Form 6-K TENARIS SA For: Jun 01

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of June 1, 2015

TENARIS, S.A.

(Translation of Registrant's name into English)

TENARIS, S.A.

29, Avenue de la Porte-Neuve 3rd floor

L-2227 Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F Ö Form 40-F __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes __ No Ö

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-__.

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended. This report contains Tenaris’s Restated Annual Report on the Consolidated Financial Statements for the Fiscal Year 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 1, 2015

Tenaris, S.A.

TENARIS S.A.

RESTATED ANNUAL REPORT

ON THE

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE FISCAL YEAR 2014

|

TABLE OF CONTENTS

|

||

|

COMPANY PROFILE

|

2

|

|

|

LETTER FROM THE CHAIRMAN

|

3

|

|

|

MANAGEMENT REPORT

|

5

|

|

|

|

Leading Indicators

|

7

|

|

|

Information on Tenaris

|

8

|

|

|

The Company

|

8

|

|

|

Overview

|

8

|

|

|

History and Development of Tenaris

|

8

|

|

|

Business Overview

|

9

|

|

|

Research and Development

|

11

|

|

|

Principal Risks and Uncertainties

|

14

|

|

|

Operating and Financial Review and Prospects

|

16

|

|

|

Quantitative and Qualitative Disclosure about Market Risk

|

25

|

|

|

Recent Developments

|

27

|

|

|

Environmental Regulation

|

27

|

|

|

Related Party Transactions

|

27

|

|

|

Employees

|

27

|

|

|

Corporate Governance

|

28

|

|

MANAGEMENT CERTIFICATION

|

39

|

|

|

FINANCIAL INFORMATION

|

40

|

|

|

|

Restated Consolidated Financial Statements

|

40

|

company profile

Tenaris is a leading supplier of tubes and related services for the world’s energy industry and certain other industrial applications. Our mission is to deliver value to our customers through product development, manufacturing excellence and supply chain management. We seek to minimize risk for our customers and help them reduce costs, increase flexibility and improve time-to-market. Our employees around the world are committed to continuous improvement by sharing knowledge across a single global organization.

| Tenaris’ 2014 annual report was previously issued on March 31, 2015. This restated annual report reflects the restatement of the Company’s consolidated financial statements for the fiscal year 2014 in connection with the reduction of the carrying value of Tenaris’ investment in Usinas Siderúrgicas de Minas Gerais S.A. – Usiminas (“Usiminas”) to $122 million as of September 30, 2014, following a revision of its value in use calculation. For more information concerning this restatement see “General Information-Restatement of previously issued financial statements” and note 12 “Investments in non-consolidated companies – Usiminas”, to our audited restated consolidated financial statements included in this restated annual report. | ||

2

Letter From The Chairman

Dear Shareholders,

We successfully completed a satisfactory year in 2014 with a record level of monthly shipments in December. We continued to make progress in North America and other areas, with shipments of seamless pipe products rising 7% year on year. However, our sales of high value premium products were affected by the onset of inventory adjustments in Saudi Arabia in the second half and overall sales were further affected by an exceptionally low level of demand in Brazil. These offsetting trends resulted in our overall sales and EBITDA remaining at the same level of 2013 as we successfully maintained our margins at an industry-leading level.

Our positioning in shale and deepwater operations worldwide contributed strongly to these results. Sales of OCTG products for U.S. onshore operations rose 24% year on year. In Argentina, sales of OCTG rose by 13% year on year as YPF continued to explore the potential of the Vaca Muerta shale. Sales to Gulf of Mexico deepwater projects rose significantly year on year, and in sub-Saharan Africa they rose a further 12% consolidating the good performance of 2013.

2014 was also a good year for the deployment of our new premium products for complex deepwater and HPHT applications. Our BlueDock™ connector was successfully run by Petrobras in Brazil and Repsol in Trinidad. In the Gulf of Mexico, we successfully qualified our Wedge 623™ and Blue® Riser connections for Shell’s Mars B project. And we successfully introduced our Blue® Quick Seal, Blue® Max and Blue® Heavy Wall connections for deepwater and HPHT operations in the North Sea and Angola. In the last few months, this success has been complemented by significant contract awards for TengizChevroil’s operations in Kazakhstan, for Maersk’s UK operations in the North Sea, and Statoil’s Mariner project in the North Sea.

During the year, we made progress with our investment plans focused on enhancing our capability to produce high-end products, strengthening our position in North America, improving health and safety conditions and reducing our environmental footprint.

We reinforced our safety routines during the year. In addition to our Safe Hour meetings, we established regular meetings with our sub-contractors to share our safety-first priorities, introduced a communications campaign throughout the company centered on 12 basic safety rules and extended our Safestart training program. The Safestart program was first introduced in our Conroe mill in the U.S. in 2011 and aims to encourage personal responsibility for safety and reduce injuries on and off the job by focusing on risk perception. Our safety indicators for the year show a mixed result but the trend in the second half was positive and we recorded our lowest quarterly values for our main safety indicators in the fourth quarter. We will continue to focus on improving our safety performance, which is an essential element of our competitive differentiation in the eyes of our customers and the communities where we operate.

The market environment that faces us in 2015 is very different from that we have had in the past few years. Demand for oil and gas has grown at a lower pace than the additional supply of tight oil from the shales in North America, and the imbalance led to a sudden change in the circumstances that allowed the price of oil to remain in a range of around $100 per barrel for over 3 years. Customers have reacted to the collapse in oil and LNG prices by cutting their investment budgets and looking for a structural change in their costs of operations. We estimate that overall market demand for OCTG in 2015 will decline by around 30% compared to 2014, including reductions in inventory.

Despite the rapid reaction by oil and gas companies, it will take time to rebalance oil supply and demand. We are, therefore, preparing for what could be a prolonged downturn. We are confident however that the longer-term fundamentals of the oil and gas industry remain positive. Demand for oil and gas will grow with the improvement in the global economy, decline rates are accelerating impacted by the higher incidence of shale production, and we see the long-term equilibrium in oil and gas prices at a higher level than the prices of today.

We are working actively with our customers to help them reduce costs by optimization of processes and efficient management of pipe materials and inventories and optimum product selection to support their level of activity. At the same time, we are adjusting our operations to fit the new environment. We are reducing our labor costs worldwide through a wide set of measures, while preserving our key competences and maintaining our focus on the relation with our communities. The costs of our metallic load are declining and we are optimizing allocation among our plants to take advantage of currency movements and differential operating costs. We are reviewing our fixed costs with a view to making our structure more efficient and are taking actions to reduce our investment in working capital.

3

In the United States and Canada, despite the rapid decline in the market, we are seeing opportunities to improve elements of the supply chain system and expand market share against imports. Although unfairly traded imports from Korea continue at a very high level in spite of the trade case ruling of August, we expect that domestic producers should have an opportunity to displace them on competitive terms. By 2017, when our Bay City mill will enter operations, we expect the market will have recovered and domestic producers should be able to effectively serve the market.

Our long term investment plan, including Bay City, will continue in 2015, but we are confident that our cash flow from operations will be sufficient to cover these investments and maintain our dividend payments.

We are also maintaining our strong focus on training, that has positioned Tenaris as a leader in corporate education. We expanded our agreement with edX, the open, online learning initiative founded by Harvard and MIT. TenarisUniversity, in cooperation with the Roberto Rocca Technical School, produced its first MOOC (Massive Online Open Course) – an Introduction to Computer Numerical Control – aimed at young technical students. Over 4,000 participants have enrolled in the course from 100 different countries with a 22% completion rate and a very high rating, well above the average for MOOCs in general. This year, we will produce several further MOOCs and use the edX platform for several Special Purpose Online Courses aimed at our own training needs.

