Form 8-K Allegiant Travel CO For: May 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 16, 2016

Allegiant Travel Company

_______________________________________________

(Exact name of registrant as specified in its charter)

Nevada | 001-33166 | 20-4745737 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1201 N. Town Center Drive, Las Vegas, NV | 89144 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (702) 851-7300

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 7 Regulation FD

Item 7.01 Regulation FD.

The Company is furnishing under Item 7.01 of this Current Report on Form 8-K the information included as Exhibits 99.1 and 99.2 to this report. Exhibit 99.1 contains certain information about the Company, its financial and operating results, competitive position, fleet strategy and business strategy. This information is being presented at meetings with investors or is otherwise being made available to interested parties. Statements in the presentation included as Exhibit 99.1 regarding the airline industry and market conditions for aircraft are based on management’s views of current market conditions.

Exhibit 99.2 is the letter to shareholders included in the annual report being sent to shareholders of the Company and which accompanies the proxy statement being mailed to shareholders on or about May 16, 2016. Statements in the shareholder letter included as Exhibit 99.2 regarding the airline industry, industry trends, market conditions for aircraft and future prospects of the Company are based on management’s views of current market conditions.

The information in Sections 7 and 9 of this Current Report on Form 8-K, including the information set forth in the Exhibits, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. As such, this information shall not be incorporated by reference into any of the Company’s reports or other filings made with the Securities and Exchange Commission.

Forward-Looking Statements: Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in the management presentation and shareholder letter that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements may include, among others, guidance regarding future operating costs and revenue, guidance regarding future capacity and departure growth, our ability to consummate announced aircraft transactions, timing of aircraft deliveries and retirements, aircraft utilization rates, future capital expenditures and other statements or comments about our future performance or strategic plans. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," “guidance,” "anticipate," "intend," "plan," "estimate," “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports and registration statements filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, an accident involving or problems with our aircraft, our reliance on our automated systems, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed, the effect of the economic conditions on leisure travel, debt balances, debt covenants, terrorist attacks, risks inherent to airlines, demand for air services to our leisure destinations from the markets served by us, our dependence on our leisure destination markets, our competitive environment, our reliance on third parties who provide facilities or services to us, the possible loss of key personnel, economic and other conditions in markets in which we operate, aging aircraft and other governmental regulation, increases in maintenance costs and cyclical and seasonal fluctuations in our operating results.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(a) | Not applicable. |

(b) | Not applicable. |

(c) | Not applicable. |

(d) | Exhibits |

Exhibit No. | Description of Document |

99.1 | Management Presentation. |

99.2 | Shareholder Letter. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 16, 2016 | ALLEGIANT TRAVEL COMPANY | ||

By: | /s/ Scott Sheldon | ||

Name: | Scott Sheldon | ||

Title: | Chief Financial Officer | ||

EXHIBIT INDEX

Exhibit No. | Description of Document |

99.1 | Management Presentation |

99.2 | Shareholder Letter. |

Management Presentation May 2016

Forward looking statements 2 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company“) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

Unique business model and results Highly resilient and profitable – Profitable last 53 quarters (1) – LTM 1Q16 EBITDA $483.3mm (2) – LTM 1Q16 Return on Capital 25.3%(2) Strong balance sheet – Rated BB and Ba3(3) – Adjusted debt/ EBITDAR 1.4x(2) – $88mm returned to shareholders in 1Q16 • $100 mm in share repurchase authority as of 4/27/16 – Recurring quarterly cash dividend of $0.70 per share Management owns >20% 3 (1) Excluding non-cash mark to market hedge adjustments prior to 2008 and 4Q06 one time tax adjustment (2) See GAAP reconciliation and other calculations in Appendix (3) Corporate rating of Ba3 by Moody’s and BB by Standard & Poor’s

Advantages over the typical carrier 4 Leisure customer – Will travel in all economic conditions – Vacations are valued – price dependent Small/medium cities – Filling a large void – Increasing opportunity - industry restructuring – Diversity of network - minimizes competition Flexibility – Adjust rapidly to changing macro (fuel/economy) – Changes in capacity - immediate impact on price – Minimize threat of irrational behavior from others Low cost fleet – used aircraft – Match capacity to demand, highly variable – Relatively low capital needs, higher free cash flow – Can grow and return cash to shareholders Built to be different Leisure customer Underserved markets Little competition Low cost aircraft Low frequency/variable capacity Unbundled pricing Closed distribution Bundled packages Highly profitable

Measured, profitable growth 5 226 233 296 298 175 200 225 250 275 300 2013 2014 2015 1Q16 Routes 7.89 8.69 10.24 10.68 6.00 7.00 8.00 9.00 10.00 11.00 2013 2014 2015 LTM 1Q16 A S M s - b ill io n s Scheduled ASMs $996 $1,137 $1,262 $1,281 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 2013 2014 2015 LTM 1Q16 U S D - m m Total revenue 66 70 80 82 60 70 80 90 2013 2014 2015 1Q16 Aircraft in service Aircraft number and routes are end of period

