Form 8-K BIOLASE, INC For: Jan 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2017

BIOLASE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36385 | 87-0442441 | ||

| (State of Incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

4 Cromwell

Irvine, California 92618

(Address of principal executive offices) (Zip Code)

(949) 361-1200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

On January 9, 2017, Harold C. Flynn, Jr., President and Chief Executive Officer of Biolase, Inc. (the “Company”), will participate in investor presentations at the 35th Annual JP Morgan Healthcare Conference in San Francisco, California that include a written communication comprised of slides. The slides from the presentations are attached hereto as Exhibit 99.1, and are hereby incorporated by reference.

A copy of the slides will be available for viewing and download at http://www.biolase.com/investors for a period of 30 days.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

99.1 Presentation material with investors from the 35th Annual JP Morgan Healthcare Conference, dated January 9, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BIOLASE, INC. | ||||||

| Date: January 9, 2017 | By: | /s/ David C. Dreyer | ||||

| David C. Dreyer | ||||||

| SVP and Chief Financial Officer | ||||||

Exhibit Index

| Exhibit |

Description | |

| 99.1 | Presentation material with investors from the 35th Annual JP Morgan Healthcare Conference, dated January 9, 2017. | |

World Leader in Dental Lasers Transformational Technology Enabling Better Patient Outcomes NASDAQ CM:BIOL San Francisco, January 2017 Exhibit 99.1

Statements made during BIOLASE’s investor meetings in San Francisco being held the week of the 35th Annual JP Morgan Healthcare Conference (the “Meetings”) and its representative’s answers to questions that refer to BIOLASE’s estimated or anticipated future results or other non-historical facts are forward-looking statements, as are any statements its representatives make during the Meetings concerning BIOLASE's strategic initiatives, anticipated financial performance and product launches. Attendees at the Meetings are cautioned not to place undue reliance on these forward-looking statements, which reflect BIOLASE's current expectations and speak only as of the dates of the Meetings. Actual results may differ materially from BIOLASE’s current expectations depending upon a number of factors affecting BIOLASE’s business including, among others, adverse changes in general economic and market conditions, competitive factors, uncertainty of customer acceptance of new product offerings, risks associated with managing the growth of the business, and those other risks and uncertainties that are described, from time-to-time, in the “Risk Factors” section of BIOLASE's annual and quarterly reports filed with the Securities and Exchange Commission. BIOLASE does not undertake any responsibility to revise or update any forward-looking statements made during the Meetings. Safe Harbor Statement

Disrupting dentistry through transformational technology and products, world class education: Turnaround – continuing revenue and profit growth with focus on commercial execution, international performance/expansion, superlative education Strategic pivot to focus on high-value, prevalent and undertreated diseases Industry-leading innovation to increase market share, drive valuation improvement Near Term Catalysts: Expanded portfolio of new products, EPIC PRO, introduced November 30 Leverage Development and Distribution agreement with IPG Medical Leadership team build out & new European leadership New renowned Clinical and Dental Education leadership Landmark Clinical Study Upside Opportunity: Potential for substantial revenue, profit and valuation growth in dental Leveraging IP in adjacent medical laser markets, e.g. Ophthalmology, ENT, etc. Investment Thesis

Experienced Leadership team enables continued progress and transformation of BIOLASE Harold C. Flynn, Jr. President & CEO David Dreyer Chief Financial Officer Michael Roux Vice President, Marketing Dmitri Boutoussov Chief Technology Officer Richard Whipp Vice President, Operations Joseph Rotino Vice President, Regulatory & Quality Assurance Matthew Wilson Vice President, HR Dr. Samuel Low Chief Dental Officer Vice President, Clinical & Dental Affairs William Brown Vice President, Bus. Dev. & International Holger Arens Vice President & Managing Director, EMEA

Broad experience in dentistry, medical lasers, medical device and pharma companies; from start-ups to Fortune 100 companies New CEO, July 2015; Led Zimmer Dental for eight years Introduced transformational products; developed world’s leading dental regenerative portfolio Executed international M&A; led global sales force of over 300 Also experienced medical device leader with IDEXX Laboratories, Abbott Laboratories Chief Dental Officer was President of American Academy of Periodontology, distinguished Professor at Univ. of Florida New European leader with over 15 years of successful dental leadership experience Leadership has developed a significant amount of the intellectual property related to laser dentistry New & Expanding Leadership

