Form 6-K VimpelCom Ltd. For: Jan 30

�

�

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

�

�

FORM 6-K

�

�

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of January 2015

Commission File Number 1-34694

�

�

VimpelCom Ltd.

(Translation of registrant�s name into English)

�

�

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

�

�

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

�

| Form 20-F��x������������Form 40-F��� |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):���.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):���.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

�

| Yes���������������No��x |

If �Yes� is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-����������������.

�

�

�

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

�

| ������������VIMPELCOM LTD. | ||||||

| ��������(Registrant) | ||||||

| Date: February 2, 2015 | ||||||

| By: | /s/ Scott Dresser | |||||

| Name: | Scott Dresser | |||||

| Title: | Group General Counsel | |||||

�

VimpelCom and Global Telecom Holding announce successful

closing of Algeria transaction

Amsterdam (January 30, 2015) - VimpelCom Ltd. (�VimpelCom�, �the Company� or �the Group�) (NASDAQ: VIP), a leading global provider of telecommunications services headquartered in Amsterdam and serving 223�million customers in 14 countries, and its subsidiary Global Telecom Holding S.A.E. (�GTH�) (EGX: GTHE, LSE: GLTD), today announce the closing of the sale by GTH of a 51% interest in Omnium Telecom Algeria SpA (formerly known as Orascom Telecom Alg�rie SpA, �OTA� or �Djezzy�) to the Algerian National Investment Fund, Fonds National d�Investissement (the �FNI�), for USD 2.6 billion.

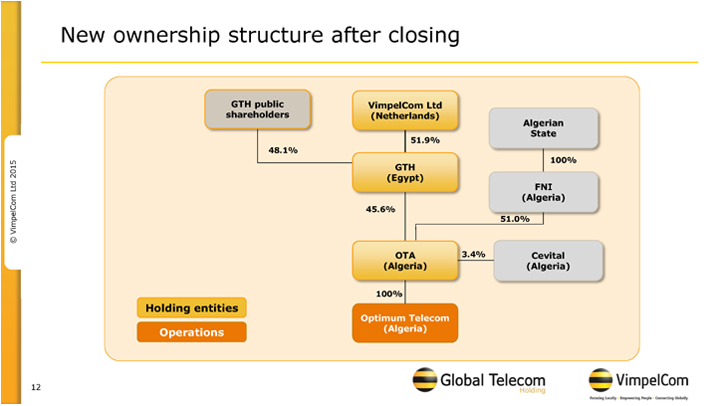

GTH and the FNI have entered into a shareholders agreement (the �Shareholders Agreement�), which governs their relationship as shareholders in OTA going forward. GTH will continue to exercise operational control over OTA and, as a result, both GTH and VimpelCom will continue to fully consolidate OTA.

Jo Lunder, Chief Executive Officer of VimpelCom, commented: �Today, we have entered into a long-term relationship with the Algerian National Fund, creating a private-public ownership structure for Djezzy. With this new ownership structure, Djezzy is positioned better than ever to lead the way in Algeria, offering customers high quality mobile services and the best digital experience. The deal, on a group level, also releases significant cash amounts to GTH and VimpelCom to pay down gross debt.�

Settlement of Disputes

At Closing, GTH terminated its international arbitration against the Algerian State initiated on April�12, 2012 and the parties to the arbitration settled the arbitration and all claims relating thereto. At the same time, the foreign exchange and import restrictions put in place by the Bank of Algeria against OTA on April�15, 2010 were lifted, following the payment by OTA to the Algerian Treasury of the fine of DZD 99 billion (equivalent to approximately USD 1.1 billion). In addition, OTA has written off the related tax receivable on its balance sheet.

Credit Facility

Shortly prior to Closing, OTA and its wholly-owned subsidiary Optimum Telecom Algerie S.p.A. established credit facilities with a syndicate of Algerian and international banks in an amount of DZD 82 billion (approximately USD 0.9 billion).

