Form 8-K AMERICAN INTERNATIONAL For: Nov 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2015

AMERICAN INTERNATIONAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware

|

1-8787

|

13-2592361

| ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

175 Water Street

New York, New York 10038

(Address of principal executive offices)

Registrant’s telephone number, including area code: (212) 770-7000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 — Regulation FD

Item 7.01. Regulation FD Disclosure.

American International Group, Inc. (the “Company”) is furnishing the Investor Presentation, dated November 17, 2015, attached as Exhibit 99.1 to this Current Report on Form 8-K (the “Investor Presentation”), which the Company may use from time to time in presentations to investors and other stakeholders. The Investor Presentation will also be available on the Company’s website at www.aig.com.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. | |

| 99.1 | Investor Presentation dated November 17, 2015 (furnished and not filed for purposes of Item 7.01). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AMERICAN INTERNATIONAL GROUP, INC. | ||||||

| (Registrant) | ||||||

| Date: November 17, 2015 |

By:

|

/s/ James J. Killerlane III | ||||

| Name: James J. Killerlane III | ||||||

| Title: Associate General Counsel and Assistant Secretary | ||||||

EXHIBIT INDEX

| Exhibit No. |

Description |

|||

| 99.1 | Investor Presentation dated November 17, 2015 (furnished and not filed for purposes of Item 7.01). | |||

American International Group, Inc. Investor Presentation Third Quarter 2015 November 17, 2015 Exhibit 99.1

Cautionary Statement Regarding Forward Looking Information This document and the remarks made within this presentation may include, and officers and representatives of American International Group, Inc. (AIG) may from time to time make, projections, goals, assumptions and statements that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These projections, goals, assumptions and statements are not historical facts but instead represent only AIG’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside AIG’s control. These projections, goals, assumptions and statements include statements preceded by, followed by or including words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “view,” “target” or “estimate.” It is possible that AIG’s actual results and financial condition will differ, possibly materially, from the results and financial condition indicated in these projections, goals, assumptions and statements. Factors that could cause AIG’s actual results to differ, possibly materially, from those in the specific projections, goals, assumptions and statements include: changes in market conditions; the occurrence of catastrophic events, both natural and man-made; significant legal proceedings; the timing and applicable requirements of any new regulatory framework to which AIG is subject as a nonbank systemically important financial institution and as a global systemically important insurer; concentrations in AIG’s investment portfolios; actions by credit rating agencies; judgments concerning casualty insurance underwriting and insurance liabilities; judgments concerning the recognition of deferred tax assets; judgments concerning estimated restructuring charges and estimated cost savings; and such other factors discussed in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) and Part II, Item 1A. Risk Factors in AIG’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2015, Part I, Item 2. MD&A in AIG’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015, Part I, Item 2. MD&A in AIG’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2015 and Part I, Item 1A. Risk Factors and Part II, Item 7. MD&A in AIG’s Annual Report on Form 10-K for the year ended December 31, 2014. AIG is not under any obligation (and expressly disclaims any obligation) to update or alter any projections, goals, assumptions or other statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise. This document and the remarks made orally may also contain certain non-GAAP financial measures. The reconciliation of such measures to the most comparable GAAP measures in accordance with Regulation G is included in the Third Quarter 2015 Financial Supplement available in the Investor Information section of AIG's corporate website, www.aig.com, as well as in the Appendix to this presentation. Note: Information included in the presentation is as of September 30, 2015, unless otherwise indicated.

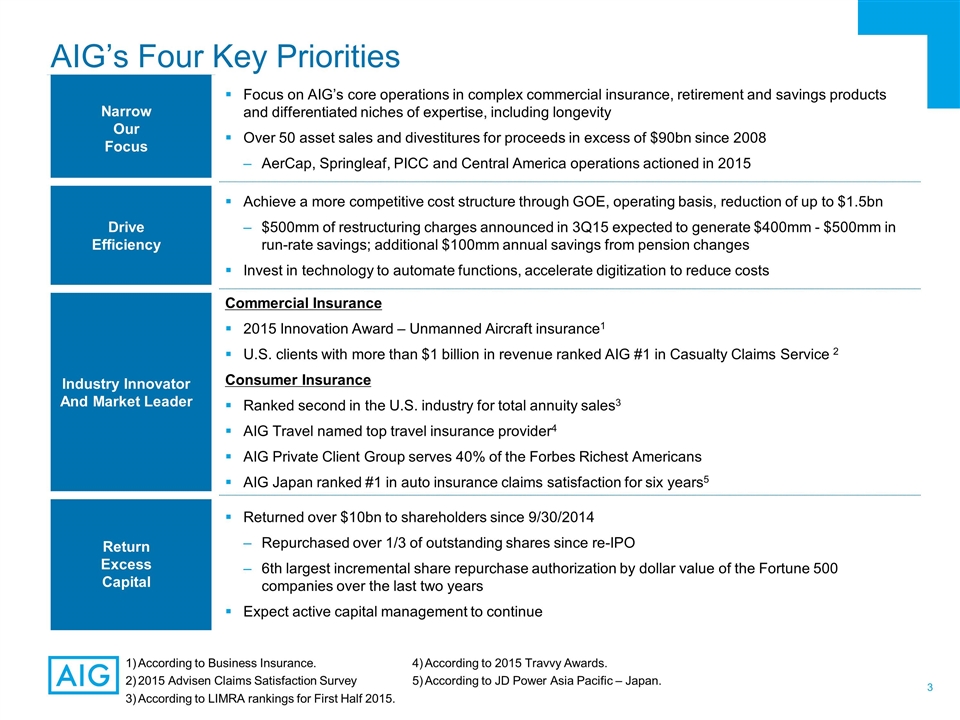

Narrow Our Focus Focus on AIG’s core operations in complex commercial insurance, retirement and savings products and differentiated niches of expertise, including longevity Over 50 asset sales and divestitures for proceeds in excess of $90bn since 2008 AerCap, Springleaf, PICC and Central America operations actioned in 2015 Drive Efficiency Achieve a more competitive cost structure through GOE, operating basis, reduction of up to $1.5bn $500mm of restructuring charges announced in 3Q15 expected to generate $400mm - $500mm in run-rate savings; additional $100mm annual savings from pension changes Invest in technology to automate functions, accelerate digitization to reduce costs Industry Innovator And Market Leader Commercial Insurance 2015 Innovation Award – Unmanned Aircraft insurance1 U.S. clients with more than $1 billion in revenue ranked AIG #1 in Casualty Claims Service 2 Consumer Insurance Ranked second in the U.S. industry for total annuity sales3 AIG Travel named top travel insurance provider4 AIG Private Client Group serves 40% of the Forbes Richest Americans AIG Japan ranked #1 in auto insurance claims satisfaction for six years5 Return Excess Capital Returned over $10bn to shareholders since 9/30/2014 Repurchased over 1/3 of outstanding shares since re-IPO 6th largest incremental share repurchase authorization by dollar value of the Fortune 500 companies over the last two years Expect active capital management to continue AIG’s Four Key Priorities According to Business Insurance. 2015 Advisen Claims Satisfaction Survey According to LIMRA rankings for First Half 2015. According to 2015 Travvy Awards. According to JD Power Asia Pacific – Japan.

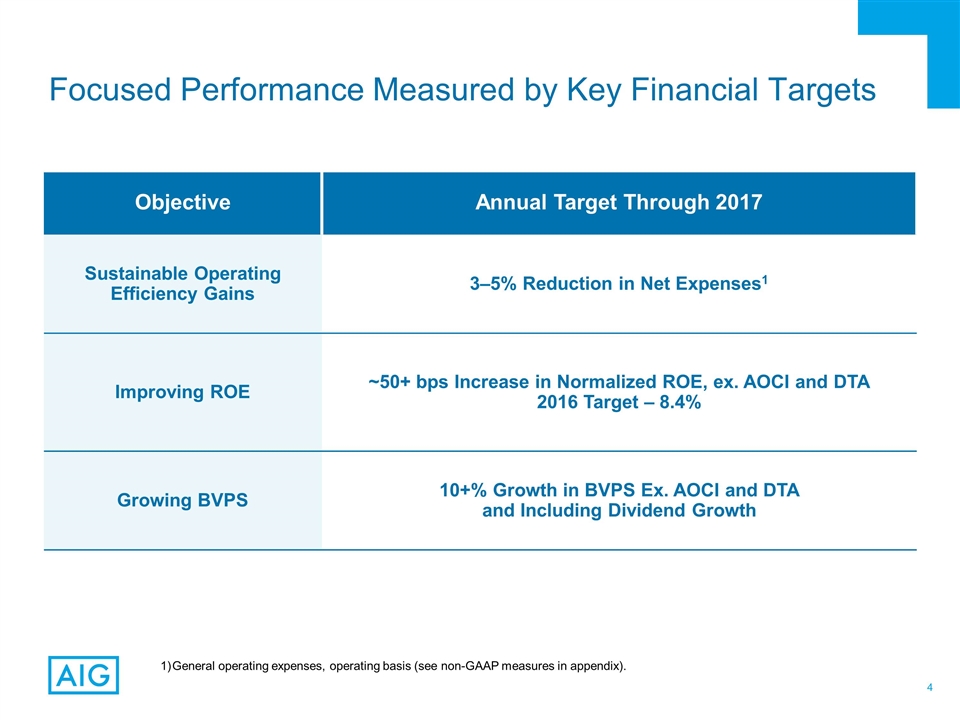

Focused Performance Measured by Key Financial Targets Objective Annual Target Through 2017 Sustainable Operating Efficiency Gains 3–5% Reduction in Net Expenses1 Improving ROE ~50+ bps Increase in Normalized ROE, ex. AOCI and DTA 2016 Target – 8.4% Growing BVPS 10+% Growth in BVPS Ex. AOCI and DTA and Including Dividend Growth General operating expenses, operating basis (see non-GAAP measures in appendix).

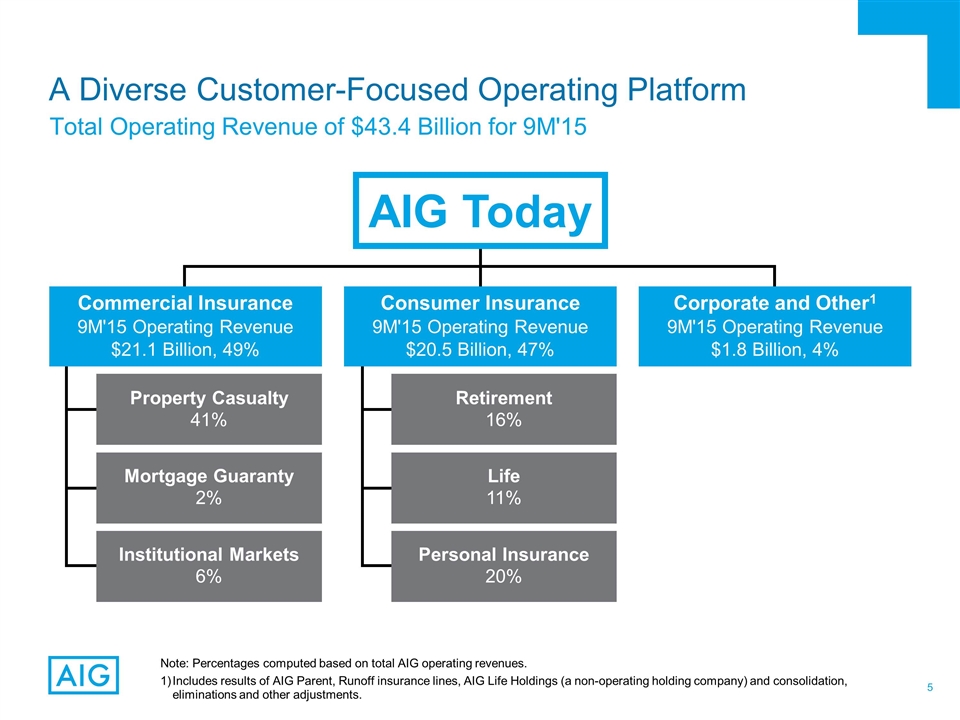

Total Operating Revenue of $43.4 Billion for 9M'15 Note: Percentages computed based on total AIG operating revenues. Includes results of AIG Parent, Runoff insurance lines, AIG Life Holdings (a non-operating holding company) and consolidation, eliminations and other adjustments. A Diverse Customer-Focused Operating Platform Retirement 16% Life 11% Personal Insurance 20% Commercial Insurance 9M'15 Operating Revenue $21.1 Billion, 49% Consumer Insurance 9M'15 Operating Revenue $20.5 Billion, 47% Corporate and Other1 9M'15 Operating Revenue $1.8 Billion, 4% Property Casualty 41% Mortgage Guaranty 2% Institutional Markets 6% AIG Today

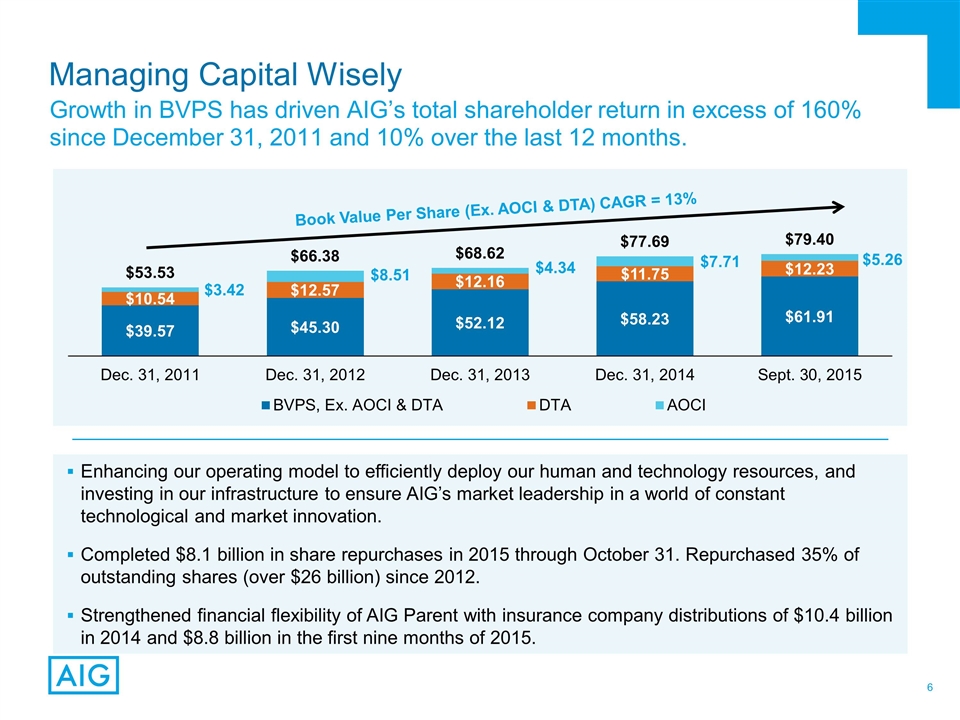

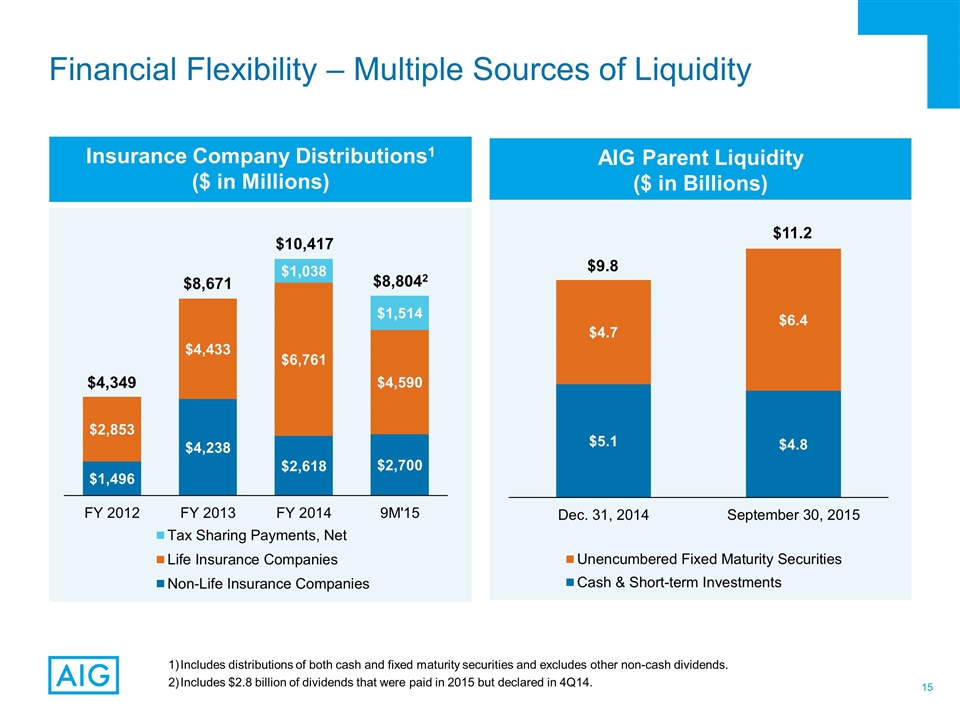

Managing Capital Wisely Book Value Per Share (Ex. AOCI & DTA) CAGR = 13% Enhancing our operating model to efficiently deploy our human and technology resources, and investing in our infrastructure to ensure AIG’s market leadership in a world of constant technological and market innovation. Completed $8.1 billion in share repurchases in 2015 through October 31. Repurchased 35% of outstanding shares (over $26 billion) since 2012. Strengthened financial flexibility of AIG Parent with insurance company distributions of $10.4 billion in 2014 and $8.8 billion in the first nine months of 2015. Growth in BVPS has driven AIG’s total shareholder return in excess of 160% since December 31, 2011 and 10% over the last 12 months.