We concluded 2014 with operating income of $1.9 billion on sales of $10.3 billion and earnings per share of $1.141, 13% lower than 2013, as we recorded impairment charges of $206 million on the value of our welded pipe assets in Colombia and Canada. Our cash flow from operations remained strong and we ended the year with a net cash position of $1.3 billion after investing $1.1 billion in capital expenditure and paying out $531 million in dividends. Considering the change in market conditions and the high level of our capital expenditure commitments, we are proposing to maintain the final dividend at 30 cents per share, making for an increase in the total annual dividend of 5%.

We believe that we entered this downturn in a better position than our competitors based on our strong financial position, our global positioning, our extensive customer base and the quality of our products and services. We are also confident that we will emerge from it with our competitive positioning strengthened and fully prepared to support our customers in a new cycle.

This is a difficult time for our industry and our employees. I would like to thank them for their contribution to last year’s results and their ongoing commitment as we position the company for the new market environment. I would also like to express my thanks to our customers, suppliers and shareholders for their continuing support and confidence in Tenaris.

March 30, 2015

/s/ Paolo Rocca

Paolo Rocca

1 Earnings per share as of February 18, 2015. This figure was restated to earnings per share of $0.98 subsequent to the issuance of this letter, on May 28, 2015. For more information, see “I General Information” to our audited restated consolidated financial statements included in this restated annual report.

4

Management Report

CERTAIN DEFINED TERMS

Unless otherwise specified or if the context so requires:

|

·

|

References in this restated annual report to “the Company” refer exclusively to Tenaris S.A., a Luxembourg public limited liability company (société anonyme).

|

|

·

|

References in this restated annual report to “Tenaris”, “we”, “us” or “our” refer to Tenaris S.A. and its consolidated subsidiaries. See Accounting Policies A, B and L to our audited restated consolidated financial statements included in this restated annual report.

|

|

·

|

References in this restated annual report to “San Faustin” refer to San Faustin S.A., a Luxembourg public limited liability company (société anonyme) and the Company’s controlling shareholder.

|

|

·

|

“Shares” refers to ordinary shares, par value $1.00, of the Company.

|

|

·

|

“ADSs” refers to the American Depositary Shares, which are evidenced by American Depositary Receipts, and represent two Shares each.

|

|

·

|

“OCTG” refers to oil country tubular goods.

|

|

·

|

“tons” refers to metric tons; one metric ton is equal to 1,000 kilograms, 2,204.62 pounds, or 1.102 U.S. (short) tons.

|

|

·

|

“billion” refers to one thousand million, or 1,000,000,000.

|

|

·

|

“U.S. dollars”, “US$”, “USD” or “$” each refers to the United States dollar.

|

PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION

Accounting Principles

We prepare our consolidated financial statements in conformity with International Financial Reporting Standards, as issued by the International Accounting Standards Board, or IFRS, and adopted by the European Union, or E.U.

We publish consolidated financial statements expressed in U.S. dollars. Our restated consolidated financial statements included in this restated annual report are those as of December 31, 2014 and 2013, and for the years ended December 31, 2014, 2013 and 2012.

Rounding

Certain monetary amounts, percentages and other figures included in this restated annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This restated annual report and any other oral or written statements made by us to the public may contain “forward-looking statements”. Forward looking statements are based on management’s current views and assumptions and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements.

5

We use words such as “aim”, “will likely result”, “will continue”, “contemplate”, “seek to”, “future”, “objective”, “goal”, “should”, “will pursue”, “anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”, “believe” and words and terms of similar substance to identify forward-looking statements, but they are not the only way we identify such statements. This restated annual report contains forward-looking statements, including with respect to certain of our plans and current goals and expectations relating to Tenaris’s future financial condition and performance. Sections of this restated annual report that by their nature contain forward-looking statements include, but are not limited to, “Business Overview”, “Principal Risks and Uncertainties”, and “Operating and Financial Review and Prospects”. In addition to the risks related to our business discussed under “Principal Risks and Uncertainties”, other factors could cause actual results to differ materially from those described in the forward-looking statements. These factors include, but are not limited to:

|

·

|

our ability to implement our business strategy or to grow through acquisitions, joint ventures and other investments;

|

|

·

|

the competitive environment and our ability to price our products and services in accordance with our strategy;

|

|

·

|

trends in the levels of investment in oil and gas exploration and drilling worldwide;

|

|

·

|

general macroeconomic and political conditions in the countries in which we operate or distribute pipes; and

|

|

·

|

our ability to absorb cost increases and to secure supplies of essential raw materials and energy.

|

By their nature, certain disclosures relating to these and other risks are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or losses that may affect our financial condition and results of operations could differ materially from those that have been estimated. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this restated annual report. Except as required by law, we are not under any obligation, and expressly disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

6

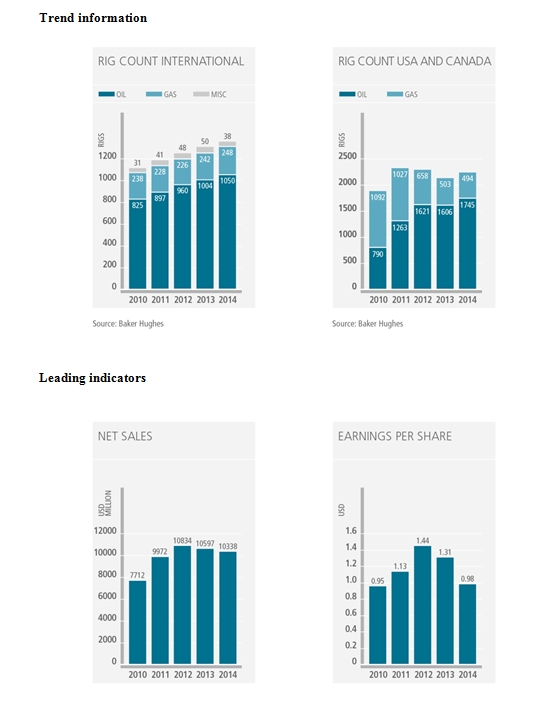

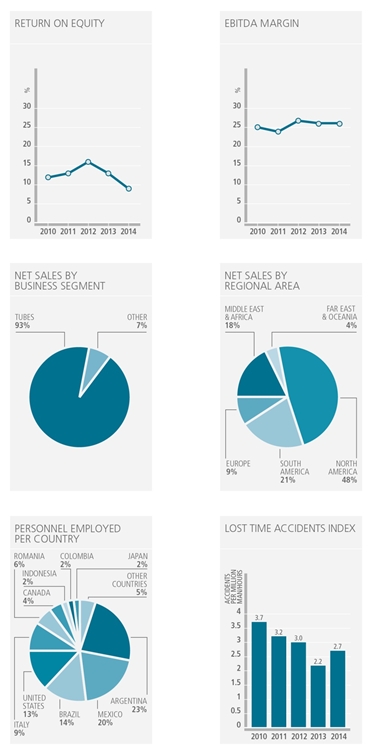

Leading Indicators

|

2014 Restated(1)

|

2013

|

2012

|

||||||||||

|

TUBES SALES VOLUMES (thousands of tons)

|

||||||||||||

|

Seamless

|

2,790 | 2,612 | 2,676 | |||||||||

|

Welded

|

885 | 1,049 | 1,188 | |||||||||

|

Total

|

3,675 | 3,661 | 3,864 | |||||||||

|

TUBES PRODUCTION VOLUMES (thousands of tons)

|

||||||||||||

|

Seamless

|

2,940 | 2,611 | 2,806 | |||||||||

|

Welded

|

908 | 988 | 1,188 | |||||||||

|

Total

|

3,848 | 3,599 | 3,994 | |||||||||

|

FINANCIAL INDICATORS (millions of $)

|

||||||||||||

|

Net sales

|

10,338 | 10,597 | 10,834 | |||||||||

|

Operating income

|

1,899 | 2,185 | 2,357 | |||||||||

|

EBITDA (2)