Agreement with OTA�s minority shareholder Cevital

GTH and Cevital S.p.A., a minority shareholder in OTA (�Cevital�), amended their previously disclosed Framework Agreement. Pursuant to the amended Framework Agreement, following Closing, Cevital will continue to be a shareholder in OTA and will hold 3.43% of the share capital of OTA. At Closing, the existing OTA shareholder arrangements to which Cevital was a party were terminated and Cevital dismissed all pending litigation against OTA in settlement for a dinar payment by OTA equating to approximately USD 50�million plus Cevital�s entitled share of the pre-Closing dividend paid by OTA to its shareholders.

�VimpelCom Ltd. January�30, 2015

�

Use of Proceeds

Total net proceeds, including OTA dividends in respect of the financial years 2008-2013 paid to GTH, amounting to approximately USD 3.8 billion net of all taxes and after settlement of all outstanding disputes between the parties as well as the payment of associated fines, will be used to pay down existing shareholder loans provided by VimpelCom to GTH.

An Analyst and Investor conference call to discuss further details of the transaction and settlement is planned for 14:00 CET today. For dial-in information please visit www.vimpelcom.com or www.gtelecom.com.

DISCLAIMER

This announcement contains �forward-looking statements� within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and include statements regarding the expected benefits of the transactions described above. Any statement in this announcement that expresses or implies VimpelCom�s or GTH�s intentions, beliefs, expectations or predictions (and the assumptions underlying them) is a forward-looking statement. Forward-looking statements involve inherent risks, uncertainties and assumptions, including, without limitation, the possibility that the benefits of the transactions may not materialize as expected or at all. If such risks or uncertainties materialize or such assumptions prove incorrect, actual results could differ materially from those expressed or implied by such forward-looking statements and assumptions. Certain other risks that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VimpelCom�s Annual Report on Form 20-F for the year ended December�31, 2013, and other public filings made by the VimpelCom with the U.S. Securities and Exchange Commission, which risk factors are incorporated herein by reference. The forward-looking statements contained in this announcement are made as of the date hereof, and VimpelCom and GTH expressly disclaim any obligation to update or correct any forward-looking statements made herein due to the occurrence of events after the issuance of this announcement.

About VimpelCom

VimpelCom, an international telecoms company operating in 14 countries and headquartered in Amsterdam, is one of the world�s largest integrated telecommunications services operators providing voice and data services through a range of traditional and broadband mobile and fixed technologies in Russia, Italy, Ukraine, Kazakhstan, Uzbekistan, Tajikistan, Armenia, Georgia, Kyrgyzstan, Laos, Algeria, Bangladesh, Pakistan, and Zimbabwe. VimpelCom�s operations around the globe cover territory with a total population of approximately 739�million people. VimpelCom provides services under the �Beeline�, �Kyivstar�, �WIND�, �Infostrada� �Mobilink�, �banglalink�, �Telecel�, and �Djezzy� brands. As of September�30, 2014, VimpelCom had 223�million mobile customers on a combined basis. VimpelCom is traded on the NASDAQ Global Select Market under the symbol (VIP). For more information visit: http://www.vimpelcom.com

About Global Telecom Holding

GTH, which is 51.9% owned by VimpelCom, is a leading international telecommunications company operating mobile networks in high growth markets in the Middle East, Africa and Asia, covering territory with a total population of approximately 415�million with an average mobile telephony penetration of approximately 63% as of September�30, 2014. GTH operates mobile networks in Algeria (�OTA�), Pakistan (�Mobilink�), and Bangladesh (�banglalink�). In addition it has an indirect equity ownership in Telecel Zimbabwe (Zimbabwe). GTH reached more than 91�million customers as of September�30, 2014. GTH is traded on the Egyptian Exchange under the symbol (GTHE.CA), and on the London Stock Exchange, its GDRs are traded under the symbol (GLTD:LI). For more information visit: http://www.gtelecom.com

�

�VimpelCom Ltd. January 30, 2015

�

About Omnium Telecom Algeria (Djezzy)

Djezzy operates a mobile network in Algeria and provides a range of prepaid and postpaid products encompassing voice, data and multimedia. In 2013, Djezzy recorded USD 1.8 billion of revenue and USD 1.1 billion of EBITDA. As of September�30, 2014, Djezzy�s network served 18.2�million customers in Algeria.

