Form 8-K Ashford Inc. For: Nov 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 15, 2016

ASHFORD INC.

(Exact name of registrant as specified in its charter)

MARYLAND | 001-36400 | 46-5292553 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS employer identification number) | ||

14185 Dallas Parkway, Suite 1100 | ||||

Dallas, Texas | 75254 | |||

(Address of principal executive offices) | (Zip code) | |||

Registrant’s telephone number, including area code: (972) 490-9600

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

ITEM 7.01 REGULATION FD DISCLOSURE

Ashford Inc. is presenting a Powerpoint slideshow today to the investment community. The Powerpoint slideshow is attached hereto as Exhibit 99.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Number | Description |

99.1 | Powerpoint slideshow presentation |

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 15, 2016

ASHFORD INC.

By: /s/ David A. Brooks

David A. Brooks

Chief Operating Officer and General Counsel

Chief Operating Officer and General Counsel

Company Presentation – November 2016

2

In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be

considered forward-looking and subject to certain risks and uncertainties that could cause results to differ

materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate,"

"should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements.

Such forward-looking statements include, but are not limited to, our business and investment strategy, our

understanding of our competition, current market trends and opportunities, projected operating results, and

projected capital expenditures.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause

actual results to differ materially from those anticipated including, without limitation: general volatility of the

capital markets and the market price of our common stock; changes in our business or investment strategy;

availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the

market in which we operate, interest rates or the general economy, the degree and nature of our competition,

and the satisfaction of the conditions to the completion of the proposed combination of Ashford Inc. with

Remington Holdings L.P. These and other risk factors are more fully discussed in each company's filings with the

Securities and Exchange Commission.

EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as

trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the

property's net operating income by the purchase price. Net operating income is the property's funds from

operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the

change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are

non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the

SEC.

This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell,

any securities of Ashford Hospitality Trust, Inc., Ashford Hospitality Prime, Inc., Ashford Inc., or any of their

respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

Safe Harbor

Ashford Inc. Strategic Overview

3

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

W Atlanta Downtown

Atlanta, GA

Marriott Fremont

Fremont, CA

Le Pavillon Hotel

New Orleans, LA

High-growth, fee-based, low-capex business model

Diversified platform of multiple fee generators

Seeks to grow in three primary areas:

Expanding the existing platforms accretively and

accelerating performance to earn incentive fees

Starting new platforms for additional base and incentive

fees

Investing in businesses that can achieve accelerated

growth through doing business with our existing platforms

Highly-aligned management team with superior long-term track

record

Leader in asset and investment management for the real estate

& hospitality sectors

Ashford Inc. Overview

4

- Publicly Traded (NYSE:

AHP)

- 11 hotels – 3,467 owned

rooms

- Total Market Cap of $1.2

billion

- High RevPAR portfolio

- Luxury hotels

- Gateway and resort

markets

- Conservative leverage

- Insider ownership: 16%

- Publicly Traded (NYSE:

AHT)

- 123 hotels – 25,986

owned rooms

- Total Market Cap of $4.8

billion

- Targets RevPAR below

Ashford Prime

- Investment across full-

service and upper-

upscale hotels

- Opportunistic leverage

- Insider ownership: 18%

- 89 properties – 17,411

managed rooms

- Assets located in 28

states and Washington,

D.C.

