Form 8-K Alexander & Baldwin, For: Nov 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2016

ALEXANDER & BALDWIN, INC.

(Exact name of registrant as specified in its charter)

| Hawaii | 001-35492 | 45-4849780 |

| (State or other jurisdiction of incorporation) | (Commission File Number) |

(I.R.S. Employer Identification No.) |

822 Bishop Street, P. O. Box 3440

Honolulu, Hawaii 96801

(Address of principal executive office and zip code)

(808) 525-6611

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

On November 2, 2016, Alexander & Baldwin, Inc. (the “Company”) made available on its website its Supplemental Information, which provides certain supplemental operating and financial information for its operating segments for the three and nine months ended September 30, 2016 and 2015. A copy of this Supplemental Information is being furnished as Exhibit 99.1 to this report.

In connection with the previously announced November 2, 2016 presentation for investors hosted by the Company, to discuss its strategic direction, to be webcast at www.alexanderbaldwin.com, the Company will be using the presentation materials attached as Exhibit 99.2 to this report.

Statements in this Form 8-K and the attached exhibits that are not historical facts, including potential benefits, consequences and impact of a potential REIT conversion, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statement. These forward-looking statements are not guarantees of future performance. This release should be read in conjunction with pages 17-29 of Alexander & Baldwin, Inc.’s 2015 Form 10-K and other filings with the SEC through the date of this release, which identify important factors that could affect the forward-looking statements in this release. We do not undertake any obligation to update our forward-looking statements.

These forward-looking statements include, but are not limited to, the Company’s plans regarding (i) the possibility of converting to a REIT and the timing thereof, and (ii) the potential advantages, benefits and impact of, and opportunities created by, converting to a REIT. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and the following:

| • | There are a number of implementation and operational complexities to address before the Company decides whether to pursue a REIT conversion, including possible internal reorganizations. The Company can provide no assurance as to whether it will convert to a REIT. |

| • | REIT qualification involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended, as well as various factual determinations not entirely within the Company’s control. If the Company determines to convert to a REIT, the Company cannot give assurance that it will so qualify or remain so qualified. |

| • | The Company can give no assurances that its board of directors will approve a conversion to a REIT, even if there are no impediments to such conversion. |

| • | The Company’s exploration of a potential REIT conversion may create a potential diversion in our management's attention from traditional business concerns. |

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits |

| 99.1 | Alexander & Baldwin, Inc.’s Supplemental Information, for the three and nine months ended September 30, 2016 and 2015. | ||

| 99.2 | Slides related to presentation, November 2, 2016. | ||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 2, 2016 | |

| ALEXANDER & BALDWIN, INC. | |

| /s/ Paul K. Ito | |

| Paul K. Ito | |

| Senior Vice President, | |

| Chief Financial Officer and Treasurer |

Exhibit 99.1

Alexander & Baldwin, Inc.

Table of Contents

| Section | Page |

| Glossary of terms | 4-5 |

| Consolidated Balance Sheets | 6 |

| Consolidated Statements of Operations | 7 |

| Consolidated Condensed Statements of Cash Flows | 8 |

| Notes Payable & Long-Term Debt | 9 |

| Components of NAV | 10-11 |

| Property Report – Hawaii | 12 |

| Property Report - U.S. Mainland | 13 |

| Net Operating Income | 14 |

| Percent Occupancy | 15 |

| Commercial Real Estate Transactional Activity | 16 |

| Top Ten Tenants (In-Service Properties) Based Upon ABR | 17 |

| Lease Expiration Schedule | 18 |

| Commercial Portfolio Repositioning, Redevelopment & Development Summary | 19 |

| Active Development Projects | 20 |

| Landholdings as of September 30, 2016 | 21 |

| Materials & Construction Select Data | 22 |

| Statement on Management’s Use of Non-GAAP Financial Measures | 24 |

| Reconciliation of Net Income (Loss) Available to A&B Shareholders to Funds From Operations | 25 |

| Reconciliation of Consolidated Net Income (Loss) to EBITDA | 26 |

| Reconciliation of Materials & Construction Segment Operating Profit to EBITDA | 27 |

| Reconciliation of Commercial Real Estate Operating Profit to NOI (Non-GAAP) | 28 |

| Reconciliation of Commercial Real Estate Operating Profit to NOI Trailing 12 mos (Non-GAAP) |

29 |

Forward-Looking Statements

Statements in this Supplement that are not historical facts are “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statement. These forward-looking statements are not guarantees of future performance. This Supplement should be read in conjunction with pages 17-29 of Alexander & Baldwin, Inc.’s 2015 Form 10-K and other filings with the SEC through the date of this Supplement, which identify important factors that could affect the forward-looking statements in this Supplement. We do not undertake any obligation to update our forward-looking statements.

Basis of Presentation

The information contained in this Supplement does not purport to disclose all items required by accounting principles generally accepted in the United States of America (GAAP). The information contained in this Supplement is unaudited and should be read in conjunction with Alexander & Baldwin, Inc.’s 2015 Form 10-K and other filings with the SEC through the date of this Supplement.

| 2 |

Alexander & Baldwin, Inc.

Company Profile

Alexander & Baldwin, Inc. is a 146-year-old Hawaii company focused on creating value from its tremendous real estate assets.

| Assets1 | · | $1.1B portfolio of primarily Hawaii grocery-anchored strip retail commercial properties located in prime neighborhood locations across the state |

| · | Approximately $470M of active developments for sale on several major islands across the state | |

| · | 87,500 acres of land in Hawaii, making A&B the state’s fourth largest landowner | |

| · | Ownership of Hawaii’s largest materials and paving construction company |

| Hawaii-focused Strategy | · | Increase commercial real estate portfolio value and cash flow |

| · | Accelerate monetization of development pipeline | |

| · | Leverage strong Materials & Construction segment positioning | |

| · | Minimize sugar cessation costs and successfully transition HC&S lands to diversified agriculture | |

| · | Continue disciplined and prudent financial management |

| Team | · | Led by Chris Benjamin, A&B president & CEO and Lance Parker, A&B Properties president |

| · | Deep Hawaii market knowledge and network | |

| · | Reputation for integrity, performance and commitment to the community |

COMMERCIAL REAL ESTATE HIGHLIGHTS

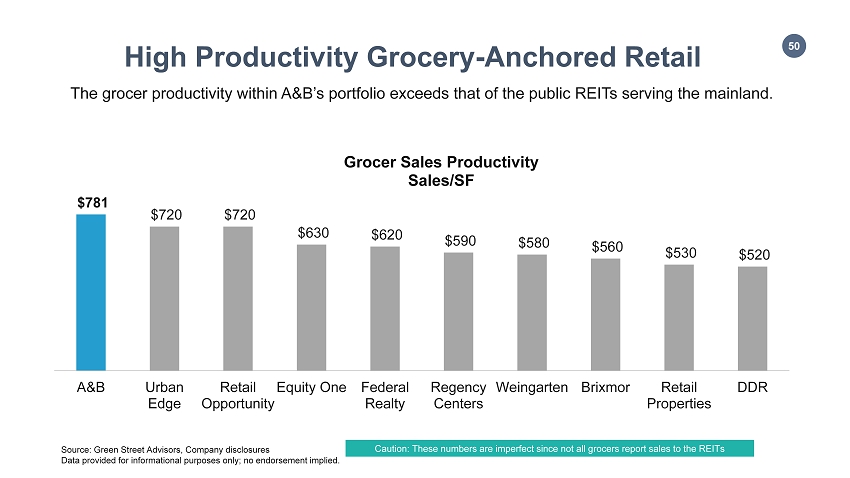

| #1 | Strip retail centers owner in Hawaii ABR of $26.60 psf |

| 2.9M | Square feet of GLA in Hawaii |

TRADING HIGHLIGHTS

| ALEX | NYSE listed ticker symbol |

| 1.9B | Market capitalization |

| 129K | 3-month average trading volume |

| Indices | MID, DJUSRE, RTY |

1 Represents book value as of September 30, 2016.

| 3 |

Alexander & Baldwin, Inc.

Glossary of Terms

| Annualized Base Rent (ABR) | The current month's contractual rent multiplied by 12. |

| Backlog | Backlog represents the amount of revenue that Grace Pacific and Maui Paving, LLC, a 50-percent-owned unconsolidated affiliate, expect to realize on contracts awarded or government contracts in which the Grace Pacific has been confirmed to be the lowest bidder and formal communication of the award is perfunctory. |

| Earnings Before Interest, Taxes, Depreciation and Amortization(EBITDA) |

EBITDA is calculated for the Materials & Construction segment by adjusting consolidated segment operating profit (which excludes interest and tax expenses), as applicable, by adding back depreciation and amortization and subtracting income attributable to non-controlling interests. EBITDA is a Non-GAAP measure used by the Company in evaluating the operating performance on a consistent and comparable basis from period to period. The Company provides this information to investors as an additional means of evaluating the performance of the segment's ongoing core operations and should be not be viewed as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

EBITDA is also presented for the Company on a consolidated basis. EBITDA is calculated by adjusting the Company’s consolidated net loss to exclude the impact of interest expense, income taxes, and depreciation and amortization. The Company provides this information to investors as an additional means of evaluating the performance of the Company’s operations and should be not be viewed as a substitute for, or superior to, financial measures calculated in accordance with GAAP. |

| NAREIT Funds From Operations (FFO) |

A supplemental measure of real estate company operating performance. It is computed by adjusting net income (loss) available to A&B shareholders computed in accordance with generally accepted accounting principles (GAAP) to add back depreciation and amortization of real estate assets and exclude extraordinary items and gains and losses on sales of commercial real estate. FFO is a Non-GAAP measure and should not be considered as an alternative to net income as an indication of the Company's performance and is not necessarily indicative of cash flow as a measure of liquidity or ability to pay dividends. It is, however, a meaningful, additional measure of operating performance primarily because it excludes the assumption that the value of real estate assets diminishes predictably over time, and because industry analysts have accepted it as a performance measure. Comparison of the Company's presentation of FFO to similarly titled measures for other real estate companies may not necessarily be meaningful due to possible differences in the calculation of the term.

Many publicly traded real estate industry peers are REITs and report operations using FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”). Although we are not a REIT, management believes it is important to publish this measure to allow for easier comparison of our performance to our peers. A major difference between the A&B and its REIT peers is that A&B is a taxable entity and any taxable income generated likely results in payment of federal or state income taxes. REIT peers typically do not pay federal or state income taxes on their qualified REIT investments, but distribute a significant portion of their taxable income to shareholders. |

| GLA | Gross leasable area. |

| GAAP | Generally accepted accounting principles in the United States of America. |

| Occupancy | The percentage of square footage leased to gross leasable space. |

| 4 |

Alexander & Baldwin, Inc.

Glossary of Terms (continued)

| Net Operating Income | Net operating income (NOI) is a Non-GAAP measure derived from commercial real estate revenues (determined in accordance with GAAP, less straight-line rental adjustments) minus property operating expenses (determined in accordance with GAAP). NOI does not have any standardized meaning prescribed by GAAP, and therefore, may differ from definitions of NOI used by other companies. NOI should not be considered as an alternative to net income (determined in accordance with GAAP) as an indicator of the Company’s financial performance, or as an alternative to cash flow from operating activities as a measure of the Company’s liquidity. NOI is commonly used as a measure of operating performance because it is an indicator of the return on property investment, and provides a method of comparing property performance over time. NOI excludes general and administrative expenses, straight-line rental adjustments, interest income, interest expense, depreciation and amortization expense, and gains on sales of interests in real estate. The Company believes that the Leasing segment’s operating profit is the most directly comparable GAAP measurement to NOI. |

| Same-store | Properties that were owned throughout the entire duration of both periods under comparison, including stabilized properties. |

| Stabilized | A commercial property is considered stabilized when it either reaches 80% economic occupancy or 12 months following acquisition or construction completion. |

| Straight-line rent | GAAP requirement to average tenant rents over the life of the lease regardless of actual cash collected. |

| Year built | Year of most recent repositioning/redevelopment or year built if no repositioning/redevelopment has occurred. |

| 5 |

Alexander & Baldwin, Inc.

