Form 8-K AMERIGAS PARTNERS LP For: Aug 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2015

AmeriGas Partners, L.P.

(Exact name of registrant as specified in its charter)

Delaware | 1-13692 | 23-2787918 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

460 No. Gulph Road, King of Prussia, Pennsylvania | 19406 | |||

(Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: 610 337-7000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2015, AmeriGas Propane, Inc., the general partner of AmeriGas Partners, L.P. (the “Partnership”), issued a press release announcing financial results for the Partnership for the fiscal quarter ended June 30, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On August 4, 2015, the Partnership will hold a live Internet Audio Webcast of its conference call to discuss its financial results for the fiscal quarter ended June 30, 2015.

Presentation materials containing certain historical and forward-looking information relating to the Partnership (the “Presentation Materials”) have been made available on the Partnership’s website. A copy of the Presentation Materials is furnished as Exhibit 99.2 to this report and is incorporated herein by reference in this Item 7.01. All information in Exhibit 99.2 is presented as of the particular dates referenced therein, and the Partnership does not undertake any obligation to, and disclaims any duty to, update any of the information provided.

In accordance with General Instruction B.2 of Form 8-K, the information in this report, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in that filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being furnished herewith:

99.1 | Press Release of AmeriGas Partners, L.P. dated August 3, 2015. |

99.2 | Presentation of AmeriGas Partners, L.P. dated August 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AmeriGas Partners, L.P. | |||

August 4, 2015 | By: | /s/ Daniel J. Platt | |

Name: Daniel J. Platt | |||

Title: Treasurer of AmeriGas Propane, Inc., the general partner of AmeriGas Partners, L.P. | |||

EXHIBIT INDEX

The Following Exhibits Are Furnished:

EXHIBIT NO. | DESCRIPTION |

99.1 | Press Release of AmeriGas Partners, L.P. dated August 3, 2015. |

99.2 | Presentation of AmeriGas Partners, L.P. dated August 4, 2015. |

Exhibit 99.1

Contact: | 610-337-7000 | For Immediate Release: | |||||

William Ruthrauff, ext. 6571 | August 3, 2015 | ||||||

Shelly Oates, ext. 3202 | |||||||

AmeriGas Partners Reports Third Quarter Earnings

VALLEY FORGE, Pa., August 3 - AmeriGas Propane, Inc., general partner of AmeriGas Partners, L.P. (NYSE: APU), reported an adjusted seasonal net loss of $40.2 million for the quarter ended June 30, 2015, compared with an adjusted seasonal net loss of $35.0 million for the quarter ended June 30, 2014. Adjusted net income attributable to AmeriGas Partners eliminates the impact of mark-to-market changes in commodity derivative instruments not associated with current period transactions. Most of the mark-to-market adjustments relate to our normal business practice of hedging fixed-price commitments to our customers. On a GAAP basis, including the impact of such mark-to-market changes, AmeriGas Partners reported a seasonal net loss of $25.6 million for the fiscal quarter ended June 30, 2015.

