Form 6-K VimpelCom Ltd. For: Nov 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2016

Commission File Number 1-34694

VimpelCom Ltd.

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| VIMPELCOM LTD. | ||||||

| (Registrant) | ||||||

| Date: November 8, 2016 | ||||||

| By: | /s/ Scott Dresser | |||||

| Name: | Scott Dresser | |||||

| Title: | Group General Counsel | |||||

|

|

Wind and 3 Italia merger: transformative transaction completion

Amsterdam – 8 November 2016

Jean-Yves Charlier – Chief Executive Officer Andrew Davies – Chief Financial Officer

© VimpelCom Ltd 2016

1

|

|

Disclaimer

This presentation contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, the transaction described herein, the anticipated benefits from the Italy Joint Venture transaction, including network improvements and synergies, and future market developments and trends. Any statement in this announcement that expresses or implies VimpelCom’s intentions, beliefs, expectations or predictions (and the assumptions underlying them) is a forward-looking statement. Forward-looking statements involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of: volatility in the Italian telecommunication market; unforeseen developments from competition; governmental regulation of the telecommunications industries in Italy; the expected benefits of the transaction may not materialize as expected or at all, due to, among other things, the parties’ inability to successfully implement integration strategies or otherwise realize the synergies anticipated; the businesses of either or both of 3 Italia or Wind may not perform as expected due to uncertainty or other market factors; the successful deleveraging of the JV; the ability of the JV to distribute to its parents; the JV’s impact on VimpelCom’s financial profile and consideration of a meaningful dividend policy within the timeframe indicated; and other risks and uncertainties beyond the parties’ control may materialize. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VimpelCom’s Annual Report on Form 20-F for the year ended December 31, 2015 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by VimpelCom with the SEC. The forward-looking statements speak only as of the date hereof, and VimpelCom disclaims any obligation to update them or to announce publicly any revision to any of the forward-looking statements contained in this presentation, or to make corrections to reflect future events or developments.

© VimpelCom Ltd 2016

2

|

|

Wind and 3 Italia merger completion – agenda

Jean-Yves Charlier – Chief Executive Officer

1. Strong momentum in the Italian market for the launch of the joint venture (“JV”)

2. Italian market structure & competition

3. Rationale and ambitions for the JV

4. Integration plan now launched

5. JV will generate significant synergies across all areas

6. Iliad impact to be mitigated by the strong JV position and proceeds from the remedy taker agreements

7. Solid corporate governance with senior Board members and empowered management team

8. Strong management team in place from the start

Andrew Davies – Chief Financial Officer

1. Transaction structure

2. Enhanced profitability and cash flow generation

3. JV expected to significantly deleverage and distribute to parents

4. JV has no imminent debt maturities

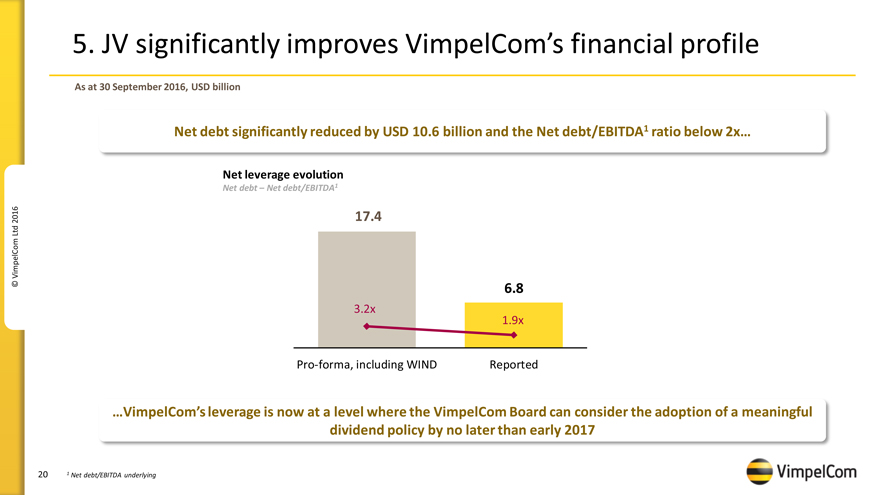

5. JV significantly improves VimpelCom’s financial profile

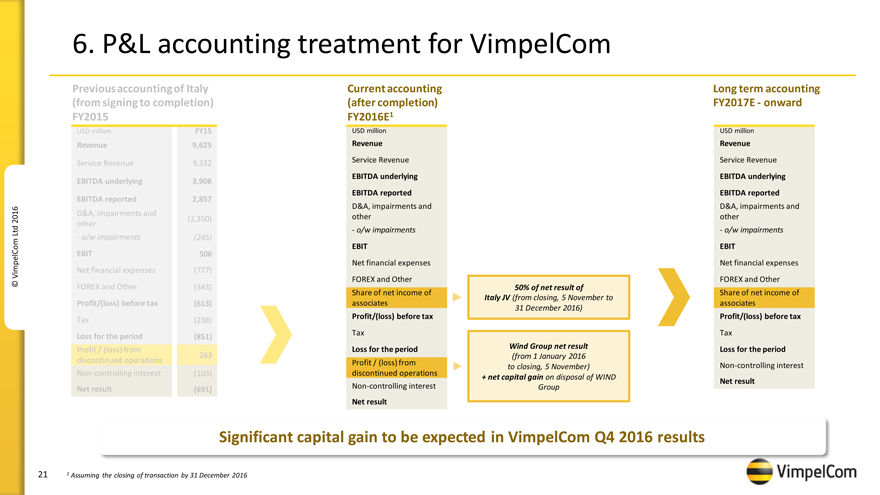

6. P&L accounting treatment for VimpelCom

7. Final remarks

Q&A session

© VimpelCom Ltd 2016

3

|

|

1. Strong momentum in the Italian market for the launch of the JV

Mobile telecommunication revenues

EUR billion

7.7 -8.6% p.a.

