Form 8-K BANC OF CALIFORNIA, INC. For: Oct 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 18, 2016

BANC OF CALIFORNIA, INC.

(Exact name of registrant as specified in its charter)

| Maryland | 001-35522 | 04-3639825 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

| 18500 Von Karman Avenue, Suite 1100, Irvine, California | 92612 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (855) 361-2262

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On October 19, 2016, Banc of California, Inc. (the “Company”) issued a press release announcing its 2016 third quarter financial results. The Company also announced that it has accelerated the date of its conference call to discuss these third quarter financial results to Wednesday, October 19, 2016 at 7:00 a.m. Pacific Time. Interested parties may attend the conference call by dialing 888-317-6003, and referencing event code 8186667. A live audio webcast will be available through the webcast link to be posted on the Company’s Investor Relations website at www.bancofcal.com/investor.

Copies of the press release and presentation materials are attached to this report as Exhibits 99.1 and 99.2 and are incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On October 18, 2016, the Company issued a press release relating to an anonymous article posted on a financial blog announcing that the Boards of Directors of the Company, and its wholly-owned subsidiary, Banc of California, National Association, are aware of the allegations in the article posted on Seeking Alpha, Ltd.

By letter dated October 18, 2016, Winston & Strawn, LLP responded to the article in a letter to Seeking Alpha, Ltd. demanding removal and retraction of the article as constituting reckless and defamatory libel per se.

Copies of the press release and the letter from Winston & Strawn, LLP to Seeking Alpha, Ltd. are attached to this report as Exhibits 99.3 and 99.4 and are incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information included in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Nor shall such information be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Item 8.01 Other Events.

On October 18, 2016, the Company also announced that its Board of Directors has approved a share buyback program under Rule 10b-18 authorizing the Company to buy back, from time to time during the 12 months ending on October 18, 2017, an aggregate amount representing up to 10% of the Company’s currently outstanding common shares.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are necessarily subject to risk and uncertainty and actual results could differ materially from those anticipated due to various factors, including those set forth from time to time in the documents filed or furnished by Banc of California, Inc. with the Securities and Exchange Commission. You should not place undue reliance on forward-looking statements and Banc of California, Inc. undertakes no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| 99.1 | Banc of California, Inc. Press Release, dated October 19, 2016. | |

| 99.2 | Banc of California, Inc. Earnings Conference Call Presentation materials, dated October 19, 2016. | |

| 99.3 | Banc of California, Inc. Press Release, dated October 18, 2016. | |

| 99.4 | Letter (without exhibit) from Winston & Strawn, LLP to Seeking Alpha, Ltd., dated October 18, 2016. | |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BANC OF CALIFORNIA, INC. | ||||||

| October 19, 2016 | /s/ John C. Grosvenor | |||||

| John C. Grosvenor | ||||||

| Executive Vice President, General Counsel and | ||||||

| Corporate Secretary | ||||||

4

EXHIBIT INDEX

| Number |

Description | |

| 99.1 | Banc of California, Inc. Press Release, dated October 19, 2016. | |

| 99.2 | Banc of California, Inc. Earnings Conference Call Presentation materials, dated October 19, 2016. | |

| 99.3 | Banc of California, Inc. Press Release, dated October 18, 2016. | |

| 99.4 | Letter (without exhibit) from Winston & Strawn, LLP to Seeking Alpha, Ltd., dated October 18, 2016. | |

5

Exhibit 99.1

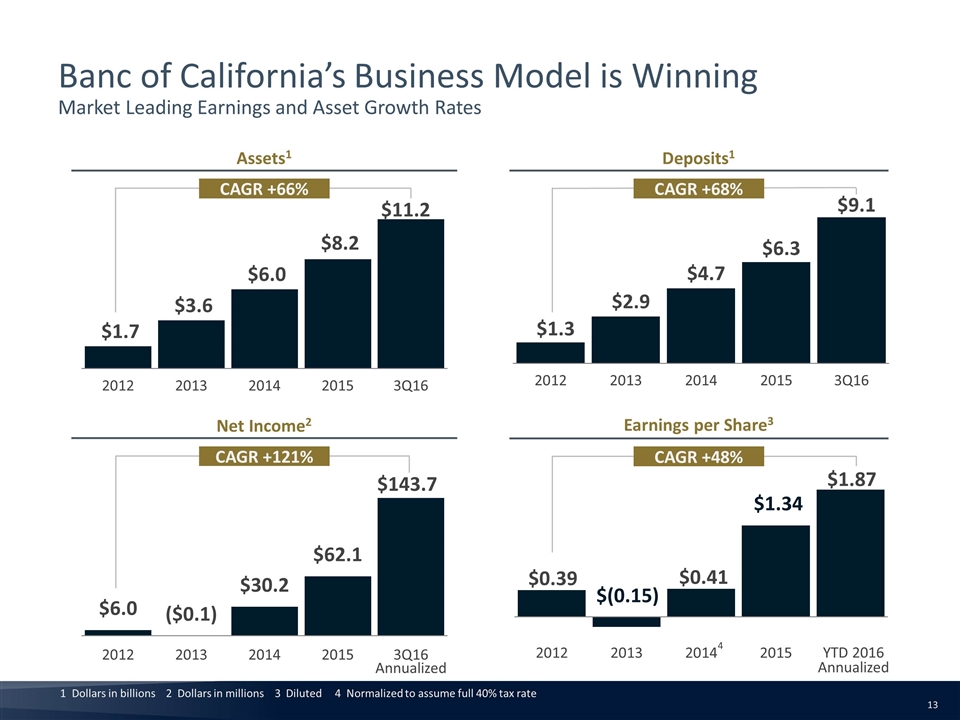

Banc of California Reports Record

Third Quarter Earnings

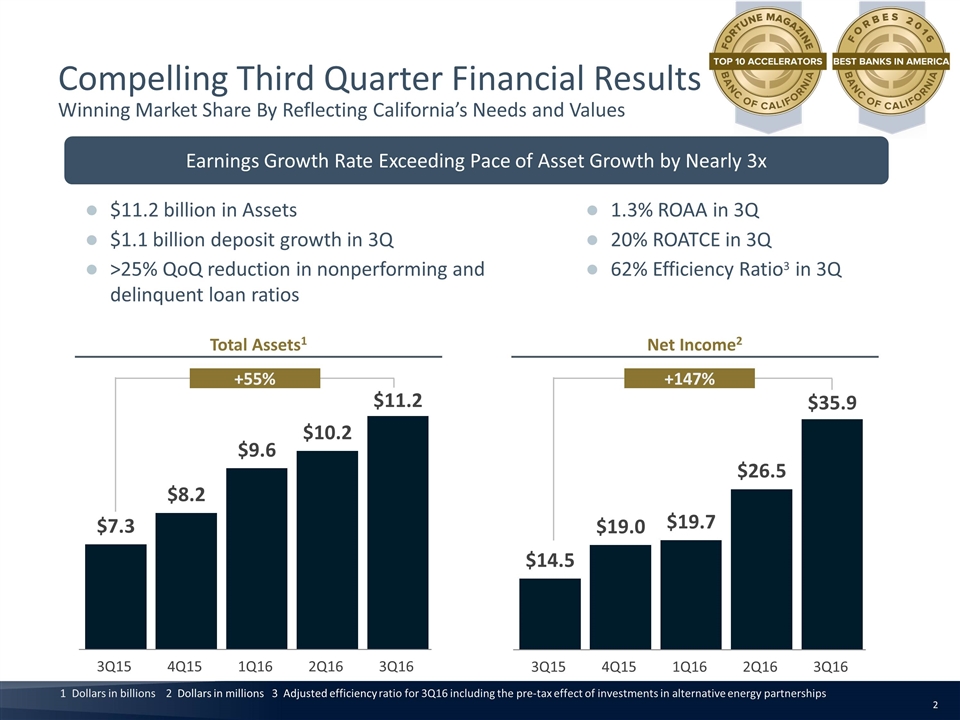

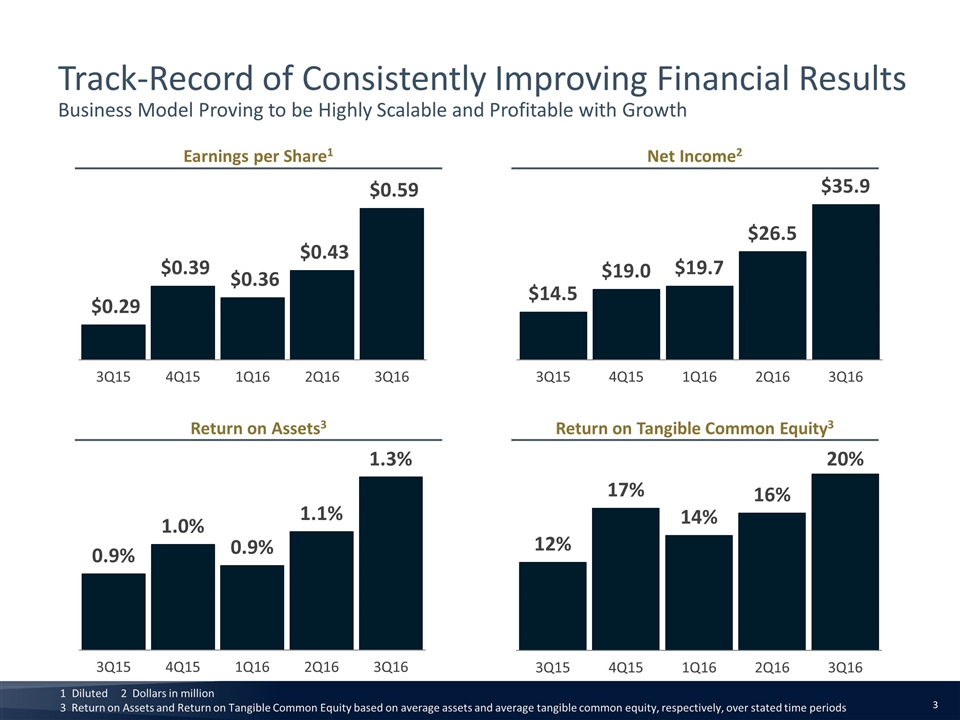

IRVINE, Calif., (October 19, 2016) –Banc of California, Inc. (NYSE: BANC) today reported record quarterly net income of $35.9 million for the third quarter of 2016, resulting in earnings per share of $0.59 for the quarter, fully diluted. Third quarter net income increased 147% compared to the third quarter of 2015. Net income available to common shareholders for the third quarter was $30.8 million, an increase of 168% compared to the third quarter of 2015.