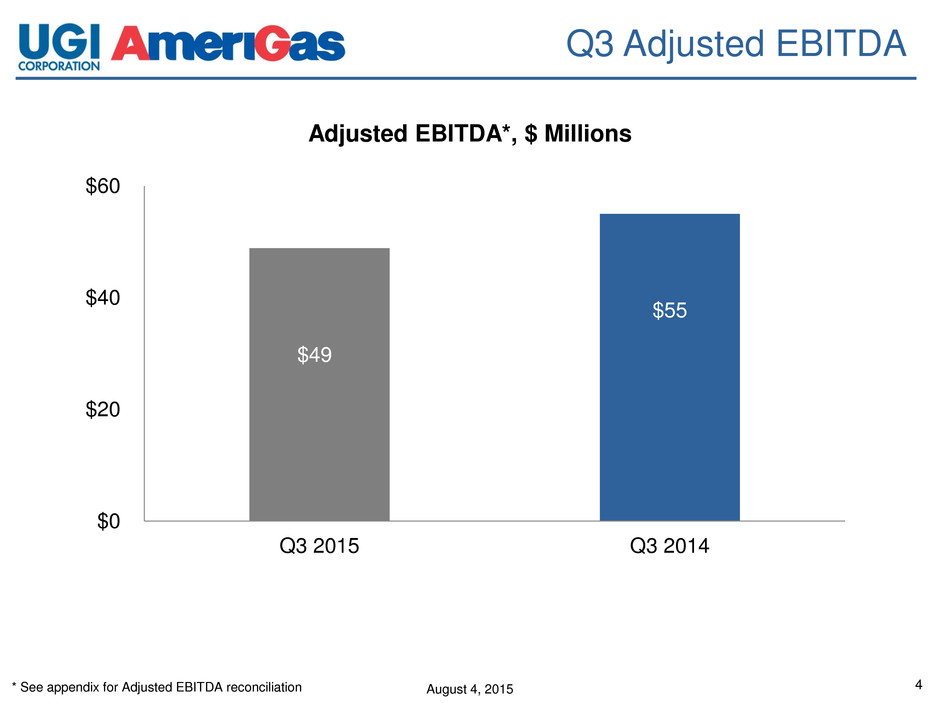

The Partnership’s adjusted earnings before interest expense, income taxes, depreciation and amortization (Adjusted EBITDA) was $48.9 million for the third quarter of fiscal 2015 compared with $55.0 million in the prior year. Retail volumes sold for the third quarter decreased 6.2% to 202.2 million gallons from 215.6 million gallons in the prior year. The decrease in retail gallons sold reflects temperatures that were 10.2% warmer than the prior year and 18.5% warmer than normal according to the National Oceanic and Atmospheric Administration (NOAA).

Jerry E. Sheridan, president and chief executive officer of AmeriGas, said, “Warmer spring weather led to an early end to the heating season for the first time in three years. In addition, the wet weather experienced later in the quarter had a negative impact on our barbeque cylinder exchange business. We were pleased to deliver nearly $50 million in Adjusted EBITDA during the quarter in spite of these weather challenges, as we remained focused on operational execution and cost management. We also continued to benefit, along with our customers, from lower commodity costs that continued to decline this quarter and were approximately 55% lower than the same period last year.”

Sheridan continued, “Given the challenge of the weather this quarter and our assessment of operating conditions for the remainder of the year, we now expect Adjusted EBITDA of $635 million to $645 million for the fiscal year ending September 30, 2015.”

-MORE-

AmeriGas Partners Reports Third Quarter Earnings | Page 2 |

About AmeriGas

AmeriGas is the nation’s largest retail propane marketer, serving approximately two million customers in all 50 states from over 2,000 distribution locations. UGI Corporation, through subsidiaries, is the sole General Partner and owns 26% of the Partnership and the public owns the remaining 74%.

AmeriGas Partners, L.P. will hold a live Internet Audio Webcast of its conference call to discuss third quarter fiscal 2015 earnings and other current activities at 9:00 AM EDT on Tuesday, August 4, 2015. Interested parties may listen to the audio webcast both live and in replay on the Internet at http://investors.amerigas.com/investor-relations/events-presentations or at the company website http://www.amerigas.com under Investor Relations. A telephonic replay will be available from 12:00 PM EDT on August 4 through 11:59 PM EDT on August 10. The replay may be accessed at (855) 859-2056, and internationally at 1-404-537-3406, conference ID 62313636.

Comprehensive information about AmeriGas is available on the Internet at http://www.amerigas.com

This press release contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read the Partnership’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of propane, increased customer conservation measures, the capacity to transport propane to our market areas, the impact of pending and future legal proceedings, political, economic and regulatory conditions in the U.S. and abroad, and our ability to successfully integrate acquisitions and achieve anticipated synergies. The Partnership undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today.

AP-05 | ### | 8/3/15 | ||

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

Three Months Ended June 30, | Nine Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

Revenues: | ||||||||||||||||||||||||

Propane | $ | 414,146 | $ | 549,976 | $ | 2,254,961 | $ | 2,941,701 | $ | 2,754,128 | $ | 3,412,665 | ||||||||||||

Other | 63,831 | 63,261 | 212,125 | 210,985 | 273,207 | 271,991 | ||||||||||||||||||

477,977 | 613,237 | 2,467,086 | 3,152,686 | 3,027,335 | 3,684,656 | |||||||||||||||||||

Costs and expenses: | ||||||||||||||||||||||||

Cost of sales - propane | 172,803 | 320,839 | 1,163,089 | 1,750,500 | 1,447,181 | 2,015,346 | ||||||||||||||||||