Consolidated Balance Sheets (Unaudited)

($ in millions)

| ASSETS | September 30, 2016 | December 31, 2015 | ||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 5.8 | $ | 1.3 | ||||

| Accounts and other notes receivable, net | 38.4 | 38.6 | ||||||

| Contracts retention | 12.4 | 11.5 | ||||||

| Costs and estimated earnings in excess of billings on uncompleted contracts | 16.6 | 16.3 | ||||||

| Inventories | 47.3 | 55.9 | ||||||

| Income tax receivable | 11.5 | 14.0 | ||||||

| Prepaid expenses and other assets | 12.6 | 14.9 | ||||||

| Total current assets | 144.6 | 152.5 | ||||||

| Investments in affiliates | 430.8 | 416.4 | ||||||

| Real estate developments | 192.6 | 183.5 | ||||||

| Property, plant & equiptment – net | 1,256.1 | 1,269.4 | ||||||

| Intangible assets - net | 55.8 | 54.4 | ||||||

| Goodwill | 102.3 | 102.3 | ||||||

| Other assets | 42.0 | 63.8 | ||||||

| Total assets | $ | 2,224.2 | $ | 2,242.3 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Notes payable and current portion of long-term debt | $ | 82.4 | $ | 90.4 | ||||

| Accounts payable | 30.1 | 35.5 | ||||||

| Billings in excess of costs and estimated earnings on uncompleted contracts | 2.7 | 2.6 | ||||||

| Accrued interest | 3.9 | 5.5 | ||||||

| Indemnity holdback related to Grace acquisition | 9.3 | 9.3 | ||||||

| HC&S cessation related liabilities - current | 16.9 | 6.4 | ||||||

| Accrued and other liabilities | 36.2 | 35.0 | ||||||

| Total current liabilities | 181.5 | 184.7 | ||||||

| Long-term Liabilities: | ||||||||

| Long-term debt | 523.9 | 496.6 | ||||||

| Deferred income taxes | 184.2 | 202.1 | ||||||

| Accrued pension and postretirement benefits | 58.6 | 59.7 | ||||||

| Other non-current liabilities | 49.6 | 60.5 | ||||||

| Total long-term liabilities | 816.3 | 818.9 | ||||||

| Commitments and Contingencies | ||||||||

| Redeemable Noncontrolling Interest | 11.6 | 11.6 | ||||||

| Equity: | ||||||||

| Common stock | 1,156.2 | 1,151.7 | ||||||

| Accumulated other comprehensive loss | (43.8 | ) | (45.3 | ) | ||||

| Retained earnings | 98.7 | 117.2 | ||||||

| Total A&B shareholders' equity | 1,211.1 | 1,223.6 | ||||||

| Noncontrolling interest | 3.7 | 3.5 | ||||||

| Total equity | 1,214.8 | 1,227.1 | ||||||

| Total liabilities and equity | $ | 2,224.2 | $ | 2,242.3 | ||||

| 6 |

Alexander & Baldwin, Inc.

Consolidated Statements of Operations (Unaudited)

($

in millions, except per-share amounts)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Operating revenue: | ||||||||||||||||

| Commercial Real Estate | $ | 32.9 | $ | 33.0 | $ | 102.3 | $ | 100.5 | ||||||||

| Real Estate Development and Sales | 12.8 | 19.9 | 13.4 | 87.8 | ||||||||||||

| Materials and Construction | 52.1 | 51.0 | 144.8 | 165.3 | ||||||||||||

| Agribusiness | 40.9 | 40.8 | 89.7 | 95.5 | ||||||||||||

| Total operating revenue | 138.7 | 144.7 | 350.2 | 449.1 | ||||||||||||

| Operating costs and expenses: | ||||||||||||||||

| Cost of Commercial Real Estate | 19.4 | 20.8 | 60.3 | 61.3 | ||||||||||||

| Cost of Real Estate Development and Sales | 3.1 | 6.7 | 3.3 | 47.4 | ||||||||||||

| Cost of Construction contracts and Materials | 41.0 | 40.7 | 114.9 | 134.1 | ||||||||||||

| Cost of Agribusiness revenues | 38.8 | 49.8 | 87.6 | 107.1 | ||||||||||||

| Selling, general and administrative | 14.7 | 12.6 | 42.6 | 41.3 | ||||||||||||

| REIT evaluation costs | 1.9 | - | 3.8 | - | ||||||||||||

| HC&S cessation costs | 17.6 | - | 51.6 | - | ||||||||||||

| Gain on the sale of improved property | - | - | (8.0 | ) | (1.9 | ) | ||||||||||

| Total operating costs and expenses | 136.5 | 130.6 | 356.1 | 389.3 | ||||||||||||

| Operating income (loss) | 2.2 | 14.1 | (5.9 | ) | 59.8 | |||||||||||

| Other income and (expense): | ||||||||||||||||

| Income related to joint ventures | 0.1 | 2.9 | 3.5 | 30.7 | ||||||||||||

| Reductions in solar investments | (0.2 | ) | (0.1 | ) | (9.7 | ) | (1.7 | ) | ||||||||

| Interest income and other | 0.5 | 0.4 | 1.6 | 0.8 | ||||||||||||

| Interest expense | (6.4 | ) | (6.5 | ) | (20.1 | ) | (20.2 | ) | ||||||||

| Income (loss) before income taxes | (3.8 | ) | 10.8 | (30.6 | ) | 69.4 | ||||||||||

| Income tax expense (benefit) | (2.4 | ) | 3.8 | (21.6 | ) | 26.4 | ||||||||||

| Net income (loss) | (1.4 | ) | 7.0 | (9.0 | ) | 43.0 | ||||||||||

| Income attributable to noncontrolling interest | (0.5 | ) | (0.3 | ) | (1.1 | ) | (1.2 | ) | ||||||||

| Net income (loss) attributable to A&B | $ | (1.9 | ) | $ | 6.7 | $ | (10.1 | ) | $ | 41.8 | ||||||

| Earnings (loss) per share: | ||||||||||||||||

| Basic - Net income (loss) available to A&B shareholders | $ | (0.03 | ) | $ | 0.11 | $ | (0.19 | ) | $ | 0.83 | ||||||

| Diluted - Net income (loss) available to A&B shareholders | $ | (0.03 | ) | $ | 0.11 | $ | (0.19 | ) | $ | 0.82 | ||||||

| Weighted average number of shares outstanding: | ||||||||||||||||

| Basic | 49.0 | 48.9 | 49.0 | 48.8 | ||||||||||||

| Diluted | 49.0 | 49.4 | 49.0 | 49.3 | ||||||||||||

| Supplemental information ($ in millions) | ||||||||||||||||

| EBITDA | $ | 31.3 | $ | 31.1 | $ | 73.0 | $ | 131.4 | ||||||||

| Operating profit | $ | 10.2 | $ | 22.2 | $ | 19.0 | $ | 107.0 | ||||||||

Note: See appendix for a statement about management’s use of Non-GAAP financial measures and required reconciliations.

| 7 |

Alexander & Baldwin, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

($ in millions)

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2016 | 2015 | |||||||

| Cash flows from operating activities: | $ | 48.4 | $ | 115.3 | ||||

| Cash flows from investing activities: | ||||||||

| Capital expenditures for property, plant and equipment | (105.3 | ) | (34.9 | ) | ||||

| Capital expenditures related to 1031 commercial property transactions | (6.2 | ) | (1.3 | ) | ||||

| Proceeds from disposal of property and other assets | 11.4 | 5.1 | ||||||

| Proceeds from disposals related to 1031 commercial property transactions | 59.3 | 25.2 | ||||||

| Payments for purchases of investments in affiliates and investments | (36.0 | ) | (22.5 | ) | ||||

| Proceeds from investments in affiliates | 6.0 | 37.6 | ||||||

| Change in restricted cash associated with 1031 transactions | 16.2 | (2.7 | ) | |||||

| Net cash provided by (used in) investing activities | (54.6 | ) | 6.5 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from issuance of long-term debt | 222.0 | 71.0 | ||||||

| Payments of long-term debt and deferred financing costs | (191.1 | ) | (182.1 | ) | ||||

| Payments under line-of-credit, net | (11.8 | ) | (0.4 | ) | ||||

| Distribution to noncontrolling interests | (0.5 | ) | (1.1 | ) | ||||

| Dividends paid | (8.8 | ) | (7.4 | ) | ||||

| (Tax withholding payments) proceeds from issuance of capital stock and other, net | 0.9 | (0.5 | ) | |||||

| Net cash provided by (used in) financing activities | 10.7 | (120.5 | ) | |||||

| Cash and cash equivalents: | ||||||||

| Net increase (decrease) for the year | 4.5 | 1.3 | ||||||

| Balance, beginning of year | 1.3 | 2.8 | ||||||

| Balance, end of year | $ | 5.8 | $ | 4.1 | ||||

| 8 |

Alexander & Baldwin, Inc.

Notes Payable & Long-Term Debt (Unaudited)

As of September 30, 2016

($ in millions, unaudited)

| Principal payments | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt: | Stated rate % | Weighted average interest rate | Maturity date | Weighted average maturity date (years) | 2016 | 2017 | 2018 | 2019 | 2020 | Thereafter | Total principal | Unamortized deferred financing cost/(discount) premium | Total | |||||||||||||||||||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pearl Highlands | 4.15 | 4.15 | 2024 | 3.16 | $ | 0.5 | $ | 1.9 | $ | 1.9 | $ | 2.0 | $ | 2.1 | $ | 82.1 | $ | 90.5 | $ | - | $ | 90.5 | ||||||||||||||||||||||||||||||

| Midstate Hayes | 6.38 | 6.38 | 2017 | 0.05 | - | 8.2 | - | - | - | - | 8.2 | - | 8.2 | |||||||||||||||||||||||||||||||||||||||

| KTC III | (a) | 5.95 | 2021 | 0.25 | 0.1 | 0.2 | 0.2 | 0.3 | 0.3 | 9.7 | 10.8 | - | 10.8 | |||||||||||||||||||||||||||||||||||||||

| GLP Asphalt Plant | (b) | 5.95 | 2021 | 0.08 | 0.3 | 1.2 | 1.3 | 1.4 | 1.5 | 0.3 | 6.0 | - | 6.0 | |||||||||||||||||||||||||||||||||||||||

| Manoa Marketplace | (c) | 3.135 | 2029 | 3.27 | - | - | - | 0.7 | 1.6 | 57.7 | 60.0 | 0.3 | 59.7 | |||||||||||||||||||||||||||||||||||||||

| Kahala Avenue Lots | (d) | 3.15 | 2016 | 0.01 | 6.3 | - | - | - | - | - | 6.3 | - | 6.3 | |||||||||||||||||||||||||||||||||||||||

| The Shops at Kukuiula | (e) | 2.83 | 2016 | 0.04 | 35.2 | - | - | - | - | - | 35.2 | - | 35.2 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 6.86 | $ | 42.4 | $ | 11.5 | $ | 3.4 | $ | 4.4 | $ | 5.5 | $ | 149.8 | $ | 217.0 | $ | 0.3 | $ | 216.7 | |||||||||||||||||||||||||||||||||

| Unsecured Debt: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prudential Series A | 5.53 | 5.53 | 2024 | 0.49 | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 28.5 | $ | 28.5 | $ | - | $ | 28.5 | ||||||||||||||||||||||||||||||

| Prudential Series B | 5.55 | 5.55 | 2026 | 0.96 | - | - | - | - | - | 46.0 | 46.0 | - | 46.0 | |||||||||||||||||||||||||||||||||||||||

| Prudential Series C | 5.56 | 5.56 | 2026 | 0.43 | - | - | 1.0 | 1.0 | 1.0 | 22.0 | 25.0 | - | 25.0 | |||||||||||||||||||||||||||||||||||||||