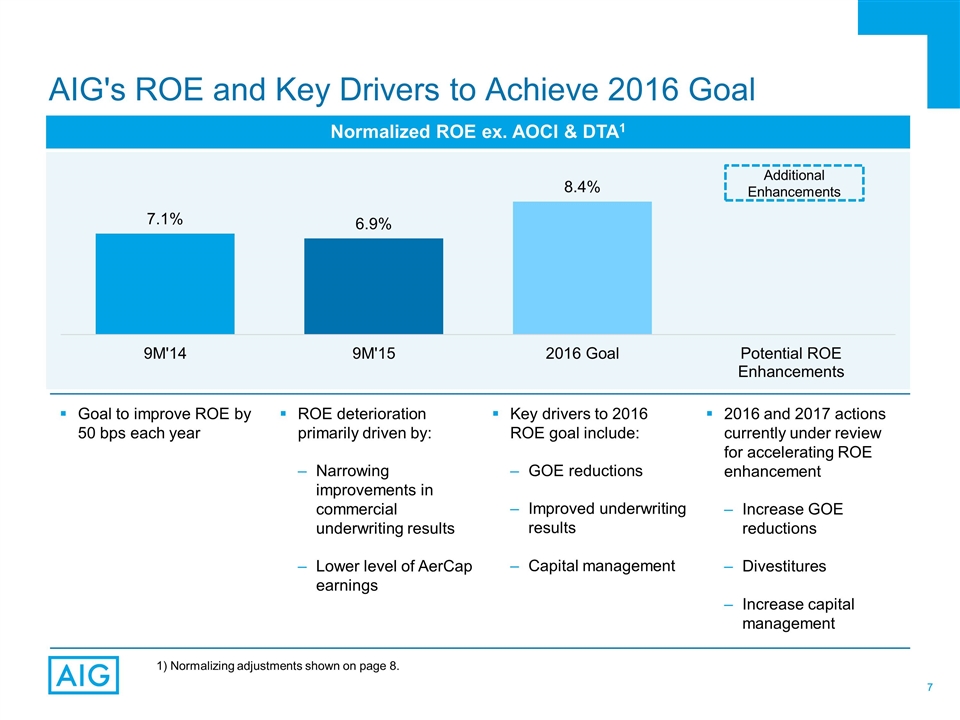

AIG's ROE and Key Drivers to Achieve 2016 Goal Goal to improve ROE by 50 bps each year ROE deterioration primarily driven by: Narrowing improvements in commercial underwriting results Lower level of AerCap earnings Key drivers to 2016 ROE goal include: GOE reductions Improved underwriting results Capital management 2016 and 2017 actions currently under review for accelerating ROE enhancement Increase GOE reductions Divestitures Increase capital management Normalized ROE ex. AOCI & DTA1 1) Normalizing adjustments shown on page 8. Additional Enhancements

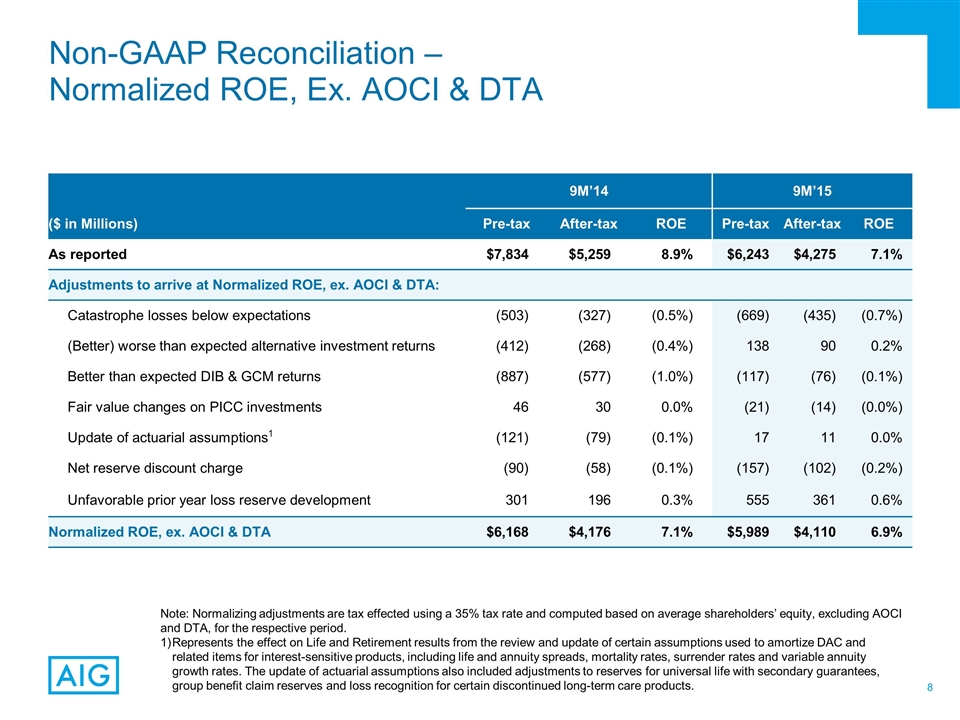

Non-GAAP Reconciliation – Normalized ROE, Ex. AOCI & DTA 9M’14 9M’15 ($ in Millions) Pre-tax After-tax ROE Pre-tax After-tax ROE As reported $7,834 $5,259 8.9% $6,243 $4,275 7.1% Adjustments to arrive at Normalized ROE, ex. AOCI & DTA: Catastrophe losses below expectations (503) (327) (0.5%) (669) (435) (0.7%) (Better) worse than expected alternative investment returns (412) (268) (0.4%) 138 90 0.2% Better than expected DIB & GCM returns (887) (577) (1.0%) (117) (76) (0.1%) Fair value changes on PICC investments 46 30 0.0% (21) (14) (0.0%) Update of actuarial assumptions1 (121) (79) (0.1%) 17 11 0.0% Net reserve discount charge (90) (58) (0.1%) (157) (102) (0.2%) Unfavorable prior year loss reserve development 301 196 0.3% 555 361 0.6% Normalized ROE, ex. AOCI & DTA $6,168 $4,176 7.1% $5,989 $4,110 6.9% Note: Normalizing adjustments are tax effected using a 35% tax rate and computed based on average shareholders’ equity, excluding AOCI and DTA, for the respective period. Represents the effect on Life and Retirement results from the review and update of certain assumptions used to amortize DAC and related items for interest-sensitive products, including life and annuity spreads, mortality rates, surrender rates and variable annuity growth rates. The update of actuarial assumptions also included adjustments to reserves for universal life with secondary guarantees, group benefit claim reserves and loss recognition for certain discontinued long-term care products.

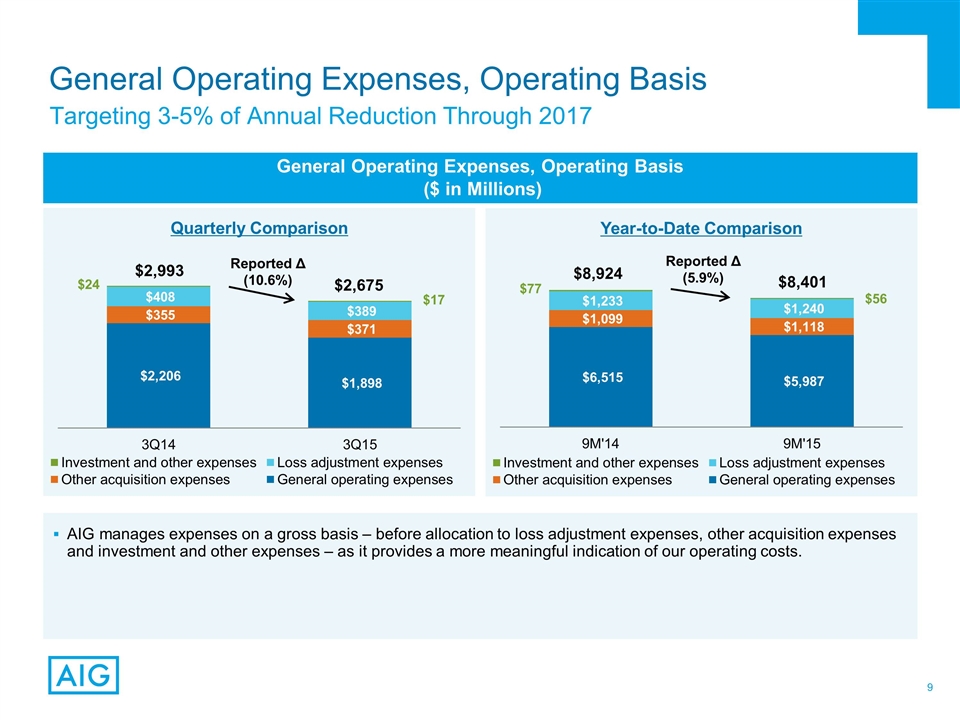

Targeting 3-5% of Annual Reduction Through 2017 General Operating Expenses, Operating Basis AIG manages expenses on a gross basis – before allocation to loss adjustment expenses, other acquisition expenses and investment and other expenses – as it provides a more meaningful indication of our operating costs. General Operating Expenses, Operating Basis ($ in Millions) Reported Δ (10.6%) Reported Δ (5.9%) $2,993 $2,675 $8,924 $8,401

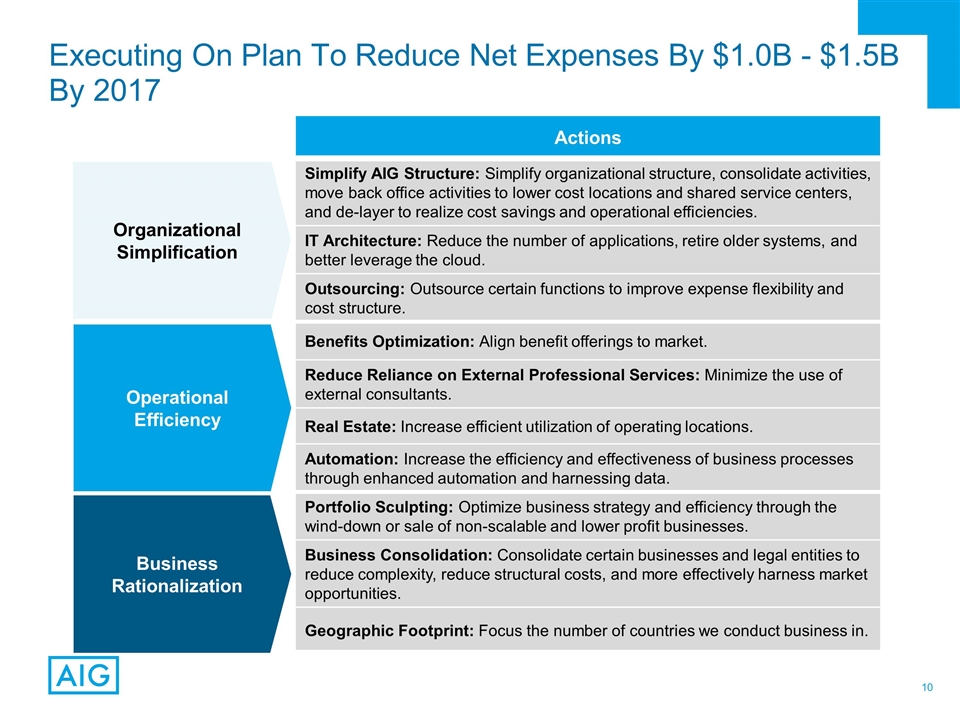

Executing On Plan To Reduce Net Expenses By $1.0B - $1.5B By 2017 Actions Simplify AIG Structure: Simplify organizational structure, consolidate activities, move back office activities to lower cost locations and shared service centers, and de-layer to realize cost savings and operational efficiencies. IT Architecture: Reduce the number of applications, retire older systems, and better leverage the cloud. Outsourcing: Outsource certain functions to improve expense flexibility and cost structure. Benefits Optimization: Align benefit offerings to market. Reduce Reliance on External Professional Services: Minimize the use of external consultants. Real Estate: Increase efficient utilization of operating locations. Automation: Increase the efficiency and effectiveness of business processes through enhanced automation and harnessing data. Portfolio Sculpting: Optimize business strategy and efficiency through the wind-down or sale of non-scalable and lower profit businesses. Business Consolidation: Consolidate certain businesses and legal entities to reduce complexity, reduce structural costs, and more effectively harness market opportunities. Geographic Footprint: Focus the number of countries we conduct business in. Organizational Simplification Business Rationalization Operational Efficiency

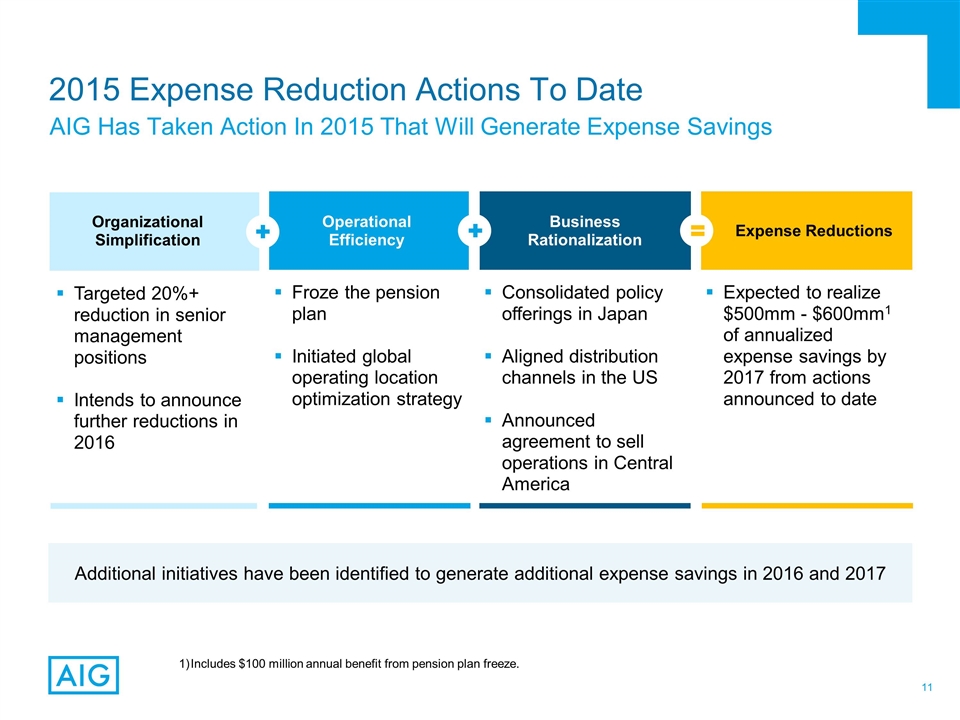

2015 Expense Reduction Actions To Date AIG Has Taken Action In 2015 That Will Generate Expense Savings Operational Efficiency Business Rationalization Expense Reductions Froze the pension plan Initiated global operating location optimization strategy Consolidated policy offerings in Japan Aligned distribution channels in the US Announced agreement to sell operations in Central America Expected to realize $500mm - $600mm1 of annualized expense savings by 2017 from actions announced to date Additional initiatives have been identified to generate additional expense savings in 2016 and 2017 Organizational Simplification Targeted 20%+ reduction in senior management positions Intends to announce further reductions in 2016 Includes $100 million annual benefit from pension plan freeze.

