Form 6-K TOYOTA MOTOR CORP/ For: May 29

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of May, 2015

Commission File Number 001-14948

Toyota Motor Corporation

(Translation of Registrant’s Name Into English)

1, Toyota-cho, Toyota City,

Aichi Prefecture 471-8571,

Japan

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Material Contained in this Report:

| I. |

English translation of the Japanese-language report on corporate governance publicly disclosed with the Tokyo Stock Exchange on June 29, 2006 by the registrant and amended on May 29, 2015. |

| II. |

English excerpt translation of a Report on Number of Listed Shares, as filed by the registrant with the Tokyo Stock Exchange on May 20, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Toyota Motor Corporation | ||||

| By: |

/s/ Yasushi Kyoda | |||

| Name: |

Yasushi Kyoda | |||

| Title: |

General Manager of Accounting Division | |||

Date: May 29, 2015

(Translation)

May 29, 2015

TOYOTA MOTOR CORPORATION

Akio Toyoda

Telephone Number: 0565-28-2121

Code Number: 7203

http://www.toyota.co.jp

Corporate governance at Toyota Motor Corporation (“TMC”) is as follows:

| I. | TMC ’s Basic Policy on Corporate Governance and Capital Structure, Business Attributes and Other Basic Information |

| 1. | Basic Policy |

TMC has positioned the stable long-term growth of corporate value as a top-priority management issue. We believe that in carrying this out, it is essential that we achieve long-term and stable growth by building positive relationships with all stakeholders, including shareholders and customers as well as business partners, local communities and employees, and by supplying products that will satisfy our customers. This position is reflected in the “Guiding Principles at Toyota”, which is a statement of TMC’s fundamental business policies. Also, TMC adopted and presented the CSR Policy “Contribution towards Sustainable Development”, an interpretation of the “Guiding Principles at Toyota” that organizes the relationships with its stakeholders. We are working to enhance corporate governance through a variety of measures designed to further increase our competitiveness as a global company.

| 2. | Capital Structure |

| Percentage of Shares Held by Foreign Investors |

Greater than 30% |

[Description of Major Shareholders]

| Name of Shareholders |

Number of Shares Held (Shares) |

Ownership Interest (%) |

||||||

| Japan Trustee Services Bank, Ltd. |

351,323,830 | 10.28 | ||||||

| Toyota Industries Corporation |

224,515,684 | 6.57 | ||||||

| The Master Trust Bank of Japan, Ltd. |

160,750,968 | 4.70 | ||||||

| State Street Bank and Trust Company (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) |

128,583,321 | 3.76 | ||||||

| Nippon Life Insurance Company |

120,084,490 | 3.51 | ||||||

| The Bank of New York Mellon as Depositary Bank for Depositary Receipt Holders |

82,545,759 | 2.42 | ||||||

| DENSO CORPORATION |

82,533,366 | 2.41 | ||||||

| Trust & Custody Services Bank, Ltd. |

67,407,546 | 1.97 | ||||||

| JPMorgan Chase Bank, N.A. (standing proxy: Settlement & Clearing Services Division, Mizuho Bank, Ltd.) |

65,062,984 | 1.90 | ||||||

| Mitsui Sumitomo Insurance Company, Limited |

64,063,595 | 1.87 | ||||||

– 1 –

| Existence of Controlling Shareholders (excluding parent company) |

— | |

| Existence of Parent Company |

None |

| Supplementary Information |

The information set forth in this Description of Major Shareholders section is dated as of March 31, 2015. In addition to the above, TMC owns 271,183,861 of its own shares as treasury stock.

| 3. | Business Attributes |

| Stock exchange and section |

Tokyo: 1st Section, Nagoya: 1st Section, Fukuoka: Existing Market, Sapporo: Existing Market | |

| Fiscal year end |

End of March | |

| Line of business |

Transportation equipment | |

| Number of employees at the end of the previous fiscal year (consolidated) |

Greater than 1000 persons | |

| Sales during the previous fiscal year (consolidated) |

Greater than JPY 1 trillion | |

| Number of consolidated subsidiaries at the end of the previous fiscal year |

Greater than 300 companies |

| 4. | Guidelines for measures to protect minority shareholders in the event of transactions with controlling shareholders |

-

| 5. | Other particular conditions that may materially affect corporate governance |

Daihatsu Motor Co., Ltd. and Hino Motors, Ltd. are listed subsidiaries of TMC in which we hold the majority of the total issued and outstanding shares. While we continue to maintain a close cooperative relationship with these two companies, TMC respects the independence of their business activities.

– 2 –

II. Corporate Governance System of Management Business Organization, Etc. for Management Decision Making, Execution of Duties and Management Audit

| 1. | Organization structures and organizational operations |

| Organizational form |

Company with an Audit & Supervisory Board | |

| [Members of the Board of Directors] | ||

| Number of Members of the Board of Directors pursuant to the Articles of Incorporation |

20 persons | |

| Term of Members of the Board of Directors pursuant to the Articles of Incorporation |

1 year | |

| Chairman of the Board of Directors |

Chairman (excluding concurrently serving as President) | |

| Number of Members of the Board of Directors |

15 persons | |

| Election of Outside Members of the Board of Directors |

Elected | |

| Number of Outside Members of the Board of Directors |

3 persons | |

| Established number of Independent Members of the Board of Directors within the Outside Members of the Board of Directors |