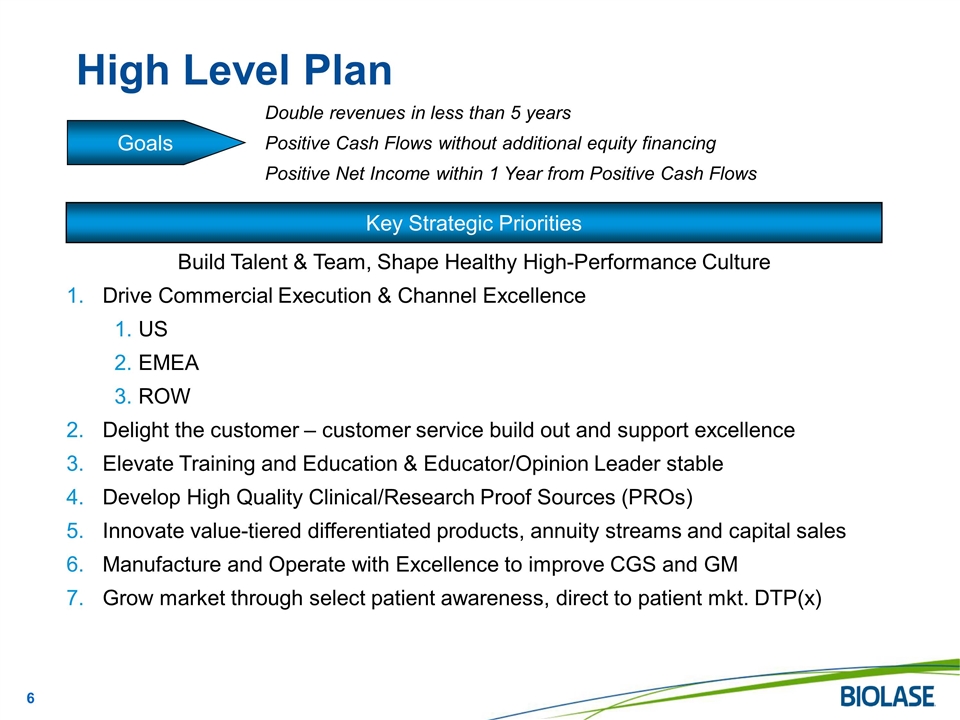

High Level Plan Key Strategic Priorities Goals Build Talent & Team, Shape Healthy High-Performance Culture Drive Commercial Execution & Channel Excellence US EMEA ROW Delight the customer – customer service build out and support excellence Elevate Training and Education & Educator/Opinion Leader stable Develop High Quality Clinical/Research Proof Sources (PROs) Innovate value-tiered differentiated products, annuity streams and capital sales Manufacture and Operate with Excellence to improve CGS and GM Grow market through select patient awareness, direct to patient mkt. DTP(x) Double revenues in less than 5 years Positive Cash Flows without additional equity financing Positive Net Income within 1 Year from Positive Cash Flows 6

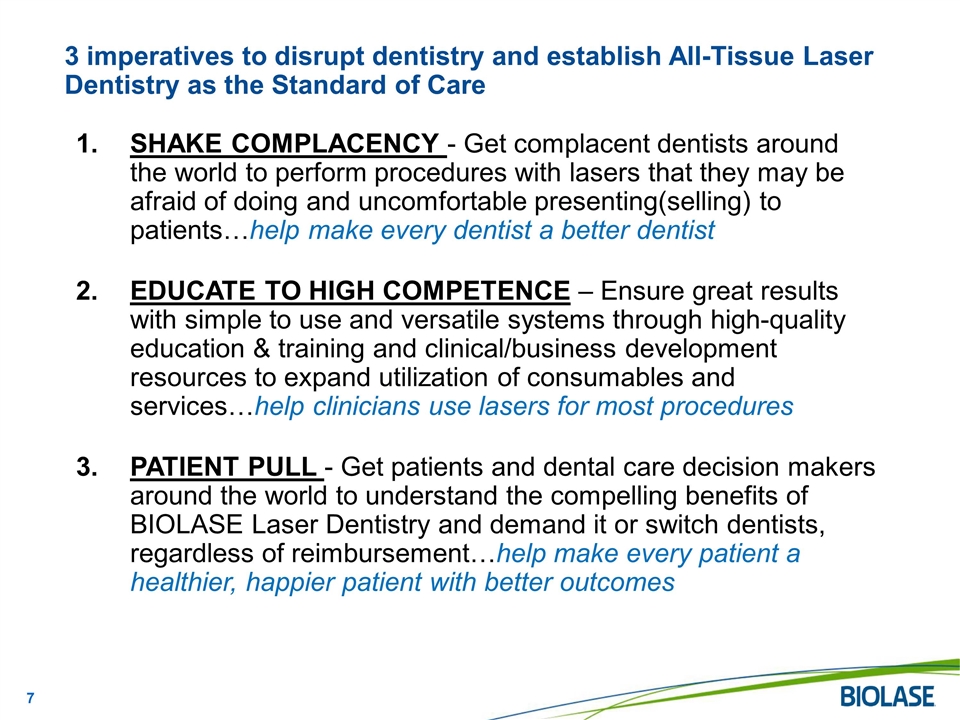

SHAKE COMPLACENCY - Get complacent dentists around the world to perform procedures with lasers that they may be afraid of doing and uncomfortable presenting(selling) to patients…help make every dentist a better dentist EDUCATE TO HIGH COMPETENCE – Ensure great results with simple to use and versatile systems through high-quality education & training and clinical/business development resources to expand utilization of consumables and services…help clinicians use lasers for most procedures PATIENT PULL - Get patients and dental care decision makers around the world to understand the compelling benefits of BIOLASE Laser Dentistry and demand it or switch dentists, regardless of reimbursement…help make every patient a healthier, happier patient with better outcomes 3 imperatives to disrupt dentistry and establish All-Tissue Laser Dentistry as the Standard of Care 7

Laser Dentistry addresses challenges facing today’s dentists as described by the ADA, CDC, other professional organizations Seeking Better Patient Reported Outcomes With More Competition, Less Busy and Become Bored Missing Opportunity To Treat Earlier and Make More Money Average Pay Decreasing Over Last 10 Years Dentistry More Competitive – Need to Stand Out Patients Becoming Consumers and “Review” More Increasing Pressure from a Profession in Transition – What’s Next?

