Form 8-K ATHERSYS, INC / NEW For: Nov 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 5, 2015

Athersys, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-33876 | 20-4864095 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) | ||

| 3201 Carnegie Avenue, Cleveland, Ohio | 44115-2634 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (216) 431-9900

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

On November 5, 2015, Athersys, Inc. issued a press release announcing financial results for its third quarter ended September 30, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished to the Securities and Exchange Commission and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section. Furthermore, the information contained in Item 2.02 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. |

Exhibit Description | |

| 99.1 | Press Release dated November 5, 2015 | |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 5, 2015

| ATHERSYS, INC. | ||

| By: | /s/ Laura K. Campbell | |

| Name: Laura K. Campbell | ||

| Title: Vice President of Finance | ||

EXHIBIT INDEX

| Exhibit No. |

Exhibit Description | |

| 99.1 | Press Release dated November 5, 2015 | |

Exhibit 99.1

Contacts:

William (B.J.) Lehmann, J.D.

President and Chief Operating Officer

Tel: (216) 431-9900

ATHERSYS REPORTS THIRD QUARTER 2015 RESULTS

Management to host conference call at 4:30 pm EST today

CLEVELAND, November 5, 2015 – Athersys, Inc. (NASDAQ: ATHX) today announced its financial results for the three months ended September 30, 2015.

Highlights of the third quarter of 2015 and recent events include:

| • | Announced signing of a letter of intent with a Japanese company to collaborate on the development and commercialization of MultiStem® cell therapy for several indications in Japan, including ischemic stroke, after termination of the license agreement with Chugai Pharmaceutical Co., Ltd; |

| • | Advanced discussions with several other companies about collaborating in the development and commercialization of MultiStem therapy in multiple areas, including ischemic stroke; |

| • | Advanced planning for progressing MultiStem ischemic stroke program in Japan and globally, focusing on patients who receive treatment within 36 hours of stroke; |

| • | Progressed other clinical programs, adding sites to the Phase 2 acute myocardial infarction (“AMI”) trial and completing final preparations for launch of acute respiratory distress syndrome (“ARDS”) trial – studies that are partially supported with grant funding; |

| • | Reported revenues of $0.4 million for quarter ended September 30, 2015 and net loss of $6.5 million for the period, which includes non-cash income of $0.3 million related to the change in fair value of our warrant liabilities and non-cash expense of $0.7 million related to stock-based compensation; |

| • | Recorded net loss per share of $0.08 for the quarter ended September 30, 2015; and |

| • | Ended the quarter with $28.5 million in cash and cash equivalents. |

“Although we have ended our collaboration with Chugai, we are encouraged by the interest of other potential business partners in our MultiStem programs and stem cell technologies,” said Dr. Gil Van Bokkelen, Chairman and CEO of Athersys, Inc. “As announced previously, we recently signed a letter of intent with a Japanese company for the development of MultiStem cell therapy in Japan for several indications, including stroke, and we remain enthusiastic about accelerated development opportunities for regenerative medicine products in Japan, confirmed by recent approvals by the Japanese Pharmaceutical and Medical Devices Agency. We also have ongoing discussions with companies with interests in applications outside of Japan. Clearly, a key focus will be business development over the next several months.

“We are particularly excited about the potential for our ischemic stroke program, especially as continued analyses confirm a robust benefit for serious stroke patients who received MultiStem treatment within 36 hours following the stroke. We are planning the next stage of clinical activity, which we intend to initiate by the middle of next year.

“We have also made progress in our Phase 2 acute myocardial infarction study and have added sites to help drive enrollment,” added Dr. Van Bokkelen. “Also, with recent regulatory and operations progress, we expect to launch our exploratory study in the ARDS area this quarter. We believe that MultiStem therapy has the potential to moderate the hyper-inflammation associated with ARDS and help patients regain lung function, alleviate the need for ventilator-assisted breathing, and enable faster recovery.

“We have maintained a good balance sheet to support our current activities. Additionally, as noted, we continue to focus on business development activities oriented to further improving the balance sheet, offsetting development costs, and bringing partner capabilities to bear for various development programs,” concluded Dr. Van Bokkelen.

