Form 8-K ASHFORD HOSPITALITY TRUS For: Jun 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): June 23, 2015

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

Maryland | 001-31775 | 86-1062192 | ||

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS employer identification number) | ||

14185 Dallas Parkway, Suite 1100 | ||||

Dallas, Texas | 75254 | |||

(Address of principal executive offices) | (Zip code) | |||

Registrant’s telephone number, including area code (972) 490-9600

Check the appropriated box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14-a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 REGULATION FD DISCLOSURE

Ashford Hospitality Trust, Inc. presented a Powerpoint slideshow on June 23, 2015 to the investment community. The Powerpoint slideshow is attached hereto as Exhibit 99.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit

Number Description

99.1 | Powerpoint slideshow presentation. |

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 23, 2015

ASHFORD HOSPITALITY TRUST, INC.

By: /s/ DAVID A. BROOKS

David A. Brooks

Chief Operating Officer and General Counsel

1 Company Presentation - June 2015

2 Safe Harbor In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward- looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. Historical results are not indicative of future performance. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's funds from operations minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security.

Compelling Opportunity 3

4 Opportunistic Strategy Predominantly focused on opportunities to invest in upper-upscale, full- service hotels in all market locations with the following characteristics: Value-add opportunities Strong yields and outsized growth prospects Markets with favorable supply/demand dynamics Ability to install Remington as manager to drive improved operating performance Highly-aligned management team with proven track record of long-term value creation Leveraged way to invest in hotel cycle Industry leading dividend yield

5 Compelling Opportunity Attractive industry fundamentals with demand growth exceeding supply growth Currently seeking accretive hotel acquisition opportunities Affiliated property manager results in strong operating results and flow- throughs Upcoming refinancings with potential for significant excess proceeds Net working capital of $664 million at 3/31/15

6 Strong Track Record & Performance

Demonstrated Long-Term Track Record 7 • Disciplined growth, operational expertise, and capital allocation to maximize shareholder returns Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Total Shareholder Returns as of 6/12/15 Source: Bloomberg Total Shareholder Return -15% 87% 101% 202% 226% 12% 84% 95% 41% 30% -50% 50% 150% 250% 1-yr 3-yr 5-Yr 7-Yr 10-yr AHT Peer Avg

Highly-Aligned Management 8 • With insider ownership* of approximately 15% for AHT, management is highly-aligned with shareholder interests Publicly-Traded Hotel REIT Insider Ownership Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes direct & indirect interests & interests of related parties 15%* 14%* 5% 4% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 0.5% 0% 2% 4% 6% 8% 10% 12% 14% 16%

9 Strong RevPAR Growth FY 2014 RevPAR Growth Source: Company filings. • Ashford Trust has delivered strong RevPAR growth versus its peers 11.6% 10.9% 10.5% 9.9% 8.8% 8.0% 7.2% 6.8% 6.1% 5.9% 5.7% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Q1 2015 RevPAR Growth 13.1% 11.9% 8.5% 7.9% 7.0% 6.9% 6.9% 5.4% 5.3% 3.8% 3.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0%

