Form 6-K Silver Wheaton Corp. For: Mar 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016

Commission File Number: 001-32482

SILVER WHEATON CORP.

(Translation of registrant's name into English)

Suite 3500, 1021 West Hastings Street

Vancouver, British Columbia

V6E 0C3

(604) 684-9648

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

| 99.1 | NI 43-101 Technical Report | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SILVER WHEATON CORP. | ||

| (Registrant) | ||

| Date: March 30, 2016 | By: | /s/ Curt Bernardi |

| Curt Bernardi | ||

| Title: | Senior Vice President, Legal and Corporate Secretary | |

|

|

Salobo Operations

Para State Brazil

NI 43-101 Technical Report

Prepared for:

Silver Wheaton Corp.

Prepared by:

Gerrit Vos, P.Eng.

Dr Georges Verly, P.Eng.

Dr Armando Simon, P.Geo.

Pierre Lacombe, P.Eng.

Donald Hickson, P.Eng.

Vikram Khera, P.Eng.

Stella Searston, RM SME

Effective Date: 31 December, 2015

Project Number: 179678

CERTIFICATE OF QUALIFIED PERSON

I, Gerrit Vos, P.Eng., am employed as Technical Director – Mining, Construction & Speciality Consulting with Amec Foster Wheeler plc. (Amec Foster Wheeler).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a member of the Association of Professional Engineers and Geoscientists of British Columbia (APEGBC). I graduated in 1978 from the University of Technology in Delft, the Netherlands with a Masters degree in Mining Engineering.

I have practiced my profession for 37 years. I have been directly involved in various mines in Brazil including Sossego and other copper–gold projects such as Agua Rica in Argentina and Bisha in Eritrea, As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (NI 43–101).

I visited the Salobo Operations from 20 to 26 June, 2015.

I am responsible for Sections 1.12, 1.13, 1.14, 1.16, 1.19, 1.20, 1.22, 1.23; Sections 2.2, 2.3, 2.4, 2.5; Section 3.1; Section 15; Section 16; Sections 18.1, 18.2, 18.5, 18.6, 18.7, 18.8, 18.9, 18.10; Section 20.3; Sections 21.1.1, 21.1.2, 21.1.4, 21.1.5, 21.2.1, 21.2.2, 21.2.4, 21.3; Sections 24.1.2, 24.2.1; Sections 25.6, 25.7, 25.9, 25.12, 25.13, 25.15; and Section 27 of the technical report.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Gerrit Vos |

|

| Gerrit Vos, P.Eng. |

| Amec Foster Wheeler plc. | |

| International House, Dover Place, | |

| Ashford, Kent, TN23 1HU, UK | www.amecfw.com |

| Tel: +44 (0)1233 65 3600 |

CERTIFICATE OF QUALIFIED PERSON

I, Dr Georges Verly, P.Eng., am employed as the Chief Geostatistician with Amec Foster Wheeler Americas Limited (Amec Foster Wheeler).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a member of the Association of Professional Engineers and Geoscientists of British Columbia. I graduated from École Polytechnique de Montréal with a B.Sc.A. degree in Geological Engineering in 1977 and an M.Sc.A. degree in Geostatistics in 1980. I graduated from Stanford University with a PhD degree in Applied Earth Sciences in 1984.

I have practiced my profession for 39 years. I have been directly involved in geostatistical resource estimation and simulation, and auditing of gold, copper, nickel and other mineral properties.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (NI 43–101).

I visited the Salobo Operations on 29 June, 2015.

I am responsible for Sections 1.10, 1.11; Sections 2.2, 2.3, 2.4, 2.5; Sections 3.1, 3.2; Section 14; Sections 25.5, 25.15; and Section 27 of the technical report.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Dr Georges Verly |

|

| Dr Georges Verly, P.Eng. |

| Amec Foster Wheeler Americas Limited | |

| 111 Dunsmuir Street, Suite 400 | |

| Vancouver, B.C. V6B 5W3 | www.amecfw.com |

| Tel (604) 664-4315 | |

| Fax (604) 669-9516 |

CERTIFICATE OF QUALIFIED PERSON

I, Dr Armando Simon, P.Geo, am employed as a Principal Geologist with Amec Foster Wheeler International Ingeniería y Construcción Limitada (Amec Foster Wheeler).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the technical report).

I am a Registered Member of the Chilean Mining Commission (RM CMC #71), a Professional Geologist (PGeo; #1633) registered with the Association of Professional Geologists of Ontario (APGO), and a Registered Professional Geoscientist (RPGeo; #10053) with the Australian Institute of Geoscentists (AIG). I graduated from the University of Bucharest with a Bachelor of Engineering degree in Geology and Geophysics in 1974, and a Doctorate of Engineering with mention in Economic Geology in 1985.

Since 1974, I have continually been involved in mineral exploration projects for precious and base metals and industrial minerals in Algeria, Argentina, Australia, Brazil, Canada, Colombia, D.R. Congo, Cuba, Chile, Ecuador, Eritrea, Ethiopia, Guatemala, Guinea, Guyana, Jamaica, Kazakhstan, Madagascar, Mali, Mexico, Nicaragua, Pakistan, Peru, Portugal, Romania, Russia, South Africa, and Vietnam.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (NI 43–101).

I visited the Salobo Operations from 20 to 26 June, 2015.

I am responsible for Sections 1.5, 1.6, 1.7, 1.8, 1.23, Sections 2.2, 2.3, 2.5; Sections 3.1, 3.2; Section 6; Section 7; Section 8; Section 9; Section 10; Section 11; Section 12; Section 24.1.1; Sections 25.2, 25.3, 25.15; Section 26 and Section 27 of the technical report.

I am independent of Silver Wheaton Corp. as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Dr Armando Simon |

|

| Dr Armando Simon, P.Geo. |

| Amec Foster Wheeler International Ingeniería y Construcción Limitada | |

| Av. Apoquindo 3846, Piso 15, Las Condes, | |

| Santiago, Chile | www.amecfw.com |

| Tel: 56 2 2109500 | |

| Fax: 56 2 2109510 |

CERTIFICATE OF QUALIFIED PERSON

I, Pierre Lacombe, P.Eng., Ing., was a consultant to Amec Foster Wheeler Americas Limited (“Amec Foster Wheeler”) when the site visit, data gathering, report preparation and review process for the technical report were carried out.

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a member of Ordre des Ingénieurs du Québec (#39496), Professional Engineers Ontario (#100210593) and the Professional Engineers and Geoscientists of Newfoundland & Labrador (#08150). I graduated from École Polytechnique of Montréal, Canada, in 1984 with a B. Eng. in Mining Engineering.

I have practiced my profession for 32 years, during which I have been directly involved in the operations and management of mineral processing plants for base metals, in their design and commissioning in North, Central and South America.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (NI 43–101).

I visited the Salobo Operations from 20 to 26 June, 2015.

I am responsible for Sections 1.9, 1.15; Sections 2.2, 2.3, 2.5; Sections 3.1, 3.2; Section 13; Section 17; Section 19.1; Sections 21.1.1, 21.1.3, 21.2.1, 21.2.3, 21.3; Sections 24.1.3, 24.2.2; and Sections 25.4, and 25.8 of the technical report. I am responsible for the aspects relevant to mineral processing in Sections 1.19, 1.20; Sections 25.12, 25.13, 25.15, and Section 27.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Pierre Lacombe |

|

| Pierre Lacombe, P.Eng., Ing. |

| Amec Foster Wheeler Americas Limited | |

| 2020 Winston Park Drive, Suite 700 | |

| Oakville, ON, L6H 6X7 | |

| Canada | www.amecfw.com |

| Tel:+1 905 829 5400 | |

| Fax:+1 905 829 5401 |

CERTIFICATE OF QUALIFIED PERSON

I, Donald (Don) Hickson, am employed as E&I Division Manager / Principal Tailings Engineer with Amec Foster Wheeler (Perú) S.A. (Amec Foster Wheeler) (“Amec Foster Wheeler”).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a registered professional engineer (P.Eng.) of Alberta, Canada (APEGGA). I graduated from the University of Waterloo, in 1991 with a Bachelor of Applied Science degree.

I have practiced my profession for 24 years. I have been directly involved in analysis and design related to Tailings, Groundwater, Environmental, and Mine Closure for multiple mining projects, carried out over several countries including Canada, United States, Peru, Chile, Brazil, Colombia, and Bolivia.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (“NI 43–101”).

I have not visited the Salobo Operations.

I am responsible for Sections 1.17, 1.22, 1.23; Sections 2.2, 2.3, 2.5; Sections 3.1, 3.2; Sections 18.3, 18.4; Sections 20.1, 20.2, 20.4, 20.5, 20.6, 20.7, 20.8, 20.9; Section 24.2.3; Sections 25.10, 25.15; and Section 27 of the technical report.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have no previous involvement with the Salobo Operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Donald Hickson |

|

| Donald Hickson, P.Eng. |

| Amec Foster Wheeler (Perú) S.A. | |

| Calle Las Begonias 441, Piso 8 | |

| San Isidro, Lima 27, Perú | |

| Tel (511) 221-3130 | |

| Fax (511) 221-3143 | www.amecfw.com |

CERTIFICATE OF QUALIFIED PERSON

I, Vikram Khera, P.Eng., am employed as a Financial Analyst with Amec Foster Wheeler Americas Ltd (“Amec Foster Wheeler”).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a member of the Professional Engineers Ontario. I graduated from the University of British Columbia in 2002 with a Bachelor of Applied Science degree.

I have practiced my profession for over 12 years.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (“NI 43–101”).

I have not visited the Salobo Operations.

