Form 8-K BOB EVANS FARMS INC For: Sep 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 10, 2015 (September 10, 2015)

Bob Evans Farms, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 0-1667 | 31-4421866 | ||

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

| 8111 Smith’s Mill Road, New Albany, Ohio | 43054 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (614) 491-2225

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2b) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c) |

Item 8.01 Other Events.

On September 10, 2015, Bob Evans Farms, Inc. (the “Company”) issued an investor presentation titled “Investor Presentation, CL King Best Ideas Conference 2015, New York—September 10, 2015” (“Investor Presentation”). The Company’s Investor Presentation is available on its “Investors Relations” website under “Events & Presentations” at http://investors.bobevans.com/events.cfm and is also furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company’s reports on Forms 10-K, 10-Q and 8-K filed with the U.S. Securities and Exchange Commission (“SEC”), and other publicly available information, should also be consulted for other important information about the Company.

The information included in the Investor Presentation includes financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company’s management uses these non-GAAP measures in its analysis of the Company’s performance. The Company believes that the presentation of certain non-GAAP measures provides useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses as well as its segments. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The reconciliation of the non-GAAP information to GAAP is included in the Investor Presentation furnished as Exhibit 99.1.

Some of the matters discussed in this Current Report on Form 8-K, including Exhibit 99.1, constitute forward-looking statements within the meaning of the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements other than those made solely with respect to historical fact and are based on the intent, belief or current expectations of the Company and/or its management. The Company’s business and operations are subject to a variety of risks and uncertainties that might cause actual results to differ materially from those projected by any forward-looking statements. Factors that could cause such differences include, but are not limited to, the risk factors and other materials set forth in the Company’s filings with the SEC.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit Number |

Description | |

| 99.1 | Bob Evans Farms, Inc. Investor Presentation, CL King Best Ideas Conference 2015, New York—September 10, 2015 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: September 10, 2015

| BOB EVANS FARMS, INC. | ||

| By: | /s/ Kevin C. O’Neil | |

| Kevin C. O’Neil, Vice President, Assoc. General Counsel and Asst. Secretary | ||

Exhibit 99.1

|

|

Investor Presentation

CL King Best Ideas Conference 2015

New York

September 10, 2015

Mark Hood, Chief Financial Officer

Scott Taggart, VP, Investor Relations

| 1 |

|

|

|

Safe Harbor Statement

Certain statements in this presentation that are not historical facts are forward-looking statements. Forward-looking statements involve various important assumptions, risks and uncertainties. Actual results may differ materially from those predicted by the forward-looking statements because of various factors and possible events, including, without limitation:

Negative publicity or litigation regarding allegations of food-related illness,

Failure to achieve and maintain positive same-store sales,

Changing business conditions, including energy costs,

Overall macroeconomic conditions that may affect consumer spending, either nationwide or in one or more of the Company’s major markets

Competition in the restaurant and food products industries,

Ability to control restaurant operating costs, which are impacted by market changes in the cost or availability of labor and food, minimum wage and other employment laws, health care costs, fuel and utility costs,

Changes in the cost or availability of acceptable new restaurant sites,

Adverse weather conditions in locations where we operate our restaurants,

Consumer acceptance of changes in menu offerings, price, atmosphere and/or service procedures,

Consumer acceptance of our restaurant concepts in new geographic areas, and

Changes in hog and other commodity costs.

We also bear the risk of incorrectly analyzing these risks or developing strategies to address them that prove to be unsuccessful.

Certain risks, uncertainties and assumptions are discussed under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended April 24, 2015. We note these factors for investors as contemplated by the Private Securities Litigation Reform Act of 1995. It is impossible to predict or identify all such risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks and uncertainties. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the statement is made to reflect unanticipated events. Any further disclosures in our filings with the Securities and Exchange Commission should also be consulted. All subsequent written and oral forward-looking statements attributable to us or any person acting on behalf of the company are qualified by the cautionary statements in this section.

| 2 |

|

|

|

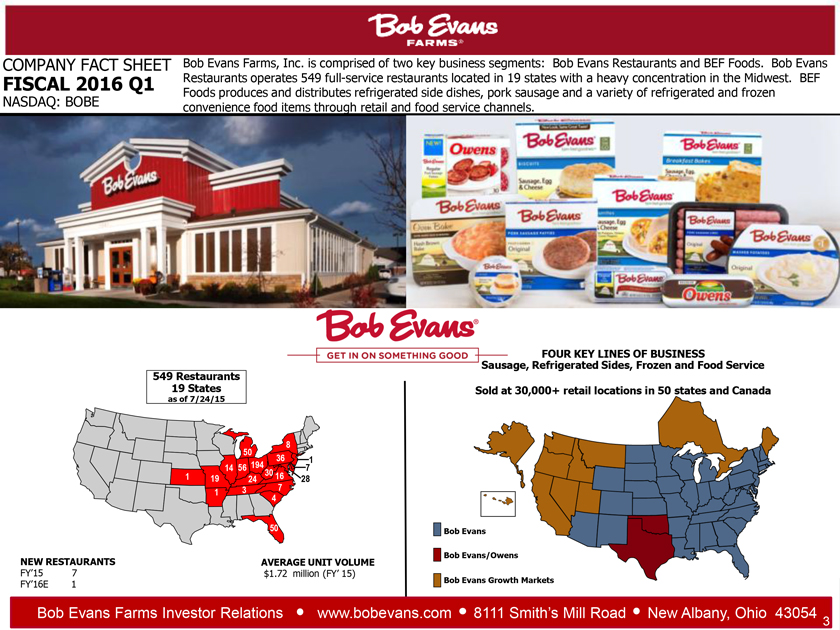

COMPANY FACT SHEET FISCAL 2016 Q1 NASDAQ: BOBE

Bob Evans Farms, Inc. is comprised of two key business segments: Bob Evans Restaurants and BEF Foods. Bob Evans Restaurants operates 549 full-service restaurants located in 19 states with a heavy concentration in the Midwest. BEF Foods produces and distributes refrigerated side dishes, pork sausage and a variety of refrigerated and frozen convenience food items through retail and food service channels.

FOUR KEY LINES OF BUSINESS Sausage, Refrigerated Sides, Frozen and Food Service

Sold at 30,000+ retail locations in 50 states and Canada

549 Restaurants 19 States

as of 7/24/15

NEW RESTAURANTS

FY’15 7

FY’16E 1

AVERAGE UNIT VOLUME

$1.72 million (FY’ 15)

Bob Evans

Bob Evans/Owens

Bob Evans Growth Markets

Bob Evans Farms Investor Relations www.bobevans.com 8111 Smith’s Mill Road New Albany, Ohio 43054

| 3 |

|

|

|

VISION

BOB EVANS RESTAURANTS

BEF FOODS, INC.

| 4 |

|

|

|

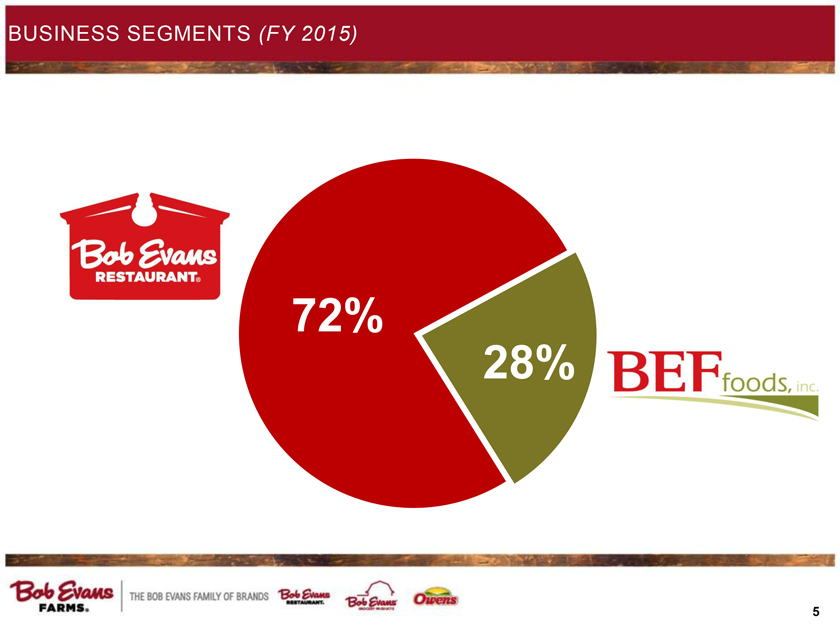

Business Segments (FY 2015)

72%

28%

| 5 |

|

|

|

BOB EVANS’ TURNAROUND PLAN: 4 PRIORITIES

1. Improve the brand experience for our restaurant guests and grocery customers

2. Profitably increase sales in our restaurants, and increase points of distribution of our consumer food products

3. Reduce costs, particularly at the corporate level

4. Allocate capital efficiently

| 6 |

|

|

|

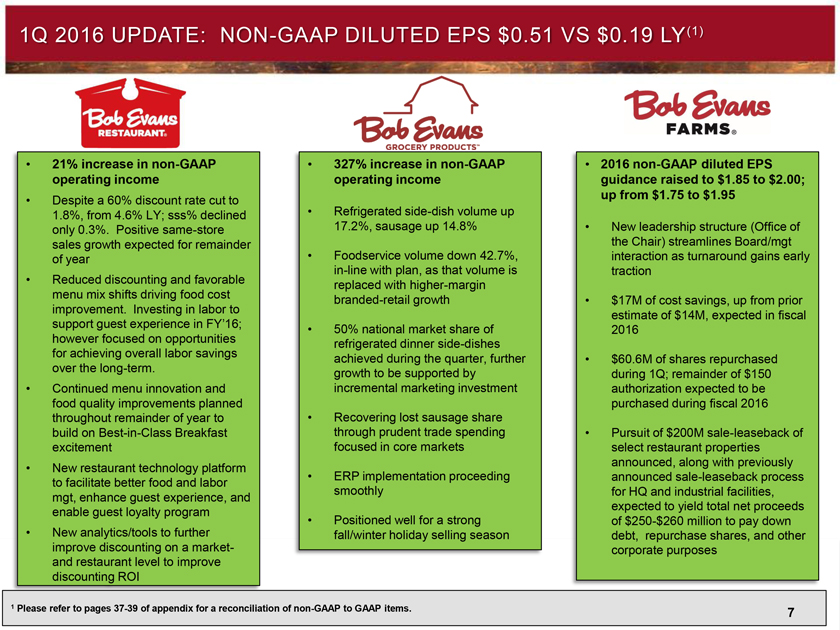

1Q 2016 UPDATE: NON-GAAP DILUTED EPS $0.51 VS $0.19 LY(1)

21% increase in non-GAAP operating income

Despite a 60% discount rate cut to 1.8%, from 4.6% LY; sss% declined only 0.3%. Positive same-store sales growth expected for remainder of year

Reduced discounting and favorable menu mix shifts driving food cost improvement. Investing in labor to support guest experience in FY’16; however focused on opportunities for achieving overall labor savings over the long-term.