|

2,720 | 2,795 | 2,875 | |||||||||

|

Net income

|

1,181 | 1,574 | 1,702 | |||||||||

|

Cash flow from operations

|

2,044 | 2,377 | 1,856 | |||||||||

|

Capital expenditures

|

1,089 | 753 | 790 | |||||||||

|

BALANCE SHEET (millions of $)

|

||||||||||||

|

Total assets

|

16,511 | 15,931 | 15,960 | |||||||||

|

Total borrowings

|

999 | 931 | 1,744 | |||||||||

|

Net financial debt/ (cash) (3)

|

(1,257 | ) | (911 | ) | 271 | |||||||

|

Total liabilities

|

3,704 | 3,461 | 4,460 | |||||||||

|

Shareholders’ equity including non-controlling interests

|

12,806 | 12,470 | 11,500 | |||||||||

|

PER SHARE / ADS DATA ($ PER SHARE / PER ADS)(4)

|

||||||||||||

|

Number of shares outstanding (5) (thousands of shares)

|

1,180,537 | 1,180,537 | 1,180,537 | |||||||||

|

Earnings per share

|

0.98 | 1.31 | 1.44 | |||||||||

|

Earnings per ADS

|

1.96 | 2.63 | 2.88 | |||||||||

|

Dividends per share (6)

|

0.45 | 0.43 | 0.43 | |||||||||

|

Dividends per ADS (6)

|

0.90 | 0.86 | 0.86 | |||||||||

|

ADS Stock price at year-end

|

30.21 | 43.69 | 41.92 | |||||||||

|

Number of employees (5)

|

27,816 | 26,825 | 26,673 | |||||||||

|

1.

|

The consolidated financial statements for the year ended December 31, 2014, included in the previously issued annual report, have been restated to reduce the carrying amount of the Company’s investment in Usiminas. For more information, see “I General Information” to our audited restated consolidated financial statements included in this restated annual report.

|

|

2.

|

Defined as operating income plus depreciation, amortization and impairment charges/(reversals). In 2014, the EBITDA figure excludes an impairment charge of $206 million on our welded pipe operations in Colombia and Canada and in 2012, the EBITDA figure excludes a non-recurring gain of $49 million, corresponding to a tax related lawsuit collected in Brazil.

|

|

3.

|

Defined as borrowings less cash and cash equivalents and other current investments.

|

|

4.

|

Each ADS represents two shares.

|

|

5.

|

As of December 31.

|

|

6.

|

Paid in respect of the year.

|

7

Information on Tenaris

The Company

Our holding company’s legal and commercial name is Tenaris S.A. The Company was established as a public limited liability company (société anonyme) organized under the laws of the Grand Duchy of Luxembourg. The Company’s registered office is located at 29 avenue de la Porte-Neuve, 3rd Floor, L-2227, Luxembourg, telephone (352) 2647-8978.

The Company has no branches. For information on the Company’s subsidiaries, see note 29 “Principal subsidiaries” to our audited restated consolidated financial statements included in this restated annual report.

Overview

We are a leading global manufacturer and supplier of steel pipe products and related services for the world’s energy industry and for other industrial applications. Our customers include most of the world’s leading oil and gas companies as well as engineering companies engaged in constructing oil and gas gathering, transportation, processing and power generation facilities. Our principal products include casing, tubing, line pipe, and mechanical and structural pipes.

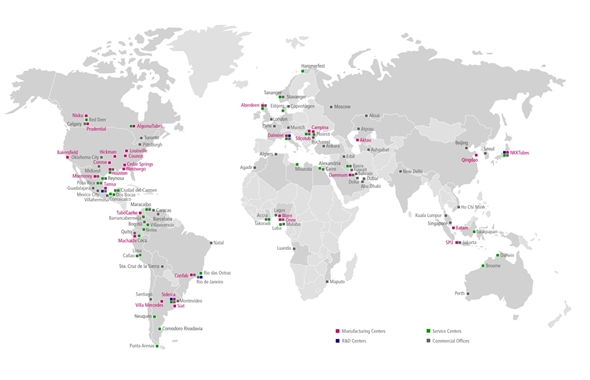

We operate an integrated worldwide network of steel pipe manufacturing, research, finishing and service facilities with industrial operations in the Americas, Europe, Asia and Africa and a direct presence in most major oil and gas markets.

Our mission is to deliver value to our customers through product development, manufacturing excellence, and supply chain management. We seek to minimize risk for our customers and help them reduce costs, increase flexibility and improve time-to-market. Our employees around the world are committed to continuous improvement by sharing knowledge across a single global organization.

History and Development of Tenaris

Tenaris began with the formation of Siderca S.A.I.C., or Siderca, the sole Argentine producer of seamless steel pipe products, by San Faustin’s predecessor in Argentina in 1948. We acquired Siat, an Argentine welded steel pipe manufacturer, in 1986. We grew organically in Argentina and then, in the early 1990s, began to evolve beyond this initial base into a global business through a series of strategic investments. These investments included the acquisition, directly or indirectly, of controlling or strategic interests in the following companies:

|

·

|

Tubos de Acero de México S.A., or Tamsa, the sole Mexican producer of seamless steel pipe products (June 1993);

|

|

·

|

Dalmine S.p.A., or Dalmine, a leading Italian producer of seamless steel pipe products (February 1996);

|

|

·

|

Tubos de Acero de Venezuela S.A., or Tavsa, the sole Venezuelan producer of seamless steel pipe products (October 1998)2;

|

|

·

|

Confab Industrial S.A., or Confab, the leading Brazilian producer of welded steel pipe products (a controlling interest in August 1999, and the remainder during the second quarter of 2012);

|

|

·

|

NKKTubes, a leading Japanese producer of seamless steel pipe products (August 2000);

|

|

·

|

Algoma Tubes Inc., or AlgomaTubes, the sole Canadian producer of seamless steel pipe products (October 2000);

|

|

·

|

S.C. Silcotub S.A., or Silcotub, a leading Romanian producer of seamless steel pipe products (July 2004);

|

|

·

|

Maverick Tube Corporation, or Maverick, a leading North American producer of welded steel pipe products with operations in the United States, Canada and Colombia (October 2006);

|

|

·

|

Hydril Company, or Hydril, a leading North American manufacturer of premium connection products for oil and gas drilling production (May 2007);

|

|

·

|

Seamless Pipe Indonesia Jaya, or SPIJ, an Indonesian oil country tubular goods, or OCTG, processing business with heat treatment and premium connection threading facilities (April 2009);

|

2 In 2009, the Venezuelan government nationalized Tavsa and other companies in which we had investments. For more information on the Tavsa nationalization process, see note 30 “Nationalization of Venezuelan Subsidiaries” to our audited restated consolidated financial statements included in this restated annual report.

8

|

·

|

Pipe Coaters Nigeria Ltd, the leading company in the Nigerian coating industry (November 2011);

|

|

·

|

Usinas Siderúrgicas de Minas Gerais S.A., or Usiminas, where through our subsidiary Confab, we hold an interest representing 5.0% of the shares with voting rights and 2.5% of the total share capital (January 2012); and

|

|

·

|

a sucker rod business, in Campina, Romania (February 2012).

|

In addition, we have established a global network of pipe finishing, distribution and service facilities with a direct presence in most major oil and gas markets and a global network of research and development centers.