I am responsible for Sections 1.18, 1.21, 1.22, 1.23; Sections 2.2, 2.4, 2.5; Sections 3.3, 3.4; Section 19; Section 22; Section 24.1.4; Sections 25.11, 25.14, 25.15; and Section 27 of the technical report.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Vikram Khera |

|

| Vikram Khera, P.Eng. |

| Amec Foster Wheeler Americas Ltd | |

| 2020 Winston Park Drive, Suite 700 | |

| Oakville, ON, L6H 6X7 | |

| Tel: (905) 829 5400 | |

| Fax: (905) 829 5401 | www.amecfw.com |

CERTIFICATE OF QUALIFIED PERSON

I, Stella Searston, RM SME, am employed as a Principal Geologist with Amec Foster Wheeler E&C Services Inc. (Amec Foster Wheeler).

This certificate applies to the technical report titled “Salobo Operations, Para State, Brazil, NI 43-101 Technical Report” that has an effective date of 31 December, 2015 (the “technical report”).

I am a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM #111778), a Member of the Australian Institute of Geoscientists (MAIG #2406) and a Registered Member of the Society for Mining, Metallurgy and Exploration (RM SME #4168111). I graduated from James Cook University in Australia in 1987 with a Bachelor of Science degree in geology, and from the University of Tasmania in 1999 with a Master of Economic Geology degree. I have practiced professionally since graduation in 1987. In that time I have been directly involved in generation of, and review of, mineral tenure, surface and other property rights, geological, mineralization, exploration and drilling data, geological models, sampling, sample preparation, assaying and other resource-estimation related analyses, quality assurance-quality control databases, resource estimates, risk analyses, preliminary economic assessment, pre-feasibility, and feasibility studies, and due diligence studies in Australia, Southern Africa, the Pacific and North and South America.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43–101 Standards of Disclosure for Mineral Projects (NI 43–101).

I have not visited the Salobo Operations.

I am responsible for Sections 1.1, 1.2, 1.3, 1.4, 1.22, 1.23, 1.24; Section 2.1, 2.2, 2.4, 2.5, 2.6; Section 3; Section 4; Section 5; Section 23; Sections 24.1.1, 24.2.4; Sections 25.1, 25.15; Section 26; and Section 27 of the technical report.

I am independent of Silver Wheaton Corp as independence is described by Section 1.5 of NI 43–101.

I have been involved with the Salobo Operations during the preparation of the technical report, and I have no previous involvement with the operations.

I have read NI 43–101 and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the technical report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the technical report not misleading.

Dated: 23 March 2016

| /s/ Stella Searston |

|

| Stella Searston, RM SME |

| Amec Foster Wheeler E&C Services Inc. | |

| Mining and Metals Consulting Group | |

| 961 Matley Lane, Suite 110 | |

| Reno, NV, 89502 | www.amecfw.com |

| Tel: +1 775 329-6123 | |

| Fax: 1 775 322 9380 |

IMPORTANT NOTICE

This report was prepared as National Instrument 43-101 Technical Report for Silver Wheaton Corp. (Silver Wheaton) by Amec Foster Wheeler Americas Limited (Amec Foster Wheeler). The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in Amec Foster Wheeler’s services, based on i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Silver Wheaton subject to terms and conditions of its contract with Amec Foster Wheeler. Except for the purposes legislated under Canadian provincial securities law, any other uses of this report by any third party is at that party’s sole risk

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| C O N T E N T S | ||||

| 1.0 | SUMMARY | 1-1 | ||

| 1.1 | Introduction | 1-1 | ||

| 1.2 | Terms of Reference | 1-1 | ||

| 1.3 | Project Setting | 1-1 | ||

| 1.4 | Mineral Tenure, Surface Rights, Royalties and Agreements | 1-2 | ||

| 1.5 | Geology and Mineralization | 1-2 | ||

| 1.6 | History | 1-3 | ||

| 1.7 | Drilling and Sampling | 1-3 | ||

| 1.8 | Data Verification | 1-5 | ||

| 1.9 | Metallurgical Testwork | 1-6 | ||

| 1.10 | Mineral Resource Estimation | 1-7 | ||

| 1.11 | Mineral Resource Statement | 1-8 | ||

| 1.12 | Mineral Reserve Estimation | 1-10 | ||

| 1.13 | Mineral Reserve Statement | 1-10 | ||

| 1.14 | Mining Methods | 1-13 | ||

| 1.15 | Recovery Methods | 1-13 | ||

| 1.16 | Project Infrastructure | 1-14 | ||

| 1.17 | Environmental, Permitting and Social Considerations | 1-15 | ||

| 1.17.1 | Environmental Considerations | 1-15 | ||

| 1.17.2 | Tailings Storage Facility | 1-15 | ||

| 1.17.3 | Water Management | 1-16 | ||

| 1.17.4 | Closure and Reclamation Planning | 1-16 | ||

| 1.17.5 | Permitting Considerations | 1-16 | ||

| 1.17.6 | Social Considerations | 1-16 | ||

| 1.18 | Markets and Contracts | 1-16 | ||

| 1.19 | Capital Cost Estimates | 1-17 | ||

| 1.20 | Operating Cost Estimates | 1-17 | ||

| 1.21 | Economic Analysis | 1-18 | ||

| 1.22 | Risks and Opportunities | 1-18 | ||

| 1.23 | Interpretation and Conclusions | 1-19 | ||

| 1.24 | Recommendations | 1-19 | ||

| 2.0 | INTRODUCTION | 2-1 | ||

| 2.1 | Terms of Reference | 2-1 | ||

| 2.2 | Qualified Persons | 2-4 | ||

| 2.3 | Site Visits and Scope of Personal Inspection | 2-4 | ||

| 2.4 | Effective Dates | 2-4 | ||

| 2.5 | Information Sources and References | 2-5 | ||

| 2.6 | Previous Technical Reports | 2-5 | ||

| 3.0 | RELIANCE ON OTHER EXPERTS | 3-1 | ||

| 3.1 | Mineral Tenure, Surface Rights and Royalties | 3-1 | ||

| 3.2 | Environmental, Permitting and Social and Community Impacts | 3-1 | ||

| 3.3 | Taxation | 3-3 | ||

| March 2016

Project Number:179678 |

TOC i | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 3.4 | Markets, Contracts and Commodity Pricing | 3-3 | ||

| 4.0 | PROPERTY DESCRIPTION AND LOCATION | 4-1 | ||

| 4.1 | Location | 4-1 | ||

| 4.2 | Property and Title in Brazil | 4-1 | ||

| 4.2.1 | Introduction | 4-1 | ||

| 4.2.2 | Mineral Tenure | 4-1 | ||

| 4.2.3 | Surface Rights | 4-3 | ||

| 4.2.4 | Royalties/Mining Taxes | 4-3 | ||

| 4.2.5 | Environmental Licencing | 4-3 | ||

| 4.2.6 | Social Licence | 4-4 | ||

| 4.2.7 | Water Rights | 4-5 | ||

| 4.2.8 | Fraser Institute Survey | 4-5 | ||

| 4.3 | Project Ownership | 4-6 | ||

| 4.4 | Mineral Tenure | 4-6 | ||

| 4.5 | Surface Rights | 4-6 | ||

| 4.6 | Royalties and Encumbrances | 4-6 | ||

| 4.7 | Property Agreements | 4-8 | ||

| 4.8 | Permits | 4-8 | ||

| 4.9 | Environmental Liabilities | 4-8 | ||

| 4.10 | Social License | 4-8 | ||

| 4.11 | Comments on Section 4 | 4-8 | ||

| 5.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 | ||

| 5.1 | Accessibility | 5-1 | ||

| 5.2 | Climate | 5-1 | ||

| 5.3 | Local Resources and Infrastructure | 5-1 | ||

| 5.4 | Physiography | 5-3 | ||

| 5.5 | Comments on Section 5 | 5-3 | ||

| 6.0 | HISTORY | 6-1 | ||

| 6.1 | Exploration History | 6-1 | ||

| 6.2 | Production History | 6-2 | ||

| 7.0 | GEOLOGICAL SETTING AND MINERALIZATION | 7-1 | ||

| 7.1 | Regional Geology | 7-1 | ||

| 7.2 | Project Geology | 7-4 | ||

| 7.2.1 | Lithologies | 7-4 | ||

| 7.2.2 | Structure | 7-4 | ||

| 7.2.3 | Metamorphism | 7-7 | ||

| 7.2.4 | Alteration | 7-8 | ||

| 7.2.5 | Mineralization | 7-8 | ||

| 7.2.6 | Weathering | 7-10 | ||

| 7.2.7 | Mineralization Age | 7-11 | ||

| 7.3 | Deposit Descriptions | 7-11 | ||

| 7.4 | Comments on Section 7 | 7-18 | ||

| 8.0 | DEPOSIT TYPES | 8-1 | ||

| March 2016

Project Number:179678 |

TOC ii | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 8.1 | Comments on Section 8 | 8-3 | ||

