Form 8-K ALERE INC. For: Jan 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2016

ALERE INC.

(Exact name of registrant as specified in charter)

| Delaware | 1-16789 | 04-3565120 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

51 Sawyer Road, Suite 200, Waltham, Massachusetts 02453

(Address of Principal Executive Offices) (Zip Code)

(781) 647-3900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure.

On January 11, 2016, Alere Inc. made a presentation at the 2016 J.P. Morgan Healthcare Conference. Certain preliminary financial information regarding the fiscal year ended December 31, 2015 are referenced in the presentation. A copy of the presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 7.01 and Exhibit 99.1 incorporated herein shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| 99.1 | Alere Inc. Presentation for J.P. Morgan Healthcare Conference on January 11, 2016, furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALERE INC. | ||||||

| Date: January 11, 2016 | By: | /s/ Douglas Barry | ||||

| Douglas Barry | ||||||

| Associate General Counsel | ||||||

Index of Exhibits

| EXHIBIT NO. |

DESCRIPTION | |

| 99.1 | Alere Inc. Presentation for J.P. Morgan Healthcare Conference on January 11, 2016, furnished herewith. | |

Namal Nawana | CEO and President 34th Annual JP Morgan Healthcare Conference San Francisco, January 11, 2016 © 2015 Alere Inc. Namal Nawana, CEO and President Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the federal securities laws. This includes all statements concerning or relating to our ability to improve clinical outcomes, improve access to care and to reduce healthcare costs. Such forward-looking statements are estimates reflecting management’s best judgment based upon current information and involve a number of risks and uncertainties. Actual results and the timing of certain events could differ materially from those projected or contemplated by the forward-looking statements due to numerous factors, including without limitation, the risks and uncertainties described in our periodic reports filed with the Securities and Exchange Commission, including our Form 10-K for the year ended December 31, 2014, as well as in our Quarterly Reports on Form 10-Q. Our Company undertakes no obligation to update forward-looking statements.

Early Views on Fourth Quarter 2015 Revenue Return to organic growth of approximately 1% vs. -1.7% in Q3’15 Excluding flu and pain management organic growth was approximately 3% Alere i placement target achieved at nearly 4,000 as of 12/31/15 Summary of unplanned negative variances* in Q4 vs. previous guidance range of $640-$660M: Foreign exchange ($12M) North American flu ($9M) BBI divestiture early close ($5M) Expect revenue of approximately $630 million* Full Q4/2015 financial results to be announced in mid-February 2016 financial guidance to be provided with Q4’15 earnings * Preliminary unaudited estimate

Global Leader in Rapid Diagnostics * Adjusted for recent divestitures $1.4B in revenue from outpatient settings $2.5B* 2014 adjusted net revenue 1.4B+ delivered in 2015 tests #1 of rapid, point of care tests global provider 120K+ instruments installed Alere™ i entry to POC molecular

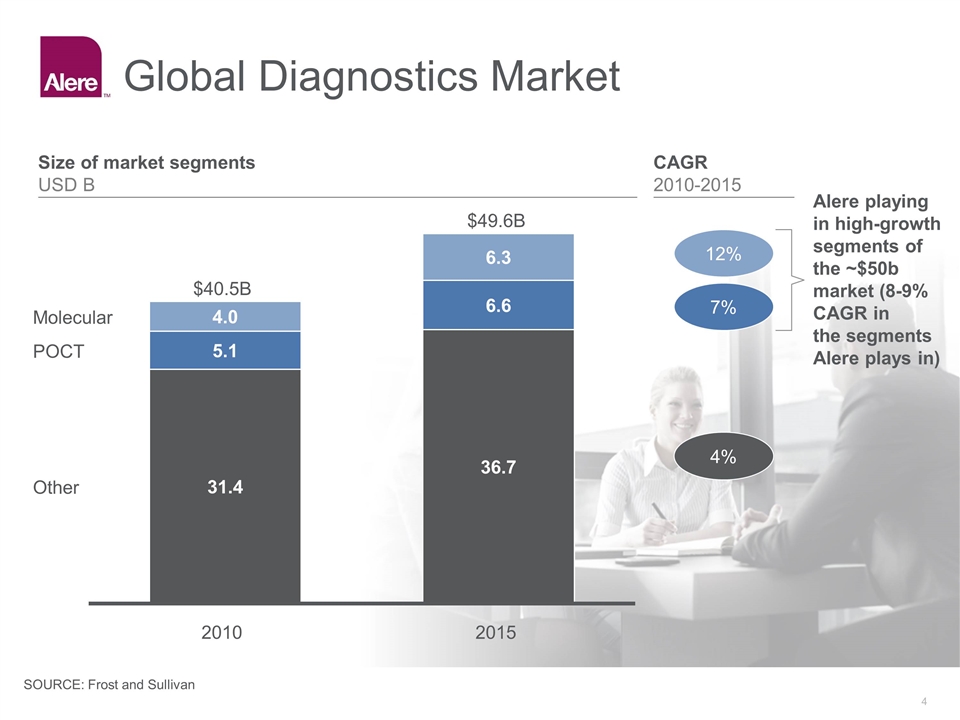

Global Diagnostics Market $B 2015 $B Alere playing in high-growth segments of the ~$50b market (8-9% CAGR in the segments Alere plays in) CAGR 2010-2015 4% 7% 12% Size of market segments USD B SOURCE: Frost and Sullivan

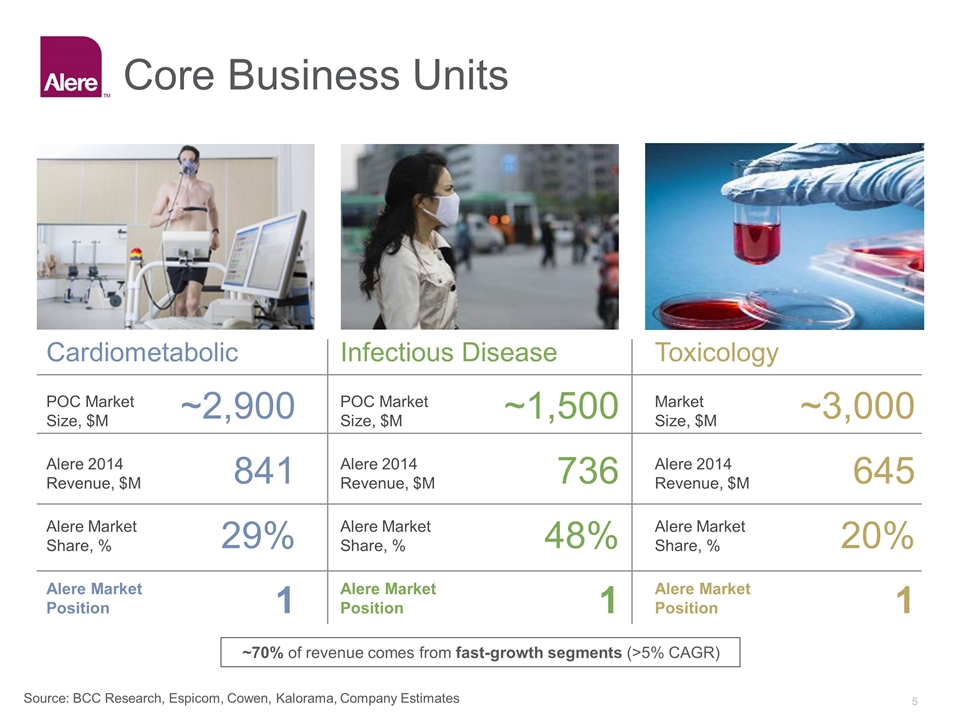

Core Business Units Cardiometabolic POC Market Size, $M Alere 2014 Revenue, $M Alere Market Share, % Alere Market Position Infectious Disease POC Market Size, $M Alere 2014 Revenue, $M Alere Market Share, % Alere Market Position Toxicology Market Size, $M Alere 2014 Revenue, $M Alere Market Share, % Alere Market Position ~2,900 841 29% 1 ~1,500 736 48% 1 ~3,000 645 20% 1 Source: BCC Research, Espicom, Cowen, Kalorama, Company Estimates ~70% of revenue comes from fast-growth segments (>5% CAGR)

