Form 8-K BIOLASE, INC For: Jun 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 8, 2016

BIOLASE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-19627 | 87-0442441 | ||

| (State of Incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) | ||

|

4 Cromwell Irvine, California 92618 (Address of principal executive offices) (Zip Code) | ||||

(949) 361-1200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

On June 8, 2016, David C. Dreyer, Chief Financial Officer of Biolase, Inc. (the “Company”), delivered a presentation at the LD Micro Invitational conference in Los Angeles, California that included a written communication comprised of slides. The slides from the presentation are attached hereto as Exhibit 99.1, and are hereby incorporated by reference.

A copy of the slides will be available for viewing and download at http://www.biolase.com/investors for a period of 30 days.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Presentation material from the LD Micro Summit, dated June 8, 2016.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BIOLASE, INC. | ||||||

| Date: June 8, 2016 | By: | /s/ David C. Dreyer | ||||

| David C. Dreyer | ||||||

| Chief Financial Officer | ||||||

3

Exhibit Index

| Exhibit No. |

Description | |

| 99.1 | Presentation material from the LD Micro Summit, dated June 8, 2016. |

4

Transformational Technology from the World Leader in Dental Lasers Enabling Better Patient Reported Outcomes NASDAQ:BIOL Exhibit 99.1

Statements made during BIOLASE’s presentation and in its representative’s answers to questions at the 6th annual LD Micro Invitational investor conference (the “Conference”) that refer to BIOLASE’s estimated or anticipated future results or other non-historical facts are forward-looking statements, as are any statements its representatives make at the Conference concerning BIOLASE's strategic initiatives, anticipated financial performance and product launches. Attendees at the Conference are cautioned not to place undue reliance on these forward-looking statements, which reflect BIOLASE's current expectations and speak only as of the date of BIOLASE's participation in the Conference. Actual results may differ materially from BIOLASE’s current expectations depending upon a number of factors affecting BIOLASE’s business including, among others, adverse changes in general economic and market conditions, competitive factors, uncertainty of customer acceptance of new product offerings, risks associated with managing the growth of the business, and those other risks and uncertainties that are described, from time-to-time, in the “Risk Factors” section of BIOLASE's annual and quarterly reports filed with the Securities and Exchange Commission. BIOLASE does not undertake any responsibility to revise or update any forward-looking statements made during its participation in the Conference. Safe Harbor Statement

BIOLASE has been clear industry leader with more than 31,000 lasers sold and is best positioned as industry leader going forward Experienced leadership, strategy and plan now in place to achieve sustained growth, positive cash flow, and profitability Turnaround – significant opportunity exists for value creation and shareholder returns Development and distribution agreement with IPG Medical expands access to technology and product lines; yields sizeable clinical and economic benefits Disruptive laser technology that will change the management of highly prevalent yet under-treated dental conditions Substantial benefits to patients and dental practitioners that will increase adoption and utilization of laser dentistry BIOLASE technology’s unmatched versatility enables large potential increases in utilization World Leader in Laser Dentistry, positioned to break through with transformational technology, achieve attractive financial returns

Biolase has a clear purpose, a focused mission, and values that guide the shaping of a high performance culture Purpose: What we do for others - To restore & repair dental anatomy, alleviate pain, and reduce fear and anxiety related to dentistry to improve patient quality of life. Mission: What business are we in - To increase stakeholder value by growing and dominating the global dental laser markets. Values: The high performance culture we are shaping Caring about Patients above all else Serving and supporting Customers is our lifeblood Caring about and for our People and stakeholders Operating with Integrity at all times; doing the right thing Innovating to meeting needs of dental market better than other companies Always Competing to win by a wide margin