Business Overview

Our business strategy is to continue expanding our operations worldwide and further consolidate our position as a leading global supplier of high-quality tubular products and services to the energy and other industries by:

|

·

|

pursuing strategic investment opportunities in order to strengthen our presence in local and global markets;

|

|

·

|

expanding our comprehensive range of products and developing new high-value products designed to meet the needs of customers operating in increasingly challenging environments;

|

|

·

|

securing an adequate supply of production inputs and reducing the manufacturing costs of our core products; and

|

|

·

|

enhancing our offer of technical and pipe management services designed to enable customers to optimize their selection and use of our products and reduce their overall operating costs.

|

Pursuing strategic investment opportunities and alliances

We have a solid record of growth through strategic investments and acquisitions. We pursue selective strategic investments and acquisitions as a means to expand our operations and presence in selected markets, enhance our global competitive position and capitalize on potential operational synergies. Our track record on companies’ acquisitions is described above (See “History and Development of Tenaris”). In addition, we continue to build a new greenfield seamless mill in Bay City, Texas. The new facility will include a state-of-the-art rolling mill as well as finishing and heat treatment lines. We plan to bring the 600,000 tons per year capacity mill and logistics center into operation in 2017, within a budget in a range of $1.5 billion to $1.8 billion. As of December 31, 2014, approximately $0.4 billion had already been invested and an additional $0.5 billion had been committed.

Developing high-value products

We have developed an extensive range of high-value products suitable for most of our customers’ operations using our network of specialized research and testing facilities and by investing in our manufacturing facilities. As our customers expand their operations, we seek to supply high-value products that reduce costs and enable them to operate safely in increasingly challenging environments.

Securing inputs for our manufacturing operations

We seek to secure our existing sources of raw material and energy inputs, and to gain access to new sources, of low-cost inputs which can help us maintain or reduce the cost of manufacturing our core products over the long term. For example, in February 2014, we entered into an agreement with our affiliates Ternium and Tecpetrol to build a natural gas-fired combined cycle electric power plant in Mexico¸ expected to be completed in 2016, which would supply Tenaris’s and Ternium’s respective Mexican industrial facilities. For information on the new power plant, see note 12 c) “Investments in non-consolidated companies – Techgen S.A. de C.V.” to our audited restated consolidated financial statements included in this restated annual report.

Enhancing our offer of technical and pipe management services

We continue to enhance our offer of technical and pipe management services for our customers worldwide. Through the provision of these services, we seek to enable our customers to optimize their operations, reduce costs and to concentrate on their core businesses. They are also intended to differentiate us from our competitors and further strengthen our relationships with our customers worldwide through long-term agreements. For example, in Mexico, since 1994, we supply Pemex, the state-owned oil company, one of the world’s largest crude oil and condensates producers under just-in-time, or JIT, agreements, which allow us to provide it with comprehensive pipe management services on a continuous basis.

9

Our Competitive Strengths

We believe our main competitive strengths include:

|

·

|

our global production, commercial and distribution capabilities, offering a full product range with flexible supply options backed up by local service capabilities in important oil and gas producing and industrial regions around the world;

|

|

·

|

our ability to develop, design and manufacture technologically advanced products;

|

|

·

|

our solid and diversified customer base and historic relationships with major international oil and gas companies around the world, and our strong and stable market shares in the countries in which we have manufacturing operations;

|

|

·

|

our proximity to our customers;

|

|

·

|

our human resources around the world with their diverse knowledge and skills;

|

|

·

|

our low-cost operations, primarily at state-of-the-art, strategically located production facilities with favorable access to raw materials, energy and labor, and more than 60 years of operating experience; and

|

|

·

|

our strong financial condition.

|

Business Segments

Tenaris has one major business segment, Tubes, which is also the reportable operating segment.

The Tubes segment includes the production and sale of both seamless and welded steel tubular products and related services mainly for the oil and gas industry, particularly oil country tubular goods (OCTG) used in drilling operations, and for other industrial applications with production processes that consist in the transformation of steel into tubular products. Business activities included in this segment are mainly dependent on the oil and gas industry worldwide, as this industry is a major consumer of steel pipe products, particularly OCTG used in drilling activities. Demand for steel pipe products from the oil and gas industry has historically been volatile and depends primarily upon the number of oil and natural gas wells being drilled, completed and reworked, and the depth and drilling conditions of these wells. Sales are generally made to end users, with exports being done through a centrally managed global distribution network and domestic sales made through local subsidiaries. Corporate general and administrative expenses have been allocated to the Tubes segment.

Others include all other business activities and operating segments that are not required to be separately reported, including the production and selling of sucker rods, welded steel pipes for electric conduits, industrial equipment, coiled tubing, energy and raw materials that exceed internal requirements.

For more information on our business segments, see accounting policy C “Segment information” to our audited restated consolidated financial statements included in this restated annual report.

Our Products

Our principal finished products are seamless and welded steel casing and tubing, line pipe and various other mechanical and structural steel pipes for different uses. Casing and tubing products are also commonly referred to as OCTG products. We manufacture our steel pipe products in a wide range of specifications, which vary in diameter, length, thickness, finishing, steel grades, threading and coupling. For most complex applications, including high pressure and high temperature applications, seamless steel pipes are usually specified and, for some standard applications, welded steel pipes can also be used.

Casing. Steel casing is used to sustain the walls of oil and gas wells during and after drilling.

Tubing. Steel tubing is used to conduct crude oil and natural gas to the surface after drilling has been completed.

Line pipe. Steel line pipe is used to transport crude oil and natural gas from wells to refineries, storage tanks and loading and distribution centers.

Mechanical and structural pipes. Mechanical and structural pipes are used by general industry for various applications, including the transportation of other forms of gas and liquids under high pressure.

Cold-drawn pipe. The cold-drawing process permits the production of pipes with the diameter and wall thickness required for use in boilers, superheaters, condensers, heat exchangers, automobile production and several other industrial applications.

10

Premium joints and couplings. Premium joints and couplings are specially designed connections used to join lengths of steel casing and tubing for use in high temperature or high pressure environments. A significant portion of our steel casing and tubing products are supplied with premium joints and couplings. We own an extensive range of premium connections, and following the integration of the premium connections business of Hydril , we market our premium connection products under the TenarisHydril brand name. In addition, we hold licensing rights to manufacture and sell the Atlas Bradford range of premium connections outside of the United States.

Coiled tubing. Coiled tubing is used for oil and gas drilling and well workovers and for subsea pipelines.

Other Products. We also manufacture sucker rods used in oil extraction activities, industrial equipment of various specifications and diverse applications, including liquid and gas storage equipment, and welded steel pipes for electric conduits used in the construction industry. In addition, we sell raw materials that exceed our internal requirements.

Research and Development

Research and development, or R&D, of new products and processes to meet the increasingly stringent requirements of our customers is an important aspect of our business.

R&D activities are carried out primarily at our specialized research facilities located at Campana in Argentina, at Veracruz in Mexico, at Dalmine in Italy, at the product testing facilities of NKKTubes in Japan and at the new R&D center at Ilha do Fundao, Rio de Janeiro, Brazil (which commenced operations in 2014). We strive to engage some of the world’s leading industrial research institutions to solve the problems posed by the complexities of oil and gas projects with innovative applications. In addition, our global technical sales team is made up of experienced engineers who work with our customers to identify solutions for each particular oil and gas drilling environment.

Product development and research currently being undertaken are focused on the increasingly challenging energy markets and include:

|

•

|

proprietary premium joint products including Dopeless® technology;

|

|

•

|

heavy wall deep water line pipe, risers and welding technology;

|

|

•

|

proprietary steels;

|

|

•

|

tubes and components for the car industry and mechanical applications;

|

|

•

|

tubes for boilers;

|

|

•

|

welded pipes for oil and gas and other applications;

|

|

•

|

sucker rods; and

|

|

•

|

coatings.

|

In addition to R&D aimed at new or improved products, we continuously study opportunities to optimize our manufacturing processes. Recent projects in this area include modeling of rolling and finishing process and the development of different process controls, with the goal of improving product quality and productivity at our facilities.

We seek to protect our intellectual property, from R&D and innovation, through the use of patents and trademarks that allow us to differentiate ourselves from our competitors.