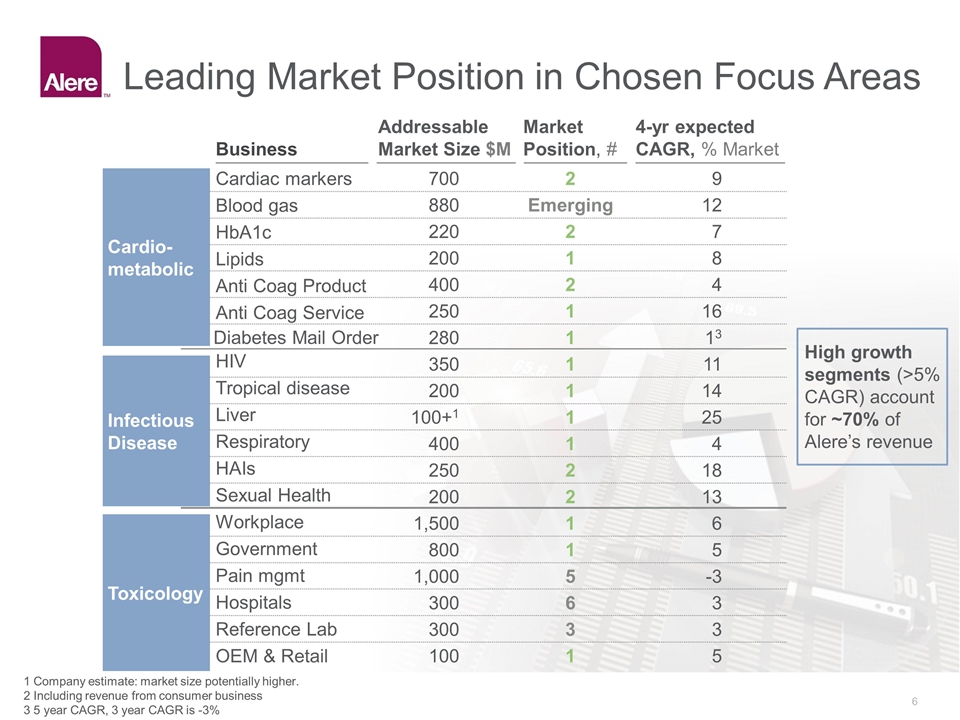

Leading Market Position in Chosen Focus Areas 1 Company estimate: market size potentially higher. 2 Including revenue from consumer business 3 5 year CAGR, 3 year CAGR is -3% Business Addressable Market Size $M Market Position, # 4-yr expected CAGR, % Market 700 2 9 Blood gas 880 Emerging 12 HbA1c 220 2 7 Lipids 200 1 8 Anti Coag Product 400 2 4 Cardiac markers Anti Coag Service 250 1 16 350 1 11 Tropical disease 200 1 14 Liver 100+1 1 25 Respiratory 400 1 4 HAIs 250 2 18 HIV Sexual Health 200 2 13 1,500 1 6 Government 800 1 5 Pain mgmt 1,000 5 -3 Hospitals 300 6 3 Reference Lab 300 3 3 Workplace OEM & Retail 100 1 5 High growth segments (>5% CAGR) account for ~70% of Alere’s revenue Infectious Disease Toxicology Cardio-metabolic Diabetes Mail Order 280 1 13

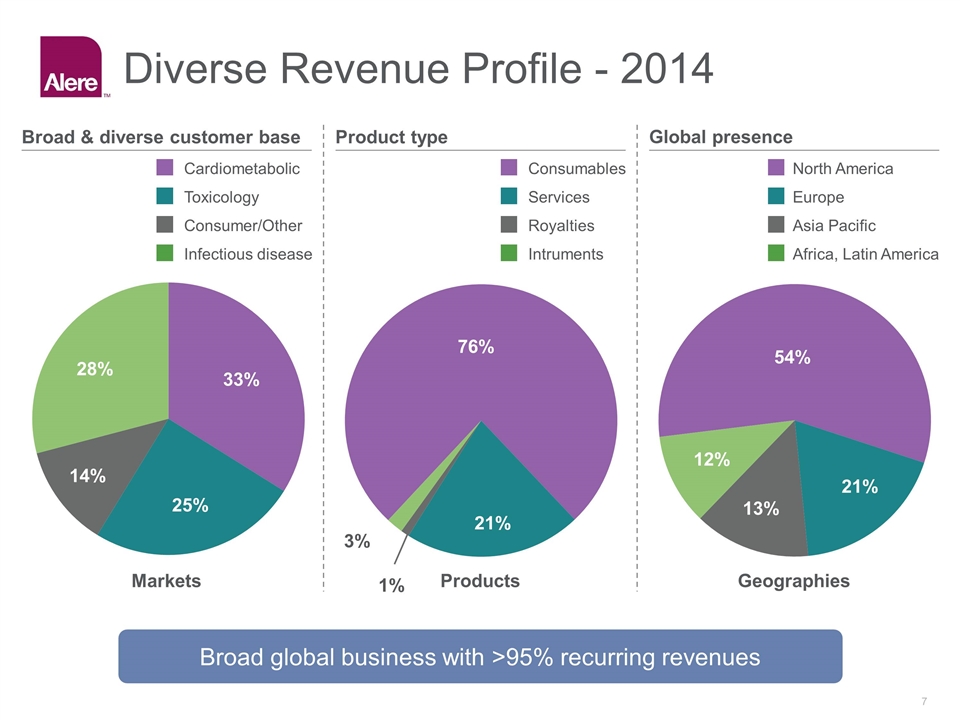

Diverse Revenue Profile - 2014 Broad & diverse customer base Product type Global presence 28% % 14% 33% Markets Products Geographies Infectious disease Consumer/Other Cardiometabolic Toxicology 3% % 21% % 13% 54% 21% 12% Broad global business with >95% recurring revenues

Our Products and Services

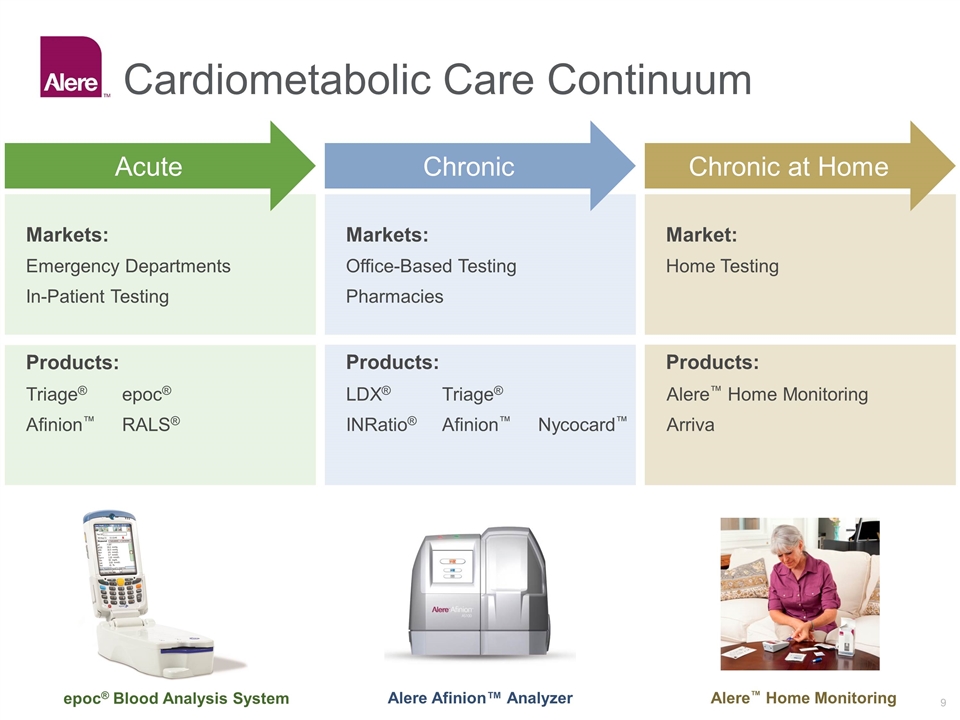

Products: Products: Cardiometabolic Care Continuum Markets: Emergency Departments In-Patient Testing Products: Markets: Office-Based Testing Pharmacies Market: Home Testing Chronic Chronic at Home Triage®epoc® Afinion™RALS® LDX® Triage® INRatio®Afinion™ Nycocard™ Alere™ Home Monitoring Arriva Acute epoc® Blood Analysis System Alere Afinion™ Analyzer Alere™ Home Monitoring