Continued menu innovation and food quality improvements planned throughout remainder of year to build on Best-in-Class Breakfast excitement

New restaurant technology platform to facilitate better food and labor mgt, enhance guest experience, and enable guest loyalty program

New analytics/tools to further improve discounting on a market- and restaurant level to improve discounting ROI

327% increase in non-GAAP operating income Refrigerated side-dish volume up 17.2%, sausage up 14.8% Foodservice volume down 42.7%, in-line with plan, as that volume is replaced with higher-margin branded-retail growth 50% national market share of refrigerated dinner side-dishes achieved during the quarter, further growth to be supported by incremental marketing investment Recovering lost sausage share through prudent trade spending focused in core markets ERP implementation proceeding smoothly Positioned well for a strong fall/winter holiday selling season

2016 non-GAAP diluted EPS guidance raised to $1.85 to $2.00; up from $1.75 to $1.95 New leadership structure (Office of the Chair) streamlines Board/mgt interaction as turnaround gains early traction $17M of cost savings, up from prior estimate of $14M, expected in fiscal 2016 $60.6M of shares repurchased during 1Q; remainder of $150 authorization expected to be purchased during fiscal 2016 Pursuit of $200M sale-leaseback of select restaurant properties announced, along with previously announced sale-leaseback process for HQ and industrial facilities, expected to yield total net proceeds of $250-$260 million to pay down debt, repurchase shares, and other corporate purposes

| 1 |

|

Please refer to pages 37-39 of appendix for a reconciliation of non-GAAP to GAAP items. |

| 7 |

|

|

|

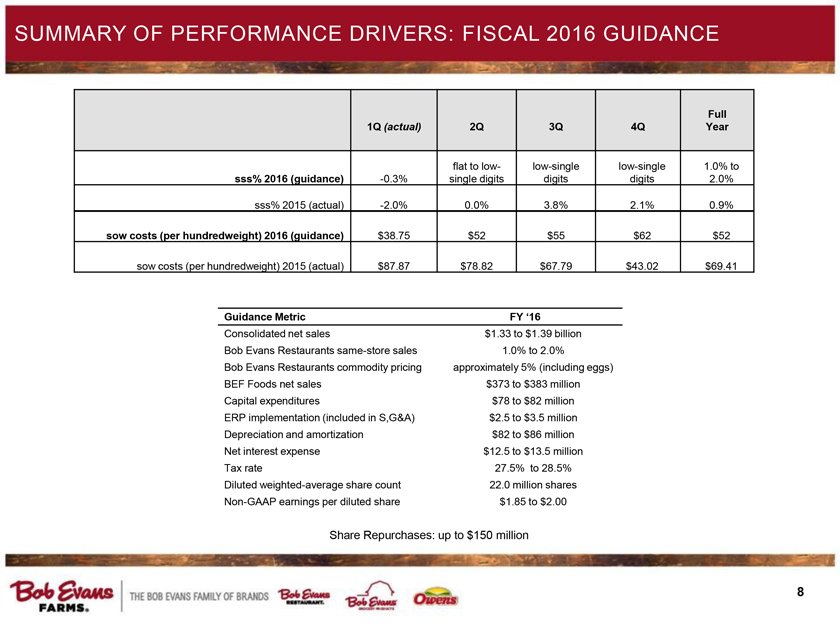

Summary of Performance Drivers: Fiscal 2016 Guidance

1Q (actual)

2Q

3Q

4Q

Full

Year

sss% 2016 (guidance)

-0.3%

flat to low-single digits

low-single digits

low-single digits

1.0% to 2.0%

sss% 2015 (actual)

-2.0%

0.0%

3.8%

2.1%

0.9%

sow costs (per hundredweight) 2016 (guidance)

$38.75

$52

$55

$62

$52

sow costs (per hundredweight) 2015 (actual)

$87.87

$78.82

$67.79

$43.02

$69.41 Guidance Metric

FY ‘16

Consolidated net sales

$1.33 to $1.39 billion

Bob Evans Restaurants same-store sales

1.0% to 2.0%

Bob Evans Restaurants commodity pricing

approximately 5% (including eggs)

BEF Foods net sales

$373 to $383 million

Capital expenditures

$78 to $82 million

ERP implementation (included in S,G&A)

$2.5 to $3.5 million

Depreciation and amortization

$82 to $86 million

Net interest expense

$12.5 to $13.5 million

Tax rate

27.5% to 28.5%

Diluted weighted-average share count

22.0 million shares

Non-GAAP earnings per diluted share

$1.85 to $2.00

Share Repurchases: up to $150 million

| 8 |

|

|

|

549 restaurants in 19 states as of 7/24/15

Full-service family restaurants featuring a

wide variety of menu items for both on-and-off premise dining

9

|

|

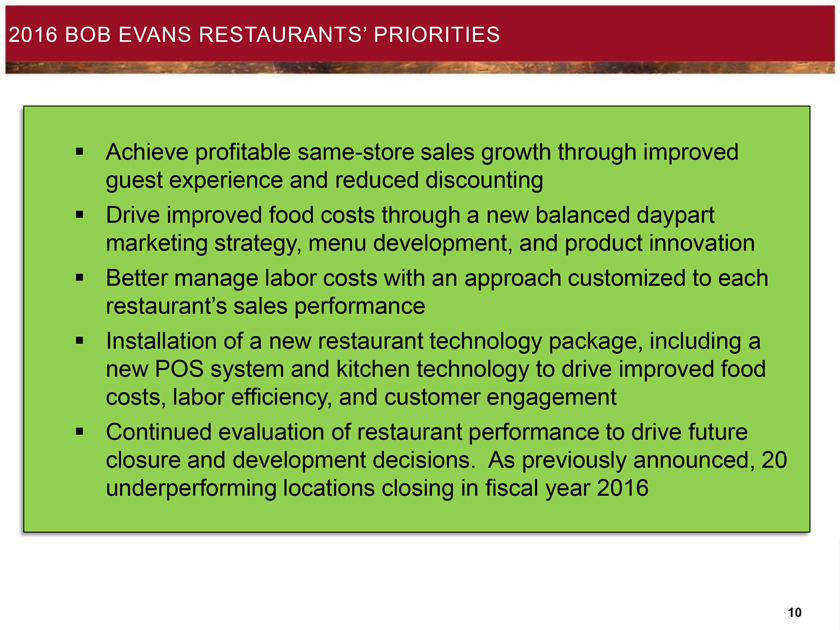

2016 BOB EVANS RESTAURANTS’ PRIORITIES

Achieve profitable same-store sales growth through improved guest experience and reduced discounting

Drive improved food costs through a new balanced daypart marketing strategy, menu development, and product innovation

Better manage labor costs with an approach customized to each restaurant’s sales performance

Installation of a new restaurant technology package, including a new POS system and kitchen technology to drive improved food costs, labor efficiency, and customer engagement

Continued evaluation of restaurant performance to drive future closure and development decisions. As previously announced, 20 underperforming locations closing in fiscal year 2016

10

|

|

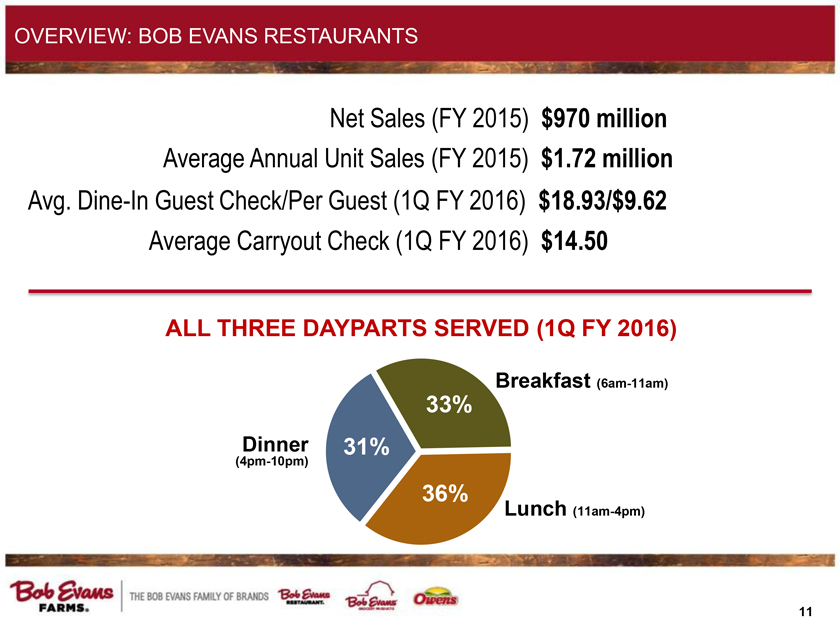

OVERVIEW: BOB EVANS RESTAURANTS

Net Sales (FY 2015) $970 million

Average Annual Unit Sales (FY 2015) $1.72 million

Avg. Dine-In Guest Check/Per Guest (1Q FY 2016) $18.93/$9.62

Average Carryout Check (1Q FY 2016) $14.50

ALL THREE DAYPARTS SERVED (1Q FY 2016)

Dinner

(4pm-10pm)

Breakfast (6am-11am)

Lunch (11am-4pm)

33%

31%

36%

11

|

|

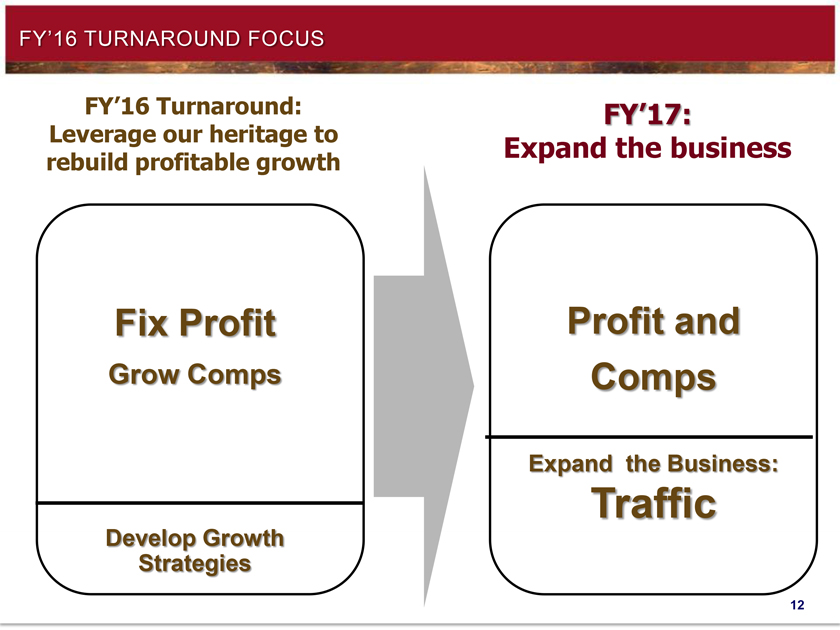

FY’16 TURNAROUND FOCUS

FY’16 Turnaround:

Leverage our heritage to rebuild profitable growth FY’17:

Expand the business Fix Profit

Grow Comps Develop Growth Strategies Profit and

Comps Expand the Business: Traffic

12

|

|

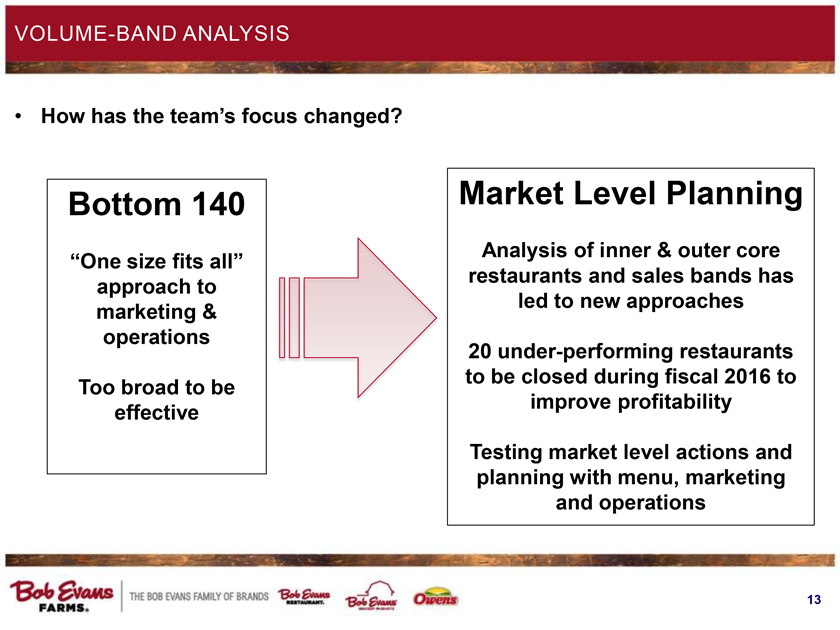

VOLUME-BAND ANALYSIS How has the team’s focus changed?

Bottom 140 “One size fits all” approach to marketing & operations Too broad to be effective

Market Level Planning Analysis of inner & outer core restaurants and sales bands has led to new approaches 20 under-performing restaurants to be closed during fiscal 2016 to improve profitability Testing market level actions and planning with menu, marketing and operations

13

|

|

EVOLVING MENU

Recent menu actions:

“Best-in-Class Breakfast”

“10 under $6” values

Premium Broasted® Chicken meals

$4 appetizers

New beverages

Broasted is a registered trademark of The Broaster Company, LLC.

14

|

|

BEST-IN-CLASS BREAKFAST

15

|

|

BEST-IN-CLASS BREAKFAST

Recent/upcoming breakfast actions:

Launch of Brioche French Toast

Launch of Brioche French Toast Sandwiches

Launch of seasonal toppings on Brioche, Hotcakes, Waffles and Crepes

Test and launch of upgraded breakfast entrees including fresh sausage, cracked eggs, fresh potatoes, fresh baked biscuits, not-from-concentrate orange juice, and better butter blend

Test and launch of better omelets and better hotcakes

16

|

|

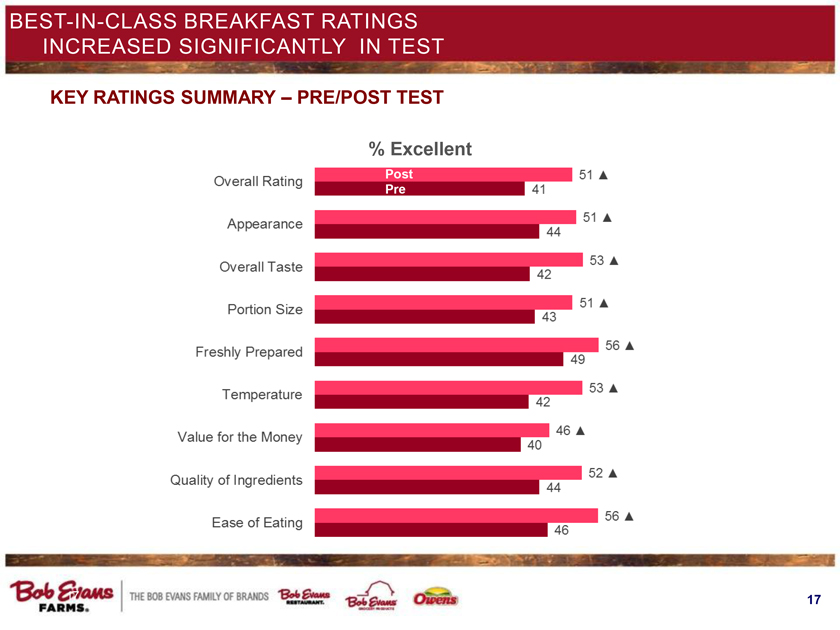

BEST-IN-CLASS BREAKFAST RATINGS INCREASED SIGNIFICANTLY IN TEST

KEY RATINGS SUMMARY – PRE/POST TEST

% Excellent

Overall Rating Post 51 Pre 41

Appearance 51 44

Overall Taste 53 42

Portion Size 51 43

Freshly Prepared 56 49

Temperature 53 42

Value for the Money 46 40

Quality of Ingredients 52 44

Ease of Eating 56 46

17

|

|

TICKET DRIVERS: BEVERAGES AND APPETIZERS

New Beverage Product Pipeline

$4 Appetizers

18

|

|

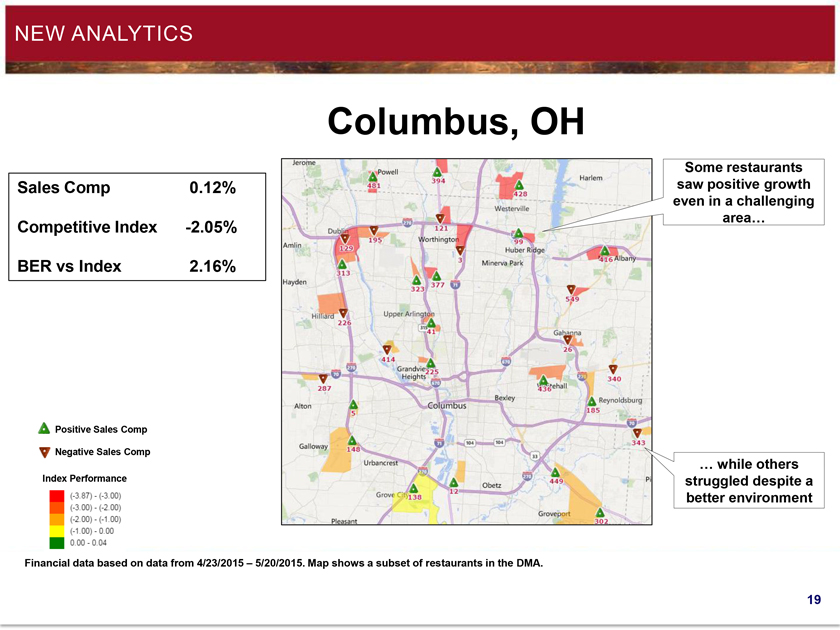

NEW ANALYTICS

Columbus, OH

Sales Comp 0.12%

Competitive Index -2.05%

BER vs Index 2.16%

Some restaurants saw positive growth even in a challenging area…

Positive Sales Comp

Negative Sales Comp

Index Performance

… while others struggled despite a better environment

Financial data based on data from 4/23/2015 – 5/20/2015. Map shows a subset of restaurants in the DMA.

19

|

|

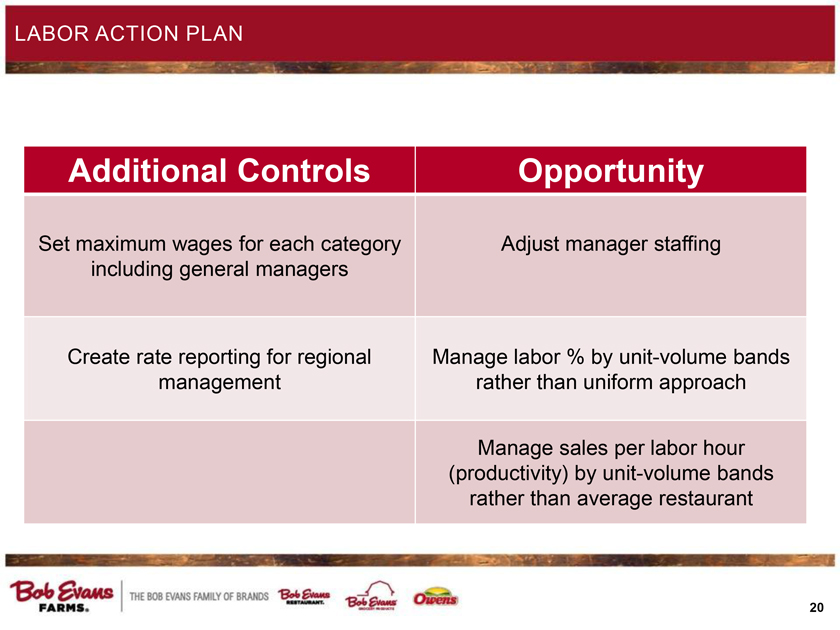

LABOR ACTION PLAN

Additional Controls

Opportunity

Set maximum wages for each category including general managers

Adjust manager staffing

Create rate reporting for regional management

Manage labor % by unit-volume bands rather than uniform approach Manage sales per labor hour (productivity) by unit-volume bands rather than average restaurant

20

|

|

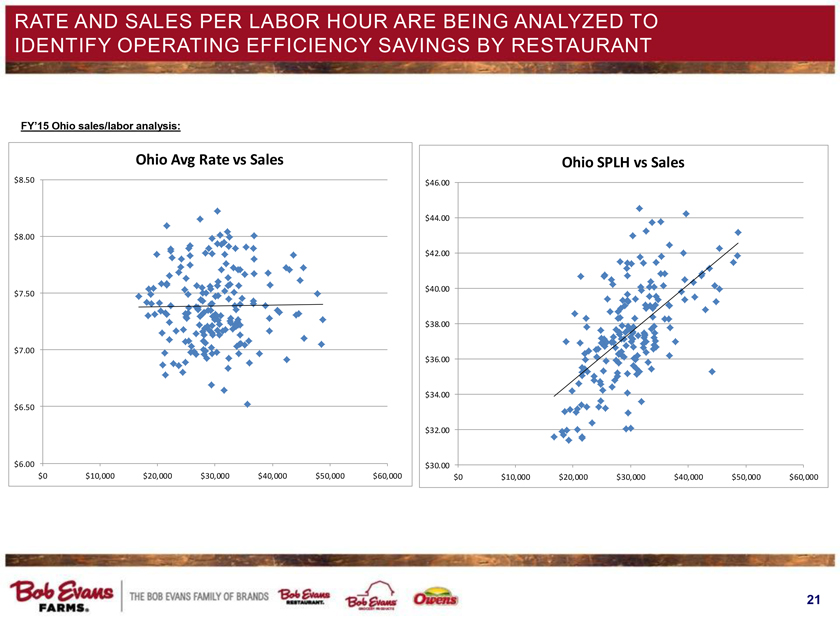

RATE AND SALES PER LABOR HOUR ARE BEING ANALYZED TO IDENTIFY OPERATING EFFICIENCY SAVINGS BY RESTAURANT

FY’15 Ohio sales/labor analysis:

Ohio Avg Rate vs Sales $6.00 $6.50 $7.00 $7.50 $8.00 $8.50 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000

Ohio SPLH vs Sales $30.00 $32.00 $34.00 $36.00 $38.00 $40.00 $42.00 $44.00 $46.00 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000

21

|

|

TWO BRANDS distinct geographic strengths

22

|

|

2016 BEF FOODS’ PRIORITIES

Drive double-digit growth of refrigerated side-dish products with marketing investments and expanded points of distribution

Begin $20+ million expansion of Lima, Ohio, refrigerated side-dish plant to meet strong consumer demand

Strategically employ trade spending to protect and selectively grow core sausage markets

Successfully implement new ERP system across plant network to drive continued efficiency gains and profitable sales growth

New product launches, most notably a line of natural side dishes

23

|

|

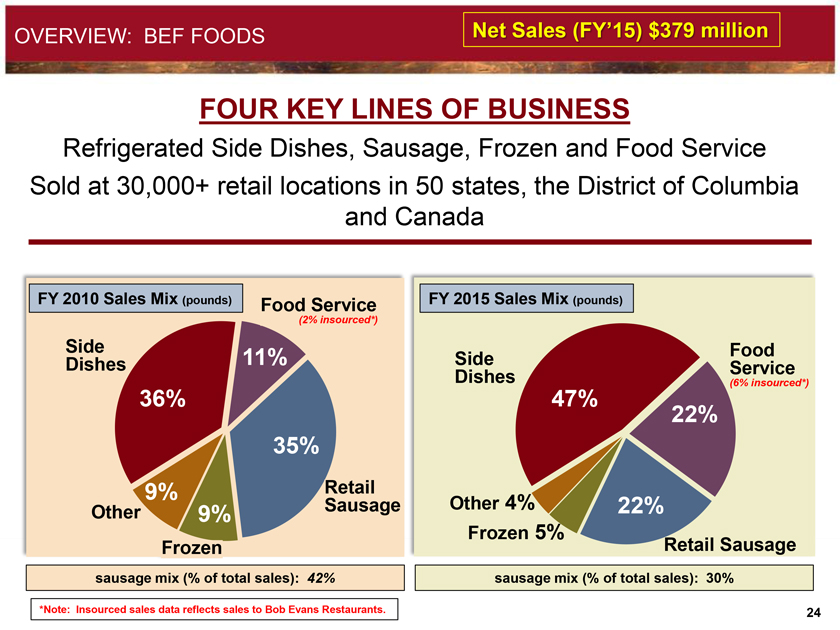

OVERVIEW: BEF FOODS

Net Sales (FY’15) $379 million

FOUR KEY LINES OF BUSINESS

Refrigerated Side Dishes, Sausage, Frozen and Food Service

Sold at 30,000+ retail locations in 50 states, the District of Columbia and Canada

FY 2010 Sales Mix (pounds)

Food Service

(2% insourced*)

Side

Dishes

Other

Frozen

Retail

Sausage

36%

9%

9%

11%

35%

sausage mix (% of total sales): 42%

FY 2015 Sales Mix (pounds)

Side

Dishes

Food

Service

(6% insourced*)

Other 4%

Frozen 5%

Retail Sausage

47%

22%

22%

sausage mix (% of total sales): 30%

*Note: Insourced sales data reflects sales to Bob Evans Restaurants.

24

|

|

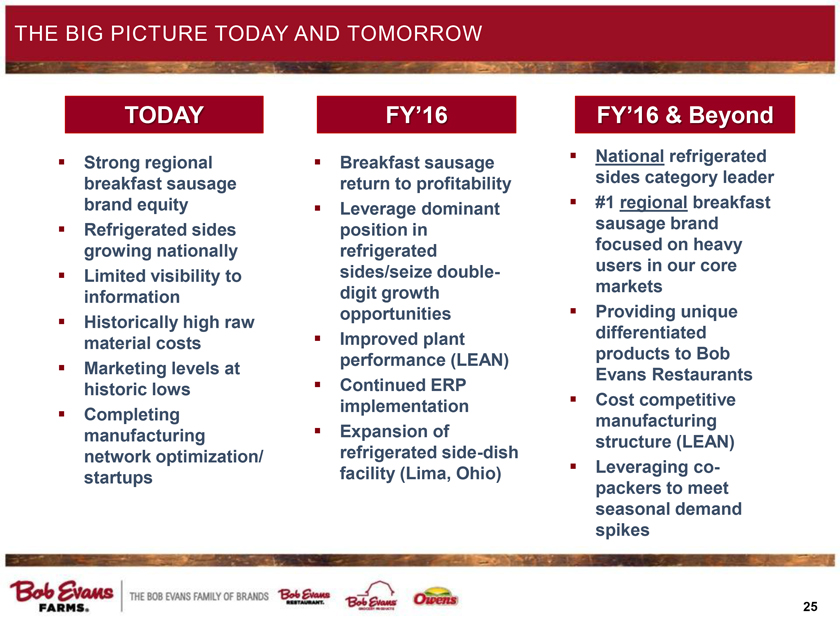

THE BIG PICTURE TODAY AND TOMORROW

TODAY

Strong regional breakfast sausage brand equity

Refrigerated sides growing nationally

Limited visibility to information

Historically high raw material costs

Marketing levels at historic lows

Completing manufacturing network optimization/startups

FY’16

Breakfast sausage return to profitability

Leverage dominant position in refrigerated sides/seize double-digit growth opportunities

Improved plant performance (LEAN)

Continued ERP implementation

Expansion of refrigerated side-dish facility (Lima, Ohio)

FY’16 & Beyond

National refrigerated sides category leader

#1 regional breakfast sausage brand focused on heavy users in our core markets

Providing unique differentiated products to Bob Evans Restaurants

Cost competitive manufacturing structure (LEAN)

Leveraging co-packers to meet seasonal demand spikes

25

|

|

BOB EVANS FOODS BUSINESS STRATEGY

Growing Bob Evans from a strong regional food brand to a national food brand leveraging the dominant refrigerated sides position, while protecting the #1 breakfast sausage position(1) in the core

Refrigerates Side Dishes – Aggressively grow

Breakfast Sausage - Maintain

Frozen - Maintain

Food Service – Be selective

Source: IRI Bob Evans Core MULO*, 52 weeks ending 8/9/15

26

|

|

BOB EVANS FOODS – RETAIL PRODUCT CATEGORIES

Refrigerated side dishes

Breakfast sausage

Frozen

27

|

|

OUR SIDES UNIQUELY DELIVER A QUALITY EATING EXPERIENCE

•RESTAURANT QUALITY AT HOME “I LOVE THE FACT THAT I CAN PRETTY MUCH GET THE SAME THING IN THE STORE AS I GET IN THE RESTAURANT”

•CONSISTENT TASTE AND QUALITY “THE QUALITY AND TASTE IS ALWAYS THERE....HAVE NEVER BEEN LET DOWN BY THIS PRODUCT LINE”

•CONVENIENT YET SATISFYING “I LIKE THE EASE OF PREPARATION. IN A RUSH, I KNOW THAT I CAN STILL SERVE A SATISFYING SIDE DISH”

•QUALITY TASTE “IT DOESN’T TASTE CHEAP”

Repeat % Rate – Refrigerated Side Dishes1

65%

51%

48%

48% 43% Bob Evans

Private Label

Simply Diners Hormel Resers

Source: 1) IRI Panel; 52 weeks ending 8-9-15; Total US MULO; % of Buyers, 2x+ Buyers

28

|

|

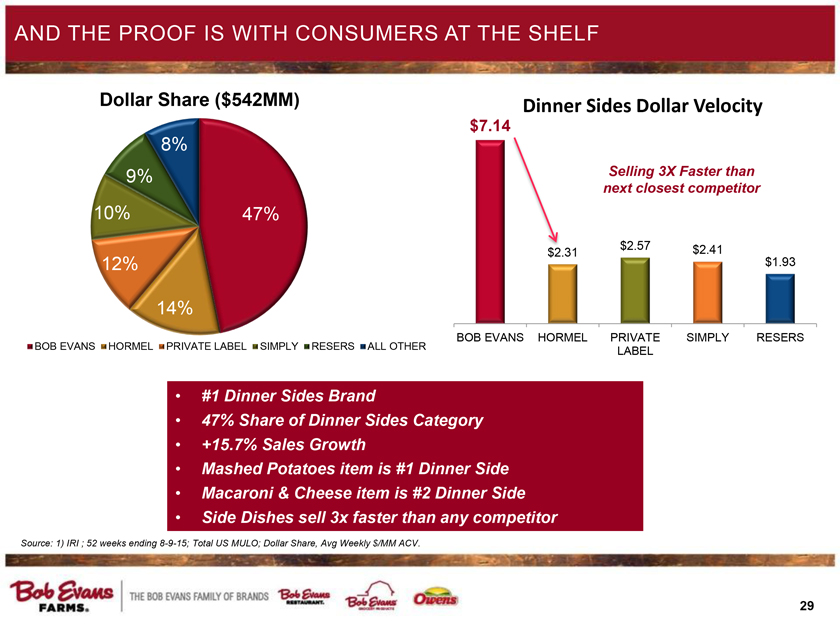

AND THE PROOF IS WITH CONSUMERS AT THE SHELF

Dinner Sides Dollar Velocity 47% 14% 12% 10% 9% 8% BOB EVANS HORMEL PRIVATE LABEL SIMPLY RESERS ALL OTHER Dollar Share ($542MM) • #1 Dinner Sides Brand • 47% Share of Dinner Sides Category • +15.7% Sales Growth • Mashed Potatoes item is #1 Dinner Side • Macaroni & Cheese item is #2 Dinner Side • Side Dishes sell 3x faster than any competitor Source: 1) IRI ; 52 weeks ending 8-9-15; Total US MULO; Dollar Share, Avg Weekly $/MM ACV. $7.14 $2.31 $2.57 $2.41 $1.93 BOB EVANS HORMEL PRIVATE LABEL SIMPLY RESERS Selling 3X Faster than next closest competitor

