Form 6-K VimpelCom Ltd. For: Feb 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of February 2015

Commission File Number 1-34694

VimpelCom Ltd.

(Translation of registrant’s name into English)

The Rock Building, Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| VIMPELCOM LTD. | ||||||

| (Registrant) | ||||||

| Date: February 25, 2015 | ||||||

| By: | /s/ Scott Dresser | |||||

| Name: | Scott Dresser | |||||

| Title: | Group General Counsel | |||||

VIMPELCOM REPORTS 4Q14 AND FY14 RESULTS

KEY RESULTS AND DEVELOPMENTS

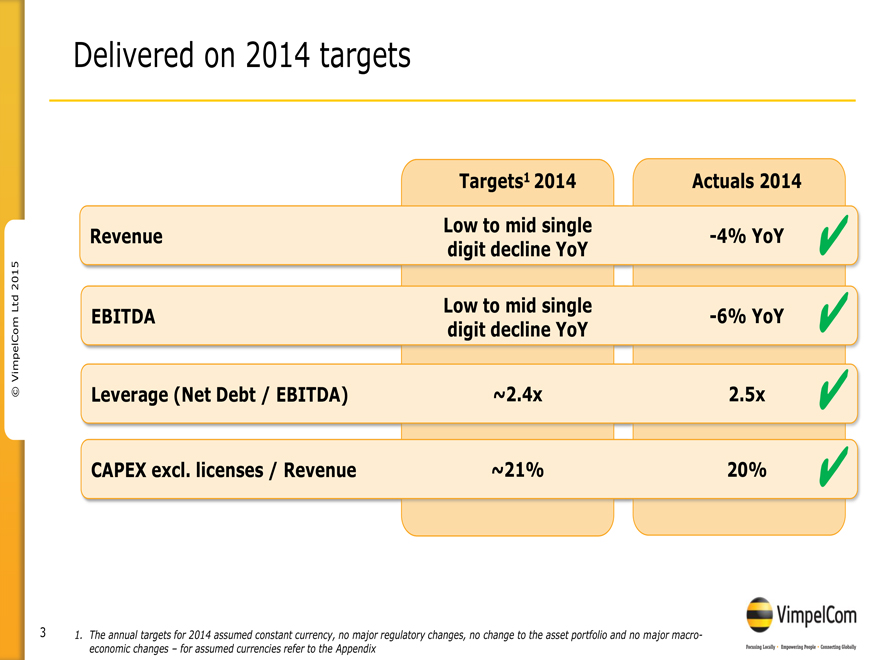

| • | Delivered on 2014 targets |

| • | Total revenue 4Q14 declined organically1 3% YoY; reported revenue declined 21% due to adverse currency movements |

| • | EBITDA2 4Q14 declined organically 8% YoY; reported EBITDA increased 58% YoY mainly due to the one-off charge in 4Q13 related to the fine from Bank of Algeria; EBITDA margin of 36.4% |

| • | Net loss FY14 of USD 0.7 billion impacted by USD 1.0 billion of non-cash impairments |

| • | Mobile customer base grew 4.7 million YoY3 in 4Q14 to 221.6 million |

| • | Operating cash flow 4Q14 improved USD 1.1 billion YoY; FY14 operating cash flow of USD 4.1 billion |

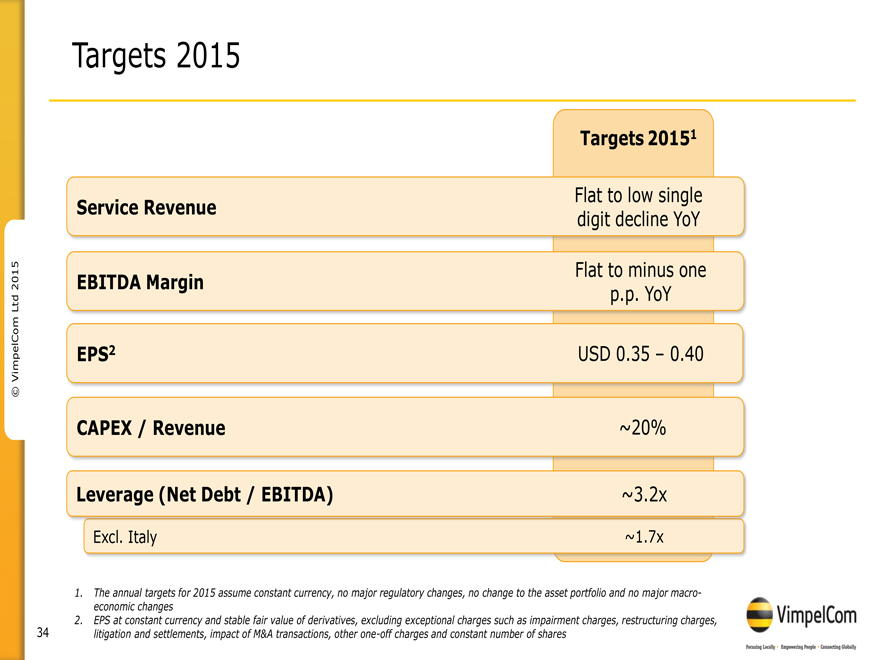

| • | 2015 targets: |

| • | Service revenue of flat to low single digit organic1 YoY decline; |

| • | EBITDA margin flat to minus one percentage point organically1 YoY; |

| • | EPS4 of USD 0.35-0.40; |

| • | Capex/revenue of 20%; |

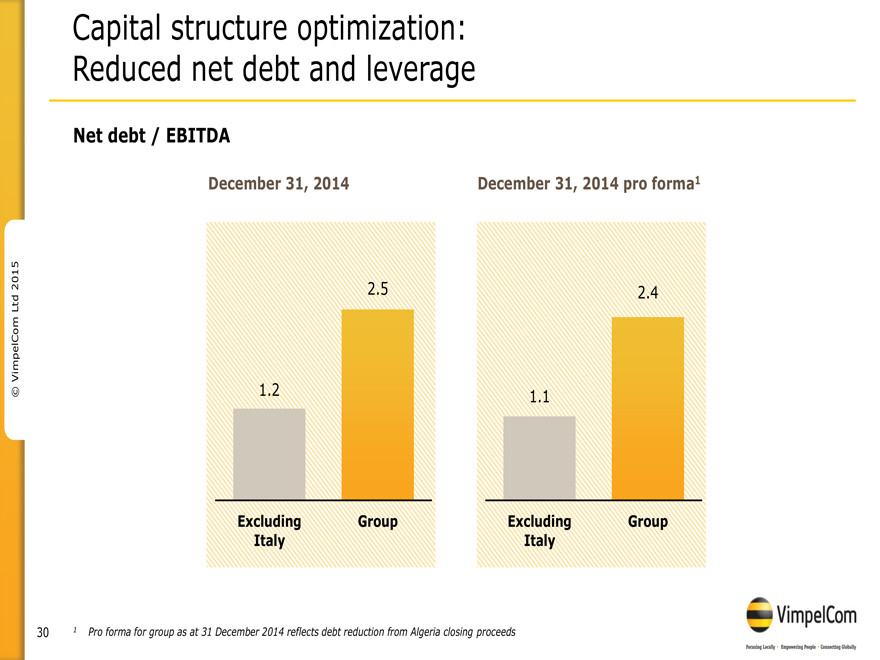

| • | Net debt to EBITDA for the Group of ~3.2x, excluding Italy ~1.7x |

Amsterdam (February 25, 2015) - “VimpelCom Ltd.” (“VimpelCom”, “Company” or “Group”) (NASDAQ: VIP), a leading global provider of telecommunications services with operations in 14 countries and worldwide headquarters in Amsterdam, today announces financial and operating results for the quarter and year ended December 31, 2014.

JO LUNDER, CHIEF EXECUTIVE OFFICER, COMMENTS:

“The majority of our operating businesses have demonstrated good progress over the year, with substantial investments in high speed data networks leading to a better customer experience. We expect the operating environment to remain difficult in 2015, however I am confident that we have the right strategy to deliver on our targets.”

CONSOLIDATED FINANCIAL AND OPERATING HIGHLIGHTS

| USD mln | 4Q14 | 4Q13 | Reported YoY |

Organic1 YoY |

FY14 | FY13 | Reported YoY |

Organic1 YoY |

||||||||||||||||||||||||

| Total revenue |

4,391 | 5,552 | (21 | %) | (3 | %) | 19,627 | 22,546 | (13 | %) | (4 | %) | ||||||||||||||||||||

| Service revenue |

4,207 | 5,290 | (20 | %) | (2 | %) | 18,725 | 21,529 | (13 | %) | (4 | %) | ||||||||||||||||||||

| EBITDA2 |

1,600 | 1,013 | 58 | % | (8 | %) | 7,970 | 8,260 | (4 | %) | (6 | %) | ||||||||||||||||||||

| EBITDA margin2 |

36.4 | % | 18.2 | % | 18.2 | pp | 40.6 | % | 36.6 | % | 4.0 | pp | ||||||||||||||||||||

| EBIT |

(421 | ) | (3,218 | ) | n.m. | 2,586 | 346 | n.m. | ||||||||||||||||||||||||

| Net loss attributable to VimpelCom shareholders |

(935 | ) | (3,861 | ) | (76 | %) | (691 | ) | (2,625 | ) | (74 | %) | ||||||||||||||||||||

| EPS, basic (USD) |

(0.53 | ) | (2.21 | ) | (76 | %) | (0.40 | ) | (1.53 | ) | (74 | %) | ||||||||||||||||||||

| Capital expenditures excluding licenses5 |

1,201 | 1,682 | (29 | %) | 3,907 | 3,998 | (2 | %) | ||||||||||||||||||||||||

| Operating cash flow (EBITDA less CAPEX) |

399 | (669 | ) | n.m. | 4,063 | 4,262 | (5 | %) | ||||||||||||||||||||||||

| Net debt / LTM EBITDA6 |

2.5 | 2.4 | 5 | % | 2.5 | 2.4 | 5 | % | ||||||||||||||||||||||||

| Total mobile customers (millions)3 |

221.6 | 216.9 | 2 | % | 221.6 | 216.9 | 2 | % | ||||||||||||||||||||||||

| 1) | Revenue and EBITDA organic growth are non-GAAP financial measures that exclude the effect of foreign currency translation, certain items such as liquidations and disposals and settlements as a result of closing of transaction in Algeria |

| 2) | EBITDA and EBITDA margin are non-GAAP financial measures. For reconciliations see Attachment C |

| 3) | Following the sale of the interest in Wind Canada, CAR and Burundi the numbers exclude respective customers in 4Q13 and FY13 |

| 4) | EPS at constant currency and stable fair value of derivatives, excluding exceptional charges such as impairment charges, restructuring charges, litigation and settlements, impact of M&A transactions, other one-off charges and constant number of shares |

| 5) | FY13 excludes EUR 136 million of non-cash increase in intangible assets related to the contract with Terna for the right of way of WIND’s backbone |

| 6) | Normalized LTM EBITDA excluding one-off charges related to the closing of transaction in Algeria For all definitions please see Attachment F |

VimpelCom Ltd. 4Q 2014 | 1

CONTENTS

| CEO statement |

3 | |||

| Strategic update and main events |

5 | |||

| Vimpelcom Group – Financial and Operating Results 4Q14 |

4 | |||

| Vimpelcom Group – Financial and Operating Results FY14 |

6 | |||

| Business Unites Performance in 4Q14 |

||||

| Russia |

14 | |||

| Italy |

16 | |||

| Africa & Asia |

18 | |||

| Ukraine |

21 | |||

| CIS |

23 | |||

| Conference Call Information |

26 | |||

| Content of the Attachments |

28 |

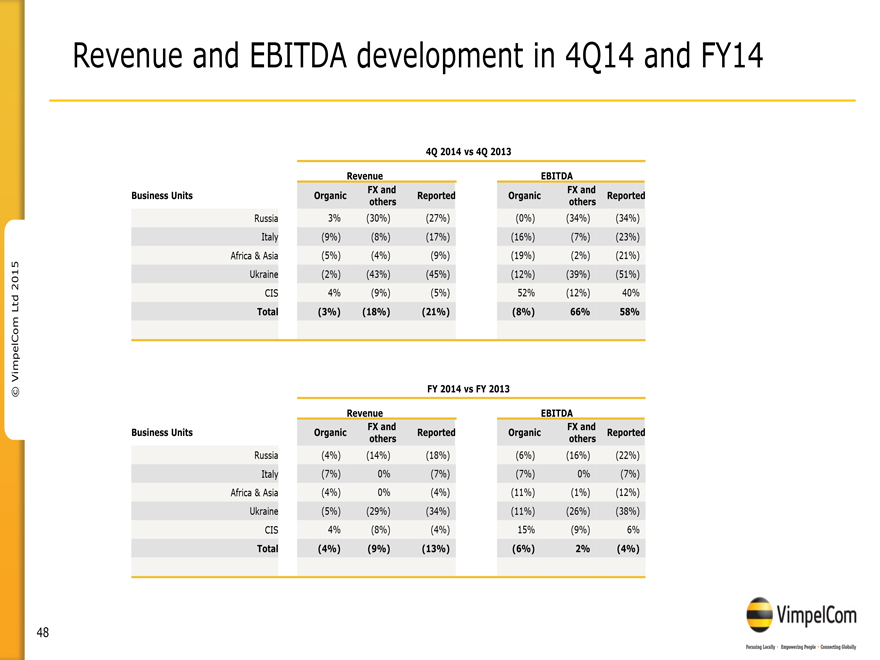

ORGANIC GROWTH REVENUE AND EBITDA

| 4Q14 vs 4Q13 | ||||||||||||||||||||||||

| Revenue | EBITDA | |||||||||||||||||||||||

| Business Units | Organic | FX and others |

Reported | Organic | FX and others |

Reported | ||||||||||||||||||

| Russia |

3 | % | (30 | %) | (27 | %) | 0 | % | (34 | %) | (34 | %) | ||||||||||||

| Italy |

(9 | %) | (8 | %) | (17 | %) | (16 | %) | (7 | %) | (23 | %) | ||||||||||||

| Africa & Asia |

(5 | %) | (4 | %) | (9 | %) | (19 | %) | (2 | %) | (21 | %) | ||||||||||||

| Ukraine |

(2 | %) | (43 | %) | (45 | %) | (12 | %) | (39 | %) | (51 | %) | ||||||||||||

| CIS |

4 | % | (9 | %) | (5 | %) | 52 | % | (12 | %) | 40 | % | ||||||||||||

| Total |

(3 | %) | (18 | %) | (21 | %) | (8 | %) | 66 | % | 58 | % | ||||||||||||

| FY14 vs FY13 | ||||||||||||||||||||||||

| Revenue | EBITDA | |||||||||||||||||||||||

| Business Units | Organic | FX and others |

Reported | Organic | FX and others |

Reported | ||||||||||||||||||

| Russia |

(4 | %) | (14 | %) | (18 | %) | (6 | %) | (16 | %) | (22 | %) | ||||||||||||

| Italy |

(7 | %) | 0 | % | (7 | %) | (7 | %) | 0 | % | (7 | %) | ||||||||||||

| Africa & Asia |

(4 | %) | 0 | % | (4 | %) | (11 | %) | (1 | %) | (12 | %) | ||||||||||||

| Ukraine |

(5 | %) | (29 | %) | (34 | %) | (11 | %) | (26 | %) | (38 | %) | ||||||||||||

| CIS |

4 | % | (8 | %) | (4 | %) | 15 | % | (9 | %) | 6 | % | ||||||||||||

| Total |

(4 | %) | (9 | %) | (13 | %) | (6 | %) | 2 | % | (4 | %) | ||||||||||||

MOBILE CUSTOMERS1

| million | 4Q14 | 4Q13 | YoY | |||||||||

| Russia |

57.2 | 56.5 | 1 | % | ||||||||

| Italy |

21.6 | 22.3 | (3 | %) | ||||||||

| Algeria |

18.4 | 17.6 | 5 | % | ||||||||

| Pakistan |

38.5 | 37.6 | 2 | % | ||||||||

| Bangladesh |

30.8 | 28.8 | 7 | % | ||||||||

| Ukraine |

26.2 | 25.8 | 2 | % | ||||||||

| Kazakhstan |

9.8 | 9.2 | 7 | % | ||||||||

| Uzbekistan |

10.6 | 10.5 | 1 | % | ||||||||

| Other |

8.5 | 8.6 | (1 | %) | ||||||||

| Total |

221.6 | 216.9 | 2 | % | ||||||||

| 1 | Following the sale of the interest in Wind Canada, CAR and Burundi the numbers exclude respective customers in 4Q13 |

PRESENTATION OF FINANCIAL RESULTS

VimpelCom results presented in this earnings release are based on IFRS and have not been audited. Please note that audited financials will be filed in the Company’s annual report on Form 20-F, and may require adjustments due to subsequent events or for other reasons. Certain amounts and percentages that appear in this earnings release have been subject to rounding adjustments. As a result, certain numerical figures shown as totals, including in tables may not be an exact arithmetic aggregation of the figures that precede or follow them.