We spent $107 million for R&D in 2014, compared to $106 million in 2013 and $83 million in 2012.

11

TENARIS IN NUMBERS

12

13

Principal Risks and Uncertainties

We face certain risks associated to our business and the industry in which we operate. We are a global steel pipe manufacturer with a strong focus on manufacturing products and related services for the oil and gas industry. Demand for our products depends primarily on the level of exploration, development and production activities of oil and gas companies which is affected by current and expected future prices of oil and natural gas. Several factors, such as the supply and demand for oil and gas, and political and global economic conditions, affect these prices. For example, the current fall in oil and gas prices and in drilling activity is resulting in a decline in consumption and demand of OCTG products which will negatively affect our revenues and profitability. Performance may be further affected by changes in governmental policies (including imposition or strengthening of trade restrictions), the impact of credit restrictions on our customers’ ability to perform their payment obligations with us and any adverse economic, political or social developments in our major markets. Furthermore, competition in the global market for steel pipe products may cause us to lose market share and hurt our sales and profitability. Our profitability may also be hurt if increases in the cost of raw materials and energy could not be offset by higher selling prices. In addition, there is an increased risk of unfairly-traded steel pipe imports in markets in which Tenaris produces and sells its products. A recession in the developed countries, a cooling of emerging market economies or an extended period of below-trend growth in the economies that are major consumers of steel pipe products would likely result in reduced demand of our products, adversely affecting our revenues, profitability and financial condition.

We have significant operations in various countries, including Argentina, Brazil, Canada, Colombia, Italy, Japan, Mexico, Nigeria, Romania and the United States, and we sell our products and services throughout the world. Therefore, like other companies with worldwide operations, our business and operations have been, and could in the future be, affected from time to time to varying degrees by political, economical and social developments and changes in, laws and regulations. These developments and changes may include, among others, nationalization, expropriations or forced divestiture of assets; restrictions on production, imports and exports, interruptions in the supply of essential energy inputs; exchange and/or transfer restrictions, inability or increasing difficulties to repatriate income or capital or to make contract payments; inflation; devaluation; war or other international conflicts; civil unrest and local security concerns, including high incidences of crime and violence involving drug trafficking organizations that threaten the safe operation of our facilities and operations; direct and indirect price controls; tax increases and changes in the interpretation, application or enforcement of tax laws and other retroactive tax claims or challenges; changes in laws, norms and regulations; cancellation of contract rights; and delays or denials of governmental approvals. As a global company, a portion of our business is carried out in currencies other than the U.S. dollar, which is the Company’s functional currency. As a result, we are exposed to foreign exchange rate risk, which could adversely affect our financial position and results of operations.

Beginnig in 2009, Venezuela nationalized our investments in Tubos de Acero de Venezuela S.A. or Tavsa, Matesi, Materiales Siderúrgicos S.A., or Matesi, and Complejo Siderurgico de Guayana, C.A., or Comsigua, and Venezuela formally assumed exclusive operational control over the assets of the aforementioned companies. Our investments in Tavsa, Matesi and Comsigua are protected under applicable bilateral investment treaties, including the bilateral investment treaty between Venezuela and the Belgian-Luxembourgish Union, and Tenaris continues to reserve all of its rights under contracts, investment treaties and Venezuelan and international law. Tenaris has consented to the jurisdiction of the International Centre for Settlement of Investment Disputes, or ICSID, in connection with the nationalization process. Tenaris and its wholly-owned subsidiary Talta - Trading e Marketing Sociedad Unipessoal Lda, or Talta, initiated arbitration proceedings against Venezuela before the ICSID seeking adequate and effective compensation for the expropriation of their investments in Matesi and Tavsa and Comsigua. However, we can give no assurance that the Venezuelan government will agree to pay a fair and adequate compensation for our interest in Tavsa, Matesi and Comsigua, or that any such compensation will be freely convertible into or exchangeable for foreign currency. For further information on the nationalization of the Venezuelan subsidiaries, see note 30 “Nationalization of Venezuelan Subsidiaries” to our audited restated consolidated financial statements included in this restated annual report.

A key element of our business strategy is to develop and offer higher value-added products and services and to continuously identify and pursue growth-enhancing strategic opportunities. We must necessarily base any assessment of potential acquisitions, joint ventures and investments, on assumptions with respect to operations, profitability and other matters that may subsequently prove to be incorrect. Failure to successfully implement our strategy, or to integrate future acquisitions and strategic investments, or to sell acquired assets or business unrelated to our business under favorable terms and conditions, could affect our ability to grow, our competitive position and our sales and profitability.

We may be required to record a significant charge to earnings if we must reassess our goodwill or other assets as a result of changes in assumptions underlying the carrying value of certain assets, particularly as a consequence of deteriorating market conditions. At December 31, 2014 we had $1,745 million in goodwill corresponding mainly to the acquisition of Hydril, in 2007 ($920 million) and Maverick, in 2006 ($675 million). As of December 31, 2014, we recorded an impairment charge of $206 million on the value of our welded pipe assets in Colombia and Canada ($96 million on goodwill and the rest on other assets, including customer relationships), reflecting the decline in oil prices, and their impact on drilling activity and the demand outlook for welded pipe products in the regions served by these facilities. Additionally, as of September 30, 2014 we also recorded a $161 million impairment on the carrying value of our investment in Usiminas. This action follows the conclusion of a discussion with the SEC Staff after which the Company revised the carrying value of its Usiminas investment and restated its financial statements to reduce the carrying amount of the Usiminas investment to $122 million as of September 30, 2014. As a result of this restatement, the financial statements at December 31, 2014 and March 31, 2015 were also restated to reflect the lower carrying value of the Usiminas investment. The Company recalculated value in use as of September 30, 2014, based primarily on the assumptions in a more conservative scenario, including, among other revisions, a lower operating income, an increase in the discount rate and a decrease in the perpetuity growth rate. If our management were to determine in the future that the goodwill or other assets were impaired, particularly as a consequence of deteriorating market conditions, we would be required to recognize a non-cash charge to reduce the value of these assets, which would adversely affect our results of operations.

14

Potential environmental, product liability and other claims arising from the inherent risks associated with the products we sell and the services we render, including well failures, line pipe leaks, blowouts, bursts and fires, that could result in death, personal injury, property damage, environmental pollution or loss of production could create significant liabilities for us. Environmental laws and regulations may, in some cases, impose strict liability (even joint and several strict liability) rendering a person liable for damages to natural resources or threats to public health and safety without regard to negligence or fault. In addition, we are subject to a wide range of local, provincial and national laws, regulations, permit requirements and decrees relating to the protection of human health and the environment, including laws and regulations relating to hazardous materials and radioactive materials and environmental protection governing air emissions, water discharges and waste management. Laws and regulations protecting the environment have become increasingly complex and more stringent and expensive to implement in recent years. The cost of complying with such regulations is not always clearly known or determinable since some of these laws have not yet been promulgated or are under revision. These costs, along with unforeseen environmental liabilities, may increase our operating costs or negatively impact our net worth.

We conduct business in certain countries known to experience governmental corruption. Although we are committed to conducting business in a legal and ethical manner in compliance with local and international statutory requirements and standards applicable to our business, there is a risk that our employees or representatives may take actions that violate applicable laws and regulations that generally prohibit the making of improper payments to foreign government officials for the purpose of obtaining or keeping business, including laws relating to the 1997 OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions such as the U.S. Foreign Corrupt Practices Act, or FCPA.

As a holding company, our ability to pay expenses, debt service and cash dividends depends on the results of operations and financial condition of our subsidiaries, which could be restricted by legal, contractual or other limitations, including exchange controls or transfer restrictions, and other agreements and commitments of our subsidiaries.

The Company’s controlling shareholder may be able to take actions that do not reflect the will or best interests of other shareholders.