More than 60,000,000 people have gum disease, and health risk of oral-systemic connection in U.S. alone Under-diagnosed, Under-treated, Under-managed Waterlase iPlus Home Screen Significant Growth Opportunity

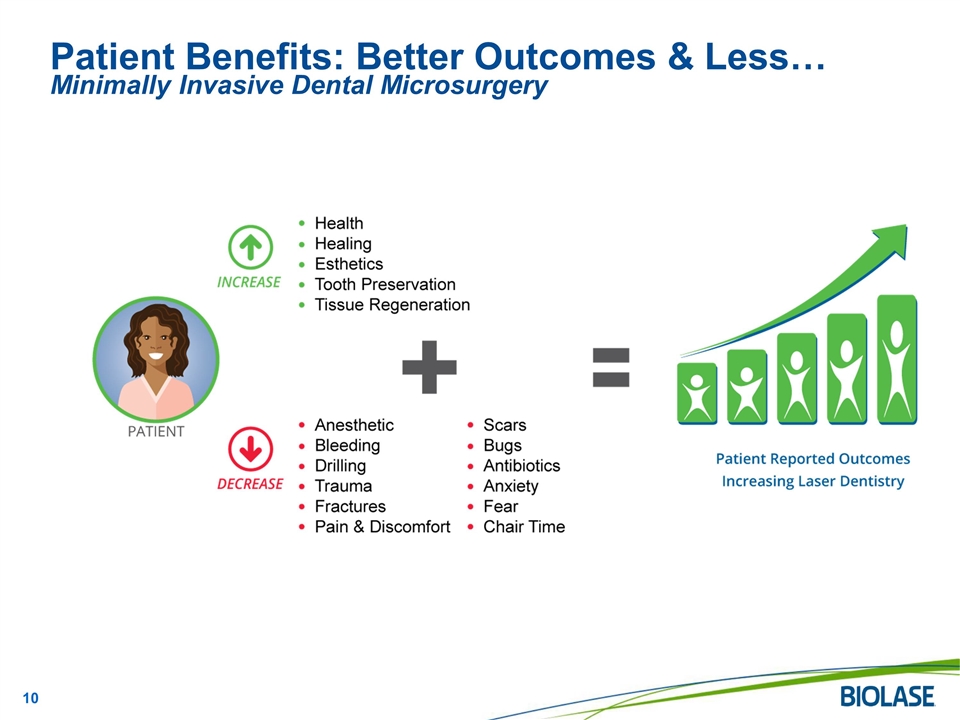

Patient Benefits: Better Outcomes & Less… Minimally Invasive Dental Microsurgery

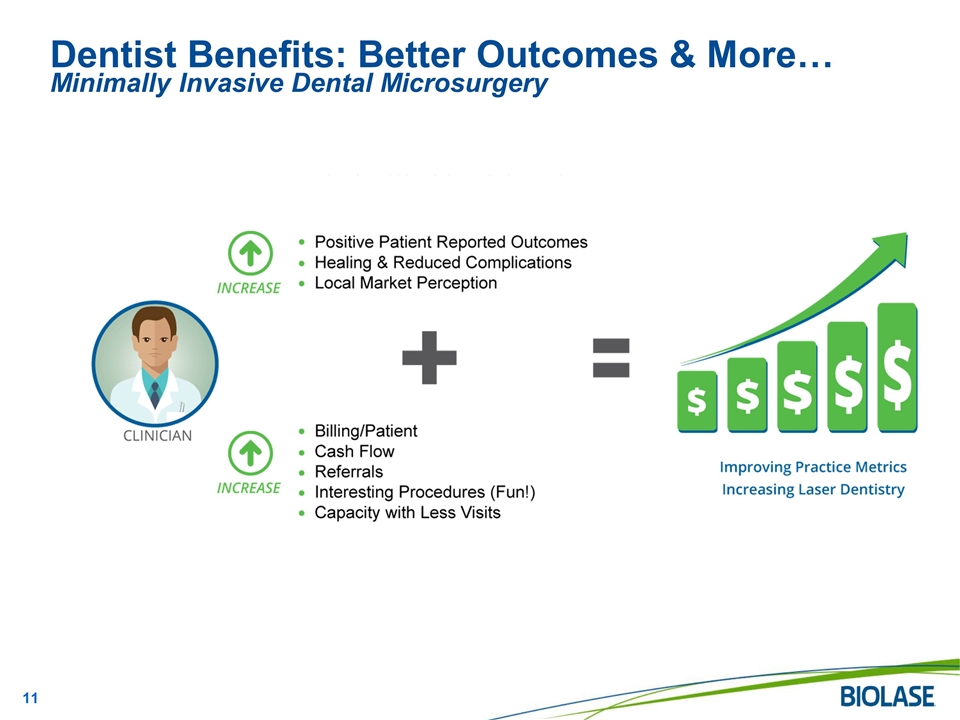

Dentist Benefits: Better Outcomes & More… Minimally Invasive Dental Microsurgery

New! – Most powerful and capable diode dental laser ever Best in class speed, comfort, and precision cutting FDA 510(k) pending Leverages IPG Medical technology A growing full-spectrum portfolio of laser systems and procedural consumables World’s Best selling All-Tissue dental laser- 80 FDA Cleared indications Replaces drill with substantial reduced need for anesthesia for teeth & bone Replaces scalpel for minimally invasive, minimally bleeding microsurgery for soft tissues

