Form 8-K Altra Industrial Motion For: Apr 29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K |

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 29, 2016

Date of Report (Date of earliest event reported)

ALTRA INDUSTRIAL MOTION CORP. (Exact name of registrant as specified in its charter) | ||

Delaware | 001-33209 | 61-1478870 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

300 Granite Street, Suite 201 Braintree, Massachusetts | 02184 | |||

(Address of principal executive offices) | (Zip Code) | |||

(781) 917-0600 (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 2.02 | Results of Operations and Financial Condition |

On April 29, 2016, Altra Industrial Motion Corp. (“the Company”) announced certain unaudited financial results for the first quarter ended March 31, 2016. A copy of the announcement is attached hereto as Exhibit 99.1, which is incorporated by reference herein. On April 29, 2016, the Company will hold a conference call with investors to discuss unaudited first quarter results. The chart presentation to be used during the call is attached hereto as Exhibit 99.2 to this report and is incorporated by reference herein.

Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

99.1 | Press release of Altra Industrial Motion Corp., dated April 29, 2016. | |

99.2 | Charts to be used during the investor conference call on April 29, 2016. | |

EXHIBIT INDEX | ||

99.1 | Press release of Altra Industrial Motion Corp., dated April 29, 2016. | |

99.2 | Charts to be used during the investor conference call on April 29, 2016. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ALTRA INDUSTRIAL MOTION CORP. | ||

/s/ Carl R. Christenson | ||

Name: | Carl R. Christenson | |

Title: | Chairman and Chief Executive Officer | |

Date: April 29, 2016

Altra Reports First-Quarter 2016 Results

10 bps Gross Margin and 20 bps Operating Income margin improvement despite sales decline.

BRAINTREE, Mass., April 29, 2016 - Altra Industrial Motion Corp. (Nasdaq: AIMC), a global manufacturer and marketer of electromechanical power transmission and motion control products, today announced unaudited financial results for the first quarter ended March 31, 2016.

Financial Highlights

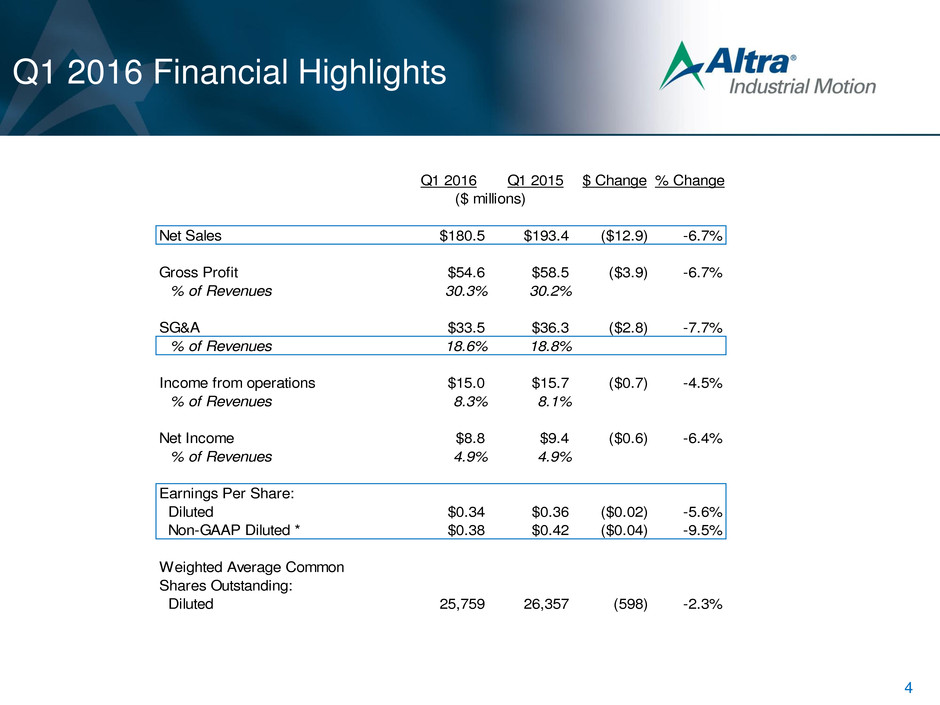

• | First-quarter 2016 net sales were $180.5 million, compared with $193.4 million in the first quarter of 2015, a decrease of 6.7%. The decrease in net sales was driven by an unfavorable impact from foreign exchange of 1.8% and an organic sales decline of 4.9%. |

