Form 8-K ALCOA INC. For: Apr 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 14, 2016 (April 11, 2016)

ALCOA INC.

(Exact name of Registrant as specified in its charter)

| Pennsylvania | 1-3610 | 25-0317820 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| 390 Park Avenue, New York, New York | 10022-4608 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Office of Investor Relations 212-836-2674

Office of the Secretary 212-836-2732

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. | Results of Operations and Financial Condition. |

On April 11, 2016, Alcoa Inc. held its first quarter 2016 earnings conference call, broadcast live by webcast. A transcript of the call and a copy of the slides presented during the call are attached hereto as Exhibits 99.1 and 99.2, respectively, and are hereby incorporated by reference.

* * * * *

The information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, is being furnished in accordance with the provisions of General Instruction B.2 of Form 8-K.

Forward-Looking Statements

This communication contains statements that relate to future events and expectations, and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts concerning global demand growth for aluminum, supply/demand balances, and growth of the aerospace, automotive, and other end markets; statements regarding targeted financial results or operating performance; statements about Alcoa’s strategies, outlook, business and financial prospects; and statements regarding the separation transaction, including the future performance of Value-Add Company and Upstream Company if the separation is completed, the expected benefits of the separation, and the expected timing of the Form 10 filing and the completion of the separation. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) uncertainties as to the timing of the separation and whether it will be completed; (b) the possibility that various closing conditions for the separation may not be satisfied; (c) failure of the separation to qualify for the expected tax treatment; (d) the possibility that any third-party consents required in connection with the separation will not be received; (e) the impact of the separation on the businesses of Alcoa; (f) the risk that the businesses will not be separated successfully or such separation may be more difficult, time-consuming or costly than expected, which could result in additional demands on Alcoa’s resources, systems, procedures and controls, disruption of its ongoing business and diversion of management’s attention from other business concerns; (g) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices and premiums, as applicable, for primary aluminum, alumina, and other products,

2

and fluctuations in indexed-based and spot prices for alumina; (h) deterioration in global economic and financial market conditions generally; (i) unfavorable changes in the markets served by Alcoa; (j) the impact of changes in foreign currency exchange rates on costs and results; (k) increases in energy costs; (l) the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations (including executing on the business improvement plans, moving the Upstream alumina and aluminum businesses down on the industry cost curves, and increasing revenues and improving margins in the Value-Add businesses) anticipated from restructuring programs and productivity improvement, cash sustainability, technology advancements (including, without limitation, advanced aluminum alloys, Alcoa Micromill, and other materials and processes), and other initiatives; (m) Alcoa’s inability to realize expected benefits, in each case as planned and by targeted completion dates, from acquisitions, divestitures, facility closures, curtailments, or expansions, or international joint ventures; (n) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products; (o) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation; (p) the impact of cyber attacks and potential information technology or data security breaches; (q) the potential failure to retain key employees while the separation transaction is pending or after it is completed; (r) the risk that increased debt levels, deterioration in debt protection metrics, contraction in liquidity, or other factors could adversely affect the targeted credit ratings for Value-Add Company or Upstream Company; and (s) the other risk factors discussed in Alcoa’s Form 10-K for the year ended December 31, 2015, and other reports filed with the U.S. Securities and Exchange Commission (SEC). Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

The following are furnished as exhibits to this report:

| 99.1 | Transcript of Alcoa Inc. first quarter 2016 earnings call. | |

| 99.2 | Slides presented during Alcoa Inc. first quarter 2016 earnings call. | |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALCOA INC. | ||

| By: | /s/ Audrey Strauss | |

| Name: | Audrey Strauss | |

| Title: | Executive Vice President, Chief Legal Officer and Secretary | |

Dated: April 14, 2016

4

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Transcript of Alcoa Inc. first quarter 2016 earnings call. | |

| 99.2 | Slides presented during Alcoa Inc. first quarter 2016 earnings call. | |

5

Exhibit 99.1

| Event ID: | 137608125962 | |

| Event Name: | Q1 2016 Alcoa Inc Earnings Call | |

| Event Date: | 2016-04-11T21:00:00 UTC |

P: Operator;;

C: Matthew Garth; Alcoa Inc.; VP of Financial Planning and Analysis & IR

C: Klaus Kleinfeld; Alcoa Inc.; Chairman & CEO

C: William Oplinger; Alcoa Inc.; EVP & CFO

P: Evan Kurtz; Morgan Stanley; Analyst

P: Curt Woodworth; Credit Suisse; Analyst

P: David Gagliano; BMO Capital Markets; Analyst

P: Justin Bergner; Gabelli & Company; Analyst

P: Tony Rizzuto; Cowen and Company; Analyst

P: Josh Sullivan; Sterne, Agee & Leach, Inc.; Analyst

P: Charles Bradford; Bradford Research; Analyst

P: Justine Fisher; Goldman Sachs; Analyst

+++ presentation

Operator^ Good day, ladies and gentlemen, and welcome to the first-quarter 2016 Alcoa earnings conference call. My name is Shannon, and I will be your operator for today. As a reminder, today’s conference is being recorded for replay purposes. I would now like to turn the conference over to your host for today, Matthew Garth, Vice President of Financial Planning and Analysis and Investor Relations. Please proceed.

Matthew Garth^ Thank you, Shannon. Good afternoon, and welcome to Alcoa’s first-quarter 2016 earnings conference call.

Let me begin by apologizing for the late distribution of the press release. Our news wire provider network went down, so we distributed the release as quickly as we could. I’m joined today by Klaus Kleinfeld, Chairman and Chief Executive Officer; and William Oplinger, Executive Vice President and Chief Financial Officer. After comments by Klaus and Bill, we will take your questions.

Before we begin, I’d like to remind you that today’s discussion will contain forward-looking statements relating to future events and expectations. You can find factors that cause the Company’s actual results to differ materially from these projections listed in today’s press release and presentation, and in our most recent SEC filings. In addition, we have included some non-GAAP financial measures in our discussion. Reconciliations to the most directly-comparable GAAP financial measures can be found in today’s press release, in the appendix to today’s presentation, and on our website at www.alcoa.com under the “Invest” section. Any reference in our discussion today to historical EBITDA means adjusted EBITDA, from which we have provided reconciliations and calculations in the appendix. With that, I’d like to turn the call over to Klaus.

Klaus Kleinfeld^ Very good, Matt. Thank you very much. In the usual fashion, let me characterize the quarter. Solid performance, strong

productivity, separation on track. We have, for your better digestion actually, separated out your Arconic, as the new value-add company will be called, and new Alcoa, gives you a better taste for the future two firms.

Let’s start with the Arconic segment. Revenue is $3.3 billion, down 2.2% overall. This is really a combination of the growth of 6.7%, predominantly acquisition related, and a decline of 8.3% from metals and FX changes, and also minus 0.6% from divestitures or closing of operations. Profits are up 8%, record adjusted EBITDA margin of 16.4%.

If we then go down into the segments, global rolled products profit up 26%, the EBITDA margin per metric ton, probably the best measure of how they’re doing, $374. And if you include the Warrick metal, cold metal plant it would have been even at $390 per metric ton.

And then in Engineered Products and Solutions, record first-quarter revenues, record first-quarter profit up 4%, Transportation and Construction Solutions up 3% profitability, and record first-quarter adjusted EBITDA margin of 14.9%. Good news, also, we’ve been able to secure a supply agreement with Airbus for 3D printed titanium parts for Airbus on the planes. So this is obviously also indicating an important future business opportunity.

We’ve been able to secure multi-year $1 billion industrial gas turbine contract, the largest IGT contract to date. We have been able to sell Remmele Medical, proceeds of $102 million. $179 million of productivity, plan is $650 million in 2016. Global rolled products, transportation, construction solutions are on track to meet their three-year targets, and we have set a new goal for EPS that will better reflect the aerospace market and the Firth Rixson performance, and obviously we’ll go into it and I’ll talk to this in detail in my presentation.

So then, when you go to the new Alcoa segments, third-party revenues of $1.7 billion, down 32%. This also is a combination of growth of 4.5%, offset by 26% through lower prices and FX, and another 10.6% through the curtailment and closures of operations. Both segments are profitable. We’ve been able to sign a $350 million third-party bauxite contract.

Ma’aden, the refinery is now at 80%, nameplate capacity, we’ve been able to curtail, fully curtail. We are able to fully curtail Point Comfort by the second quarter. Warrick smelter is closed, $175 million of productivity, plan is $550 million in 2016.

We’ve sold the pipeline, natural gas pipeline, or our stake in it, in Western Australia, for $154 million, and we are on track to meet our three-year targets, which is a cost curve target to get down to 38th percentile for aluminum and the 21st percentile for alumina. And as a third point, separation is on track. With this, let me hand over, Bill, to you.