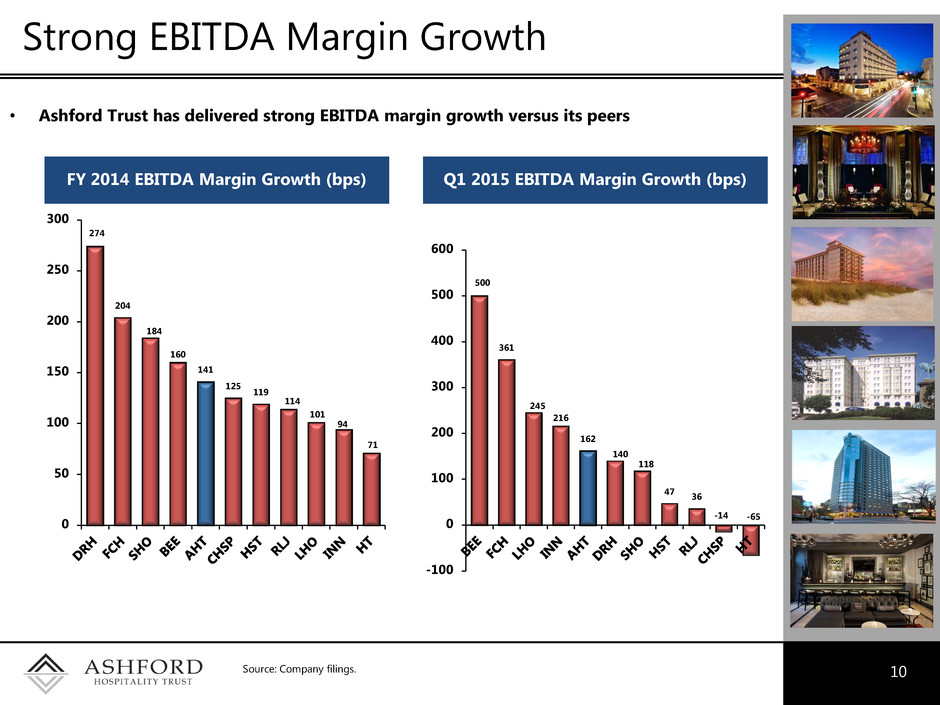

10 Strong EBITDA Margin Growth FY 2014 EBITDA Margin Growth (bps) Source: Company filings. • Ashford Trust has delivered strong EBITDA margin growth versus its peers 274 204 184 160 141 125 119 114 101 94 71 0 50 100 150 200 250 300 Q1 2015 EBITDA Margin Growth (bps) 500 361 245 216 162 140 118 47 36 -14 -65 -100 0 100 200 300 400 500 600

11 Attractive Relative Valuation vs. Peers Source: Citibank research. • Ashford Trust is trading at an attractive valuation relative to its peers TEV/2016 EBITDA 12.9x 12.2x 12.1x 12.1x 11.8x 11.8x 11.5x 11.1x 10.0x 9.0x 8.9x 6.0 8.0 10.0 12.0 14.0 HT LHO RLJ HST INN SHO DRH FCH CHSP CLDT AHT

12 2013 2014 Var Q1 2014 Q1 2015 Var RevPAR $95.94 $105.39 9.8% $102.04 $110.69 8.5% Hotel Revenue $1,031,840 $1,117,739 8.3% $305,113 $326,443 7.0% Hotel EBITDA $312,766 $354,513 13.3% $92,757 $104,545 12.7% EBITDA Flow 48.6% 55.3% The above table assumes the properties owned and included in continuing operations as of December 31, 2014 (115) and March 31, 2015 (116) were owned as of the beginning of each of the periods shown Revenue and EBITDA figures displayed in $000's Strong Asset Performance 50.1% 42.8% 60.0% 69.4% 55.3% 48.6% 55.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2009 2010 2011 2012 2013 2014 Q1 2015 Annual Hotel EBITDA Flow-Through