Highlights for the quarter included:

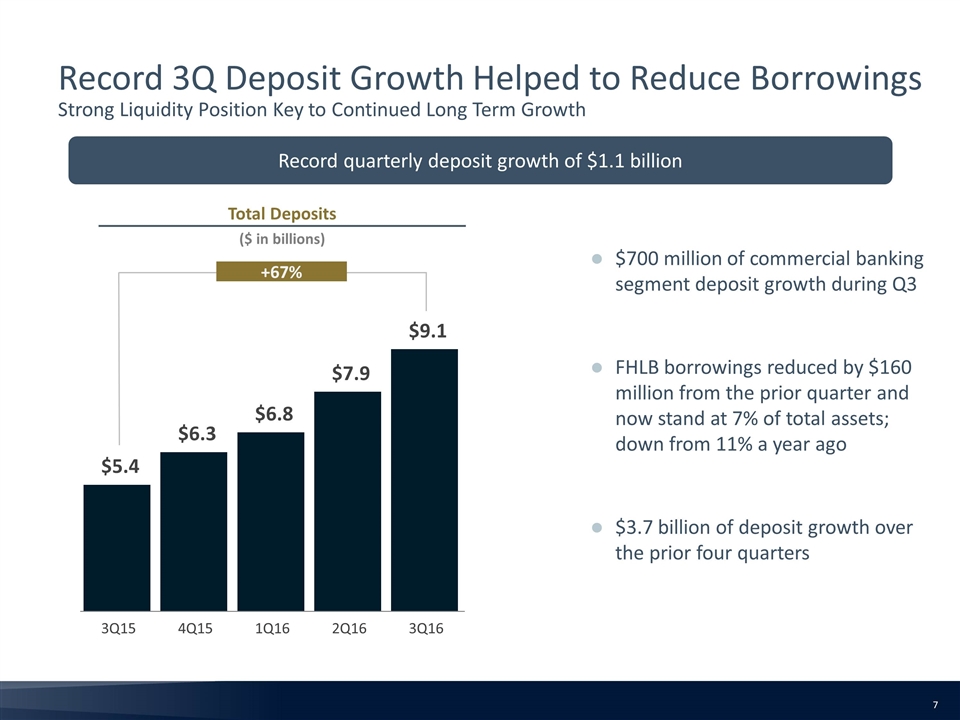

| • | Record quarterly deposit growth of $1.1 billion, or 15%, and annual deposit growth of $3.7 billion, or 67%. |

| • | Quarterly loan production of $2.6 billion, driven by quarterly commercial banking segment loan and lease originations of $1.1 billion, an increase of 44% from a year ago. |

| • | Held for investment loan growth of $333 million for the third quarter, an increase of $1.8 billion, or 39% from a year ago. |

| • | The Company’s return on average assets for the quarter was 1.3% and its return on average tangible common equity for the quarter was 19.5%. |

The Company finished the quarter with consolidated assets totaling $11.2 billion, an increase of $1.1 billion, or 10%, compared to the prior quarter, and an increase of $4.0 billion, or 55%, compared to a year ago.

“Our third quarter financial performance showcases the strong credit discipline and growing earnings power of our franchise,” said Steven Sugarman, Chairman and Chief Executive Officer of Banc of California. “We remain focused on ensuring that as we grow, we maintain the controls, culture and values that are making Banc of California great. We continue to see meaningful opportunities to capture market share by empowering California through its diverse businesses, entrepreneurs and communities.”

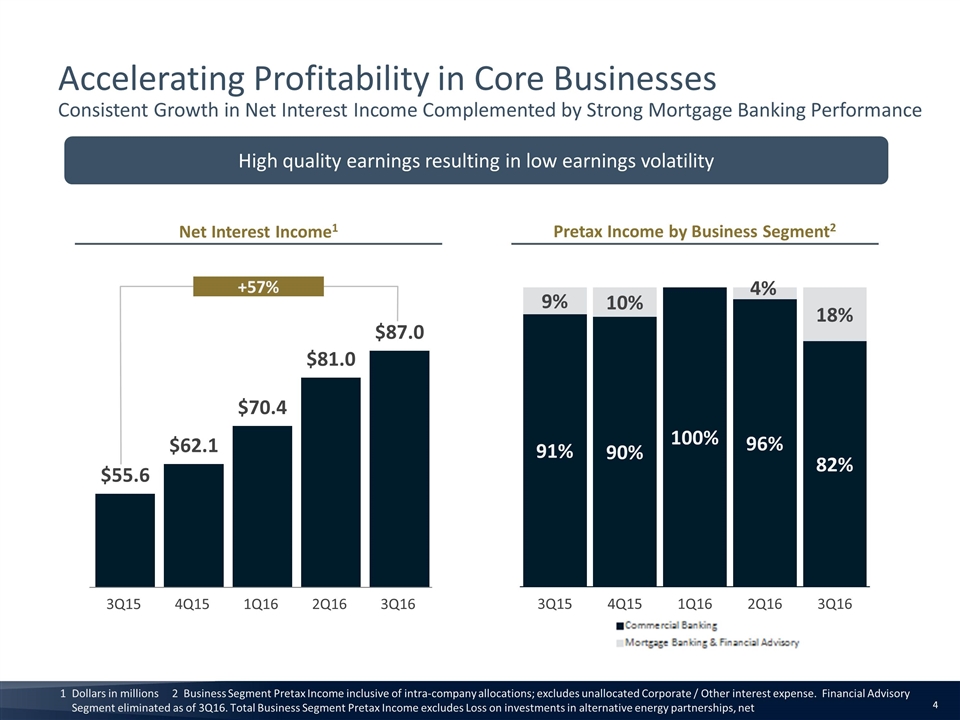

During the quarter, Banc of California grew its recurring net interest income by $5.9 million, or 7% from the prior quarter, grew total deposits by $1.1 billion, increased held for investment loans by $333 million, or 5% from the prior quarter and reduced FHLB borrowings by $160 million or 17% from the prior quarter.

“We continue to see growth in assets, deposits and loans across our business units. Our consistent progress has now resulted in our franchise meeting or exceeding all of our stated financial targets for 2016, including return on tangible common equity over 15% and return on assets over 1%,” said Francisco Turner, Chief Strategy Officer of Banc of California.

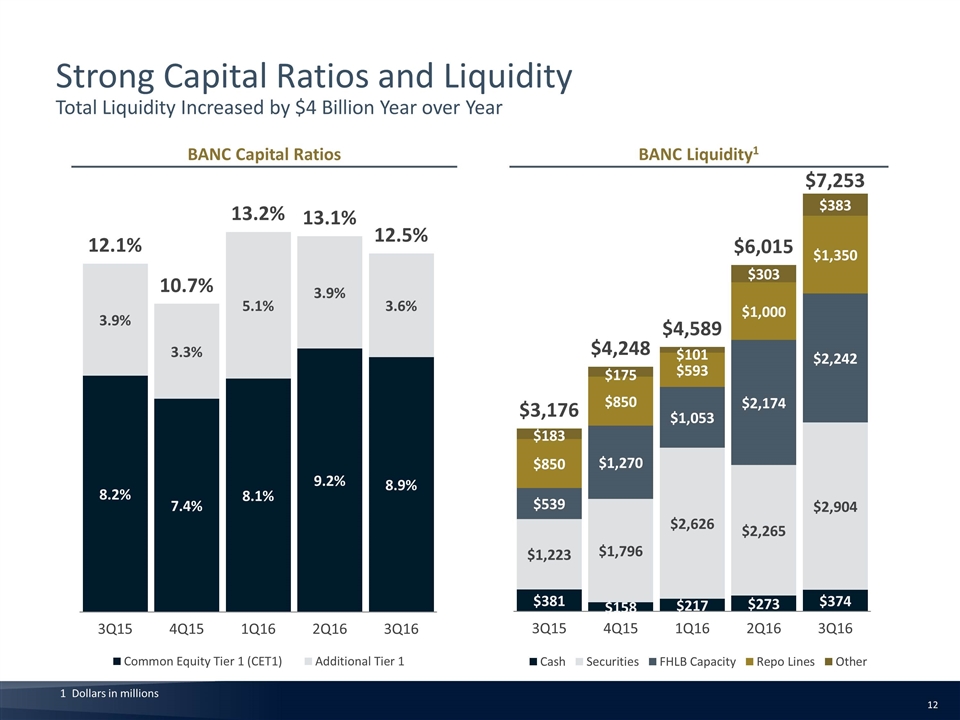

“We have built and strengthened our balance sheet and liquidity position, supported by the strong deposit inflows we continued to experience in the third quarter,” said James McKinney, Chief Financial Officer of Banc of California. “We maintain a strong capital position and have implemented numerous sources of contingent capital including our increased holding company line of credit. As of the end of the third quarter, we now maintain over $7 billion of contingent liquidity to support Banc of California’s balance sheet and to adequately serve all of the diverse needs of our clients. I could not be prouder of the success we have made in ensuring a strong and durable balance sheet with the best possible liquidity to withstand diverse market conditions.”

The Company also announced that it has accelerated the date of its conference call to discuss third quarter financial results to Wednesday, October 19, 2016 at 7:00 a.m. Pacific Time (PT). Interested parties are welcome to attend the conference call by dialing 888-317-6003, and referencing event code 8186667. A live audio webcast will also be available and the webcast link will be posted on the Company’s Investor Relations website at www.bancofcal.com/investor. The slide presentation for the call will also be available on the Company’s Investor Relations website prior to the call.

18500 Von Karman Ave. • Suite 1100 • Irvine, CA 92612 • (949) 236-5250 • www.bancofcal.com

About Banc of California, Inc.

Banc of California, Inc. (NYSE: BANC) provides comprehensive banking services to California’s diverse businesses, entrepreneurs and communities. Banc of California operates over 100 offices in California and the West.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are necessarily subject to risk and uncertainty and actual results could differ materially from those anticipated due to various factors, including those set forth from time to time in the documents filed or furnished by Banc of California, Inc. with the Securities and Exchange Commission. You should not place undue reliance on forward-looking statements and Banc of California, Inc. undertakes no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

Source: Banc of California, Inc.

| INVESTOR RELATIONS INQUIRIES: | MEDIA INQUIRIES: | |

| Banc of California, Inc. | Vectis Strategies | |

| Timothy Sedabres, (855) 361-2262 | David Herbst, (213) 973-4113 x101 |

-2-

Banc of California, Inc.