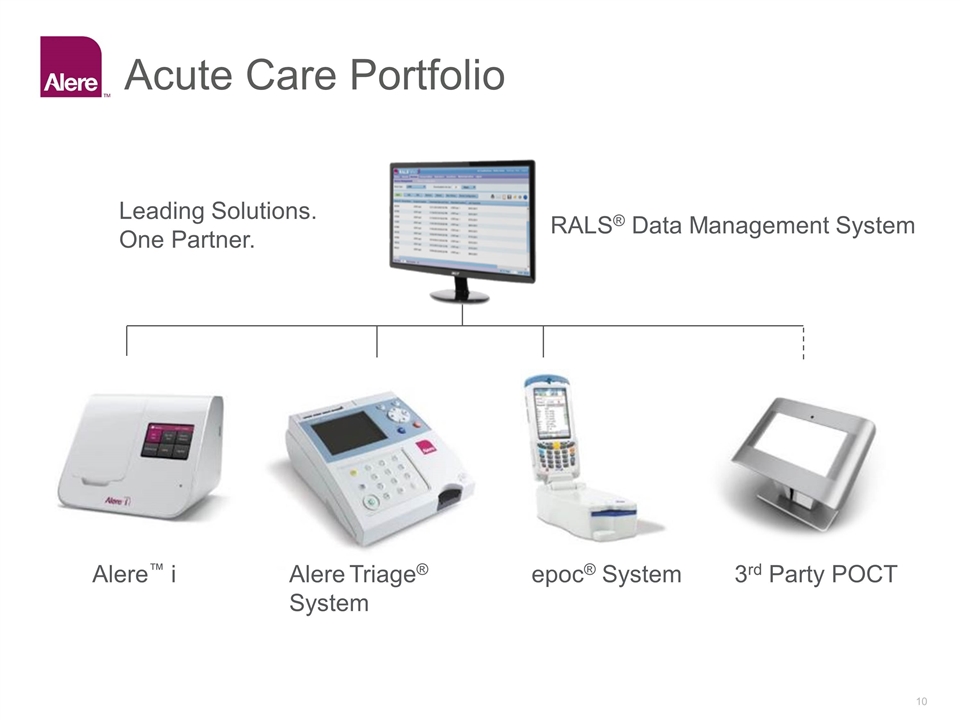

Acute Care Portfolio Alere™ i Alere Triage® System epoc® System 3rd Party POCT RALS® Data Management System Leading Solutions. One Partner.

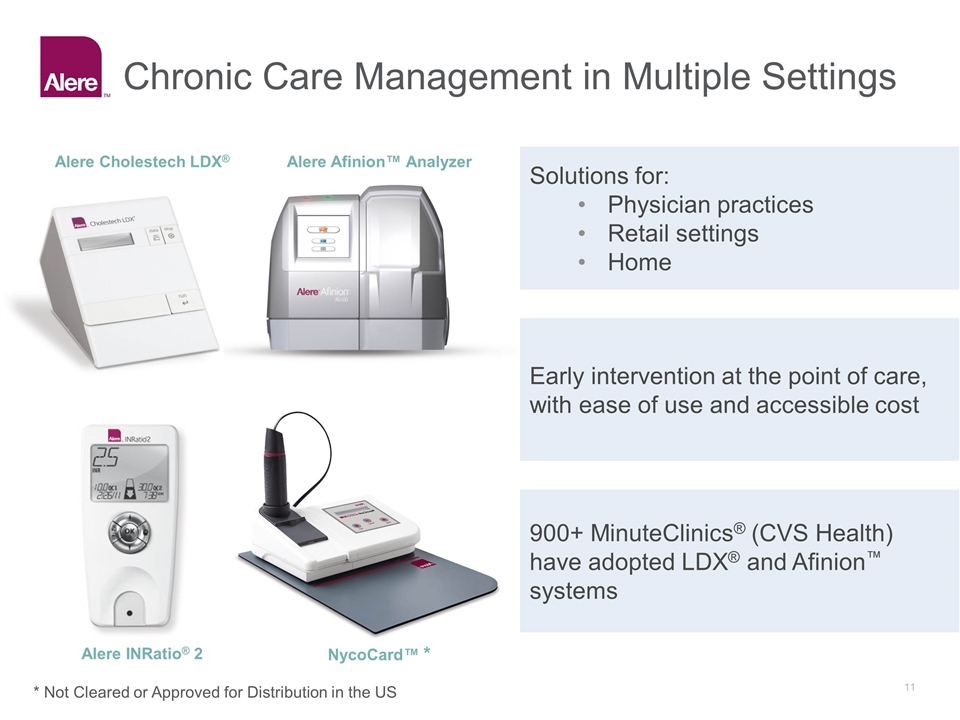

Chronic Care Management in Multiple Settings Solutions for: Physician practices Retail settings Home Early intervention at the point of care, with ease of use and accessible cost 900+ MinuteClinics® (CVS Health) have adopted LDX® and Afinion™ systems Alere Afinion™ Analyzer Alere Cholestech LDX® Alere INRatio® 2 NycoCard™ * * Not Cleared or Approved for Distribution in the US

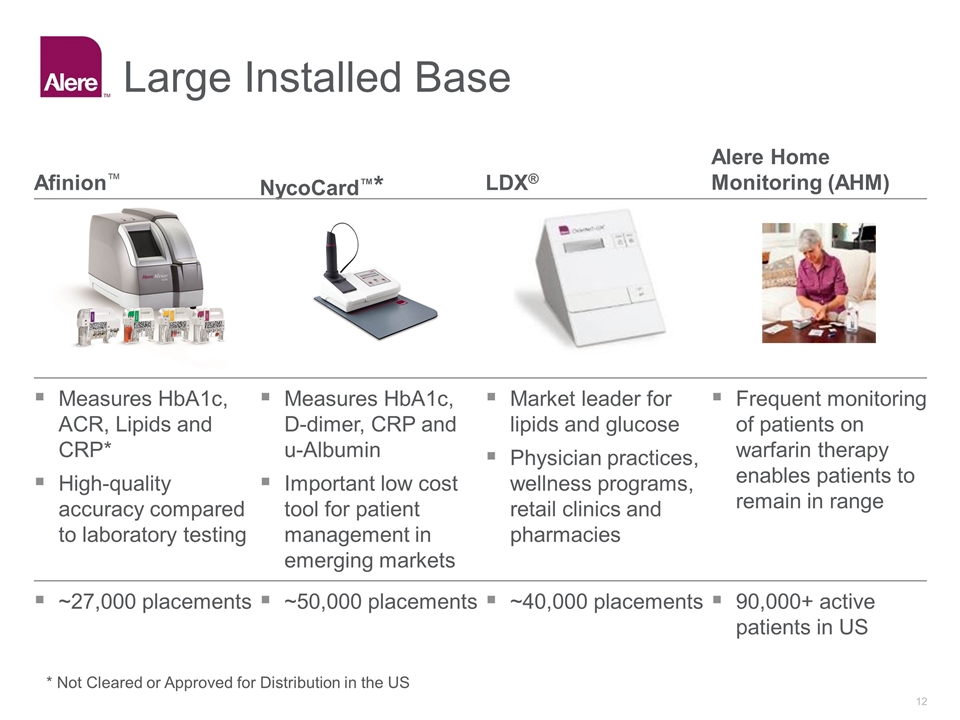

Large Installed Base NycoCard™* LDX® Afinion™ Alere Home Monitoring (AHM) Frequent monitoring of patients on warfarin therapy enables patients to remain in range Market leader for lipids and glucose Physician practices, wellness programs, retail clinics and pharmacies Measures HbA1c, D-dimer, CRP and u-Albumin Important low cost tool for patient management in emerging markets Measures HbA1c, ACR, Lipids and CRP* High-quality accuracy compared to laboratory testing 90,000+ active patients in US ~40,000 placements ~50,000 placements ~27,000 placements * Not Cleared or Approved for Distribution in the US