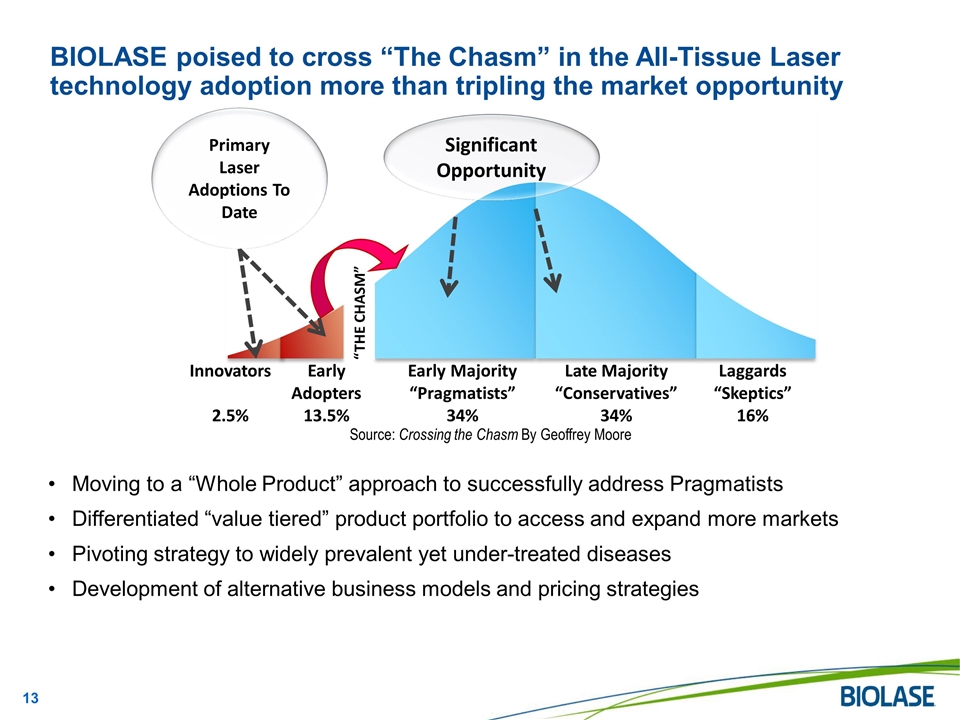

Moving to a “Whole Product” approach to successfully address Pragmatists Differentiated “value tiered” product portfolio to access and expand more markets Pivoting strategy to widely prevalent yet under-treated diseases Development of alternative business models and pricing strategies BIOLASE poised to cross “The Chasm” in the All-Tissue Laser technology adoption more than tripling the market opportunity Source: Crossing the Chasm By Geoffrey Moore Early Adopters 13.5% Early Majority “Pragmatists” 34% Late Majority “Conservatives” 34% Laggards “Skeptics” 16% Significant Opportunity Primary Laser Adoptions To Date Innovators 2.5% “THE CHASM”

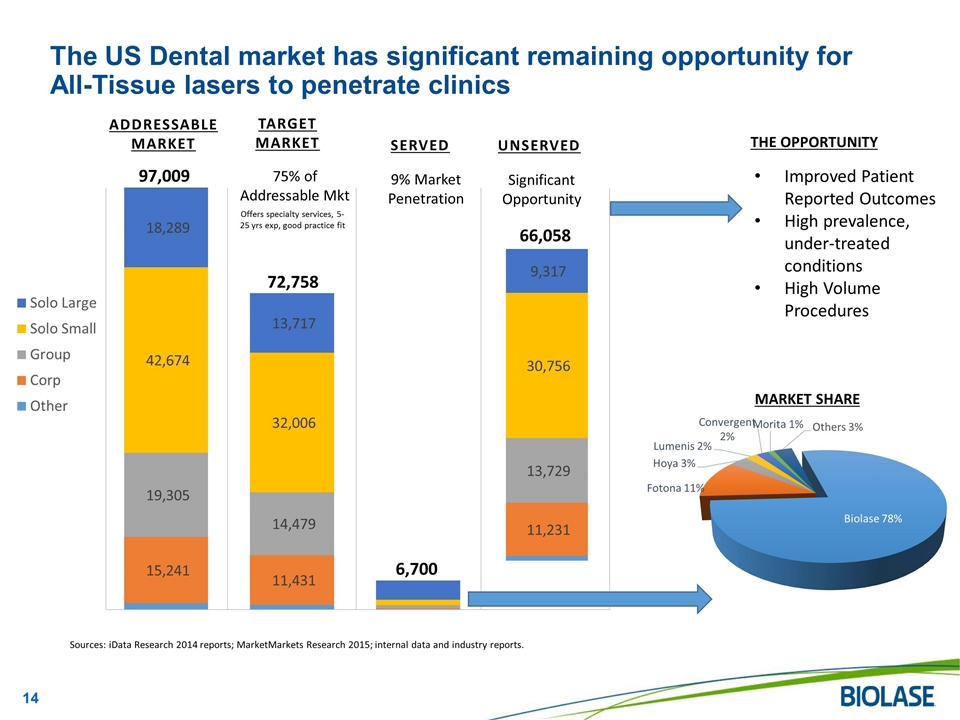

The US Dental market has significant remaining opportunity for All-Tissue lasers to penetrate clinics Improved Patient Reported Outcomes High prevalence, under-treated conditions High Volume Procedures THE OPPORTUNITY ADDRESSABLE MARKET TARGET MARKET SERVED UNSERVED 97,009 72,758 6,700 66,058 75% of Addressable Mkt Offers specialty services, 5-25 yrs exp, good practice fit Sources: iData Research 2014 reports; MarketMarkets Research 2015; internal data and industry reports. MARKET SHARE Significant Opportunity 9% Market Penetration