| 9.0 | EXPLORATION | 9-1 | ||

| 9.1 | Exploration History | 9-1 | ||

| 9.2 | Grids and Surveys | 9-1 | ||

| 9.3 | Geological Mapping | 9-1 | ||

| 9.4 | Geochemical Sampling | 9-2 | ||

| 9.5 | Geophysics | 9-2 | ||

| 9.5.1 | Gamma-Spectrometric Survey | 9-2 | ||

| 9.5.2 | Ground Magnetometric Survey | 9-3 | ||

| 9.5.3 | IP Survey | 9-3 | ||

| 9.5.4 | Ground Transient Electromagnetic Survey | 9-7 | ||

| 9.5.5 | Airborne Gravity Survey | 9-7 | ||

| 9.6 | Petrology, Mineralogy, and Research Studies | 9-7 | ||

| 9.7 | Exploration Potential | 9-11 | ||

| 9.8 | Comments on Section 9 | 9-11 | ||

| 10.0 | DRILLING | 10-1 | ||

| 10.1 | Drill Methods | 10-1 | ||

| 10.2 | Geological Logging | 10-1 | ||

| 10.2.1 | Legacy | 10-1 | ||

| 10.2.2 | SMSA (1997) | 10-1 | ||

| 10.2.3 | SMSA/CVRD (2002–2003) | 10-4 | ||

| 10.3 | Recovery | 10-5 | ||

| 10.4 | Collar Surveys | 10-5 | ||

| 10.5 | Downhole Surveys | 10-5 | ||

| 10.6 | Geotechnical and Hydrological Drilling | 10-5 | ||

| 10.7 | Metallurgical Drilling | 10-5 | ||

| 10.8 | Sample Length/True Thickness | 10-7 | ||

| 10.9 | Comments on Section 10 | 10-7 | ||

| 11.0 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-1 | ||

| 11.1 | Sampling Methods | 11-1 | ||

| 11.1.1 | Drill Core | 11-1 | ||

| 11.1.2 | Grade-Control Sampling | 11-1 | ||

| 11.2 | Metallurgical Sampling | 11-1 | ||

| 11.3 | Bulk Density and Specific Gravity Determinations | 11-3 | ||

| 11.4 | Analytical and Test Laboratories | 11-3 | ||

| 11.5 | Sample Preparation and Analysis | 11-5 | ||

| 11.5.1 | Legacy | 11-5 | ||

| 11.5.2 | CVRD (2002–2003) | 11-5 | ||

| 11.5.3 | Grade Control Samples | 11-6 | ||

| 11.6 | Quality Assurance and Quality Control | 11-10 | ||

| 11.6.1 | Legacy | 11-10 | ||

| 11.6.2 | Current Quality Control | 11-11 | ||

| 11.7 | Databases | 11-12 | ||

| 11.8 | Sample Security | 11-13 | ||

| 11.9 | Sample Storage | 11-13 | ||

| March 2016

Project Number:179678 |

TOC iii | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 11.10 | Comments on Section 11 | 11-14 | ||

| 12.0 | DATA VERIFICATION | 12-1 | ||

| 12.1 | Major Mining Studies | 12-1 | ||

| 12.2 | External Audits and Reviews | 12-1 | ||

| 12.3 | Amec Foster Wheeler Reviews | 12-1 | ||

| 12.4 | Comments on Section 12 | 12-2 | ||

| 13.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 | ||

| 13.1 | Metallurgical Testwork | 13-1 | ||

| 13.1.1 | Variability Tests | 13-1 | ||

| 13.1.2 | High Pressure Grind Roll Trade-off Study (2006) | 13-5 | ||

| 13.1.3 | Mixed Ore Zone Copper Recovery Testwork | 13-6 | ||

| 13.2 | Recovery Estimates | 13-8 | ||

| 13.3 | Metallurgical Variability | 13-10 | ||

| 13.4 | Deleterious Elements | 13-10 | ||

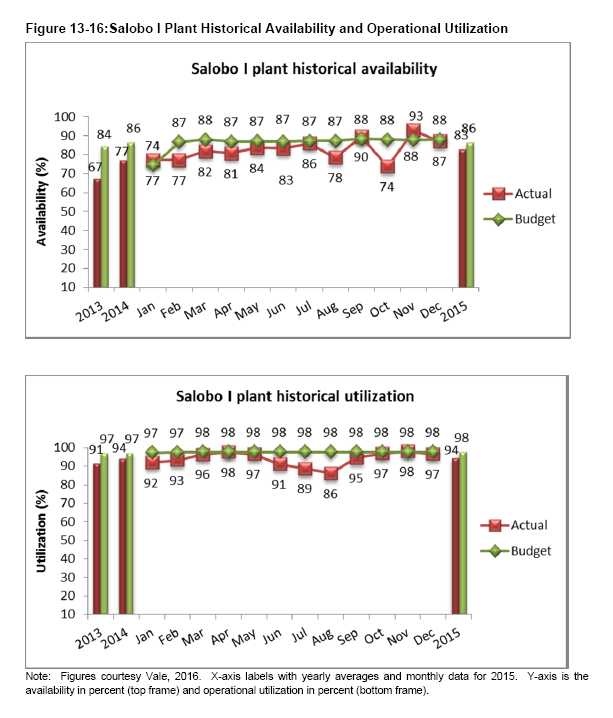

| 13.5 | Actual Plant Results versus Budgeted Projections | 13-13 | ||

| 13.5.1 | Historical Metallurgical Results | 13-13 | ||

| 13.5.2 | Historical Plant Utilization | 13-16 | ||

| 13.6 | Comments on Section 13 | 13-21 | ||

| 14.0 | MINERAL RESOURCE ESTIMATES | 14-1 | ||

| 14.1 | Introduction | 14-1 | ||

| 14.2 | Geological Models | 14-1 | ||

| 14.3 | Grade Capping / Outlier Restrictions | 14-2 | ||

| 14.4 | Composites | 14-2 | ||

| 14.5 | Exploratory Data Analysis | 14-6 | ||

| 14.5.1 | Declustering | 14-6 | ||

| 14.5.2 | Original Sample Statistics | 14-6 | ||

| 14.5.3 | Composite Statistics | 14-6 | ||

| 14.5.4 | Contact Analysis | 14-7 | ||

| 14.6 | Variography | 14-7 | ||

| 14.6.1 | Block Model Dimensions | 14-7 | ||

| 14.7 | Block Model Assignments | 14-7 | ||

| 14.7.1 | Lithology | 14-7 | ||

| 14.7.2 | Mineralization/Grade Shells | 14-9 | ||

| 14.7.3 | Density | 14-9 | ||

| 14.8 | Estimation/Interpolation Method | 14-9 | ||

| 14.9 | Block Model Validation | 14-10 | ||

| 14.9.1 | Block Model Visual Validation | 14-10 | ||

| 14.9.2 | Global Grade Bias Check | 14-10 | ||

| 14.9.3 | Local Grade Bias Check | 14-10 | ||

| 14.9.4 | Selectivity Check | 14-15 | ||

| 14.9.5 | Reconciliation with Production | 14-15 | ||

| 14.10 | Classification of Mineral Resources | 14-15 | ||

| 14.11 | Reasonable Prospects of Eventual Economic Extraction | 14-19 | ||

| 14.12 | Mineral Resource Statement | 14-21 | ||

| 14.13 | Factors That May Affect the Mineral Resource Estimate | 14-21 | ||

| March 2016

Project Number:179678 |

TOC iv | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 14.14 | Comments on Section 14 | 14-23 | ||

| 15.0 | MINERAL RESERVE ESTIMATES | 15-1 | ||

| 15.1 | Introduction | 15-1 | ||

| 15.2 | Mineral Reserves Statement | 15-1 | ||

| 15.3 | Factors That May Affect the Mineral Reserve Estimate | 15-1 | ||

| 15.4 | Pit Optimization | 15-4 | ||

| 15.4.1 | Selective Mining Unit Sizing | 15-5 | ||

| 15.4.2 | Surface Topography | 15-5 | ||

| 15.4.3 | Density and Moisture | 15-6 | ||

| 15.4.4 | Pit Slope Angles | 15-6 | ||

| 15.4.5 | Mining Costs | 15-7 | ||

| 15.4.6 | Consideration of Dilution, Mining Losses and Reconciliation | 15-7 | ||

| 15.4.7 | Plant Recovery | 15-12 | ||

| 15.5 | Pit and Phase Selection | 15-12 | ||

| 15.5.1 | Final Pit Design | 15-12 | ||

| 15.6 | Comments on Section 15 | 15-15 | ||

| 16.0 | MINING METHODS | 16-1 | ||

| 16.1 | Overview | 16-1 | ||

| 16.2 | Geotechnical Considerations | 16-1 | ||

| 16.3 | Consideration of Marginal Cutoff Grades and Dilution | 16-2 | ||

| 16.4 | Production Schedule | 16-4 | ||

| 16.5 | Grade Control | 16-9 | ||

| 16.6 | Mining Equipment | 16-9 | ||

| 16.7 | Blasting and Explosives | 16-11 | ||

| 16.8 | Comments on Section 16 | 16-12 | ||

| 17.0 | RECOVERY METHODS | 17-1 | ||

| 17.1 | Process Flowsheet | 17-1 | ||

| 17.2 | Plant Design | 17-2 | ||

| 17.3 | Energy, Water, and Process Materials Requirements | 17-6 | ||

| 17.4 | Comments on Section 17 | 17-6 | ||

| 18.0 | PROJECT INFRASTRUCTURE | 18-1 | ||

| 18.1 | Road and Logistics | 18-1 | ||

| 18.2 | Stockpiles and Waste Rock Storage Facilities | 18-1 | ||

| 18.3 | Tailings Storage Facilities | 18-4 | ||

| 18.4 | Water Management | 18-4 | ||

| 18.5 | Site Infrastructure | 18-4 | ||

| 18.6 | Power and Electrical | 18-4 | ||

| 18.7 | Fuel | 18-5 | ||

| 18.8 | General Waste | 18-5 | ||

| 18.9 | Water Supply | 18-5 | ||

| 18.10 | Comments on Section 18 | 18-6 | ||

| 19.0 | MARKET STUDIES AND CONTRACTS | 19-1 | ||

| 19.1 | Market Studies | 19-1 | ||

| 19.2 | Commodity Price Projections | 19-2 | ||

| March 2016

Project Number:179678 |

TOC v | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 19.3 | Contracts | 19-2 | ||