Our financial risk management is described in Section III. Financial Risk Management, and our provisions and contingent liabilities are described in accounting policy P and notes 22, 23 and 25 of our audited restated consolidated financial statements included in this restated annual report.

15

Operating and Financial Review and Prospects

The following discussion and analysis of our financial condition and results of operations are based on, and should be read in conjunction with, our audited restated consolidated financial statements and the related notes included elsewhere in this restated annual report. This discussion and analysis presents our financial condition and results of operations on a consolidated basis. We prepare our consolidated financial statements in conformity with IFRS, as issued by the IASB and adopted by the E.U.

Certain information contained in this discussion and analysis and presented elsewhere in this restated annual report, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. See “Cautionary Statement Concerning Forward-Looking Statements”. In evaluating this discussion and analysis, you should specifically consider the various risk factors identified in “Principal Risks and Uncertainties”, other risk factors identified elsewhere in this restated annual report and other factors that could cause results to differ materially from those expressed in such forward-looking statements.

Overview

We are a leading global manufacturer and supplier of steel pipe products and related services for the energy industry and other industries.

We are a leading global manufacturer and supplier of steel pipe products and related services for the world’s energy industry as well as for other industrial applications. Our customers include most of the world’s leading oil and gas companies as well as engineering companies engaged in constructing oil and gas gathering and processing and power facilities. We operate an integrated worldwide network of steel pipe manufacturing, research, finishing and service facilities with industrial operations in the Americas, Europe, Asia and Africa and a direct presence in most major oil and gas markets.

Our main source of revenue is the sale of products and services to the oil and gas industry, and the level of such sales is sensitive to international oil and gas prices and their impact on drilling activities.

Demand for our products and services from the global oil and gas industry, particularly for tubular products and services used in drilling operations, represents a substantial majority of our total sales. Our sales, therefore, depend on the condition of the oil and gas industry and our customers’ willingness to invest capital in oil and gas exploration and development as well as in associated downstream processing activities. The level of these expenditures is sensitive to oil and gas prices as well as the oil and gas industry’s view of such prices in the future. In the past few months, crude oil prices have fallen from over $100 per barrel in June 2014 to their current levels of around $50 per barrel, as rapid production growth in the U.S. and Canada, slowing global demand growth and OPEC’s decision not to cut production levels have combined to create an excess of supply in the market. Natural gas prices have also fallen on increased supply and limited demand growth. In this context, oil and gas operators are substantially cutting their exploration and production budgets for the year 2015, particularly in North America, and are focused on reducing costs throughout their operations.

In 2014, worldwide drilling activity increased 5% compared to the level of 2013. In the United States the rig count in 2014 increased by 6% and in Canada by 7%. In the rest of the world, the rig count increased 3% in 2014. However, due to the significant decline in oil and gas prices in the past few months, drilling activity is being reduced rapidly in North America, with the U.S. rig count falling 573 rigs (31%) sequentially in the first two months of the year and the Canadian rig count falling 200 rigs (35%) year on year in the same period.

A growing proportion of exploration and production spending by oil and gas companies has been directed at offshore, deep drilling and non-conventional drilling operations in which high-value tubular products, including special steel grades and premium connections, are usually specified. Technological advances in drilling techniques and materials are opening up new areas for exploration and development. More complex drilling conditions are expected to continue to demand new and high value products and services in most areas of the world.

Our business is highly competitive.

The global market for steel pipes is highly competitive, with the primary competitive factors being price, quality, service and technology. We sell our products in a large number of countries worldwide and compete primarily against European and Japanese producers in most markets outside North America. In the United States and Canada we compete against a wide range of local and foreign producers. Competition in markets worldwide has been increasing, particularly for products used in standard applications, as producers in countries like China and Russia increase production capacity and enter export markets.

In addition, there is an increased risk of unfairly-traded steel pipe imports in markets in which we produce and sell our products. In August 2014, the U.S. imposed anti-dumping duties on OCTG imports from various countries, including Korea. However, despite the trade case ruling, imports from Korea continue at a very high level. Similarly, in Canada, an investigation is underway and while the final determination on injury is still pending, in March 2015 the Canada Border Services Agency introduced anti-dumping duties on OCTG imports from Korea and other countries.

16

Our production costs are sensitive to prices of steelmaking raw materials and other steel products.

We purchase substantial quantities of steelmaking raw materials, including ferrous steel scrap, direct reduced iron (DRI), pig iron, iron ore and ferroalloys, for use in the production of our seamless pipe products. In addition, we purchase substantial quantities of steel coils and plate for use in the production of our welded pipe products. Our production costs, therefore, are sensitive to prices of steelmaking raw materials and certain steel products, which reflect supply and demand factors in the global steel industry and in the countries where we have our manufacturing facilities.

The costs of steelmaking raw materials and of steel coils and plates declined during 2014, particularly at the end of the year.

Restatement of Previously Issued Financial Statements – Carrying value of Usiminas investment

Subsequent to the issuance of the Company’s audited annual consolidated financial statements for the years ended December 31, 2014, 2013 and 2012 and following the approval of such consolidated financial statements by the board of directors and the general meeting of shareholders, the Company has restated such consolidated financial statements to reduce the carrying amount of the Company’s investment in Usiminas.

This restatement follows the conclusion of previously disclosed discussions with the SEC Staff regarding Staff comments relating to the carrying value of the Company’s investment in Usiminas under IFRS as of September 30, 2014 and subsequent periods. The Staff had requested information regarding Tenaris’s value in use calculations and the differences between the carrying amounts and certain other indicators of value, including the purchase price of BRL12 (approximately $4.8) per share which the Company’s affiliate Ternium paid in October 2014 for the acquisition of 51.4 million additional Usiminas ordinary shares from Caixa de Previdência dos Funcionários do Banco do Brazil – PREVI (“PREVI”), and indicated that the PREVI transaction price provided objective evidence of the value of the Usiminas investment.

As a result of these discussions, the Company has re-evaluated and revised the assumptions used to calculate the carrying value of the Usiminas investment at September 30, 2014. In calculating the value in use of the Usiminas investment initially reported at September 30, 2014, the Company had combined the assumptions used in two different projected scenarios. For the purposes of the restated consolidated financial statements, however, the Company recalculated value in use as of September 30, 2014 based primarily on the assumptions in the most conservative scenario, including, among other revisions, a lower operating income, an increase in the discount rate and a decrease in the perpetuity growth rate. As a result, the Company recorded an impairment of $161.2 million as of September 30, 2014, resulting in a carrying value for the Usiminas investment of BRL12 per share. In addition, the Company’s investment in Ternium was also adjusted to reflect the change in carrying value of that company’s participation in Usiminas. Because of this impairment and adjustment as of September 30, 2014, the Company did not record a further impairment or adjustment as of December 31, 2014.

Accordingly, the Company’s 2014 annual consolidated financial statements have been amended and restated to reduce the carrying amount of the Company’s investment in Usiminas. The restatement, which is treated as the correction of an error under accounting rules, impacts the consolidated statement of financial position, the consolidated statement of changes in equity, the consolidated income statement, the consolidated statement of other comprehensive income and the consolidated statement of cash flows for the year ended December 31, 2014. The restatement impacts only the year ended December 31, 2014. No impact was recorded on the consolidated financial statements for the years ended December 31, 2013 and 2012.

Outlook

While the extent and duration of the decline in drilling activity remains unclear, we expect demand for OCTG products to decline around 30% in 2015 compared to 2014. We expect that the decline in drilling activity and demand for OCTG will be more rapid and pronounced in the United States and Canada and more gradual in the rest of the world.

