Form 6-K/A CREDIT SUISSE GROUP AG For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

Form 6-K/A

______________

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 27, 2015

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

______________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

|

Form 20-F

|

Form 40-F

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report on Form 6-K/A of Credit Suisse Group AG and Credit Suisse AG supersedes and replaces the report on Form 6-K of Credit Suisse Group AG and Credit Suisse AG dated February 12, 2015 (accession number 0001370368-15-000008) in its entirety.

Fourth Quarter and Full Year 2014 Results Presentation to Investors Revised – February 27, 2015 As announced on February 27, 2015, we updated our previously reported unaudited financial results for 4Q14 and 2014 to reflect additional after tax charges of CHF 230 million. These charges reflect an increase in litigation provisions due to developments in industry-wide litigation and investigations in the United States relating to mortgages. This revised presentation updates those financial results and related information to reflect these charges and does not update or modify any other information contained in the presentation originally published on February 12, 2015 that does not relate to these charges.

Disclaimer Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, objectives, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk Factors" in our Annual Report on Form 20-F for the fiscal year ended December 31, 2013 and in "Cautionary statement regarding forward-looking information" in our fourth quarter 2014 earnings release filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements except as may be required by applicable law. Statement regarding non-GAAP financial measures This presentation also contains non-GAAP financial measures, including adjusted cost run-rates. Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation, which is available on our website at credit-suisse.com. Statement regarding capital, liquidity and leverage As of January 1, 2013, Basel 3 was implemented in Switzerland along with the Swiss “Too Big to Fail” legislation and regulations thereunder. Our related disclosures are in accordance with our current interpretation of such requirements, including relevant assumptions. Changes in the interpretation of these requirements in Switzerland or in any of our assumptions and/or estimates could result in different numbers from those shown in this presentation. Capital and ratio numbers for periods prior to 2013 are based on estimates, which are calculated as if the Basel 3 framework had been in place in Switzerland during such periods. Unless otherwise noted, leverage ratio, leverage exposure and total capital amounts included in this presentation are based on the current FINMA framework. Swiss Total Capital Leverage ratio is calculated as Swiss Total Capital divided by a three-month average leverage exposure, which consists of balance sheet assets, off-balance sheet exposures that consist of guarantees and commitments, and regulatory adjustments that include cash collateral netting reversals and derivative add-ons. The “look-through” CET1 leverage ratio is calculated as “look-through” BIS CET1 capital divided by the three-month average Swiss leverage exposure. Statement regarding impact of Swiss National Bank (SNB) actions and Credit Suisse mitigating measures Illustrative impact of SNB actions and Credit Suisse mitigating measures applied to 2014 results and assumes that the SNB actions occurred on January 1, 2014, FX rates of USD/CHF 0.92 and EUR/CHF 1.04 (as of close of business on January 30, 2015 according to Bloomberg) and certain other modeling parameters; actual results may differ significantly. February 27, 2015 *

Introduction Brady W. Dougan, Chief Executive Officer February 27, 2015 *

Key messages from Credit Suisse results February 27, 2015 * All data for Core Results. All references on this slide and the rest of the presentation to Group reported pre-tax income refer to income from continuing operations before taxes. Return on regulatory capital is based on after-tax income and assumes that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure 1 Includes net gains on sales with a benefit of 3bp for 4Q14 4Q14 Strategic pre-tax income of CHF 1.0 bn, down 4% from 4Q13, mainly due to lower performance fees and adverse impact of low interest rate environment, partly offset by sales gains, loan growth and strong collaboration revenues Continued high Strategic return on regulatory capital of 30% in 4Q14 and 29% in 2014 driven by significant efficiency improvements, notwithstanding investments in growth initiatives Wealth Management net margin of 27bps1 in 4Q14 and 2014 reflects resilience of franchise amid challenging macro backdrop, complemented by successful execution of growth initiatives such as UHNWI lending and franchise expansion in emerging markets 4Q14 Wealth Management Client NNA of CHF 4.4 bn; Corporate & Institutional Clients NNA of CHF 3.6 bn; CHF (10.6) bn of NNA in Asset Management due primarily to the completion of a transaction with a new venture in Brazil; 2014 Strategic net new assets remain solid at CHF 36.4 bn 4Q14 Strategic pre-tax income (ex. FVA) of CHF 0.7 bn, up 43% from 4Q13, driving solid Strategic return on regulatory capital (excl. FVA) of 12%; Strategic return on regulatory capital of 17% in 2014, reflecting consistent and solid performance In line with the industry, we introduced Funding Valuation Adjustments (FVA) in 4Q14; as a result, we recorded an initial charge of CHF 279 mn in the quarter, of which CHF 108 mn was in the Strategic business Strong improvement in capital efficiency with reported end-period leverage exposure reduction of USD 62 bn and Basel 3 RWA reduction of USD 10 bn since 3Q14 Robust equity trading results driven by favorable trading environment and increased client activity across products, particularly in Asia; continued momentum in M&A offset by slowdown in underwriting activity; well diversified fixed income franchise benefited from continued strength in Securitized Products and improved Macro results Private Banking & Wealth Management 4Q14 Strategic pre-tax income of CHF 1,007 mn and Strategic return on regulatory capital of 30% Investment Banking 4Q14 Strategic pre-tax income (ex. FVA) of CHF 687 mn and Strategic return on regulatory capital (ex. FVA) of 12% 4Q14 Strategic return on equity of 11% and return on equity of 6% for the overall business Capital and dividend Achieved “Look-through” CET1 ratio of 10.1% at end 4Q14, exceeding the 10% year-end 2014 target Continued momentum in winding down of Non-Strategic portfolio; on track to reach end-2015 targets Recommend cash dividend of CHF 0.70 per share, consistent with the prior year; optional scrip dividend alternative for shareholders who wish to increase their holding in Credit Suisse

* Credit Suisse response to SNB actions February 27, 2015 Currency translation impact of CHF (250) mn Of which IB CHF (105) mn and PB&WM CHF (120) mn Net impact on net interest income in PB&WM Expected incremental cost savings from 2015 - 2017 Incremental cost savings of CHF 200 mn by end-2017 Expect incremental realignment costs of ~CHF 200 mn to be incurred over 2015-2017 to achieve the full incremental cost savings by end-2017 Reduction in future fair value deferred compensation expense of ~CHF 75 mn per annum over next 3 years Expected higher client FX transactional volumes Remainder of Group cost savings from 2011 cost plan of CHF 0.95 bn2 by end-2015 Growth initiatives already implemented in PB&WM E.g. enhanced mandates offering, launched a differentiating advisory service; strengthening of our advise-based distribution Illustrative impact of SNB actions Illustrative impact of response to SNB actions Illustrative 2014 pre-tax income impact (CHF mn) (250) (20) – (40) +200 Remainder of 2011 cost plan +50 -100 Negative impact: ~CHF (280) mn1 Response to SNB actions: +CHF 325 - 375 mn Proactive plan combining cost and growth initiatives expected to restore anticipated profit loss Expected further impact from previously announced measures 1 Negative impact of ~CHF (280) mn based on the mid-point of net interest income impact 2 Remainder of cost savings from 2011 cost plan calculated from expense reductions measured at reported FX rates against 6M11 annualized total expenses, excluding realignment and other significant expense items and variable compensation expenses Net impact of +CHF 45 - 95 mn +9502 Growth initiatives +75

Financial results David Mathers, Chief Financial Officer February 27, 2015 *

Results Overview February 27, 2015 * 1 Return on Equity for Strategic results calculated by dividing annualized Strategic net income by average Strategic shareholders' equity (derived by deducting 10% of Non-Strategic RWA from reported shareholders’ equity) 2 Assumes assets managed across businesses relate to Strategic businesses only 3 Excludes pre-tax charges of CHF 765 mn in 4Q13 and 2013 relating to the settlement with the Federal Housing Finance Agency over mortgage-backed securities and pre-tax charge of CHF 600 mn in 2013 and CHF 1,618 mn in 2014 relating to the final settlement of all outstanding U.S. cross-border matters, in Non-Strategic and total reported results in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net revenues 6,000 6,287 6,024 25,126 25,475 Pre-tax income 1,449 1,622 1,461 6,790 7,173 Cost / income ratio 75% 73% 75% 72% 72% Return on equity1 11% 11% 11% 12% 13% Net new assets2 in CHF bn (0.2) 8.8 5.4 36.4 38.0 Net revenues 6,376 6,537 5,920 25,815 25,217 Pre-tax income / (loss) 901 1,301 (529) 3,232 3,504 Pre-tax income ex significant settlements impact3 901 1,301 836 4,850 4,869 Net income / (loss) attributable to shareholders 691 1,025 (476) 1,875 2,326 Diluted earnings / (loss) per share in CHF 0.39 0.61 (0.37) 1.07 1.22 Return on equity 6% 10% (5%) 4% 6% Return on equity ex significant settlements impact3 6% 10% 5% 8% 8% Net revenues 376 250 (104) 689 (258) Pre-tax income / (loss) (548) (321) (1,990) (3,558) (3,669) Pre-tax income significant settlements impact3 (548) (321) (625) (1,940) (2,304)