13 Portfolio Ashford Trust Markets

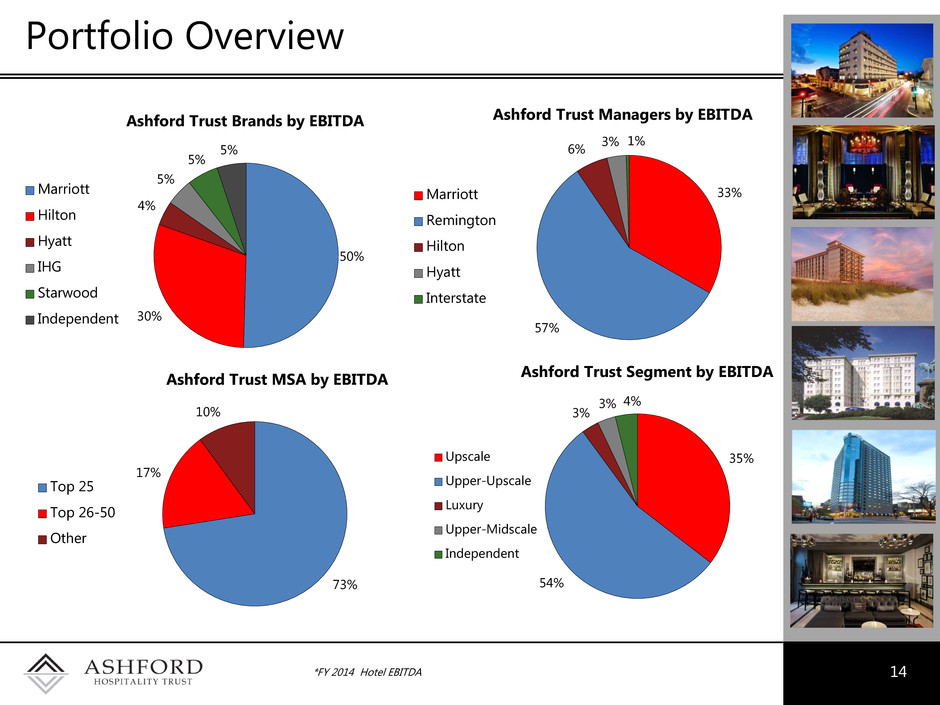

Portfolio Overview 14 *FY 2014 Hotel EBITDA 50% 30% 4% 5% 5% 5% Ashford Trust Brands by EBITDA Marriott Hilton Hyatt IHG Starwood Independent 33% 57% 6% 3% 1% Ashford Trust Managers by EBITDA Marriott Remington Hilton Hyatt Interstate 73% 17% 10% Ashford Trust MSA by EBITDA Top 25 Top 26-50 Other 35% 54% 3% 3% 4% Ashford Trust Segment by EBITDA Upscale Upper-Upscale Luxury Upper-Midscale Independent

Ashford Trust – Capital Structure 15 • Target Net Debt/Gross Assets of 50-60% • Maintain mix of fixed and floating rate debt – currently 38.3% fixed/61.7% floating* • Ladder maturities • Proactively refinance upcoming maturities • All debt is property-level and non-recourse Balance Sheet Initiatives Debt Maturities 90.7 174.8 468.1 197.3 569.1 - 100.0 200.0 300.0 400.0 500.0 600.0 2015 2016 2017 2018 2019 De b t ( $ i n m il li o n s) Fixed-Rate Floating-Rate *As of 3/31/15

Significant Liquidity 16 • Maintain excess cash balance to capitalize on opportunities – in Q1 2015 raised over $300 million in excess proceeds from refinancings • Significant additional value through net working capital balance Net Working Capital (1) (2) Enterprise Value (1) Ashford Trust's pro rata share (2) As of 3/31/15 $ in millions Cash and cash equivalents $355.6 Marketable securities, net 60.2 Restricted cash 142.8 Accounts receivable, net 52.5 Prepaid expenses 22.7 Due from affiliates, net (6.8) Due from 3rd party hotel managers, net 37.5 Market value of Ashford Inc. investment 71.0 Market value of Ashford Prime investment 83.5 Total current assets $819.1 Accounts payable, net & accrued expenses $131.8 Dividends payable 23.3 Total current liabilities $155.1 Net working capital $664.0 $ in millions except per share data Stock Price (as of 6/12/15) $8.15 Fully diluted shares outstanding (mm) (2) 120.0 Equity value $978.0 Preferred equity (Par value) (2) 393.9 Debt (1) (2) 3,381.3 Total Market Capitalization $4,752.6 Less: Net working capital (1) (2) (664.0) Total Enterprise Value $4,088.6

Attractive Industry Fundamentals 17

• Demand expected to exceed supply through at least 2015 18 Attractive Supply/Demand Imbalance Source: PKF -8.0 -6.0 -4.0 -2.0 0.0 2.0 4.0 6.0 8.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015F Supply Growth Demand Growth Yea r- o v e r- Year % Gro w th PKF Forecast

19 Source: PKF 7.7% 6.1% -2.0% -16.7% 5.4% 8.2% 6.8% 5.4% 8.3% 7.2% 6.8% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% Historical RevPAR Growth Forecasted RevPAR Growth PKF RevPAR Growth Forecasts

