Form 8-K Andersons, Inc. For: Jun 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): | June 2, 2016 | |

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

Ohio | 000-20557 | 34-1562374 |

_____________________ (State or other jurisdiction | _____________ (Commission | ______________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

480 West Dussel Drive, Maumee, Ohio | 43537 | |

_________________________________ (Address of principal executive offices) | ___________ (Zip Code) | |

Registrant’s telephone number, including area code: | 419-893-5050 | |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On May 31, 2016, The Andersons, Inc. (the "Company") filed a Form 8-K attaching a new investor presentation as Exhibit 99.1 thereto. As a result of an unintentional error, the return on invested capital chart on page 27 of Exhibit 99.1 included an incorrect number. Attached as Exhibit 99.1 is a revised investor presentation reflecting the corrected number.

The presentation is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is filed with this Current Report on Form 8-K/A:

Exhibit No. | Description | |

99.1 | Revised presentation dated June 2, 2016 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

The Andersons, Inc. | ||||

June 2, 2016 | By: | /s/ Naran U. Burchinow | ||

Name: Naran U. Burchinow | ||||

Title: General Counsel & Secretary | ||||

Exhibit Index

Exhibit No. | Description | |

99.1 | Revised presentation dated June 2, 2016 | |

For internal use only Investor Presentation June 2016

For internal use only2 Certain information discussed today constitutes forward-looking statements. Actual results could differ materially from those presented in the forward looking statements as a result of many factors including general economic conditions, weather, competitive conditions in the Company’s industries, both in the US and internationally, and additional factors that are described in the Company’s publically-filed documents, including its ’34 Act filings and the prospectuses prepared in connection with the Company’s offerings. This Presentation includes financial information of which the Company’s independent auditors have not completed their review. Although the Company believes that the assumptions upon which the financial information and its forward looking statements are based are reasonable, it can give no assurances that these assumptions will prove to be accurate. This presentation and today's prepared remarks contain non-GAAP financial measures. Reconciliations of the non-GAAP to GAAP measures may be found within the financial tables of our earnings release. “Adjusted Pre-Tax Income Attributable to The Andersons” is our primary measure of period-over-period comparisons, and we believe it is a meaningful measure for investors to compare our results from period to period. We have excluded nonrecurring items and items that we believe are not representative of our ongoing operations when calculating this Adjusted Pre-Tax Income. Forward looking statements & non-GAAP measures

For internal use only3 Our long-term strategic plan for the Company is already being implemented, with key initiatives in place and recent achievements including: Reduced senior management positions leaner overhead Brought in two external leaders fresh senior management perspectives Launched cost reduction initiative eliminate $10+ million of run-rate costs over the next two years Management’s goals are aligned with shareholders’ pay-for-performance culture We have a strong portfolio of complementary businesses with a foundation in agriculture that is positioned to weather the cyclical highs and lows of the commodity industries in which we operate ─ Looking to add bolt on acquisitions in specialty grain handling and specialty fertilizers We have seen and successfully navigated through downturns before and continue to focus on growth and value creation New CEO, Renewed Andersons Re-energized and moving forward Comprehensive long-term strategic plan to drive growth and value creation for shareholders and other stakeholders

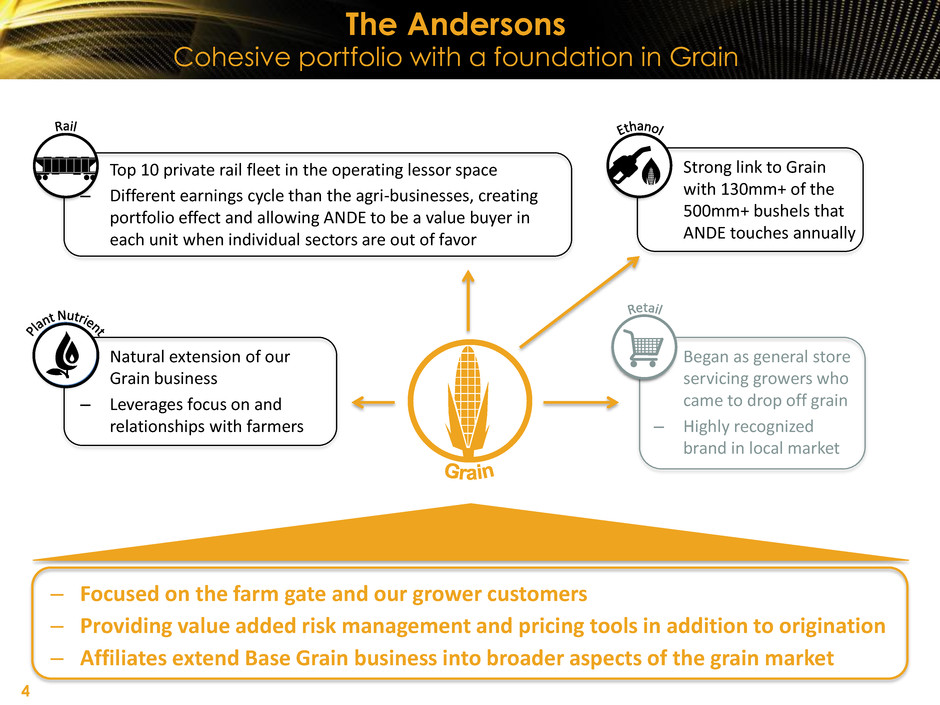

For internal use only4 – Strong link to Grain with 130mm+ of the 500mm+ bushels that ANDE touches annually – Natural extension of our Grain business – Leverages focus on and relationships with farmers – Focused on the farm gate and our grower customers – Providing value added risk management and pricing tools in addition to origination – Affiliates extend Base Grain business into broader aspects of the grain market – Top 10 private rail fleet in the operating lessor space – Different earnings cycle than the agri-businesses, creating portfolio effect and allowing ANDE to be a value buyer in each unit when individual sectors are out of favor – Began as general store servicing growers who came to drop off grain – Highly recognized brand in local market The Andersons Cohesive portfolio with a foundation in Grain

For internal use only Response to unsolicited proposal

For internal use only6 HC2’s proposal undervalues ANDE Wrong time, wrong price, wrong buyer HC2’s offer is not in the best interest of The Andersons’ shareholders and other stakeholders Opportunistic attempt to acquire ANDE near historic lows in the industry cycle Substantially undervalues the company - 20% discount to 52-week high and 47% discount to recent all time high OPPORTUNISTIC HC2’s ability to finance and execute such a transaction is highly questionable - HC2’s market cap is less than one sixth of The Andersons and their shares have traded down nearly 60% over the past year - HC2 has a mere $138 million in cash on hand and its claim to have secured financing is thin: - No evidence of commitment from lenders - No evidence of the new equity that would be necessary to support the financing - HC2’s stock price performance reflects market’s lack of confidence in the bidder HIGHLY CONTINGENT WITH UNCERTAIN FINANCING SEC alleged various violations of SEC rules and securities laws, including anti-fraud rules, and misappropriation of client assets - “Falcone and Harbinger engaged in serious misconduct that harmed investors, and their admissions leave no doubt that they violated the federal securities laws.” – Andrew Ceresney, Co-Director of the SEC’s Division of Enforcement Falcone admitted to facts alleged by SEC in a consent order (including borrowing over $100 million from a Harbinger Capital fund to pay personal taxes without disclosure) Agreed to pay an $11.5 million fine and not to serve in almost any capacity for a registered investment company or to control any New York licensed insurer PHILIP FALCONE’S HISTORY OF MISCONDUCT HCHC 1 Year

For internal use only A sale of Grain & Rail would be costly, and ultimately destroy value for shareholders ANDE has a cohesive portfolio of complementary agri-businesses - Each segment plays an important part in The Andersons’ role as trusted partner to farmers - The businesses interact in a mutually beneficial way, driving each other’s operational success Grain is the foundation of the business, linking and supporting the other segments Management has a strategy in place to drive the growth and profitability of each business individually, while maximizing corporate productivity DISRUPTION OF THE ANDE VALUE PROPOSITION Resulting ANDE RemainCo is incomplete, incongruous, and unattractive - Financial profile of the remaining businesses is insufficient for a public company - Cherry-picking by HC2 leaves burdensome overhead, stranded investments (Lansing, Thompsons) Shareholders would be left to either dispose of the remaining businesses (another costly process) or operate an overly cost-burdened company REMAINCO IS INCOMPLETE PROHIBITIVELY HIGH FRICTION COSTS 7 Burdensome friction costs borne entirely by ANDE’s shareholders - Tax leakage based on tax basis at time of transaction - ANDE’s debt agreements contain typical covenants regarding breakage penalties imposed in the event of an asset sale or change-of-control transaction which would be very costly HC2’s alternate plan to acquire Grain & Rail is a non-starter