Contact information

�

| Investor Relations | �� | Media and Public Relations |

| VimpelCom Ltd. | �� | VimpelCom Ltd. |

| Gerbrand Nijman / Remco Vergeer | �� | Bobby Leach / Artem Minaev |

| [email protected] | �� | [email protected] |

| Tel: +31 20 79 77 200 (Amsterdam) | �� | Tel: +31 20 79 77 200 (Amsterdam) |

| Investor Relations | �� | |

| Global Telecom Holding | �� | |

| Ola Abdel Maksoud Tayel |

�� | |

| Tel: +202 2461 8640 (Cairo) | �� | |

�

�VimpelCom Ltd. January 30, 2015

�

Successful closing in Algeria A&I conference call January�30, 2015 VimpelCom: Jo Lunder, Andrew Davies GTH: Vincenzo Nesci, Hassan Helmy

Disclaimer This presentation contains �forward-looking statements� within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and include statements regarding the expected benefits of the transactions described herein. Any statement in this presentation that expresses or implies VimpelCom�s or GTH�s intentions, beliefs, expectations or predictions (and the assumptions underlying them) is a forward-looking statement. Forward-looking statements involve inherent risks, uncertainties and assumptions, including, without limitation, the possibility that closing will not complete due to failure to receive proceeds, the possibility that the benefits of the transactions may not materialize as expected or at all. If such risks or uncertainties materialize or such assumptions prove incorrect, actual results could differ materially from those expressed or implied by such forward-looking statements and assumptions. Certain other risks that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in VimpelCom�s Annual Report on Form 20-F for the year ended December�31, 2013, and other public filings made by the VimpelCom with the U.S. Securities and Exchange Commission, which risk factors are incorporated herein by reference. The forward-looking statements contained in this presentation are made as of the date hereof, and VimpelCom and GTH expressly disclaim any obligation to update or correct any forward-looking statements made herein due to the occurrence of events after the issuance of this announcement.

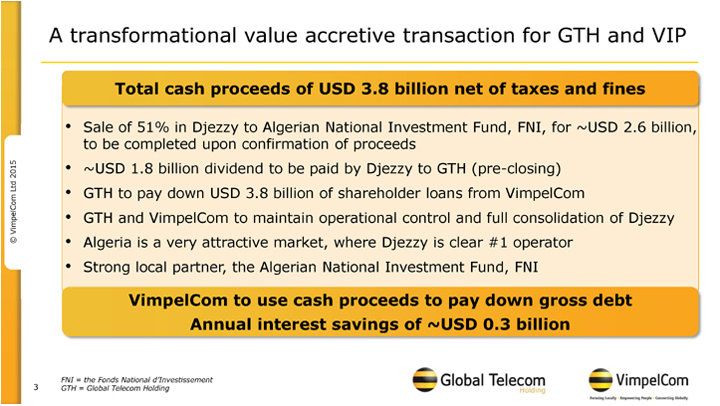

A transformational value accretive transaction for GTH and VIP Total cash proceeds of USD 3.8 billion net of taxes and fines � Sale of 51% in Djezzy to Algerian National Investment Fund, FNI, for ~USD 2.6 billion, to be completed upon confirmation of proceeds � ~USD 1.8 billion dividend to be paid by Djezzy to GTH (pre-closing) � GTH to pay down USD 3.8 billion of shareholder loans from VimpelCom � GTH and VimpelCom to maintain operational control and full consolidation of Djezzy � Algeria is a very attractive market, where Djezzy is clear #1 operator � Strong local partner, the Algerian National Investment Fund, FNI VimpelCom to use cash proceeds to pay down gross debt Annual interest savings of ~USD 0.3 billion