+1.3%

Other 0.1 2015-16

6.6 6.6

6.5

2.7 0.1 0.1

0.1

+1.5%

2.2 2.1 2.1

2.6

2.2 +0.6%

2.2 2.2

2.3 2.1 2.1 2.2 +1.6%

H1 2013 H1 2014 H1 2015 H1 2016

The joint venture will be able to take advantage of the 2016 mobile market tailwinds

4 Source: Company reports

© VimpelCom Ltd 2016

|

|

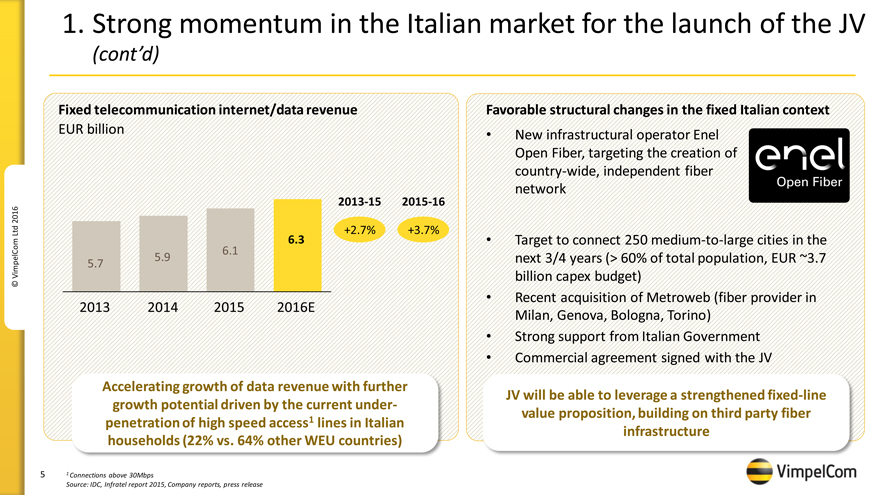

1. Strong momentum in the Italian market for the launch of the JV

(cont’d)

Fixed telecommunication internet/data revenue

EUR billion

2013-15 2015-16

6.3 +2.7% +3.7% 6.1 5.9 5.7

2013 2014 2015 2016E

Accelerating growth of data revenue with further growth potential driven by the current under-penetration of high speed access1 lines in Italian households (22% vs. 64% other WEU countries)

5 1 Connections above 30Mbps

Source: IDC, Infratel report 2015, Company reports, press release

Favorable structural changes in the fixed Italian context

• New infrastructural operator Enel Open Fiber, targeting the creation of country-wide, independent fiber network

• Target to connect 250 medium-to-large cities in the next 3/4 years (> 60% of total population, EUR ~3.7 billion capex budget)

• Recent acquisition of Metroweb (fiber provider in Milan, Genova, Bologna, Torino)

• Strong support from Italian Government

• Commercial agreement signed with the JV

JV will be able to leverage a strengthened fixed-line value proposition, building on third party fiber infrastructure

© VimpelCom Ltd 2016

|

|

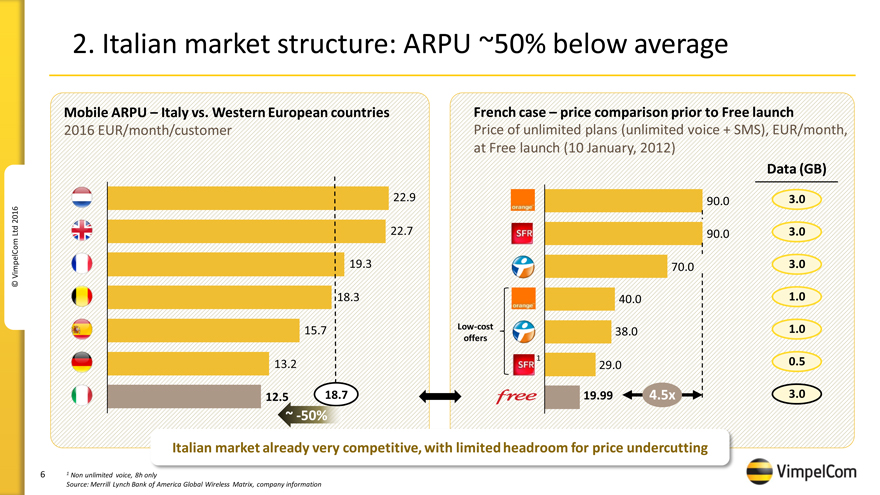

2. Italian market structure: ARPU ~50% below average

Mobile ARPU – Italy vs. Western European countries French case – price comparison prior to Free launch

2016 EUR/month/customer Price of unlimited plans (unlimited voice + SMS), EUR/month, at Free launch (10 January, 2012)

Data (GB)

22.9 90.0 3.0 22.7 90.0 3.0 19.3 70.0 3.0 18.3 40.0 1.0

15.7 Low-cost 1.0

38.0

offers

1 0.5

13.2 29.0

12.5 18.7 19.99 4.5x 3.0

~ -50%

Italian market already very competitive, with limited headroom for price undercutting

6 1 Non unlimited voice, 8h only

Source: Merrill Lynch Bank of America Global Wireless Matrix, company information