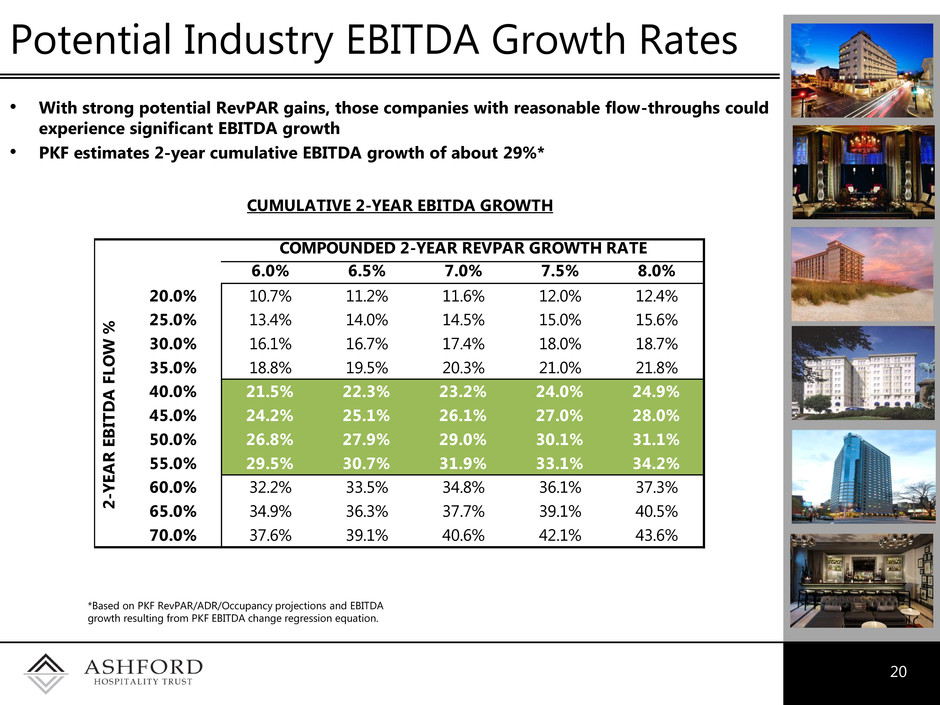

20 Potential Industry EBITDA Growth Rates *Based on PKF RevPAR/ADR/Occupancy projections and EBITDA growth resulting from PKF EBITDA change regression equation. • With strong potential RevPAR gains, those companies with reasonable flow-throughs could experience significant EBITDA growth • PKF estimates 2-year cumulative EBITDA growth of about 29%* COMPOUNDED 2-YEAR REVPAR GROWTH RATE COMPOUNDED 2-YEAR REVPAR GROWTH RATE 29.0% 6.0% 6.5% 7.0% 7.5% 8.0% 20.0% 10.7% 11.2% 11.6% 12.0% 12.4% 25.0% 13.4% 14.0% 14.5% 15.0% 15.6% 30.0% 16.1% 16.7% 17.4% 18.0% 18.7% 35.0% 18.8% 19.5% 20.3% 21.0% 21.8% 40.0% 21.5% 22.3% 23.2% 24.0% 24.9% 45.0% 24.2% 25.1% 26.1% 27.0% 28.0% 50.0% 26.8% 27.9% 29.0% 30.1% 31.1% 55.0% 29.5% 30.7% 31.9% 33.1% 34.2% 60.0% 32.2% 33.5% 34.8% 36.1% 37.3% 65.0% 34.9% 36.3% 37.7% 39.1% 40.5% 70.0% 37.6% 39.1% 40.6% 42.1% 43.6% 2- YE AR EB IT DA FL OW % CUMULATIVE 2-YEAR EBITDA GROWTH

• Historically, attractive returns remain for investors from this point in the lodging cycle 21 Historical Industry Stock Returns Index includes AHT, BEE, DRH, FCH, HST, HT, LHO, and SHO. Companies are included in the data from the time of their IPO Current data as of May 31, 2015 % 50% 100% 150% 200% 250% 300% 350% 0 12 24 36 48 60 72 84 96 108 T S R Months from Peak to Peak 1989-1997 1997-2007 2007-Current

Growth & Acquisition Strategy 22

23 Highly quantitative approach focused on long-term accretion Proven track record of value-creating opportunistic acquisitions Disciplined capital allocation Multiple ways to grow platform: Internal growth from asset performance Portfolio/single asset acquisitions Excess cash from potential refinancings Partial ownership of Ashford Prime Partial ownership of Ashford Inc. Growth & Acquisition Strategy

24 Competitive Strengths Broad and multi-faceted relationships with both owners and brokers Deep market knowledge across U.S. markets given existing geographic footprint Remington relationship provides ability to underwrite both more thoroughly and more quickly Ability to commit to and perform under tighter timeframes Significant liquidity provides surety and speed of closing