| Prudential Series D | 6.90 | 6.90 | 2020 | 0.46 | - | 16.3 | 16.3 | 16.2 | 16.2 | - | 65.0 | - | 65.0 | |||||||||||||||||||||||||||||||||||||||

| Prudential Series E | 3.90 | 3.90 | 2024 | 0.82 | 3.4 | 5.6 | 9.8 | 9.8 | 9.0 | 33.9 | 71.5 | - | 71.5 | |||||||||||||||||||||||||||||||||||||||

| Prudential Series F | 4.35 | 4.35 | 2026 | 0.42 | - | - | - | - | 2.4 | 19.6 | 22.0 | - | 22.0 | |||||||||||||||||||||||||||||||||||||||

| Prudential Series G | 3.88 | 3.88 | 2027 | 0.81 | - | - | 7.5 | 7.5 | 5.4 | 29.6 | 50.0 | 0.9 | 49.1 | |||||||||||||||||||||||||||||||||||||||

| Unsecured term note #1 | 3.31 | 3.31 | 2018 | 0.01 | 0.5 | 1.9 | 0.9 | - | - | - | 3.3 | - | 3.3 | |||||||||||||||||||||||||||||||||||||||

| Unsecured term note #2 | 2.00 | 2.00 | 2018 | 0.00 | 0.2 | 0.7 | 0.1 | - | - | - | 1.0 | - | 1.0 | |||||||||||||||||||||||||||||||||||||||

| Unsecured term note #3 | 2.65 | 2.65 | 2016 | - | 0.1 | - | - | - | - | - | 0.1 | - | 0.1 | |||||||||||||||||||||||||||||||||||||||

| Unsecured term note #4 | 5.19 | 5.19 | 2019 | 0.04 | 0.5 | 2.0 | 2.1 | 2.3 | - | - | 6.9 | - | 6.9 | |||||||||||||||||||||||||||||||||||||||

| Unsecured term note #5 | 1.85 | 1.85 | 2017 | 0.01 | 0.7 | 2.5 | - | - | - | - | 3.2 | - | 3.2 | |||||||||||||||||||||||||||||||||||||||

| Revolving credit line | (f) | 2.04 | 2021 | 0.74 | - | - | - | - | 68.0 | - | 68.0 | - | 68.0 | |||||||||||||||||||||||||||||||||||||||

| Subtotal | 5.19 | $ | 5.4 | $ | 29.0 | $ | 37.7 | $ | 36.8 | $ | 102.0 | $ | 179.6 | $ | 390.5 | $ | 0.9 | $ | 389.6 | |||||||||||||||||||||||||||||||||

| Total | 5.79 | $ | 47.8 | $ | 40.5 | $ | 41.1 | $ | 41.2 | $ | 107.5 | $ | 329.4 | $ | 607.5 | $ | 1.2 | $ | 606.3 | |||||||||||||||||||||||||||||||||

| (a) | Loan has a stated interest rate of LIBOR plus 1.5%, but is swapped through maturity to a 5.95% fixed rate. | Liquidity: | |||||

| (b) | Loan has a stated interest rate of LIBOR plus 1.0%, but is swapped through maturity to a 5.98% fixed rate. | Cash and cash equivalents | $ | 5.8 | |||

| (c) | Loan has a stated interest rate of LIBOR plus 1.35%, but is swapped through maturity to a 3.135% fixed rate. | Restricted cash (1031) | $ | 1.2 | |||

| (d) | Loan has an effective interest rate of 3.15% for 2016. | Available under unsecured credit facility | $ | 269.3 | |||

| (e) | Loan has an effective interest rate of 2.83% for 2016. | ||||||

| (f) | LIBOR plus 175 bps, based on pricing grid. | Ratios: | |||||

| Principal debt to total enterprise value | 24.4 | % | |||||

| Principal debt to total assets | 27.3 | % | |||||

| 9 |

Alexander & Baldwin, Inc.

Components of NAV

($ in millions)

| Commercial Real Estate - Company Information | Commercial Real Estate - Hawaii Market Information | |||||||

| Income producing assets | NOI TTM Ended September 30, 2016 | Hawaii market cap rate information Income producing assets | Range of Market Cap Rates | |||||

| Hawaii retail | $ | 44.7 | Hawaii retail | 4.0% - 6.0% | ||||

| Hawaii industrial | $ | 11.1 | Hawaii industrial | 5.0% - 7.0% | ||||

| Hawaii office | $ | 3.7 | Hawaii office | 6.0% - 8.0% | ||||

| Hawaii ground leases | $ | 12.3 | ||||||

| Mainland retail | $ | 2.3 | ||||||

| Mainland industrial | $ | 4.7 | ||||||

| Mainland office | $ | 8.2 | ||||||

| Total | $ | 87.0 | ||||||

| Materials & Construction Company Information | Materials & Construction - Market Information | |||||||||||||||||||||||

| Materials

& Construction historical EBITDA | 1Q | 2Q | 3Q | 4Q | Total | Materials and Construction peers: | Ticker | |||||||||||||||||

| 2016 | $ | 10.4 | $ | 7.8 | $ | 8.0 | $ | 26.2 | Cementos Argos S.A | CMT | ||||||||||||||

| 2015 | $ | 9.5 | $ | 9.7 | $ | 10.2 | $ | 11.7 | $ | 41.1 | CEMEX S.A.B. de C.V | CX | ||||||||||||

| 2014 | $ | 7.2 | $ | 11.4 | $ | 9.0 | $ | 10.4 | $ | 38.0 | CRH plc | CRH | ||||||||||||

| 2013 | (a) | (a) | (a) | $ | 6.8 | $ | 6.8 | HeidelbergCement AG | HDELY | |||||||||||||||

| Martin Marietta Materials, Inc | MLM | |||||||||||||||||||||||

| Monarch Cement Co | MCEM | |||||||||||||||||||||||

| Summit Materials Inc | SUM | |||||||||||||||||||||||

Development Sales - Company Information | Vulcan Materials Company | VMC | ||||||||||||||||||||||

| Book | Specialty Construction Companies: | |||||||||||||||||||||||

| Value as | Colas SA | RE.PA | ||||||||||||||||||||||

| of September | Granite Construction Inc | GVA | ||||||||||||||||||||||

| 30, 2016 | Great Lakes Dredge & Dock Corp | GLDD | ||||||||||||||||||||||

|

Active Development Projects | (b) | Orion Group Holdings, Inc | ORN | |||||||||||||||||||||

| Residential units | $ | 75.5 | Sterling Construction Co. Inc | TPCSTRL | ||||||||||||||||||||

| Lot sales | $ | 392.0 | Tutor Perini Corporation | TPC | ||||||||||||||||||||

| $ | 467.5 | |||||||||||||||||||||||

| (a) | Grace Pacific was acquired on October 1, 2013 |

| (b) | The book value of active development projects includes land stated at it's acquisition value. In the case of development projects on A&B's historical landholdings, such as Kamalani and Maui Business Park, the value of land would be approximately $150 per acre. |

| 10 |

Alexander & Baldwin, Inc.

Components of NAV (Cont.)

($ in millions, except Nominal Sales Data)

| Landholdings - Company Information | ||||||||||||||||||||

| A&B Nominal Sales January 2011-September 2016 | ||||||||||||||||||||

| Landholdings not valued elsewhere | Acres | Acres Sold | Average | High | Low | |||||||||||||||

| Urban | 253 | 70 | $ | 2,002,575 | $ | 4,600,000 | $ | 435,600 | ||||||||||||

| Urban entitlement process | 740 | |||||||||||||||||||

| Agriculture | 55,230 | 1,861 | $ | 28,700 | $ | 151,600 | $ | 13,750 | ||||||||||||

| Conservation (c) | 29,835 | |||||||||||||||||||

| Total | 86,058 | |||||||||||||||||||

| Other Company Information | ||||||||||||||||||||

| Total debt at September 30, 2016 | $ | 606.3 | ||||||||||||||||||

| Shares outstanding at September 30, 2016 (in millions) | 49.0 | |||||||||||||||||||

| (c) | Conservation land is generally utilized in the collection of water, which benefits the agricultural land, and therefore, generally these lands should not be separately valued. |

| 11 |

Alexander & Baldwin, Inc.

Property Report - Hawaii

| Property | City/Island | Year built / renovated | Number of buildings | Gross

leasable area at 09/30/16 (sq. ft.) | Leased % | ABR per leased sq. ft. | 3Q2016 NOI ($ in 000s) | 3Q2016 % NOI to HI portfolio NOI | Total

Principal Debt ($ in 000s) | |||||||||||||||||||||||||

| (a) | (b) | |||||||||||||||||||||||||||||||||

| Retail | ||||||||||||||||||||||||||||||||||

| Pearl Highlands Center | Oahu | 1992-1994 | 1 | 415,200 | 97 | $ | 23.88 | $ | 2,429 | 13.1 | $ | 90,496 | ||||||||||||||||||||||

| Kailua Retail | Oahu | 1947-2014 | 15 | 316,400 | 96 | $ | 29.19 | 2,416 | 13.1 | 10,842 | ||||||||||||||||||||||||

| Waianae Mall | Oahu | 1975 | 1 | 170,300 | 86 | $ | 18.83 | 525 | 2.8 | - | ||||||||||||||||||||||||

| Manoa Marketplace | Oahu | 1977 | 1 | 139,300 | 97 | $ | 34.34 | 1,174 | 6.4 | 60,000 | ||||||||||||||||||||||||

| Kaneohe Bay Shopping Center | (c) | Oahu | 1971/2008 | 1 | 124,800 | 100 | $ | 22.83 | 591 | 3.2 | - | |||||||||||||||||||||||

| Waipio Shopping Center | Oahu | 1986-2004 | 1 | 113,800 | 99 | $ | 26.63 | 838 | 4.5 | - | ||||||||||||||||||||||||

| Aikahi Park Shopping Center | Oahu | 1971 | 1 | 98,000 | 82 | $ | 16.72 | 707 | 3.8 | - | ||||||||||||||||||||||||

| The Shops at Kukui'ula | Kauai | 2009 | 1 | 89,000 | 94 | $ | 45.90 | 990 | 5.4 | 35,168 | ||||||||||||||||||||||||

| Lanihau Marketplace | Hawaii | 1987 | 1 | 88,300 | 99 | $ | 20.74 | 498 | 2.7 | - | ||||||||||||||||||||||||

| Kunia Shopping Center | Oahu | 2004 | 1 | 60,600 | 81 | $ | 37.63 | 459 | 2.5 | - | ||||||||||||||||||||||||

| Lahaina Square | Maui | 1973 | 1 | 50,200 | 77 | $ | 17.38 | 108 | 0.6 | - | ||||||||||||||||||||||||

| Kahului Shopping Center | Maui | 1951 | 1 | 49,900 | 86 | $ | 19.56 | 135 | 0.7 | - | ||||||||||||||||||||||||

| Napili Plaza | Maui | 1991 | 1 | 45,700 | 89 | $ | 26.95 | 271 | 1.5 | - | ||||||||||||||||||||||||

| Gateway at Mililani Mauka | Oahu | 2008, 2011, 2013 | 4 | 34,900 | 91 | $ | 50.90 | 417 | 2.3 | - | ||||||||||||||||||||||||

| Port Allen Marina Center | Kauai | 2002 | 1 | 23,600 | 92 | $ | 22.01 | 93 | 0.5 | - | ||||||||||||||||||||||||

| Subtotal – Retail | 32 | 1,820,000 | 94 | $ | 26.60 | $ | 11,651 | 63.1 | $ | 196,506 | ||||||||||||||||||||||||

| Industrial | ||||||||||||||||||||||||||||||||||

| Komohana Industrial Park | (d) | Oahu | 1990 | 1 | 238,300 | 100 | $ | 11.37 | $ | 1,102 | 5.9 | $ | - | |||||||||||||||||||||

| Kakaako Commerce Center | Oahu | 1971 | 1 | 206,000 | 79 | $ | 12.66 | 458 | 2.5 | - | ||||||||||||||||||||||||