William Oplinger^ Thanks, Klaus. As we usually do, let’s review the income statement. First-quarter 2016 revenue totaled $4.9 billion, down approximately 15% year-over-year. Organic growth, and growth from the

recent acquisitions was offset by lower alumina and metal pricing, and the impact of divested and closed businesses. Cost of goods sold percentage decreased by 230 basis points sequentially, largely due to productivity gains.

Overhead spending increased year-over-year, primarily as a result of costs related to planned separation of the Company, and the acquisition of RTI. Other expenses of $34 million were related to the results of our Ma’aden joint venture and unfavorable currency translation. First-quarter effective tax rate of 73.2% was primarily due to non-deductible separation costs, and tax associated with an asset sale and discrete tax items in the quarter. Excluding these impacts, our operational rate was 32%.

Overall, net income for the quarter was $16 million or $0.00 per share. Preferred dividends were $18 million in the quarter, which reduced EPS by $0.01 per share. Excluding special items, net income was $108 million, or $0.07 a share.

Let’s take a closer look at the special items. In the quarter, we recorded after-tax charges of $92 million or $0.07 per share, primarily related to restructuring and separation costs. Restructuring across the business included accelerated depreciation of the Warrick smelter, costs from the Wenatchee and Point Comfort curtailments, and headcount reductions associated with lower market demand, largely in the aerospace businesses.

In the EPS segment we’ve reduced 600 positions in the first quarter, and have a plan to reduce an additional 400 positions this year, also, given the current market environment, we’re evaluating a further reduction of up to 1,000 positions. Portfolio transaction costs stem from work being done to separate the Company. Note that roughly 75% of the restructuring-related charges are non-cash.

Now, let’s look at our performance versus a year ago. First-quarter adjusted earnings of $108 million were down $255 million from the prior-year quarter, driven largely by the drop in alumina and metal prices. Lower prices, predominantly related to new contracts that have been signed over the last year, drove a negative impact also. However, strong productivity gains in all segments contributed $232 million in savings, which more than offset $80 million in cost increases. The largest driver of these cost increases were costs associated with our recent exits in the upstream business, as well as increases in labor and benefits.

Now let’s move to the segment results. GRP turned in another strong quarter, as growth in automotive sheet shipments and solid productivity gains were partially offset by spending on growth projects and utilizing cold metal at the Warrick facility, after the smelter shutdown. As Klaus alluded to, EBITDA per ton was $374 a metric ton, or $390 a metric ton, excluding the costs associated with the Warrick curtailment, well above the three-year target of $344 a metric ton.

As we look to the second quarter of 2016, we expect GRP’s performance to reflect the following factors: Strong automotive sheet shipments, lower

commercial transportation build rates, and $15 million of costs after-tax to secure metal as a result of the Warrick smelter curtailment. Overall, ATOI for the segment is expected to be up 5% to 7%, excluding the Warrick impact.

Let’s move to EPS. EPS posted record revenue for the first quarter, driven by the inclusion of RTI, now known as ATEP, Alcoa Titanium Engineered Products. ATOI was $162 million for the quarter, up 4% versus the prior year. ATEP contributed $17 million in ATOI, which is ahead of our business case estimates.

Firth Rixson delivered ATOI of $11 million, and an EBITDA of $34 million. On an operational basis, after-tax productivity gains in the segment of $66 million more than offset cost increases of $39 million, and growth project spend of $15 million. As I mentioned in the overall Alcoa bridge, the unfavorable price mix is mainly in our base aerospace segments. Klaus will spend some more time talking about the performance drivers in EPS here shortly.

As we look to the second quarter, we expect the aerospace market to remain solid. However, it will be tampered by declines in legacy program deliveries, careful new program ramp-ups, and inventory management at OEMs. We expect to gain share through innovation, and continue to drive productivity across all businesses, amid pricing pressures. Overall, for the second quarter, we anticipate ATOI to be up 5% to 10% year-over-year.

Now, let’s move to TCS. TCS first-quarter revenue declined 9% year-over-year driven by the North American heavy duty truck market, and the relatively weak Brazilian market. ATOI for the first quarter was $39 million, up slightly versus the prior-year quarter, as productivity gains more than offset currency, market headwinds, and cost increases.

As we look to the second quarter, we expect improvement in the North American non-residential construction market, with sustained levels in Europe. Continued softness in the North American heavy duty truck market, offset by European improvement, continued weakness in our Brazil operations, stemming from the current economic environment. However, the second-quarter ATOI is expected to be flat year-over-year, as strong productivity gains counter these factors.

Let’s now move on to Alumina. Sequentially, the alumina segment was heavily impacted by declines in API pricing, which fell another 19% on average this quarter. Strong productivity at our operating locations, and improved mix of smelter grade shipments priced on API helped to partially offset these pricing headwinds. We’ve ramped down our Point Comfort refinery, which is currently operating on one digester, and we will be fully curtailed in the second quarter.

Creep production, however, with our system will offset the Point Comfort decline, yielding flat production sequentially. As we look forward to the second quarter, API pricing, as it usually does, will follow a 30-day lag, and LME pricing to follow a 60-day lag. Continued expansion of third party sales of bauxite, as Klaus alluded to, we recently signed a large bauxite contract. Benefit from acceleration of our productivity program. ATOI is expected to be up $15 million, excluding impacts of pricing and currency.

Let me turn to Primary Metals. Primary Metals first-quarter ATOI improved by $54 million sequentially, due to very strong productivity improvements, and further declines in alumina costs. The closure of the Warrick smelter was completed in the quarter. Looking forward to the second quarter, we expect production will decrease 50,000 metric tons, because of the Warrick closure.

Pricing, as it usually does, will follow a 15-day lag to the LME, and energy sales will continue to decline, but our accelerated productivity program and favorable raw material costs will more than offset these headwinds. In this segment, ATOI is expected to be up $10 million, excluding the impacts of pricing and currency.

Before I move on to working capital, let me summarize the second-quarter guidance. GRP up 5% to 7%, excluding the Warrick cold metal plant. EPS up 5% to 10%. TCS flat in tough market conditions, and the upstream up $25 million, excluding pricing and currency impacts.

Let’s take a look at working capital. DWC increased 14 days year-over-year. Acquisitions, mainly ATEP, drove 10 days, while the organic business increased by 4 days. In the organic portion of the business, the increase of 4 days is almost entirely related to the ramp-up of our automotive sheet business and new growth programs and EPS.

We move on to the cash flow statement. Cash from operations was negative $430 million for the quarter, leading to free cash flow of negative $681 million. This reflects our usual seasonal increase in working capital, as well as annual incentive compensation payments, semi-annual interest payments, and the third of five annual DOJ and SEC settlement payments, related to the Alba case.

This quarter, we contributed $70 million of cash to the pension plan. One question we often get asked is whether the pension expense sits in the segments or in corporate, so I’ll take a second to clear that up. Pension expense associated with the active employees and retirees from existing businesses is included in the respective segment. Pension expense associated with sold, closed businesses, or corporate employees, sits in corporate. Capital expenditures for the quarter were $251 million, with $123 million related to return-seeking projects.

We ended the quarter with $1.4 billion of cash. We’ve also announced the sale of a few assets to increase our cash position, so let me take a look at those in more detail. As you can see from this slide, we’ve initiated the sale of non-essential assets as part of our actions to strengthen liquidity during the separation process.

These include both upstream and future Arconic assets. We’ve announced the sales of our stake, as Klaus alluded to, in the Western Australia pipeline, and ATEP’s medical device business, and have already closed on the pipeline deal. In addition, we are redeeming the corporate owned life insurance program which was set up a number of decades ago. Those sales

generated $234 million in the first quarter, with approximately $270 million more expected in the second quarter. So if we move to the balance sheet, we ended the quarter with $1.4 billion in cash on hand and debt at $9.1 billion, resulting in net debt of $7.7 billion, slightly higher than our position last year at this time.

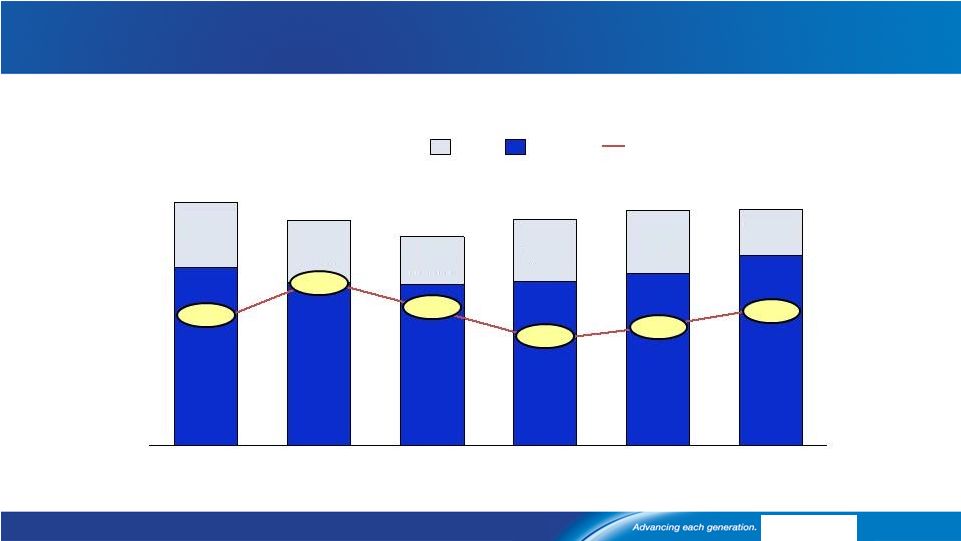

Now let’s take a look at the aluminum market fundamentals. We’re revising our 2016 global demand for aluminum from 6% to 5%, with consumption on pace to reach 59.7 million metric tons. The slight decline in demand is from two key markets, China and North America.

