Form 8-K AMICUS THERAPEUTICS INC For: Nov 06

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

�

FORM�8-K

�

CURRENT REPORT PURSUANT TO

SECTION�13 OR 15(D)�OF THE

SECURITIES EXCHANGE ACT OF 1934

�

Date of Report (Date of earliest event reported): November�6, 2014

�

AMICUS THERAPEUTICS,�INC.

(Exact Name of Registrant as Specified in Its Charter)

�

Delaware

(State or Other Jurisdiction of

Incorporation)

�

|

001-33497 |

� |

71-0869350 |

|

(Commission File Number) |

� |

(IRS Employer Identification No.) |

�

|

1 Cedar Brook Drive, Cranbury, NJ |

� |

08512 |

|

(Address of Principal Executive Offices) |

� |

(Zip Code) |

�

Registrant�s telephone number, including area code: (609) 662-2000

�

�

(Former Name or Former Address, if Changed Since Last Report.)

�

Check the appropriate box below if the Form�8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

�

o Written communications pursuant to Rule�425 under the Securities Act (17 CFR 230.425)

�

o Soliciting material pursuant to Rule�14a-12 under the Exchange Act (17 CFR 240.14a-12)

�

o Pre-commencement communications pursuant to Rule�14d-2(b)�under the Exchange Act (17 CFR 240.14d-2(b))

�

o Pre-commencement communications pursuant to Rule�13e-4(c)�under the Exchange Act (17 CFR 240.13e-4(c))

�

�

�

�

Item 2.02.� Results of Operations and Financial Condition.

�

On November�6, 2014, Amicus Therapeutics,�Inc. (the �Company�) issued a press release announcing its financial results for the third quarter ended September�30, 2014. A copy of this press release is attached hereto as Exhibit�99.1. The Company will also host a conference call and webcast on November�6, 2014 to discuss its third quarter results of operations. A copy of the conference call presentation materials is also attached hereto as Exhibit�99.2.

�

In accordance with General Instruction B.2. of Form�8-K, the information in this Current Report on Form�8-K and the Exhibit shall not be deemed �filed� for purposes of Section�18 of the Securities Exchange Act of 1934, as amended (the �Exchange Act�), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

�

Item 9.01. Financial Statements and Exhibits.

�

(d)�Exhibits:� The Exhibit�Index annexed hereto is incorporated herein by reference.

�

�

SIGNATURES

�

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

�

|

� |

Amicus Therapeutics,�Inc. | |

|

� |

� |

� |

|

� |

� |

� |

|

Date: November�6, 2014 |

By: |

/s/ William D. Baird III |

|

� |

� |

William D. Baird III |

|

� |

� |

Chief Financial Officer |

�

�

EXHIBIT�INDEX

�

|

Exhibit�No. |

� |

Description |

|

99.1 |

� |

Press Release dated November�6, 2014 |

|

99.2 |

� |

November�6, 2014 Conference Call Presentation Materials |

�

Exhibit 99.1

�

�

Amicus Therapeutics Announces Third Quarter 2014 Financial Results and Corporate Updates

�

Important New Migalastat Data on Cardiac and Other Key Secondary Endpoints for Study 012 to be Presented At American Society of Nephrology Meeting on November�15

�

Migalastat Pre-Submission Meeting with European Regulators On Track for 4Q14

�

Conference Call and Webcast Today at 5:00pm ET

�

CRANBURY, NJ, November�6, 2014 � Amicus Therapeutics (Nasdaq: FOLD), a biopharmaceutical company at the forefront of therapies for rare and orphan diseases, today announced financial results for the third quarter ended September�30, 2014. The Company also provided program updates and reiterated full-year 2014 operating expense guidance.

�

�This was another strong quarter for Amicus and built upon the momentum we saw in the first half of the year,� said John F. Crowley, Chairman and Chief Executive Officer of Amicus Therapeutics,�Inc. �We look forward to presenting additional important efficacy data for migalastat from Study 012 at the American Society of Nephrology meeting next week.� We are now poised for critical and productive discussions with regulatory agencies as we work toward the commercialization of migalastat. Additionally, our next-generation ERTs continue to make excellent progress toward the start of clinical studies. We plan to provide additional updates on these programs before year-end.�

�

Financial Highlights for Third Quarter Ended September�30, 2014

�

������������������ Cash, cash equivalents, and marketable securities totaled $85.2 million at September�30, 2014, which includes proceeds from the sale of shares under the 2014 ATM equity financing, compared to $82.0 million at December�31, 2013.