| 19.4 | Comments on Section 19 | 19-3 | ||

| 20.0 | ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY | |||

| IMPACT | 20-1 | |||

| 20.1 | Baseline Studies | 20-1 | ||

| 20.1.1 | Atmospheric Conditions | 20-1 | ||

| 20.1.2 | Terrestrial Environment | 20-2 | ||

| 20.1.3 | Aquatic Environment | 20-4 | ||

| 20.1.4 | Socioeconomic | 20-4 | ||

| 20.1.5 | Heritage | 20-5 | ||

| 20.2 | Environmental Considerations | 20-5 | ||

| 20.2.1 | Air Quality | 20-5 | ||

| 20.2.2 | Waste Characterization | 20-5 | ||

| 20.2.3 | Environmental Control Plan | 20-6 | ||

| 20.3 | Stockpiles and Waste Rock Storage Facilities | 20-6 | ||

| 20.4 | Tailings Storage Facility | 20-8 | ||

| 20.4.1 | Site Investigation and Characterization | 20-8 | ||

| 20.4.2 | Tailings Characterization | 20-11 | ||

| 20.4.3 | Tailings Storage Facility Design Considerations | 20-12 | ||

| 20.4.4 | Tailings Storage Facility Water Management | 20-15 | ||

| 20.4.5 | Construction and Operations | 20-18 | ||

| 20.4.6 | Future Planning | 20-19 | ||

| 20.5 | Water Management | 20-19 | ||

| 20.6 | Closure Plan | 20-23 | ||

| 20.7 | Permitting | 20-23 | ||

| 20.8 | Considerations of Social and Community Impacts | 20-25 | ||

| 20.9 | Comments on Section 20 | 20-26 | ||

| 21.0 | CAPITAL AND OPERATING COSTS | 21-1 | ||

| 21.1 | Capital Cost Estimates | 21-1 | ||

| 21.1.1 | Basis of Estimate | 21-1 | ||

| 21.1.2 | Mine Capital Costs | 21-1 | ||

| 21.1.3 | Process Capital Costs | 21-1 | ||

| 21.1.4 | Sustaining Capital | 21-1 | ||

| 21.1.5 | Capital Cost Summary | 21-2 | ||

| 21.2 | Operating Cost Estimates | 21-2 | ||

| 21.2.1 | Basis of Estimate | 21-2 | ||

| 21.2.2 | Mine Operating Costs | 21-3 | ||

| 21.2.3 | Process Operating Costs | 21-3 | ||

| 21.2.4 | Operating Cost Summary | 21-6 | ||

| 21.3 | Comments on Section 21 | 21-6 | ||

| 22.0 | ECONOMIC ANALYSIS | 22-1 | ||

| 23.0 | ADJACENT PROPERTIES | 23-1 | ||

| 24.0 | OTHER RELEVANT DATA AND INFORMATION | 24-1 | ||

| 24.1 | Opportunities | 24-1 | ||

| March 2016

Project Number:179678 |

TOC vi | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 24.1.1 | Exploration | 24-1 | ||

| 24.1.2 | Mining | 24-1 | ||

| 24.1.3 | Process | 24-1 | ||

| 24.1.4 | Economic Analysis | 24-1 | ||

| 24.2 | Risks | 24-2 | ||

| 24.2.1 | Mining | 24-2 | ||

| 24.2.2 | Process | 24-2 | ||

| 24.2.3 | Water Treatment and Tailings | 24-2 | ||

| 24.2.4 | Legislation | 24-2 | ||

| 25.0 | INTERPRETATION AND CONCLUSIONS | 25-1 | ||

| 25.1 | Mineral Tenure, Surface Rights, Royalties and Agreements | 25-1 | ||

| 25.2 | Geology and Mineralization | 25-1 | ||

| 25.3 | Exploration, Drilling and Analytical Data Collection in Support of Mineral Resource Estimation | 25-1 | ||

| 25.4 | Metallurgical Testwork | 25-2 | ||

| 25.5 | Mineral Resource Estimates | 25-3 | ||

| 25.6 | Mineral Reserve Estimates | 25-3 | ||

| 25.7 | Mining Plan | 25-4 | ||

| 25.8 | Recovery Plan | 25-4 | ||

| 25.9 | Infrastructure | 25-5 | ||

| 25.10 | Environmental, Permitting and Social Considerations | 25-5 | ||

| 25.11 | Markets and Contracts | 25-7 | ||

| 25.12 | Capital Cost Estimates | 25-7 | ||

| 25.13 | Operating Cost Estimates | 25-7 | ||

| 25.14 | Economic Analysis | 25-8 | ||

| 25.15 | Risks and Opportunities | 25-8 | ||

| 26.0 | RECOMMENDATIONS | 26-1 | ||

| 27.0 | REFERENCES | 27-1 | ||

| T A B L E S | ||

| Table 1-1: | Salobo Measured and Indicated Mineral Resources | 1-9 |

| Table 1-2: | Salobo Inferred Mineral Resources | 1-9 |

| Table 1-3: | Mineral Reserves Estimate | 1-12 |

| Table 6-1: | Salobo Production History (2012 to April 2015) | 6-3 |

| Table 7-1: | Project Stratigraphy | 7-6 |

| Table 9-1: | Exploration Summary 1978–2003 | 9-2 |

| Table 10-1: | Drill Hole Summary Table | 10-2 |

| Table 11-1: | Specific Gravity Determinations | 11-4 |

| Table 11-2: | Summary of Primary Laboratories Used for Assaying During Exploration Phase and Main Analysis Methods | 11-4 |

| Table 11-3: | Analytical Package used for Blast-Hole Samples | 11-8 |

| Table 11-4: | Adjustment for Copper Assays for pre-2002 Drilling Programs | 11-12 |

| Table 11-5: | Adjustment for Gold Assays for pre-2002 Drilling Programs | 11-12 |

| March 2016

Project Number:179678 |

TOC vii | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| Table 14-1: | Estimation Domains (Sulphide) | 14-6 |

| Table 14-2: | Composite Sharing During Estimation | 14-8 |

| Table 14-3: | Summary of Copper Variogram Parameters | 14-8 |

| Table 14-4: | Block Model Framework | 14-9 |

| Table 14-5: | Summary of the Block Grade Estimation Plan for Copper, Salobo | 14-11 |

| Table 14-6: | Global Bias Check | 14-14 |

| Table 14-7: | Salobo Long Term to Short Term Feed Ore Reconciliation (January 2014 to June 2015) | 14-16 |

| Table 14-8: | Salobo Mineral Resource Open Pit Optimization Technical and Economic Parameters Summary | 14-20 |

| Table 14-9: | Salobo Mineral Resource 0.286% CuEq Cutoff Grade Optimization Technical and Economic Parameters Summary | 14-20 |

| Table 14-10: | Salobo Measured and Indicated Mineral Resources | 14-22 |

| Table 14-11: | Salobo Inferred Mineral Resources | 14-22 |

| Table 15-1: | Mineral Reserves Estimate | 15-3 |

| Table 15-2: | Pit Optimization Parameters | 15-5 |

| Table 15-3: | Geotechnical Design Sectors | 15-8 |

| Table 15-4: | Mining Cost Assumptions | 15-10 |

| Table 15-5: | Mine Design Criteria | 15-16 |

| Table 15-6: | Production by Pit Phase | 15-17 |

| Table 16-1: | Mine Scheduling Capacity | 16-5 |

| Table 16-2: | LOMP Schedule | 16-6 |

| Table 16-3: | Low Grade Stockpile to Plant Schedule | 16-8 |

| Table 16-4: | Mine Fleet Requirements | 16-10 |

| Table 17-1: | Major Process Equipment | 17-7 |

| Table 19-1: | Commodity Price Projections | 19-3 |

| Table 19-2: | Exchange Rate Projections | 19-3 |

| Table 20-1: | Stockpile and Waste Rock Facility Design Parameters | 20-7 |

| Table 20-2: | Tailings Storage Facility Key Design Parameters | 20-9 |

| Table 20-3: | Tailings Characteristics | 20-12 |

| Table 20-4: | Salobo TSF Instrumentation | 20-20 |

| Table 20-5: | Salobo TSF Proposed Embankment Lifts | 20-20 |

| Table 20-6: | Water Capture Dam Key Design Criteria | 20-21 |

| Table 20-7: | Key Federal Environmental Permits | 20-25 |

| Table 21-1: | Sustaining Capital ($US M) | 21-3 |

| Table 21-2: | Sustaining Capital – Process ($US M) | 21-3 |

| Table 21-3: | Plant Operating Costs per Compilation in SAP – Q4 2014 | 21-5 |

| Table 21-4: | Projected Process Plant Operating Costs | 21-6 |

| Table 21-5: | Comparison of Historical and Adjusted Projected Processing Costs | 21-6 |

| F I G U R E S | ||

| Figure 1-1: | Life-of-Mine Mine Schedule | 1-11 |

| Figure 2-1: | Location Plan | 2-2 |

| Figure 2-2: | Longitudinal Section Showing Mineral Resources and Mineral Reserves | 2-3 |

| Figure 4-1: | Mineral Tenure Layout Plan | 4-7 |

| March 2016

Project Number:179678 |

TOC viii | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| Figure 5-1: | General Access Plan showing Locations of Key Regional Infrastructure | 5-2 |

| Figure 7-1: | Simplified Geology Map of the South American Platform (A), showing Location of the Carajás Province (B) | 7-2 |

| Figure 7-2: | Simplified Regional Geology of the Carajás Province Showing Major Deposits | 7-3 |