3 persons | |

Relationship with the Company (1)

| Name |

Attribution |

Relationship with the Company (*) | ||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | ||||||||||||||

| Ikuo Uno |

Comes from other company | D | ||||||||||||||||||||||

| Haruhiko Kato |

Comes from other company | ¡ | ||||||||||||||||||||||

| Mark T. Hogan |

Comes from other company | D | ||||||||||||||||||||||

| * | Selected the relevant “Relationship with the Company” |

| * | ¡ indicates the relevant item that the person falls under as of “today or recently.” D indicates the relevant item that the person falls under as of “previously.” |

| * | l indicates the relevant item that the person’s close family member falls under as of “today or recently.” p indicates the relevant item that the person’s close family member falls under as of “previously.” |

| a | A management executive officer of the listed company or its subsidiary |

| b | A management executive officer or non-management executive director of a parent company of the listed company |

| c | A management executive officer of a subsidiary of a parent company of the listed company |

| d | A person who has a significant business relationship with the listed company or who is a management executive officer of entity which has such significant business relationship |

| e | A person with whom the listed company has a significant business relationship or who is a management executive officer of entity with whom the listed company has a significant business relationship |

| f | A consultant, accounting expert or legal expert who receives significant remuneration or other assets from the listed company other than remuneration as a director or executive officer |

| g | A principal shareholder of the listed company (if a principal shareholder is a legal entity, a management executive officer of such legal entity) |

| h | A management executive officer of entity with whom the listed company has a business relationship (does not fall under d, e, and f) (only with respect to the person) |

| i | A management executive officer of a company whose outside director assumes the post on a reciprocal basis with the listed company (only with respect to the person) |

| j | A management executive officer of an entity to whom the listed company makes a donation |

| k | Other |

– 3 –

Relationship with the Company (2)

| Name |

Independent |

Supplementary Information |

Reason for election as Outside Member of the Board

of | |||

| Ikuo Uno | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Ikuo Uno, formerly served as an executive of Nippon Life Insurance Company. A summary of the business transactions entered into between TMC and Nippon Life Insurance Company has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

| Haruhiko Kato | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Haruhiko Kato, concurrently serves as an executive of Japan Securities Depository Center, Inc. A summary of the business transactions entered into between TMC and Japan Securities Depository Center, Inc. has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

– 4 –

| Name |

Independent |

Supplementary Information |

Reason for election as Outside Member of the Board

of | |||

| Mark T. Hogan | ¡ | TMC’s current Outside Member of the Board of Directors, Mr. Mark T. Hogan, formerly served as an executive of General Motors Corporation. General Motors Company acquired substantially all of the assets and assumed certain liabilities of General Motors Corporation. A summary of the business transactions entered into between TMC and General Motors Company has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to reflect his broad experiences and insight in his field of expertise in TMC’s management decision-making. Designated as an Independent Member of the Board of Directors of TMC as he would be able to supervise the appropriateness of business conduct from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. |

| Establishment or non-establishment of an optional committee which corresponds to the Nominating Committee or Compensation Committee |

Established |

| Status of establishment of an optional committee, members of the committee, and attributes of the chairperson of the committee |

– 5 –

| Name of the Committee |

Total Number of Members |

Number of Full-time Members |

Number of Inside Members of the Board of Directors |

Number of Outside Members of the Board of Directors |

Number of Outside Experts |

Number of Others |

Committee Chair (Chair-person) |

|||||||||||||||||||||||

| Optional Committee Corresponding to the Nominating Committee |

Executive Appointment Meeting |

4 | — | 3 | 1 | — | — | |

Inside Member of the Board of Directors |

| ||||||||||||||||||||

| Optional Committee Corresponding to the Compensation Committee |

Executive Compensation Meeting |

4 | — | 3 | 1 | — | — | |

Inside Member of the Board of Directors |

| ||||||||||||||||||||

Supplementary Information

-

[Auditors]

| Establishment or non-establishment of an Audit & Supervisory Board |

Established | |

| Number of Audit & Supervisory Board Members pursuant to the Articles of Incorporation |

7 persons | |

| Number of Audit & Supervisory Board Members |

6 persons |

Cooperative relationships between Audit & Supervisory Board Members, Independent Accountants, and Internal Audit Division

Audit & Supervisory Board Members periodically receive reports from Independent Accountants on audit plans, methods and results of auditing at meetings of the Audit & Supervisory Board. They also hold meetings and exchange their opinions as they consider necessary concerning auditing in general.

As for internal auditing, a specialized independent department evaluates the effectiveness of internal controls over financial reporting. Audit & Supervisory Board Members receive reports from the department on audit plans, methods and results of auditing periodically or whenever necessary.

| Election or non-election of Outside Audit & Supervisory Board Members |

Elected | |

| Number of Outside Audit & Supervisory Board Members |

3 persons | |

| Established number of Independent Audit & Supervisory Board Members within the Outside Audit & Supervisory Board Members |

3 persons |

| Relationship with the Company (1) |

| Name |

Attribution |

Relationship with the Company (*) | ||||||||||||||||||||||||||

| a | b | c | d | e | f | g | h | i | j | k | l | m | ||||||||||||||||

| Kunihiro Matsuo |

Attorney-at-law | |||||||||||||||||||||||||||

| Yoko Wake |

Academic | ¡ | ||||||||||||||||||||||||||

| Teisuke Kitayama |

Comes from other company | D | ||||||||||||||||||||||||||

| * | Selected the relevant “Relationship with the Company” |

| * | ¡ indicates the relevant item that the person falls under as of “today or recently.” D indicates the relevant item that the person falls under as of “previously.” |