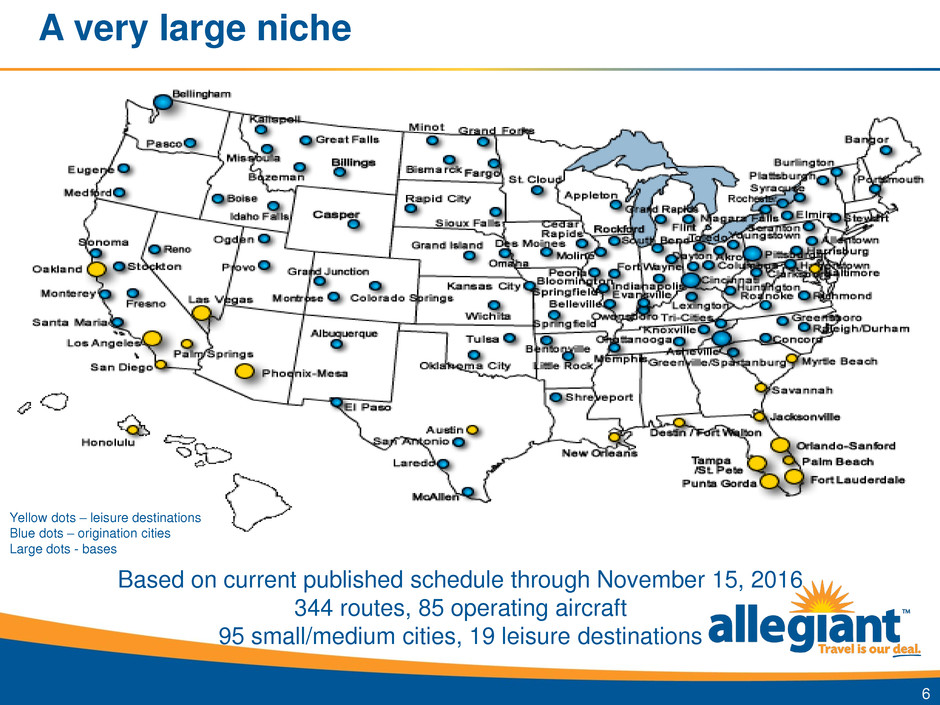

A very large niche Based on current published schedule through November 15, 2016 344 routes, 85 operating aircraft 95 small/medium cities, 19 leisure destinations 6 Yellow dots – leisure destinations Blue dots – origination cities Large dots - bases

Little competition 56 288 Routes w competition Routes wo competition Current competitive landscape Uniquely built to profitably operate in underserved markets 7 Competitors – overlapping routes Legacy carriers 44 Brand / lower cost carriers 6 ULCC carriers 19 Based on current published schedule through November 15, 2016, announcements and cancellations as of May 2, 2016 Legacy carriers – American, Delta, Southwest, United. Brand / lower cost carriers – Alaska, Hawaiian, JetBlue ULCC carriers – Frontier, Spirit Competitive routes are those that have non-stop flights between similar markets

Low frequency model 8 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec S y ste m b lock h o u rs/ A C/ d a y 2013 2014 2015 2016E Avg. block hours/AC/day 1 - Peak = peak is defined as 11/23 – 12/1, 12/21 – 1/3, 2/18 – 4/14, 6/3 – 8/18. Remaining is off peak 2 – Aircraft are end of year 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2x 3x 4x 5x or greater % o f to tal d epa rt u re s Weekly frequency of departures Weekly market frequency Peak Off peak Leisure = seasonality Small cities = low frequency(1) 2013 2014 2015 2016E Aircraft - 2 66 70 80 85

Low costs even with low utilization 7.8 JBLU 5.5 SAVE 7.4 ALK 5.8 ALGT 5.0 5.5 6.0 6.5 7.0 7.5 8.0 5 6 7 8 9 10 11 12 13 14 CA S M e x f u e l (ce n ts ) Average daily aircraft utilization – LTM (block hours per day) CASM ex fuel vs daily aircraft utilization 9 As of LTM 1Q16, ALGT – Allegiant, JBLU – JetBlue, ALK – Alaska mainline, SAVE – Spirit

Airbus 10 Actual and projected fleet count of in service aircraft (based on signed contracts only) – end of period Total fleet includes A320, A319, MD-80 and Boeing 757 Total fleet count reflects assumptions of current market expectations, demand for Allegiant service, aircraft retirements, and is subject to change Continuously evaluate potential aircraft transactions and seek to acquire additional aircraft opportunistically MD-80s can be retired at our pace 56 52 46 38 10 17 21 32 14 16 20 23 20 30 40 50 60 70 80 90 100 2015 2016E 2017E 2018E Expected fleet MD80 + B757 A319 A320 80 85 87 93 5% 21% 33% 37% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 2013 2014 2015 LTM 1Q16 Airbus % of scheduled service ASMs

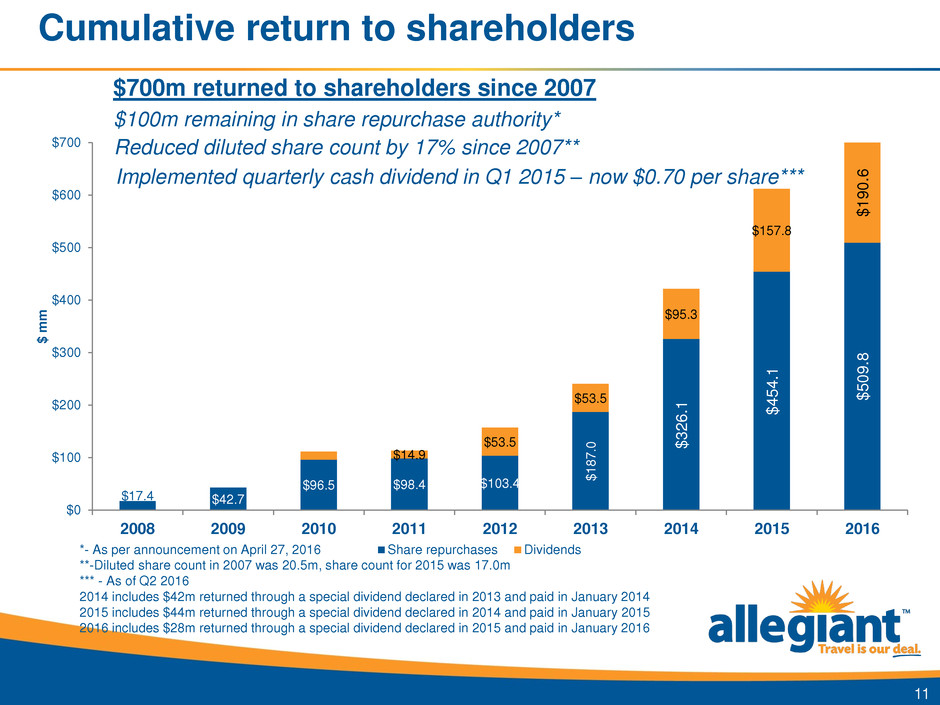

Cumulative return to shareholders $17.4 $42.7 $96.5 $98.4 $103.4 $ 1 8 7 .0 $ 3 2 6 .1 $ 4 5 4 .1 $ 5 0 9 .8 $14.9 $53.5 $53.5 $95.3 $157.8 $ 1 9 0 .6 $0 $100 $200 $300 $400 $500 $600 $700 2008 2009 2010 2011 2012 2013 2014 2015 2016 $ m m Share repurchases Dividends 11 $700m returned to shareholders since 2007 $100m remaining in share repurchase authority* *- As per announcement on April 27, 2016 **-Diluted share count in 2007 was 20.5m, share count for 2015 was 17.0m *** - As of Q2 2016 2014 includes $42m returned through a special dividend declared in 2013 and paid in January 2014 2015 includes $44m returned through a special dividend declared in 2014 and paid in January 2015 2016 includes $28m returned through a special dividend declared in 2015 and paid in January 2016 Reduced diluted share count by 17% since 2007** Implemented quarterly cash dividend in Q1 2015 – now $0.70 per share***