- Managed properties are

either branded by one of

five major franchisors or

operated independently

- Typical term of

agreements (includes

renewals) – 35 years

- Project managed over

$1 billion of

development,

renovations & other

projects

- Experience with every

major brand in

renovating, converting or

repositioning hotels

Real Estate Asset Management Real Estate Services

Property Management Project Management

Proposed Combination Long-Term Agreements

All data as of November 3, 2016

Base Fee/Minimum Fee

Base Fee: 0.70% x Total Market Capitalization

Minimum Fee: Greater of 90% of the Base Fee paid in the same quarter of the

prior year OR the Peer G&A Ratio x Total Market Capitalization

Payable quarterly

Incentive Fee

5% of the TSR outperformance (compared to defined peer set) times Equity

Market Capitalization – fee is subject to a 25% outperformance cap

Incentive Fee Payment

Fee is determined annually and paid over 3 years in equal annual installments

- up to 50% can be paid in stock at AHT/AHP election

Other Payments/Fees Reimbursement for internal audit and other overhead costs

Long-Term Advisory Agreements

5

67%

-29% -28%

100% 91%

15%

59%

36%

111%

30%

73%

401%

237%

20%

42% 39%

-100%

-50%

0%

50%

100%

150%

200%

250%

300%

350%

400%

450%

Inception 10-Yr 9-Yr 8-Yr 7-Yr 6-Yr 5-Yr 4-Yr

Peer Avg AHT

Demonstrated Long-Term Track Record

6

(1) Since IPO on August 26, 2003

Peer average includes: CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, RLJ, SHO

Returns as of 11/3/16

Source: SNL

Total Shareholder Return

Long-term performance

significantly outperforms

peers

(1)

Ashford Hospitality Prime Overview

Bardessono Hotal & Spa

Yountville, CA

Ashford Hospitality Prime

8

Focused strategy of

investing in luxury

hotels in resort and

gateway markets

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Grow platform

through accretive

acquisitions of high

quality assets

Highly-aligned

management team

and advisory

structure

Simple and

straightforward

investment profile

Grow organically

through strong

revenue and cost

control initiatives

Targets conservative

leverage levels of Net

Debt/EBITDA of 5.0x or

less

9

Excellent Progress on Strategic Alternatives

Appointed Richard J. Stockton as new

CEO effective November 14, 2016

Added Ken Fearn as an independent

director

Since April 8, 2016 we have bought

back approximately 2.9 million shares

for $39 million

Investment has been redeemed

Increased dividend 20% to $0.12

Courtyard Seattle sold for $84.5 million

at 6.8% TTM NOI cap rate

Increase dividend

WHAT WE SAID WE WOULD DO

Sell up to 4 non-strategic hotels

Liquidate investment fund

$50 million stock repurchase program

Add 2 independent directors

Appoint new CEO

WHAT WE HAVE DONE

High Quality Portfolio

10 Ashford Prime Hotels

Marriott Seattle

Seattle, WA

Hilton Torrey Pines

La Jolla, CA

Bardessono Hotel & Spa

Yountville, CA

Pier House Resort

Key West, FL

Renaissance Tampa

Tampa, FL

Courtyard Philadelphia

Philadelphia, PA

Capital Hilton

Washington D.C.

Courtyard San Francisco

San Francisco, CAz Renaissance Tampa

Tampa, FL

Courtyard Philadelphia

Philadelphia, PA

apital Hilton

ashington . .

