Form 8-K Armour Residential REIT, For: Nov 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 8-K

______________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 20, 2014

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

� | � | � |

Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

� | � | � |

3001 Ocean Drive, Suite 201 Vero Beach, Florida | � | 32963 |

(Address of Principal Executive Offices) | � | (Zip Code) |

(772) 617-4340

(Registrants Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[_]����Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[_]����Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

[_]����Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[_]����Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01.����Regulation FD Disclosure.

On November 20, 2014, ARMOUR Residential REIT, Inc. (

ARMOUR

) produced for distribution a slide deck presentation, which contains updates on ARMOUR's financial position, business and operations. Attached as Exhibit 99.1 to this report is the slide deck presentation produced by ARMOUR.

The slide deck presentation attached to this report as Exhibit 99.1 is furnished pursuant to this Item 7.01 and shall not be deemed filed in this or any other filing of ARMOUR under the Securities Exchange Act of 1934, as amended, unless expressly incorporated by specific reference in any such filing.

Item 9.01.����Financial Statements and Exhibits. �

(d) Exhibits

� | � |

Exhibit No. | Description |

99.1 | Slide Deck Presentation, dated November 20, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 20, 2014

ARMOUR RESIDENTIAL REIT, INC.

By: /s/ Mark Gruber���������������������������

Name: Mark Gruber

Title: Chief Operating Officer

Exhibit Index

� | � |

Exhibit No. | Description |

99.1 | Slide Deck Presentation, dated November 20, 2014 |

ARMOUR RESIDENTIAL REIT, Inc. Company Update November 20, 2014

�

PLEASE READ: Important Regulatory and Yield Estimate Risk Disclosures 2 Certain statements made in this presentation regarding ARMOUR Residential REIT, Inc. (

ARMOUR

or the

Company

), and any other statements regarding ARMOURs future expectations, beliefs, goals or prospects constitute forward-looking statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. Any statements that are not statements of historical fact (including statements containing the words

believes,

plans,

anticipates,

expects,

estimates

and similar expressions) should also be considered forward-looking statements. Forward-looking statements include but are not limited to statements regarding the projections for ARMOURs business and plans for future growth and operational improvements. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. ARMOUR assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities, financial instruments, or common or privately issued stock. The statements, information and estimates contained herein are based on information that the presenter believes to be reliable as of today's date, but cannot be represented that such statements, information or estimates are complete or accurate. Actual realized yields, durations and net durations described herein will depend on a number of factors that cannot be predicted with certainty. Estimated yields do not reflect any of the costs of operation of ARMOUR. THE INFORMATION PRESENTED HEREIN IS UNAUDITED AND UNREVIEWED.

�

ARMOUR Portfolio & Hedge Update 3 As described in previous Monthly Company Updates, ARMOUR sold 15yr MBS securities in September that will settle in December 2014. Therefore, these assets have been removed from the portfolio in this presentation. However, since these transactions were done on a forward settle basis and the bonds will remain on repo until they settle, they are still included in all the repo reporting herein. During November, we have added some longer final maturity Agency mortgages to the portfolio that have either many years of seasoning or have lower loan balances. These characteristics generally mean the cash flows will be relatively stable and predictable in various interest rate environments.