• | First-quarter net income was $8.8 million, or $0.34 per diluted share, compared with $9.4 million, or $0.36 per diluted share, in the first quarter of 2015. Non-GAAP net income in the first quarter of 2016 was $9.9 million, or $0.38 per diluted share, compared with $11.1 million, or $0.42 per diluted share, a year ago.* |

• | The Company returned to shareholders $2.2 million by repurchasing approximately 91,400 shares, during the first quarter under its $50 million repurchase program. Since the program's inception in May 2014, the Company has purchased approximately $37.1 million, or 1.3 million shares, under the program. |

• | Reconciliation of Non-GAAP Net Income*: |

Quarter Ended | Quarter Ended | ||||||

March 31, 2016 | March 31, 2015 | ||||||

Net income attributable to Altra Industrial Motion Corp. | $ | 8,810 | $ | 9,398 | |||

Restructuring costs | 1,553 | 1,756 | |||||

Acquisition related expenses | — | 738 | |||||

Tax impact of above adjustments | (464 | ) | (761 | ) | |||

Non-GAAP net income* | $ | 9,899 | $ | 11,131 | |||

Non-GAAP diluted earnings per share* | $ | 0.38 | $ | 0.42 | |||

In Thousands of Dollars, except per share amounts | |||||||

Management Comments

“We are on plan with our strategic actions to improve Altra’s long-term operating performance amid the current soft economic environment for many of our end markets,” said Carl Christenson, Altra's Chairman and CEO. “We are seeing the positive benefits of our operational excellence and business simplification initiatives, although these gains were offset in the quarter by the 7% lower sales volume as well as an unfavorable product mix. We are on track to have completed six consolidations by the end of the current second quarter, and we anticipate announcing a seventh planned consolidation during the third quarter. In addition, our supply chain management initiative is progressing well. Finally, we continued our balanced capital allocation as we repurchased $2.2 million of Altra shares.”

Business Outlook

“We are now past the anniversary of when several of our end markets began to weaken. Therefore, we will have easier comparisons as we approach the second half of the year and we expect that year-over-year shipment and order declines will begin to moderate. Although we do still expect year-over-year sales to be lower for 2016, some external data indicates that in the second half of the year we may see the global industrial environment improve slightly. The conventional energy end market is still the most concerning and we expect it to take some time before equipment and component demand in this market begins to recover. Our two segments with limited oil and gas exposure reported meaningful year-over-year improvement in operating income as a percentage of sales demonstrating our strong operating leverage. Looking longer-term, we are excited by the potential for significant margin appreciation as a result of our aggressive performance improvement actions when our most out-of-favor markets return to growth.”

Altra is maintaining its previous annual revenue guidance and expects full-year 2016 sales in the range of $700 to $720 million and non-GAAP diluted EPS guidance in the range of $1.40 to $1.50. This guidance includes savings from the restructuring and consolidation actions taken to date. The Company expects its tax rate for the full year to be approximately 29% to 31% before discrete items. Altra continues to expect capital expenditures in the range of $20 to $24 million and depreciation and amortization in the range of $30 to $32 million for 2016.*

Conference Call

The Company will conduct an investor conference call to discuss its unaudited first-quarter 2016 financial results this morning at 10:00 a.m. ET. The public is invited to listen to the conference call by dialing (877) 407-8293 domestically or (201) 689-8349 for international access. A live webcast of the call will be available in the "Investor Relations" section of www.altramotion.com. Individuals may download charts that will be used during the call at www.altramotion.com under presentations in the Investor Relations section. The charts will be available after earnings are released. A replay of the recorded conference call will be available at the conclusion of the call on April 29 through midnight on May 13, 2016. To listen to the replay, dial (877) 660-6853 domestically or (201) 612-7415 for international access (conference ID #13635362). A webcast replay also will be available.