© VimpelCom Ltd 2016

|

|

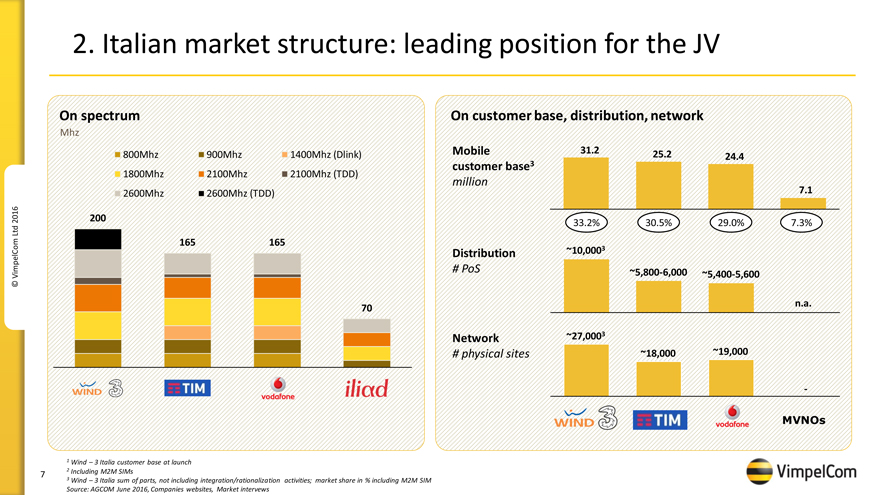

2. Italian market structure: leading position for the JV

On spectrum On customer base, distribution, network

Mhz

Mobile 31.2 25.2

800Mhz 900Mhz 1400Mhz (Dlink) 24.4 customer base3

1800Mhz 2100Mhz 2100Mhz (TDD) million 7.1

2600Mhz 2600Mhz (TDD)

200

33.2% 30.5% 29.0% 7.3%

165 165 ~10,0003

Distribution

# PoS ~5,800-6,000

~5,400-5,600

n.a. 70

Network ~27,0003

# physical sites ~18,000 ~19,000

-

MVNOs

1 Wind – 3 Italia customer base at launch

2 Including M2M SIMs

7

3 Wind – 3 Italia sum of parts, not including integration/rationalization activities; market share in % including M2M SIM

Source: AGCOM June 2016, Companies websites, Market intervews

© VimpelCom Ltd 2016

|

|

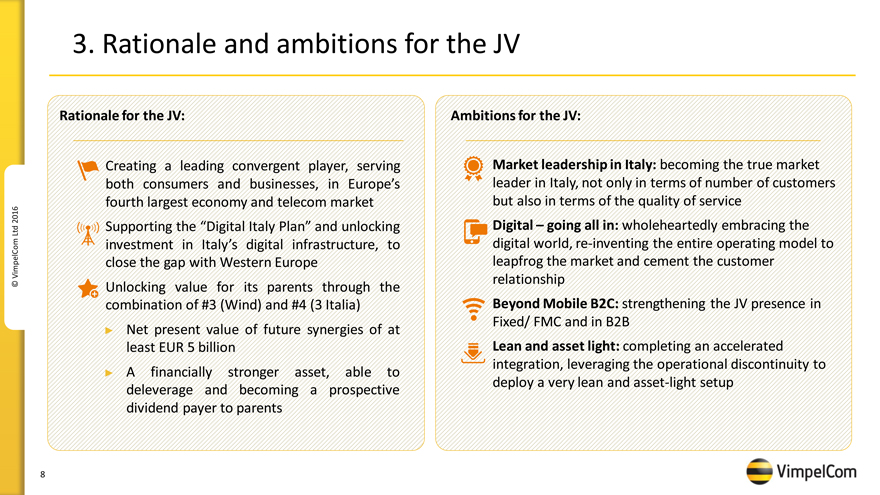

3. Rationale and ambitions for the JV

Rationale for the JV:

Creating a leading convergent player, serving both consumers and businesses, in Europe’s fourth largest economy and telecom market Supporting the “Digital Italy Plan” and unlocking investment in Italy’s digital infrastructure, to close the gap with Western Europe Unlocking value for its parents through the combination of #3 (Wind) and #4 (3 Italia)

Net present value of future synergies of at least EUR 5 billion

A financially stronger asset, able to deleverage and becoming a prospective dividend payer to parents

Ambitions for the JV:

Market leadership in Italy: becoming the true market leader in Italy, not only in terms of number of customers but also in terms of the quality of service Digital – going all in: wholeheartedly embracing the digital world, re-inventing the entire operating model to leapfrog the market and cement the customer relationship Beyond Mobile B2C: strengthening the JV presence in Fixed/ FMC and in B2B

Lean and asset light: completing an accelerated integration, leveraging the operational discontinuity to deploy a very lean and asset-light setup

8

© VimpelCom Ltd 2016

|

|

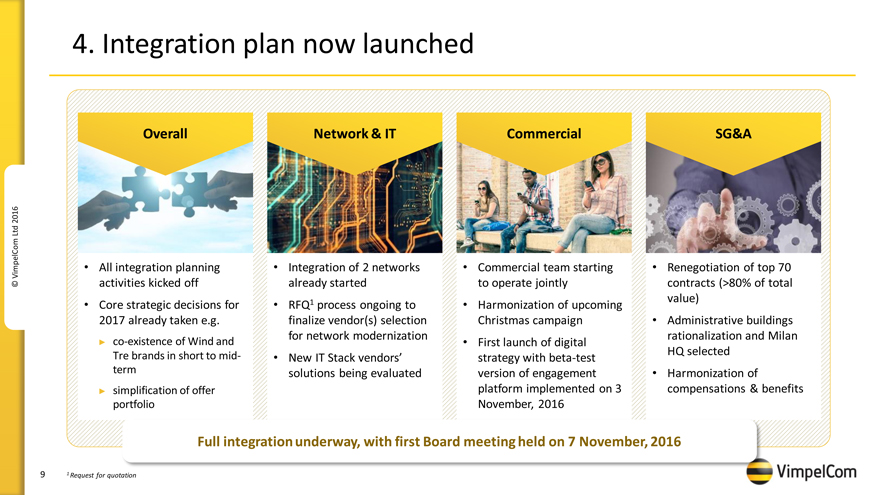

4. Integration plan now launched

Overall

• All integration planning activities kicked off

• Core strategic decisions for 2017 already taken e.g.

co-existence of Wind and Tre brands in short to mid-term

simplification of offer portfolio

Network & IT

• Integration of 2 networks already started

• RFQ1 process ongoing to finalize vendor(s) selection for network modernization

• New IT Stack vendors’ solutions being evaluated

Commercial

• Commercial team starting to operate jointly

• Harmonization of upcoming Christmas campaign

• First launch of digital strategy with beta-test version of engagement platform implemented on 3 November, 2016

SG&A

• Renegotiation of top 70 contracts (>80% of total value)