Marriott Plano Legacy

Plano, TX

The Ritz-Carlton St. Thomas

St. Thomas, USVI

Sofitel Chicago Magnificent Mile

Chicago, IL

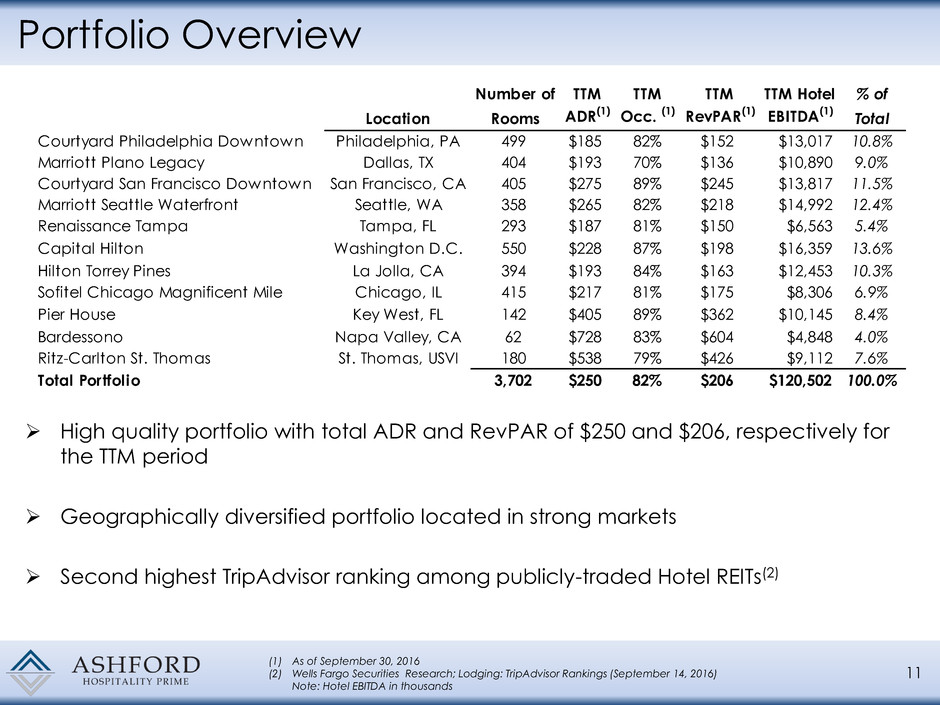

Portfolio Overview

11

(1) As of September 30, 2016

(2) Wells Fargo Securities Research; Lodging: TripAdvisor Rankings (September 14, 2016)

Note: Hotel EBITDA in thousands

High quality portfolio with total ADR and RevPAR of $250 and $206, respectively for

the TTM period

Geographically diversified portfolio located in strong markets

Second highest TripAdvisor ranking among publicly-traded Hotel REITs(2)

Number of TTM TTM TTM TTM Hotel % of

Location Rooms ADR

(1) Occ. (1) RevPAR(1) EBITDA(1) Total

Courtyard Philadelphia Downtown Philadelphia, PA 499 $185 82% $152 $13,017 10.8%

Marriott Plano Legacy Dallas, TX 404 $193 70% $136 $10,890 9.0%

Courtyard San Francisco Downtown San Francisco, CA 405 $275 89% $245 $13,817 11.5%

Marriott Seattle Waterfront Seattle, WA 358 $265 82% $218 $14,992 12.4%

Renaissance Tampa Tampa, FL 293 $187 81% $150 $6,563 5.4%

Capital Hilton Washington D.C. 550 $228 87% $198 $16,359 13.6%

Hilton Torrey Pines La Jolla, CA 394 $193 84% $163 $12,453 10.3%

Sofitel Chicago Magnificent Mile Chicago, IL 415 $217 81% $175 $8,306 6.9%

Pier House Key West, FL 142 $405 89% $362 $10,145 8.4%

Bardessono Napa Valley, CA 62 $728 83% $604 $4,848 4.0%

Ritz-Carlton St. Thomas St. Thomas, USVI 180 $538 79% $426 $9,112 7.6%

Total Portfolio 3,702 $250 82% $206 $120,502 100.0%

Capital Structure and Net Working Capital

Conservative leverage in line with platform strategy

Targeted Net Debt / EBITDA of 5.0x

All debt is non-recourse, property level mortgage debt

Targeted cash balance of 25% to 30% of market capitalization

Maintain excess cash balance to capitalize on opportunities

Hedge unfavorable economic shocks

Dry powder to execute opportunistic acquisitions

12

Total Enterprise Value Net Working Capital

Figures in millions except per share values

Stock Price (As of November 3, 2016) $12.39

Fully Diluted Shares Outstanding 30.4

Equity Value $376.9

Plus: Convertible Preferred Equity 72.3

Plus: Deb 712.5

Total Market Capitalization $1,161.6

Less: Net Working Capital (145.1)

Total Enterprise Value $1,016.5

Cash & Cash Equivalents $126.0

Restricted Cash 39.3

Accounts Receivable, net 16.1

Prepaid Expenses 4.2

Due From Affiliates, net (2.8)

Due f om Third Party Hotel Managers 5.7

Investment in Ashford Inc. (1) 9.3

Total Current Assets $197.8

Accounts Payable, net & Accrued Expenses $47.8

Dividends Payable 4.9

Total Current Liabilities $52.7

Net Working Capital $145.1

As of September 30, 2016

(1) At market value as of November 3, 2016

Ashford Hospitality Trust Overview

W Atlanta Downtown

Atlanta, GA

Ashford Hospitality Trust

14

ord Hospitality

Opportunistic platform focused on upper-upscale, full-service hotels

Attractive dividend yield

Targets moderate debt levels of 55-60% net debt/gross assets

Targets cash level of 25-35% of total equity market cap

Superior long-term total shareholder return performance

Highly-aligned management team & advisory structure

15 Ashford Trust Hotels

High Quality, Geographically Diverse Portfolio

Le Pavillon Hotel

New Orleans, LA

Lakeway Resort & Spa

Austin, TX

Hilton Costa Mesa

Costa Mesa, CA

Marriott Fremont

Fremont, CA

Le Meridien Minneapolis

Minneapolis, MN Chicago Silversmith

Chicago, IL

Hilton Back Bay

Boston, MA

The Churchill

Washington, D.C.