25 Ashford Trust Recent Developments Q1 2015 RevPAR up 8.5%, Hotel EBITDA up 12.7% and EBITDA flow-through was 55% In January 2015, the Company refinanced two mortgage loans resulting in excess proceeds of over $100 million after closing costs and reserves Also in June, the Company announced that it was acquiring the W Atlanta Downtown for $56.8 million ($239,000 per key) In March 2015, the Company acquired the remaining interest in the Highland Portfolio from its JV partner for $250.1 million (total transaction value of $1.735 billion or $215,000 per key) and simultaneously refinanced 24 properties in the portfolio resulting in net proceeds of approximately $200 million In April 2015, the Company closed on the acquisition of the Hampton Inn & Suites Gainesville for $25.3 million ($204,000 per key) In June, the Company closed on the acquisition of the Le Pavillon Hotel in New Orleans for $62.5 million ($277,000 per key) and completed a concurrent financing of a $43.8 million floating rate loan on the property

26 Marriott Fremont Transaction *TTM through 4/30/15 Strengths/Performance: • Closed on acquisition in August 2014 • Excellent location in strong Silicon Valley hotel market with a diversified customer base • High quality asset with minimal capex needs – recently renovated guestrooms, meeting space and Greatroom- certified lobby • YTD through April, Revenues increased by 22% over prior year period • YTD through April, EBITDA increased $1.1 million or 78% over prior year period with 95% EBITDA flow through Acquisition Overview: • Purchase Price: $50.0 million ($140,000 per key) • RevPAR of $123* • Purchased for 45% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.1% • Expected forward 12-month EBITDA multiple of 10.0x • Ability to perform on an accelerated timetable gave us competitive advantage • Location: Fremont, CA • Rooms: 357 • Year Built: 1999 • 15,000 sf of meeting space • Fee simple • Segmentation: 77% transient; 23% group Property Information:

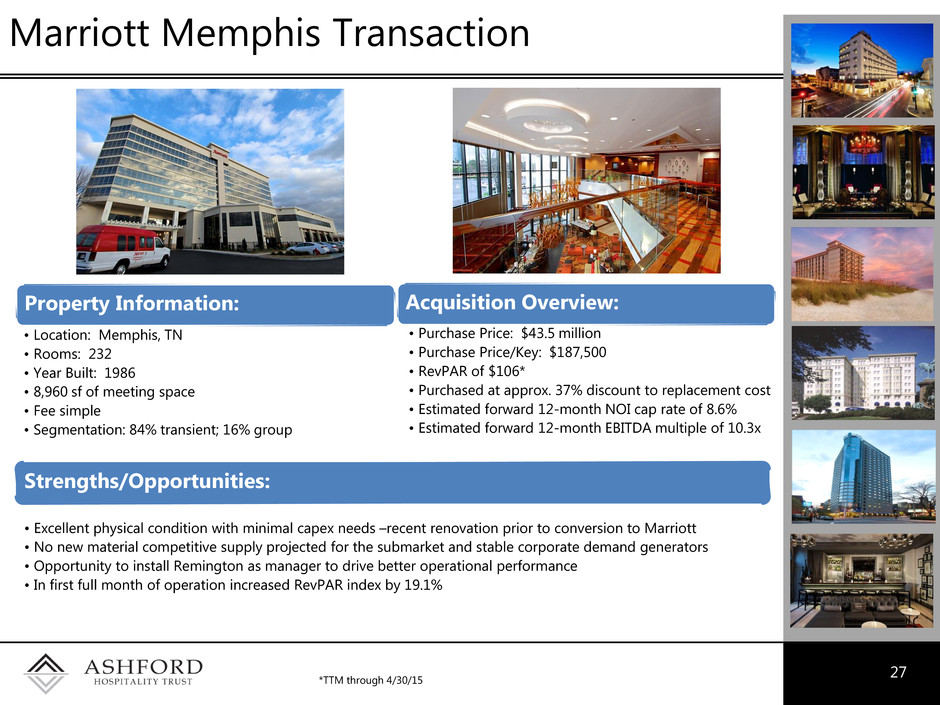

27 Marriott Memphis Transaction *TTM through 4/30/15 Strengths/Opportunities: • Excellent physical condition with minimal capex needs –recent renovation prior to conversion to Marriott • No new material competitive supply projected for the submarket and stable corporate demand generators • Opportunity to install Remington as manager to drive better operational performance • In first full month of operation increased RevPAR index by 19.1% Acquisition Overview: • Purchase Price: $43.5 million • Purchase Price/Key: $187,500 • RevPAR of $106* • Purchased at approx. 37% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.6% • Estimated forward 12-month EBITDA multiple of 10.3x • Location: Memphis, TN • Rooms: 232 • Year Built: 1986 • 8,960 sf of meeting space • Fee simple • Segmentation: 84% transient; 16% group Property Information:

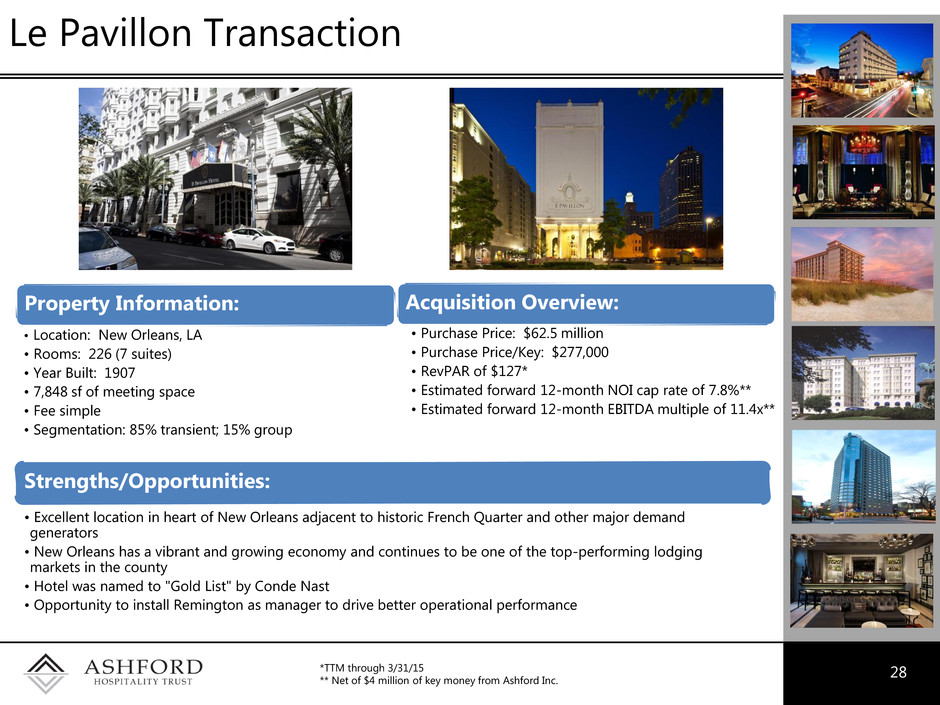

28 Le Pavillon Transaction *TTM through 3/31/15 ** Net of $4 million of key money from Ashford Inc. Strengths/Opportunities: • Excellent location in heart of New Orleans adjacent to historic French Quarter and other major demand generators • New Orleans has a vibrant and growing economy and continues to be one of the top-performing lodging markets in the county • Hotel was named to "Gold List" by Conde Nast • Opportunity to install Remington as manager to drive better operational performance Acquisition Overview: • Purchase Price: $62.5 million • Purchase Price/Key: $277,000 • RevPAR of $127* • Estimated forward 12-month NOI cap rate of 7.8%** • Estimated forward 12-month EBITDA multiple of 11.4x** • Location: New Orleans, LA • Rooms: 226 (7 suites) • Year Built: 1907 • 7,848 sf of meeting space • Fee simple • Segmentation: 85% transient; 15% group Property Information:

Accretive Growth 29 - Ashford Trust management is focused on accretive growth - Our definition of accretion: the 5-year Total Return (TR) post-transaction must be greater than the 5-year Total Return pre-transaction - Transactions are modeled on a leverage-neutral basis Base Model Transaction (Leverage-Neutral) Combined Model 5-year TR 5-year TR Combined 5-year TR > Base 5-year TR

30 Corporate Governance Enhancements Recently, Ashford Trust has made a number of positive corporate governance enhancements: Amendment to bylaws providing for a majority voting standard in the election of directors in uncontested elections Amendment to bylaws to permit shareholders to amend the bylaws Amendment to bylaws to reduce threshold to call a special meeting of shareholders from 50% to 35% of outstanding common stock Implemented policy requiring director resignation in the event a director does not receive a majority of votes cast at election The board of directors continues to review additional enhancements to the Company's corporate governance policies to more firmly align the Company with the interests of its shareholders

31 Company Presentation - June 2015

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ASHFORD HOSPITALITY TRUST ANNOUNCES CEO SUCCESSION PLAN

- Verizon readies for 2024 wildfire season

- First Annual Cultural Celebration Day in Lansing, Illinois Calls For Participants

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share