Altra Industrial Motion Corp. | ||||||||

Consolidated Statements of Income Data | Quarter Ended | |||||||

In Thousands of Dollars, except per share amount | March 31, 2016 | March 31, 2015 | ||||||

(Unaudited) | (Unaudited) | |||||||

Net sales | $ | 180,453 | $ | 193,361 | ||||

Cost of sales | 125,823 | 134,888 | ||||||

Gross profit | $ | 54,630 | $ | 58,473 | ||||

Gross profit as a percent of net sales | 30.3 | % | 30.2 | % | ||||

Selling, general & administrative expenses | 33,536 | 36,302 | ||||||

Research and development expenses | 4,564 | 4,762 | ||||||

Restructuring Charges | 1,553 | 1,756 | ||||||

Income from operations | $ | 14,977 | $ | 15,653 | ||||

Income from operations as a percent of net sales | 8.3 | % | 8.1 | % | ||||

Interest expense, net | 2,896 | 2,956 | ||||||

Other non-operating income, net | (278 | ) | (829 | ) | ||||

Income before income taxes | $ | 12,359 | $ | 13,526 | ||||

Provision for income taxes | 3,549 | 4,136 | ||||||

Income tax rate | 28.7 | % | 30.6 | % | ||||

Net income | 8,810 | 9,390 | ||||||

Net loss attributable to non-controlling interest | — | 8 | ||||||

Net income attributable to Altra Industrial Motion Corp. | 8,810 | 9,398 | ||||||

Weighted Average common shares outstanding | ||||||||

Basic | 25,740 | 26,280 | ||||||

Diluted | $ | 25,759 | 26,357 | |||||

Net income per share | ||||||||

Basic | $ | 0.34 | $ | 0.36 | ||||

Diluted | $ | 0.34 | $ | 0.36 | ||||

Reconciliation of Non-GAAP Income From Operations: | ||||||||

Income from operations | $ | 14,977 | $ | 15,653 | ||||

Restructuring costs | 1,553 | 1,756 | ||||||

Acquisition related expenses | — | 738 | ||||||

Non-GAAP income from operations * | $ | 16,530 | $ | 18,147 | ||||

Reconciliation of Non-GAAP Net Income: | ||||||||

Net income attributable to Altra Industrial Motion Corp. | 8,810 | 9,398 | ||||||

Restructuring costs | 1,553 | 1,756 | ||||||

Acquisition related expenses | — | 738 | ||||||

Tax impact of above adjustments | (464 | ) | (761 | ) | ||||

Non-GAAP net income * | $ | 9,899 | $ | 11,131 | ||||

Non-GAAP diluted earnings per share * | $ | 0.38 | (1) | $ | 0.42 | (2) | ||

(1) - tax impact is calculated by multiplying the estimated effective tax rate for the period of 29.9% by the above items | ||||||||

(2) - tax impact is calculated by multiplying the estimated effective tax rate for the period of 30.5% by the above items | ||||||||

Consolidated Balance Sheets | |||||||

In Thousands of Dollars | March 31, 2016 | December 31, 2015 | |||||

(unaudited) | |||||||

Assets: | |||||||

Current Assets | |||||||

Cash and cash equivalents | $ | 44,843 | $ | 50,320 | |||

Trade receivables, net | 103,869 | 94,720 | |||||

Inventories | 119,434 | 121,156 | |||||

Income tax receivable | 2,479 | 5,146 | |||||

Prepaid expenses and other current assets | 12,704 | 11,217 | |||||

Assets held for sale | 4,826 | 4,597 | |||||

Total current assets | 288,155 | 287,156 | |||||

Property, plant and equipment, net | 147,526 | 145,413 | |||||

Intangible assets, net | 95,619 | 96,069 | |||||

Goodwill | 98,490 | 97,309 | |||||

Deferred income taxes | 3,292 | 3,201 | |||||

Other non-current assets, net | 2,848 | 3,184 | |||||

Total assets | $ | 635,930 | $ | 632,332 | |||

Liabilities, and stockholders' equity | |||||||

Current liabilities | |||||||

Accounts payable | $ | 37,258 | $ | 40,297 | |||

Accrued payroll | 17,833 | 22,312 | |||||

Accruals and other current liabilities | 37,701 | 34,990 | |||||

Income tax payable | 3,059 | 3,563 | |||||

Current portion of long-term debt | 1,963 | 3,187 | |||||

Total current liabilities | 97,814 | 104,349 | |||||

Long-term debt, less current portion and net of unaccreted discount | 232,839 | 231,568 | |||||