| Waipio Industrial | Oahu | 1988-1989 | 5 | 158,400 | 100 | $ | 14.55 | 581 | 3.1 | - | ||||||||||||||||||||||||

| P&L Building | Maui | 1970 | 1 | 104,100 | 100 | $ | 12.60 | 330 | 1.8 | - | ||||||||||||||||||||||||

| Kailua Industrial/Other | Oahu | 1951-1974 | 6 | 68,800 | 96 | $ | 13.21 | 180 | 1.0 | - | ||||||||||||||||||||||||

| Port Allen | Kauai | 1983 -1993 | 3 | 63,800 | 100 | $ | 11.38 | 162 | 0.9 | - | ||||||||||||||||||||||||

| Subtotal – Industrial | 17 | 839,400 | 95 | $ | 12.59 | $ | 2,813 | 15.2 | $ | - | ||||||||||||||||||||||||

| Office | ||||||||||||||||||||||||||||||||||

| Kahului Office Building | Maui | 1974/1996 | 1 | 59,600 | 86 | $ | 27.61 | $ | 326 | 1.8 | $ | - | ||||||||||||||||||||||

| Gateway at Mililani Mauka South | (e) | Oahu | 1992, 2006, 2008, 2016 | 3 | 37,100 | 93 | $ | 43.24 | 323 | 1.8 | - | |||||||||||||||||||||||

| Kahului Office Center | Maui | 1991 | 1 | 33,400 | 88 | $ | 25.99 | 192 | 1.0 | - | ||||||||||||||||||||||||

| Stangenwald Building | Oahu | 1901/1980 | 1 | 27,100 | 92 | $ | 18.40 | 104 | 0.6 | - | ||||||||||||||||||||||||

| Judd Building | Oahu | 1898/1979 | 1 | 20,200 | 86 | $ | 17.98 | 46 | 0.2 | - | ||||||||||||||||||||||||

| Maui Clinic Building | (f) | Maui | 1958/2010 | 1 | 16,600 | 28 | $ | 25.82 | (14 | ) | (0.1 | ) | - | |||||||||||||||||||||

| Lono Center | Maui | 1973 | 1 | 13,700 | 80 | $ | 26.95 | 33 | 0.2 | - | ||||||||||||||||||||||||

| Subtotal – Office | 9 | 207,700 | 83 | $ | 27.92 | $ | 1,010 | 5.5 | $ | - | ||||||||||||||||||||||||

| Ground Leases | ||||||||||||||||||||||||||||||||||

| Kailua | Oahu | 19 acres | - | - | - | - | $ | 862 | 4.7 | $ | - | |||||||||||||||||||||||

| Other Oahu | Oahu | 22 acres | - | - | - | - | 1,214 | 6.5 | - | |||||||||||||||||||||||||

| Neighbor Islands | (g) | Neighbor Islands | 3143 acres | - | - | - | - | 924 | 5.0 | - | ||||||||||||||||||||||||

| Subtotal - Ground Leases | 3184 acres | - | - | - | - | 3,000 | 16.2 | $ | - | |||||||||||||||||||||||||

| Total Hawaii | 58 | 2,867,100 | 93 | $ | 22.49 | $ | 18,474 | 100.0 | $ | 196,506 | ||||||||||||||||||||||||

| (a) | Represents the average percentage of space leased during the period referenced or A&B's ownership period, whichever is shorter. |

| (b) | See page appendix for a statement about management's use of non-GAAP financial measures and required reconciliations. |

| (c) | A&B owns the leasehold improvements of this center and does not own the fee interest. |

| (d) | Includes ground lease income. |

| (e) | A 18,415-square-foot expansion was completed and added to the commercial portfolio in June 2016. |

| (f) | Negative NOI and low occupancy relates to property repositioning. |

| (g) | Includes 64 ground leased urban acres. |

| 12 |

Alexander & Baldwin, Inc.

Property Report – U.S. Mainland

| Property | City/State | Year built / renovated | Number of buildings | Gross leasable area at 09/30/16 (sq. ft.) | Leased % | Annualized Base Rent (ABR) ($ in 000s) | ABR per leased sq. ft. | 3Q2016 NOI ($ in 000s) | 3Q2016 % NOI to ML portfolio NOI | Total Principal debt ($ in 000s) | ||||||||||||||||||||||||

| (a) | (b) | |||||||||||||||||||||||||||||||||

| Retail: | ||||||||||||||||||||||||||||||||||

| Little Cottonwood Center | Sandy, UT | 1998-2008 | 1 | 141,500 | 94 | $ | 1,445 | $ | 10.76 | $ | 330 | 12.9 | $ | - | ||||||||||||||||||||

| Royal MacArthur Center | Dallas, TX | 2006 | 1 | 44,900 | 90 | 909 | $ | 22.49 | 216 | 8.4 | - | |||||||||||||||||||||||

| Subtotal – Retail | 2 | 186,400 | 93 | $ | 2,354 | $ | 13.47 | $ | 546 | 21.3 | $ | - | ||||||||||||||||||||||

| Industrial: | ||||||||||||||||||||||||||||||||||

| Midstate Hayes | Visalia, CA | 2002-2008 | 4 | 790,200 | 89 | $ | 2,728 | $ | 4.11 | $ | 648 | 25.3 | $ | 8,221 | ||||||||||||||||||||

| Sparks Business Center | Sparks, NV | 1996-1998 | 1 | 396,100 | 95 | 1,845 | $ | 4.96 | 449 | 17.5 | - | |||||||||||||||||||||||

| Subtotal – Industrial | 5 | 1,186,300 | 91 | $ | 4,573 | $ | 4.41 | $ | 1,097 | 42.8 | $ | 8,221 | ||||||||||||||||||||||

| Office: | ||||||||||||||||||||||||||||||||||

| 1800 and 1820 Preston Park | Plano, TX | 1997-1998/2010 | 2 | 198,800 | 87 | $ | 3,206 | $ | 18.53 | $ | 480 | 18.7 | $ | - | ||||||||||||||||||||

| Concorde Commerce Center | Phoenix, AZ | 1998 | 1 | 138,700 | 91 | 2,573 | $ | 20.37 | 330 | 12.8 | - | |||||||||||||||||||||||

| Deer Valley Financial Center | Phoenix, AZ | 2001 | 1 | 126,600 | 82 | 1,603 | $ | 15.70 | 112 | 4.4 | - | |||||||||||||||||||||||

| Subtotal – Office | 4 | 464,100 | 87 | $ | 7,382 | $ | 18.39 | $ | 922 | 35.9 | $ | - | ||||||||||||||||||||||

| Total Mainland | 11 | 1,836,800 | 90 | $ | 14,309 | $ | 8.87 | $ | 2,565 | 100.0 | $ | 8,221 | ||||||||||||||||||||||

| (a) | Represents the average percentage of space leased during the period reference or A&B's ownership period, whichever is shorter. |

| (b) | See page appendix for a statement about management's use of non-GAAP financial measures and required reconciliations. |

| 13 |

Alexander & Baldwin, Inc.

Net Operating Income (NOI)

($ in millions, unaudited)

| 3Q16 | 3Q15 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | (a) | $ | 11.7 | $ | 2.8 | $ | 1.0 | $ | 3.0 | $ | 18.5 | $ | 9.9 | $ | 2.7 | $ | 0.9 | $ | 2.9 | $ | 16.4 | 18.2 | 3.7 | 11.1 | 3.4 | 12.8 | ||||||||||||||||||||||||||||||||||||

| Mainland | 0.5 | 1.1 | 1.0 | - | 2.6 | 0.6 | 1.1 | 2.3 | - | 4.0 | (16.7 | ) | - | (56.5 | ) | - | (35.0 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 12.2 | $ | 3.9 | $ | 2.0 | $ | 3.0 | $ | 21.1 | $ | 10.5 | $ | 3.8 | $ | 3.2 | $ | 2.9 | $ | 20.4 | 16.2 | 2.6 | (37.5 | ) | 3.4 | 3.4 | ||||||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2016 | Nine months ended September 30, 2015 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | (a) | $ | 35.2 | $ | 8.4 | $ | 2.8 | $ | 8.9 | $ | 55.3 | $ | 29.2 | $ | 8.1 | $ | 2.8 | $ | 9.6 | $ | 49.7 | 20.5 | 3.7 | - | (7.3 | ) | 11.3 | |||||||||||||||||||||||||||||||||||

| Mainland | 1.7 | 3.5 | 5.3 | - | 10.5 | 1.9 | 3.5 | 7.6 | - | 13.0 | (10.5 | ) | - | (30.3 | ) | - | (19.2 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 36.9 | $ | 11.9 | $ | 8.1 | $ | 8.9 | $ | 65.8 | $ | 31.1 | $ | 11.6 | $ | 10.4 | $ | 9.6 | $ | 62.7 | 18.6 | 2.6 | (22.1 | ) | (7.3 | ) | 4.9 | |||||||||||||||||||||||||||||||||||

Same Store NOI

($ in millions, unaudited)

| 3Q16 | 3Q15 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | (b) | $ | 10.5 | $ | 2.8 | $ | 0.7 | $ | 3.0 | $ | 17.0 | $ | 9.9 | $ | 2.7 | $ | 0.7 | $ | 2.8 | $ | 16.1 | 6.1 | 3.7 | - | 7.1 | 5.6 | ||||||||||||||||||||||||||||||||||||

| Mainland | 0.5 | 1.1 | 0.9 | - | 2.5 | 0.6 | 1.1 | 1.0 | - | 2.7 | (16.7 | ) | - | (10.0 | ) | - | (7.4 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 11.0 | $ | 3.9 | $ | 1.6 | $ | 3.0 | $ | 19.5 | $ | 10.5 | $ | 3.8 | $ | 1.7 | $ | 2.8 | $ | 18.8 | 4.8 | 2.6 | (5.9 | ) | 7.1 | 3.7 | ||||||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2016 | Nine months ended September 30, 2015 | % Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | Retail | Industrial | Office | Ground | Total | |||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | (c) | $ | 28.6 | $ | 8.4 | $ | 2.1 | $ | 9.8 | $ | 48.9 | $ | 27.1 | $ | 8.1 | $ | 2.3 | $ | 10.0 | $ | 47.5 | 5.5 | 3.7 | (8.7 | ) | (2.0 | ) | 2.9 | ||||||||||||||||||||||||||||||||||

| Mainland | 1.7 | 3.5 | 2.8 | - | 8.0 | 1.9 | 3.4 | 3.0 | - | 8.3 | (10.5 | ) | 2.9 | (6.7 | ) | - | (3.6 | ) | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 30.3 | $ | 11.9 | $ | 4.9 | $ | 9.8 | $ | 56.9 | $ | 29.0 | $ | 11.5 | $ | 5.3 | $ | 10.0 | $ | 55.8 | 4.5 | 3.5 | (7.5 | ) | (2.0 | ) | 2.0 | |||||||||||||||||||||||||||||||||||

| (a) | For purposes of calculating third quarter 2016 NOI and the nine months ended September 30, 2016 NOI from Aikahi Park Shopping Center (APSC), tenant improvements and ground lease NOI were included in Hawaii retail. Ground lease NOI for APSC in the third quarter of 2015 and nine months ended September 30, 2015 was included in Hawaii ground leases to April 2015 and in Hawaii retail as of May 2015. |

| (b) | Ground lease NOI from APSC was included in the calculation of the third quarter 2016 and 2015 same-store NOI in Hawaii retail. |

| (c) | Ground lease NOI from APSC was included in the calculation of the nine months ended September 30, 2016 and 2015 same-store NOI in Hawaii ground leases. |

Note: See page appendix for a statement about management's use of non-GAAP financial measures and required reconciliations.

| 14 |

Alexander & Baldwin, Inc.