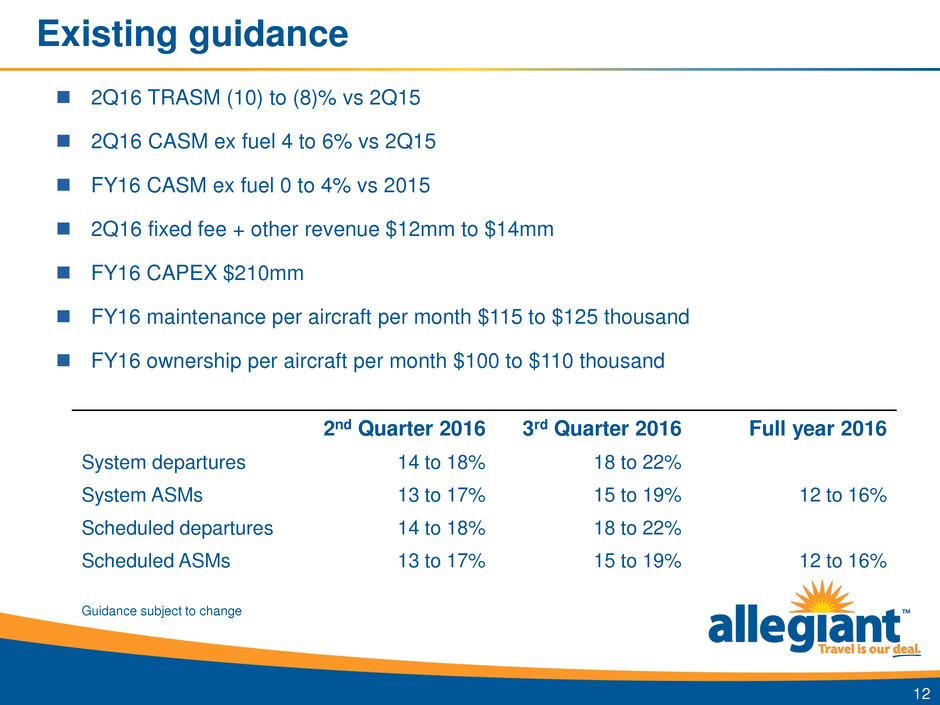

2Q16 TRASM (10) to (8)% vs 2Q15 2Q16 CASM ex fuel 4 to 6% vs 2Q15 FY16 CASM ex fuel 0 to 4% vs 2015 2Q16 fixed fee + other revenue $12mm to $14mm FY16 CAPEX $210mm FY16 maintenance per aircraft per month $115 to $125 thousand FY16 ownership per aircraft per month $100 to $110 thousand 2nd Quarter 2016 3rd Quarter 2016 Full year 2016 System departures 14 to 18% 18 to 22% System ASMs 13 to 17% 15 to 19% 12 to 16% Scheduled departures 14 to 18% 18 to 22% Scheduled ASMs 13 to 17% 15 to 19% 12 to 16% Existing guidance 12 Guidance subject to change

Appendix

GAAP reconciliation EBITDA calculations 14 $mm LTM 1Q16 2015 2014 2013 Net Income attributable to Allegiant Travel Co. 227.5 220.4 86.7 92.3 +Total comprehensive income (loss) 0 (.4) 1.2 .1 +Provision for Income Taxes 132.7 126.4 50.8 54.9 +Other Expenses 1 24.7 25.1 20.4 8.5 +Depreciation and Amortization 98.4 98.1 83.4 69.3 =EBITDA 483.3 469.6 242.5 225.1 + Write down of Boeing 757 fleet 43.3 =Adjusted EBITDA 285.8 + Aircraft lease rental 1.8 2.3 15.9 9.2 =EBITDAR 485.1 471.9 301.7 234.3 Total debt 651.0 641.7 2 593.1 234.3 +7 x annual aircraft lease rent 12.6 16.1 111.3 64.4 Adjusted total debt 663.6 657.8 704.4 298.7 =Adjusted Debt to EBITDAR 1.4x 1.4x 2.3x 1.3x Average # of in service aircraft in period 77 74 69 63 =EBITDA per aircraft 6.3 6.3 4.1 3.6 Interest expense 26.9 26.5 21.2 9.5 = Interest coverage 18.0x 17.7x 13.5x 23.7x 1- Ex unconsolidated affiliate earnings 2 - Prior to 2015, total debt does not include debt issuance costs reclassification per GAAP guidance update 2014 EBITDA and subsequent calculations are adjusted to exclude a one time write-down of $43.3m

GAAP reconciliation Return on equity 15 $mm LTM 1Q16 2015 2014 2013 2012 Net Income attributable to Allegiant Travel Co. 227.5 220.4 113.2 92.3 78.6 Mar 2016 Dec 2015 Mar 2015 Dec 2014 Dec 2013 Dec 2012 Total shareholders equity 362.5 350.0 302.4 294.1 377.3 401.7 Return on equity 68% 68% 34% 24% 21% ROE = Net income / Avg shareholders equity 2014 net income calculation found on Adjustment for special item GAAP reconciliation table

GAAP reconciliation Return on capital employed calculation $mm LTM 1Q16 2015 2014 2013 + Net income attributable to Allegiant Travel Co. 227.5 220.4 113.2 92.3 + Income tax 132.7 126.4 66.8 54.9 + Interest expense 26.9 26.5 21.2 9.5 - Interest income 2.3 1.4 0.8 1.0 384.8 371.9 200.4 155.7 + Interest income 2.3 1.4 0.8 1.0 Tax rate 36.8% 36.5% 37.1% 37.4% Numerator 244.6 237.0 126.6 98.1 Total assets prior year (1) 1,299.0 1,235.1 930.2 798.2 - Current liabilities prior year (1) 394.0 362.0 290.7 210.5 + ST debt of prior year (1) 60.8 52.6 20.2 11.6 Denominator 965.8 925.7 659.7 599.3 = Return on capital employed 25.3% 25.6% 19.2% 16.4% 16 1 - Prior to 2015, total debt does not include debt issuance costs reclassification per GAAP guidance update 2014 net income calculation found on Adjustment for special item GAAP reconciliation table

