Form 6-K Teekay Offshore Partners For: May 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: May 19, 2016

Commission file number 1- 33198

TEEKAY OFFSHORE PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

4th Floor, Belvedere Building

69 Pitts Bay Road

Hamilton, HM 08, Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40- F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No x

Item 1 — Information Contained in this Form 6-K Report

Attached as Exhibit 99.1 is a copy of an announcement of Teekay Offshore Partners L.P. dated May 19, 2016, relating to its results for the first quarter ended March 31, 2016.

Attached as Exhibit 99.2 is a copy of Teekay Offshore Partners L.P.’s Investor Presentation dated May 19, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TEEKAY OFFSHORE PARTNERS L.P.

Teekay Offshore GP L.L.C., its general partner | ||||||

| Date: May 19, 2016 | By: | /s/ Peter Evensen | ||||

| Peter Evensen | ||||||

| Chief Executive Officer and Chief Financial Officer | ||||||

| (Principal Financial and Accounting Officer) | ||||||

Exhibit 99.1

TEEKAY OFFSHORE PARTNERS REPORTS

FIRST QUARTER 2016 RESULTS

Highlights

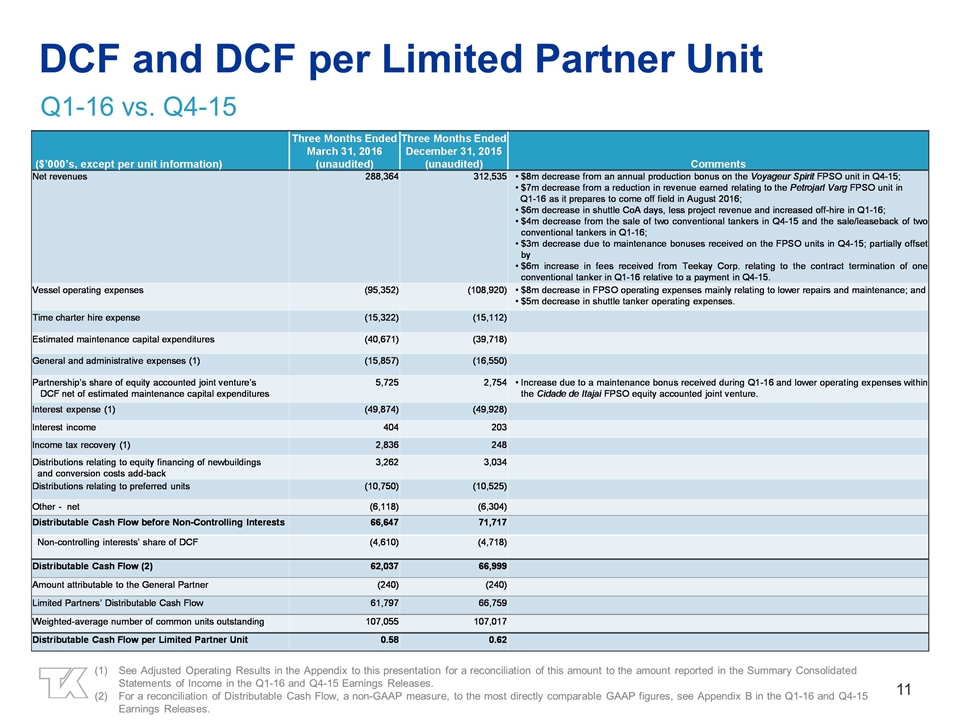

| • | Generated distributable cash flow(1) of $62.0 million, or $0.58 per common unit, in the first quarter of 2016. |

| • | Generated cash flow from vessel operations(2) of $166.1 million in the first quarter of 2016, an increase of 22 percent from the same period of the prior year. |

| • | Declared first quarter 2016 cash distribution of $0.11 per common unit. |

| • | Executing on financing initiatives to address Teekay Offshore’s 2016 and 2017 funding requirements, which the Partnership expects to finalize in June 2016. |

| • | Completed the sale of two conventional tankers and one shuttle tanker for total gross proceeds of approximately $55 million. |

| • | Total liquidity of approximately $336 million as at March 31, 2016. |

Hamilton, Bermuda, May 19, 2016 - Teekay Offshore GP LLC, the general partner of Teekay Offshore Partners L.P. (Teekay Offshore or the Partnership) (NYSE: TOO), today reported the Partnership’s results for the quarter ended March 31, 2016. During the first quarter of 2016, the Partnership generated distributable cash flow(1) of $62.0 million, compared to $60.6 million in the same period of the prior year. The increase in distributable cash flow was primarily due to the acquisition of the Petrojarl Knarr (Knarr) floating production, storage and offloading (FPSO) unit in July 2015, the commencement of the Arendal Spirit unit for maintenance and safety (UMS) charter contract in June 2015, and the commencement of the East Coast Canada shuttle tanker contracts in June 2015. These increases were partially offset by the reduction in revenue earned on the Petrojarl Varg (Varg) FPSO unit as it prepares to come off field in August 2016, the expiration of two shuttle tanker contracts in the second quarter of 2015, and the sale of two conventional tankers and one shuttle tanker during 2015.

On April 1, 2016, the Partnership declared a cash distribution of $0.11 per common unit for the quarter ended March 31, 2016. The cash distribution was paid on May 13, 2016 to all unitholders of record on April 29, 2016.

CEO Commentary

“The Partnership generated higher cash flows in the first quarter of 2016 compared to the same period in the prior year as our fleet continues to operate at high uptime and utilization,” commented Peter Evensen, Chief Executive Officer of Teekay Offshore GP LLC. “The increase in cash flow was mainly driven by various growth projects that delivered during 2015, which more than offset the lower revenue from the Varg FPSO as the unit begins to wind down operations after almost 18 years on the Varg field. We continue to receive a strong level of customer interest in the Varg FPSO for various other offshore production opportunities in Norway.”

Mr. Evensen continued, “Since reporting our earnings in February 2016, we have made significant progress toward addressing the Partnership’s 2016 and 2017 funding needs and I am pleased to report that we have completed, or are nearing completion of, a number of financing initiatives which we believe will cover all of our liquidity requirements over the medium-term. This includes new committed facilities for our East Coast Canada shuttle tankers, refinancing $75 million of the existing Varg FPSO debt facility, an agreement to extend the majority of our 2017 and 2018 Norwegian bond maturities to late-2018, and discussions with the shipyard to defer the delivery of two UMS newbuildings. We are also in advanced discussions with investors on a new $200 million preferred equity issuance.”

| (1) | Distributable cash flow is a non-GAAP financial measure used by certain investors to measure the financial performance of the Partnership and other master limited partnerships. Please see Appendix B for a reconciliation of distributable cash flow to the most directly comparable financial measure under United States generally accepted accounting principles (GAAP). |

| (2) | Cash flow from vessel operations (CFVO) is a non-GAAP financial measure used by certain investors to measure the financial performance of shipping companies. CFVO should not be considered as an alternative to net income, equity income or any other indicator of the Partnership’s performance required by GAAP. Please refer to Appendix E and F included in this release for a description and reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure. |

Teekay Offshore Partners L.P. Investor Relations Tel: +1 604 844-6654 www.teekayoffshore.com

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

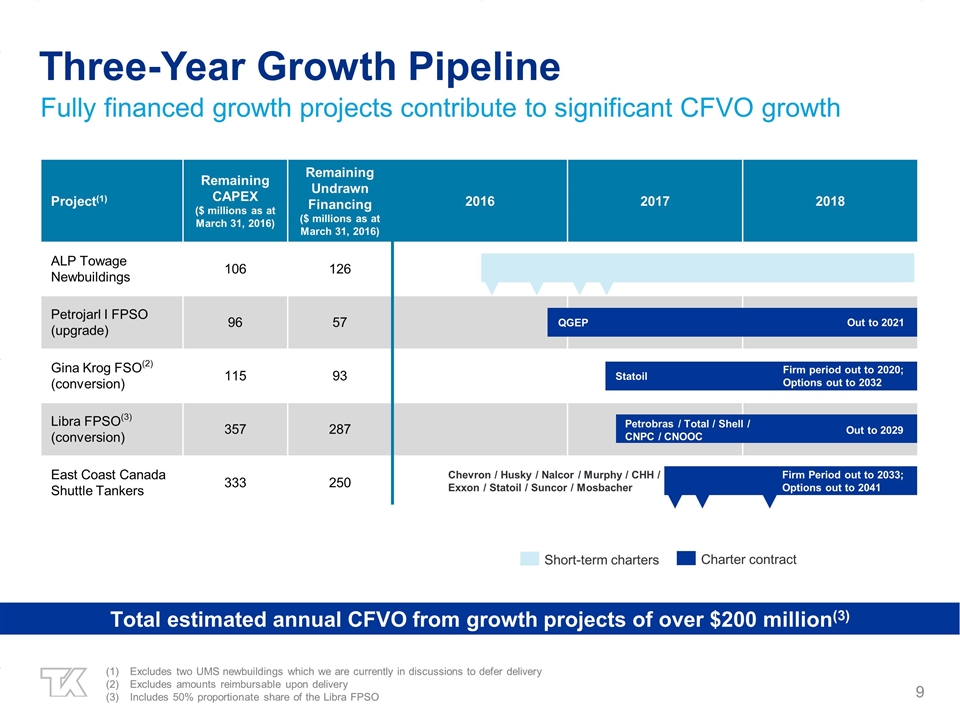

Mr. Evensen continued, “Upon our anticipated completion of these various initiatives, which we expect will occur prior to the end of June 2016, the Partnership’s financial position will be significantly strengthened. Importantly, we will have secured all the necessary financing for our pipeline of growth projects delivering through early-2018 which, once delivered, are expected to add over $200 million to Teekay Offshore’s annual cash flow from vessel operations, including our 50 percent share of cash flows from the Libra FPSO.”