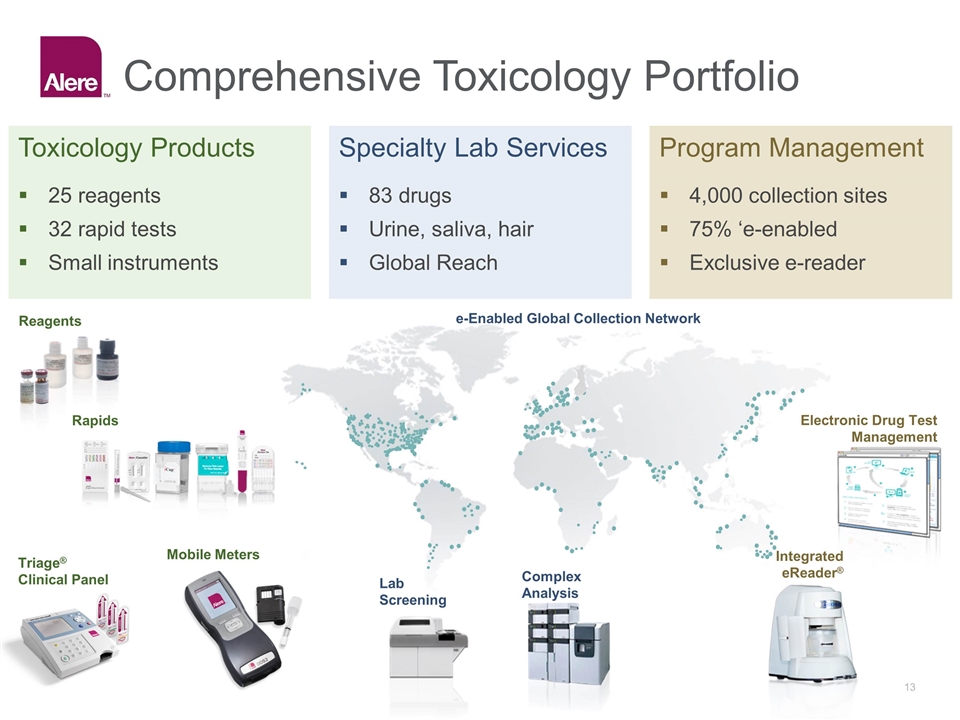

Comprehensive Toxicology Portfolio Toxicology Products Specialty Lab Services Program Management 25 reagents 32 rapid tests Small instruments 83 drugs Urine, saliva, hair Global Reach 4,000 collection sites 75% ‘e-enabled Exclusive e-reader Integrated eReader® Electronic Drug Test Management e-Enabled Global Collection Network Reagents Rapids Triage® Clinical Panel Complex Analysis Lab Screening Mobile Meters

United States Postal Service Blue Chip Customer Base 60% of the Fortune 500 under multi-year contracts with Alere

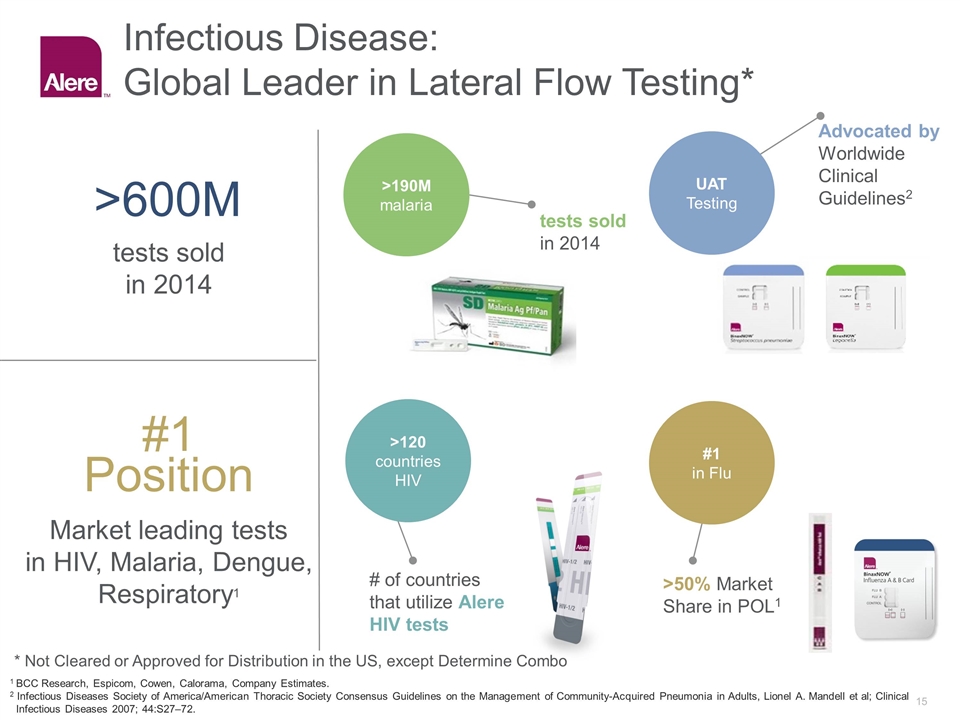

Infectious Disease: Global Leader in Lateral Flow Testing* #1 Position >600M Market leading tests in HIV, Malaria, Dengue, Respiratory1 tests sold in 2014 >190M malaria >120 countries HIV UAT Testing #1 in Flu tests sold in 2014 Advocated by Worldwide Clinical Guidelines2 # of countries that utilize Alere HIV tests >50% Market Share in POL1 1 BCC Research, Espicom, Cowen, Calorama, Company Estimates. 2 Infectious Diseases Society of America/American Thoracic Society Consensus Guidelines on the Management of Community-Acquired Pneumonia in Adults, Lionel A. Mandell et al; Clinical Infectious Diseases 2007; 44:S27–72. * Not Cleared or Approved for Distribution in the US, except Determine Combo