������������������ Total 3Q14 operating expenses increased to $17.1 million compared to $15.2 million for the third quarter of 2013 due to increases in research and development costs.

������������������ Net cash spend for 3Q14 was $15.2 million, compared to $13.7 million for the third quarter 2013.

������������������ Net loss was $17.1 million, or $0.22 per share, compared to a net loss of $14.6 million, or $0.29 per share, for the third quarter 2013.

�

2014 Financial Guidance

�

Amicus continues to expect full-year 2014 net cash spend of between $54 million and $59 million. The Company�s balance sheet was strengthened with a $40.0 million ATM financing in which a total of 14.3 million shares were sold at various times during the second quarter and early third quarter of 2014. Including the proceeds from this financing, the current cash position is projected to fund Amicus� current operating plan into 2016.

�

Program Updates

�

Migalastat Monotherapy for Fabry Disease

�

Amicus is developing its wholly owned pharmacological chaperone migalastat HCl (�migalastat�) monotherapy for the treatment of people with Fabry disease. As a monotherapy, migalastat is designed to bind and stabilize alpha-Gal A enzyme in patients with amenable mutations. Migalastat monotherapy is being investigated in two Phase 3 registration studies (Study 011 and Study 012) and an open-label extension study (Study 041) in Fabry patients with amenable mutations.

�

Positive Phase 3 Results from Study 011 Reported at American Society of Human Genetics (ASHG) Annual Meeting

�

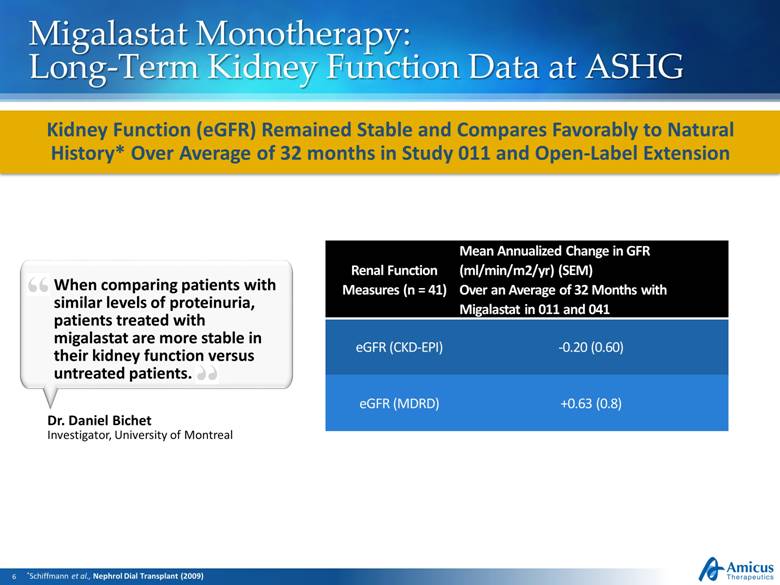

In October�2014, positive results from Study 011 and Study 041 were presented in a poster at ASHG by Daniel G. Bichet, M.D., M.Sc., Professor, Department of Physiology, University of Montreal.� Data presented showed that patients receiving migalastat for an average of 32 months showed continued stability of kidney function and compared favorably to published natural history (1) in Fabry disease. Decline in kidney function is a key cause of morbidity and mortality in patients with Fabry disease.

�

�

Positive Phase 3 Results Reported from Study 012

�

In August, Amicus reported positive 18-month data from its second Phase 3 study (Study 012) of migalastat in Fabry patients with amenable mutations. The study demonstrated comparability of migalastat to enzyme replacement therapy (ERT) on both co-primary endpoints of kidney function (estimated GFR and measured GFR).

�

Data from Study 012 will be presented at a scientific congress for the first time at the American Society of Nephrology (ASN) Kidney Week 2014 in Philadelphia on Saturday, November�15, 2014. The data will be in a poster entitled �Migalastat and Enzyme Replacement Therapy Have Comparable Effects on Renal Function in Fabry Disease: Phase 3 Study Results�. This presentation will also include important new data on cardiac and other key secondary endpoints from Study 012.