Consolidated Statements of Financial Condition

(Dollars in thousands)

(Unaudited)

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Cash and cash equivalents |

$ | 372,603 | $ | 271,732 | $ | 215,012 | $ | 156,124 | $ | 378,963 | ||||||||||

| Time deposits in financial institutions |

1,500 | 1,500 | 1,500 | 1,500 | 1,900 | |||||||||||||||

| Securities available for sale |

1,941,588 | 1,302,785 | 1,663,711 | 833,596 | 693,219 | |||||||||||||||

| Securities held to maturity |

962,315 | 962,282 | 962,262 | 962,203 | 529,532 | |||||||||||||||

| Loans held for sale |

846,844 | 893,782 | 863,944 | 668,841 | 596,565 | |||||||||||||||

| Loans and leases receivable |

6,568,791 | 6,236,115 | 5,463,068 | 5,184,394 | 4,730,077 | |||||||||||||||

| Allowance for loan and lease losses |

(40,233 | ) | (37,483 | ) | (35,845 | ) | (35,533 | ) | (34,774 | ) | ||||||||||

| Federal Home Loan Bank and other bank stock |

69,190 | 81,115 | 61,146 | 59,069 | 40,643 | |||||||||||||||

| Servicing rights, net |

63,843 | 53,650 | 49,406 | 50,727 | 41,646 | |||||||||||||||

| Other real estate owned, net |

275 | 429 | 325 | 1,097 | 34 | |||||||||||||||

| Premises and equipment, net |

133,228 | 120,755 | 114,668 | 111,539 | 34,689 | |||||||||||||||

| Goodwill |

39,244 | 39,244 | 39,244 | 39,244 | 39,244 | |||||||||||||||

| Other intangible assets, net |

15,335 | 16,514 | 17,836 | 19,158 | 20,504 | |||||||||||||||

| Deferred income tax |

408 | 7,270 | 7,441 | 11,341 | 13,388 | |||||||||||||||

| Income tax receivable |

12,487 | 5,904 | — | 604 | 2,649 | |||||||||||||||

| Bank-owned life insurance investment |

101,909 | 101,314 | 100,734 | 100,171 | 99,570 | |||||||||||||||

| Other assets |

127,077 | 100,754 | 92,520 | 71,480 | 68,961 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 11,216,404 | $ | 10,157,662 | $ | 9,616,972 | $ | 8,235,555 | $ | 7,256,810 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||||||

| Deposits |

||||||||||||||||||||

| Noninterest-bearing deposits |

$ | 1,267,363 | $ | 1,093,686 | $ | 1,398,728 | $ | 1,121,124 | $ | 1,011,169 | ||||||||||

| Interest-bearing deposits |

7,810,956 | 6,835,270 | 5,438,873 | 5,181,961 | 4,410,821 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

9,078,319 | 7,928,956 | 6,837,601 | 6,303,085 | 5,421,990 | |||||||||||||||

| Advances from Federal Home Loan Bank |

770,000 | 930,000 | 1,195,000 | 930,000 | 830,000 | |||||||||||||||

| Securities sold under repurchase agreements |

— | — | 257,100 | — | — | |||||||||||||||

| Other borrowings |

49,903 | — | — | — | — | |||||||||||||||

| Notes payable, net |

176,579 | 177,743 | 260,896 | 261,876 | 262,779 | |||||||||||||||

| Reserve for loss on repurchased loans |

11,369 | 10,438 | 9,781 | 9,700 | 9,098 | |||||||||||||||

| Income taxes payable |

908 | — | 12,303 | 1,241 | 5,939 | |||||||||||||||

| Accrued expenses and other liabilities |

157,902 | 170,641 | 176,761 | 77,248 | 83,470 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

10,244,980 | 9,217,778 | 8,749,442 | 7,583,150 | 6,613,276 | |||||||||||||||

| Commitments and contingent liabilities |

||||||||||||||||||||

| Preferred stock, Series A, non-cumulative perpetual |

— | — | 31,934 | 31,934 | 31,934 | |||||||||||||||

| Preferred stock, Series B, non-cumulative perpetual |

— | — | 10,000 | 10,000 | 10,000 | |||||||||||||||

| Preferred stock, Series C, 8.00% non-cumulative perpetual |

37,943 | 37,943 | 37,943 | 37,943 | 37,943 | |||||||||||||||

| Preferred stock, Series D, 7.375% non-cumulative perpetual |

110,873 | 110,873 | 110,873 | 110,873 | 110,873 | |||||||||||||||

| Preferred stock, Series E, 7.00% non-cumulative perpetual |

120,255 | 120,255 | 120,258 | — | — | |||||||||||||||

| Common stock |

536 | 510 | 454 | 395 | 393 | |||||||||||||||

| Common stock, class B non-voting non-convertible |

2 | 2 | 1 | 1 | — | |||||||||||||||

| Additional paid-in capital |

611,069 | 608,303 | 509,123 | 429,790 | 427,599 | |||||||||||||||

| Retained earnings |

112,751 | 88,385 | 73,179 | 63,534 | 52,277 | |||||||||||||||

| Treasury stock |

(29,070 | ) | (29,070 | ) | (29,070 | ) | (29,070 | ) | (29,070 | ) | ||||||||||

| Accumulated other comprehensive income/(loss), net |

7,065 | 2,683 | 2,835 | (2,995 | ) | 1,585 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity |

971,424 | 939,884 | 867,530 | 652,405 | 643,534 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and stockholders’ equity |

$ | 11,216,404 | $ | 10,157,662 | $ | 9,616,972 | $ | 8,235,555 | $ | 7,256,810 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

1

Banc of California, Inc.

Consolidated Statements of Operations

(Dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | ||||||||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | 2016 | 2015 | ||||||||||||||||||||||

| Interest and dividend income |

||||||||||||||||||||||||||||

| Loans, including fees |

$ | 80,370 | $ | 73,743 | $ | 67,144 | $ | 62,248 | $ | 60,454 | $ | 221,257 | $ | 179,308 | ||||||||||||||

| Securities |

19,934 | 19,393 | 16,047 | 11,163 | 5,054 | 55,374 | 9,100 | |||||||||||||||||||||

| Dividends and other interest-earning assets |

1,931 | 1,504 | 1,049 | 788 | 1,007 | 4,484 | 3,731 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest and dividend income |

102,235 | 94,640 | 84,240 | 74,199 | 66,515 | 281,115 | 192,139 | |||||||||||||||||||||

| Interest expense |

||||||||||||||||||||||||||||

| Deposits |

11,224 | 8,385 | 8,107 | 6,862 | 6,395 | 27,716 | 18,921 | |||||||||||||||||||||

| Federal Home Loan Bank advances |

1,413 | 1,966 | 1,262 | 890 | 587 | 4,641 | 1,230 | |||||||||||||||||||||

| Securities sold under repurchase agreements |

48 | 389 | 160 | 15 | 3 | 597 | 3 | |||||||||||||||||||||

| Notes payable and other interest-bearing liabilities |

2,589 | 2,863 | 4,294 | 4,366 | 3,980 | 9,746 | 10,334 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total interest expense |

15,274 | 13,603 | 13,823 | 12,133 | 10,965 | 42,700 | 30,488 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income |

86,961 | 81,037 | 70,417 | 62,066 | 55,550 | 238,415 | 161,651 | |||||||||||||||||||||

| Provision for loan and lease losses |

2,592 | 1,769 | 321 | 1,260 | 735 | 4,682 | 6,209 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income after provision for loan and lease losses |

84,369 | 79,268 | 70,096 | 60,806 | 54,815 | 233,733 | 155,442 | |||||||||||||||||||||

| Noninterest income |

||||||||||||||||||||||||||||

| Customer service fees |

1,566 | 1,173 | 848 | 957 | 1,118 | 3,587 | 3,100 | |||||||||||||||||||||

| Loan servicing (loss) income |

2,096 | (3,347 | ) | (5,288 | ) | 3,663 | (2,254 | ) | (6,539 | ) | (689 | ) | ||||||||||||||||

| Net gain on sale of securities available for sale |

487 | 12,824 | 16,789 | 1,510 | 1,750 | 30,100 | 1,748 | |||||||||||||||||||||

| Net gain on sale of loans |

11,063 | 2,147 | 2,195 | 15,164 | 9,737 | 15,405 | 22,047 | |||||||||||||||||||||

| Mortgage banking income |

50,159 | 43,795 | 33,684 | 30,334 | 37,015 | 127,638 | 114,351 | |||||||||||||||||||||

| Advisory service fees |

— | 510 | 997 | 1,942 | 2,294 | 1,507 | 7,926 | |||||||||||||||||||||

| Loan brokerage income |

1,384 | 759 | 874 | 678 | 660 | 3,017 | 2,462 | |||||||||||||||||||||

| Gain on sale of building |

— | — | — | — | — | — | 9,919 | |||||||||||||||||||||

| All other income |

7,875 | 7,743 | 1,860 | 2,571 | 407 | 17,478 | 2,536 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest income |

74,630 | 65,604 | 51,959 | 56,819 | 50,727 | 192,193 | 163,400 | |||||||||||||||||||||

| Noninterest expense |

||||||||||||||||||||||||||||

| Salaries and employee benefits |

68,033 | 61,022 | 57,183 | 54,008 | 53,215 | 186,238 | 159,106 | |||||||||||||||||||||

| Occupancy and equipment |

12,728 | 11,943 | 11,740 | 11,200 | 10,109 | 36,411 | 30,205 | |||||||||||||||||||||

| Professional fees |

6,732 | 6,763 | 6,212 | 4,808 | 5,261 | 19,707 | 15,385 | |||||||||||||||||||||

| Data processing |

2,837 | 2,838 | 2,194 | 2,104 | 2,170 | 7,869 | 6,080 | |||||||||||||||||||||

| Loss on investments in alternative energy partnerships, net |

17,660 | — | — | — | — | 17,660 | — | |||||||||||||||||||||

| Amortization of intangible assets |

1,179 | 1,322 | 1,322 | 1,346 | 1,401 | 3,823 | 4,490 | |||||||||||||||||||||

| All other expenses |

15,093 | 16,187 | 10,449 | 13,193 | 9,587 | 41,729 | 30,276 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total noninterest expense |

124,262 | 100,075 | 89,100 | 86,659 | 81,743 | 313,437 | 245,542 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income before income taxes |

34,737 | 44,797 | 32,955 | 30,966 | 23,799 | 112,489 | 73,300 | |||||||||||||||||||||

| Income tax (benefit) expense |

(1,200 | ) | 18,269 | 13,268 | 11,928 | 9,263 | 30,337 | 30,266 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

35,937 | 26,528 | 19,687 | 19,038 | 14,536 | 82,152 | 43,034 | |||||||||||||||||||||

| Preferred stock dividends |

5,112 | 5,114 | 4,575 | 3,030 | 3,040 | 14,801 | 6,793 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income available to common stockholders |

$ | 30,825 | $ | 21,414 | $ | 15,112 | $ | 16,008 | $ | 11,496 | $ | 67,351 | $ | 36,241 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Basic earnings per total common share |

$ | 0.60 | $ | 0.44 | $ | 0.36 | $ | 0.40 | $ | 0.29 | $ | 1.42 | $ | 0.95 | ||||||||||||||

| Diluted earnings per total common share |

$ | 0.59 | $ | 0.43 | $ | 0.36 | $ | 0.39 | $ | 0.29 | $ | 1.40 | $ | 0.93 | ||||||||||||||

2

Banc of California, Inc.