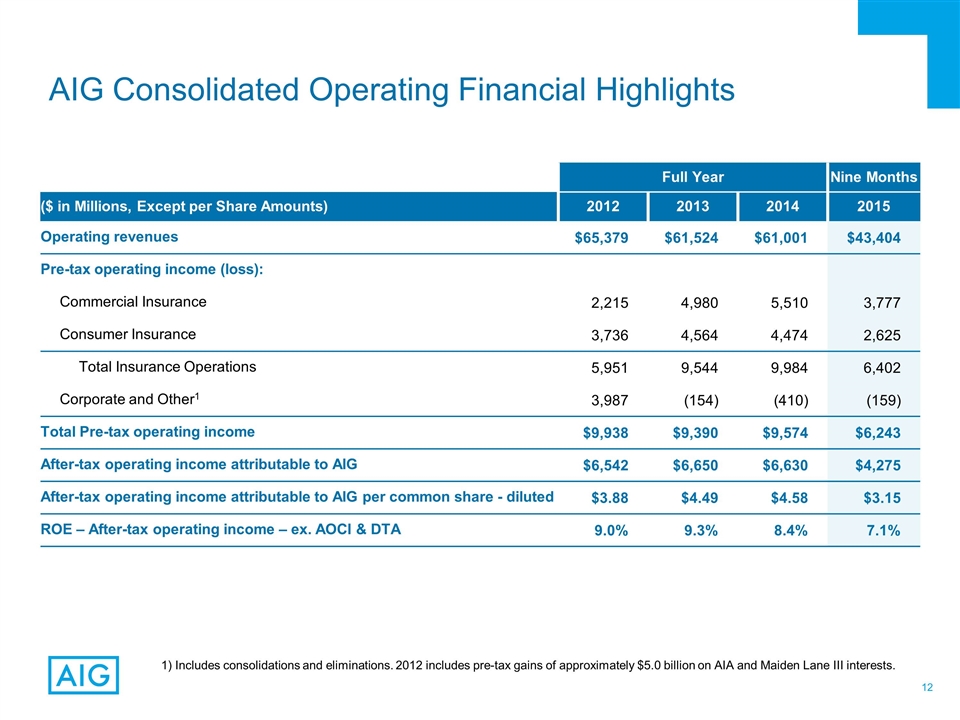

1) Includes consolidations and eliminations. 2012 includes pre-tax gains of approximately $5.0 billion on AIA and Maiden Lane III interests. AIG Consolidated Operating Financial Highlights Full Year Nine Months ($ in Millions, Except per Share Amounts) 2012 2013 2014 2015 Operating revenues $65,379 $61,524 $61,001 $43,404 Pre-tax operating income (loss): Commercial Insurance 2,215 4,980 5,510 3,777 Consumer Insurance 3,736 4,564 4,474 2,625 Total Insurance Operations 5,951 9,544 9,984 6,402 Corporate and Other1 3,987 (154) (410) (159) Total Pre-tax operating income $9,938 $9,390 $9,574 $6,243 After-tax operating income attributable to AIG $6,542 $6,650 $6,630 $4,275 After-tax operating income attributable to AIG per common share - diluted $3.88 $4.49 $4.58 $3.15 ROE – After-tax operating income – ex. AOCI & DTA 9.0% 9.3% 8.4% 7.1%

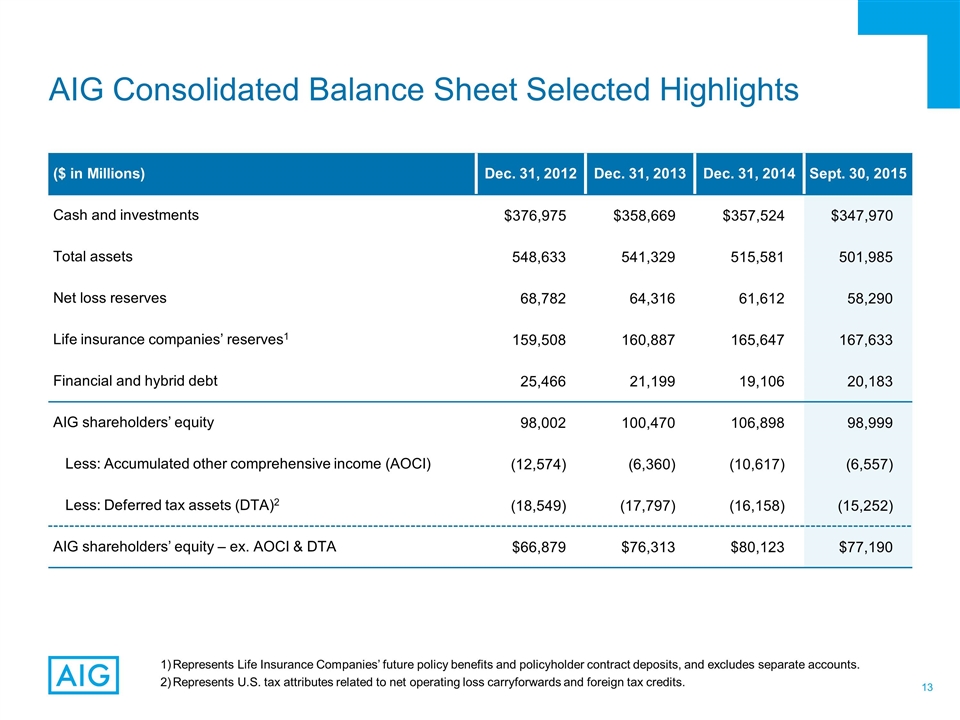

Represents Life Insurance Companies’ future policy benefits and policyholder contract deposits, and excludes separate accounts. Represents U.S. tax attributes related to net operating loss carryforwards and foreign tax credits. AIG Consolidated Balance Sheet Selected Highlights ($ in Millions) Dec. 31, 2012 Dec. 31, 2013 Dec. 31, 2014 Sept. 30, 2015 Cash and investments $376,975 $358,669 $357,524 $347,970 Total assets 548,633 541,329 515,581 501,985 Net loss reserves 68,782 64,316 61,612 58,290 Life insurance companies’ reserves1 159,508 160,887 165,647 167,633 Financial and hybrid debt 25,466 21,199 19,106 20,183 AIG shareholders’ equity 98,002 100,470 106,898 98,999 Less: Accumulated other comprehensive income (AOCI) (12,574) (6,360) (10,617) (6,557) Less: Deferred tax assets (DTA)2 (18,549) (17,797) (16,158) (15,252) AIG shareholders’ equity – ex. AOCI & DTA $66,879 $76,313 $80,123 $77,190

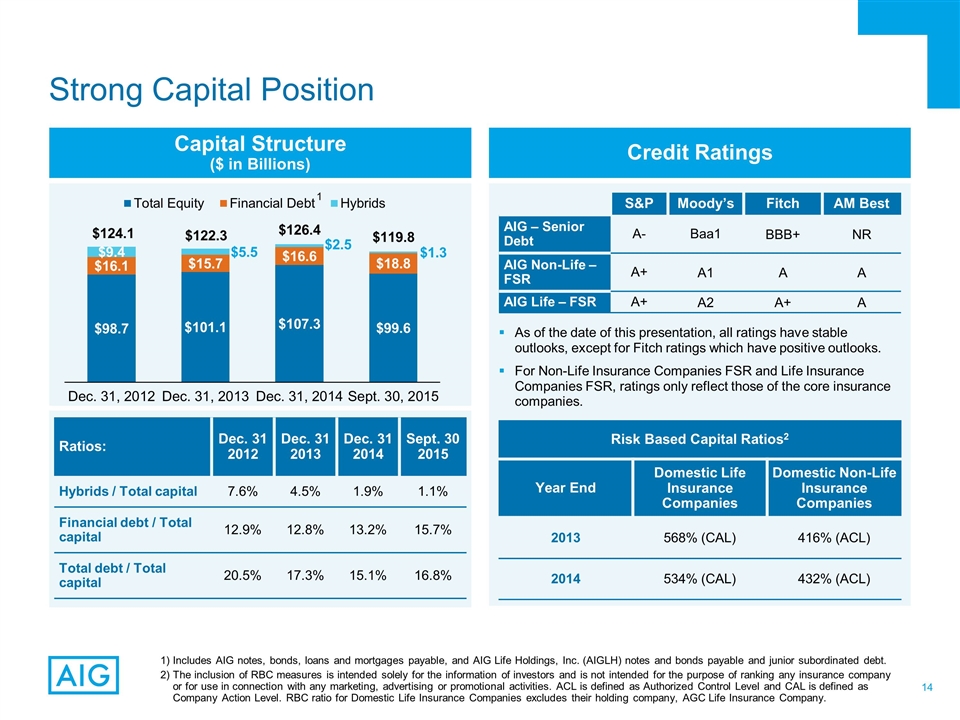

Credit Ratings Capital Structure ($ in Billions) Includes AIG notes, bonds, loans and mortgages payable, and AIG Life Holdings, Inc. (AIGLH) notes and bonds payable and junior subordinated debt. The inclusion of RBC measures is intended solely for the information of investors and is not intended for the purpose of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities. ACL is defined as Authorized Control Level and CAL is defined as Company Action Level. RBC ratio for Domestic Life Insurance Companies excludes their holding company, AGC Life Insurance Company. Strong Capital Position As of the date of this presentation, all ratings have stable outlooks, except for Fitch ratings which have positive outlooks. For Non-Life Insurance Companies FSR and Life Insurance Companies FSR, ratings only reflect those of the core insurance companies. $124.1 $122.3 Ratios: Dec. 31 2012 Dec. 31 2013 Dec. 31 2014 Sept. 30 2015 Hybrids / Total capital 7.6% 4.5% 1.9% 1.1% Financial debt / Total capital 12.9% 12.8% 13.2% 15.7% Total debt / Total capital 20.5% 17.3% 15.1% 16.8% Risk Based Capital Ratios2 Year End Domestic Life Insurance Companies Domestic Non-Life Insurance Companies 2013 568% (CAL) 416% (ACL) 2014 534% (CAL) 432% (ACL) S&P Moody’s Fitch AM Best AIG – Senior Debt A- Baa1 BBB+ NR AIG Non-Life – FSR A+ A1 A A AIG Life – FSR A+ A2 A+ A $126.4 1 $119.8

AIG Parent Liquidity ($ in Billions) Insurance Company Distributions1 ($ in Millions) Includes distributions of both cash and fixed maturity securities and excludes other non-cash dividends. Includes $2.8 billion of dividends that were paid in 2015 but declared in 4Q14. Financial Flexibility – Multiple Sources of Liquidity $4,349 $9.8 $8,671 $10,417 $8,8042 $11.2

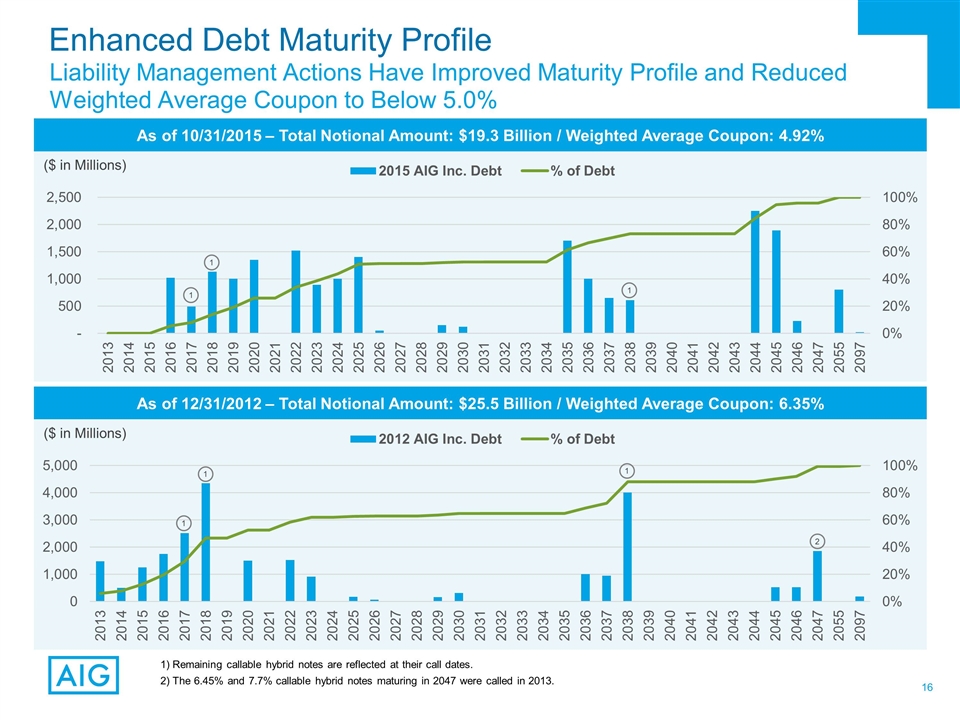

Enhanced Debt Maturity Profile As of 12/31/2012 – Total Notional Amount: $25.5 Billion / Weighted Average Coupon: 6.35% Liability Management Actions Have Improved Maturity Profile and Reduced Weighted Average Coupon to Below 5.0% As of 10/31/2015 – Total Notional Amount: $19.3 Billion / Weighted Average Coupon: 4.92% ($ in Millions) ($ in Millions) 1 1 1 1 1 1 2 Remaining callable hybrid notes are reflected at their call dates. The 6.45% and 7.7% callable hybrid notes maturing in 2047 were called in 2013.