VimpelCom Ltd. 4Q 2014 | 2

JO LUNDER, CHIEF EXECUTIVE OFFICER, COMMENTS:

VimpelCom Ltd. 4Q 2014 | 3

| VimpelCom Ltd. 4Q 2014 | 4 |

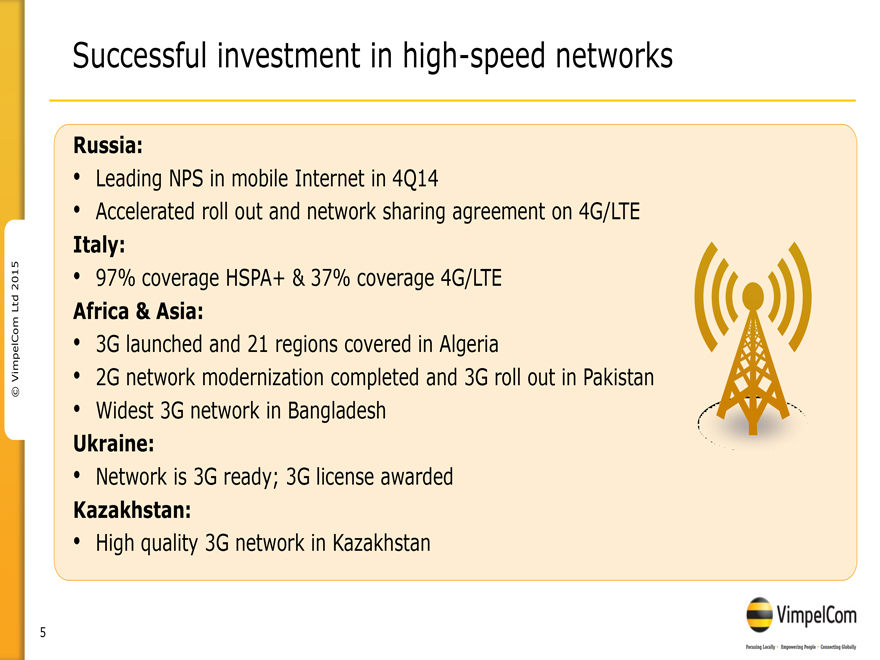

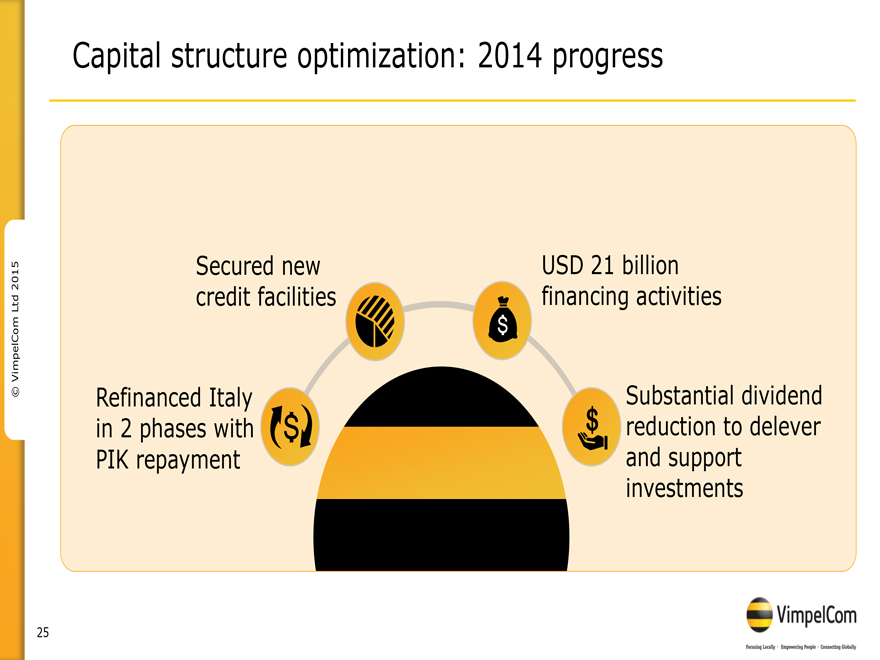

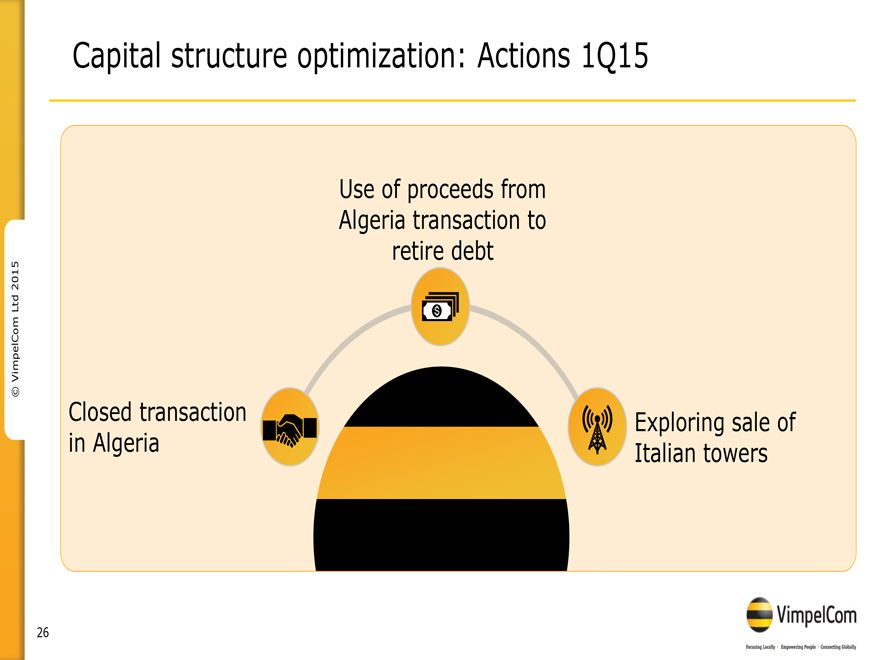

STRATEGIC UPDATE AND MAIN EVENTS

| • | Successful closing of Algeria transaction |

| • | 4G/LTE network sharing initiative with MTS launched in Russia |

| • | 3G license awarded in Ukraine |

| • | 4G/LTE launched in Georgia |

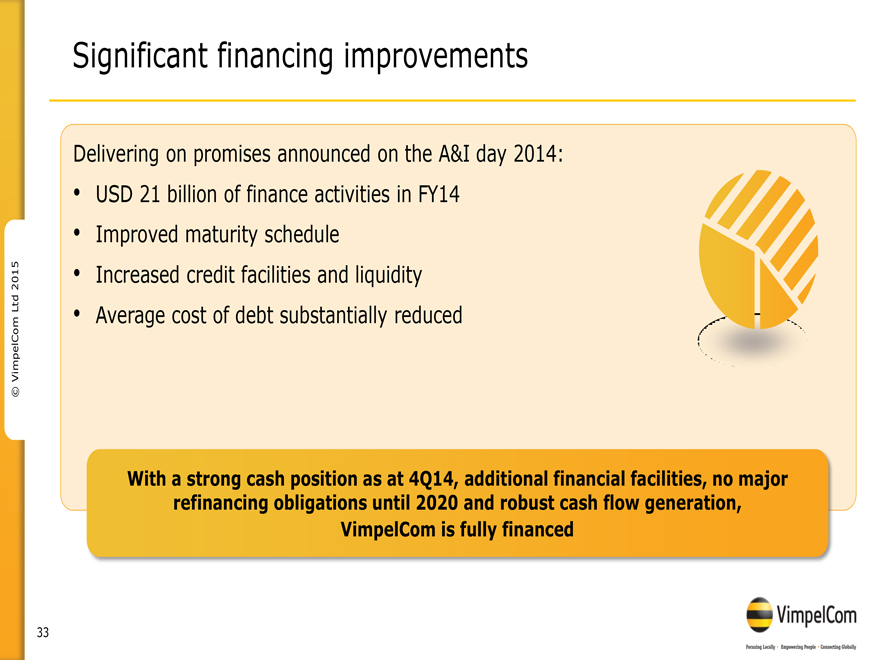

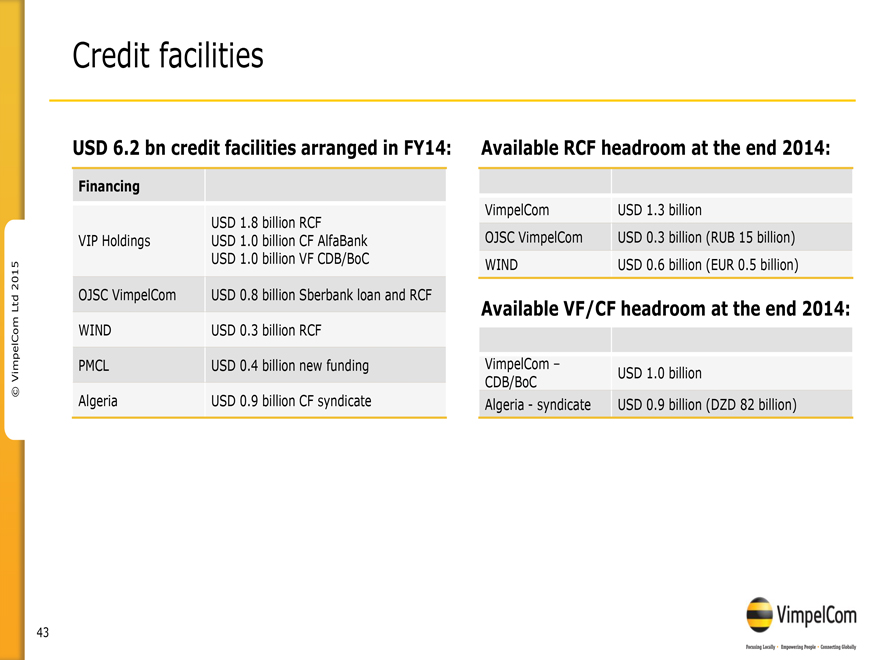

| • | Additional credit facility of USD 1 billion put in place |

| • | Update on Uzbekistan investigation |

| VimpelCom Ltd. 4Q 2014 | 5 |

VimpelCom Ltd. 4Q 2014 | 6

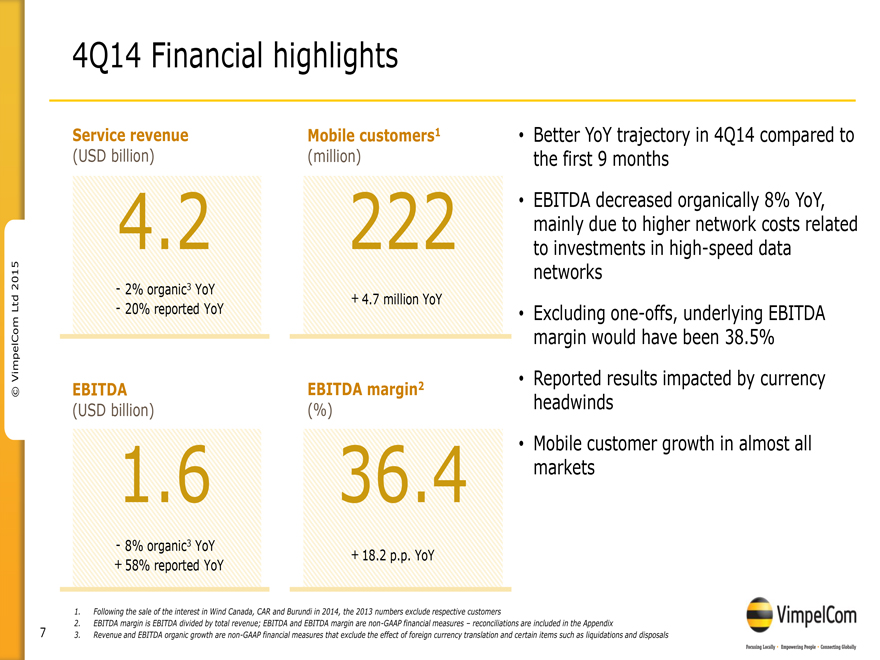

VIMPELCOM GROUP – FINANCIAL AND OPERATING RESULTS 4Q14

| • | Revenue of USD 4.4 billion declined organically 3% YoY |

| • | EBITDA of USD 1.6 billion decreased organically 8% YoY due to the pressure on revenue and cost increases |

| • | EBITDA margin of 36.4% |

| • | Customer base grew 4.7 million YoY |

| • | Operating cash flow improved USD 1.1 billion YoY |

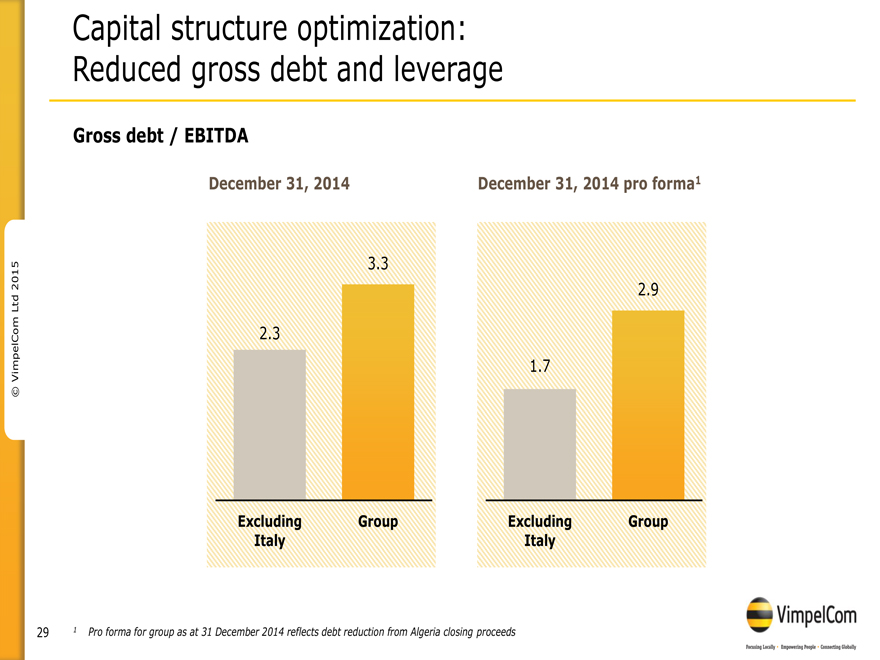

| • | Net debt / EBITDA stable QoQ at 2.5x, excluding Italy 1.2x |

OPERATING FINANCIALS PER BUSINESS UNIT

| USD mln | 4Q14 | 4Q13 | Reported YoY |

Organic YoY |

FY14 | FY13 | Reported YoY |

Organic YoY |

||||||||||||||||||||||||

| Total revenue |

4,391 | 5,552 | (21 | %) | (3 | %) | 19,627 | 22,546 | (13 | %) | (4 | %) | ||||||||||||||||||||

| of which: |

||||||||||||||||||||||||||||||||

| Russia |

1,580 | 2,173 | (27 | %) | 3 | % | 7,459 | 9,109 | (18 | %) | (4 | %) | ||||||||||||||||||||

| Italy |

1,401 | 1,685 | (17 | %) | (9 | %) | 6,155 | 6,618 | (7 | %) | (7 | %) | ||||||||||||||||||||

| Africa & Asia |

788 | 863 | (9 | %) | (5 | %) | 3,360 | 3,506 | (4 | %) | (4 | %) | ||||||||||||||||||||

| Ukraine |

216 | 394 | (45 | %) | (2 | %) | 1,062 | 1,610 | (34 | %) | (5 | %) | ||||||||||||||||||||

| CIS |

477 | 502 | (5 | %) | 4 | % | 1,873 | 1,947 | (4 | %) | 4 | % | ||||||||||||||||||||

| other |

(71 | ) | (65 | ) | (282 | ) | (244 | ) | ||||||||||||||||||||||||

| EBITDA |

1,600 | 1,013 | 58 | % | (8 | %) | 7,970 | 8,260 | (4 | %) | (6 | %) | ||||||||||||||||||||

| of which: |

||||||||||||||||||||||||||||||||

| Russia |

580 | 876 | (34 | %) | 0 | % | 2,980 | 3,815 | (22 | %) | (6 | %) | ||||||||||||||||||||

| Italy |

529 | 687 | (23 | %) | (16 | %) | 2,408 | 2,592 | (7 | %) | (7 | %) | ||||||||||||||||||||

| Africa & Asia |

326 | 411 | (21 | %) | (19 | %) | 1,486 | 1,679 | (12 | %) | (11 | %) | ||||||||||||||||||||

| Ukraine |

92 | 186 | (51 | %) | (12 | %) | 484 | 781 | (38 | %) | (11 | %) | ||||||||||||||||||||

| CIS |

210 | 152 | 40 | % | 52 | % | 912 | 858 | 6 | % | 15 | % | ||||||||||||||||||||

| other1 |

(137 | ) | (1,299 | ) | (300 | ) | (1,465 | ) | ||||||||||||||||||||||||

| EBITDA margin |

36.4 | % | 18.2 | % | 18.2 | pp | 40.6 | % | 36.6 | % | 4.0 | pp | ||||||||||||||||||||

| 1 | Including Algeria adjustments |

FINANCIAL AND OPERATING PERFORMANCE OVERVIEW 4Q14

| VimpelCom Ltd. 4Q 2014 | 7 |

| 1) | net of the impact of the non-recurring items accounted for in 3Q14 but commercially related to 4Q14 |