�

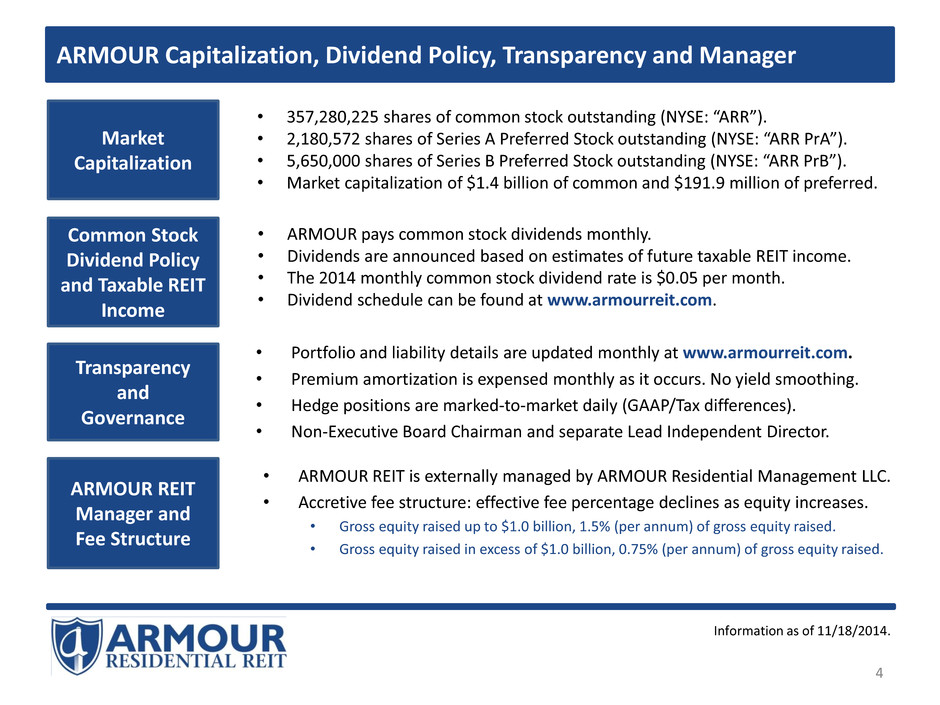

ARMOUR Capitalization, Dividend Policy, Transparency and Manager " Portfolio and liability details are updated monthly at www.armourreit.com. " Premium amortization is expensed monthly as it occurs. No yield smoothing. " Hedge positions are marked-to-market daily (GAAP/Tax differences). " Non-Executive Board Chairman and separate Lead Independent Director. Transparency and Governance 4 ARMOUR REIT Manager and Fee Structure " ARMOUR REIT is externally managed by ARMOUR Residential Management LLC. " Accretive fee structure: effective fee percentage declines as equity increases. " Gross equity raised up to $1.0 billion, 1.5% (per annum) of gross equity raised. " Gross equity raised in excess of $1.0 billion, 0.75% (per annum) of gross equity raised. Common Stock Dividend Policy and Taxable REIT Income Market Capitalization " 357,280,225 shares of common stock outstanding (NYSE:

ARR

). " 2,180,572 shares of Series A Preferred Stock outstanding (NYSE:

ARR PrA

). " 5,650,000 shares of Series B Preferred Stock outstanding (NYSE:

ARR PrB

). " Market capitalization of $1.4 billion of common and $191.9 million of preferred. " ARMOUR pays common stock dividends monthly. " Dividends are announced based on estimates of future taxable REIT income. " The 2014 monthly common stock dividend rate is $0.05 per month. " Dividend schedule can be found at www.armourreit.com. Information as of 11/18/2014.

�

ARMOUR Balance Sheet Targets ARMOUR invests in Agency mortgage securities. Net balance sheet weighted average duration target of 1.5 or less. " 4.38 gross asset duration. " -4.44 hedge duration. " -0.07 net balance sheet duration. Hedge a minimum of 40% of assets and funding rate risk. " $13.1 billion in hedges (swaps, Treasuries and futures). " 86.4% of assets hedged. " 95.6% of repurchase agreements hedged. Hold 40% of unlevered equity in cash between prepayment periods. " $962.8 million in total liquidity. " $318.8 million in true cash. " $451.8 million in unlevered securities. " $192.2 million in short term Agency P&I. Long term debt to equity target of 8x - 9x. " $15.3 billion in net REPO borrowings. " 8.3 x Q3 2014 shareholders equity. 5 Assets Duration Hedging Liquidity Leverage Information as of 11/18/2014.