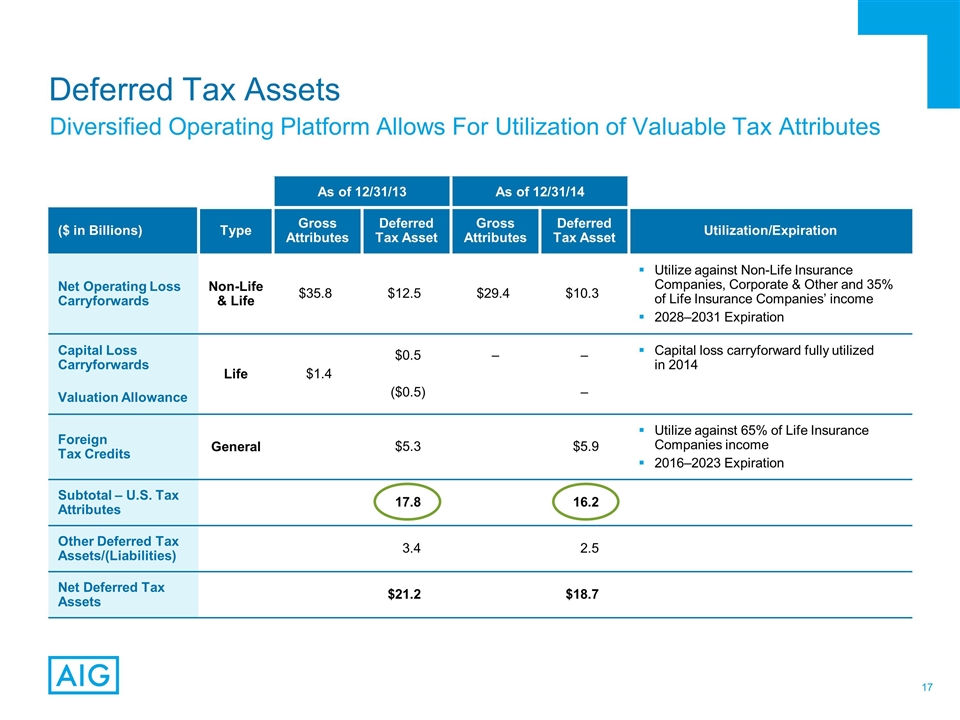

Diversified Operating Platform Allows For Utilization of Valuable Tax Attributes Deferred Tax Assets As of 12/31/13 As of 12/31/14 ($ in Billions) Type Gross Attributes Deferred Tax Asset Gross Attributes Deferred Tax Asset Utilization/Expiration Net Operating Loss Carryforwards Non-Life & Life $35.8 $12.5 $29.4 $10.3 Utilize against Non-Life Insurance Companies, Corporate & Other and 35% of Life Insurance Companies’ income 2028–2031 Expiration Capital Loss Carryforwards Valuation Allowance Life $1.4 $0.5 ($0.5) – – – Capital loss carryforward fully utilized in 2014 Foreign Tax Credits General $5.3 $5.9 Utilize against 65% of Life Insurance Companies income 2016–2023 Expiration Subtotal – U.S. Tax Attributes 17.8 16.2 Other Deferred Tax Assets/(Liabilities) 3.4 2.5 Net Deferred Tax Assets $21.2 $18.7

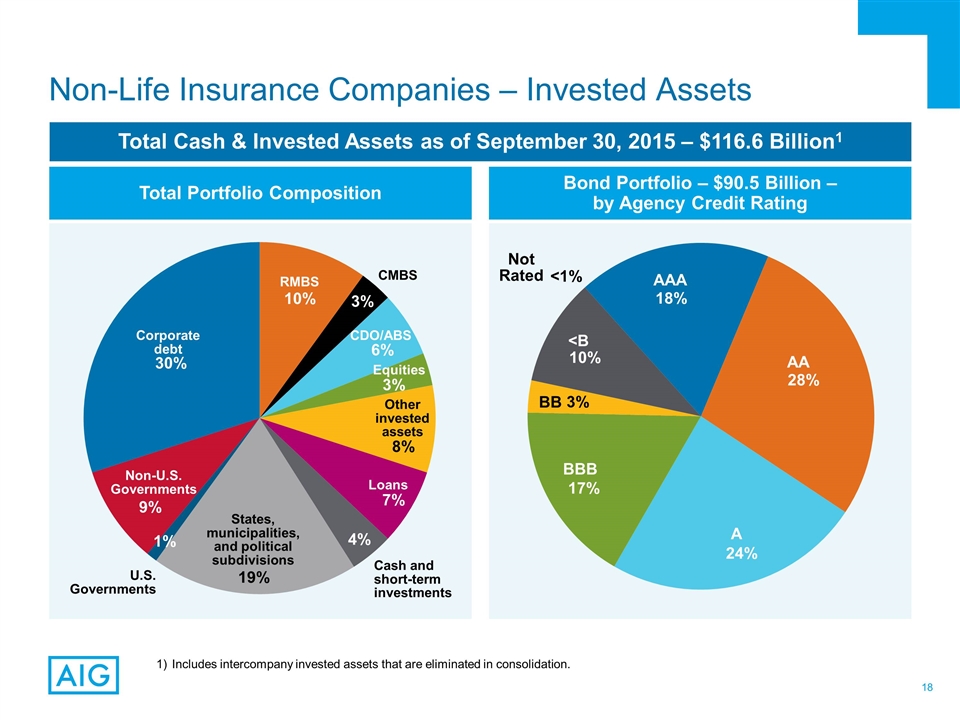

Non-Life Insurance Companies – Invested Assets Total Portfolio Composition Bond Portfolio – $90.5 Billion – by Agency Credit Rating Total Cash & Invested Assets as of September 30, 2015 – $116.6 Billion1 Corporate debt Non-U.S. Governments U.S. Governments States, municipalities, and political subdivisions Cash and short-term investments Loans Other invested assets Equities CDO/ABS RMBS CMBS AAA AA A BBB Not Rated BB <B Includes intercompany invested assets that are eliminated in consolidation.

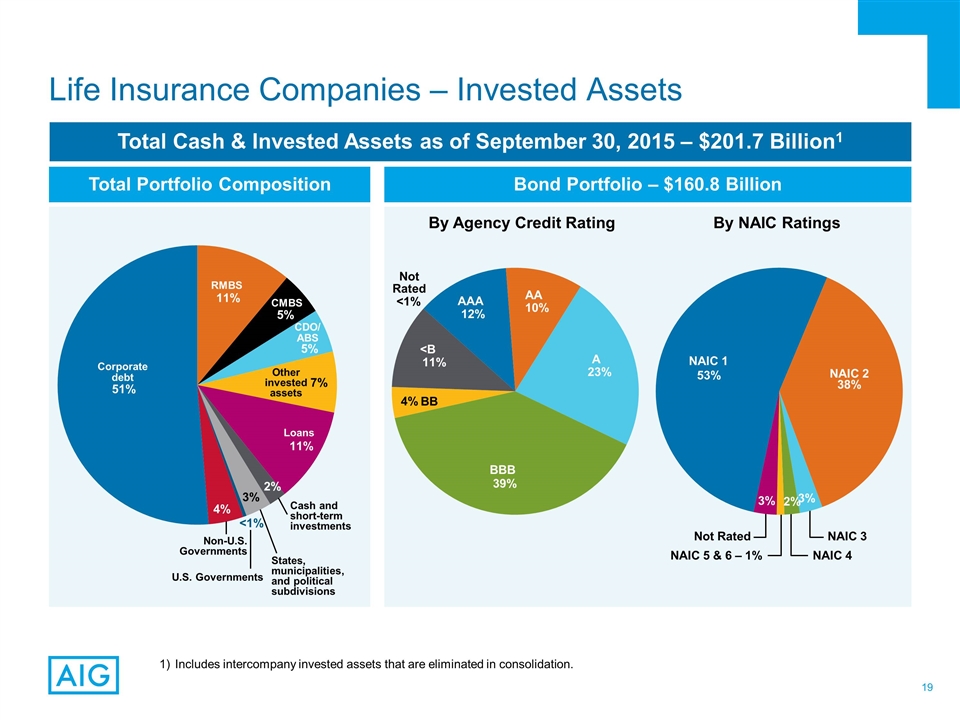

Life Insurance Companies – Invested Assets Total Portfolio Composition Bond Portfolio – $160.8 Billion Total Cash & Invested Assets as of September 30, 2015 – $201.7 Billion1 Corporate debt RMBS CMBS CDO/ ABS Other invested assets Loans Cash and short-term investments Non-U.S. Governments U.S. Governments States, municipalities, and political subdivisions AAA AA A BBB BB <B Not Rated NAIC 3 NAIC 4 NAIC 5 & 6 – 1% Not Rated By Agency Credit Rating By NAIC Ratings NAIC 1 NAIC 2 Includes intercompany invested assets that are eliminated in consolidation.

Commercial Insurance

Commercial Insurance – Strategy Customer Strategic Growth Underwriting Excellence Claims Excellence Operational Effectiveness Capital Efficiency Investment Strategy Aspire to be our customers’ most valued insurer by offering innovative products, excellent service and access to an extensive global network Grow our higher-value businesses while investing in transformative opportunities Improve our business portfolio through better pricing and risk selection by using enhanced data, analytics and the application of science to deliver superior risk-adjusted returns Improve claims processes, analytics and tools to deliver superior customer service and decrease our loss ratio Continue initiatives to modernize our technology and infrastructure; implement best practices to improve speed and quality of service Increase capital fungibility and diversification, streamline our legal entity structure, optimize reinsurance and improve tax efficiency Increase asset diversification and take advantage of yield-enhancement opportunities to meet our capital, liquidity, risk and return objectives Strategic Levers to Drive Shareholder Value Creation

Commercial Insurance – Diversified Products and Services General Liability Commercial Automobile Liability Workers’ Compensation Excess Casualty Crisis Management Risk Management Other Customized Structured Programs for Large Corporate and Multinational Customers Global Property covers exposures to man-made and natural disasters, includes business interruption Industrial, Energy and Commercial Property Multinational Property Directors & Officers Liability, Errors & Omissions Cyber Security Fidelity Employment Practices Fiduciary Liability Kidnap and Ransom Aerospace Environmental Political Risk Trade Credit Marine Surety Package Protects mortgage investors against the risk of borrower default related to high loan to value mortgages First-Lien Mortgage Guaranty Insurance Stable Wrap Products Structured Settlement and Terminal Funding Annuities High Net Worth Products Corporate- and Bank-owned Life Insurance GICs Specialty Casualty Property Financial Lines Property Casualty Mortgage Guaranty Institutional Markets

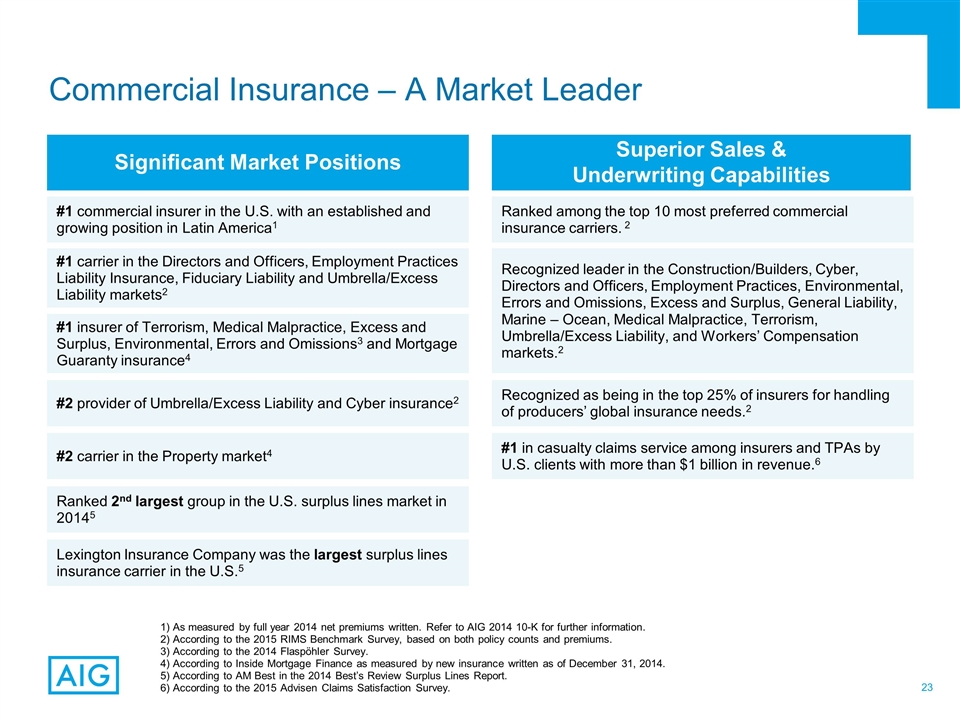

As measured by full year 2014 net premiums written. Refer to AIG 2014 10-K for further information. According to the 2015 RIMS Benchmark Survey, based on both policy counts and premiums. According to the 2014 Flaspöhler Survey. According to Inside Mortgage Finance as measured by new insurance written as of December 31, 2014. According to AM Best in the 2014 Best’s Review Surplus Lines Report. According to the 2015 Advisen Claims Satisfaction Survey. Commercial Insurance – A Market Leader Significant Market Positions Superior Sales & Underwriting Capabilities #1 commercial insurer in the U.S. with an established and growing position in Latin America1 #1 carrier in the Directors and Officers, Employment Practices Liability Insurance, Fiduciary Liability and Umbrella/Excess Liability markets2 #1 insurer of Terrorism, Medical Malpractice, Excess and Surplus, Environmental, Errors and Omissions3 and Mortgage Guaranty insurance4 #2 provider of Umbrella/Excess Liability and Cyber insurance2 #2 carrier in the Property market4 Ranked 2nd largest group in the U.S. surplus lines market in 20145 Lexington Insurance Company was the largest surplus lines insurance carrier in the U.S.5 Ranked among the top 10 most preferred commercial insurance carriers. 2 Recognized leader in the Construction/Builders, Cyber, Directors and Officers, Employment Practices, Environmental, Errors and Omissions, Excess and Surplus, General Liability, Marine – Ocean, Medical Malpractice, Terrorism, Umbrella/Excess Liability, and Workers’ Compensation markets.2 Recognized as being in the top 25% of insurers for handling of producers’ global insurance needs.2 #1 in casualty claims service among insurers and TPAs by U.S. clients with more than $1 billion in revenue.6

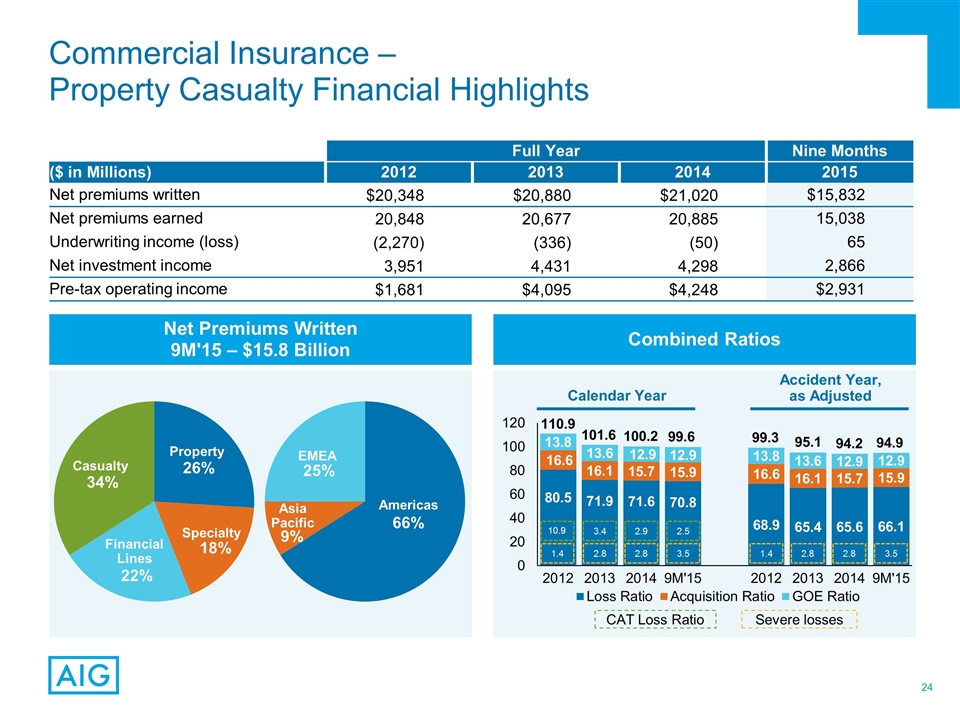

Commercial Insurance – Property Casualty Financial Highlights Full Year Nine Months ($ in Millions) 2012 2013 2014 2015 Net premiums written $20,348 $20,880 $21,020 $15,832 Net premiums earned 20,848 20,677 20,885 15,038 Underwriting income (loss) (2,270) (336) (50) 65 Net investment income 3,951 4,431 4,298 2,866 Pre-tax operating income $1,681 $4,095 $4,248 $2,931 Net Premiums Written 9M'15 – $15.8 Billion Combined Ratios 110.9 101.6 100.2 99.3 95.1 94.2 Accident Year, as Adjusted Calendar Year Property Specialty Financial Lines Casualty Americas EMEA Asia Pacific 99.6 94.9 Severe losses 1.4 2.8 2.8 3.5 1.4 2.8 2.8 3.5 CAT Loss Ratio 3.4 2.9 2.5 10.9