29

|

|

Appendix

30

|

|

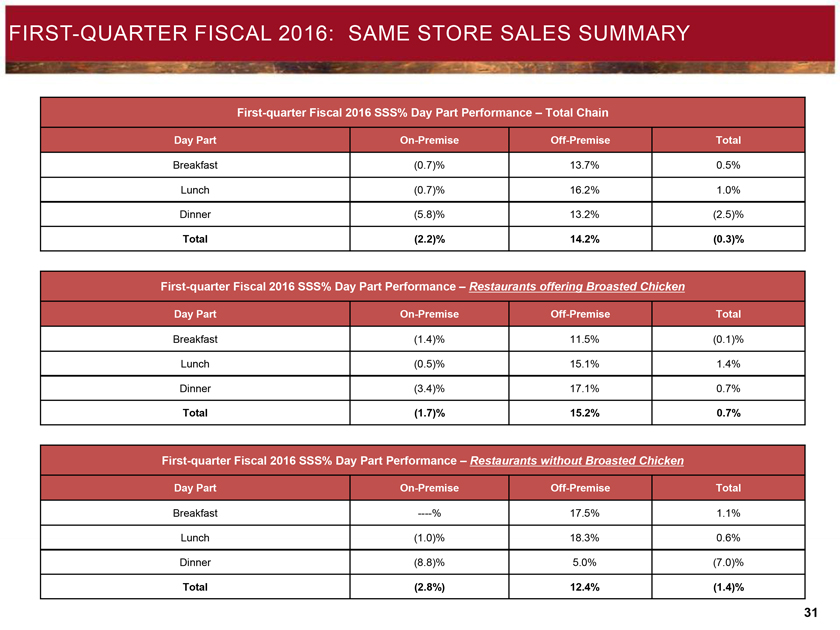

FIRST-QUARTER FISCAL 2016: SAME STORE SALES SUMMARY

First-quarter Fiscal 2016 SSS% Day Part Performance – Total Chain

Day Part

On-Premise

Off-Premise

Total

Breakfast

(0.7)%

13.7%

0.5%

Lunch

(0.7)%

16.2%

1.0%

Dinner

(5.8)%

13.2%

(2.5)%

Total

(2.2)%

14.2%

(0.3)%

First-quarter Fiscal 2016 SSS% Day Part Performance – Restaurants offering Broasted Chicken

Day Part

On-Premise

Off-Premise

Total

Breakfast

(1.4)%

11.5%

(0.1)%

Lunch

(0.5)%

15.1%

1.4%

Dinner

(3.4)%

17.1%

0.7%

Total

(1.7)%

15.2%

0.7%

First-quarter Fiscal 2016 SSS% Day Part Performance – Restaurants without Broasted Chicken

Day Part

On-Premise

Off-Premise

Total

Breakfast

----%

17.5%

1.1%

Lunch

(1.0)%

18.3%

0.6%

Dinner

(8.8)%

5.0%

(7.0)%

Total

(2.8%)

12.4%

(1.4)%

31

|

|

OFF-PREMISES SALES LAYERS

CARRYOUT

BAKERY

CATERING

1Q16 Growth / Mix

11.3% / 10.8%

1Q16 Growth / Mix

5.0% / 1.7%

1Q16 Growth / Mix

90.6% / 1.1%

32

|

|

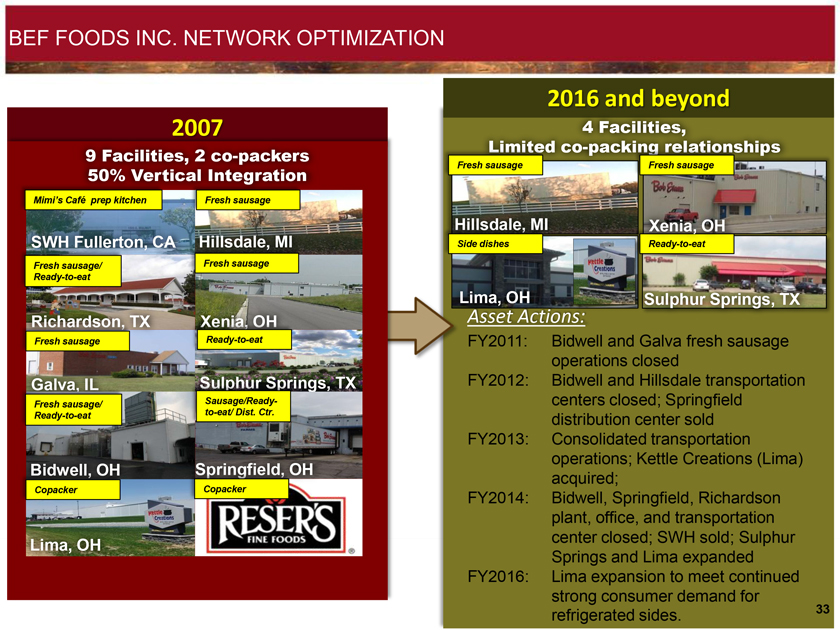

BEF FOODS INC. NETWORK OPTIMIZATION

2007

9 Facilities, 2 co-packers

50% Vertical Integration

2016 and beyond

4 Facilities,

Limited co-packing relationships

Asset Actions:

FY2011: Bidwell and Galva fresh sausage operations closed

FY2012: Bidwell and Hillsdale transportation centers closed; Springfield distribution center sold

FY2013: Consolidated transportation operations; Kettle Creations (Lima) acquired;

FY2014: Bidwell, Springfield, Richardson plant, office, and transportation center closed; SWH sold; Sulphur Springs and Lima expanded

FY2016: Lima expansion to meet continued strong consumer demand for refrigerated sides.

33

|

|

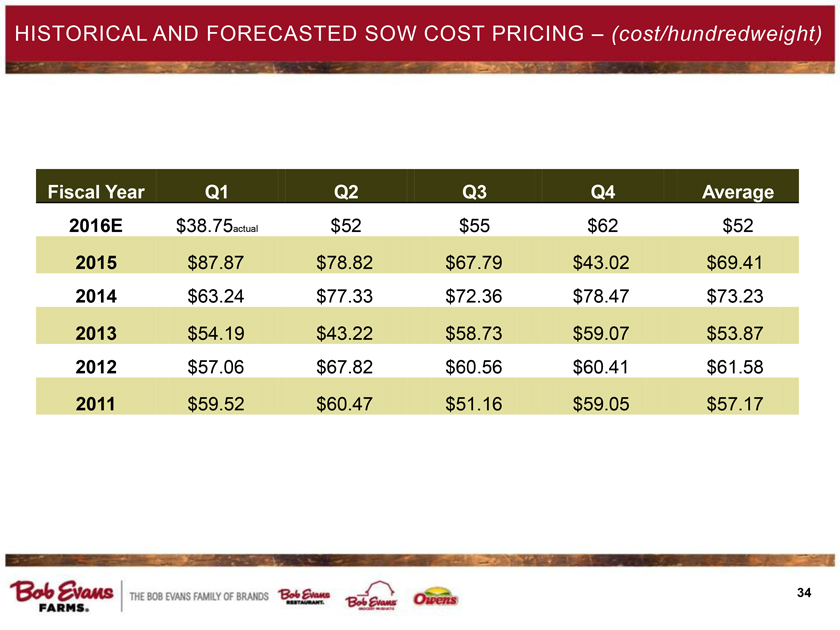

HISTORICAL AND FORECASTED SOW COST PRICING – (cost/hundredweight)

Fiscal Year

Q1

Q2

Q3

Q4

Average

2016E

$38.75actual

$52

$55

$62

$52

2015

$87.87

$78.82

$67.79

$43.02

$69.41

2014

$63.24

$77.33

$72.36

$78.47

$73.23

2013

$54.19

$43.22

$58.73

$59.07

$53.87

2012

$57.06

$67.82

$60.56

$60.41

$61.58

2011

$59.52

$60.47

$51.16

$59.05

$57.17

34

|

|

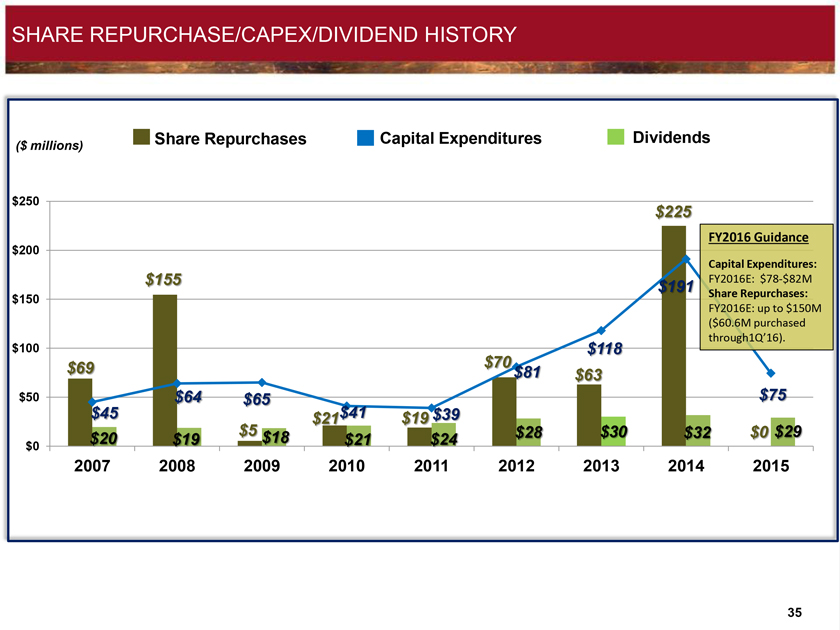

SHARE REPURCHASE/CAPEX/DIVIDEND HISTORY

Share Repurchases Capital Expenditures Dividends

($ millions)

$250

$225

FY2016 Guidance $200

Capital Expenditures: $155 $191 FY2016E: $78-$82M $150 Share Repurchases:

FY2016E: up to $150M

($60.6M purchased $100 through1Q’16).