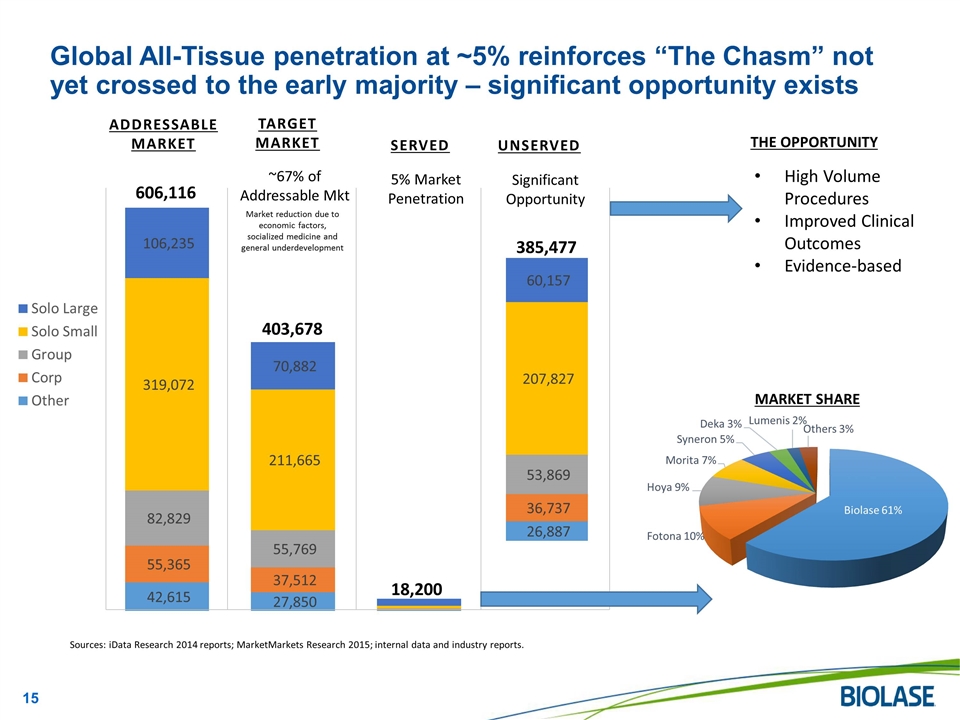

Global All-Tissue penetration at ~5% reinforces “The Chasm” not yet crossed to the early majority – significant opportunity exists High Volume Procedures Improved Clinical Outcomes Evidence-based THE OPPORTUNITY ADDRESSABLE MARKET TARGET MARKET SERVED UNSERVED 606,116 403,678 18,200 385,477 Sources: iData Research 2014 reports; MarketMarkets Research 2015; internal data and industry reports. MARKET SHARE ~67% of Addressable Mkt Significant Opportunity 5% Market Penetration Market reduction due to economic factors, socialized medicine and general underdevelopment