Summary of Recent Events

Financing Initiatives

Since early 2016, the Partnership has been negotiating a series of financing initiatives intended to fund its unfunded capital expenditures and upcoming debt maturities. The main financing initiatives include:

| • | obtaining additional bank financing, including a $250 million debt facility for the three East Coast of Canada newbuilding shuttle tankers, a $40 million debt facility for six un-mortgaged vessels, and a new $35 million tranche added to an existing debt facility secured by two shuttle tankers; |

| • | refinancing $75 million of an existing revolving credit facility relating to the Varg FPSO unit; |

| • | extending the majority of the principal maturity payments to late-2018 for two of the Partnership’s existing NOK senior unsecured bonds, previously due in January 2017 and January 2018; |

| • | extending beyond 2018 the maturity date of $200 million of existing intercompany loans made by Teekay Corporation to the Partnership; |

| • | issuing $200 million of preferred equity; and |

| • | deferring the delivery of the two remaining UMS newbuildings. |

Completion of each of these initiatives is subject to, and conditioned upon, completion of each of the other initiatives described above, as well as the financing initiatives being undertaken by Teekay Corporation. Please refer to Teekay Corporation’s first quarter 2016 earnings release for additional information regarding these initiatives.

In April 2016, the Partnership completed the new $35 million tranche on an existing debt facility secured by two shuttle tankers. As of May 18, 2016, the Partnership has received lender commitments for the other bank financing initiatives, received a majority of lender commitments for the Varg FPSO refinancing, received commitments from a majority of the NOK bondholders to extend the bond maturities (only 66.7% of the votes are required to approve the proposal), extended the $200 million Teekay Corporation intercompany loan maturity, is in discussions to defer the delivery of the two remaining UMS newbuildings, and is in advanced discussions relating to the preferred equity financing. The Partnership expects to complete all these initiatives before June 30, 2016.

Arendal Spirit UMS Update

On April 21, 2016, during the process of lifting the gangway connecting the Arendal Spirit UMS to an FPSO unit in a period of heavy waves, the gangway of the Arendal Spirit suffered extensive damage, resulting in the UMS being declared off-hire by its charterer, Petrobras. The Partnership is arranging to replace this gangway with the gangway from the second UMS newbuilding, which is currently in the process of being transported from the shipyard in China to Brazil. The Partnership anticipates having the new gangway installed on the Arendal Spirit by mid-June, at which point the unit is expected to recommence full operations.

2

- more -

Sale-leaseback of Two Conventional Tankers

In March 2016, the Partnership completed the sale of two conventional tankers, the Kilimanjaro Spirit and Fuji Spirit, to a third party for aggregate sales proceeds of approximately $50 million. After repaying existing debt secured by these vessels, this transaction added approximately $30 million to the Partnership’s liquidity position. Related to the sale of these vessels, the Partnership has arranged to charter back both vessels for a period of three-years with an additional one-year extension option at $23,000 per day and $22,750 per day, respectively. One vessel has been fixed on a two-year time charter-out contract at $25,000 per day and the other vessel is currently trading in the spot conventional tanker market.

Sale of One Shuttle Tanker

In January 2016, the Partnership completed the sale of one shuttle tanker, the Navion Torinita, to a third party for aggregate sale proceeds of approximately $5 million.

Financial Summary

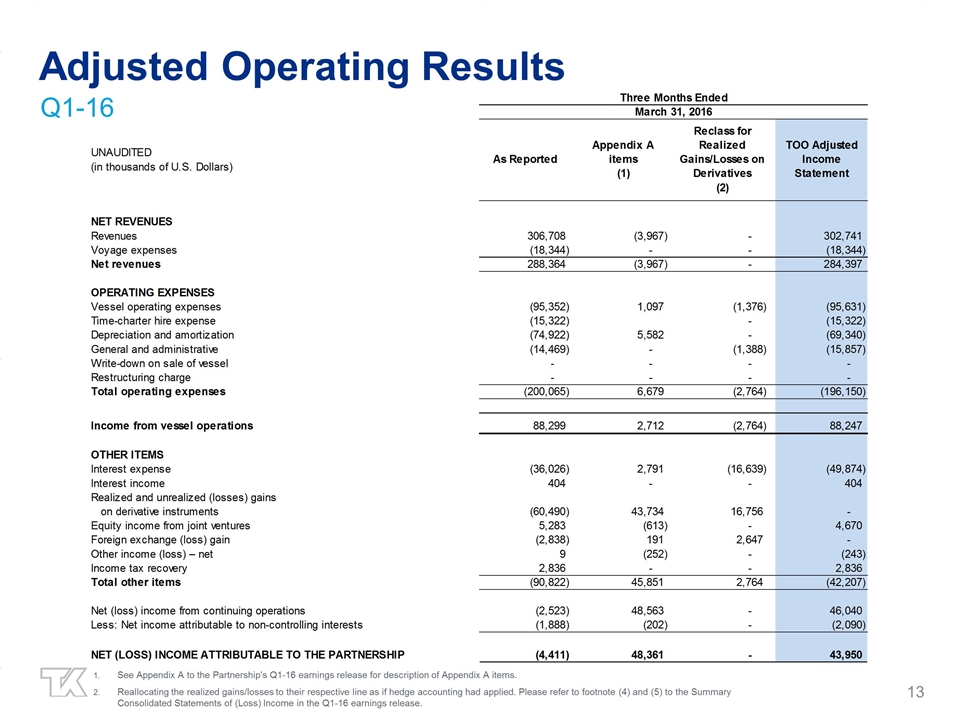

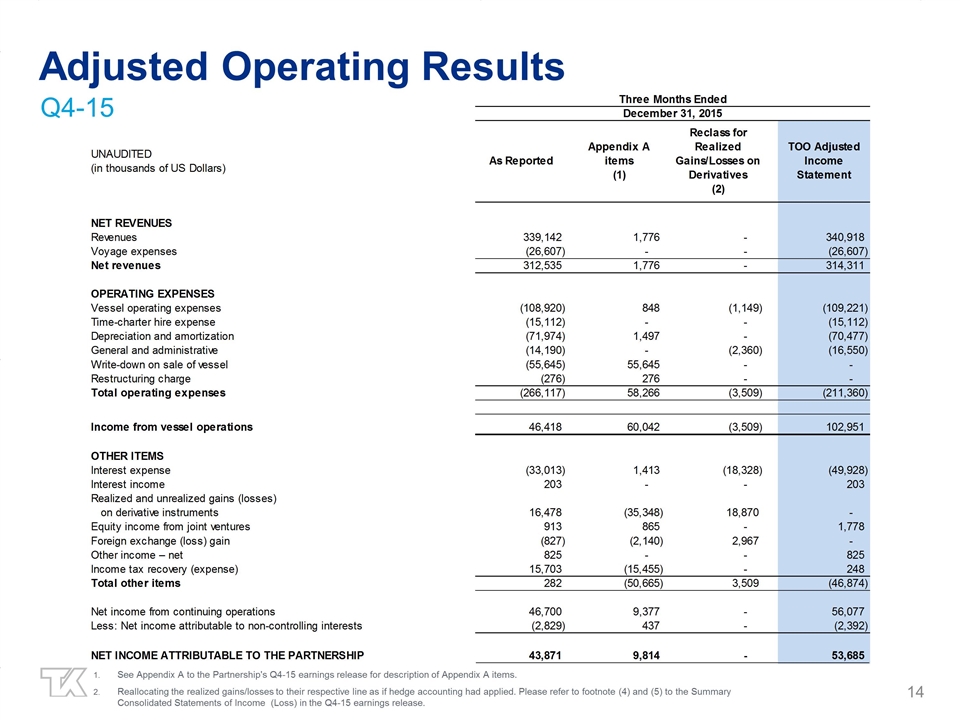

The Partnership reported adjusted net income attributable to the partners(1) of $44.0 million for the quarter ended March 31, 2016, compared to $40.5 million for the same period of the prior year. Adjusted net income attributable to the partners excludes a number of specific items that had the net effect of decreasing net income by $48.4 million and $57.7 million for the quarters ended March 31, 2016 and 2015, respectively, as detailed in Appendix A to this release. Including these items, the Partnership reported, on a GAAP basis, net loss attributable to the partners of $4.4 million for the first quarter of 2016, compared to a net loss attributable to the partners of $17.2 million in the same period of the prior year. Net revenues(2) increased to $288.4 million for the first quarter of 2016, compared to $242.5 million in the same period of the prior year.

Adjusted net income attributable to the partners for the three months ended March 31, 2016 increased from the same period in the prior year mainly due to the acquisition of the Knarr FPSO unit on July 1, 2015, the Arendal Spirit UMS commencing its charter contract in June 2015, and the commencement of the East Coast of Canada shuttle tanker contracts in June 2015. These increases were partially offset by a reduction in revenue earned relating to the Varg FPSO unit as it prepares to come off field in August 2016, the expiration of two shuttle tanker contracts in the second quarter of 2015, and the sale of two conventional tankers and one shuttle tanker during 2015.