$118

$69 $70

$81 $63

$50 $64 $65 $75

$45 $41 $19 $39

$5 $18 $28 $30 $32 $0 $29

$20 $19 $21 $24

$0

2007 2008 2009 2010 2011 2012 2013 2014 2015

35

|

|

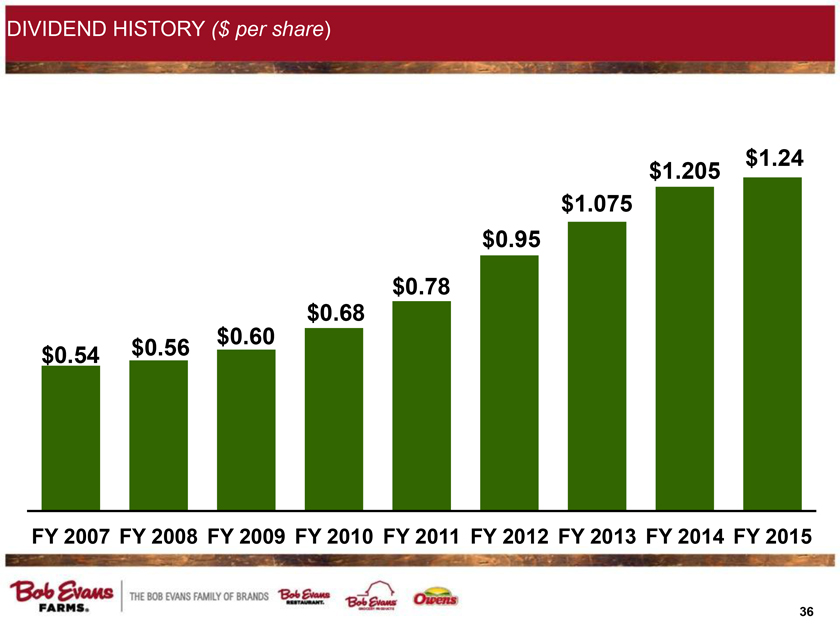

DIVIDEND HISTORY ($ per share)

$1.24

$1.205

$1.075

$0.95

$0.78

$0.68

$0.60

$0.54 $0.56

FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015

36

|

|

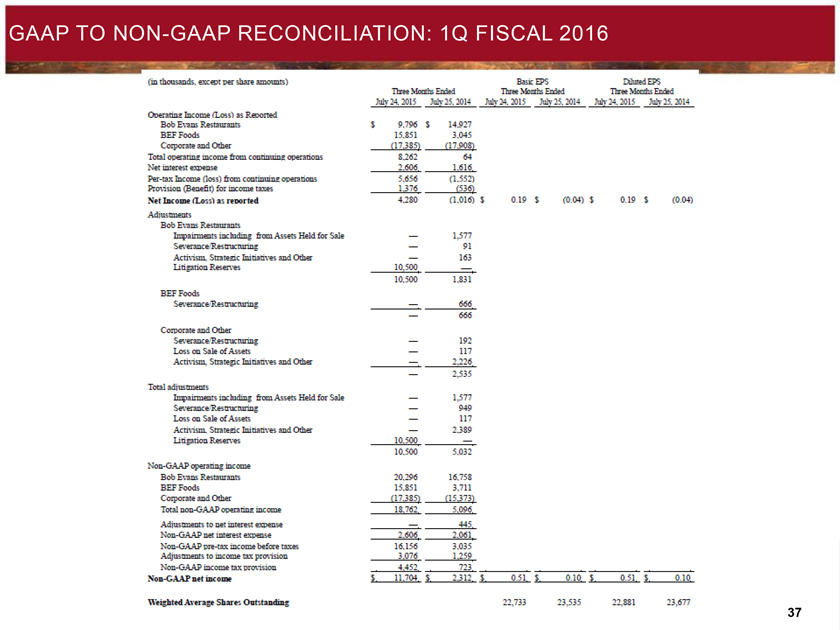

GAAP TO NON-GAAP RECONCILIATION: 1Q FISCAL 2016

37

|

|

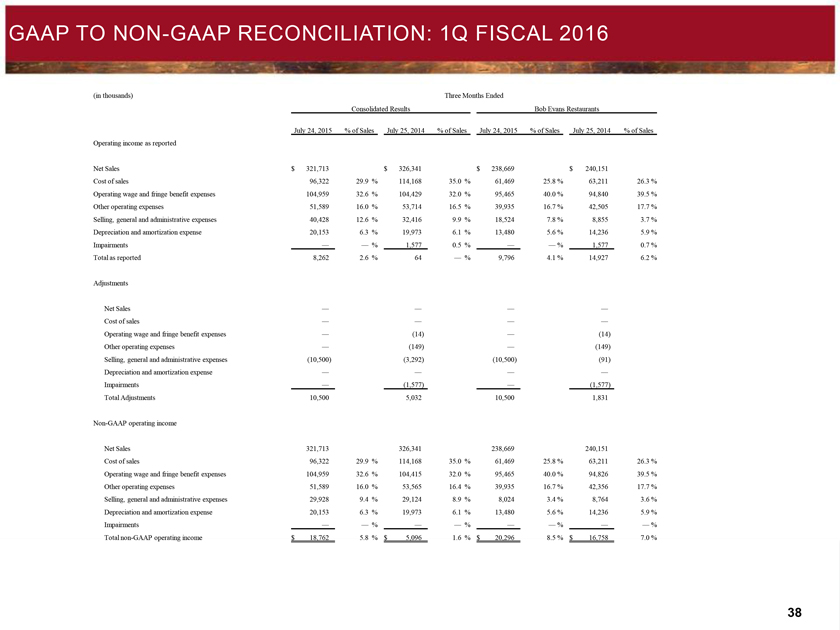

GAAP TO NON-GAAP RECONCILIATION: 1Q FISCAL 2016

(in thousands)

Three Months Ended

Consolidated Results

Bob Evans Restaurants

July 24, 2015

% of Sales

July 25, 2014

% of Sales

July 24, 2015

% of Sales

July 25, 2014

% of Sales

Operating income as reported

Net Sales

$ 321,713

$ 326,341

$ 238,669

$ 240,151

Cost of sales

96,322

29.9

%

114,168

35.0

%

61,469

25.8

%

63,211

26.3

%

Operating wage and fringe benefit expenses

104,959

32.6

%

104,429

32.0

%

95,465

40.0

%

94,840

39.5

%

Other operating expenses

51,589

16.0

%

53,714

16.5

%

39,935

16.7

%

42,505

17.7

%

Selling, general and administrative expenses

40,428

12.6

%

32,416

9.9

%

18,524

7.8

%

8,855

3.7

%

Depreciation and amortization expense

20,153

6.3

%

19,973

6.1

%

13,480

5.6

%

14,236

5.9

%

Impairments

—

—

%

1,577

0.5

%

—

—

%

1,577

0.7

%

Total as reported

8,262

2.6

%

64

—

%

9,796

4.1

%

14,927

6.2

%

Adjustments

Net Sales

—

—

—

—

Cost of sales

—

—

—

—

Operating wage and fringe benefit expenses

—

| (14) |

|

—

| (14) |

|

Other operating expenses

—

(149)

—

(149)

Selling, general and administrative expenses

(10,500)

(3,292)

(10,500)

| (91) |

|

Depreciation and amortization expense

—

—

—

—

Impairments

—

(1,577)

—

(1,577)

Total Adjustments

10,500

5,032

10,500

1,831

Non-GAAP operating income

Net Sales

321,713

326,341

238,669

240,151

Cost of sales

96,322

29.9

%

114,168

35.0

%

61,469

25.8

%

63,211

26.3

%

Operating wage and fringe benefit expenses

104,959

32.6

%

104,415

32.0

%

95,465

40.0

%

94,826

39.5

%

Other operating expenses

51,589

16.0

%

53,565

16.4

%

39,935

16.7

%

42,356

17.7

%

Selling, general and administrative expenses

29,928

9.4

%

29,124

8.9

%

8,024

3.4

%

8,764

3.6

%

Depreciation and amortization expense

20,153

6.3

%

19,973

6.1

%

13,480

5.6

%

14,236

5.9

%

Impairments

—

—

%

—

—

%

—

—

%

—

—

%

Total non-GAAP operating income

$

18,762

5.8

%

$

5,096

1.6

%

$

20,296

8.5

%

$

16,758

7.0%

38

|

|

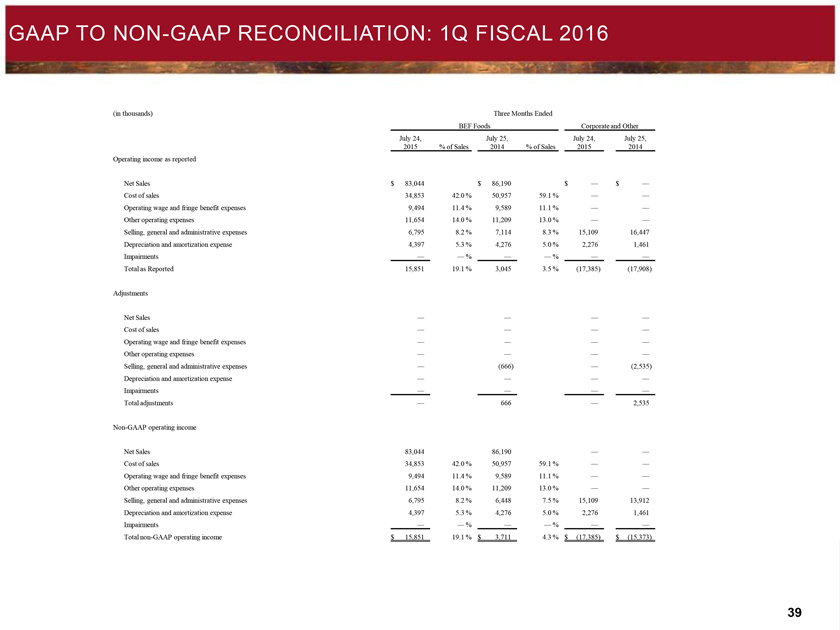

GAAP TO NON-GAAP RECONCILIATION: 1Q FISCAL 2016

(in thousands)

Three Months Ended

BEF Foods

Corporate and Other

July 24, 2015

% of Sales

July 25, 2014

% of Sales

July 24, 2015

July 25, 2014

Operating income as reported

Net Sales

Cost of sales

Operating wage and fringe benefit expenses

Other operating expenses

Selling, general and administrative expenses

Depreciation and amortization expense

Impairments

Total as Reported

Adjustments

Net Sales

Cost of sales

Operating wage and fringe benefit expenses

Other operating expenses

Selling, general and administrative expenses

Depreciation and amortization expense

Impairments

Total adjustments

Non-GAAP operating income

Net Sales

Cost of sales

Operating wage and fringe benefit expenses

Other operating expenses

Selling, general and administrative expenses

Depreciation and amortization expense

Impairments

Total non-GAAP operating income $

83,044

34,853

9,494

11,654

6,795

4,397

—

15,851

—

—

—

—

—

—

—

—

83,044

34,853

9,494

11,654

6,795

4,397

—

$ 15,851

$ 86,190

$ —

$ —

42.0 %

50,957

59.1 %

—

—

11.4 %

9,589

11.1 %

—

—

14.0 %

11,209

13.0 %

—

—

8.2 %

7,114

8.3

%

15,109

16,447

5.3 %

4,276

5.0 %

2,276

1,461

— %

—

— %

—

—

19.1 %

3,045

3.5 %

(17,385)

(17,908)

—

—

—

—

—

—

—

—

—

—

—

—

(666)

—

(2,535)

—

—

—

—

—

—

666

—

2,535

86,190

—

—

42.0 %

50,957

59.1 %

—

—

11.4 %

9,589

11.1 %

—

—

14.0 %

11,209

13.0 %

—

—

8.2 %

6,448

7.5 %

15,109

13,912

5.3 %

4,276

5.0 %

2,276

1,461

— %

—

— %

—

—

19.1 %

$ 3,711

4.3 %

$ (17,385)

$ (15,373)