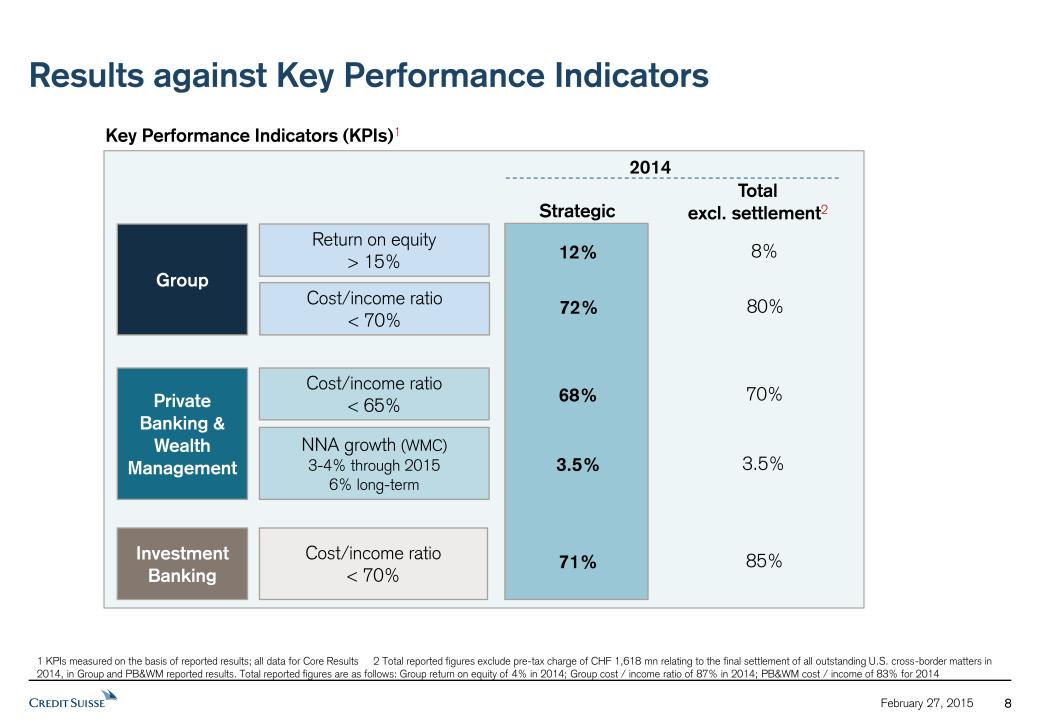

* Results against Key Performance Indicators February 27, 2015 * 1 KPIs measured on the basis of reported results; all data for Core Results 2 Total reported figures exclude pre-tax charge of CHF 1,618 mn relating to the final settlement of all outstanding U.S. cross-border matters in 2014, in Group and PB&WM reported results. Total reported figures are as follows: Group return on equity of 4% in 2014; Group cost / income ratio of 87% in 2014; PB&WM cost / income of 83% for 2014 Key Performance Indicators (KPIs)1 Cost/income ratio < 70% Return on equity > 15% Group Private Banking & Wealth Management Investment Banking Cost/income ratio < 65% NNA growth (WMC) 3-4% through 2015 6% long-term 3.5% 8% 70% 85% Strategic 3.5% 68% 12% 71% 2014 Total excl. settlement2 Cost/income ratio < 70% 80% 72%

* February 27, 2015 PB&WM Strategic with pre-tax income of CHF 1 bn in 4Q14 and CHF 3.7 bn in 2014, up 3% 1 Calculated using income after tax denominated in CHF; assumes tax rate of 30% in 4Q14, 3Q14, 4Q13, and 2014, and 29% in 2013, and capital allocated based on average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure 2 Assumes assets managed across businesses relate to Strategic businesses only 3 Includes pre-tax charge of CHF 1,618 mn relating to the final settlement of all outstanding U.S. cross-border matters in Non-Strategic and reported total operating expenses in 2014 in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net revenues 3,206 2,939 3,260 12,108 12,434 Provision for credit losses 39 26 27 112 82 Compensation and benefits 1,216 1,150 1,242 4,775 5,027 Other operating expenses 944 891 943 3,495 3,698 Total operating expenses 2,160 2,041 2,185 8,270 8,725 Pre-tax income 1,007 872 1,048 3,726 3,627 Basel 3 RWA in CHF bn 102 100 89 102 89 Leverage exposure in CHF bn 369 362 326 369 326 Cost/income ratio 67% 69% 67% 68% 70% Return on regulatory capital 1 30% 27% 35% 29% 31% Net new assets2 in CHF bn (0.2) 8.8 5.4 36.4 38.0 Assets under management2 in CHF bn 1,366 1,353 1,238 1,366 1,238 Net revenues 20 186 169 529 1,008 Total operating expenses3 142 116 776 2,156 1,325 Pre-tax income / (loss) (125) 71 (624) (1,638) (387) Net revenues 3,226 3,125 3,429 12,637 13,442 Total operating expenses3 2,302 2,157 2,961 10,426 10,050 Pre-tax income 882 943 424 2,088 3,240 Basel 3 RWA in CHF bn 108 107 96 108 96 Leverage exposure in CHF bn 381 377 348 381 348 4Q14 Strategic results vs. 4Q13 Pre-tax income of CHF 1.0 bn Revenues down 2% due to lower performance fees and lower net interest income partly mitigated by gains on sales, strong loan growth, improved collaboration revenues, and the appreciation of the US dollar Slightly lower expenses reflecting efficiency gains, partly offset by the appreciation of the US dollar and slightly higher litigation expenses The increase vs. 3Q14 in expenses includes CHF 14 mn higher seasonal expenses such as marketing and advertising, CHF 23 mn higher regulatory and infrastructure costs and CHF 49 mn higher full year compensation accruals, all partly driven by the appreciation of the US dollar Net new assets driven by CHF 9.2 bn outflows relating to Verde Asset Management, a venture in Brazil closely affiliated with Credit Suisse 2014 Strategic results Pre-tax income of CHF 3.7 bn, up 3% reflecting significant efficiency improvements, partially offset by lower net interest income Operating expenses reduced by CHF 0.5 bn; cost/income ratio improved to 68% Increase in RWA reflects loan growth in addition to methodology and FX impacts

Wealth Management Clients business with 10% growth in pre-tax income in 2014 February 27, 2015 * 1 Includes gains from the sale of the affluent business in Italy and Wealth Management Clients’ share of the gain on the partial sale of an investment in Euroclear PLC 2 Calculated using income after tax denominated in CHF; assumes tax rate of 30% in 4Q14, 3Q14, 4Q13, and 2014, and 29% in 2013, and capital allocated based on average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net interest income 695 695 760 2,784 3,050 Recurring commissions & fees 765 744 742 2,967 2,956 Transaction- & perf.-based revenues 600 603 554 2,442 2,438 Other revenues1 93 - - 93 - Net revenues 2,153 2,042 2,056 8,286 8,444 Provision for credit losses 10 17 18 60 78 Total operating expenses 1,566 1,489 1,572 5,966 6,316 Pre-tax income 577 536 466 2,260 2,050 Cost / income ratio 73% 73% 76% 72% 75% Net loans in CHF bn 168 164 150 168 150 Basel 3 RWA in CHF bn 51 51 47 51 47 Return on regulatory capital2 30% 28% 27% 30% 30% Net new assets in CHF bn 4.4 5.1 1.7 27.5 18.9 Assets under management in CHF bn 874 864 791 874 791 4Q14 Strategic results vs. 4Q13 Pre-tax income up 24%, or CHF 111 mn, including gains from the sale of our affluent business in Italy, partial sale of investment in Euroclear and the appreciation of the US dollar Non-interest revenues up 5%, despite the significant decrease of Hedging Griffo performance fees Expenses stable, with efficiency gains offset by the appreciation of the US dollar and higher litigation expenses The increase vs. 3Q14 includes CHF 13 mn of higher seasonal expenses such as marketing and advertising, CHF 14 mn increase in regulatory and infrastructure costs and CHF 24 mn higher full year compensation accruals, all partly driven by the appreciation of the US dollar 2014 Strategic results Pre-tax income up 10%, or CHF 210 mn, with progress made in repositioning select non-profitable businesses in mature markets Stable non-interest revenues with lower performance fees Net interest income down by 9%, as higher loan income was more than offset by continued impact from the low interest rate environment Significant efficiency gains with 6% expense reduction; cost/income ratio 72% Consistently high return on capital on an increased capital base supported by loan growth, particularly in UHNWI segment where loan volume increased 39% from 2013 to CHF 39 bn

Wealth Management Clients business with net new assets of CHF 27.5 bn, well diversified across regions February 27, 2015 * 6.6 Switzerland APAC EMEA = Europe, Middle East and Africa Emerging/Mature markets by client domicile while regional data based on management areas 1 Excludes Western European cross-border outflows 2 Western European cross-border outflows of CHF 7.4 bn in 2014; additional Western European cross-border outflows of CHF 4.0 bn in Non-Strategic unit in 2014 4% 5% 2% Net new assets in CHF bn EMEA reported •% Americas 2014 4Q14 2% Mature Markets Emerging Markets Western European cross-border outflows Western European cross-border outflows 2% 3.5% 2 2 9% APAC Americas EMEA Switzerland 15% 2% 3% 3% 34.9 34.9 % Annualized net new assets growth rate 2.0% Inflows1 NNA NNA by customer domicile by management region Inflows1 4.4% 3.1% 4Q14 Net new assets of CHF 4.4 bn in seasonally weak 4Q EMEA with strong finish to the year, with growth in Eastern Europe and the Middle East Solid inflows in Americas and Switzerland from UHNWI client segment Asia Pacific with a full year growth rate of 15%; growth rate moderated in 4Q14 2014 Net new assets of CHF 27.5 bn at 3.5% growth rate well within the near-term target range of 3% to 4% Emerging markets continue to be a key growth driver with 9% growth rate Strong contribution from UHNWI client segment with net new assets of CHF 20.9 bn at 6% growth rate Western European cross-border outflows of CHF 11.4 bn (of which CHF 7.4 bn in the Strategic businesses) vs. CHF 10.5 bn in 2013

Improvement in net margin; lower interest income, growth in asset base and change in client mix drove gross margin compression * All data for Wealth Management Clients business Net margin = Pre-tax income / average AuM Gross margin = Net revenues / average AuM 1 Gains on sales net of related expenses Net margin on AuM in basis points Net revenues in CHF mn 38 38 28 104 33 35 29 97 32 35 28 99 23 25 2,056 2,042 2,153 Gross margin on AuM in basis points 45% 48% 48% 793 846 870 Average assets under management (AuM) in CHF bn Ultra-high-net-worth clients' share 26 8,286 8,444 48% 833 45% 788 31 38 38 33 36 29 107 99 Net margin improved to 27bp for both 4Q14 and full-year Includes net gains on sales1 with a benefit of 3bp for 4Q14 Full year impact from 4Q14 net gains on sales of CHF 72 mn1 largely offset by CHF 54 mn of certain litigation provisions in 2H14 Higher transaction- & performance-based revenues with continued strong collaboration revenues and improved foreign exchange transaction and brokerage income, offset in part by the significant decrease in performance fees Higher recurring commissions & fees with improved discretionary mandates fees partially offset by lower retrocessions 4Q14 vs. 4Q13 Lower net interest income reflects higher loan income offsetting the adverse impact of the lower interest rate environment; quarter-on-quarter decline stabilized in 2H14 27 27 Other revenues 4 Other revenues 1 February 27, 2015