W Atlanta Downtown

Atlanta, GA

Crowne Plaza Key West

Key West, FL

Marriott Sugar Land

Sugar Land, TX

Hilton Santa Fe

Santa Fe, NM

Renaissance Nashville

Nashville, TN

Westin Princeton

Princeton, NJ

Marriott Beverly Hills

Beverly Hills, CA

Embassy Suites Portland

Portland, OR

Marriott Gateway

Arlington, VA

Portfolio Overview

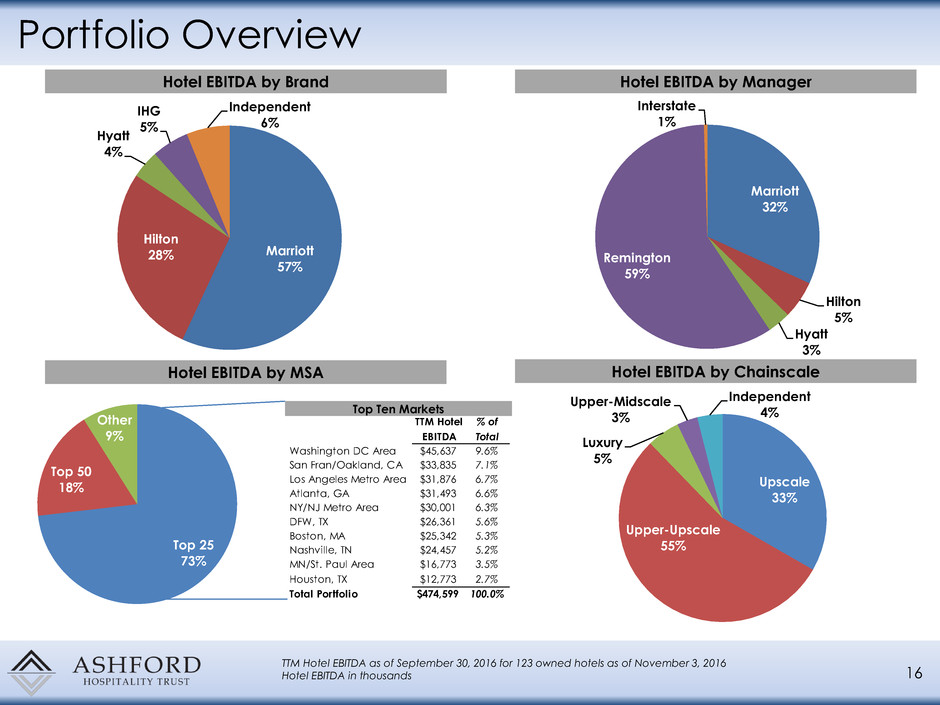

16

Top 25

73%

Top 50

18%

Other

9%

TTM Hotel EBITDA as of September 30, 2016 for 123 owned hotels as of November 3, 2016