39

|

|

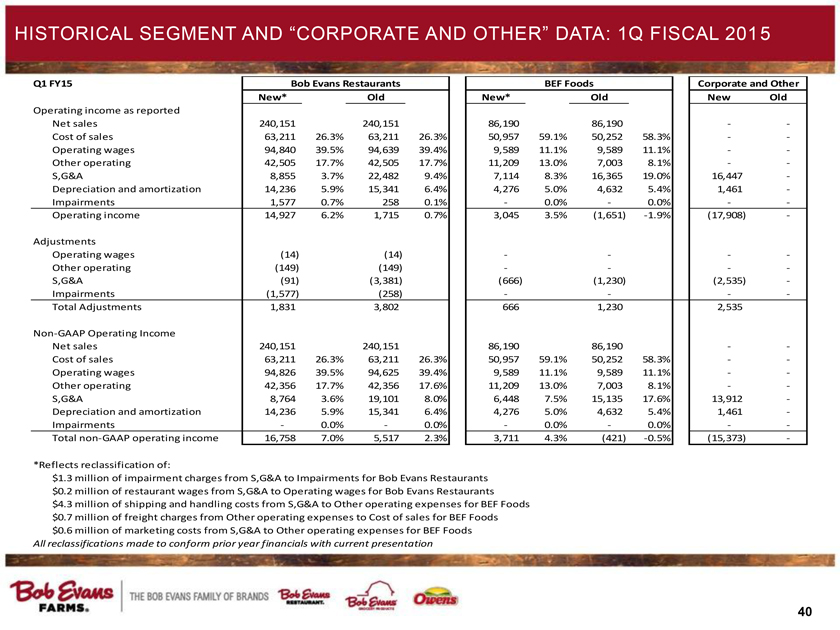

HISTORICAL SEGMENT AND “CORPORATE AND OTHER” DATA: 1Q FISCAL 201 5

Q1 FY15

Bob Evans Restaurants BEF Foods Corporate and Other New* Old New* Old New

Old

Operating income as reported Net sales

240,151 240,151 86,19086,190 -

-

Cost of sales

63,211

26.3%

63,211

26.3%

50,957

59.1%

50,252

58.3%

-

-

Operating wages

94,840

39.5%

94,639

39.4%

9,589

11.1%

9,589

11.1%

-

-

Other operating

42,505

17.7%

42,505

17.7%

11,209

13.0%

7,003

8.1%

-

-

S,G&A

8,855

3.7%

22,482

9.4%

7,114

8.3%

16,365

19.0%

16,447

-

Depreciation and amortization

14,236

5.9%

15,341

6.4%

4,276

5.0%

4,632

5.4%

1,461

-

Impairments

1,577

0.7%

258

0.1%

-

0.0%

-

0.0%

-

-

Operating income

14,927

6.2%

1,715

0.7%

3,045

3.5%

(1,651)

-1.9%

(17,908)

-

Adjustments Operating wages

(14) (14)

- - -

-

Other operating

(149) (149)

- - -

-

S,G&A

(91) (3,381) (666) (1,230) (2,535)

-

Impairments

(1,577) (258)

- - -

-

Total Adjustments

1,831 3,802 666 1,230 2,535 Non-GAAP Operating Income Net sales

240,151 240,151 86,190 86,190 -

-

Cost of sales

63,211

26.3%

63,211

26.3%

50,957

59.1%

50,252

58.3%

-

-

Operating wages

94,826

39.5%

94,625

39.4%

9,589

11.1%

9,589

11.1%

-

-

Other operating

42,356

17.7%

42,356

17.6%

11,209

13.0%

7,003

8.1%

-

-

S,G&A

8,764

3.6%

19,101

8.0%

6,448

7.5%

15,135

17.6%

13,912

-

Depreciation and amortization

14,236

5.9%

15,341

6.4%

4,276

5.0%

4,632

5.4%

1,461

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Total non-GAAP operating income

16,758

7.0%

5,517

2.3%

3,711

4.3%

(421)

-0.5%

(15,373)

-

*Reflects reclassification of: $1.3 million of impairment charges from S,G&A to Impairments for Bob Evans Restaurants $0.2 million of restaurant wages from S,G&A to Operating wages for Bob Evans Restaurants $4.3 million of shipping and handling costs from S,G&A to Other operating expenses for BEF Foods $0.7 million of freight charges from Other operating expenses to Cost of sales for BEF Foods $0.6 million of marketing costs from S,G&A to Other operating expenses for BEF Foods

All reclassifications made to conform prior year financials with current presentation

40

|

|

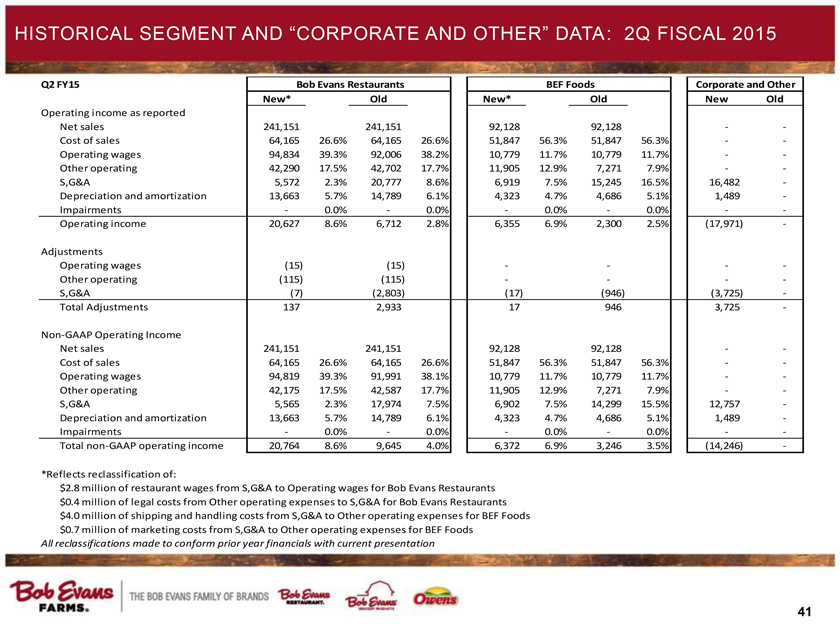

HISTORICAL SEGMENT AND “CORPORATE AND OTHER” DATA: 2Q FISCAL 2015

Q2 FY15

Bob Evans Restaurants BEF Foods Corporate and Other New* Old New* Old New

Old

Operating income as reported Net sales

241,151 241,151 92,128 92,128 -

-

Cost of sales

64,165

26.6%

64,165

26.6%

51,847

56.3%

51,847

56.3%

-

-

Operating wages

94,834

39.3%

92,006

38.2%

10,779

11.7%

10,779

11.7%

-

-

Other operating

42,290

17.5%

42,702

17.7%

11,905

12.9%

7,271

7.9%

-

-

S,G&A

5,572

2.3%

20,777

8.6%

6,919

7.5%

15,245

16.5%

16,482

-

Depreciation and amortization

13,663

5.7%

14,789

6.1%

4,323

4.7%

4,686

5.1%

1,489

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Operating income

20,627

8.6%

6,712

2.8%

6,355

6.9%

2,300

2.5%

(17,971)

-

Adjustments Operating wages

(15) (15) - - -

-

Other operating

(115) (115) - - -

-

S,G&A

(7) (2,803) (17) (946) (3,725)

-

Total Adjustments

137 2,933 17 946 3,725

-

Non-GAAP Operating Income Net sales

241,151 241,151 92,128 92,128 -

-

Cost of sales

64,165

26.6%

64,165

26.6%

51,847

56.3%

51,847

56.3%

-

-

Operating wages

94,819

39.3%

91,991

38.1%

10,779

11.7%

10,779

11.7%

-

-

Other operating

42,175

17.5%

42,587

17.7%

11,905

12.9%

7,271

7.9%

-

-

S,G&A

5,565

2.3%

17,974

7.5%

6,902

7.5%

14,299

15.5%

12,757

-

Depreciation and amortization

13,663

5.7%

14,789

6.1%

4,323

4.7%

4,686

5.1%

1,489

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Total non-GAAP operating income

20,764

8.6%

9,645

4.0%

6,372

6.9%

3,246

3.5%

(14,246)

- *Reflects reclassification of: $2.8 million of restaurant wages from S,G&A to Operating wages for Bob Evans Restaurants $0.4 million of legal costs from Other operating expenses to S,G&A for Bob Evans Restaurants $4.0 million of shipping and handling costs from S,G&A to Other operating expenses for BEF Foods $0.7 million of marketing costs from S,G&A to Other operating expenses for BEF Foods

All reclassifications made to conform prior year financials with current presentation

41

|

|

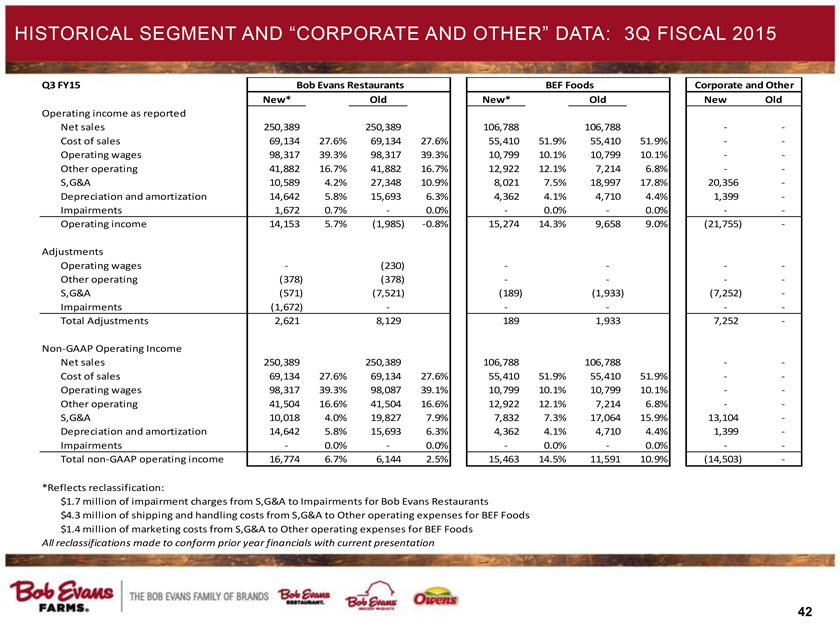

HISTORICAL SEGMENT AND “CORPORATE AND OTHER” DATA: 3Q FISCAL 2015

Q3 FY15

Bob Evans Restaurants BEF Foods Corporate and Other New* Old New* Old New

Old

Operating income as reported Net sales

250,389 250,389 106,788 106,788 -

-

Cost of sales

69,134

27.6%

69,134

27.6%

55,410

51.9%

55,410

51.9%

-

-

Operating wages

98,317

39.3%

98,317

39.3%

10,799

10.1%

10,799

10.1%

-

-

Other operating

41,882

16.7%

41,882

16.7%

12,922

12.1%

7,214

6.8%

-

-

S,G&A

10,589

4.2%

27,348

10.9%

8,021

7.5%

18,997

17.8%

20,356

-

Depreciation and amortization

14,642

5.8%

15,693

6.3%

4,362

4.1%

4,710

4.4%

1,399

-

Impairments

1,672

0.7%

-

0.0%

-

0.0%

-

0.0%

-

-

Operating income

14,153

5.7%

(1,985)