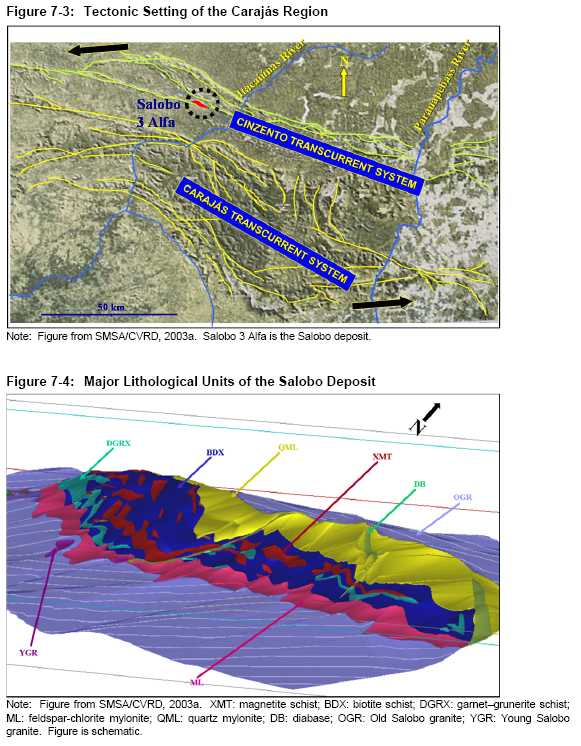

| Figure 7-3: | Tectonic Setting of the Carajás Region | 7-5 |

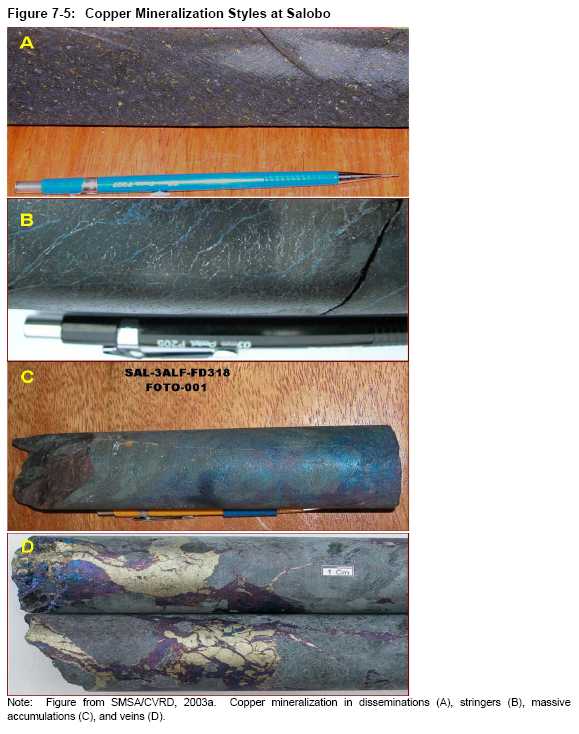

| Figure 7-4: | Major Lithological Units of the Salobo Deposit | 7-5 |

| Figure 7-5: | Copper Mineralization Styles at Salobo | 7-9 |

| Figure 7-6: | Oxide-Copper Mineralization Filling Fractures at the Transition Zone | 7-12 |

| Figure 7-7: | Mineralized Bodies after the 1997–1998 Geological Modeling | 7-12 |

| Figure 7-8: | Lithology Model showing Main Mineralized Units (BDX, XMT and DGRX) in Plan View -150 m | 7-13 |

| Figure 7-9: | Lithology Model showing Main Mineralized Units (BDX, XMT and DGRX) in Plan View -450 m | 7-14 |

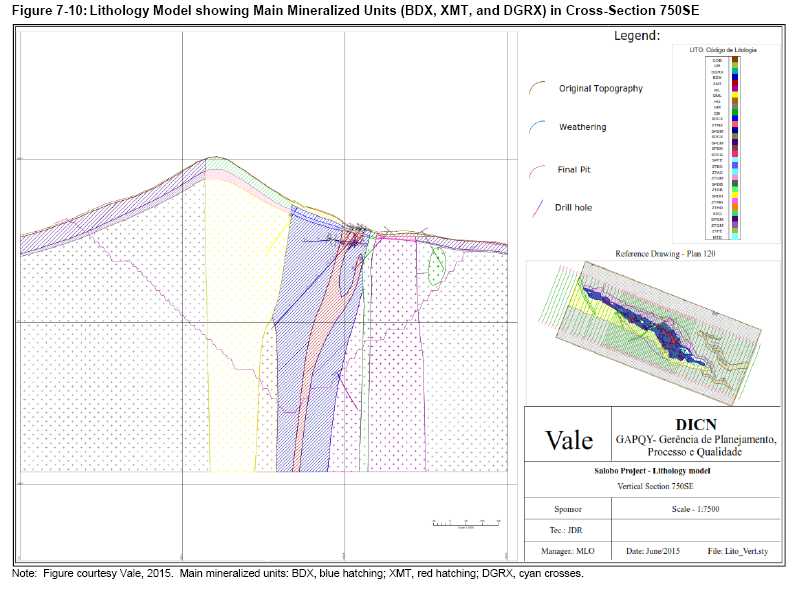

| Figure 7-10: | Lithology Model showing Main Mineralized Units (BDX, XMT, and DGRX) in Cross- Section 750SE | 7-15 |

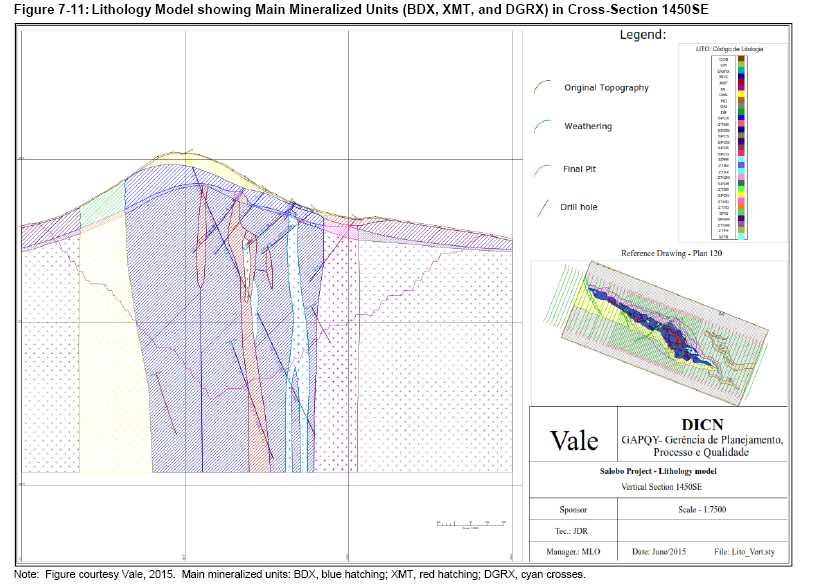

| Figure 7-11: | Lithology Model showing Main Mineralized Units (BDX, XMT, and DGRX) in Cross- Section 1450SE | 7-16 |

| Figure 7-12: | Lithology Model Codes and Colour Codes for Figure 7-8 to Figure 7-11 | 7-17 |

| Figure 8-1: | Cartoon Schematic, IOCG Deposit | 8-3 |

| Figure 9-1: | Ternary Radiometric Map | 9-4 |

| Figure 9-2: | Analytical Signal Map | 9-5 |

| Figure 9-3: | Chargeability Map | 9-6 |

| Figure 9-4: | TEM Resistivity Pseudo-Section along Line 1300 E | 9-8 |

| Figure 9-5: | Coincident Magnetic and Gravimetric Anomalies | 9-9 |

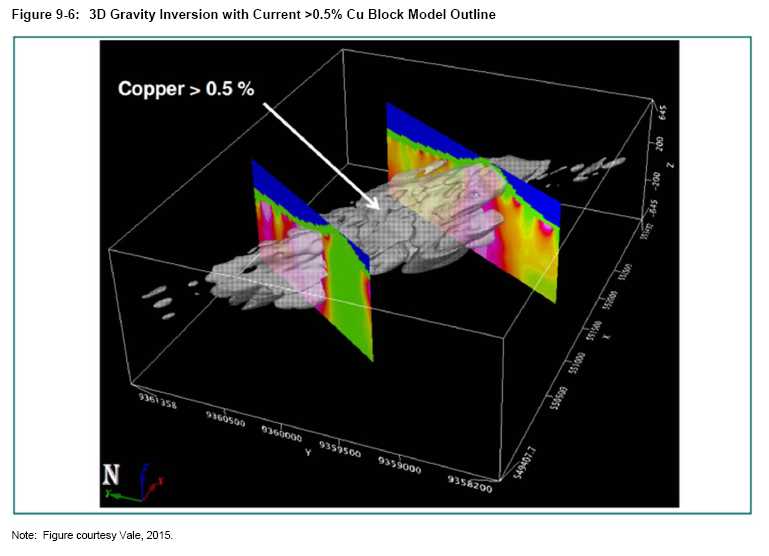

| Figure 9-6: | 3D Gravity Inversion with Current >0.5% Cu Block Model Outline | 9-10 |