GAAP reconciliation Free cash flow calculations 17 $mm LTM 1Q16 2015 2014 2013 Cash from operations 362.8 365.4 269.8 196.9 - Cash CAPEX 260.2 252.7 279.4 177.5 = Free cash flow 102.6 112.7 (9.6) 19.4 2014 CAPEX does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisitions closed in June 2014

GAAP reconciliation Net debt 18 $mm Mar 2016 Dec 2015 Dec 2014 Dec 2013 Current maturities of long term debt (1) 79.8 74.1 53.8 20.2 Long term debt, net of current maturities (1) 571.3 567.6 539.3 214.1 Total debt 1 651.1 641.7 593.1 234.3 Cash and cash equivalents 102.1 87.1 89.6 97.7 Short term investments 240.7 245.6 269.8 253.4 Long term investments 68.4 64.8 57.4 36.0 Total cash and investments 411.2 397.5 416.8 387.1 = Net debt 239.9 $244.2 $176.3 ($152.8) End of period 1 - Prior to 2015, debt does not include debt issuance costs reclassification per GAAP guidance update

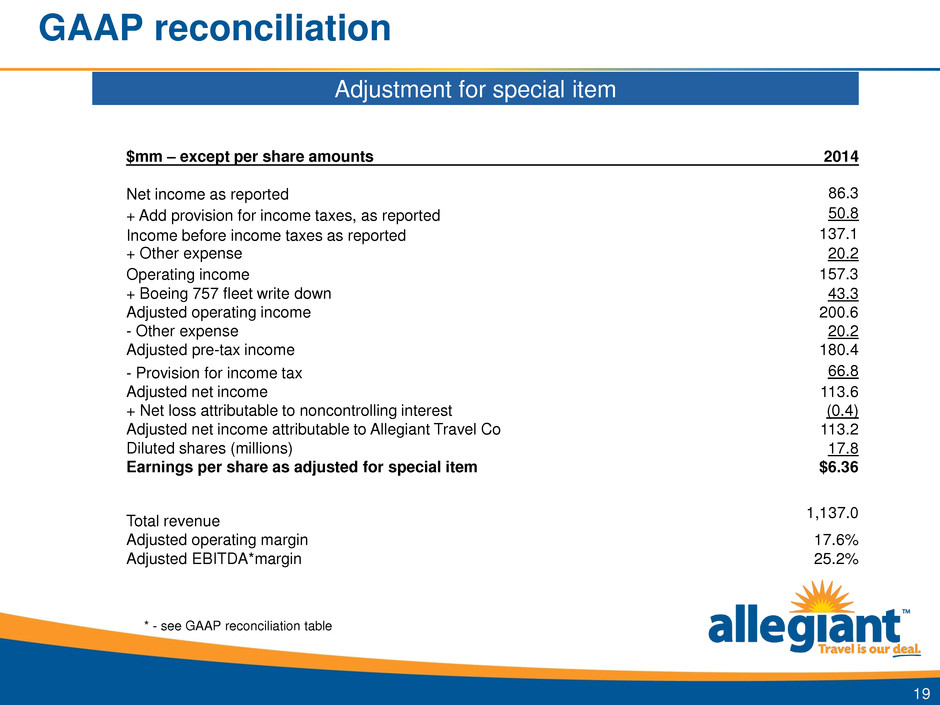

GAAP reconciliation Adjustment for special item 19 2014 $mm – except per share amounts Net income as reported 86.3 + Add provision for income taxes, as reported 50.8 Income before income taxes as reported 137.1 + Other expense 20.2 Operating income 157.3 + Boeing 757 fleet write down 43.3 Adjusted operating income 200.6 - Other expense 20.2 Adjusted pre-tax income 180.4 - Provision for income tax 66.8 Adjusted net income 113.6 + Net loss attributable to noncontrolling interest (0.4) Adjusted net income attributable to Allegiant Travel Co 113.2 Diluted shares (millions) 17.8 Earnings per share as adjusted for special item $6.36 Total revenue 1,137.0 Adjusted operating margin 17.6% Adjusted EBITDA*margin 25.2% * - see GAAP reconciliation table

Revenue components 20 $91.69 $91.30 $78.63 $75.95 $50 $60 $70 $80 $90 2013 2014 2015 LTM 1Q16 Average fare - scheduled service $5.21 $4.56 $4.29 $4.19 $0.00 $2.00 $4.00 $6.00 2013 2014 2015 LTM 1Q16 Average fare - ancillary third party products $40.52 $41.37 $46.43 $46.42 $30.00 $40.00 $50.00 2013 2014 2015 LTM 1Q16 Average fare - ancillary air-related charges $137.43 $137.23 $129.35 $126.56 $110 $120 $130 $140 2013 2014 2015 LTM 1Q16 Average fare - total All revenue is revenue per scheduled passenger

LTM 1Q16 cost per passenger Low cost drivers $27 $23 $30 $34 $10 $15 $11 $13 $10 $4 $9 $14 $24 $21 $54 $44 $20 $24 $29 $38 ALGT SAVE LUV JBLU 21 Source: Company filings Ownership includes depreciation & amortization + aircraft rent Other excludes special items and one-time charges for other carriers Other Aircraft $47 $50 $61 $44 $83 $82 Ex fuel cost = $64 Fuel cost = $27 Total Allegiant = $91 Ex fuel cost = $103 Fuel cost = $30 Total Southwest = $133 Ex fuel cost = $109 Fuel cost = $34 Total JetBlue = $143 $42 $45 Ex fuel cost = $64 Fuel cost = $23 Total Spirit = $87 Fuel Ownership Maintenance Other Labor