For internal use only Company overview

For internal use only9 ANDE is well-positioned to capitalize on strong demographic trends: • Expanding world population • Growing middle class • Demand for protein Value in supply chain of US grain The Andersons Cohesive portfolio with a foundation in Grain

For internal use only Base Grain – Merchant & Services Leverage storage & handling capabilities to create value from difference in time and distance between grain harvest and processing Provides value added services to farmers including risk management and pricing tools Affiliate investments Lansing Trade Group –focused on merchandising physical commodities including grains, feed ingredients, energy products, and freight within North America and internationally Thompsons, Ltd – a leading Canadian provider of risk management, advanced agronomy, food grade beans, and grain marketing services 10 (Ownership ~31%) New facility under construction (Joint ownership with Lansing) Divested underperforming assets Grain Group overview Focus on the farmer

For internal use only Primary near-term goal: get performance of cornerstone division back on track Recently divested underperforming assets in Iowa Committed to improving strength of our core (Eastern Corn Belt) Re-focusing and building on “Partner of Choice” proposition, including business / risk management services for farmers We believe that changes in on-farm and commercial storage are not structural to industry, but have significant influence on local economics of specific assets – Company is adapting as market conditions evolve IA exit, TN investment Secondary, longer-term strategy elements: Expand capabilities in handling and services for specialty grains (non-GMO, organic) Achieve cost and capability benefits from new ERP system Continue to invest in assets that expand our footprint and deliver profitable growth Recently appointed Corey Jorgenson as the Grain Group president – Corey comes to us with nearly 20 years of experience including general management, agricultural trading and risk management at Cargill 11 Grain Group strategy Building on long term value in bringing crops to market

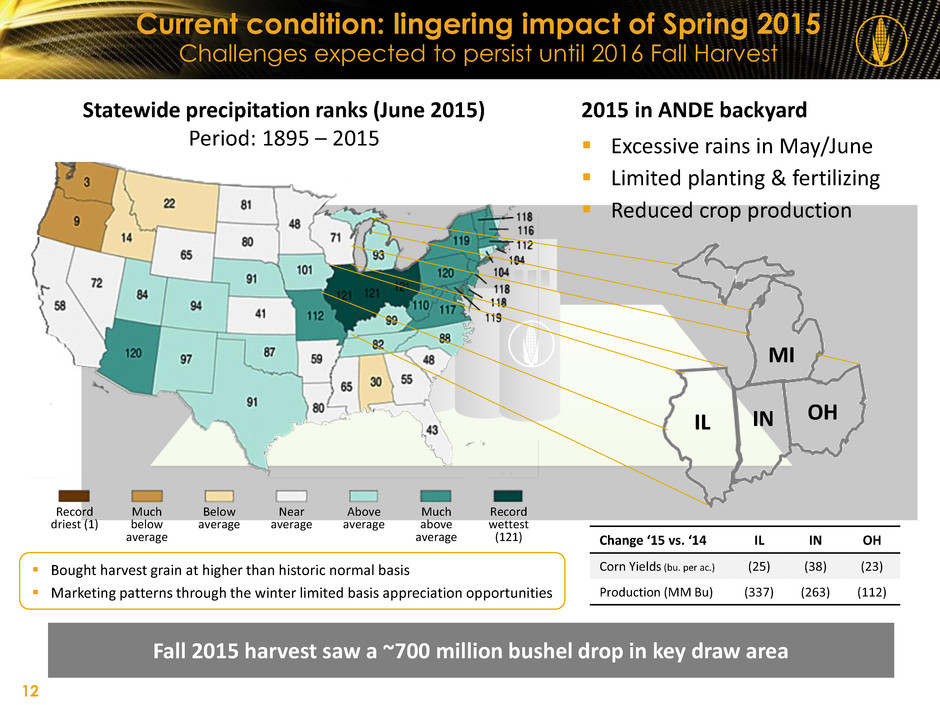

For internal use only Current condition: lingering impact of Spring 2015 Challenges expected to persist until 2016 Fall Harvest 12 2015 in ANDE backyard Excessive rains in May/June Limited planting & fertilizing Reduced crop production Statewide precipitation ranks (June 2015) Period: 1895 – 2015 Record driest (1) Much below average Below average Near average Above average Much above average Record wettest (121) MI INIL OH Change ‘15 vs. ‘14 IL IN OH Corn Yields (bu. per ac.) (25) (38) (23) Production (MM Bu) (337) (263) (112) Bought harvest grain at higher than historic normal basis Marketing patterns through the winter limited basis appreciation opportunities Fall 2015 harvest saw a ~700 million bushel drop in key draw area

For internal use only Lack of basis appreciation in quarter contributed to $10mm reduction in space income for Base Grain Chinese anti-dumping and countervailing duties significantly impacted DDGS trading for Lansing Trade Group Exited underperforming assets in Iowa Construction of new space in Tennessee is on track for fall harvest 13 $ in millions, except margin Q1 ’16 Q1 ’15 VPY FY ’15 Base Grain Revenues $538.8 $558.7 ($19.9) $2,483.6 Gross Profit $16.2 $29.7 ($13.5) $123.6 Gross Profit Margin 3.0% 5.3% (2.3%) 5.0% Pre-tax Income ($13.3) ($0.4) ($12.9) ($45.8) Adj. Pre-Tax Income ─ ─ ─ $0.6 Affiliates Pre-Tax Income ($4.1) $1.3 ($5.4) $13.3 Group Pre-tax Income ($17.4) $0.7 ($18.1) ($9.4) Group Adjusted Pre-tax Income ─ ─ ─ $13.9 Q1 Performance Adjusted Five Year Performance $0 $1,500 $3,000 $4,500 -$30 $0 $30 $60 2012 2013 2014 2015 2016 Q1 Q2 Q3 Q4 Revenue P re -t a x In co me/L o ss in m ill io n s R eve n u e in m illio n s Grain Group Financial performance

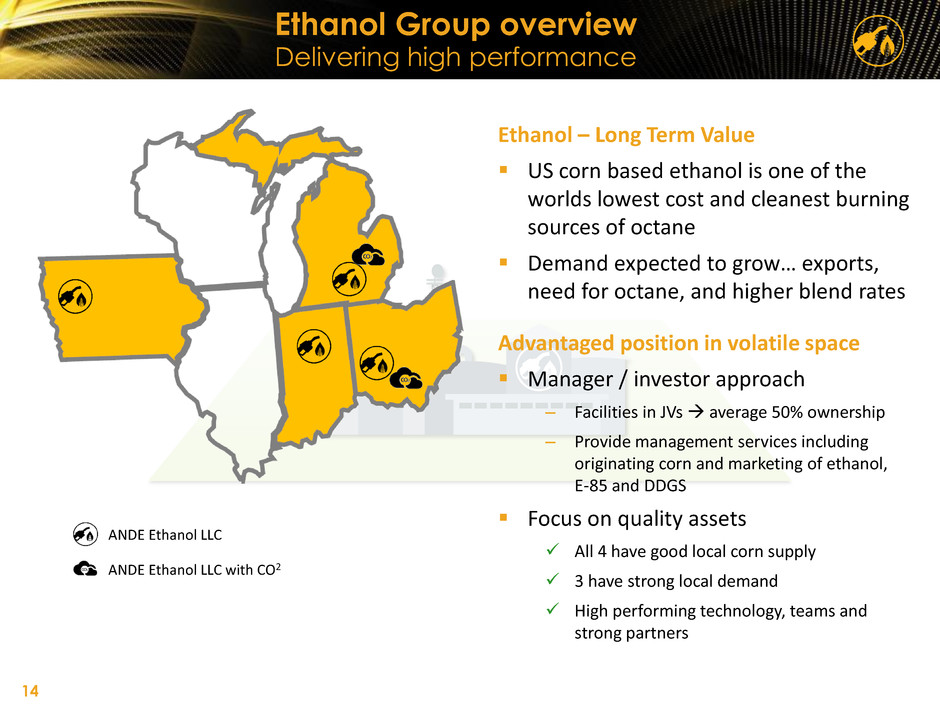

For internal use only Ethanol – Long Term Value US corn based ethanol is one of the worlds lowest cost and cleanest burning sources of octane Demand expected to grow… exports, need for octane, and higher blend rates Advantaged position in volatile space Manager / investor approach – Facilities in JVs average 50% ownership – Provide management services including originating corn and marketing of ethanol, E-85 and DDGS Focus on quality assets All 4 have good local corn supply 3 have strong local demand High performing technology, teams and strong partners 14 ANDE Ethanol LLC with CO2 ANDE Ethanol LLC Ethanol Group overview Delivering high performance