Chinese growth is being reduced to 6.5% versus our prior forecast of 8%, due to slower growth in the construction and electrical segments. North American demand growth is being reduced to 4%. However, at the same time, we’ve seen a reduction in supply, leaving our 2016 deficit projection largely intact. Aluminum supply growth is projected at only 2% year-over-year. At approximately 3% supply growth, China’s net supply growth rate is the lowest that it’s been since the global financial crisis.

Even outside of China, we see the majority of growth coming from Asia, while North America has curtailed significant production, putting the rest of the world on track for 1.5% supply growth in 2016. So the net impact is a global deficit of aluminum of approximately 1.1 million metric tons, with the rest of the world in deficit by nearly 2 million metric tons and China in surplus. Global inventories on a days of consumption basis have fallen, both year-over-year and versus last quarter, and we expect them to continue to fall, due to the global deficit this year. Premiums seem to have stabilized with all three of the major global premiums currently above their low points from the fourth quarter.

We move to the alumina market. The 2016 alumina market is also in deficit of approximately 1.4 million metric tons. However, this is a fairly large revision from our prior estimate of 2.2 million metric tons. The lower deficit is predominantly the result of lower demand due to smelting, as I alluded to on the smelting side, and Chinese refinery restarts.

Similar to aluminum, alumina demand growth is projected to outpace supply growth globally in 2016, moving the market from the 2015 surplus to a projected deficit. The price has responded to the improving fundamentals, recovering almost $50 per ton since the lows we experienced at the beginning of the year. Now, let me turn it back over to Klaus.

Klaus Kleinfeld^ Thank you very much, Bill. So why don’t we start with a look into the end markets that are most relevant for Arconic and also for the new future Alcoa.

Start with aerospace. Aerospace we project 6% to 8% growth this year. This is a little lower than our 8% to 9% that we saw for this year earlier in the year.

We see that the market is going through a transition, given an unprecedented level of new model introductions, and we are seeing lower orders due to that for legacy models, and a careful ramp-up of the new models. Large commercial aircraft deliveries stand at 9%, plus 9%. The order book, the jet order book is bigger than nine years of production.

We actually see solid airline fundamentals from passenger mile demand to the cargo demand, airline profitability is expected to hit a record this year. The global trend is also fully intact with the middle class as well as urbanization and the cancellations are below the five-year average and below 2% of the gross order book.

Let’s go to automotive, and let’s start with North America. We believe a 1% to 5% growth. This confirms our earlier view. Production was up 7.4%, strong sales, 3.1%, sustained demand also, we see the average age of the vehicles of 12 years and older is increasing, so pent-up demand showing in there.

Stable inventories with 65 days. The average transaction price is up 2%. So all of that are pretty good news in that market in North America.

In EU, automotive in EU rising production of 1.9% and the west, 4.3% offset by minus 14% in Eastern Europe. Strong registrations, over 10%, and exports increased, expected to increase by 6.9%. China, production’s recovering, plus 3.9%. We expect for the full year, 2% to 5%, and then sales, plus 4.1% year-to-date and minus 1.3% year-over-year.

So let’s go to the next segment. The heavy duty trucks and trailer. North America, we already had a pretty bleak outlook for this year.

And originally said minus 19 to minus 23. Looks even worse than what we saw before. Granted, it comes off now a high base of last year. We see minus 23 to minus 27.

Production is down 19%, weak rate growth demand, weak orders down 42%, inventories climbing 15.6%, it now stands at 66,800. The 10-year average is 47,400, so gives you a feel for it. The order book is falling, it stands currently at 131,000. This is still bigger than the historic average of 101,000, which is reflective of the strength that we’ve seen in the previous year there.

So Europe, we actually think that it’s also a little slower, 1% to 5%. We originally thought it would be 3% to 7%. We see strength in Western Europe, production’s up 20%, registrations are up almost 22%. At the same time, we see a decline in Eastern Europe, down 8.6%, mainly driven by the two big markets, Russia and Turkey.

In China, sales are up 26.8%. Production’s turning, slowly turning. Remember, they had this artifact with end of 2014 with the change in emission standards there.

So packaging, no news on all fronts. We believe North America minus 1% to zero, Europe 1% to 2% growth, China, 5% to 8% growth.

Then on building and construction, North America 4% to 6% growth. We see the non-residential contracts awarded at plus 4.7%. Architectural building index relatively steady. Housing starts at 10.6 plus.

Europe we believe is going to be between zero and minus 2%, flat to slight decline, obviously very substantially, depending on what country in Europe you look at. China, plus 3% to 5%, we see there.

Last segment here, industrial gas turbines, we see a growth of 2% to 4%, actually stabilizing, strongly driven by the new high efficient turbines, with advanced technology. Heavy duty gas turbine orders are up 12%, that’s pretty nice. And the 60 hertz gas-fired generation market is up 18.5%, also strong demand for spares and component upgrades. So that actually concludes the part of the end markets.

So let’s now go over to look at the business side, and let’s start with what we call future Arconic, or value-add businesses. Let’s talk about the first-quarter performance and the outlook for the second quarter, and then for full year. This is a very unique year, because usually, as you know, we don’t give a full-year guidance at this time of the year, but this is the final year of this time’s three-year target, so we put this in here to give you an overview on that.

So on GRP, to start with the first one, order shipments up 38%, strong productivity. You can see the mix is changing in the portfolio. We also believe in the second quarter that the profitability is going to be up 5% to 7% year over year, and we are confirming our target which is $6 billion to $6.2 billion of revenues, and $344 per metric ton of profitability.

On TCS, we have seen a record first quarter with an EBITDA margin of 14.9%, in spite of the headwinds, obviously that our wheels business has been facing through the heavy duty trucks and trailer business, that I just mentioned. Very, very good performance. Our outlook for the second quarter is pretty much, because of that, flat year-over-year, and we are confirming the target of $2 billion to $2.2 billion revenues, and a 15% return on that.

EPS, we have seen a record first quarter. We’ve seen an EBITDA margin of 21%, and we will see more about ATEP or former RTI that’s ahead of what we planned, and Firth Rixson is progressing but behind, and I’ll talk more about this in depth. We are, as the second quarter outlook, saying this is going to be up 5% to 10%.

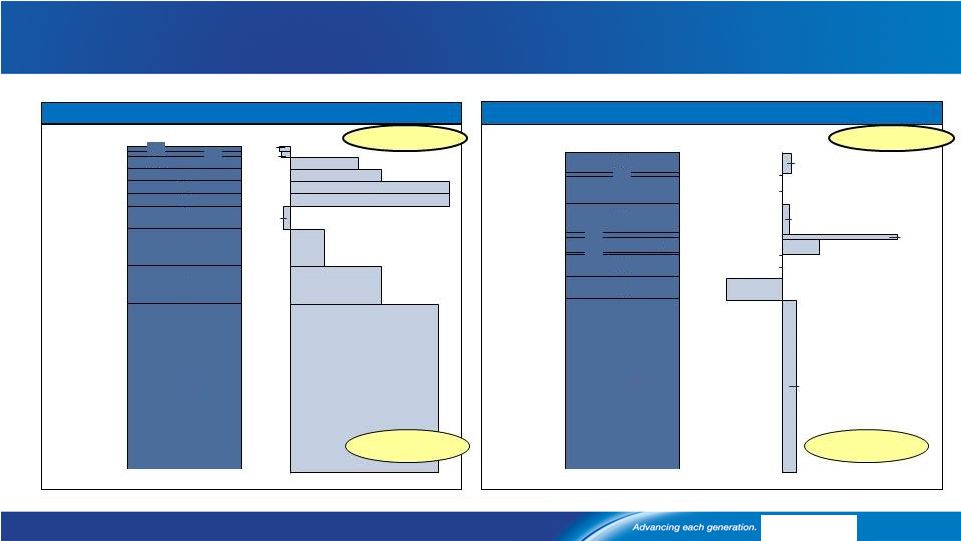

As you remember, our three-year target was at $7.2 billion revenues, with a 23%. We are lowering this target and putting out a new goal, and our goal in depth into this, to explain what the situation is there, and the new goal is $6 billion to $6.2 billion in revenues and profitability between 21% to 22%. So let’s give you more details, so that you can reconcile the old to the new target.