For 2015, we expect our sales in the United States and Canada to be affected by the aforementioned reduced drilling activity and by the uncertainty concerning the still very high level of unfairly-traded steel pipe imports and its impact on OCTG inventories in the United States. In the Eastern Hemisphere, our sales will be affected by OCTG destocking in Saudi Arabia and lower offshore drilling activity in sub-Saharan Africa, the North Sea and the Far East. However, we expect our sales in South America to be supported by sales for pipeline projects in Argentina and Brazil. The reduction in demand for OCTG is putting downward pressure on prices.

We are adjusting our operations to face the new environment, making certain adjustments in our workforce worldwide and optimizing allocation among our plants to take advantage of differences in operating costs and currency movements. We are also reviewing our fixed costs with a view to making our structure more efficient. The costs of our metallic load have been declining, which will ultimately help to soften the reduction in operating margins. Additionally, we will continue to focus on working capital efficiencies, primarily on inventories and receivables.

17

Results of Operations

|

Millions of U.S. dollars (except number of shares and per share amounts)

|

For the year ended December 31,

|

|||||||

|

2014 Restated(1)

|

2013

|

|||||||

|

Selected consolidated income statement data

|

||||||||

|

Continuing operations

|

||||||||

|

Net sales

|

10,338 | 10,597 | ||||||

|

Cost of sales

|

(6,287 | ) | (6,457 | ) | ||||

|

Gross profit

|

4,051 | 4,140 | ||||||

|

Selling, general and administrative expenses

|

(1,964 | ) | (1,941 | ) | ||||

|

Other operating income (expenses), net

|

(188 | ) | (14 | ) | ||||

|

Operating income

|

1,899 | 2,185 | ||||||

|

Finance income

|

38 | 35 | ||||||

|

Finance cost

|

(44 | ) | (70 | ) | ||||

|

Other financial results

|

39 | 7 | ||||||

|

Income before equity in earnings of non-consolidated companies and income tax

|

1,932 | 2,156 | ||||||

|

Equity in earnings (losses) of non-consolidated companies

|

(165 | ) | 46 | |||||

|

Income before income tax

|

1,767 | 2,202 | ||||||

|

Income tax

|

(586 | ) | (628 | ) | ||||

|

Income for the year (2)

|

1,181 | 1,574 | ||||||

|

Income attributable to (2):

|

||||||||

|

Owners of the parent

|

1,159 | 1,551 | ||||||

|

Non-controlling interests

|

23 | 23 | ||||||

|

Income for the year(2)

|

1,181 | 1,574 | ||||||

|

Depreciation and amortization

|

(616 | ) | (610 | ) | ||||

|

Weighted average number of shares

outstanding

|

1,180,536,830 | 1,180,536,830 | ||||||

|

Basic and diluted earnings per share

|

0.98 | 1.31 | ||||||

|

Dividends per share(3)

|

0.45 | 0.43 | ||||||

____________________

|

|

(1)

|

The consolidated financial statements for the year ended December 31, 2014, included in the previously issued annual report, have been restated to reduce the carrying amount of the Company’s investment in Usiminas. For more information, see “I General Information” to our audited restated consolidated financial statements included in this restated annual report.

|

|

|

(2)

|

International Accounting Standard No. 1 (“IAS 1”) (revised), requires that income for the year as shown on the income statement does not exclude non-controlling interests. Earnings per share, however, continue to be calculated on the basis of income attributable solely to the owners of the parent.

|

|

|

(3)

|

Dividends per share correspond to the dividends paid in respect of the year.

|

18

|

Millions of U.S. dollars (except number of shares)

|

At December 31,

|

|||||||

|

2014 Restated(1)

|

2013

|

|||||||

|

Selected consolidated financial position data

|

||||||||

|

Current assets

|

7,396 | 6,904 | ||||||

|

Property, plant and equipment, net

|

5,160 | 4,674 | ||||||

|

Other non-current assets

|

3,955 | 4,353 | ||||||

|

Total assets

|

16,511 | 15,931 | ||||||

|

Current liabilities

|

2,603 | 2,120 | ||||||

|

Non-current borrowings

|

31 | 246 | ||||||

|

Deferred tax liabilities

|

714 | 751 | ||||||

|

Other non-current liabilities

|

357 | 344 | ||||||

|

Total liabilities

|

3,704 | 3,461 | ||||||

|

Capital and reserves attributable to the owners of the parent

|

12,654 | 12,290 | ||||||

|

Non-controlling interests

|

152 | 179 | ||||||

|

Total equity

|

12,806 | 12,470 | ||||||

|

Total liabilities and equity

|

16,511 | 15,931 | ||||||

|

Share capital

|

1,181 | 1,181 | ||||||

|

Number of shares outstanding(Fa

|

1,180,536,830 | 1,180,536,830 | ||||||

|

|

(1)

|

The consolidated financial statements for the year ended December 31, 2014, included in the previously issued annual report, have been restated to reduce the carrying amount of the Company’s investment in Usiminas. For more information, see “I General Information” to our audited restated consolidated financial statements included in this restated annual report.

|

19

The following table sets forth our operating and other costs and expenses as a percentage of net sales for the periods indicated.

|

Percentage of net sales

|

For the year ended December 31,

|

|||||||

|

2014 Restated(1)

|

2013

|

|||||||

|

Continuing Operations

|

||||||||

|

Net sales

|

100.0 | 100.0 | ||||||

|

Cost of sales

|

(60.8 | ) | (60.9 | ) | ||||

|

Gross profit

|

39.2 | 39.1 | ||||||

|

Selling, general and administrative expenses

|

(19.0 | ) | (18.3 | ) | ||||

|

Other operating income (expenses), net

|

(1.8 | ) | (0.1 | ) | ||||

|

Operating income

|

18.4 | 20.6 | ||||||

|

Finance income

|

0.4 | 0.3 | ||||||

|

Finance cost

|

(0.4 | ) | (0.7 | ) | ||||

|

Other financial results

|

0.4 | 0.1 | ||||||

|

Income before equity in earnings of non-consolidated companies and income tax

|

18.7 | 20.3 | ||||||

|

Equity in (losses) earnings of non-consolidated companies

|

(1.6 | ) | 0.4 | |||||

|

Income before income tax

|

17.1 | 20.8 | ||||||

|

Income tax

|

(5.7 | ) | (5.9 | ) | ||||

|

Income for the year

|

11.4 | 14.9 | ||||||

|

Income attributable to:

|

||||||||

|

Owners of the parent

|

11.2 | 14.6 | ||||||

|

Non-controlling interests

|

0.2 | 0.2 | ||||||

|

|

(1)

|

The consolidated financial statements for the year ended December 31, 2014, included in the previously issued annual report, have been restated to reduce the carrying amount of the Company’s investment in Usiminas. For more information, see “I General Information” to our audited restated consolidated financial statements included in this restated annual report.

|

Fiscal Year Ended December 31, 2014, Compared to Fiscal Year Ended December 31, 2013

The following table shows our net sales by business segment for the periods indicated below:

|

Millions of U.S. dollars

|

For the year ended December 31,

|

|||||||||||||||||||

|

2014

|

2013

|

Increase / (Decrease)

|

||||||||||||||||||

|

Tubes

|

9,582 | 93 | % | 9,812 | 93 | % | (2 | %) | ||||||||||||

|

Others

|

756 | 7 | % | 784 | 7 | % | (4 | %) | ||||||||||||

|

Total

|

10,338 | 100 | % | 10,597 | 100 | % | (2 | %) | ||||||||||||

Tubes

The following table indicates, for our Tubes business segment, sales volumes of seamless and welded pipes for the periods indicated below:

|

Thousands of tons

|

For the year ended December 31,

|

|||||||||||

|

2014

|

2013

|

Increase / (Decrease)

|

||||||||||

|

Seamless

|

2,790 | 2,612 | 7 | % | ||||||||

|

Welded

|

885 | 1,049 | (16 | %) | ||||||||

|

Total

|

3,675 | 3,661 | 0 | % | ||||||||

20

The following table indicates, for our Tubes business segment, net sales by geographic region, operating income and operating income as a percentage of net sales for the periods indicated below:

|

Millions of U.S. dollars

|

For the year ended December 31,

|

|||||||||||

|

2014

|

2013

|

Increase / (Decrease)

|

||||||||||

|

Net sales

|

||||||||||||

|

- North America

|

4,609 | 4,077 | 13 | % | ||||||||

|

- South America

|

1,823 | 2,237 | (19 | %) | ||||||||

|

- Europe

|

924 | 890 | 4 | % | ||||||||

|

- Middle East & Africa

|

1,817 | 2,094 | (13 | %) | ||||||||

|

- Far East & Oceania

|

408 | 513 | (20 | %) | ||||||||

|

Total net sales

|

9,582 | 9,812 | (2 | %) | ||||||||

|

Operating income

|

1,866 | 2,097 | (11 | %) | ||||||||

|

Operating income (% of sales)

|

19.5 | % | 21.4 | % | ||||||||

Operating income in 2014 includes an impairment charge of $206 million on our welded pipe operations in Colombia and Canada.