VimpelCom Ltd. 4Q 2014 | 8

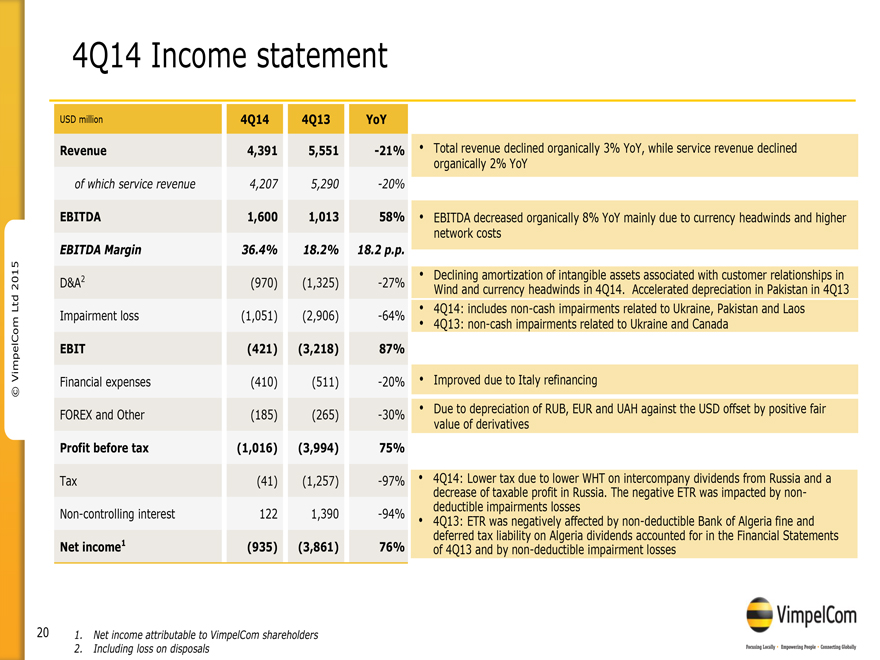

INCOME STATEMENT ELEMENTS & CAPITAL EXPENDITURES 4Q14

| USD mln | 4Q14 | 4Q13 | YoY | Organic YoY |

||||||||||||

| Total revenue |

4,391 | 5,552 | (21 | %) | (3 | %) | ||||||||||

| Mobile service revenue |

3,565 | 4,455 | (20 | %) | (2 | %) | ||||||||||

| EBITDA |

1,600 | 1,013 | 58 | % | (8 | %) | ||||||||||

| EBITDA margin |

36.4 | % | 18.2 | % | 18.2 | pp | ||||||||||

| EBIT |

(421 | ) | (3,218 | ) | n.m. | |||||||||||

| Financial income and expenses |

(410 | ) | (511 | ) | (20 | %) | ||||||||||

| Net foreign exchange (loss)/gain and others |

(185 | ) | (265 | ) | (30 | %) | ||||||||||

| Profit before tax |

(1,016 | ) | (3,994 | ) | 75 | % | ||||||||||

| Income tax expense |

(41 | ) | (1,257 | ) | (97 | %) | ||||||||||

| Profit for the period |

(1,057 | ) | (5,251 | ) | 80 | % | ||||||||||

| Net income attributable to VimpelCom shareholders |

(935 | ) | (3,861 | ) | 76 | % | ||||||||||

| USD mln | 4Q14 | 4Q13 | YoY | |||||||||||||

| Capital expenditures1 |

1,211 | 1,721 | (30 | %) | ||||||||||||

| Capital expenditures1 excluding licenses |

1,201 | 1,683 | (29 | %) | ||||||||||||

| Capex1 excl licenses/Revenue |

27 | % | 30 | % | ||||||||||||

VimpelCom Ltd. 4Q 2014 | 9

STATEMENT OF FINANCIAL POSITION & CASH FLOW 4Q14

| USD mln | 4Q14 | 3Q14 | QoQ | |||||||||

| Total assets |

40,997 | 45,833 | (11 | %) | ||||||||

| Shareholders’ equity |

4,893 | 7,868 | (38 | %) | ||||||||

| Gross debt |

26,443 | 27,714 | (5 | %) | ||||||||

| Net debt |

19,992 | 21,736 | (8 | %) | ||||||||

| Gross debt / LTM EBITDA1 |

3.3 | 3.2 | ||||||||||

| Net debt / LTM EBITDA1 |

2.5 | 2.5 | ||||||||||

| USD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

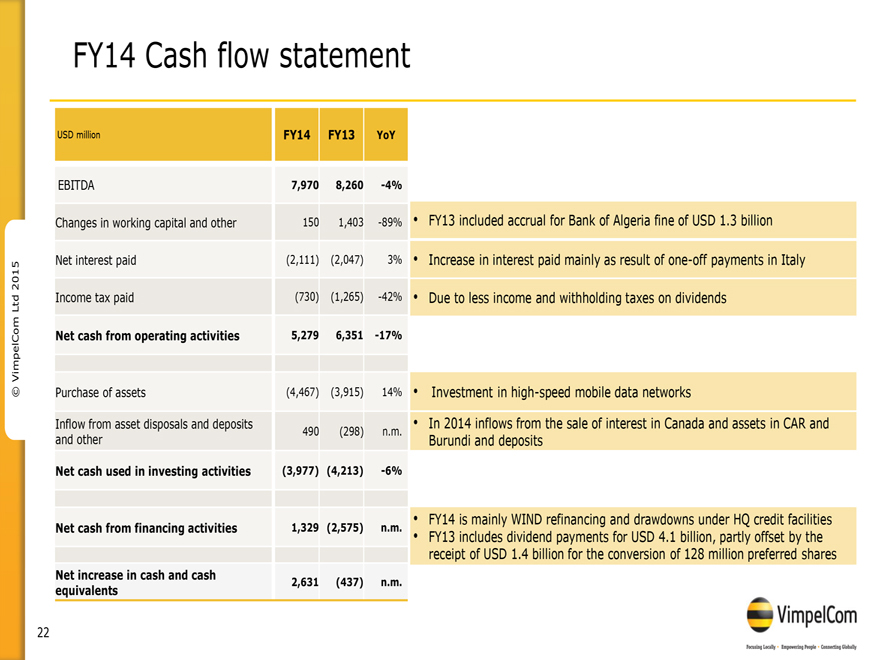

| Net cash from operating activities |

1,398 | 2,010 | (30 | %) | 5,279 | 6,351 | (17 | %) | ||||||||||||||||

| Net cash used in investing activities |

(906 | ) | (1,503 | ) | (40 | %) | (3,977 | ) | (4,213 | ) | (6 | %) | ||||||||||||

| Net cash from/(used in) financing activities |

261 | (1,030 | ) | n.m. | 1,329 | (2,575 | ) | n.m. | ||||||||||||||||

| 1) | Normalized LTM EBITDA excluding one-off charges related to the Algeria resolution |

VimpelCom Ltd. 4Q 2014 | 10

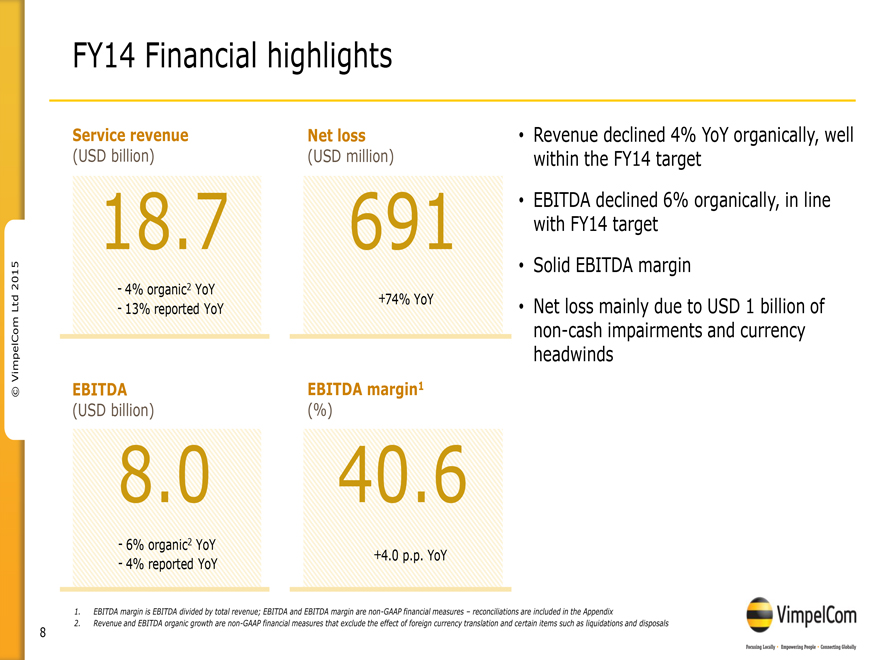

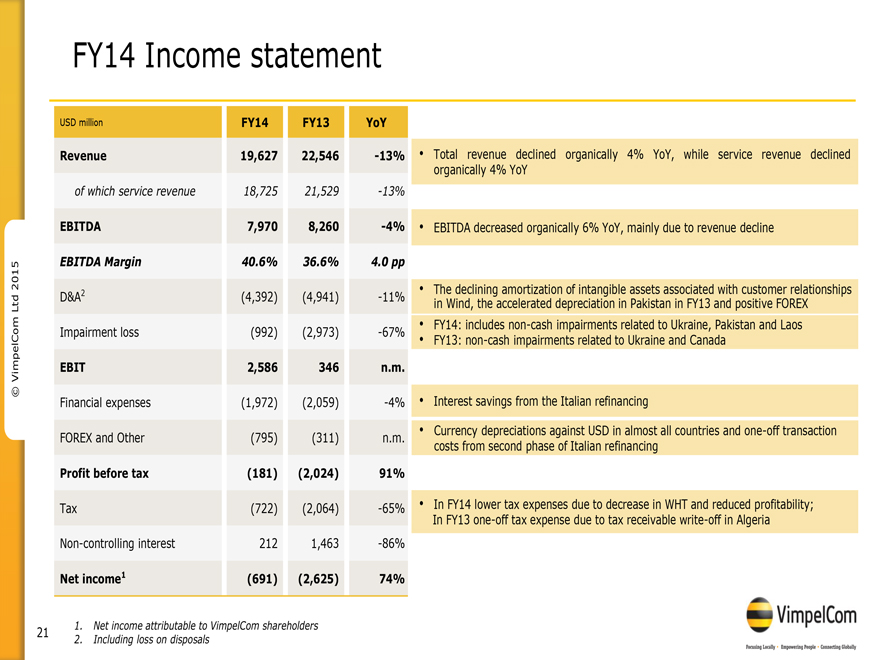

VIMPELCOM GROUP – FINANCIAL AND OPERATING RESULTS FY14

| • | Revenue of USD 19.6 billion declined organically 4% YoY, in-line with 2014 target |

| • | EBITDA of USD 8.0 billion declined organically 6% YoY, in-line with 2014 target |

| • | Solid EBITDA margin of 40.6% |

| • | CAPEX to revenue of 20% |

| • | Operating cash flow of USD 4.1 billion |

VimpelCom Ltd. 4Q 2014 | 11

INCOME STATEMENT ELEMENTS & CAPITAL EXPENDITURES FY14

| USD mln | FY14 | FY13 | YoY | Organic YoY |

||||||||||||

| Total revenue |

19,627 | 22,546 | (13 | %) | (4 | %) | ||||||||||

| Mobile service revenue |

15,810 | 18,152 | (13 | %) | (4 | %) | ||||||||||

| EBITDA |

7,970 | 8,260 | (4 | %) | (6 | %) | ||||||||||

| EBITDA margin |

40.6 | % | 36.6 | % | 4.0 | pp | ||||||||||

| EBIT |

2,586 | 346 | n.m. | |||||||||||||

| Financial income and expenses |

(1,972 | ) | (2,059 | ) | (4 | %) | ||||||||||

| Net foreign exchange (loss)/gain and others |

(795 | ) | (311 | ) | n.m. | |||||||||||

| Profit before tax |

(181 | ) | (2,024 | ) | 91 | % | ||||||||||

| Income tax expense |

(722 | ) | (2,064 | ) | (65 | %) | ||||||||||

| Profit for the period |

(903 | ) | (4,088 | ) | 78 | % | ||||||||||

| Net income attributable to VimpelCom shareholders |

(691 | ) | (2,625 | ) | 74 | % | ||||||||||

| USD mln | FY14 | FY13 | YoY | |||||||||

| Capital expenditures |

4,255 | 4,309 | (1 | %) | ||||||||

| Capital expenditures excluding licenses |

3,907 | 4,001 | (2 | %) | ||||||||

| Capex excl licenses/Revenue |

20 | % | 18 | % | ||||||||

VimpelCom Ltd. 4Q 2014 | 12

BUSINESS UNITS PERFORMANCE IN 4Q14

| • | Russia |

| • | Italy |

| • | Africa & Asia |

| • | Ukraine |

| • | CIS |

VimpelCom Ltd. 4Q 2014 | 13

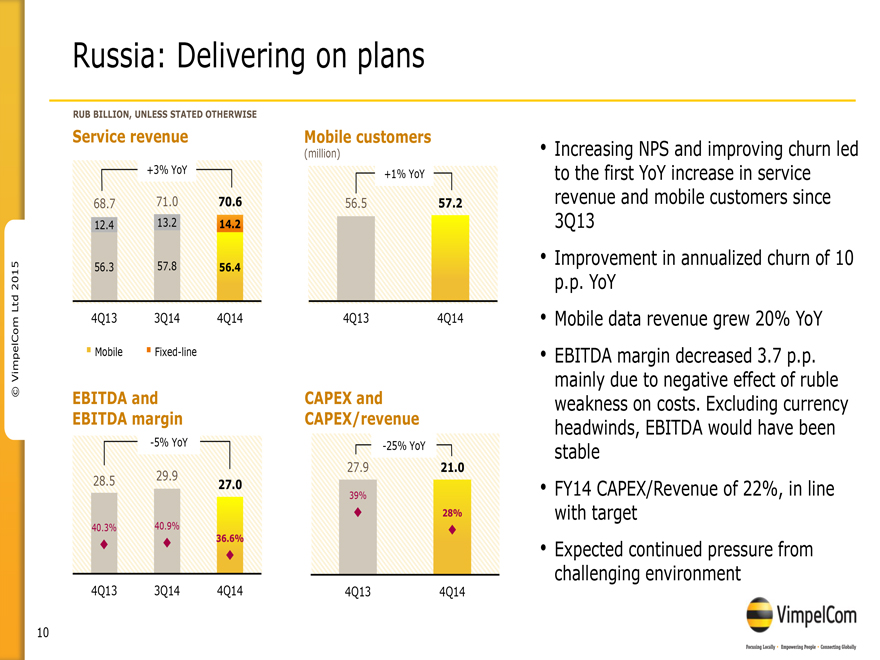

RUSSIA – 4Q14

| • | Continued focus on Customer Excellence led to increasing NPS and improving churn |

| • | Service revenue grew 3% YoY, the first increase in service revenue since 3Q13 |

| • | Stable mobile service revenue YoY; solid mobile data revenue growth of 20% YoY |

| • | Mobile customers increased 0.7 million YoY, reaching 57.2 million |

| • | EBITDA decreased 5% YoY mainly driven by increased service costs due to FOREX, leading to an EBITDA margin of 36.6% |