Credit metrics 16.4% 19.2% 25.6% 25.3% 15.9% 10% 20% 30% 2013 2014 2015 LTM 1Q16 LUV LTM 1Q16 22 Return on capital employed 24.0% 34.0% 68.0% 68.0% 31.1% 10% 20% 30% 40% 50% 60% 70% 80% 2013 2014 2015 LTM 1Q16 LUV LTM 1Q16 Return on equity 23.7 x 13.5 x 17.7 x 18.0 x 39.9 x 10 15 20 25 30 35 40 45 2013 2014 2015 LTM 1Q16 LUV LTM 1Q16 Interest coverage 1.3 x 2.3 x 1.4 x 1.4 x 1.0 x 0 1 2 3 2013 2014 2015 LTM 1Q16 LUV LTM 1Q16 Adjusted Debt / EBITDAR LUV = Southwest Airlines, based on published information Please see GAAP reconciliation table in appendix for calculation 2014 EBITDAR refers to an adjusted amount found in EBITDA tables in appendix

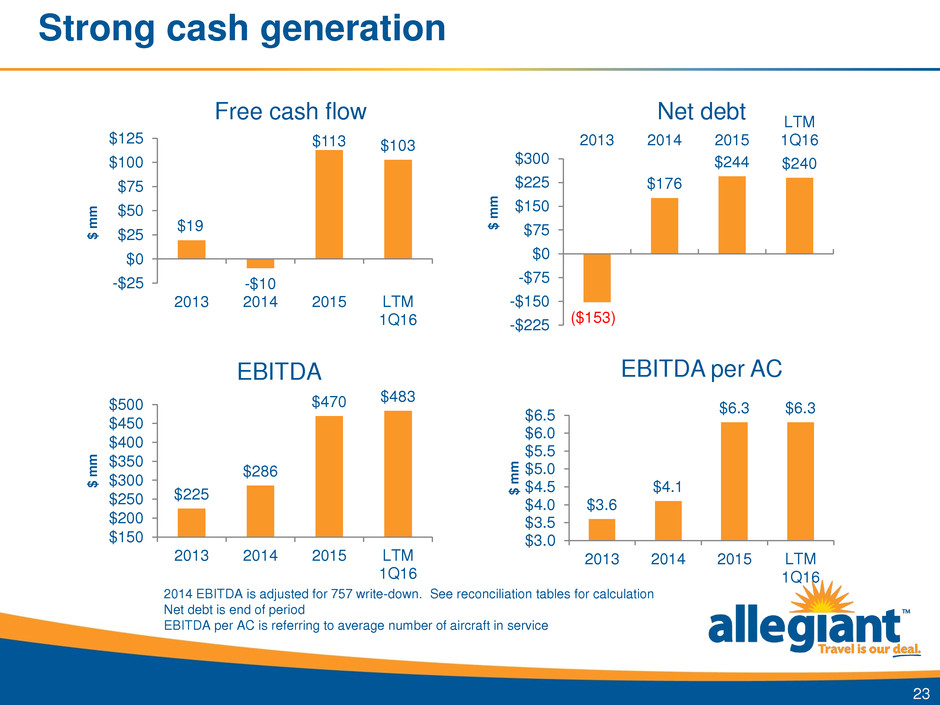

Strong cash generation $225 $286 $470 $483 $150 $200 $250 $300 $350 $400 $450 $500 2013 2014 2015 LTM 1Q16 $ m m 23 EBITDA $3.6 $4.1 $6.3 $6.3 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 2013 2014 2015 LTM 1Q16 $ m m EBITDA per AC Free cash flow $19 -$10 $113 $103 -$25 $0 $25 $50 $75 $100 $125 2013 2014 2015 LTM 1Q16 $ m m ($153) $176 $244 $240 -$225 -$150 -$75 $0 $75 $150 $225 $300 2013 2014 2015 LTM 1Q16 $ m m Net debt 2014 EBITDA is adjusted for 757 write-down. See reconciliation tables for calculation Net debt is end of period EBITDA per AC is referring to average number of aircraft in service

Sources/uses of cash $178 $279 $253 $210 $0 $50 $100 $150 $200 $250 $300 2013 2014 2015 2016E * $ m m 24 CAPEX $22.7 $168.8 $67.9 $73.3 $0.0 $50.0 $100.0 $150.0 $200.0 2013 2014 2015 LTM 1Q16 $ m m Debt payments Cash from operations $197 $270 $365 $363 $0 $150 $300 $450 2013 2014 2015 LTM 1Q16 $ m m $84 $181 $190 $176 $0 $50 $100 $150 $200 2013 2014 2015 LTM 1Q16 $ m m Returning cash to shareholders 2014 CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisition closed in June 2014 * - 2016 CAPEX guidance as of 4/27/16, subject to change

Airbus growth will help improve fuel burn 25 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 2012 2013 2014 2015 LTM 1Q16 Fuel expense/total revenue 1 - As of LTM 1Q16 Fuel has greatest leverage to earnings – Fuel ~ 29% of total operating expense(1) – Airbus aircraft flew 38% of LTM 1Q16 scheduled block hours 67.0 67.5 68.0 68.5 69.0 69.5 70.0 70.5 71.0 2013 2014 2015 LTM 1Q16 Historical ASMs/gallon System fuel cost per gallon $3.18 $3.20 $3.01 $1.86 $1.69

