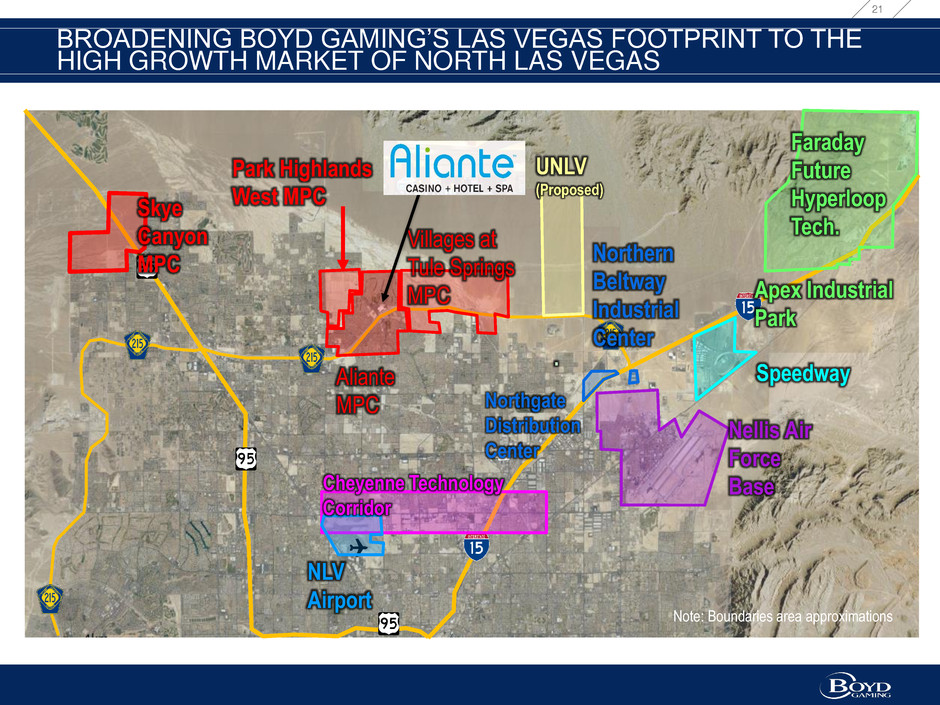

BROADENING BOYD GAMING’S LAS VEGAS FOOTPRINT TO THE HIGH GROWTH MARKET OF NORTH LAS VEGAS 21 North Las Vegas Market Housing Developments with a Projected 20,000 Homes are Currently Planned in North Las Vegas This is a start to a more comprehensive development map centered around Aliante SpeedwayAliante MPC Villages at Tule Springs MPC Park Highlands West MPCSkye Canyon MPC Note: Boundaries area approximations Apex Industrial Park Faraday Future Hyperloop Tech. UNLV (Proposed) NLV Airport Cheyenne Technology Corridor . Nellis Air Force Base Northgate Distribution Center Northern Beltway Industrial Center

NORTH LAS VEGAS MARKET 22 Perfectly Positioned within the Aliante Master Planned Community with ease of access from the I-215

NORTH LAS VEGAS MARKET GROWTH PROJECTS Apex Industrial Park • 2,000 acres of available industrial lots • Site of choice for Faraday Future, Hyperloop Technologies and parcels are being considered by other existing and start-up companies. • Conveniently positioned on the I-15 with ease of access to the US 93 and Union Pacific Railroad • Full build out expected to yield up to 50,000 direct jobs and contribute to the creation of over 120,000 total 23

NORTH LAS VEGAS MARKET GROWTH PROJECTS Faraday Future • Broke ground on April 13, 2016 • Purchased 3 parcels of land (14 acres) • Proposed full site to be 900 acres with an approximately $1 billion total investment • 3 Million Square Feet of Industrial Space • Up to 3,000 construction jobs • Estimated 4,500 direct permanent jobs and 9,000 indirect jobs 24

NORTH LAS VEGAS MARKET GROWTH PROJECTS Hyperloop Technologies • 20,000 square foot facility under construction • Two-Mile test track under construction • Initially investing over $121.6 million in facilities and equipment 25

NORTH LAS VEGAS MARKET GROWTH PROJECTS Other North Las Vegas Industrial Projects 26 Northgate Distribution Center Buildings 1&2 806,000 SF Lone Mountain Corporate Center 694,500 SF Prologis North 15 Freeway Distribution Center 410,600 SF Sunpoint Business Center 311,500 SF Prologis Cheyenne Distribution Center #3 163,800 SF

NORTH LAS VEGAS MARKET GROWTH PROJECTS The Villages at Tule Springs • Approximately 2,000 Acres • Over 8,000 homes • An additional 600 developable acres in the adjoining Park Highlands West proposed development 27