Deferred income taxes | 44,527 | 44,185 | |||||

Pension liabilities | 8,835 | 8,328 | |||||

Long-term taxes payable | 655 | 647 | |||||

Other long-term liabilities | 689 | 688 | |||||

Total stockholders’ equity | 250,571 | 242,567 | |||||

Total liabilities, and stockholders’ equity | $ | 635,930 | $ | 632,332 | |||

Reconciliation of operating working capital: | |||||||

Trade receivables, net | 103,869 | 94,720 | |||||

Inventories | 119,434 | 121,156 | |||||

Accounts payable | (37,258 | ) | (40,297 | ) | |||

Operating working capital * | $ | 186,045 | $ | 175,579 | |||

Year to Date Ended | |||||||

March 31, 2016 | March 31, 2015 | ||||||

(Unaudited) | (Unaudited) | ||||||

Cash flows from operating activities | |||||||

Net income | $ | 8,810 | $ | 9,390 | |||

Adjustments to reconcile net income to net cash flows: | |||||||

Depreciation | 5,119 | 5,343 | |||||

Amortization of intangible assets | 2,119 | 2,162 | |||||

Amortization of deferred financing costs | 196 | 239 | |||||

Loss/(Gain) on foreign currency, net | 217 | (67 | ) | ||||

Accretion of debt discount, net | 968 | 892 | |||||

Loss/(Gain) on impairment / disposal of fixed assets | 448 | (26 | ) | ||||

Stock based compensation | 1,163 | 1,110 | |||||

Changes in assets and liabilities: | |||||||

Trade receivables | (8,087 | ) | (10,091 | ) | |||

Inventories | 2,929 | 991 | |||||

Accounts payable and accrued liabilities | (6,832 | ) | 2,823 | ||||

Other current assets and liabilities | (1,311 | ) | (82 | ) | |||

Other operating assets and liabilities | 311 | 90 | |||||

Net cash provided by operating activities | 6,050 | 12,774 | |||||

Cash flows from investing activities | |||||||

Purchase of property, plant and equipment | (5,653 | ) | (7,731 | ) | |||

Net cash used in investing activities | (5,653 | ) | (7,731 | ) | |||

Cash flows from financing activities | |||||||

Payments on term loan facility | — | (2,359 | ) | ||||

Payments on Revolving Credit Facility | (4,447 | ) | — | ||||

Dividend payments | — | (3,178 | ) | ||||

Proceeds from equipment and working capital notes | — | 945 | |||||

Payments of equipment and working capital notes | (1,244 | ) | (412 | ) | |||

Proceeds from mortgages and other debt | 3,351 | 3,647 | |||||

Borrowing under Revolving Credit Facility | — | 5,000 | |||||

Shares surrendered for tax withholding | (91 | ) | (128 | ) | |||

Payments on mortgages and other debt | (37 | ) | (53 | ) | |||

Purchases of common stock under share repurchase program | (2,159 | ) | (4,558 | ) | |||

Net cash flows used in financing activities | (4,627 | ) | (1,096 | ) | |||

Effect of exchange rate changes on cash and cash equivalents | (1,247 | ) | (4,024 | ) | |||

Net change in cash and cash equivalents | (5,477 | ) | (77 | ) | |||

Cash and cash equivalents at beginning of year | 50,320 | 47,503 | |||||

Cash and cash equivalents at end of period | $ | 44,843 | $ | 47,426 | |||

Reconciliation to free cash flow: | |||||||

Net cash flows from operating activities | 6,050 | 12,774 | |||||

Purchase of property, plant and equipment | (5,653 | ) | (7,731 | ) | |||

Free cash flow * | $ | 397 | $ | 5,043 | |||

Altra Industrial Motion Corp. | |||||||

Selected Segment Data | Quarter Ended | ||||||

In Thousands of Dollars, except per share amount | March 31, 2016 | March 31, 2015 | |||||

(Unaudited) | (Unaudited) | ||||||

Net Sales | |||||||

Couplings Clutches & Brakes | $ | 75,623 | $ | 89,115 | |||

Electromagnetic Clutches & Brakes | 57,349 | 57,636 | |||||

Gearing | 48,920 | 49,206 | |||||

Eliminations | (1,439 | ) | (2,596 | ) | |||

Total | $ | 180,453 | $ | 193,361 | |||

Income from operations | |||||||

Couplings Clutches & Brakes | $ | 6,291 | $ | 9,955 | |||

Electromagnetic Clutches & Brakes | 6,463 | 5,328 | |||||

Gearing | 5,762 | 4,750 | |||||

Restructuring | (1,553 | ) | (1,756 | ) | |||

Corporate | (1,986 | ) | (2,624 | ) | |||

Total | $ | 14,977 | $ | 15,653 | |||

About Altra Industrial Motion Corp.