February 27, 2015 * Corporate and Institutional Clients with consistent performance 1 Other revenues in 4Q14 include fair value changes on securitization transactions and the Corporate and Institutional Clients’ share of the gain on the partial sale of an investment in Euroclear PLC. Other periods presented include fair value changes on securitization transactions 2 Calculated using income after tax denominated in CHF; assumes tax rate of 30% in 4Q14, 3Q14, 4Q13, and 2014, and 29% in 2013, and capital allocated based on average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net interest income 290 273 278 1,086 1,105 Recurring commissions & fees 112 113 108 460 451 Transaction- & perf.-based revenues 111 107 102 453 455 Other revenues1 5 (5) (3) (26) (15) Net revenues 518 488 485 1,973 1,996 Provision for credit losses 29 9 9 52 4 Total operating expenses 269 239 263 1,004 1,027 Pre-tax income 220 240 213 917 965 Cost / income ratio 52% 49% 54% 51% 52% Net loans in CHF bn 69 67 62 69 62 Basel 3 RWA in CHF bn 38 37 34 38 34 Return on regulatory capital2 19% 21% 20% 21% 23% Net new assets in CHF bn 3.6 0.9 4.0 5.5 8.8 Assets under management in CHF bn 276 267 250 276 250 4Q14 results vs. 4Q13 Pre-tax income of CHF 220 mn Revenues up 7% driven by higher loan income, recurring revenue growth and gains from the partial sale of investment in Euroclear Credit provisions of CHF 29 mn reflect a small number of individual provisions relating to structured trade finance and shipping Operating expenses broadly stable vs. 4Q13 Higher vs. 3Q14 driven by CHF 9 mn increase in regulatory and infrastructure costs and CHF 17 mn higher full year compensation accruals Full year 2014 results Revenues were stable with higher loan income and strong collaboration revenues, offset by fair value changes on securitization transactions (in other revenues) Operating expenses reduced by 2%; cost / income ratio improved to 51% Increase in RWA driven by loan growth and FX; increase from methodology changes partly offset by mitigating actions

* February 27, 2015 Asset Management with stable cost / income ratio despite lower performance fees compared to a strong 2013 4Q14 results vs. 4Q13 Solid pre-tax income of CHF 210 mn Lower year-end performance fees (down CHF 167 mn) and lower private equity carried interest (down CHF 27 mn) Expenses down 7% vs. 4Q13 with benefit from cost savings and lower commission expenses Net new assets driven by CHF 9.2 bn outflows resulted from the change of management of funds from Hedging Griffo to a new venture in Brazil, Verde Asset Management, in which we have a significant investment Full year 2014 results Strong pre-tax income of CHF 549 mn, down 10% reflecting lower annual and semi-annual performance fees (down CHF 214 mn) Recurring fees increased by 2%; recurring fee-based margin slightly down Expenses down CHF 82 mn, or 6%; cost / income ratio higher at 70% due to drop in performance fees Excluding the outflows in Brazil, net new assets were slightly lower than the strong 2013, with solid inflows in both alternative and traditional products offset by outflows in fixed income and equity products in CHF mn 4Q14 3Q14 4Q13 2014 2013 Recurring commissions & fees 300 292 299 1,174 1,147 Transaction- & perf.-based revenues 265 117 481 692 925 Other revenues (30) - (61) (17) (78) Net revenues 535 409 719 1,849 1,994 Total operating expenses 325 313 350 1,300 1,382 Pre-tax income 210 96 369 549 612 Cost / income ratio 61% 77% 49% 70% 69% Fee-based margin in basis points 57 42 87 48 58 o/w recurring fee-based margin 36 36 39 36 38 Basel 3 RWA in CHF bn 13 12 9 13 9 Return on regulatory capital1 81% 40% 220% 61% 87% Net new assets in CHF bn (10.6) 3.3 (0.5) 3.7 15.0 Assets under management in CHF bn 388 391 352 388 352 1 Calculated using income after tax denominated in CHF; assumes tax rate of 30% in 4Q14, 3Q14, 4Q13, and 2014, and 29% in 2013, and capital allocated based on average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure

February 27, 2015 1 * Continued progress in winding down our Non-Strategic portfolio 4Q14 results Lower revenues reflecting investment related losses within Non-Strategic Asset Management businesses Operating expenses were higher compared to 3Q14 reflecting higher realignment expenses Full year 2014 results Operating expenses included the CHF 1,618 mn charge in 2Q14 relating to the final settlement of all outstanding US cross border matters Basel 3 RWA down 25%, Leverage exposure down 50% Note: Risk-weighted asset and leverage exposure goals are measured on constant FX basis and are subject to change based on future FX movements 1 4Q13 RWA includes CHF 2 bn external methodology impact in 1Q14 2 Includes gains on sales of CHF 265 mn in 2013 (CHF 146 mn from our ETF business, CHF 91 mn from Strategic Partners and CHF 28 mn from JO Hambro) and CHF 200 mn in 2014 (CHF 91 mn from CFIG and CHF 109 mn from our domestic private banking business booked in Germany) 3 Realignment expenses in PB&WM relating both to continuing operations and operations treated as discontinued at the Group level Leverage Exposure in CHF bn Basel 3 RWA in CHF bn (17%) 8 7 6 5 22 (3) 11 4 (64%) 14 (1) (50%) (25%) in CHF mn 4Q14 3Q14 4Q13 2014 2013 Select onshore businesses 3 122 28 169 164 Legacy cross-border businesses 35 38 52 158 203 AM divestitures and discontinued operations (29) 12 54 155 534 Other Non-Strategic positions & items 11 14 35 47 107 Net revenues 2 20 186 169 529 1,008 Provision for credit losses 3 (1) 17 11 70 Total operating expenses 142 116 776 2,156 1,325 o/w US litigation provisions - - 600 1'618 600 o/w realignment expenses 3 59 24 50 136 109 Pre-tax income (125) 71 (624) (1,638) (387) Pre-tax income excl. US litigation provisions (125) 71 (24) (20) 213 Net new assets in CHF bn (2.8) (1.4) (1.0) (8.2) (5.9) 1

Improved 2014 Investment Banking returns reflect strength of diversified franchise with stable revenues and increased capital efficiency Note: Rounding differences may occur with externally published spreadsheets 1 Strategic revenues include FVA impact of CHF (108) mn in 4Q14 and 2014 and Non-Strategic revenues include FVA impact of CHF (171) mn in 4Q14 and 2014 2 Return on regulatory capital is based on after-tax income denominated in US dollars and assumes tax rates of 28% in 2013 for the Strategic business and 26% for total Investment Banking, and of 30% in 4Q14, 3Q14, 2014 and that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure 3 Includes provisions for credit losses, compensation and benefits and other expenses in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net revenues1 2,748 3,419 2,781 13,087 13,096 Provisions for credit losses 14 29 4 38 7 Compensation and benefits 1,137 1,412 1,322 5,494 5,267 Other operating expenses 1,018 983 974 3,811 3,928 Total operating expenses 2,155 2,395 2,296 9,305 9,195 Pre-tax income 579 995 481 3,744 3,894 Basel 3 RWA USD bn 151 159 154 151 154 Leverage exposure USD bn 730 791 748 730 748 Cost/income ratio 78% 70% 83% 71% 70% Return on regulatory capital2 10% 17% 9% 17% 17% Net revenues1 (294) (116) (113) (572) (531) Total expenses3 550 363 932 1,342 1,644 Pre-tax income / (loss) (844) (479) (1,045) (1,914) (2,175) Basel 3 RWA USD bn 10 12 21 10 21 Leverage exposure USD bn 64 66 88 64 88 Net revenues1 2,454 3,303 2,668 12,515 12,565 Total expenses3 2,719 2,787 3,232 10,685 10,846 Pre-tax income / (loss) (265) 516 (564) 1,830 1,719 Basel 3 RWA USD bn 161 171 175 161 175 Leverage exposure USD bn 794 856 836 794 836 Return on regulatory capital2 -- 8% (9%) 8% 7% 4Q14 results Results include initial FVA of CHF 279 mn reflecting Strategic FVA of 108 mn and Non-Strategic FVA of 171mn Strategic return on regulatory capital of 12% excluding FVA Consistent Strategic revenues amid increased market volatility highlights stability of diversified franchise Improved overall capital efficiency vs. 3Q14; reduced leverage exposure by USD 62 bn and RWA by USD 10 bn Full year 2014 results Stable Strategic revenues and improved capital efficiency driving strong Strategic return on regulatory capital of 17%, excluding FVA Total expenses down 1% vs. 2013 Strategic expenses stable as increase in deferred and variable compensation expenses offset continued progress in infrastructure initiatives and other operating expenses Significant progress in wind-down of Non-Strategic unit resulting in 51% reduction in RWA and 27% reduction in leverage exposure * February 27, 2015

* Stable 4Q14 Fixed Income revenues in volatile markets; diversified yield franchise driving full year growth February 27, 2015 Compared to 4Q131 Fixed income franchise revenues declined 2% excluding FVA of CHF 96 mn; strong sales and trading results, up 19%, offset by challenging underwriting revenues, down 36%, in volatile markets Significant revenue increase in high-returning Securitized Products franchise driven by continued strength in #1 ranked asset finance business2 Lower Credit revenues primarily driven by weak high yield underwriting performance in the US and Europe consistent with industry volumes; lower trading results given reduced client activity Modest decline in Emerging Markets revenues reflecting strength in EMEA offset by weakness in Latin America Improved Macro revenues in both Rates and FX, from subdued levels, driven by higher client activity and volumes Compared to full year 2013 Market-leading yield franchises driving revenue growth and generating returns above Investment Banking average Strong Securitized Products performance driven by growth across products and sustained leading market share Well-balanced Emerging Markets franchise reflecting higher financing client activity across regions Credit franchise delivered stable revenues reflecting diversification across products and regions Fixed Income sales & trading and underwriting excluding FVA – Strategic Revenues in CHF mn Note: Underwriting revenues are also included in the total Fixed Income franchise view 1 Fixed income sales & trading and underwriting revenues exclude FVA impact of CHF 96 mn and USD 99 mn 2 Source: Thomson/IFR for ABS and MBS 1,418 2,227 1,2921 7,701 8,0241 Fixed Income sales & trading and underwriting - Strategic revenues USD mn Debt underwriting Fixed Income sales and trading 1 1