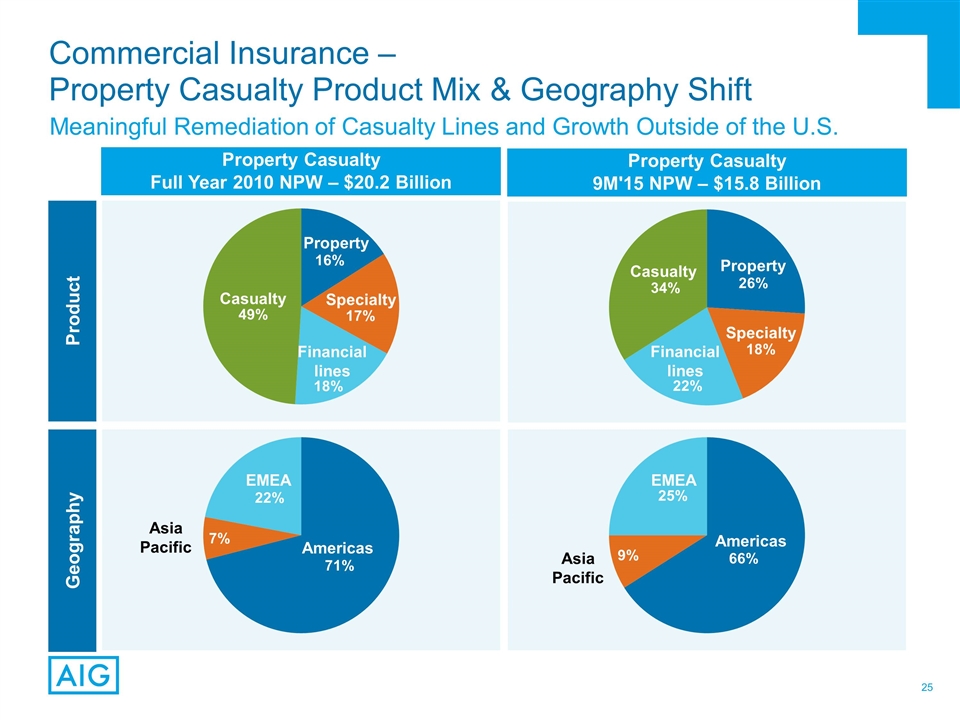

Meaningful Remediation of Casualty Lines and Growth Outside of the U.S. Commercial Insurance – Property Casualty Product Mix & Geography Shift Property Casualty Full Year 2010 NPW – $20.2 Billion Property Casualty 9M'15 NPW – $15.8 Billion Product Geography Casualty Property Specialty Financial lines Casualty Property Specialty Financial lines EMEA Americas Asia Pacific EMEA Americas Asia Pacific

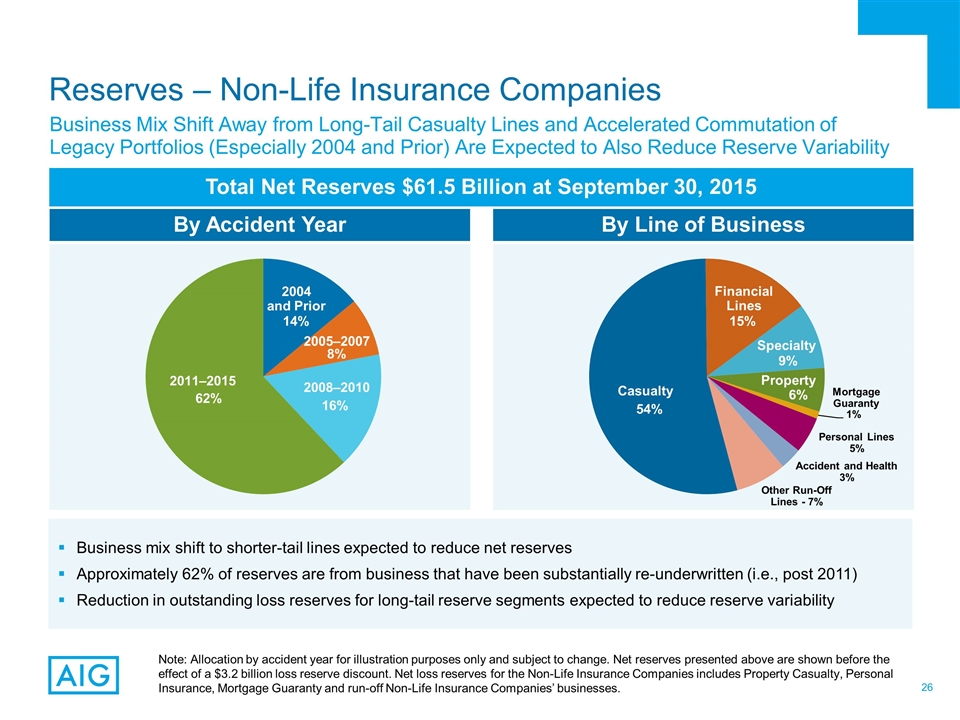

Business Mix Shift Away from Long-Tail Casualty Lines and Accelerated Commutation of Legacy Portfolios (Especially 2004 and Prior) Are Expected to Also Reduce Reserve Variability Reserves – Non-Life Insurance Companies Total Net Reserves $61.5 Billion at September 30, 2015 Business mix shift to shorter-tail lines expected to reduce net reserves Approximately 62% of reserves are from business that have been substantially re-underwritten (i.e., post 2011) Reduction in outstanding loss reserves for long-tail reserve segments expected to reduce reserve variability 2004 and Prior 2005–2007 2008–2010 2011–2015 Note: Allocation by accident year for illustration purposes only and subject to change. Net reserves presented above are shown before the effect of a $3.2 billion loss reserve discount. Net loss reserves for the Non-Life Insurance Companies includes Property Casualty, Personal Insurance, Mortgage Guaranty and run-off Non-Life Insurance Companies’ businesses. Casualty Financial Lines Specialty Property Mortgage Guaranty Personal Lines 5% Accident and Health 3% Other Run-Off Lines - 7% By Accident Year By Line of Business

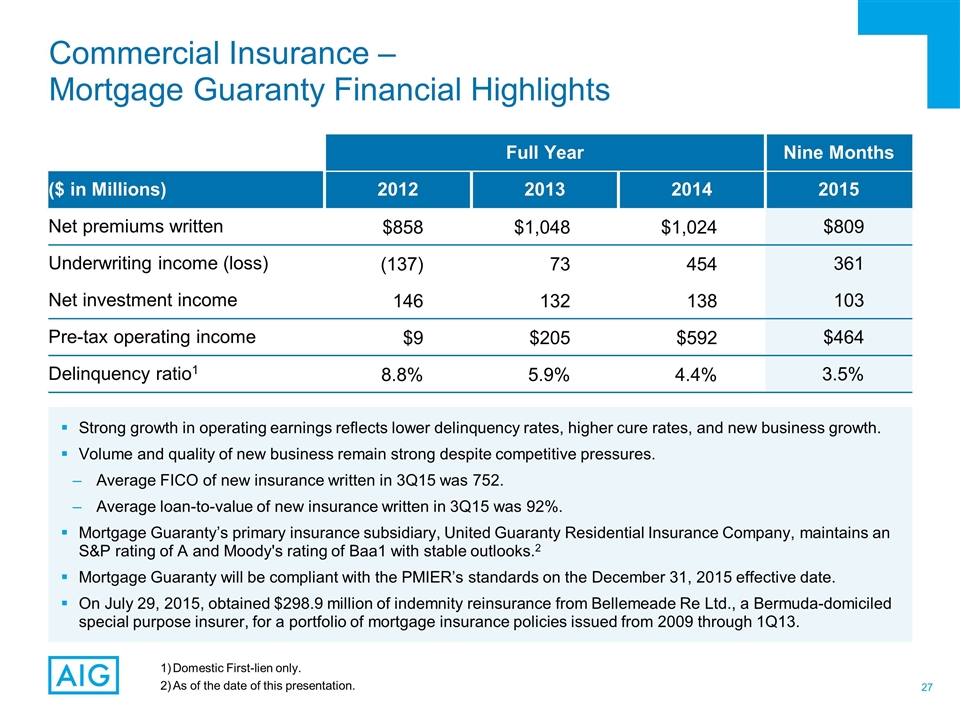

Strong growth in operating earnings reflects lower delinquency rates, higher cure rates, and new business growth. Volume and quality of new business remain strong despite competitive pressures. Average FICO of new insurance written in 3Q15 was 752. Average loan-to-value of new insurance written in 3Q15 was 92%. Mortgage Guaranty’s primary insurance subsidiary, United Guaranty Residential Insurance Company, maintains an S&P rating of A and Moody's rating of Baa1 with stable outlooks.2 Mortgage Guaranty will be compliant with the PMIER’s standards on the December 31, 2015 effective date. On July 29, 2015, obtained $298.9 million of indemnity reinsurance from Bellemeade Re Ltd., a Bermuda-domiciled special purpose insurer, for a portfolio of mortgage insurance policies issued from 2009 through 1Q13. Domestic First-lien only. As of the date of this presentation. Commercial Insurance – Mortgage Guaranty Financial Highlights Full Year Nine Months ($ in Millions) 2012 2013 2014 2015 Net premiums written $858 $1,048 $1,024 $809 Underwriting income (loss) (137) 73 454 361 Net investment income 146 132 138 103 Pre-tax operating income $9 $205 $592 $464 Delinquency ratio1 8.8% 5.9% 4.4% 3.5%

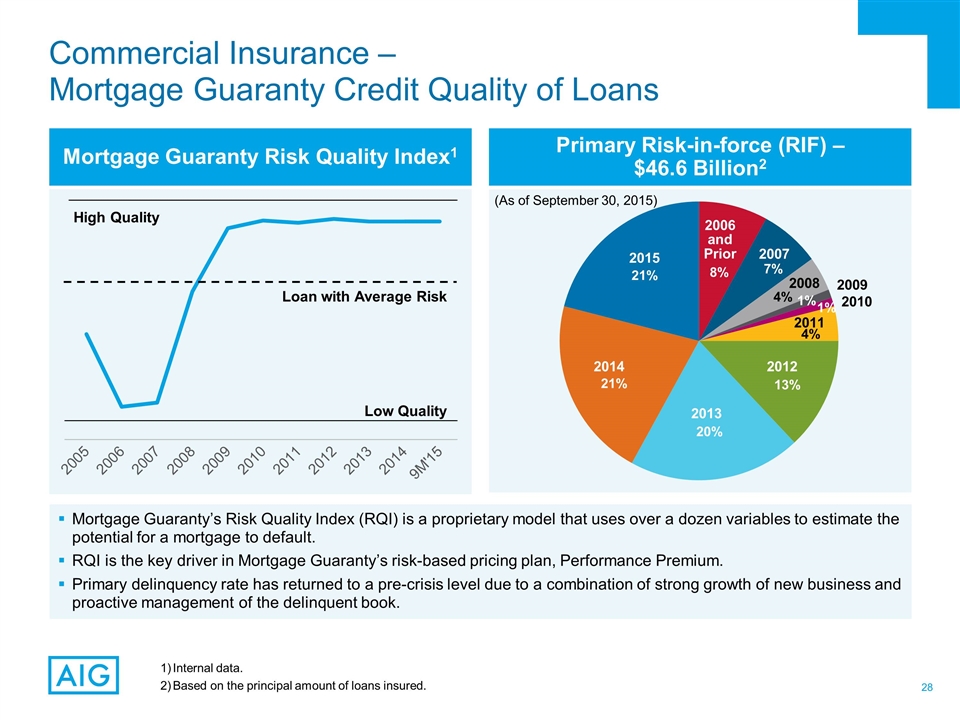

Mortgage Guaranty’s Risk Quality Index (RQI) is a proprietary model that uses over a dozen variables to estimate the potential for a mortgage to default. RQI is the key driver in Mortgage Guaranty’s risk-based pricing plan, Performance Premium. Primary delinquency rate has returned to a pre-crisis level due to a combination of strong growth of new business and proactive management of the delinquent book. Internal data. Based on the principal amount of loans insured. Commercial Insurance – Mortgage Guaranty Credit Quality of Loans Mortgage Guaranty Risk Quality Index1 Primary Risk-in-force (RIF) – $46.6 Billion2 Low Quality Loan with Average Risk High Quality 2014 2013 2012 2011 2010 2009 2008 2007 2015 2006 and Prior (As of September 30, 2015)

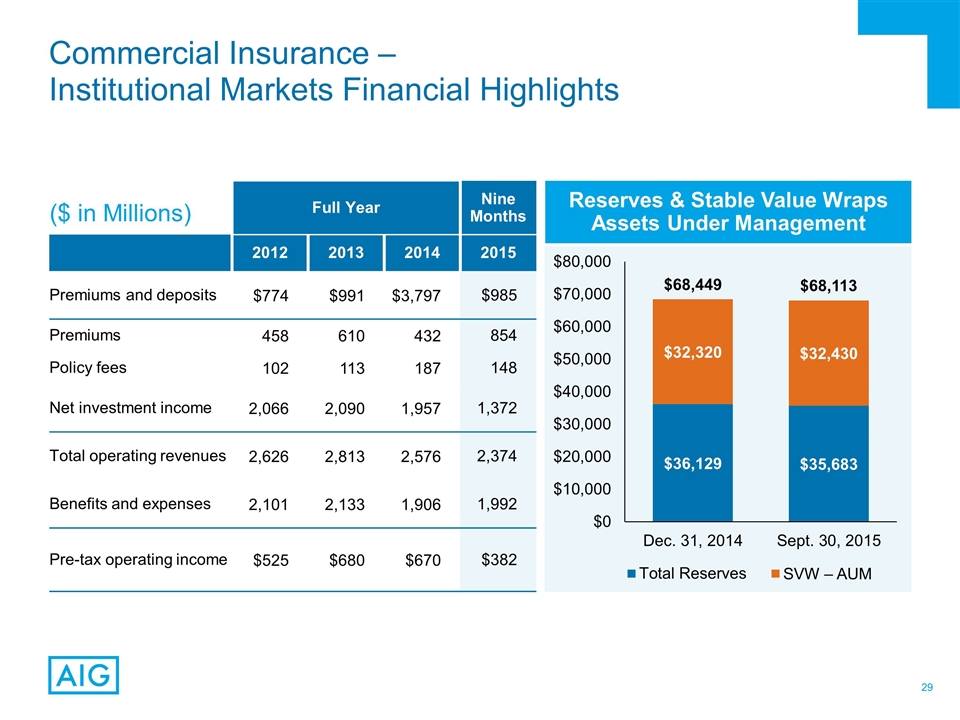

($ in Millions) Commercial Insurance – Institutional Markets Financial Highlights Reserves & Stable Value Wraps Assets Under Management Full Year Nine Months 2012 2013 2014 2015 Premiums and deposits $774 $991 $3,797 $985 Premiums 458 610 432 854 Policy fees 102 113 187 148 Net investment income 2,066 2,090 1,957 1,372 Total operating revenues 2,626 2,813 2,576 2,374 Benefits and expenses 2,101 2,133 1,906 1,992 Pre-tax operating income $525 $680 $670 $382

Consumer Insurance

Consumer Insurance – Strategy Customer Information-Driven Strategy Focused Growth Operational Effectiveness Profitability and Capital Management Investment Strategy Aspire to be our customers’ most valued insurer. Through our unique franchise, which brings together a broad portfolio of retirement, life insurance and personal insurance products offered through multiple distribution networks, Consumer Insurance aims to provide customers with the products they need, delivered through the channels they prefer. Utilize customer insight, analytics and the application of science to optimize customer acquisition, product profitability, product mix, channel performance and risk management capabilities. Invest in areas where Consumer Insurance can grow profitably and sustainably. Target growth in select markets according to market size, growth potential, market maturity and customer demographics. Simplify processes, enhance operating environments, and leverage the best platforms and tools for multiple operating segments to increase competitiveness, improve service and product capabilities and facilitate delivery of our target customer experience. Deliver solid earnings through disciplined pricing and expense management, sustainable underwriting improvements and diversification of risk, and increase capital efficiency within insurance entities to enhance return on equity. Maintain a diversified, high quality portfolio of fixed maturity securities that largely matches the duration characteristics of the related insurance liabilities, and pursue yield-enhancement opportunities that meet liquidity, risk and return objectives. Distinguish Ourselves in the Markets and Products We Choose. Be the Provider of Choice Among Our Target Segments and Channels.