For internal use only15 Ethanol is a natural downstream extension of our Grain Business – US ethanol is the most cost-effective, clean-burning source of octane – Renewal of US ethanol government mandate in 2016 Well positioned to profit from our unmatched productive capacity for corn in the US (as a huge surplus starch source) and the high demand for cost-effective, environmentally friendly, and domestically produced liquid transportation fuel Strategic direction to growing value: – De-risk through manager/investor model: earning origination, marketing and management fees – Expand high performing asset in Albion, MI advantaged location, surplus corn, ethanol deficit – Open to other expansion, but strict requirements for assets with above-industry advantages Strategic partnership with Marathon Petroleum augments our upstream farming insight with downstream capabilities at the pump Perform at the top of the industry and invest in high quality assets to provide: – Good returns in “normal” times and great occasional upside – Limited downside by being positioned to operate cash positive when industry margins are tight Ethanol Group strategy Good base earnings – more structural upside than downside

For internal use only ($0.80) ($0.60) ($0.40) ($0.20) $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 8 Year Range 2016 8 Year Average 2014 2015 16 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Sources: NYMEX Chicago Ethanol (Platts) Futures Electronic (Front Month); CBOT Corn Futures Electronic (Front Month); Est industry 2.8 gal / bushel Seasonally weak margins in winter improve into summer driving 8-year corn vs. ethanol margins Ethanol Group Basic industry margin history

For internal use only Group remained cash positive through challenging quarter Headwind from higher-than-normal corn basis in Eastern Corn Belt relative to national market High industry supply during seasonally slow demand quarter impacted margins Albion expansion has begun and is on schedule 17 $ in millions Q1 ’16 Q1 ’15 VPY FY ’15 Revenues $114.7 $132.8 ($18.1) (13.6%) $556.2 Equity earnings of affiliates ($3.2) $1.7 ($4.9) (327%) $17.2 Consolidated operations and service fees $0.5 $3.6 ($3.1) (68.9%) $11.3 Pre-tax income ($2.7) $5.3 ($8.0) (152%) $28.5 Q1 Performance Adjusted Five Year Performance $0 $200 $400 $600 $800 $1,000 -$20 $0 $20 $40 $60 $80 $100 2012 2013 2014 2015 2016 Q1 Q2 Q3 Q4 Revenue P re -t a x In co me/L o ss in m ill io n s R eve n u e in m illio n s Ethanol Group Financial performance

For internal use only Plant Nutrient foundation Natural adjacency to Grain business, leveraging relationships and intelligence with the farm and drive to bring value and sustainability to growers Founded in wholesale distribution of basic row crop fertilizer (NPK) Significant expansion of specialty nutrient capabilities with May 2015 acquisition of Nutra-Flo Specialty focus creates value for farmers and shareholders Delivering solutions for precision agriculture Specialty nutrients help maximize yields and minimize environmental impact Improve economics for the farmer Manufacturing facility 18 Headquarters Market area l l l North Sioux City Sioux City Gibbon Sergeant Bluff Maumee Upper Sandusky Logansport CareyWalton Seymour Webberville Manufacturing facility Headquarters Market area Plant Nutrient Group overview Expanded market in 2015

For internal use only Plant Nutrient is a natural strategic extension of our relationships with farmers Growing the business on a good foundation: – Leveraging strong Eastern Corn Belt wholesale distribution and retail farm center capabilities significant expansion into specialty fertilizer manufacturing and Western distribution – Fully integrated Nutra-Flo acquisition made The Andersons a leading US producer of low-salt liquid starter fertilizers Strategic direction for growing value: – Macro trend towards precision agriculture provides growth segment of otherwise mature NPK market – Earn 2x - 3x margins as a manufacturer of specialty products vs. distributor of commodities – As environmental regulations become more stringent, our specialty products provide a much more sustainable model Growth opportunities in both organic expansion of current product lines and further M&A to augment specialty products offerings 19 Plant Nutrient Group strategy Focused on bringing profitable solutions to the farm

For internal use only20 Basic NPK = nitrogen, phosphorous, potassium Specialty = value added nutrients, low-salt liquid starter fertilizers, micro-nutrients Other = other farm centers, lawn, cob 205 594 225 243 179 537 240 278 212 83 134 73 69 88 129 78 104 119 124 222 83 186 126 237 80 161 129 0 200 400 600 800 1,000 Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Basic NPK Specialty Other v PY +2% +35% +18% Nutra-Flo acquisition significantly driving specialty products growth Historical seasonality (tons sold) Plant Nutrient Group Tons sold historically heaviest in Q2 with modest uptick in Q4

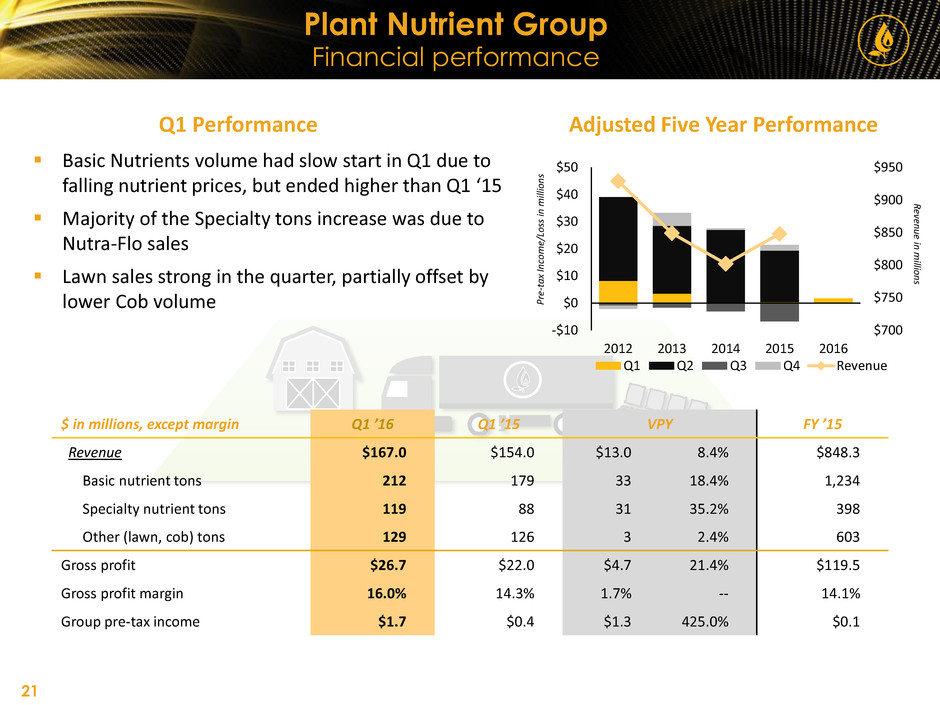

For internal use only Basic Nutrients volume had slow start in Q1 due to falling nutrient prices, but ended higher than Q1 ‘15 Majority of the Specialty tons increase was due to Nutra-Flo sales Lawn sales strong in the quarter, partially offset by lower Cob volume 21 $ in millions, except margin Q1 ’16 Q1 ’15 VPY FY ’15 Revenue $167.0 $154.0 $13.0 8.4% $848.3 Basic nutrient tons 212 179 33 18.4% 1,234 Specialty nutrient tons 119 88 31 35.2% 398 Other (lawn, cob) tons 129 126 3 2.4% 603 Gross profit $26.7 $22.0 $4.7 21.4% $119.5 Gross profit margin 16.0% 14.3% 1.7% -- 14.1% Group pre-tax income $1.7 $0.4 $1.3 425.0% $0.1 Q1 Performance Adjusted Five Year Performance P re -t a x In co me/L o ss in m ill io n s R eve n u e in m illio n s $700 $750 $800 $850 $900 $950 -$10 $0 $10 $20 $30 $40 $50 2012 2013 2014 2015 2016 Q1 Q2 Q3 Q4 Revenue Plant Nutrient Group Financial performance