– 6 –

| * | l indicates the relevant item that the person’s close family member falls under as of “today or recently.” p indicates the relevant item that the person’s close family member falls under as of “previously.” |

| a | A management executive officer of the listed company or its subsidiary |

| b | A non-management executive director or accounting advisor of the listed company or its subsidiary |

| c | A management executive officer or non-management executive director of a parent company of the listed company |

| d | An audit & supervisory board member of a parent company of the listed company |

| e | A management executive officer of a subsidiary of a parent of the listed company |

| f | A person who has a significant business relationship with the listed company or who is a management executive officer of entity which has such significant business relationship |

| g | A person with whom the listed company has a significant business relationship or who is a management executive officer of entity with whom the listed company has a significant business relationship |

| h | A consultant, accounting expert or legal expert who receives significant remuneration or other assets from the listed company other than remuneration as a director or executive officer |

| i | A principal shareholder of the listed company (if a principal shareholder is a legal entity, a management executive officer of such legal entity) |

| j | A management executive officer of entity with whom the listed company has a business relationship (does not fall under f, g, and h) (only with respect to the person) |

| k | A management executive officer of a company whose outside director assumes the post on a reciprocal basis with the listed company (only with respect to the person) |

| l | A management executive officer of an entity to whom the listed company makes a donation |

| m | Other |

Relationship with the Company (2)

| Name |

Independent Audit |

Supplementary Information |

Reason for election as Outside Audit & Supervisory

Board | |||

| Kunihiro Matsuo | ¡ | — | In order to receive advice based on his broad experiences and insight in his field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as he would be able to undertake audits from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

| Yoko Wake | ¡ | TMC’s current Outside Audit & Supervisory Board Member, Ms. Yoko Wake, concurrently serves as an executive of the Association for World Economic Studies. A summary of the business transactions entered into between TMC and the Association for World Economic Studies has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors | In order to receive advice based on her broad experiences and insight in her field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as she would be able to undertake audits from a fair and neutral perspective because she is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and she does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. | |||

– 7 –

| Name |

Independent Audit |

Supplementary Information |

Reason for election as Outside Audit & Supervisory

Board | |||

| Teisuke Kitayama |

¡ | TMC’s current Outside Audit & Supervisory Board Member, Mr. Teisuke Kitayama, formerly serves as an executive of Sumitomo Mitsui Banking Corporation. A summary of the business transactions entered into between TMC and Sumitomo Mitsui Banking Corporation has been omitted, since TMC has determined that the size and nature of the business transactions should not influence the judgment of shareholders and investors. | In order to receive advice based on his broad experiences and insight in his field of expertise. Designated as an Independent Audit & Supervisory Board Member of TMC as he would be able to undertake audits from a fair and neutral perspective because he is not (i) a person who executes business of the parent company or fellow subsidiary of TMC, (ii) a person who executes business of a major business counterparty of TMC, or (iii) an attorney, an accountant, a consultant or a relative (up to a second degree of kinship) of the foregoing who receives a large amount of money or other financial asset other than remuneration for directorship from TMC, and he does not fall under any of the categories of people who are required by stock exchange rules to explain their independence. |

[Independent Members of the Board of Directors / Audit & Supervisory Board Members]

| Number of Independent Members of the Board of Directors/Audit & Supervisory Board Members |

6 persons |

Other matters relating to Independent Members of the Board of Directors / Audit & Supervisory Board Members

All Outside Members of the Board of Directors / Audit & Supervisory Board Members that qualify as Independent Members of the Board of Directors / Audit & Supervisory Board Members have been designated as Independent Members of the Board of Directors / Audit & Supervisory Board Members.

– 8 –

[Incentives]

| Implementation of measures on incentive allotment to Members of the Board of Directors |

Adoption of stock option plans |

Supplementary Information

We had granted stock options up to and including August 2010, but have not made such offerings since 2011.

| Grantees of stock options |

Members of the Board of Directors (other than Outside Members of the Board of Directors), Employees, Members of the Board of Directors of subsidiaries, Employees of subsidiaries and Others |

Supplementary Information

The Grantees of stock options listed above are those who hold unexpired options that were granted to them up to and including August 2010.

[Remuneration for Members of the Board of Directors]

| Disclosure Status (of individual Member of the Board of Directors remuneration) |

Only a portion of remuneration is individually disclosed. |

Supplementary Information

Names and details of those who receive, in aggregate, consolidated remuneration of one hundred million Japanese yen or more will be disclosed on an individual basis in annual securities reports.

Annual securities reports and business reports are also made available for public inspection on TMC’s Internet website.

| Existence of guidelines for the amount and calculation method of remuneration |

Yes |

Information regarding guidelines for the amount and calculation method of remuneration

Remuneration for Members of the Board of Directors was set at 130 million yen or less per month, pursuant to the resolution of the 107th Ordinary General Shareholders’ Meeting held on June 17, 2011. In addition, the amount of Audit & Supervisory Board Members’ remuneration was set at 30 million yen or less per month, pursuant to the resolution of the 104th Ordinary General Shareholders’ Meeting, held on June 24, 2008.

[Support System for Outside Members of the Board of Directors (Outside Audit & Supervisory Board Members)]

Full-time Audit & Supervisory Board Members, Members of the Board of Directors and others disclose adequate information to Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members, such as by giving prior explanations on agenda items to be proposed to the Board of Directors. In addition, the Audit & Supervisory Board Office has been established as a specialized independent organization to assist the Audit & Supervisory Board Members.