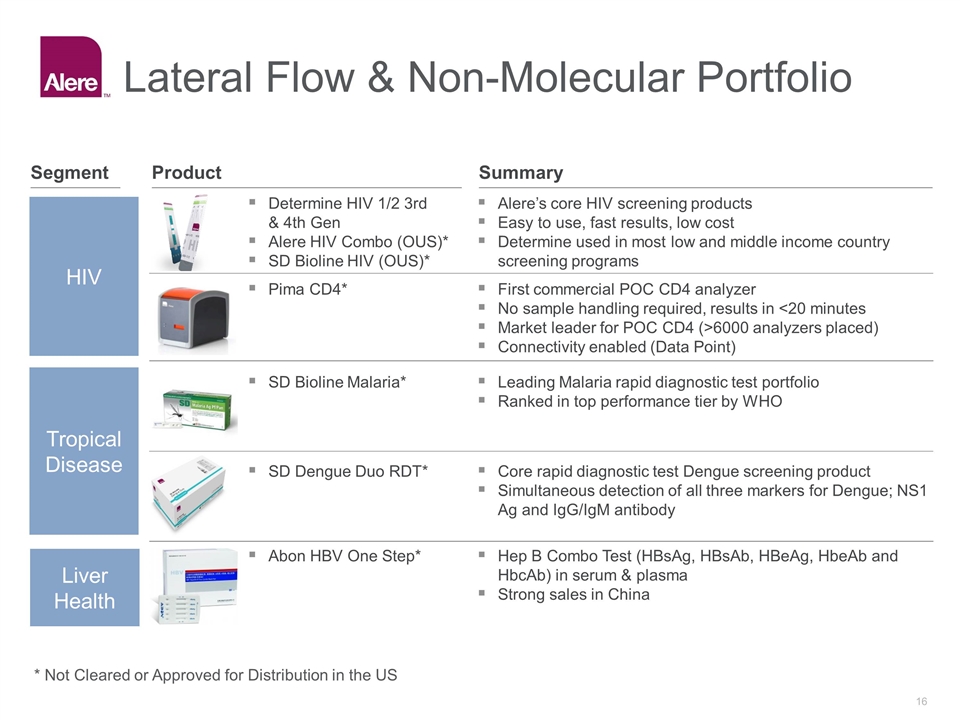

HIV Tropical Disease Liver Health Alere’s core HIV screening products Easy to use, fast results, low cost Determine used in most low and middle income country screening programs Determine HIV 1/2 3rd & 4th Gen Alere HIV Combo (OUS)* SD Bioline HIV (OUS)* SD Bioline Malaria* Core rapid diagnostic test Dengue screening product Simultaneous detection of all three markers for Dengue; NS1 Ag and IgG/IgM antibody Leading Malaria rapid diagnostic test portfolio Ranked in top performance tier by WHO SD Dengue Duo RDT* First commercial POC CD4 analyzer No sample handling required, results in <20 minutes Market leader for POC CD4 (>6000 analyzers placed) Connectivity enabled (Data Point) Pima CD4* Hep B Combo Test (HBsAg, HBsAb, HBeAg, HbeAb and HbcAb) in serum & plasma Strong sales in China Abon HBV One Step* Lateral Flow & Non-Molecular Portfolio Summary Product Segment * Not Cleared or Approved for Distribution in the US

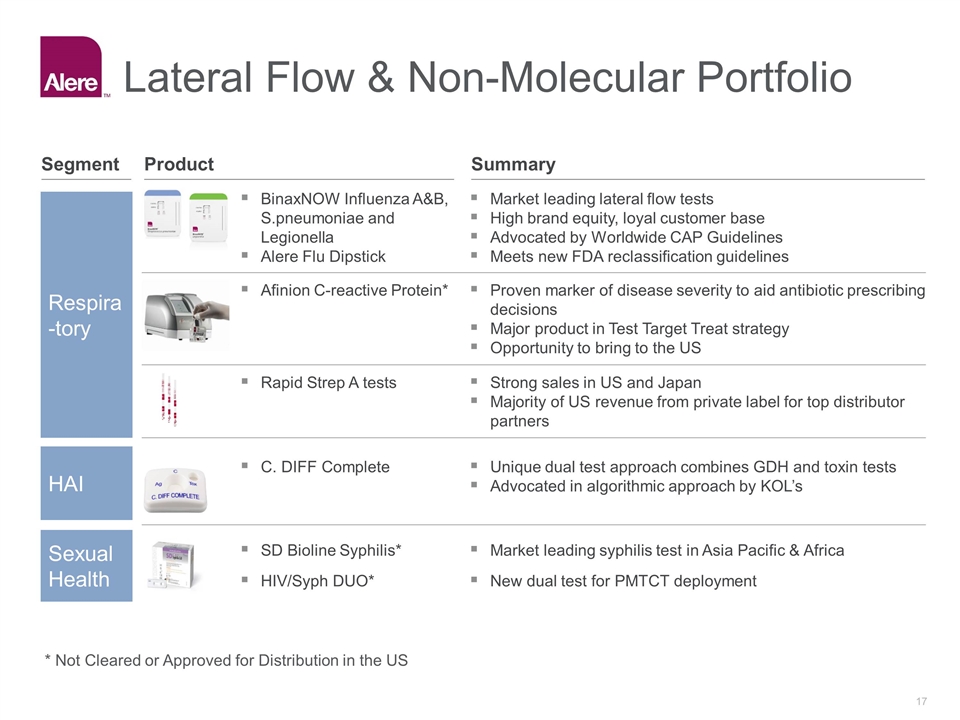

Lateral Flow & Non-Molecular Portfolio Market leading lateral flow tests High brand equity, loyal customer base Advocated by Worldwide CAP Guidelines Meets new FDA reclassification guidelines Strong sales in US and Japan Majority of US revenue from private label for top distributor partners Unique dual test approach combines GDH and toxin tests Advocated in algorithmic approach by KOL’s Market leading syphilis test in Asia Pacific & Africa Respiratory Respira-tory HAI Sexual Health Proven marker of disease severity to aid antibiotic prescribing decisions Major product in Test Target Treat strategy Opportunity to bring to the US BinaxNOW Influenza A&B, S.pneumoniae and Legionella Alere Flu Dipstick Rapid Strep A tests C. DIFF Complete SD Bioline Syphilis* Afinion C-reactive Protein* HIV/Syph DUO* New dual test for PMTCT deployment Summary Product Segment * Not Cleared or Approved for Distribution in the US

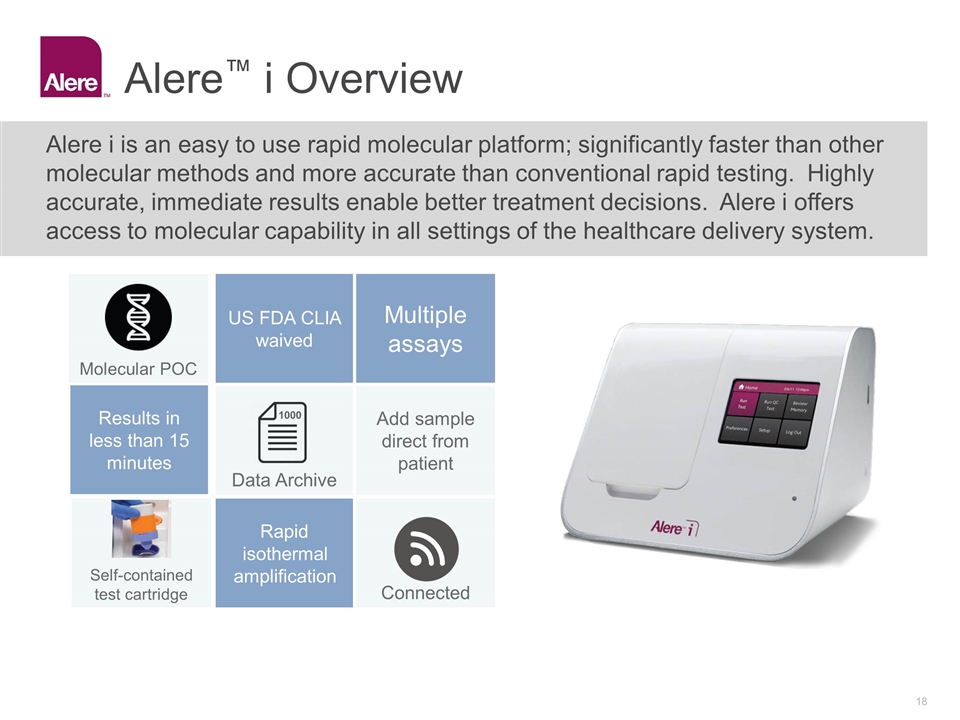

Alere™ i Overview Alere i is an easy to use rapid molecular platform; significantly faster than other molecular methods and more accurate than conventional rapid testing. Highly accurate, immediate results enable better treatment decisions. Alere i offers access to molecular capability in all settings of the healthcare delivery system. US FDA CLIA waived Multiple assays Add sample direct from patient Self-contained test cartridge Rapid isothermal amplification Connected 1000 Data Archive Molecular POC Results in less than 15 minutes