Cost of sales - other | 23,745 | 22,822 | 64,607 | 61,336 | 85,253 | 86,355 | ||||||||||||||||||

Operating and administrative expenses | 223,306 | 225,141 | 727,303 | 744,007 | 947,259 | 954,668 | ||||||||||||||||||

Depreciation | 37,370 | 37,069 | 113,454 | 116,925 | 150,549 | 158,563 | ||||||||||||||||||

Amortization | 10,666 | 10,788 | 32,065 | 32,411 | 42,849 | 43,151 | ||||||||||||||||||

Other operating income, net | (5,548 | ) | (7,848 | ) | (23,088 | ) | (21,534 | ) | (29,004 | ) | (30,652 | ) | ||||||||||||

462,342 | 608,811 | 2,077,430 | 2,683,645 | 2,644,087 | 3,227,431 | |||||||||||||||||||

Operating income | 15,635 | 4,426 | 389,656 | 469,041 | 383,248 | 457,225 | ||||||||||||||||||

Interest expense | (40,274 | ) | (41,328 | ) | (122,404 | ) | (124,964 | ) | (163,021 | ) | (166,177 | ) | ||||||||||||

(Loss) income before income taxes | (24,639 | ) | (36,902 | ) | 267,252 | 344,077 | 220,227 | 291,048 | ||||||||||||||||

Income tax expense | (802 | ) | (847 | ) | (2,478 | ) | (2,204 | ) | (2,885 | ) | (3,359 | ) | ||||||||||||

Net (loss) income | (25,441 | ) | (37,749 | ) | 264,774 | 341,873 | 217,342 | 287,689 | ||||||||||||||||

Deduct net income attributable to noncontrolling interest | (137 | ) | (12 | ) | (3,868 | ) | (4,633 | ) | (3,783 | ) | (4,505 | ) | ||||||||||||

Net (loss) income attributable to AmeriGas Partners, L.P. | $ | (25,578 | ) | $ | (37,761 | ) | $ | 260,906 | $ | 337,240 | $ | 213,559 | $ | 283,184 | ||||||||||

General partner’s interest in net (loss) income attributable to AmeriGas Partners, L.P. | $ | 8,389 | $ | 6,155 | $ | 24,321 | $ | 20,689 | $ | 30,380 | $ | 25,540 | ||||||||||||

Limited partners’ interest in net (loss) income attributable to AmeriGas Partners, L.P. | $ | (33,967 | ) | $ | (43,916 | ) | $ | 236,585 | $ | 316,551 | $ | 183,179 | $ | 257,644 | ||||||||||

Income (loss) per limited partner unit (a) | ||||||||||||||||||||||||

Basic | $ | (0.37 | ) | $ | (0.47 | ) | $ | 2.53 | $ | 3.04 | $ | 1.97 | $ | 2.76 | ||||||||||

Diluted | $ | (0.37 | ) | $ | (0.47 | ) | $ | 2.53 | $ | 3.04 | $ | 1.96 | $ | 2.76 | ||||||||||

Average limited partner units outstanding: | ||||||||||||||||||||||||

Basic | 92,918 | 92,888 | 92,908 | 92,873 | 92,904 | 92,865 | ||||||||||||||||||

Diluted | 92,918 | 92,888 | 92,972 | 92,941 | 92,970 | 92,939 | ||||||||||||||||||

SUPPLEMENTAL INFORMATION: | ||||||||||||||||||||||||

Retail gallons sold (millions) | 202.2 | 215.6 | 990.4 | 1,064.6 | 1,201.4 | 1,270.0 | ||||||||||||||||||

Wholesale gallons sold (millions) | 11.3 | 10.1 | 42.1 | 82.9 | 52.6 | 102.8 | ||||||||||||||||||

Total margin (b) | $ | 281,429 | $ | 269,576 | $ | 1,239,390 | $ | 1,340,850 | $ | 1,494,901 | $ | 1,582,955 | ||||||||||||

Adjusted total margin (c) | $ | 266,616 | $ | 272,357 | $ | 1,288,068 | $ | 1,343,631 | $ | 1,550,293 | $ | 1,585,736 | ||||||||||||