VimpelCom Ltd. 4Q 2014 | 14

RUSSIA KEY INDICATORS

| RUB mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

73,947 | 70,660 | 5 | % | 281,898 | 289,910 | (3 | %) | ||||||||||||||||

| Mobile service revenue |

56,360 | 56,253 | 0 | % | 221,438 | 229,020 | (3 | %) | ||||||||||||||||

| Fixed-line service revenue |

14,217 | 12,402 | 15 | % | 52,064 | 49,413 | 5 | % | ||||||||||||||||

| EBITDA |

27,042 | 28,479 | (5 | %) | 111,935 | 121,422 | (8 | %) | ||||||||||||||||

| EBITDA margin |

36.6 | % | 40.3 | % | (3.7 | pp) | 39.7 | % | 41.9 | % | (2.2 | pp) | ||||||||||||

| Capex |

20,970 | 27,871 | (25 | %) | 61,310 | 58,792 | 4 | % | ||||||||||||||||

| Capex/Revenue |

28 | % | 39 | % | 22 | % | 20 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Total operating revenue |

59,637 | 58,087 | 3 | % | 229,266 | 239,852 | (4 | %) | ||||||||||||||||

| - of which mobile data |

10,523 | 8,792 | 20 | % | 38,065 | 31,688 | 20 | % | ||||||||||||||||

| Customers (mln) |

57.2 | 56.5 | 1 | % | ||||||||||||||||||||

| - of which broadband (mln) |

3.7 | 3.1 | 16 | % | ||||||||||||||||||||

| ARPU (RUB) |

325 | 327 | (1 | %) | ||||||||||||||||||||

| MOU (min) |

316 | 293 | 8 | % | ||||||||||||||||||||

| Fixed-line |

||||||||||||||||||||||||

| Total operating revenue |

14,309 | 12,574 | 14 | % | 52,632 | 50,058 | 5 | % | ||||||||||||||||

| Broadband revenue |

3,230 | 3,152 | 2 | % | 12,771 | 12,632 | 1 | % | ||||||||||||||||

| Broadband customers (mln) |

2.3 | 2.3 | 0 | % | ||||||||||||||||||||

| Broadband ARPU (RUB) |

477 | 451 | 6 | % | ||||||||||||||||||||

VimpelCom Ltd. 4Q 2014 | 15

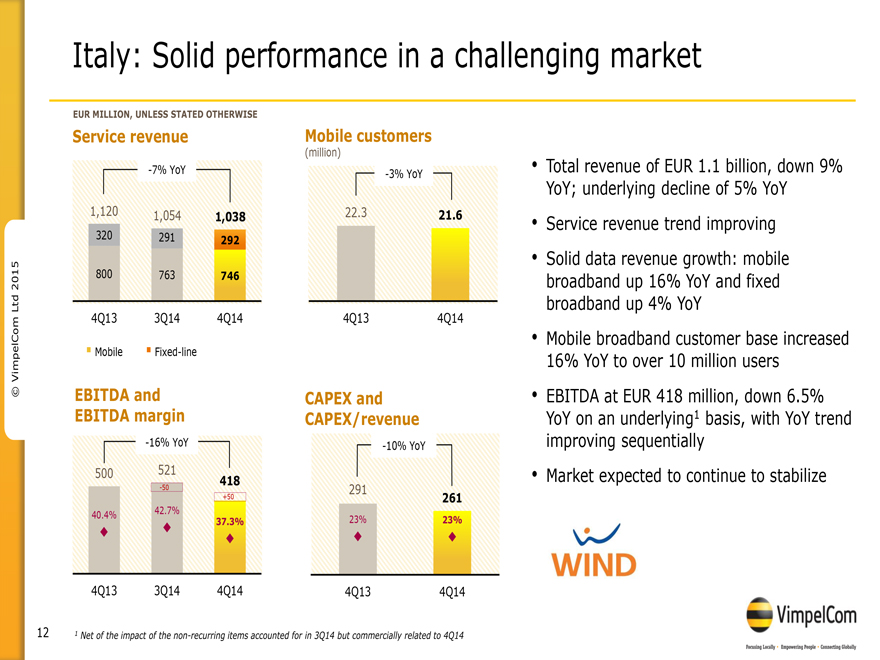

ITALY – 4Q14

| • | Solid performance with improving trend in a challenging market |

| • | Further improvement in mobile service revenue YoY trend versus 3Q14 |

| • | Solid data revenue growth: mobile broadband up 16% YoY and fixed broadband up 4% YoY |

| • | Total revenue of EUR 1.1 billion, down 9% YoY; underlying1 decline of 5% YoY |

| • | EBITDA at EUR 418 million down 6.5% YoY on an underlying basis, improving sequentially |

| 1) | net of the impact of the non-recurring items accounted for in 3Q14 but commercially related to 4Q14 |

VimpelCom Ltd. 4Q 2014 | 16

ITALY KEY INDICATORS

| EUR mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

1,123 | 1,237 | (9 | %) | 4,633 | 4,983 | (7 | %) | ||||||||||||||||

| Mobile service revenue |

746 | 800 | (7 | %) | 2,975 | 3,282 | (9 | %) | ||||||||||||||||

| Fixed-line service revenue |

292 | 320 | (9 | %) | 1,192 | 1,295 | (8 | %) | ||||||||||||||||

| EBITDA |

418 | 500 | (16 | %) | 1,804 | 1,944 | (7 | %) | ||||||||||||||||

| EBITDA margin |

37.3 | % | 40.4 | % | (3.1 | pp) | 39.0 | % | 39.1 | % | (0.1 | pp) | ||||||||||||

| C apex1 |

261 | 291 | (10 | %) | 757 | 789 | (4 | %) | ||||||||||||||||

| C apex1/Revenue |

23 | % | 23 | % | 16 | % | 16 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Total revenue |

820 | 907 | (10 | %) | 3,328 | 3,648 | (9 | %) | ||||||||||||||||

| C ustomers (mln) |

21.6 | 22.3 | (3 | %) | ||||||||||||||||||||

| - of which broadband (mln) 2 |

10.2 | 8.8 | 16 | % | ||||||||||||||||||||

| ARPU (€ ) |

11.4 | 11.9 | (4 | %) | ||||||||||||||||||||

| MOU (min) |

274 | 256 | 7 | % | ||||||||||||||||||||

| Fixed |

||||||||||||||||||||||||

| Total revenue |

302 | 330 | (8 | %) | 1,305 | 1,335 | (2 | %) | ||||||||||||||||

| Total voice customers (mln) |

2.8 | 3.0 | (5 | %) | ||||||||||||||||||||

| ARPU (€ ) |

29 | 30 | (5 | %) | ||||||||||||||||||||

| Broadband customers (mln) |

2.2 | 2.2 | (0 | %) | ||||||||||||||||||||

| Broadband ARPU (€ ) |

22 | 21 | 5 | % | ||||||||||||||||||||

| Dual-play customers (mln) |

1.9 | 1.9 | 2 | % | ||||||||||||||||||||

| 1) | CAPEX in FY13 excludes EUR 136 million of non-cash increase in intangible assets related to the contract with Terna for the right of way of WIND’s backbone; excluding FOC assets |

| 2) | Mobile broadband include customers that have performed at least one mobile Internet event in the previous month |

VimpelCom Ltd. 4Q 2014 | 17

AFRICA & ASIA – 4Q14

| • | Successful closing of the transaction in Algeria strengthens Djezzy’s position and prospects for growth |

| • | Double-digit revenue growth in Bangladesh and improving trend in Pakistan more than offset by the competitive pressure in Algeria resulting in a revenue decrease of 5% YoY to USD 788 million |

| • | EBITDA decreased organically 19% YoY to USD 326 million; EBITDA margin was 41.4% |

| • | Customer base grew 4% YoY to reach 90 million |

| VimpelCom Ltd. 4Q 2014 | 18 |

VimpelCom Ltd. 4Q 2014 | 19

AFRICA & ASIA KEY INDICATORS

| USD mln | 4Q14 | 4Q13 | YoY | Organic YoY |

FY14 | FY13 | YoY | Organic YoY |

||||||||||||||||||||||||

| Total revenue |

788 | 863 | (9 | %) | (5 | %) | 3,360 | 3,506 | (4 | %) | (4 | %) | ||||||||||||||||||||

| Mobile service revenue |

781 | 830 | (6 | %) | (4 | %) | 3,297 | 3,435 | (4 | %) | (4 | %) | ||||||||||||||||||||

| EBITDA |

326 | 411 | (21 | %) | (19 | %) | 1,486 | 1,679 | (12 | %) | (11 | %) | ||||||||||||||||||||

| EBITDA margin |

41.4 | % | 47.6 | % | (6.2 | pp) | 44.2 | % | 47.9 | % | (3.7 | pp) | ||||||||||||||||||||

| Capex |

258 | 330 | (22 | %) | 1,253 | 610 | 105 | % | ||||||||||||||||||||||||

| Capex1/Revenue |

33 | % | 34 | % | (3 | %) | 28 | % | 13 | % | 115 | % | ||||||||||||||||||||

| Mobile customers (mln) |

90.0 | 86.9 | 4 | % | ||||||||||||||||||||||||||||

| AFRICA & ASIA BUSINESS UNIT: COUNTRY DETAIL | ||||||||||||||||||||||||

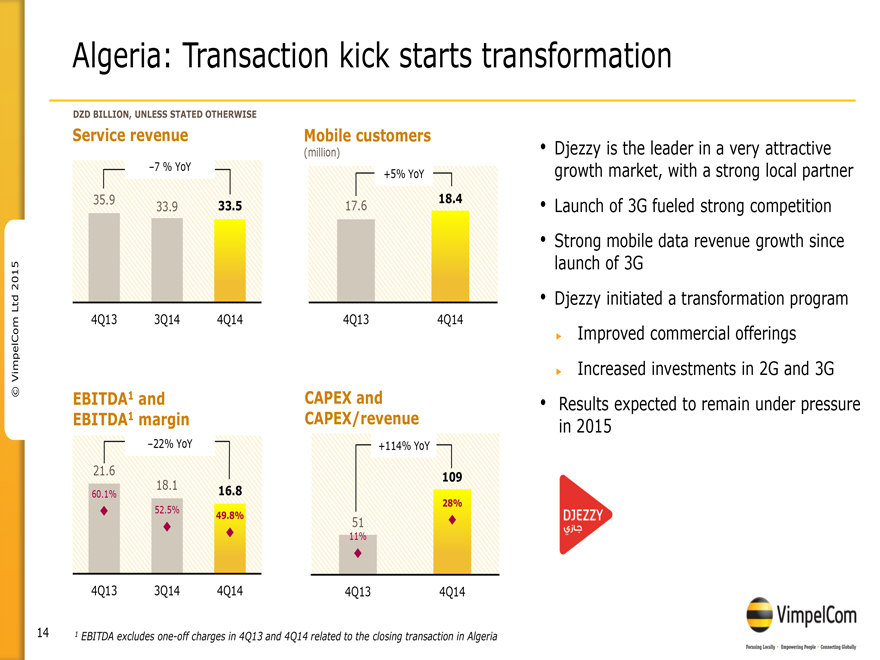

| ALGERIA | ||||||||||||||||||||||||

| DZD bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

34 | 36 | (6 | %) | 136 | 143 | (5 | %) | ||||||||||||||||

| Mobile service revenue |

33 | 36 | (7 | %) | 135 | 143 | (5 | %) | ||||||||||||||||

| EBITDA |

17 | 22 | (22 | %) | 73 | 85 | (14 | %) | ||||||||||||||||

| EBITDA margin |

49.8 | % | 60.1 | % | (10.3 | pp) | 53.5 | % | 59.1 | % | (5.6 | pp) | ||||||||||||