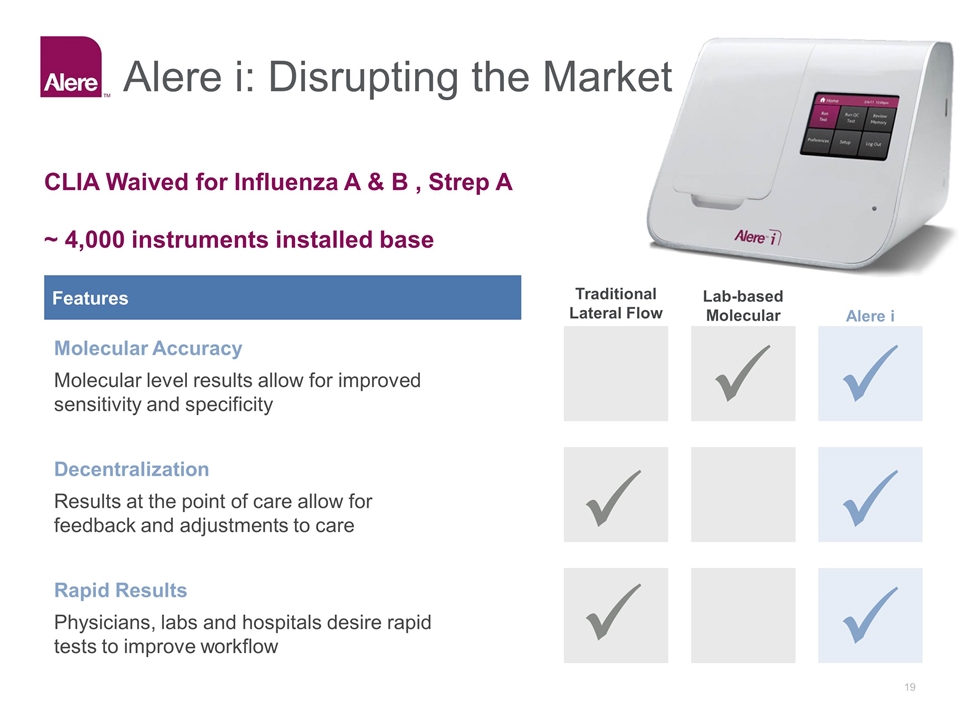

Alere i: Disrupting the Market Features Traditional Lateral Flow Lab-based Molecular Alere i Molecular Accuracy Molecular level results allow for improved sensitivity and specificity Decentralization Results at the point of care allow for feedback and adjustments to care Rapid Results Physicians, labs and hospitals desire rapid tests to improve workflow CLIA Waived for Influenza A & B , Strep A ~ 4,000 instruments installed base

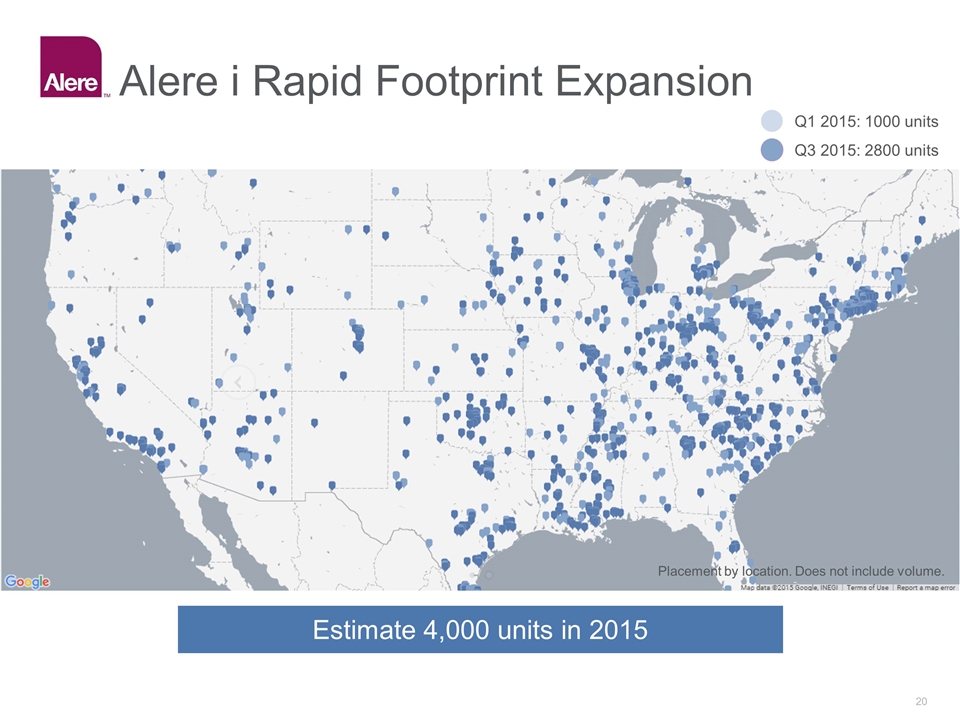

Alere i Rapid Footprint Expansion Placement by location. Does not include volume. Q1 2015: 1000 units Q3 2015: 2800 units Estimate 4,000 units in 2015

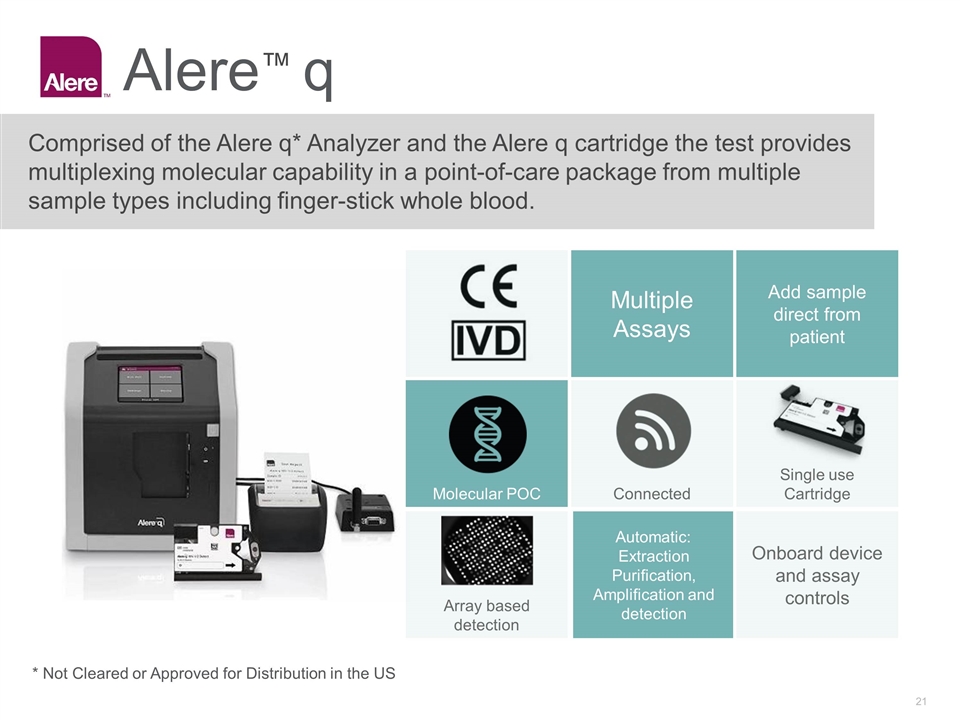

Alere™ q Comprised of the Alere q* Analyzer and the Alere q cartridge the test provides multiplexing molecular capability in a point-of-care package from multiple sample types including finger-stick whole blood. Molecular POC Multiple Assays Add sample direct from patient Connected Single use Cartridge Array based detection Automatic: Extraction Purification, Amplification and detection Onboard device and assay controls * Not Cleared or Approved for Distribution in the US