EBITDA (c) | $ | 63,534 | $ | 52,271 | $ | 531,307 | $ | 613,744 | $ | 572,863 | $ | 654,434 | ||||||||||||

Adjusted EBITDA (c) | $ | 48,871 | $ | 55,024 | $ | 579,493 | $ | 616,497 | $ | 627,695 | $ | 662,980 | ||||||||||||

Adjusted net (loss) income attributable to AmeriGas Partners, L.P. (c) | $ | (40,241 | ) | $ | (35,008 | ) | $ | 309,092 | $ | 339,993 | $ | 268,391 | $ | 285,937 | ||||||||||

Expenditures for property, plant and equipment: | ||||||||||||||||||||||||

Maintenance capital expenditures | $ | 11,803 | $ | 16,581 | $ | 43,577 | $ | 46,972 | $ | 66,892 | $ | 64,467 | ||||||||||||

Transition capital related to Heritage integration | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 4,645 | ||||||||||||

Growth capital expenditures | $ | 8,838 | $ | 12,702 | $ | 34,281 | $ | 33,320 | $ | 44,608 | $ | 41,502 | ||||||||||||

(a) | Income (loss) per limited partner unit is computed in accordance with accounting guidance regarding the application of the two-class method for determining earnings per share as it relates to master limited partnerships. Refer to Note 2 to the consolidated financial statements included in the AmeriGas Partners, L.P. Annual Report on Form 10-K for the fiscal year ended September 30, 2014. |

(b) | Total margin represents total revenues less cost of sales — propane and cost of sales — other. |

(c) | The Partnership’s management uses certain non-GAAP financial measures, including adjusted total margin, EBITDA, adjusted EBITDA |

(continued)

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

(continued)

and adjusted net income attributable to AmeriGas Partners, L.P., when evaluating the Partnership’s overall performance. These financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures.

Management believes earnings before interest, income taxes, depreciation and amortization (“EBITDA”), as adjusted for the effects of gains and losses on commodity derivative instruments not associated with current-period transactions and other gains and losses that competitors do not necessarily have ("Adjusted EBITDA"), is a meaningful non-GAAP financial measure used by investors to(1) compare the Partnership’s operating performance with that of other companies within the propane industry and (2) assess the Partnership’s ability to meet loan covenants. The Partnership’s definition of Adjusted EBITDA may be different from those used by other companies. Management uses Adjusted EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes, the effects of gains and losses on commodity derivative instruments not associated with current-period transactions or historical cost basis. In view of the omission of interest, income taxes, depreciation and amortization, gains and losses on commodity derivative instruments not associated with current-period transactions and other gains and losses that competitors do not necessarily have from Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses Adjusted EBITDA to assess the Partnership’s profitability because its parent, UGI Corporation, uses the Partnership’s EBITDA, as adjusted to exclude gains and losses on commodity derivative instruments not associated with current-period transactions, to assess the profitability of the Partnership which is one of UGI Corporation’s industry segments. UGI Corporation discloses the Partnership’s EBITDA, as so adjusted, in its disclosure about industry segments as the profitability measure for its domestic propane segment.

Management believes the presentation of other non-GAAP financial measures, comprised of adjusted total margin and adjusted net income (loss) attributable to AmeriGas Partners, L.P., provide useful information to investors to more effectively evaluate the period-over-period results of operations of the Partnership. Management uses these non-GAAP financial measures because they eliminate the impact of (1) gains and losses on commodity derivative instruments that are not associated with current-period transactions and (2) other gains and losses that competitors do not necessarily have to provide insight into the comparison of period-over-period profitability to that of other master limited partnerships.

The following tables include reconciliations of adjusted total margin, EBITDA, adjusted EBITDA and adjusted net income attributable to AmeriGas Partners, L.P. to the most directly comparable financial measure calculated and presented in accordance with GAAP for all the periods presented:

(continued)

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

(continued)

Three Months Ended June 30, | Nine Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

Adjusted total margin: | ||||||||||||||||||||||||

Total revenues | $ | 477,977 | $ | 613,237 | $ | 2,467,086 | $ | 3,152,686 | $ | 3,027,335 | $ | 3,684,656 | ||||||||||||

Cost of sales - propane | (172,803 | ) | (320,839 | ) | (1,163,089 | ) | (1,750,500 | ) | (1,447,181 | ) | (2,015,346 | ) | ||||||||||||