And I would actually encourage everybody who has a chance to look at the slides, to look at the slides, so that you can actually follow these buckets in the best possible way, right? Because I think you want to understand what’s really going on there. So let’s start here on the revenue side. On the revenue side, we’re coming down from $7.2 billion to $6 billion to $6.2 billion.

We already said at Investor Day, compared to when we put the target up, the exchange rate has changed. That alone has an impact on the revenue of roughly $200 million. Then comes the aero industry headwinds that we’ve seen here, and that is an impact of roughly $500 million.

The non-aero headwinds, which is mainly the off-highway segment and the mining segment here, as well as oil and gas, adds another $200 million revenue headwinds. Then the lower performance of Firth Rixson, another $300 million, and there’s a positive one of $200 million of share gains. That pretty much explains why we have set this target, and what has been happening in there.

Let’s now to go to the right hand side, and do exactly the same thing on the profitability side, so on the EBITDA side. So you’ve seen what we’re doing on the right-hand side, what this shows here, is what are we planning to do to get to the new target which is 1.260 to 1.360 which is basically the amount in between 21% and 22%. So we’re focusing on those things that we can control very strongly.

So productivity, we expect to have at $400 million. Then we have counter position to that, which is cost increases of $280 million. But if you look at the character of these cost increases, this is not all bad because quite — the majority of that really is costs that are either ramped up costs for organic growth, like our aluminum lithium facility in Lafayette, or the move to low-cost countries where we basically invest in bringing this over there, and will substantially reduce our costs going forward here.

Then competitive pricing, that also shouldn’t be a surprise. You know how the customers are beating down on everybody in the aerospace industry. At the same time, you’ve seen that we have been able to win $10 billion of new contracts. We had to give about $100 million of pricing. At the same time, beneath that, you actually see there’s also already in this year a positive part with the share gains, that we are getting there roughly $60 million, and then obviously a big positive, It’s obviously more important to be on the platform than not to be on the platform. And then, at the last point, is we see a full year of RTI in here which we call ATEP now. We’re substantially ahead of plan, and that adds another $110 million.

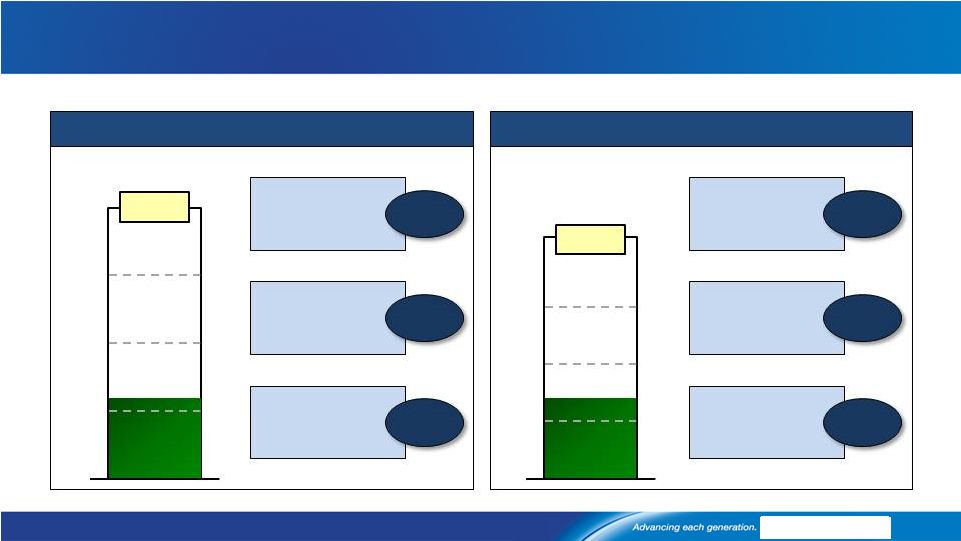

So let’s go to the next slide and let me address Firth Rixson, because that’s where a lot of questions obviously are coming from you all. This is clearly behind our original expectation, and this has been impacted by market headwinds, the press outage, and the isothermal ramp-up, and I referred to those things already in previous conversations, but let me put some numbers around it. But before I do that, let me update you where these things stand.

The press is back online. And in isothermal, we are also seeing additional demand. We’re pursuing this. The qualification of the existing contract continues. We believe that production shipments will start in 2017.

All included, that said, our 2016 revenue guidance comes down from our plan from $1.6 billion to $1.1 billion to $1 billion, with a margin of 14% to 16%, and an absolute EBITDA of $150 million to $170 million. So if you now go to the yellow box here in the upper left corner, you actually see that, and that’s a bit of good news, that we are making progress here. Because if you compare the first quarter of 2015 with the first quarter now, you’re actually seeing profitability is up from 11.6 to 14.3.

Let’s also spend a minute on how do we get to this performance, and so that we better understand what goes into achieving this 2016, this new 2016 goal. Again, the focus is on those actions that we have full control over ourselves. So it’s no surprise for you, that you see a big chunk of that being productivity, and another chunk of this being actions by management, like exiting unprofitable product, entering new engine platforms, optimizing available capacity, right? At the same time, there are some headwinds and these headwinds will remain, and we’ve talked about that.

So we have improved the performance, as you’ve seen, but we are clearly behind. And if I were to quantify that, I’d probably say probably by about two years behind here. So keep in mind, at the same time, the Firth Rixson acquisition is not about a quarter or a year.

The Firth Rixson acquisition, you have to see in light of what it is doing for Arconic. It is an important cornerstone for our aerospace presence. It is allowing us already today to have a full product suite for the jet engines. This has positioned us on a very different level via our jet engine, as well as our industrial gas turbine customers.

So let’s also now go and talk about another substantial acquisition that we did last year, which is RTI, or as we call it today, ATEP. So the integration is going very well. The performance is up, and it’s ahead of plan. If you look here on this slide, on the left hand side, this shows the pre-acquisition EBITDA and EBITDA margin, and the margin has been around 14%.

If you now look to the right hand side, and look at the first-quarter performance of former RTI, now ATEP, the profitability has been increased to 18.7%. What have we done? We’ve been able to accelerate our synergies. We are probably a year ahead, and we’ve been able to gain share. All of this together has allowed us to overcome the market headwinds that we’ve also seen here.

So therefore, we feel comfortable with our targets for this year, that you see on the right hand side here, to basically be able to get to 17% to 19% margin and generate $135 million to $160 million of EBITDA in 2016. Just to make this complete, our third but much smaller acquisition, TITAL, is fully on track.

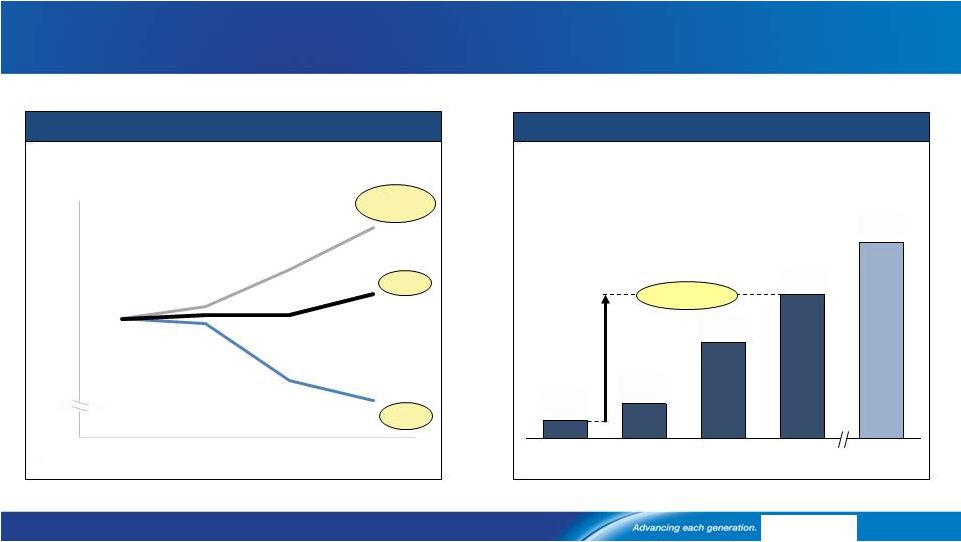

You have seen this, in this quarter, the excellent performance of GRP. We have consistently and continued to shift to higher margin, higher value product in GRP. One of the questions that I’ve been receiving from some of you is, why don’t we see more of this and faster? And I want to provide some color, so that you see what is really going on in this.

So therefore, here on the left hand side, you see the measure for profitability in this business is basically the conversion margin, EBITDA per metric ton, right? And we’ve broken out here GRP into really two segments, packaging and aero transportation, industrial, which is basically the rest. You see what’s been happening. A massive decline in profitability in packaging, minus 55% in this timeframe that we’ve chosen here.