Focused Growth Consumer Insurance – Market Maturity Model Early Stage Market Advanced Stage Market Product Channel Customer Segment Personal Accident Travel Warranty Auto & Home Life Health Retirement Micro Insurance Broad Market/ Wholesaling Career Agency, IFAs Public Agencies Financial Services Sponsors – including Brokers, Banks & Reinsurance Self-Employed Employed Emerging Banked Middle Class Affluent High Net Worth General Population

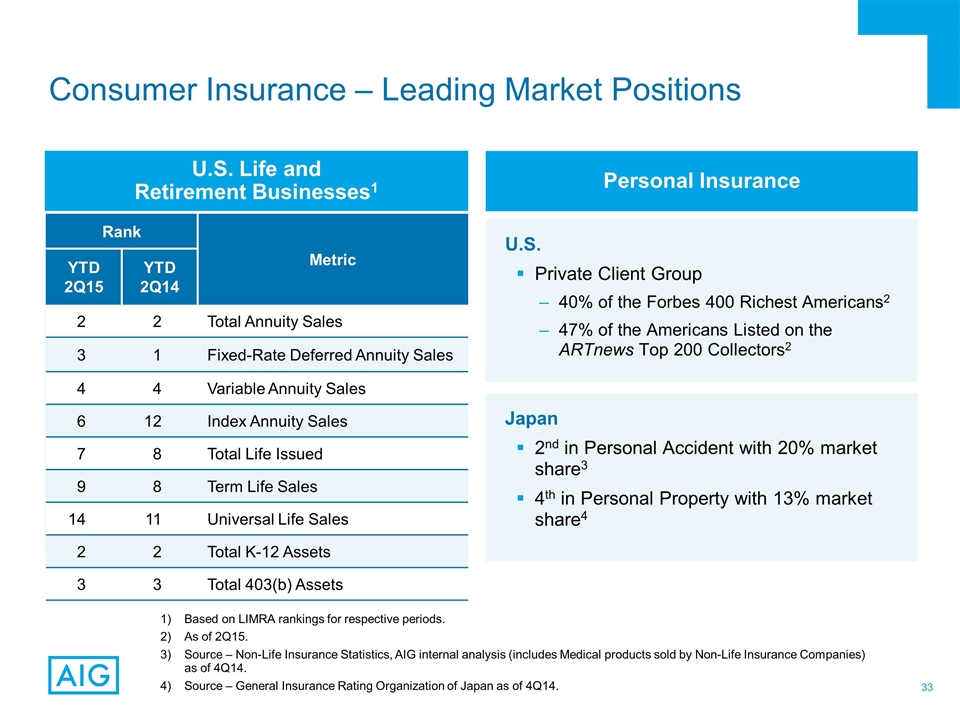

Based on LIMRA rankings for respective periods. As of 2Q15. Source – Non-Life Insurance Statistics, AIG internal analysis (includes Medical products sold by Non-Life Insurance Companies) as of 4Q14. Source – General Insurance Rating Organization of Japan as of 4Q14. Consumer Insurance – Leading Market Positions U.S. Life and Retirement Businesses1 Personal Insurance U.S. Private Client Group 40% of the Forbes 400 Richest Americans2 47% of the Americans Listed on the ARTnews Top 200 Collectors2 Rank Metric YTD 2Q15 YTD 2Q14 2 2 Total Annuity Sales 3 1 Fixed-Rate Deferred Annuity Sales 4 4 Variable Annuity Sales 6 12 Index Annuity Sales 7 8 Total Life Issued 9 8 Term Life Sales 14 11 Universal Life Sales 2 2 Total K-12 Assets 3 3 Total 403(b) Assets Japan 2nd in Personal Accident with 20% market share3 4th in Personal Property with 13% market share4

Consumer Insurance Operations Continue to Be Recognized for Excellence Globally Consumer Insurance – Leading Businesses Market Tools – U.S. 2015 Achievement in Customer Excellence for Life Insurance (ACE Award for 8th Consecutive Year) DALBAR – U.S. 2014 Annuity Service Excellence Award (8th Consecutive Year) 2014 #1 Ranking for Annuity Client Quarterly Statements (14th Consecutive Year) 2014 Communication Seal for VALIC.com (3rd Consecutive Year) 2014 Mobile InSIGHT – Innovations in the World of Apps Trailblazer Rating (VALIC Mobile for iPad) PlanSponsor Magazine – U.S. Earned 14 Best-in-Class Awards for Participant and Plan Sponsor Services for VALIC in 2014 International MarCom Awards – U.S. 2014 Platinum and Gold Awards for Retirement (34 in total) Travvy Awards – U.S. AIG Travel Named Top Travel Insurance Provider in 2015 Insurance and Financial Communications Association – U.S. 2015 Best in Show and Awards of Excellence for Retirement (8 in total) Money Week Awards – China AIG Travel – China Named Best Travel Insurance Product in 2015 Underwriting Services Awards – U.K. AIG UK Group Travel and Personal Accident Team of the Year in 2014 Australian Business Awards 2014 ABA100 Winner for Best Technology Product in 2014 JD Power Asia Pacific – Japan AIG Japan (AIU, FFM and American Home) ranked #1 in 2014 Auto Insurance Claims Satisfaction survey (for 6th Year) Reader’s Digest – Singapore AIG Singapore Most Trusted Brand Award for Auto Insurance 2015 Indonesian Insurance Awards AIG Indonesia Named Best Private General Insurance 2014 Gaivota de Ouro Insurance Industry Awards, Seguro Total Magazine – Brazil AIG Brazil Earned Group Life Award in 2014 AVA Digital Awards – U.S. Earned 4 Platinum Awards in 2015 Saigon Liberation Newspaper Awards AIG Travel Named Favorite Vietnamese Brand Award (10th Consecutive Year) Motordata Research Consortium – Malaysia AIG Malaysia Named Insurer of the Year 2014 MENA Insurance Awards – EMEA EMEA Consumer Named Most Innovative Insurer Product in 2015 Business Insurance 2015 Innovation Award – AIG World Travel Fair AIG Travel Named Best Quality Service Travel Insurance Company for Travel Accident 2015

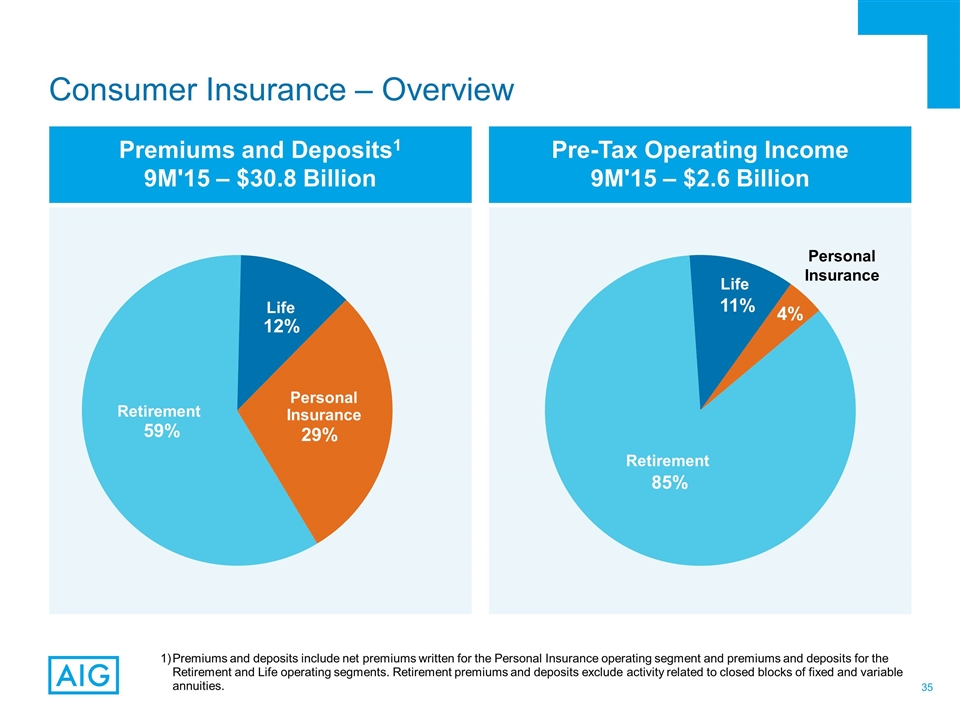

1)Premiums and deposits include net premiums written for the Personal Insurance operating segment and premiums and deposits for the Retirement and Life operating segments. Retirement premiums and deposits exclude activity related to closed blocks of fixed and variable annuities. Consumer Insurance – Overview Premiums and Deposits1 9M'15 – $30.8 Billion Pre-Tax Operating Income 9M'15 – $2.6 Billion Life Retirement Life Personal Insurance Retirement Personal Insurance

1) Excludes activity related to closed blocks of fixed and variable annuities. Consumer Insurance – Retirement Financial Highlights Full Year Nine Months ($ in Millions) 2012 2013 2014 2015 Premiums and deposits1 $16,048 $23,729 $24,023 $18,204 Premiums 120 188 287 127 Policy fees 743 861 1,010 802 Net investment income 6,502 6,628 6,489 4,584 Advisory fee and other income 1,344 1,754 1,998 1,543 Total operating revenues 8,709 9,431 9,784 7,056 Benefits and expenses 5,908 5,941 6,289 4,817 Pre-tax operating income $2,801 $3,490 $3,495 $2,239 Premiums and Deposits 9M'15 – $18.2 Billion Assets Under Management September 30, 2015 – $220.3 Billion Retail Mutual Funds Fixed Annuities Group Retirement Variable Annuities Retail Mutual Funds Fixed Annuities Group Retirement Retirement Income Solutions Index Annuities

Base Net Investment Spreads1 1) Annualized return on base portfolio. 2) Excludes the amortization of sales inducement assets. Consumer Insurance – Retirement – Base Yields and Spreads Base Yields1 The trend in base yields reflects the reinvestment of cash flows at yields lower than the overall portfolio rate. The Group Retirement 2Q15 base yield and net investment spread included a one-time accretion adjustment on a U.S. Treasury Strip Bond. Cost of Funds2

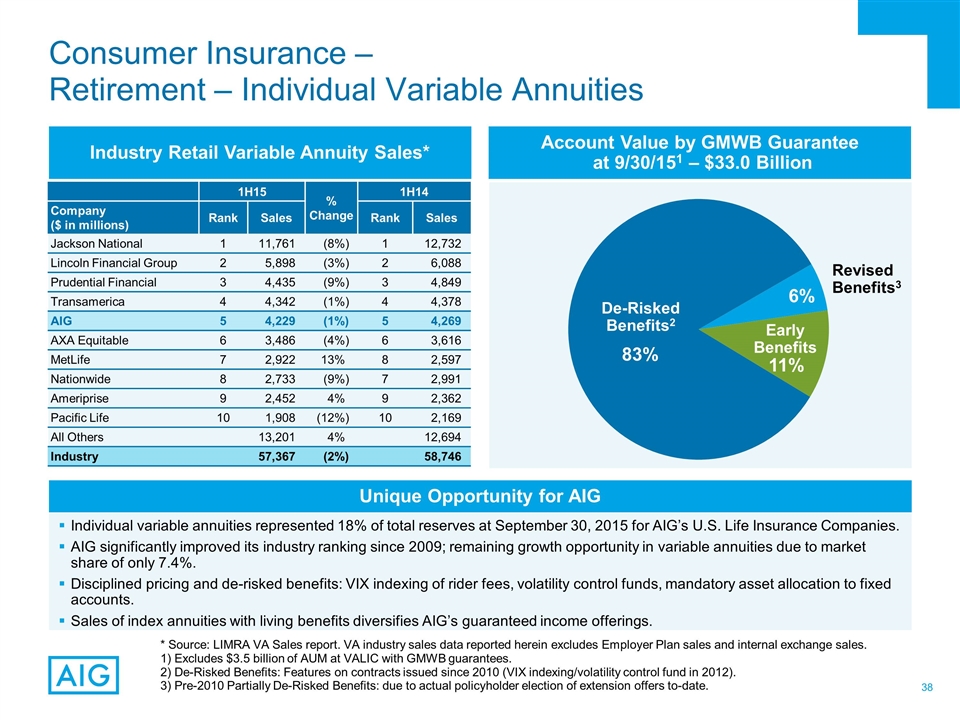

Individual variable annuities represented 18% of total reserves at September 30, 2015 for AIG’s U.S. Life Insurance Companies. AIG significantly improved its industry ranking since 2009; remaining growth opportunity in variable annuities due to market share of only 7.4%. Disciplined pricing and de-risked benefits: VIX indexing of rider fees, volatility control funds, mandatory asset allocation to fixed accounts. Sales of index annuities with living benefits diversifies AIG’s guaranteed income offerings. * Source: LIMRA VA Sales report. VA industry sales data reported herein excludes Employer Plan sales and internal exchange sales. 1) Excludes $3.5 billion of AUM at VALIC with GMWB guarantees. 2) De-Risked Benefits: Features on contracts issued since 2010 (VIX indexing/volatility control fund in 2012). 3) Pre-2010 Partially De-Risked Benefits: due to actual policyholder election of extension offers to-date. Consumer Insurance – Retirement – Individual Variable Annuities Industry Retail Variable Annuity Sales* Account Value by GMWB Guarantee at 9/30/151 – $33.0 Billion Unique Opportunity for AIG 1H15 % Change 1H14 Company ($ in millions) Rank Sales Rank Sales Jackson National 1 11,761 (8%) 1 12,732 Lincoln Financial Group 2 5,898 (3%) 2 6,088 Prudential Financial 3 4,435 (9%) 3 4,849 Transamerica 4 4,342 (1%) 4 4,378 AIG 5 4,229 (1%) 5 4,269 AXA Equitable 6 3,486 (4%) 6 3,616 MetLife 7 2,922 13% 8 2,597 Nationwide 8 2,733 (9%) 7 2,991 Ameriprise 9 2,452 4% 9 2,362 Pacific Life 10 1,908 (12%) 10 2,169 All Others 13,201 4% 12,694 Industry 57,367 (2%) 58,746 De-Risked Benefits2 Early Benefits Revised Benefits3

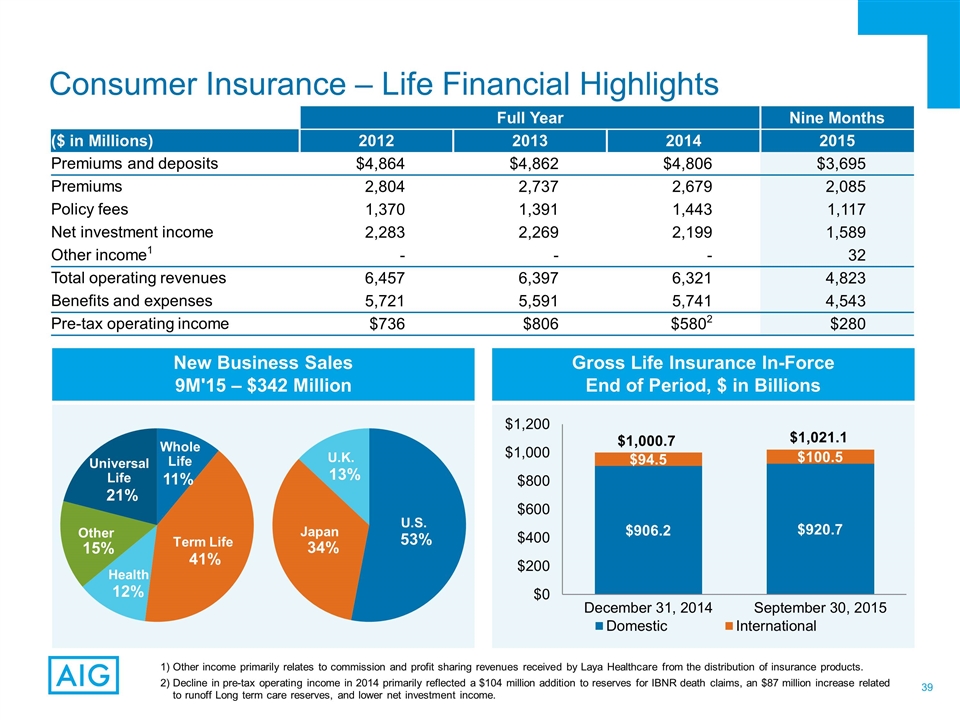

Other income primarily relates to commission and profit sharing revenues received by Laya Healthcare from the distribution of insurance products. Decline in pre-tax operating income in 2014 primarily reflected a $104 million addition to reserves for IBNR death claims, an $87 million increase related to runoff Long term care reserves, and lower net investment income. Consumer Insurance – Life Financial Highlights Full Year Nine Months ($ in Millions) 2012 2013 2014 2015 Premiums and deposits $4,864 $4,862 $4,806 $3,695 Premiums 2,804 2,737 2,679 2,085 Policy fees 1,370 1,391 1,443 1,117 Net investment income 2,283 2,269 2,199 1,589 Other income1 - - - 32 Total operating revenues 6,457 6,397 6,321 4,823 Benefits and expenses 5,721 5,591 5,741 4,543 Pre-tax operating income $736 $806 $5802 $280 New Business Sales 9M'15 – $342 Million Gross Life Insurance In-Force End of Period, $ in Billions $1,000.7 Whole Life Term Life Health Other Universal Life U.S. Japan $1,021.1 U.K.