For accounting purposes, the Partnership is required to recognize, through the consolidated statements of (loss) income, changes in the fair value of derivative instruments as unrealized gains or losses. This revaluation does not affect the economics of any hedging transactions nor does it have any impact on the Partnership’s actual cash flows or the calculation of its distributable cash flow.

| (1) | Adjusted net income attributable to the partners is a non-GAAP financial measure. Please refer to Appendix A included in this release for a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure under GAAP and information about specific items affecting net loss that are typically excluded by securities analysts in their published estimates of the Partnership’s financial results. |

| (2) | Net revenues is a non-GAAP financial measure used by certain investors to measure the financial performance of shipping companies. Please refer to Appendix C included in this release for a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure under GAAP. |

3

- more -

Operating Results

The following table highlights certain financial information for Teekay Offshore’s six segments: the FPSO segment, the Shuttle Tanker segment, the FSO segment, the UMS segment, the Towage segment and the Conventional Tanker segment (please refer to the “Teekay Offshore’s Fleet” section of this release below and Appendices C through F for further details).

| Three Months Ended | ||||||||||||||||||||||||||||

| March 31, 2016 | ||||||||||||||||||||||||||||

| (in thousands of U.S. Dollars) | (unaudited) | |||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Net revenues(1) |

132,784 | 112,246 | 14,151 | 13,482 | 7,565 | 8,136 | 288,364 | |||||||||||||||||||||

| Vessel operating expenses |

(46,915 | ) | (28,881 | ) | (5,473 | ) | (7,927 | ) | (4,885 | ) | (1,271 | ) | (95,352 | ) | ||||||||||||||

| Time-charter hire expense |

— | (14,812 | ) | — | — | — | (510 | ) | (15,322 | ) | ||||||||||||||||||

| Depreciation and amortization |

(37,583 | ) | (30,648 | ) | (2,172 | ) | (1,696 | ) | (2,823 | ) | — | (74,922 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| CFVO from consolidated vessels(2) |

72,131 | 62,878 | 9,836 | 4,862 | 1,967 | 6,182 | 157,856 | |||||||||||||||||||||

| CFVO from equity accounted vessels(3) |

8,233 | — | — | — | — | — | 8,233 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total CFVO(2)(3) |

80,364 | 62,878 | 9,836 | 4,862 | 1,967 | 6,182 | 166,089 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||

| March 31, 2015 | ||||||||||||||||||||||||||||

| (in thousands of U.S. Dollars) | (unaudited) | |||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment (4) |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Net revenues(1) |

98,275 | 118,561 | 14,354 | — | 3,782 | 7,494 | 242,466 | |||||||||||||||||||||

| Vessel operating expenses |

(36,766 | ) | (34,317 | ) | (6,359 | ) | — | (751 | ) | (1,374 | ) | (79,567 | ) | |||||||||||||||

| Time-charter hire expense |

— | (6,321 | ) | — | — | (662 | ) | — | (6,983 | ) | ||||||||||||||||||

| Depreciation and amortization |

(24,485 | ) | (28,367 | ) | (2,920 | ) | — | (548 | ) | (1,674 | ) | (57,994 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| CFVO from consolidated vessels(2) |

44,118 | 67,738 | 8,531 | (507 | ) | 2,059 | 5,868 | 127,807 | ||||||||||||||||||||

| CFVO from equity accounted vessel(3) |

8,854 | — | — | — | — | — | 8,854 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total CFVO(2)(3) |

52,972 | 67,738 | 8,531 | (507 | ) | 2,059 | 5,868 | 136,661 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Net revenues is a non-GAAP financial measure used by certain investors to measure the financial performance of shipping companies. Please refer to Appendix C, included in this release for a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure. |

| (2) | CFVO from consolidated vessels represents income (loss) from vessel operations before depreciation and amortization expense, write-down and gain on sale of vessels, and amortization of the non-cash portion of revenue contracts, and includes the realized losses on the settlement of foreign exchange forward contracts and adjusts for direct financing leases to a cash basis. CFVO is a non-GAAP financial measure used by certain investors to measure the financial performance of shipping companies. CFVO should not be considered as an alternative to net income, equity income or any other indicator of the Partnership’s performance required by GAAP. Please refer to Appendix E included in this release for a description and reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure. |

| (3) | CFVO from equity accounted vessels represents the Partnership’s proportionate share of CFVO from its equity-accounted vessels, the Cidade de Itajai FPSO unit and the Libra FPSO conversion project. Please see Appendix F for a description and reconciliation of CFVO from equity accounted vessels (a non-GAAP financial measure) as used in this release to the most directly comparable GAAP financial measure. |

| (4) | The Partnership acquired 100 percent of the outstanding shares of Logitel Offshore Holding AS (Logitel) during the third quarter of 2014 and operations began in the second quarter of 2015. |

4

- more -

FPSO Segment

Cash flow from vessel operations from the Partnership’s FPSO segment (which also includes the results from two equity-accounted FPSO units), increased to $80.4 million for the first quarter of 2016, compared to $53.0 million for the same period of the prior year, primarily due to the acquisition of the Knarr FPSO unit from Teekay Corporation in July 2015, partially offset by a reduction in revenue earned relating to the Varg FPSO unit as it prepares to come off field in August 2016. In accordance with the Varg FPSO charter contract, from February 1, 2016 to August 1, 2016, the Partnership does not receive the capital portion of the charter hire but does continue to receive the operating portion of the charter hire.

Shuttle Tanker Segment

Cash flow from vessel operations from the Partnership’s Shuttle Tanker segment decreased to $62.9 million for the first quarter of 2016 compared to $67.7 million for the same period of the prior year, primarily due to the sale of Navion Svenita in March 2015 and the expirations of a long-term contract of affreightment and a time-charter out contract over the past year, partially offset by the commencement of the East Coast of Canada shuttle tanker contracts in June 2015 and an increase in charter rates in certain contracts.

FSO Segment

Cash flow from vessel operations from the Partnership’s FSO segment increased to $9.8 million for the first quarter of 2016, compared to $8.5 million for the same period of the prior year, primarily due to lower crew costs due to the strengthening of the U.S. Dollar compared to the same period of the prior year.

UMS Segment

Cash flow from vessel operations from the Partnership’s UMS segment increased to $4.9 million for the first quarter of 2016, due to the Arendal Spirit UMS commencing its charter contract with Petrobras in June 2015.

Towage Segment

Cash flow from vessel operations from the Partnership’s Towage segment decreased slightly to $2.0 million for the first quarter of 2016, compared to $2.1 million for the same period of the prior year as the increase in fleet size during 2015 was offset by lower charter rates and utilization.

Conventional Tanker Segment

Cash flow from vessel operations from the Partnership’s Conventional Tanker segment increased to $6.2 million for the first quarter of 2016, compared to $5.9 million for the same period of the prior year, primarily due to a $4.0 million early termination fee received from Teekay Corporation relating to the charter contract termination for the Kilimanjaro Spirit during the first quarter of 2016, partially offset by the sale of two conventional tankers, the SPT Explorer and Navigator Spirit, in the fourth quarter of 2015.

5

- more -

Teekay Offshore’s Fleet

The following table summarizes Teekay Offshore’s fleet as of May 1, 2016.

| Number of Vessels | ||||||||||||||||

| Owned Vessels |

Chartered-in Vessels |

Committed Newbuildings / Conversions / Upgrade |

Total | |||||||||||||

| Shuttle Tanker Segment |

29 | (i) | 3 | 3 | (ii) | 35 | ||||||||||

| FPSO Segment |

6 | (iii) | — | 2 | (iv) | 8 | ||||||||||

| FSO Segment |

6 | — | 1 | (v) | 7 | |||||||||||

| Towage Segment |

6 | — | 4 | (vi) | 10 | |||||||||||

| Conventional Segment |

— | 2 | — | 2 | ||||||||||||

| UMS Segment |

1 | — | 2 | (vii) | 3 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

48 | 5 | 12 | 65 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (i) | Includes six shuttle tankers in which Teekay Offshore’s ownership interest is 50 percent, one shuttle tanker in which Teekay Offshore’s ownership interest is 67 percent and one HiLoad DP unit. |

| (ii) | Includes three Suezmax-size, DP2 shuttle tanker newbuildings scheduled to be delivered in the third quarter of 2017 through the first quarter of 2018 for employment under the East Coast of Canada contracts. |

| (iii) | Includes one FPSO unit, the Cidade de Itajai, in which Teekay Offshore’s ownership interest is 50 percent. |

| (iv) | Consists of the Petrojarl I FPSO upgrade project and Teekay Offshore’s 50 percent ownership interest in the Libra FPSO conversion project. |

| (v) | Consists of the Randgrid shuttle tanker, which is being converted into an FSO unit for use with the Gina Krog FSO project scheduled to deliver early-2017. |

| (vi) | Consists of four long-distance towing and offshore installation vessel newbuildings scheduled to deliver in the third quarter of 2016 through the first quarter of 2017. |

| (vii) | Consists of two UMS newbuildings scheduled to deliver in late-2019, subject to the finalization of a deferral agreement with the shipyard. |

Liquidity Update

As of March 31, 2016, the Partnership had total liquidity of $336 million, comprised of cash and cash equivalents.

6

- more -

Availability of 2015 Annual Report

Teekay Offshore Partners L.P. filed its 2015 Annual Report on Form 20-F with the U.S. Securities and Exchange Commission (SEC) on April 18, 2016. Copies are available on Teekay Offshore’s website, under “Investors – Teekay Offshore Partners L.P. – Financials & Presentations”, at www.teekay.com. Unitholders may request a printed copy of this annual report, including the complete audited financial statements free of charge by contacting Teekay Offshore’s Investor Relations.

Conference Call

The Partnership plans to host a conference call on Thursday, May 19, 2016 at 12:00 pm (ET) to discuss the results for the first quarter of 2016. All unitholders and interested parties are invited to listen to the live conference call by choosing from the following options:

| • | By dialing 1-800-524-8950 or 416-260-0113, if outside North America, and quoting conference ID code 4260566. |

| • | By accessing the webcast, which will be available on Teekay Offshore’s website at www.teekay.com (the archive will remain on the website for a period of 30 days). |

An accompanying First Quarter 2016 Earnings Presentation will also be available at www.teekay.com in advance of the conference call start time.

The conference call will be recorded and available until Thursday, June 2, 2016. This recording can be accessed following the live call by dialing 1-888-203-1112 or 647-436-0148, if outside North America, and entering access code 4260566.

About Teekay Offshore Partners L.P.

Teekay Offshore Partners L.P. is an international provider of marine transportation, oil production, storage, long-distance towing and offshore installation and maintenance and safety services to the offshore oil industry, primarily focusing on the deepwater offshore oil regions of the North Sea, Brazil and the East Coast of Canada. Teekay Offshore is structured as a publicly-traded master limited partnership (MLP) with consolidated assets of approximately $5.7 billion, comprised of 65 offshore assets, including floating production, storage and offloading (FPSO) units, shuttle tankers, floating storage and offtake (FSO) units, units for maintenance and safety (UMS), long-distance towing and offshore installation vessels and conventional tankers. The majority of Teekay Offshore’s fleet is employed on medium-term, stable contracts.

Teekay Offshore’s common units trade on the New York Stock Exchange under the symbol “TOO”.

For Investor Relations

enquiries contact:

Ryan Hamilton

Tel: +1 (604) 609-6442

Website: www.teekay.com

This news release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, or any other securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

7

- more -

Teekay Offshore Partners L.P.