Selected Financial Data

(Dollars in thousands)

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | ||||||||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | 2016 | 2015 | ||||||||||||||||||||||

| Average balances |

||||||||||||||||||||||||||||

| Total assets |

$ | 10,860,257 | $ | 10,061,237 | $ | 8,833,176 | $ | 7,590,781 | $ | 6,681,590 | $ | 9,921,657 | $ | 6,291,536 | ||||||||||||||

| Total gross loans and leases |

7,245,472 | 6,663,340 | 5,995,436 | 5,531,539 | 5,271,293 | 6,636,978 | 5,222,290 | |||||||||||||||||||||

| Investment Securities |

2,776,304 | 2,696,524 | 2,128,882 | 1,506,626 | 828,326 | 2,534,788 | 530,124 | |||||||||||||||||||||

| Total interest earning assets |

10,432,247 | 9,619,937 | 8,344,167 | 7,264,341 | 6,449,862 | 9,468,979 | 6,046,305 | |||||||||||||||||||||

| Total interest-bearing deposits |

7,164,061 | 5,696,893 | 5,332,032 | 4,685,145 | 4,314,330 | 6,068,343 | 4,160,352 | |||||||||||||||||||||

| Total borrowings |

1,297,382 | 2,067,234 | 1,309,710 | 1,141,554 | 745,959 | 1,557,157 | 655,726 | |||||||||||||||||||||

| Total interest bearing liabilities |

8,461,443 | 7,764,127 | 6,641,742 | 5,826,699 | 5,060,289 | 7,625,500 | 4,816,078 | |||||||||||||||||||||

| Total stockholders’ equity |

968,684 | 898,164 | 762,923 | 654,106 | 645,713 | 876,922 | 598,335 | |||||||||||||||||||||

| Profitability and other ratios |

||||||||||||||||||||||||||||

| Return on average assets (1) |

1.32 | % | 1.06 | % | 0.90 | % | 1.00 | % | 0.86 | % | 1.11 | % | 0.91 | % | ||||||||||||||

| Return on average equity (1) |

14.76 | % | 11.88 | % | 10.38 | % | 11.55 | % | 8.93 | % | 12.51 | % | 9.62 | % | ||||||||||||||

| Return on average tangible common equity (2) |

19.51 | % | 15.65 | % | 14.46 | % | 16.57 | % | 12.25 | % | 16.84 | % | 13.40 | % | ||||||||||||||

| Dividend payout ratio (3) |

20.00 | % | 27.27 | % | 33.33 | % | 30.00 | % | 41.38 | % | 25.35 | % | 37.89 | % | ||||||||||||||

| Net interest spread |

3.18 | % | 3.26 | % | 3.22 | % | 3.22 | % | 3.23 | % | 3.22 | % | 3.40 | % | ||||||||||||||

| Net interest margin (1) |

3.32 | % | 3.39 | % | 3.39 | % | 3.39 | % | 3.42 | % | 3.36 | % | 3.57 | % | ||||||||||||||

| Noninterest income to total revenue (4) |

46.18 | % | 44.74 | % | 42.46 | % | 47.79 | % | 47.73 | % | 44.63 | % | 50.27 | % | ||||||||||||||

| Noninterest income to average total assets (1) |

2.73 | % | 2.62 | % | 2.37 | % | 2.97 | % | 3.01 | % | 2.59 | % | 3.47 | % | ||||||||||||||

| Noninterest expense to average total assets (1) |

4.55 | % | 4.00 | % | 4.06 | % | 4.53 | % | 4.85 | % | 4.22 | % | 5.22 | % | ||||||||||||||

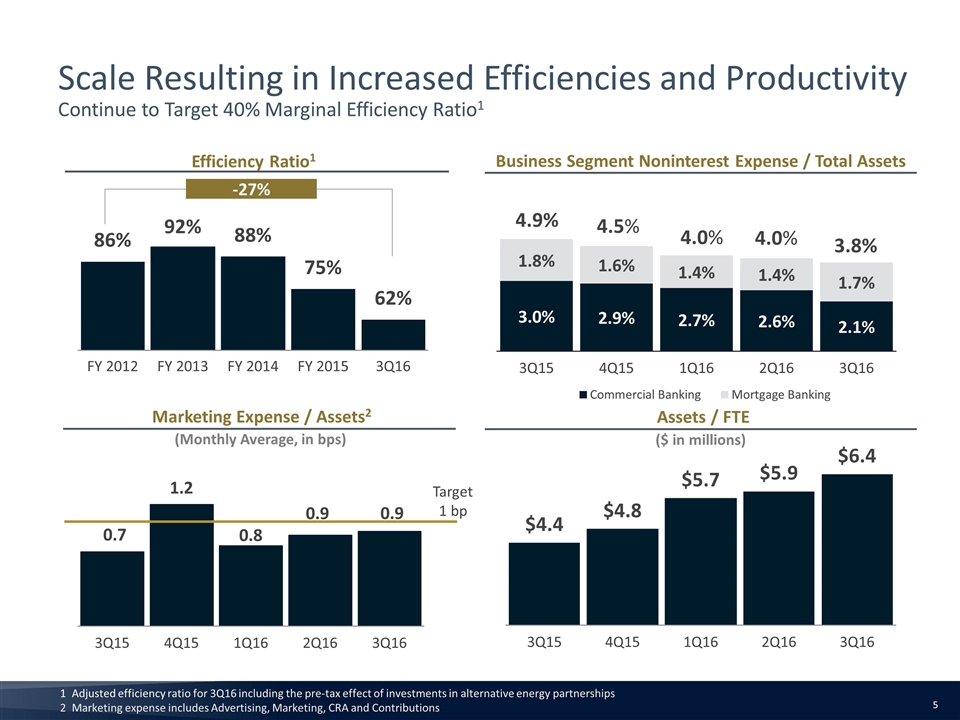

| Efficiency ratio (5) |

76.90 | % | 68.24 | % | 72.81 | % | 72.89 | % | 76.92 | % | 72.79 | % | 75.54 | % | ||||||||||||||

| Adjusted efficiency ratio for including the pre-tax effect of investments in alternative energy partnerships (2) , (5) |

62.38 | % | 68.24 | % | 72.81 | % | 72.89 | % | 76.92 | % | 67.23 | % | 75.54 | % | ||||||||||||||

| Average held for investment loans and leases to average deposits |

75.92 | % | 82.88 | % | 79.76 | % | 86.88 | % | 86.03 | % | 79.27 | % | 82.63 | % | ||||||||||||||

| Average investment securities to average total assets |

25.56 | % | 26.80 | % | 24.10 | % | 19.85 | % | 12.40 | % | 25.55 | % | 8.43 | % | ||||||||||||||

| Average stockholders’ equity to average total assets |

8.92 | % | 8.93 | % | 8.64 | % | 8.62 | % | 9.66 | % | 8.84 | % | 9.51 | % | ||||||||||||||

| Allowance for loan and lease losses (ALLL) |

||||||||||||||||||||||||||||

| Balance at beginning of period |

$ | 37,483 | $ | 35,845 | $ | 35,533 | $ | 34,774 | $ | 34,787 | $ | 35,533 | $ | 29,480 | ||||||||||||||

| Loans and leases charged off |

(393 | ) | (772 | ) | (102 | ) | (718 | ) | (788 | ) | (1,267 | ) | (1,224 | ) | ||||||||||||||

| Recoveries |

551 | 641 | 93 | 217 | 40 | 1,285 | 309 | |||||||||||||||||||||

| Provision for loan and lease losses |

2,592 | 1,769 | 321 | 1,260 | 735 | 4,682 | 6,209 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at end of period |

$ | 40,233 | $ | 37,483 | $ | 35,845 | $ | 35,533 | $ | 34,774 | $ | 40,233 | $ | 34,774 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Annualized net loan charge-offs to average total gross loans held for investment |

-0.01 | % | 0.01 | % | 0.00 | % | 0.04 | % | 0.07 | % | -0.01 | % | 0.03 | % | ||||||||||||||

| Reserve for loss on repurchased loans |

||||||||||||||||||||||||||||

| Balance at beginning of period |

$ | 10,438 | $ | 9,781 | $ | 9,700 | $ | 9,098 | $ | 9,411 | $ | 9,700 | $ | 8,303 | ||||||||||||||

| Provision for loan repurchases |

1,241 | 851 | 379 | 735 | 716 | 2,471 | 3,617 | |||||||||||||||||||||

| Change in estimates |

— | — | — | 846 | — | — | — | |||||||||||||||||||||

| Utilization of reserve for loan repurchases |

(310 | ) | (194 | ) | (298 | ) | (979 | ) | (1,029 | ) | (802 | ) | (2,822 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at end of period |

$ | 11,369 | $ | 10,438 | $ | 9,781 | $ | 9,700 | $ | 9,098 | $ | 11,369 | $ | 9,098 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Ratios are presented on an annualized basis. |

| (2) | Non-GAAP measure. See Non-GAAP measures section for reconciliation of the calculation. |

| (3) | Dividends declared per common share divided by basic earnings per share. |

| (4) | Total revenue is equal to the sum of net interest income before provision and noninterest income. |

| (5) | The ratios were calculated by dividing noninterest expense by the sum of net interest income before provision for loan and lease losses and noninterest income. |

3

Banc of California, Inc.