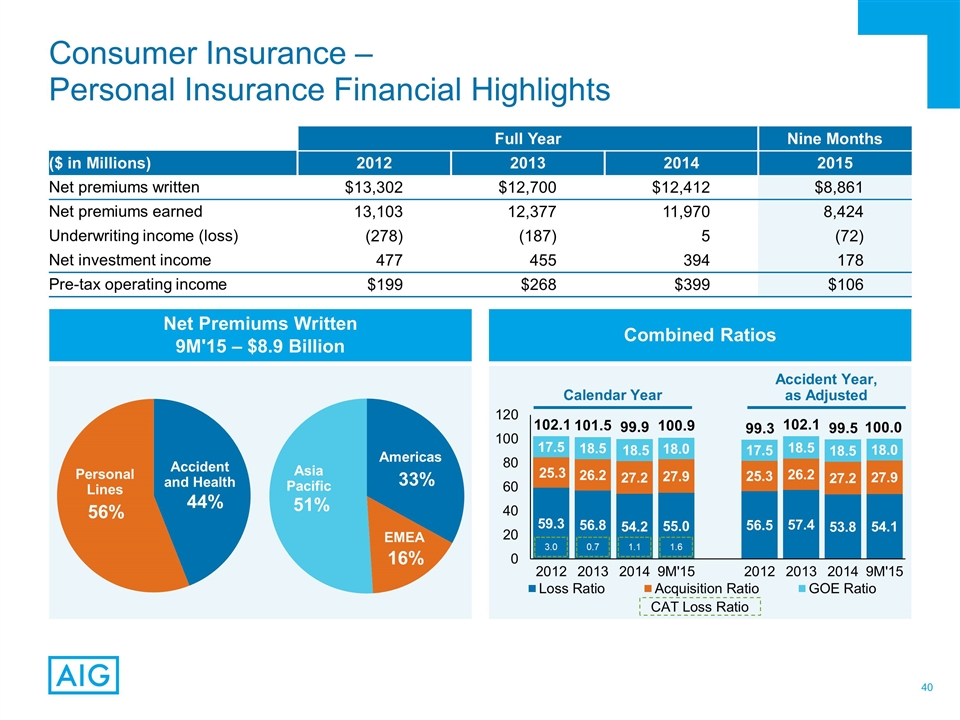

Consumer Insurance – Personal Insurance Financial Highlights Net Premiums Written 9M'15 – $8.9 Billion Combined Ratios Full Year Nine Months ($ in Millions) 2012 2013 2014 2015 Net premiums written $13,302 $12,700 $12,412 $8,861 Net premiums earned 13,103 12,377 11,970 8,424 Underwriting income (loss) (278) (187) 5 (72) Net investment income 477 455 394 178 Pre-tax operating income $199 $268 $399 $106 Accident Year, as Adjusted Calendar Year 102.1 101.5 99.9 99.3 102.1 99.5 Accident and Health Personal Lines Americas EMEA Asia Pacific 100.9 100.0 CAT Loss Ratio 3.0 0.7 1.1 1.6

Appendix

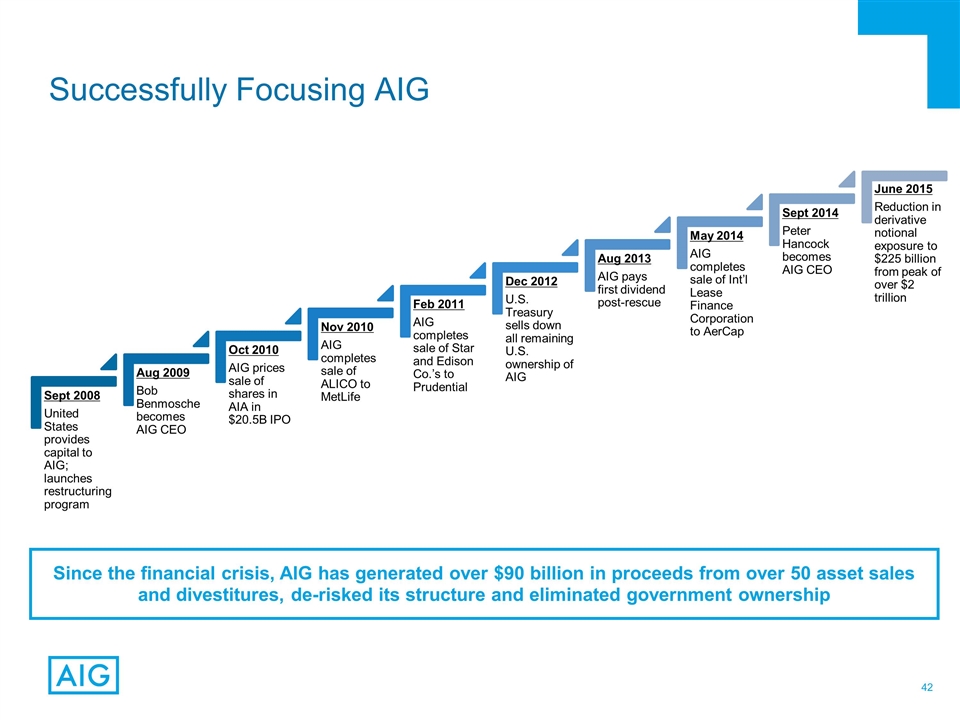

Sept 2008 United States provides capital to AIG; launches restructuring program Aug 2009 Bob Benmosche becomes AIG CEO Oct 2010 AIG prices sale of shares in AIA in $20.5B IPO Nov 2010 AIG completes sale of ALICO to MetLife Feb 2011 AIG completes sale of Star and Edison Co.’s to Prudential Dec 2012 U.S. Treasury sells down all remaining U.S. ownership of AIG Aug 2013 AIG pays first dividend post-rescue May 2014 AIG completes sale of Int’l Lease Finance Corporation to AerCap Sept 2014 Peter Hancock becomes AIG CEO June 2015 Reduction in derivative notional exposure to $225 billion from peak of over $2 trillion Successfully Focusing AIG Since the financial crisis, AIG has generated over $90 billion in proceeds from over 50 asset sales and divestitures, de-risked its structure and eliminated government ownership

We use the following operating performance measures because we believe they enhance the understanding of the underlying profitability of continuing operations and trends of our business segments. We believe they also allow for more meaningful comparisons with our insurance competitors. When we use these measures, reconciliations to the most comparable GAAP measure are provided, on a consolidated basis. Operating revenue excludes Net realized capital gains (losses), Aircraft leasing revenues, income from non-operating litigation settlements (included in Other income for GAAP purposes) and changes in fair values of fixed maturity securities designated to hedge living benefit liabilities, net of interest expense (included in Net investment income for GAAP purposes). Book Value Per Share Excluding Accumulated Other Comprehensive Income (AOCI), Book Value Per Share Excluding AOCI and Deferred Tax Assets (DTA) and Book Value Per Share Excluding AOCI and DTA and Including Dividend Growth are used to show the amount of our net worth on a per-share basis. We believe these measures are useful to investors because they eliminate the effect of non-cash items that can fluctuate significantly from period to period, including changes in fair value of our available for sale securities portfolio, foreign currency translation adjustments and U.S. tax attribute deferred tax assets. Deferred tax assets represent U.S. tax attributes related to net operating loss carryforwards and foreign tax credits. Amounts are estimates based on projections of full year attribute utilization. Book Value Per Share Excluding AOCI is derived by dividing Total AIG shareholders’ equity, excluding AOCI, by Total common shares outstanding. Book Value Per Share Excluding AOCI and DTA is derived by dividing Total AIG shareholders’ equity, excluding AOCI and DTA, by Total common shares outstanding. Book Value Per Share Excluding AOCI and DTA and including dividend growth is derived by dividing Total AIG shareholders’ equity, excluding AOCI and DTA and including growth in dividends to shareholders, by Total common shares outstanding. After-tax operating income attributable to AIG is derived by excluding the following items from net income attributable to AIG: deferred income tax valuation allowance releases and charges; changes in fair value of fixed maturity securities designated to hedge living benefit liabilities (net of interest expense); changes in benefit reserves and deferred policy acquisition costs (DAC), value of business acquired (VOBA), and sales inducement assets (SIA) related to net realized capital gains and losses; other income and expense — net, related to Corporate and Other run-off insurance lines; loss on extinguishment of debt; net realized capital gains and losses; non-qualifying derivative hedging activities, excluding net realized capital gains and losses; income or loss from discontinued operations; Return on Equity – After-tax Operating Income Excluding AOCI and Return on Equity – After-tax Operating Income Excluding AOCI and DTA are used to show the rate of return on shareholders’ equity. We believe these measures are useful to investors because they eliminate the effect of non-cash items that can fluctuate significantly from period to period, including changes in fair value of our available for sale securities portfolio, foreign currency translation adjustments and U.S. tax attribute deferred tax assets. Deferred tax assets represent U.S. tax attributes related to net operating loss carryforwards and foreign tax credits. Amounts are estimates based on projections of full year attribute utilization. Return on Equity – After-tax Operating Income Excluding AOCI is derived by dividing actual or annualized after-tax operating income attributable to AIG by average AIG shareholders’ equity, excluding average AOCI. Return on Equity – After-tax Operating Income Excluding AOCI and DTA is derived by dividing actual or annualized after-tax operating income attributable to AIG, by average AIG shareholders’ equity, excluding average AOCI and DTA. Glossary of Non-GAAP Financial Measures AIG income and loss from divested businesses, including: gain on the sale of International Lease Finance Corporation (ILFC); and certain post-acquisition transaction expenses incurred by AerCap Holdings N.V. (AerCap) in connection with its acquisition of ILFC and the difference between expensing AerCap’s maintenance rights assets over the remaining lease term as compared to the remaining economic life of the related aircraft and related tax effects; legacy tax adjustments primarily related to certain changes in uncertain tax positions and other tax adjustments; non-operating litigation reserves and settlements; reserve development related to non-operating run-off insurance business; and restructuring and other costs related to initiatives designed to reduce operating expenses, improve efficiency and simplify our organization.

Pre-tax operating income: includes both underwriting income and loss and net investment income, but excludes net realized capital gains and losses, other income and expense — net and non-operating litigation reserves and settlements. Underwriting income and loss is derived by reducing net premiums earned by losses and loss adjustment expenses incurred, acquisition expenses and general operating expenses. Ratios: We, along with most property and casualty insurance companies, use the loss ratio, the expense ratio and the combined ratio as measures of underwriting performance. These ratios are relative measurements that describe, for every $100 of net premiums earned, the amount of losses and loss adjustment expenses, and the amount of other underwriting expenses that would be incurred. A combined ratio of less than 100 indicates underwriting income and a combined ratio of over 100 indicates an underwriting loss. The underwriting environment varies across countries and products, as does the degree of litigation activity, all of which affect such ratios. In addition, investment returns, local taxes, cost of capital, regulation, product type and competition can have an effect on pricing and consequently on profitability as reflected in underwriting income and associated ratios. Accident year loss and combined ratios, as adjusted: both the accident year loss and combined ratios, as adjusted, exclude catastrophe losses and related reinstatement premiums, prior year development, net of premium adjustments, and the impact of reserve discounting. Catastrophe losses are generally weather or seismic events having a net impact in excess of $10 million each. Normalized Return on Equity, Excluding AOCI and DTA further adjusts Return on Equity – After-tax Operating Income, excluding AOCI and DTA for the effects of certain volatile or market related items. Normalized Return on Equity, Excluding AOCI and DTA is derived by excluding the following tax adjusted effects from Return on Equity – After-tax Operating Income, Excluding AOCI and DTA: Catastrophe losses compared to expectations Alternative investment returns compared to expectations DIB/GCM returns compared to expectations Fair value changes on PICC investments Update of actuarial assumptions Net reserve discount change Life insurance IBNR death claim charge Prior year loss reserve development General operating expenses, operating basis, is derived by making the following adjustments to general operating and other expenses: include (i) loss adjustment expenses, reported as policyholder benefits and losses incurred and (ii) certain investment and other expenses reported as net investment income, and exclude (i) advisory fee expenses, (ii) non-deferrable insurance commissions, (iii) direct marketing and acquisition expenses, net of deferrals, (iv) non-operating litigation reserves and (v) other expense related to a retroactive reinsurance agreement. We use general operating expenses, operating basis, because we believe it provides a more meaningful indication of our ordinary course of business operating costs. Glossary of Non-GAAP Financial Measures (continued) AIG Commercial Insurance: Property Casualty and Mortgage Guaranty; Consumer Insurance: Personal Insurance

Glossary of Non-GAAP Financial Measures (continued) Pre-tax operating income and loss is derived by excluding the following items from pre-tax income and loss: loss on extinguishment of debt net realized capital gains and losses changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains and losses income and loss from divested businesses, including Aircraft Leasing Corporate and Other net gain or loss on sale of divested businesses, including: gain on the sale of ILFC and certain post-acquisition transaction expenses incurred by AerCap in connection with its acquisition of ILFC and the difference between expensing AerCap’s maintenance rights assets over the remaining lease term as compared to the remaining economic life of the related aircraft and our share of AerCap’s income taxes non-operating litigation reserves and settlements reserve development related to non-operating run-off insurance business restructuring and other costs related to initiatives designed to reduce operating expenses, improve efficiency and simplify our organization. Results from discontinued operations are excluded from all of these measures. Commercial Insurance: Institutional Markets; Consumer Insurance: Retirement and Life Pre-tax operating income is derived by excluding the following items from pre-tax income: changes in fair values of fixed maturity securities designated to hedge living benefit liabilities (net of interest expense); net realized capital gains and losses; changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains and losses; non-operating litigation reserves and settlements Premiums and deposits: includes direct and assumed amounts received and earned on traditional life insurance policies, group benefit policies and life-contingent payout annuities, as well as deposits received on universal life, investment-type annuity contracts and mutual funds. Acronyms YTD – Year-to-date YoY – Year-over-year NPW – Net premiums written AUM – Assets under management FX – Foreign exchange AOCI – Accumulated other comprehensive income DTA – Deferred tax assets PYD – Prior year loss reserve development

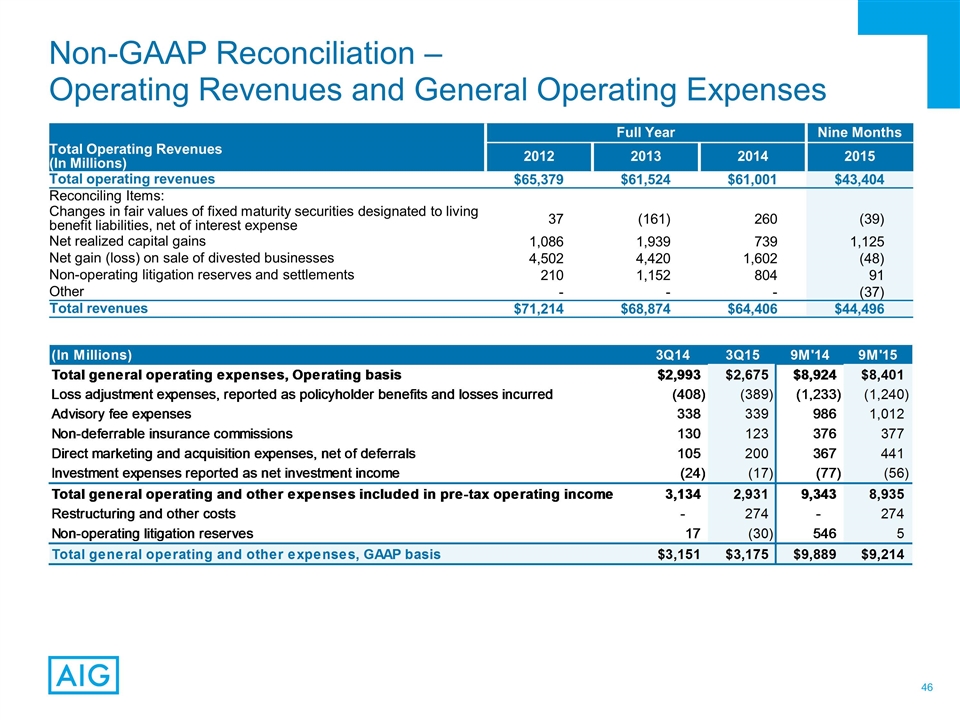

Non-GAAP Reconciliation – Operating Revenues and General Operating Expenses Full Year Nine Months Total Operating Revenues (In Millions) 2012 2013 2014 2015 Total operating revenues $65,379 $61,524 $61,001 $43,404 Reconciling Items: Changes in fair values of fixed maturity securities designated to living benefit liabilities, net of interest expense 37 (161) 260 (39) Net realized capital gains 1,086 1,939 739 1,125 Net gain (loss) on sale of divested businesses 4,502 4,420 1,602 (48) Non-operating litigation reserves and settlements 210 1,152 804 91 Other - - - (37) Total revenues $71,214 $68,874 $64,406 $44,496