At the same time, as we are doing portfolio actions and selling and closing rolling mills, as well as order ramps up, we’ve been able to increase the aero transportation industrial segments, the profitability by 62%. And the good news is, and that’s what you see on the right hand side, auto will continue to grow in the coming years. So we very much push for constant productivity, and that is what we can control, and as you know, that’s much needed in light of the headwinds.

So the good news is, if you look at the left hand side here, at Arconic, we currently have 11,644 actions under way for this year, right? And the actions so far have generated $179 million of productivity by the end of the first quarter. The target is to get up to $650 million of productivity by 2016, and I think we’re well on track to do that.

The same good news is true for the future new Alcoa. Future new Alcoa has achieved $175 million of productivity target at $550 million, and there are 5,518 actions underway to get to that target. Also, well deployed, as we would call it.

So let’s also look at new Alcoa, our upstream business. We’re driving down the cost curve, and we’re meeting the three-year targets. Alumina curtailed Point Comfort, will be curtailed Point Comfort this quarter.

Saudi Arabia, 80% at nameplate capacity, Suralco curtailed, good productivity, outlook up $15 million, with constant pricing and currency for the second quarter, and we are confirming the target to come down to the 21st percentile by the end of the year on the cost curve. Aluminum, Warrick smelter closed. Wenatchee curtailed. Record low cost per ton in Saudi Arabia, good productivity. In the second quarter, we believe the profits will be up by $10 million, again, assuming pricing and currency constant. And we are confirming our cost curve target to come down to the 38th percentile by the end of the year.

Lastly, let me update you on the separation. We are on course for the second half of 2016. There’s a lot of detailed work going into separating a 120-year-old firm. Very exciting, but I would say the most interesting thing for you out there has probably been the launch of our new value-add name, and the refresh of the Alcoa brand, which we should see on page 14. There it is, for those that haven’t seen that yet.

Let me summarize this. We’re pulling all upstream levers. Arconic is geared for profitable growth, substantially in aero and auto. We see traction there, our robust business improvement programs underway, and we are on track for the separation in the second half. So with this, I turn it over to the Q&A.

+++ q-and-a

Operator^ (Operator Instructions)

Your first question comes from the line of Evan Kurtz from Morgan Stanley. Your line is open. Please go ahead.

Evan Kurtz^ Thanks everyone. Thanks for taking my questions. Just a quick one on aerospace. Seems like the market might be weakening a little bit. I was wondering how you protect yourself from that? Do you have any minimum requirements, contracts where you get some take or pay penalties if they dip below a certain amount in a given year?

Klaus Kleinfeld^ The contracts vary substantially, but typically, the way this works is you get certain components on a jet engine or on a plane platform, and then it all depends on whether — how much this sells, and typically if it doesn’t sell, you don’t get it. If it sells more, you get more. That’s really how this works.

Evan Kurtz^ Okay. So if they were to cut production schedules more, that would be a one-for-one relative to your revenue in aerospace, is that how to think about it?

Klaus Kleinfeld^ That’s exactly how you have to think about it. What you’re seeing here is a little bit of a different phenomenon. They are very carefully ramping up the new platforms, and that’s, I think, a very responsible behavior on their side, because there’s a lot of new technology in the jet engines, as well as in the structures, so they are carefully ramping it up, so that they are not spreading the goods all over the planet, and then if there are maintenance issues, they have an issue.

I see it rather than stretching out, because the demand, as you can see by what I just talked about on the end market, demand continues to be strong, right? You have a nine year order book. And there’s almost no cancellations and the fundamentals are strong, so that’s what’s happening in the market.

Evan Kurtz^ Thanks for that. My follow-up is just on the bauxite opportunity. Nice to see the $300 million third-party sale. What is the — I was hoping could you size the opportunity there. How much spare bauxite capacity do you have? I assume with some of the refineries down, that you can go above and beyond that, but any quantifying, that would be helpful.

William Oplinger^ We have curtailed Point Comfort. We’ve curtailed Suriname. And so any additional bauxite that we’re getting out of the system, we’re selling into the third-party market. And so the size of that deal that we just recently announced is $350 million over a couple of years, and as we’re looking to grow our third-party bauxite business.

Klaus Kleinfeld^ The nice thing is with the mining, it’s much easier to increase your capacity, as well as to slow down your capacity. This is not like in a refinery or in a smelter, where you have certain increments. A smelter you basically can typically only do a half a line, in a refinery it’s a digester that’s the unit that you can bring up or down.

In a bauxite mine, it’s much, much easier, and you can ramp it up and ramp it down much faster. You leave it in the air, in — you leave it in the ground, we’re still on aerospace, you leave it in the ground, you leave it in the ground, if there’s no demand, and you bring it out. Frankly, I think we are really not limited by our own capabilities. We have one of the largest bauxite reserves.

William Oplinger^ We have one of the largest bauxite reserves, and we’re the largest bauxite miner. We mine around 45 million metric tons a year, and looking to get bigger in the third party market.

Klaus Kleinfeld^ Exactly.

Evan Kurtz^ Thanks, everyone.

Operator^ Your next question comes from the line of Curt Woodworth from Credit Suisse. Your line is open. Please go ahead.

Curt Woodworth^ First question just on the guidance at Firth Rixson. When you look at it relative to your initial guidance, say 18 months ago, you’re off almost $190 million of EBITDA, and you commented that you think that’s — you’re two years behind your initial plans. The question is, how much of the miss is on the isothermal piece, and then when you say you’re two years out, does that mean you still think you can hit that initial target you outlined for the $1.6 billion of revenue, and the $350 million of EBITDA?

Klaus Kleinfeld^ Well, the good news on the isothermal, we have structured the contract in such a way that we have a performance clause in there. This is not directly for the isothermal alone. It’s for Savannah, and that was more for practical purposes, how to calculate that. That’s $130 million, if I recall that correctly. So that’s a performance, that’s a performance part in the purchasing agreement, with the seller. So in case that doesn’t happen, we would not have to —

Curt Woodworth^ That’s $150 million earn-out that we —.

Klaus Kleinfeld^ Exactly. So that’s the good news there. The other thing is on isothermal, as I mentioned before, it is coming up, the qualification is underway, and we have had additional requests from customers, which we are currently working on securing, which obviously allow us to improve the utilization of the isothermal press. We knew from the start on that isothermal, it’s a very, very complicated technology, and that’s why we did the earn-out, because we knew there was a risk in it from the start. Again, to be clear, the earn-out is on Savannah in total, not just on isothermal.

The question you mentioned, the second part of your question, will we get it in two years? Frankly, after our recent experiences, I would really leave it as I described it. We’re two years behind, and I would say we will work on it.

And the other plan, which is something that I shared with some of you already, but let me share it here. We are planning the moment — we are separating the two companies. We will be coming out with new three-year or multi-year, let me put it this way, multi-year targets.

By that time, so in the second half of the year you will also get much more clarity on the longer term for both companies, and we will also come out with the measurements that are more in tune with the two types of businesses that you will be seeing, a commodity business, as well as the high performance technology business. We have been talking to quite a number of investors, and we’re currently in the process of getting the investor matrix lined up.

Curt Woodworth^ As a follow-up, just on the packaging business, you said that profitability’s down about 55%. It’s not clear what the timetable is on that chart but it looks like it’s —

Klaus Kleinfeld^ Timetable’s very simple. It starts basically with the year —

William Oplinger^ 2011.

Klaus Kleinfeld^ 2011. We put the 2011 at 100%, and then you see how it’s going from there.

Curt Woodworth^ Falling 55% roughly, in say two years. Do you think that’s a structural change? How much of that — do you see a bottoming, and is it a combination of say, scrap spreads narrowing and pricing pressure, or mix, and do you think you can turn that around at all, because it’s still significant.

Klaus Kleinfeld^ Looks on the chart as two years but really it’s four, because we only showed 2011 to basically early 2016.

Curt Woodworth^ It is pretty flat the first year.

Klaus Kleinfeld^ Well, yes, in the first two years. The answer is very simple, yes, there is a structural change in the business and that’s also why we have been doing things like, for instance, changing Tennessee, that used to be a packaging mill only, into an automotive and packaging mill. That’s why we have been restructuring some other parts, closing some down, on our Australian mills, for instance, two Australian mills.

We sold the three mills in Europe, two in Spain, one in France, this all goes into it. We clearly believe that there is a structural change in the market, and we’re very happy that we have been building up the higher value businesses in there, and that’s really what you can see here also. But the unfortunate thing is the market, the packaging market has really substantially deteriorated.

William Oplinger^ And I would also point out, Curt, you look at the strength of the productivity that GRP has done year over year, and that’s really an attempt to offset some of these declines in the market in packaging.

Curt Woodworth^ Okay. Got it. Thank you.

Operator^ Your next question comes from the line of David Gagliano from BMO Capital Markets.