* Higher Equities revenues reflecting strength and stability of market leading franchise February 27, 2015 Note: Underwriting revenues are also included in the total Equity franchise view 1 Equity sales & trading and underwriting revenues exclude FVA impact of CHF 13 mn and USD 14 mn Compared to 4Q13 Equity franchise revenue increased reflecting strong performance in Asia, more favorable trading environment and increased client activity Higher Prime Services revenue from client portfolio optimization and increased trading and clearing activity Diversified Derivatives franchise delivering continued revenue momentum through expansion into growth markets, notably Asia Cash Equities results reflect higher commission revenue, across all regions, due to higher market volumes Lower Equity Underwriting revenue reflecting a decline in industry-wide fees across all regions Compared to Full Year 2013 Strong growth in Prime Services, Derivatives and Equity Underwriting offset by challenging trading activity Continued growth in Asia following strong 2013 performance which benefited from quantitative easing in Japan 1,490 1,383 1,4931 6,071 6,0021 Equity sales & trading and underwriting - Strategic revenues USD mn Equity underwriting Equity sales and trading 1 1 Equity sales & trading and underwriting excluding FVA – Strategic Revenues in CHF mn

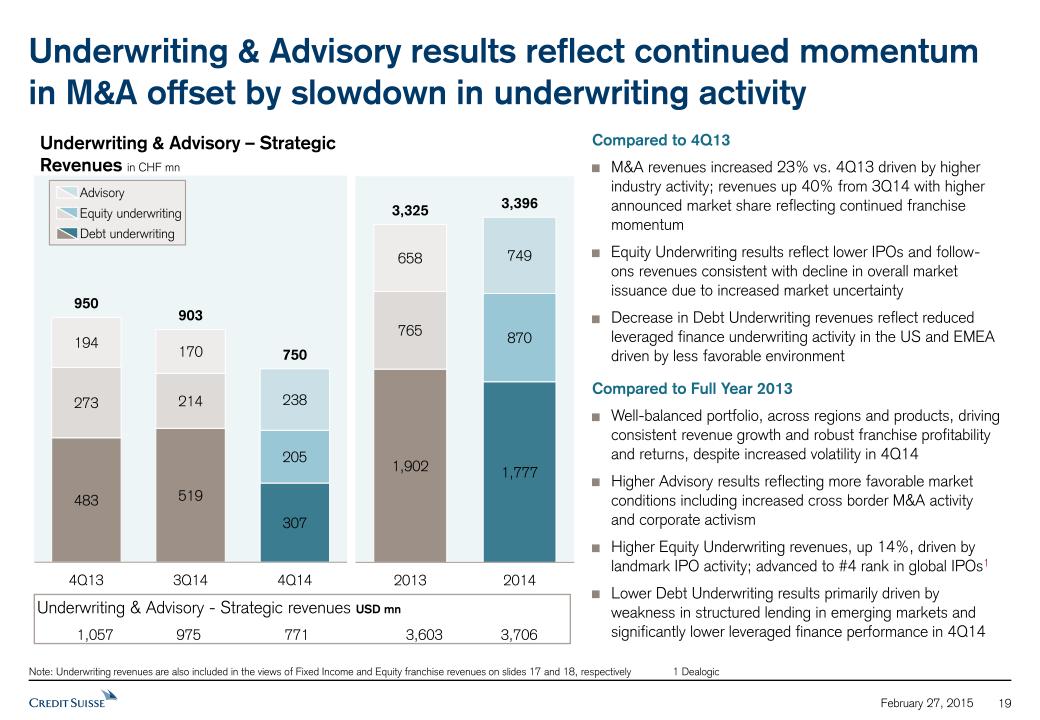

* Underwriting & Advisory results reflect continued momentum in M&A offset by slowdown in underwriting activity February 27, 2015 Note: Underwriting revenues are also included in the views of Fixed Income and Equity franchise revenues on slides 17 and 18, respectively 1 Dealogic 1,057 975 3,603 3,706 Underwriting & Advisory - Strategic revenues USD mn 771 Underwriting & Advisory – Strategic Revenues in CHF mn Equity underwriting Advisory Debt underwriting Compared to 4Q13 M&A revenues increased 23% vs. 4Q13 driven by higher industry activity; revenues up 40% from 3Q14 with higher announced market share reflecting continued franchise momentum Equity Underwriting results reflect lower IPOs and follow-ons revenues consistent with decline in overall market issuance due to increased market uncertainty Decrease in Debt Underwriting revenues reflect reduced leveraged finance underwriting activity in the US and EMEA driven by less favorable environment Compared to Full Year 2013 Well-balanced portfolio, across regions and products, driving consistent revenue growth and robust franchise profitability and returns, despite increased volatility in 4Q14 Higher Advisory results reflecting more favorable market conditions including increased cross border M&A activity and corporate activism Higher Equity Underwriting revenues, up 14%, driven by landmark IPO activity; advanced to #4 rank in global IPOs1 Lower Debt Underwriting results primarily driven by weakness in structured lending in emerging markets and significantly lower leveraged finance performance in 4Q14

* February 27, 2015 Continued progress in wind-down of Non-Strategic RWA and Leverage Exposure Note: Risk-weighted asset and leverage exposure goals are measured on constant FX basis and are subject to change based on future FX movements. Rounding differences may occur with externally published spreadsheets 1 Includes business impact, internally driven methodology and policy impact and FX movements 2 Includes provisions for credit losses Non-Strategic unit in CHF mn 4Q14 3Q14 4Q13 2014 2013 Net revenues (294) (116) (113) (572) (531) o/w FVA (171) - - (171) - o/w Legacy Funding (33) (34) (93) (148) (382) o/w Other Funding (60) (51) (89) (208) (333) Total expenses2 550 363 932 1,342 1,644 Pre-tax income / (loss) (844) (479) (1,045) (1,914) (2,175) o/w Litigation-related (392) (227) (855) (824) (1,314) Compared to 3Q14 Higher pre-tax income losses than 3Q14 reflecting: Increased negative net revenues resulting from FVA recognition of CHF 171 mn; excluding FVA, negative net revenues in line with 3Q14 Lower RWA exit costs relative to long term exit costs of 2-3% of RWA Higher litigation expenses Continued progress in winding-down capital positions; on-track to meet RWA and leverage exposure reduction targets by end-2015 Reduced RWA by USD 2 bn to USD 10 bn from 3Q14 Reduced leverage exposure by USD 2 bn from 3Q14 Executed sale of commodities portfolio; RWA and leverage exposure position reductions to be substantially completed in 2015 Basel 3 RWA in USD bn Leverage Exposure in USD bn 4Q13 Year-end 2015 target 2Q14 (40%) Business impact & other1 1Q14 3Q14 2Q14 Business impact & other (63%) 1Q14 4Q13 3Q14 Year-end 2015 target 4Q14 4Q14 (52%) (27%)

Solid return on regulatory capital from Strategic businesses * February 27, 2015 Investment Banking after-tax return on regulatory capital (USD-denominated) Note: Return on regulatory capital is based on after-tax income denominated in US dollars and assumes tax rates of 28% in 2013 for the Strategic business and of 30% in 2014 for both the Strategic business and total Investment Banking and that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure 1 Excludes FVA of USD 113 mn in Strategic business 2 Includes FVA of USD 178 mn in Non-Strategic business 3 Other includes impact of Non-Strategic revenue losses excluding funding charges, Non-Strategic operating expenses excluding litigation and capital impact Compared to 2013 Stable and consistent Strategic return on regulatory capital of 17% for 2014 excluding FVA of USD 113 mn; overall return on regulatory capital of 9% excluding FVA of USD 291 mn Strategic expenses increased 2% in USD from 2013 as higher deferred compensation from prior year awards, variable compensation and litigation expenses offset cost reductions from infrastructure initiatives Wind-down of Non-Strategic unit driving improved Investment Banking returns Strategic 2013 Revenue (excluding FVA1) and Capital impact Cost impact 2014 Strategic IB excluding FVA Non-Strategic including FVA2 Reported Total IB Litigation Funding Other2,3 Strategic FVA impact Reported Strategic IB

Estimated BCBS leverage exposure progression to end-2015 February 27, 2015 * BCBS leverage amounts are calculated based on our interpretation of, and assumptions and estimates related to, the BCBS requirements as implemented by FINMA that are effective for 1Q15, and the application of those requirements on our 4Q14 results. Changes in these requirements or any of our interpretations, assumptions or estimates would result in different numbers from those shown here Estimated BCBS leverage exposure progression to end-2015 Investment Banking Leverage Exposure USD in billions Strategic Non-Strategic Significant progress in reducing leverage exposure by USD 62 bn vs. 3Q14 mainly driven by business reductions in the strategic business (20-22%) Target USD 150-170 bn of leverage exposure reduction by end 2015 USD 21 bn decrease from BCBS definition impact, post-mitigation measures 1 1 Excludes reductions in Non-Strategic We expect USD 150 bn – 170 bn in reductions through 2015 to be delivered relatively equally from: Clearing-based initiatives and increased efficiencies from compression of trades Planned reductions in the Non-Strategic unit and optimization of liquidity and funding requirements Continued client optimizations across Investment Banking businesses Further business optimizations including planned reductions in Macro

Illustrative impact of SNB action and Credit Suisse response; update on capital progress and targets February 27, 2015 *

