Form 6-K VimpelCom Ltd. For: May 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of May 2016

Commission File Number 1-34694

VimpelCom Ltd.

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| VIMPELCOM LTD. | ||||||

| (Registrant) | ||||||

| Date: May 12, 2016 |

||||||

| By: | /s/ Scott Dresser | |||||

| Name: | Scott Dresser | |||||

| Title: | Group General Counsel | |||||

VIMPELCOM REPORTS POSITIVE REVENUE MOMENTUM

WITH 1Q 2016 RESULTS, FY16 GUIDANCE CONFIRMED

KEY RESULTS AND DEVELOPMENTS

| • | Revenue organic1 growth of 4% YoY, driven by strong growth in Emerging Markets and Eurasia |

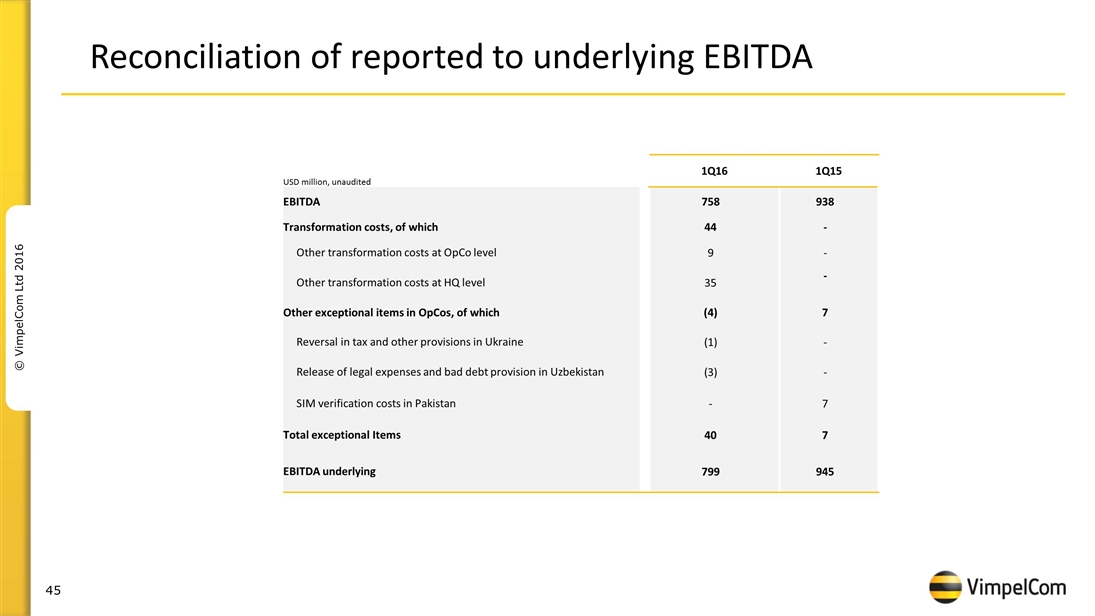

| • | Underlying2 EBITDA organically increased 2% YoY. Reported EBITDA declined 19% YoY mainly due to currency headwinds and exceptional items of USD 40 million almost entirely related to performance transformation |

| • | Reported net income of USD 189 million of which USD 38 million from continued operations |

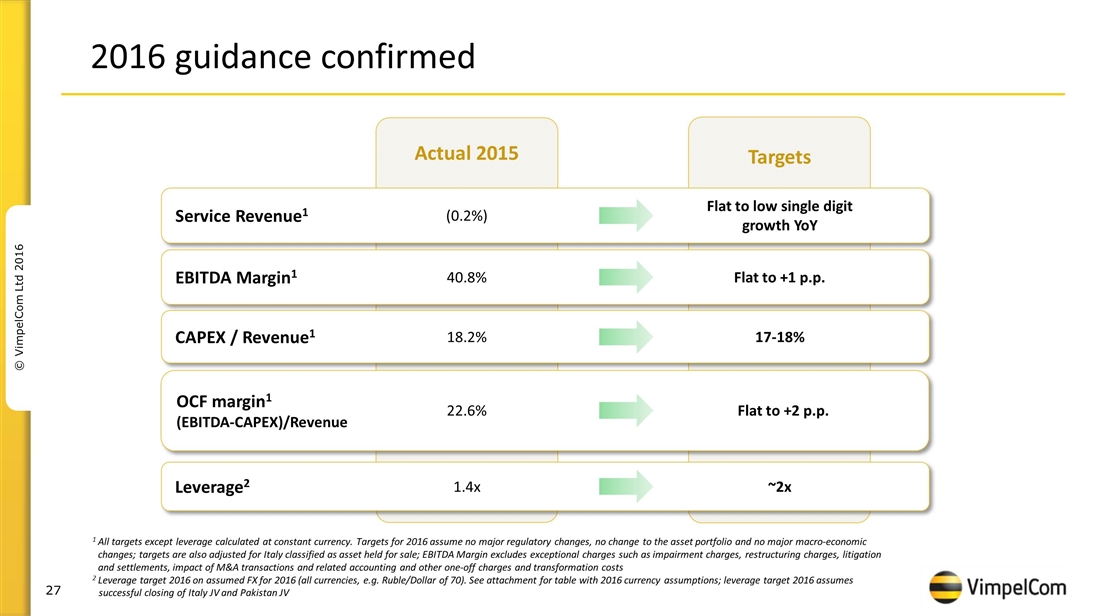

| • | Results on track and FY16 guidance confirmed |

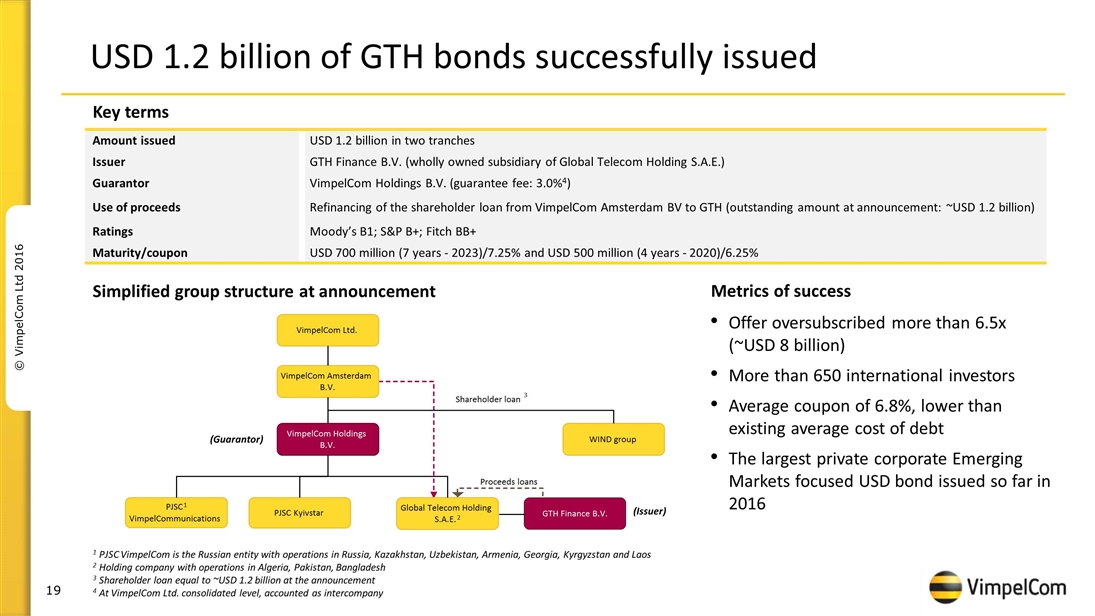

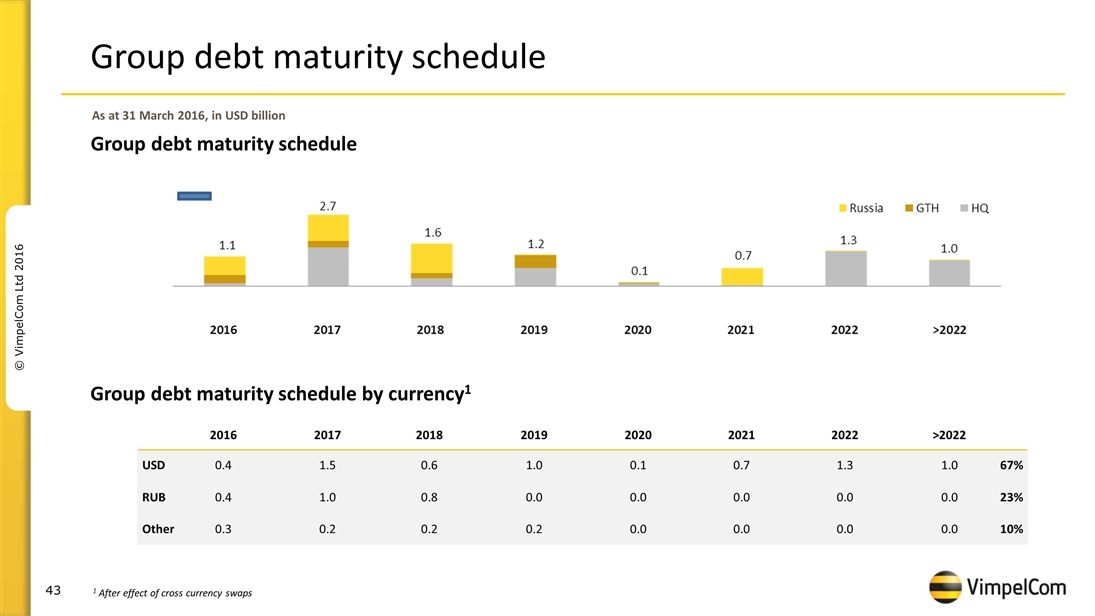

| • | USD 1.2 billion bonds successfully issued on April 26, 2016 with 4 and 7 year maturities and 6.8% average coupon |

Amsterdam (May 12, 2016)—VimpelCom Ltd. (NASDAQ: VIP), the international communications and technology company, which is committed to bringing the digital world to each and every customer, today announces financial and operating results for the quarter ended March 31, 2016. These results and the prior year numbers reflect the reclassification of Italy as an asset held for sale pursuant to the announcement of the joint venture with 3 Italia in August 2015.

JEAN-YVES CHARLIER, CHIEF EXECUTIVE OFFICER, COMMENTS:

“VimpelCom has reported organic growth in both revenue (+4%) and underlying EBITDA (+2%) in the first quarter of 2016. As a result, underlying net income3 for the quarter improved by USD 270 million year-on-year to USD 237 million, demonstrating that the operating momentum we had at the end of 2015 has continued into 2016. Although we still face currency headwinds and adverse economic conditions in some of our markets, there are signs of an easing in pressures, with the exception of Russia. Excluding the payments in relation to the agreements regarding the Uzbekistan investigations, we generated positive free cash flow in the quarter as our performance transformation program accelerates. Our strategy to profoundly transform VimpelCom is firmly on course, particularly in the areas of cost base transformation, streamlining our portfolio, and greater globalization of our internal operations. VimpelCom remains on track to achieve its financial targets for the year.”

CONSOLIDATED FINANCIAL AND OPERATING HIGHLIGHTS (ITALY RECLASSIFIED AS AN ASSET HELD FOR SALE)

| USD mln | 1Q16 | 1Q15 | Reported YoY |

Organic1 YoY |

||||||||||||

| Total revenue, of which |

2,023 | 2,312 | (12%) | 4% | ||||||||||||

| mobile and fixed service revenue |

1,953 | 2,260 | (14%) | 3% | ||||||||||||

| mobile data revenue |

301 | 286 | 5% | 27% | ||||||||||||

| EBITDA |

758 | 938 | (19%) | (2%) | ||||||||||||

| EBITDA underlying2 |

799 | 945 | (15%) | 2% | ||||||||||||

| EBITDA margin underlying (EBITDA underlying / total revenue) |

39.5% | 40.9% | (1.4 p.p.) | (0.8 p.p.) | ||||||||||||

| Net income/(loss) from continued operations |

38 | (88) | n.m | |||||||||||||

| Net income/(loss) from discontinued operations |

197 | 261 | (24%) | |||||||||||||

| Net income/(loss) for the period attr. to VIP shareholders |

189 | 184 | 3% | |||||||||||||

| Capital expenditures excl. licenses |

151 | 210 | (28%) | |||||||||||||

| LTM Capex excl licenses/revenue |

18.2% | 20.3% | (2.1 p.p.) | |||||||||||||

| Operating cash flow (EBITDA underlying less Capex) |

647 | 734 | (12%) | |||||||||||||

| Operating cash flow margin (operating cash flow / total revenue) |

32.0% | 31.8% | 0.2 p.p. | |||||||||||||

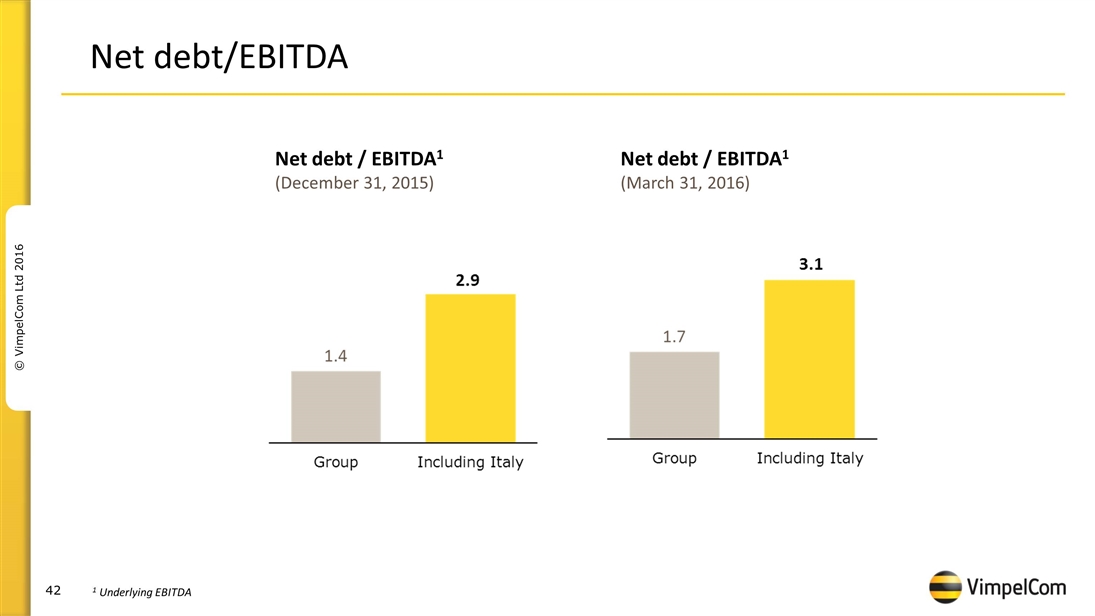

| Net debt |

6,407 | 5,883 | 9% | |||||||||||||

| Net debt / underlying LTM EBITDA |

1.7 | 1.2 | ||||||||||||||

| Total mobile customers (millions)4 |

194.0 | 195.1 | ||||||||||||||

| Total fixed-line broadband customers (millions) |

3.4 | 3.5 | ||||||||||||||

| 1) | EBITDA, net debt, underlying EBITDA and organic growth are non-GAAP financial measures (see attachment D for reconciliation); organic change reflects changes in revenue and EBITDA excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions |

| 2) | Underlying EBITDA excludes transformation costs and material exceptional adjustments, see Attachment D |

| 3) | Underlying net loss in 1Q15 of USD 33 million excludes exceptional items in EBITDA of USD 7 million, the gain from tower sale in Italy of USD 322 million and impairments of USD 98 million; Underlying net income in 1Q16 of USD 237 million excludes exceptional items in EBITDA of USD 40 million and impairments of USD 8 million |

| 4) | Excluding Italy |

For all definitions please see Attachment G

VimpelCom Ltd. 1Q 2016 | 1

CONTENTS

| 3 | ||||

| 4 | ||||

| 8 | ||||

| 18 | ||||

| 19 | ||||

| 21 |

PRESENTATION OF FINANCIAL RESULTS

VimpelCom’s results presented in this earnings release are based on IFRS and have not been audited. Certain amounts and percentages that appear in this earnings release have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including those in tables, may not be an exact arithmetic aggregation of the figures that precede or follow them.

VimpelCom Ltd. 1Q 2016 | 2

| • | Italy joint venture regulatory review process ongoing, Phase II review process started |

| • | Mobilink and Warid Telecom merger receives first regulatory approval from CCP |

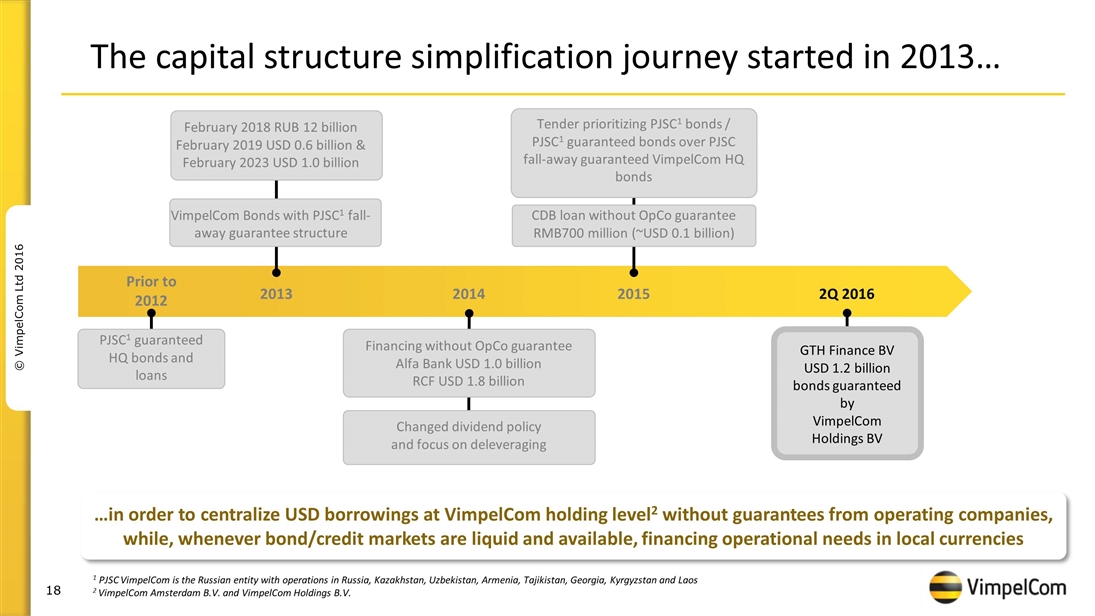

| • | GTH issued USD 1.2 billion bonds guaranteed by VimpelCom Holdings to refinance shareholder loan |

| • | Telenor preference shares in VimpelCom redeemed; change in share ownership |

| • | Settlements with the SEC/DOJ/OM regarding Uzbekistan investigation entered into and payments completed |

| • | New CEO appointed in Algeria |

| VimpelCom Ltd. 1Q 2016 | 3 |

| • | Revenue showed increasing organic growth of 4% YoY |

| • | Underlying EBITDA organically increased by 2% YoY. Reported EBITDA declined 19% YoY mainly due to currency headwinds and exceptional items of USD 40 million related to performance transformation |

| • | Reported net income of USD 189 million, of which USD 38 million from continued operations |