2. Matters pertaining to functions relating to the execution of duties, audit and supervision, appointment and decisions regarding remuneration, etc. (Outline of the current corporate governance system)

– 9 –

In March 2011, TMC announced the “Toyota Global Vision” and commenced “Visionary Management”. This is based on Toyota’s values that have guided Toyota since its founding, such as “The Toyoda Precepts”, the “Guiding Principles at Toyota” and the “Toyota Way”, which aim to exceed customer expectations by the development of ever-better cars and enriching the lives of societies, and to be rewarded with a smile that ultimately leads to the stable base of business.

Toyota’s current management structure is based on the structure introduced in April 2011. In order to fulfill the Toyota Global Vision, Toyota reduced the Board of Directors and decision-making layers, and has endeavored to swiftly communicate the views of customers and information from operations on-ground to management and facilitate rapid management decision making.

In April 2013, TMC made organizational changes with the aim of further increasing the speed of decision-making by clarifying responsibilities for operations and earnings, specifically by dividing the automotive business into the following four units — Lexus International, which covers the Lexus business; Toyota No. 1 and Toyota No. 2, which unify regional operations; and Unit Center, which covers engine, transmission and other “unit”-related operations — in order to realize organizational change that supports operations and earnings responsibility of each unit.

Additionally, in order to achieve sustainable growth through the continuous development of even-better cars that exceed customer expectations around the world, and realize the Toyota Global Vision, the TNGA Planning Division, an organization directly under Toyota’s top management, was established in order to rapidly promote the implementation of the “Toyota New Global Architecture (TNGA).”

With respect to our system regarding members of the Board of Directors, we believe that it is important to elect individuals that comprehend and engage in TMC’s strengths, including commitment to manufacturing, with an emphasis on frontline operations and problem solving based on the actual situation on the site (Genchi Genbutsu). At the 109th Ordinary General Shareholders’ Meeting held in June 2013, three Outside Members of the Board of Directors were appointed in order to further reflect the opinions of those from outside the company in management’s decision-making process. While TMC currently does not have its own standard or policy on independence in appointing Outside Members of the Board of Directors, TMC believes that such appointments are appropriate since various rules on independence, such as stock exchange regulations, are used as references in making such appointments. Our Outside Members of the Board of Directors advise us in our management decision-making process based on their broad experiences and insight in their respective fields of expertise.

Appointment of Members of the Board of Directors is considered at the “Executive Appointment Meeting” and remuneration is considered at the “Executive Compensation Meeting”, each of which is comprised of the Chairman, President, Executive Vice President in charge of Human Resources and Outside Member of the Board of Directors.

TMC has an “International Advisory Board” consisting of advisors from each region overseas, and, as appropriate, receives advice on a wide range of management issues from a global perspective. In addition, TMC has a wide variety of conferences and bodies for deliberations and the monitoring of management and corporate activities that reflect the views of various stakeholders, including the “Labor-Management Council, the Joint Labor-Management Round Table Conference”.

In terms of CSR and enhancement of corporate value, under the Board of Directors, the “Corporate Planning Committee” considers growth strategies that weave in TMC’s contributions to various social issues and TMC promotes on a company-wide basis CSR and enhancement of corporate value as part of business operations. As part of management of operations, the “Corporate Governance Committee” deliberates the corporate governance structure that executes such strategies. TMC has also created a number of channels for employees to make inquiries concerning compliance matters, including the Compliance Hotline, which enables them to consult with an outside attorney, and takes measures to ensure that TMC is aware of significant information concerning legal compliance as quickly as possible. TMC will continue to promote the “Toyota Code of Conduct” which is a guideline for employees’ behavior and conduct for employees of TMC and its consolidated subsidiaries (together “Toyota”) all around the world. TMC will work to advance corporate ethics through training and education at all levels and in all departments.

– 10 –

TMC has adopted an auditor system. Six Audit & Supervisory Board Members (including three Outside Audit & Supervisory Board Members) play a role in TMC’s corporate governance efforts by undertaking audits in accordance with the audit policies and plans determined by the Audit & Supervisory Board. In addition, TMC has secured the personnel and framework supporting the audit by Audit & Supervisory Board Members. The Outside Audit & Supervisory Board Members advise TMC from a fair and neutral perspective, based on their broad experiences and insight in their respective fields of expertise. While TMC currently does not have its own standard or policy on independence in appointing Outside Audit & Supervisory Board Members, TMC believes that such appointments are appropriate since various rules on independence, such as stock exchange regulations, are used as references in making such appointments. The state of internal controls and internal audits are reported to Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members) through the Audit & Supervisory Board and the “Corporate Governance Committee”, and the status of accounting audits is reported by independent External Auditors to the Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members) through the Audit & Supervisory Board. To enhance the system for internal audits, a specialized organization made independent of direct control by the management evaluates the effectiveness of the system to secure the appropriateness of documents regarding financial calculation and other information in accordance with Section 404 of the U.S. Sarbanes Oxley Act and Article 24-4-4 (1) of the Financial Instruments and Exchange Law of Japan. In order to enhance the reliability of the financial reporting of TMC, the three auditing functions — audit by Audit & Supervisory Board Members, internal audit, and accounting audit by Independent External Auditors — aid in conducting an effective and efficient audit through meetings held periodically and as necessary to share information and come to understandings through discussion on audit plans and results.