�

Based on the positive results from Study 012, Amicus expects to submit a marketing application for migalastat monotherapy in Europe, and is scheduled to meet with the European Medicines Agency in the fourth quarter of this year.� Amicus also plans to meet with the U.S. Food and Drug Administration in the first quarter of 2015 to discuss the data from both Phase 3 Fabry monotherapy studies to determine the fastest U.S. registration pathway for migalastat.

�

Next-Generation Enzyme Replacement Therapy (ERT) for Fabry Disease

�

Amicus is also developing a next-generation ERT (migalastat co-formulated with ERT) for Fabry disease. In combination with ERT, migalastat is designed to bind and stabilize the infused alpha-Gal A enzyme, independent of a patient�s genetic mutation. Amicus has reported positive data from a Phase 2 clinical study (Study 013) of migalastat co-administered with currently approved ERTs for Fabry disease, as well as positive preclinical data of migalastat co-formulated with a proprietary investigational ERT for Fabry disease (JCR Pharmaceutical Co Ltd�s JR-051).

�

Amicus has completed a successful Phase 1 study assessing the pharmacokinetics of an intravenous formulation of migalastat in healthy volunteers to identify the optimal dose for co-formulation with ERT. The Company has also completed manufacturing of drug supply of co-formulated JR-051. Amicus plans to begin a Phase 1/2 clinical study of its next generation ERT pending the outcome of ongoing business development discussions regarding potential future sources of Fabry enzyme for its product candidate. Amicus expects to provide further updates on the next-generation Fabry ERT development strategy by the end of 2014.

�

Next-Generation ERT for Pompe Disease

�

Amicus is advancing a wholly owned recombinant human acid alpha-glucosidase (rhGAA) for Pompe disease into late preclinical development. This differentiated Pompe ERT, designated ATB200, has a unique carbohydrate structure and may be further optimized through co-formulation with a pharmacological chaperone to improve enzyme stability and tolerability, and by applying the Company�s peptide tagging technology for better targeting. In preclinical studies, ATB200 has shown superior tissue uptake and activity, and superior substrate reduction, compared to current standard of care. Amicus has successfully completed scale-up activities to provide sufficient supply of ATB200 for IND-enabling toxicology studies, and the Company continues to expect to initiate a Phase 1/2 clinical study in 2015.

�

Conference Call and Webcast

�

Amicus Therapeutics will host a conference call and audio webcast today, November�6, 2014 at 5:00�p.m. ET to discuss third quarter 2014 financial results and program updates. Interested participants and investors may access the conference call at 5:00�p.m. ET by dialing 877-303-5859 (U.S./Canada) or 678-224-7784 (international).

�

An audio webcast can also be accessed via the Investors section of the Amicus Therapeutics corporate web site at http://www.amicusrx.com, and will be archived for 30 days. Web participants are encouraged to go to the web site 15 minutes prior to the start of the call to register, download and install any necessary software. A telephonic replay of the call will be available for seven days beginning at 8:00�p.m. ET today. Access numbers for this replay are 855-859-2056 (U.S./Canada) and 404-537-3406 (international); participant code 17044123.

�

About Amicus Therapeutics

�

Amicus Therapeutics (Nasdaq: FOLD) is a biopharmaceutical company at the forefront of therapies for rare and orphan diseases. The Company is developing novel, first-in-class treatments for a broad range of human genetic diseases, with a focus on delivering new benefits to individuals with lysosomal storage diseases. Amicus� lead programs in development include the small molecule pharmacological chaperone migalastat as a monotherapy for Fabry disease, as well as next-generation enzyme replacement therapy (ERT) products for Fabry disease, Pompe disease, and MPS I.

�

About Chaperone-Advanced Replacement Therapy (CHART)

�

The Chaperone-Advanced Replacement Therapy (CHART�) platform combines unique pharmacological chaperones with enzyme replacement therapies (ERTs) for lysosomal storage diseases (LSDs). In a chaperone-advanced

�

�

replacement therapy, a unique pharmacological chaperone is designed to bind to and stabilize a specific therapeutic enzyme in its properly folded and active form. This proposed CHART mechanism may allow for enhanced tissue uptake of active enzyme, greater lysosomal activity, more reduction of substrate, and lower immunogenicity compared to ERT alone. Improvements in enzyme stability may also enable more convenient delivery of next-generation therapies. Amicus is leveraging the CHART platform to develop proprietary next-generation therapies that consist of lysosomal enzymes co-formulated with pharmacological chaperones.