| CAPEX (USD mln)1 |

109 | 51 | 114 | % | 415 | 84 | n.m. | |||||||||||||||||

| CAPEX/Revenue |

28 | % | 11 | % | 25 | % | 5 | % | ||||||||||||||||

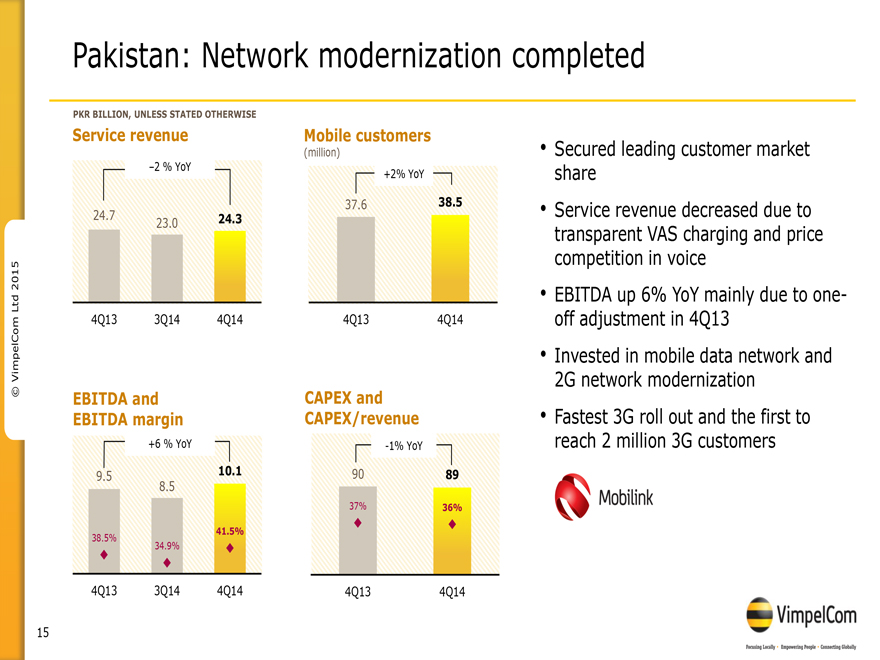

| PAKISTAN | ||||||||||||||||||||||||

| PKR bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

26 | 26 | (1 | %) | 102 | 108 | (6 | %) | ||||||||||||||||

| Mobile service revenue |

24 | 25 | (2 | %) | 98 | 104 | (6 | %) | ||||||||||||||||

| EBITDA |

10 | 9 | 6 | % | 39 | 45 | (13 | %) | ||||||||||||||||

| EBITDA margin |

41.5 | % | 38.5 | % | 3.0 | pp | 40.0 | % | 42.8 | % | (2.8 | pp) | ||||||||||||

| CAPEX (USD mln)1 |

89 | 90 | (1 | %) | 352 | 190 | 85 | % | ||||||||||||||||

| CAPEX/Revenue |

36 | % | 37 | % | 35 | % | 18 | % | ||||||||||||||||

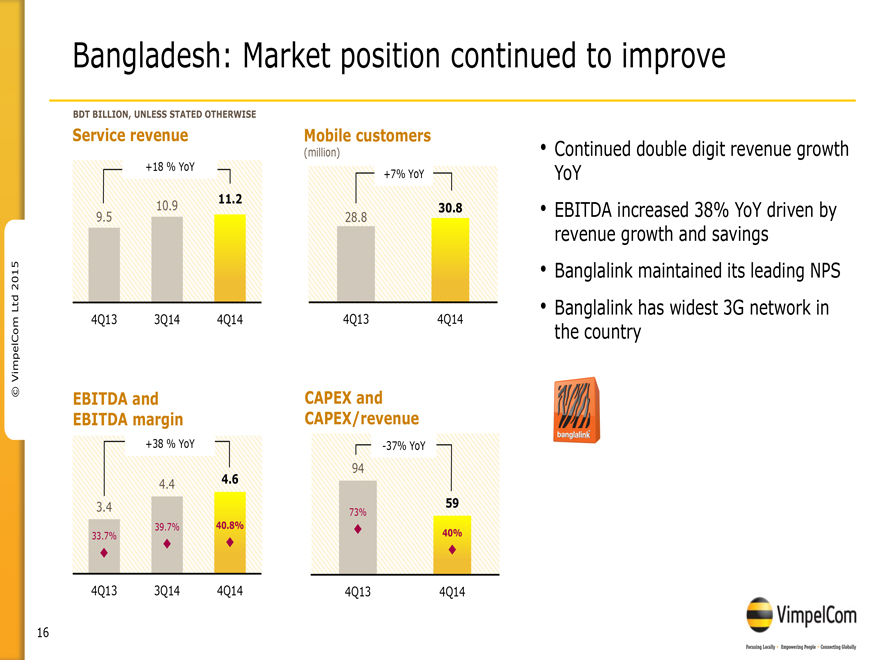

| BANGLADESH | ||||||||||||||||||||||||

| BDT bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

11 | 10 | 14 | % | 44 | 39 | 11 | % | ||||||||||||||||

| Mobile service revenue |

11 | 9 | 18 | % | 43 | 39 | 11 | % | ||||||||||||||||

| EBITDA |

5 | 3 | 38 | % | 17 | 15 | 17 | % | ||||||||||||||||

| EBITDA margin |

40.8 | % | 33.7 | % | 7.1 | pp | 38.9 | % | 37.1 | % | 1.8 | pp | ||||||||||||

| CAPEX (USD mln)1 |

59 | 94 | (37 | %) | 178 | 133 | 34 | % | ||||||||||||||||

| CAPEX/Revenue |

40 | % | 73 | % | 32 | % | 26 | % | ||||||||||||||||

| 1) | CAPEX excl. licenses |

VimpelCom Ltd. 4Q 2014 | 20

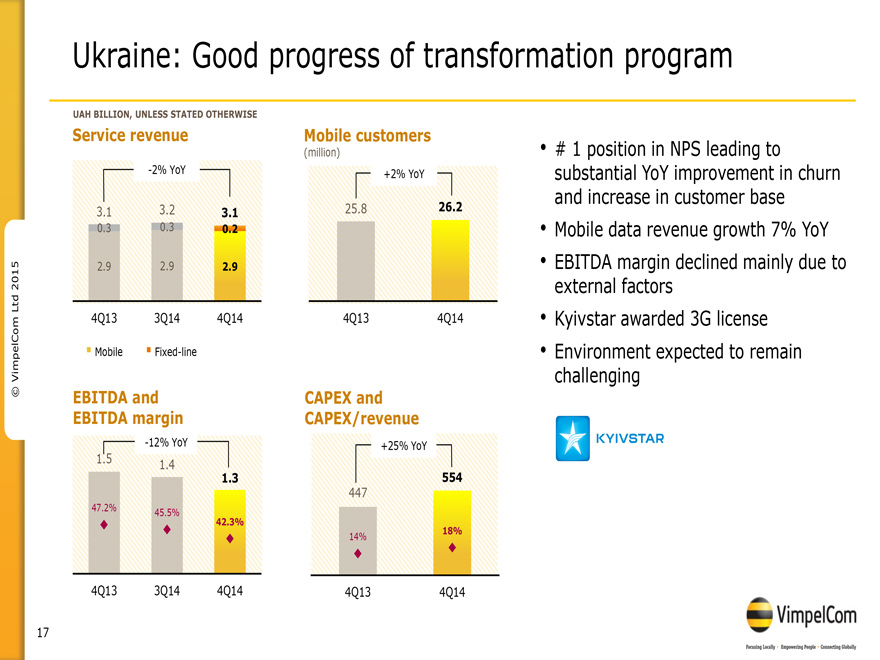

UKRAINE – 4Q14

| • | Good progress on transformation program in Ukraine, which led to continued improvements in NPS, churn and market position |

| • | Mobile customer base increased 2% YoY to 26.2 million |

| • | Mobile service revenue stable at UAH 2.9 billion |

| • | EBITDA declined 12% YoY to UAH 1.3 billion; EBITDA margin of 42.3% |

VimpelCom Ltd. 4Q 2014 | 21

UKRAINE KEY INDICATORS

| UAH mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

3,095 | 3,149 | (2 | %) | 12,231 | 12,871 | (5 | %) | ||||||||||||||||

| Mobile service revenue |

2,863 | 2,856 | 0 | % | 11,190 | 11,579 | (3 | %) | ||||||||||||||||

| Fixed-line service revenue |

225 | 282 | (20 | %) | 1,017 | 1,102 | (8 | %) | ||||||||||||||||

| EBITDA |

1,311 | 1,487 | (12 | %) | 5,526 | 6,239 | (11 | %) | ||||||||||||||||

| EBITDA margin |

42.3 | % | 47.2 | % | (4.9 | pp) | 45.2 | % | 48.5 | % | (3.3 | pp) | ||||||||||||

| Capex |

554 | 447 | 24 | % | 1,657 | 1,690 | (2 | %) | ||||||||||||||||

| Capex/Revenue |

18 | % | 14 | % | 14 | % | 13 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Total operating revenue |

2,870 | 2,866 | 0 | % | 11,212 | 11,768 | (5 | %) | ||||||||||||||||

| Customers (mln) |

26.2 | 25.8 | 2 | % | ||||||||||||||||||||

| ARPU (UAH) |

36.1 | 36.5 | (1 | %) | ||||||||||||||||||||

| MOU (min) |

524 | 504 | 4 | % | ||||||||||||||||||||

| Fixed-line |

||||||||||||||||||||||||

| Total operating revenue |

225 | 283 | (20 | %) | 1,020 | 1,103 | (8 | %) | ||||||||||||||||

| Broadband revenue |

110.8 | 107.0 | 4 | % | 443.4 | 407.6 | 9 | % | ||||||||||||||||

| Broadband customers (mln) |

0.8 | 0.8 | 7 | % | ||||||||||||||||||||

| Broadband ARPU (UAH) |

45.5 | 48.1 | (5 | %) | ||||||||||||||||||||

VimpelCom Ltd. 4Q 2014 | 22

CIS – 4Q14

| • | Solid results, total revenue increased organically by 4% YoY |

| • | Mobile customers increased 4% YoY to 26.5 million; customer growth in all CIS markets |

| • | Strong mobile data revenue growth of 24% YoY |

| • | EBITDA reached USD 210 million with organic increase of 3% YoY adjusted for one-offs; EBITDA margin of 44.0% |

| • | Continued robust results in Kazakhstan |

VimpelCom Ltd. 4Q 2014 | 23

VimpelCom Ltd. 4Q 2014 | 24

CIS KEY INDICATORS

| USD mln | 4Q14 | 4Q13 | YoY | Organic YoY |

FY14 | FY13 | YoY | Organic YoY |

||||||||||||||||||||||||

| Total revenue |

477 | 501 | (5 | %) | 4 | % | 1,873 | 1,946 | (4 | %) | 4 | % | ||||||||||||||||||||

| Mobile service revenue |

434 | 455 | (5 | %) | 4 | % | 1,700 | 1,773 | (4 | %) | 4 | % | ||||||||||||||||||||

| Fixed-line service revenue |

41 | 42 | (3 | %) | 10 | % | 165 | 162 | 2 | % | 11 | % | ||||||||||||||||||||

| EBITDA |

210 | 150 | 40 | % | 52 | % | 912 | 856 | 6 | % | 15 | % | ||||||||||||||||||||

| EBITDA margin |

44.0 | % | 30.0 | % | 14.0 | pp | 48.7 | % | 44.0 | % | 4.7 | pp | ||||||||||||||||||||

| Capex |

121 | 62 | 81 | % | 268 | 370 | (30 | %) | ||||||||||||||||||||||||

| Capex/Revenue |

25 | % | 12 | % | 14 | % | 19 | % | ||||||||||||||||||||||||

| Mobile |

||||||||||||||||||||||||||||||||

| Customers (mln) |

26.5 | 25.4 | 4 | % | ||||||||||||||||||||||||||||

| - of which broadband (mln) |

14 | 13 | 4 | % | ||||||||||||||||||||||||||||

| Fixed |

||||||||||||||||||||||||||||||||

| Broadband customers (mln) |

0.4 | 0.4 | 7 | % | ||||||||||||||||||||||||||||

| Broadband revenue |

14.1 | 15.4 | (8 | %) | 56.1 | 59.4 | (5 | %) | ||||||||||||||||||||||||

For details per country unit please see Attachment B

CIS BUSINESS UNIT: COUNTRY DETAIL

KAZAKHSTAN

| KZT mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

34,965 | 33,730 | 4 | % | 135,266 | 127,748 | 6 | % | ||||||||||||||||

| Mobile service revenue |

31,148 | 30,482 | 2 | % | 120,513 | 115,835 | 4 | % | ||||||||||||||||

| Fixed-line service revenue |

3,769 | 3,214 | 17 | % | 14,565 | 11,781 | 24 | % | ||||||||||||||||

| EBITDA |

14,061 | 16,101 | (13 | %) | 62,492 | 59,427 | 5 | % | ||||||||||||||||

| EBITDA margin |

40.2 | % | 47.7 | % | (7.5 | pp) | 46.2 | % | 46.5 | % | (0.3 | pp) | ||||||||||||

| Capex (USD mln) |

57 | 58 | (1 | %) | 109 | 159 | (32 | %) | ||||||||||||||||

| Capex / Revenue |

30 | % | 26 | % | 14 | % | 19 | % | ||||||||||||||||

UZBEKISTAN

| USD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

186 | 173 | 7 | % | 718 | 673 | 7 | % | ||||||||||||||||

| Mobile service revenue |

184 | 171 | 8 | % | 710 | 664 | 7 | % | ||||||||||||||||

| Fixed-line service revenue |

2 | 2 | (10 | %) | 7 | 8 | (10 | %) | ||||||||||||||||

| EBITDA |

115 | 21 | n.m. | 461 | 347 | 33 | % | |||||||||||||||||

| EBITDA margin |

61.6 | % | 11.9 | % | 49.7 | pp | 64.2 | % | 51.5 | % | 12.7 | pp | ||||||||||||

| Capex (USD mln) |

28 | (17 | ) | n.m. | 79 | 142 | (44 | %) | ||||||||||||||||

| Capex / Revenue |

15 | % | (10 | %) | 11 | % | 21 | % | ||||||||||||||||

VimpelCom Ltd. 4Q 2014 | 25

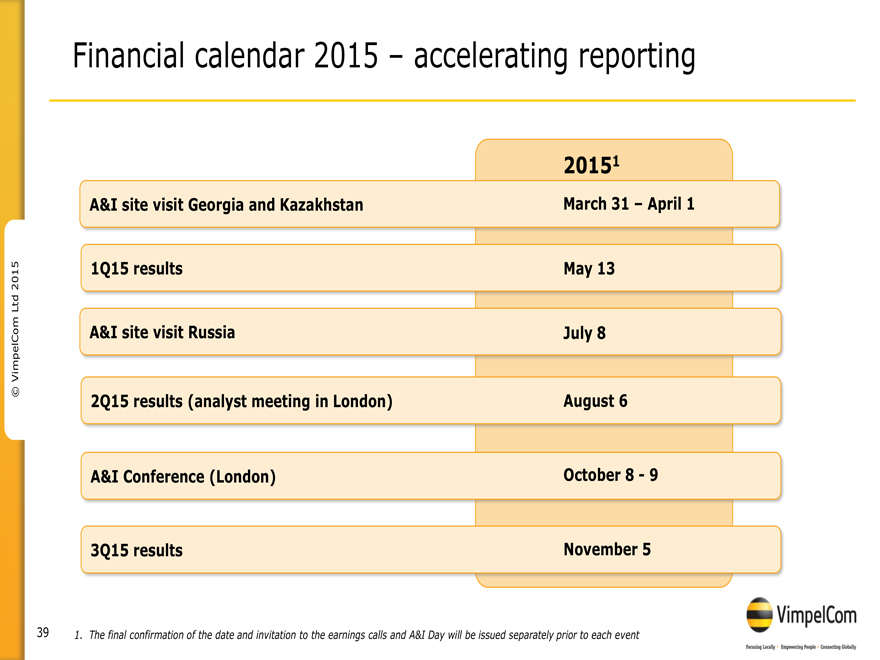

CONFERENCE CALL INFORMATION

On February 25, 2015, the Company will host an analyst & investor presentation in London on its fourth quarter and full year 2014 results at 2:00 pm CET (1:00 pm GMT), which can be followed via Internet or conference call.

The call and slide presentation may be accessed at http://www.vimpelcom.com.

2:00 pm CET investor and analyst conference call

US call-in number: +1 (877) 616-4476

Confirmation Code: 80666172

International call-in number: + 1 (402) 875-4763

Confirmation Code: 80666172

The conference call replay and the slide presentations webcast will be available until March 15, 2015. The slide presentation will also be available for download on the Company’s website.

Investor and analyst call replay

US Replay Number: +1 (855) 859-2056

Confirmation Code: 80666172

International Replay Number: +1 (404) 537-3406

Confirmation Code: 80666172

CONTACT INFORMATION

| INVESTOR RELATIONS

|

MEDIA AND PUBLIC RELATIONS

| |

| Gerbrand Nijman / Remco Vergeer | Bobby Leach / Artem Minaev | |

| [email protected] | [email protected] | |

| Tel: +31 20 79 77 200 (Amsterdam) | Tel: +31 20 79 77 200 (Amsterdam) |

VimpelCom Ltd. 4Q 2014 | 26

DISCLAIMER

This press release contains “forward-looking statements”, as the phrase is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements relate to, among other things, the Company’s anticipated performance, future market developments and trends, its intended use of proceeds from the Algeria transaction, anticipated interest cost savings, operational and network development and anticipated benefits from network investment, expectations regarding its 4G/LTE agreement with MTS, anticipated benefits from 3G services in Ukraine and 4G/LTE services in Georgia, expectations regarding ongoing investigations of the SEC, the DOJ and the Dutch public prosecutor’s office, and the Company’s ability to realize its strategic initiatives in the various countries of operation. The forward-looking statements included in this presentation are based on management’s best assessment of the Company’s strategic and financial position and of future market conditions and trends. These discussions involve risks and uncertainties. The actual outcome may differ materially from these statements as a result of continued volatility in the economies in our markets, unforeseen developments from competition, governmental regulation of the telecommunications industries, general political uncertainties in our markets and/or litigation with third parties. Certain factors that could cause actual results to differ materially from those discussed in any forward-looking statements include the risk factors described in the Company’s Annual Report on Form 20-F for the year ended December 31, 2013 filed with the U.S. Securities and Exchange Commission (the “SEC”) and other public filings made by the Company with the SEC, which risk factors are incorporated herein by reference. The Company disclaims forward looking statements speak only as of the date hereof, and the obligation to update them or to announce publicly any revision to any of the forward-looking statements contained in this release, or to make corrections to reflect future events or developments.

ABOUT VIMPELCOM LTD

VimpelCom, headquartered in Amsterdam, is one of the world’s largest integrated telecommunications services operators providing voice and data services through a range of traditional and broadband mobile and fixed technologies in Russia, Italy, Ukraine, Kazakhstan, Uzbekistan, Tajikistan, Armenia, Georgia, Kyrgyzstan, Laos, Algeria, Bangladesh, Pakistan and Zimbabwe. VimpelCom’s operations around the globe cover territory with a total population of approximately 739 million people. VimpelCom provides services under the “Beeline”, “Kyivstar”, “WIND”, “Infostrada” “Mobilink”, “banglalink”, “Telecel”, and “Djezzy” brands. As of December 31, 2014 VimpelCom had 222 million mobile customers on a combined basis. VimpelCom is traded on the NASDAQ Global Stock Market under the symbol (VIP). For more information visit: http://www.vimpelcom.com.