TMC has entered into a limited liability agreements with Outside Members of the Board of Directors and Outside Audit & Supervisory Board Members pursuant to Article 427, Paragraph 1 of the Companies Act to limit the amount of their liabilities as stipulated in Article 423, Paragraph 1 of the Companies Act to the minimum amount stipulated in Article 425, Paragraph 1 of the Companies Act.

| 3. | Reason for the selection of the current corporate governance system |

TMC believes it is important to put in place a system that enables customer opinions and on-site information to be swiftly communicated to management in order to make a prompt management decision, and enables us to review whether such management decisions are accepted by our customers and society. TMC believes that our current system, involving the supervision and auditing of the execution of business by our Board of Directors (including Outside Members of the Board of Directors) and Audit & Supervisory Board Members (including Outside Audit & Supervisory Board Members), is the most appropriate system for us.

– 11 –

| III. | Implementation of measures for shareholders and other stakeholders |

1. Approach toward the vitalization of General Shareholders’ Meeting and the facilitation of exercise of voting rights

| Supplementary Information | ||

| Early distribution of notice of convocation of General Shareholders’ Meeting |

In connection with the 111th Ordinary General Shareholders’ Meeting to be held on June 16, 2015, we distributed the notice of convocation of General Shareholders’ Meeting 22 days prior to the date of the meeting and posted the notice of convocation on our homepage prior to distribution. | |

| Scheduling of General Shareholders’ Meeting avoiding the date on which General Shareholders’ Meeting of companies are concentrated |

We convene General Shareholders’ Meeting avoiding the date on which General Shareholders’ Meeting of companies are most and second most concentrated on. | |

| Exercise of voting rights by electronic means |

We enable shareholders to exercise voting rights on the Internet. | |

| Measures aimed at participation in electronic voting platforms and other improvements in voting environments geared towards institutional investors |

We participate in an electronic voting platform for institutional investors operated by ICJ Corporation. | |

| Provision of summary English-language convocation notices |

We create English-language convocation notices, and make them available on both our company homepage as well as within electronic voting platforms for institutional investors. | |

| 2. | IR activities |

| Explanation by representative members of the board |

Supplementary Information | |||

| Convene periodic briefing for individual investors |

No | In addition to convening briefings a few times a year (not regularly scheduled), on the exclusive site for individual investors, the operating summary and business activities are clearly disclosed. | ||

| Convene periodic briefing for analysts and institutional investors |

Yes | Explaining financial results and business strategies of the relevant business year every quarter. Also convenes business briefings (unscheduled) concerning the medium- and long-term direction of the business. | ||

| Convene periodic briefing for foreign investors |

Yes | Explaining financial results and business strategies of the relevant business year by visiting foreign investors and holding conference calls every quarter. In addition, business briefings (unscheduled) concerning the medium- and long-term direction of the business are convened in the United States and in Europe. | ||

| Disclosure of IR documents on the website |

— | In addition to legal disclosure documents such as annual securities reports, reference materials for earnings results briefings, etc. are timely disclosed as well. TMC works to enhance its information services by distributing videos of TMC’s press conferences, such as announcements of new model launches. | ||

| IR related divisions (personnel) |

— | TMC maintains IR personnel in the Accounting Division and Public Affairs Division, and offices resident IR personnel in New York and London. | ||

| Other |

— | Implementing one-on-one meetings with investors, plant tours, etc. | ||

– 12 –

| 3. | Activities concerning respect for stakeholders |

| Supplementary Information | ||

| Setting forth provisions in the internal regulations concerning respect for the stakeholders’ position |

For sustainable development, TMC has engaged in management emphasizing all of its stakeholders, and worked to maintain and develop favorable relationships with its stakeholders through open and fair communication. This philosophy is outlined and disclosed in the CSR Policy “Contribution towards Sustainable Development”. | |

| Promotion of environmental preservation activities and CSR activities |

TMC has long engaged in business with the idea of corporate social responsibility (“CSR”) in mind. This idea is clarified in the CSR Policy “Contribution towards Sustainable Development”, and it clearly conveys TMC’s basic policies concerning CSR to both internal and external stakeholders. Regarding the environment, TMC has positioned it as a top management priority and adopted the “Toyota Earth Charter” in 1992. TMC created the “Toyota Environmental Action Plan” that sets forth mid-term targets and action plans on a global basis, and promotes continuous environmental preservation activities. As for philanthropic activities, TMC newly adopted the “Basic Philosophy and Policy on Philanthropic Activities” in 2005 in light of the global expansion of its business and the increasing societal expectations towards Toyota. TMC vigorously promotes philanthropic activities according to local conditions in each country and region in order to contribute to the development of a prosperous society and to promote its continuous development. These CSR activities are disclosed in the report titled “Sustainability Report”. | |

| Establishment of policy concerning disclosure of information to stakeholders |

TMC has engaged in timely and fair disclosure of corporate and financial information as stated in the CSR Policy “Contribution towards Sustainable Development”. In order to ensure the accurate, fair, and timely disclosure of information, TMC has established the Disclosure Committee chaired by an officer of the Accounting Division. The Committee holds regular meetings for the purpose of preparation, reporting and assessment of its annual securities report, quarterly report under the Financial Instruments and Exchange Law of Japan and Form 20-F under the U.S. Securities Exchange Act, and also holds extraordinary committee meetings from time to time whenever necessary. | |

– 13 –

| IV. | Basic Approach to Internal Control System and its Development |

| 1. | Basic Policy Regarding the System to Secure the Appropriateness of Business |

TMC, together with its subsidiaries, has created and maintained a sound corporate climate based on the “Guiding Principles at Toyota” and the “Toyota Code of Conduct”. TMC integrates the principles of problem identification and continuous improvement into its business operation process and makes continuous efforts to train employees who will put these principles into practice.