For internal use only Rail Group origins in Grain Grew out of service to Grain customers Beginnings in Grain covered hoppers diversified over time into broad portfolio of equipment types Currently provides leasing, repair and management services for a fleet of nearly 23,000 railcars, barges and locomotives 17 railcar repair facilities across the United States 22 Box car 7.6% Locomotive 0.2% Open top hopper 5.7% Covered hopper 58.5% Refrigerator car 0.2% Tank car 14.2% Flat car 1.9% Gondola 8.8% PD hopper 3.0% Total railcar fleet by car type Diversification dampens industry volatility Rail Group overview Diversified portfolio

For internal use only23 Focus on older cars and repair facilities to drive earnings in a profitable niche – Rail cars represent long-lived assets (potentially ~50/65 years) where we can make a good return on the middle to back half of a car’s life Repair and fabrication capabilities support full service leasing and ability to cater to specific customer needs We add value by being more agile for smaller accounts and lease quantities Strong portfolio management has positioned the business to better perform through the cycle, including the current downturn – Diverse fleet of assets with a wide variety of customers and relatively evenly spread lease maturities which dampens shocks from market demand Strategic direction for growing value: – Opportunistically grow the fleet without losing discipline as a value buyer – Seek portfolios of assets and / or businesses that would be attractive acquisitions Rail Group strategy Continued focus on long-lived assets

For internal use only24 As of Mar. 31, 2016. ~1,800 idle railcars Grain / Grain Products, 25% Fertilizer / Minerals, 14% Sand / Sand Products / Cement, 10% Plastics, 10% Oil / Ethanol / Gasoline, 8% Wood & Forestry / Paper, 8% Metals & Products, 5% Chemicals, 4% Aggregates & Stone / Limestone, 5% Coal / Coke, 3% Finished / Refined Goods, 1% Other, 6% Rail Group Railcar fleet by customer commodity industry

For internal use only Diverse portfolio and relatively even spread of lease renewals helping sustained utilization rates Lease rates were stable while cost of sales were higher due to increased depreciation on some newer cars Lower railcar sales in quarter due to timing Growth in repair revenue and earnings Redeemed investment in short-line 25 $ in millions, except margin Q1 ’16 Q1 ’15 VPY FY ’15 Revenue $39.6 $44.2 ($4.6) $170.8 Gross profit $14.5 $17.3 ($2.8) $67.7 Gross profit margin 36.8% 39.2% (2.4%) 39.6% Lease income $4.4 $5.0 ($0.6) $31.5 Railcar sales income $2.4 $4.5 ($2.1) $13.3 Service & other $2.6 $0.8 $1.8 $5.9 Pre-tax income $9.4 $10.3 ($0.9) $50.7 Utilization 91.5% 91.8% (0.3%) 92.4% Q1 Performance Adjusted Five Year Performance P re -t a x In co me/L o ss in m ill io n s R eve n u e in m illio n s $135 $145 $155 $165 $175 $0 $10 $20 $30 $40 $50 $60 2012 2013 2014 2015 2016 Q1 Q2 Q3 Q4 Revenue Rail Group Financial performance

For internal use only26 Established portfolio of inter-connected businesses Rail Group Different economic factors than the agri- businesses, creating portfolio effect and allowing ANDE to be a value buyer in each unit when individual sectors are out of favor Ethanol Group Strong link to Grain with 130mm+ of the +500mm bushels that ANDE touches annually Leverage market intelligence capabilities across Grain and Ethanol groups Customer of Rail Group Plant Nutrient Group Strong complement to our Grain business Leverages focus on and relationships with farmers In many cases, co-located with grain to leverage shared labor in off-setting seasons Grain Group Focused on the farmer Providing value added risk management and pricing tools in addition to origination Shipper via rail to processors nationwide Affiliates extend portfolio reach Portfolio provides synergies and balanced performance & cash flows for long term Founded in Grain and positioned to deliver long-term earnings growth with the portfolio and balance sheet to weather industry cycles

For internal use only $1.39 $2.32 $3.39 $2.82 $3.18 $3.46 $1.45 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 2009 2010 2011 2012 2013 2014 2015 Adjusted EPS ROIC WACC Power to deliver long-term returns 27 Portfolio built for the long term . . . Portfolio of businesses operating on different cycles Strong balance sheet to weather tough markets and capacity to be a value buyer . . . yielding long-term returns amidst short- term volatility Proven track record of managing the portfolio for long term returns, through both good and challenging cycles Average ROIC: 10.0% Average WACC: 7.9% Note: 2014 and 2015 EPS figures represent non-GAAP adjusted figures. EPS excludes pension settlement, goodwill impairment, and other one-time non- operating gains/losses.

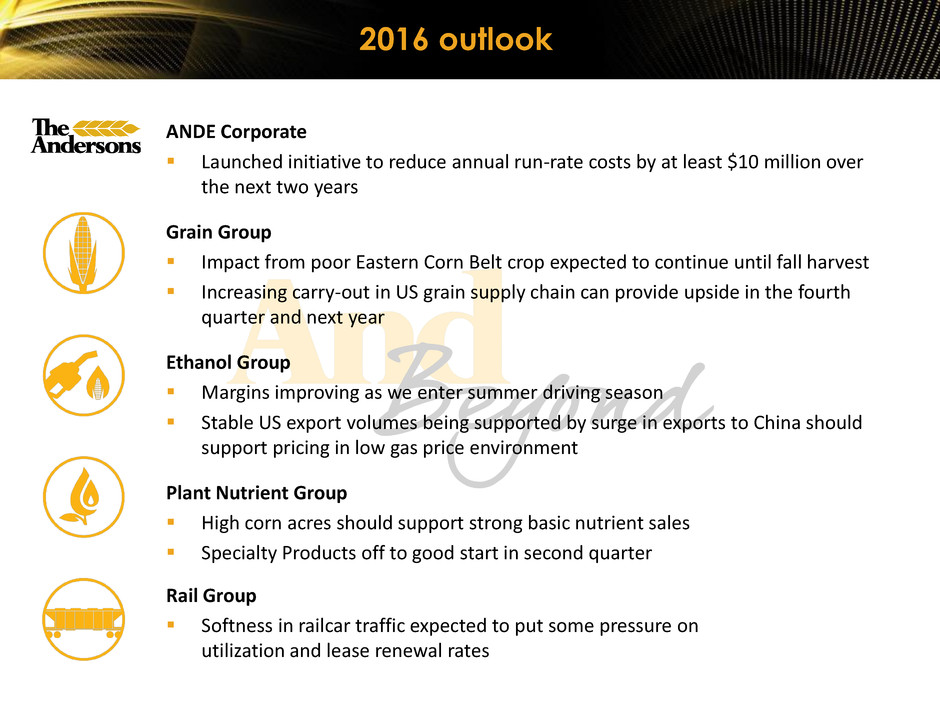

For internal use only ANDE Corporate Launched initiative to reduce annual run-rate costs by at least $10 million over the next two years Grain Group Impact from poor Eastern Corn Belt crop expected to continue until fall harvest Increasing carry-out in US grain supply chain can provide upside in the fourth quarter and next year Ethanol Group Margins improving as we enter summer driving season Stable US export volumes being supported by surge in exports to China should support pricing in low gas price environment Plant Nutrient Group High corn acres should support strong basic nutrient sales Specialty Products off to good start in second quarter Rail Group Softness in railcar traffic expected to put some pressure on utilization and lease renewal rates 2016 outlook