�

(1)�Schiffman et al., Nephrol Dial Transplant (2009)

�

Forward-Looking Statements

�

This press release contains, and the accompanying conference call will contain, �forward-looking statements� within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of Amicus� candidate drug products, the timing and reporting of results from preclinical studies and clinical trials evaluating Amicus� candidate drug products, and the projected cash position for the Company. Words such as, but not limited to, �look forward to,� �believe,� �expect,� �anticipate,� �estimate,� �intend,� �potential,� �plan,� �targets,� �likely,� �may,� �will,� �would,� �should� and �could,� and similar expressions or words identify forward-looking statements. Such forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions and uncertainties. The inclusion of forward-looking statements should not be regarded as a representation by Amicus that any of its plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong. They can be affected by inaccurate assumptions Amicus might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing and outcomes of discussions with regulatory authorities and the potential goals, progress, timing and results of preclinical studies and clinical trials, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in the business of Amicus, including, without limitation: the potential that results of clinical or pre-clinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities may not grant or may delay approval for our product candidates; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we will need additional funding to complete all of our studies and, our dependence on third parties in the conduct of our clinical studies. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. With respect to statements regarding projections of the Company�s cash position, actual results may differ based on market factors and the Company�s ability to execute its operational and budget plans. In addition, all forward looking statements are subject to other risks detailed in our Annual Report on Form�10-K for the year ended December�31, 2013. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and Amicus undertakes no obligation to revise or update this news release to reflect events or circumstances after the date hereof. This caution is made under the safe harbor provisions of Section�21E of the Private Securities Litigation Reform Act of 1995.

�

CONTACTS:

�

Investors:

Amicus Therapeutics

Sara Pellegrino

Director,�Investor Relations

(609) 662-5044

�

Media:

Pure Communications

Dan Budwick

(973) 271-6085

�

�

Table 1

Amicus Therapeutics,�Inc.

Consolidated Statements of Operations

(Unaudited)

(In thousands, except share and per share amounts)

�

|

� |

� |

Three�Months |

� |

Nine�Months |

� | ||||||||

|

� |

� |

Ended�September�30, |

� |

Ended�September�30, |

� | ||||||||

|

� |

� |

2013 |

� |

2014 |

� |

2013 |

� |

2014 |

� | ||||

|

Revenue: |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Research revenue |

� |

$ |

39 |

� |

$ |

293 |

� |

$ |

39 |

� |

$ |

1,224 |

� |

|

Total revenue |

� |

$ |

39 |

� |

$ |

293 |

� |

$ |

39 |

� |

$ |

1,224 |

� |

|

� |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Operating Expenses: |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Research and development |

� |

$ |

10,110 |

� |

$ |

12,049 |

� |

$ |

32,824 |

� |

$ |

32,019 |

� |

|

General and administrative |

� |

4,635 |

� |

5,270 |

� |

14,288 |

� |

15,199 |

� | ||||

|

Changes in fair value of contingent consideration payable |

� |

� |

� |

(600 |

) |

� |

� |

(400 |

) | ||||

|

Restructuring charges |

� |

� |

� |

15 |

� |

� |

� |

(74 |

) | ||||

|

Depreciation and amortization |

� |

429 |

� |

375 |

� |

1,318 |

� |

1,183 |

� | ||||

|

Total operating expenses |

� |

15,174 |

� |

17,109 |

� |

48,430 |

� |

47,927 |

� | ||||

|

Loss from operations |

� |

(15,135 |

) |

(16,816 |

) |

(48,391 |

) |

(46,703 |

) | ||||

|

Other income (expenses): |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Interest income |

� |

36 |

� |

55 |

� |

147 |

� |

133 |

� | ||||

|

Interest expense |

� |

(7 |

) |

(377 |

) |

(26 |

) |

(1,106 |

) | ||||

|

Change in fair value of warrant liability |

� |

517 |

� |

� |

� |

874 |

� |

� |

� | ||||

|

Other expense |

� |

� |

� |

(11 |

) |

� |

� |

(30 |

) | ||||

|

� |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Net loss |

� |

$ |

(14,589 |

) |

$ |

(17,149 |

) |

$ |

(47,396 |

) |

$ |

(47,706 |

) |

|

� |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Net loss per common share � basic and diluted |

� |

$ |

(0.29 |

) |

$ |

(0.22 |

) |

$ |

(0.96 |

) |

$ |

(0.68 |

) |

|

� |

� |

� |

� |

� |

� |

� |

� |

� |

� | ||||

|

Weighted-average common shares outstanding � basic and diluted |

� |

49,621,188 |

� |

78,889,346 |

� |

49,621,188 |

� |

70,216,251 |

� | ||||

�

�

Table 2

Amicus Therapeutics,�Inc.