Accordingly, TMC has developed its basic policy regarding the following items as stipulated in the Companies Act:

| (1) | System to ensure that the Members of the Board of Directors execute their responsibilities in compliance with relevant laws and regulations and the Articles of Incorporation |

1) TMC will ensure that Members of the Board of Directors act in compliance with relevant laws and regulations and the Articles of Incorporation, based on the Code of Ethics and other explanatory documents that include necessary legal information, presented on occasions such as trainings for new Members of the Board of Directors.

2) TMC will make decisions regarding business operations after comprehensive discussions at the Board of Directors’ meeting and other meetings of various cross-sectional decision-making bodies. Matters to be decided are properly submitted and discussed at the meetings of those decision-making bodies in accordance with the relevant rules.

3) TMC will appropriately discuss significant matters and measures relating to issues such as corporate ethics, compliance and risk management at the Corporate Governance Meeting and other meetings.

| (2) | System to retain and manage information relating to the execution of the duties of Members of the Board of Directors |

Information relating to exercising duties by Members of the Board of Directors shall be appropriately retained and managed by each division in charge pursuant to the relevant internal rules and laws and regulations.

| (3) | Rules and systems related to the management of risk of loss |

1) TMC will properly manage the capital fund through its budgeting system and other forms of control, conduct business operations, and manage the budget, based on the authorities and responsibilities in accordance with the “Ringi” system (effective consensus-building and approval system) and other systems. Significant matters will be properly submitted and discussed at the Board of Directors’ meeting and other meetings of various bodies in accordance with the standards stipulated in the relevant rules.

2) TMC will ensure accurate financial reporting by issuing documentation on the financial flow and the control system, etc., and by properly and promptly disclosing information through the Disclosure Committee.

3) TMC will manage various risks relating to safety, quality, the environment, etc. and compliance by establishing coordinated systems with all regions, establishing rules or preparing and delivering manuals and by other means, as necessary through each relevant division.

4) As a precaution against events such as natural disasters, TMC will prepare manuals, conduct emergency drills, arrange risk diversification and insurance, etc. as needed.

| (4) | System to ensure that Members of the Board of Directors exercise their duties efficiently |

1) TMC will manage consistent policies by specifying the policies at each level of the organization based on the medium- to long-term management policies and the Company’s policies for each fiscal term.

2) The Members of the Board of Directors will promptly determine the management policies based on precise on-the-spot information and, in accordance with Toyota’s advantageous “field-oriented” approach, appoint and delegate a high level of authority to officers who take responsibility for business operations in each region, function, and process. The responsible officers will proactively compose relevant business plans under their leadership and execute them in a swift and timely manner in order to carry out Toyota’s management policies. The Members of the Board of Directors will supervise the execution of duties by the responsible officers.

3) TMC, from time to time, will make opportunities to listen to the opinions of various stakeholders, including external experts in each region, and reflect those opinions in TMC’s management and corporate activities.

– 14 –

| (5) | System to ensure that employees conduct business in compliance with relevant laws and regulations and the Articles of Incorporation |

1) TMC will clarify the responsibilities of each organization unit and maintain a basis to ensure continuous improvements in the system.

2) TMC will continuously review the legal compliance and risk management framework to ensure effectiveness.

For this purpose, each organization unit shall confirm the effectiveness by conducting self-checks, among others, and report the result to the Corporate Governance Meeting and other meetings.

3) TMC will promptly obtain information regarding legal compliance and corporate ethics and respond to problems and questions related to compliance through its Compliance Hotline that TMC established outside the company, as well as through other channels.

| (6) | System to ensure the appropriateness of business operations of the corporation and the business group consisting of the parent company and subsidiaries |

To share Toyota’s management principles, TMC will expand the “Guiding Principles at Toyota” and the “Toyota Code of Conduct” to its subsidiaries, and develop and maintain a sound environment of internal controls for the business group by also promoting its management principles through exchanges of personnel.

In addition, TMC will manage its subsidiaries in a comprehensive manner appropriate to their positioning by clarifying the roles of the division responsible for the subsidiaries’ financing and management and the roles of the division responsible for the subsidiaries’ business activities. Those divisions will confirm the appropriateness and legality of the operations of the subsidiaries by exchanging information with those subsidiaries, periodically and as needed.

1 System concerning a report to the corporation on matters relating to the execution of the duties of Members of the Board of Directors, etc. of subsidiaries

TMC will require prior consent of TMC or a report to TMC on important managerial matters of subsidiaries based on the internal rules agreed between TMC and its subsidiaries. The important managerial matters of subsidiaries will be discussed at TMC’s Board of Directors’ meeting and other meetings in accordance with the standards stipulated in the relevant rules relating to submission of matters to such meetings.

2 Rules and systems related to the management of risk of loss at subsidiaries

TMC will require its subsidiaries to establish a system to implement initiatives related to the management of risk, such as finance, safety, quality, environment, and natural disasters, and require them to immediately report to TMC on significant risks. TMC will discuss significant matters and measures at the Corporate Governance Meeting and other meetings in accordance with the standards stipulated in the relevant rules relating to submission of matters to such meetings.