FINANCIALS BY BUSINESS UNIT

| USD mln | 1Q16 | 1Q15 | Reported YoY |

Organic YoY |

Forex and Other |

|||||||||||||||

| Total revenue |

2,023 | 2,312 | (12%) | 4% | (16%) | |||||||||||||||

| Russia |

890 | 1,067 | (17%) | 0% | (17%) | |||||||||||||||

| Emerging markets |

710 | 724 | (2%) | 6% | (7%) | |||||||||||||||

| Eurasia |

436 | 552 | (21%) | 5% | (26%) | |||||||||||||||

| HQ and eliminations |

(13) | (31) | n.a. | n.a. | n.a. | |||||||||||||||

| EBITDA |

758 | 938 | (19%) | (2%) | (17%) | |||||||||||||||

| Russia |

324 | 421 | (23%) | (8%) | (15%) | |||||||||||||||

| Emerging markets |

345 | 326 | 6% | 15% | (9%) | |||||||||||||||

| Eurasia |

218 | 265 | (18%) | 8% | (26%) | |||||||||||||||

| HQ and eliminations |

(129) | (74) | n.a. | n.a. | n.a | |||||||||||||||

| EBITDA margin |

37.5% | 40.6% | (3.1p.p.) | |||||||||||||||||

| EBITDA underlying |

799 | 945 | (15%) | 2% | ||||||||||||||||

| Russia |

325 | 421 | (23%) | (7%) | ||||||||||||||||

| Emerging markets |

353 | 333 | 6% | 15% | ||||||||||||||||

| Eurasia |

215 | 265 | (19%) | 7% | ||||||||||||||||

| HQ and eliminations |

(94) | (74) | 27% | n.a. | ||||||||||||||||

| EBITDA margin underlying |

39.5% | 40.9% | (1.4p.p.) | (0.8p.p.) | ||||||||||||||||

VimpelCom Ltd. 1Q 2016 | 4

VimpelCom Ltd. 1Q 2016 | 5

INCOME STATEMENT ELEMENTS & CAPITAL EXPENDITURES

| USD mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

2,023 | 2,312 | (12%) | |||||||||

| Service revenue |

1,953 | 2,260 | (14%) | |||||||||

| EBITDA |

758 | 938 | (19%) | |||||||||

| EBITDA margin |

37.5% | 40.6% | (3.1p.p.) | |||||||||

| Depreciation and amortization and other |

(454) | (630) | (28%) | |||||||||

| EBIT |

304 | 308 | (1%) | |||||||||

| Financial income and expenses |

(168) | (215) | (22%) | |||||||||

| Net foreign exchange (loss)/gain and others |

19 | (101) | (119%) | |||||||||

| Profit/(loss) before tax |

155 | (8) | n.m | |||||||||

| Income tax expense |

(117) | (80) | 46% | |||||||||

| Profit/(loss) from continued operations |

38 | (88) | n.m | |||||||||

| Profit/(loss) from discontinued operations |

197 | 261 | (24%) | |||||||||

| Net income/(loss) attributable to VimpelCom shareholders |

189 | 184 | 3% | |||||||||

| 1Q16 | 1Q15 | YoY | ||||||||||

| Capex expenditures |

195 | 264 | (26%) | |||||||||

| Capex expenditures excl licenses |

151 | 210 | (28%) | |||||||||

| LTM Capex excl licenses/revenue |

18% | 20% | ||||||||||

VimpelCom Ltd. 1Q 2016 | 6

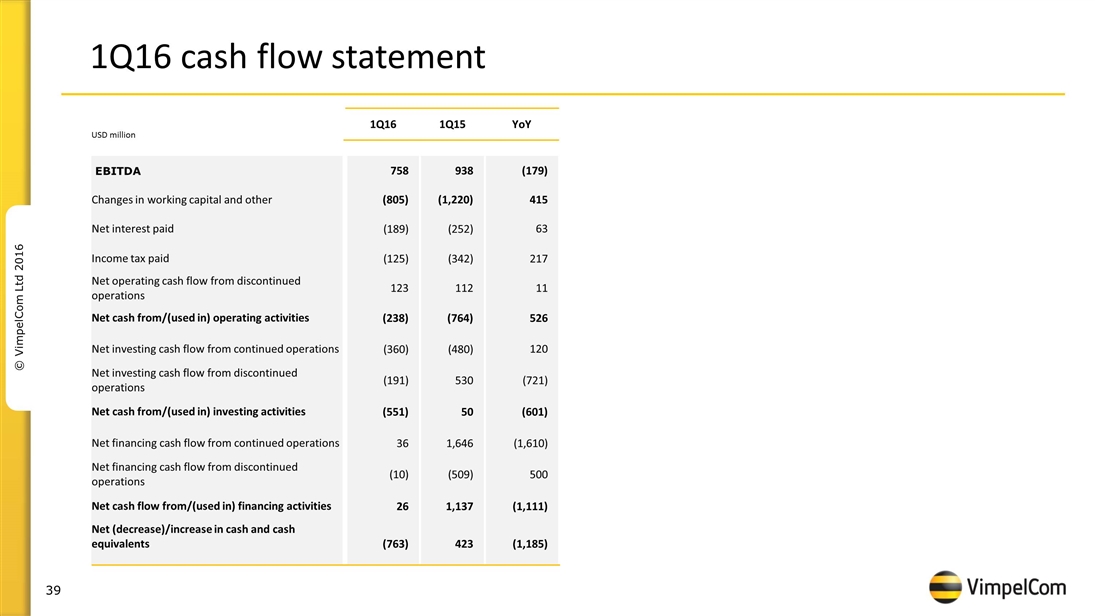

FINANCIAL POSITION & CASH FLOW

| USD mln | 1Q16 | 4Q15 | QoQ | |||||||||

| Total assets |

33,969 | 33,854 | 0% | |||||||||

| Shareholders’ equity |

4,045 | 3,765 | 7% | |||||||||

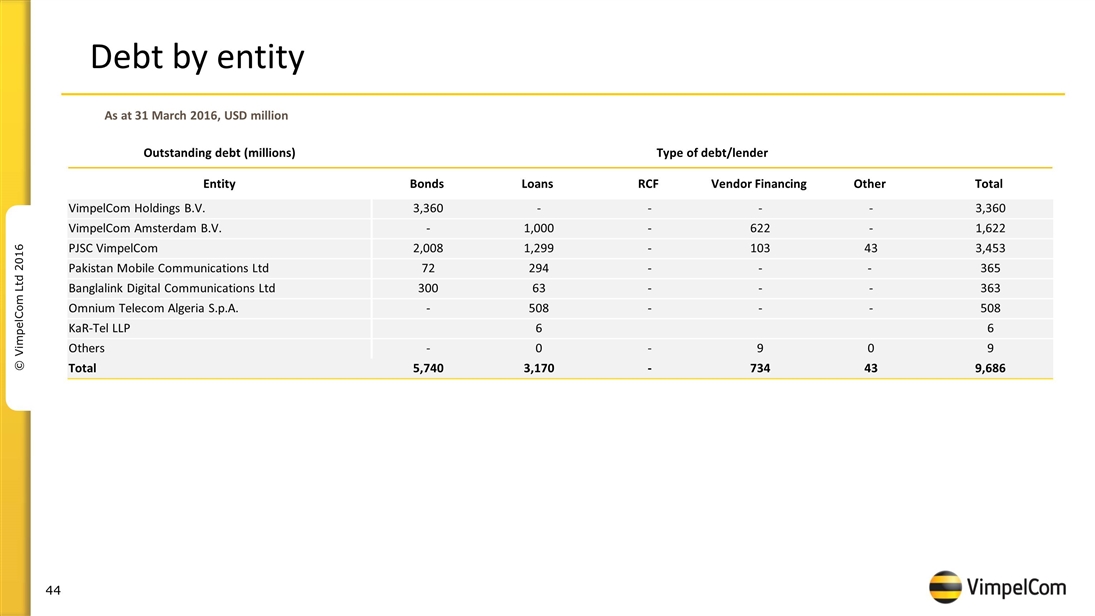

| Gross debt |

9,686 | 9,544 | 1% | |||||||||

| Net debt |

6,407 | 5,496 | 17% | |||||||||

| Net debt / underlying LTM EBITDA |

1.7 | 1.4 | ||||||||||

| USD mln | 1Q16 | 1Q15 | YoY | |||||||||

| Net cash from / (used in) operating activities |

(238) | (764) | 526 | |||||||||

| from continued operations |

(361) | (876) | 515 | |||||||||

| from discontinued operations |

123 | 112 | 11 | |||||||||

| Net cash from / (used in) investing activities |

(551) | 50 | (601) | |||||||||

| from continued operations |

(360) | (480) | 120 | |||||||||

| from discontinued operations |

(191) | 530 | (721) | |||||||||

| Net cash from / (used in) financing activities |

26 | 1,137 | (1,111) | |||||||||

| from continued operations |

36 | 1,646 | (1,610) | |||||||||

| from discontinued operations |

(10) | (509) | 500 | |||||||||

VimpelCom Ltd. 1Q 2016 | 7

| • Russia

|

||||

| • Algeria |

||||

| • Pakistan |

Emerging markets | |||

| • Bangladesh |

||||

| • Ukraine |

||||

| • Kazakhstan |

Eurasia | |||

| • Other |

||||

VimpelCom Ltd. 1Q 2016 | 8

FINANCIALS BY COUNTRY

| USD mln | 1Q16 | 1Q15 | Reported YoY |

Organic YoY |

||||||||||||

| Service revenue |

1,953 | 2,260 | (14%) | 3% | ||||||||||||

| Russia |

852 | 1,036 | (18%) | (1%) | ||||||||||||

| Algeria |

276 | 320 | (14%) | (0%) | ||||||||||||

| Pakistan |

257 | 236 | 9% | 12% | ||||||||||||

| Bangladesh |

153 | 145 | 6% | 6% | ||||||||||||

| Ukraine |

135 | 151 | (10%) | 12% | ||||||||||||

| Kazakhstan |

79 | 164 | (51%) | (7%) | ||||||||||||

| Uzbekistan |

165 | 167 | (1%) | 15% | ||||||||||||

| Kyrgyzstan |

31 | 38 | (18%) | (0%) | ||||||||||||

| Armenia |

22 | 26 | (16%) | (14%) | ||||||||||||

| Tajikistan |

19 | 26 | (27%) | (27%) | ||||||||||||

| Georgia |

10 | 14 | (30%) | (17%) | ||||||||||||

| HQ and eliminations |

(47 | ) | (62 | ) | n.a. | n.a. | ||||||||||

| EBITDA reported |

758 | 938 | (19%) | (2%) | ||||||||||||

| Russia |

324 | 421 | (23%) | (8%) | ||||||||||||

| Algeria |

158 | 169 | (6%) | 9% | ||||||||||||

| Pakistan |

116 | 96 | 21% | 25% | ||||||||||||

| Bangladesh |

70 | 60 | 18% | 19% | ||||||||||||

| Ukraine |

71 | 63 | 13% | 43% | ||||||||||||

| Kazakhstan |

31 | 81 | (61%) | (26%) | ||||||||||||

| Uzbekistan |

100 | 105 | (4%) | 11% | ||||||||||||

| Kyrgyzstan |

17 | 21 | (16%) | 2% | ||||||||||||

| Armenia |

8 | 9 | (13%) | (11%) | ||||||||||||

| Tajikistan |

12 | 14 | (15%) | (15%) | ||||||||||||

| Georgia |

2 | 2 | (4%) | 14% | ||||||||||||

| HQ and eliminations |

(152 | ) | (102 | ) | n.a. | n.a. | ||||||||||

| EBITDA Underlying |

799 | 945 | (15%) | 2% | ||||||||||||

| Russia |

325 | 421 | (23%) | (7%) | ||||||||||||

| Algeria |

158 | 169 | (6%) | 9% | ||||||||||||

| Pakistan |

119 | 103 | 16% | 20% | ||||||||||||

| Bangladesh |

75 | 60 | 25% | 26% | ||||||||||||

| Ukraine |

71 | 63 | 12% | 42% | ||||||||||||

| Kazakhstan |

32 | 81 | (60%) | (24%) | ||||||||||||

| Uzbekistan |

97 | 105 | (7%) | 7% | ||||||||||||

| Kyrgyzstan |

17 | 21 | (16%) | 2% | ||||||||||||

| Armenia |

8 | 9 | (13%) | (11%) | ||||||||||||

| Tajikistan |

12 | 14 | (15%) | (15%) | ||||||||||||

| Georgia |

2 | 2 | 0% | 18% | ||||||||||||

| HQ and eliminations |

(118 | ) | (102 | ) | n.a. | n.a. | ||||||||||

Note: HQ and eliminations in “financials by countries” differ from the “financials by business unit” due to eliminations within business unit.