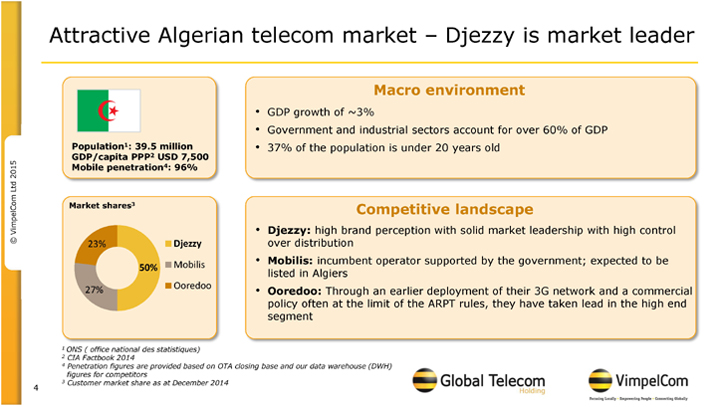

Attractive Algerian telecom market � Djezzy is market leader Macro environment � GDP growth of ~3% � Government and industrial sectors account for over 60% of GDP Population1: 39.5�million � 37% of the population is under 20 years old GDP/capita PPP2 USD 7,500 Mobile penetration4: 96% Market shares3 Competitive landscape � Djezzy: high brand perception with solid market leadership with high control 23% Djezzy over distribution Mobilis � Mobilis: incumbent operator supported by the government; expected to be 50% listed in Algiers Ooredoo 27% � Ooredoo: Through an earlier deployment of their 3G network and a commercial policy often at the limit of the ARPT rules, they have taken lead in the high end segment es) sed on OTA closing base and our data warehouse (DWH) Customer market share as at December 2014

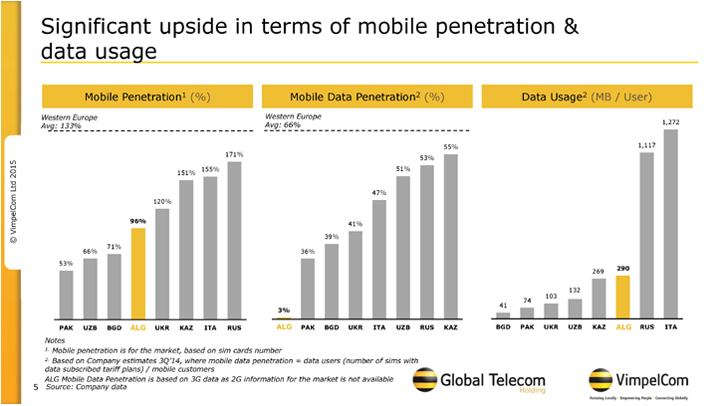

Significant upside in terms of mobile penetration�& data usage Mobile Penetration1 (%)�Mobile Data Penetration2 (%)�Data Usage2 (MB / User) Western Europe Western Europe Avg: 66% 1,272 Avg: 133% 55% 1,117 171% 53% 155% 51% 151% 47% 120% 96% 41% 39% 71% 66% 36% 53% 290 269 103 132 74 41 3% ALG BGD PAK UKR UZB KAZ ALG ALG RUS ITA PAK UZB BGD ALG UKR KAZ ITA RUS ALG PAK BGD UKR ITA UZB RUS KAZ Notes 1. Mobile penetration is for the market, based on sim cards number 2. Based on Company estimates 3Q�14, where mobile data penetration = data users (number of sims with data subscribed tariff plans) / mobile customers 5 ALG Source: Mobile Company Data Penetration data is based on 3G data as 2G information for the market is not available

Strategic focus � Invest in high-speed 3G network, focusing on the latest technology � Continued 3G roll out and launch of data services with attractive bundles � Maintain leadership in customer experience and NPS � Emphasize Djezzy as the preferred Algerian mobile brand

Shareholders agreement � VimpelCom/GTH to retain operational control over OTA � VimpelCom/GTH to continue to consolidate the results of OTA � OTA dividend policy ? Target pay-out ratio of not less than 42.5% of consolidated net income � Board composition ? OTA: 4 by GTH (incl. Chairman with casting vote), 4 by FNI ? Optimum Telecom: 6 by GTH (incl. Chairman with casting vote), 4 by FNI and 2 employee representatives � No share transfers permitted during first 7 years � Secured an attractive exit via put option