Updated Phase 2 Ischemic Stroke Clinical Trial Results

The ongoing analyses confirm accelerated recovery for subjects treated with MultiStem prior to 36 hours compared to placebo. Further, biomarker analyses demonstrate a significant reduction in acute post-stroke inflammation for MultiStem patients. These factors may contribute to lower average hospitalization for subjects treated with MultiStem prior to 36 hours compared to placebo.

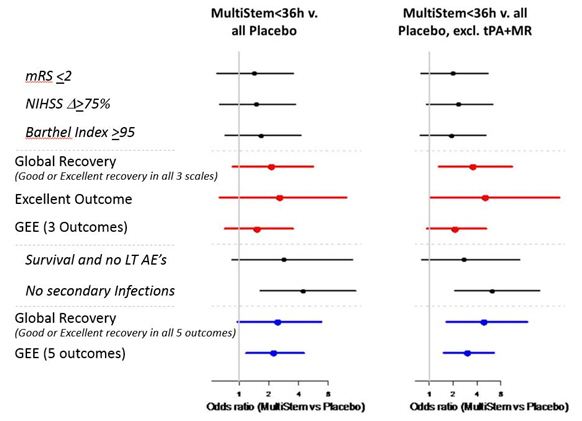

Additionally, our analyses show that patients treated with MultiStem prior to 36 hours tend to have better recovery across multiple functional and clinical outcomes as evident in Figure 1 below. Patients receiving treatment with MultiStem within 36 hours have meaningfully better odds of achieving recovery – whether measured by single outcomes or considering recovery holistically across multiple outcomes – when compared with patients not receiving MultiStem treatment. Considering the five dichotomous outcomes below, in the post-hoc analyses (subjects treated with MultiStem therapy <36 hours v. all placebo, excluding subjects receiving prior tPA and mechanical reperfusion treatment from both groups), 41% of MultiStem patients successfully achieved each of the five outcomes compared to only 12% of Placebo patients.

Figure 1

Plot showing the odds ratios for a MultiStem-related treatment effect for the outcomes indicated. Numbers greater than 1 are in favor of MultiStem. Each horizontal line represents the 95% confidence interval.

Figure 1 includes three pre-specified secondary endpoints – modified Rankin Score £ 2 (disability measure), NIH stroke scale (NIHSS) delta ³75% (neurological deficit), and Barthel Index ³ 95% (activities of daily living) at 90 days following the stroke – and the pre-specified primary endpoint using the “generalized estimating equation (GEE)” method to calculate an integrated assessment of treatment effect between the groups using these three outcomes. An exploratory endpoint, “Global recovery,” a combined dichotomous endpoint based on the simultaneous achievement of the three component endpoints above (mRS£2, NIHSS delta³75%, and BI³95%) is included. Excellent outcome, a combined dichotomous endpoint measuring achievement of mRS£1, NIHSS£1, and BI³95% and a pre-specified secondary outcome, is also shown. Finally, two important safety outcomes are represented – survival without life threatening adverse events and secondary infections – and all five components are evaluated together using the approaches above.

Third Quarter Financial Results

For the three months ended September 30, 2015, total revenues were $0.4 million compared to $0.3 million in the comparable period in 2014, reflecting an increase in grant revenues. Grant revenues may fluctuate from period to period due to the timing of grant-related activities and the award and expiration of grants, while contract revenues will be driven by license, royalty and milestone payments from existing and new business collaborations. We will retain the $10 million up-front cash payment from Chugai Pharmaceutical Co. Ltd. (“Chugai”) received in 2015, which will be recognized in full as revenue in October 2015 in connection with the recently announced termination of the collaboration.

Research and development expenses were $5.1 million for the third quarter of 2015 compared to $5.8 million for the third quarter of 2014. The decrease was driven by lower clinical and preclinical development costs, sponsored research costs, personnel costs, research supplies and travel costs. General and administrative expenses increased to $1.9 million in the third quarter of 2015 compared to $1.7 million in the same period of 2014 due to increased professional fees and consulting costs. The non-cash income from the change in the fair value of our warrant liabilities was $0.3 million in the third quarter of 2015 and $2.5 million in the comparable prior-year period.