| Figure 10-1: | Geological Drill-Hole Location Plan by Campaigns | 10-3 |

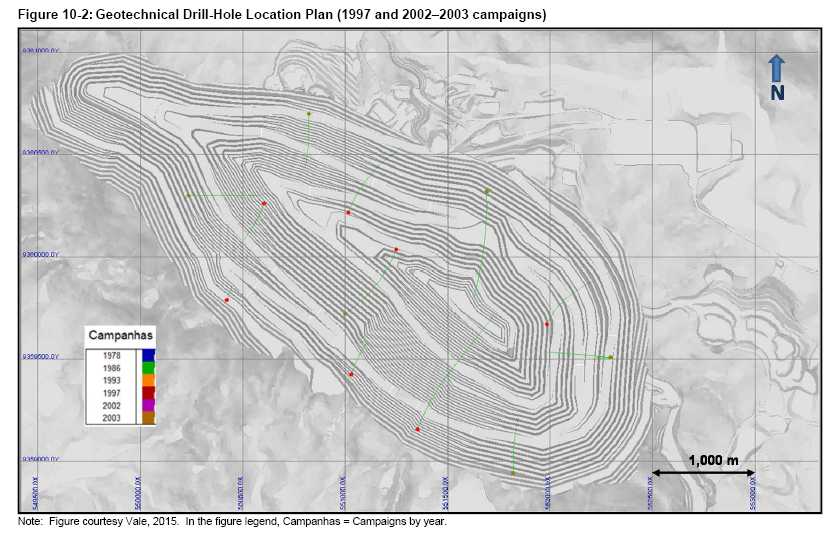

| Figure 10-2: | Geotechnical Drill-Hole Location Plan (1997 and 2002–2003 campaigns) | 10-6 |

| Figure 11-1: | Blast-Hole Sampling Pattern | 11-2 |

| Figure 11-2: | Blasthole Sampling at Salobo | 11-2 |

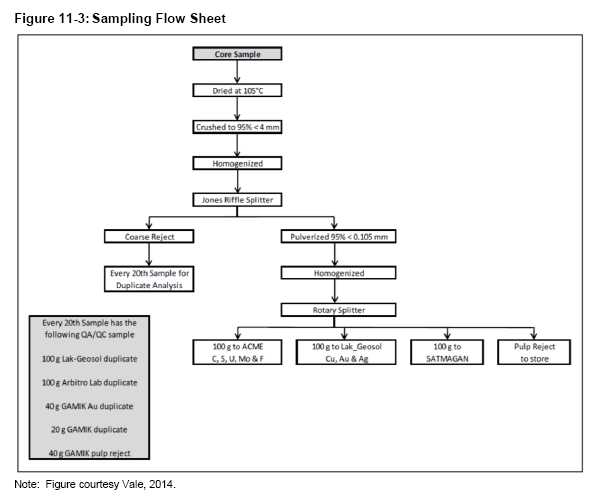

| Figure 11-3: | Sampling Flow Sheet | 11-6 |

| Figure 11-4: | Assay Room at the Salobo Laboratory | 11-8 |

| Figure 11-5: | Mettler-Toledo Ion-Selective Electrode Instrument for F Analysis | 11-9 |

| Figure 11-6: | Drill Core Storage | 11-13 |

| Figure 13-1: | Copper Recoveries in 2003–2004 Variability Testwork | 13-3 |

| Figure 13-2: | Gold Recoveries from Variability and LCT Testwork Programs | 13-3 |

| Figure 13-3: | Derivation of Copper Recovery Projection, 2003–2004 Variability Testwork | 13-4 |

| Figure 13-4: | Derivation of Gold Recovery Projection from Variability Testwork | 13-4 |

| Figure 13-5: | Testwork with Mixed Ore – Effect of Dispersant and Collector Dosage | 13-7 |

| Figure 13-6: | Expected Metallurgy of Various Sulphide-Mixed Ore Blends | 13-7 |

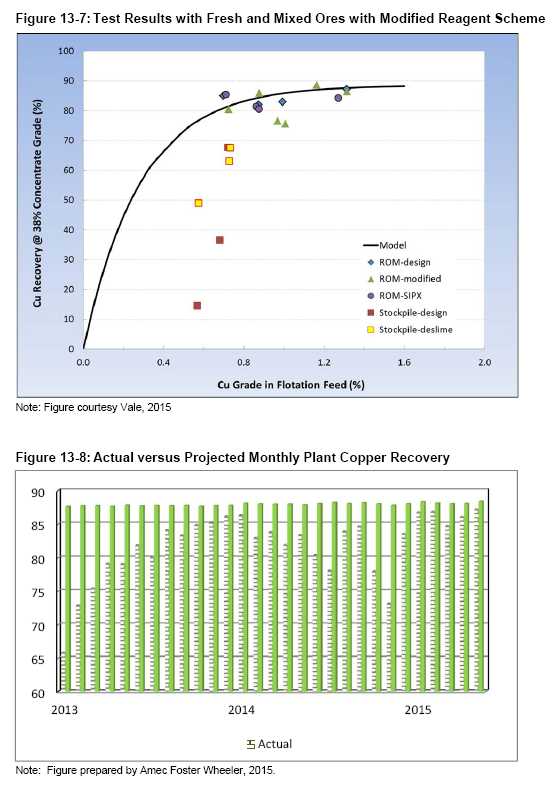

| Figure 13-7: | Test Results with Fresh and Mixed Ores with Modified Reagent Scheme | 13-9 |

| Figure 13-8: | Actual versus Projected Monthly Plant Copper Recovery | 13-9 |

| Figure 13-9: | Actual versus Projected Monthly Plant Gold Recovery | 13-10 |

| Figure 13-10: | Evolution of Fluorine Content in Cu Concentrate | 13-12 |

| Figure 13-11: | Evolution of Chlorine Content in Cu Concentrate | 13-12 |

| Figure 13-12: | Historical Plant Performance – Cu Recovery | 13-14 |

| Figure 13-13: | Historical Plant Performance – Au Recovery | 13-14 |

| March 2016

Project Number:179678 |

TOC ix | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| Figure 13-14: | Historical Plant Performance – Ag Recovery | 13-15 |

| Figure 13-15: | Historical Plant Performance – Concentrate Cu Grade | 13-15 |

| Figure 13-16: | Salobo I Plant Historical Availability and Operational Utilization | 13-17 |

| Figure 13-17: | Salobo II Plant Historical Availability and Operated Utilization | 13-18 |

| Figure 13-18: | Number of Unplanned Feed Interruptions to Grinding Lines | 13-20 |

| Figure 13-19: | Average Duration of Feed Interruptions to Grinding Lines | 13-20 |

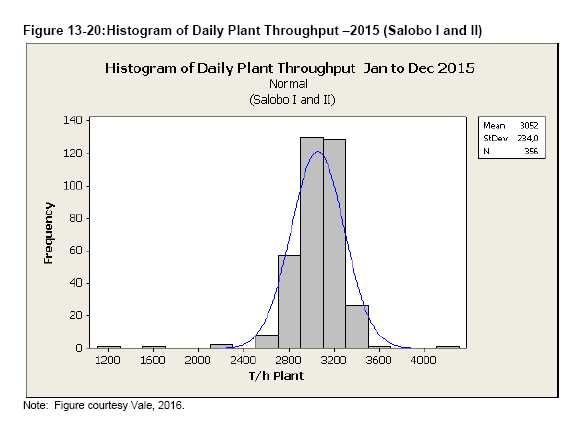

| Figure 13-20: | Histogram of Daily Plant Throughput –2015 (Salobo I and II) | 13-21 |

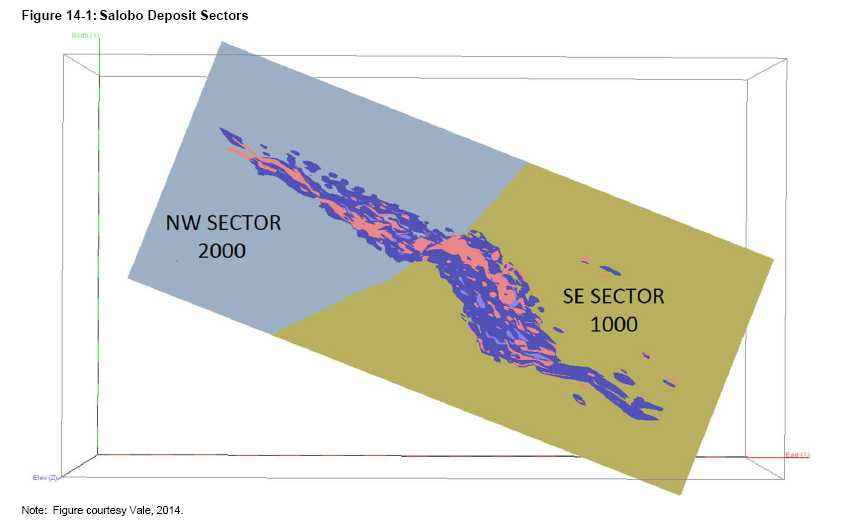

| Figure 14-1: | Salobo Deposit Sectors | 14-3 |

| Figure 14-2: | Lithology Model – Section 950SE (looking west) | 14-4 |

| Figure 14-3: | Cu Grade Shell Model – Section 950SE (looking west) | 14-5 |

| Figure 14-4: | `Low Grade to High Grade Shell Cu and Au Contact Plots | 14-8 |

| Figure 14-5: | Copper Composites and Copper Block Grades in Plan View at 120 Elevation | 14-12 |

| Figure 14-6: | Copper composites and Copper Block Grades in Section at 1700SE (looking west) | 14-13 |

| Figure 14-7: | Copper Swath Plots for Sector 1 Low (1103) and High (1203) Grade Domains | 14-14 |

| Figure 14-8: | Mineral Resource Classification in Plan View at 0 Elevation | 14-17 |