• Administrative buildings rationalization and Milan HQ selected

• Harmonization of compensations & benefits

Full integration underway, with first Board meeting held on 7 November, 2016

9 1 Request for quotation

© VimpelCom Ltd 2016

|

|

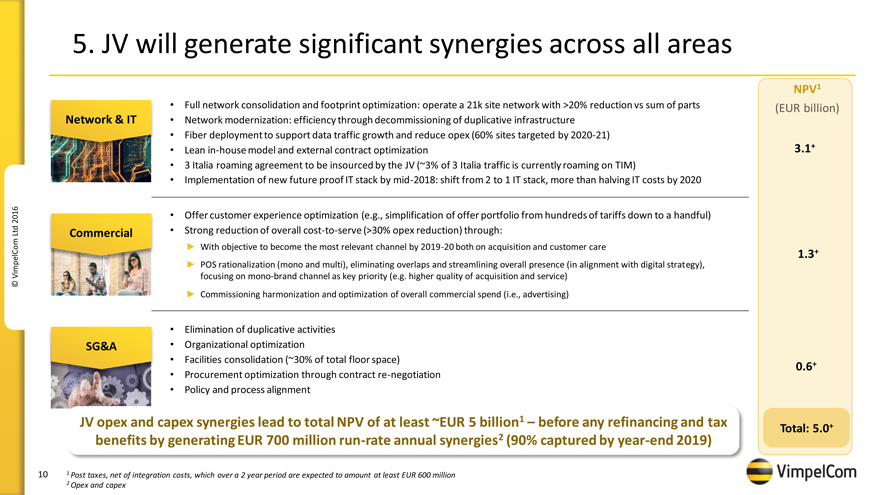

5. JV will generate significant synergies across all areas

Network & IT

• Full network consolidation and footprint optimization: operate a 21k site network with >20% reduction vs sum of parts

• Network modernization: efficiency through decommissioning of duplicative infrastructure

• Fiber deployment to support data traffic growth and reduce opex (60% sites targeted by 2020-21)

• Lean in-house model and external contract optimization

• 3 Italia roaming agreement to be insourced by the JV (~3% of 3 Italia traffic is currently roaming on TIM)

• Implementation of new future proof IT stack by mid-2018: shift from 2 to 1 IT stack, more than halving IT costs by 2020

Commercial

Offer customer experience optimization (e.g., simplification of offer portfolio from hundreds of tariffs down to a handful)

Strong reduction of overall cost-to-serve (>30% opex reduction) through:

With objective to become the most relevant channel by 2019-20 both on acquisition and customer care

POS rationalization (mono and multi), eliminating overlaps and streamlining overall presence (in alignment with digital strategy), focusing on mono-brand channel as key priority (e.g. higher quality of acquisition and service)

Commissioning harmonization and optimization of overall commercial spend (i.e., advertising)

SG&A

• Elimination of duplicative activities

• Organizational optimization

• Facilities consolidation (~30% of total floor space)

• Procurement optimization through contract re-negotiation

• Policy and process alignment

JV opex and capex synergies lead to total NPV of at least ~EUR 5 billion1 – before any refinancing and tax benefits by generating EUR 700 million run-rate annual synergies2 (90% captured by year-end 2019)

10 1 Post taxes, net of integration costs, which over a 2 year period are expected to amount at least EUR 600 million 2 Opex and capex

NPV1

(EUR billion)

3.1+

1.3+

0.6+

Total: 5.0+

© VimpelCom Ltd 2016

|

|

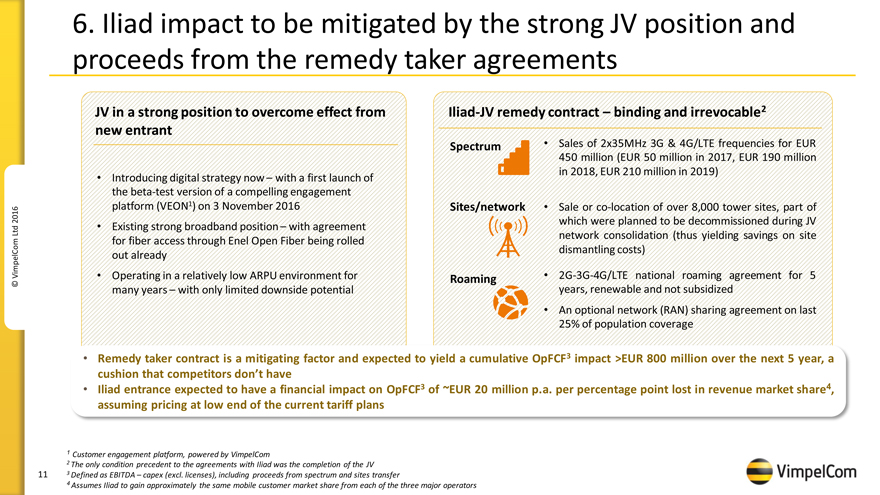

6. Iliad impact to be mitigated by the strong JV position and proceeds from the remedy taker agreements

JV in a strong position to overcome effect from new entrant

• Introducing digital strategy now – with a first launch of the beta-test version of a compelling engagement platform (VEON1) on 3 November 2016

• Existing strong broadband position – with agreement for fiber access through Enel Open Fiber being rolled out already

• Operating in a relatively low ARPU environment for many years – with only limited downside potential

Iliad-JV remedy contract – binding and irrevocable2

Spectrum • Sales of 2x35MHz 3G & 4G/LTE frequencies for EUR 450 million (EUR 50 million in 2017, EUR 190 million in 2018, EUR 210 million in 2019)

Sites/network • Sale or co-location of over 8,000 tower sites, part of which were planned to be decommissioned during JV network consolidation (thus yielding savings on site dismantling costs)

Roaming • 2G-3G-4G/LTE national roaming agreement for 5 years, renewable and not subsidized

• An optional network (RAN) sharing agreement on last 25% of population coverage

• Remedy taker contract is a mitigating factor and expected to yield a cumulative OpFCF3 impact >EUR 800 million over the next 5 year, a cushion that competitors don’t have