(Operator Instructions)

David Gagliano^ Thank you for taking my questions. Also, thank you for the increased visibility on the targets in the downstream. Actually, I have a question that’s related to the other two segments. I don’t know if I’m reading this correctly, but it looks to me like you say the GRP and the TCS segments are on track to meet the three-year targets for 2016.

And you gave revenue numbers for each of those segments in the press release. But if I look back at the November 2015 investor day, the revenue numbers in the press release for those two segments are about $1 billion below what they were, as of November 2015. So I’m wondering if you could give us a similar bridge that you gave for the EPS segment, to explain the difference.

Klaus Kleinfeld^ To be honest, I’m looking at it right now and I’m happy to put this out in the deck. I’m not sure whether, we probably have to run this through our legal process here. But I tell you, it’s very simple, and it ties back to what I just explained. Remember how much we have divested and closed also in the GRP side.

What we’ve basically done, if you take the original target, was nominal $7.1 billion, right? And we’ve divested and closed about $1.1 billion. So the target for 2013 where we put this out was roughly — the starting point was roughly $6 billion. And then if you look at what we have been able to add, through all the other things here, so automotive and stuff, and look at the LME and the FX, it brings it basically down to $6.1 billion.

William Oplinger^ And on the TCS side, Dave, there’s around $200 million negative impact from currency, also. So the numbers that you see on page 6, from it’s probably not page 6 on your deck, but from Klaus’ presentation, have been adjusted for ForEx impacts.

David Gagliano^ Okay. And so just — but just to clarify, on the GRP business, the $7 billion number that was provided November 2015 was pre —

Klaus Kleinfeld^ $7.1 billion.

David Gagliano^ $7.1 billion, was pre any divestitures?

Klaus Kleinfeld^ It was pre any divestitures and closures, and they have eliminated on that chart the LME and FX. You also have to see the LME pass-through part here and GRP.

David Gagliano^ Okay. Great. Thanks very much.

Operator^ Your next question comes from the line of Justin Bergner from Gabelli & Company. Your line is open. Please go ahead.

Justin Bergner^ Question on the separation. Is there any update you can give us on when we can expect the first Form 10 filing, or any update you can give us on sort of how matters are progressing vis-a-vis pension and the PBGC?

Klaus Kleinfeld^ Two things really. On the Form 10, we’ve always said first half of 2016 is when we put out the — is when we will put out the Form 10. And we will —

William Oplinger^ Regarding the PBGC, we’ve had initial conversations, initial discussions with the PBGC. It’s gone well, and we’ll update you, as we can. But the initial discussions have gone well.

Justin Bergner^ Great. That’s good to hear. As you divest some of these non-core assets, is it possible to provide us a net proceeds number, relative to that $750 million, and should we expect Alcoa to continue to work through divesting non-core assets opportunistically in the quarters ahead?

Klaus Kleinfeld^ We’re always looking at opportunities, how to monetize and generate value. So I think this has always been the case, if you look also in the previous year.

William Oplinger^ On the net proceeds side, you almost have to go one by one. But on the pipeline, you realize that we will have a tax impact, and also, we are a — it’s an AWAC asset, so we get our 60% share there. On Remmele, there will be a small tax impact, and then on the corporate owned life insurance, that will largely show up as cash this year, and we’re likely to consume a tax attribute in future years. So largely, that one will be without tax impact this year in 2016. So the total proceeds, slightly less than the $750 million we have for the gross.

Justin Bergner^ Great. Thanks for taking my questions.

Operator^ Your next question comes from the line of Tony Rizzuto from Cowen and Co. Your line is open. Please go ahead.

Tony Rizzuto^ Thanks for taking my questions. My first question is, what percentage of your aero business is spares or aftermarket versus OEM business?

Klaus Kleinfeld^ That’s a good one. Do you know it offhand?

William Oplinger^ I don’t know it offhand, Klaus. I hate to put a number out there without the actual numbers.

Klaus Kleinfeld^ Neither would I. Neither would I.

Tony Rizzuto^ I’ll follow up with you guys then offline.

Klaus Kleinfeld^ Exactly, Tony.

Tony Rizzuto^ Okay. And then the second question if I may, maybe if I could possibly ask a third question if that’s all right —

Klaus Kleinfeld^ Let’s start with the second before the third.

Tony Rizzuto^ All right. With regard to GRP, it sounded like you are seeing increased pressures on margins in the packaging market. Is that fair? Is that a fair statement?

Klaus Kleinfeld^ Just look at the slide that we just discussed here. There’s no way to deny that. At the same time, I’m not sure — I would say, we have seen the level to come down to this level, as we have it. So I think that — you’re talking about GRP, right, on packaging?

Tony Rizzuto^ Yes. And I’m talking about the level of acceleration in those pressures, because I am hearing — (multiple speakers)

Klaus Kleinfeld^ I would say this, at this point in time, we’re not seeing that increasing, but we’re also not seeing it trend upward.

William Oplinger^ I would reference you back, Tony, at least to our short-term guidance. And so we’re trying to be very clear in all of our short-term guidance that all of our segments are trending upward, with the exception of TCS. And so on the GRP side, we said, I think 5% to 7% year-over-year. So even if we see additional pricing pressures, we’re able to mitigate it through good cost control.

Klaus Kleinfeld^ With regards to the spares, our good team is just providing it, and I don’t want to go into each one of the segments, but I would say — I would say, it varies substantially depending on which one of the aerospace segments you are looking at, and it can go from — I think it also varies, if you look at by year, and I only have here in front of me one year. So it varies, if you look at, this is 2015, if you look at 2015, it varies from 50% in that year, some businesses, to 16%, or actually 10%, 10% in some other businesses, right? But I would be very careful with this number, right? Because the segment that has the 50% I think that’s a very unique situation that we had in 2015.

Tony Rizzuto^ Okay. That’s helpful. May I ask a quick third question if I may?

Klaus Kleinfeld^ Sure, go ahead.

Tony Rizzuto^ Of the upstream adjusted EBITDA that you reported, $185 million in Q1, approximately what percentage would be from power sales?

William Oplinger^ Let us come back to you on that one, Tony. I don’t have the numbers in front of me, but I think that the — just to give you some color, power sales have been down on a sequential quarter basis, and on a year-over-year basis, as we’ve seen the Brazilian power prices come off fairly substantially. So I can get you that number in a minute.

Tony Rizzuto^ All right. Got it. Thank you so much, gentlemen.

Operator^ Your next question comes from the line of Josh Sullivan from Sterne Capital. Your line is open. Please go ahead.

Josh Sullivan^ Just regarding the revised EPS guidance, you talked about pricing pressures from the OEMs. Do you think we’ve seen the bottom of that pressure, or just how do you see that playing out over the next 24 months? And if you could dissect that between maybe the legacy aircraft, and next generation aircraft?

Klaus Kleinfeld^ Look, I think that there’s enormous pressure from the OEMs. They are under pressure, through their customers. This pressure will continue. We are assuming this pressure will continue, and we will have to continue to build productivity in, and we will also have to continue to win through innovation, and basically put out new cars, come out with new ideas so it’s not just giving a certain reduction on price, but coming up with a technical solution that’s superior, so that we can jointly win. And that’s I think where our technical skills come in, and we are pretty good at that.

But the pricing pressure will continue. That’s what we are assuming, and we are in the business also to help our customers to win. So that will be going on. You also see, we’re pretty proud of having won this Airbus contract for 3D metals printing, and in this case, it’s titanium. I don’t know whether you noticed that.

As you may be aware of, also, we brought our new powder metals plant online beginning of the year, and that allows us to do powder very, very high quality metals powder for three different types of metal alloys, and in the main titanium alloys, nickel alloy as well as aluminum alloys. So this is a big, big enabler for the future growth.

Josh Sullivan^ Okay. Thank you.

Operator^ Your next question comes from the line of Charles Bradford from Bradford research. Your line is open. Please go ahead.

Charles Bradford^ Just a simple question on the insurance sales. Was there a profit, and do you expect to book a profit in the second quarter, when you finish up those sales? It may have been in your deck. I might have missed it.

William Oplinger^ There was no book — no accounting gain on those sales, Chuck. There is a lower tax basis, so we will have some tax expense associated with it, but no book gain.

Charles Bradford^ Thank you.

William Oplinger^ And Tony, to answer Tony Rizzuto, I was able to grab the numbers fairly quickly. Around 25% of that $185 million of upstream EBITDA is associated with energy sales. Now, that’s our energy business unit. So that would be inclusive of energy that we’re selling externally, and internally. So it would be inclusive of energy we sell at the Warrick facility, up in Canada, at our ownership there, and then also in Brazil.

Klaus Kleinfeld^ Next question, please.

Operator^ (Operator Instructions)

Your next question comes from the line of Justine Fisher from Goldman Sachs. Your line is open. Please go ahead.