Selected Financial Data, Continued

(Dollars in thousands)

(Unaudited)

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

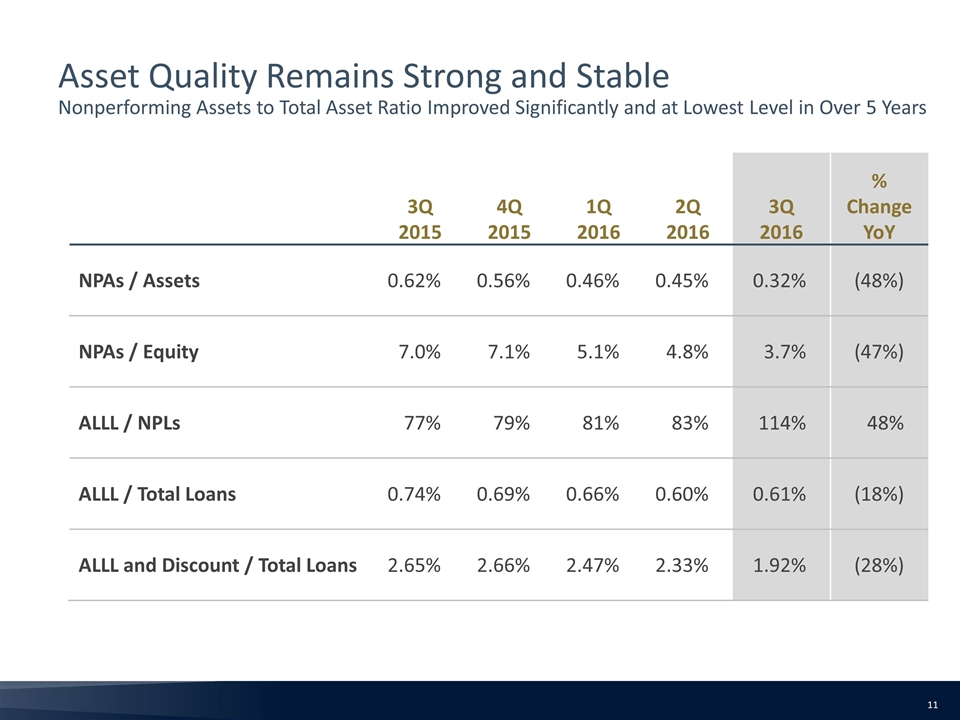

| Asset quality information and ratios |

||||||||||||||||||||

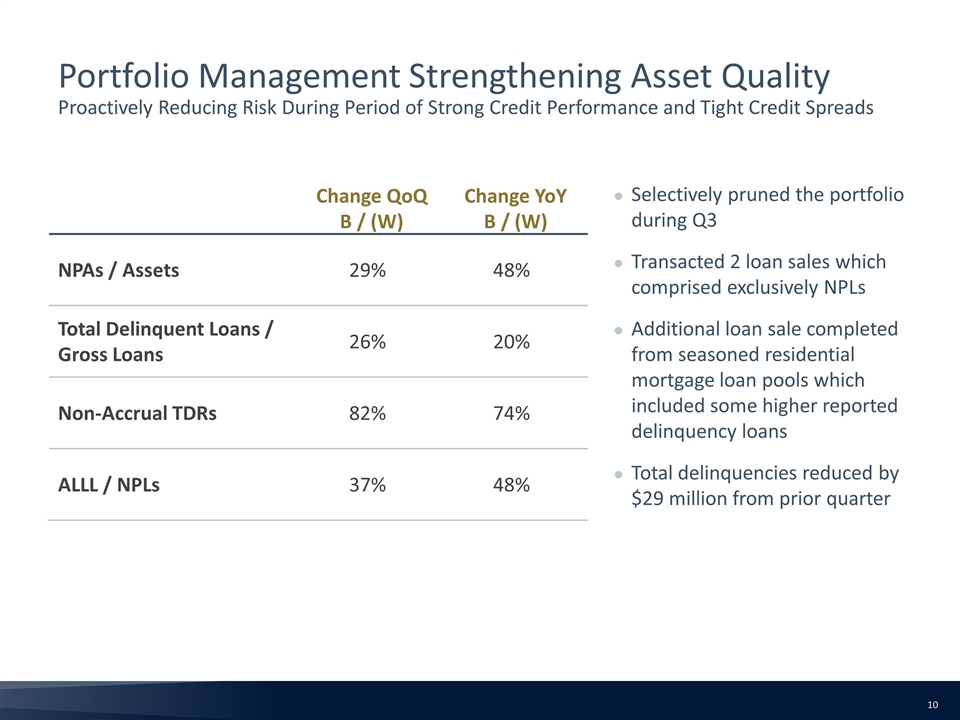

| 30 to 89 days delinquent, excluding PCI loans |

$ | 39,054 | $ | 50,494 | $ | 36,022 | $ | 39,946 | $ | 48,550 | ||||||||||

| 90+ days delinquent, excluding PCI loans |

22,827 | 28,675 | 27,469 | 23,338 | 23,725 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total delinquent loans, excluding PCI loans |

61,881 | 79,169 | 63,491 | 63,284 | 72,275 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PCI loans, 30 to 89 days delinquent |

39,113 | 48,255 | 44,191 | 40,291 | 17,593 | |||||||||||||||

| PCI loans, 90+ days delinquent |

6,145 | 8,952 | 9,806 | 6,894 | 6,223 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total delinquent PCI loans |

45,258 | 57,207 | 53,997 | 47,185 | 23,816 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total delinquent loans |

$ | 107,139 | $ | 136,376 | $ | 117,488 | $ | 110,469 | $ | 96,091 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total delinquent non-PCI loans to total non-PCI loans |

1.04 | % | 1.44 | % | 1.33 | % | 1.42 | % | 1.66 | % | ||||||||||

| Total delinquent loans to gross loans |

1.63 | % | 2.19 | % | 2.15 | % | 2.13 | % | 2.03 | % | ||||||||||

| Non-performing loans, excluding PCI loans |

$ | 35,223 | $ | 45,012 | $ | 44,216 | $ | 45,129 | $ | 45,188 | ||||||||||

| 90+ days delinquent and still accruing loans, excluding PCI loans |

— | — | — | — | — | |||||||||||||||

| Other real estate owned |

275 | 429 | 325 | 1,097 | 34 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Non-performing assets |

$ | 35,498 | $ | 45,441 | $ | 44,541 | $ | 46,226 | $ | 45,222 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ALLL to non-performing loans |

114.22 | % | 83.27 | % | 81.07 | % | 78.74 | % | 76.95 | % | ||||||||||

| Non-performing loans to gross loans |

0.54 | % | 0.72 | % | 0.81 | % | 0.87 | % | 0.96 | % | ||||||||||

| Non-performing assets to total assets |

0.32 | % | 0.45 | % | 0.46 | % | 0.56 | % | 0.62 | % | ||||||||||

| Troubled Debt Restructings (TDRs) |

||||||||||||||||||||

| Performing TDRs |

$ | 11,160 | $ | 14,450 | $ | 15,128 | $ | 7,842 | $ | 9,378 | ||||||||||

| Non-performing TDRs |

520 | 2,864 | 2,545 | 1,970 | 2,017 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total TDRs |

$ | 11,680 | $ | 17,314 | $ | 17,673 | $ | 9,812 | $ | 11,395 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

4

Banc of California, Inc.

Selected Financial Data, Continued

(Dollars in thousands)

(Unaudited)

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

| Loan and lease breakdown by ALLL evaluation type |

||||||||||||||||||||

| Originated loans and leases |

||||||||||||||||||||

| Individually evaluated for impairment |

$ | 22,306 | $ | 25,661 | $ | 26,565 | $ | 30,654 | $ | 31,008 | ||||||||||

| Collectively evaluated for impairment |

4,789,155 | 4,254,975 | 3,484,995 | 3,117,528 | 2,776,601 | |||||||||||||||

| Acquired loans not impaired at acquisition |

||||||||||||||||||||

| Individually evaluated for impairment |

3,397 | 3,470 | 3,530 | 3,629 | 1,704 | |||||||||||||||

| Collectively evaluated for impairment |

958,135 | 1,022,696 | 1,079,711 | 1,124,874 | 1,174,573 | |||||||||||||||

| Seasoned SFR mortgage loan pools - non-impaired |

||||||||||||||||||||

| Individually evaluated for impairment |

6,581 | 9,717 | 9,287 | — | — | |||||||||||||||

| Collectively evaluated for impairment |

146,850 | 168,352 | 175,004 | 194,978 | 373,634 | |||||||||||||||

| Acquired with deteriorated credit quality |

642,367 | 751,244 | 683,976 | 712,731 | 372,557 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 6,568,791 | $ | 6,236,115 | $ | 5,463,068 | $ | 5,184,394 | $ | 4,730,077 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| ALLL breakdown |

||||||||||||||||||||

| Originated loans and leases |

||||||||||||||||||||

| Individually evaluated for impairment |

$ | 137 | $ | 215 | $ | 365 | $ | 369 | $ | 512 | ||||||||||

| Collectively evaluated for impairment |

37,858 | 34,575 | 32,202 | 32,713 | 31,419 | |||||||||||||||

| Acquired loans not impaired at acquisition |

||||||||||||||||||||

| Individually evaluated for impairment |

— | — | — | — | — | |||||||||||||||

| Collectively evaluated for impairment |

1,606 | 1,458 | 2,061 | 2,245 | 2,637 | |||||||||||||||

| Seasoned SFR mortgage loan pools - non-impaired |

||||||||||||||||||||

| Individually evaluated for impairment |

528 | 1,131 | 1,011 | — | — | |||||||||||||||

| Collectively evaluated for impairment |

— | — | — | — | — | |||||||||||||||

| Acquired with deteriorated credit quality |

104 | 104 | 206 | 206 | 206 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total ALLL |

$ | 40,233 | $ | 37,483 | $ | 35,845 | $ | 35,533 | $ | 34,774 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Discount on Purchased/Acquired Loans |

||||||||||||||||||||

| Acquired loans not impaired at acquisition |

$ | 18,400 | $ | 20,136 | $ | 20,781 | $ | 21,366 | $ | 21,759 | ||||||||||

| Seasoned SFR mortgage loan pools - non-impaired |

9,789 | 11,304 | 11,862 | 12,545 | 27,699 | |||||||||||||||

| Acquired with deteriorated credit quality |

57,780 | 76,505 | 66,573 | 68,372 | 41,280 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Discount |

$ | 85,969 | $ | 107,945 | $ | 99,216 | $ | 102,283 | $ | 90,738 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios |

||||||||||||||||||||

| To originated loans and leases: |

||||||||||||||||||||

| Individually evaluated for impairment |

0.61 | % | 0.84 | % | 1.37 | % | 1.20 | % | 1.65 | % | ||||||||||

| Collectively evaluated for impairment |

0.79 | % | 0.81 | % | 0.92 | % | 1.05 | % | 1.13 | % | ||||||||||

| Total ALLL |

0.79 | % | 0.81 | % | 0.93 | % | 1.05 | % | 1.14 | % | ||||||||||

| To originated loans and leases and acquired loans not impaired at acquisition: |

||||||||||||||||||||

| Individually evaluated for impairment |

0.53 | % | 0.74 | % | 1.21 | % | 1.08 | % | 1.57 | % | ||||||||||

| Collectively evaluated for impairment |

0.69 | % | 0.68 | % | 0.75 | % | 0.82 | % | 0.86 | % | ||||||||||

| Total ALLL |

0.69 | % | 0.68 | % | 0.75 | % | 0.83 | % | 0.87 | % | ||||||||||

| Total ALLL and discount (1) |

1.00 | % | 1.06 | % | 1.21 | % | 1.33 | % | 1.41 | % | ||||||||||

| To total loans and leases: |

||||||||||||||||||||

| Individually evaluated for impairment |

2.06 | % | 3.46 | % | 3.49 | % | 1.08 | % | 1.57 | % | ||||||||||

| Collectively evaluated for impairment |

0.67 | % | 0.66 | % | 0.72 | % | 0.79 | % | 0.79 | % | ||||||||||

| Total ALLL |

0.61 | % | 0.60 | % | 0.66 | % | 0.69 | % | 0.74 | % | ||||||||||

| Total ALLL and discount (1) |

1.92 | % | 2.33 | % | 2.47 | % | 2.66 | % | 2.65 | % | ||||||||||

| (1) | The ratios were calculated by dividing a sum of ALLL and discounts by carrying value of loans. |

5

Banc of California, Inc.