VimpelCom Ltd. 1Q 2016 | 9

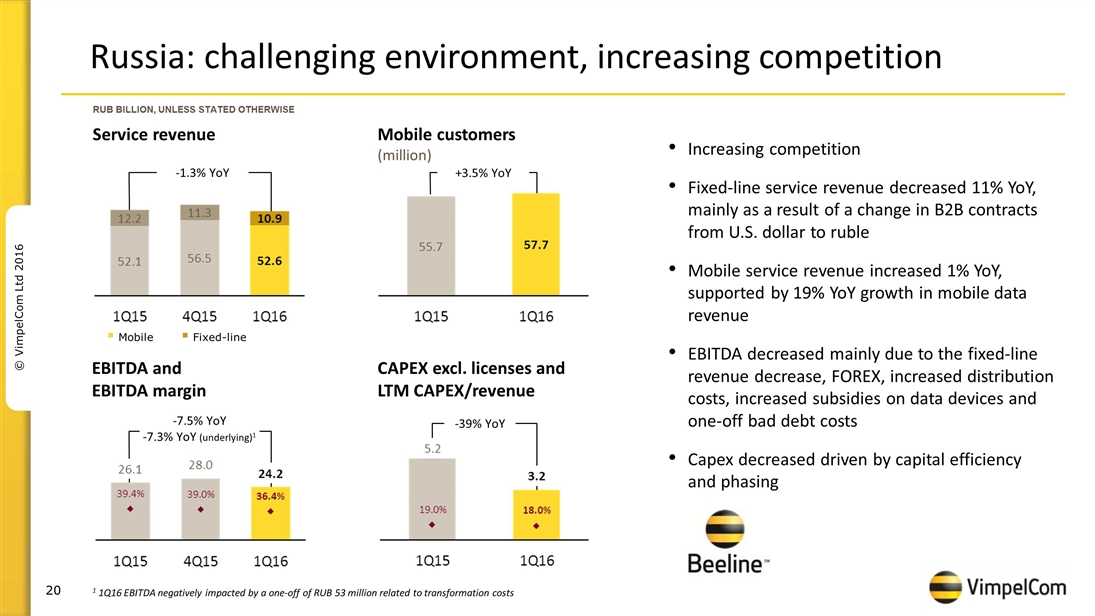

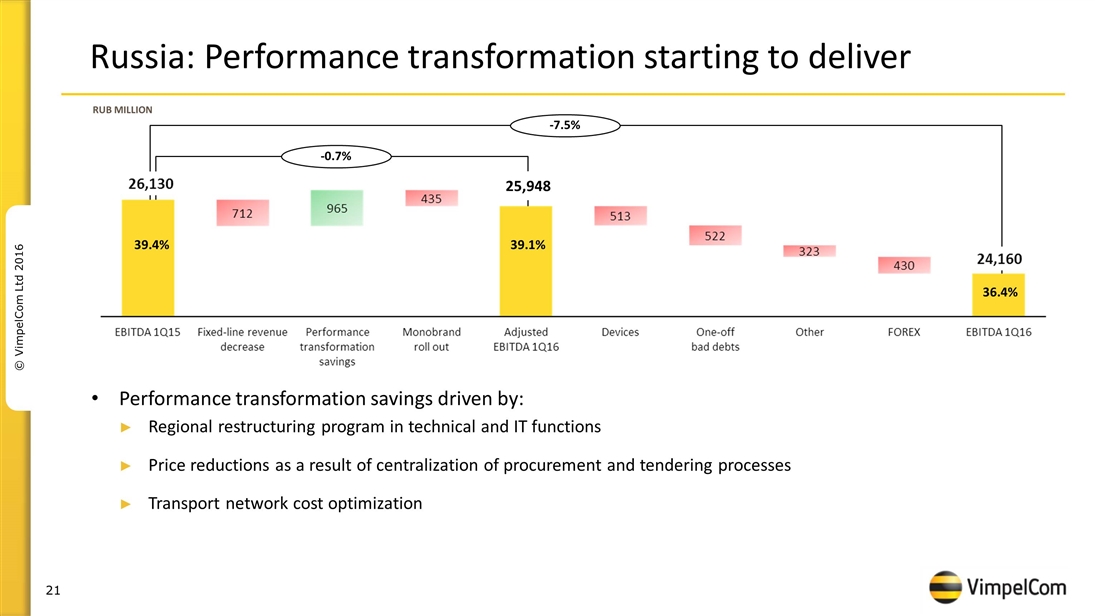

RUSSIA

| RUB mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

66,297 | 66,276 | 0% | |||||||||

| Mobile service revenue |

52,620 | 52,148 | 1% | |||||||||

| Fixed-line service revenue |

10,862 | 12,200 | (11%) | |||||||||

| EBITDA |

24,159 | 26,130 | (8%) | |||||||||

| EBITDA underlying |

24,212 | 26,130 | (7%) | |||||||||

| EBITDA margin |

36.4% | 39.4% | (3.0 p.p.) | |||||||||

| EBITDA margin underlying |

36.5% | 39.4% | (2.9 p.p.) | |||||||||

| Capex excl licenses |

3,181 | 5,179 | (39%) | |||||||||

| LTM Capex excl licenses /revenue |

18% | 19% | (1.0 p.p) | |||||||||

| Mobile |

||||||||||||

| Total revenue |

55,371 | 54,024 | 2% | |||||||||

| - of which mobile data |

12,188 | 10,204 | 19% | |||||||||

| Customers (mln) |

57.7 | 55.7 | 4% | |||||||||

| - of which data users (mln) |

32.6 | 31.0 | 5% | |||||||||

| ARPU (RUB) |

291 | 300 | (3%) | |||||||||

| MOU (min) |

315 | 303 | 4% | |||||||||

| Data usage (MB) |

1,931 | 1,483 | 30% | |||||||||

| Fixed-line |

||||||||||||

| Total revenue |

10,926 | 12,252 | (11%) | |||||||||

| Broadband revenue |

2,811 | 3,168 | (11%) | |||||||||

| Broadband customers (mln) |

2.2 | 2.3 | (4%) | |||||||||

| Broadband ARPU (RUB) |

422 | 459 | (8%) | |||||||||

VimpelCom Ltd. 1Q 2016 | 10

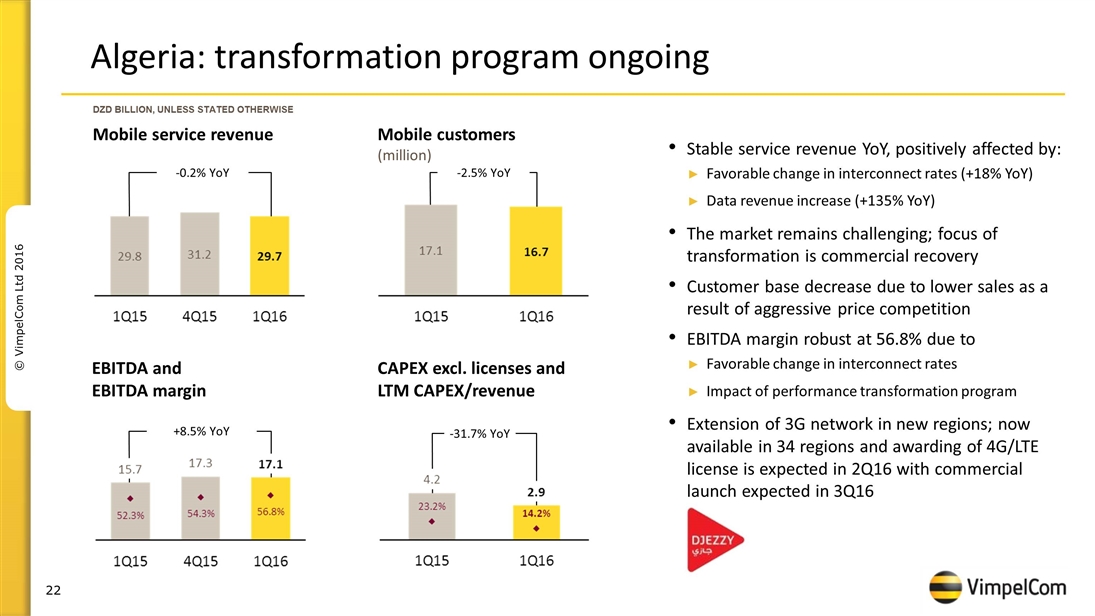

ALGERIA

| DZD bln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

30.0 | 30.0 | 0% | |||||||||

| Mobile service revenue |

29.7 | 29.8 | (0%) | |||||||||

| of which mobile data |

1.7 | 0.7 | 135% | |||||||||

| EBITDA |

17.1 | 15.7 | 9% | |||||||||

| EBITDA Underlying |

17.1 | 15.7 | 9% | |||||||||

| EBITDA margin |

56.8% | 52.3% | 4.4 p.p. | |||||||||

| EBITDA Underlying margin |

56.8% | 52.3% | 4.4 p.p. | |||||||||

| Capex excl licenses |

2.9 | 4.2 | (32%) | |||||||||

| LTM Capex excl licenses/revenue |

14% | 23% | (9.0 p.p.) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

16.7 | 17.1 | (2%) | |||||||||

| - of which mobile data customers (mln) 1 |

4.3 | 1.8 | 134% | |||||||||

| ARPU (DZD) |

583 | 566 | 3% | |||||||||

| MOU (min) |

348 | 344 | 1% | |||||||||

| Data usage (MB) |

295 | 208 | 42% | |||||||||

| 1) | Data customers were restated in order to comply with VimpelCom Group definition |

VimpelCom Ltd. 1Q 2016 | 11

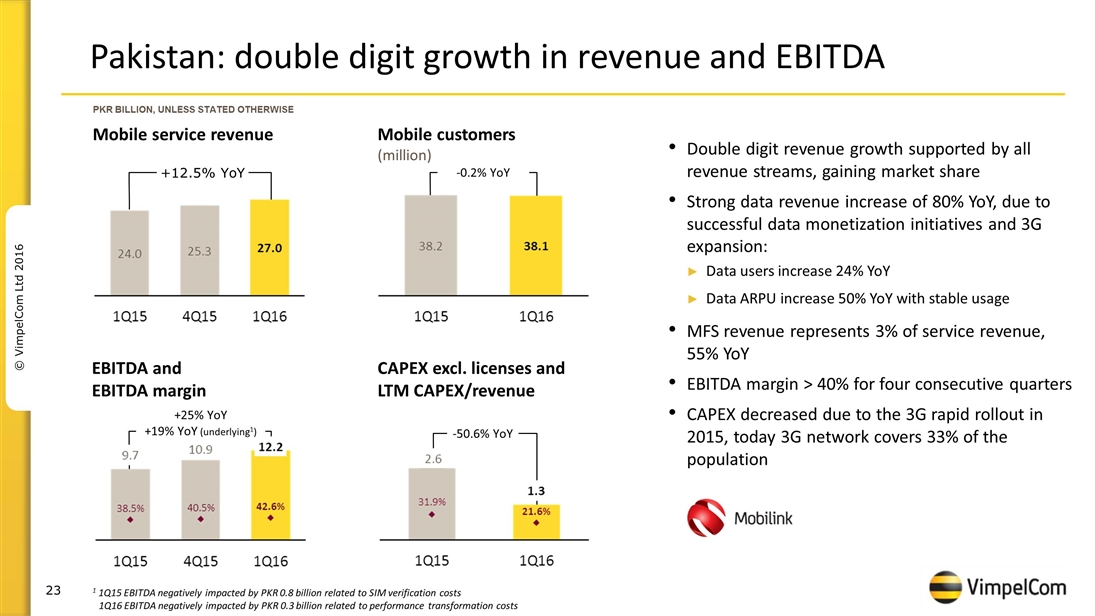

PAKISTAN

| PKR bln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

28.6 | 25.3 | 13% | |||||||||

| Mobile service revenue |

27.0 | 24.0 | 12% | |||||||||

| of which mobile data |

3.4 | 1.9 | 80% | |||||||||

| EBITDA |

12.2 | 9.7 | 25% | |||||||||

| EBITDA Underlying |

12.5 | 10.4 | 20% | |||||||||

| EBITDA margin |

42.6% | 38.5% | 4.1 p.p. | |||||||||

| EBITDA Underlying margin |

43.8% | 41.3% | 2.5 p.p. | |||||||||

| Capex excl licenses |

1.3 | 2.6 | (51%) | |||||||||

| LTM Capex excl licenses /revenue |

22% | 32% | (10.4 p.p) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

38.1 | 38.2 | (0.2%) | |||||||||

| - of which mobile data customers (mln) |

18.3 | 14.8 | 24% | |||||||||

| ARPU (PKR) |

234 | 203 | 15% | |||||||||

| MOU (min) |

692 | 559 | 24% | |||||||||

| Data usage (MB) |

297 | 298 | 0% | |||||||||

VimpelCom Ltd. 1Q 2016 | 12

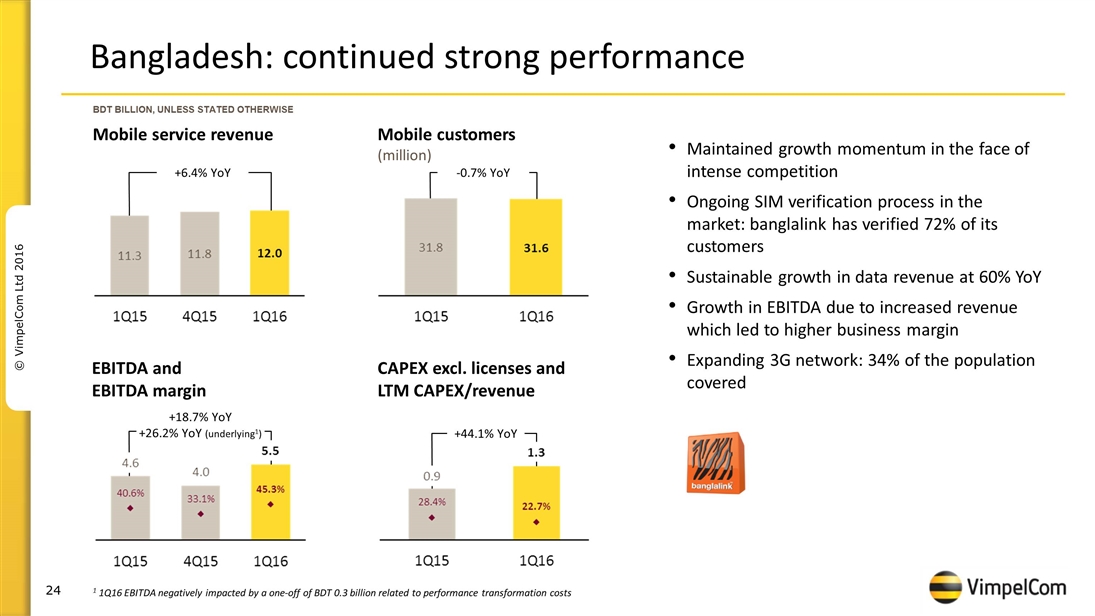

BANGLADESH

| BDT bln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

12.2 | 11.4 | 6% | |||||||||

| Mobile service revenue |

12.0 | 11.3 | 6% | |||||||||

| of which mobile data |

1.1 | 0.7 | 60% | |||||||||

| EBITDA |

5.5 | 4.6 | 19% | |||||||||

| EBITDA Underlying |

5.9 | 4.6 | 26% | |||||||||

| EBITDA margin |

45.3% | 40.6% | 4.7 p.p. | |||||||||

| EBITDA Underlying margin |

48.1% | 40.6% | 7.6 p.p. | |||||||||

| Capex excl licenses |

1.3 | 0.9 | 44% | |||||||||

| LTM Capex excl licenses /revenue |

23% | 28% | (5.6 p.p) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

31.6 | 31.8 | (0.7%) | |||||||||

| - of which mobile data customers (mln) |

14.4 | 12.9 | 12% | |||||||||

| ARPU (BDT) |

124 | 119 | 4% | |||||||||

| MOU (min) |

311 | 295 | 6% | |||||||||

| Data usage (MB) |

157 | 65 | 141% | |||||||||

VimpelCom Ltd. 1Q 2016 | 13

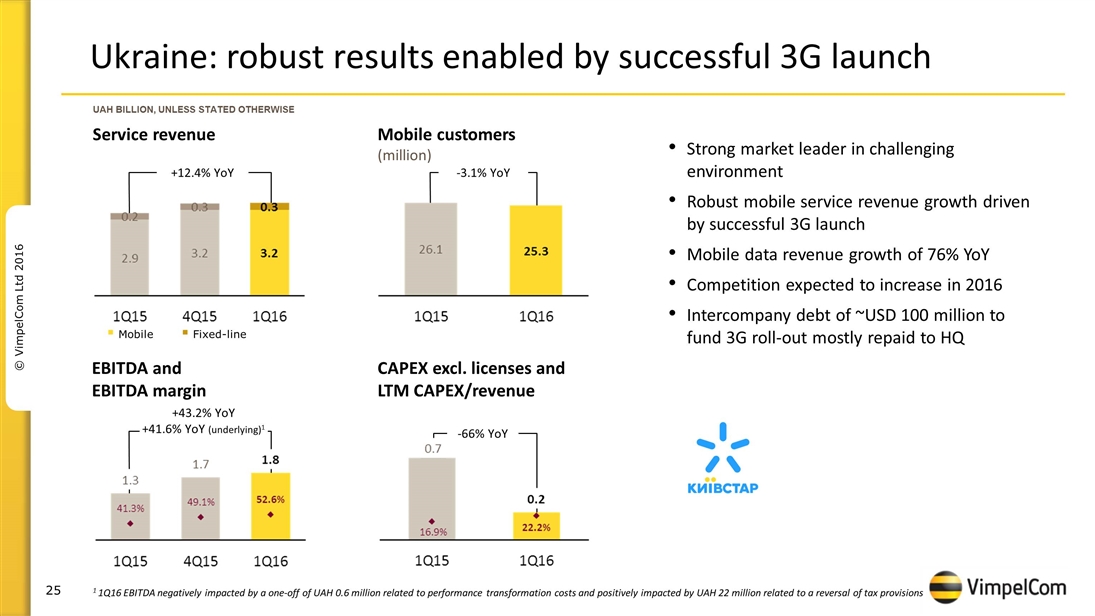

UKRAINE

| UAH mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

3,478 | 3,092 | 12% | |||||||||

| Mobile service revenue |

3,210 | 2,851 | 13% | |||||||||

| Fixed-line service revenue |

259 | 233 | 11% | |||||||||

| EBITDA |

1,830 | 1,278 | 43% | |||||||||

| EBITDA underlying |

1,810 | 1,278 | 42% | |||||||||

| EBITDA margin |

52.6% | 41.3% | 11.3 p.p. | |||||||||

| EBITDA underlying margin |

52.0% | 41.3% | 10.7 p.p. | |||||||||

| Capex excl licenses |

249 | 742 | (66%) | |||||||||

| LTM Capex excl licenses /revenue |

22% | 17% | 5.3 p.p. | |||||||||

| Mobile |

||||||||||||

| Total operating revenue |

3,220 | 2,859 | 13% | |||||||||

| of which mobile data |

496 | 281 | 76% | |||||||||

| Customers (mln) |

25 | 26 | (3%) | |||||||||

| of which data customers(mln) |

10.3 | 11.3 | (8%) | |||||||||

| ARPU (UAH) |

42 | 36 | 16% | |||||||||

| MOU (min) |

572 | 536 | 7% | |||||||||

| Data usage |

229 | 150 | 52% | |||||||||

| Fixed-line |

||||||||||||

| Total operating revenue |

259 | 233 | 11% | |||||||||

| Broadband revenue |

148 | 117 | 26% | |||||||||

| Broadband customers (mln) |

0.8 | 0.8 | (1%) | |||||||||

| Broadband ARPU (UAH) |

61 | 48 | 27% | |||||||||

VimpelCom Ltd. 1Q 2016 | 14

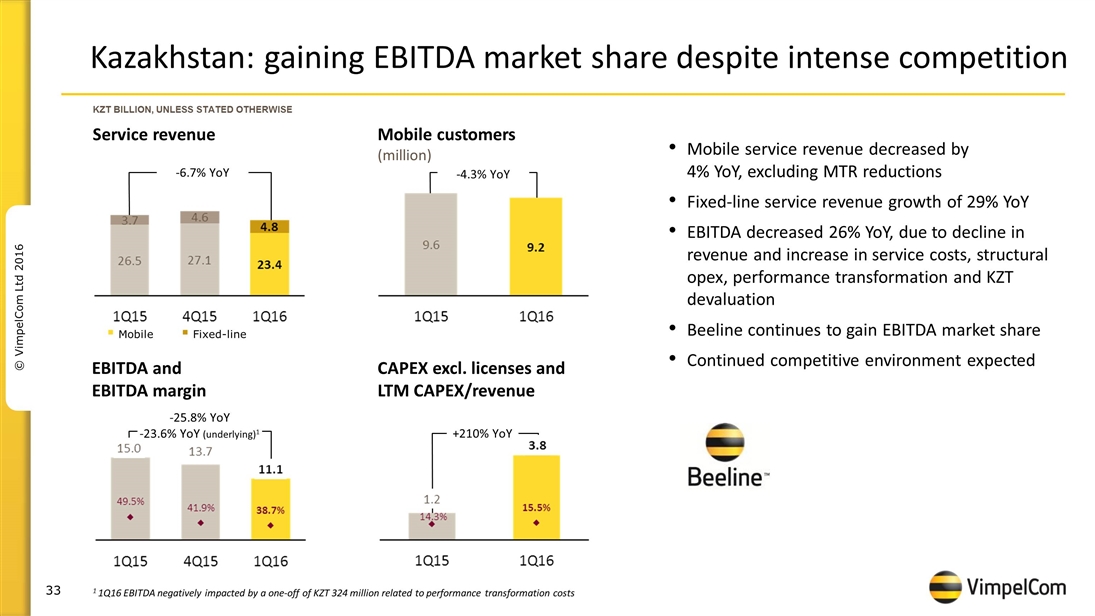

KAZAKHSTAN

| KZT mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

28,723 | 30,284 | (5.2%) | |||||||||

| Mobile service revenue |

23,424 | 26,537 | (12%) | |||||||||

| Fixed-line service revenue |

4,784 | 3,707 | 29% | |||||||||

| EBITDA |

11,119 | 14,981 | (26%) | |||||||||

| Underlying EBITDA |

11,444 | 14,981 | (24%) | |||||||||

| EBITDA margin |

38.7% | 49.5% | (10.8 p.p.) | |||||||||

| Underlying EBITDA margin |

39.8% | 49.5% | (9.6 p.p.) | |||||||||

| Capex excl licenses |

3,838 | 1,239 | 210% | |||||||||

| LTM Capex excl licenses /revenue |

16% | 14% | 1.2 p.p | |||||||||

| Mobile |

||||||||||||

| Total revenue |

23,931 | 26,564 | (10%) | |||||||||

| - of which mobile data |

5,775 | 5,456 | 6% | |||||||||

| Mobile customers (mln) |

9.2 | 9.6 | (4%) | |||||||||

| - of which mobile data customers (mln) |

4.8 | 5.2 | (6%) | |||||||||

| Mobile ARPU (KZT) |

806 | 898 | (10%) | |||||||||

| MOU (min) |

299 | 273 | 10% | |||||||||

| Data usage (MB) |

1,010 | 414 | 144% | |||||||||

| Fixed-line |

||||||||||||

| Total revenue |

4,792 | 3,720 | 29% | |||||||||

| Broadband revenues |

774 | 625 | 24% | |||||||||

| Broadband customers (mln) |

0.2 | 0.2 | 9% | |||||||||

| Broadband ARPU (KZT) |

3,332 | 2,942 | 13% | |||||||||

VimpelCom Ltd. 1Q 2016 | 15

VimpelCom Ltd. 1Q 2016 | 16

VimpelCom Ltd. 1Q 2016 | 17

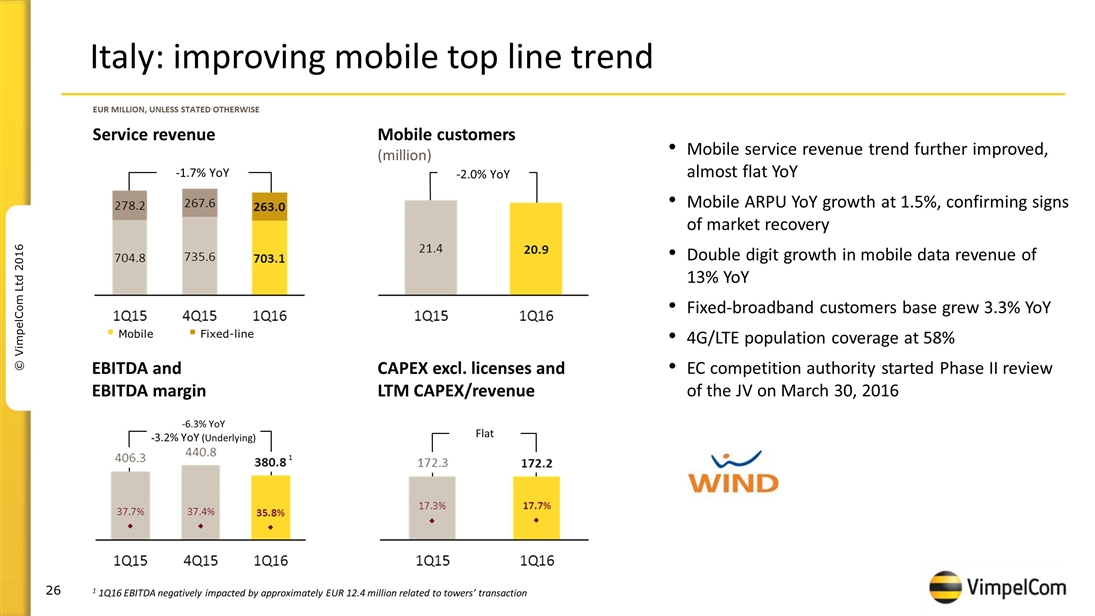

ITALY (RECLASSIFIED AS AN ASSET HELD FOR SALE)

| EUR mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

1,064 | 1,078 | (1%) | |||||||||

| Mobile service revenue |

703 | 705 | (0%) | |||||||||

| Fixed-line service revenue |

263 | 278 | (5%) | |||||||||

| EBITDA |

381 | 406 | (6%) | |||||||||

| EBITDA margin |

36% | 38% | (1.9 p.p.) | |||||||||

| Capex excl licenses |

172.2 | 172.2 | 0.0% | |||||||||

| LTM Capex excl licenses/revenue |

18% | 17% | 0.3 p.p. | |||||||||

| Mobile |

||||||||||||

| Total revenue |

796 | 781 | 2% | |||||||||

| - of which mobile data |

174 | 154 | 13% | |||||||||

| Customers (mln) |

20.9 | 21.4 | (2%) | |||||||||

| - of which data customers (mln) |

11.6 | 10.9 | 6% | |||||||||

| ARPU (EUR) |

11 | 11 | 2% | |||||||||

| MOU (min) |

270 | 267 | 1% | |||||||||

| Data usage (MB) |

1,742 | 1,392 | 25% | |||||||||

| Fixed-line |

||||||||||||

| Total revenue |

269 | 297 | (10%) | |||||||||

| Total voice customers (mln) |

2.8 | 2.8 | (2%) | |||||||||

| ARPU (EUR) |

27.3 | 27.9 | (2%) | |||||||||

| Broadband customers (mln) |

2.3 | 2.2 | 3% | |||||||||

| Broadband ARPU (EUR) |

20.5 | 21.1 | (3%) | |||||||||

| Dual-play customers (mln) |

2.1 | 2.0 | 7% | |||||||||

VimpelCom Ltd. 1Q 2016 | 18

On May 12, 2016, VimpelCom will host an analyst & investor conference call on its 1Q 2016 results at 2:00 pm CET (1:00 pm BST). The call and slide presentation may be accessed at http://www.vimpelcom.com

2:00 pm CET investor and analyst conference call

US call-in number: + 1 (877) 280 1254

Confirmation Code: 7526428

International call-in number: + 1 (646) 254 3388

Confirmation Code: 7526428

The conference call replay and the slide presentations webcast will be available until May 25, 2016. The slide presentation will also be available for download on VimpelCom’s website.