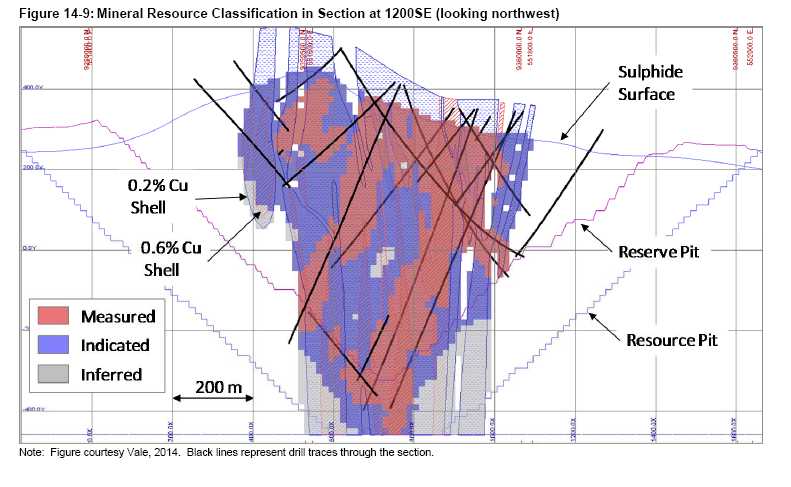

| Figure 14-9: | Mineral Resource Classification in Section at 1200SE (looking northwest) | 14-18 |

| Figure 15-1: | Life of Mine Planning Sequence | 15-2 |

| Figure 15-2: | Sensitivity to Pit Optimization Input Variables | 15-4 |

| Figure 15-3: | Plan View of Geotechnical Design Sectors | 15-9 |

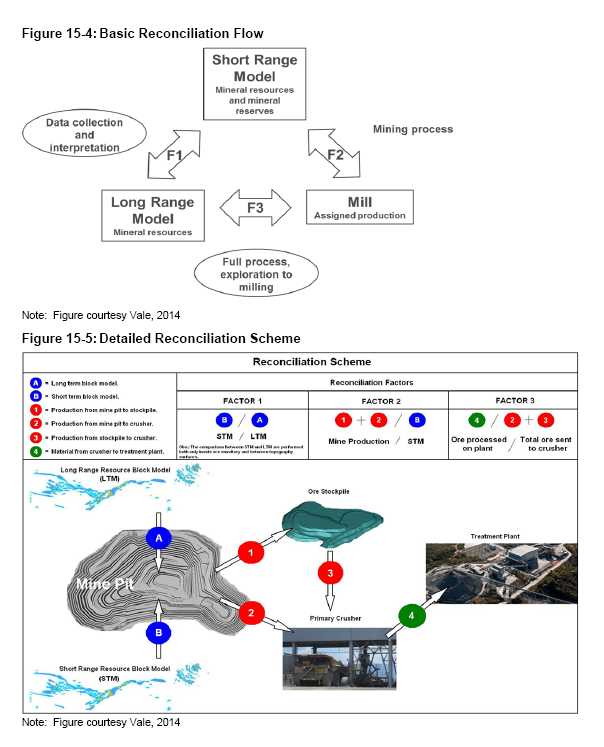

| Figure 15-4: | Basic Reconciliation Flow | 15-11 |

| Figure 15-5: | Detailed Reconciliation Scheme | 15-11 |

| Figure 15-6: | Pit by Pit Graph | 15-13 |

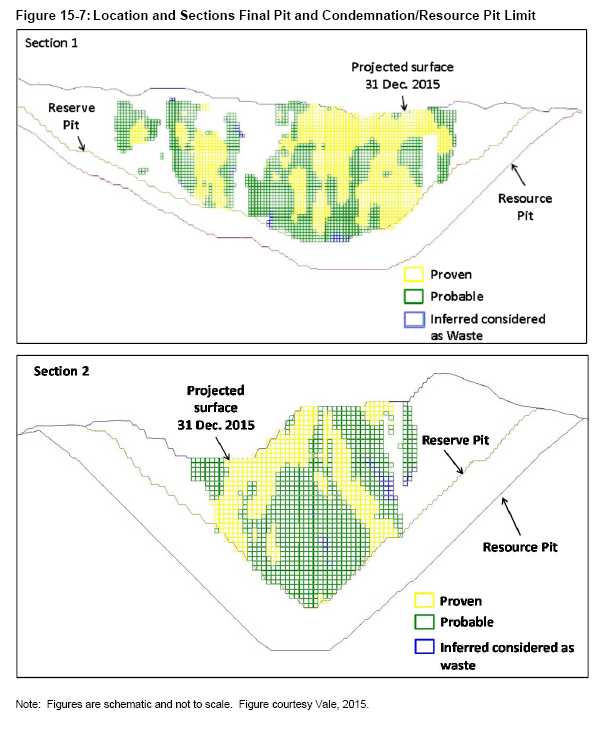

| Figure 15-7: | Location and Sections Final Pit and Condemnation/Resource Pit Limit | 15-14 |

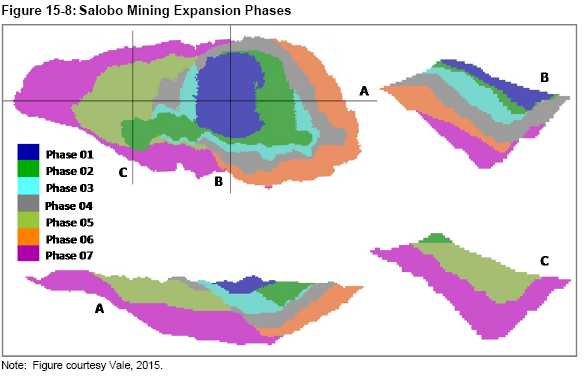

| Figure 15-8: | Salobo Mining Expansion Phases | 15-16 |

| Figure 16-1: | Open Pit Wall, June, 2015 (looking northwest) | 16-3 |

| Figure 16-2: | Mining per Phase per Year | 16-5 |

| Figure 16-3: | Life-of-Mine Mine Schedule | 16-7 |

| Figure 17-1: | Simplified Process Flowsheet | 17-3 |

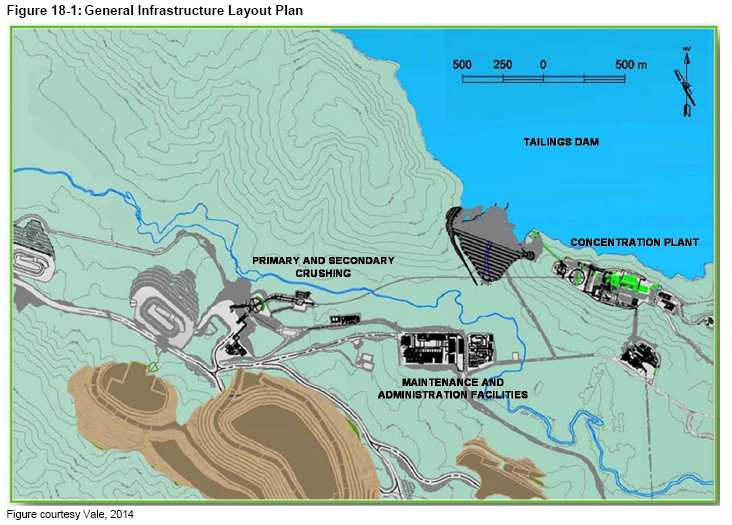

| Figure 18-1: | General Infrastructure Layout Plan | 18-2 |

| Figure 20-1: | Mine Location in Relation to Forest Reserves | 20-3 |

| Figure 20-2: | Salobo Tailings Storage Facility Final Footprint | 20-10 |

| Figure 20-3: | Volume and Area versus Elevation Curves | 20-14 |

| Figure 20-4: | Layout of Tailings Transport and Deposition Points | 20-14 |

| Figure 20-5: | Photograph Looking South from Dam Crest Displaying Spillway Chute, Downstream Face of the TSF Embankment and Geotechnical Drill Rig at the Toe | 20-16 |

| Figure 20-6: | Photograph from Dam Crest Looking North Displaying Water Reclaim Pumps | 20-17 |

| Figure 20-7: | Salobo TSF Water Balance Schematic | 20-17 |

| Figure 20-8: | Simplified Schematic of Mine Components and Water Flows at Salobo | 20-21 |

| Figure 20-9: | Water Capture Dam Volume/Area v Elevation Curve | 20-22 |

| Figure 20-10 | Water Capture Dam and Spillway General Layout Plan | 20-22 |

| March 2016

Project Number:179678 |

TOC x | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 1.0 |

SUMMARY |

| 1.1 |

Introduction |

Silver Wheaton Corp. (Silver Wheaton) requested that Amec Foster Wheeler Americas Limited (Amec Foster Wheeler) prepare an independent technical report (the Report) in compliance with the requirements of National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and Form 43–101F1 Technical Report on the Salobo open pit mining operations (Salobo Operations or the Project), located in northern Brazil, in the southeastern portion of Pará State.

The Salobo Operations comprise the Salobo open pit copper–gold mine (Salobo Mine).

| 1.2 |

Terms of Reference |

The corporate entity that conducts the mining operations is Salobo Metais SA (SMSA), an indirectly wholly-owned subsidiary of Vale SA. For the purposes of this Report, unless otherwise noted, Vale SA and Salobo Metais SA will be referred to interchangeably as Vale.

Silver Wheaton’s interest in the Salobo Operations is restricted to a metal streaming agreement that applies to 50% of the gold produced as a byproduct at the Salobo Mine for the life of the mine (the streaming agreement).