Net loss for the three months ended September 30, 2015 was $6.5 million, which included non-cash income of $0.3 million from the warrant valuation and non-cash expense of $0.7 million from stock-based compensation, compared to net loss of $4.7 million for the three months ended September 30, 2014, which included non-cash income of $2.5 million from the warrant valuation and non-cash expense of $0.7 million from stock-based compensation.

As of September 30, 2015, we had $28.5 million in cash and cash equivalents, compared to $26.1 million at December 31, 2014. Cash used in operating activities during the third quarter of 2015 was $3.7 million (including the receipt of $2.0 million that was temporarily withheld by Japanese taxing authorities related to Chugai) compared to $6.2 million cash used in the third quarter of 2014.

Conference Call

As previously announced, Gil Van Bokkelen, Chairman and Chief Executive Officer, and William (B.J.) Lehmann, President and Chief Operating Officer, will host a conference call today to review the results as follows:

| Date | November 5, 2015 | |

| Time | 4:30 p.m. (Eastern Time) | |

| Telephone access: U.S. and Canada | 800-273-1254 | |

| Telephone access: International | 973-638-3440 | |

| Access code | 22710391 | |

| Live webcast | www.athersys.com, under the Investors section |

A replay will be available for on-demand listening shortly after the completion of the call until 11:59 PM (Eastern Time) on November 19, 2015 by dialing 800-585-8367 or 855-859-2056 (U.S. and Canada), or 404-537-3406, and entering access code 22710391. The archived webcast will be available for one year at the aforementioned URL.

About Athersys

Athersys is a clinical stage biotechnology company engaged in the discovery and development of therapeutic product candidates designed to extend and enhance the quality of human life. The Company is developing its MultiStem® cell therapy product, a patented, adult-derived “off-the-shelf” stem cell product platform for disease indications in the cardiovascular, neurological, inflammatory and immune disease areas. The Company currently has several clinical stage programs involving MultiStem, including for treating inflammatory bowel disease, ischemic stroke, damage caused by myocardial infarction, and for the prevention of graft-versus-host disease. Athersys has also developed a diverse portfolio that includes other technologies and product development opportunities, and has forged strategic partnerships and collaborations with leading pharmaceutical and biotechnology companies, as well as world-renowned research institutions in the United States and Europe to further develop its platform and products. More information is available at www.athersys.com.

The Athersys, Inc. logo is available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=4548.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These forward-looking statements relate to, among other things, the expected timetable for development of our product candidates, our growth strategy, and our future financial performance, including our operations, economic performance, financial condition, prospects, and other future events. We have attempted to identify forward-looking statements by using such words as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “should,” “suggest,” “will,” or other similar expressions. These forward-looking statements are only predictions and are largely based on our current expectations. A number of known and unknown risks, uncertainties, and other factors could affect the accuracy of these statements. Some of the more significant known risks that we face that could cause actual results to differ materially from those implied by forward-looking statements are the risks and uncertainties inherent in the process of discovering, developing, and commercializing products that are safe and effective for use as human therapeutics, such as the uncertainty regarding market acceptance of our product candidates and our ability to generate revenues, including MultiStem for the treatment of ischemic stroke, acute myocardial infarction, and acute respiratory distress syndrome and other disease indications, including graft-versus-host disease. These risks may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these

forward-looking statements. Other important factors to consider in evaluating our forward-looking statements include: our possible inability to realize commercially valuable discoveries in our collaborations with pharmaceutical and other biotechnology companies; the success of our collaborations, including our ability to reach milestones and receive milestone payments, and whether any products are successfully developed and sold so that we earn royalty payments; our collaborators’ ability to continue to fulfill their obligations under the terms of our collaboration agreements; the success of our efforts to enter into new strategic partnerships or collaborations and advance our programs, including the ability to enter into a definitive arrangement with the Japanese company for the development and commercialization of MultiStem cell therapy in Japan; our ability to raise additional capital; results from our MultiStem clinical trials; the possibility of delays in, adverse results of, and excessive costs of the development process; our ability to successfully initiate and complete clinical trials; changes in external market factors; changes in our industry’s overall performance; changes in our business strategy; our ability to protect our intellectual property portfolio; our possible inability to execute our strategy due to changes in our industry or the economy generally; changes in productivity and reliability of suppliers; and the success of our competitors and the emergence of new competitors. You should not place undue reliance on forward-looking statements contained in this press release, and we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise.