Net sales of tubular products and services decreased 2% to $9,582 million in 2014, compared to $9,812 million in 2013, reflecting flat overall volumes and a 3% decrease in average selling prices, driven by a less rich mix of products sold both for seamless and welded pipes. In North America, sales increased due to higher sales in the U.S. shale plays reflecting higher drilling activity and improved pricing conditions following the final determination of anti-dumping duties on imports from Korea and other countries, as well as higher levels of sales to deepwater projects in the Gulf of Mexico. In South America, sales decreased due to a virtual halt of shipments for pipeline products in Brazil and Argentina, due to our customers financial and operating constraints. In Europe, sales increased mainly due to a higher level of sales of OCTG products in continental Europe. In the Middle East and Africa, sales decreased mainly due to lower levels of sales in the Middle East reflecting the onset of OCTG destocking in Saudi Arabia in the second half and lower sales in the United Arab Emirates, partially offset by an increase in sales to offshore projects in sub-Saharan Africa. In the Far East and Oceania, sales decreased mainly due to lower sales of OCTG products in Indonesia and China and of line pipe products to offshore and Hydrocarbon Processing Industry projects.

Operating income from tubular products and services, decreased 11% to $1,866 million in 2014, from $2,097 million in 2013. Operating income in 2014 includes an impairment charge of $206 million on our welded pipe operations in Colombia and Canada. Excluding the impairment charge operating income and margins would have been relatively flat as the decline in average selling prices was offset by a similar decline in costs.

Others

The following table indicates, for our Others business segment, net sales, operating income and operating income as a percentage of net sales for the periods indicated below:

|

Millions of U.S. dollars

|

For the year ended December 31,

|

|||||||||||

|

2014

|

2013

|

Increase / (Decrease)

|

||||||||||

|

Net sales

|

756 | 784 | (4 | %) | ||||||||

|

Operating income

|

33 | 88 | (62 | %) | ||||||||

|

Operating income (% of sales)

|

4.4 | % | 11.2 | % | ||||||||

Net sales of other products and services decreased 4% to $756 million in 2014, compared to $784 million in 2013, mainly due to lower sales of industrial equipment in Brazil, partially offset by higher levels of sales of coiled tubes and pipes for electric conduit in the United States.

Operating income from other products and services, decreased 62% to $33 million in 2014, from $88 million in 2013, reflecting the reduction in activity levels in our industrial equipment business in Brazil, which had a negative impact in operating performance and margins.

Selling, general and administrative expenses, or SG&A, increased as a percentage of net sales to 19.0% in 2014 compared to 18.3% in 2013, mainly due to the effect of a 3% increase in labor costs on lower sales.

Other operating income and expenses resulted in expenses of $188 million in 2014, compared to $14 million in 2013, mainly due to an asset impairment charge in 2014, amounting to $206 million. These charges mainly reflect the decline in oil prices, and its impact on drilling activity and therefore on the expected demand for OCTG products, particularly on our welded pipe operations in Colombia and Canada.

Financial results amounted to a gain of $33 million in 2014, compared to a loss of $29 million in 2013. The improvement in financial results was mainly due to lower financial costs due to a lower average debt position compared to the previous year in addition to a lower proportion of unhedged Argentine peso-denominated debt (which has higher interest rates).

21

Equity in earnings (losses) of non-consolidated companies generated a loss of $165 million in 2014, compared to a gain of $46 million in 2013. Our 2014 results were negatively affected by a $161 million impairment charge on our Usiminas investment. See “General Information-Restatement of previously issued financial statements” and note 12 “Investments in non-consolidated companies – Usiminas S.A.”, to our audited restated consolidated financial statements included in this restated annual report.

Income tax charges totalled $586 million in 2014, equivalent to 30.3% of income before equity in earnings of non-consolidated companies and income tax, compared to $628 million in 2013, equivalent to 29.1% of income before equity in earnings of non-consolidated companies and income tax. During 2014, excluding the part of the impairment on goodwill ($96 million), which has no effect on deferred tax, the tax rate would have been 28.9%.

Net income decreased 25% during the year, to $1,181 million in 2014, compared to $1,574 million in 2013. This decline is mostly attributable to a $206 million impairment charge ($171 million after tax) at our Colombian and Canadian welded pipe operations, plus the $161 million impairment charge at our investment in Usiminas in Brazil discussed elsewhere in this restated annual report.

Income attributable to owners of the parent was $1,159 million, or $0.98 per share ($1.96 per ADS), in 2014, compared to $1,551 million, or $1.31 per share ($2.63 per ADS), in 2013. This decline is mostly attributable to a $206 million impairment charge ($171 million after tax) at our Colombian and Canadian welded pipe operations, plus the $161 million impairment charge at our investment in Usiminas in Brazil discussed elsewhere in this restated annual report.

Income attributable to non-controlling interest was $23 million in 2014, like in 2013. These results are mainly attributable to NKKTubes, our Japanese subsidiary.

Liquidity and Capital Resources

The following table provides certain information related to our cash generation and changes in our cash and cash equivalents position for each of the last two years:

|

Millions of U.S. dollars

|

For the year ended December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Net cash provided by operating activities

|

2,044 | 2,377 | ||||||

|

Net cash used in investing activities

|

(1,786 | ) | (1,309 | ) | ||||

|

Net cash used in financing activities

|

(424 | ) | (1,217 | ) | ||||

|

Decrease in cash and cash equivalents

|

(165 | ) | (149 | ) | ||||

|

Cash and cash equivalents at the beginning of year (excluding overdrafts)

|

598 | 773 | ||||||

|

Effect of exchange rate changes

|

(16 | ) | (26 | ) | ||||

|

Decrease in cash and cash equivalents

|

(165 | ) | (149 | ) | ||||

|

Cash and cash equivalents at the end of year (excluding overdrafts)

|

416 | 598 | ||||||

|

Cash and cash equivalents at the end of year (excluding overdrafts)

|

416 | 598 | ||||||

|

Bank overdrafts

|

1 | 16 | ||||||

|

Other investments

|

1,838 | 1,227 | ||||||

|

Borrowings

|

(999 | ) | (931 | ) | ||||

|

Net cash / (debt)

|

1,257 | 911 | ||||||

Our financing strategy aims at maintaining adequate financial resources and access to additional liquidity. During 2014 we generated $2.0 billion of operating cash flow, our capital expenditures amounted to $1.1 billion and we paid dividends amounting to $531 million. At the end of the year we had a net cash position of $1.3 billion, compared to $911 million at the beginning of the year.

We believe that funds from operations, the availability of liquid financial assets and our access to external borrowing through the financial markets will be sufficient to satisfy our working capital needs, to finance our planned capital spending program, to service our debt in the foreseeable future and to address short-term changes in business conditions.