Percent Occupancy

| Three months ended September 30, 2016 | Three months ended September 30, 2015 | % point change | ||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | ||||||||||||||||||||||||||||||||||||

| Hawaii | 94 | 95 | 83 | 93 | 94 | 95 | 84 | 93 | - | - | (1 | ) | - | |||||||||||||||||||||||||||||||||||

| Mainland | 93 | 91 | 87 | 90 | 92 | 99 | 93 | 96 | 1 | (8 | ) | (6 | ) | (6 | ) | |||||||||||||||||||||||||||||||||

| Total | 94 | 93 | 86 | 92 | 94 | 97 | 91 | 95 | - | (4 | ) | (5 | ) | (3 | ) | |||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2016 | Three months ended September 30, 2015 | % point change | ||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | ||||||||||||||||||||||||||||||||||||

| Hawaii | 94 | 95 | 82 | 93 | 94 | 95 | 83 | 93 | - | - | (1 | ) | - | |||||||||||||||||||||||||||||||||||

| Mainland | 93 | 96 | 89 | 94 | 93 | 99 | 91 | 95 | - | (3 | ) | (2 | ) | (1 | ) | |||||||||||||||||||||||||||||||||

| Total | 94 | 96 | 88 | 93 | 94 | 97 | 90 | 94 | - | (1 | ) | (2 | ) | (1 | ) | |||||||||||||||||||||||||||||||||

Same Store Percent Occupancy

| Three months ended September 30, 2016 | Three months ended September 30, 2015 | % point change | ||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | ||||||||||||||||||||||||||||||||||||

| Hawaii | 93 | 95 | 81 | 93 | 94 | 95 | 82 | 93 | (1 | ) | - | (1 | ) | - | ||||||||||||||||||||||||||||||||||

| Mainland | 93 | 91 | 87 | 90 | 92 | 99 | 87 | 95 | 1 | (8 | ) | - | (5 | ) | ||||||||||||||||||||||||||||||||||

| Total | 93 | 93 | 85 | 92 | 94 | 97 | 85 | 94 | (1 | ) | (4 | ) | - | (2 | ) | |||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2016 | Nine months ended September 30, 2015 | % point change | ||||||||||||||||||||||||||||||||||||||||||||||

| Location | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | Retail | Industrial | Office | Total | ||||||||||||||||||||||||||||||||||||

| Hawaii | 94 | 95 | 80 | 93 | 94 | 95 | 81 | 94 | - | - | (1 | ) | (1 | ) | ||||||||||||||||||||||||||||||||||

| Mainland | 93 | 96 | 86 | 93 | 93 | 99 | 87 | 95 | - | (3 | ) | (1 | ) | (2 | ) | |||||||||||||||||||||||||||||||||

| Total | 94 | 96 | 84 | 93 | 94 | 97 | 85 | 94 | - | (1 | ) | (1 | ) | (1 | ) | |||||||||||||||||||||||||||||||||

| 15 |

Alexander & Baldwin, Inc.

Commercial Real Estate Transactional Activity (2015-2016)

($ in millions)

| Property disposed in 2016 | Disposition date (month/year) | Disposition price (in millions) | Gross leasable area (sq. ft.) | Leased % at disposition | ||||||||||

| Ninigret Office Park | 6/16 | $ | 30 | 185,500 | 100 | |||||||||

| Gateway Oaks | 6/16 | $ | 8 | 59,700 | 92 | |||||||||

| Prospect Park | 6/16 | $ | 22 | 163,300 | 100 | |||||||||

| Total | $ | 60 | 408,500 | |||||||||||

| Property acquired in 2016 | Acquisition date (month/year) | Acquisition price (in millions) | Gross leasable area (sq. ft.) | Leased % at acquisition | ||||||||||

| Manoa Marketplace | 1/16 | $ | 82 | 139,300 | 99 | |||||||||

| Property disposed in 2015 | Disposition date (month/year) | Disposition price (in millions) | Gross leasable area (sq. ft.) | Leased % at disposition | ||||||||||

| Union Bank | 12/15 | $ | 10 | 84,000 | 53 | |||||||||

| San Pedro Plaza | 5/15 | $ | 17 | 171,900 | 69 | |||||||||

| Wilshire Shopping Center | 3/15 | $ | 4 | 46,500 | 72 | |||||||||

| Total | $ | 31 | 302,400 | |||||||||||

| Property acquired in 2015 | Acquisition date (month/year) | Acquisition price (in millions) | Gross leasable area (sq. ft.) | Leased % at acquisition | ||||||||||

| Aikahi Park Shopping Center - Improved Property | 5/15 | $ | 2 | 98,000 | 86 | |||||||||

| 16 |

Alexander & Baldwin, Inc.

Top Ten Tenants (In-Service Properties) Based Upon ABR

As of September 30, 2016

| Tenant | Number of leases | Weighted average remaining terms (months) | Annualized Base Rent (ABR) | % of ABR | GLA (sq. ft.) | Percentage of total GLA | ||||||||||||||

| Sam's Club | 1 | 52 | $ | 3,307,920 | 4.5 | 180,908 | 3.8 | |||||||||||||

| CVS Corporation | 6 | 101 | 2,623,459 | 3.5 | 150,411 | 3.2 | ||||||||||||||

| United Healthcare Services, Inc. | 1 | 39 | 2,216,050 | 3.0 | 108,100 | 2.3 | ||||||||||||||

| Foodland Supermarket, Ltd. / Food Pantry Ltd. | 7 | 73 | 1,741,170 | 2.3 | 111,259 | 2.4 | ||||||||||||||

| 24 Hour Fitness USA, Inc. | 1 | 99 | 1,375,000 | 1.9 | 45,870 | 1.0 | ||||||||||||||

| Albertsons Companies, Inc. | 4 | 85 | 1,316,122 | 1.8 | 168,621 | 3.6 | ||||||||||||||

| Whole Foods Market, Inc. | 1 | 184 | 1,120,304 | 1.5 | 31,647 | 0.7 | ||||||||||||||

| Office Depot, Inc. | 1 | 7 | 1,016,719 | 1.4 | 75,824 | 1.6 | ||||||||||||||

| Keystone Automotive Operations, Inc. | 1 | 15 | 1,015,980 | 1.4 | 230,300 | 4.9 | ||||||||||||||

| International Paper | 1 | 22 | 977,709 | 1.3 | 252,040 | 5.4 | ||||||||||||||

| Total | 24 | $ | 16,710,433 | 22.6 | 1,354,980 | 28.9 | ||||||||||||||

| 17 |

Alexander & Baldwin, Inc.

Lease Expiration Schedule

As of September 30, 2016

| Total Portfolio | Ground Lease Expirations | |||||||||||||||||||||||||||||

| Expiration year | Number of leases | Sq. ft. of expiring leases | % of total leased GLA | ABR expiring ($ in millions) | % of total ABR | Expiration year | ABR expiring ($ in millions) | % of portfolio ABR | ||||||||||||||||||||||

| Month-to-month | $ | 0.8 | 6.2 | |||||||||||||||||||||||||||

| 2016 | 54 | 112,990 | 2.7 | $ | 2.8 | 3.7 | 2016 | 0.6 | 4.6 | |||||||||||||||||||||

| 2017 | 184 | 1,093,354 | 26.4 | 15.3 | 20.1 | 2017 | 0.6 | 4.6 | ||||||||||||||||||||||

| 2018 | 139 | 785,042 | 19.0 | 9.1 | 12.0 | 2018 | 0.3 | 2.3 | ||||||||||||||||||||||

| 2019 | 122 | 528,927 | 12.8 | 12.0 | 15.8 | 2019 | 0.3 | 2.3 | ||||||||||||||||||||||

| 2020 | 93 | 386,479 | 9.4 | 8.8 | 11.6 | 2020 | 1.0 | 7.7 | ||||||||||||||||||||||

| 2021 | 76 | 440,241 | 10.7 | 9.4 | 12.4 | 2021 | 0.9 | 6.9 | ||||||||||||||||||||||

| 2022 | 22 | 113,554 | 2.8 | 2.9 | 3.8 | 2022 | 0.3 | 2.3 | ||||||||||||||||||||||

| 2023 | 26 | 163,378 | 4.0 | 2.6 | 3.4 | 2023 | - | - | ||||||||||||||||||||||

| 2024 | 14 | 175,748 | 4.3 | 4.5 | 5.9 | 2024 | - | - | ||||||||||||||||||||||

| 2025 | 21 | 58,481 | 1.4 | 2.5 | 3.3 | 2025 | 0.1 | 0.8 | ||||||||||||||||||||||

| Thereafter | 28 | 268,965 | 6.5 | 6.1 | 8.0 | Thereafter | 8.1 | 62.3 | ||||||||||||||||||||||

| Total | 779 | 4,127,159 | 100.0 | $ | 76.0 | 100.0 | $ | 13.0 | 100.0 | |||||||||||||||||||||

Note: Lease expirations do not include month to month leases.

| 18 |

Alexander & Baldwin, Inc.

Commercial Portfolio Repositioning, Redevelopment & Development Summary

As of September 30, 2016

| Incremental | Stabilized | |||||||||||||||||||||||||||||||

| Capital | Stabilized NOI | Yield on | Leasing Activity | |||||||||||||||||||||||||||||

| Project | Phase | In-service | ($ in Millions) | ($ in Millions) | Cost | Sq. Ft. | % Leased | % LOI | Total | |||||||||||||||||||||||

| Gateway at Mililani South Expansion | Completed | Jun-16 | $ | 6.0 | $ | 0.8 | 13 | % | 18,415 | 85 | 15 | 100 | ||||||||||||||||||||

| Pearl Highlands Center – Food Court Repositioning | Pre-construction | Late 2017 | $ | 3.0 | $ | 0.3 | 10-12 | % | 6,300 | -- | 60 | 60 | ||||||||||||||||||||

| Lau Hala Shops Repositioning | Construction | 2018 | $ | 21.0 | $1.9-$2.4 | 9-11 | % | 48,400 | -- | 87 | 87 | |||||||||||||||||||||

| Total | $ | 30.0 | $3.0-$3.5 | 10-12 | % | 73,115 | ||||||||||||||||||||||||||

| 19 |

Alexander & Baldwin, Inc.

Active Development Projects

As of September 30, 2016

| (Dollars in millions) | Construction timing | Sales Closings Timing | ||||||||||||||||||||||||||||||||||||||||||

| Project | Location | Product type | Est.

economic interest | Planned units, saleable acres or gross leasable square feet | Average

unit (sf) or lot size (acres) | Units/

acres closed through 9/30/16 | Targeted

sales price range per square foot or NOI | Est. project cost | A&B

Projected Capital Commitment (JVs Only) | A&B

Capital Invested | A&B

net investment as of 9/30/16 | Start/Est. start | Est.