Patient Promise: Better Outcomes & Less… Minimally Invasive Dental Microsurgery

Dentist Promise: Better Outcomes & More… Minimally Invasive Dental Microsurgery

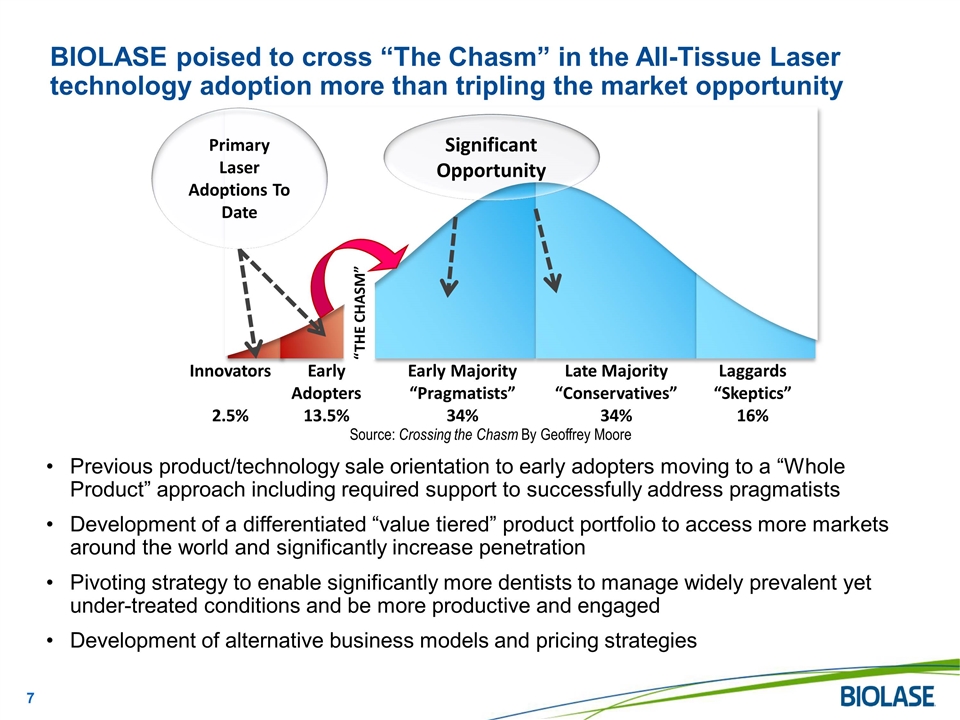

Previous product/technology sale orientation to early adopters moving to a “Whole Product” approach including required support to successfully address pragmatists Development of a differentiated “value tiered” product portfolio to access more markets around the world and significantly increase penetration Pivoting strategy to enable significantly more dentists to manage widely prevalent yet under-treated conditions and be more productive and engaged Development of alternative business models and pricing strategies BIOLASE poised to cross “The Chasm” in the All-Tissue Laser technology adoption more than tripling the market opportunity Source: Crossing the Chasm By Geoffrey Moore Early Adopters 13.5% Early Majority “Pragmatists” 34% Late Majority “Conservatives” 34% Laggards “Skeptics” 16% Significant Opportunity Primary Laser Adoptions To Date Innovators 2.5% “THE CHASM”