Cost of sales - other | (23,745 | ) | (22,822 | ) | (64,607 | ) | (61,336 | ) | (85,253 | ) | (86,355 | ) | ||||||||||||

Total margin | 281,429 | 269,576 | 1,239,390 | 1,340,850 | 1,494,901 | 1,582,955 | ||||||||||||||||||

(Subtract net gains) add net losses on commodity derivative instruments not associated with current-period transactions | (14,813 | ) | 2,781 | 48,678 | 2,781 | 55,392 | 2,781 | |||||||||||||||||

Adjusted total margin | $ | 266,616 | $ | 272,357 | $ | 1,288,068 | $ | 1,343,631 | $ | 1,550,293 | $ | 1,585,736 | ||||||||||||

Adjusted net income (loss) attributable to AmeriGas Partners, L.P.: | ||||||||||||||||||||||||

Net (loss) income attributable to AmeriGas Partners, L.P. | $ | (25,578 | ) | $ | (37,761 | ) | $ | 260,906 | $ | 337,240 | $ | 213,559 | $ | 283,184 | ||||||||||

(Subtract net gains) add net losses on commodity derivative instruments not associated with current-period transactions | (14,813 | ) | 2,781 | 48,678 | 2,781 | 55,392 | 2,781 | |||||||||||||||||

Noncontrolling interest in net gains (losses) on commodity derivative instruments not associated with current-period transactions | 150 | (28 | ) | (492 | ) | (28 | ) | (560 | ) | (28 | ) | |||||||||||||

Adjusted net (loss) income attributable to AmeriGas Partners, L.P. | $ | (40,241 | ) | $ | (35,008 | ) | $ | 309,092 | $ | 339,993 | $ | 268,391 | $ | 285,937 | ||||||||||

Three Months Ended June 30, | Nine Months Ended June 30, | Twelve Months Ended June 30, | ||||||||||||||||||||||

2015 | 2014 | 2015 | 2014 | 2015 | 2014 | |||||||||||||||||||

EBITDA and Adjusted EBITDA: | ||||||||||||||||||||||||

Net (loss) income attributable to AmeriGas Partners, L.P. | $ | (25,578 | ) | $ | (37,761 | ) | $ | 260,906 | $ | 337,240 | $ | 213,559 | $ | 283,184 | ||||||||||

Income tax expense | 802 | 847 | 2,478 | 2,204 | 2,885 | 3,359 | ||||||||||||||||||

Interest expense | 40,274 | 41,328 | 122,404 | 124,964 | 163,021 | 166,177 | ||||||||||||||||||

Depreciation | 37,370 | 37,069 | 113,454 | 116,925 | 150,549 | 158,563 | ||||||||||||||||||

Amortization | 10,666 | 10,788 | 32,065 | 32,411 | 42,849 | 43,151 | ||||||||||||||||||

EBITDA | 63,534 | 52,271 | 531,307 | 613,744 | 572,863 | 654,434 | ||||||||||||||||||

Heritage Propane acquisition and transition expenses | — | — | — | — | — | 5,793 | ||||||||||||||||||

(Subtract net gains) add net losses on commodity derivative instruments not associated with current-period transactions | (14,813 | ) | 2,781 | 48,678 | 2,781 | 55,392 | 2,781 | |||||||||||||||||

Noncontrolling interest in net gains (losses) on commodity derivative instruments not associated with current-period transactions | 150 | (28 | ) | (492 | ) | (28 | ) | (560 | ) | (28 | ) | |||||||||||||

Adjusted EBITDA | $ | 48,871 | $ | 55,024 | $ | 579,493 | $ | 616,497 | $ | 627,695 | $ | 662,980 | ||||||||||||

(continued)

AMERIGAS PARTNERS, L.P. AND SUBSIDIARIES

REPORT OF EARNINGS

(Thousands, except per unit and where otherwise indicated)

(Unaudited)

(continued)

The following table includes a reconciliation of forecasted net income attributable to AmeriGas Partners, L.P. to forecasted Adjusted EBITDA for the fiscal year ending September 30, 2015:

Forecast Fiscal Year Ending September 30, 2015 | |||

Adjusted net income attributable to AmeriGas Partners, L.P. (estimate) (d) | $ | 280,000 | |