Settlement of disputes � Payment of the Bank of Algeria fine of ~USD 1.1 billion ? Charge of USD 1.3 billion in the 2013 Financial Statements, revalued by USD 0.2 billion in the 2014 Financial Statements due to FOREX � Discontinuation of tax disputes ? Write-off of related tax receivables of USD 0.7 billion in the 2013 Financial Statements � Bank of Algeria ban on international payments is lifted � International arbitration definitely discontinued � Cevital to stay as minority shareholder ? Amended Framework Agreement ? Settled all pending litigations for a payment of USD 50�million

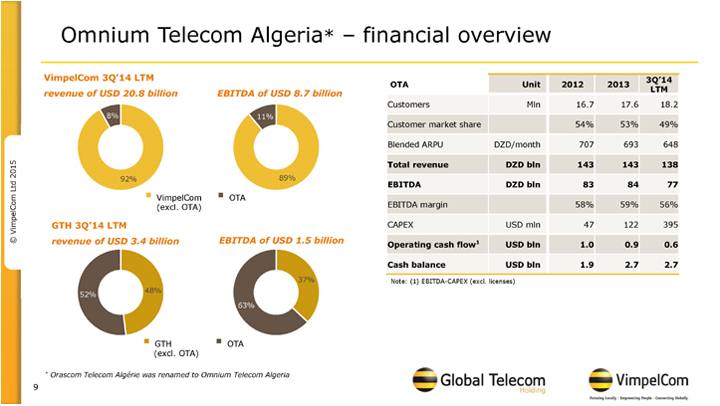

Omnium Telecom Algeria* � financial overview VimpelCom 3Q�14 LTM 3Q�14 OTA Unit 2012 2013 revenue of USD 20.8 billion EBITDA of USD 8.7 billion LTM Customers Mln 16.7 17.6 18.2 8% 11% Customer market share 54% 53% 49% Blended ARPU DZD/month 707 693 648 Total revenue DZD bln 143 143 138 92% 89% EBITDA DZD bln 83 84 77 � VimpelCom � OTA (excl. OTA) EBITDA margin 58% 59% 56% GTH 3Q�14 LTM CAPEX USD mln 47 122 395 EBITDA of USD 1.5 billion revenue of USD 3.4 billion Operating cash flow1 USD bln 1.0 0.9 0.6 Cash balance USD bln 1.9 2.7 2.7 37% Note: (1)�EBITDA-CAPEX (excl. licenses) 48% 52% 63% � GTH � OTA (excl. OTA) * Orascom Telecom Alg�rie was renamed to Omnium Telecom Algeria 9