Investor and analyst call replay

US Replay Number: +1 (866) 932 5017

Confirmation Code: 9715424

UK Replay Number: 0 800 358 7735

Confirmation Code: 9715424

CONTACT INFORMATION

| INVESTOR RELATIONS

Bart Morselt Tel: +31 20 79 77 200 (Amsterdam) |

MEDIA AND PUBLIC RELATIONS

Neil Moorhouse Tel: +31 20 79 77 200 (Amsterdam) |

VimpelCom Ltd. 1Q 2016 | 19

DISCLAIMER

This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things; the Company’s stated 2016 performance targets; future market developments and trends; expected synergies and timing of completion of the Italy joint venture and the Warid Telecom transaction; operational and network development and network investment, including expectations regarding the roll out and benefits of 4G/LTE in Russia and Italy, anticipated timing of roll-out and benefits from 3G services in Algeria, Pakistan and Ukraine and the Company’s ability to realize its targets and strategic initiatives in the various countries of operation. The forward-looking statements included in this release are based on management’s best assessment of the Company’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of continued volatility in the economies in our markets, unforeseen developments from competition, governmental regulation of the telecommunications industries, general political uncertainties in our markets, government investigations or other regulatory actions and/or litigation with third parties, failure to satisfy or waive the conditions to completion of all or any of the Italy joint venture and the Warid Telecom transaction, failure to obtain the requisite regulatory approvals or the receipt of approvals on terms not acceptable to the parties to these transactions, failure of the expected benefits of the Italy joint venture and the Warid Telecom transaction to materialize as expected or at all due to, among other things, the parties’ inability to successfully implement integration strategies or otherwise realize the anticipated synergies, and other risks beyond the parties’ control and failure to meet expectations regarding various strategic initiatives, including, but not limited to, the performance transformation program. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015 filed with the SEC and other public filings made by the Company with the SEC. The forward-looking statements speak only as of the date hereof, and the Company disclaims any obligation to update them or to announce publicly any revision to any of the forward-looking statements contained in this release, or to make corrections to reflect future events or developments.

ABOUT VIMPELCOM

VimpelCom (NASDAQ: VIP) is an international communications and technology company driven by a vision to unlock new opportunities for customers as they navigate the digital world. Present in some of the world’s most dynamic markets, VimpelCom provides more than 200 million customers with voice, fixed broadband, data and digital services. VimpelCom’s heritage as a pioneer in technology is the driving force behind a major transformation focused on bringing the digital world to each and every customer. VimpelCom offers services to customers in 14 markets including Russia, Italy, Algeria, Pakistan, Uzbekistan, Kazakhstan, Ukraine, Bangladesh, Kyrgyzstan, Tajikistan, Armenia, Georgia, Laos, and Zimbabwe. VimpelCom operates under the “Beeline”, “Kyivstar”, “WIND”, “Mobilink”, “banglalink”, “Telecel”, and “Djezzy” brands.

|

Follow us on Twitter @VimpelCom | |

|

visit our blog @ blog.vimpelcom.com | |

|

go to our website @ http://www.vimpelcom.com | |

VimpelCom Ltd. 1Q 2016 | 20

| Attachment A |

VimpelCom ltd interim financial schedules | 22 | ||||

| Attachment B |

Debt overview | 25 | ||||

| Attachment C |

Country details | 26 | ||||

| Attachment D |

Reconciliation tables | 28 | ||||

| Average rates of functional currencies to USD | ||||||

| Attachment E |

WIND Telecomunicazioni group condensed financial statement of income | 30 | ||||

| Attachment F |

Reconciliation of revised financial statements 4Q15 | 31 | ||||

| Attachment G |

32 | |||||

For more information on financial and operating data for specific countries, please refer to the supplementary file Factbook1Q2016.xls on VimpelCom’s website at http://vimpelcom.com/ir/financials/results.wbp

VimpelCom Ltd. 1Q 2016 | 21

ATTACHMENT A: VIMPELCOM LTD INTERIM FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF INCOME

| USD mln | 1Q16 | 1Q15 | ||||||

| Total operating revenues |

2,023 | 2,312 | ||||||

| of which other revenues |

26 | 18 | ||||||

| Operating expenses |

||||||||

| Service costs, equipment and accessories |

445 | 514 | ||||||

| Selling, general and administrative expenses |

820 | 860 | ||||||

| Depreciation |

332 | 398 | ||||||

| Amortization |

112 | 127 | ||||||

| Impairment loss |

8 | 98 | ||||||

| Loss on disposals of non-current assets |

2 | 7 | ||||||

| Total operating expenses |

1,719 | 2,004 | ||||||

| Operating (profit)/ loss |

304 | 308 | ||||||

| Finance costs |

180 | 227 | ||||||

| Finance income |

(12 | ) | (12 | ) | ||||

| Other non-operating losses/(gains) |

38 | 9 | ||||||

| Shares of loss/(profit) of associates and joint ventures accounted for using the equity method |

5 | (16 | ) | |||||

| Net foreign exchange (gain)/ loss |

(62 | ) | 108 | |||||

| Profit /(loss) before tax |

155 | (8 | ) | |||||

| Income tax expense |

117 | 80 | ||||||

| Profit/ (loss) from continued operations |

38 | (88 | ) | |||||

| Profit/ (loss) from discontinued operations |

197 | 261 | ||||||

| Profit/(loss) for the period |

235 | 173 | ||||||

| Non-controlling interest |

(46 | ) | 11 | |||||

| The owners of the parent |

189 | 184 | ||||||

VimpelCom Ltd. 1Q 2016 | 22

ATTACHMENT A: VIMPELCOM LTD INTERIM FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| USD mln | 31 March 2016 | 31 December 2015 | ||||||

| Assets |

||||||||

| Non-current assets |

||||||||

| Property and equipment |

6,211 | 6,239 | ||||||

| Intangible assets |

2,170 | 2,224 | ||||||

| Goodwill |

4,358 | 4,223 | ||||||

| Investments in associates and joint ventures |

211 | 201 | ||||||

| Deferred tax asset |

150 | 150 | ||||||

| Income Tax advances, non-current |

17 | 28 | ||||||

| Financial assets |

175 | 164 | ||||||

| Other non-financial assets |

118 | 105 | ||||||

| Total non-current assets |

13,410 | 13,334 | ||||||

| Current assets |

||||||||

| Inventories |

91 | 104 | ||||||

| Trade and other receivables |

700 | 677 | ||||||

| Other non-financial assets |

366 | 334 | ||||||

| Current income tax asset |

283 | 259 | ||||||

| Other financial assets |

287 | 395 | ||||||

| Cash and cash equivalents |

2,928 | 3,614 | ||||||

| Total current assets |

4,656 | 5,383 | ||||||

| Assets classified as held for sale |

15,902 | 15,137 | ||||||

| Total assets |

33,969 | 33,854 | ||||||

| Equity and liabilities |

||||||||

| Equity |

||||||||

| Equity attributable to equity owners of the parent |

4,045 | 3,765 | ||||||

| Non-controlling interests |

153 | 129 | ||||||

| Total equity |

4,198 | 3,894 | ||||||

| Non-current liabilities |

||||||||

| Debt |

7,911 | 8,025 | ||||||

| Other financial liabilities |

70 | 70 | ||||||

| Provisions |

355 | 350 | ||||||

| Other non-financial liabilities |

81 | 95 | ||||||

| Deferred tax liability |

380 | 404 | ||||||

| Total non-current liabilities |

8,796 | 8,944 | ||||||

| Current liabilities |

||||||||

| Trade and other payables |

1,508 | 1,768 | ||||||

| Dividends payable to the owners and NCI |

0 | 0 | ||||||

| Debt |

1,775 | 1,519 | ||||||

| Other financial liabilities |

233 | 174 | ||||||

| Other non-financial liabilities |

1,160 | 1,039 | ||||||

| Current income tax payable |

40 | 19 | ||||||

| Provisions |

197 | 1,020 | ||||||

| Total current liabilities |

4,914 | 5,539 | ||||||

| Liabilities associated with assets held for sale |

16,061 | 15,477 | ||||||

| Total equity and liabilities |

33,969 | 33,854 | ||||||

VimpelCom Ltd. 1Q 2016 | 23

ATTACHMENT A: VIMPELCOM LTD FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

| USD mln | 1Q16 | 1Q15 | ||||||

| Operating activities |

||||||||

| Profit after tax |

38 | (88) | ||||||

| Income tax expenses |

117 | 80 | ||||||

| Profit before tax |

155 | (8) | ||||||

| Non-cash adjustment to reconcile profit before tax to net operating cash flows: |

| |||||||

| Depreciation |

332 | 398 | ||||||

| Amortization |

112 | 127 | ||||||

| Impairment loss |

8 | 98 | ||||||

| Loss/(Gain) From disposal of non current assets |

1 | 7 | ||||||

| Finance income |

(12 | ) | (12) | |||||

| Finance cost |

180 | 227 | ||||||

| Other non operating losses / (Gains) |

37 | 11 | ||||||

| Net foreign exchange loss / (gain) |

(62 | ) | 108 | |||||

| Share of loss of associates and joint ventures |

5 | (16) | ||||||

| Movements in provisions and pensions |

(816 | ) | (1,148) | |||||

| Changes in working capital |

13 | (74) | ||||||

| Net interest paid |

(202 | ) | (263) | |||||

| Net interest received |

12 | 11 | ||||||

| Income tax paid |

(125 | ) | (342) | |||||

| Changes due to discontinued operations from operating activity |

123 | 112 | ||||||

| Net cash from/(used in) operating activities |

(238 | ) | (764) | |||||

| Proceeds from sale of property and equipment |

2 | 5 | ||||||

| Proceeds from sale of intangible assets |

0 | 1 | ||||||

| Purchase of property, plant and equipment |

(338 | ) | (362) | |||||

| Purchase of licenses |

(44 | ) | (28) | |||||

| Purchase of other intangible assets |

(57 | ) | (59) | |||||

| Outflow for loan granted |

(2 | ) | (100) | |||||

| Inflow from loan granted |

0 | 2 | ||||||

| Inflows/(outflows) from financial assets |

2 | 61 | ||||||

| Inflows/(outflows) from deposits |

76 | (0) | ||||||

| Acquisition of a subsidiary, net of cash acquired |

0 | 0 | ||||||

| Proceeds from sales of share in subsidiaries, net of cash |

0 | 0 | ||||||

| Receipt of dividends |

— | 0 | ||||||

| Discontinued operations in investing activity |

(191 | ) | 530 | |||||

| Net cash from/(used in) investing activities |

(551 | ) | 50 | |||||

| Net proceeds from exercise of share options |

0 | 1 | ||||||

| Acquisition of non-controlling interest |

— | — | ||||||

| Gross proceeds from borrowings |

498 | 803 | ||||||

| Fees paid for the borrowings |

(7 | ) | — | |||||

| Repayment of borrowings |

(456 | ) | (1,425) | |||||

| Dividends paid to equity holders |

— | (0) | ||||||

| Proceeds from sale of treasury stock |

— | — | ||||||

| Dividends paid to non-controlling interests |

— | (57) | ||||||

| Proceeds from sale of non-controlling interests |

— | 2,325 | ||||||

| Discontinued operations in financing activity |

(10 | ) | (509) | |||||

| Net cash from/(used in) financing activities |

26 | 1,137 | ||||||

| Net increase/(decrease) in cash and cash equivalents |

(763 | ) | 423 | |||||

| Cash and cash equivalent at beginning of period |

3,614 | 6,342 | ||||||

| Net foreign exchange difference related to continued operations |

(1 | ) | (266) | |||||

| Net foreign exchange difference related to discontinued operations |

10 | — | ||||||

| Cash and cash equivalent reclassified as Held for Sale at the beginning of the period |

314 | — | ||||||

| Cash and cash equivalent reclassified as Held for Sale at the end of the period |

(246 | ) | — | |||||

| Cash and cash equivalent at end of period |

2,928 | 6,499 | ||||||

VimpelCom Ltd. 1Q 2016 | 24

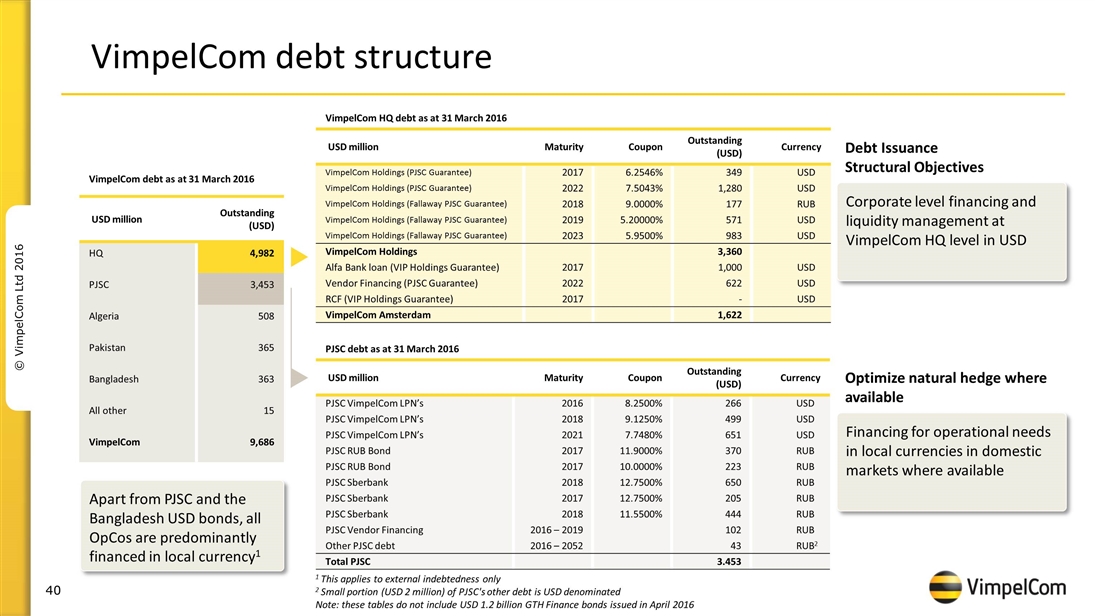

AS AT MARCH 31, 2016

| Type of debt | Interest rate | Debt currency |

Outstanding debt (mln) |

Outstanding debt (USD mln) |

Maturity date |

Guarantor | ||||||||||||||

| VimpelCom Holdings B.V. |

||||||||||||||||||||

| Notes |

6.2546% | USD | 349 | 349 | 01.03.2017 | PJSC VimpelCom | ||||||||||||||

| Notes |

7.5043% | USD | 1,280 | 1,280 | 01.03.2022 | PJSC VimpelCom | ||||||||||||||

| Notes |

9.0000% | RUB | 12,000 | 177 | 13.02.2018 | PJSC VimpelCom | ||||||||||||||

| Notes |

5.2000% | USD | 571 | 571 | 13.02.2019 | PJSC VimpelCom | ||||||||||||||

| Notes |

5.9500% | USD | 983 | 983 | 13.02.2023 | PJSC VimpelCom | ||||||||||||||

| VimpelCom Amsterdam B.V. |

||||||||||||||||||||

| Loan from AO Alfa Bank |

1 month LIBOR plus 3.15% |

USD | 500 | 500 | 17.04.2017 | VimpelCom Holdings B.V. | ||||||||||||||

| Loan from AO Alfa Bank |

1 month LIBOR plus 3.15% |

USD | 500 | 500 | 03.05.2017 | VimpelCom Holdings B.V. | ||||||||||||||

| Loan from China Development Bank Corporation |

6 month LIBOR plus 3.3% |

USD | 415 | 415 | 21.12.2020 | PJSC VimpelCom | ||||||||||||||

| Loan from HSBC Bank plc |

1.7200% | USD | 206 | 206 | 31.07.2022 | EKN, PJSC VimpelCom | ||||||||||||||

| PJSC VimpelCom |

||||||||||||||||||||

| Loan from VIP Finance Ireland (funded by the issuance of loan participation notes by VIP Finance Ireland) |

9.1250% | USD | 499 | 499 | 30.04.2018 | None | ||||||||||||||

| Loan from VIP Finance Ireland (funded by the issuance of loan participation notes by VIP Finance Ireland) |

7.7480% | USD | 651 | 651 | 02.02.2021 | None | ||||||||||||||

| Loan from UBS (Luxembourg) S.A. (funded by the issuance of loan participation notes by UBS (Luxembourg) S.A.) |

8.2500% | USD | 266 | 266 | 23.05.2016 | None | ||||||||||||||

| RUB denominated bonds |

10.0000% | RUB | 15,052 | 223 | 08.03.2022 | * | None | |||||||||||||

| RUB denominated bonds |

11.9000% | RUB | 25,000 | 370 | 03.10.2025 | ** | None | |||||||||||||

| Loan from Sberbank |

12.7500% | RUB | 43,929 | 650 | 11.04.2018 | None | ||||||||||||||

| Loan from Sberbank |

12.7500% | RUB | 13,889 | 205 | 29.05.2017 | None | ||||||||||||||

| Loan from Sberbank |

11.5500% | RUB | 30,000 | 444 | 29.06.2018 | None | ||||||||||||||

| Loan from HSBC Bank plc, Nordea Bank AB (publ) |

3 month MOSPRIME plus 1.0% |

RUB | 2,962 | 44 | 30.04.2019 | EKN | ||||||||||||||

| Pakistan Mobile Communications Limited (“PMCL”) |

||||||||||||||||||||

| Loan from Habib Bank Limited |

6 months KIBOR + 1.15% |

PKR | 4,500 | 43 | 16.05.2019 | None | ||||||||||||||

| Syndicated loan via MCB Bank Limited |

3 months KIBOR + 1.25% |

PKR | 3,500 | 33 | 28.11.2017 | None | ||||||||||||||

| Syndicated loan via MCB Bank Limited |

6 months KIBOR + 1.25% |

PKR | 7,000 | 67 | 16.05.2019 | None | ||||||||||||||

| Loan from United Bank Limited |

6 months KIBOR + 1.10% |

PKR | 4,000 | 38 | 16.05.2021 | None | ||||||||||||||

| Sukuk Certificates |

3 months KIBOR + 0.88% |

PKR | 6,900 | 66 | 22.12.2019 | None | ||||||||||||||

| Syndicated loan via Allied Bank Limited |

6 months KIBOR + 1.00% |

PKR | 3,619 | 35 | 26.11.2018 | None | ||||||||||||||

| Banglalink Digital Communications Ltd. (“BDC”) |

||||||||||||||||||||

| Senior Notes |

8.6250% | USD | 300 | 300 | 06.05.2019 | None | ||||||||||||||

| Omnium Telecom Algeria SpA |

||||||||||||||||||||

| Syndicated Loan Facility |

Bank of Algeria Re-Discount Rate + 2.0% |

DZD | 50,000 | 461 | 30.09.2019 | None | ||||||||||||||

|

Other loans, equipment financing and capital lease obligations |

310 | |||||||||||||||||||

| * | Subject to investor put option at March 17, 2017 |

| ** | Subject to investor put option at October 13, 2017 |

Note: the table does not include USD 1.2 billion of indebtedness as a result of the issuance of bonds by GTH Finance B.V. in April 2016.