�

ARMOUR Portfolio Strategy and Investment Methodology 6 � Diversify Broadly " Diversification limits idiosyncratic pool risk. " Over 1300 cusips. � Highly Liquid Assets " Purchase those Agency securities that are highly liquid (easily traded and priced). " ARMOUR purchases

pass-through

securities. " No collateralized mortgage obligations (

CMOs

). � Diversified Sources " Source assets through a mix of direct purchases from: " Originators. " Dealer inventories. " Institutional investors. � Loan Analysis Inelasticity vs. Elasticity " Credit work on non-credit assets. " Original and current loan balance. " Year of origination. " Originating company, third-party originators. " Loan seasoning. " Principal amortization schedule. " Original loan-to-value ratio. " Geography. " 62% of our 15yr MBS are between 85K 175K loan balances. � Pool Analysis " NO TBA pools Only specified pools. " Prepayment history. " Prepayment expectations. " Premium over par. "

Hedgability.

" Liquidity. Management has a focused and disciplined approach to evaluating assets for inclusion in the ARMOUR portfolio. ARMOUR employs a strong bias toward a buy and hold strategy rather than a trading strategy. ARMOUR will strategically sell assets when it believes market conditions warrant. Information as of 11/18/2014.

�

ARMOUR Portfolio and Derivatives Overview 7 Duration estimates are derived from third-party software. Actual realized yields, durations and net durations described herein will depend on a number of factors that cannot be predicted with certainty. If rates decline, the value of our derivatives will typically decline. Inversely, if rates increase, the value of our derivatives will typically increase. Information as of 11/18/2014. Portfolio value is based on independent third-party pricing. Portfolio information includes all forward settling trades. Some totals may not foot due to rounding. Note: The table above shows the effect of sales upon settlement. Agency Assets 4.38 Interest Rate Swaps & Eurodollar Futures -4.11 Treasuries -0.33 Net Balanc S Duration -0.07 Duration Contribution to Balance Sheet Assets 15,104.5$ 86.4% Net Repo Balance 13,650.4$ 95.6% Amount (millions) Total Hedge % ARMs (0-12 MTR, weighted average of 6 MTR) 134.1$ 104.6% 105.4% 3.43/3.89 1.14 Agency Multifamily Ballooning in 120 Months or Less 1,252.4$ 102.8% 103.8% 3.26/4.44 7.69 Fix d Rates Maturing in 120 Months or Less 6.3$ 104.7% 108.6% 4.54/5.03 2.56 Fixed Rates Maturing Between 121 and 180 Months 8,053.8$ 104.7% 105.5% 3.34/3.81 3.68 Fixed Rates Maturing Between 181 and 240 Months 4,927.0$ 105.8% 105.5% 3.60/4.11 3.80 Fixed Rates Maturing Betwee 241 a d 360 Months 731.1$ 106.7% 106.9% 4.03/4.50 3.78 Total r W ighted Average 15,104.5$ 105.0% 105.4% 3.45/4.00 4.04 Weighted Average Purchase Price Weighted Average Current Market Price Weighted Average Net/Gross Coupon Estimated Effective Duration Using Current Values Current Value (millions) Agency Asset Class

�

ARMOUR Hedge Detail 8 Information as of 11/18/2014. Some totals may not foot due to rounding. Derivative Type Remaining Term Weighted Average Remaining Term (Months) Notional Amount (millions) Weighted Average Rate Interest Rate Swap 0-12 Months 7 905.0$ 1.12 Interest Rate Swap 13-24 Months 17 2,925.0$ 1.24 Interest Rate Swap 25-36 Months 32 350.0$ 0.63 Interest Rate Swap 37-48 Months 39 300.0$ 1.00 Interest Rate Swap 49-60 Months 60 1,000.0$ 1.58 Interest Rate Swap 61-72 Months 63 300.0$ 1.48 Interest Rate Swap 73-84 Months 0 -$ 0.00 Interest Rate Swap 85-96 Months 92 2,450.0$ 1.47 Interest Rate Swap 97-108 Months 99 2,800.0$ 2.08 Interest Rate Swap 109-120 Months 0 -$ 0.00 Interest Rate Swap 121-132 Months 122 1,000.0$ 2.66 Eurodollar Futures 0-10 Months 6 25.0$ 2.13 Total or Weighted Average 65 $ 12,055.0 1.60 5 Year Treasuries $ 1,000.0 Notional Amount (millions)

�

ARMOUR Portfolio Constant Prepayment Rates (

CPR

) 9 ARMOUR expenses premium amortization monthly as it occurs. Constant Prepayment Rate (

CPR

) is the annualized equivalent of single monthly mortality (

SMM

). CPR attempts to predict the percentage of principal that will prepay over the next twelve months based on historical principal pay downs. CPR is reported on the 4th business day of the month for the previous month's prepayment activity.