Justine Fisher^ The first question I have is related to the pension liabilities. You had mentioned earlier in the presentation that there are liabilities associated with operating businesses, and then anything that’s curtailed goes with — can be left at the corporate level, I guess, as opposed to the segment level. Does that mean that those liabilities would potentially be offloaded to the PBGC, so if we are looking at potential standalone for the upstream business, we can exclude — I won’t quantify, but exclude some of the legacy liabilities that are on current Alcoa’s balance sheet?

William Oplinger^ No, we would not be looking at offloading any of the legacy liabilities to the PBGC. The legacy liabilities will be split between the two companies. That’s part of the activity that we’re going through now. And clearly, when we sit down with the PBGC, they have an interest in how those get split, and the creditworthiness of the two companies. So that’s part of the exercise, but none get offloaded per se.

Justine Fisher^ Okay. Could you reduce or reschedule any of the cash payments related to those liabilities, that might saddle the upstream Company?

William Oplinger^ We are making the minimum ERISA payments today on those liabilities. And so, we’re currently on a GAAP basis, around 74% funded. On an ERISA basis, I believe it’s in the lower 90s. But there would not be any further reduction of payments that we could make, that we’re making, less than we’re making currently.

Justine Fisher^ Just one last question. In this timetable on steps to completion in the presentation, it mentions complete financing in the second half of 2016. What financing is that? I mean, if the debt can move downstream and you guys haven’t announced anything, but if hypothetically it did, it seems to me there wouldn’t necessarily need to be any new financing. Can you talk about what that refers to?

William Oplinger^ Sure. We would be looking, the debt ultimately will be attributed to the upstream and the downstream. In order to do that, we will go out and without getting into too much detail around the orientation of the separation, we will go out into the market, raise debt on one of the two entities, and then pay off debt at the other entity. And so that’s what the financing would be.

Justine Fisher^ Okay. Thanks very much.

Operator^ At this time, this is all the time we have, and I’d like to turn the call back to Mr. Klaus Kleinfeld.

Klaus Kleinfeld^ Very good. So you have seen this quarter, our profits were up in every Arconic segment. Alumina, aluminum segment, both profitable in a very low pricing environment. We are laser beam focused on the things that we can control, productivity, high productivity, we showed you this, winning major contracts, monetizing non-essential assets. You should expect our focus continues there.

Looking ahead, we are on track to meet our three-year targets in all businesses except EPS, and I hope I gave you also the clear adjusted expectations to better reflect what is going on in aerospace, as well as the lower Firth Rixson performance, and the better RTI performance that shows you our new expectations for EPS, and those ones, and the other thing here is separation is on track. So stay tuned.

We will obviously have many more opportunities coming up here to talk. Thank you very much for joining us for this call. Thank you.

Operator^ This concludes today’s conference call. You may now disconnect.

[Alcoa logo] [Alcoa logo] 1 April 11, 2016 1 st Quarter Earnings Conference [Alcoa logo] Exhibit 99.2 |

[Alcoa logo] Important Information 2 Forward–Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,”

“intends,” “may,” “outlook,”

“plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning.

All statements that reflect Alcoa’s expectations, assumptions

or projections about the future, other than statements of

historical fact, are forward-looking statements, including, without limitation, forecasts concerning global demand growth for aluminum, supply/demand balances, and growth of the aerospace, automotive, and other end markets; statements regarding targeted financial

results or operating performance; statements about Alcoa’s

strategies, outlook, business and financial prospects; and statements regarding the separation transaction, including the future performance of Value-Add Company and Upstream Company if the separation is completed, the expected benefits of the separation, and the expected

timing of

the Form 10 filing and the completion of the

separation. Forward-looking statements are not guarantees of future

performance and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can

give no assurance that these expectations will be attained and it

is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) uncertainties as to the timing of the separation and whether it will be completed; (b)

the possibility that various closing conditions for the

separation may not be satisfied; (c) failure of the separation to qualify for

the expected tax treatment; (d) the possibility that any

third-party consents required in connection with the

separation will not be received; (e) the impact of the separation on the

businesses of Alcoa; (f) the risk that the businesses will not be separated successfully or such separation may be more difficult, time-consuming or costly than expected, which could result in additional demands on Alcoa’s resources, systems,

procedures and controls, disruption of its ongoing business and

diversion of management’s attention from other business concerns; (g) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices and premiums, as applicable, for primary aluminum, alumina, and other products,

and fluctuations in indexed-based and spot prices for

alumina;; (h) deterioration in global economic and financial market conditions generally; (i) unfavorable changes in the markets served by Alcoa; (j) the impact of changes in foreign currency exchange rates on costs and results; (k) increases in energy costs; (l) the inability to achieve the level of revenue growth,

cash generation, cost savings, improvement in profitability and

margins, fiscal discipline, or strengthening of competitiveness and operations (including executing on the business improvement plans, moving the Upstream alumina and aluminum businesses down on the industry cost curves, and increasing revenues and improving margins in the Value-Add

businesses) anticipated from restructuring programs and

productivity improvement, cash sustainability, technology

advancements (including, without limitation, advanced aluminum alloys, Alcoa Micromill, and other materials and processes), and other initiatives; (m) Alcoa’s inability to realize expected benefits, in each case as planned and by targeted

completion dates, from acquisitions, divestitures, facility

closures, curtailments, or expansions, or international joint

ventures; (n) political, economic, and regulatory risks in the countries in which Alcoa operates or sells products; (o) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation; (p) the impact of

cyber attacks and potential information technology or data

security breaches; (q) the potential failure to retain key employees while the separation transaction is pending or after it is completed; (r) the risk that increased debt levels, deterioration in debt protection metrics, contraction in liquidity, or other factors could adversely affect the targeted credit ratings

for Value-Add Company or Upstream Company; and (s) the other

risk factors discussed in Alcoa’s Form 10-K for the year ended December 31, 2015, and other reports filed with the U.S. Securities and Exchange Commission (SEC). Alcoa disclaims

any obligation to update publicly any forward-looking statements, whether

in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market.

[Alcoa logo] |

[Alcoa logo] Important Information (continued) 3 Non-GAAP Financial Measures Some of the information included in this presentation is derived from Alcoa’s consolidated financial information but is not

presented in Alcoa’s financial statements prepared in

accordance with accounting principles generally accepted in the United States of America (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered

an alternative to the GAAP measure. Reconciliations to the

most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation. Alcoa has not provided a reconciliation of any forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures, due primarily to variability and difficulty in making accurate forecasts and projections, as not all of the

information necessary for a quantitative reconciliation is

available to Alcoa without unreasonable effort. Any reference to historical EBITDA means adjusted EBITDA, for which we have provided calculations and reconciliations in the Appendix. |

[Alcoa logo] [Alcoa logo] Klaus Kleinfeld Chairman and Chief Executive Officer 4 April 11, 2016 [Alcoa logo] |

[Alcoa logo] Separation on Track 1Q 2016 Overview 5 Delivering Solid Performance, Strong Productivity – Separation on Track Arconic Segments (Value-Add) Revenue $3.3B down 2.2% YoY: 6.7% revenue

increase predominantly related to acquisitions, offset by 8.3%

decline from metal and foreign exchange and 0.6% revenue decline from divested or closed operations ATOI of $269M, up 8% YoY, adj. EBITDA $537M, up 7% YoY, Record adjusted EBITDA margin 16.4% Global Rolled Products: $68m ATOI, up 26% YoY and adjusted EBITDA per metric ton $374, up 8% YoY due to strong cost control; automotive sheet shipment growth up 38% YoY Engineered Products and Solutions: Record Q1 Revenue of $1.4B; Record 1Q ATOI of $162M, up 4% YoY Transportation and Construction Solutions: $39M ATOI, up 3% YoY, Record 1Q adjusted EBITDA margin of 14.9% Supply Agreement for 3D-printed titanium fuselage and engine pylon parts to Airbus Multi-year ~$1B contract for advanced Industrial Gas Turbine (IGT) components, Alcoa’s largest IGT contract to date Agreement to sell RTI Remmele Medical business for $102m

Achieved $179 million in Productivity savings, on target to deliver $650 million in 2016 Global Rolled Products, Transportation and Construction Solutions on track to meet three-year 2016 targets; New goals set for EPS to better reflect aerospace market conditions and Firth Rixson performance

New Alcoa Segments (Upstream) 3 rd Party Revenue of $1.7B down 32.2% YoY: 4.5% revenue increase from organic growth more than offset by 26.1% revenue decline due to lower pricing and foreign exchange impacts and 10.6% revenue decline predominantly related to

curtailed or closed operations

Total Revenue of $2.1B, ATOI of $22 million, and adj. EBITDA of $185M

Profitable Alumina and Primary Metals segments despite 19% price decline in API, and flat aluminum pricing, sequentially; YoY declines of 40% and 26%, respectively

Signed new Third-Party Bauxite Contracts valued at over $350

million over the next two years Ma’aden-Alcoa joint venture

refinery continued to ramp-up, now at 80% of nameplate capacity

Pt. Comfort, Texas refinery on track to be

fully curtailed by end of second quarter; closed Warrick smelter in Indiana Achieved $175 million in productivity

savings, on target to deliver $550 million in 2016 Sold stake in Dampier to Bunbury Natural Gas Pipeline in Western

Australia (WA) for $154m.