• Iliad entrance expected to have a financial impact on OpFCF3 of ~EUR 20 million p.a. per percentage point lost in revenue market share4, assuming pricing at low end of the current tariff plans

1 Customer engagement platform, powered by VimpelCom

2 The only condition precedent to the agreements with Iliad was the completion of the JV

3 Defined as EBITDA – capex (excl. licenses), including proceeds from spectrum and sites transfer

4 Assumes Iliad to gain approximately the same mobile customer market share from each of the three major operators

11

© VimpelCom Ltd 2016

|

|

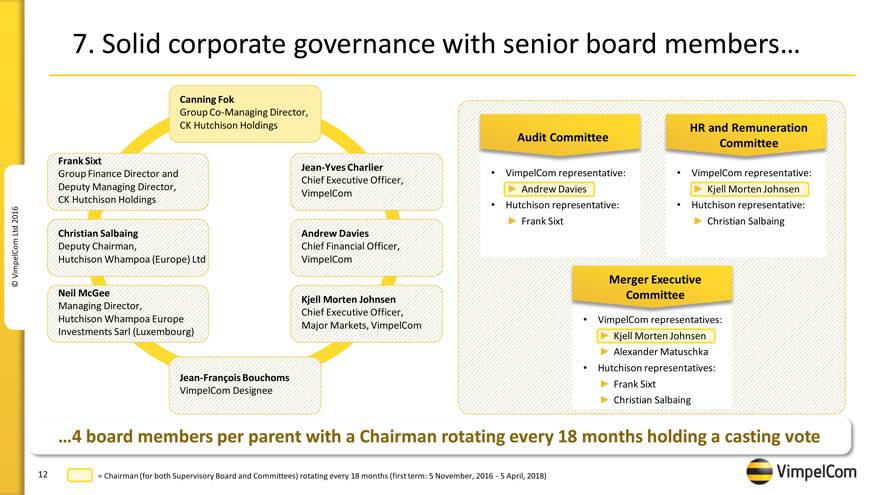

7. Solid corporate governance with senior board members…

Canning Fok

Group Co-Managing Director, CK Hutchison Holdings

Frank Sixt

Jean-Yves Charlier

Group Finance Director and

Chief Executive Officer, Deputy Managing Director, VimpelCom CK Hutchison Holdings

Christian Salbaing Andrew Davies

Deputy Chairman, Chief Financial Officer, Hutchison Whampoa (Europe) Ltd VimpelCom

Neil McGee

Kjell Morten Johnsen

Managing Director,

Chief Executive Officer, Hutchison Whampoa Europe Major Markets, VimpelCom Investments Sarl (Luxembourg)

Jean-François Bouchoms

VimpelCom Designee

Audit Committee HR and Remuneration Committee

VimpelCom representative: VimpelCom representative:

Andrew Davies Kjell Morten Johnsen

Hutchison representative: Hutchison representative:

Frank Sixt Christian Salbaing

Merger Executive Committee

VimpelCom representatives:

Kjell Morten Johnsen

Alexander Matuschka

Hutchison representatives:

Frank Sixt

Christian Salbaing

…4 board members per parent with a Chairman rotating every 18 months holding a casting vote

12 = Chairman (for both Supervisory Board and Committees) rotating every 18 months (first term: 5 November, 2016—5 April, 2018)

© VimpelCom Ltd 2016

|

|

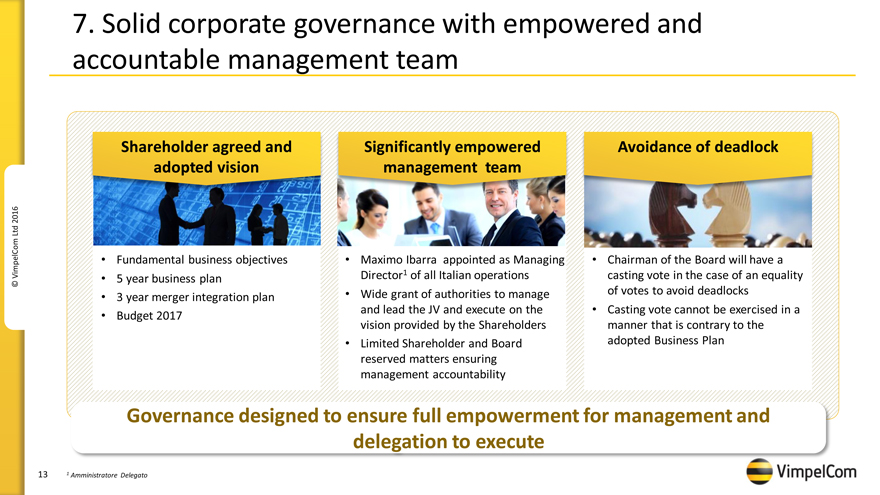

7. Solid corporate governance with empowered and accountable management team

Shareholder agreed and adopted vision

• Fundamental business objectives

• 5 year business plan

• 3 year merger integration plan

• Budget 2017

Significantly empowered management team

• Maximo Ibarra appointed as Managing Director1 of all Italian operations

• Wide grant of authorities to manage and lead the JV and execute on the vision provided by the Shareholders

• Limited Shareholder and Board reserved matters ensuring management accountability

Avoidance of deadlock

• Chairman of the Board will have a casting vote in the case of an equality of votes to avoid deadlocks

• Casting vote cannot be exercised in a manner that is contrary to the adopted Business Plan

Governance designed to ensure full empowerment for management and delegation to execute