Hotel EBITDA in thousands

Hotel EBITDA by Brand Hotel EBITDA by Manager

Hotel EBITDA by MSA Hotel EBITDA by Chainscale

Top Ten Markets

Marriott

57%

Hilton

28%

Hyatt

4%

IHG

5%

Independent

6%

Marriott

32%

Hilton

5%

Hyatt

3%

Remington

59%

Interstate

1%

Upscale

33%

Upper-Upscale

55%

Luxury

5%

Upper-Midscale

3%

Independent

4%

TTM Hotel % of

EBITDA Total

Washington DC Area $45,637 9.6%

San Fran/Oakland, CA $33,835 7.1%

Los Angeles Metro Area $31,876 6.7%

Atlanta, GA $31,493 6.6%

NY/NJ Metro Area $30,001 6.3%

DFW, X $26,361 5.6%

Boston, MA $25,342 5.3%

Nashville, TN $24,457 5.2%

MN/St. Paul Area $16,773 3.5%

Houston, TX $12,773 2.7%

Total Portfolio $474,599 100.0%

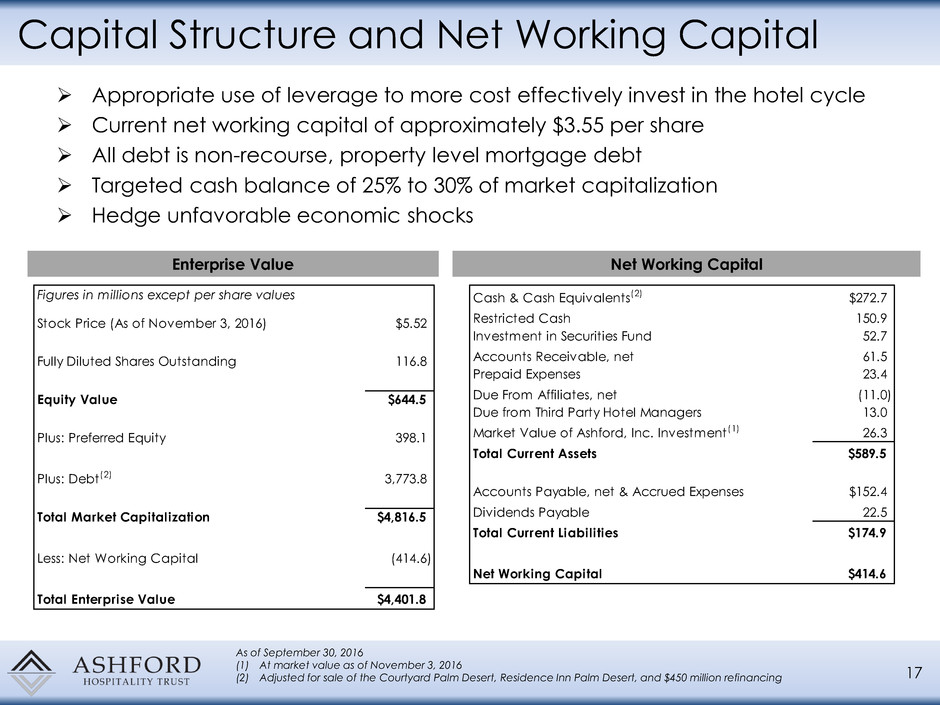

Capital Structure and Net Working Capital

Appropriate use of leverage to more cost effectively invest in the hotel cycle

Current net working capital of approximately $3.55 per share

All debt is non-recourse, property level mortgage debt

Targeted cash balance of 25% to 30% of market capitalization

Hedge unfavorable economic shocks

17

Enterprise Value Net Working Capital

As of September 30, 2016

(1) At market value as of November 3, 2016

(2) Adjusted for sale of the Courtyard Palm Desert, Residence Inn Palm Desert, and $450 million refinancing

Figures in millions except per share values

Stock Price (As of November 3, 2016) $5.52

Fully Diluted Shares Outstanding 116.8

Equity Value $644.5

Plus: Preferred Equity 398.1

Plus: Debt(2) 3,773.8

Total Market Capitalization $4,816.5

Less: Net Working Capital (414.6)

Total Enterprise Value $4,401.8

Cash & Cash Equivalents(2) $272.7

Restricted Cash 150.9

Investment in Securities Fund 52.7

Accounts Receivable, net 61.5

Prepaid Expenses 23.4

Due From Affiliates, net (11.0)

Due from Third Party Hotel Managers 13.0

Market Value of Ashford, Inc. Investment(1) 26.3

Total Current Assets $589.5

Accounts Payable, net & Accrued Expenses $152.4

Dividends Payable 22.5

Total Current Liabilities $174.9

Net Working Capital $414.6

Proposed Remington Combination Overview

AINC has entered into an agreement to combine with Remington(1) for total

transaction value of $299.5 million

916,500 subsidiary nonvoting common shares issued at $100 per share

(current market value of $59.5 million)

$230 million in subsidiary convertible preferred stock

• 6.625% yield

• $120 conversion price (85% premium)(2)

$10 million cash consideration(3)

Remington sellers retain 20% of Remington through limited partner interests

AINC to create new subsidiary (“NewCo”) & contribute all assets to NewCo

Securities issued to sellers will be NewCo securities, but are intended to be

economically equivalent to AINC securities

NewCo stock will be issued to sellers at 54% premium to pre-announcement

market price of AINC stock(2) and 127% premium to current market price(4)

Sellers only taking 3% of the consideration in cash signifying strong belief in

future prospects for AINC & Remington

18

(1) Remington Holdings LP and its affiliates. A 20% interest in Remington Holdings will be retained by the current owners.