VimpelCom Ltd. 1Q 2016 | 25

CUSTOMERS

| Mobile | Fixed-line broadband | |||||||||||||||||||||||

| million | 1Q16 | 1Q15 | YoY | 1Q16 | 1Q15 | YoY | ||||||||||||||||||

| Russia |

57.7 | 55.7 | 4 | % | 2.2 | 2.3 | (4 | %) | ||||||||||||||||

| Algeria |

16.7 | 17.1 | (2 | %) | — | — | — | |||||||||||||||||

| Pakistan |

38.1 | 38.2 | (0 | %) | — | — | — | |||||||||||||||||

| Bangladesh |

31.6 | 31.8 | (1 | %) | — | — | — | |||||||||||||||||

| Emerging markets |

86.3 | 87.1 | (1 | %) | — | — | — | |||||||||||||||||

| Ukraine |

25.3 | 26.1 | (3 | %) | 0.8 | 0.8 | (1 | %) | ||||||||||||||||

| Kazakhstan |

9.2 | 9.6 | (4 | %) | 0.2 | 0.2 | 9 | % | ||||||||||||||||

| Uzbekistan |

9.5 | 10.4 | (8 | %) | 0.00 | 0.01 | (100 | %) | ||||||||||||||||

| Armenia |

0.8 | 0.8 | 7 | % | 0.1 | 0.2 | (5 | %) | ||||||||||||||||

| Tajikistan |

1.2 | 1.3 | (6 | %) | — | — | — | |||||||||||||||||

| Georgia |

1.2 | 1.3 | (4 | %) | — | — | — | |||||||||||||||||

| Kyrgystan |

2.6 | 2.7 | (6 | %) | — | — | — | |||||||||||||||||

| Eurasia |

49.8 | 52.1 | (4 | %) | 1.2 | 1.2 | (1 | %) | ||||||||||||||||

| Laos |

0.2 | 0.2 | 4 | % | — | — | ||||||||||||||||||

| Total |

194.0 | 195.1 | (1 | %) | 3.4 | 3.5 | (3 | %) | ||||||||||||||||

| Italy |

20.9 | 21.4 | (2 | %) | 2.3 | 2.2 | 3 | % | ||||||||||||||||

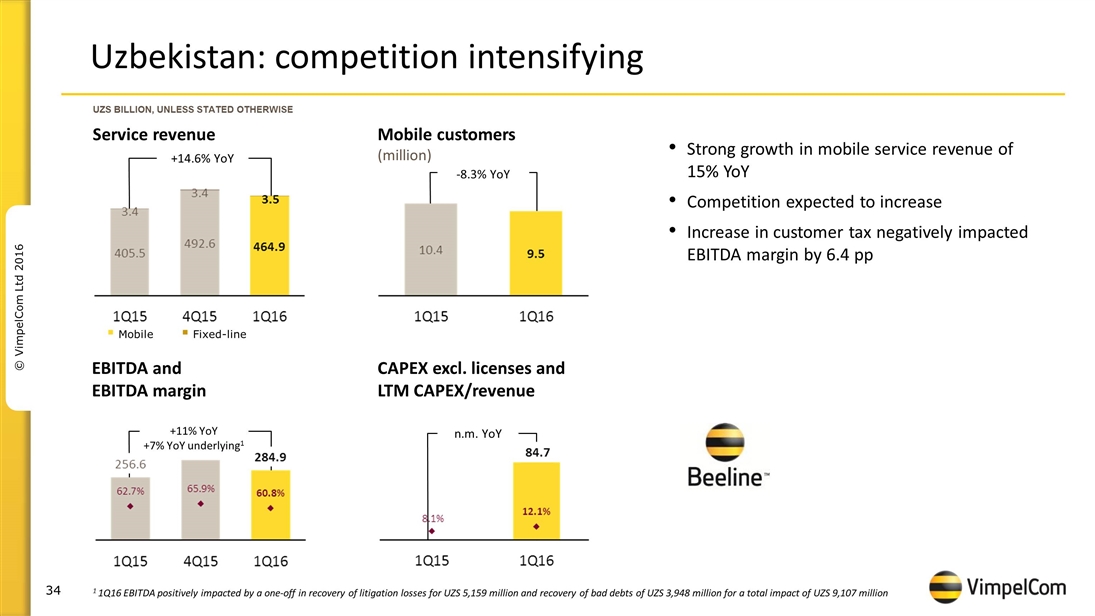

UZBEKISTAN

| UZS bln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

469 | 409 | 15% | |||||||||

| Mobile service revenue |

465 | 405 | 15% | |||||||||

| of which mobile data |

90 | 84 | 7% | |||||||||

| Fixed-line service revenue |

3 | 3 | 4% | |||||||||

| EBITDA |

285 | 257 | 11% | |||||||||

| EBITDA margin |

61% | 63% | (1.9 p.p.) | |||||||||

| Capex excl licenses |

85 | (0) | n.m. | |||||||||

| LTM Capex excl licenses /revenue |

12% | 8% | 4.0 p.p | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

9.5 | 10.4 | (8%) | |||||||||

| Of which mobile data customers |

4.4 | 5.2 | (16%) | |||||||||

| ARPU (UZS) |

15,877 | 12,883 | 23% | |||||||||

| MOU (min) |

472 | 498 | (5%) | |||||||||

| Data usage (MB) |

218 | 154 | 42% | |||||||||

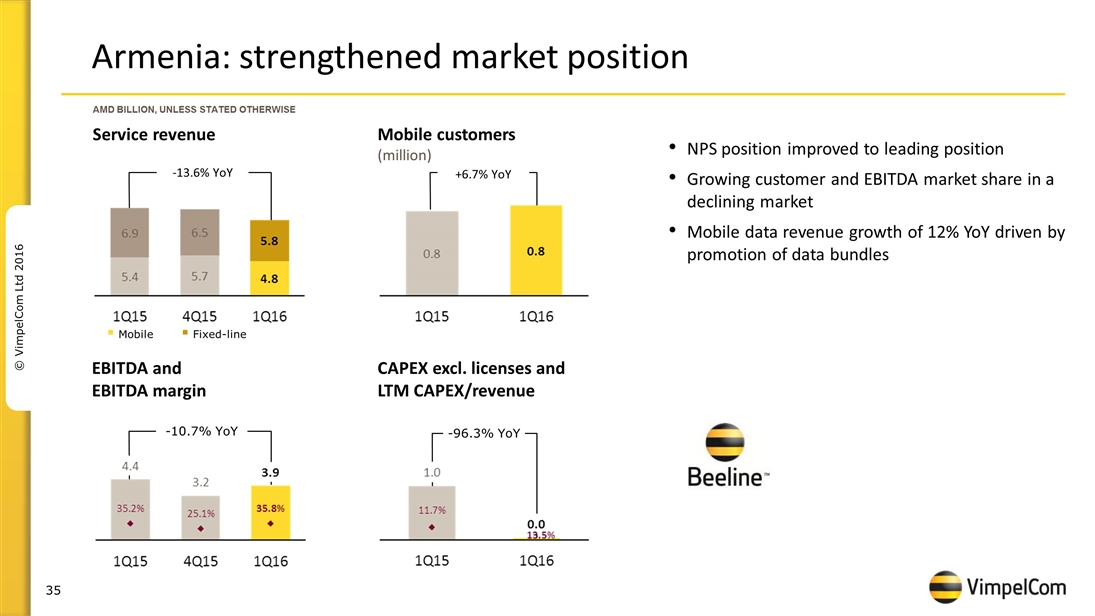

ARMENIA

| AMD mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

11,010 | 12,528 | (12%) | |||||||||

| Mobile service revenue |

4,847 | 5,355 | (9%) | |||||||||

| - of which mobile data |

709 | 633 | 12% | |||||||||

| Fixed service revenue |

5,774 | 6,943 | (17%) | |||||||||

| EBITDA |

3,942 | 4,415 | (11%) | |||||||||

| EBITDA margin |

36% | 35% | 0.6 p.p | |||||||||

| Capex excl licenses |

247 | 975 | (75%) | |||||||||

| LTM Capex excl licenses /revenue |

14% | 12% | 2.2 p.p. | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

0.8 | 0.8 | 7% | |||||||||

| -of which mobile data customers |

0.4 | 0.4 | 5% | |||||||||

| ARPU (USD) |

1,861 | 2,229 | (16%) | |||||||||

| MOU (min) |

335 | 341 | (2%) | |||||||||

| Data usage(MB) |

1,504 | 1,248 | 21% | |||||||||

VimpelCom Ltd. 1Q 2016 | 26

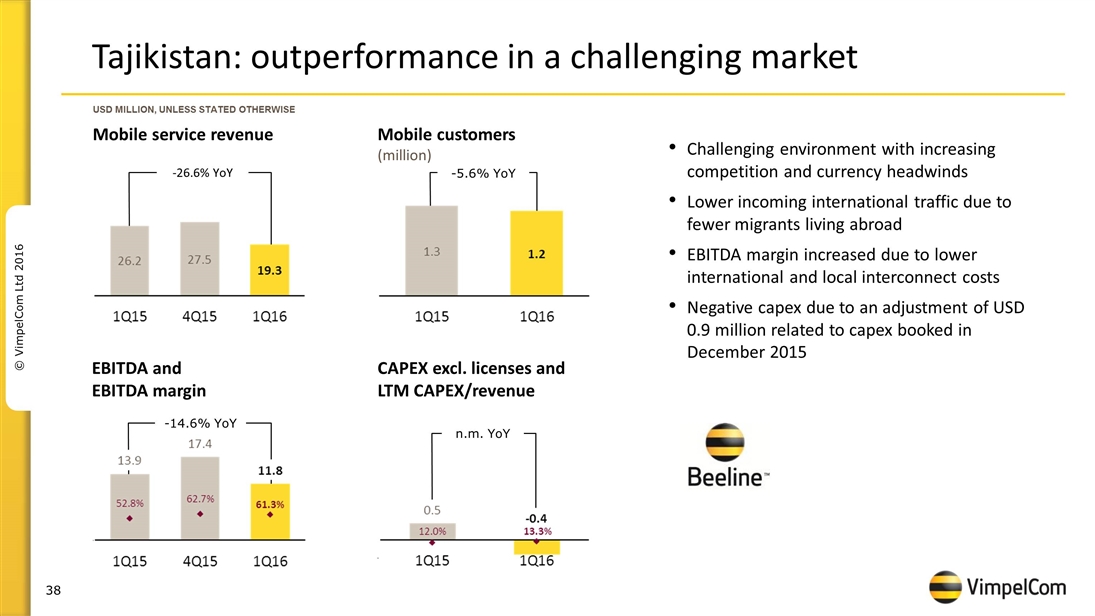

TAJIKISTAN

| USD mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

19 | 26 | (27%) | |||||||||

| Mobile service revenue |

19 | 26 | (27%) | |||||||||

| - of which mobile data |

1 | 1 | (32%) | |||||||||

| EBITDA |

12 | 14 | (15%) | |||||||||

| EBITDA margin |

61.3% | 52.8% | 8.5 p.p | |||||||||

| Capex excl licenses |

(0) | 0 | n.m. | |||||||||

| LTM Capex excl licenses/revenue |

13% | 12% | 1.3 p.p | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

1.2 | 1.3 | (6%) | |||||||||

| - of which mobile data customers (mln) |

0.5 | 0.5 | 3% | |||||||||

| ARPU (USD) |

5.4 | 6.8 | (20%) | |||||||||

| MOU (min) |

279 | 263 | 6% | |||||||||

| Data usage (MB) |

265 | 89 | 199% | |||||||||

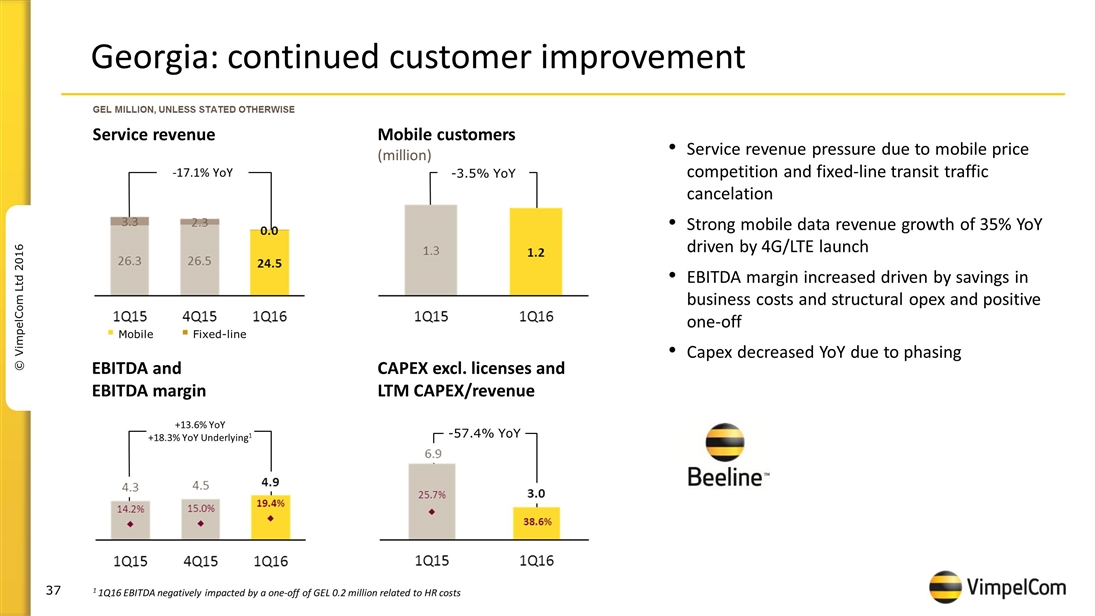

| GEORGIA | ||||||||||||

| GEL mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

25 | 30 | (17%) | |||||||||

| Mobile service revenue |

25 | 26 | (7%) | |||||||||

| -of which mobile data |

1 | 1 | 35% | |||||||||

| Fixed-line service revenue |

0 | 3 | (100%) | |||||||||

| EBITDA |

5 | 4 | 14% | |||||||||

| EBITDA margin |

19% | 14% | 5.2 p.p | |||||||||

| Capex excl licenses |

3 | 7 | (57%) | |||||||||

| LTM Capex excl licenses /revenue |

39% | 26% | 12.9 p.p | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

1.2 | 1.3 | (4%) | |||||||||

| -data customers |

0.4 | 0.5 | (3%) | |||||||||

| ARPU (GEL) |

6 | 7 | (7%) | |||||||||

| MOU (min) |

234 | 226 | 4% | |||||||||

| Data usage (MB) |

597 | 89 | 571% | |||||||||

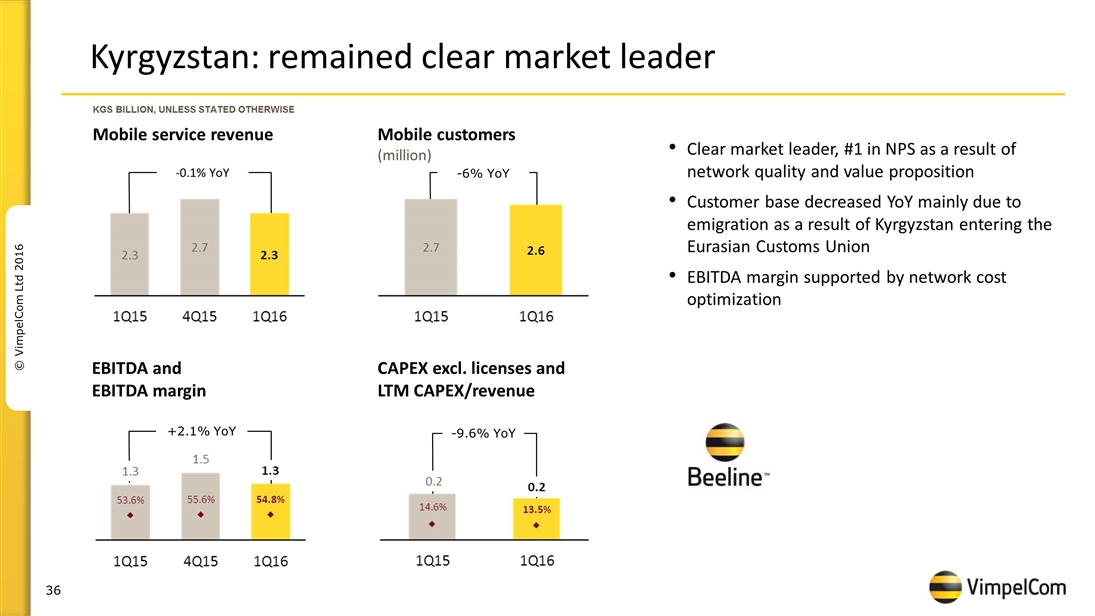

| KYRGYZSTAN | ||||||||||||

| KGZ mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total revenue |

2,332 | 2,340 | (0%) | |||||||||

| Mobile service revenue |

2,316 | 2,318 | (0%) | |||||||||

| - of which mobile data |

304 | 291 | 4% | |||||||||

| EBITDA |

1,279 | 1,253 | 2% | |||||||||

| EBITDA margin |

54.8% | 53.6% | 1.3 p.p | |||||||||

| Capex excl licenses |

152 | 168 | (10%) | |||||||||

| LTM Capex excl licenses/revenue |

13% | 15% | (1.1 p.p) | |||||||||

| Mobile |

||||||||||||

| Customers (mln) |

2.6 | 2.7 | (6%) | |||||||||

| - of which mobile data customers (mln) |

1.5 | 1.6 | (6%) | |||||||||

| ARPU (KGZ) |

289 | 281 | 3% | |||||||||

| MOU (min) |

206 | 261 | (21%) | |||||||||

| Data usage (MB) |

422 | 184 | 130% | |||||||||

VimpelCom Ltd. 1Q 2016 | 27

ATTACHMENT D: RECONCILIATION TABLES

RECONCILIATION OF CONSOLIDATED EBITDA OF VIMPELCOM

| USD mln | 1Q16 | 1Q15 | ||||||

| Unaudited |

||||||||

| EBITDA |

758 | 938 | ||||||

| Depreciation |

(332 | ) | (398 | ) | ||||

| Amortization |

(112 | ) | (127 | ) | ||||

| Impairment loss |

(8 | ) | (98 | ) | ||||

| Loss on disposals of non-current assets |

(1 | ) | (7 | ) | ||||

| EBIT |

304 | 308 | ||||||

| Financial Income and Expenses |

(168 | ) | (215 | ) | ||||

| - including finance income |

12 | 12 | ||||||

| - including finance costs |

(180 | ) | (227 | ) | ||||

| Net foreign exchange (loss)/gain and others |

19 | (101 | ) | |||||

| - including Other non-operating (losses)/gains |

(38 | ) | (9 | ) | ||||

| - including Shares of loss of associates and joint ventures accounted for using the equity method |