VimpelCom Ltd. 4Q 2014 | 27

CONTENT OF THE ATTACHMENTS

| Attachment A | Financial Schedules | 29 | ||||

| Attachment B |

Debt Overview | 32 | ||||

| Attachment C |

Country units key indicators CIS and Africa & Asia | 35 | ||||

| Attachment D |

Reconciliation Tables | 38 | ||||

| Average Rates of Functional Currencies to USD (EBITDA) | ||||||

| Attachment E |

WIND Telecomunicazioni group condensed financial statement of income | 40 | ||||

| Attachment F |

Definitions | 41 | ||||

For more information on financial and operating data for specific countries, please refer to the supplementary file

Factbook4Q2014.xls on VimpelCom’s website at http://vimpelcom.com/ir/financials/results.wbp

VimpelCom Ltd. 4Q 2014 | 28

ATTACHMENT A: FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED CONSOLIDATED STATEMENTS OF INCOME

| USD mln | 4Q14 | 4Q13 | FY14 | FY13 | ||||||||||||

| Total operating revenue |

4,391 | 5,552 | 19,627 | 22,546 | ||||||||||||

| of which other revenue |

32 | 120 | 383 | 292 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Service costs, equipment and accessories |

1,144 | 1,416 | 4,932 | 5,913 | ||||||||||||

| Selling, general and administrative expenses |

1,647 | 3,123 | 6,725 | 8,373 | ||||||||||||

| Depreciation |

623 | 810 | 2,839 | 3,050 | ||||||||||||

| Amortization |

324 | 458 | 1,479 | 1,791 | ||||||||||||

| Impairment loss |

1,051 | 2,906 | 992 | 2,973 | ||||||||||||

| Loss on disposals of non-current assets |

23 | 57 | 74 | 100 | ||||||||||||

| Total operating expenses |

4,812 | 8,770 | 17,041 | 22,200 | ||||||||||||

| Operating profit |

(421 | ) | (3,218 | ) | 2,586 | 346 | ||||||||||

| Finance costs |

415 | 532 | 2,026 | 2,150 | ||||||||||||

| Finance income |

(5 | ) | (21 | ) | (54 | ) | (91 | ) | ||||||||

| Other non-operating losses/(gains) |

(139 | ) | 194 | 152 | 172 | |||||||||||

| Shares of loss of associates and joint ventures accounted for using the equity method |

(4 | ) | 47 | 38 | 159 | |||||||||||

| Net foreign exchange (gain)/ loss |

328 | 24 | 605 | (20 | ) | |||||||||||

| Profit before tax |

(1,016 | ) | (3,994 | ) | (181 | ) | (2,024 | ) | ||||||||

| Income tax expense |

41 | 1,257 | 722 | 2,064 | ||||||||||||

| Profit for the period |

(1,057 | ) | (5,251 | ) | (903 | ) | (4,088 | ) | ||||||||

| Non-controlling interest |

(122 | ) | (1,390 | ) | (212 | ) | (1,463 | ) | ||||||||

| Net income attributable to VimpelCom shareholders |

(935 | ) | (3,861 | ) | (691 | ) | (2,625 | ) | ||||||||

VimpelCom Ltd. 4Q 2014 | 29

ATTACHMENT A: FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| USD mln | 31 December 2014 | 31 December 2013 | ||||||

| Assets |

||||||||

| Non-current assets |

||||||||

| Property and equipment |

11,849 | 15,493 | ||||||

| Intangible assets |

7,717 | 9,837 | ||||||

| Goodwill |

10,285 | 14,709 | ||||||

| Investments in associates and joint ventures |

265 | 449 | ||||||

| Deferred tax asset |

575 | 295 | ||||||

| Income Tax advances, non-current |

91 | 53 | ||||||

| Financial assets |

602 | 262 | ||||||

| Other non-financial assets |

26 | 16 | ||||||

| Total non-current assets |

31,410 | 41,114 | ||||||

| Current assets |

||||||||

| Inventories |

117 | 192 | ||||||

| Trade and other receivables |

1,841 | 2,407 | ||||||

| Other non-financial assets |

797 | 789 | ||||||

| Current income tax asset |

219 | 335 | ||||||

| Other financial assets |

266 | 441 | ||||||

| Cash and cash equivalents |

6,342 | 4,454 | ||||||

| Total current assets |

9,582 | 8,618 | ||||||

| Assets classified as held for sale |

5 | 144 | ||||||

| Total assets |

40,997 | 49,876 | ||||||

| Equity and liabilities |

||||||||

| Equity |

||||||||

| Equity attributable to equity owners of the parent |

4,893 | 9,733 | ||||||

| Non-controlling interests |

(952 | ) | (655 | ) | ||||

| Total equity |

3,941 | 9,078 | ||||||

| Non-current liabilities |

||||||||

| Debt |

23,654 | 25,557 | ||||||

| Other financial liabilities |

282 | 1,245 | ||||||

| Provisions |

527 | 418 | ||||||

| Other non-financial liabilities |

401 | 432 | ||||||

| Deferred tax liability |

1,637 | 1,639 | ||||||

| Total non-current liabilities |

26,501 | 29,291 | ||||||

| Current liabilities |

||||||||

| Trade and other payables |

3,998 | 4,862 | ||||||

| Debt |

2,789 | 1,897 | ||||||

| Other financial liabilities |

399 | 529 | ||||||

| Other non-financial liabilities |

1,929 | 2,106 | ||||||

| Current income tax payable |

72 | 166 | ||||||

| Provisions |

1,368 | 1,877 | ||||||

| Total current liabilities |

10,555 | 11,437 | ||||||

| Liabilities associated with assets held for sale |

70 | |||||||

| Total equity and liabilities |

40,997 | 49,876 | ||||||

VimpelCom Ltd. 4Q 2014 | 30

ATTACHMENT A: FINANCIAL SCHEDULES

VIMPELCOM LTD UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| USD mln | 4Q14 | 4Q13 | FY14 | FY13 | ||||||||||||

| Operating activities |

||||||||||||||||

| Profit after tax |

(1,057 | ) | (5,251 | ) | (903 | ) | (4,088 | ) | ||||||||

| Income Tax Expenses |

41 | 1,257 | 722 | 2,064 | ||||||||||||

| Profit before tax |

(1,016 | ) | (3,994 | ) | (181 | ) | (2,024 | ) | ||||||||

| Non-cash adjustment to reconcile profit before tax to net operating cash flows: |

||||||||||||||||

| Depreciation |

623 | 810 | 2,839 | 3,050 | ||||||||||||

| Amortization |

324 | 458 | 1,479 | 1,791 | ||||||||||||

| Impairment loss |

1,051 | 2,906 | 992 | 2,973 | ||||||||||||

| Loss From Disposal Of Non Current Assets |

23 | 57 | 74 | 100 | ||||||||||||

| Finance income |

(5 | ) | (21 | ) | (54 | ) | (91 | ) | ||||||||

| Finance cost |

415 | 532 | 2,026 | 2,150 | ||||||||||||

| Other Non Operating Losses / (Gains) |

(139 | ) | 194 | 152 | 172 | |||||||||||

| Net Foreign Exchange Loss / (Gain) |

328 | 24 | 605 | (20 | ) | |||||||||||

| Share Of Loss Of Associates And Joint Ventures |

(4 | ) | 47 | 38 | 159 | |||||||||||

| Movements in provisions and pensions |

60 | 1,380 | 169 | 1,463 | ||||||||||||

| Changes in working capital |

243 | 409 | (20 | ) | (60 | ) | ||||||||||

| Net interest paid |

(442 | ) | (397 | ) | (2,157 | ) | (2,084 | ) | ||||||||

| Net interest received |

10 | 9 | 47 | 37 | ||||||||||||

| Income tax paid |

(73 | ) | (404 | ) | (730 | ) | (1,265 | ) | ||||||||

| Net cash from operating activities |

1,398 | 2,010 | 5,279 | 6,351 | ||||||||||||

| Proceeds from sale of property and equipment |

8 | 4 | 19 | 40 | ||||||||||||

| Proceeds from sale of intangible assets |

0 | — | 2 | — | ||||||||||||

| Purchase of property, plant and equipment |

(869 | ) | (1,342 | ) | (3,560 | ) | (3,955 | ) | ||||||||

| Purchase of Licenses |

(24 | ) | — | (423 | ) | — | ||||||||||

| Purchase of Other intangible assets |

(141 | ) | — | (506 | ) | — | ||||||||||

| Outflow for loan granted |

(0 | ) | (118 | ) | (23 | ) | (118 | ) | ||||||||

| Inflow from loan granted |

0 | — | 110 | — | ||||||||||||

| Inflows/(outflows) from financial assets |

37 | — | 42 | — | ||||||||||||

| Inflows/(outflows) from deposits |

16 | (97 | ) | 290 | (316 | ) | ||||||||||

| Receipts from / Payment for associates and JCE |

(0 | ) | 3 | (0 | ) | 2 | ||||||||||

| Proceeds from sales of share in subsidiaries, net of cash |

68 | (4 | ) | 69 | 83 | |||||||||||

| Receipt of dividends |

(1 | ) | 51 | 3 | 51 | |||||||||||

| Net cash used in investing activities |

(906 | ) | (1,503 | ) | (3,977 | ) | (4,213 | ) | ||||||||

| Gross proceeds from borrowings |

1,197 | 1,421 | 17,464 | 5,587 | ||||||||||||

| Fees paid for the borrowings |

(7 | ) | — | (727 | ) | — | ||||||||||

| Repayment of borrowings |

(853 | ) | (1,677 | ) | (15,322 | ) | (5,487 | ) | ||||||||

| Purchase of own shares |

— | — | — | (12 | ) | |||||||||||

| Dividends paid to equity holders |

(60 | ) | (774 | ) | (71 | ) | (4,055 | ) | ||||||||

| Dividends paid to non-controlling interests |

(18 | ) | — | (19 | ) | — | ||||||||||

| Proceeds from sale of treasury stock |

2 | — | 4 | — | ||||||||||||

| Share capital issued and paid |

— | — | — | 1,392 | ||||||||||||

| Net cash from financing activities |

261 | (1,030 | ) | 1,329 | (2,575 | ) | ||||||||||

| Net increase in cash and cash equivalents |

753 | (523 | ) | 2,631 | (437 | ) | ||||||||||

| Net foreign exchange difference |

(292 | ) | 87 | (743 | ) | (58 | ) | |||||||||

| Cash and cash equivalent at beginning of period |

5,852 | 4,890 | 4,454 | 4,949 | ||||||||||||

| Cash and cash equivalent reclassified as Held for Sale |

29 | — | — | — | ||||||||||||

| Cash and cash equivalent at end of period |

6,342 | 4,454 | 6,342 | 4,454 | ||||||||||||

VimpelCom Ltd. 4Q 2014 | 31

ATTACHMENT B: DEBT OVERVIEW

| as at 31 December 2014 | Type of debt | Interest rate | Outstanding debt (mln) |

Maturity date |

Guarantor | |||||

| VimpelCom Holdings B.V. |

Notes |

6.25%(1) | USD 500 | March 1, 2017 | OJSC VimpelCom | |||||

| VimpelCom Holdings B.V. |

Notes |

7.50%(2) | USD 1,500 | March 1, 2022 | OJSC VimpelCom | |||||

| VimpelCom Holdings B.V. |

Notes |

9.00% | USD 213.3 (RUB 12,000) |

February 13, 2018 | OJSC VimpelCom | |||||

| VimpelCom Holdings B.V. |

Notes |

5.20% | USD 600 | February 13, 2019 | OJSC VimpelCom | |||||

| VimpelCom Holdings B.V. |

Notes |

5.95% | USD 1,000 | February 13, 2023 | OJSC VimpelCom | |||||

| VimpelCom Amsterdam B.V. |

Loan from China Development Bank Corp. |

6 month LIBOR plus 3.30% |

USD 498.3 | December 21, 2020 | OJSC VimpelCom | |||||

| VimpelCom Amsterdam B.V. |

Loan from HSBC Bank plc |

1.72% | USD 254.1 | July 31, 2022 | EKN, OJSC VimpelCom | |||||

| VimpelCom Amsterdam B.V. |

Revolving Credit Facility |

6 month LIBOR plus 2.95% |

USD 500 | April 7, 2017 | None | |||||

| VimpelCom Amsterdam B.V. |

Loan from OAO “Alfa-Bank” |

6 month LIBOR plus 3.25% |

USD 500 | April 17, 2017 | None | |||||

| VimpelCom Amsterdam B.V. |

Loan from OAO “Alfa-Bank” |

6 month LIBOR plus 3.25% |

USD 500 | May 3, 2017 | None | |||||

| OJSC VimpelCom |

Loan from UBS (Luxembourg) S.A. (funded by the issuance of loan participation notes by UBS (Luxembourg) S.A.) |

8.25% | USD 600 | May 23, 2016 | None | |||||

| OJSC VimpelCom |

Loan from VIP Finance Ireland (funded by the issuance of loan participation notes by VIP Finance Ireland) |

9.13% | USD 1,000 | April 30, 2018 | None | |||||

| OJSC VimpelCom |

Loan from VIP Finance Ireland (funded by the issuance of loan participation notes by VIP Finance Ireland) |

6.49% | USD 500 | February 2, 2016 | None | |||||

| OJSC VimpelCom |

Loan from VIP Finance Ireland Limited (funded by the issuance of loan participation notes by VIP Finance Ireland) |

7.75% | USD 1,000 | February 2, 2021 | None | |||||

| OJSC VimpelCom |

RUB denominated bonds |

8.85% | USD 444.4 (RUB 25,000) |

March 8, 2022(3) | None | |||||

| OJSC VimpelCom |

RUB denominated bonds |

8.85% | USD 177.8 (RUB 10,000) |

March 14, 2022(4) | None |

VimpelCom Ltd. 4Q 2014 | 32

ATTACHMENT B: DEBT OVERVIEW (CONTINUED)

| as at 31 December 2014 | Type of debt | Interest rate | Outstanding debt (mln) |

Maturity date |

Guarantor | |||||

| OJSC VimpelCom |

Loan from VC-Invest (funded by the RUB denominated bonds by VC-Invest) |

8.30% | USD 355.5 (RUB 20,000) |

October 13, 2015 | OJSC VimpelCom | |||||

| OJSC VimpelCom |

Loan from Sberbank |

9.00% | USD 1,093.2 (RUB 61,500) |

April 11, 2018 | None | |||||

| OJSC VimpelCom |

Loan from Sberbank |

8.75% | USD 45.5 (RUB 2,559.9) |

December 16, 2015 | None | |||||

| OJSC VimpelCom |

Loan from Sberbank |

10,75% | USD 444.4 (RUB 25,000) |

May 29, 2017 | None | |||||

| OJSC VimpelCom |

Loans from HSBC Bank PLC |

3 month MosPRIME plus 1.05% |

USD 44 (RUB 2,474.7) |

November 30, 2017 | EKN | |||||

| OJSC VimpelCom |

Loans from Unicredit Bank AG |

AB SEK Rate plus 0.75% |

USD 30.6 | June 15, 2016 | EKN | |||||

| OJSC VimpelCom |

Loan from HSBC Bank PLC and Nordea Bank AB (publ) |

3 month MosPRIME plus 1.00% |

USD 72.9 (RUB 4,100.8) |

April 30, 2019 | EKN | |||||

| WIND Telecomunicazioni S.p.A. |

Senior facilities |

All tranches: | ||||||||

| Deutsche Bank A.G., Credit Suisse A.G., Banca IMI S.p.A, BNP Paribas, the Royal Bank of Scotland, Citigroup, Crédit Agricole Corporate and Investment Bank, Goldman Sachs International, J.P. Morgan plc, Morgan Stanley Bank International Limited, Natixis, S.A. and UniCredit S.p.A. With Banca Nazionale del Lavora S.p.A., Gruppo BNP Paribas, Crédit Agricole Corporate and Investment Bank, Milan Branch, and The Royal Bank of Scotland plc, Milan Branch, as Original Lenders |

EURIBOR +4.25%(5)

EURIBOR + 4.50%

EURIBOR + 4.75% |

USD 210.7 (EUR 174.2)

USD 1,347.6 (EUR 1,113.9)

USD 597.2 (EUR 493.6) |

November 26, 2018

November 26, 2019

November 26, 2019 |

WIND Telecomunicazioni S.p.A. | ||||||

| WIND Telecomunicazioni S.p.A. |

Debt vs Italian Government (4G/LTE) |

Rendistato+1.0% | USD 196 (EUR 162) |

October 3, 2016 | ||||||

| WIND Telecomunicazioni S.p.A. |

Annuity loans several lender unwound swaps |

3.39%-5.53% | USD 44.9 (EUR 37.1) |

September 26, 2016 | None | |||||

| WIND Telecomunicazioni S.p.A. |

Revolving Credit Facility |

EURIBOR + 4.25% | USD 121 (EUR 100) |

November 26, 2018 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Telecomunicazioni S.p.A. |