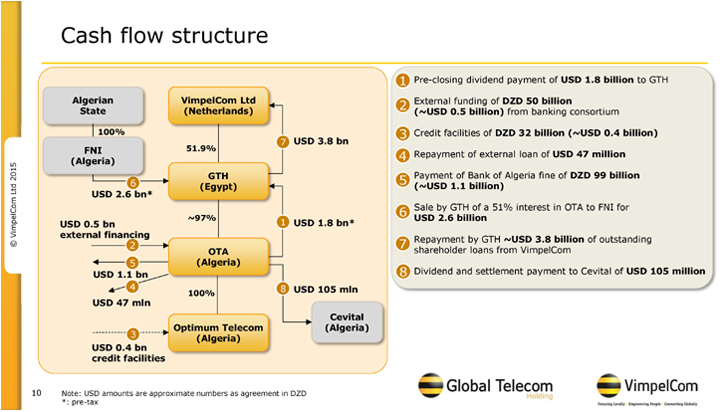

Cash flow structure 1 Pre-closing dividend payment of USD 1.8 billion to GTH Algerian VimpelCom Ltd 2 External funding of DZD 50 billion State (Netherlands) (~USD 0.5 billion) from banking consortium 100% 3 Credit facilities of DZD 32 billion (~USD 0.4 billion) 7 USD 3.8 bn FNI 51.9% 4 Repayment of external loan of USD 47�million (Algeria) GTH 5 Payment of Bank of Algeria fine of DZD 99 billion 6 (Egypt) (~USD 1.1 billion) USD 2.6 bn* 6 Sale by GTH of a 51% interest in OTA to FNI for ~97% 1 USD 2.6 billion USD 0.5 bn USD 1.8 bn* external financing 7 Repayment by GTH ~USD 3.8 billion of outstanding 2 shareholder loans from VimpelCom OTA 5 (Algeria) Dividend and settlement payment to Cevital of USD 105�million USD 1.1 bn 8 4 8 USD 105 mln 100% USD 47 mln Cevital Optimum Telecom (Algeria) 3 (Algeria) USD 0.4 bn credit facilities 10 Note: USD amounts are approximate numbers as agreement in DZD *: pre-tax

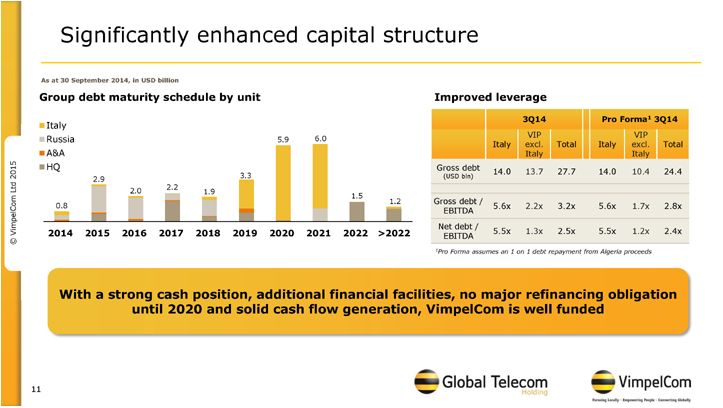

Significantly enhanced capital structure As at 30�September 2014, in USD billion Group debt maturity schedule by unit Improved leverage Italy 3Q14 Pro Forma1 3Q14 6.0 VIP VIP Russia 5.9 A&A Italy excl. Total Italy excl. Total Italy Italy HQ Gross debt 14.0 13.7 27.7 14.0 10.4 24.4 2.9 3.3 (USD bln) 2.2 2.0 1.9 1.5 1.2 Gross debt / 0.8 5.6x 2.2x 3.2x 5.6x 1.7x 2.8x EBITDA Net debt / 2014 2015 2016 2017 2018 2019 2020 2021 2022 >2022 5.5x 1.3x 2.5x 5.5x 1.2x 2.4x EBITDA 1Pro Forma assumes an 1 on 1 debt repayment from Algeria proceeds With a strong cash position, additional financial facilities, no major refinancing obligation until 2020 and solid cash flow generation, VimpelCom is well funded

New ownership structure after closing GTH public VimpelCom Ltd shareholders (Netherlands) Algerian State 51.9% 48.1% 100% GTH (Egypt) FNI (Algeria) 45.6% 51.0% OTA 3.4% Cevital (Algeria) (Algeria) 100% Holding entities Optimum Telecom Operations (Algeria)

Delivering successful results for all stakeholders � USD 3.8 billion cash proceeds to be used to pay down gross debt � Expected Group annual interest savings of ~USD 0.3 billion � Retain operational control and ability to consolidate Djezzy � Partnership and co-operation with Algerian Government � Develop Algerian business capitalizing on market leading position to generate sustainable profitable growth

Q&A

VimpelCom 4Q14 and FY14 results announcement February�25, 2015 London Live presentation in London Webcast via vimpelcom.com

Further information Investor Relations VimpelCom T: +31 20 79 77 234 E: [email protected] Investor Relations Global Telecom Holding T: +202 2461 86 40 E: [email protected] Visit our websites Install VimpelCom www.vimpelcom.com iPad App www.gtelecom.com

Thank you!

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Dicello Levitt LLP Announces Investor Class Action Lawsuit Filed Against QuidelOrtho Corp. f/k/a Quidel Corp. (NASDAQ: QDEL) And Lead Plaintiff Deadline

- ROSEN, A TOP RANKED LAW FIRM, Encourages CI&T Inc Investors to Inquire About Securities Class Action Investigation – CINT

- Deveron Announces Closing of Private Placement of Convertible Debentures

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share