Altra Industrial Motion Corp., through its subsidiaries, is a leading global designer, producer and marketer of a wide range of electromechanical power transmission products. The Company brings together strong brands covering over 40 product lines with production facilities in 12 countries. Altra's leading brands include Ameridrives Couplings, Bauer Gear Motor, Bibby Turboflex, Boston Gear, Delroyd Worm Gear, Formsprag Clutch, Guardian Couplings, Huco, Industrial Clutch, Inertia Dynamics, Kilian Manufacturing, Lamiflex Couplings, Marland Clutch, Matrix, Nuttall Gear, Stieber Clutch, Svendborg Brakes, TB Wood's, Twiflex, Warner Electric, Warner Linear, and Wichita Clutch.

The Altra Industrial Motion Corp. logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=4038.

* Discussion of Non-GAAP Financial Measures

As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted earnings per share, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP diluted earnings per share is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories.

Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non-GAAP diluted earnings per share, non-GAAP free cash flow and non-GAAP operating working capital provides important

supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations.

Forward-Looking Statements

All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as "believes," "expects," "potential," "continues," "may," "should," "seeks," "predicts," "anticipates," "intends," "projects," "estimates," "plans," "could," "designed", "should be," and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, those relating to the Company's progress on corporate initiatives, including its supply chain management initiative, the Company's views and assessment of economic conditions, foreign currency trends, end market conditions and industrial demand, the Company's expectations with respect to sales, the Company’s progress on executing its acquisition and organic growth strategies and new product development, the Company’s progress on implementing profit improvement initiatives, the Company's progress and future plans on implementing and pursuing consolidation and cost reduction activities, the impact and timing of the Company's cost management and restructuring activities on earnings, margins and shareholder value, the Company's unaudited 2016 financial information, and the Company's guidance for full year 2016

In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage and operating covenants under our debt instruments, (19) risks associated with restrictions contained in our Convertible Notes and Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg and Guardian acquisitions and integration and other acquisitions, (24) risks associated with the closure of the Company's manufacturing facility in Changzhou, China, (25) risks associated with certain minimum purchase agreements we have with suppliers, (26) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (27) risks associated with interest rate swap contracts, (28) risks associated with the potential dilution of our common stock as a result of our convertible notes, (29) risks associated with our exposure

to renewable energy markets, (30) risks related to regulations regarding conflict minerals, (31) risks related to restructuring and plant consolidations, and (32) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise. AIMC-E

CONTACT:

Altra Industrial Motion Corp.

Christian Storch, Chief Financial Officer

781-917-0541

First Quarter 2016 Results April 29, 2016 10:00 AM ET Dial In Number 877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com Replay Through May 13, 2016 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13635362 Webcast Replay at www.altramotion.com

Safe Harbor Statement Cautionary Statement Regarding Forward Looking Statements All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as "believes," "expects," "potential," "continues," "may," "should," "seeks," "predicts," "anticipates," "intends," "projects," "estimates," "plans," "could," "designed", "should be," and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, those relating to the Company's progress on corporate initiatives, including its supply chain management initiative, the Company's views and assessment of economic conditions, foreign currency trends, end market conditions and industrial demand, the Company's expectations with respect to sales, the Company’s progress on executing its acquisition and organic growth strategies and new product development, the Company’s progress on implementing profit improvement initiatives, the Company's progress and future plans on implementing and pursuing consolidation and cost reduction activities, the impact and timing of the Company's cost management and restructuring activities on earnings, and other potential cost management and restructuring activities on earnings, margins and shareholder value, the Company's unaudited 2016 financial information, and the Company's guidance for full year 2016 In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage and operating covenants under our debt instruments, (19) risks associated with restrictions contained in our Convertible Notes and Credit Facility, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg and Guardian acquisitions and integration and other acquisitions, (24) risks associated with the closure of the Company's manufacturing facility in Changzhou, China, (25) risks associated with certain minimum purchase agreements we have with suppliers, (26) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (27) risks associated with interest rate swap contracts, (28) risks associated with the potential dilution of our common stock as a result of our convertible notes, (29) risks associated with our exposure to renewable energy markets, (30) risks related to regulations regarding conflict minerals, (31) risks related to restructuring and plant consolidations, and (32) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra Industrial Motion Corp. does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise. 1