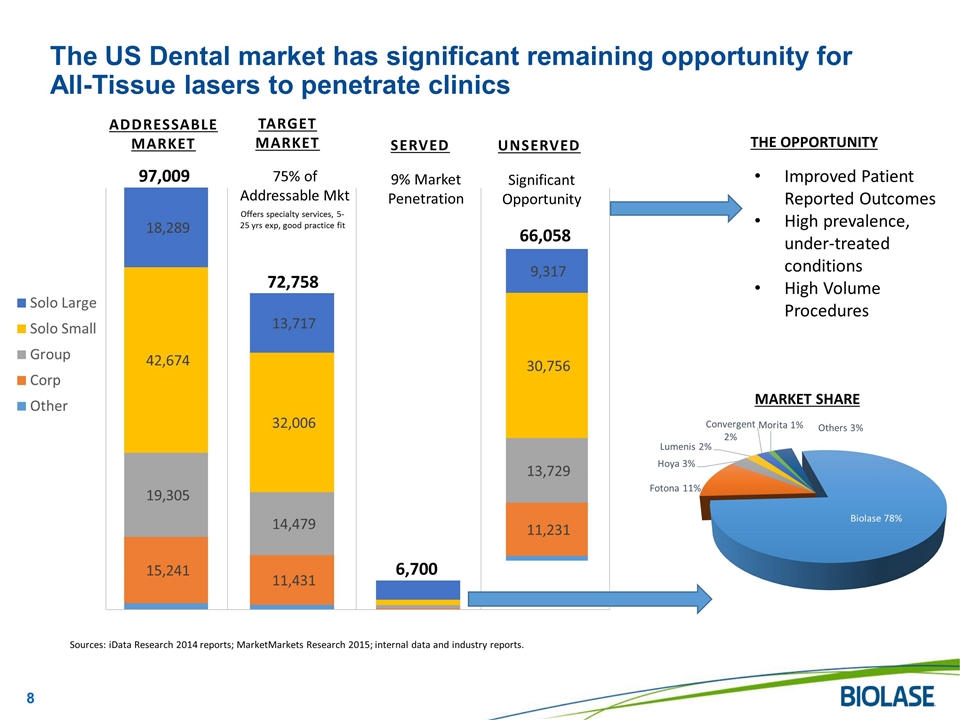

The US Dental market has significant remaining opportunity for All-Tissue lasers to penetrate clinics Improved Patient Reported Outcomes High prevalence, under-treated conditions High Volume Procedures THE OPPORTUNITY ADDRESSABLE MARKET TARGET MARKET SERVED UNSERVED 97,009 72,758 6,700 66,058 75% of Addressable Mkt Offers specialty services, 5-25 yrs exp, good practice fit Sources: iData Research 2014 reports; MarketMarkets Research 2015; internal data and industry reports. MARKET SHARE Significant Opportunity 9% Market Penetration

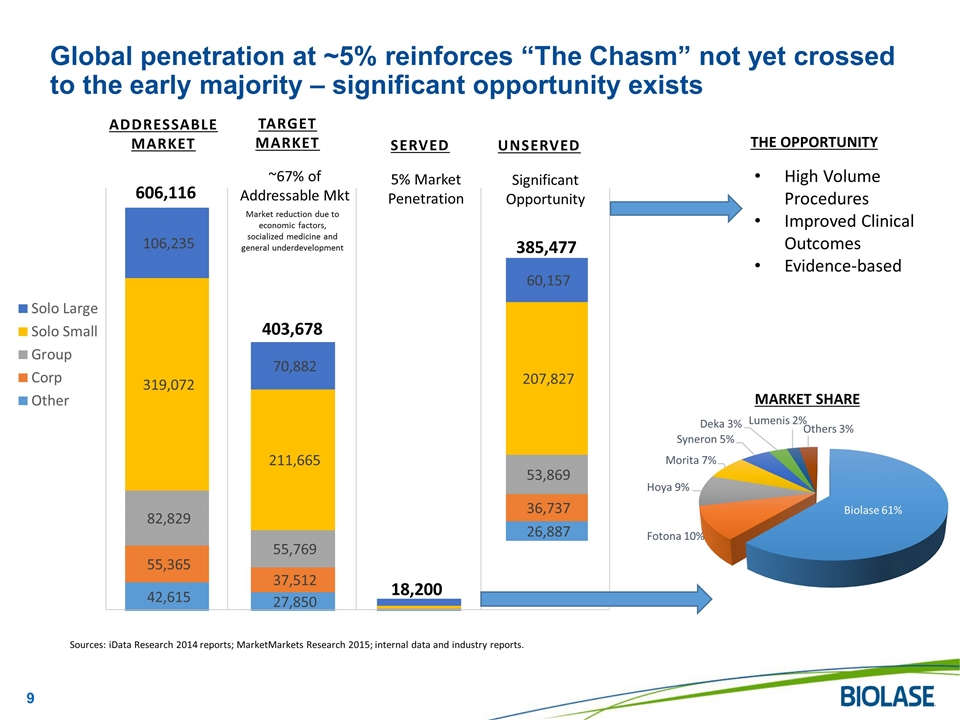

Global penetration at ~5% reinforces “The Chasm” not yet crossed to the early majority – significant opportunity exists High Volume Procedures Improved Clinical Outcomes Evidence-based THE OPPORTUNITY ADDRESSABLE MARKET TARGET MARKET SERVED UNSERVED 606,116 403,678 18,200 385,477 Sources: iData Research 2014 reports; MarketMarkets Research 2015; internal data and industry reports. MARKET SHARE ~67% of Addressable Mkt Significant Opportunity 5% Market Penetration Market reduction due to economic factors, socialized medicine and general underdevelopment