Gas supply secured for three WA alumina

refineries On

track to meet 2016 Cost Curve Goals: 21 st percentile in Alumina and 38 th percentile in Primary Metals Launched New Value-Add

Brand “Arconic”

& Refreshed New Alcoa

Brand Form 10

to be filed in first half 2016 See appendix for EBITDA reconciliations and adjusted EBITDA margin of 21.0%; Aerospace sales up 14%YoY |

[Alcoa logo] William Oplinger Executive Vice President and Chief Financial Officer 6 April 11, 2016 |

[Alcoa logo] Income Statement Summary $ Millions, except aluminum prices and per-share amounts 1Q15 4Q15 1Q16 Prior Year Change Sequential Change Realized Aluminum Price ($/MT) $2,420 $1,799 $1,793 ($627) ($6) Revenue $5,819 $5,245 $4,947 ($872) ($298) Cost of Goods Sold $4,443 $4,404 $4,041 ($402) ($363) COGS % Revenue 76.4% 84.0% 81.7% 5.3 % pts. (2.3 % pts.) Selling, General Administrative, Other $232 $262 $260 $28 ($2) SGA % Revenue 4.0% 5.0% 5.3% 1.3 % pts. 0.3 % pts. Other (Income) Expenses, Net ($12) $29 $34 $46 $5 Restructuring and Other Charges $177 $735 $93 ($84) ($642) Effective Tax Rate 47.0% (6.1%) 73.2% 26.2 % pts. 79.3 % pts. EBITDA $1,089 $519 $603 ($486) $84 Net Income (Loss) $195 ($701) $16 ($179) $717 Net Income (Loss) per Diluted Share $0.14 ($0.55) $0.00 ($0.14) $0.55 Income excl. Special Items $363 $65 $108 ($255) $43 Income per Diluted Share excl. Special Items $0.28 $0.04 $0.07 ($0.21) $0.03 See appendix for EBITDA and Adjusted Income reconciliations 7 |

[Alcoa logo] Special Items See appendix for Adjusted Income reconciliation

$ Millions, except per-share amounts

1Q15 4Q15 1Q16 Income Statement Classification Segment Net Income (Loss) $195 ($701) $16 Net Income (Loss) per Diluted Share $0.14 ($0.55) $0.00 Restructuring-Related ($158) ($287) ($63) Restructuring and Other Charges/COGS Corporate/All Tax Items ($4) ($189) ($12) Income Taxes Corporate Portfolio Transaction Costs ($7) ($12) ($17) SG&A Corporate Mark-to-Market Energy Contracts $1 ($5) - Other Expenses, Net Corporate Italian Energy Matter - ($201) - Restructuring and Other Charges Corporate Q4’15 Overhead Reduction Program - ($47) - Restructuring and Other Charges/COGS Corporate Goodwill Impairment - ($25) - Impairment of Goodwill Corporate Special Items ($168) ($766) ($92) Net Income excl. Special Items $363 $65 $108 Net Income per Diluted Share excl. Special Items $0.28 $0.04 $0.07 8 |

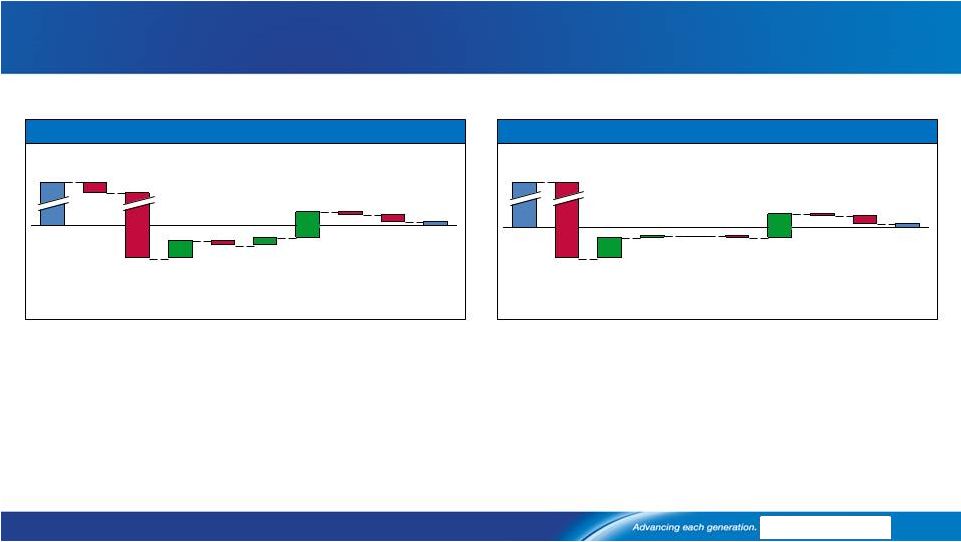

[Alcoa logo] Net Income excluding Special Items ($ Millions) Adjusted Earnings Down on Lower LME, API and Regional Premiums Market -$366 Performance +$208 Cost Headwinds -$97 Note: Metal Price = LME + Regional Premium; Regional Premium previously reported in Price/Mix category

See appendix for Adjusted Income reconciliation

$108 $363 -$32 Volume $8 Currency $4 API -$87 Metal Price -$283 1Q 15 -$9 Productivity Price / Mix $232 -$8 1Q 16 Raw Materials Cost Increases / Other -$80 Energy 9 |

[Alcoa logo] 1Q 15 1 4Q 15 1Q 16 3 rd Party Revenue ($ Millions) 1,621 1,422 1,397 3 rd Party Conversion Revenue ($ Millions) 757 732 737 ATOI ($ Millions) 54 52 68 EBITDA/MT ($) 347 312 374 1Q16 Actual and 2Q16 Outlook – Global Rolled Products GRP: Productivity and Auto Uplift Offset Headwinds EBITDA/MT up 12% YoY excluding impact to secure alternative metal supply

at Warrick

Auto sheet shipments up 38% year-over-year Volume and pricing pressure from packaging,

Lower demand from Aero

due to inventory overhang and significantly

reduced N.A. heavy duty truck build rates Continued investments of $5M in Growth projects including Micromill

TM R&D, Saudi JV and throughput/capacity increases

at key plants Strong productivity

more than offset cost increases

Auto sheet shipments expected to

be up ~35% as Tennessee Auto

ramp-up accelerates Continued pricing pressure from packaging Lower demand from

Aero due to new model transition and

reduced N.A. heavy duty truck build rates expected to continue ATOI is expected to be up 5-7% excluding $15M impact to secure alternative metal supply at Warrick, and current currency rates

2 nd Quarter Year-over-Year Outlook 1 st Quarter Business Highlights 1 st Quarter ATOI Results $ Millions 1 st Quarter ATOI Performance Bridge -$6 -$2 -$2 -$4 -$5 -$2 1Q16 Warrick Cold Metal Plan (CMP) Cost Incr./ Other Prod- uctivity Price / Mix Volume Currency 1Q15 Growth Projects 1. 1Q15 amounts have been revised to remove impact of metal price lag 2. EBITDA/MT include impact from Warrick metal

supply. Without that impact, EBITDA/MT is $390. See appendix for additional information

and EBITDA reconciliation. 10

$68 $35 $54 2 |

[Alcoa logo] 1Q 15 4Q 15 1Q 16 3 Party Revenue ($ Millions) 1,257 1,409 1,449 ATOI ($ Millions) 156 123 162 EBITDA Margin 22.4% 17.3% 21.0% 1 Quarter ATOI Performance Bridge 1Q16 Actual and 2Q16 Outlook – Engineered Products and Solutions Aerospace market remains strong despite slower ramp up of next generation platforms due to simultaneous launches of new

technologies and

inventory overhangs at OEMs Oil & Gas, European Industrial Gas Turbine, North America Commercial Transportation markets increasingly softer

Pricing pressure across all markets, except

IGT Share gains through innovation

and productivity continue

ATOI is expected to be up 5% to 10%

year-over

-year

1 Quarter ATOI Results 1 Quarter Business Highlights Price / Mix -$30 1Q16 Growth Projects Volume Currency -$15 ATEP Cost Increases -$39 Productivity 1Q15 EPS: Strong Productivity and Benefits From Acquisitions Revenue growth of 15% year-over-year driven by acquisitions,

partially offset by pricing pressure, inventory

overhang in Aero

OEMs, and softening

markets Alcoa Titanium and Engineered Products (ATEP) ATOI of +$17M; EBITDA margin at 18.7%, above 1Q’15 of 14.1%

Year-over-year improvement driven by productivity and

ATEP 1

1Q15 amounts have been revised to remove impact of metal price lag; see appendix for

additional information & EBITDA reconciliation.