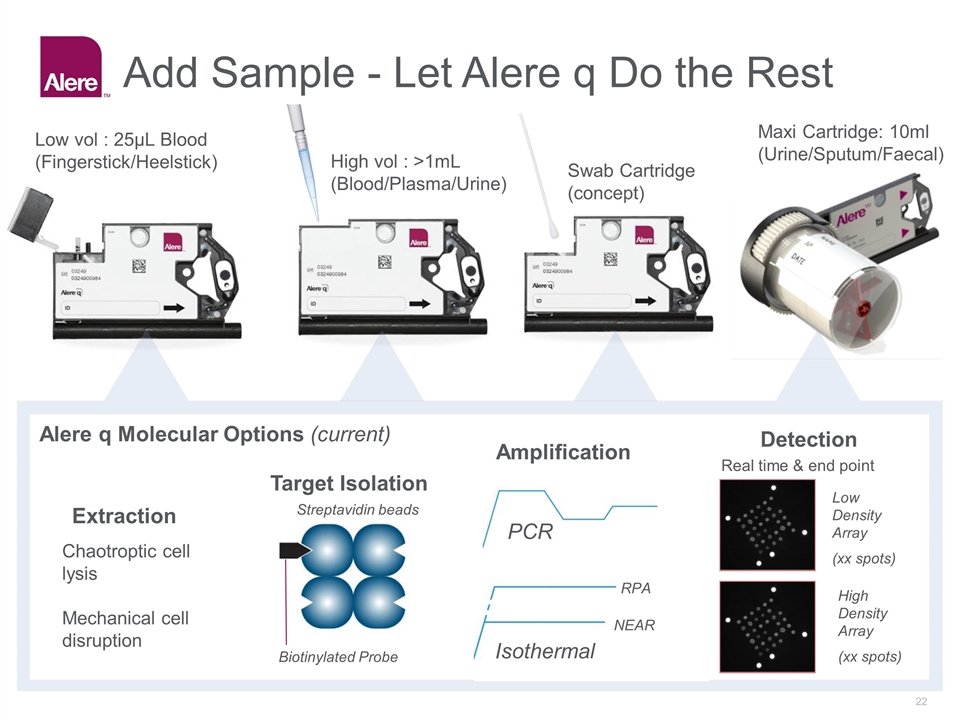

Add Sample - Let Alere q Do the Rest PCR Extraction Target Isolation Amplification Detection Chaotroptic cell lysis Mechanical cell disruption Isothermal NEAR RPA Streptavidin beads Biotinylated Probe Alere q Molecular Options (current) Low vol : 25µL Blood (Fingerstick/Heelstick) Swab Cartridge (concept) Maxi Cartridge: 10ml (Urine/Sputum/Faecal) High vol : >1mL (Blood/Plasma/Urine) Low Density Array (xx spots) High Density Array (xx spots) Real time & end point

Financial Overview

Strong, recurring and diversified revenue 1 Core markets growing at >5% 2 Cost structure improvements with substantial opptys ahead 3 Strengthened financial profile 4 Investment Thesis

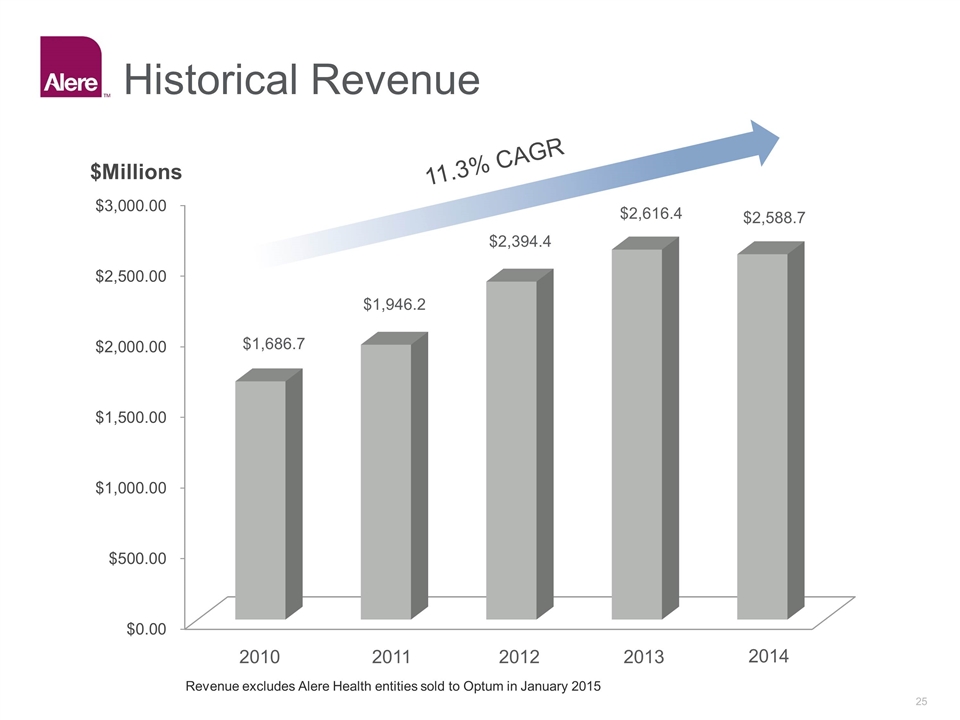

Historical Revenue 11.3% CAGR 2010 2011 2012 2013 2014 $1,686.7 $1,946.2 $2,394.4 $2,616.4 $2,588.7 Revenue excludes Alere Health entities sold to Optum in January 2015

Organic Growth Growth to accelerate with increased market penetration Key growth drivers Alere™ i (Flu A/B, Strep A) HIV (Determine™ Combo, CD4, Alere™ q) Afinion™ epoc® Core Toxicology Toxicology Reagents International market penetration

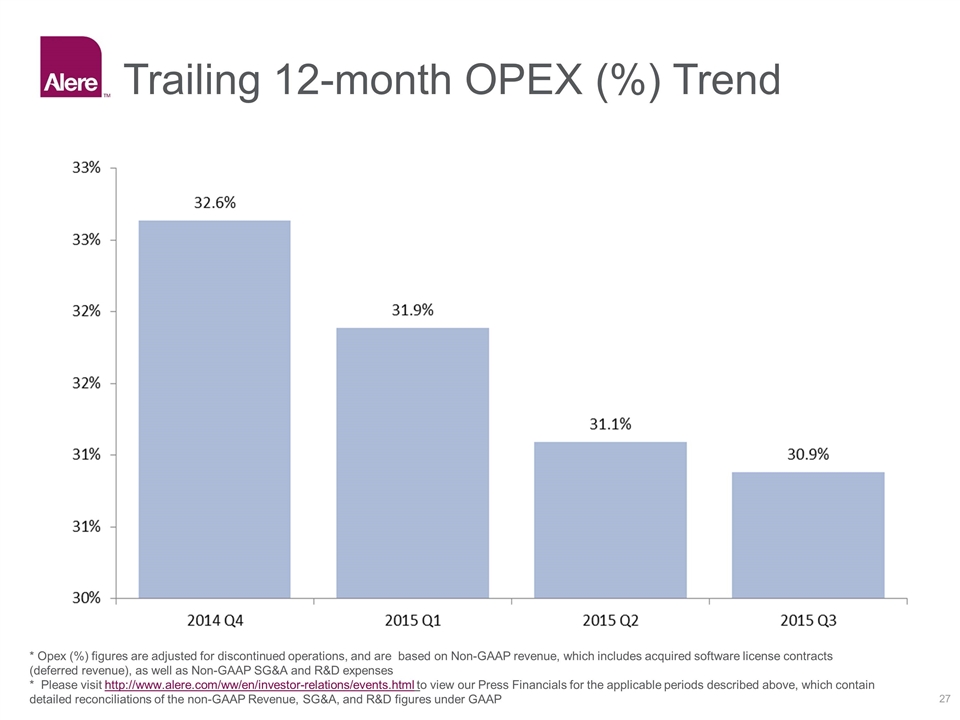

Trailing 12-month OPEX (%) Trend * Opex (%) figures are adjusted for discontinued operations, and are based on Non-GAAP revenue, which includes acquired software license contracts (deferred revenue), as well as Non-GAAP SG&A and R&D expenses * Please visit http://www.alere.com/ww/en/investor-relations/events.html to view our Press Financials for the applicable periods described above, which contain detailed reconciliations of the non-GAAP Revenue, SG&A, and R&D figures under GAAP