Summary Consolidated Statements of (Loss) Income

(in thousands of U.S. Dollars, except unit data)

| Three Months Ended | ||||||||||||

| March 31, 2016 |

December 31, 2015 |

March 31, 2015 |

||||||||||

| (unaudited) | (unaudited) | (unaudited)(1) | ||||||||||

| Revenues |

306,708 | 339,142 | 264,983 | |||||||||

| Voyage expenses |

(18,344 | ) | (26,607 | ) | (22,517 | ) | ||||||

| Vessel operating expenses |

(95,352 | ) | (108,920 | ) | (79,567 | ) | ||||||

| Time-charter hire expense |

(15,322 | ) | (15,112 | ) | (6,983 | ) | ||||||

| Depreciation and amortization(2) |

(74,922 | ) | (71,974 | ) | (57,994 | ) | ||||||

| General and administrative |

(14,469 | ) | (14,190 | ) | (15,020 | ) | ||||||

| (Write-down) and gain on sale of vessels(3) |

— | (55,645 | ) | (13,853 | ) | |||||||

| Restructuring charge |

— | (276 | ) | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Income from vessel operations |

88,299 | 46,418 | 69,049 | |||||||||

| Interest expense |

(36,026 | ) | (33,013 | ) | (24,799 | ) | ||||||

| Interest income |

404 | 203 | 135 | |||||||||

| Realized and unrealized (losses) gains on derivative instruments(4) |

(60,490 | ) | 16,478 | (62,808 | ) | |||||||

| Equity income |

5,283 | 913 | 4,091 | |||||||||

| Foreign currency exchange loss(5) |

(2,838 | ) | (827 | ) | (4,644 | ) | ||||||

| Other income – net |

9 | 825 | 254 | |||||||||

|

|

|

|

|

|

|

|||||||

| (Loss) income before income tax recovery |

(5,359 | ) | 30,997 | (18,722 | ) | |||||||

| Income tax recovery |

2,836 | 15,703 | 79 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net (loss) income |

(2,523 | ) | 46,700 | (18,643 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Non-controlling interests in net (loss) income |

1,888 | 2,829 | 3,998 | |||||||||

| Dropdown Predecessor’s interest in net loss(1) |

— | — | (5,415 | ) | ||||||||

| Preferred unitholders’ interest in net (loss) income |

10,750 | 10,750 | 2,719 | |||||||||

| General Partner’s interest in net (loss) income |

(304 | ) | 662 | 3,764 | ||||||||

| Limited partners’ interest in net (loss) income |

(14,857 | ) | 32,459 | (23,709 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Weighted-average number of common units: |

||||||||||||

| - basic |

107,055,382 | 107,016,572 | 92,391,826 | |||||||||

| - diluted |

107,055,382 | 107,047,391 | 92,391,826 | |||||||||

| Total number of common units outstanding at end of period |

107,128,349 | 107,026,979 | 92,413,598 | |||||||||

|

|

|

|

|

|

|

|||||||

| (1) | The Partnership has recast its financial results to include the financial results of the Knarr FPSO unit relating to the period prior to its acquisition by the Partnership from Teekay Corporation when it was under common control, which pre-acquisition results are referred to in this release as the Dropdown Predecessor. In accordance with GAAP, business acquisitions of entities under common control that have begun operations are required to be accounted for in a manner whereby the Partnership’s financial statements are retroactively adjusted to include the historical results of the acquired vessels from the date the vessels were originally under the control of Teekay Corporation. For these purposes, the Knarr FPSO unit was under common control by Teekay Corporation from March 9, 2015 to July 1, 2015, when it was sold to the Partnership. |

| (2) | The Partnership considers its shuttle tankers to comprise of two components: i) a conventional tanker (the “tanker component”) and ii) specialized shuttle equipment (the “shuttle component”). The Partnership differentiates these two components on the principle that a shuttle tanker can also operate as a conventional tanker without the use of the shuttle component. The economics of this alternate use depend on the supply and demand fundamentals in the two segments. Historically, the useful life of both components was assessed as 25 years commencing from the date the vessel is delivered from the shipyard. During the three months ended March 31, 2016, the Partnership has considered factors related to the ongoing use of the shuttle component and has reassessed the useful life as being 20 years based on the challenges associated with adverse market conditions in the energy sector and other long term factors associated with the global oil industry. This change in estimate, commencing January 1, 2016, impacts the entire fleet of its shuttle tanker vessels. Separately, the Partnership has reviewed the depreciation of the tanker component for eight vessels in its fleet that are 17 years of age or older. Based on the Partnership’s expected operating plan for these vessels, the Partnership has reassessed the estimated useful life of the tanker component for these vessels as 20 years commencing January 1, 2016. The effect of these changes in estimates was to increase depreciation expense and net loss by $7.3 million for the three months ended March 31, 2016. |

8

- more -

| (3) | The write-down for the three months ended December 31, 2015 includes the impairment of two of the Partnership’s 2000s-built conventional tankers and five of the Partnership’s 1990s-built shuttle tankers to their estimated fair value, using appraised values. The write-down of the two conventional tankers was the result of the expected sale of the vessels and the vessels were classified as held for sale on the Partnership’s consolidated balance sheet as at December 31, 2015. The write-down of the five shuttle tankers, which have an average age of 17.5 years, was the result of changes in our expectations of their future opportunities, primarily due to their advanced age. |

The write-down and gain on sale of vessels for the three months ended March 31, 2015 includes the impairment of two of the Partnership’s 1990s-built shuttle tankers to their estimated fair values, using appraised values, and the gain on the sale of a 1997-built shuttle tanker, the Navion Svenita. The write-downs were the result of a change in the operating plans of one vessel and the expected sale of one vessel.

| (4) | Realized losses on derivative instruments relate to amounts the Partnership actually paid to settle derivative instruments, and the unrealized (losses) gains on derivative instruments relate to the change in fair value of such derivative instruments, as detailed in the table below: |

| Three Months Ended | ||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||

| Realized losses relating to: |

||||||||||||

| Interest rate swaps |

(13,967 | ) | (15,363 | ) | (13,419 | ) | ||||||

| Foreign currency forward contracts |

(2,933 | ) | (3,909 | ) | (3,253 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| (16,900 | ) | (19,272 | ) | (16,672 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Unrealized (losses) gains relating to: |

||||||||||||

| Interest rate swaps |

(51,921 | ) | 34,255 | (41,040 | ) | |||||||

| Foreign currency forward contracts |

8,331 | 1,495 | (5,096 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| (43,590 | ) | 35,750 | (46,136 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total realized and unrealized (losses) gains on derivative instruments |

(60,490 | ) | 16,478 | (62,808 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| (5) | Foreign currency exchange loss includes realized losses relating to the amounts the Partnership paid to settle its non-designated cross currency swaps that were entered into as an economic hedge relating to the Partnership’s Norwegian Kroner (NOK)-denominated unsecured bonds as detailed in the table below. In addition, in the three months ended March 31, 2016, the realized loss on cross currency swaps includes a $32.6 million loss on the maturity of the cross currency swaps associated with the NOK 500 million bond settled during the quarter, which was offset by a $32.6 million gain on settlement of the bond, not included in the table below. The Partnership issued NOK 600 million of unsecured bonds in 2012 maturing in 2017, NOK 1,300 million of unsecured bonds in 2013, of which NOK 500 million matured in 2016 and NOK 800 million is maturing in 2018, and NOK 1,000 million of unsecured bonds in 2014 maturing in 2019. Foreign currency exchange loss also includes unrealized gains (losses) relating to the change in fair value of such derivative instruments, partially offset by unrealized (losses) gains on the revaluation of the NOK bonds, as detailed in the table below: |

| Three Months Ended | ||||||||||||

| March 31, 2016 | December 31, 2015 |

March 31, 2015 | ||||||||||

| Realized losses on cross currency swaps |

(35,276 | ) | (2,967 | ) | (2,380 | ) | ||||||

| Unrealized gains (losses) on cross currency swaps |

52,895 | (9,409 | ) | (32,201 | ) | |||||||

| Unrealized (losses) gains on revaluation of NOK bonds |

(51,487 | ) | 12,615 | 29,392 | ||||||||

9

- more -

Teekay Offshore Partners L.P.

Consolidated Balance Sheets

(in thousands of U.S. Dollars)

| As at | As at | |||||||

| March 31, 2016 | December 31, 2015 | |||||||

| (unaudited) | (unaudited) | |||||||

| ASSETS |

||||||||

| Current |

||||||||

| Cash and cash equivalents |

335,751 | 258,473 | ||||||

| Restricted cash - current |

6,836 | 51,431 | ||||||

| Accounts receivable |

131,775 | 153,662 | ||||||

| Vessels held for sale |

— | 55,450 | ||||||

| Net investments in direct financing leases - current |

6,328 | 5,936 | ||||||

| Prepaid expenses |

38,279 | 34,027 | ||||||

| Due from affiliates |

57,936 | 81,271 | ||||||

| Other current assets |

21,221 | 20,490 | ||||||

|

|

|

|

|

|||||

| Total current assets |

598,126 | 660,740 | ||||||

|

|

|

|

|

|||||

| Restricted cash - long-term |

15,864 | 9,089 | ||||||

| Vessels and equipment |

||||||||

| At cost, less accumulated depreciation |

4,250,285 | 4,348,535 | ||||||

| Advances on newbuilding contracts and conversion costs |

470,005 | 395,084 | ||||||

| Net investments in direct financing leases |

9,747 | 11,535 | ||||||

| Investment in equity accounted joint ventures |

70,656 | 77,647 | ||||||

| Deferred tax asset |

31,600 | 30,050 | ||||||

| Other assets |

76,160 | 82,341 | ||||||

| Goodwill |

129,145 | 129,145 | ||||||

|

|

|

|

|

|||||

| Total assets |

5,651,588 | 5,744,166 | ||||||

|

|

|

|

|

|||||

| LIABILITIES AND EQUITY |

||||||||

| Current |

||||||||

| Accounts payable |

20,858 | 15,899 | ||||||

| Accrued liabilities |

124,955 | 91,065 | ||||||

| Deferred revenues |

49,122 | 54,378 | ||||||

| Due to affiliates |

105,326 | 304,583 | ||||||

| Current portion of derivative instruments |

209,795 | 201,456 | ||||||

| Current portion of long-term debt |

615,803 | 485,069 | ||||||

| Current portion of in-process revenue contracts |

12,744 | 12,779 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

1,138,603 | 1,165,229 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

2,675,444 | 2,878,805 | ||||||

| Derivative instruments |

205,997 | 221,329 | ||||||

| Due to affiliates |

200,000 | — | ||||||

| In-process revenue contracts |

59,883 | 63,026 | ||||||

| Other long-term liabilities |

186,331 | 192,258 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

4,466,258 | 4,520,647 | ||||||

|

|

|

|

|

|||||

| Redeemable non-controlling interest |

2,297 | 3,173 | ||||||

| Convertible Preferred Units (10.4 million units issued and outstanding at March 31, 2016 and December 31, 2015) |