* Illustrative impact of the SNB actions February 27, 2015 On January 15, the SNB took the unexpected action to remove the minimum exchange rate of CHF 1.20 per Euro and lowered the interest rate on sight deposit balances by 50 basis points to -0.75%. This happened after Credit Suisse’s 2014 year end and had no impact on our 2014 results. However, due to the structure of our business and financial reporting, the moves have ongoing consequences. Mitigating management measures have been initiated. Illustrative impact and implications of SNB actions Illustrative impact of the SNB actions on Group Pre-tax income in CHF mn Adjusted 2014 Pre-tax income1 Illustrative SNB impact on pre-tax income +140 (160) IB: (130) CC: (30) FX translation impact Reflects mostly the weakening of the EUR/CHF rate; prevailing USD/CHF exchange rate is largely unchanged vs. the average in 2014 Net Interest Income in PB&WM Net negative impact of CHF 20 - 40 mn from lower CHF interest rates on non-maturing products and fixed term deposits, partially offset by client rate adjustments Illustrative net FX translation impact of ~(250) Illustrative impact of ~CHF (280) mn2 from SNB actions on 2014 pre-tax income (260) PB&WM revenue IB + CC revenue PB&WM expense IB + CC expense Illustrative net interest income impact (20) – (40) Private Banking & Wealth Management Investment Banking & Corporate Center Illustrative FX translation impact +30 IB: +25 CC: +5 1 Adjusted 2014 pre-tax income excludes CHF 1,618 mn in 2014 relating to the final settlement of all outstanding U.S. cross-border matters from reported results 2 Represents the midpoint of illustrative net interest income impact range of CHF 20 – 40 mn

Remainder of 2011 cost plan of +950 * February 27, 2015 Illustrative impact of response to SNB actions Illustrative cumulative impact of Credit Suisse response and previously-announced measures on Group pre-tax income in CHF mn Illustrative SNB pre-tax income impact +75 Expected 2015 incremental cost savings CHF 75 mn per annum reduction in future deferred compensation from lower fair value of future deferred compensation Expected higher client FX transactional volumes A floating EUR creates additional hedging needs and potentially higher trading volumes for our clients with CHF 50-100 mn of benefit per annum Expected 2016-17 incremental cost savings Incremental cost savings of CHF 200 mn by end-2017 Driven by planned improved alignment of CHF cost base with CHF revenues and offshoring of support roles Incremental realignment costs of ~CHF 200 mn to be incurred over 2015-2017 to achieve the full incremental cost savings by end-2017 Remainder of cost savings by end-2015 Remaining cost savings from 2011 cost plan of CHF 0.95 bn2 with CHF 0.25 bn in PB&WM, CHF 0.25 bn in IB and >CHF 0.4 bn in infrastructure Growth initiatives already implemented Additional strategic opportunities Private Banking & Wealth Management 2015 incremental cost savings Client FX hedging volumes 1 Excludes pre-tax charges of CHF 1,618 mn in 2014 relating to the final settlement of all outstanding U.S. cross-border matters; illustrative impact calculated based on the midpoint of net interest income impact range of CHF 20 – 40 mn 2 Remainder of cost savings from 2011 cost plan calculated from expense reductions measured at reported FX rates against 6M11 annualized total expenses, excluding realignment and other significant expense items and variable compensation expenses Expect further impact from previously-announced measures 2016-17 incremental cost savings +50 - 100 Investment Banking Illustrative post-mitigation pre-tax income impact Illustrative post-addt’l savings pre-tax income impact Group-wide +200 6% of 2014 Group PTI1 Impact of all measures including the completion of the 2011 cost plan Expect to fully offset the adverse impact of the SNB actions by 2017 2-3% of 2014 Group PTI1

February 27, 2015 * (7) Investment Banking Group Basel 3 "look-through" risk-weighted assets (CHF bn), CET1 ratio (“look-through”, %) +5 FX impact 4Q14 Basel 3 risk-weighted assets 3Q14 -- PB&WM Note: Rounding differences may occur with externally published spreadsheets 1 Includes Strategic PB&WM and Corporate Center risk-weighted assets 4Q14 10.1% Comments CET1 ratio over 2015-2017 expected to increase from 10.1% due to retention of equity to meet potential higher Swiss leverage requirements Continued RWA discipline with increased allocation of capital from the IB to PB&WM PB&WM RWA increased by CHF 12 bn from 4Q13 to 4Q14 Group RWA expected to be in the range of CHF 250 – 260 bn by end-2016 with further wind-down in the Non-Strategic portfolio; in the longer term, may anticipate inflation in RWA outlook given planned BCBS changes “Look-through” CET1 ratio of 10.1%, surpassing year-end 2014 target 9.8% 171 161 Non-Strategic (2) IB Basel 3 risk-weighted assets (USD bn) Non-Strategic IB Strategic IB 3Q14 Strategic (8) 4Q14 124 Strategic +2 Non-Strategic (1) Non-Strategic PB&WM Strategic PB&WM 1 123 3Q14 4Q14 PB&WM Basel 3 risk-weighted assets (CHF bn)

February 27, 2015 * Revised leverage targets reflect continued regulatory developments and impact from the SNB actions Group leverage exposure (end period, CHF bn) 1,225 1,198 Reported 3Q14 Reported 4Q142 Estimated 4Q14 BCBS equivalent2 (51) Business reductions Leverage Ratio (“look-through”, %) Comments BIS CET1 Lev. ratio BIS Tier 1 Lev. ratio Swiss Total Lev. ratio CET1 Swiss Total Capital Tier-1 instruments Tier-2 instr. High trigger Low trigger 2.3% 3.3% 3.8% 2.4% 3.3% 3.9% Reported 3Q14 3.4% 4.0% ~3.0% ~4.0% ~4.5% 1 Off-balance sheet exposures and regulatory adjustments 2 End-2014 FX rates of USD/CHF:0.99, EUR/CHF:1.20 3 Adjustments assume post SNB actions FX rates of USD/CHF:0.92 and EUR/CHF:1.04 (FX rate as of close-of-business Jan 30, 2015; source: Bloomberg) 4 Calculated based on end-4Q14 BCBS equivalent Targeting a “look-through” BCBS Tier-1 leverage ratio of 4%, of which “look-through” CET1 leverage of 3% Revised end-2015 BCBS equivalent leverage target of CHF 930-950 bn denotes a further CHF 50-70 bn reduction from prior leverage target of CHF 1,050 bn (= CHF 1,000 bn adjusted to current FX3) 2014 dividend of CHF 0.70 proposed with scrip alternative offered; going forward dividend distribution targeted at 50% of net income provided “look-through” CET1 capital ratio exceeds 10% and “look-through” CET1 leverage ratio exceeds 3% 2.4% Balance sheet assets (US GAAP) Exposure Add-ons1 +24 FX impact (31) Net BCBS definition impact End-2015 BCBS target3 Reported 4Q14 Estimated 4Q14 Based on BCBS equiv. leverage4 CET1 = Common equity tier 1 BCBS leverage amounts are calculated based on our interpretation of, and assumptions and estimates related to, the BCBS requirements as implemented by FINMA that are effective for 1Q15, and the application of those requirements on our 4Q14 results. Changes in these requirements or any of our interpretations, assumptions or estimates would result in different numbers from those shown here End-2015 Based on BCBS target

Summary Brady W. Dougan, Chief Executive Officer February 27, 2015 *

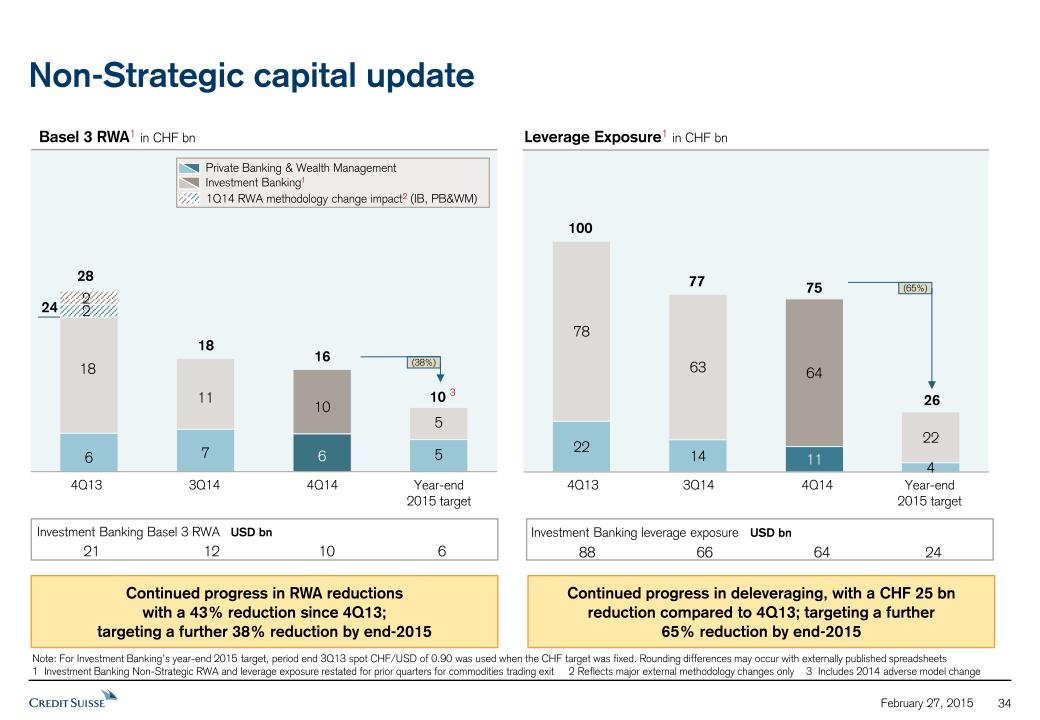

Further progress on strengthening our capital ratios Strong capital generation with “look-through” CET1 ratio at 10.1% at year end 4Q14, a 60bps improvement over the 9.5% level at the end of 2Q14 post the impact of the US cross-border settlement Targeting approximately CHF 230 bn of BCBS leverage exposure reduction and expected to bring our “look-through” CET1 leverage ratio to ~3% by year-end 2015 Executing on > CHF 4.5 bn cost savings plan and run down of Non-Strategic units Delivered CHF 3.5 bn of cost savings by year-end 2014 with the remaining > CHF 1 bn in cost savings from the 2011 program expected to be achieved by year-end 2015 Continued progress in winding down of the Non-Strategic units with risk weighted assets reduced by 43%1 in 2014; targeting a further 38% reduction by year end 2015 Announced mitigation measures expected to more than offset the implications of the SNB actions ~CHF 105 - 155 mn of illustrative negative impact of SNB actions on pre-tax income post mitigation; expected to be more than offset by incremental cost savings and the benefits of previously announced cost measures and revenue initiatives We plan to continue to execute on our strategy and are well positioned for the future We plan to concentrate on growing our PB&WM franchise and focus on our high returning IB businesses Recommend cash dividend for 2014 of CHF 0.70 per share with optional scrip dividend alternative; committed to returning 50% of net income to shareholders provided “look-through” CET1 ratio >10% and “look-through” CET1 leverage ratio > 3% * Credit Suisse 4Q14 Key messages February 27, 2015 1 Includes 1Q14 RWA methodology change impact; Investment Banking Non-Strategic RWA restated for 4Q13 for commodities trading exit