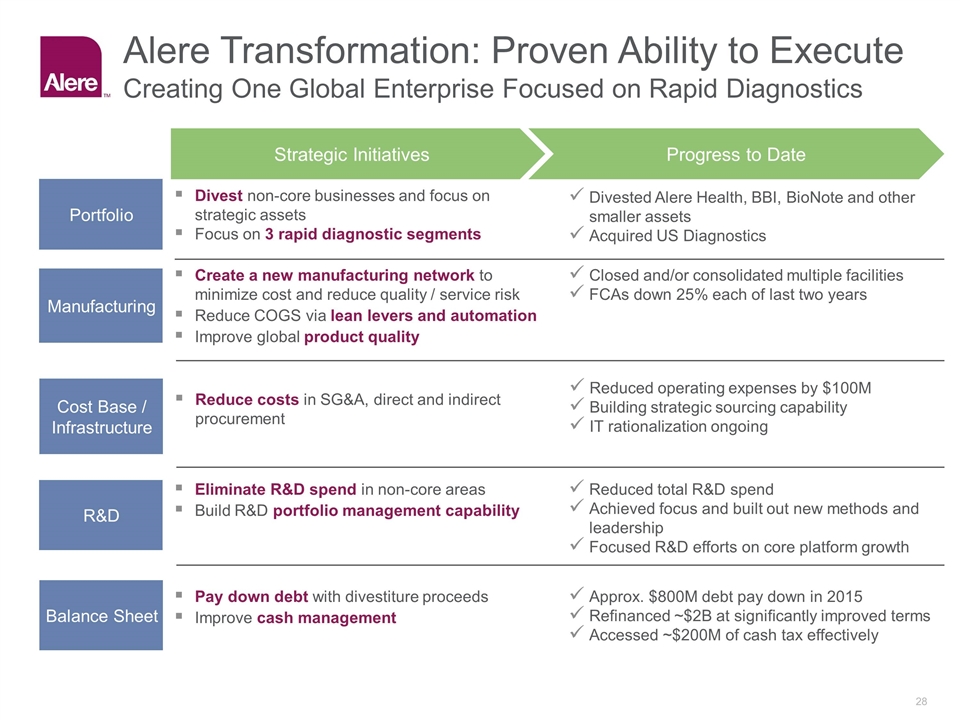

Cost Base / Infrastructure Reduced operating expenses by $100M Building strategic sourcing capability IT rationalization ongoing Reduce costs in SG&A, direct and indirect procurement Manufacturing Closed and/or consolidated multiple facilities FCAs down 25% each of last two years Create a new manufacturing network to minimize cost and reduce quality / service risk Reduce COGS via lean levers and automation Improve global product quality R&D Reduced total R&D spend Achieved focus and built out new methods and leadership Focused R&D efforts on core platform growth Eliminate R&D spend in non-core areas Build R&D portfolio management capability Portfolio Divested Alere Health, BBI, BioNote and other smaller assets Acquired US Diagnostics Divest non-core businesses and focus on strategic assets Focus on 3 rapid diagnostic segments Strategic Initiatives Progress to Date Balance Sheet Approx. $800M debt pay down in 2015 Refinanced ~$2B at significantly improved terms Accessed ~$200M of cash tax effectively Pay down debt with divestiture proceeds Improve cash management Alere Transformation: Proven Ability to Execute Creating One Global Enterprise Focused on Rapid Diagnostics

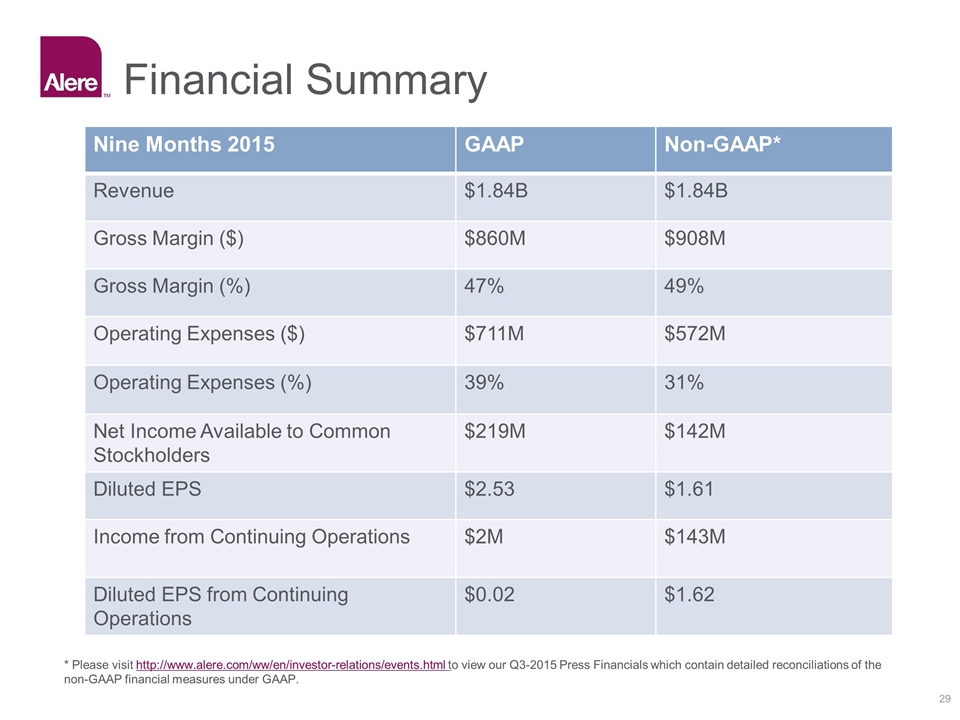

Financial Summary * Please visit http://www.alere.com/ww/en/investor-relations/events.html to view our Q3-2015 Press Financials which contain detailed reconciliations of the non-GAAP financial measures under GAAP. Nine Months 2015 GAAP Non-GAAP* Revenue $1.84B $1.84B Gross Margin ($) $860M $908M Gross Margin (%) 47% 49% Operating Expenses ($) $711M $572M Operating Expenses (%) 39% 31% Net Income Available to Common Stockholders $219M $142M Diluted EPS $2.53 $1.61 Income from Continuing Operations $2M $143M Diluted EPS from Continuing Operations $0.02 $1.62

Alere Highlights Focused, global leader in rapid diagnostics #1 position in high growth Dx segments Strong and expanding global installed base Transforming the company: portfolio, operations/quality, infrastructure and R&D Potential to accelerate breakthrough innovation Track record of operating margin improvement, with significant identified opportunities for further upside

© 2015 Alere. All rights reserved. The Alere Logo, Alere, Afinion, Cholestech LDX, Determine, DDS, epoc, eReader, INRatio, Knowing now matters, MeterPro, Pima and Triage are trademarks of the Alere group of companies.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Builders Capital Mortgage Corp. Releases Annual Financial Statements; Reports Strong Results for 2023: Annual Income up 21.6% Year-Over-Year

- Glow Announces Late Filing of Financial Statements

- William H. Reinhardt Elected Vice President – Research, Adams Diversified Equity Fund

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share