substantial completion | Start/Est. start | Est. end | |||||||||||||||||||||||||||||

| (a) | (b) | (c) | (e) | |||||||||||||||||||||||||||||||||||||||||

| Residential units | ||||||||||||||||||||||||||||||||||||||||||||

| Kamalani (Increment 1) | Kihei, Maui | Primary residential | 100% | 170 units | 994 | - | $400 | $ | 64 | N/A | $ | 13 | $ | 13 | 2016 | 2019 | 2017 | 2019 | ||||||||||||||||||||||||||

| Ka Milo at Mauna Lani | Kona, Hawaii | Resort residential | 50% | 137 units | 2,165 sf | 85 units | $530-$800 | 125 | 16 | 16 | 5 | 2005 | 2018 | 2007 | 2018 | |||||||||||||||||||||||||||||

| Keala 'O Wailea (MF-11) | Wailea, Maui | Resort residential | 65%+/-5% | 70 units | 1,385 sf | - | $600-$1,000 | 64 | 9 | 9 | 9 | 2015 | 2018 | 2017 | 2018 | |||||||||||||||||||||||||||||

| The Collection | Honolulu, Oahu | Primary residential/commercial | 90% +/-5% | 465 units (464 saleable) | 904 sf | - | $795 | 279 | 54 | 54 | 49 | 2014 | 2016 | 2016 | 2017 | |||||||||||||||||||||||||||||

| Total | $ | 532 | $ | 79 | $ | 92 | $ | 76 | ||||||||||||||||||||||||||||||||||||

| Lot sales | ||||||||||||||||||||||||||||||||||||||||||||

| Kahala Avenue Portfolio | Honolulu, Oahu | Residential | 100% | 30 lots | 0.5 acres | 22 lots | $150-$385 | $ | 135 | N/A | $ | 134 | $ | 49 | N/A | N/A | 2013 | 2018 | ||||||||||||||||||||||||||

| Maui Business Park II | Kahului, Maui | Light industrial lots | 100% | 136 acres | 0.5 - 11 acres | 30 acres | $38-$60 | 96 | N/A | 78 | 46 | 2011 | 2021 | 2012 | 2028 | |||||||||||||||||||||||||||||

| The Ridge at Wailea (MF-19) | Wailea, Maui | Resort residential | 100% | 9 lots (4.5 acres) | 0.5 acres | 1 lot | $60-$100 | 10 | N/A | 9 | 9 | 2007 | 2009 | 2014 | 2020 | |||||||||||||||||||||||||||||

| Kukui'ula | Poipu, Kauai | Resort residential | 85% +/- 5% | Up to 1,500 units (640 saleable acres) | 0.42 acres | 134 lots | $40-$110 | 854 | 300 | 298 | 288 | 2006 | 2030 | (d) | 2006 | 2030 | ||||||||||||||||||||||||||||

| Total | $ | 1,095 | $ | 300 | $ | 519 | $ | 392 | ||||||||||||||||||||||||||||||||||||

| (a) | Economic interest represents the Company's estimated share of distributions after return of capital contributions based on current forecasts of sales activity. Actual results coud differ materially from projected results due to the timing of expected sales, increases or decreases in estimated sales prices or costs and other factors. As a result, esimate economic interests are subject to change. |

| (b) | Includes land cost at book value and capitalized interest, but excludes sales commissions and closing costs. |

| (c) | Includes land cost at contribution value and total expected A&B capital to be contributed. The estimate includes due diligence costs and capitalized interest, but excludes capital projected to be contribued by equity partners, third-party debt, and amounts expected to be funded from project cash flows and/or buyer deposits. |

| (d) | Estimated substantial construction completion for Kukui'ula represents the estimated completion date for major project infrastructure and amenities. Constuction activities related to parcel development is expected to continue past 2030. |

| (e) | The book value of active development projects includes land stated at it's acquisition value. In the case of development projects on A&B's historical landholdings, like Kamalani and Maui Business Park, the value of land would be approximately $150 per acre. |

| 20 |

Alexander & Baldwin, Inc.

Landholdings as of September 30, 2016

| Maui | Kauai | Oahu | Molokai | Big Island | Hawaii

Total Acres | Mainland Total Acres | Total Acres | |||||||||||||||||||||||||

| Land under commercial properties/ urban ground leases | 97 | 19 | 184 | - | 10 | 310 | 125 | 435 | ||||||||||||||||||||||||

| Land in active development | 237 | - | 5 | - | - | 242 | - | 242 | ||||||||||||||||||||||||

| Land used in other operations | 22 | 20 | - | - | - | 42 | - | 42 | ||||||||||||||||||||||||

| Land management | ||||||||||||||||||||||||||||||||

| Urban | 211 | 42 | - | - | - | 253 | - | 253 | ||||||||||||||||||||||||

| Agriculture | 48,541 | 6,614 | 75 | - | - | 55,230 | - | 55,230 | ||||||||||||||||||||||||

| Urban entitlement process | 480 | 260 | - | - | - | 740 | - | 740 | ||||||||||||||||||||||||

| Conservation & preservation | 15,870 | 13,325 | 640 | - | - | 29,835 | - | 29,835 | ||||||||||||||||||||||||

| Materials & Construction landholdings | - | - | 540 | 265 | - | 805 | - | 805 | ||||||||||||||||||||||||

| Total landholdings | 65,458 | 20,280 | 1,444 | 265 | 10 | 87,457 | 125 | 87,582 | ||||||||||||||||||||||||

A&B Land Sales Data - Maui & Kauai 2011-2016

| Total

Acres Sold | Weighted Average Price Per Acre | High | Low | |||||||||||||||||

| Ag-zoned | ||||||||||||||||||||

| 0-5 acres | 10 | $ | 116,400 | $ | 151,600 | $ | 84,400 | |||||||||||||

| 5-20 acres | 66 | $ | 71,700 | $ | 104,200 | $ | 35,600 | |||||||||||||

| 20-100 acres | 554 | $ | 30,500 | $ | 55,700 | $ | 13,750 | |||||||||||||

| 100+acres | 1,231 | $ | 24,800 | $ | 35,450 | $ | 14,600 | |||||||||||||

| Total/Weighted Average | 1,861 | $ | 28,700 | $ | 151,600 | $ | 13,750 | |||||||||||||

| Urban-zoned | ||||||||||||||||||||

| 0-3 acres | 8 | $ | 2,360,450 | $ | 4,600,000 | $ | 435,600 | |||||||||||||

| 3-25 acres | 62 | $ | 1,644,700 | $ | 2,814,000 | $ | 718,700 | |||||||||||||

| Total/Weighted Average | 70 | $ | 1,726,500 | $ | 4,600,000 | $ | 435,600 | |||||||||||||

| 21 |

Alexander & Baldwin, Inc.

Materials & Construction Select Data

($ in millions, except crew days)

| Historical EBITDA | 1Q | 2Q | 3Q | 4Q | Full Year | |||||||||||||||

| 2016 | 10.4 | 7.8 | 8.0 | 26.2 | ||||||||||||||||

| 2015 | 9.5 | 9.7 | 10.2 | 11.7 | 41.1 | |||||||||||||||

| 2014 | 7.2 | 11.4 | 9.0 | 10.4 | 38.0 | |||||||||||||||

| 2013 | (a) | (a) | (a) | 6.8 | 6.8 | |||||||||||||||

| Aggregate used/sold (tons in thousands) | 1Q | 2Q | 3Q | 4Q | Full Year | |||||||||||||||

| 2016 | 183.2 | 159.5 | 158.1 | 500.8 | ||||||||||||||||

| 2015 | 235.0 | 234.4 | 180.5 | 190.3 | 840.2 | |||||||||||||||

| 2014 | 145.4 | 167.5 | 166.0 | 232.5 | 711.4 | |||||||||||||||

| 2013 | (a) | (a) | (a) | 112.3 | 112.3 | |||||||||||||||

| Asphalt placed (tons in thousands) | 1Q | 2Q | 3Q | 4Q | Full Year | |||||||||||||||

| 2016 | 117.9 | 86.9 | 126.9 | 331.7 | ||||||||||||||||

| 2015 | 116.4 | 115.5 | 106.9 | 127.9 | 466.7 | |||||||||||||||

| 2014 | 108.9 | 149.4 | 98.7 | 113.5 | 470.5 | |||||||||||||||

| 2013 | (a) | (a) | (a) | 114.5 | 114.5 | |||||||||||||||

| Backlog | 31-Mar | 30-Jun | 30-Sep | 31-Dec | |||||||||||||

| 2016 | 225.7 | 264.1 | 242.5 | ||||||||||||||

| 2015 | 205.0 | 249.7 | 242.0 | 225.7 | |||||||||||||

| 2014 | 255.6 | 247.5 | 233.9 | 217.6 | |||||||||||||

| 2013 | (a) | (a) | (a) | 217.1 | |||||||||||||

| Oahu crew days lost to weather | 1Q | 2Q | 3Q | 4Q | Full Year | |||||||||||||||

| 2016 | 28.0 | 52.5 | 78.5 | 159.0 | ||||||||||||||||

| 2015 | 25.0 | 14.0 | 79.0 | 57.5 | 175.5 | |||||||||||||||

| 2014 | 28.0 | 37.0 | 19.5 | 36.0 | 120.5 | |||||||||||||||

| 2013 | (a) | (a) | (a) | 15.0 | 15.0 | |||||||||||||||

| Oahu total available crew days | 1Q | 2Q | 3Q | 4Q | Full Year | |||||||||||||||

| 2016 | 377.0 | 378.0 | 444.0 | 1199.0 | ||||||||||||||||

| 2015 | 354.0 | 364.0 | 384.0 | 387.0 | 1489.0 | |||||||||||||||

| 2014 | 330.0 | 378.0 | 322.0 | 327.0 | 1357.0 | |||||||||||||||

| 2013 | (a) | (a) | (a) | 315.0 | 315.0 | |||||||||||||||

| (a) | Grace was acquired on October 1, 2013. |

See appendix for a statement about management's use on non-GAAP financial measures and a reconciliation of Materials & Construction operating profit to segment EBITDA.

| 22 |

Appendix

| 23 |

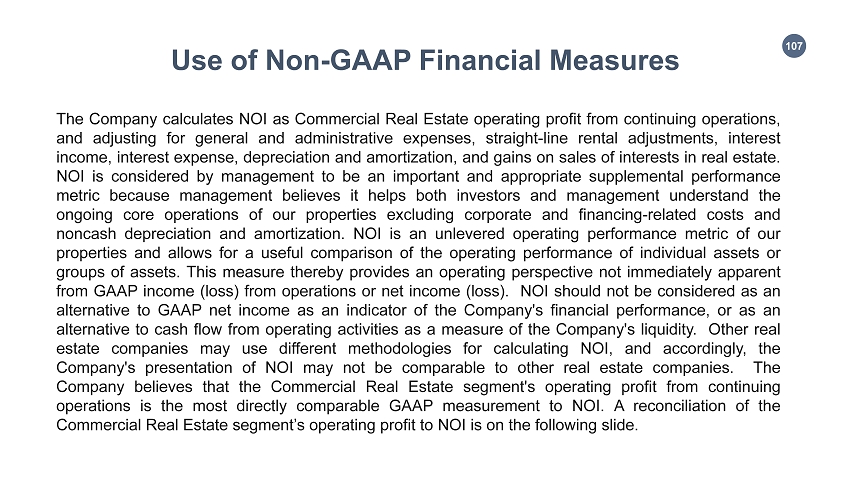

Alexander & Baldwin, Inc.

Management’s Use of Non-GAAP Financial Measures

The Company presents the following Non-GAAP financial measures in this Real Estate Supplement:

| · | Consolidated Company FFO (Funds Flow from Operations) |

| · | Consolidated Company EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) |

| · | Materials & Construction segment EBITDA |

| · | Commercial Real Estate Segment NOI and same-store NOI |

The calculations of these financial measures are described in the Glossary of Terms on page 4-5 of this Supplement.

The Company uses these Non-GAAP measures when evaluating operating performance because management believes that they provide additional insight into the Company’s and segment’s core operating results, future cash flow generation and/or the underlying business trends affecting performance on a consistent and comparable basis from period to period. These measures generally are provided to investors as an additional means of evaluating the performance of ongoing core operations. The Non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Required reconciliations of these Non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP are set forth in the following pages of this appendix.

| 24 |

Alexander & Baldwin, Inc.

Reconciliation of Net Income (Loss) Available to A&B Shareholders to Funds from Operations

($ in millions)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Net Income (Loss) Available to A&B Shareholders | $ | (1.5 | ) | $ | 5.4 | $ | (9.2 | ) | $ | 40.5 | ||||||

| (Gain)/Loss on sale of real estate | - | - | (8.1 | ) | (1.9 | ) | ||||||||||

| Add: Depreciation and amortization on real estate1 | 7.0 | 7.5 | 21.9 | 23.6 | ||||||||||||

| Income tax expense (benefit) adjustment: | ||||||||||||||||

| (Gain)/Loss on sale of real estate | - | - | 3.2 | 0.7 | ||||||||||||

| Depreciation and amortization on real estate | (3.0 | ) | (3.1 | ) | (9.2 | ) | (9.6 | ) | ||||||||

| FFO | $ | 2.5 | $ | 9.8 | $ | (1.4 | ) | $ | 53.3 | |||||||

1 Excludes depreciation and amortization of real estate in Agribusiness and Materials & Construction

| Items included in net income and FFO | ||||||||||||||||

| HC&S sugar cessation costs | $ | 17.6 | $ | - | $ | 51.6 | $ | - | ||||||||

| Commercial Real Estate acqusition costs | - | 0.1 | 1.4 | 0.2 | ||||||||||||

| Income tax expense (benefit) adjustment: | ||||||||||||||||

| HC&S sugar cessation costs | (6.9 | ) | - | (20.1 | ) | - | ||||||||||

| Commercial Real Estate acqusition costs | - | - | (0.6 | ) | (0.1 | ) | ||||||||||

| Total | $ | 10.7 | $ | 0.1 | $ | 32.3 | $ | 0.1 | ||||||||

| 25 |

Alexander & Baldwin, Inc.