Supplemental slides Slide Group and divisional capital and return profile 31 Capital ratios progression 32 Leverage ratios progression 33 Non-Strategic capital update 34 Non-Strategic run-off profile 35 Continued success from UHNWI lending initiative 36 Strategic Investment Banking return profile 37 Total Investment Banking results in USD 38 Strategic Investment Banking results in USD 39 Investment Banking Strategic Basel 3 RWA movement 40 Annualized expense savings through 2014 41-43 Currency mix (Group, PB&WM, IB, capita metrics) 44-46 Collaboration revenues 47 Shareholders’ equity and “look-through” CET1 capital breakdown 48 Reconciliation of return on equity, return on tangible equity and return on regulatory capital 49

February 27, 2015 * Accelerated move to more balanced business mix and further operating efficiency to drive returns improvement Strategic Capital end period in CHF bn All financials and return calculations above based on reported results 1 Return on regulatory capital is based on after-tax income and assumes tax rates of 25% in 2011, 2012 and 1Q13 and 30% thereafter and that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets prior to 2013 and the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure from 2013 onwards. Return on regulatory capital is different from externally disclosed Return on Equity. PB&WM and Group returns calculated based on CHF denominated financials; IB returns based on USD denominated financials Return on regulatory capital1 Private Banking & Wealth Management Capital end period in USD bn Investment Banking Capital end period in CHF bn Return on regulatory capital1 Group Return on regulatory capital1 (2)% Strategic Strategic Strategic Strategic Healthy returns demonstrate effectiveness of repositioned capital-efficient business model 1,138 Leverage exposure Basel 3 RWA

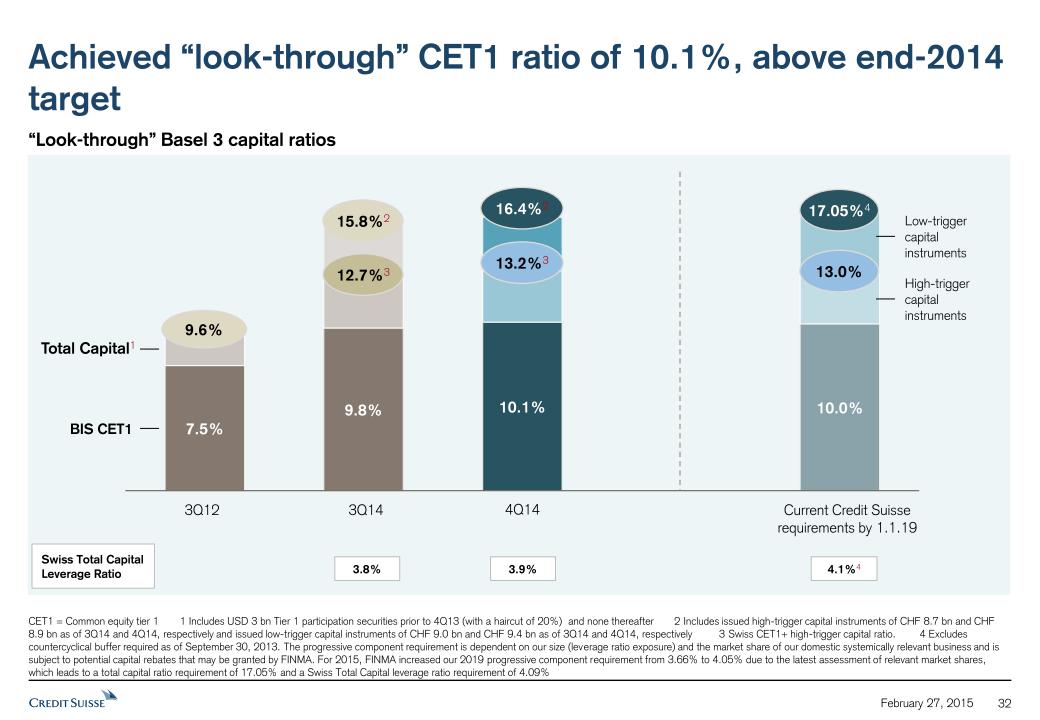

Achieved “look-through” CET1 ratio of 10.1%, above end-2014 target February 27, 2015 * “Look-through” Basel 3 capital ratios Total Capital1 BIS CET1 High-trigger capital instruments Low-trigger capital instruments 4.1%4 Swiss Total Capital Leverage Ratio 3.9% 9.6% 3Q12 3Q14 Current Credit Suisse requirements by 1.1.19 13.2%3 16.4%2 13.0% 17.05%4 CET1 = Common equity tier 1 1 Includes USD 3 bn Tier 1 participation securities prior to 4Q13 (with a haircut of 20%) and none thereafter 2 Includes issued high-trigger capital instruments of CHF 8.7 bn and CHF 8.9 bn as of 3Q14 and 4Q14, respectively and issued low-trigger capital instruments of CHF 9.0 bn and CHF 9.4 bn as of 3Q14 and 4Q14, respectively 3 Swiss CET1+ high-trigger capital ratio. 4 Excludes countercyclical buffer required as of September 30, 2013. The progressive component requirement is dependent on our size (leverage ratio exposure) and the market share of our domestic systemically relevant business and is subject to potential capital rebates that may be granted by FINMA. For 2015, FINMA increased our 2019 progressive component requirement from 3.66% to 4.05% due to the latest assessment of relevant market shares, which leads to a total capital ratio requirement of 17.05% and a Swiss Total Capital leverage ratio requirement of 4.09% 4Q14 12.7%3 15.8%2 3.8%

in CHF bn 2Q14 Lev. ratio1 3Q14 capital 3Q14 Lev. ratio1 4Q14 capital 4Q14 Lev. Ratio1 CET1 Leverage ratio 27.9 28.6 Add: Tier 1 high-trigger capital instruments 6.0 6.2 Add: Tier 1 low-trigger capital instruments 4.9 5.1 BIS Tier 1 Leverage ratio 38.8 39.9 Deduct: Tier 1 low-trigger capital instruments (4.9) (5.1) Add: Tier 2 high-trigger capital instrument 2.6 2.7 SNB Loss Absorbing Lev. Ratio 36.6 37.5 Add: Tier 1 low-trigger capital instruments 4.9 5.1 Add: Tier 2 low-trigger capital instruments 4.1 4.3 BIS Total Capital Leverage ratio 45.5 46.9 Add: Swiss regulatory adjustments (0.1) (0.2) Swiss Total Capital Leverage ratio 45.4 46.7 Rounding differences may occur 1 Leverage ratios based on total Swiss “look-through” average leverage exposure of CHF 1,145 bn in 2Q14, CHF 1,191 bn in 3Q14 and CHF 1,213 bn in 4Q14 2 The progressive component requirement is dependent on our size (leverage ratio exposure) and the market share of our domestic systemically relevant business and is subject to potential capital rebates that may be granted by FINMA. For 2015, the 2019 progressive capital component was increased by FINMA to 4.05% (compared to 3.66% in 2014) due to the latest assessment of relevant market shares 3.3% 3.3% 3.1% 3.1% “Look-through” CET1 Leverage ratio improved to 2.4%; “look-through” BIS Total Capital Leverage ratio and Swiss Total Capital Leverage ratio both improved to 3.9% Committed to “look-through” Swiss Total Capital Leverage ratio target of ~4.5% by end 2015, implying a “look-through” CET1 leverage ratio of ~3.0% Leverage calculation “Look-through” 3.2% 3.0% 3.8% 3.9% 3.8% Leverage ratios within reach of 2019 requirement 4.1%2 2019 Swiss Total Capital Leverage ratio requirement: 3.9% 3.8% 3.7% February 27, 2015 2.3% 2.4% 2.3% *

Non-Strategic capital update February 27, 2015 * 30 Private Banking & Wealth Management Investment Banking1 1Q14 RWA methodology change impact2 (IB, PB&WM) 4Q13 Year-end 2015 target 3Q14 (38%) Basel 3 RWA1 in CHF bn (65%) Leverage Exposure1 in CHF bn 18 10 24 100 77 26 28 3 Note: For Investment Banking’s year-end 2015 target, period end 3Q13 spot CHF/USD of 0.90 was used when the CHF target was fixed. Rounding differences may occur with externally published spreadsheets 1 Investment Banking Non-Strategic RWA and leverage exposure restated for prior quarters for commodities trading exit 2 Reflects major external methodology changes only 3 Includes 2014 adverse model change Continued progress in deleveraging, with a CHF 25 bn reduction compared to 4Q13; targeting a further 65% reduction by end-2015 Continued progress in RWA reductions with a 43% reduction since 4Q13; targeting a further 38% reduction by end-2015 4Q14 16 4Q13 Year-end 2015 target 3Q14 4Q14 75 21 12 6 Investment Banking Basel 3 RWA USD bn 10 88 66 24 64 Investment Banking leverage exposure USD bn