3 System to ensure that Members of the Board of Directors, etc. of subsidiaries exercise their duties efficiently

TMC will require Members of the Board of Directors of its subsidiaries to promptly determine the management policies based on precise on-the-ground information, determine responsibilities, implement appropriate delegation of authority based on the responsibilities, and efficiently conduct business.

4 System to ensure that the Members of Board of Directors, etc. and employees of subsidiaries conduct business in compliance with relevant laws and regulations and the Articles of Incorporation

TMC will require its subsidiaries to establish a system concerning compliance. TMC will periodically confirm its status and report the result to TMC’s Corporate Governance Meeting and other meetings. TMC will promptly obtain information regarding legal compliance and corporate ethics of its subsidiaries and respond to problems and questions related to compliance of its subsidiaries through the whistleblower offices established by its subsidiaries and through the whistleblower office that TMC has established outside the company and cover its subsidiaries in Japan and other channels.

– 15 –

| (7) | System concerning employees who assist the Audit & Supervisory Board Members when required; system concerning independence of the said employees from Members of Board of Directors; and system to ensure the effectiveness of instructions from the Audit & Supervisory Board Members to the said employees |

TMC has established the Audit & Supervisory Board Office and has assigned a number of full-time staff to support this function. The said employees must follow the directions and orders from the Audit & Supervisory Board Members, and any changes in its personnel will require prior consent of the Audit & Supervisory Board or a full-time Audit & Supervisory Board Member selected by the Audit & Supervisory Board.

| (8) | System concerning a report to Audit & Supervisory Board Members and system to ensure that a person who has made the said report does not receive unfair treatment due to the making of said report |

1) Members of the Board of Directors, from time to time, will properly report to the Audit & Supervisory Board Members any major business operations through the divisions in charge. If any fact that may cause significant damage to TMC and its subsidiaries is discovered, they will report the matter to the Audit & Supervisory Board Members immediately.

2) Members of the Board of Directors, Senior Managing Officers, Managing Officers, and employees will report on the business upon requests by the Audit & Supervisory Board Members periodically and as needed, and Members of the Board of Directors, etc. of subsidiaries will report as necessary. In addition, Members of the Board of Directors, Senior Managing Officers, Managing Officers, and employees will report to Audit & Supervisory Board Members on the significant matters that have been reported to the whistleblower offices established by TMC or its subsidiaries.

3) TMC will maintain internal rules stipulating that a person who has made a report to the Audit & Supervisory Board Members will not receive unfair treatment due to the making of said report.

| (9) | Policies on prepaid expenses for the execution of the duties of the Audit & Supervisory Board Members, on expenses for procedures for repayment and the execution of other relevant duties, or on debt processing |

Regarding the expenses necessary for the Audit & Supervisory Board Members to execute their duties, TMC will take appropriate budgetary steps to secure the amount that the Audit & Supervisory Board Members deem necessary. TMC will also pay for expenses that become necessary as a result of circumstances that were not expected at the time of the taking of budgetary steps.

| (10) | Other systems to ensure that the Audit & Supervisory Board Members conducted audits effectively |

TMC will ensure that the Audit & Supervisory Board Members attend major Executives’ Meetings, inspect important Company documents, and make opportunities to exchange information between the Audit & Supervisory Board Members and Accounting Auditor periodically and as needed, as well as appoint external experts.

| 2. | Basic Policy and Preparation towards the Elimination of Antisocial Forces |

| (1) | Basic Policy for Elimination of Antisocial Forces |

Based upon the “Guiding Principles at Toyota” and the “Toyota Code of Conduct”, TMC’s basic policy is to have no relationship with antisocial forces. TMC will take resolute action as an organization against any undue claims and actions by antisocial forces or groups, and has drawn the attention of such policy to its employees by means such as clearly stipulating it in the “Toyota Code of Conduct”.

– 16 –

| (2) | Preparation towards Elimination of Antisocial Forces |

| 1) | Establishment of Divisions Overseeing Measures Against Antisocial Forces and Posts in Charge of Preventing Undue Claims |

TMC established divisions that oversee measures against antisocial forces (“Divisions Overseeing Measures Against Antisocial Forces”) in its major offices as well as assigned persons in charge of preventing undue claims. TMC also established a system whereby undue claims, organized violence and criminal activities conducted by antisocial forces are immediately reported to and consulted with Divisions Overseeing Measures Against Antisocial Forces.

| 2) | Liaising with Specialist Organizations |

TMC has been strengthening its liaison with specialist organizations by joining liaison committees organized by specialists such as the police. It has also been receiving guidance on measures to be taken against antisocial forces from such committees.

| 3) | Collecting and Managing Information concerning Antisocial Forces |

By liaising with experts and the police, Divisions Overseeing Measures Against Antisocial Forces share up-to-date information on antisocial forces and utilize such information to call TMC’s employees’ attention to antisocial forces.

| 4) | Preparation of Manuals |

TMC compiles cases concerning measures against antisocial forces and distributes them to each department within TMC.

| 5) | Training Activities |

TMC promotes training activities to prevent damages caused by antisocial forces by sharing information on antisocial forces within the company as well as holding lectures at TMC and its group companies.

| V. | Others |

| 1. | Matters regarding defense against a takeover bid |

Matters regarding defense against a takeover bid None

Supplementary Information

No measures to defend against a takeover bid are scheduled to be adopted.

| 2. | Matters regarding other corporate governance systems, etc. |

Company Structure and Procedures Regarding Timely Disclosure

The following describes Toyota’s company structure and procedures regarding the timely disclosure of Company information.