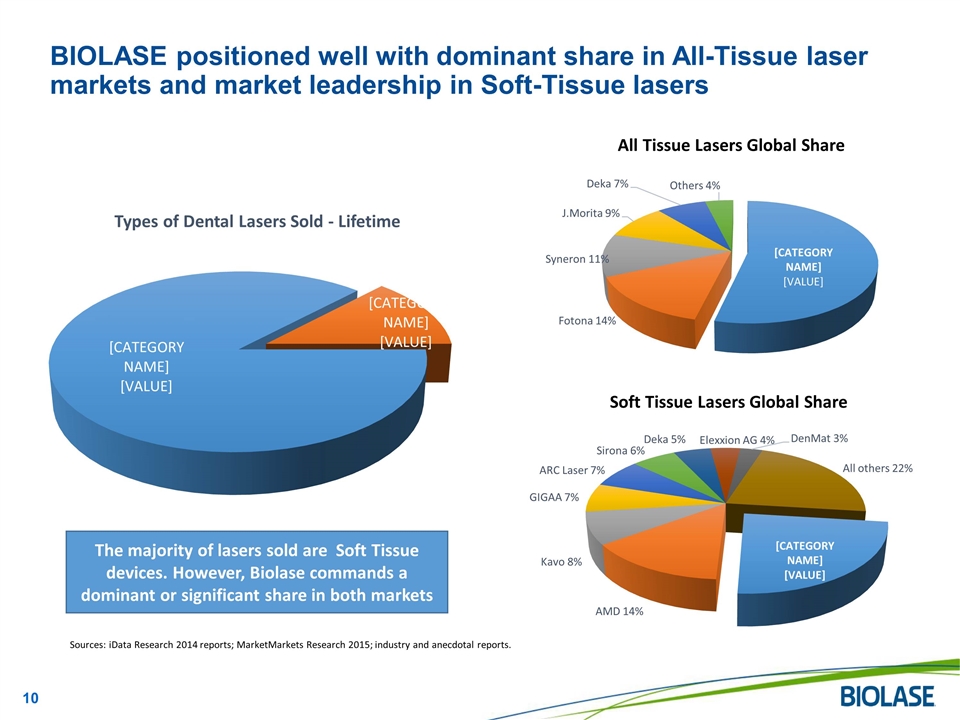

BIOLASE positioned well with dominant share in All-Tissue laser markets and market leadership in Soft-Tissue lasers Soft Tissue Lasers Global Share All Tissue Lasers Global Share The majority of lasers sold are Soft Tissue devices. However, Biolase commands a dominant or significant share in both markets Sources: iData Research 2014 reports; MarketMarkets Research 2015; industry and anecdotal reports.

Historical market revenue trends achieved mid to high single digit CAGR – BIOLASE can achieve mid to high teens CAGR (000s) Sources: iData Research 2014 reports; MarketMarkets Research 2015; industry and anecdotal reports. All Tissue Laser Market - Global Soft Tissue Laser Market - Global Total Dental Laser Market - Global Legend NAM EU ROW TOTAL (000s)