Terna Debt |

10.05% | USD 159.2 (EUR 131.6) |

December 31, 2035 | None | |||||

| WIND Acquisition Finance S.A. |

Senior Secured Notes |

3 month EURIBOR plus 5.25% |

USD 181.5 (EUR 150) |

April 30, 2019 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Acquisition Finance S.A. |

Senior Secured Notes |

6.50% | USD 550 | April 30, 2020 | Wind Telecomunicazioni |

VimpelCom Ltd. 4Q 2014 | 33

ATTACHMENT B: DEBT OVERVIEW (CONTINUED)

| as at 31 December 2014 | Type of debt | Interest rate | Outstanding debt (mln) |

Maturity date |

Guarantor | |||||

| WIND Acquisition Finance S.A. |

Senior Notes |

7.00% | USD 2,117.1 (EUR 1,750) |

April 23, 2021 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Acquisition Finance S.A. |

Senior Notes |

7.38% | USD 2,800 | April 23, 2021 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Acquisition Finance S.A. |

Senior Secured Notes |

4.00% | USD 2,540.5 (EUR 2,100) |

July 15, 2020 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Acquisition Finance S.A. |

Senior Secured Notes |

4.75% | USD 1,900 | July 15, 2020 | Wind Telecomunicazioni S.p.A. | |||||

| WIND Acquisition Finance S.A. |

Senior Secured Notes |

3 month EURIBOR plus 4.00% |

USD 695,6 (EUR 575) |

July 15, 2020 | Wind Telecomunicazioni S.p.A. | |||||

| Pakistan Mobile Communications Limited (“PMCL”) |

Syndicated loan via MCB Bank Limited |

6 month KIBOR plus 1.25% |

USD 59.7 (PKR6,000) |

November 28, 2017 | None | |||||

| PMCL |

Syndicated loan via MCB Bank Limited |

6 month KIBOR plus 1.25% |

USD 69.6 (PKR7,000) |

May 16, 2019 | None | |||||

| PMCL |

Loan from Habib Bank Limited |

6 month KIBOR plus 1.15% |

USD 44.8 (PKR4,500) |

May 16, 2019 | None | |||||

| PMCL |

Loan from United Bank Limited |

6 month KIBOR plus 1.10% |

USD 39.8 (PKR4,000) |

May 16, 2021 | None | |||||

| Banglalink Digital Communications Ltd. (“Banglalink”) |

Senior Notes |

8.63% | USD 300 | May 6, 2019 | None | |||||

| Banglalink |

Facility Eastern Bank Limited |

9.00%-10.00% | USD 32.1 (BDT2,500) |

May 31, 2016 | None | |||||

| Banglalink |

Facility Standard Chartered Bank |

8.25%-8.50% | USD 44.9 (BDT3,500) |

April 29, 2016 | None | |||||

| OTA |

Loan from Hermes |

3 months LIBOR + 0.9% |

USD 46.6 | January 30, 2015 | VimpelCom Amsterdam B.V. | |||||

| Other loans, equipment financing and capital lease obligations |

— |

— | USD 469 | — | — |

| (1) | Effective from June 29, 2011, this fixed interest rate was subject to interest rate swap arrangements to effectively swap the fixed interest rate for a floating interest rate based on three-month U.S. dollar LIBOR. The weighted average spread over LIBOR for the notes was 4.187%. In August 2012, we unwound our interest rate swaps related to these notes, resulting in a reduction of the effective interest rate on the notes due March 2017 of approximately 1.5%. As a result of the unwind, the company received a cash amount of approximately US$35 million including accrued interest |

| (2) | Effective from June 29, 2011, this fixed interest rate was subject to interest rate swap arrangements to effectively swap the fixed interest rate for a floating interest rate based on three-month U.S. dollar LIBOR. The weighted average spread over LIBOR for the notes was 4.375%. In August 2012, we unwound our interest rate swaps related to a principal amount of US$1,300 million of these notes, and in November 2012 we unwound the interest rate swaps related to the remaining US$200 million principal amount, resulting in a reduction of the effective interest rate on these notes of approximately 2.0%. As a result of the unwinds, the company received a cash amount of approximately US$218 million including accrued interest. |

| (3) | These bonds are subject to an investor put option at March 17, 2015. |

| (4) | These bonds are subject to an investor put option at March 23, 2015. |

| (5) | Interest on the all tranches of the senior facility is based on EURIBOR for loans in Euros and LIBOR for loans in any other currency. Also interest rate margins may be reduced based on specified improvement in leverage ratios. |

VimpelCom Ltd. 4Q 2014 | 34

ATTACHMENT C: COUNTRY UNITS KEY INDICATORS

AFRICA & ASIA BUSINESS UNIT: COUNTRY DETAIL

ALGERIA

| DZD bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

34 | 36 | (6 | %) | 136 | 143 | (5 | %) | ||||||||||||||||

| Mobile service revenue |

33 | 36 | (7 | %) | 135 | 143 | (5 | %) | ||||||||||||||||

| EBITDA |

17 | 22 | (22 | %) | 73 | 85 | (14 | %) | ||||||||||||||||

| EBITDA margin |

49.8 | % | 60.1 | % | (10.3 | pp) | 53.5 | % | 59.1 | % | (5.6 | pp) | ||||||||||||

| Capex1 (USD mln) |

109 | 51 | 114 | % | 415 | 84 | n.m. | |||||||||||||||||

| Capex / Revenue |

28 | % | 11 | % | 25 | % | 5 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

18.4 | 17.6 | 5 | % | ||||||||||||||||||||

| ARPU (DZD) |

610 | 689 | (12 | %) | ||||||||||||||||||||

| MOU (min) |

182 | 211 | (13 | %) | ||||||||||||||||||||

PAKISTAN

| PKR bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

26 | 26 | (1 | %) | 102 | 108 | (6 | %) | ||||||||||||||||

| Mobile service revenue |

24 | 25 | (2 | %) | 98 | 104 | (6 | %) | ||||||||||||||||

| EBITDA |

10 | 9 | 6 | % | 39 | 45 | (13 | %) | ||||||||||||||||

| EBITDA margin |

41.5 | % | 38.5 | % | 3.0 | pp | 40.0 | % | 42.8 | % | (2.8 | pp) | ||||||||||||

| Capex1 (USD mln) |

89 | 90 | (1 | %) | 352 | 190 | 85 | % | ||||||||||||||||

| Capex / Revenue |

36 | % | 37 | % | 35 | % | 18 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

38.5 | 37.6 | 2 | % | ||||||||||||||||||||

| ARPU (PKR) |

204 | 219 | (7 | %) | ||||||||||||||||||||

| MOU (min) |

273 | 222 | 23 | % | ||||||||||||||||||||

BANGLADESH

| BDT bln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

11 | 10 | 14 | % | 44 | 39 | 11 | % | ||||||||||||||||

| Mobile service revenue |

11 | 9 | 18 | % | 43 | 39 | 11 | % | ||||||||||||||||

| EBITDA |

5 | 3 | 38 | % | 17 | 15 | 17 | % | ||||||||||||||||

| EBITDA margin |

40.8 | % | 33.7 | % | 7.1 | pp | 38.9 | % | 37.1 | % | 1.8 | pp | ||||||||||||

| Capex1 (USD mln) |

59 | 94 | (37 | %) | 178 | 133 | 34 | % | ||||||||||||||||

| Capex / Revenue |

40 | % | 73 | % | 32 | % | 26 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

30.8 | 28.8 | 7 | % | ||||||||||||||||||||

| ARPU (BDT) |

122 | 110 | 10 | % | ||||||||||||||||||||

| MOU (min) |

186 | 183 | 2 | % | ||||||||||||||||||||

SEA (CONSOLIDATED)

| USD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

5 | 7 | (18 | %) | 29 | 33 | (14 | %) | ||||||||||||||||

| EBITDA |

2 | 2 | 35 | % | 10 | 6 | 74 | % | ||||||||||||||||

| EBITDA margin |

42.7 | % | 25.8 | % | 16.9 | pp | 33.6 | % | 16.7 | % | 16.9 | pp | ||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

0.2 | 0.3 | (25 | %) | ||||||||||||||||||||

| 1) | CAPEX excluding licenses |

VimpelCom Ltd. 4Q 2014 | 35

CIS BUSINESS UNIT: COUNTRY DETAIL

KAZAKHSTAN

| KZT mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

34,965 | 33,730 | 4 | % | 135,266 | 127,748 | 6 | % | ||||||||||||||||

| Mobile service revenue |

31,148 | 30,482 | 2 | % | 120,513 | 115,835 | 4 | % | ||||||||||||||||

| Fixed-line service revenue |

3,769 | 3,214 | 17 | % | 14,565 | 11,781 | 24 | % | ||||||||||||||||

| EBITDA |

14,061 | 16,101 | (13 | %) | 62,492 | 59,427 | 5 | % | ||||||||||||||||

| EBITDA margin |

40.2 | % | 47.7 | % | (7.5 | pp) | 46.2 | % | 46.5 | % | (0.3 | pp) | ||||||||||||

| Capex (USD mln) |

55 | 58 | (4 | %) | 109 | 159 | (32 | %) | ||||||||||||||||

| Capex / Revenue |

29 | % | 26 | % | 14 | % | 19 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

9.8 | 9.2 | 7 | % | ||||||||||||||||||||

| ARPU (KZT) |

1,041 | 1,109 | (6 | %) | ||||||||||||||||||||

| MOU (min) |

298 | 301 | (1 | %) | ||||||||||||||||||||

| UZBEKISTAN | ||||||||||||||||||||||||

| USD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

186 | 173 | 7 | % | 718 | 673 | 7 | % | ||||||||||||||||

| Mobile service revenue |

184 | 171 | 8 | % | 710 | 664 | 7 | % | ||||||||||||||||

| Fixed-line service revenue |

2 | 2 | (10 | %) | 7 | 8 | (10 | %) | ||||||||||||||||

| EBITDA |

115 | 21 | 457 | % | 461 | 347 | 33 | % | ||||||||||||||||

| EBITDA margin |

61.6 | % | 11.9 | % | 49.7 | pp | 64.2 | % | 51.5 | % | 12.7 | pp | ||||||||||||

| Capex (USD mln) |

28 | -17 | 262 | % | 79 | 142 | (44 | %) | ||||||||||||||||

| Capex / Revenue |

15 | % | -10 | % | 11 | % | 21 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

10.6 | 10.5 | 1 | % | ||||||||||||||||||||

| ARPU (USD) |

6 | 5 | 6 | % | ||||||||||||||||||||

| MOU (min) |

528 | 493 | 7 | % | ||||||||||||||||||||

| ARMENIA | ||||||||||||||||||||||||

| AMD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

13,859 | 15,378 | (10 | %) | 57,479 | 59,278 | (3 | %) | ||||||||||||||||

| Mobile service revenue |

6,155 | 6,573 | (6 | %) | 24,642 | 25,587 | (4 | %) | ||||||||||||||||

| Fixed-line service revenue |

7,407 | 8,510 | (13 | %) | 31,622 | 32,760 | (3 | %) | ||||||||||||||||

| EBITDA |

2,478 | 5,421 | (54 | %) | 18,671 | 23,340 | (20 | %) | ||||||||||||||||

| EBITDA margin |

17.9 | % | 35.2 | % | (17.3 | pp) | 32.5 | % | 39.4 | % | (6.9 | pp) | ||||||||||||

| Capex (USD mln) |

6 | 4 | 39 | % | 15 | 12 | 27 | % | ||||||||||||||||

| Capex / Revenue |

19 | % | 11 | % | 11 | % | 8 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

0.8 | 0.7 | 12 | % | ||||||||||||||||||||

| ARPU (AMD) |

2,588 | 3,093 | (16 | %) | ||||||||||||||||||||

| MOU (min) |

371 | 388 | (4 | %) | ||||||||||||||||||||

| TAJIKISTAN | ||||||||||||||||||||||||

| USD mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

33 | 37 | (9 | %) | 142 | 148 | (4 | %) | ||||||||||||||||

| Mobile service revenue |

33 | 36 | (8 | %) | 142 | 145 | (2 | %) | ||||||||||||||||

| EBITDA |

13 | 18 | (27 | %) | 62 | 74 | (16 | %) | ||||||||||||||||

| EBITDA margin |

38.5 | % | 48.2 | % | (9.7 | pp) | 43.5 | % | 49.7 | % | (6.2 | pp) | ||||||||||||

| Capex |

11 | 5 | 122 | % | 18 | 16 | 8 | % | ||||||||||||||||

| Capex / Revenue |

34 | % | 14 | % | 12 | % | 11 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

1.3 | 1.3 | 2 | % | ||||||||||||||||||||

| ARPU (USD) |

9 | 10 | (10 | %) | ||||||||||||||||||||

| MOU (min) |

287 | 307 | (6 | %) | ||||||||||||||||||||

VimpelCom Ltd. 4Q 2014 | 36

GEORGIA

| GEL mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

39 | 38 | 2 | % | 140 | 147 | (5 | %) | ||||||||||||||||

| Mobile service revenue |

35 | 33 | 4 | % | 128 | 132 | (3 | %) | ||||||||||||||||

| Fixed-line service revenue |

3 | 2 | 56 | % | 8 | 8 | (4 | %) | ||||||||||||||||

| EBITDA |

8 | 11 | (23 | %) | 35 | 45 | (21 | %) | ||||||||||||||||

| EBITDA margin |

21.4 | % | 28.6 | % | (7.2 | pp) | 25.1 | % | 30.4 | % | (5.3 | pp) | ||||||||||||

| Capex (USD mln) |

10 | 4 | 182 | % | 20 | 18 | 15 | % | ||||||||||||||||

| Capex / Revenue |

48 | % | 16 | % | 26 | % | 20 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