252,334 | 252,498 | ||||||

| Equity |

||||||||

| Limited partners - common units (107.1 million and 107.0 million units issued and outstanding at March 31, 2016 and December 31, 2015, respectively) |

603,518 | 629,264 | ||||||

| Limited partners - preferred units (11.0 million units issued and outstanding at March 31, 2016 and December 31, 2015) |

266,925 | 266,925 | ||||||

| General Partner |

17,082 | 17,608 | ||||||

| Non-controlling interests |

56,009 | 53,355 | ||||||

| Accumulated other comprehensive (loss) income |

(12,835 | ) | 696 | |||||

|

|

|

|

|

|||||

| Total equity |

930,699 | 967,848 | ||||||

|

|

|

|

|

|||||

| Total liabilities and total equity |

5,651,588 | 5,744,166 | ||||||

|

|

|

|

|

|||||

10

- more -

Teekay Offshore Partners L.P.

Consolidated Statements of Cash Flows

(in thousands of U.S. Dollars)

| Three Months Ended | ||||||||

| March 31, 2016 | March 31, 2015 | |||||||

| (unaudited) | (unaudited)(1) | |||||||

| Cash and cash equivalents provided by (used for) |

||||||||

| OPERATING ACTIVITIES |

||||||||

| Net loss |

(2,523 | ) | (18,643 | ) | ||||

| Non-cash items: |

||||||||

| Unrealized (gain) loss on derivative instruments |

(9,356 | ) | 78,337 | |||||

| Equity income |

(5,283 | ) | (4,091 | ) | ||||

| Depreciation and amortization |

74,922 | 57,994 | ||||||

| Write-down and (gain) on sale of vessels |

— | 13,853 | ||||||

| Deferred income tax recovery |

(3,538 | ) | (434 | ) | ||||

| Amortization of in-process revenue contracts |

(3,177 | ) | (3,142 | ) | ||||

| Unrealized foreign currency exchange gain and other |

24,901 | (22,532 | ) | |||||

| Change in non-cash working capital items related to operating activities |

52,860 | 23,262 | ||||||

| Expenditures for dry docking |

(3,445 | ) | (3,963 | ) | ||||

|

|

|

|

|

|||||

| Net operating cash flow |

125,361 | 120,641 | ||||||

|

|

|

|

|

|||||

| FINANCING ACTIVITIES |

||||||||

| Proceeds from long-term debt |

50,410 | 379,717 | ||||||

| Scheduled repayments of long-term debt |

(125,030 | ) | (65,812 | ) | ||||

| Prepayments of long-term debt |

(21,607 | ) | (13,606 | ) | ||||

| Debt issuance costs |

(99 | ) | (4,658 | ) | ||||

| Purchase of Teekay Knarr AS and Knarr L.L.C from Teekay Corporation (net of cash acquired of $14.2 million) |

— | 14,247 | ||||||

| Decrease in restricted cash |

37,820 | 10,870 | ||||||

| Cash distributions paid by the Partnership |

(22,763 | ) | (57,722 | ) | ||||

| Cash distributions paid by subsidiaries to non-controlling interests |

(110 | ) | (2,610 | ) | ||||

| Other |

(204 | ) | 288 | |||||

|

|

|

|

|

|||||

| Net financing cash flow |

(81,583 | ) | 260,714 | |||||

|

|

|

|

|

|||||

| INVESTING ACTIVITIES |

||||||||

| Net expenditures for vessels and equipment, including advances on newbuilding contracts and conversion costs |

(25,277 | ) | (320,989 | ) | ||||

| Proceeds from sale of vessels and equipment |

55,450 | 8,918 | ||||||

| Repayment from joint ventures |

— | 5,225 | ||||||

| Direct financing lease payments received |

1,396 | 1,146 | ||||||

| Return of capital from (investment in) equity accounted joint ventures |

1,931 | (5,016 | ) | |||||

| Increase in restricted cash |

— | (34,082 | ) | |||||

|

|

|

|

|

|||||

| Net investing cash flow |

33,500 | (344,798 | ) | |||||

|

|

|

|

|

|||||

| Increase in cash and cash equivalents |

77,278 | 36,557 | ||||||

| Cash and cash equivalents, beginning of the period |

258,473 | 252,138 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of the period |

335,751 | 288,695 | ||||||

|

|

|

|

|

|||||

| (1) | In accordance with GAAP, the Consolidated Statement of Cash Flows for the three months ended March 31, 2015 includes the cash flows relating to the Knarr FPSO unit Dropdown Predecessor for the period from March 9, 2015 to March 31, 2015, when the vessel was under the common control of Teekay Corporation, but prior to its acquisition by the Partnership. |

11

- more -

Teekay Offshore Partners L.P.

Appendix A – Specific Items Affecting Net Loss

(in thousands of U.S. Dollars)

Set forth below is a reconciliation of the Partnership’s unaudited adjusted net income attributable to the partners, a non-GAAP financial measure, to net loss attributable to the partners as determined in accordance with GAAP. The Partnership believes that, in addition to conventional measures prepared in accordance with GAAP, certain investors use this information to evaluate the Partnership’s financial performance. The items below are also typically excluded by securities analysts in their published estimates of the Partnership’s financial results. Adjusted net income attributable to the partners is intended to provide additional information and should not be considered a substitute for measures of performance prepared in accordance with GAAP.

| Three Months Ended | ||||||||

| March 31, 2016 | March 31, 2015 | |||||||

| (unaudited) | (unaudited) | |||||||

| Net loss – GAAP basis |

(2,523 | ) | (18,643 | ) | ||||

| Adjustments: |

||||||||

| Net income attributable to non-controlling interests |

(1,888 | ) | (3,998 | ) | ||||

| Net loss attributable to Dropdown Predecessor |

— | 5,415 | ||||||

|

|

|

|

|

|||||

| Net loss attributable to the partners |

(4,411 | ) | (17,226 | ) | ||||

|

|

|

|

|

|||||

| Add (subtract) specific items affecting net loss: |

||||||||

| Foreign currency exchange losses(1) |

191 | 4,696 | ||||||

| Unrealized losses on derivative instruments(2) |

42,926 | 36,627 | ||||||

| Write-down and (gain) on sale of vessels(3) |

— | 13,853 | ||||||

| Pre-operational costs(4) |

5,150 | 2,307 | ||||||

| Early termination fee and other(5) |

296 | — | ||||||

| Non-controlling interests’ share of items above(6) |

(202 | ) | 251 | |||||

|

|

|

|

|

|||||

| Total adjustments |

48,361 | 57,734 | ||||||

|

|

|

|

|

|||||

| Adjusted net income attributable to the partners |

43,950 | 40,508 | ||||||

|

|

|

|

|

|||||

| (1) | Foreign currency exchange losses primarily relate to the Partnership’s revaluation of all foreign currency-denominated monetary assets and liabilities based on the prevailing exchange rate at the end of each reporting period and unrealized gains or losses related to the Partnership’s cross currency swaps for outstanding Norwegian bonds of the Partnership and excludes the realized gains and losses relating to the cross currency swaps. |

| (2) | Reflects the unrealized losses due to changes in the mark-to-market value of interest rate swaps and foreign exchange forward contracts that are not designated as hedges for accounting purposes, hedge ineffectiveness from derivative instruments designated as hedges for accounting purposes, the unrealized mark-to-market value of the interest rate swaps within the Cidade de Itajai FPSO joint venture and hedge ineffectiveness within the Libra FPSO equity accounted joint venture. |

| (3) | Please refer to footnote (3) of the summary consolidated statements of loss for a description of the write-down of vessels for the three months ended March 31, 2015. |

| (4) | Reflects the realized losses on foreign currency forward contracts relating to upgrade costs on the Petrojarl I FPSO unit and the conversion costs on the Gina Krog FSO unit, depreciation and amortization expense relating to the Petrojarl I FPSO unit while undergoing conversion, and costs associated to the delivery deferral of the Stavanger Spirit UMS. |

| (5) | Other items for the three months ended March 31, 2016 includes $4.3 million relating to an increase in depreciation expense as a result of the change in the useful life estimate of the shuttle component of the Partnership’s shuttle tankers from 25 years to |

| 20 years effective January 1, 2016, partially offset by an early termination fee received from Teekay Corporation of $4.0 million related to the sale of the Kilimanjaro Spirit conventional tanker. |

| (6) | Items affecting net loss include amounts attributable to the Partnership’s consolidated non-wholly-owned subsidiaries. Each item affecting net loss is analyzed to determine whether any of the amounts originated from a consolidated non-wholly-owned subsidiary. Each amount that originates from a consolidated non-wholly-owned subsidiary is multiplied by the non-controlling interests’ percentage share in this subsidiary to arrive at the non-controlling interests’ share of the amount. The amount identified as “non-controlling interests’ share of items above” in the table above is the cumulative amount of the non-controlling interests’ proportionate share of items listed in the table. |

12

- more -

Teekay Offshore Partners L.P.