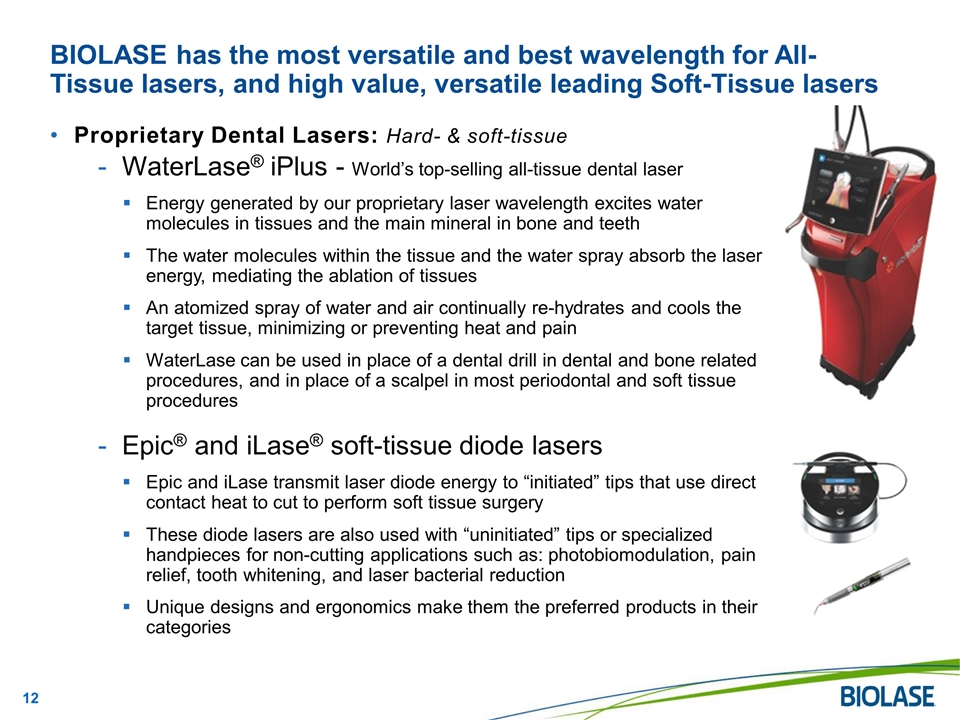

Proprietary Dental Lasers: Hard- & soft-tissue WaterLase® iPlus - World’s top-selling all-tissue dental laser Energy generated by our proprietary laser wavelength excites water molecules in tissues and the main mineral in bone and teeth The water molecules within the tissue and the water spray absorb the laser energy, mediating the ablation of tissues An atomized spray of water and air continually re-hydrates and cools the target tissue, minimizing or preventing heat and pain WaterLase can be used in place of a dental drill in dental and bone related procedures, and in place of a scalpel in most periodontal and soft tissue procedures Epic® and iLase® soft-tissue diode lasers Epic and iLase transmit laser diode energy to “initiated” tips that use direct contact heat to cut to perform soft tissue surgery These diode lasers are also used with “uninitiated” tips or specialized handpieces for non-cutting applications such as: photobiomodulation, pain relief, tooth whitening, and laser bacterial reduction Unique designs and ergonomics make them the preferred products in their categories BIOLASE has the most versatile and best wavelength for All-Tissue lasers, and high value, versatile leading Soft-Tissue lasers

Compelling WaterLase value proposition with many benefits – in process of being made simple and consistent for target segments Better Dentistry Better Patient Reported Outcomes Better ROI and business returns 80 FDA cleared indications, enabling significantly more procedures With 4 or less procedures, can generate significant positive cash flow and a timely pay back Best value in laser dentistry

Two-thirds of 2015 revenue came from laser system sales and 55% the sales were made in the U.S. United States 55% International 45%