13 1 Amministratore Delegato

© VimpelCom Ltd 2016

|

|

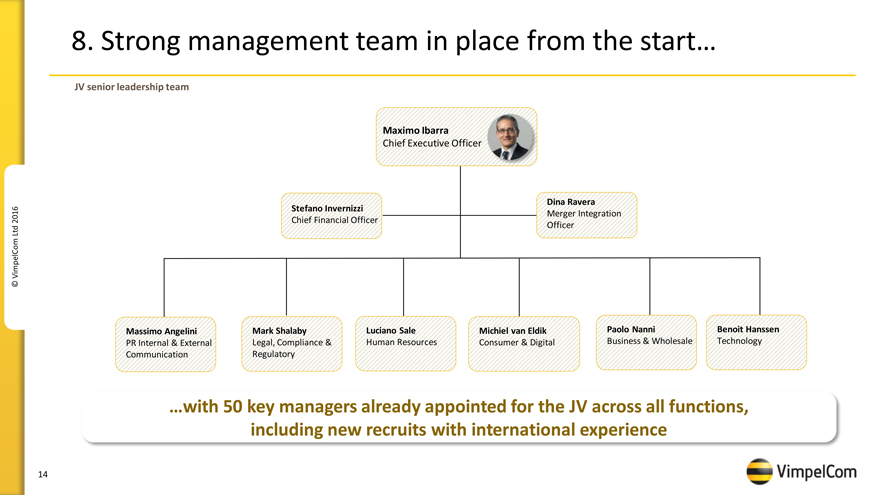

8. Strong management team in place from the start…

JV senior leadership team

Maximo Ibarra

Chief Executive Officer

Dina Ravera Stefano Invernizzi

Merger Integration Chief Financial Officer Officer

Massimo Angelini Mark Shalaby Luciano Sale Michiel van Eldik Paolo Nanni Benoit Hanssen

PR Internal & External Legal, Compliance & Human Resources Consumer & Digital Business & Wholesale Technology Communication Regulatory

…with 50 key managers already appointed for the JV across all functions, including new recruits with international experience

14

© VimpelCom Ltd 2016

|

|

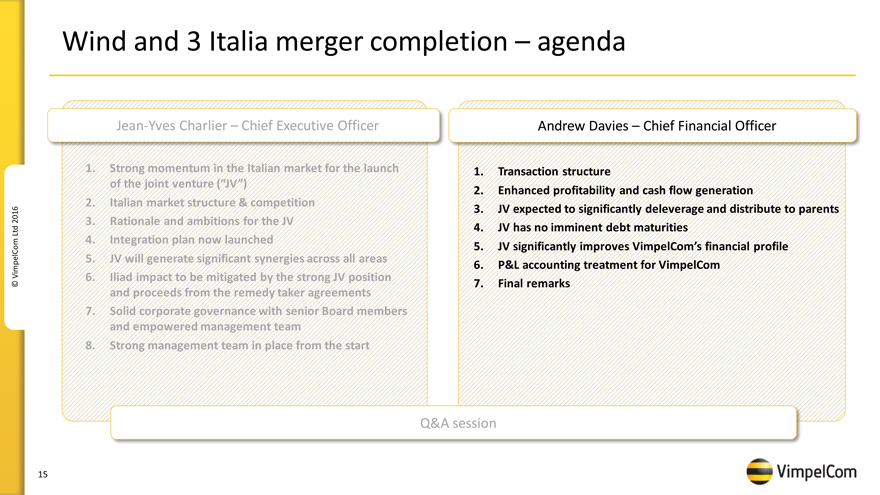

Wind and 3 Italia merger completion – agenda

Jean-Yves Charlier – Chief Executive Officer

1. Strong momentum in the Italian market for the launch of the joint venture (“JV”)

2. Italian market structure & competition

3. Rationale and ambitions for the JV

4. Integration plan now launched

5. JV will generate significant synergies across all areas

6. Iliad impact to be mitigated by the strong JV position and proceeds from the remedy taker agreements

7. Solid corporate governance with senior Board members and empowered management team

8. Strong management team in place from the start

Andrew Davies – Chief Financial Officer

1. Transaction structure

2. Enhanced profitability and cash flow generation

3. JV expected to significantly deleverage and distribute to parents 4. JV has no imminent debt maturities 5. JV significantly improves VimpelCom’s financial profile 6. P&L accounting treatment for VimpelCom 7. Final remarks

Q&A session

15

© VimpelCom Ltd 2016

|

|

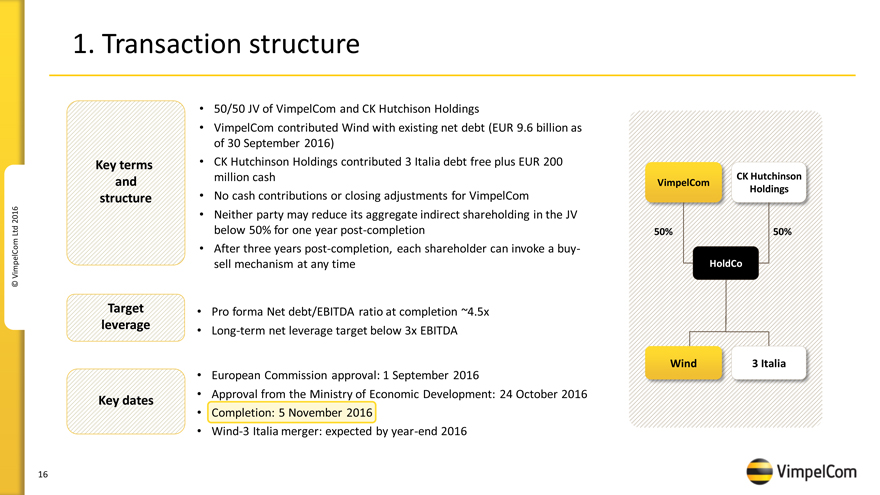

1. Transaction structure

Key terms and structure

• 50/50 JV of VimpelCom and CK Hutchison Holdings

• VimpelCom contributed Wind with existing net debt (EUR 9.6 billion as of 30 September 2016)

• CK Hutchinson Holdings contributed 3 Italia debt free plus EUR 200 million cash

• No cash contributions or closing adjustments for VimpelCom

• Neither party may reduce its aggregate indirect shareholding in the JV below 50% for one year post-completion

• After three years post-completion, each shareholder can invoke a buy-sell mechanism at any time