Appendix B – Reconciliation of Non-GAAP Financial Measure

Distributable Cash Flow

(in thousands of U.S. Dollars, except unit and per unit amounts)

Distributable cash flow represents net loss adjusted for depreciation and amortization expense, non-controlling interests, non-cash items, distributions relating to equity financing of newbuilding installments, distributions on our preferred units, vessel and business acquisition costs, estimated maintenance capital expenditures, write-down and gains on sale of vessels, unrealized losses from derivatives, non-cash income taxes and unrealized foreign exchange related items. Maintenance capital expenditures represent those capital expenditures required to maintain over the long-term the operating capacity of, or the revenue generated by, the Partnership’s capital assets. Distributable cash flow is a quantitative standard used in the publicly-traded partnership investment community to assist in evaluating a partnership’s ability to make quarterly cash distributions. Distributable cash flow is not defined by GAAP and should not be considered as an alternative to net loss or any other indicator of the Partnership’s performance required by GAAP. The table below reconciles distributable cash flow to net loss for the three months ended March 31, 2016 and March 31, 2015.

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2016 | 2015 | |||||||

| (unaudited) | (unaudited) | |||||||

| Net loss |

(2,523 | ) | (18,643 | ) | ||||

| Net loss attributable to Dropdown Predecessor |

— | 5,415 | ||||||

|

|

|

|

|

|||||

| Net loss attributable to the partners and non-controlling interests’ |

(2,523 | ) | (13,228 | ) | ||||

| Depreciation and amortization |

74,922 | 53,604 | ||||||

| Equity income from joint ventures |

(5,283 | ) | (4,091 | ) | ||||

| Distributions relating to equity financing of newbuildings and conversion costs |

3,262 | 3,749 | ||||||

| Partnership’s share of equity accounted joint venture’s distributable cash flow net of estimated maintenance capital expenditures(1) |

5,725 | 5,654 | ||||||

| Write-down and (gain on sale) of vessels |

— | 13,853 | ||||||

| Distributions relating to preferred units |

(10,750 | ) | (2,719 | ) | ||||

| Estimated maintenance capital expenditures(2) |

(40,671 | ) | (29,254 | ) | ||||

| Unrealized losses on derivative instruments(3) |

43,590 | 36,097 | ||||||

| Foreign currency exchange and other, net |

(1,373 | ) | 4,033 | |||||

|

|

|

|

|

|||||

| Distributable cash flow before non-controlling interests |

66,647 | 67,698 | ||||||

| Non-controlling interests’ share of DCF |

(4,610 | ) | (7,086 | ) | ||||

|

|

|

|

|

|||||

| Distributable Cash Flow |

62,037 | 60,612 | ||||||

| Amount attributable to the General Partner |

(240 | ) | (5,264 | ) | ||||

|

|

|

|

|

|||||

| Limited partners’ Distributable Cash Flow |

61,797 | 55,348 | ||||||

| Weighted-average number of common units outstanding |

107,055,382 | 92,391,826 | ||||||

|

|

|

|

|

|||||

| Distributable Cash Flow per limited partner unit |

0.58 | 0.60 | ||||||

|

|

|

|

|

|||||

| (1) | Estimated maintenance capital expenditures relating to the Partnership’s equity accounted joint venture for the three months ended March 31, 2016 and 2015 were $1.0 million. |

| (2) | Effective January 1, 2016, the Partnership changed the estimated useful life of its shuttle tankers that are 17 years of age or older and the shuttle component of its shuttle tankers from 25 years to 20 years. This resulted in an increase in estimated maintenance capital expenditure of $3.1 million for the three months ended March 31, 2016. |

| (3) | Derivative instruments include interest rate swaps and foreign exchange forward contracts. |

13

- more -

Teekay Offshore Partners L.P.

Appendix C – Reconciliation of Non-GAAP Financial Measure

Net Revenues

(in thousands of U.S. Dollars)

Net revenues represents revenues less voyage expenses, which comprise all expenses relating to certain voyages, including bunker fuel expenses, port fees, cargo loading and unloading expenses, canal tolls, agency fees and commissions. Net revenues is a non-GAAP financial measure used by certain investors to measure the financial performance of shipping companies, however, it is not required by GAAP and should not be considered as an alternative to revenues or any other indicator of the Partnership’s performance required by GAAP.

| Three Months Ended March 31, 2016 | ||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Revenues |

132,784 | 126,184 | 14,363 | 13,482 | 11,083 | 8,812 | 306,708 | |||||||||||||||||||||

| Voyage expenses |

— | (13,938 | ) | (212 | ) | — | (3,518 | ) | (676 | ) | (18,344 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net revenues |

132,784 | 112,246 | 14,151 | 13,482 | 7,565 | 8,136 | 288,364 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Three Months Ended March 31, 2015 |

||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment(1) |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Revenues |

98,275 | 138,090 | 14,486 | — | 6,070 | 8,062 | 264,983 | |||||||||||||||||||||

| Voyage expenses |

— | (19,529 | ) | (132 | ) | — | (2,288 | ) | (568 | ) | (22,517 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net revenues |

98,275 | 118,561 | 14,354 | — | 3,782 | 7,494 | 242,466 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | The Partnership acquired 100% of the outstanding shares of Logitel during the third quarter of 2014 and operations began in the second quarter of 2015. |

14

- more -

Teekay Offshore Partners L.P.

Appendix D – Supplemental Segment Information

(in thousands of U.S. Dollars)

| Three Months Ended March 31, 2016 | ||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Net revenues (See Appendix C) |

132,784 | 112,246 | 14,151 | 13,482 | 7,565 | 8,136 | 288,364 | |||||||||||||||||||||

| Vessel operating expenses |

(46,915 | ) | (28,881 | ) | (5,473 | ) | (7,927 | ) | (4,885 | ) | (1,271 | ) | (95,352 | ) | ||||||||||||||

| Time-charter hire expense |

— | (14,812 | ) | — | — | — | (510 | ) | (15,322 | ) | ||||||||||||||||||

| Depreciation and amortization |

(37,583 | ) | (30,648 | ) | (2,172 | ) | (1,696 | ) | (2,823 | ) | — | (74,922 | ) | |||||||||||||||

| General and administrative |

(8,674 | ) | (3,957 | ) | (238 | ) | (693 | ) | (734 | ) | (173 | ) | (14,469 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from vessel operations |

39,612 | 33,948 | 6,268 | 3,166 | (877 | ) | 6,182 | 88,299 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Three Months Ended March 31, 2015 | ||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Net revenues (See Appendix C) |

98,275 | 118,561 | 14,354 | — | 3,782 | 7,494 | 242,466 | |||||||||||||||||||||

| Vessel operating expenses |

(36,766 | ) | (34,317 | ) | (6,359 | ) | — | (751 | ) | (1,374 | ) | (79,567 | ) | |||||||||||||||

| Time-charter hire expense |

— | (6,321 | ) | — | — | (662 | ) | — | (6,983 | ) | ||||||||||||||||||

| Depreciation and amortization |

(24,485 | ) | (28,367 | ) | (2,920 | ) | — | (548 | ) | (1,674 | ) | (57,994 | ) | |||||||||||||||

| General and administrative |

(4,942 | ) | (8,399 | ) | (610 | ) | (507 | ) | (310 | ) | (252 | ) | (15,020 | ) | ||||||||||||||

| (Write-down) and gain on sale of |

||||||||||||||||||||||||||||

| vessels |

— | (13,853 | ) | — | — | — | — | (13,853 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) from vessel operations |

32,082 | 27,304 | 4,465 | (507 | ) | 1,511 | 4,194 | 69,049 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

15

- more -

Teekay Offshore Partners L.P.

Appendix E – Reconciliation of Non-GAAP Financial Measure

Cash Flow From (Used For) Vessel Operations From Consolidated Vessels

(in thousands of U.S. Dollars)

Cash flow from (used for) vessel operations from consolidated vessels represents income (loss) from vessel operations before depreciation and amortization expense, write-down and gain on sale of vessels, and amortization of the non-cash portion of revenue contracts, and includes the realized gains and losses on the settlement of foreign exchange forward contracts and adjusts for direct financing leases to a cash basis. Cash flow from vessel operations is included because certain investors use this data to measure a company’s financial performance. Cash flow from vessel operations is not required by GAAP and should not be considered as an alternative to net income or any other indicator of the Partnership’s performance required by GAAP.

| Three Months Ended | ||||||||||||||||||||||||||||

| March 31, 2016 | ||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Income (loss) from vessel operations |

||||||||||||||||||||||||||||

| (See Appendix D) |

39,612 | 33,948 | 6,268 | 3,166 | (877 | ) | 6,182 | 88,299 | ||||||||||||||||||||

| Depreciation and amortization |

37,583 | 30,648 | 2,172 | 1,696 | 2,823 | — | 74,922 | |||||||||||||||||||||

| Realized (losses) gains from the settlements of non-designated foreign exchange forward contracts |

(1,067 | ) | (1,718 | ) | — | — | 21 | — | (2,764 | ) | ||||||||||||||||||

| Amortization of non-cash portion of revenue contracts |

(3,997 | ) | — | — | — | — | — | (3,997 | ) | |||||||||||||||||||

| Falcon Spirit revenue accounted for as direct financing lease |

— | — | (758 | ) | — | — | — | (758 | ) | |||||||||||||||||||

| Falcon Spirit cash flow from time-charter contracts |

— | — | 2,154 | — | — | — | 2,154 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash flow from vessel operations from consolidated vessels |

72,131 | 62,878 | 9,836 | 4,862 | 1,967 | 6,182 | 157,856 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||

| March 31, 2015 | ||||||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| FPSO Segment |

Shuttle Tanker Segment |

FSO Segment |

UMS Segment |

Towage Segment |

Conventional Tanker Segment |

Total | ||||||||||||||||||||||

| Income (loss) from vessel operations |

||||||||||||||||||||||||||||

| (See Appendix D) |

32,082 | 27,304 | 4,465 | (507 | ) | 1,511 | 4,194 | 69,049 | ||||||||||||||||||||

| Cash flow from vessel operations from consolidated vessels attributable to Dropdown Predecessor |

(8,399 | ) | — | — | — | — | — | (8,399 | ) | |||||||||||||||||||

| Depreciation and amortization |

24,485 | 28,367 | 2,920 | — | 548 | 1,674 | 57,994 | |||||||||||||||||||||

| Realized losses from the settlements of non-designated foreign exchange forward contracts |

(908 | ) | (1,786 | ) | — | — | — | — | (2,694 | ) | ||||||||||||||||||

| Amortization of non-cash portion of revenue contracts |

(3,142 | ) | — | — | — | — | — | (3,142 | ) | |||||||||||||||||||

| Write-down and (gain) on sale of vessels |

— | 13,853 | — | — | — | — | 13,853 | |||||||||||||||||||||

| Falcon Spirit revenue accounted for as direct financing lease |

— | — | (984 | ) | — | — | — | (984 | ) | |||||||||||||||||||

| Falcon Spirit cash flow from time-charter contracts |

— | — | 2,130 | — | — | — | 2,130 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash flow from (used for) vessel operations from consolidated vessels |

44,118 | 67,738 | 8,531 | (507 | ) | 2,059 | 5,868 | 127,807 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

16

- more -

Teekay Offshore Partners L.P.