Selected Financial Data, Continued

(Dollars in thousands)

(Unaudited)

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

| Composition of held for investment loans and leases |

||||||||||||||||||||

| Commercial real estate |

$ | 721,838 | $ | 725,107 | $ | 713,693 | $ | 727,707 | $ | 690,862 | ||||||||||

| Multi-family |

1,199,207 | 1,147,597 | 1,021,097 | 904,300 | 823,415 | |||||||||||||||

| Construction |

99,086 | 86,852 | 68,241 | 55,289 | 39,475 | |||||||||||||||

| Commercial and industrial |

1,531,041 | 1,306,866 | 983,961 | 876,999 | 822,690 | |||||||||||||||

| SBA |

67,737 | 65,477 | 71,640 | 57,706 | 52,985 | |||||||||||||||

| Lease financing |

234,540 | 228,663 | 212,836 | 192,424 | 162,504 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total commercial loans |

3,853,449 | 3,560,562 | 3,071,468 | 2,814,425 | 2,591,931 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Single family residential mortgage |

2,601,375 | 2,555,344 | 2,282,445 | 2,255,584 | 2,013,450 | |||||||||||||||

| Other consumer |

113,967 | 120,209 | 109,155 | 114,385 | 124,696 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total consumer loans |

2,715,342 | 2,675,553 | 2,391,600 | 2,369,969 | 2,138,146 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross loans and leases |

$ | 6,568,791 | $ | 6,236,115 | $ | 5,463,068 | $ | 5,184,394 | $ | 4,730,077 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Composition percentage of held for investment loans and leases |

||||||||||||||||||||

| Commercial real estate |

11.0 | % | 11.6 | % | 13.1 | % | 14.0 | % | 14.6 | % | ||||||||||

| Multi-family |

18.3 | % | 18.4 | % | 18.7 | % | 17.4 | % | 17.4 | % | ||||||||||

| Construction |

1.5 | % | 1.4 | % | 1.2 | % | 1.1 | % | 0.8 | % | ||||||||||

| Commercial and industrial |

23.3 | % | 21.0 | % | 18.0 | % | 16.9 | % | 17.4 | % | ||||||||||

| SBA |

1.0 | % | 1.0 | % | 1.3 | % | 1.1 | % | 1.1 | % | ||||||||||

| Lease financing |

3.6 | % | 3.7 | % | 3.9 | % | 3.7 | % | 3.4 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total commercial loans |

58.7 | % | 57.1 | % | 56.2 | % | 54.2 | % | 54.7 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Single family residential mortgage |

39.6 | % | 41.0 | % | 41.8 | % | 43.6 | % | 42.7 | % | ||||||||||

| Other consumer |

1.7 | % | 1.9 | % | 2.0 | % | 2.2 | % | 2.6 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total consumer loans |

41.3 | % | 42.9 | % | 43.8 | % | 45.8 | % | 45.3 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross loans and leases |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Composition of deposits |

||||||||||||||||||||

| Noninterest-bearing checking |

$ | 1,267,363 | $ | 1,093,686 | $ | 1,398,728 | $ | 1,121,124 | $ | 1,011,169 | ||||||||||

| Interest-bearing checking |

2,369,332 | 2,053,656 | 2,052,507 | 1,697,055 | 1,458,208 | |||||||||||||||

| Money market |

2,900,248 | 2,343,561 | 1,534,492 | 1,479,931 | 1,238,180 | |||||||||||||||

| Savings |

880,712 | 909,242 | 844,177 | 823,618 | 814,230 | |||||||||||||||

| Certificates of deposit |

1,660,664 | 1,528,811 | 1,007,697 | 1,181,357 | 900,203 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 9,078,319 | $ | 7,928,956 | $ | 6,837,601 | $ | 6,303,085 | $ | 5,421,990 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Composition percentage of deposits |

||||||||||||||||||||

| Noninterest-bearing checking |

14.0 | % | 13.8 | % | 20.5 | % | 17.8 | % | 18.6 | % | ||||||||||

| Interest-bearing checking |

26.1 | % | 25.9 | % | 30.0 | % | 26.8 | % | 26.9 | % | ||||||||||

| Money market |

31.9 | % | 29.5 | % | 22.4 | % | 23.5 | % | 22.8 | % | ||||||||||

| Savings |

9.7 | % | 11.5 | % | 12.3 | % | 13.1 | % | 15.0 | % | ||||||||||

| Certificates of deposit |

18.3 | % | 19.3 | % | 14.8 | % | 18.8 | % | 16.7 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

6

Banc of California, Inc.

Average Balance, Average Yield Earned, and Average Cost Paid

(Dollars in thousands)

(Unaudited)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||

| September 30, 2016 | June 30, 2016 | March 31, 2016 | ||||||||||||||||||||||||||||||||||

| Average | Yield | Average | Yield | Average | Yield | |||||||||||||||||||||||||||||||

| Balance | Interest | / Cost | Balance | Interest | / Cost | Balance | Interest | / Cost | ||||||||||||||||||||||||||||

| Interest earning assets |

||||||||||||||||||||||||||||||||||||

| Loans held for sale and SFR mortgage |

$ | 2,618,879 | $ | 24,365 | 3.70 | % | $ | 2,428,168 | $ | 22,488 | 3.72 | % | $ | 2,144,834 | $ | 19,808 | 3.71 | % | ||||||||||||||||||

| Seasoned SFR mortgage loan pools |

907,387 | 11,924 | 5.23 | % | 878,068 | 12,404 | 5.68 | % | 876,142 | 12,710 | 5.83 | % | ||||||||||||||||||||||||

| Commercial real estate, multi-family, and construction |

2,033,718 | 23,097 | 4.52 | % | 1,907,649 | 21,049 | 4.44 | % | 1,760,646 | 19,816 | 4.53 | % | ||||||||||||||||||||||||

| Commercial and industrial, SBA, and lease financing |

1,576,379 | 19,734 | 4.98 | % | 1,343,961 | 16,642 | 4.98 | % | 1,105,971 | 13,665 | 4.97 | % | ||||||||||||||||||||||||

| Other consumer |

109,109 | 1,250 | 4.56 | % | 105,494 | 1,160 | 4.42 | % | 107,843 | 1,145 | 4.27 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Gross loans and leases |

7,245,472 | 80,370 | 4.41 | % | 6,663,340 | 73,743 | 4.45 | % | 5,995,436 | 67,144 | 4.50 | % | ||||||||||||||||||||||||

| Securities |

2,776,304 | 19,934 | 2.86 | % | 2,696,524 | 19,393 | 2.89 | % | 2,128,882 | 16,047 | 3.03 | % | ||||||||||||||||||||||||

| Other interest-earning assets |

410,471 | 1,931 | 1.87 | % | 260,073 | 1,504 | 2.33 | % | 219,849 | 1,049 | 1.92 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-earning assets |

10,432,247 | 102,235 | 3.90 | % | 9,619,937 | 94,640 | 3.96 | % | 8,344,167 | 84,240 | 4.06 | % | ||||||||||||||||||||||||

| Allowance for loan and lease losses |

(38,258 | ) | (37,637 | ) | (35,575 | ) | ||||||||||||||||||||||||||||||

| BOLI and non-interest earning assets |

466,268 | 478,937 | 524,584 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total assets |

$ | 10,860,257 | $ | 10,061,237 | $ | 8,833,176 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Interest-bearing liabilities |

||||||||||||||||||||||||||||||||||||

| Savings |

$ | 887,973 | $ | 1,704 | 0.76 | % | $ | 866,051 | $ | 1,603 | 0.74 | % | $ | 834,965 | $ | 1,572 | 0.76 | % | ||||||||||||||||||

| Interest-bearing checking |

2,300,128 | 3,972 | 0.69 | % | 1,981,702 | 3,135 | 0.64 | % | 1,900,834 | 3,244 | 0.69 | % | ||||||||||||||||||||||||

| Money market |

2,427,356 | 3,226 | 0.53 | % | 1,672,662 | 1,962 | 0.47 | % | 1,437,332 | 1,679 | 0.47 | % | ||||||||||||||||||||||||

| Certificates of deposit |

1,548,604 | 2,322 | 0.60 | % | 1,176,478 | 1,685 | 0.58 | % | 1,158,901 | 1,612 | 0.56 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-bearing deposits |

7,164,061 | 11,224 | 0.62 | % | 5,696,893 | 8,385 | 0.59 | % | 5,332,032 | 8,107 | 0.61 | % | ||||||||||||||||||||||||

| FHLB advances |

1,104,663 | 1,413 | 0.51 | % | 1,663,791 | 1,966 | 0.48 | % | 955,659 | 1,262 | 0.53 | % | ||||||||||||||||||||||||

| Securities sold under repurchase agreements |

12,539 | 48 | 1.52 | % | 210,299 | 389 | 0.74 | % | 90,395 | 160 | 0.71 | % | ||||||||||||||||||||||||

| Long-term debt and other interest-bearing liabilities |

180,180 | 2,589 | 5.72 | % | 193,144 | 2,863 | 5.96 | % | 263,656 | 4,294 | 6.55 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-bearing liabilities |

8,461,443 | 15,274 | 0.72 | % | 7,764,127 | 13,603 | 0.70 | % | 6,641,742 | 13,823 | 0.84 | % | ||||||||||||||||||||||||

| Noninterest-bearing deposits |

1,178,849 | 1,205,987 | 1,230,991 | |||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities |

251,281 | 192,959 | 197,520 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities |

9,891,573 | 9,163,073 | 8,070,253 | |||||||||||||||||||||||||||||||||

| Total stockholders’ equity |

968,684 | 898,164 | 762,923 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 10,860,257 | $ | 10,061,237 | $ | 8,833,176 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income/spread |

$ | 86,961 | 3.18 | % | $ | 81,037 | 3.26 | % | $ | 70,417 | 3.22 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest margin |

3.32 | % | 3.39 | % | 3.39 | % | ||||||||||||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities |

123.29 | % | 123.90 | % | 125.63 | % | ||||||||||||||||||||||||||||||

| Total deposits |

$ | 8,342,910 | $ | 11,224 | 0.54 | % | $ | 6,902,880 | $ | 8,385 | 0.49 | % | $ | 6,563,023 | $ | 8,107 | 0.50 | % | ||||||||||||||||||

| Total funding (1) |

$ | 9,640,292 | $ | 15,274 | 0.63 | % | $ | 8,970,114 | $ | 13,603 | 0.61 | % | $ | 7,872,733 | $ | 13,823 | 0.71 | % | ||||||||||||||||||

| (1) | Total funding is the sum of interest-bearing liabilities and noninterest-bearing deposits. The cost of total funding is calculated as annualized total interest expense divided by average total funding. |

7

Banc of California, Inc.