-0.8%

15,274

14.3%

9,658

9.0%

(21,755)

-

Adjustments Operating wages

- (230) - - -

-

Other operating

(378) (378) - - -

-

S,G&A

(571) (7,521) (189) (1,933) (7,252)

-

Impairments

(1,672) - - - -

-

Total Adjustments

2,621 8,129 1891,933 7,252

-

Non-GAAP Operating Income Net sales

250,389 250,389 106,788 106,788 -

-

Cost of sales

69,134

27.6%

69,134

27.6%

55,410

51.9%

55,410

51.9%

-

-

Operating wages

98,317

39.3%

98,087

39.1%

10,799

10.1%

10,799

10.1%

-

-

Other operating

41,504

16.6%

41,504

16.6%

12,922

12.1%

7,214

6.8%

-

-

S,G&A

10,018

4.0%

19,827

7.9%

7,832

7.3%

17,064

15.9%

13,104

-

Depreciation and amortization

14,642

5.8%

15,693

6.3%

4,362

4.1%

4,710

4.4%

1,399

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Total non-GAAP operating income

16,774

6.7%

6,144

2.5%

15,463

14.5%

11,591

10.9%

(14,503)

- *Reflects reclassification: $1.7 million of impairment charges from S,G&A to Impairments for Bob Evans Restaurants $4.3 million of shipping and handling costs from S,G&A to Other operating expenses for BEF Foods $1.4 million of marketing costs from S,G&A to Other operating expenses for BEF Foods

All reclassifications made to conform prior year financials with current presentation

42

|

|

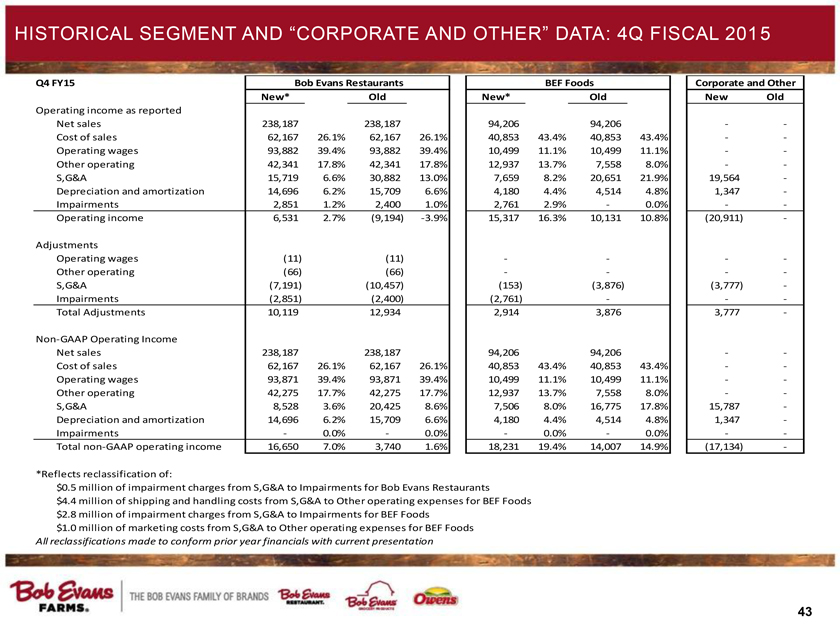

HISTORICAL SEGMENT AND “CORPORATE AND OTHER” DATA: 4Q FISCAL 201 5

Q4 FY15

Bob Evans Restaurants BEF Foods Corporate and Other New* Old New* Old New

Old

Operating income as reported Net sales

238,187 238,187 94,206 94,206 -

-

Cost of sales

62,167

26.1%

62,167

26.1%

40,853

43.4%

40,853

43.4%

-

-

Operating wages

93,882

39.4%

93,882

39.4%

10,499

11.1%

10,499

11.1%

-

-

Other operating

42,341

17.8%

42,341

17.8%

12,937

13.7%

7,558

8.0%

-

-

S,G&A

15,719

6.6%

30,882

13.0%

7,659

8.2%

20,651

21.9%

19,564

-

Depreciation and amortization

14,696

6.2%

15,709

6.6%

4,180

4.4%

4,514

4.8%

1,347

-

Impairments

2,851

1.2%

2,400

1.0%

2,761

2.9%

-

0.0%

-

-

Operating income

6,531

2.7%

(9,194)

-3.9%

15,317

16.3%

10,131

10.8%

(20,911)

-

Adjustments Operating wages

(11) (11)

- - -

-

Other operating

(66) (66)

- - -

-

S,G&A

(7,191)

(10,457)

(153)

(3,876)

(3,777)

-

Impairments

(2,851) (2,400) (2,761)

- -

-

Total Adjustments

10,119 12,934 2,914 3,876 3,777

-

Non-GAAP Operating Income Net sales

238,187 238,187 94,206 94,206 -

-

Cost of sales

62,167

26.1%

62,167

26.1%

40,853

43.4%

40,853

43.4%

-

-

Operating wages

93,871

39.4%

93,871

39.4%

10,499

11.1%

10,499

11.1%

-

-

Other operating

42,275

17.7%

42,275

17.7%

12,937

13.7%

7,558

8.0%

-

-

S,G&A

8,528

3.6%

20,425

8.6%

7,506

8.0%

16,775

17.8%

15,787

-

Depreciation and amortization

14,696

6.2%

15,709

6.6%

4,180

4.4%

4,514

4.8%

1,347

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Total non-GAAP operating income

16,650

7.0%

3,740

1.6%

18,231

19.4%

14,007

14.9%

(17,134)

-

*Reflects reclassification of: $0.5 million of impairment charges from S,G&A to Impairments for Bob Evans Restaurants $4.4 million of shipping and handling costs from S,G&A to Other operating expenses for BEF Foods $2.8 million of impairment charges from S,G&A to Impairments for BEF Foods $1.0 million of marketing costs from S,G&A to Other operating expenses for BEF Foods

All reclassifications made to conform prior year financials with current presentation

43

|

|

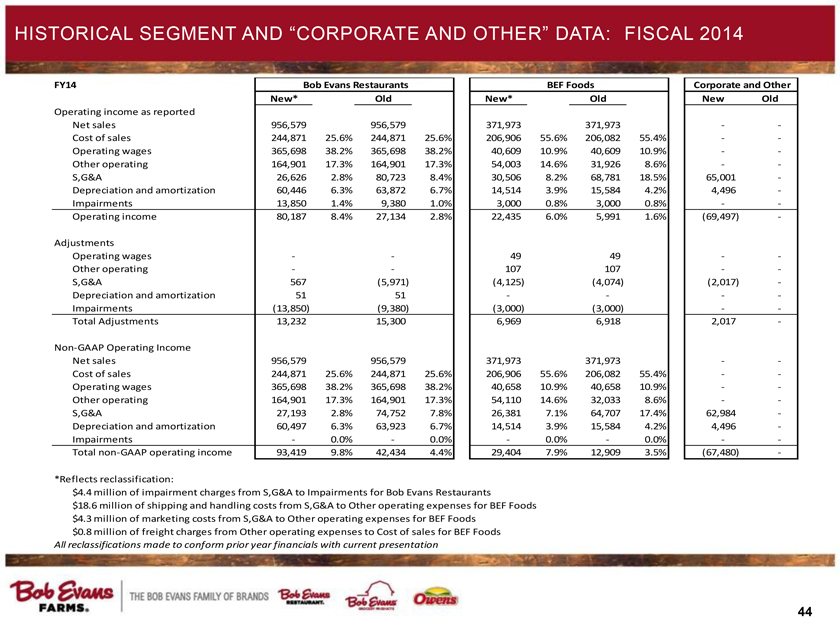

HISTORICAL SEGMENT AND “CORPORATE AND OTHER” DATA: FISCAL 2014

FY14

Bob Evans Restaurants BEF Foods Corporate and Other New* Old New* Old New

Old

Operating income as reported Net sales

956,579 956,579 371,973 371,973 -

-

Cost of sales

244,871

25.6%

244,871

25.6%

206,906

55.6%

206,082

55.4%

-

-

Operating wages

365,698

38.2%

365,698

38.2%

40,609

10.9%

40,609

10.9%

-

-

Other operating

164,901

17.3%

164,901

17.3%

54,003

14.6%

31,926

8.6%

-

-

S,G&A

26,626

2.8%

80,723

8.4%

30,506

8.2%

68,781

18.5%

65,001

-

Depreciation and amortization

60,446

6.3%

63,872

6.7%

14,514

3.9%

15,584

4.2%

4,496

-

Impairments

13,850

1.4%

9,380

1.0%

3,000

0.8%

3,000

0.8%

-

-

Operating income

80,187

8.4%

27,134

2.8%

22,435

6.0%

5,991

1.6%

(69,497)

-

Adjustments Operating wages

- -

4949

-

-

Other operating

--

107

107

-

-

S,G&A

567

(5,971)

(4,125)

(4,074)

(2,017)

-

Depreciation and amortization

5151

- - -

-

Impairments

(13,850)

(9,380)

(3,000)

(3,000)

-

-

Total Adjustments

13,232 15,300 6,969 6,918 2,017

-

Non-GAAP Operating Income Net sales

956,579 956,579 371,973 371,973 -

-

Cost of sales

244,871

25.6%

244,871

25.6%

206,906

55.6%

206,082

55.4%

-

-

Operating wages

365,698

38.2%

365,698

38.2%

40,658

10.9%

40,658

10.9%

-

-

Other operating

164,901

17.3%

164,901

17.3%

54,110

14.6%

32,033

8.6%

-

-

S,G&A

27,193

2.8%

74,752

7.8%

26,381

7.1%

64,707

17.4%

62,984

-

Depreciation and amortization

60,497

6.3%

63,923

6.7%

14,514

3.9%

15,584

4.2%

4,496

-

Impairments

-

0.0%

-

0.0%

-

0.0%

-

0.0%

-

-

Total non-GAAP operating income

93,419

9.8%

42,434

4.4%

29,404

7.9%

12,909

3.5%

(67,480)

-

*Reflects reclassification: $4.4 million of impairment charges from S,G&A to Impairments for Bob Evans Restaurants $18.6 million of shipping and handling costs from S,G&A to Other operating expenses for BEF Foods $4.3 million of marketing costs from S,G&A to Other operating expenses for BEF Foods $0.8 million of freight charges from Other operating expenses to Cost of sales for BEF Foods

All reclassifications made to conform prior year financials with current presentation

44

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Astellas' XTANDI™ (Enzalutamide) Granted European Commission Approval for Use in Additional Recurrent Early Prostate Cancer Treatment Setting

- Mirasol Resources Closes First Tranche of Private Placement

- Atomic Minerals to Proceed with Debt Settlement Transaction

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share