(2) Based on closing stock price of AINC as of September 17, 2015

(3) Paid out quarterly over 4 years

(4) Based on closing stock price of AINC as of November 3, 2016

Proposed Remington Combination Overview (cont.)

Attractive valuation relative to the intrinsic

value of the business and recent

comparable transactions

Subsidiary common shares issued at $100

per share, a 54% premium to pre-

announcement market price of AINC(1)

and 127% premium to current market

price(2)

Subsidiary as-converted shares issued at

85% premium to pre-announcement

market price of AINC(1)

Very little cash consideration for large

transformational combination signifying

strong belief by the sellers in the future

growth prospects for AINC and Remington

19

(1) Based on closing stock price of AINC as of September 17, 2015

(2) Based on closing stock price of AINC as of November 3, 2016

Financial Benefits Strategic Benefits

Adds incremental incentive fees which are

tied to property performance, not strictly

shareholder returns, as is currently the case

for AINC

Adds talented executives to help lead

AINC’s growing platform

Enhances strong alignment of sellers

through issuance of non-voting common

equity and convertible preferred equity

Combination creates the only public,

pure-play provider of asset and property

management services to the lodging

industry

OpenKey Update

OpenKey is a universal smartphone app for keyless entry

into hotel guestrooms

Secure interfaces with many global lock manufacturers,

including four of the largest: Assa Abloy, Kaba, Salto, and

Miwa

OpenKey has also begun to work with Hotek, a Bluetooth

lock upgrade company

20

Installed in three of Ashford Trust’s hotels and are in the process of considering more

60,000 hotel rooms in the immediate pipeline outside of Ashford hotels

Contracted 409 rooms, 674 rooms, and 4,328 rooms in the first, second, and third quarters,

respectively

Recently launched a white-label platform allowing hotels and brands to use their own imagery

on top of the OpenKey software

Expected property level cost savings through labor efficiencies, replacement of RFID cards, and

decreased customer acquisition costs

Balance Sheet

21 As of September 30, 2016

Asset light business model

Cash available for investments

Currently no debt

Corporate cash of $26.3 million

Figures in millions

ASSETS

Cash & Cash Equivalents $79.6

Restricted Cash 10.1

Investments in Securities 7.2

Receivables 0.0

Prepaid Expenses and Other 0.9

Due from Ashford Trust OP 6.2

Due from Ashford Prime OP 1.6

Total Current Assets $105.7

Investments in Unconsolidated Affiliates $0.5

Furniture, Fixtures and Equipment, net 10.8

Deferred Tax Assets 5.0

Other Assets 4.0

Total Assets $126.0

LIABILITIES AND EQUITY

Accounts Payable, net & Accrued Expenses $10.2

Due to Affiliates 1.4

Liabilities Associated with Investments 0.0

Other Liabilities 10.1

Total Current Liabilities $21.7

Accrued Expenses $0.3

Deferred Income 3.6

Deferred Compensation Plan 10.0

Total Liabilities $35.6

Re eemable Noncrontrolling Interest $1.4

Equity $88.9

Total Liabilities and Equity $126.0

Key Takeaways

High growth, fee based business model

Asset light with very low capital requirements

Diversified fee generators

Strong management team with a long track record of

creating shareholder value

Highly-aligned platform through high insider

ownership

22

Company Presentation – November 2016

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- The Honest Company to Report First Quarter Financial Results on May 8, 2024

- Arcus Biosciences to Present New Data from Phase 2 Studies of Novel Immuno-Oncology Combinations at the 2024 ASCO Annual Meeting

- Acrivon Therapeutics Reports Initial Positive Clinical Data for ACR-368 and Pipeline Program Progress Today at Corporate R&D Event

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share