Interest expense (estimate) | 163,000 | ||

Income tax expense (estimate) | 4,000 | ||

Depreciation (estimate) | 151,000 | ||

Amortization (estimate) | 42,000 | ||

Adjusted EBITDA (e) | $ | 640,000 | |

(d) | Represents estimated net income attributable to AmeriGas Partners, L.P. after adjusting for gains and losses on commodity derivative instruments not associated with current-period transactions. It is impracticable to determine actual gains and losses on commodity derivative instruments not associated with current-period transactions that will be reported in GAAP net income as such gains and losses will depend upon future changes in commodity prices for propane which cannot be forecasted. |

(e) | Represents the midpoint of Adjusted EBITDA guidance range for fiscal 2015. |

August 4, 2015 2015 Q3 Earnings Conference Call August 4, 2015

August 4, 2015 2 About This Presentation This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read AmeriGas’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of propane, increased customer conservation measures, the impact of pending and future legal proceedings, political, regulatory and economic conditions in the United States and in foreign countries, the timing and success of our acquisitions, commercial initiatives and investments to grow our business, and our ability to successfully integrate acquired businesses and achieve anticipated synergies. AmeriGas undertakes no obligation to release revisions to its forward- looking statements to reflect events or circumstances occurring after today.

August 4, 2015 Jerry Sheridan CEO of AmeriGas

August 4, 2015 4 Q3 Adjusted EBITDA * See appendix for Adjusted EBITDA reconciliation $49 $55 $0 $20 $40 $60 Q3 2015 Q3 2014 Adjusted EBITDA*, $ Millions

August 4, 2015 5 • Weather was 18% warmer than normal and 10% warmer than the prior year while retail volume was 6% lower than the prior year • Cylinder exchange volume declined 2% as the quarter was the second wettest on record • Despite impact of weather, National Accounts volume up substantially Operational Highlights

August 4, 2015 6 • Unit margin expanded $0.04 as propane prices were 56% lower than the prior year • Operating expenses 1% lower than last year as vehicle fuel was 30% less expensive • YTD completed 7 acquisitions • FY15 guidance range $635-645mm Operational Highlights

August 4, 2015 Q&A

August 4, 2015 Appendix

August 4, 2015 9 AmeriGas Supplemental Information: Footnotes The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income. EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA and Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership, which is one of UGI Corporation’s business segments. UGI Corporation discloses the Partnership's EBITDA in its disclosures about its business segments as the profitability measure for its domestic propane segment.

August 4, 2015 10 AmeriGas Partners EBITDA Reconciliation 2015 2014 EBITDA and Adjusted EBITDA: Net (loss) income attributable to AmeriGas Partners, L.P. (25,578)$ (37,761)$ Income tax expense 802 847 Interest expense 40,274 41,328 Depreciation 37,370 37,069 Amortization 10,666 10,788 EBITDA 63,534 52,271 (Subtra t et gains) add net losses on commodity derivative instruments not associated with current-period transactions (14,813) 2,781 Noncontrolling interest in net gains (losses) on commodity derivative instruments not associated with current-period transactions 150 (28) Adjusted EBITDA 48,871$ 55,024$ Three Months Ended June 30,

August 4, 2015 11 AmeriGas Partners Adj. EBITDA Guidance Reconciliation Forecast Fiscal Year Ending September 30, 2015 Adjusted net income attributable to AmeriGas Partners, L.P. (estimate) (d) 280,000$ Interest expense (estimate) 163,000 Income tax expense (estimate) 4,000 Depreciation (estimate) 151,000 Amortization (estimate) 42,000 Adjusted EBITDA (e) 640,000$ (d) (e) Represents the midpoint of Adjusted EBITDA guidance range for fiscal 2015. Represents estimated net income attributable to AmeriGas Partners, L.P. after adjusting for gains and losses on commodity derivative instruments not associated with current-period transactions. It is impracticable to determine actual gains and losses on commodity derivative instruments not associated with current-period transactions that will be reported in GAAP net income as such gains and losses will depend upon future changes in commodity prices for propane which cannot be forecasted.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ideanomics Announces Receipt of Notice from Nasdaq Regarding Late Filing of Annual Report on Form 10-K

- DiCello Levitt LLP Announces Investor Class Action Lawsuit Filed Against Lincoln National Corporation (NYSE: LNC) and Lead Plaintiff Deadline

- Tiger Aesthetics Medical, LLC Acquires Assets of Sientra, Inc.

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share