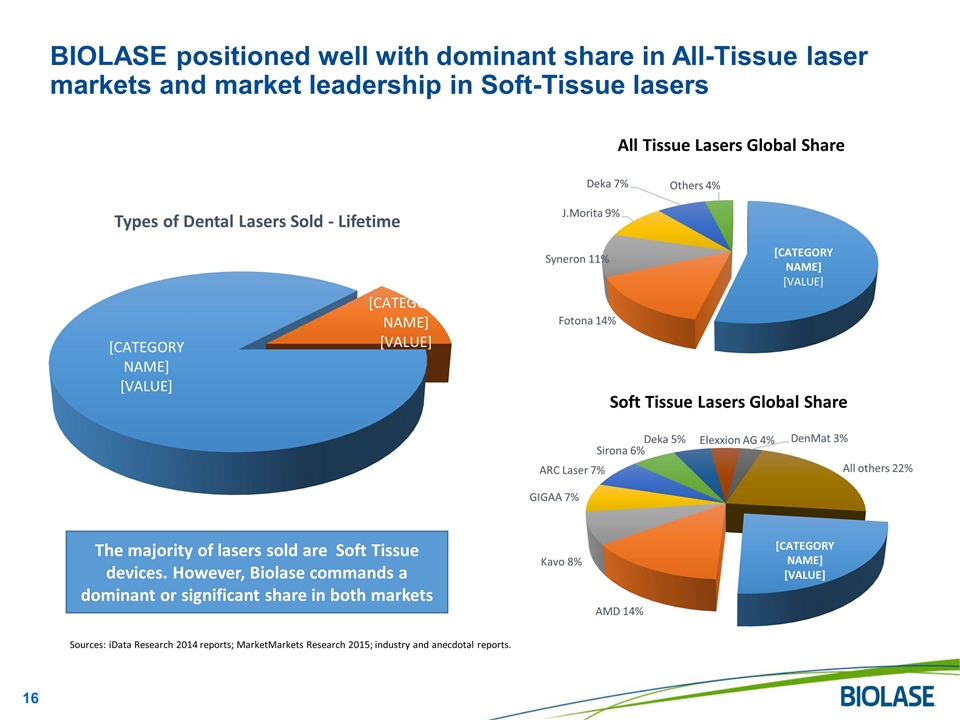

BIOLASE positioned well with dominant share in All-Tissue laser markets and market leadership in Soft-Tissue lasers Soft Tissue Lasers Global Share All Tissue Lasers Global Share The majority of lasers sold are Soft Tissue devices. However, Biolase commands a dominant or significant share in both markets Sources: iData Research 2014 reports; MarketMarkets Research 2015; industry and anecdotal reports.

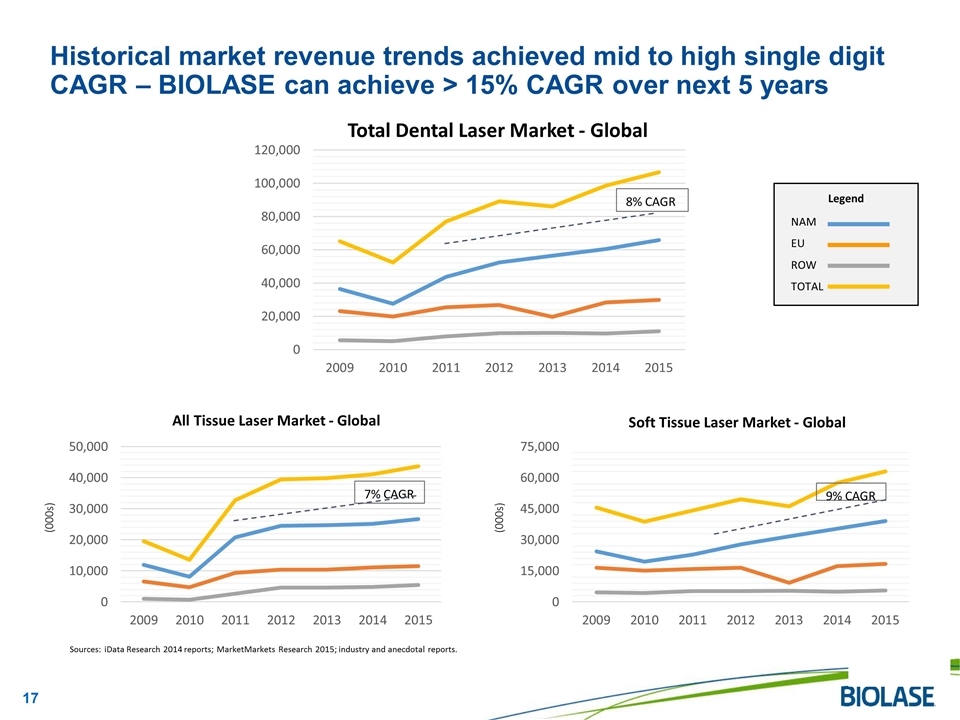

Historical market revenue trends achieved mid to high single digit CAGR – BIOLASE can achieve > 15% CAGR over next 5 years (000s) Sources: iData Research 2014 reports; MarketMarkets Research 2015; industry and anecdotal reports. All Tissue Laser Market - Global Soft Tissue Laser Market - Global Total Dental Laser Market - Global Legend NAM EU ROW TOTAL (000s)

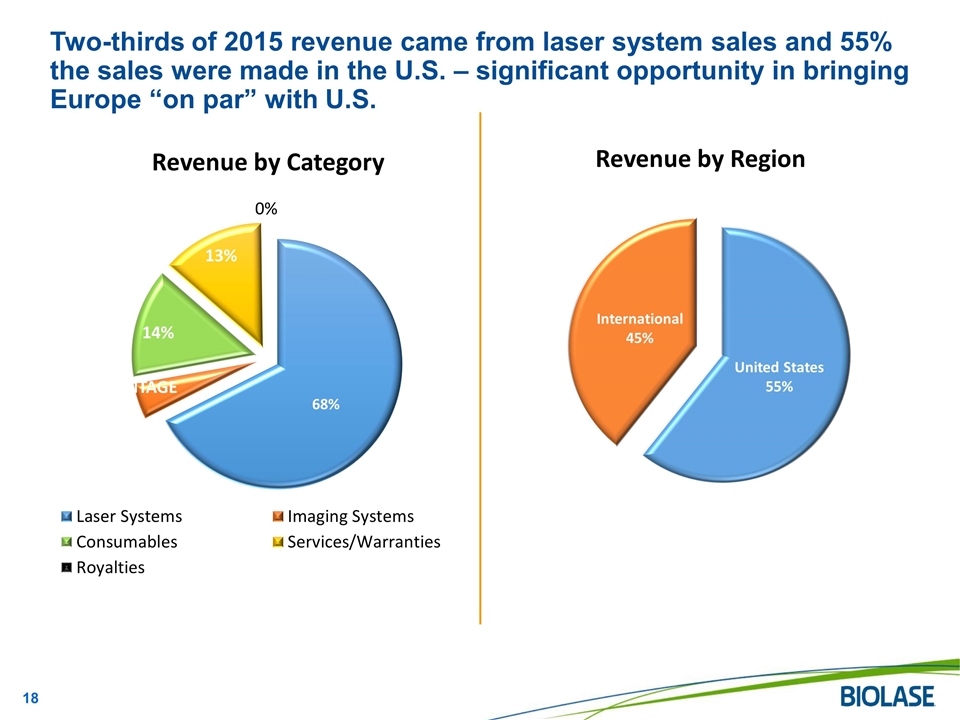

Two-thirds of 2015 revenue came from laser system sales and 55% the sales were made in the U.S. – significant opportunity in bringing Europe “on par” with U.S. United States 55% International 45%