(5 | ) | 16 | |||||

| - including Net foreign exchange gain |

62 | (108 | ) | |||||

| EBT |

155 | (8 | ) | |||||

| Income tax expense |

117 | 80 | ||||||

| Profit/ (loss) from discontinued operations |

197 | 261 | ||||||

| Profit/(loss) for the year |

235 | 173 | ||||||

| Profit/(loss) for the year attributable to non-controlling interest |

46 | (11 | ) | |||||

| Profit for the year attributable to the owners of the parent |

189 | 184 | ||||||

VimpelCom Ltd. 1Q 2016 | 28

RECONCILIATION OF CONSOLIDATED REPORTED AND UNDERLYING EBITDA OF VIMPELCOM

| USD mln, unaudited | 1Q16 | 1Q15 | ||||||

| EBITDA |

758 | 938 | ||||||

|

|

|

|

|

|||||

| Transformation costs, of which |

44 | — | ||||||

| other transformation costs at OpCo level |

9 | |||||||

| other transformation costs at HQ level |

35 | |||||||

| Other exceptional items in OpCos, of which |

(4 | ) | 7 | |||||

| Reversal in tax provisions in Ukraine |

(1 | ) | ||||||

| Reversal of legal expenses and bad debt in Uzbekistan |

(3 | ) | ||||||

| Sim re-verification costs in Pakistan |

7 | |||||||

|

|

|

|

|

|||||

| Total exceptional items |

40 | 7 | ||||||

| EBITDA underlying |

799 | 945 | ||||||

VimpelCom Ltd. 1Q 2016 | 29

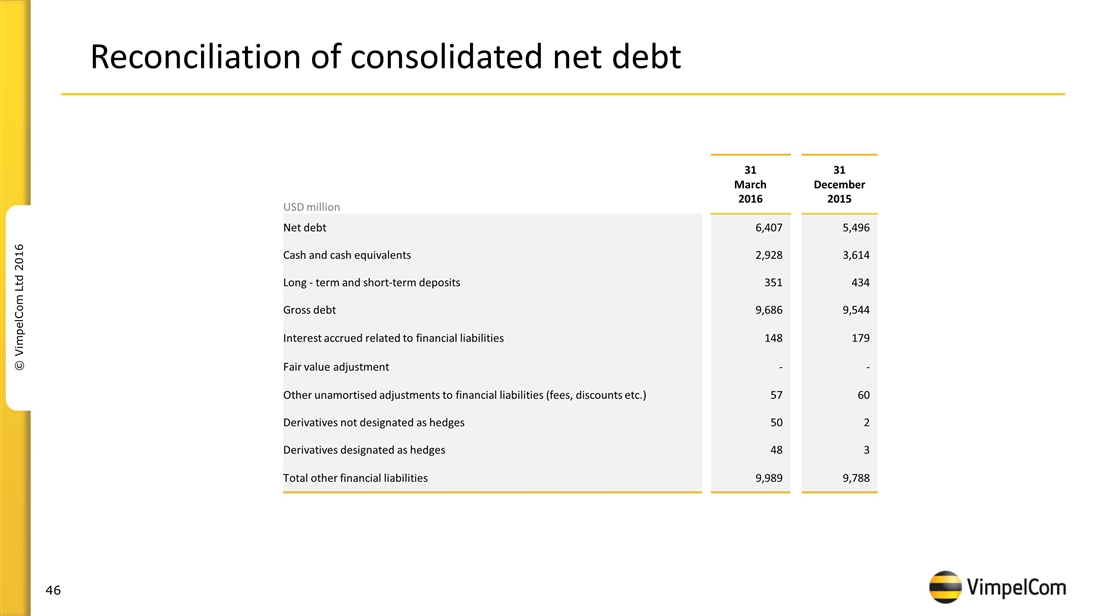

RECONCILIATION OF VIMPELCOM CONSOLIDATED NET DEBT

| USD mln | 31 March 2016 | 31 December 2015 | 31 March 2015 | |||||||||

| Net debt |

6,407 | 5,496 | 5,883 | |||||||||

| Cash and cash equivalents |

2,928 | 3,614 | 6,135 | |||||||||

| Long - term and short-term deposits |

351 | 434 | 118 | |||||||||

| Gross debt |

9,686 | 9,544 | 12,136 | |||||||||

| Interest accrued related to financial liabilities |

148 | 179 | 157 | |||||||||

| Fair value adjustment |

— | — | — | |||||||||

| Other unamortised adjustments to financial liabilities (fees, discounts etc.) |

57 | 60 | 60 | |||||||||

| Derivatives not designated as hedges |

50 | 2 | — | |||||||||

| Other liabilities at amortized costs |

— | — | 271 | |||||||||

| Derivatives designated as hedges |

48 | 3 | 33 | |||||||||

| Total other financial liabilities |

9,989 | 9,788 | 12,657 | |||||||||

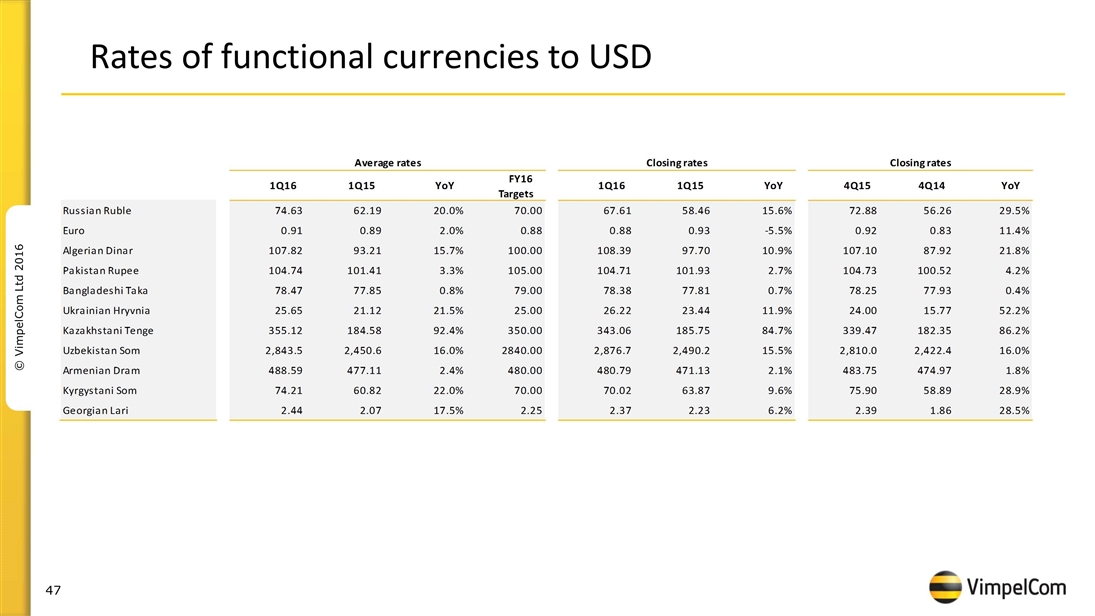

RATES OF FUNCTIONAL CURRENCIES TO USD1

| Average rates | Closing rates | |||||||||||||||||||||||

| 1Q16 | 1Q15 | YoY | 1Q16 | 1Q15 | YoY | |||||||||||||||||||

| Russian Ruble |

74.63 | 62.19 | 20.0 | % | 67.61 | 58.46 | 15.6 | % | ||||||||||||||||

| Euro |

0.91 | 0.89 | 2.0 | % | 0.88 | 0.93 | -5.5 | % | ||||||||||||||||

| Algerian Dinar |

107.82 | 93.21 | 15.7 | % | 108.39 | 97.70 | 10.9 | % | ||||||||||||||||

| Pakistan Rupee |

104.74 | 101.41 | 3.3 | % | 104.71 | 101.93 | 2.7 | % | ||||||||||||||||

| Bangladeshi Taka |

78.47 | 77.85 | 0.8 | % | 78.38 | 77.81 | 0.7 | % | ||||||||||||||||

| Ukrainian Hryvnia |

25.65 | 21.12 | 21.5 | % | 26.22 | 23.44 | 11.9 | % | ||||||||||||||||

| Kazakh Tenge |

355.12 | 184.58 | 92.4 | % | 343.06 | 185.65 | 84.8 | % | ||||||||||||||||

| Uzbekistan Som |

2,843.5 | 2,450.6 | 16.0 | % | 2,876.7 | 2,490.2 | 15.5 | % | ||||||||||||||||

| Armenian Dram |

488.59 | 477.11 | 2.4 | % | 480.79 | 471.13 | 2.1 | % | ||||||||||||||||

| Kyrgyz Som |

74.21 | 60.82 | 22.0 | % | 70.02 | 63.87 | 9.6 | % | ||||||||||||||||

| Georgian Lari |

2.44 | 2.07 | 17.5 | % | 2.37 | 2.23 | 6.2 | % | ||||||||||||||||

| 1) | Functional currency in Tajikistan is USD |

ATTACHMENT E: WIND TELECOMUNICAZIONI GROUP CONDENSED STATEMENTS OF INCOME

| EUR mln | 1Q16 | 1Q15 | YoY | |||||||||

| Total Revenue |

1,064 | 1,078 | (1%) | |||||||||

| EBITDA |

381 | 406 | (6%) | |||||||||

| D&A |

(280 | ) | 189 | n.m. | ||||||||

| EBIT |

101 | 596 | n.m. | |||||||||

| Financial Income and expenses |

(61 | ) | (77 | ) | n.m. | |||||||

| EBT |

40 | 519 | n.m. | |||||||||

| Income Tax |

(29 | ) | (62 | ) | n.m. | |||||||

| Net profit/(loss) |

11 | 456 | n.m. | |||||||||

VimpelCom Ltd. 1Q 2016 | 30

ATTACHMENT F: RECONCILIATION OF REVISED FINANCIAL STATEMENTS 4Q15

REVISED STATEMENT OF FINANCIAL POSITION

Subsequent to the 4Q 2015 earnings release certain non-significant accounting adjustments were made to the financial statements, which are reflected in the tables below. References to 4Q 2015 figures throughout this earnings release reflect the figures as revised below.

| USD mln | 4Q15 as reported on February 17, 2016 |

Russia: reversal of restructuring provision |

Italy: reversal of deferred tax liability on a |

Uzbekistan reclassification |

4Q15 Revised |

|||||||||||||||

| Assets |

||||||||||||||||||||

| Total non-current assets |

13,317 | 17 | 13,334 | |||||||||||||||||

| Total current assets |

5,387 | (4 | ) | 5,383 | ||||||||||||||||

| Assets classified as held for sale |

15,137 | 15,137 | ||||||||||||||||||

| Total assets |

33,841 | (4 | ) | 17 | 33,854 | |||||||||||||||

| Equity and liabilities |

||||||||||||||||||||

| Equity attributable to equity owners of the parent |

3,729 | 14 | 22 | 3,765 | ||||||||||||||||

| Non-controlling interests |

129 | 129 | ||||||||||||||||||

| Total equity |

3,858 | 14 | 22 | 3,894 | ||||||||||||||||

| Total non-current liabilities |

8,874 | 70 | 8,944 | |||||||||||||||||

| Total current liabilities |

5,633 | (18 | ) | (5 | ) | (70 | ) | 5,539 | ||||||||||||

| Liabilities associated with assets held for sale |

15,477 | 15,477 | ||||||||||||||||||

| Total equity and liabilities |

33,841 | (4 | ) | 17 | 33,854 | |||||||||||||||

REVISED STATEMENT OF INCOME

| USD mln | 4Q15 as reported on February 17, 2016 |

Russia: reversal of provision |

Italy: reversal of liability on a loan |

4Q15 Revised |

||||||||||||

| Total operating revenues |

9,625 | 9,625 | ||||||||||||||

| Operating expenses |

9,119 | (18 | ) | 9,101 | ||||||||||||

| Operating profit |

506 | 18 | 524 | |||||||||||||

| Profit before tax |

(613 | ) | 18 | (595 | ) | |||||||||||

| Income tax expense |

238 | 4 | (22 | ) | 220 | |||||||||||

| Profit for the period |

(589 | ) | 14 | 22 | (553 | ) | ||||||||||

| Attributable to: |

||||||||||||||||

| Non-controlling interest |

103 | 102 | ||||||||||||||

| Net income attributable to VimpelCom shareholders |

(691 | ) | 14 | 22 | (655 | ) | ||||||||||

VimpelCom Ltd. 1Q 2016 | 31

ARPU (Average Revenue per User) is calculated by dividing service revenue for the relevant period, including revenue from voice-, roaming-, interconnect-, and value added services (including mobile data, SMS, MMS), but excluding revenue from visitors roaming, connection fees, sales of handsets and accessories and other non-service revenue, by the average number of customers during the period and dividing by the number of months in that period. For Italy Business Unit, visitors roaming revenue is included into service revenue for ARPU calculation.

Data customers are the customer contracts that served as a basis for revenue generating activity in the three months prior to the measurement date, as a result of activities including monthly Internet access using FTTB and xDSL technologies as well as mobile Internet access via WiFi and USB modems using 2.5G/3G/4G/HSPA+ technologies. The Italy Business Unit measures fixed data customers based on the number of active contracts signed and mobile data includes customers that have performed at least one mobile Internet event in the previous month. The Russia Business Unit includes IPTV activities. For Kazakhstan and Eurasia subsidiaries, mobile data customers are those who have performed at least one mobile Internet event in the three-month period prior to the measurement date. For Algeria, data customers are 3G customers who have performed at least one mobile data event on 3G network in the previous four months.

Capital expenditures (Capex) are purchases of new equipment, new construction, upgrades, software, other long lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Long-lived assets acquired in business combinations are not included in capital expenditures.

EBIT is a non-GAAP measure and is calculated as EBITDA plus depreciation, amortization and impairment loss. Our management uses EBIT as a supplemental performance measure and believes that it provides useful information of earnings of the Company before making accruals for financial income and expenses and net foreign exchange (loss)/gain and others. Reconciliation of EBIT to net income attributable to VimpelCom Ltd., the most directly comparable IFRS financial measure, is presented above.

EBITDA is a non-GAAP financial measure. EBITDA is defined as earnings before interest, tax, depreciation and amortization. VimpelCom calculates EBITDA as operating income before depreciation, amortization, loss from disposal of non-current assets and impairment loss and includes certain non-operating losses and gains mainly represented by litigation provisions for all of its Business Units except for its Russia Business Unit. The Russia Business Unit’s EBITDA is calculated as operating income before depreciation, amortization, loss from disposal of non-current assets and impairment loss. EBITDA should not be considered in isolation or as a substitute for analyses of the results as reported under IFRS. Our management uses EBITDA and EBITDA margin as supplemental performance measures and believes that EBITDA and EBITDA margin provide useful information to investors because they are indicators of the strength and performance of the Company’s business operations, including its ability to fund discretionary spending, such as capital expenditures, acquisitions and other investments, as well as indicating its ability to incur and service debt. In addition, the components of EBITDA include the key revenue and expense items for which the Company’s operating managers are responsible and upon which their performance is evaluated. EBITDA also assists management and investors by increasing the comparability of the Company’s performance against the performance of other telecommunications companies that provide EBITDA information. This increased comparability is achieved by excluding the potentially inconsistent effects between periods or companies of depreciation, amortization and impairment losses, which items may significantly affect operating income between periods. However, our EBITDA results may not be directly comparable to other companies’ reported EBITDA results due to variances and adjustments in the components of EBITDA (including our calculation of EBITDA) or calculation measures. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. Reconciliation of EBITDA to net income attributable to VimpelCom Ltd., the most directly comparable IFRS financial measure, is presented above.

EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage.

Households passed are households located within buildings, in which indoor installation of all the FTTB equipment necessary to install terminal residential equipment has been completed.

MBOU (Megabyte of use) is calculated by dividing the total data traffic by the average mobile data customers during the period.

VimpelCom Ltd. 1Q 2016 | 32

MFS (Mobile financial services) is a variety of innovative services, such as mobile commerce or m-commerce, that use a mobile phone as the primary payment user interface and allow mobile customers to conduct money transfers to pay for items such as goods at an online store, utility payments, fines and state fees, loan repayments, domestic and international remittances, mobile insurance and tickets for air and rail travel, all via their mobile phone.

MNP (Mobile number portability) is a facility provided by telecommunications operators, which enables customers to keep their telephone numbers when they change operators.

Mobile customers are SIM-cards registered in the system as of a measurement date, users of which generated revenue at any time during the three months prior to the measurement date. This includes revenue coming from any incoming and outgoing calls, subscription fee accruals, debits related to service, outgoing SMS, Multimedia Messaging Service (referred to as MMS), data transmission and receipt sessions, but does not include incoming SMS and MMS sent by VimpelCom or abandoned calls. VimpelCom’s total number of mobile customers also includes SIM-cards for use of mobile Internet service via USB modems and customers for WiFi. The number for Italy is based on SIM-cards, users of which generated revenue at any time during the twelve months prior to the measurement date.