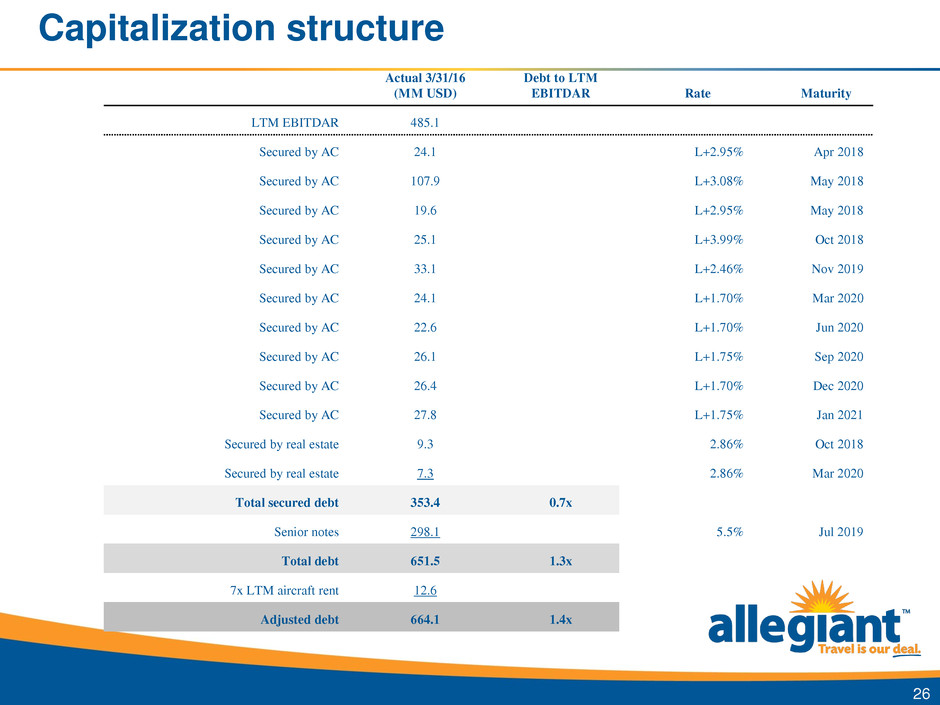

Capitalization structure Actual 3/31/16 (MM USD) Debt to LTM EBITDAR Rate Maturity LTM EBITDAR 485.1 Secured by AC 24.1 L+2.95% Apr 2018 Secured by AC 107.9 L+3.08% May 2018 Secured by AC 19.6 L+2.95% May 2018 Secured by AC 25.1 L+3.99% Oct 2018 Secured by AC 33.1 L+2.46% Nov 2019 Secured by AC 24.1 L+1.70% Mar 2020 Secured by AC 22.6 L+1.70% Jun 2020 Secured by AC 26.1 L+1.75% Sep 2020 Secured by AC 26.4 L+1.70% Dec 2020 Secured by AC 27.8 L+1.75% Jan 2021 Secured by real estate 9.3 2.86% Oct 2018 Secured by real estate 7.3 2.86% Mar 2020 Total secured debt 353.4 0.7x Senior notes 298.1 5.5% Jul 2019 Total debt 651.5 1.3x 7x LTM aircraft rent 12.6 Adjusted debt 664.1 1.4x 26

EXHIBIT 99.2

May 2016

Dear Allegiant Shareholder:

2015 was another profitable year for your company. Revenues were at an all-time high as the Company grew capacity almost 18 percent to take advantage of lower fuel prices. To support this growth, we added 13 Airbus A320 series aircraft and began operations on 63 new routes. This growth is further supported by the addition of three mid-continent bases in Cincinnati (CVG), Asheville (AVL), and Pittsburgh (PIT) to backfill the reduction in capacity at these airports by larger carriers. In addition, these new bases provide greater flexibility for our operations, allowing us to more efficiently schedule the Company’s fleet as well as add new routes that currently have limited or no non-stop air transportation competition. Operating margin for the year was the highest in the Company’s history and we maintained our streak of consecutive profitable quarters, which is currently at 53 as of the end of first quarter 2016.

Events and Trends

Clearly, the most impactful financial benefit during the past 18 months has been the relative price of energy. In 2015, the Company paid an average of $1.86 per gallon of fuel compared to over $3 in 2014. In the 4th quarter of 2013 we spent $53 per passenger for fuel while in the 4th quarter of 2015 it was $26. Part of this reduction is tied to our migration to Airbus aircraft and the efficiencies of that aircraft. During these same periods we generated 71 ASMs (available seat miles) per gallon versus 68 in Q4 2013, a 4.4 percent increase in fuel productivity in the past two years. We expect this trend to continue in the coming years as we move to our newer generation fleet. Our 166 seat MD-80s produce 62 ASMs per gallon while our 177 seat A320s generate as many as 88 ASMs per gallon, or a 42 percent increase in fuel efficiency. Few airlines will have this degree of increased fuel efficiency in the coming years.

Fuel prices in the past decades have been, in our view, the primary driver behind capacity behavior. Accordingly, the sharp reduction in fuel costs incentivized us to increase our pace of growth this past year. We added almost 18 percent more ASMs in 2015 compared to 2014, versus 10 percent more ASMs in 2014 as compared to 2013. Over the years we have demonstrated a unique ability to flex our system capacity to respond to economic changes. Indeed, all of our cycles - the 7 day week (where we restrict the amount of flying on off peak days such as Tuesday, Wednesday, or Saturday compared to the peak days of Thursday, Friday, Sunday, and Monday), or the annual seasonality (where we fly half the daily utilization of our fleet in September as compared to March) demonstrate a unique flexibility to offer service in a manner to optimize returns. This same approach has proven effective in difficult times such as 2008, when we acted quickly to reduce capacity in response to exploding fuel prices. The ability to continually adapt to the demands of the marketplace is fundamental to our business model and our industry leading margins (29.4 percent in 2015), as well as our current 53 consecutive quarters of profitability, including profitable quarters throughout the difficult 2008 period.

We continue to stress our limited frequency approach focusing on less than daily flights in a market versus multiple flights a day which is typical of most carriers. Our limited offerings (over 50 percent of our 300 plus markets have only two flights per week) greatly expand the number of markets available to us and fit nicely with our leisure oriented customer. The leisure customer is exceptionally price sensitive. Our customers focus their travel decisions primarily on the cost of a trip. In most instances they don’t have to travel, but rather want to travel. They are disciplined in their decision making and won’t travel if the fare doesn’t fit within their budget. Our profitability is very much dependent on having a cost structure which allows us to offer lower fares than otherwise available (to stimulate the leisure traveler to fly) and still generate acceptable returns.

2015 Growth - Medium-sized Cities and increased utilization

A large component of our 18 percent increase in ASMs this past year was created through increased fleet utilization - 5.9 hours per day versus 5.4 in 2014, an increase of nine percent. Our increase in utilization is a result of increased flying in off peak months and off peak days. We are able to pursue these opportunities with desirable profit margins primarily as a reaction to lower fuel prices. If fuel prices begin to climb, we can easily remove flying that we do in the off peak periods. While off peak flying is typically negative for unit revenues, our primary goal is to drive higher earnings per share for the Company, and we will adjust tactics and schedules accordingly.

Network growth also continued throughout 2015, bringing our total routes to 296 - a 29 percent increase from the end of 2014. Total cities served increased to 105, and included the additions of Austin (TX), Jacksonville (FL), New Orleans (LA), and Savannah (GA) as new leisure destinations. Since the end of 2010, we have grown the number of routes by 85 percent and total revenue by 90 percent.