�

ARMOUR REPO Composition 10 (1) ARMOUR has signed MRAs with 38 counterparties. Information as of 11/18/2014. Some totals may not foot due to rounding. 1 BNP Paribas Securities Corp. 1,218.7$ 7.9% 155 105 345 2 J.P. Morgan Securities LLC 1,199.6$ 7.7% 163 111 153 3 Merrill Lynch, Pierce, Fenner & Smith Inc. 1,181.3$ 7.6% 78 32 87 4 Mitsubishi UFJ Securities (USA), Inc. 1,085.4$ 7.0% 99 73 87 5 Wells Fargo Bank, N.A. 924.1$ 6.0% 31 26 30 6 ICBC Financial Services LLC 859.0$ 5.5% 146 64 135 7 The Bank of Nova Scotia 723.9$ 4.7% 65 42 79 8 Citibank, N.A. 700.0$ 4.5% 365 209 248 9 Credit Suisse Securities (USA) LLC 654.5$ 4.2% 70 50 86 10 Barclays Capital Inc. 652.2$ 4.2% 30 20 28 11 Morgan Stanley & Co. LLC 650.8$ 4.2% 89 73 87 12 Nomura Securities International, Inc. 649.4$ 4.2% 80 51 85 13 The Bank of New York Mellon 500.0$ 3.2% 328 278 316 14 Daiwa Securities America Inc. 463.3$ 3.0% 65 16 28 15 ING Financial Markets LLC 457.2$ 2.9% 82 45 80 16 RBS Securities Inc. 443.1$ 2.9% 66 45 70 17 KGS-Alpha Capital Markets, L.P. 374.7$ 2.4% 142 76 149 18 Royal Bank of Canada 363.0$ 2.3% 72 37 73 19 CRT Capital Group LLC 351.6$ 2.3% 56 6 6 20 South Street Securities LLC 327.6$ 2.1% 31 6 6 21 Mizuho Securities USA Inc. 311.3$ 2.0% 90 29 29 22 Citigroup Global Markets Inc. 285.6$ 1.8% 85 34 69 23 UBS Securities LLC 262.1$ 1.7% 87 41 58 24 Pierpont Securities LLC 227.0$ 1.5% 76 32 92 25 Guggenheim Securities, LLC 191.7$ 1.2% 71 48 76 26 Goldman, Sachs & Co. 158.0$ 1.0% 90 58 58 27 Deutsche Bank Securities Inc. 140.4$ 0.9% 58 30 52 28 Natixis Financial Products LLC 79.4$ 0.5% 89 83 83 29 E D & F Man Capital Markets Inc. 66.9$ 0.4% 91 22 22 Total or Weighted Average 15,501.9$ 100.0% 112 68 Longest Remaining Term in Days Weighted Average Remaining Term in Days Weighted Average Original Term in Days Percentage of REPO Positions with ARMOUR Principal Borrowed (millions) REPO Counter-Party(1) Weighted Average Repo Rate 0.36% Weighted Average Haircut 4.89% November Paydowns (177.8) Net REPO after Paydowns 15,324.1 Debt to Quarter End Shareholders' Equity Ratio 8.3

�

11 www.armourreit.com ARMOUR Residential REIT, Inc. 3001 Ocean Drive Suite 201 Vero Beach, FL 32963 772-617-4340

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Altius Renewable Royalties Reports Q1 2024 Expected Proportionate Royalty Revenue(1) of US$2.5 million

- Non-Destructive Testing Market to Reach USD 35.66 Billion by 2031 Owing to Rising Demand for Quality Assurance from Various End Use Industries

- H. Joseph Yost, Ph.D. Appointed Senior Vice Provost for Research

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share