MOU (Monthly Average Minutes of Use per User) is generally calculated by dividing the total number of minutes of usage for incoming and outgoing calls during the relevant period (excluding guest roamers) by the average number of mobile customers during the period and dividing by the number of months in that period. Algeria, Pakistan and Bangladesh units measure MOU based on billed minutes.

Net debt is a non-GAAP financial measure and is calculated as the sum of interest bearing long-term debt and short-term debt minus cash and cash equivalents, long-term and short-term deposits and fair value hedges. The Company believes that net debt provides useful information to investors because it shows the amount of debt outstanding to be paid after using available cash and cash equivalent and long-term and short-term deposits. Net debt should not be considered in isolation as an alternative to long-term debt and short-term debt, or any other measure of the company financial position. Reconciliation of net debt to long-term debt and short-term debt, the most directly comparable IFRS financial measures, is presented above in the reconciliation tables section.

Net foreign exchange (loss)/gain and others represents the sum of Net foreign exchange (loss)/gain, Equity in net (loss)/gain of associates and Other (expense)/income, net (primarily losses from derivative instruments), and is adjusted for certain non-operating losses and gains mainly represented by litigation provisions. Our management uses Net foreign exchange (loss)/gain and others as a supplemental performance measure and believes that it provides useful information about the impact of our debt denominated in foreign currencies on our results of operations due to fluctuations in exchange rates, the performance of our equity investees and other losses and gains the Company needs to manage the business.

NPS (Net Promoter Score) is the methodology VimpelCom uses to measure customer satisfaction.

Operational expenses (Opex) represents service costs and selling, general and administrative expenses.

Organic growth in revenue and EBITDA are non-GAAP financial measures that reflect changes in Revenue and EBITDA excluding foreign currency movements and other factors, such as businesses under liquidation, disposals, mergers and acquisitions.

Underlying growth Revenue and EBITDA also excludes MTR reductions and one-offs. We believe investors should consider these measures as they are more indicative of our ongoing performance and management uses these measures to evaluate the Company’s operational results and trends.

Reportable segments: the Company identified Russia, Italy, Algeria, Pakistan, Bangladesh, Ukraine and Eurasia based on the business activities in different geographical areas. Intersegment revenue is eliminated in consolidation.

Service costs represent costs directly associated with revenue generating activity such as traffic related expenses, costs of content and sim-cards as well as costs of handsets, telephone equipment and accessories sold.

Selling, general and administrative expenses represent expenses associated with customer acquisition and retention activities, network and IT maintenance, regular frequency payment, professional and consulting support, rent of premises, utilities, personnel and outsourcing as well as other general and administrative expenses. These expenses do not include personnel costs that have been capitalized as part of long-lived assets.

VimpelCom Ltd. 1Q 2016 | 33

1Q16 Results Presentation Amsterdam – May 12, 2016 Jean-Yves Charlier – Chief Executive Officer Andrew Davies – Chief Financial Officer

Disclaimer This presentation contains “forward-looking statements”, as the phrase is defined in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical facts, and include statements relating to, among other things, the Company's anticipated performance for 2016, future market developments and trends. The forward-looking statements included in this presentation are based on management’s best assessment of the Company’s strategic and financial position and of future market conditions, trends and other potential developments. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of: continued volatility in the economies in our markets; unforeseen developments from competition; governmental regulation of the telecommunications industries; general political uncertainties in our markets; government investigations and/or litigation with third parties; failure to realize synergies and/or the timing of completion of the Italy joint venture and the Warid Telecom transaction; failure to meet expectations regarding operational and network development and network investment, including expectations regarding the roll-out and the benefits of 4G/LTE in Russia and Italy, anticipated timing of roll-out and benefits from 3G services in Algeria, Pakistan and Ukraine, and failure to meet expectations regarding various strategic initiatives, including, but not limited to, the performance transformation program and/or changes to the capital structure. Certain other factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by the Company with the SEC. The forward-looking statements speak only as of the date hereof, and the Company disclaims any obligation to update them or to announce publicly any revision to any of the forward-looking statements contained in this presentation, or to make corrections to reflect future events or developments.

1Q16 Results update - speakers and agenda Jean-Yves Charlier – Chief Executive Officer Group highlights Financial highlights Andrew Davies – Chief Financial Officer Group results review Country results review Group FY16 guidance Jean-Yves Charlier – Chief Executive Officer Final remarks Q&A session

Revenue and underlying EBITDA back to organic growth, driven by strong EM, Ukraine and Uzbekistan, partially offset by Russia Highlights 1Q16 Italy JV regulatory review process ongoing; Phase II started, transaction expected to complete around year end Performance transformation accelerating and on track GTH Finance B.V. issued USD 1.2 billion bonds guaranteed by VimpelCom Holdings B.V. to refinance the shareholder loan Mobilink and Warid Telecom merger in Pakistan received first of four regulatory approvals; closing expected around the end of 2Q16 Settlements with the SEC/DOJ/OM regarding Uzbekistan investigation entered into and payments completed Strong organic mobile data revenue growth of 27% YoY supported by all operations

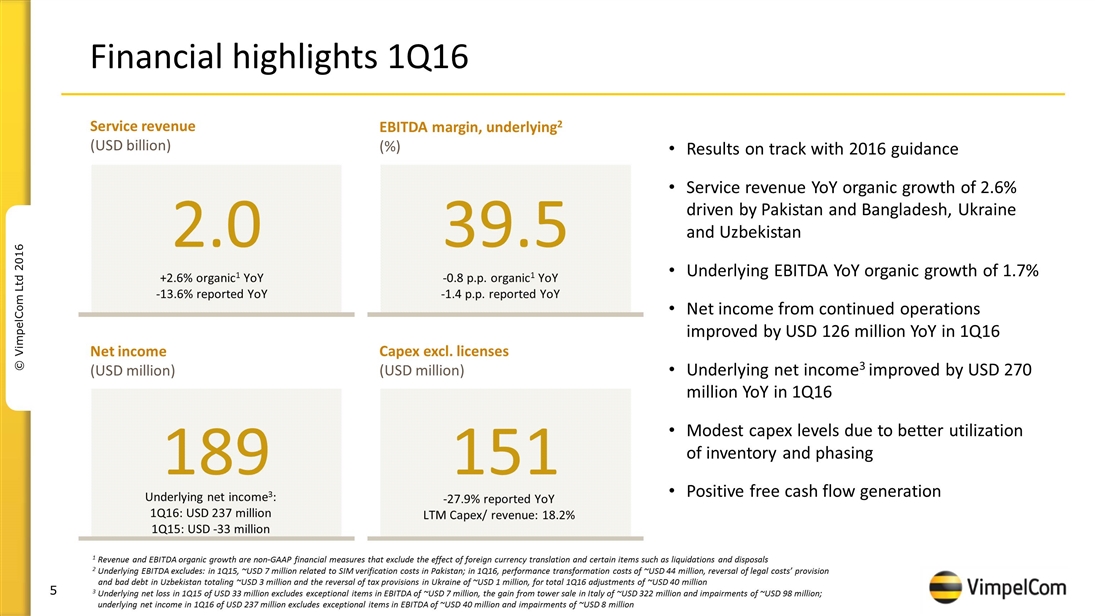

Financial highlights 1Q16 1 Revenue and EBITDA organic growth are non-GAAP financial measures that exclude the effect of foreign currency translation and certain items such as liquidations and disposals 2 Underlying EBITDA excludes: in 1Q15, ~USD 7 million related to SIM verification costs in Pakistan; in 1Q16, performance transformation costs of ~USD 44 million, reversal of legal costs’ provision and bad debt in Uzbekistan totaling ~USD 3 million and the reversal of tax provisions in Ukraine of ~USD 1 million, for total 1Q16 adjustments of ~USD 40 million 3 Underlying net loss in 1Q15 of USD 33 million excludes exceptional items in EBITDA of ~USD 7 million, the gain from tower sale in Italy of ~USD 322 million and impairments of ~USD 98 million; underlying net income in 1Q16 of USD 237 million excludes exceptional items in EBITDA of ~USD 40 million and impairments of ~USD 8 million Service revenue (USD billion) 2.0 Net income (USD million) EBITDA margin, underlying2 (%) Results on track with 2016 guidance Service revenue YoY organic growth of 2.6% driven by Pakistan and Bangladesh, Ukraine and Uzbekistan Underlying EBITDA YoY organic growth of 1.7% Net income from continued operations improved by USD 126 million YoY in 1Q16 Underlying net income3 improved by USD 270 million YoY in 1Q16 Modest capex levels due to better utilization of inventory and phasing Positive free cash flow generation 189 39.5 -0.8 p.p. organic1 YoY -1.4 p.p. reported YoY 151 +2.6% organic1 YoY -13.6% reported YoY Capex excl. licenses (USD million) -27.9% reported YoY LTM Capex/ revenue: 18.2% Underlying net income3: 1Q16: USD 237 million 1Q15: USD -33 million

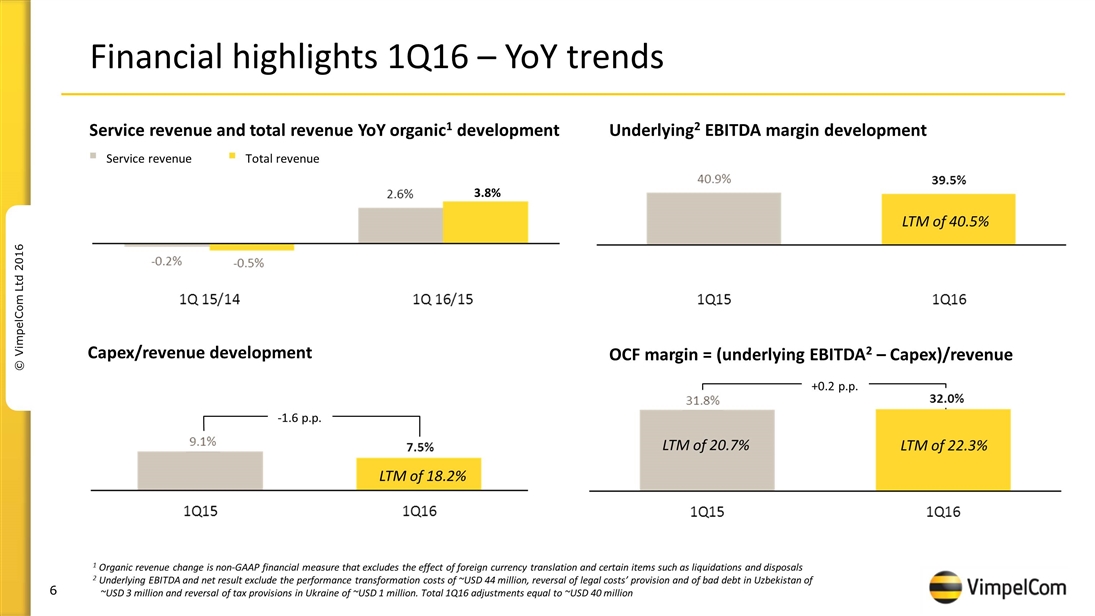

Financial highlights 1Q16 – YoY trends 1 Organic revenue change is non-GAAP financial measure that excludes the effect of foreign currency translation and certain items such as liquidations and disposals 2 Underlying EBITDA and net result exclude the performance transformation costs of ~USD 44 million, reversal of legal costs’ provision and of bad debt in Uzbekistan of ~USD 3 million and reversal of tax provisions in Ukraine of ~USD 1 million. Total 1Q16 adjustments equal to ~USD 40 million -1.6 p.p. +0.2 p.p. Service revenue and total revenue YoY organic1 development Underlying2 EBITDA margin development Capex/revenue development OCF margin = (underlying EBITDA2 – Capex)/revenue Service revenue Total revenue 3.8% LTM of 22.3% LTM of 18.2% LTM of 40.5% LTM of 20.7%

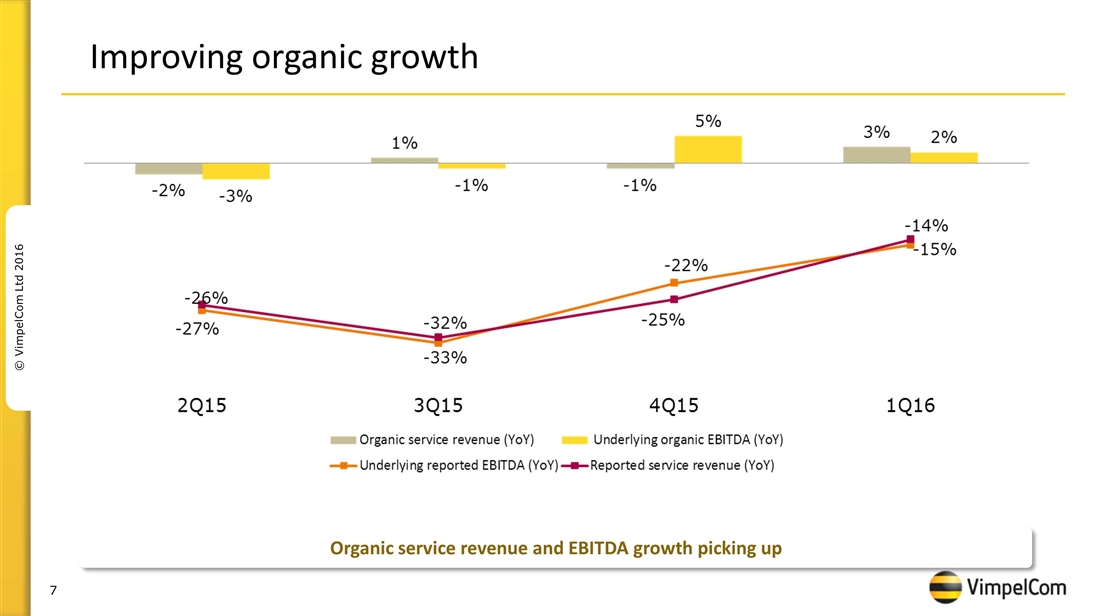

Improving organic growth Organic service revenue and EBITDA growth picking up

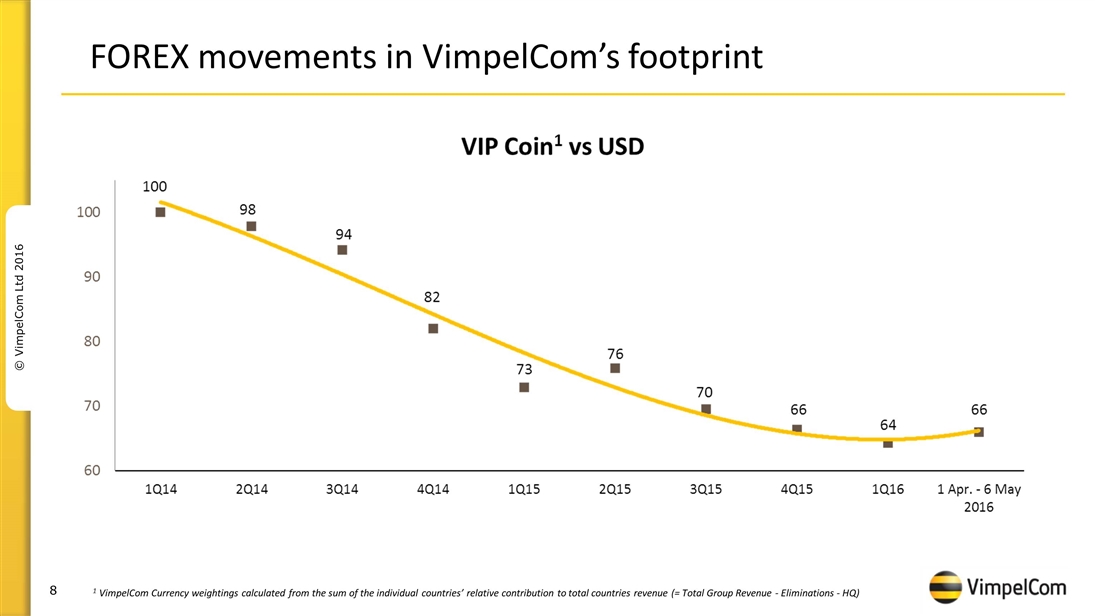

FOREX movements in VimpelCom’s footprint 1 VimpelCom Currency weightings calculated from the sum of the individual countries’ relative contribution to total countries revenue (= Total Group Revenue - Eliminations - HQ)

Creating a leading converged operator in Italian telecoms …the proposed JV will drive competition, investments and consumer benefits by creating a peer with a 34% revenue market share, able to compete in the same league The merger will create a stronger competitor to the two market leaders… Digital divide Bifurcation 4G/LTE coverage1 #1/2 players: 75%/64% #3/4 players: 35%/34% 2011-2014 mobile network Capex #1/2 players: EUR3.5/3.2 billion #3/4 players: EUR2.0/1.9 billion Mobile passive infrastructure #1/2 players: ~18k/17k sites #3/4 players: ~14k/11k sites Market share by customers2 #1/2 players: 32%/27% #3/4 players: 23%/11% Italy is behind other main European countries Smartphone penetration is low relative to other developed EU countries, but expected to increase rapidly with 4G/LTE roll-out Demand for converged offers also expected to increase rapidly The proposed JV supports Italian and EU digital competitiveness priorities The proposed JV intends to build a mobile network of >20k sites, covering 99% outdoor and 90% indoor with 4G/LTE by 2019 1 Data as of August 2015 2 Company estimates as of June 2015

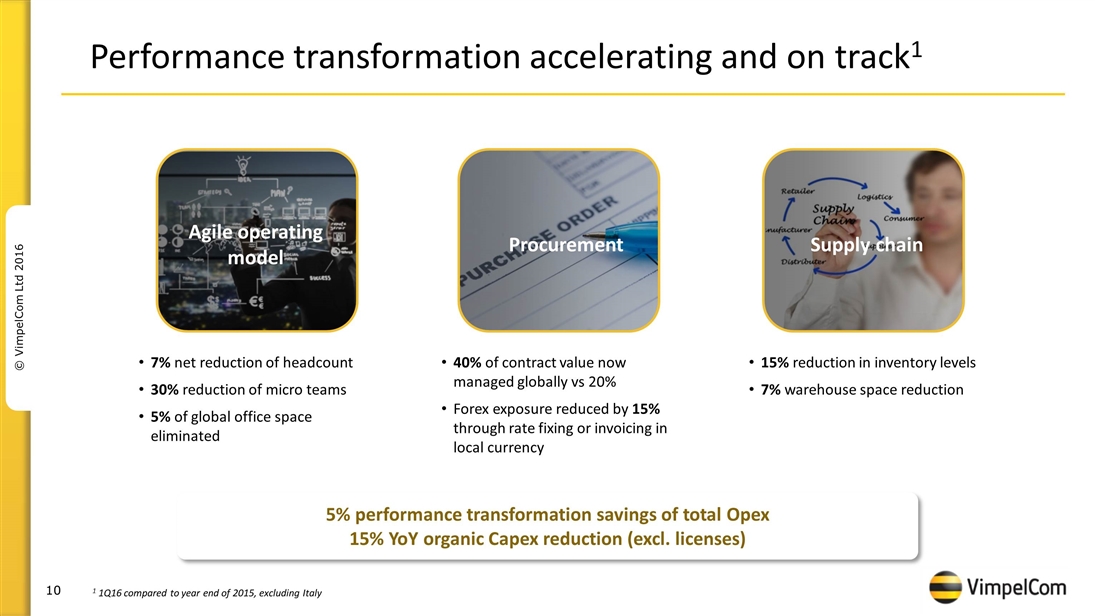

Performance transformation accelerating and on track1 Agile operating model Procurement Supply chain 7% net reduction of headcount 30% reduction of micro teams 5% of global office space eliminated 40% of contract value now managed globally vs 20% Forex exposure reduced by 15% through rate fixing or invoicing in local currency 15% reduction in inventory levels 7% warehouse space reduction 5% performance transformation savings of total Opex 15% YoY organic Capex reduction (excl. licenses) 1 1Q16 compared to year end of 2015, excluding Italy