In 2014 we began adding what we term as “medium-sized” cities to our network. While these medium-sized cities represent a deviation from our typical small city profile, they do not mark a deviation from the business model of flying underserved or unserved routes. This city profile allows for more growth opportunities than smaller cities. While routes from these medium-sized cities heading to Orlando or Las Vegas typically have competition, markets such as Cincinnati to Savannah, or to Jacksonville, would only be served through a legacy hub and consequently be priced for the business customer. These very thin routes have worked nicely for our twice a week schedule and there are many of them available.

One of the benefits of medium-sized cities is the ability to serve more markets from one location. As an example, Cincinnati, which we began to serve in early 2014, now serves 13 leisure destinations whereas a smaller city such as Des Moines serves just six leisure destinations. As we add these larger cities, there is a perception that every market from each of these cities will have competition. Of the 13 leisure destinations served from Cincinnati, only five (38 percent) of the markets are competitive. In three of those five markets, we fly to the secondary airport in the city, e.g. Orlando/Sanford versus the main Orlando airport - MCO. This attention to competitive detail does not happen by accident. Our network planning group seeks out the unserved markets which fit our low frequency model. As a result, approximately 80 to 85 percent of our routes do not have any direct competition, a ratio we have maintained, despite our network growth, for a number of years.

Growth in these medium-sized cities is critical for our future growth. Our operational structure has historically been built around bases in destination locations including four Florida and five western U.S. destination city bases. We station aircraft, pilots, flight attendants, mechanics and all necessary support personnel for the operation at these different locations. Bases such as Orlando/Sanford and Las Vegas may have up to 20 aircraft depending on the time of year. One of the problems, however, is in launching this many aircraft early each day with a limited number of gates. Launching as many as 18 to 20 aircraft from 6 to 7 gates takes as many as three hours first thing each morning. Additionally, gate utilization is not optimal because we are fighting the “peaking” effect when these aircraft turn and head south to complete the return leg of their round trip.

Our mid-con bases, (as we call them) such as Cincinnati and Pittsburgh, have sufficient size in both originating customers and large, underutilized airport facilities built in the past 20 to 30 years when there was more capacity in the U.S. transportation system. Several of our currently served cities, such as Memphis and Indianapolis, also fit this profile as potential bases in the future. Given their underutilization, these cities have been very welcoming to us. Basing aircraft in these cities would provide us with better balance in our scheduling, namely the ability to launch aircraft in two directions (both north and south) versus today’s limited northerly direction from our leisure destinations in Florida. This approach will improve gate utilization both in the early departures and throughout the day, particularly in our Florida bases such as Orlando/Sanford, St. Pete/Clearwater, Fort Myers/Punta Gorda and Ft. Lauderdale.

We chose this unidirectional operational approach early in our development because it minimized costs, but at a price. It is not the preferred marketing or sales approach for scheduling, but the mid-con bases provide a more flexible bi-directional approach. We also have a better sales and marketing schedule - we can now schedule 7/8 am departures from these mid-con bases (versus best case late morning return flights from the originators in our southern bases) to our leisure destinations, with arrivals in mid-morning. In addition, this allows for better utilization of our gates in our destination markets with this better-balanced flow.

Longer term, this growth via mid-con bases provides new customers heretofore unavailable to us in these larger cities, additional critical real estate for our operation, and lastly, an improved selling schedule.

Aircraft

We added 13 Airbus A320 series aircraft into revenue service in 2015, more than doubling our Airbus count from the prior year. We ended 2015 with 10 A319 and 14 A320 aircraft, comprising 30 percent of our total fleet. By the end of 2016, we expect to have 17 A319 and 16 A320 aircraft in service, or approximately 40 percent of our fleet. Long-term, we have signed contracts which will increase our Airbus fleet to a total of 61 aircraft by 2018, with additional transactions regularly being discussed.

Our Airbus aircraft flew 33 percent of scheduled service ASMs in 2015, compared to 21 percent in 2014. In 2016 we expect the majority of our ASMs will come from our Airbus fleet. As we add Airbus aircraft, both for growth and replacement of our MD-80 aircraft, our fuel efficiency per passenger will continue to improve. Since 2010, we have grown capacity, measured in ASMs, by over 69 percent, but fuel gallons consumed have increased just 42 percent. This increased efficiency is important given fuel has historically been our largest expense category - 31 percent of total operating expenses this past year.

Short term transition, long term benefits

As previously mentioned, we are in the process of transitioning to an all Airbus fleet. In the meantime, the 49 MD-80s currently remaining are a crucial component of our fleet. We expect to be operating MD-80s for at least the next three to four years. We are also in the process of phasing out our Boeing 757-200 series aircraft by the end of 2017.

The duration of this transition from the MD-80 to an all Airbus fleet is dependent on the availability of reasonably priced, used, A320 series aircraft. Lower fuel prices have made it more difficult to find quality, used equipment as operators have been extending the retirement of these aircraft on a short-term basis to support increased industry capacity spurred by the lower fuel prices.

We are continually searching for additional Airbus aircraft. Acquisition strategies include spot market purchases, purchases through forward contracts, and the purchase of aircraft subject to lease with other carriers which expire in the coming years, at which time they will be added to the Company’s fleet. Long-term, we remain confident the introduction of the new generation A320neo aircraft will lead to a softening of the current market conditions for the Airbus A320 series aircraft we are interested in, regardless of energy costs. We have been, and will continue to be, opportunistic buyers of additional Airbus aircraft. Our strong balance sheet and cash position allow us to move quickly and negotiate attractive deals.

Transitioning to a single fleet type will simplify our operation. A single aircraft type simplifies crew training and productivity as well as maintenance and operations at the station level. It will also reduce our carbon footprint as the Airbus is materially more fuel efficient than both the MD-80 and Boeing 757-200. As previously mentioned, there is a great deal of work to finish this transition, but we feel the enhanced operation and economic benefit is well worth the time and investment.