For internal use only Appendix

For internal use only Definitions EBITDA: Earnings before interest, taxes, depreciation, and amortization, is a non-GAAP measure. It is one of the measures the company uses to evaluate liquidity and leverage Base Grain: Grain operations owned and operated by The Andersons (does not include affiliates) Ethanol Margin Hedging: From time-to-time we establish hedge positions with futures and derivative contracts that lock in prices for purchases of corn and sales of ethanol, as well as purchases of natural gas with the intent of securing portions our future sales margins LT Debt to Capital: Ratio of long-term debt (including current maturities) to total capital defined as LT debt plus total equity Bushels Shipped: Includes shipments from our facilities, farm-to-market(F2M) and origination services for corn, soybeans, wheat, and oats F2M: Bushels that The Andersons, Inc. purchases from the farm and are delivered directly to an Andersons’ customer. The bushels are never delivered to an Andersons’ facility Bushels Owned: Bushels delivered to an Andersons’ elevator or storage facility rented by The Andersons, Inc. where title to the grain is transferred to The Andersons, Inc Bushels Stored for Others: The bushels are stored by The Andersons, Inc. for the owner of the grain for which a storage fee is charged the bushels’ owner Railcar Fleet Utilization: Percentage of railcars and locomotives in leased service CAGR: Compounded annual growth rate ROIC: Return on invested capital = (EBITA tax effected at 36% tax rate) / (LT debt + book equity) WACC: Weighted average cost of capital calculated using levered Barra beta, market cap, and total debt. Includes equity size premium from IBBOTSON 30

For internal use only Key financial data $ in millions, except per share data Q1 2016 Q1 2015 VPY FY 2015 Net sales $887.9 $918.2 ($30.3) $4,198.5 Gross profit $67.8 $83.3 ($15.5) $375.8 Operating and general expenses $79.9 $78.6 $1.3 $338.1 Equity in earnings/(loss) of affiliates ($7.0) $3.3 ($10.3) $31.9 Pre-tax Income/(loss) ($22.9) $5.0 ($27.9) ($11.6) Net income/(loss) attributable to The Andersons ($14.7) $4.1 ($18.8) ($13.1) Adjusted net income attributable to The Andersons - - - $41.2 Diluted earnings/(loss) per share (EPS) ($0.52) $0.14 ($0.66) ($0.46) Adjusted EPS (diluted) - - - $1.45 Depreciation and amortization $20.9 $17.5 $3.4 $78.5 EBITDA $6.0 $28.8 ($22.8) $85.2 Corporate unallocated expenses (adjusted) $10.9 $9.4 $1.5 $31.3 Long-term debt $402.4 $323.3 $79.1 $436.2 Long-term debt-to-equity 0.52 0.41 0.11 0.55 31 Adjusted net income for 2015 excludes one-time after tax losses of $34.8 million, $31.9 million and $1.9 million in goodwill impairment, pension settlement charges, and one-time acquisition costs, respectively and a $14.3 million after-tax gain on the partial redemption of our LTG investment. Adj sted net income for 2014 excludes a $10.7 million gain from the partial redemption of LTG

For internal use only Five-year history (as reported) Gross profit Capital expenditure 32 Pre-tax income EBITDA $352.8 $358.0 $365.2 $397.1 $375.8 2011 2012 2013 2014 2015 $147.9 $120.1 $149.5 $184.1 ($11.6) ($50.0) $0.0 $50.0 $100.0 $150.0 $200.0 2011 2012 2013 2014 2015 $77.9 $89.7 $42.1 $117.6 $110.9 2011 2012 2013 2014 2015 $212.3 $195.2 $219.9 $255.0 $85.2 2011 2012 2013 2014 2015 Note: CapEx includes net railcar purchases in m ill io n s in m ill io n s in m ill io n s in mill io n s

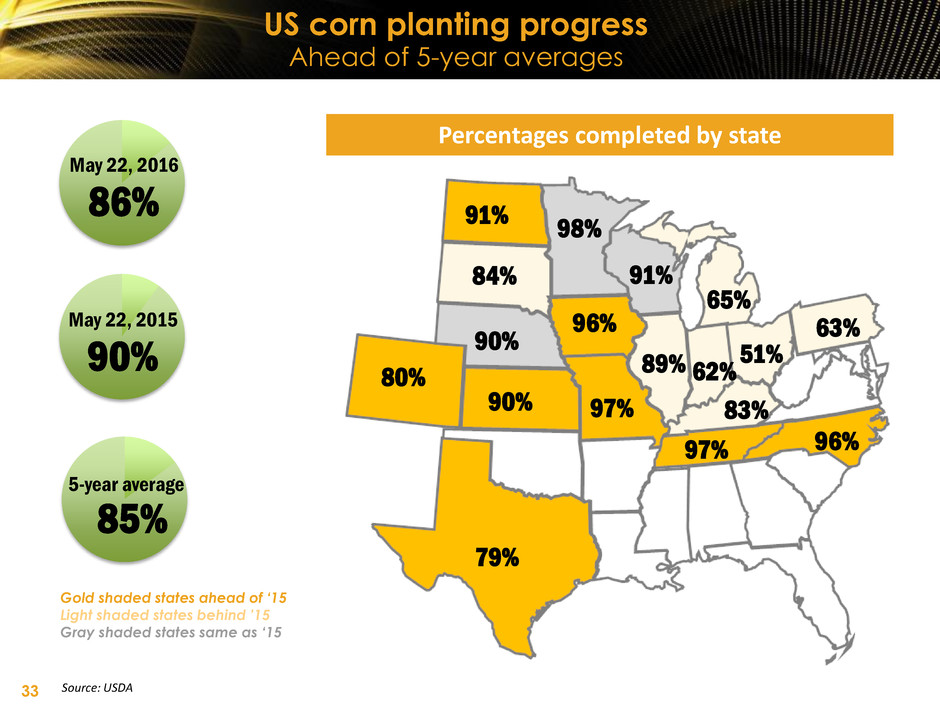

For internal use only US corn planting progress Ahead of 5-year averages 33 80% 90% 96% 62% 51%89% 96% 79% 83% 98% 65% 63% 90% 97% 84% 97% 91% 91% May 22, 2016 86% 85% 5-year average May 22, 2015 90% Source: USDA Percentages completed by state Gold shaded states ahead of ‘15 Light shaded states behind ’15 Gray shaded states same as ‘15

For internal use only 51% 81% 74% 24% 34% 46% 32% 76% 50% 86% 31% 22% 21% 82% 54% 82% 56% 66% US soybean planting progress Ahead of 5-year averages 34 May 22, 2016 56% 52% 5-year average May 22, 2015 56% Source: USDA Percentages completed by state Gold shaded states ahead of ‘15 Light shaded states behind ’15 Gray shaded states same as ‘15

For internal use only 85% 66% 59% 74% 79% 80% 55% 39% 67% 77% 59% 70% 67% 47% 87% 66% 77% 62% US winter wheat condition 35 May 22, 2016 62% May 22, 2015 74% Source: USDA Rated good-to-excellent by state