Appendix F – Reconciliation of Non-GAAP Financial Measure

Cash Flow From Vessel Operations From Equity Accounted Vessels

(in thousands of U.S. Dollars)

Cash flow from vessel operations from equity accounted vessels represents income from vessel operations before depreciation and amortization expense. Cash flow from equity accounted vessel represents the Partnership’s proportionate share of cash flow from vessel operations from its equity-accounted vessels, the Cidade de Itajai FPSO unit and the Libra FPSO conversion project. Cash flow from vessel operations from equity accounted vessels is included because certain investors use cash flow from vessel operations to measure a company’s financial performance, and to highlight this measure for the Partnership’s equity accounted joint ventures. Cash flow from vessel operations from equity accounted vessels is not required by GAAP and should not be considered as an alternative to equity income or any other indicator of the Partnership’s performance required by GAAP.

| Three Months Ended | Three Months Ended | |||||||||||||||

| March 31, 2016 | March 31, 2015 | |||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| At | Partnership’s | At | Partnership’s | |||||||||||||

| 100% | 50% | 100% | 50% | |||||||||||||

| Voyage revenues |

21,720 | 10,860 | 23,711 | 11,856 | ||||||||||||

| Vessel and other operating expenses |

(5,254 | ) | (2,627 | ) | (5,997 | ) | (2,999 | ) | ||||||||

| Depreciation and amortization |

(4,384 | ) | (2,192 | ) | (4,164 | ) | (2,082 | ) | ||||||||

| General and administrative |

— | — | (6 | ) | (3 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from vessel operations of equity accounted vessels |

12,082 | 6,041 | 13,544 | 6,772 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest expense |

(1,398 | ) | (699 | ) | (2,630 | ) | (1,315 | ) | ||||||||

| Realized and unrealized gains (losses) on derivative instruments(1) |

35 | 18 | (2,522 | ) | (1,261 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other items |

(1,363 | ) | (681 | ) | (5,152 | ) | (2,576 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income / equity income of equity accounted vessel before income tax expense |

10,719 | 5,360 | 8,392 | 4,196 | ||||||||||||

| Income tax expense |

(154 | ) | (77 | ) | (210 | ) | (105 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income / equity income of equity accounted vessels |

10,565 | 5,283 | 8,182 | 4,091 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from vessel operations of equity accounted vessels |

12,082 | 6,041 | 13,544 | 6,772 | ||||||||||||

| Depreciation and amortization |

4,384 | 2,192 | 4,164 | 2,082 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flow from vessel operations from equity accounted vessels |

16,466 | 8,233 | 17,708 | 8,854 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Realized and unrealized gains (losses) on derivative instruments for the three months ended March 31, 2016 and 2015 include total unrealized gains of $1.2 million ($0.6 million at the Partnership’s 50% share) and unrealized losses of $1.1 million ($0.5 million at the Partnership’s 50% share), respectively, related to interest rate swaps for the Cidade de Itajai FPSO unit and the Libra FPSO conversion project. |

17

- more -

Forward Looking Statements

This release contains forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) which reflect management’s current views with respect to certain future events and performance, including statements regarding: the timing and completion of financing initiatives to address the Partnership’s medium-term funding needs and their impact on the Partnership’s financial position, including, among other things, plans to refinance and access additional debt, extend the maturities to late-2018 for two NOK senior unsecured bonds, issue equity securities and defer deliveries of two UMSs; the impact of growth projects on the Partnership’s future cash flows; securing all the necessary financing for the Partnership’s pipeline of growth projects; the replacement of the Arendal Spirit UMS gangway and timing of recommencing operations; the timing and completion of negotiating contract extensions; and the interest of current and potential customers in chartering the Varg FPSO. The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: the Partnership’s ability to complete its financing initiatives, including delivery deferrals for the UMS newbuildings, to address the Partnership’s medium-term funding needs, including financing for existing growth projects; failure of lenders, bondholders, investors or other third parties to approve or agree to the proposed terms of the financing initiatives of the Partnership; failure to achieve or the delay in achieving expected benefits of such financing initiatives; vessel operations and oil production volumes; significant changes in oil prices; variations in expected levels of field maintenance; increased operating expenses; different-than-expected levels of oil production in the North Sea, Brazil and East Coast of Canada offshore fields; potential early termination of contracts; shipyard delivery or vessel conversion and upgrade delays and cost overruns; changes in exploration, production and storage of offshore oil and gas, either generally or in particular regions that would impact expected future growth; delays in the commencement of charter contracts; potential delays related to the Arendal Spirit UMS recommencing operations; failure by the Partnership to secure a new charter contract for the Varg FPSO; and other factors discussed in Teekay Offshore’s filings from time to time with the SEC, including its Report on Form 20-F for the fiscal year ended December 31, 2015. The Partnership expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Partnership’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

18

- more -

May 19, 2016 Teekay OFFSHORE partners Q1-2016 Earnings presentation Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements which reflect management’s current views with respect to certain future events and performance, including statements regarding: the timing and completion of financing initiatives to address the Partnership’s medium-term funding needs and their impact on the Partnership’s financial position, including, among other things, plans to refinance and access additional debt, extend the maturities to late-2018 for two NOK senior unsecured bonds, issue equity securities and defer deliveries of two units for maintenance and safety (UMS); the Partnership’s growth prospects; the impact of growth projects on the Partnership’s future cash flows; financing for the Partnership’s pipeline of growth projects; the Partnership’s expectations for performance in the second quarter; expectations for refinancing the Partnership’s debt; the timing for replacement of the Arendal Spirit UMS gangway and timing of recommencing operations; the timing and completion of negotiating contract extensions; future chartering of the Varg FPSO; and the timing of delivery of newbuilding shuttle tankers. The following factors are among those that could cause actual results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that should be considered in evaluating any such statement: the Partnership’s ability to complete its financing initiatives; failure of lenders, bondholders, investors or other third parties to approve or agree to the proposed terms of the financing initiatives of the Partnership; failure to achieve or any delay in achieving expected benefits of such financing initiatives; vessel operations and oil production volumes; significant changes in oil prices; variations in expected levels of field maintenance; increased operating expenses; different-than-expected levels of oil production in the North Sea, Brazil and East Coast of Canada offshore fields; potential early termination of contracts; shipyard delivery or vessel conversion and upgrade delays and cost overruns; changes in exploration, production and storage of offshore oil and gas, either generally or in particular regions that would impact expected future growth; delays in the commencement of charter contracts; potential delays related to the Arendal Spirit UMS recommencing operations; failure by the Partnership to secure a new charter contract for the Varg FPSO; and other factors discussed in the Partnership’s filings from time to time with the SEC, including its Report on Form 20-F for the fiscal year ended December 31, 2015. The Partnership expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Partnership’s expectations with respect thereto or any change in events, conditions or circumstances on which any such statement is based.

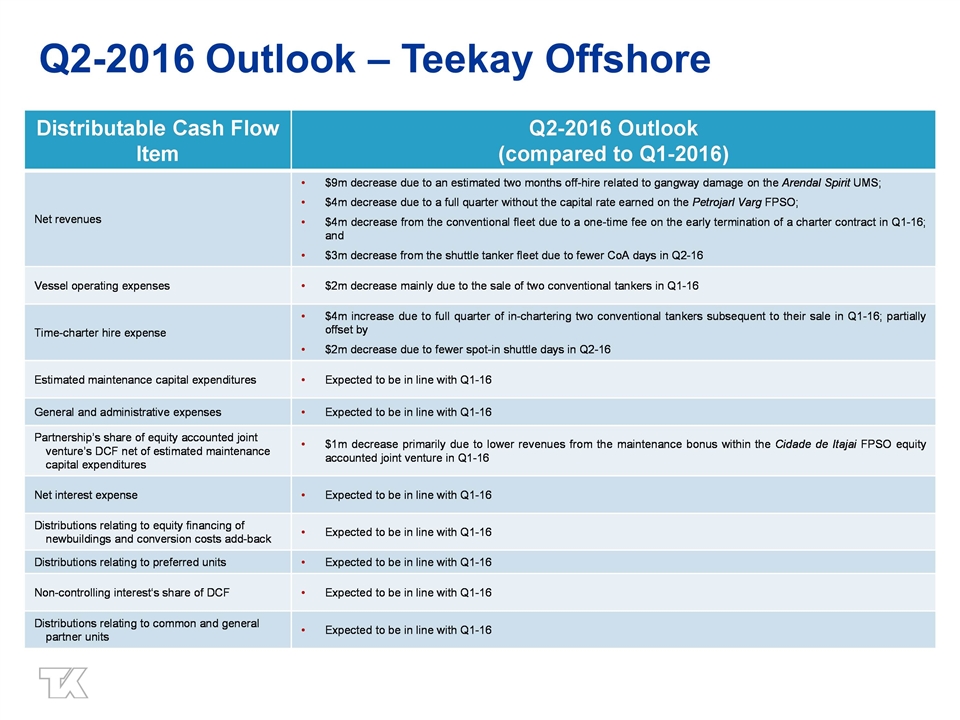

Recent Highlights Generated DCF* of $62.0 million, or $0.58 per common unit, in Q1-16 Generated CFVO* of $166.1 million in Q1-16, an increase of 22 percent from Q1-15 High fleet utilization and uptime Declared Q1-16 cash distribution of $0.11 per unit Distribution coverage ratio of 5.16x Completed sale of two conventional tankers and one shuttle tanker in Q1-16 Total liquidity of $336 million as at March 31, 2016 Nearing completion of financing initiatives to address 2016 and 2017 funding requirements Addresses near and medium-term debt maturities $1.6 billion of growth projects through 2018 fully financed** Implementing cost reduction plan expected to save over $30 million per year *Cash Flow from Vessel Operations (CFVO) and Distributable Cash Flow (DCF) are non-GAAP measures. Please see Teekay Offshore’s Q1-16 earnings release for descriptions and reconciliations of these non-GAAP measures. **Excludes two UMS newbuildings which the Partnership is currently in discussions to defer delivery