Unit Revenue/Unit Cost

We take pride in maintaining one of the lowest cost structures in the industry. Overall our cost per available seat mile (CASM) declined 19 percent to 8.45 cents from 10.47 cents (excluding our write down of our 757 fleet) in 2014 primarily because of the drop in energy costs this past year. We also saw improvement in 2015 as our cost per available seat mile, excluding fuel (CASM ex-fuel) was 6.13 cents, a reduction in CASM ex-fuel of 5 percent compared to 2014 (excluding the 757 write down).

Unit fares also declined during 2015, which was expected. Our average fare declined almost 6 percent overall (scheduled base fare was down almost 14 percent but we were able to increase ancillary revenues 10 percent for the net 6 percent down). The benefits of the lower fuel cost caused a rational expansion of capacity, as previously discussed. As we add capacity at the margin, fares decline. But these decreases were more than offset by the cost savings from lower fuel.

Labor Situation

Last year at this time we reported difficulties with the International Brotherhood of Teamsters (the IBT), the bargaining agent for our pilots. At that time, the IBT leadership called for a strike, embarking on a path away from the traditional negotiation environment under the auspices of the National Mediation Board (NMB). Through court actions we were able to prevent this effort. This marked a low point in our negotiations with our pilots.

This is the first contract with our pilots. It is well known that initial contracts take longer (years) to negotiate. Since last spring, working through the NMB process, we believe we have made good progress in negotiating the necessary elements of a contract. Both the pilots and the Company recognize the need to work collectively to put an acceptable agreement together that recognizes the interests of both groups. Our goal is to complete an agreement and have it ratified by our pilots this year.

On another front, the industry is facing a strong demand for pilots. The combination of near term industry expansion due to record profits from reduced fuel expense, and upcoming retirements of as many as 50 percent of the crew members from the big 3 - Delta, American, and United - in the next ten years has created this demand. The source of pilots for the majors has been (and will continue to be) from less mature carriers, including carriers such as ourselves and regional carriers. We sit in the middle of the pilot flow and, while we hire our needed crews from regionals as well, we are also losing crew members to larger carriers. A component of these resignations is frustration with our lack of an agreement and the contentious nature of our negotiations. It is our belief that a completed agreement will take away this uncertainty and frustration.

Regional carriers have historically hired younger, first time, commercial pilots and introduced them to the U.S. air traffic system. As these crews gain experience, including pilot in command time, they become eligible for the minimum standards of most larger carriers, including those at Allegiant. But a recent rule change passed by Congress has substantially raised the minimum requirements for new entrant crew members. Regional carriers are facing a shortage due to the inability to attract sufficient new hire crew members to offset experienced pilots leaving for other industry opportunities.

At present, we have been able to fill our pilot needs; however, we may have to become more aggressive in our recruitment efforts in the coming months and years to fill our needs.

Management structure

Our operational complexity has increased in the past few years as we have increased our fleet to 80 aircraft, and team members to nearly 3,000. To that end, at the beginning of this year I asked two of our senior officers, Jude Bricker and Scott Sheldon, to assume additional duties and take on the management of our operations group. Jude, who took on the title of Chief Operating Officer, heads our safety, maintenance and flight operations group. Scott, who has been overseeing the stations group and call center teams since earlier last year, took control of our operations center and flight attendants groups. These two gentlemen have each been with the Company for over ten years and have proven themselves to be excellent managers. Their in-depth knowledge of the Company, its personnel and its processes, allow them to move quickly to enhance the systems, processes and personnel in these different areas.

Collectively, our entire management team is keenly focused on making Allegiant a better company. We have been able to attract and retain excellent personnel. They are a critical asset of your company. We attempt to hire talented professionals and then allow them to show their wares. This growing of management talent internally has proven to be the best means of building a strong, capable management group, and continues to foster our culture of success. Not only have we been able to attract good talent but we have also worked diligently to allow them to grow and prosper both professionally and economically through promotion from within. As a result, we have a terrific group of managers, many of them we see as ‘rock stars’ who will be the future leaders of your company. Development of our management team in this fashion will continue to be a critical component of our success.

Capital Management and Operational results

2015 was a record year for your Company. Aided by a more than 39 percent reduction in unit fuel costs, the Company was able to grow capacity almost 18 percent and generate a 29.4 percent operating margin and an operating profit of $372 million. After tax earnings were $220 million or $12.97 per share, 2.67 times the $4.87 earned in 2014. These results are exceptional for any business, but particularly so for the airline industry. We are very proud of these outcomes.

Concurrently, our returns on invested capital increased 6.2 points during the year to 25.2 percent from 19 percent in 2014. A good measure of our strong return on equity is our program to return capital to our shareholders. In 2015, we returned approximately $192 million to shareholders. $62.4 million was returned in the form of dividend payments (four recurring and one special), and $129.5 million in the form of share repurchases. Our diluted average outstanding share count declined approximately 800,000 shares or 5 percent during 2015 to 17.0 million shares, down from 17.8 million shares at the end of 2014. We entered 2016 with $54 million of share repurchase authority which we used during the first quarter. We expect to be active throughout this coming year. The $192 million returned to shareholders in the past year is the highest amount in our history. Lastly, during 2015 we invested over $252 million in CAPEX, primarily used to fund the purchase of 14 Airbus A320 series aircraft.

We are proud of our capital performance, not only last year, but in years past. We continue to maintain one of the best balance sheets in the industry while returning capital to you, our shareholders, as well as investing in our team members and the Company’s growth.

Our Culture, Our Principles

Lastly, but certainly not least, we commend all of our team members. Since our humble beginnings with one aircraft operating between Fresno and Las Vegas, they have been critical to our success. Their focus on safety and reliability, as well as providing an affordable travel experience for our leisure customers, continues to be one of the keys to our success.

We have a proven, seasoned model. Our culture has been honed on the principles summarized earlier. We are focused on offering our customers a value proposition that exceeds their expectations. We are also focused on creating a positive, interesting and empowering environment for our team members - one that is stimulating, where they can grow and prosper in such a way that they naturally thrive and advance the good of the organization. Financially, we are focused on profits, growth, and the best financial returns for our shareholders.

These principles continue to serve us well.

Maurice J. Gallagher, Jr.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Travel + Leisure Co. and Allegiant Announce Multi-Year Marketing Agreement

- LuxUrban Hotels (LUXH) Announces Management and Board Changes

- UBS Upgrades Lifestyle Communities Ltd (LIC:AU) (LCOMF) to Neutral

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share