(Guiding Principles)

Toyota practices its guiding principle of disclosing operating results, business and financial information in a timely and appropriate manner. Such guiding principles are set forth in the CSR Policy “Contribution towards Sustainable Development.”

(Disclosure Committee and its Purpose)

Toyota has established a Disclosure Committee that is chaired by the officer responsible for the accounting division in an effort to ensure that the information disclosed is accurate, fair and timely.

The Disclosure Committee meets periodically to draft, report and assess annual and quarterly reports prepared pursuant to the Japanese Financial Instruments and Exchange Act, and annual reports prepared pursuant to the U.S. Securities Exchange Act of 1934, as amended. The Disclosure Committee also holds meetings on an ad hoc basis as necessary.

– 17 –

(Procedures of the Disclosure Committee)

The Disclosure Committee performs the following procedures:

| (1) | Collection of information |

Collect information of Toyota and its subsidiaries that may be subject to disclosure based on the materiality standards set forth by the Disclosure Committee through periodic and timely communications with the heads of the relevant divisions responsible for information disclosure.

| (2) | Assessment of material information to be disclosed |

Assess disclosure of collected information based on applicable laws, regulations and guidelines, such as stock exchange rules, the Japanese Financial Instruments and Exchange Act, and the U.S. Securities Exchange Act.

| (3) | Disclosure based on assessment |

Based on the assessment made above, disclose information in a timely manner. When necessary, a report to the company representative and certification procedures on the disclosure documents will precede the disclosure. The Audit & Supervisory Board Members (or the Audit & Supervisory Board) may receive reports from the Disclosure Committee as necessary and may provide opportunities for reporting and Q & A sessions with company representatives.

| (4) | Ensuring of appropriate information collection and disclosure procedures |

Make further efforts to enhance the company structure pertaining to timely and fair disclosure: the internal auditing division assesses the overall information disclosure process, and independent external auditors and outside legal counsel provide support in establishing disclosure controls and procedures, and offer guidance on the sufficiency and appropriateness of the disclosure information.

| (5) | Provision of company regulation |

Details of the procedures and the organizational structure mentioned above are stipulated in the Company’s internal disclosure guidelines.

– 18 –

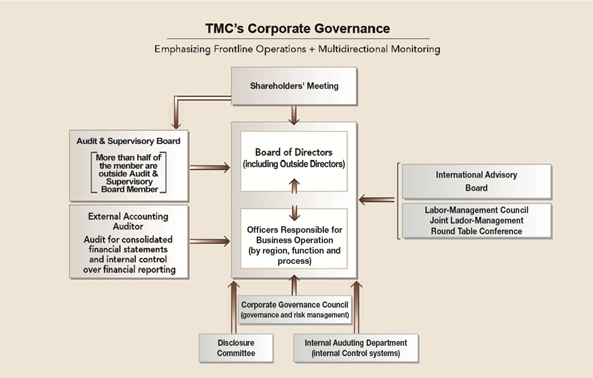

Diagram as Supplementary Information

– 19 –

(Excerpt Translation)

May 20, 2015

Toyota Motor Corporation

1, Toyota-cho, Toyota City, Aichi Prefecture

Report on Number of Listed Shares

We hereby report changes in the number of listed securities, as a result of the exercise of stock acquisition rights, etc. in April 2015 (the “Current Month”).

1. Summary

| Number of listed shares as of the end of the preceding month |

3,417,997,492 shares | |||

| Total number of shares changed during the Current Month |

0 shares | |||

| (out of which, as a result of exercise of stock acquisition rights) |

(0 shares | ) | ||

| (out of which, as a result of other reasons) |

(0 shares | ) | ||

| Number of listed shares as of the end of the Current Month |

3,417,997,492 shares |

2. Stock acquisition rights exercised

<Details of shares delivered (issued or transferred) upon exercise of stock acquisition rights>

(1) Number of shares

| Total number of shares delivered during the Current Month |

(out of which, number of newly issued shares) |

(out of which, number of shares transferred from treasury shares) |

||||||||||

| 6th series |

27,500 shares | (0 shares | ) | (27,500 shares | ) | |||||||

| 7th series |

12,000 shares | (0 shares | ) | (12,000 shares | ) | |||||||

| 8th series |

12,000 shares | (0 shares | ) | (12,000 shares | ) | |||||||

| 9th series |

9,600 shares | (0 shares | ) | (9,600 shares | ) | |||||||

(2) Exercise price

| Aggregate exercise price during the Current Month |

(out of which, aggregate amount of newly issued shares) |

(out of which, aggregate amount of shares transferred from treasury shares) |

||||||||||

| 6th series |

JPY 198,615,000 | (JPY 0 | ) | (JPY 198,615,000 | ) | |||||||

| 7th series |

JPY 56,184,000 | (JPY 0 | ) | (JPY 56,184,000 | ) | |||||||

| 8th series |

JPY 49,848,000 | (JPY 0 | ) | (JPY 49,848,000 | ) | |||||||

| 9th series |

JPY 30,268,800 | (JPY 0 | ) | (JPY 30,268,800 | ) | |||||||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Toyota Research Institute Announces Multimillion-Dollar Challenge to Accelerate Research in New Advanced Materials

- Toyota Reignites 'Start Your Impossible' Campaign: A Global Vision with Local Action, Emphasizing Belief that No Journey is Taken Alone

- Man Group PLC : Form 8.3 - International Paper Company

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share