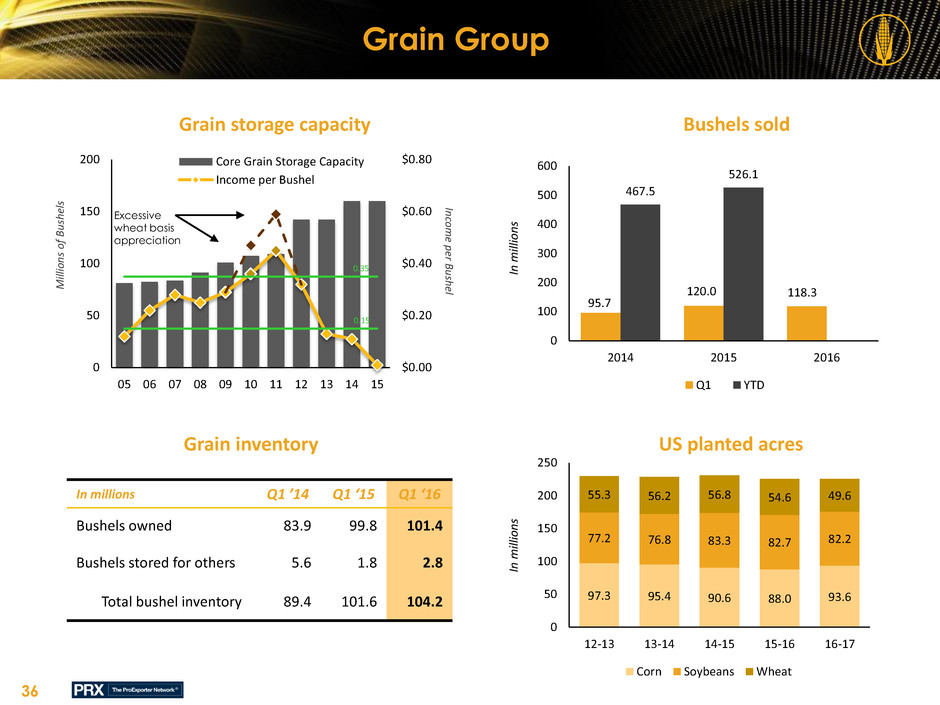

For internal use only Grain Group Grain storage capacity Bushels sold M ill io n s o f B u sh el s In co m e p er B u sh el $0.00 $0.20 $0.40 $0.60 $0.80 0 50 100 150 200 05 06 07 08 09 10 11 12 13 14 15 Core Grain Storage Capacity Income per Bushel Excessive wheat basis appreciation 0.35 0.15 95.7 120.0 118.3 467.5 526.1 0 100 200 300 400 500 600 2014 2015 2016 Q1 YTD Grain inventory US planted acres In millions Q1 ’14 Q1 ‘15 Q1 ‘16 Bushels owned 83.9 99.8 101.4 Bushels stored for others 5.6 1.8 2.8 Total bushel inventory 89.4 101.6 104.2 In mill io n s In mill io n s 36 97.3 95.4 90.6 88.0 93.6 77.2 76.8 83.3 82.7 82.2 55.3 56.2 56.8 54.6 49.6 0 50 100 150 200 250 12-13 13-14 14-15 15-16 16-17 Corn Soybeans Wheat

For internal use only 8,530 8,763 9,057 9,361 9,473 9,741 10,113 10,289 10,430 10,659 10,977 11,415 11,655 11,815 12,025 12,272 12,535 12,790 12,940 13,005 13,135 13,235 19,285 18,667 20,243 19,847 21,278 20,956 19,815 18,274 21,283 22,296 22,548 0 5,000 10,000 15,000 20,000 25,000 30,000 05-06 06-07 07-08 08-09 09-10 10-11 11-12 12-11 13-14 14-15 15-16 Off-Farm On-Farm Total Supply US storage capacity / supply impact Storage capacity utilization(a) 37 Crop year 05-06 06-07 07-08 08-09 09-10 10-11 11-12 12-13 13-14 14-15 15-16 Supply(b) 19.3 18.7 20.3 19.8 21.3 21.0 19.8 18.3 21.3 22.3 22.5 Capacity 19.9 20.6 20.9 21.4 21.8 22.3 22.9 23.2 23.5 23.8 24.2 Utilization(a) 97% 91% 97% 93% 98% 94% 86% 79% 91% 94% 93% Carry out 3.0 2.4 2.1 2.5 2.8 2.2 1.9 1.7 1.9 2.7 3.3 (a) Storage capacity utilization = Total supply(b)/total storage capacity (b) Total supply = corn, soybeans, wheat Estimated 16-17 supply: 23.3 Forecast In billions of bushels Source: PRX (The ProExporter Network), USDA In m ill io n s o f b u sh el s

For internal use only US storage capacity State Off-farm Storage Capacity Storage Capacity Percentage Ohio 425,000 41,623 9.8% Michigan 220,000 34,691 15.6% Indiana 526,000 28,125 5.0% Illinois 1,470,000 13,389 0.9% Nebraska 928,940 12,107 1.4% Iowa 1,500,000 *2,600 0.2% Tennessee 66,000 12,675 20.4% Texas 640,000 1,547 0.2% TOTAL 5,775,940 **147,350 2.6% 2015 total US commercial (off-farm) storage capacity of 10,977 million bushels, and 13,235 million on-farm storage In thousands of bushels 38 *Iowa total after sale of 8 facilities in Q2 ‘16 **Does not include Tennessee facility under construction Source: USDA

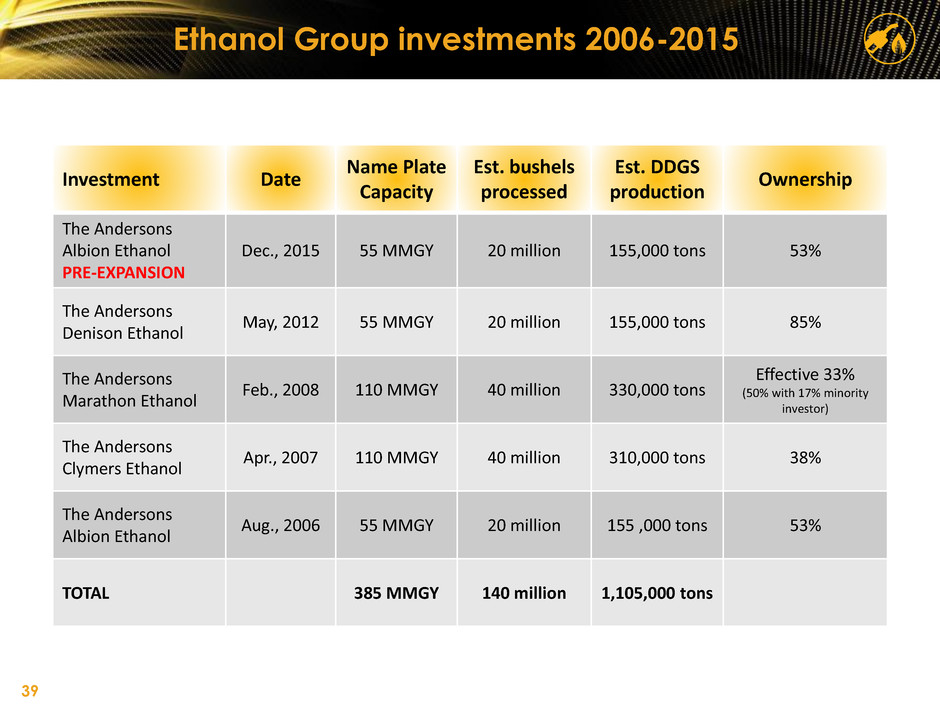

For internal use only Ethanol Group investments 2006-2015 Investment Date Name Plate Capacity Est. bushels processed Est. DDGS production Ownership The Andersons Albion Ethanol PRE-EXPANSION Dec., 2015 55 MMGY 20 million 155,000 tons 53% The Andersons Denison Ethanol May, 2012 55 MMGY 20 million 155,000 tons 85% The Andersons Marathon Ethanol Feb., 2008 110 MMGY 40 million 330,000 tons Effective 33% (50% with 17% minority investor) The Andersons Clymers Ethanol Apr., 2007 110 MMGY 40 million 310,000 tons 38% The Andersons Albion Ethanol Aug., 2006 55 MMGY 20 million 155 ,000 tons 53% TOTAL 385 MMGY 140 million 1,105,000 tons 39

For internal use only Sources of octane 84 92 101 103 106 110 113 115 75 80 85 90 95 100 105 110 115 120 125 Sub-octane Butane Benzene Toluene Xylene MTBE Ethanol Methanol Premium Gasoline Regular Gasoline Source: U.S Department of Energy, National Renewable Energy Lab Extremely high RVP Limited to 1% of the blend Banned in 26 states. No liability protection for producers Not covered by OEM warranties 40 Demand driven by economic, clean source of octane

For internal use only US ethanol exports Exports tracking to last year’s levels 41 2016 ethanol exports by destination (million gallons) Cumulative US ethanol exports 2016 gross exports expected to be 800 million – 1 billion gallons Source: EIA China, 75.1 Brazil, 49.8 Canada, 39.4 UAE, 10.9 Korea, 13.7 India, 12.5 Phillippines, 8.4 Mexico, 7.0 Peru, 7.0 Jamiaica, 6.0 Other, 8.3