1.3 | 1.1 | 15 | % | ||||||||||||||||||||

| ARPU (GEL) |

8 | 10 | (18 | %) | ||||||||||||||||||||

| MOU (min) |

230 | 226 | 2 | % | ||||||||||||||||||||

| KYRGYZSTAN | ||||||||||||||||||||||||

| KGZ mln | 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | ||||||||||||||||||

| Total revenue |

2,563 | 2,165 | 18 | % | 9,547 | 9,316 | 2 | % | ||||||||||||||||

| Mobile service revenue |

2,549 | 2,151 | 19 | % | 9,504 | 9,254 | 3 | % | ||||||||||||||||

| EBITDA |

1,333 | 927 | 44 | % | 4,877 | 4,702 | 4 | % | ||||||||||||||||

| EBITDA margin |

52.0 | % | 42.8 | % | 9.2 | pp | 51.1 | % | 50.5 | % | 0.6 | pp | ||||||||||||

| Capex (USD mln) |

10 | 8 | 22 | % | 26 | 23 | 13 | % | ||||||||||||||||

| Capex / Revenue |

22 | % | 18 | % | 15 | % | 12 | % | ||||||||||||||||

| Mobile |

||||||||||||||||||||||||

| Customers (mln) |

2.7 | 2.7 | 3 | % | ||||||||||||||||||||

| ARPU (KGZ) |

310 | 274 | 13 | % | ||||||||||||||||||||

| MOU (min) |

285 | 311 | (8 | %) | ||||||||||||||||||||

VimpelCom Ltd. 4Q 2014 | 37

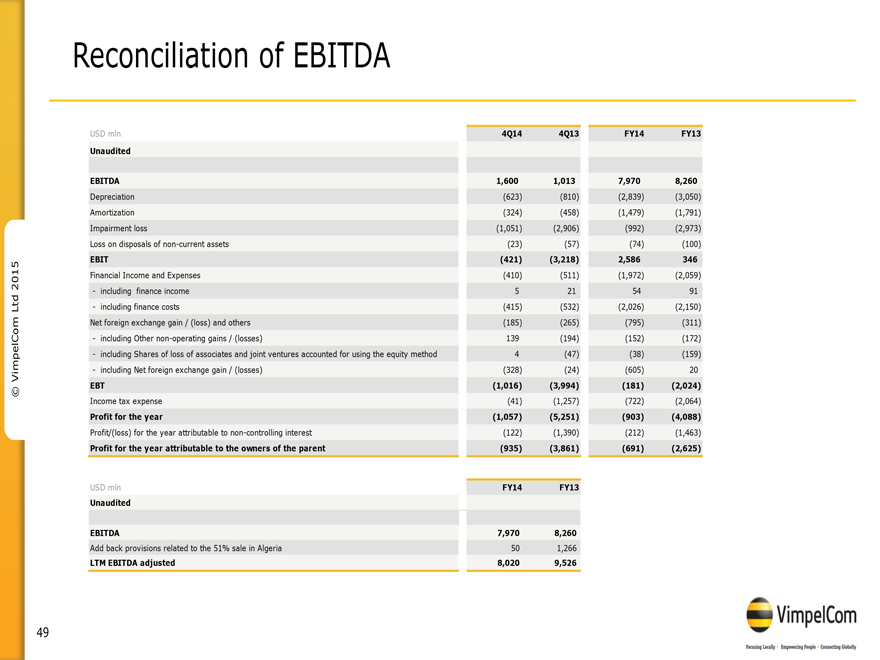

ATTACHMENT D: RECONCILIATION TABLES

RECONCILIATION OF CONSOLIDATED EBITDA OF VIMPELCOM

| USD mln | 4Q14 | 4Q13 | FY14 | FY13 | ||||||||||||

| Unaudited |

||||||||||||||||

| EBITDA |

1,600 | 1,013 | 7,970 | 8,260 | ||||||||||||

| Depreciation |

(623 | ) | (810 | ) | (2,839 | ) | (3,050 | ) | ||||||||

| Amortization |

(324 | ) | (458 | ) | (1,479 | ) | (1,791 | ) | ||||||||

| Impairment loss |

(1,051 | ) | (2,906 | ) | (992 | ) | (2,973 | ) | ||||||||

| Loss on disposals of non-current assets |

(23 | ) | (57 | ) | (74 | ) | (100 | ) | ||||||||

| EBIT |

(421 | ) | (3,218 | ) | 2,586 | 346 | ||||||||||

| Financial Income and Expenses |

(410 | ) | (511 | ) | (1,972 | ) | (2,059 | ) | ||||||||

| - including finance income |

5 | 21 | 54 | 91 | ||||||||||||

| - including finance costs |

(415 | ) | (532 | ) | (2,026 | ) | (2,150 | ) | ||||||||

| Net foreign exchange gain / (loss) and others |

(185 | ) | (265 | ) | (795 | ) | (311 | ) | ||||||||

| - including Other non-operating gains / (losses) |

139 | (194 | ) | (152 | ) | (172 | ) | |||||||||

| - including Shares of loss of associates and joint ventures accounted for using the equity method |

4 | (47 | ) | (38 | ) | (159 | ) | |||||||||

| - including Net foreign exchange gain / (losses) |

(328 | ) | (24 | ) | (605 | ) | 20 | |||||||||

| EBT |

(1,016 | ) | (3,994 | ) | (181 | ) | (2,024 | ) | ||||||||

| Income tax expense |

(41 | ) | (1,257 | ) | (722 | ) | (2,064 | ) | ||||||||

| Profit for the year |

(1,057 | ) | (5,251 | ) | (903 | ) | (4,088 | ) | ||||||||

| Profit/(loss) for the year attributable to non-controlling interest |

(122 | ) | (1,390 | ) | (212 | ) | (1,463 | ) | ||||||||

| Profit for the year attributable to the owners of the parent |

(935 | ) | (3,861 | ) | (691 | ) | (2,625 | ) | ||||||||

VimpelCom Ltd. 4Q 2014 | 38

ATTACHMENT D: RECONCILIATION TABLES

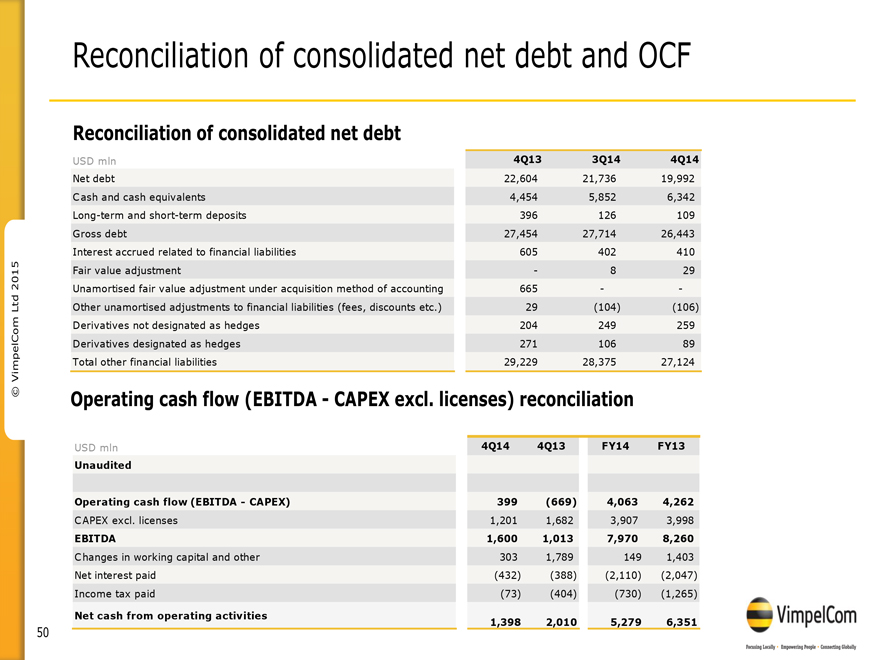

RECONCILIATION OF VIMPELCOM CONSOLIDATED NET DEBT

| USD mln | 4Q13 | 3Q14 | 4Q14 | |||||||||

| Net debt |

22,604 | 21,736 | 19,992 | |||||||||

| Cash and cash equivalents |

4,454 | 5,852 | 6,342 | |||||||||

| Long-term and short-term deposits |

396 | 126 | 109 | |||||||||

| Gross debt |

27,454 | 27,714 | 26,443 | |||||||||

| Interest accrued related to financial liabilities |

605 | 402 | 410 | |||||||||

| Fair Value adjustment |

— | 8 | 29 | |||||||||

| Unamortised fair value adjustment under acquisition method of accounting |

665 | — | — | |||||||||

| Other unamortised adjustments to financial liabilities (fees, discounts etc.) |

29 | (104 | ) | (106 | ) | |||||||

| Derivatives not designated as hedges |

204 | 249 | 259 | |||||||||

| Derivatives designated as hedges |

271 | 106 | 89 | |||||||||

| Total other financial liabilities |

29,229 | 28,375 | 27,124 | |||||||||

RECONCILIATION OF CONSOLIDATED LTM EBITDA ADJUSTED

| USD mln | FY14 | FY13 | ||||||

| Unaudited |

||||||||

| EBITDA |

7,970 | 8,260 | ||||||

| Add back provisions related to the 51% sale in Algeria |

50 | 1,266 | ||||||

| LTM EBITDA adjusted |

8,020 | 9,526 | ||||||

OPERATING CASH FLOW (EBITDA – CAPEX EXCL. LICENSES) RECONCILIATION

| USD mln | 4Q14 | 4Q13 | FY14 | FY13 | ||||||||||||

| Unaudited |

||||||||||||||||

| Operating cash flow (EBITDA - CAPEX) |

399 | (669 | ) | 4,063 | 4,262 | |||||||||||

| CAPEX excl. licenses |

1,201 | 1,682 | 3,907 | 3,998 | ||||||||||||

| EBITDA |

1,600 | 1,013 | 7,970 | 8,260 | ||||||||||||

| Changes in working capital and other |

303 | 1,789 | 149 | 1,403 | ||||||||||||

| Net interest paid |

(432 | ) | (388 | ) | (2,110 | ) | (2,047 | ) | ||||||||

| Income tax paid |

(73 | ) | (404 | ) | (730 | ) | (1,265 | ) | ||||||||

| Net cash from operating activities |

1,398 | 2,010 | 5,279 | 6,351 | ||||||||||||

RATES OF FUNCTIONAL CURRENCIES TO USD1

| Average rates | Closing rates | |||||||||||||||||||||||

| 4Q14 | 4Q13 | YoY | FY14 | FY13 | YoY | |||||||||||||||||||

| Russian Ruble |

47.42 | 32.53 | (45.8 | %) | 56.26 | 32.73 | (71.9 | %) | ||||||||||||||||

| Euro |

0.80 | 0.73 | (9.6 | %) | 0.83 | 0.73 | (13.7 | %) | ||||||||||||||||

| Algerian Dinar |

85.11 | 80.18 | (6.1 | %) | 87.92 | 78.38 | (12.2 | %) | ||||||||||||||||

| Pakistan Rupee |

101.89 | 106.93 | 4.7 | % | 100.52 | 105.33 | 4.6 | % | ||||||||||||||||

| Bangladeshi Taka |

77.52 | 77.67 | 0.2 | % | 77.93 | 77.67 | (0.3 | %) | ||||||||||||||||

| Ukrainian Hryvnia |

14.43 | 7.99 | (80.6 | %) | 15.77 | 7.99 | (97.4 | %) | ||||||||||||||||

| Kazakh Tenge |

181.39 | 153.80 | (17.9 | %) | 182.35 | 153.61 | (18.7 | %) | ||||||||||||||||

| Uzbekistan Som |

2,393.50 | 2,181.0 | (9.7 | %) | 2,422.40 | 2,202.2 | (10.0 | %) | ||||||||||||||||

| Armenian Dram |

430.64 | 405.56 | (6.2 | %) | 474.97 | 405.64 | (17.1 | %) | ||||||||||||||||

| Kyrgyz Som |

56.99 | 48.89 | (16.6 | %) | 58.89 | 49.25 | (19.6 | %) | ||||||||||||||||

| Georgian Lari |

1.81 | 1.69 | (7.1 | %) | 1.86 | 1.74 | (6.9 | %) | ||||||||||||||||

| 1) | Functional currency in Tajikistan is USD |

VimpelCom Ltd. 4Q 2014 | 39

ATTACHMENT E: WIND TELECOMUNICAZIONI GROUP CONDENSED STATEMENTS OF INCOME

| EUR mln | FY14 | FY13 | YoY | |||||||||||||

| Total Revenue |

4,633 | 4,983 | (7 | %) | ||||||||||||

| EBITDA |

1,804 | 1,944 | (7 | %) | ||||||||||||

| D&A |

(1,231 | ) | (1,276 | ) | (4 | %) | ||||||||||

| EBIT |

573 | 667 | (14 | %) | ||||||||||||

| Financial Income and expenses |

(1,386 | ) | (999 | ) | 39 | % | ||||||||||

| EBT |

(812 | ) | (332 | ) | 144 | % | ||||||||||

| Income Tax |

103 | (149 | ) | (169 | %) | |||||||||||

| Net loss |

(709 | ) | (481 | ) | 47 | % | ||||||||||

VimpelCom Ltd. 4Q 2014 | 40

ATTACHMENT F: DEFINITIONS

ARPU (Average Revenue per User) is calculated by dividing service revenue for the relevant period, including revenue from voice-, roaming-, interconnect-, and value added services (including mobile data, SMS, MMS), but excluding revenue from visitors roaming, connection fees, sales of handsets and accessories and other non-service revenue, by the average number of customers during the period and dividing by the number of months in that period. For Business Unit Italy visitors roaming revenue is included into service revenue for ARPU calculation.

Broadband customers are the customer contracts that served as a basis for revenue generating activity in the three months prior to the measurement date, as a result of activities including monthly Internet access using FTTB and xDSL technologies as well as mobile Internet access via WiFi and USB modems using 2.5G/3G/4G/HSPA+ technologies. Italian Business Unit measure fixed broadband customers based on the number of active contracts signed, mobile broadband include customers that have performed at least one mobile Internet event in the previous month. Russian Business Unit includes IPTV activities. For CIS subsidiaries mobile broadband customers are those who have performed at least one mobile Internet event in the three-month period prior to the measurement date.

Capital expenditures (CAPEX), purchases of new equipment, new construction, upgrades, software, other long lived assets and related reasonable costs incurred prior to intended use of the non-current asset, accounted at the earliest event of advance payment or delivery. Long-lived assets acquired in business combinations are not included in capital expenditures.

EBIT is a non-GAAP measure and is calculated as EBITDA plus depreciation, amortization and impairment loss. Our management uses EBIT as a supplemental performance measure and believes that it provides useful information of earnings of the Company before making accruals for financial income and expenses and Net foreign exchange (loss)/gain and others. Reconciliation of EBIT to net income attributable to VimpelCom Ltd., the most directly comparable IFRS financial measure, is presented above.

EBITDA is a non-GAAP financial measure. EBITDA is defined as earnings before interest, tax, depreciation and amortization. VimpelCom calculates EBITDA as operating income before depreciation, amortization, loss from disposal of non-current assets and impairment loss and includes certain non-operating losses and gains mainly represented by litigation provisions for all of its Business Units except for its Russia Business Unit. The Russia Business Unit’s EBITDA is calculated as operating income before depreciation, amortization, loss from disposal of non-current assets and impairment loss. EBITDA should not be considered in isolation or as a substitute for analyses of the results as reported under IFRS. Historically our management used OIBDA (defined as operating income before depreciation, amortization and impairment losses) instead of EBITDA. Following the acquisition of WIND Telecom, our management concluded that EBITDA is a more appropriate measure because it is more widely used amongst European-based analysts and investors to assess the performance of an entity and compare it with other market players. Our management uses EBITDA and EBITDA margin as supplemental performance measures and believes that EBITDA and EBITDA margin provide useful information to investors because they are indicators of the strength and performance of the Company’s business operations, including its ability to fund discretionary spending, such as capital expenditures, acquisitions and other investments, as well as indicating its ability to incur and service debt. In addition, the components of EBITDA include the key revenue and expense items for which the Company’s operating managers are responsible and upon which their performance is evaluated. EBITDA also assists management and investors by increasing the comparability of the Company’s performance against the performance of other telecommunications companies that provide EBITDA information. This increased comparability is achieved by excluding the potentially inconsistent effects between periods or companies of depreciation, amortization and impairment losses, which items may significantly affect operating income between periods. However, our EBITDA results may not be directly comparable to other companies’ reported EBITDA results due to variances and adjustments in the components of EBITDA (including our calculation of EBITDA) or calculation measures. Additionally, a limitation of EBITDA’s use as a performance measure is that it does not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenue or the need to replace capital equipment over time. Reconciliation of EBITDA to net income attributable to VimpelCom Ltd., the most directly comparable IFRS financial measure, is presented above.

EBITDA margin is calculated as EBITDA divided by total revenue, expressed as a percentage.

Households passed are households located within buildings, in which indoor installation of all the FTTB equipment necessary to install terminal residential equipment has been completed.

LLU (local loop unbundling), in Italy, this is the regulatory process of allowing multiple telecommunications operators to use connections from Telecom Italia’s local exchanges to the customer’s premises.

VimpelCom Ltd. 4Q 2014 | 41

MFS (Mobile financial services): mobile commerce or m-commerce, encapsulates a variety of innovative services that use a mobile phone as the primary payment user interface. With this technology mobile customers can conduct money transfers to pay for goods at an online store, make utility payments, pay fines and state fees, loan repayments, domestic and international remittances, pay mobile insurance and purchase tickets for air and rail travel, all via their mobile phone.

MNP (Mobile number portability) is a facility provided by telecommunications operators which enables customers to keep their telephone numbers when they change operators.

Mobile customers are SIM-cards registered in the system as of a measurement date, users of which generated revenue at any time during the three months prior to the measurement date. This includes revenue coming from any incoming and outgoing calls, subscription fee accruals, debits related to service, outgoing SMS, Multimedia Messaging Service (referred to as MMS), data transmission and receipt sessions, but does not include incoming SMS and MMS sent by VimpelCom or abandoned calls. VimpelCom’s total number of mobile customers also includes SIM-cards for use of mobile Internet service via USB modems and customers for WiFi. The number for Italy is based on SIM-cards, users of which generated revenue at any time during the twelve months prior to the measurement date. For the purpose of this earnings release, we include all customers of Zimbabwe, which is accounted for as investment at cost, into Business Unit Africa & Asia and customers of all our Canada equity investee into Business Unit Europe and North America, both of which are included into total customers of VimpelCom.