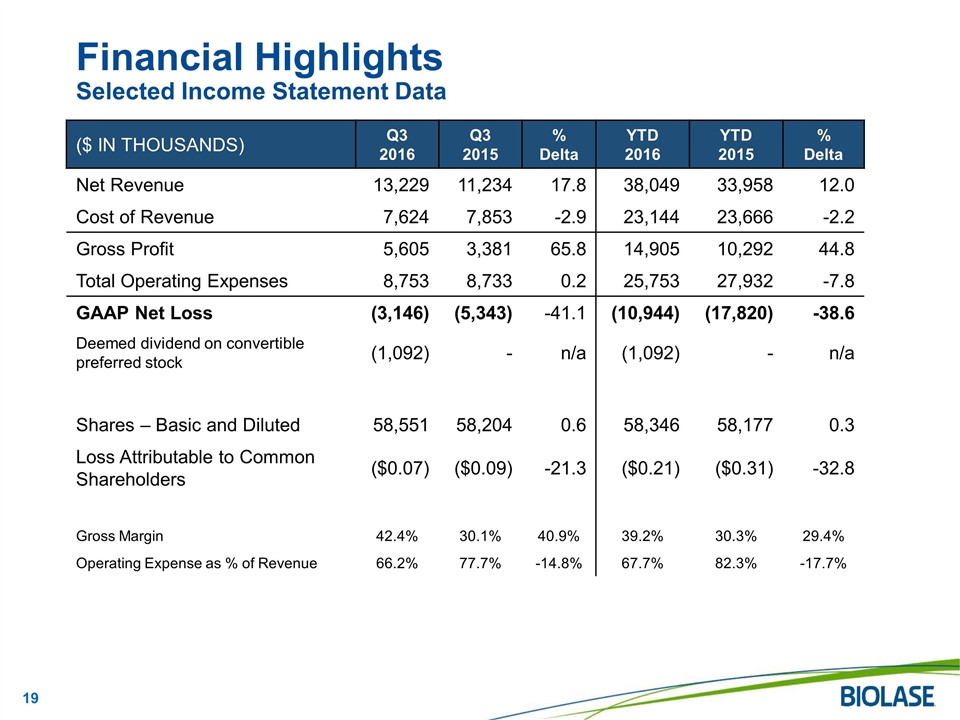

($ IN THOUSANDS) Q3 2016 Q3 2015 % Delta YTD 2016 YTD 2015 % Delta Net Revenue 13,229 11,234 17.8 38,049 33,958 12.0 Cost of Revenue 7,624 7,853 -2.9 23,144 23,666 -2.2 Gross Profit 5,605 3,381 65.8 14,905 10,292 44.8 Total Operating Expenses 8,753 8,733 0.2 25,753 27,932 -7.8 GAAP Net Loss (3,146) (5,343) -41.1 (10,944) (17,820) -38.6 Deemed dividend on convertible preferred stock (1,092) - n/a (1,092) - n/a Shares – Basic and Diluted 58,551 58,204 0.6 58,346 58,177 0.3 Loss Attributable to Common Shareholders ($0.07) ($0.09) -21.3 ($0.21) ($0.31) -32.8 Gross Margin 42.4% 30.1% 40.9% 39.2% 30.3% 29.4% Operating Expense as % of Revenue 66.2% 77.7% -14.8% 67.7% 82.3% -17.7% Financial Highlights Selected Income Statement Data