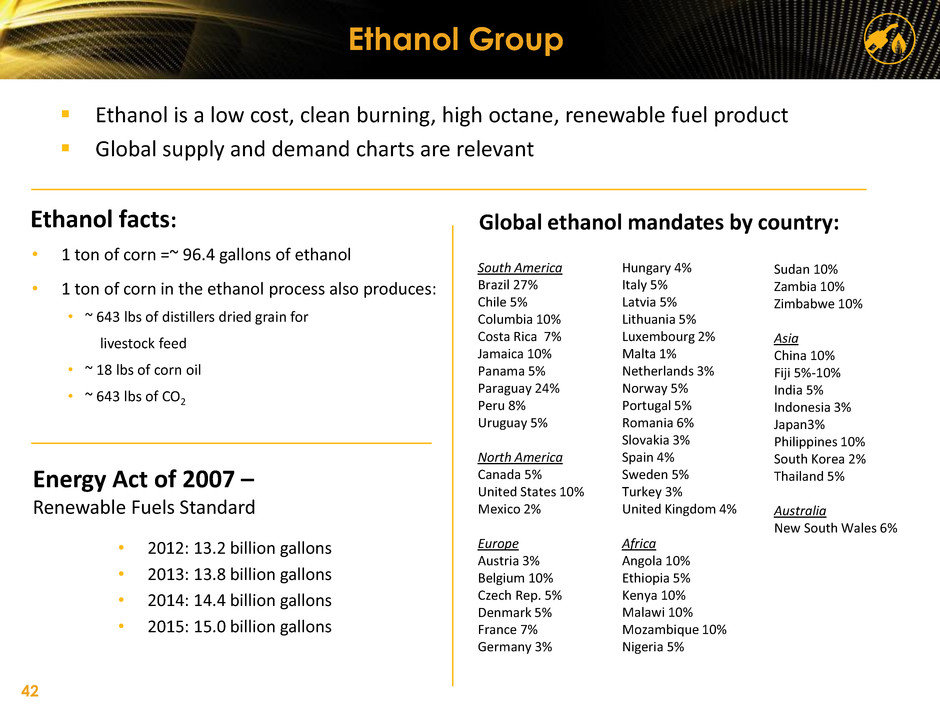

For internal use only Ethanol Group Ethanol is a low cost, clean burning, high octane, renewable fuel product Global supply and demand charts are relevant Ethanol facts: • 1 ton of corn =~ 96.4 gallons of ethanol • 1 ton of corn in the ethanol process also produces: • ~ 643 lbs of distillers dried grain for livestock feed • ~ 18 lbs of corn oil • ~ 643 lbs of CO2 Energy Act of 2007 – Renewable Fuels Standard • 2012: 13.2 billion gallons • 2013: 13.8 billion gallons • 2014: 14.4 billion gallons • 2015: 15.0 billion gallons Global ethanol mandates by country: South America Brazil 27% Chile 5% Columbia 10% Costa Rica 7% Jamaica 10% Panama 5% Paraguay 24% Peru 8% Uruguay 5% North America Canada 5% United States 10% Mexico 2% Europe Austria 3% Belgium 10% Czech Rep. 5% Denmark 5% France 7% Germany 3% Hungary 4% Italy 5% Latvia 5% Lithuania 5% Luxembourg 2% Malta 1% Netherlands 3% Norway 5% Portugal 5% Romania 6% Slovakia 3% Spain 4% Sweden 5% Turkey 3% United Kingdom 4% Africa Angola 10% Ethiopia 5% Kenya 10% Malawi 10% Mozambique 10% Nigeria 5% Sudan 10% Zambia 10% Zimbabwe 10% Asia China 10% Fiji 5%-10% India 5% Indonesia 3% Japan3% Philippines 10% South Korea 2% Thailand 5% Australia New South Wales 6% 42

For internal use only Ethanol Group 90.8 93.2 95.0 372.2 384.0 0 50 100 150 200 250 300 350 400 450 500 2014 2015 2016 Q1 YTD 5.6 5.6 6.3 27.5 35.4 0 10 20 30 40 2014 2015 2016 Q1 YTD 256 256 256 1,036 1,051 0 200 400 600 800 1,000 1,200 1,400 2014 2015 2016 Q1 YTD 20.4 19.0 18.9 85.5 81.0 0 10 20 30 40 50 60 70 80 90 2014 2015 2016 Q1 YTD Ethanol gallons produced E-85 gallons shipped DDG tons shipped Corn oil pounds shipped In mi lli o n s In m ill io n s In m ill io n s In t h o u sa n d s Not all Ethanol gallons produced are sold thru The Andersons, Inc. Not all DDGS tons shipped are sold thru The Andersons, Inc. Not all Corn Oil pounds shipped are sold thru The Andersons, Inc. 43

For internal use only Life cycle of nutrients Pre-Season • Agronomy Testing • Base load of NPK Application • Micro Nutrient Application Spring & summer growing season Fall post- harvest Spring pre- planting Post-Season • Agronomy Testing • Base load of NPK Application • Micro Nutrient Application Planting • Starter • Low Salt Side Dressing • Nitrogen (UAN) to support yields Protecting • Pesticides Emergence Tassel and ear initiation Pollination Tasselling Sillking Maturity Days Growth 7 14 28 42 56 66 70-100 44

For internal use only Nutrient demand • Twenty nutrient facilities and 13 farm centers in Ohio, Michigan, Indiana, Illinois, Iowa, Florida, Minnesota, Wisconsin and Puerto Rico • Formulate, store and distribute 2.1 million tons of dry and liquid agricultural nutrients • Six liquid fertilizer operations are ISO certified 44% 17% 2% 5% 41% 15% 14% 5% 43% 5% 19% 6% -10% 0% 10% 20% 30% 40% 50% 60% N P K Nitrogen Phosphorus Potassium Crop nutrient (N,P,K) use is highest for Corn 45 Strong corn acreage supports NPK demand

For internal use only Plant Nutrient Group Sales and Service Volume in Tons Storage Capacity Geographical footprint growth extends participation in core markets throughout the Midwest and Southeast Expanding markets and enlarging range of products and services for customers Acquired Kay Flo Industries, 2015 Manufactures granular lawn fertilizer, pesticides and ice-melt products for major retailers throughout the US ContacDG®, known as NutriDG® internationally Manufactures corncob-based products for a variety of uses including animal bedding and private-label cat litter products for Arm & Hammer® 508 572 470 572 444 397 Q1 '16 Q1 '15 Q1 '14 Dry Fertilizer Liquid Fertilizer 46 403 393 460 2,193 2,236 0 500 1,000 1,500 2,000 2,500 2014 2015 2016 Q1 FY In t h o u sa n d s In th o u sa n d s

For internal use only Rail Group earnings power $ in millions Q1 ‘14 Q2 ’14 Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ‘16 Average # of Assets 22,295 22,148 22,066 22,285 22,789 22,972 23,301 22,916 23,026 Beginning $ on BS $240.6 $237.5 $242.1 $245.8 $297.7 $313.1 $330.8 $347.1 $338.1 Average % Utilization 88.4% 89.3% 89.9% 90.3% 91.8% 93.5% 91.6% 92.7% 91.5% Lease Income $4.2 $3.7 $1.8 $3.9 $5.0 $15.6 $6.4 $4.5 $4.3 $ in millions Q1 ‘14 Q2 ‘14 Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ’16 Asset Sale Income $10.8 $2.5 $1.4 $1.2 $4.5 $4.7 $3.2 $0.8 $2.4 $ in millions Q1 ‘14 Q2 ‘14 Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ‘16 Revenue $52.3 $33.4 $32.0 $31.2 $44.2 $45.5 $44.8 $36.4 $39.6 Gross Profit $21.9 $13.9 $10.8 $13.2 $17.3 $18.2 $17.5 $14.6 $14.6 Gross Profit Margin 41.9% 41.6% 33.8% 42.2% 39.2% 40.1% 39.1% 40.1% 36.8% Pre-tax Income $15.0 $6.7 $4.2 $5.6 $10.3 $21.7 $23.2 $6.8 $9.4 Lease income Remarketing income Service & other income Total rail income 47 $ in millions Q1 ‘14 Q2 ‘14 Q3 ‘14 Q4 ‘14 Q1 ‘15 Q2 ‘15 Q3 ‘15 Q4 ‘15 Q1 ’16 Pre-tax Income $0 $0.5 $1.0 $0.5 $0.8 $1.4 $2.3 $1.5 $2.7