Average Balance, Average Yield Earned, and Average Cost Paid, Continued

(Dollars in thousands)

(Unaudited)

| Three Months Ended | ||||||||||||||||||||||||

| December 31, 2015 | September 30, 2015 | |||||||||||||||||||||||

| Average | Yield | Average | Yield | |||||||||||||||||||||

| Balance | Interest | / Cost | Balance | Interest | / Cost | |||||||||||||||||||

| Interest earning assets |

||||||||||||||||||||||||

| Loans held for sale and SFR mortgage |

$ | 1,903,331 | $ | 17,584 | 3.67 | % | $ | 1,966,373 | $ | 18,123 | 3.66 | % | ||||||||||||

| Seasoned SFR mortgage loan pools |

858,601 | 12,098 | 5.59 | % | 689,666 | 10,901 | 6.27 | % | ||||||||||||||||

| Commercial real estate, multi-family, and construction |

1,638,329 | 19,006 | 4.60 | % | 1,568,975 | 17,643 | 4.46 | % | ||||||||||||||||

| Commercial and industrial, SBA, and lease financing |

1,020,306 | 12,754 | 4.96 | % | 914,811 | 12,125 | 5.26 | % | ||||||||||||||||

| Other consumer |

110,972 | 806 | 2.88 | % | 131,468 | 1,662 | 5.02 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross loans and leases |

5,531,539 | 62,248 | 4.46 | % | 5,271,293 | 60,454 | 4.55 | % | ||||||||||||||||

| Securities |

1,506,626 | 11,163 | 2.94 | % | 828,326 | 5,054 | 2.42 | % | ||||||||||||||||

| Other interest-earning assets |

226,176 | 788 | 1.38 | % | 350,243 | 1,007 | 1.14 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-earning assets |

7,264,341 | 74,199 | 4.05 | % | 6,449,862 | 66,515 | 4.09 | % | ||||||||||||||||

| Allowance for loan and lease losses |

(35,894 | ) | (34,810 | ) | ||||||||||||||||||||

| BOLI and non-interest earning assets |

362,334 | 266,538 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total assets |

$ | 7,590,781 | $ | 6,681,590 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Interest-bearing liabilities |

||||||||||||||||||||||||

| Savings |

$ | 805,445 | $ | 1,538 | 0.76 | % | $ | 832,006 | $ | 1,575 | 0.75 | % | ||||||||||||

| Interest-bearing checking |

1,475,461 | 2,663 | 0.72 | % | 1,282,066 | 2,273 | 0.70 | % | ||||||||||||||||

| Money market |

1,343,683 | 1,267 | 0.37 | % | 1,294,554 | 1,337 | 0.41 | % | ||||||||||||||||

| Certificates of deposit |

1,060,556 | 1,394 | 0.52 | % | 905,704 | 1,210 | 0.53 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing deposits |

4,685,145 | 6,862 | 0.58 | % | 4,314,330 | 6,395 | 0.59 | % | ||||||||||||||||

| FHLB advances |

869,457 | 890 | 0.41 | % | 476,848 | 587 | 0.49 | % | ||||||||||||||||

| Securities sold under repurchase agreements |

7,010 | 15 | 0.85 | % | 2,681 | 3 | 0.44 | % | ||||||||||||||||

| Long-term debt and other interest-bearing liabilities |

265,087 | 4,366 | 6.53 | % | 266,430 | 3,980 | 5.93 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing liabilities |

5,826,699 | 12,133 | 0.83 | % | 5,060,289 | 10,965 | 0.86 | % | ||||||||||||||||

| Noninterest-bearing deposits |

1,037,966 | 916,670 | ||||||||||||||||||||||

| Non-interest-bearing liabilities |

72,010 | 58,918 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities |

6,936,675 | 6,035,877 | ||||||||||||||||||||||

| Total stockholders’ equity |

654,106 | 645,713 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 7,590,781 | $ | 6,681,590 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest income/spread |

$ | 62,066 | 3.22 | % | $ | 55,550 | 3.23 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest margin |

3.39 | % | 3.42 | % | ||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities |

124.67 | % | 127.46 | % | ||||||||||||||||||||

| Total deposits |

$ | 5,723,111 | $ | 6,862 | 0.48 | % | $ | 5,231,000 | $ | 6,395 | 0.49 | % | ||||||||||||

| Total funding (1) |

$ | 6,864,665 | $ | 12,133 | 0.70 | % | $ | 5,976,959 | $ | 10,965 | 0.73 | % | ||||||||||||

| (1) | Total funding is the sum of interest-bearing liabilities and noninterest-bearing deposits. The cost of total funding is calculated as annualized total interest expense divided by average total funding. |

8

Banc of California, Inc.

Average Balance, Average Yield Earned, and Average Cost Paid, Continued

(Dollars in thousands)

(Unaudited)

| Nine Months Ended | ||||||||||||||||||||||||

| September 30, 2016 | September 30, 2015 | |||||||||||||||||||||||

| Average | Yield | Average | Yield | |||||||||||||||||||||

| Balance | Interest | / Cost | Balance | Interest | / Cost | |||||||||||||||||||

| Interest earning assets |

||||||||||||||||||||||||

| Loans held for sale and SFR mortgage |

$ | 2,398,101 | $ | 66,661 | 3.71 | % | $ | 1,931,759 | $ | 54,584 | 3.78 | % | ||||||||||||

| Seasoned SFR mortgage loan pools |

887,273 | 37,037 | 5.58 | % | 624,642 | 30,004 | 6.42 | % | ||||||||||||||||

| Commercial real estate, multi-family, and construction |

1,901,157 | 63,962 | 4.49 | % | 1,790,108 | 61,703 | 4.61 | % | ||||||||||||||||

| Commercial and industrial, SBA, and lease financing |

1,342,959 | 50,041 | 4.98 | % | 729,529 | 28,234 | 5.17 | % | ||||||||||||||||

| Other consumer |

107,488 | 3,556 | 4.42 | % | 146,252 | 4,783 | 4.37 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross loans and leases |

6,636,978 | 221,257 | 4.45 | % | 5,222,290 | 179,308 | 4.59 | % | ||||||||||||||||

| Securities |

2,534,788 | 55,374 | 2.92 | % | 530,124 | 9,100 | 2.30 | % | ||||||||||||||||

| Other interest-earning assets |

297,213 | 4,484 | 2.02 | % | 293,891 | 3,731 | 1.70 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-earning assets |

9,468,979 | 281,115 | 3.97 | % | 6,046,305 | 192,139 | 4.25 | % | ||||||||||||||||

| Allowance for loan and lease losses |

(37,161 | ) | (31,312 | ) | ||||||||||||||||||||

| BOLI and non-interest earning assets |

489,839 | 276,543 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total assets |

$ | 9,921,657 | $ | 6,291,536 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Interest-bearing liabilities |

||||||||||||||||||||||||

| Savings |

$ | 863,088 | $ | 4,878 | 0.75 | % | $ | 881,273 | $ | 4,929 | 0.75 | % | ||||||||||||

| Interest-bearing checking |

2,061,761 | 10,352 | 0.67 | % | 1,113,267 | 6,309 | 0.76 | % | ||||||||||||||||

| Money market |

1,847,906 | 6,867 | 0.50 | % | 1,177,538 | 3,324 | 0.38 | % | ||||||||||||||||

| Certificates of deposit |

1,295,588 | 5,619 | 0.58 | % | 988,274 | 4,359 | 0.59 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing deposits |

6,068,343 | 27,716 | 0.61 | % | 4,160,352 | 18,921 | 0.61 | % | ||||||||||||||||

| FHLB advances |

1,240,872 | 4,641 | 0.50 | % | 446,571 | 1,230 | 0.37 | % | ||||||||||||||||

| Securities sold under repurchase agreements |

104,076 | 597 | 0.77 | % | 903 | 3 | 0.44 | % | ||||||||||||||||

| Long-term debt and other interest-bearing liabilities |

212,209 | 9,746 | 6.13 | % | 208,252 | 10,334 | 6.63 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing liabilities |

7,625,500 | 42,700 | 0.75 | % | 4,816,078 | 30,488 | 0.85 | % | ||||||||||||||||

| Noninterest-bearing deposits |

1,205,179 | 820,385 | ||||||||||||||||||||||

| Non-interest-bearing liabilities |

214,056 | 56,738 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities |

9,044,735 | 5,693,201 | ||||||||||||||||||||||

| Total stockholders’ equity |

876,922 | 598,335 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 9,921,657 | $ | 6,291,536 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest income/spread |

$ | 238,415 | 3.22 | % | $ | 161,651 | 3.40 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest margin |

3.36 | % | 3.57 | % | ||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities |

124.18 | % | 125.54 | % | ||||||||||||||||||||

| Total deposits |

$ | 7,273,522 | $ | 27,716 | 0.51 | % | $ | 4,980,737 | $ | 18,921 | 0.51 | % | ||||||||||||

| Total funding (1) |

$ | 8,830,679 | $ | 42,700 | 0.65 | % | $ | 5,636,463 | $ | 30,488 | 0.72 | % | ||||||||||||

| (1) | Total funding is the sum of interest-bearing liabilities and noninterest-bearing deposits. The cost of total funding is calculated as annualized total interest expense divided by average total funding. |

9

Banc of California, Inc.

Capital Ratios

(Unaudited)

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

| Capital Ratios |

||||||||||||||||||||

| Banc of California, Inc. |

||||||||||||||||||||

| Total risk-based capital ratio |

12.79 | % | 13.45 | % | 13.59 | % | 11.18 | % | 12.56 | % | ||||||||||

| Tier 1 risk-based capital ratio |

12.54 | % | 13.14 | % | 13.17 | % | 10.71 | % | 12.06 | % | ||||||||||

| Common equity tier 1 capital ratio |

8.85 | % | 9.16 | % | 8.14 | % | 7.36 | % | 8.19 | % | ||||||||||

| Tier 1 leverage ratio |

8.47 | % | 8.87 | % | 9.27 | % | 8.07 | % | 8.97 | % | ||||||||||

| Banc of California, NA |

||||||||||||||||||||

| Total risk-based capital ratio |

14.38 | % | 14.96 | % | 14.03 | % | 13.45 | % | 14.93 | % | ||||||||||

| Tier 1 risk-based capital ratio |

13.83 | % | 14.38 | % | 13.42 | % | 12.79 | % | 14.19 | % | ||||||||||

| Common equity tier 1 capital ratio |

13.83 | % | 14.38 | % | 13.42 | % | 12.79 | % | 14.19 | % | ||||||||||

| Tier 1 leverage ratio |

9.31 | % | 9.70 | % | 9.44 | % | 9.64 | % | 10.53 | % | ||||||||||

10

Banc of California, Inc.