Consolidated Balance Sheets

(Unaudited)

(in thousands, except share and per share amounts)

�

|

� |

� |

December�31, |

� |

September�30, |

� | ||

|

� |

� |

2013 |

� |

2014 |

� | ||

|

Assets: |

� |

� |

� |

� |

� | ||

|

Current assets: |

� |

� |

� |

� |

� | ||

|

Cash and cash equivalents |

� |

$ |

43,640 |

� |

$ |

19,671 |

� |

|

Investments in marketable securities |

� |

38,360 |

� |

65,511 |

� | ||

|

Receivable due from collaboration agreements |

� |

1,083 |

� |

293 |

� | ||

|

Prepaid expenses and other current assets |

� |

5,195 |

� |

1,762 |

� | ||

|

Total current assets |

� |

88,278 |

� |

87,237 |

� | ||

|

� |

� |

� |

� |

� |

� | ||

|

Property and equipment, less accumulated depreciation and amortization of $9,973 and $11,157 at December�31, 2013 and September�30, 2014, respectively |

� |

4,120 |

� |

3,129 |

� | ||

|

In-process research�& development |

� |

23,000 |

� |

23,000 |

� | ||

|

Goodwill |

� |

11,613 |

� |

11,613 |

� | ||

|

Other non-current assets |

� |

552 |

� |

508 |

� | ||

|

Total Assets |

� |

$ |

127,563 |

� |

$ |

125,487 |

� |

|

� |

� |

� |

� |

� |

� | ||

|

Liabilities and Stockholders� Equity |

� |

� |

� |

� |

� | ||

|

Current liabilities: |

� |

� |

� |

� |

� | ||

|

Accounts payable and accrued expenses |

� |

$ |

10,162 |

� |

$ |

11,331 |

� |

|

Current portion of secured loan |

� |

299 |

� |

2,493 |

� | ||

|

Total current liabilities |

� |

10,461 |

� |

13,824 |

� | ||

|

� |

� |

� |

� |

� |

� | ||

|

Deferred reimbursements |

� |

36,677 |

� |

36,677 |

� | ||

|

Secured loan, less current portion |

� |

14,174 |

� |

11,809 |

� | ||

|

Contingent consideration payable |

� |

10,600 |

� |

10,200 |

� | ||

|

Deferred tax liability |

� |

9,186 |

� |

9,186 |

� | ||

|

Other non-current liability |

� |

714 |

� |

514 |

� | ||

|

� |

� |

� |

� |

� |

� | ||

|

Commitments and contingencies |

� |

� |

� |

� |

� | ||

|

� |

� |

� |

� |

� |

� | ||

|

Stockholders� equity: |

� |

� |

� |

� |

� | ||

|

Common stock, $.01 par value, 125,000,000 shares authorized, 61,975,416 shares issued and outstanding at December�31, 2013, 125,000,000 shares authorized, 79,257,588 shares issued and outstanding at September�30, 2014 |

� |

679 |

� |

853 |

� | ||

|

Additional paid-in capital |

� |

423,593 |

� |

468,650 |

� | ||

|

Accumulated other comprehensive income |

� |

1 |

� |

2 |

� | ||

|

Accumulated deficit |

� |

(378,522 |

) |

(426,228 |

) | ||

|

Total stockholders� equity |

� |

45,751 |

� |

43,277 |

� | ||

|

Total Liabilities and Stockholders� Equity |

� |

$ |

127,563 |

� |

$ |

125,487 |

� |

�

FOLD�G

�

Exhibit 99.2

�

|

|

3Q14 Financial Results Conference Call & Webcast November 6, 2014 |

�

|

|

Safe Harbor This presentation contains �forward-looking statements� within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations and financial conditions of Amicus including but not limited to preclinical and clinical development of Amicus� candidate drug products, cash runway, ongoing collaborations and the timing and reporting of results from clinical trials evaluating Amicus� candidate drug products. Words such as, but not limited to, �look forward to,� �believe,� �expect,� �anticipate,� �estimate,� �intend,� �plan,� �would,� �should� and �could,� and similar expressions or words, identify forward-looking statements. Although Amicus believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in Amicus� forward-looking statements due to numerous known and unknown risks and uncertainties, including the �Risk Factors� described in our Annual Report on Form 10-K for the year ended December 31, 2013. All forward-looking statements are qualified in their entirety by this cautionary statement, and Amicus undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. |