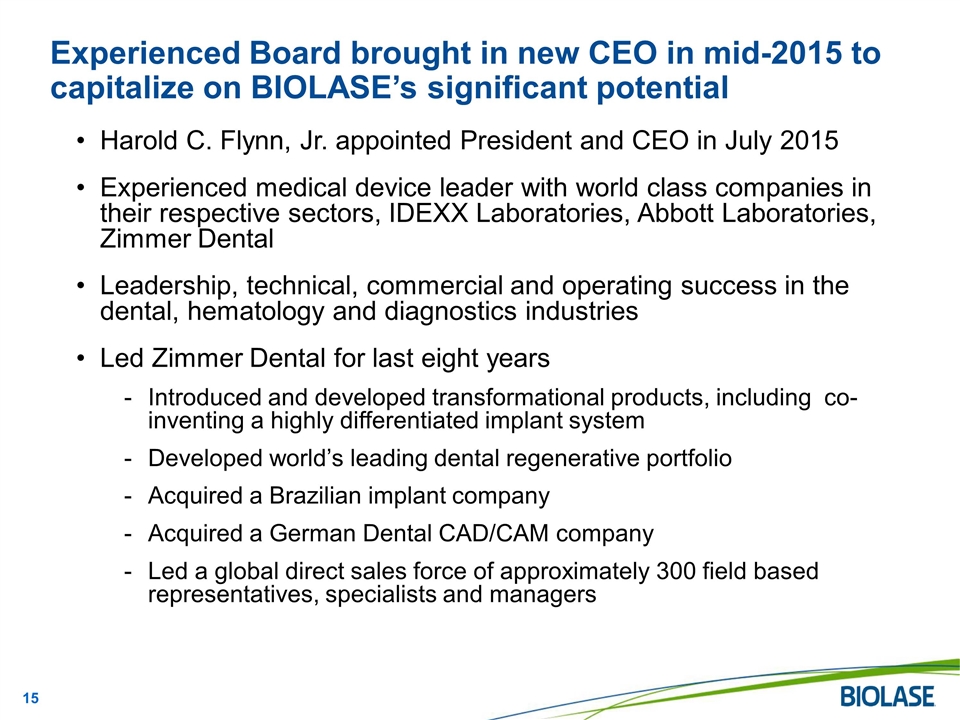

Harold C. Flynn, Jr. appointed President and CEO in July 2015 Experienced medical device leader with world class companies in their respective sectors, IDEXX Laboratories, Abbott Laboratories, Zimmer Dental Leadership, technical, commercial and operating success in the dental, hematology and diagnostics industries Led Zimmer Dental for last eight years Introduced and developed transformational products, including co-inventing a highly differentiated implant system Developed world’s leading dental regenerative portfolio Acquired a Brazilian implant company Acquired a German Dental CAD/CAM company Led a global direct sales force of approximately 300 field based representatives, specialists and managers Experienced Board brought in new CEO in mid-2015 to capitalize on BIOLASE’s significant potential

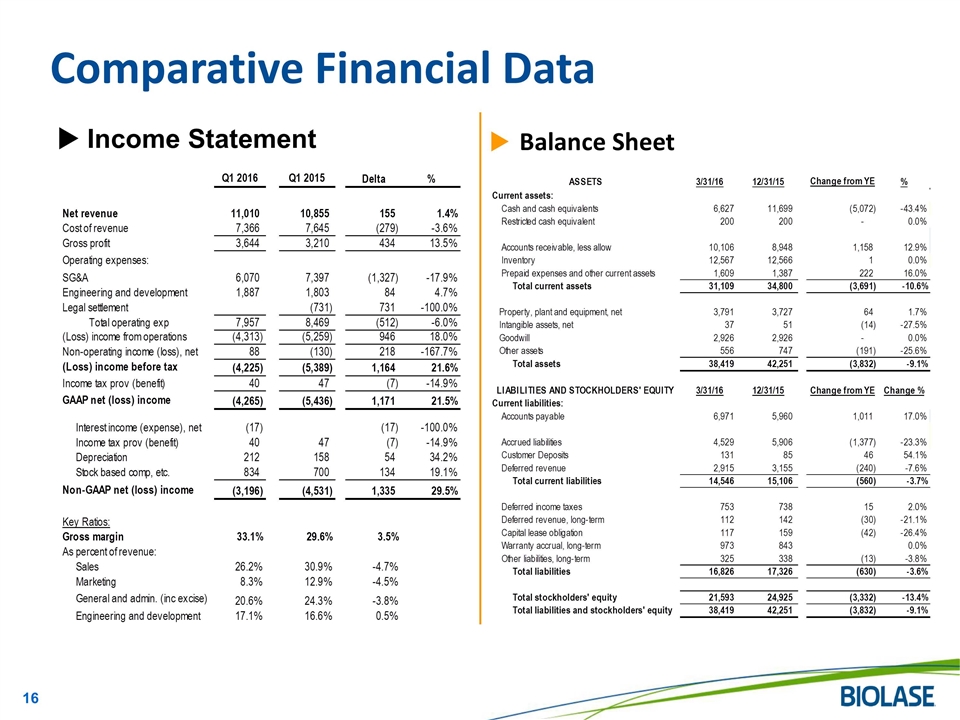

Income Statement Comparative Financial Data Balance Sheet

World leader in dental laser systems having sold more than 31,000 dental laser systems Veteran top management team with successful dental industry and medical device experience leading the turnaround and transformation of BIOLASE Leader in large U.S. and global markets that have low penetration and strong potential for significant future expansion Market leading families of best-in-class dental lasers including the flagship WaterLase iPlus 2.0 all-tissue laser and the EPIC and iLase soft tissue lasers Delivering substantial benefits to patients and dental practitioners that will increase adoption and utilization of laser dentistry New development and distribution agreement with IPG Medical – disruptive technology Strategy and plan in place to achieve sustained growth, positive cash flow, profitability Opportunity for substantial revenue, profitability and valuation upside Summary

Questions and Answers

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Natural Gas ETFs Quickly Spike to Highs

- ContextLogic Completes Sale of Substantially All Operating Assets and Liabilities Associated with Wish to Qoo10

- FendX Announces Corporate Update

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share