Non-GAAP Measures

(Dollars in thousands, except per share data)

(Unaudited)

Non-GAAP performance measure:

Tangible equity to tangible assets, tangible common equity to tangible assets ratios, return on average tangible common equity, and adjusted efficiency ratio are supplemental financial information determined by a method other than in accordance with U.S. generally accepted accounting principles (GAAP). These non-GAAP measures are used by management in the analysis of Banc of California, Inc.’s capital strength and performance of businesses. Tangible equity is calculated by subtracting goodwill and other intangible assets from total stockholders’ equity and tangible common equity is calculated by subtracting preferred stock from tangible equity. Banking and financial institution regulators also exclude goodwill and other intangible assets from total stockholders’ equity when assessing the capital adequacy of a financial institution. Adjusted efficiency ratio is calucated by subtracting loss on investments in alternative energy partnerships from noninterest expense and adding total pretax return, which includes the loss on investments in alternative energy partnerships, from investments in alternative energy partnerships to noninterest income. Management believes the presentation of these financial measures excluding the impact of these items provides useful supplemental information that is essential to a proper understanding of the capital and financial strength of Banc of California, Inc. This disclosure should not be viewed as a substitution for results determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be presented by other companies.

The following tables reconcile this non-GAAP performance measures to the GAAP performance measures for the periods indicated:

| September 30, | June 30, | March 31, | December 31, | September 30, | ||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | ||||||||||||||||

| Tangible common equity to tangible assets ratio |

||||||||||||||||||||

| Total assets |

$ | 11,216,404 | $ | 10,157,662 | $ | 9,616,972 | $ | 8,235,555 | $ | 7,256,810 | ||||||||||

| Less goodwill |

(39,244 | ) | (39,244 | ) | (39,244 | ) | (39,244 | ) | (39,244 | ) | ||||||||||

| Less other intangible assets |

(15,335 | ) | (16,514 | ) | (17,836 | ) | (19,158 | ) | (20,504 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible assets |

$ | 11,161,825 | $ | 10,101,904 | $ | 9,559,892 | $ | 8,177,153 | $ | 7,197,062 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity |

$ | 971,424 | $ | 939,884 | $ | 867,530 | $ | 652,405 | $ | 643,534 | ||||||||||

| Less goodwill |

(39,244 | ) | (39,244 | ) | (39,244 | ) | (39,244 | ) | (39,244 | ) | ||||||||||

| Less other intangible assets |

(15,335 | ) | (16,514 | ) | (17,836 | ) | (19,158 | ) | (20,504 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible equity |

916,845 | 884,126 | 810,450 | 594,003 | 583,786 | |||||||||||||||

| Less preferred stock |

(269,071 | ) | (269,071 | ) | (311,008 | ) | (190,750 | ) | (190,750 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity |

$ | 647,774 | $ | 615,055 | $ | 499,442 | $ | 403,253 | $ | 393,036 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity to total assets |

8.66 | % | 9.25 | % | 9.02 | % | 7.92 | % | 8.87 | % | ||||||||||

| Tangible equity to tangible assets |

8.21 | % | 8.75 | % | 8.48 | % | 7.26 | % | 8.11 | % | ||||||||||

| Tangible common equity to tangible assets |

5.80 | % | 6.09 | % | 5.22 | % | 4.93 | % | 5.46 | % | ||||||||||

| Common stock outstanding |

49,531,321 | 49,478,348 | 43,907,587 | 38,002,267 | 37,751,445 | |||||||||||||||

| Class B non-voting non-convertible common stock outstanding |

201,922 | 161,841 | 91,066 | 37,355 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total common stock outstanding |

49,733,243 | 49,640,189 | 43,998,653 | 38,039,622 | 37,751,445 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Minimum number of shares issuable under purchase contracts (1) |

188,742 | 218,928 | 253,155 | 601,299 | 828,246 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total common stock outstanding and shares issuable under purchase contracts |

49,921,985 | 49,859,117 | 44,251,808 | 38,640,921 | 38,579,691 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) Purchase contracts relating to the tangible equity units |

| |||||||||||||||||||

| Tangible common equity per common stock |

$ | 13.02 | $ | 12.39 | $ | 11.35 | $ | 10.60 | $ | 10.41 | ||||||||||

| Book value per common stock |

$ | 14.12 | $ | 13.51 | $ | 12.65 | $ | 12.14 | $ | 11.99 | ||||||||||

| Tangible common equity per common stock and shares issuable under purchase contracts |

$ | 12.98 | $ | 12.34 | $ | 11.29 | $ | 10.44 | $ | 10.19 | ||||||||||

| Book value per common stock and shares issuable under purchase contracts |

$ | 14.07 | $ | 13.45 | $ | 12.58 | $ | 11.95 | $ | 11.74 | ||||||||||

11

Banc of California, Inc.

Non-GAAP Measures, Continued

(Dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | ||||||||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | 2016 | 2015 | ||||||||||||||||||||||

| Return on tangible common equity |

||||||||||||||||||||||||||||

| Average total stockholders’ equity |

$ | 968,684 | $ | 898,164 | $ | 762,923 | $ | 654,106 | $ | 645,713 | $ | 876,922 | $ | 598,335 | ||||||||||||||

| Less average preferred stock |

(269,071 | ) | (269,073 | ) | (260,959 | ) | (190,750 | ) | (190,750 | ) | (266,377 | ) | (151,360 | ) | ||||||||||||||

| Less average goodwill |

(39,244 | ) | (39,244 | ) | (39,244 | ) | (39,244 | ) | (31,674 | ) | (39,244 | ) | (31,619 | ) | ||||||||||||||

| Less average other intangible assets |

(16,039 | ) | (17,299 | ) | (18,601 | ) | (19,877 | ) | (21,320 | ) | (17,308 | ) | (23,012 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Average tangible common equity |

$ | 644,330 | $ | 572,548 | $ | 444,119 | $ | 404,235 | $ | 401,969 | $ | 553,993 | $ | 392,344 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

$ | 35,937 | $ | 26,528 | $ | 19,687 | $ | 19,038 | $ | 14,536 | $ | 82,152 | $ | 43,034 | ||||||||||||||

| Less preferred stock dividends |

(5,112 | ) | (5,114 | ) | (4,575 | ) | (3,030 | ) | (3,040 | ) | (14,801 | ) | (6,793 | ) | ||||||||||||||

| Add amortization of intangible assets |

1,179 | 1,322 | 1,322 | 1,346 | 1,401 | 3,823 | 4,490 | |||||||||||||||||||||

| Add impairment on intangible assets |

— | — | — | — | — | — | 258 | |||||||||||||||||||||

| Less tax effect on amortization and impairment of intangible assets (1) |

(413 | ) | (463 | ) | (463 | ) | (471 | ) | (490 | ) | (1,338 | ) | (1,661 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income available to common stockholders |

$ | 31,591 | $ | 22,273 | $ | 15,971 | $ | 16,883 | $ | 12,407 | $ | 69,836 | $ | 39,328 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Return on average equity |

14.76 | % | 11.88 | % | 10.38 | % | 11.55 | % | 8.93 | % | 12.51 | % | 9.62 | % | ||||||||||||||

| Return on average tangible common equity |

19.51 | % | 15.65 | % | 14.46 | % | 16.57 | % | 12.25 | % | 16.84 | % | 13.40 | % | ||||||||||||||

| (1) Utilized a 35% effective tax rate |

| |||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | September 30, | September 30, | ||||||||||||||||||||||

| 2016 | 2016 | 2016 | 2015 | 2015 | 2016 | 2015 | ||||||||||||||||||||||

| Adjusted efficiency ratio for including the pre-tax effect of investments in alternative energy partnerships |

||||||||||||||||||||||||||||

| Noninterest expense |

$ | 124,262 | $ | 100,075 | $ | 89,100 | $ | 86,659 | $ | 81,743 | $ | 313,437 | $ | 245,542 | ||||||||||||||

| Loss on investments in alternative energy partnerships, net |

(17,660 | ) | — | — | — | — | (17,660 | ) | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Adjusted noninterest expense |

$ | 106,602 | $ | 100,075 | $ | 89,100 | $ | 86,659 | $ | 81,743 | $ | 295,777 | $ | 245,542 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net interest income |

$ | 86,961 | $ | 81,037 | $ | 70,417 | $ | 62,066 | $ | 55,550 | $ | 238,415 | $ | 161,651 | ||||||||||||||

| Noninterest income |

74,630 | 65,604 | 51,959 | 56,819 | 50,727 | 192,193 | 163,400 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenue |

161,591 | 146,641 | 122,376 | 118,885 | 106,277 | 430,608 | 325,051 | |||||||||||||||||||||

| Tax credit from investments in alternative energy partnerships |

19,357 | — | — | — | — | 19,357 | — | |||||||||||||||||||||

| Deferred tax expense on investments in alternative energy partnerships |

(3,387 | ) | — | — | — | — | (3,387 | ) | — | |||||||||||||||||||

| Tax effect on tax credit and deferred tax expense (1) |

11,002 | — | — | — | — | 11,002 | — | |||||||||||||||||||||

| Loss on investments in alternative energy partnerships, net |

(17,660 | ) | — | — | — | — | (17,660 | ) | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total pre-tax adjustemnts for investments in alternative energy partnerships |

9,312 | — | — | — | — | 9,312 | — | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total adjusted revenue |

$ | 170,903 | $ | 146,641 | $ | 122,376 | $ | 118,885 | $ | 106,277 | $ | 439,920 | $ | 325,051 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Efficiency ratio |

76.90 | % | 68.24 | % | 72.81 | % | 72.89 | % | 76.92 | % | 72.79 | % | 75.54 | % | ||||||||||||||

| Adjusted efficiency ratio for excluding the effect of investments in alternative energy partnerships |

62.38 | % | 68.24 | % | 72.81 | % | 72.89 | % | 76.92 | % | 67.23 | % | 75.54 | % | ||||||||||||||

| (1) Utilized a 40.79% effective tax rate |

| |||||||||||||||||||||||||||

October 19, 2016 2016 Third Quarter Earnings Investor Presentation Exhibit 99.2