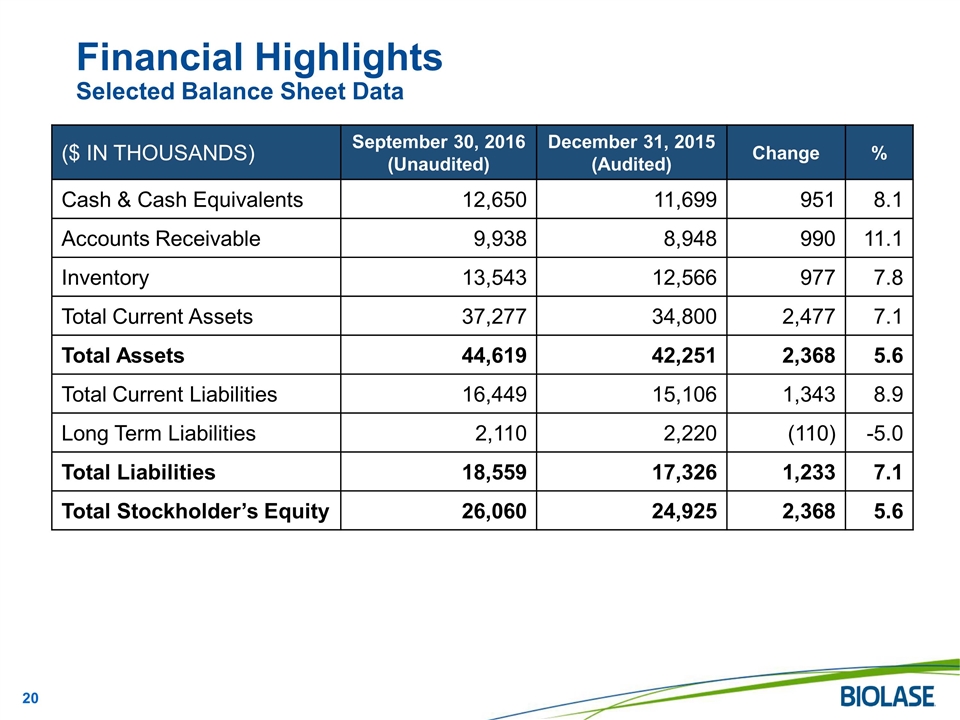

($ IN THOUSANDS) September 30, 2016 (Unaudited) December 31, 2015 (Audited) Change % Cash & Cash Equivalents 12,650 11,699 951 8.1 Accounts Receivable 9,938 8,948 990 11.1 Inventory 13,543 12,566 977 7.8 Total Current Assets 37,277 34,800 2,477 7.1 Total Assets 44,619 42,251 2,368 5.6 Total Current Liabilities 16,449 15,106 1,343 8.9 Long Term Liabilities 2,110 2,220 (110) -5.0 Total Liabilities 18,559 17,326 1,233 7.1 Total Stockholder’s Equity 26,060 24,925 2,368 5.6 Financial Highlights Selected Balance Sheet Data

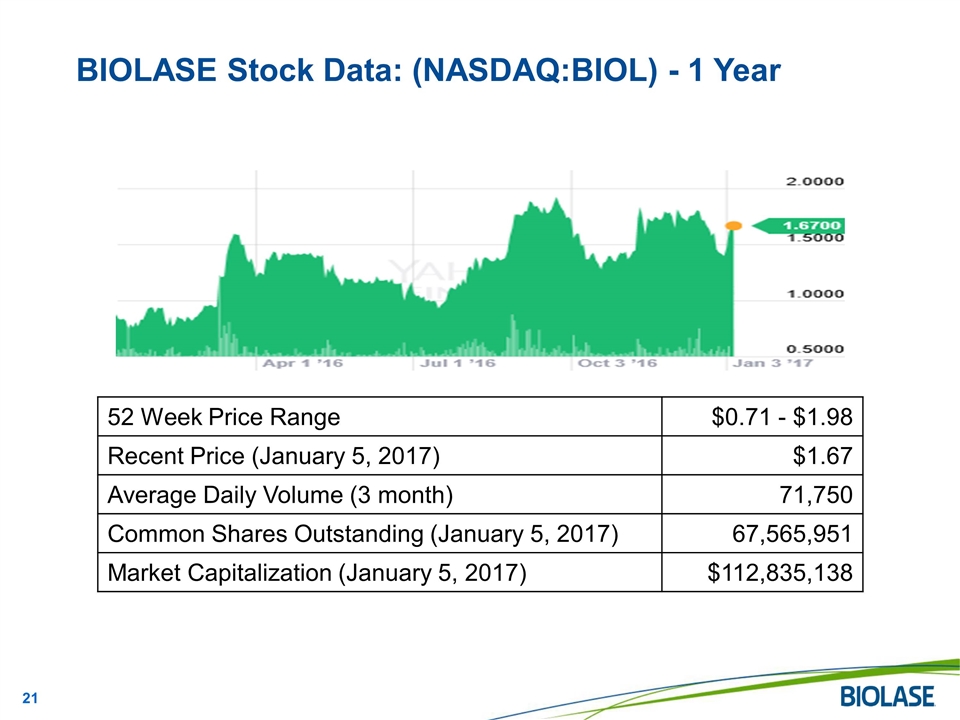

BIOLASE Stock Data: (NASDAQ: BIOL) - 1 Year 52 Week Price Range $0.71 - $1.98 Recent Price (January 5, 2017) $1.67 Average Daily Volume (3 month) 71,750 Common Shares Outstanding (January 5, 2017) 67,565,951 Market Capitalization (January 5, 2017) $112,835,138

World leader in dental laser systems having sold >32,000 dental laser systems Veteran top management team with successful dental industry and medical device experience leading the turnaround and transformation of BIOLASE Disrupting dentistry establishing new standards of care for under-managed diseases Catalyzed by new products developed for the pragmatic every-day dentist Substantial benefits to patients and dental practitioners that will increase adoption and utilization of laser dentistry Strategy & Plan in place to double sales, achieve positive cash flow & profitability Opportunity for substantial revenue, profitability and valuation upside Summary

Questions and Answers

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Natural Gas ETFs Quickly Spike to Highs

- Motlow State Community College Expands Accessibility With the Addition of YuJa Panorama Digital Accessibility Platform to Its Ed-Tech Tools

- Voices for Humanity Bears Witness to Panama's Moral Resurgence With Giselle Lima

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share