�

|

|

3Q14 Investment Highlights Strength of Clinical Programs and Breadth of Technology Platforms With Potential to Create Significant Value for Shareholders and Patients Living with LSDs First oral therapy for Fabry patients with amenable mutations Two positive Phase 3 studies WW rights EMA pre-submission meeting 4Q14 Advancing 3 next-gen ERTs into clinic in next 3 years Fabry Pompe MPS I Addressing common limitations of ERTs CHARTTM Optimized carbohydrates vIGF2 tagging |

�

|

|

Migalastat Monotherapy: Global Registration Studies Assembling Robust Dataset to Maximize Chances for Global Approvals of Migalastat Monotherapy for Fabry Patients with Amenable Mutations Study 011 (FACETS) Study 012 (ATTRACT) 67 patients na�ve to ERT Placebo-controlled (6 months) Primary endpoint: reduction in substrate (kidney GL-3) at 6 and 12 months Secondary endpoint: kidney function (eGFR and mGFR) and 12- and 24-months 60 ERT experienced patients Switch study � 36 patients switched to migalastat, 24 remained on ERT Primary endpoint: comparability to ERT based on eGFR and mGFR over 18 months |

�

|

|

Migalastat Monotherapy: Additional GL-3 Data at ASHG Additional GL-3 Data Further Validate GLP HEK Assay for Identifying Patients with Amenable Mutations Kidney Interstitial Capillary GL-3 In Study 011* *All patients with evaluable paired biopsies. Combines change from baseline to month 6 for Migalastat > Migalastat arm with change from month 6 to month 12 for Placebo > Migalastat arm. Results presented based on GLA mutation classification in GLP-validated HEK assay. |

�

|

|

�Migalastat Monotherapy: Long-Term Kidney Function Data at ASHG Kidney Function (eGFR) Remained Stable and Compares Favorably to Natural History* Over Average of 32 months in Study 011 and Open-Label Extension Mean Annualized Change in GFR Renal Function (ml/min/m2/yr) (SEM) When comparing patients with Measures (n = 41) Over an Average of 32 Months with similar levels of proteinuria, Migalastat in 011 and 041 patients treated with migalastat are more stable in eGFR (CKD-EPI) -0.20 (0.60) their kidney function versus untreated patients. eGFR (MDRD) +0.63 (0.8) Dr. Daniel Bichet Investigator, University of Montreal 5 *Schiffmann et al., Nephrol Dial Transplant (2009) |

�

|

|

Migalastat Monotherapy: Upcoming Study 012 Results at ASN Poster Title: Migalastat and Enzyme Replacement Therapy Have Comparable Effects on Renal Function in Fabry Disease: Phase 3 Study Results Date: Saturday, November 15, 2014 Time: 10:00 a.m. � 12:00 p.m. ET Location: Main Exhibit Hall A-C Poster Board Number: SA-PO1098 Collaborator: Kathleen M. Nicholls Important New Data on Cardiac and Other Key Secondary Endpoints to be Presented at American Society of Nephrology (ASN) in Philadelphia |

�

|

|

Migalastat Monotherapy Experience for Fabry Information as of August 2014. All patients are receiving investigational drug, migalastat HCl, as part of ongoing clinical trials *Retention defined as # of patients who completed a study and chose to enter extension, e.g., Study 011 12-mo into 24-mo extension Total patients who have ever taken migalastat: 143 Total patient years of therapy: (no drug-related SAEs) 377 Maximum years on therapy: 8.6 Average retention rate into next study: 96% * Patients taking migalastat today as only therapy: 97 97 Patients Today Take Migalastat HCl as Only Therapy for Fabry Disease1 |

�

|

|

Global Regulatory Strategy Totality of clinical data 8+ years of data in extension studies Complete data set from Phase 3 studies (011 and 012) Centralized Procedure underway EMA Pre-Submission Meeting on track for 4Q14 Clear regulatory pathway Non-inferiority to ERT (Study 012) Pursuing Fastest Path to Approval for Migalastat |