Target leverage

• Pro forma Net debt/EBITDA ratio at completion ~4.5x

• Long-term net leverage target below 3x EBITDA

Key dates

• European Commission approval: 1 September 2016

• Approval from the Ministry of Economic Development: 24 October 2016

• Completion: 5 November 2016

• Wind-3 Italia merger: expected by year-end 2016

CK Hutchinson VimpelCom Holdings

50% 50%

HoldCo

Wind 3 Italia

© VimpelCom Ltd 2016

16

|

|

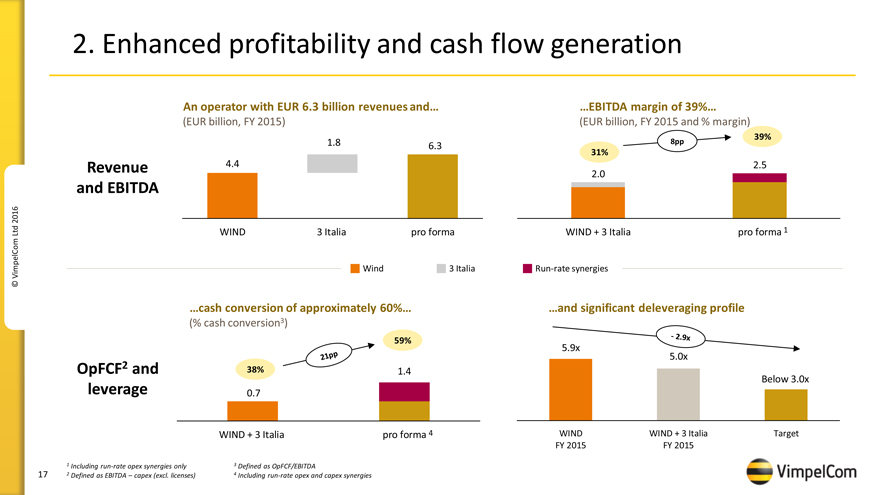

2. Enhanced profitability and cash flow generation

Revenue and EBITDA

OpFCF2 and leverage

An operator with EUR 6.3 billion revenues and…

(EUR billion, FY 2015)

1.8 6.3

4.4

WIND 3 Italia pro forma

Wind 3 Italia

…EBITDA margin of 39%…

(EUR billion, FY 2015 and % margin)

39%

8pp

31%

2.5

2.0

WIND + 3 Italia pro forma 1

Run-rate synergies

…cash conversion of approximately 60%…

(% cash conversion3)

59%

38% 1.4

0.7

WIND + 3 Italia pro forma 4

…and significant deleveraging profile

5.9x 5.0x

Below 3.0x

WIND WIND + 3 Italia Target FY 2015 FY 2015

1 Including run-rate opex synergies only 3 Defined as OpFCF/EBITDA

17 2 Defined as EBITDA – capex (excl. licenses) 4 Including run-rate opex and capex synergies

© VimpelCom Ltd 2016

|

|

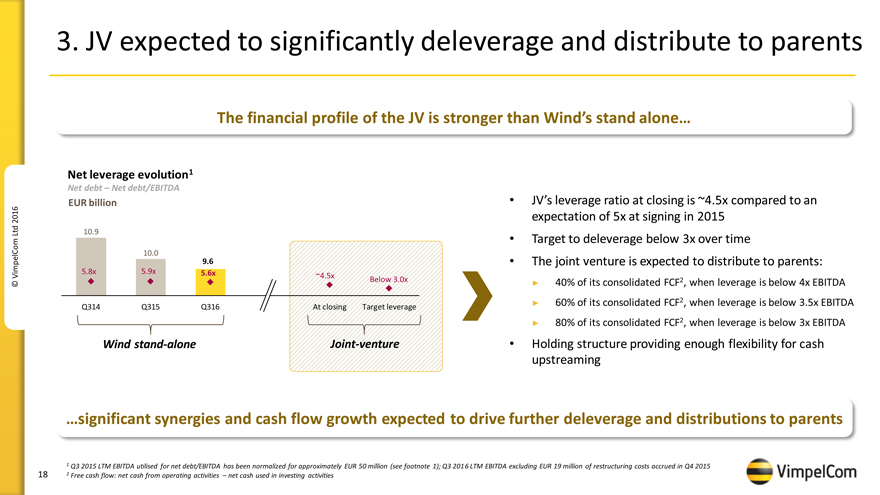

3. JV expected to significantly deleverage and distribute to parents

The financial profile of the JV is stronger than Wind’s stand alone…

Net leverage evolution1

Net debt – Net debt/EBITDA

EUR billion

10.9

10.0

9.6

5.8x 5.9x 5.6x

~4.5x

Below 3.0x

Q314 Q315 Q316 At closing Target leverage

Wind stand-alone Joint-venture

• JV’s leverage ratio at closing is ~4.5x compared to an expectation of 5x at signing in 2015

• Target to deleverage below 3x over time

• The joint venture is expected to distribute to parents:

? 40% of its consolidated FCF2, when leverage is below 4x EBITDA

? 60% of its consolidated FCF2, when leverage is below 3.5x EBITDA

? 80% of its consolidated FCF2, when leverage is below 3x EBITDA

• Holding structure providing enough flexibility for cash upstreaming

…significant synergies and cash flow growth expected to drive further deleverage and distributions to parents

1 Q3 2015 LTM EBITDA utilised for net debt/EBITDA has been normalized for approximately EUR 50 million (see footnote 1); Q3 2016 LTM EBITDA excluding EUR 19 million of restructuring costs accrued in Q4 2015

18 2 Free cash flow: net cash from operating activities – net cash used in investing activities