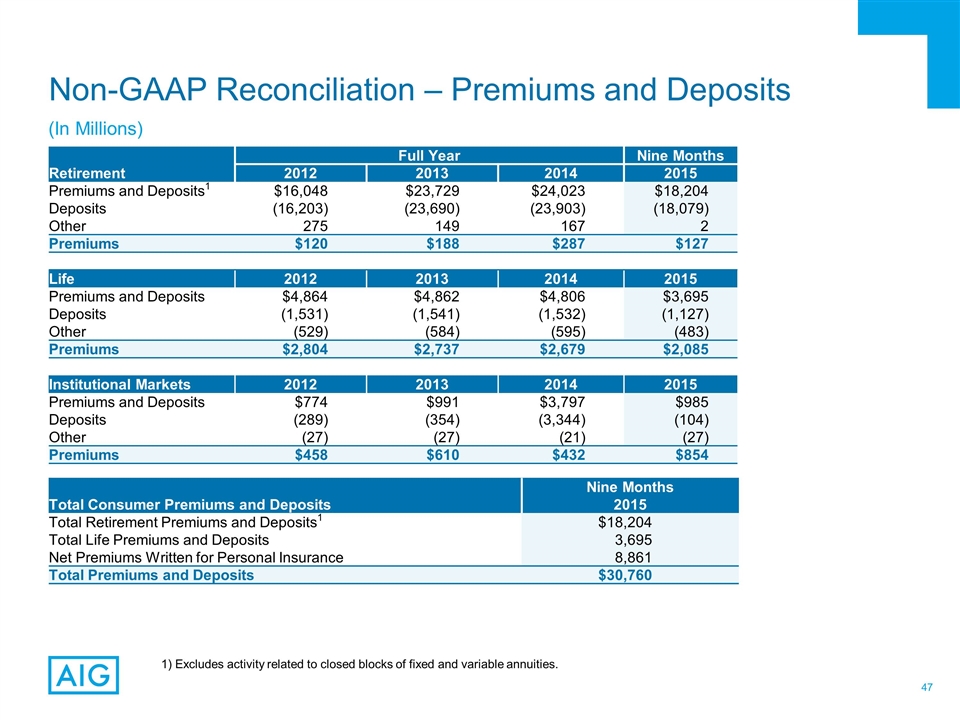

Non-GAAP Reconciliation – Premiums and Deposits Retirement Full Year Nine Months 2012 2013 2014 2015 Premiums and Deposits1 $16,048 $23,729 $24,023 $18,204 Deposits (16,203) (23,690) (23,903) (18,079) Other 275 149 167 2 Premiums $120 $188 $287 $127 Life 2012 2013 2014 2015 Premiums and Deposits $4,864 $4,862 $4,806 $3,695 Deposits (1,531) (1,541) (1,532) (1,127) Other (529) (584) (595) (483) Premiums $2,804 $2,737 $2,679 $2,085 Institutional Markets 2012 2013 2014 2015 Premiums and Deposits $774 $991 $3,797 $985 Deposits (289) (354) (3,344) (104) Other (27) (27) (21) (27) Premiums $458 $610 $432 $854 Total Consumer Premiums and Deposits Nine Months 2015 Total Retirement Premiums and Deposits1 $18,204 Total Life Premiums and Deposits 3,695 Net Premiums Written for Personal Insurance 8,861 Total Premiums and Deposits $30,760 (In Millions) 1) Excludes activity related to closed blocks of fixed and variable annuities.

Non-GAAP Reconciliation – Pre-tax and After-tax Operating Income Full Year Nine Months Pre-tax and After-tax Operating Income (In Millions, Except Per Share Data) 2012 2013 2014 2015 Pre-tax income from continuing operations $2,891 $9,368 $10,501 $6,213 Adjustments to arrive at Pre-tax operating income: Changes in fair values of fixed maturity securities designated to hedge living benefit liabilities, net of interest expense (37) 161 (260) 39 Changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains (losses) 1,213 1,608 217 84 Other (income) expense – net – 72 – – Loss on extinguishment of debt 32 651 2,282 756 Net realized capital (gains) losses (1,086) (1,939) (739) (1,125) (Income) loss from divested businesses, including gain on sale of ILFC 6,411 177 (2,169) 58 Non-operating litigation reserves and settlements 544 (708) (258) (86) Reserve development related to non-operating run-off insurance business – – – 30 Restructuring and other costs – – – 274 Non-qualifying derivative hedging gains, excluding net realized capital gains (30) – – – Pre-tax operating income $9,938 $9,390 $9,574 $6,243 Net income attributable to AIG $3,438 $9,085 $7,529 $4,037 Adjustments to arrive at After-tax operating income (amounts net of tax): Uncertain tax positions and other tax adjustments 543 791 59 142 Deferred income tax valuation allowance releases (1,911) (3,237) (181) 61 Changes in fair values of fixed maturity securities designated to hedge living benefit liabilities, net of interest expense (24) 105 (169) 25 Changes in benefit reserves and DAC, VOBA and SIA related to net realized capital gains (losses) 789 1,148 141 55 Other (income) expense – net – 47 – – Loss on extinguishment of debt 21 423 1,483 491 Net realized capital (gains) losses (687) (1,285) (470) (691) (Income) loss from discontinued businesses (1) (84) 50 – (Income) loss from divested businesses, including gain on sale of ILFC 4,039 117 (1,462) 14 Non-operating litigation reserves and settlements 353 (460) (350) (56) Reserve development related to non-operating run-off insurance business – – – 20 Restructuring and other costs – – – 177 Non-qualifying derivative hedging gains, excluding net realized capital gains (18) – – – After-tax operating income $6,542 $6,650 $6,630 $4,275 After-tax operating income per diluted share $3.88 $4.49 $4.58 $3.15

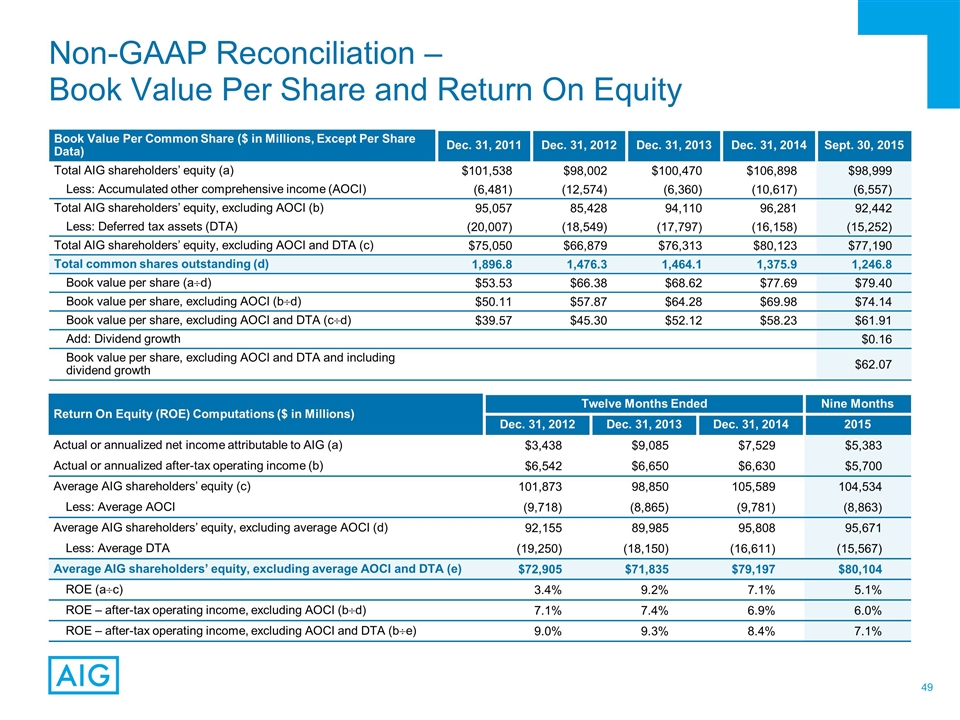

Non-GAAP Reconciliation – Book Value Per Share and Return On Equity Book Value Per Common Share ($ in Millions, Except Per Share Data) Dec. 31, 2011 Dec. 31, 2012 Dec. 31, 2013 Dec. 31, 2014 Sept. 30, 2015 Total AIG shareholders’ equity (a) $101,538 $98,002 $100,470 $106,898 $98,999 Less: Accumulated other comprehensive income (AOCI) (6,481) (12,574) (6,360) (10,617) (6,557) Total AIG shareholders’ equity, excluding AOCI (b) 95,057 85,428 94,110 96,281 92,442 Less: Deferred tax assets (DTA) (20,007) (18,549) (17,797) (16,158) (15,252) Total AIG shareholders’ equity, excluding AOCI and DTA (c) $75,050 $66,879 $76,313 $80,123 $77,190 Total common shares outstanding (d) 1,896.8 1,476.3 1,464.1 1,375.9 1,246.8 Book value per share (a¸d) $53.53 $66.38 $68.62 $77.69 $79.40 Book value per share, excluding AOCI (b¸d) $50.11 $57.87 $64.28 $69.98 $74.14 Book value per share, excluding AOCI and DTA (c¸d) $39.57 $45.30 $52.12 $58.23 $61.91 Add: Dividend growth $0.16 Book value per share, excluding AOCI and DTA and including dividend growth $62.07 Return On Equity (ROE) Computations ($ in Millions) Twelve Months Ended Nine Months Dec. 31, 2012 Dec. 31, 2013 Dec. 31, 2014 2015 Actual or annualized net income attributable to AIG (a) $3,438 $9,085 $7,529 $5,383 Actual or annualized after-tax operating income (b) $6,542 $6,650 $6,630 $5,700 Average AIG shareholders’ equity (c) 101,873 98,850 105,589 104,534 Less: Average AOCI (9,718) (8,865) (9,781) (8,863) Average AIG shareholders’ equity, excluding average AOCI (d) 92,155 89,985 95,808 95,671 Less: Average DTA (19,250) (18,150) (16,611) (15,567) Average AIG shareholders’ equity, excluding average AOCI and DTA (e) $72,905 $71,835 $79,197 $80,104 ROE (a¸c) 3.4% 9.2% 7.1% 5.1% ROE – after-tax operating income, excluding AOCI (b¸d) 7.1% 7.4% 6.9% 6.0% ROE – after-tax operating income, excluding AOCI and DTA (b¸e) 9.0% 9.3% 8.4% 7.1%

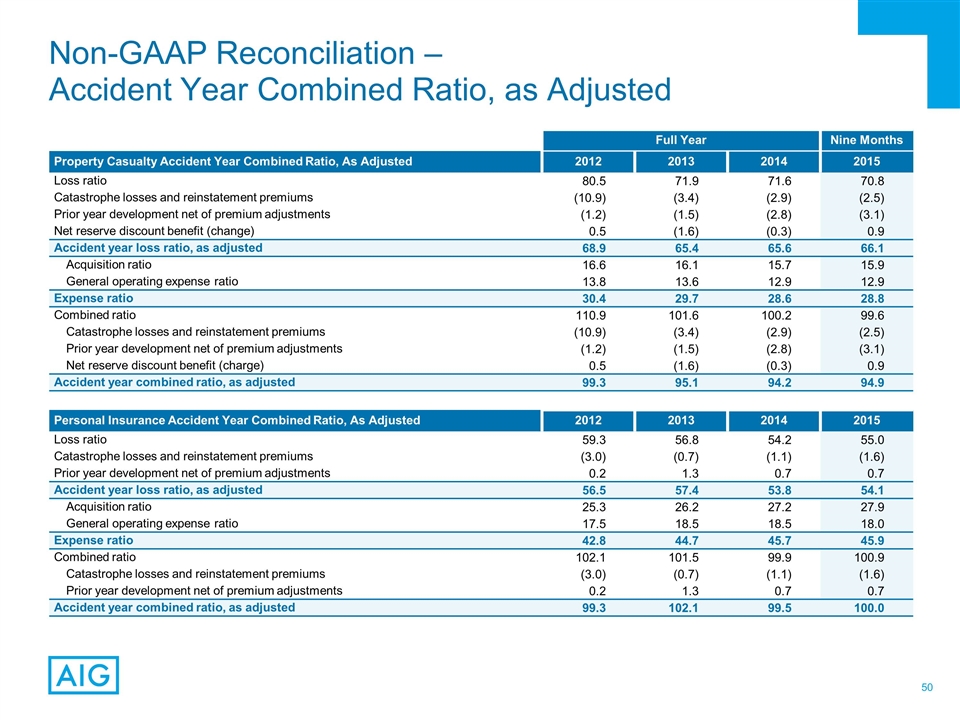

Full Year Nine Months Property Casualty Accident Year Combined Ratio, As Adjusted 2012 2013 2014 2015 Loss ratio 80.5 71.9 71.6 70.8 Catastrophe losses and reinstatement premiums (10.9) (3.4) (2.9) (2.5) Prior year development net of premium adjustments (1.2) (1.5) (2.8) (3.1) Net reserve discount benefit (change) 0.5 (1.6) (0.3) 0.9 Accident year loss ratio, as adjusted 68.9 65.4 65.6 66.1 Acquisition ratio 16.6 16.1 15.7 15.9 General operating expense ratio 13.8 13.6 12.9 12.9 Expense ratio 30.4 29.7 28.6 28.8 Combined ratio 110.9 101.6 100.2 99.6 Catastrophe losses and reinstatement premiums (10.9) (3.4) (2.9) (2.5) Prior year development net of premium adjustments (1.2) (1.5) (2.8) (3.1) Net reserve discount benefit (charge) 0.5 (1.6) (0.3) 0.9 Accident year combined ratio, as adjusted 99.3 95.1 94.2 94.9 Non-GAAP Reconciliation – Accident Year Combined Ratio, as Adjusted Personal Insurance Accident Year Combined Ratio, As Adjusted 2012 2013 2014 2015 Loss ratio 59.3 56.8 54.2 55.0 Catastrophe losses and reinstatement premiums (3.0) (0.7) (1.1) (1.6) Prior year development net of premium adjustments 0.2 1.3 0.7 0.7 Accident year loss ratio, as adjusted 56.5 57.4 53.8 54.1 Acquisition ratio 25.3 26.2 27.2 27.9 General operating expense ratio 17.5 18.5 18.5 18.0 Expense ratio 42.8 44.7 45.7 45.9 Combined ratio 102.1 101.5 99.9 100.9 Catastrophe losses and reinstatement premiums (3.0) (0.7) (1.1) (1.6) Prior year development net of premium adjustments 0.2 1.3 0.7 0.7 Accident year combined ratio, as adjusted 99.3 102.1 99.5 100.0

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AIG (AIG) Announces Retirement of David McElroy

- CORRECTION: Black Hawk Acquisition Corporation Welcomes Mr. Jonathan Ginsberg to Board

- TANDEM ALERT: Bragar Eagel & Squire, P.C. is Investigating Tandem Diabetes Care, Inc. on Behalf of Long-Term Stockholders and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share