Reconciliation of Consolidated Net Income (Loss) to EBITDA

($ in millions)

| Three months ended September 30, | Nine months ended September 30, |

||||||||||||||||||||||||||||||

| 2016 | 2015 | % Change | 2016 | 2015 | % Change | ||||||||||||||||||||||||||

| Net Income (Loss) | $ | (1.4 | ) | $ | 7.0 | (120 | %) | $ | (9.0 | ) | $ | 43.0 | (121 | %) | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||

| Depreciation and amortization | 28.7 | 13.8 | 108 | % | 83.5 | 41.8 | 100 | % | |||||||||||||||||||||||

| Interest | 6.4 | 6.5 | (2 | %) | 20.1 | 20.2 | 0 | % | |||||||||||||||||||||||

| Taxes | (2.4 | ) | 3.8 | (163 | %) | (21.6 | ) | 26.4 | (182 | %) | |||||||||||||||||||||

| EBITDA | $ | 31.3 | $ | 31.1 | 1 | % | $ | 73.0 | $ | 131.4 | (44 | %) | |||||||||||||||||||

| 26 |

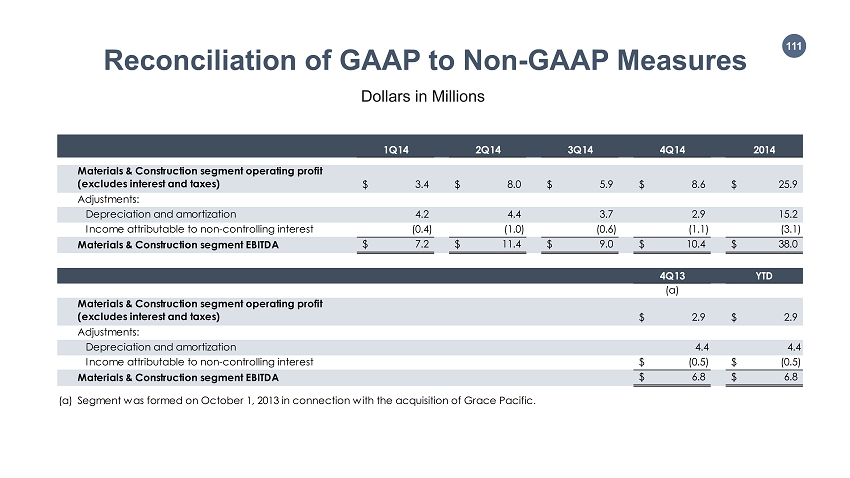

Alexander & Baldwin, Inc.

Reconciliation of Materials & Construction Segment Operating Profit to EBITDA

($ in millions)

| 1Q16 | 2Q16 | 3Q16 | 4Q16 | 2016 YTD | ||||||||||||||||

| Materials & Construction segment operating profit (excludes interest and taxes) | $ | 8.0 | $ | 4.9 | $ | 5.6 | $ | 18.5 | ||||||||||||

| Adjustments: | ||||||||||||||||||||

| Depreciation and amortization | 2.9 | 3.0 | 2.9 | 8.8 | ||||||||||||||||

| Income attributable to non-controlling interest | (0.5 | ) | (0.1 | ) | (0.5 | ) | (1.1 | ) | ||||||||||||

| Materials & Construction segment EBITDA | $ | 10.4 | $ | 7.8 | $ | 8.0 | $ | 26.2 | ||||||||||||

| 1Q15 | 2Q15 | 3Q15 | 4Q15 | 2015 | ||||||||||||||||

| Materials & Construction segment operating profit (excludes interest and taxes) | $ | 7.2 | $ | 7.0 | $ | 7.5 | $ | 9.2 | $ | 30.9 | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Depreciation and amortization | 2.9 | 3.0 | 3.0 | 2.8 | 11.7 | |||||||||||||||

| Income attributable to non-controlling interest | (0.6 | ) | (0.3 | ) | (0.3 | ) | (0.3 | ) | (1.5 | ) | ||||||||||

| Materials & Construction segment EBITDA | $ | 9.5 | $ | 9.7 | $ | 10.2 | $ | 11.7 | $ | 41.1 | ||||||||||

| 1Q14 | 2Q14 | 3Q14 | 4Q14 | 2014 | ||||||||||||||||

| Materials & Construction segment operating profit (excludes interest and taxes) | $ | 3.4 | $ | 8.0 | $ | 5.9 | $ | 8.6 | $ | 25.9 | ||||||||||

| Adjustments: | ||||||||||||||||||||

| Depreciation and amortization | 4.2 | 4.4 | 3.7 | 2.9 | 15.2 | |||||||||||||||

| Income attributable to non-controlling interest | (0.4 | ) | (1.0 | ) | (0.6 | ) | (1.1 | ) | (3.1 | ) | ||||||||||

| Materials & Construction segment EBITDA | $ | 7.2 | $ | 11.4 | $ | 9.0 | $ | 10.4 | $ | 38.0 | ||||||||||

| 4Q13 | 2013 YTD | |||||||

| (a) | (a) | |||||||

| Materials & Construction segment operating profit (excludes interest and taxes) | $ | 2.9 | $ | 2.9 | ||||

| Adjustments: | ||||||||

| Depreciation and amortization | 4.4 | 4.4 | ||||||

| Income attributable to non-controlling interest | $ | (0.5 | ) | $ | (0.5 | ) | ||

| Materials & Construction segment EBITDA | $ | 6.8 | $ | 6.8 | ||||

| (a) | Segment was formed on October 1, 2013 with the acquisition of Grace Pacific. |

| 27 |

Alexander & Baldwin, Inc.

Reconciliation of Commercial Real Estate Operating Profit to NOI (Non-GAAP)

($ in millions, unaudited)

| Quarter Ended September 30, | ||||||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||||||

| Hawaii | Mainland | Total | Hawaii | Mainland | Total | Change | ||||||||||||||||||||||

| Commercial Real Estate Operating Profit | $ | 12.9 | $ | 0.8 | $ | 13.7 | $ | 11.2 | $ | 1.3 | $ | 12.5 | 9.6 | % | ||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||

| Depreciation and amortization | 5.4 | 1.6 | 7.0 | 5.0 | 2.4 | 7.4 | (5.4 | )% | ||||||||||||||||||||

| Straight-line lease adjustments | (0.5 | ) | 0.1 | (0.4 | ) | (0.8 | ) | — | (0.8 | ) | (50.0 | )% | ||||||||||||||||

| General and administrative expenses | 0.7 | 0.1 | 0.8 | 1.0 | 0.3 | 1.3 | (38.5 | )% | ||||||||||||||||||||

| Commercial Real Estate NOI | 18.5 | 2.6 | 21.1 | 16.4 | 4.0 | 20.4 | 3.4 | % | ||||||||||||||||||||

| Acquisitions / disposition and other adjustments | (1.5 | ) | (0.1 | ) | (1.6 | ) | (0.3 | ) | (1.3 | ) | (1.6 | ) | 0.0 | % | ||||||||||||||

| Commercial Real Estate Same-Store NOI | $ | 17.0 | $ | 2.5 | $ | 19.5 | $ | 16.1 | $ | 2.7 | $ | 18.8 | 3.7 | % | ||||||||||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| 2016 | 2015 | |||||||||||||||||||||||||||

| Hawaii | Mainland | Total | Hawaii | Mainland | Total | Change | ||||||||||||||||||||||

| Commercial Real Estate Operating Profit | $ | 38.7 | $ | 3.9 | $ | 42.6 | $ | 34.8 | $ | 4.8 | $ | 39.6 | 7.6 | % | ||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||

| Depreciation and amortization | 15.9 | 5.8 | 21.7 | 14.3 | 7.5 | 21.8 | (0.5 | )% | ||||||||||||||||||||

| Straight-line lease adjustments | (1.9 | ) | 0.3 | (1.6 | ) | (2.1 | ) | — | (2.1 | ) | (23.8 | )% | ||||||||||||||||

| General and administrative expenses | 2.6 | 0.5 | 3.1 | 2.4 | 0.7 | 3.1 | — | |||||||||||||||||||||

| Other | — | — | — | 0.3 | — | 0.3 | (100.0 | )% | ||||||||||||||||||||

| Commercial Real Estate NOI | 55.3 | 10.5 | 65.8 | 49.7 | 13.0 | 62.7 | 4.9 | % | ||||||||||||||||||||

| Acquisitions / disposition and other adjustments | (6.4 | ) | (2.5 | ) | (8.9 | ) | (2.2 | ) | (4.7 | ) | (6.9 | ) | 29.0 | % | ||||||||||||||

| Commercial Real Estate Same-Store NOI | $ | 48.9 | $ | 8.0 | $ | 56.9 | $ | 47.5 | $ | 8.3 | $ | 55.8 | 2.0 | % | ||||||||||||||

| 28 |

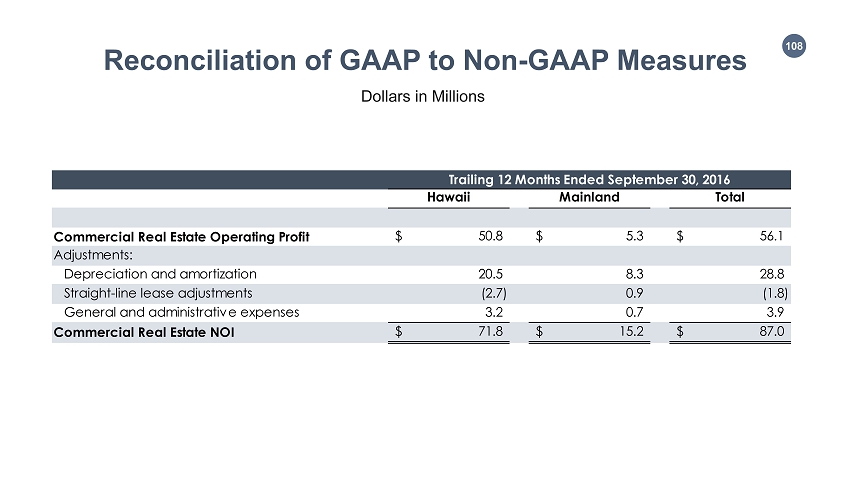

Alexander & Baldwin, Inc.