First Quarter 2016 Highlights • Gross margin percentage increased 10 bps to 30.3% • Revenues decreased 6.7% from the first quarter of 2015 • Income from operations was 8.3%, Non-GAAP income from operations was 9.2% * • Repurchased $2.2 million of Altra shares 2

End Market Review • Sales at Distribution were down year over year but up sequentially • Turf and Garden sales are off to another great start • Ag market down sharply from a year ago • Oil and gas down as expected year to date • Alternative energy was up modestly both year over year and sequentially • Metals weakened further during the quarter and was off double digits from a year ago and sequentially • Mining sales declined significantly both sequentially and year over year 3

Q1 2016 Financial Highlights 4 Q1 2016 Q1 2015 $ Change % Change Net Sales $180.5 $193.4 ($12.9) -6.7% Gross Profit $54.6 $58.5 ($3.9) -6.7% % of Revenues 30.3% 30.2% SG&A $33.5 $36.3 ($2.8) -7.7% % of Revenues 18.6% 18.8% Income from operations $15.0 $15.7 ($0.7) -4.5% % of Revenues 8.3% 8.1% Net Income $8.8 $9.4 ($0.6) -6.4% % of Revenues 4.9% 4.9% Earnings Per Share: Diluted $0.34 $0.36 ($0.02) -5.6% Non-GAAP Diluted * $0.38 $0.42 ($0.04) -9.5% Weighted Average Common Shares Outstanding: Diluted 25,759 26,357 (598) -2.3% ($ millions)

Selected Segment Data 5 Frist Quarter Q1 2016 Q1 2015 Diff Q1 2016 Q1 2015 Diff Q1 2016 Q1 2015 Diff Net Sales $75.6 $89.1 ($13.5) $57.3 $57.6 ($0.3) $48.9 $49.2 ($0.3) Income From Operations $6.3 $10.0 ($3.7) $6.5 $5.3 $1.2 $5.8 $4.8 $1.0 % of Net Sales 8.3% 11.2% 11.3% 9.2% 11.9% 9.8% $ Millions Couplings, Clutches & Brakes (CCB) Electric Clutches & Brakes (ECB) Gearing

Balance Sheet Highlights • Total Debt less Cash decreased by approximately $24.0 year over year • Repurchased 91,000 shares in Q1 6 Balance Sheet Highlights (amounts in millions) Q1 2016 Q1 2015 C sh $44.8 $47.4 Total Debt $242.9 $269.5 Total Debt less Cash $198.1 44.1% $222.1 47.6% Shareholders' Equity $250.6 55.9% $244.7 52.4% Shareholders' Equity plus Debt, less Cash $448.7 100.0% $466.8 100.0% Shares Outstanding 25.8 26.4 (0.60) Total Debt Less Cash 44.1% Shareholders' Equity 55.9%

2016 Guidance • $700 - $720 Million in sales • $1.40 - $1.50 Non-GAAP diluted earnings per share * • $20 - $24 Million in capital expenditures • $30 - $32 Million in depreciation and amortization • Tax rate approximately 29% - 31% before discrete items 7

Business Simplification On Track 8 Long Term Objective YTD Results Current Status Operational Improvements Reduce the number of facilities by 20% to 30% • Restructuring and cost reductions have improved margins • Bauer improvement is on track • Facility consolidations are on track Strategic Pricing Operating profit improvement of 150 bps • Pricing environment is more challenging • Continue to find pricing opportunities Supply Chain Management Implement hybrid SCM structure to reduce material spend • Training is substantially complete • Reorganization of procurement organization is on track SAP Deployment Entire organization on the same instance of SAP • Next phase of implementation to begin in second half of 2016 Revenue Growth Growth in excess of GDP • Key end market declines and FX rate headwinds overwhelm continued success in marketplace and operational improvements Lean Market leader for lead time and on time delivery Market leader for innovative solution responsiveness • Model Value Stream results are meeting expectations