February 27, 2015 * Non-Strategic run-off profile expected to significantly reduce pre-tax income drag over time Note: The ultimate cost of the relevant legal proceedings in the aggregate over time may significantly exceed current litigation provisions 1 Includes CHF 22 mn and CHF 57 mn of legacy funding costs in Corporate Center in 4Q14 and 2013, respectively. Includes CHF 8 mn of restructuring costs in Investment Banking in 4Q14 2 CHF 38 mn represents quarterly pro-rata cost savings of further CHF 150 mn of expenses to be achieved by end 2015 Investment Banking Includes initial transitional FVA adoption charge; amount expected to reduce hereafter Legacy funding cost reduction on track; step down by ~50% from CHF 439 mn in 20131 and expected remain relatively stable until full run-off at the end 2018 Corporate Center Impact driven by volatility in own credit spreads, as well as the size of the portfolio carried at fair value Realignment costs and IT architecture simplification expected to continue through remainder of cost reduction program Includes real estate gains and small residual accounting impact from sale of domestic private banking business booked in Germany Corp. Center PB&WM IB Remaining pre-tax drag expected to be reduced by CHF 38 mn2 from incremental cost savings (target >CHF 4.5 bn by end 2015) ~CHF 140 mn predominately relates to FID wind down (ex FVA) and Legacy Rates (ex FVA), which will be targeted for accelerated wind down 1 Private Banking & Wealth Mgmt. Includes small restructuring costs Also includes small residual impact from sale of domestic private banking business booked in Germany Corp. Center PB&WM IB Includes CHF 392 mn of certain legacy litigation provisions & fees; continue to work towards resolution of legacy litigation matters 4Q14 Non-Strategic Pre-tax income in CHF mn

February 27, 2015 * 0.9 5.6 2013 2014 CHF 5.6 bn by region Asia Pacific 1.5bn Emerging EMEA 1.2bn Latin America 0.6bn Net new lending to ultra-high-net-worth-individuals (UHNWI) client segment in Wealth Management Clients in CHF bn Emerging EMEA = Eastern Europe, Middle East and Africa Net new lending of CHF 5.6 bn in 2014 Loan volume up 39% to CHF 39 bn 4Q14 with continued strong net new lending of CHF 1.7 bn with growth across all regions Utilizing dedicated Sales & Trading Services platform and extended product capabilities for non-standard lending (e.g. real estate, hedge fund and other illiquid collateral) UHNWI loan interest margins exceed 100 bps and are accretive to overall revenue margin for the UHNWI segment Western Europe 0.6bn Switzerland 0.9bn North America 0.8bn 28.1 39.0 Loan volume in CHF bn Continued success from UHNWI lending initiative

* February 27, 2015 Solid returns driven by continued momentum in market-leading Strategic businesses % of 4Q14 IB capital base1 Improved market conditions to drive returns and profitability 14% (vs. 14% in 3Q14) 21% (vs. 21% in 3Q14) 65% (vs. 65% in 3Q14) Rolling four quarters return on regulatory capital3 High Credit Suisse market share position Low Majority of capital allocated to market leading businesses Strong returns in market leading businesses from continued market share momentum Optimize risk and capital utilization across the franchise 1 Percent of capital base (based on internal reporting structure) reflects hybrid capital which is defined as average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure at quarter-end 3Q14 vs. quarter-end 4Q14 for Strategic businesses 2 Global Macro Products includes Rates and FX franchises 3 Presentation based on internal reporting structure Bubble size reflects relative capital usage at end of 4Q14 Investment Banking Equities Fixed Income Return on regulatory capital improved vs. 3Q14 rolling four quarter return Return on regulatory capital declined vs. 3Q14 rolling four quarter return High * No indicator reflects stable return on regulatory capital vs. 3Q14 rolling four quarter return Strategic businesses (market share position vs. return on regulatory capital) Differentiated cross-asset macro platform to improve returns Improved capital efficiency in macro Cash Equities

* Total Investment Banking results in USD February 27, 2015 1 Includes FVA impact of USD (291) mn in 4Q14 and 2014 2 Return on regulatory capital is based on after-tax income denominated in US dollars and assumes tax rates of 26% for 2013 and of 30% in 4Q13, 3Q14, 4Q14 and 2014 and that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure in USD mn 4Q14 3Q14 4Q13 4Q14 vs. 3Q14 4Q14 vs. 4Q13 2014 2013 2014 vs. 2013 Net revenues1 2,527 3,560 2,963 (29%) (15%) 13,687 13,578 1% Debt underwriting 316 562 537 (44%) (41%) 1,948 2,058 (5%) Equity underwriting 211 229 303 (8%) (30%) 948 831 14% Advisory and other fees 244 184 217 33% 13% 811 714 14% Fixed income sales & trading 629 1,547 827 (59%) (24%) 5,455 5,199 5% Equity sales & trading 1,221 1,156 1,167 6% 5% 5,006 5,135 (3%) Other (94) (117) (88) (20%) 7% (478) (358) 34% Provision for credit losses 31 38 10 (18%) nm 63 15 nm Compensation and benefits 1,214 1,564 1,506 (22%) (19%) 6,176 5,883 5% Other operating expenses 1,547 1,393 2,088 11% (26%) 5,376 5,875 (8%) Total operating expenses 2,762 2,957 3,594 (7%) (22%) 11,552 11,758 (2%) Pre-tax income (266) 566 (640) nm nm 2,072 1,805 15% Cost / income ratio 109% 83% 121% -- -- 84% 87% -- Return on regulatory capital2 -- 8% (9%) -- -- 8% 7% --

* Strategic Investment Banking results in USD February 27, 2015 1 Includes FVA impact of USD (113) mn in 4Q14 and 2014 2 Return on regulatory capital is based on after-tax income denominated in US dollars and assumes tax rates of 28% for 2013 and of 30% in 4Q13, 3Q14, 4Q14 and 2014 and that capital is allocated at the average of 10% of average Basel 3 risk-weighted assets and 2.4% of average leverage exposure in USD mn 4Q14 3Q14 4Q13 4Q14 vs. 3Q14 4Q14 vs. 4Q13 2014 2013 2014 vs. 2013 Net revenues1 2,832 3,685 3,090 (23%) (8%) 14,299 14,154 1% Debt underwriting 316 562 537 (44%) (41%) 1,947 2,058 (5%) Fixed income sales & trading 877 1,665 881 (47%) (0%) 5,978 5,643 6% Fixed income franchise 1,193 2,227 1,418 (46%) (16%) 7,926 7,700 3% Equity underwriting 211 229 303 (8%) (30%) 948 831 14% Equity sales & trading 1,268 1,154 1,187 10% 7% 5,040 5,240 (4%) Equities franchise 1,479 1,383 1,490 7% (1%) 5,988 6,071 (1%) Advisory and other fees 244 184 217 33% 13% 811 714 14% Other (85) (109) (34) (22%) nm (425) (331) 28% Provision for credit losses 14 31 5 (53%) nm 39 9 nm Compensation and benefits 1,171 1,523 1,469 (23%) (20%) 6,007 5,700 5% Other operating expenses 1,047 1,058 1,084 (1%) (3%) 4,143 4,252 (3%) Total operating expenses 2,219 2,581 2,553 (14%) (13%) 10,150 9,952 2% Pre-tax income 599 1,073 532 (44%) 13% 4,109 4,193 (2%) Cost / income ratio 78% 70% 83% -- -- 71% 70% -- Return on regulatory capital2 10% 17% 9% -- -- 17% 17% --

* Investment Banking Strategic Basel 3 RWA movement February 27, 2015 4Q14 QoQ Change 3Q14 4Q13 16 - 16 17 26 +1 25 28 18 (4) 22 17 19 - 19 19 10 +3 7 8 89 +1 88 88 4Q14 QoQ Change 3Q14 4Q13 3 - 3 3 4Q14 QoQ Change 3Q14 4Q13 22 - 22 21 4Q14 QoQ Change 3Q14 4Q13 1 (3) 4 5 4Q14 QoQ Change 3Q14 4Q13 4 (2) 6 5 15 (3) 18 15 11 (2) 13 12 3 (1) 4 3 3 +2 1 2 36 (6) 42 36 Basel 3 risk-weighted assets in USD bn Note: Rounding differences may occur with externally published spreadsheets 1 Includes Rates and FX franchises 2 Includes Fixed Income other, CVA management and Fixed Income treasury Equities Fixed Income Macro1 Securitized Products Credit Emerging Markets Other2 Strategic Fixed Income Cash Equities Prime Services Derivatives Systematic Market Making Other Strategic Equities Corporate Bank Corporate Bank Investment Banking Other Other M&A and Other IBD

Expect to achieve > CHF 4.5 bn expense savings by end 2015 February 27, 2015 * 2014 Achieved Expected by YE 2015 Total savings after 2015 > 4.5 > 1.0 0.25 > 0.4 0.3 3.5 1.55 1.25 0.7 Private Banking & Wealth Management Infrastructure Investment Banking 2014 Achieved Expected by YE 2015 Total saving after 2015 >4.5 Direct cost savings by division Fully loaded cost savings by division > 1.65 0.95 1.85 Private Banking & Wealth Management Corporate Center Investment Banking Note: All expense reduction targets are measured at constant FX rates against 6M11 annualized total expenses, excl. realignment and other significant expense items and variable compensation expenses Infrastructure includes Corporate Center, which is not allocated to the front office divisions. Fully loaded view consists of infrastructure expenses that are allocated to divisions 1 Includes savings from adjustments to normalize for the immediate accounting recognition of early retirement eligible population

February 27, 2015 Achieved CHF 3.5 bn annualized expense savings through 2014 since expense measures announced in mid-2011 * All data for Core Results including expense savings from discontinued operations. All expense reductions are measured at constant FX rates against 6M11 annualized total expenses, excluding realignment and other significant expense items and variable compensation expenses. Rounding differences may occur from externally published spreadsheets 1 Related to existing population 2 Include pre-tax charge of CHF 1,618 mn in 2014 relating to the final settlement of all outstanding U.S. cross-border matters and other significant litigation items 3 Includes CC realignment costs and realignment Non-Strategic unit measures, and architecture simplification 4 Includes variable compensation related savings on reduction of force and fixed allowance 6M11 adjusted Group expense reduction achieved in CHF bn 2014 reported 2014 adjustments 20.5 annualized 10.2 2014 adjusted Savings of CHF 3.5 bn Adjustments from 6M11 reported: Variable compensation (1,034) Realignment costs (CC) (142) Other (across divisions) 50 Total (1,127) Annualized (x2) (2,253) Adjustments from 2014 reported: Variable compensation1 (1,689) Certain litigation items2 (2,489) Realignment / AS3 (855) RRP (414) Other4 (133) FX impact 89 2014 Total (5,491)