1Q16 speakers and agenda Jean-Yves Charlier – Chief Executive Officer Group highlights Financial highlights Andrew Davies – Chief Financial Officer Group results review Country results review Group FY16 guidance Jean-Yves Charlier – Chief Executive Officer Final remarks Q&A session

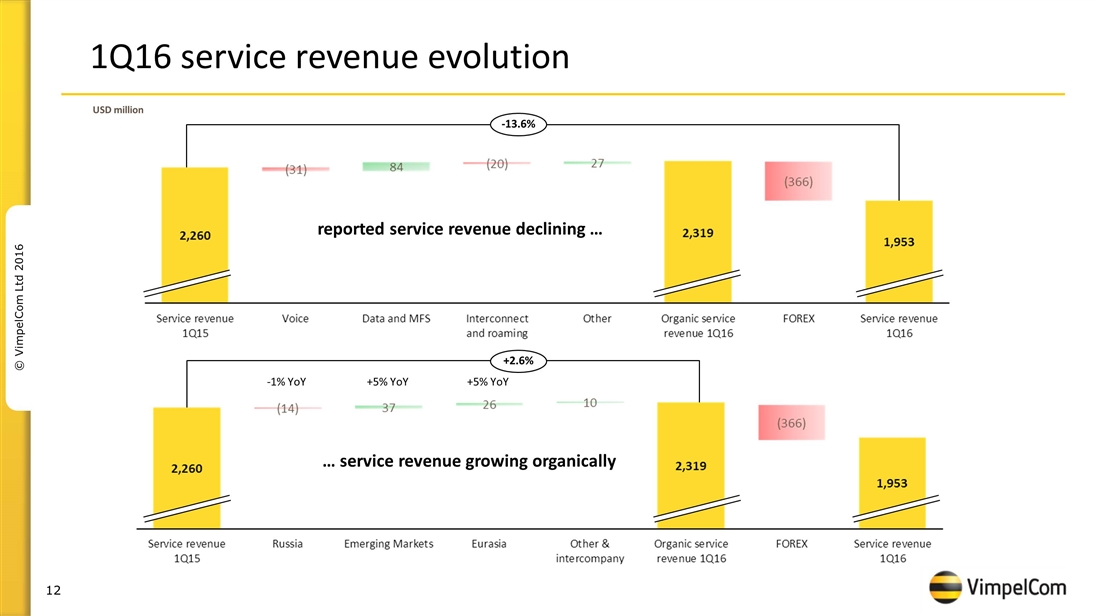

1Q16 service revenue evolution -13.6% +2.6% USD million reported service revenue declining … … service revenue growing organically -1% YoY +5% YoY +5% YoY

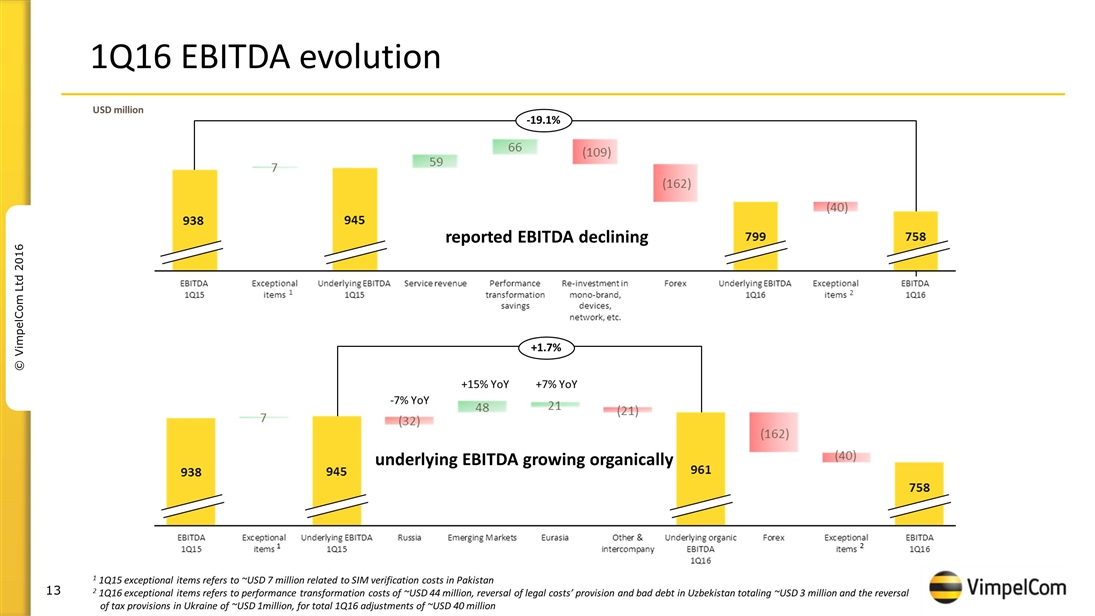

1Q16 EBITDA evolution -19.1% 2 +1.7% USD million 2 1 1Q15 exceptional items refers to ~USD 7 million related to SIM verification costs in Pakistan 2 1Q16 exceptional items refers to performance transformation costs of ~USD 44 million, reversal of legal costs’ provision and bad debt in Uzbekistan totaling ~USD 3 million and the reversal of tax provisions in Ukraine of ~USD 1million, for total 1Q16 adjustments of ~USD 40 million 1 1 reported EBITDA declining underlying EBITDA growing organically -7% YoY +15% YoY +7% YoY

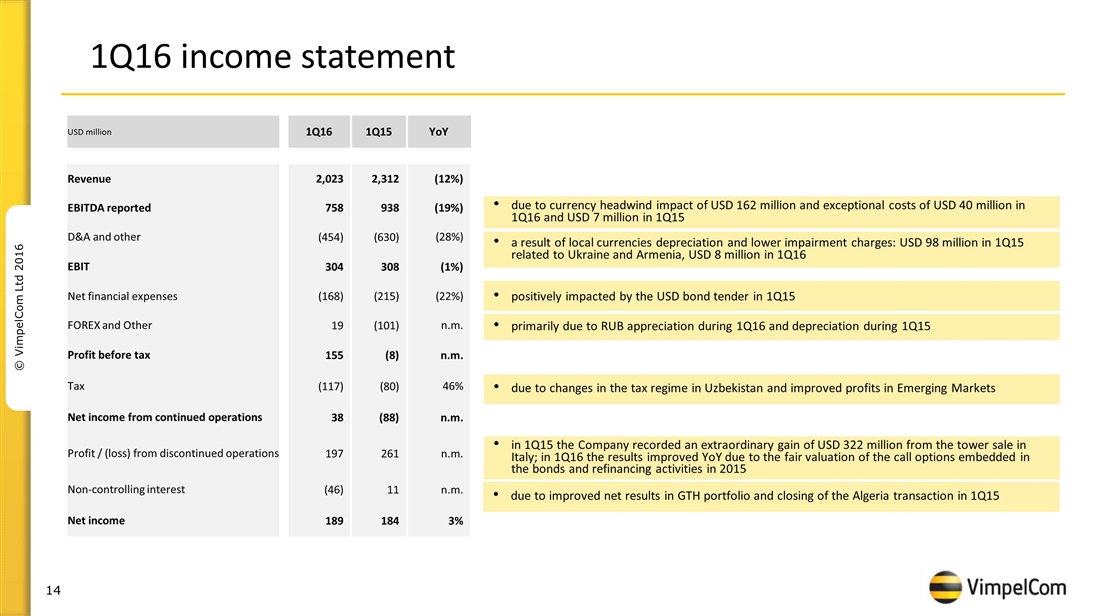

1Q16 income statement due to currency headwind impact of USD 162 million and exceptional costs of USD 40 million in 1Q16 and USD 7 million in 1Q15 a result of local currencies depreciation and lower impairment charges: USD 98 million in 1Q15 related to Ukraine and Armenia, USD 8 million in 1Q16 positively impacted by the USD bond tender in 1Q15 due to changes in the tax regime in Uzbekistan and improved profits in Emerging Markets in 1Q15 the Company recorded an extraordinary gain of USD 322 million from the tower sale in Italy; in 1Q16 the results improved YoY due to the fair valuation of the call options embedded in the bonds and refinancing activities in 2015 primarily due to RUB appreciation during 1Q16 and depreciation during 1Q15 USD million 1Q16 1Q15 YoY Revenue 2,023 2,312 (12%) EBITDA reported 758 938 (19%) D&A and other (454) (630) (28%) EBIT 304 308 (1%) Net financial expenses (168) (215) (22%) FOREX and Other 19 (101) n.m. Profit before tax 155 (8) n.m. Tax (117) (80) 46% Net income from continued operations 38 (88) n.m. Profit / (loss) from discontinued operations 197 261 n.m. Non-controlling interest (46) 11 n.m. Net income 189 184 3% due to improved net results in GTH portfolio and closing of the Algeria transaction in 1Q15

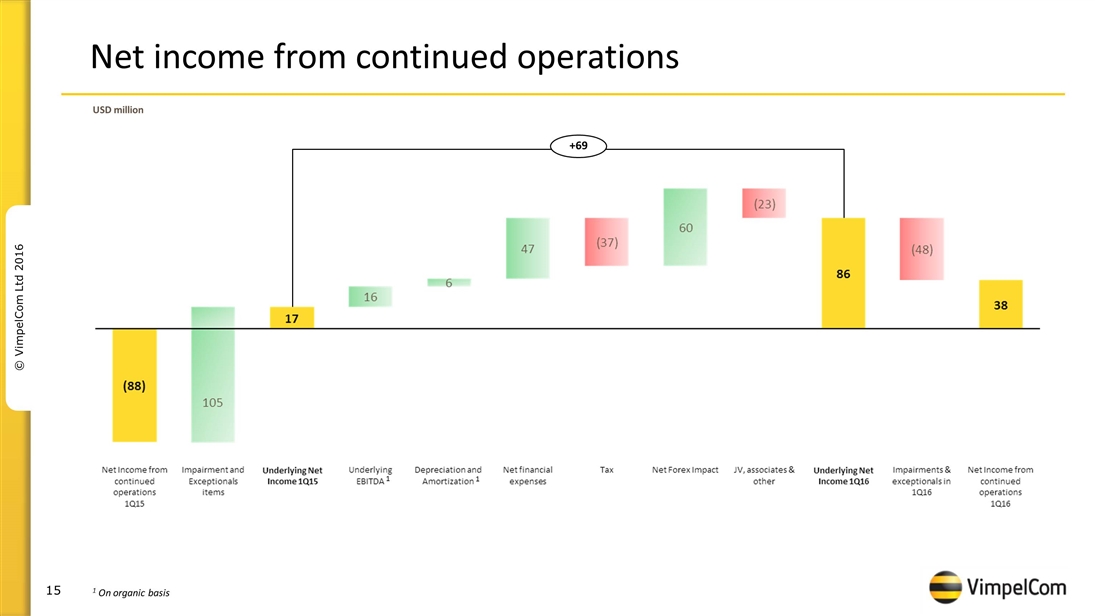

Net income from continued operations USD million +69 1 On organic basis 1 1

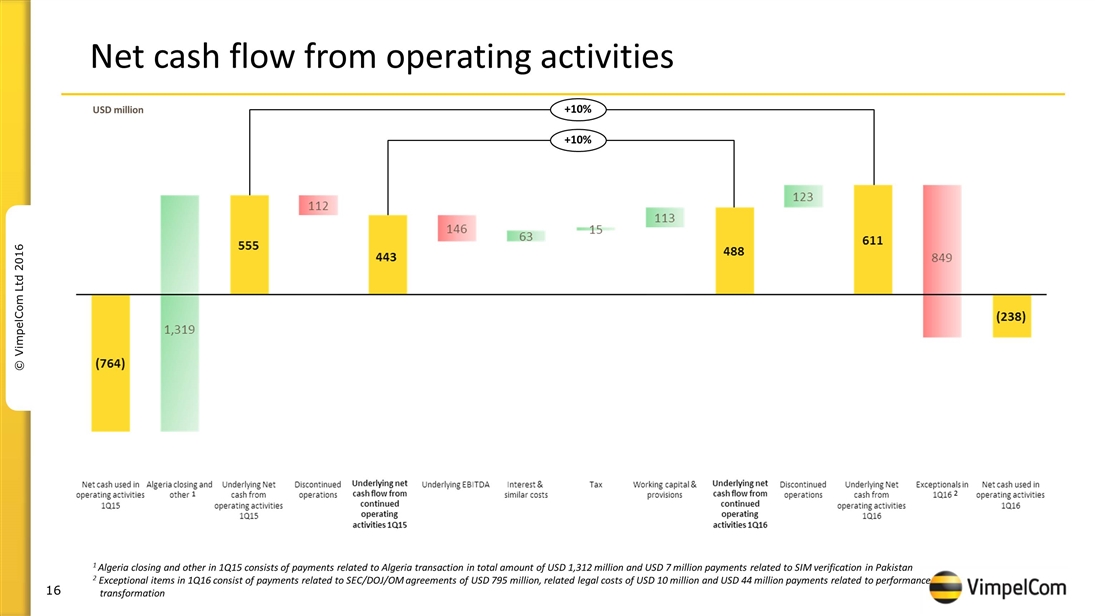

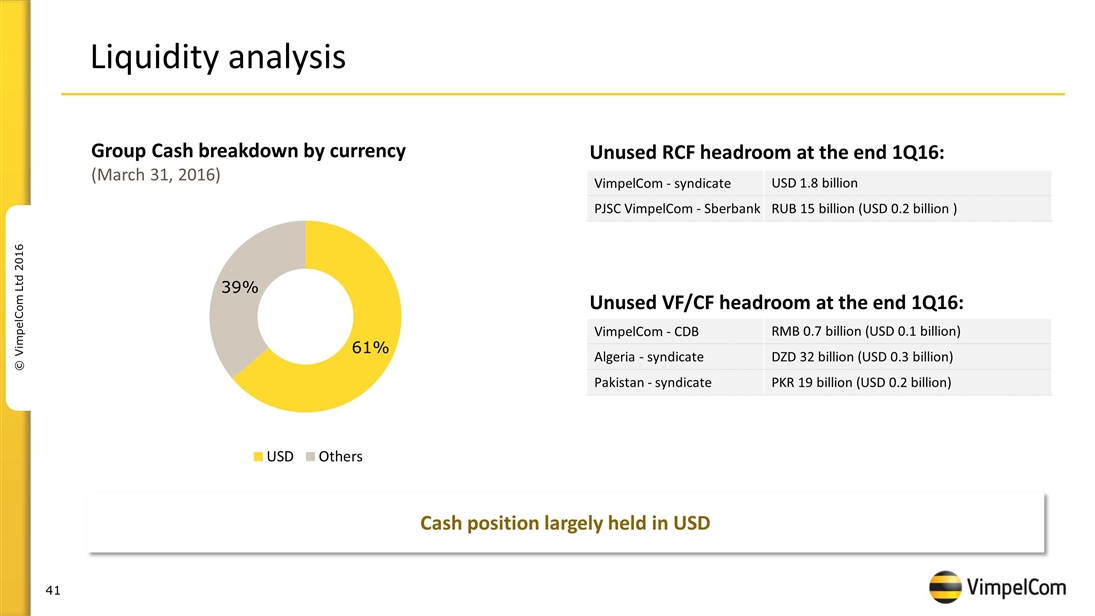

Net cash flow from operating activities USD million +10% +10% 1 Algeria closing and other in 1Q15 consists of payments related to Algeria transaction in total amount of USD 1,312 million and USD 7 million payments related to SIM verification in Pakistan 2 Exceptional items in 1Q16 consist of payments related to SEC/DOJ/OM agreements of USD 795 million, related legal costs of USD 10 million and USD 44 million payments related to performance transformation 2 1

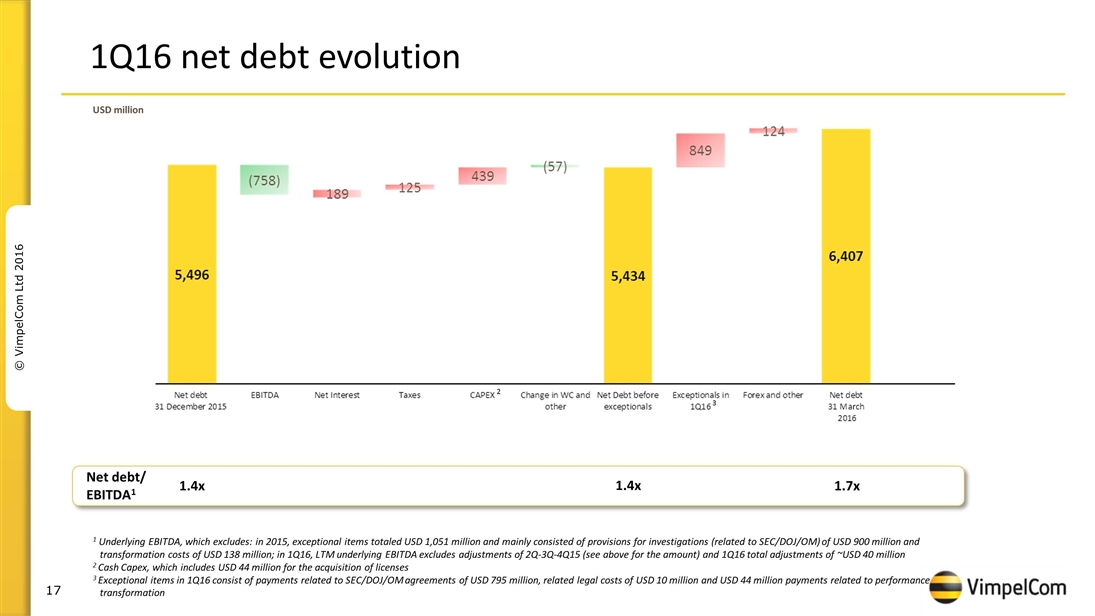

1Q16 net debt evolution 1 Underlying EBITDA, which excludes: in 2015, exceptional items totaled USD 1,051 million and mainly consisted of provisions for investigations (related to SEC/DOJ/OM) of USD 900 million and transformation costs of USD 138 million; in 1Q16, LTM underlying EBITDA excludes adjustments of 2Q-3Q-4Q15 (see above for the amount) and 1Q16 total adjustments of ~USD 40 million 2 Cash Capex, which includes USD 44 million for the acquisition of licenses 3 Exceptional items in 1Q16 consist of payments related to SEC/DOJ/OM agreements of USD 795 million, related legal costs of USD 10 million and USD 44 million payments related to performance transformation Net debt/ EBITDA1 1.7x 1.4x 2 3 1.4x USD million