�

|

|

Next-Generation ERT for Pompe Disease |

�

|

|

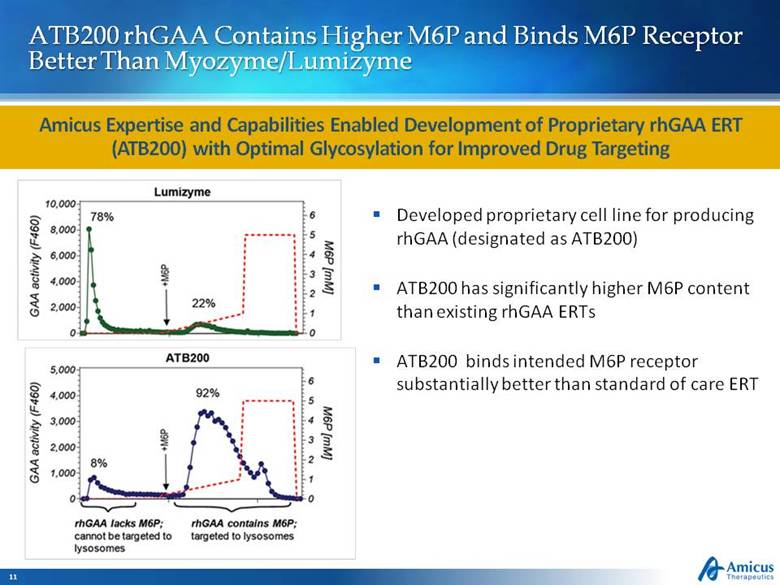

ATB200 rhGAA Contains Higher M6P and Binds M6P Receptor Better Than Myozyme/Lumizyme Amicus Expertise and Capabilities Enabled Development of Proprietary rhGAA ERT (ATB200) with Optimal Glycosylation for Improved Drug Targeting Developed proprietary cell line for producing rhGAA (designated as ATB200) ATB200 has significantly higher M6P content than existing rhGAA ERTs ATB200 binds intended M6P receptor substantially better than standard of care ERT |

�

|

|

ATB200: Next-Generation Pompe ERT (rhGAA) Updated Preclinical Proof-of-Concept Residual Muscle Glycogen After ERT ATB200 Led to Further Glycogen Reduction Compared to Lumizyme in Preclinical Studies in Gaa Knock-Out Mice Quadriceps Triceps ATB200 (20 mg/kg) ATB200 (10 mg/kg) ATB200 (20 mg/kg) + Chaperone ATB200 (20 mg/kg) ATB200 (10 mg/kg) ATB200 (20 mg/kg) + Chaperone Glycogen (ug/mg protein) Vehicle Lumizyme (20 mg/kg) 300 200 100 0 400 Vehicle Lumizyme (20 mg/kg) Glycogen (ug/mg protein) 300 200 100 0 400 500 |

�

|

|

3-in-3 Strategy: Pathway to Clinic Milestones Fabry Next-Generation ERT 1H14 Phase 1 study initiation of IV migalastat in healthy volunteers 4Q14 Update on Fabry next-generation ERT development strategy Executing Strategy to Advance 3 Next-Generation ERTs into Clinic in Next 3 Years with Lead Programs in Fabry, Pompe and MPS I Milestones Pompe Next-Generation ERT 1Q14 Initial preclinical proof-of-concept presented at LDN WORLD Ongoing Longer-term preclinical proof-of-concept studies to optimize product for clinic with better tissue uptake and enzyme stability 3Q14 Manufacturing scale-up activities 4Q14 Positive EU regulatory interactions 2H14 Selection of final drug candidate and begin IND-enabling studies |

�

|

|

3Q14 Financial Summary Financial Position Sept. 30, 2014 Current Cash: $85.2M 2014 net cash spend: $54-59M Cash runway: Into 2016 Capitalization Shares outstanding: 79,257,588 Cash Position Provides Runway Under Current Operating Plan Into 2016 |

�

|

|

3Q14 Financial Results Slide 15 ($000s) Sept. 30, 2014 Sept. 30, 2013 Total Revenue 293 39 Total Operating Expenses 17,109 15,174 Net Loss (17,149) (14,589) Net Loss Per Share (0.22) (0.29) |

�

|

|

Questions & Answers |

�

|

|

3Q14 Financial Results Conference Call & Webcast November 6, 2014 |

�

�

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Helo Corp Announces Annual 2023 Results

- FLYHT Reports Fourth Quarter and Full Year 2023 Results

- Net Income of R$ 55.3 mm in 1Q24, a 90.1% Increase YOY and Leases EBITDA Margin of 72.1%

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share