For internal use only Rail Group earnings power – five year $ in millions 2011 2012 2013 2014 2015 Average # of Assets 22,265 23,019 22,990 22,199 23,017 Beginning $ on BS $168.5 $197.1 $228.3 $240.6 $297.7 Average % Utilization 84.6% 84.6% 86.1% 89.5% 92.4% Lease Income ($1.8) $13.4 $18.9 $13.6 $31.5 $ in millions 2011 2012 2013 2014 2015 Asset Sale Income $8.4 $23.7 $19.4 $15.8 $13.3 $ in millions 2011 2012 2013 2014 2015 Rail Services & Other $3.2 $5.7 $4.5 $2.0 $5.9 $ in millions 2011 2012 2013 2014 2015 Revenue $107.4 $156.4 $164.8 $149.0 $170.8 Gross Profit $24.8 $56.7 $58.9 $59.8 $67.7 Gross Profit % 23.1% 36.3% 35.7% 40.1% 39.6% Pre-tax Income $9.8 $42.8 $42.8 $31.4 $50.7 Lease income Remarketing Income Service & Other Income Total Rail Income Sources of Income Generate lease income from long lived assets Maximize value by remarketing assets opportunistically Provide repair services embedded in leases and to third parties 48

For internal use only Tank car regulations Tank cars constructed after October 1, 2015 are required to meet new DOT Specification 117 design of performance criteria for use in an High-Hazard Flammable Train (HHFT) Existing tank cars must be retrofitted in accordance with the DOT-prescribed retrofit design or performance standard for use in HHFT Retrofits must be completed based on a mandated schedule. The retrofit timeline focuses on two risk factors, the packing group and differing types of DOT-111 and CPC-1231 tank car A retrofit reporting requirement is triggered of consignees owning or leasing tank cars covered under this rulemaking do not meet the initial retrofit milestone Less than 10% of ANDE’s fleet is subject to these regulations; decisions will not need to be made for several years DOT 117 Specification 49

For internal use only Early Easter offset lower sales of outerwear and snow removal items due to mild winter We have already shuttered underperforming sites and are close to returning the group to profitability 50 $ in millions, except margin Q1 ’16 Q1 ’15 VPY FY ’15 Revenue $27.8 $28.6 ($0.8) (2.8%) $139.5 Group pre-tax income ($2.1) ($2.2) $0.1 ($0.5) Q1 Performance Adjusted Five Year Performance P re -t a x In co me/L o ss in m ill io n s R eve n u e in m illio n s Retail Group Financial performance $130 $135 $140 $145 $150 $155 -$10 -$5 $0 $5 2012 2013 2014 2015 2016 Q1 Q2 Q3 Q4 Revenue

For internal use only Time Line 1940s 1950s 2010s 1960s 1970s 1980s 1990s 2000s The Andersons Truck Terminal (ATT) founded by Harold & Margaret Anderson in 1947. ATT is established as an operating partnership by Harold & Margaret and their six children. 1947, Grain terminal built with nine truck bays for rapid turnaround and better service to farmers. Three million bushels of grain storage added, known nationally as "The Big Pour" in 1953. The Andersons Warehouse Market opens as the first retail store in 1952. First fertilizer blending begins in 1959. 1958, Ear corn and cob milling facilities are added. In 1960, the first deep- water grain loading facility on the U.S. side of the Great Lakes is opened by The Andersons. Largest steel tank grain storage installation in North America is constructed in Maumee in 1964. Lawn Products business begins in 1964. Unit train grain shipments head to Gulf ports from Champaign, IL. Four million bushel grain elevator built in Delphi, IN. in 1975. Liquid fertilizer facilities open on the Maumee River in 1987. Open General Stores - Toledo, OH 1984 - Columbus, OH 1986 - Columbus, OH 1987. Grain elevators added - Albion and White Pigeon, MI 1981 - Dunkirk, IN 1983. 1st Railcar repair shop built Maumee, 1991. Grain and liquid storage facilites are acquired in Clymers, Walton, Logansport, Seymour, North Manchester and Waterloo, IN. 1996 Mike Anderson named CEO. Entered the ethanol business, overseeing the construction and operation of three plants and providing corn originations and DDG marketing. - Albion, MI 2006 - Clymers, IN 2007 - Greenville, OH 2008. •Significantly expanded the railcar fleet and added repair shops in Georgia, South Carolina, Mississippi, and Utah. Issued additional shares in the form of a 2-for-1 stock split and follow-on offering in 2006. The Andersons, Inc. is incorporated and is first listed on NASDAQ on Feb. 20, 1996. Unit train fertilizer shipments arrive from western U.S. and Canada, 1977. Twelve million bushel grain elevator built in Champaign, IL. in 1968. John Anderson becomes Managing Partner. Grain receipts almost triple and the river elevator expanded. Opened specialty foods store, Sylvania, OH 2007. Fertilizer acquisitions - 2008 Douglass Fertilizer Florida and Puerto Rico. - 2008 Mineral Processing Pelleted Lime Ohio, Illinois, and Nebraska. - 2009 Hartung Brothers Fertilizer Division Purchased O'Malley Grain facilities in Mansfield, IL. and Fairmont, NE.Initial investment in Lansing Trade Group, 2003. Expanded professional turf products. Grain drier building built in 1952. Ten million bushels of grain storage added (steel tanks) in Maumee, 1959. Garden Center opens in Maumee, 1961. Garden Center opens in Dublin, OH, 1967. New General store built in Maumee, 1972. Cob mill added at Delphi, IN in 1976. Fertilizer facilities added... - Champaign, IL. 1983 - Dunkirk, IN. 1984 - Webberville, MI. 1985. Major Lawn Fertilizer expansion in 1983. Added $200 million in new term debt in 2006. Enter railcar leasing market in 1989. Iowa Northern Railway investment in 2010. Unit trains began hauling grain to North Atlantic ports from Maumee, 1968. Open railcar repair shops in Henderson, NV. , Woodland, CA. and Manly, IA. Acquired B4 Grain facilities in Kearney and Riverdale NE., and assumed leased facility in Opened railcar repair facilities in Aberdeen, WA and San Diego, CA. 2011 2012 Acquired New Eezy Gro Inc., Carey, OH and Sycamore, OH The Andersons Denison Ethanol LLC acquired ethanol plant in Denison, IA Record Earnings Per Share of $5.09 Record EBITDA of $212.3 million The Grain and Plant Nutrient groups both acheived record earnings, and Ethanol Group second best earnings Plant Nutrient Group acquired Immokalee Farmers Supply, Immokalee, FL Achieved record first quarter net income of $18.4 million, or $0.98 per diluted shares Record operating income for both Grain and Rail groups Purchased substantially all assets of Mt. Pulaski Products, LLC. Purchased 12 grain facilities in Iowa and Tennessee from Green Plains Grain Company LLC. Began construction of 27,300 square-foot railcar paint and blast shop 2010 Opened newly constructed 3.8 million bushel grain elevator facility in Anselmo, NE. 2013 Opened newly constructed state-of-the- art 27,000 square ft. railcar paint facility in Maumee, OH Along with Lansing Trade Group, LLC acquired Thompsons Limited. a grain and food-grade bean handler and agronomy input provider with 11 facilities in southern Ontario and one facility in Minnesota Opened 14th railcar repair facility, Romulus, NY Acquired Mile Rail, LLC, a railcar repair and cleaning provider headquartered in Kansas City, Missouri, along with locations in Nebraska and Indiana. In addition a midwest footprint with mobile units Acquired Cycle Group, Inc., a granular manufacturer in North Carolina 2014 Acquired United Grain LLC. and Keller Grain Inc., two San Antonio,Texas based food grade corn companies Purchased Auburn Bean & Grain of Auburn, Michigan. Six grain and four agronomy locations 2015 Acquied Kay Flo Industries, a leading fertilizer manufacturing and distributior. Three facailities located in Iowa 51

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- The Andersons, Inc. to Release First Quarter Results on May 7

- ChromaDex Announces Nationwide Launch of Tru Niagen® at The Vitamin Shoppe®

- Vivid Seats Renews National Make-A-Wish® Partnership to Grant Live Event Experiences

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share