(Financial Tables Follow)

Athersys, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

| September 30, | December 31, | |||||||

| 2015 | 2014 | |||||||

| (Unaudited) | (Note) | |||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 28,533 | $ | 26,127 | ||||

| Accounts and other receivables |

315 | 694 | ||||||

| Other current assets |

383 | 427 | ||||||

| Equipment, net |

1,167 | 1,270 | ||||||

| Other noncurrent assets |

195 | 200 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 30,593 | $ | 28,718 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Accounts payable and accrued expenses |

$ | 4,088 | $ | 4,617 | ||||

| Deferred revenue |

10,000 | 75 | ||||||

| Note payable |

189 | 183 | ||||||

| Warrant liabilities |

813 | 2,948 | ||||||

| Total stockholders’ equity |

15,503 | 20,895 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 30,593 | $ | 28,718 | ||||

|

|

|

|

|

|||||

Note: The Condensed Consolidated Balance Sheet Data at December 31, 2014 has been derived from the audited financial statements as of that date.

Athersys, Inc.

Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income

(In Thousands, Except Per Share Amounts)

| Three Months ended September 30, | ||||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| Revenues |

||||||||

| Contract revenue |

$ | 39 | $ | 75 | ||||

| Grant revenue |

357 | 218 | ||||||

|

|

|

|

|

|||||

| Total revenues |

396 | 293 | ||||||

| Costs and Expenses |

||||||||

| Research and development |

5,089 | 5,775 | ||||||

| General and administrative |

1,941 | 1,695 | ||||||

| Depreciation |

66 | 91 | ||||||

|

|

|

|

|

|||||

| Total costs and expenses |

7,096 | 7,561 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(6,700 | ) | (7,268 | ) | ||||

| Other (expense) income, net |

(79 | ) | 8 | |||||

| Income from change in fair value of warrants |

255 | 2,540 | ||||||

|

|

|

|

|

|||||

| Loss before taxes |

$ | (6,524 | ) | $ | (4,720 | ) | ||

| Tax benefit |

27 | 1 | ||||||

|

|

|

|

|

|||||

| Net loss and comprehensive loss |

$ | (6,497 | ) | $ | (4,719 | ) | ||

|

|

|

|

|

|||||

| Net loss per share - Basic |

$ | (0.08 | ) | $ | (0.06 | ) | ||

| Weighted average shares outstanding- Basic |

83,141 | 77,320 | ||||||

| Net loss per share - Diluted |

$ | (0.08 | ) | $ | (0.08 | ) | ||

| Weighted average shares outstanding- Diluted |

83,426 | 78,350 | ||||||

Athersys, Inc.

Condensed Consolidated Statements of Cash Flows

(In Thousands)

| Three months ended September 30, | ||||||||

| 2015 | 2014 | |||||||

| (Unaudited) | ||||||||

| Operating activities |

||||||||

| Net loss |

$ | (6,497 | ) | $ | (4,719 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Depreciation |

66 | 91 | ||||||

| Stock-based compensation |

730 | 714 | ||||||

| Change in fair value of warrant liabilities |

(255 | ) | (2,540 | ) | ||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable and other |

2,035 | (59 | ) | |||||

| Accounts payable, accrued expenses and other |

240 | 265 | ||||||

|

|

|

|

|

|||||

| Net cash used in operating activities |

(3,681 | ) | (6,248 | ) | ||||

| Investing activities |

||||||||

| Purchases of equipment |

(26 | ) | (79 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(26 | ) | (79 | ) | ||||

| Financing activities |

||||||||

| Purchase of treasury stock |

(106 | ) | (55 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

(106 | ) | (55 | ) | ||||

|

|

|

|

|

|||||

| Increase in cash and cash equivalents |

(3,813 | ) | (6,382 | ) | ||||

| Cash and cash equivalents at beginning of the period |

32,346 | 38,750 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of the period |

$ | 28,533 | $ | 32,368 | ||||

|

|

|

|

|

|||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Moveworks Showcases the Power of its Next-Generation Copilot at Moveworks.global 2024

- ROSEN, A TRUSTED AND LEADING LAW FIRM, Encourages The Chemours Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – CC

- Luminar Day: A New Era – Luminar Achieves Global Start of Production for Volvo Cars

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share