NORTH LAS VEGAS MARKET GROWTH PROJECTS Skye Canyon • Approximately 1,700 Acres • Over 9,000 homes 28

COST SYNERGIES 29 Approximately $8.0 million in first year synergy opportunities (in millions) Purchasing Synergies Shared Services Public Company Costs Insurance and other Year One Synergies $ 3.0 $ 2.5 $ 1.5 $ 1.0 _____ $ 8.0

(in millions) Net Revenue EBITDA Margin 2015 Actual 84.2$ 17.1$ 20.3% 2016 Pro Forma 92.4$ 30.0$ 32.5% IMPROVING PERFORMANCE 30 Multiyear revenue and EBITDA growth trends continue to accelerate Source: Company Filings, Management Projections Please refer to the Form 10-K SEC filing of ALST Casino Holdco, LLC for the year ended December 31, 2015 for reconciliations of non-GAAP measures to GAAP. Pro Forma estimates assume full year ownership and full year impact of synergies as if the acquisition closed on January 1, 2016.

STRATEGIC RATIONALE • High quality asset • Originally built at a cost of over $660 million • Full suite of premium amenities that align with our non-gaming investment strategy • Las Vegas economy strengthening and positioned for continued growth • North Las Vegas projected to have significant growth in jobs and housing • Aliante ideally located to capture growth in the northern part of the Las Vegas valley • Access to new customers in a market where we have limited exposure today • Benefits from participation in brand and segment wide promotions • B Connected program to drive increased loyalty of existing customers • Approximately $8.0 million of year one cost synergies plus operational improvement opportunities • Significant long-term revenue and EBITDA growth opportunities 31 PREMIUM ASSET HIGH GROWTH MARKET REVENUE ENHANCEMENTS COST SYNERGIES & FUTURE GROWTH

THANK YOU

Important information regarding forward-looking statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements may contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and may include (without limitation) statements regarding the potential benefits to be achieved from the acquisition of the Aliante business, the potential long-term growth of Aliante and benefits from the development of the area in which Aliante is located, anticipated development projects in North Las Vegas, opportunities to increase revenue through the introduction of our B Connected loyalty program, as well as other revenue enhancements, anticipated synergies, free cash flow, that the transaction will be accretive to earnings, the timing for such benefits, timing for the closing of the transaction, the 2016 Forecast, 2016 Synergies and 2016 Pro Forma information, and any statements or assumptions underlying any of the foregoing. In addition, forward-looking statements include statements regarding improved revenue and financial performance and the discussion and charts on the slides titled “The Las Vegas Locals Market,” “North Las Vegas Market,” “North Las Vegas Market Growth Potential,” “Revenue Enhancement Opportunities”, “Cost Synergies”, “Improving Performance”, and “Strategic Rationale.” These forward-looking statements are based upon the current beliefs and expectations of management and involve certain risks and uncertainties, including (without limitation) the effects of intense competition that exists in the gaming industry, the effect of legislative changes, the effects of litigation, antitrust matters or the satisfaction or waiver of any of the closing conditions that could delay or prevent the acquisition of Aliante; and changes to the financial conditions of the parties, or the credit markets, or the economic conditions in the areas in which they operate. Additional factors are discussed in “Risk Factors” in Boyd Gaming’s Annual Report on Form 10-K for the year ended December 31, 2015, and in Boyd Gaming’s other current and periodic reports filed from time to time with the Securities and Exchange Commission. All forward-looking statements in this press release are made as of the date hereof, based on information available to Boyd Gaming as of the date hereof, and Boyd Gaming assumes no obligation to update any forward-looking statement. Non-GAAP Financial Measures Regulation G, "Conditions for Use of Non-GAAP Financial Measures," prescribes the conditions for use of non-GAAP financial information in public disclosures. We do not provide a reconciliation of forward-looking non-GAAP financial measures due to our inability to project special charges and certain expenses. FORWARD LOOKING STATEMENTS 33

Important disclosures regarding information contained within this document We obtained the industry, market and competitive position data throughout this presentation from (i) our own internal estimates and research of third party company websites and other sources, (ii) industry and general publications and research or (iii) studies and surveys conducted by third parties. Such sources generally do not guarantee the accuracy or completeness of included information. While we believe that the information included in this presentation from such publications, research, studies, surveys and websites is reliable, we have not independently verified data from these third-party sources. While we believe our internal estimates and research are reliable, neither such estimates and research nor such definitions have been verified by any independent source. This presentation also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this presentation may appear without the ® or TM symbols, but we do not intend our use or display of other companies’ trade names, trademarks or service marks with or without such symbols to imply relationships with, or endorsement or sponsorship of us by, these other companies. Disclosures 34

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Amerant Reports First Quarter 2024 Results

- Ensurge Micropower ASA - Grant of Incentive Subscription Rights

- Nexa Resources Publishes Its 2023 Sustainability Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share