* Currency mix of 2014 Group Results February 27, 2015 Credit Suisse Core Results 1 Total operating expenses and provisions for credit losses 2 Corresponds to pre-tax charge of CHF 1,618 mn (USD 1,815 mn) Applying a +/-10% movement on the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF (407) mn Excluding the final settlement impact of all outstanding U.S. cross-border matters2, USD/CHF impact on FY14 pre-tax income by CHF (569) mn EUR/CHF impact on FY14 pre-tax income by CHF (173) mn Sensitivity analysis based weighted average exchange rates of USD/CHF of 0.92 and EUR/CHF of 1.22 for full year 2014 results Applying January month-end exchange rates for USD/CHF of 0.92 and EUR/CHF of 1.04 in lieu of the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF (50) mn Excluding the final settlement impact of all outstanding U.S. cross-border matters2, USD/CHF impact on FY14 pre-tax income by CHF 2 mn EUR/CHF impact on FY14 pre-tax income by CHF (254) mn FX Sensitivity analysis CHF mn FY14 CHF USD EUR GBP Other Net revenues 25,815 21% 54% 11% 3% 11% Total expenses1 22,583 28% 44% 5% 10% 13%

* February 27, 2015 Currency mix of 2014 PB&WM Results CHF mn FY14 CHF USD EUR GBP Other Net revenues 12,637 40% 33% 15% 2% 10% Total expenses1 10,549 47% 30% 9% 3% 11% Expenses excl. Litig.2 8,931 55% 18% 11% 3% 13% Private Banking & Wealth Management Applying a +/-10% movement on the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF (90) mn Excluding the final settlement impact of all outstanding U.S. cross-border matters2, USD/CHF impact on FY14 pre-tax income by (252) mn EUR/CHF impact on FY14 pre-tax income by CHF (95) mn Applying January month-end exchange rates for USD/CHF of 0.92 and EUR/CHF of 1.04 in lieu of the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF (37) mn Excluding the final settlement impact of all outstanding U.S. cross-border matters2, USD/CHF impact on FY14 pre-tax income by CHF 15 mn EUR/CHF impact on FY14 pre-tax income by CHF (137) mn Sensitivity analysis based weighted average exchange rates of USD/CHF of 0.92 and EUR/CHF of 1.22 for full year 2014 results FX Sensitivity analysis 1 Total operating expenses and provisions for credit losses 2 Corresponds to pre-tax charge of CHF 1,618 mn (USD 1,815 mn)

* Currency mix of 2014 IB Results February 27, 2015 CHF mn FY14 CHF USD EUR GBP Other Net revenues 12,515 0% 77% 8% 4% 11% Total expenses1 10,685 3% 61% 2% 19% 15% Investment Banking Applying a +/-10% movement on the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF (314) mn EUR/CHF impact on FY14 pre-tax income by CHF (76) mn Applying January month-end exchange rates for USD/CHF of 0.92 and EUR/CHF of 1.04 in lieu of the average FX rates for 2014, the sensitivities are as follows: USD/CHF impact on FY14 pre-tax income by CHF 6 mn EUR/CHF impact on FY14 pre-tax income by CHF (114) mn 1 Total operating expenses and provisions for credit losses Sensitivity analysis based weighted average exchange rates of USD/CHF of 0.92 and EUR/CHF of 1.22 for full year 2014 results FX Sensitivity analysis

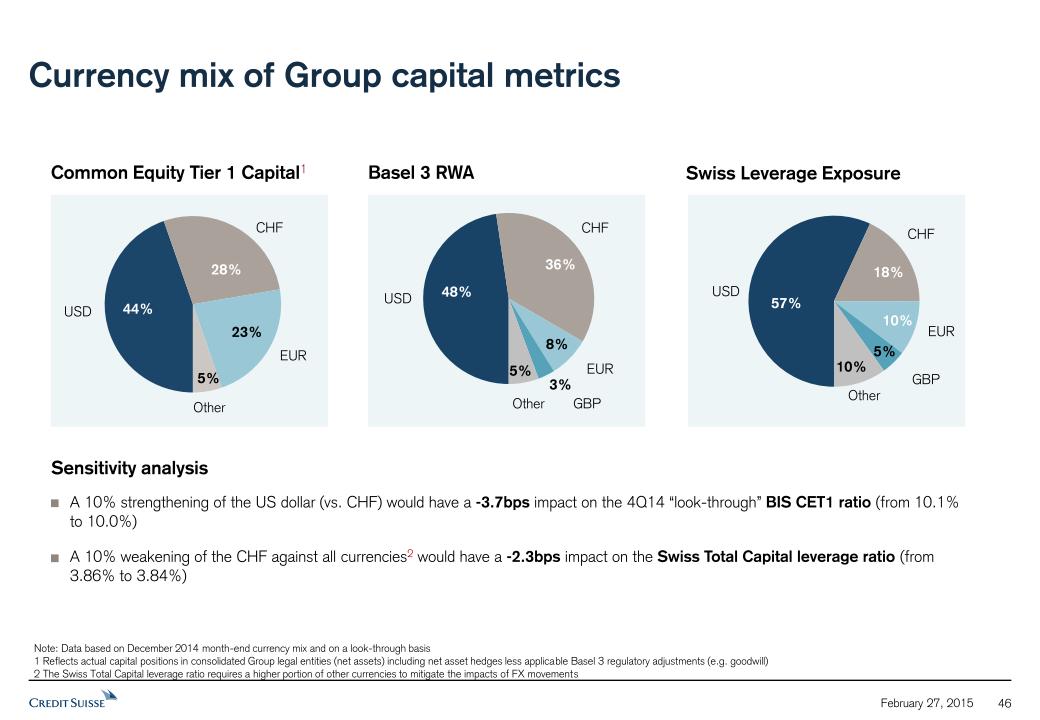

* Currency mix of Group capital metrics February 27, 2015 Swiss Leverage Exposure Basel 3 RWA USD CHF EUR GBP Other USD CHF EUR GBP Common Equity Tier 1 Capital1 Note: Data based on December 2014 month-end currency mix and on a look-through basis 1 Reflects actual capital positions in consolidated Group legal entities (net assets) including net asset hedges less applicable Basel 3 regulatory adjustments (e.g. goodwill) 2 The Swiss Total Capital leverage ratio requires a higher portion of other currencies to mitigate the impacts of FX movements Other Sensitivity analysis A 10% strengthening of the US dollar (vs. CHF) would have a -3.7bps impact on the 4Q14 “look-through” BIS CET1 ratio (from 10.1% to 10.0%) A 10% weakening of the CHF against all currencies2 would have a -2.3bps impact on the Swiss Total Capital leverage ratio (from 3.86% to 3.84%)

Collaboration revenues Contribution to overall net revenues stable at 18% compared to 3Q14 Continued strong increase in the number of cross-divisional referrals Solid performance in providing tailored solutions to UHNWI clients Collaboration revenues target range of 18% to 20% of net revenues Collaboration revenues – Core results in CHF bn / as % of net revenues February 27, 2015 *

Shareholders’ equity and “look-through” CET1 capital breakdown February 27, 2015 * 4Q14 Shareholders’ equity breakdown in CHF bn Tangible equity and misc. (not B3 effective) Goodwill and Intangibles1 IB Strategic2 PB&WM Strategic2 IB Non-Strategic2 44.0 44.0 “Look-through” Common Equity Tier 1 Capital Total regulatory deductions and adjustments 4Q14 Shareholders’ equity in CHF bn PB&WM Non-Strategic2 4Q14 Shareholders’ equity 43,959 Regulatory deductions (includes accrued dividend, treasury share reversal, scope of consolidation) (375) Adjustments subject to phase-in (15,008) Non-threshold-based (13,451) Goodwill & Intangibles (net of Deferred Tax Liability) (8,709) Deferred tax assets that rely on future profitability (excl. temporary differences) (3,250) Defined benefit pension assets (net of Deferred Tax Liability) (657) Advanced internal ratings-based provision shortfall (569) Own Credit (Bonds, Structured Notes, PAF, OTC Derivatives) (266) Own shares and cash flow hedges - Threshold-based (1,557) Deferred Tax Asset on timing differences (1,557) Total regulatory deductions and adjustments (15,383) “Look-through” Common Equity Tier 1 capital 28,576 Reconciliation of shareholders’ equity to “look-through” CET1 capital in CHF mn 1 Goodwill and intangibles, including mortgage servicing rights, gross of Deferred Tax Liability 2 Regulatory capital calculated as the average of 10% of RWA and 2.4% of Leverage Exposure at the end of 4Q14 Corporate Center

* Reconciliation of return on equity, return on tangible equity and return on regulatory capital 1 Calculated using income after tax, assumes tax rate of 30% and capital allocated on average of 10% of average RWA and 2.4% of average leverage exposure 2 For Investment Banking, capital allocation and return calculations are based on US dollar denominated numbers February 27, 2015

February 27, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorized.

|

CREDIT SUISSE GROUP AG and CREDIT SUISSE AG

|

||

|

(Registrant)

|

||

| By: |

/s/ Christian Schmid

Christian Schmid Managing Director

|

|

|

/s/ Stephan Flückiger

Stephan Flückiger

|

||

| Date: February 27, 2015 | Director |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UBS (UBS) Said To Plan More Than 100 Job Cuts In Investment Bank - Bloomberg

- Capstone Copper Provides MVDP Commissioning Update; First Quarter 2024 Results to be Released on May 2, 2024

- Barclays (BCS) Appoints Rafael Abati as Co-Head of Energy Transition EMEA

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Credit SuisseSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share