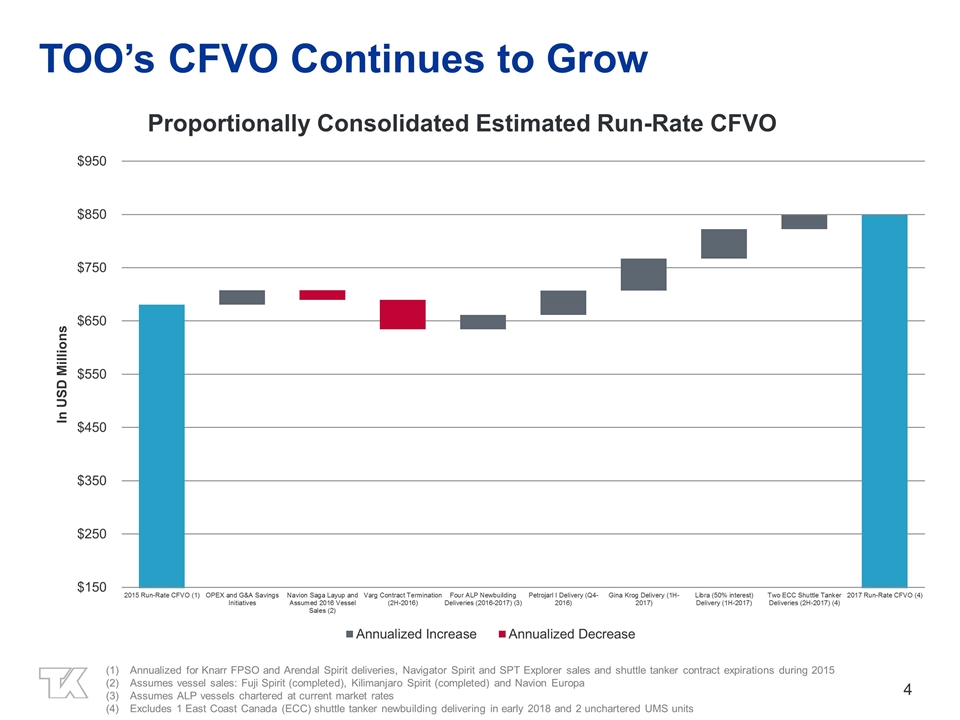

TOO’s CFVO Continues to Grow Annualized for Knarr FPSO and Arendal Spirit deliveries, Navigator Spirit and SPT Explorer sales and shuttle tanker contract expirations during 2015 Assumes vessel sales: Fuji Spirit (completed), Kilimanjaro Spirit (completed) and Navion Europa Assumes ALP vessels chartered at current market rates Excludes 1 East Coast Canada (ECC) shuttle tanker newbuilding delivering in early 2018 and 2 unchartered UMS units

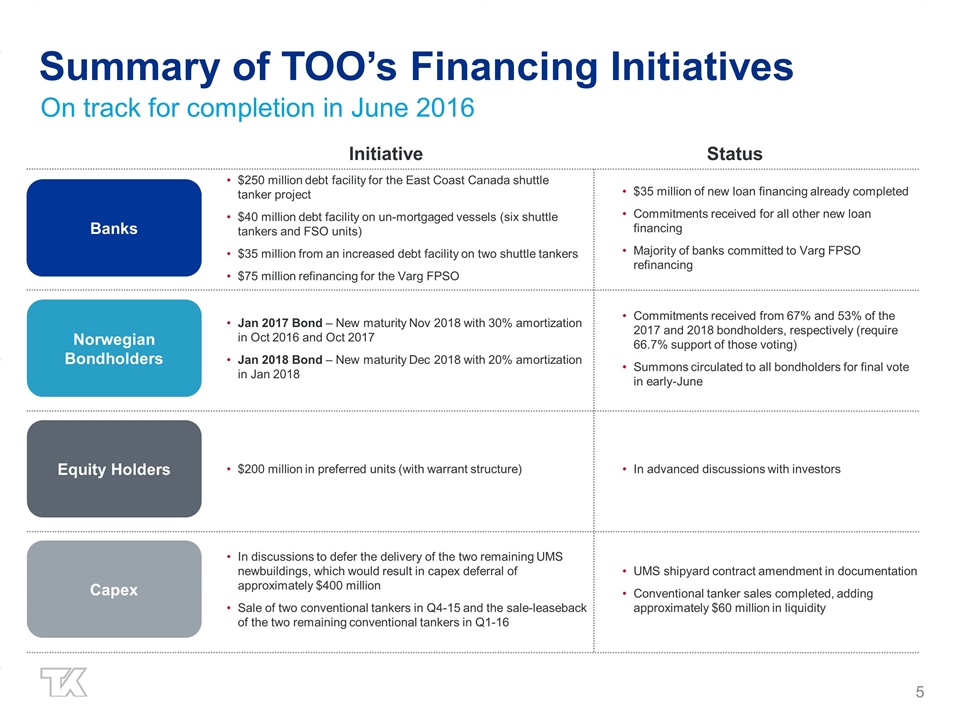

Summary of TOO’s Financing Initiatives On track for completion in June 2016 Initiative Status Banks $35 million of new loan financing already completed Commitments received for all other new loan financing Majority of banks committed to Varg FPSO refinancing Norwegian Bondholders Commitments received from 67% and 53% of the 2017 and 2018 bondholders, respectively (require 66.7% support of those voting) Summons circulated to all bondholders for final vote in early-June $250 million debt facility for the East Coast Canada shuttle tanker project $40 million debt facility on un-mortgaged vessels (six shuttle tankers and FSO units) $35 million from an increased debt facility on two shuttle tankers $75 million refinancing for the Varg FPSO Jan 2017 Bond – New maturity Nov 2018 with 30% amortization in Oct 2016 and Oct 2017 Jan 2018 Bond – New maturity Dec 2018 with 20% amortization in Jan 2018 Equity Holders In advanced discussions with investors $200 million in preferred units (with warrant structure) Capex UMS shipyard contract amendment in documentation Conventional tanker sales completed, adding approximately $60 million in liquidity In discussions to defer the delivery of the two remaining UMS newbuildings, which would result in capex deferral of approximately $400 million Sale of two conventional tankers in Q4-15 and the sale-leaseback of the two remaining conventional tankers in Q1-16

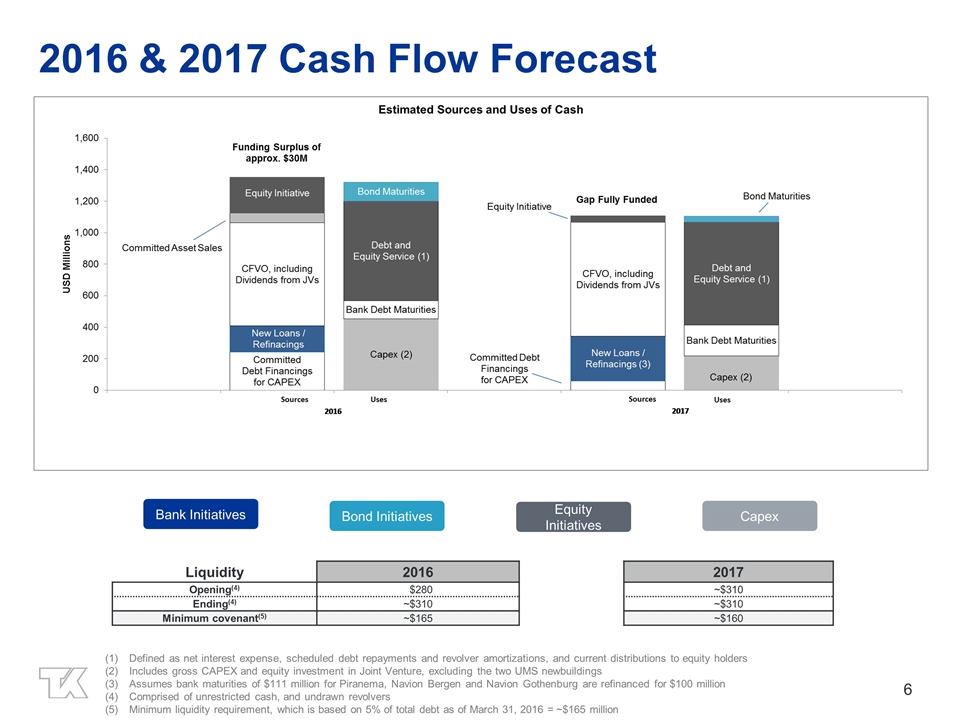

2016 & 2017 Cash Flow Forecast Defined as net interest expense, scheduled debt repayments and revolver amortizations, and current distributions to equity holders Includes gross CAPEX and equity investment in Joint Venture, excluding the two UMS newbuildings Assumes bank maturities of $111 million for Piranema, Navion Bergen and Navion Gothenburg are refinanced for $100 million Comprised of unrestricted cash, and undrawn revolvers Minimum liquidity requirement, which is based on 5% of total debt as of March 31, 2016 = ~$165 million Liquidity 2016 2017 Opening(4) $280 ~$310 Ending(4) ~$310 ~$310 Minimum covenant(5) ~$165 ~$160 Bank Initiatives Bond Initiatives Equity Initiatives Capex