Reconciliation of Commercial Real Estate Operating Profit to NOI Trailing 12 months (Non-GAAP)

($ in millions, unaudited)

| Trailing 12 Months Ended September 30, 2016 | ||||||||||||

| Hawaii | Mainland | Total | ||||||||||

| Commercial Real Estate Operating Profit | $ | 50.8 | $ | 5.3 | $ | 56.1 | ||||||

| Adjustments: | ||||||||||||

| Depreciation and amortization | 20.5 | 8.3 | 28.8 | |||||||||

| Straight-line lease adjustments | (2.7 | ) | 0.9 | (1.8 | ) | |||||||

| General and administrative expenses | 3.2 | 0.7 | 3.9 | |||||||||

| Commercial Real Estate NOI | $ | 71.8 | $ | 15.2 | $ | 87.0 | ||||||

| 29 |

Exhibit 99.2

1 Alexander & Baldwin, Inc. PREMIER HAWAII REAL ESTATE COMPANY Investor Day Presentation November 2, 2016

2 Topic Speaker Welcome C. Benjamin Company Overview: Why Hawaii? Why A&B? C. Benjamin Lunch Service – 15 - Minute Break Lunch Presentation – Platform for Value Creation: Knowledge . Creativity. Expertise. J. Pauker Hawaii Commercial Portfolio: High - Performing Assets with Embedded Opportunity L. Parker Development: Advancing & Monetizing a Diverse Pipeline L. Parker Acquisitions: The Landscape for Investing in Hawaii Real Estate J. Pauker Land: Stewardship & Value Creation on our 87,500 Acres G. Morvis Materials & Construction: Generating Solid Cash Flows G. Morvis Financials: Highlights, Capital Structure & Reporting P. Ito Evaluation of the REIT Structure: Structure Follows Strategy P. Ito Closing Remarks and Q&A C. Benjamin Agenda

3 Statements in this call and presentation that are not historical facts, including potential benefits, consequences and impact of a potential REIT conversion, are "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 , that involve a number of risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward - looking statement . These forward - looking statements are not guarantees of future performance . This release should be read in conjunction with pages 17 - 29 of Alexander & Baldwin, Inc . ’s 2015 Form 10 - K and other filings with the SEC through the date of this release, which identify important factors that could affect the forward - looking statements in this release . We do not undertake any obligation to update our forward - looking statements . These forward - looking statements include, but are not limited to, the Company’s plans regarding (i) the possibility of converting to a REIT and the timing thereof, and (ii ) the potential advantages, benefits and impact of, and opportunities created by, converting to a REIT . Such forward - looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and the following : • There are a number of implementation and operational complexities to address before the Company decides whether to pursue a REIT conversion, including possible internal reorganizations . The Company can provide no assurance as to whether it will convert to a REIT . • REIT qualification involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986 , as amended, as well as various factual determinations not entirely within the Company’s control . If the Company determines to convert to a REIT, the Company cannot give assurance that it will so qualify or remain so qualified . • The Company can give no assurances that its board of directors will approve a conversion to a REIT, even if there are no impediments to such conversion . • The Company’s exploration of a potential REIT conversion may create a potential diversion in our management's attention from traditional business concerns . Disclosure

4 Built to Last A&B is 146 years old Our history of innovating and evolving to the changing needs and demands of the Hawaii market… …produces a reputation and track record that yield a distinctive competitive advantage

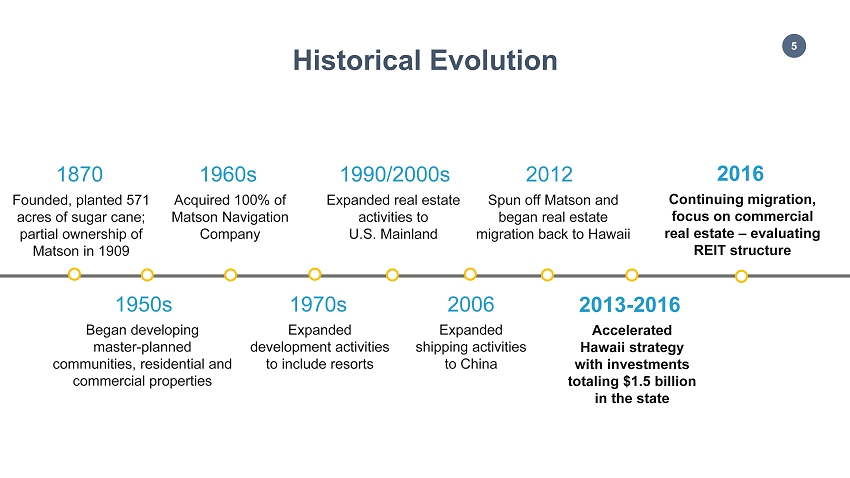

5 Began developing master - planned communities, residential and commercial properties 1950s Acquired 100% of Matson Navigation Company 1960s Expanded real estate activities to U.S . Mainland 1990/2000s Spun off Matson and began real estate migration back to Hawaii 2012 Historical Evolution Continuing migration, focus on commercial real estate – evaluating REIT structure 2016 Accelerated Hawaii strategy with investments totaling $1.5 billion in the state 2013 - 2016 Founded, planted 571 acres of sugar cane; partial ownership of Matson in 1909 1870 Expanded development activities to include resorts 1970s Expanded shipping activities to China 2006

6 Separation 2012 Migrating mainland assets to Hawaii Expanding income from existing portfolio Investing, advancing & monetizing development pipeline Stabilizing or de - risking landholding activities Investing in complementary businesses Strategic Priorities Post Separation 01 02 03 04 05

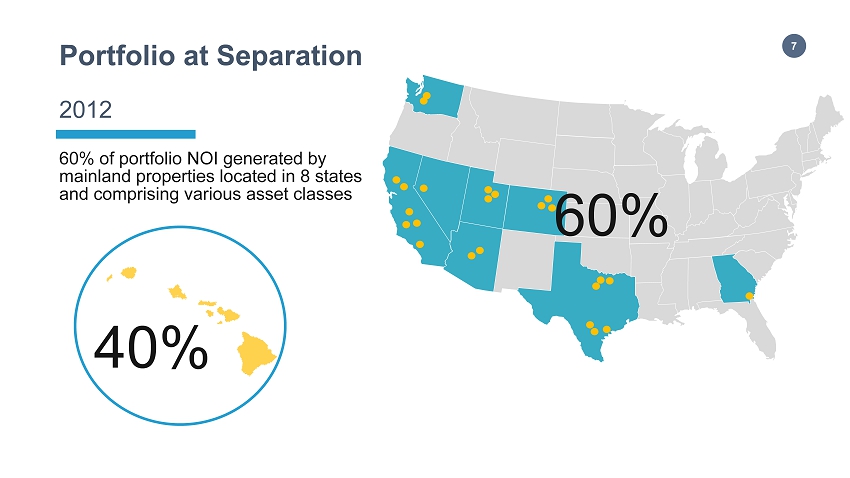

7 Portfolio at Separation 60% of portfolio NOI generated by mainland properties located in 8 states and comprising various asset classes 60% 40% 2012

8 Hawaii Focus Opportunistic migration of mainland portfolio to Hawaii over time 15% 85% Today

9 Expand Commercial Portfolio 0 10 20 30 40 50 60 70 80 90 100 2011 2012 2013 2014 2015 TTM 9/30/16 $87.0 $63.1 $68.8 $77.3 * Includes NOI from ground leases $83.9 Note: See appendix for a statement on management’s use of non - GAAP financial measures and required reconciliations. Net Operating Income* ($ in Millions) $60.8 43% Hawaii Mainland

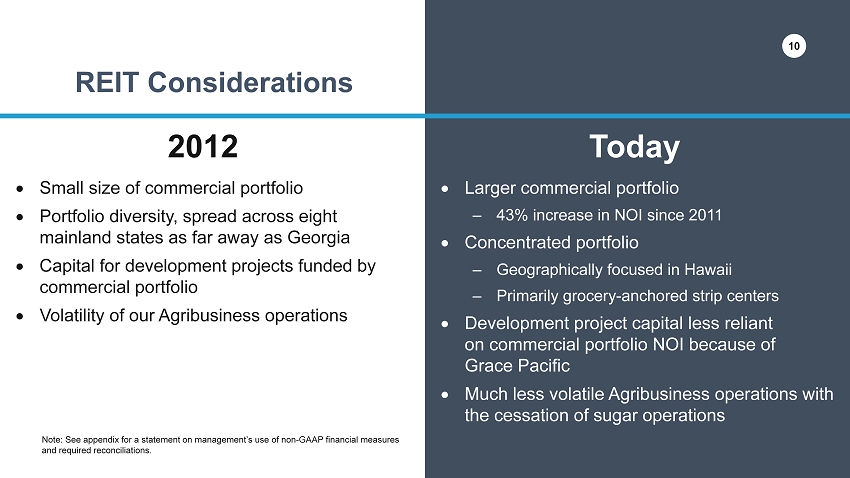

10 S mall size of commercial portfolio P ortfolio diversity, spread across eight mainland states as far away as Georgia Capital for development projects funded by commercial portfolio Volatility of our Agribusiness operations REIT Considerations Today 2012 Larger commercial portfolio – 43% increase in NOI since 2011 Concentrated portfolio – Geographically focused in Hawaii – Primarily grocery - anchored strip centers Development project capital less reliant on commercial portfolio NOI because of Grace Pacific Much less volatile Agribusiness operations with the cessation of sugar operations 10 Note: See appendix for a statement on management’s use of non - GAAP financial measures and required reconciliations.

11 Why A&B? 2 Reasons 01 02 Hawaii is an attractive market A&B is the best public company vehicle to invest in Hawaii real estate

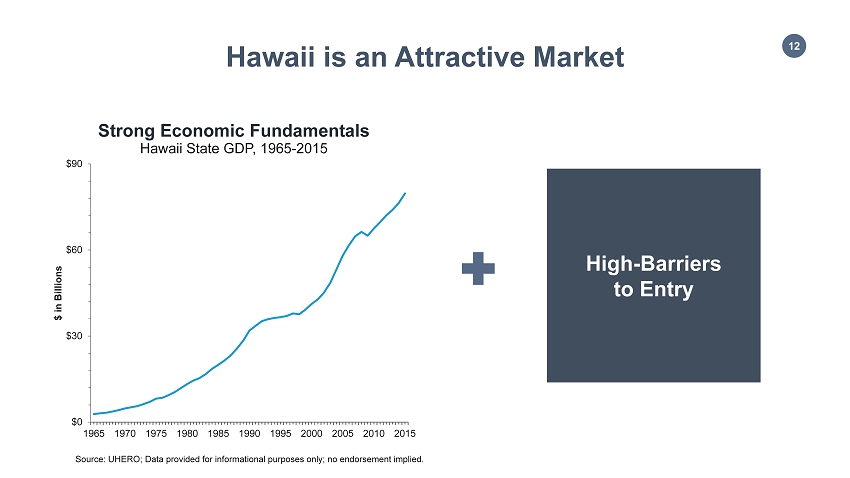

12 Hawaii is an Attractive Market High - Barriers to Entry Hawaii State GDP, 1965 - 2015 Strong Economic Fundamentals Source : UHERO ; Data provided for informational purposes only; no endorsement implied. $0 $30 $60 $90 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 $ in Billions

13 Sources: Bureau of Economic Analysis, Defense Manpower Data Center, and Chmura Economics & Analytics; U.S. Census Bureau, Population Division & 2014 Annual Survey of State Government Finances; Office of Economic Adjustment ; UHERO; Data provided for informational purposes only; no endorsement implied . $8,720 $5,352 $6,387 $1,312 State Federal Defense Government Spending Per Capita Hawaii U.S. Average #7 #2 Steady Government Spending Government Spending in Hawaii Rank State % of State GDP 1 Virginia 11.8% 2 Hawaii 9.9% 3 Alabama 5.9% 4 District of Columbia 5.8% 5 Alaska 5.7% Military Spending as Share of State GDP $0 $4 $8 $12 $16 $20 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 $ in Billions

14 Japan Resilient Visitor Industry 0 3 6 9 12 15 18 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 TTM 9/30/16 $ in Billions Visitor Expenditures 9/11 Great Recession Devaluation of Yen U.S. The longer view of visitor expenditures demonstrates the resiliency of Hawaii’s major economic growth engine. Tohoku Earthquake & Tsunami Other International Source : HTA; Data provided for informational purposes only; no endorsement implied .

15 Source : State of Hawaii Office of Planning Although there are over 4 million acres in Hawaii, only 5% of the island is designated for urban use, creating a much - restricted supply of developable land. State Acreage by Use Agriculture Conservation Urban 1,885,150 (46%) 2,022,322 (49%) 204,441 ( 5 %) Restricted Supply of Urban Land

16 The land entitlement and development process in Hawaii is complex and time consuming heightening the importance of local knowledge and serving as a barrier to entry for outsiders. A Structural Barrier to New Supply Source : Lee Sichter LLC, 2014; Data provided for informational purposes only; no endorsement implied .