© VimpelCom Ltd 2016

|

|

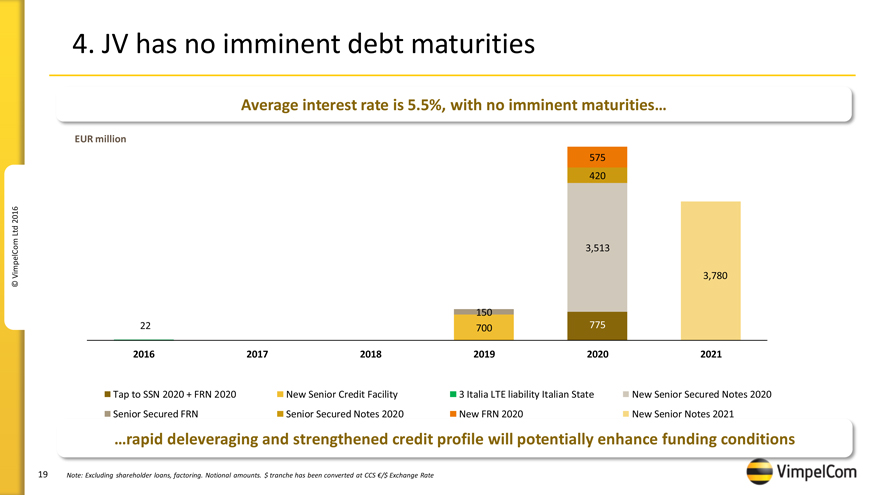

4. JV has no imminent debt maturities

Average interest rate is 5.5%, with no imminent maturities…

EUR million

575 420

3,513

3,780

150

22 700 775

2016 2017 2018 2019 2020 2021

Tap to SSN 2020 + FRN 2020 New Senior Credit Facility 3 Italia LTE liability Italian State New Senior Secured Notes 2020

Senior Secured FRN Senior Secured Notes 2020 New FRN 2020 New Senior Notes 2021

…rapid deleveraging and strengthened credit profile will potentially enhance funding conditions

19 Note: Excluding shareholder loans, factoring. Notional amounts. $ tranche has been converted at CCS €/$ Exchange Rate

© VimpelCom Ltd 2016

|

|

5. JV significantly improves VimpelCom’s financial profile

As at 30 September 2016, USD billion

Net debt significantly reduced by USD 10.6 billion and the Net debt/EBITDA1 ratio below 2x…

Net leverage evolution

Net debt – Net debt/EBITDA1

17.4

6.8

3.2x

1.9x Pro-forma, including WIND Reported

…VimpelCom’s leverage is now at a level where the VimpelCom Board can consider the adoption of a meaningful dividend policy by no later than early 2017

20 1 Net debt/EBITDA underlying

© VimpelCom Ltd 2016

|

|

6. P&L accountingtreatmentforVimpelCom

Previous accounting of Italy

(from signing to completion)

FY2015

USD million FY15

Revenue 9,625

Service Revenue 9,332

EBITDA underlying 3,908

EBITDA reported 2,857

D&A, impairments and

(2,350)

other

- o/w impairments (245)

EBIT 506

Net financial expenses (777)

FOREX and Other (343)

Profit/(loss) before tax (613)

Tax (238)

Loss for the period (851)

Profit / (loss) from

263

discontinued operations

Non-controlling interest (103)

Net result (691)

Current accounting

(after completion)

FY2016E1

USD million

Revenue

Service Revenue

EBITDA underlying

EBITDA reported

D&A, impairments and

other

- o/w impairments

EBIT

Net financial expenses

FOREX and Other

Share of net income of

associates

Profit/(loss) before tax

Tax

Loss for the period

Profit / (loss) from

discontinued operations

Non-controlling interest

Net result

50% of net result of

Italy JV (from closing, 5 November to

31 December 2016)

Wind Group net result

(from 1 January 2016 to closing, 5 November) + net capital gain on disposal of WIND

Group

Long term accounting FY2017E—onward

USD million

Revenue

Service Revenue

EBITDA underlying

EBITDA reported

D&A, impairments and other

- o/w impairments

EBIT

Net financial expenses

FOREX and Other Share of net income of associates

Profit/(loss) before tax

Tax

Loss for the period

Non-controlling interest

Net result

Significant capital gain to be expected in VimpelCom Q4 2016 results

21 1 Assuming the closing of transaction by 31 December 2016

© VimpelCom Ltd 2016

|

|

7. Final remarks

JV launched with Italian marketplace back to growth and substantial opex and capex synergies to further drive profitability and cash flow generation

Leading converged player in the Italian market, pioneering in digital engagement with users

Increasing capacity for JV to deleverage and flexibility to distribute to parents

Solid governance designed to avoid deadlock and with significantly empowered management team

Iliad market entrance impact for the JV mitigated by proceeds from remedy package

© VimpelCom Ltd 2016

22

|

|

Wind and 3 Italia merger completion – agenda

Jean-Yves Charlier – Chief Executive Officer

1. Strong momentum in the Italian market for the launch of the joint venture (“JV”)

2. Italian market structure & competition

3. Rationale and ambitions for the JV

4. Integration plan now launched

5. JV will generate significant synergies across all areas

6. Iliad impact to be mitigated by the strong JV position and proceeds from the remedy taker agreements

7. Solid corporate governance with senior Board members and empowered management team

8. Strong management team in place from the start

Andrew Davies – Chief Financial Officer

1. Transaction structure

2. Enhanced profitability and cash flow generation

3. JV expected to significantly deleverage and distribute to parents

4. JV has no imminent debt maturities

5. JV significantly improves VimpelCom’s financial profile

6. P&L accounting treatment for VimpelCom

7. Final remarks

Q&A session

23

© VimpelCom Ltd 2016

|

|

Further information

Investor Relations

Claude Debussylaan 88

1082 MD Amsterdam

The Netherlands

T: +31 20 79 77 234

Visit our website

www.vimpelcom.com

© VimpelCom Ltd 2016

24

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Fisher House at Lovell Federal Health Care Center in North Chicago will be the 100th Fisher House

- EY Announces Spark Biomedical CEO Daniel Powell as an Entrepreneur Of The Year® 2024 Southwest Award Finalist

- ROSEN, TRUSTED INVESTOR COUNSEL, Encourages The Chemours Company Investors to Secure Counsel Before Important Deadline in Securities Class Action – CC

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share