Upcoming Calendar Events • Upcoming Industrial Conferences include: • KeyBank 2016 Industrial, Automotive and Transportation Conference, Boston, MA, May 31, 2016-June 2, 2016 • Citi 2016 Small & Mid Cap Conference, New York, NY, June 9th and 10th 2016 Investor Relations Contact Information: Christian Storch Chief Financial Officer [email protected] 781-917-0541 9

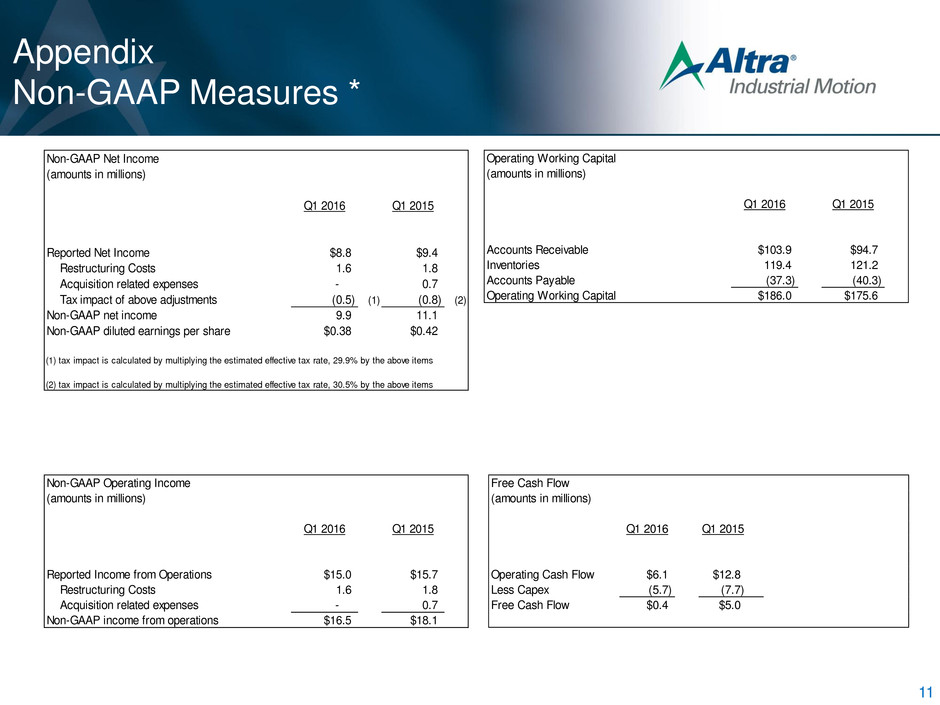

Discussion of Non-GAAP Measures *As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted earnings per share, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Non-GAAP diluted earnings per share is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories. Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non- GAAP diluted earnings per share, non-GAAP free cash flow and non-GAAP operating working capital provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations. 10

Appendix Non-GAAP Measures * 11 Non-GAAP Net Income (amounts in millions) Q1 2016 Q1 2015 Reported Net Income $8.8 $9.4 Restructuring Costs 1.6 1.8 Acquisition related expenses - 0.7 Tax impact of above adjustments (0.5) (1) (0.8) (2) Non-GAAP net income 9.9 11.1 Non-GAAP diluted earnings per share $0.38 $0.42 (1) tax impact is calculated by multiplying the estimated effective tax rate, 29.9% by the above items (2) tax impact is calculated by multiplying the estimated effective tax rate, 30.5% by the above items Non-GAAP Operating Income (amounts in millions) Q1 2016 Q1 2015 Reported Income from Operations $15.0 $15.7 Restructuring Costs 1.6 1.8 Acquisition related expenses - 0.7 Non-GAAP income from operations $16.5 $18.1 Operating Working Capital (amounts in millions) Q1 2016 Q1 2015 Accounts Receivable $103.9 $94.7 Inventories 119.4 121.2 Accounts Pa able (37.3) (40.3) Operating Working Capital $186.0 $175.6 Free Cash Flow (amounts in millions) Q1 2016 Q1 2015 Operating Cash Flow $6.1 $12.8 Le s Capex (5.7) (7.7) Free Cash Flow $0.4 $5.0

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Biosenta Announces Private Placement Financing

- Portland General Electric declares dividend

- Rise48 Equity Celebrates Milestone 50th Multifamily Acquisition

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share