The Report was prepared to support Silver Wheaton’s scientific and technical disclosure on the Salobo Operations in their Annual Information Form for the year ending 31 December, 2015.

Mineral Resources and Mineral Reserves are reported with reference to the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014; the 2014 CIM Definition Standards) and the CIM Estimation of Mineral Resources and Mineral Reserves

| 1.3 |

Project Setting |

The Salobo Operations are located approximately 90 km northwest of Carajás. An all-weather road network connects the mine site to the cities of Parauapebas (90 km), Marabá (240 km), and the commercial airport at Carajás. Railroads link Parauapebas with the port city of São Luis.

The Project is located in the Carajás mountain range in the eastern Amazon humid tropical rainforest. Temperatures range from 20.8°C to 37.8°C with an average relative humidity of 80.5% . Mean annual rainfall is 1,920 mm and evaporation is 1,500 mm. Winds are predominantly from the north and west. Mining operations are conducted year-round.

| March 2016

Project Number:179678 |

Page 1-1 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 1.4 |

Mineral Tenure, Surface Rights, Royalties and Agreements |

The Salobo Operations are owned by Vale SA.

The Salobo Operations consists of one mine, the Salobo Mine, which is located within one claim, Exploration Permit No. 1121, which was granted on 14 July, 1987 and encompasses 9,180.61 ha.

Brazilian legislation separates surface ownership from sub-surface ownership. A mining company can operate a mine even if does not own the surface; however, in this case a royalty has to be paid to the surface owner. The royalty is calculated as 50% of the Compensation for the Exploitation of Mineral Resources (Compensação Financeira pela Exploração de Recursos Minerais or CFEM) and is paid to the government. Silver Wheaton Corp (Silver Wheaton) has acquired 50% of the gold produced as a byproduct at the Salobo Mine for the life of the mine (the streaming agreement). Silver Wheaton will make ongoing payments of the lesser of US$400 (subject to a 1% annual inflation adjustment commencing in 2017) and the prevailing market price for each ounce of gold delivered under the streaming agreement.

There are no other property agreements relevant to the Salobo Operations.

| 1.5 |

Geology and Mineralization |

The deposit is considered to be an example of an iron oxide–copper–gold (IOCG) deposit. Global examples include Olympic Dam in Australia, Candelaria–Punta del Cobre in Chile, and Sossego in Brazil.

The Salobo deposit is hosted in the Carajás Mining District within Carajás Province, a sigmoidal-shaped, west–northwest–east–southeast-trending late Archean basin.

The Archean basin contains a basement assemblage that is dominated by granite–tonalitic ortho-gneisses of the Pium Complex, and amphibolite, gneisses and migmatites of the Xingu Complex. The basement rocks are overlain by volcanic and sedimentary rocks of the Itacaiúnas Supergroup, which includes the Igarapé Salobo Group, the Igarapé Pojuca Group, Grão Pará Group and the Igarapé Bahia Group. The Itacaiúnas Supergroup hosts all the Carajás IOCG deposits, including Salobo. Mineralization at the Salobo deposit is hosted by upper-greenschist-to-lower-amphibolite-metamorphosed rocks of the Igarapé Salobo Group. The major host units are biotite and magnetite schists. The Salobo hydrothermal system has a core of massive magnetite that is surrounded by less intensely altered rocks. Away from the massive magnetite, the magnetite content gradually diminishes, giving way to biotite–garnet schist and/or garnet–grunerite schist.

| March 2016

Project Number:179678 |

Page 1-2 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

The deposit extends over an area of approximately 4 km along strike (west–northwest), is 100–600 m wide, and has been recognized to depths of 750 m below the surface. The Salobo mineralization is limited in strike extent, but remains open at depth below the current design pit.

Sulphide mineralization typically consists of assemblages of magnetite–chalcopyrite–bornite and magnetite–bornite–chalcocite. Accessory minerals include hematite, molybdenite, ilmenite, uraninite, graphite, digenite, covellite, and sulphosalts.

| 1.6 |

History |

Copper mineralization was discovered by a Vale predecessor company in the Igarapé Salobo region in 1974. Detailed exploration commenced in 1977. Initial exploration efforts included stream sediment sampling, reconnaissance exploration, and ground induced polarization (IP) and magnetometer geophysical surveys. Follow-up work in 1978 identified the presence of copper sulphides in an outcrop of magnetite schists at Salobo. Subsequent work has included geological mapping, additional geophysical surveys, core drilling, exploration adits, Mineral Resource estimation, and metallurgical testwork.

A scoping study was completed in 1981, and pilot studies ran from 1985 to 1987, culminating in the grant of a mining concession. A prefeasibility study was concluded in 1988, an initial feasibility study was conducted in 1998, updates to the feasibility study were undertaken in 2001 and 2002, and a final study was completed in 2004.

The Salobo Mine commenced pre-stripping in 2009. Project ramp-up for Phase I of the Salobo Operations was completed three years later and the first concentrate was shipped in September 2012. In December 2013, the plant processed 898,000 t of ore, which represented 90% of the Phase I nameplate capacity (1 Mt run-of-mine (ROM) per month). Phase II, intended to double the nameplate capacity, was completed in 2014.

| 1.7 |

Drilling and Sampling |

Core drilling commenced in 1978 and was conducted through to 2003 in five different drilling campaigns, for a total of 416 holes (146,674 m) completed for exploration purposes, and an additional 14 drill holes (7,590 m) for geotechnical purposes. Most drill holes were vertical or oriented to the south–southwest, the latter with dips usually ranging from 60° to 70°. However, one campaign included holes with a north–northwest orientation and similar dips. Various holes were also drilled from an adit. No core drilling has occurred since 2003. Blastholes have been drilled since 2009; however, are only used for short-term mine planning purposes.

The drill core was collected, placed in boxes, and delivered by the drilling contractor to the core logging/storage area, where geological and geotechnical logging was carried out. Geologists recorded the major code for lithology, alteration, mineralization, and

| March 2016

Project Number:179678 |

Page 1-3 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

textural characteristic of each 1 m interval, with 10 cm as the definition unit. Geological contacts were logged with higher precision.

Drill collar coordinates were recorded. Collar verification was completed by plotting drill hole locations on plan and in cross-section and comparing with the topographic surface. Current collar surveying of grade-control holes is conducted by company surveyors using high-precision, differential global positioning system (GPS) equipment. Downhole surveys were performed at 3 m intervals downhole, using Reflex DDI (dip and direction pointer), Maxibor Reflex, and gyroscopic instruments.

Due to the subvertical orientation of the mineralized zones, the drill holes intersected them at low angles. As a result the mineralized thickness observed in drill holes does not correspond to the true thickness, which should be determined on a case-by-case basis. The true thickness is significantly smaller than the intersected thickness in most cases.

The quantity and quality of the lithological, geotechnical, collar and downhole survey data collected in the exploration and infill drill programs during the 1997 and later campaigns are sufficient to support Mineral Resource and Mineral Reserve estimation.

Exploration core sample intervals averaged 1 m in mineralized zones, and between 2 m and 4 m in barren zones. One half was bagged and submitted to the mine laboratory for analysis, and the remaining half was retained as backup in the same original boxes.

Blastholes are currently drilled on a 5 m x 5 m (or 5 m x 7 m) grid and are channel sampled. All blastholes located in ore zones are sampled; however, as the blasthole reaches the barren zones, the proportion of sampled holes decreases to include only those holes in the mineralized envelope.

The density determination methodology consisted of the water-displacement method. Specific gravity (SG) was measured on approximately 79,000 samples collected across the entire deposit.

A number of laboratories were used during the core drilling exploration and delineation phases. Copper analysis has consisted of assay of 0.5 g aliquots by multi-acid digestion and atomic absorption spectroscopy (AAS) at Docegeo, the Mineração Morro Velho (MMV) laboratory, and Lakefield Geosol. Gold was assayed by aqua regia leaching, with solvent extraction (MIBX) and AAS determination at Docegeo. MMV used the fire-assay (FA) method with gravimetric finish on 100 g aliquots (0.05 g/t Au detection limit). Lakefield Geosol used FA with AAS finish on 20 g aliquots. Other elements that were regularly analysed for have included carbon, sulphur, silver and fluorine. In the early stages of the exploration program platinum, palladium, nickel, molybdenum and uranium were also analyzed, however, these elements were later excluded from the analytical package.

| March 2016

Project Number:179678 |

Page 1-4 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

Blast-hole samples are prepared and assayed at the Salobo laboratory for copper, gold, iron and sulphur.

The quality control (QC) program implemented at the Salobo Operations varied considerably over time, depending on the primary analytical laboratory used for assaying. Initially, Salobo assigned the responsibility on the insertion of QC samples (standards, blanks and duplicates) to the laboratory. Due to the lack of appropriate QC results for the drilling campaigns prior to 2002, a re-assay campaign was initiated to validate the available analytical data. A total of 51,768 of the original 75,577 samples drilled prior to 2002 were re-assayed to corroborate the original results, and included pulp and coarse reject material whenever possible. Vale concluded that the external assay check review revealed bias for copper and gold assay results, and applied a correction factor to these values.

A total of 1,500 samples from the 2002–2003 drilling program were selected for re-assaying (lote especial) in order to validate the 2002–2003 assay data. Amec Foster Wheeler reviewed the lote especial QC data reported by CVRD (2003), and concluded that copper and gold check assays did not reveal significant biases, and that precision was within acceptable limits. Blanks did not show significant contamination during preparation.

A QC program has been implemented to monitor blast-hole sampling quality. This program includes the insertion of 5% twin samples, 5% field duplicates (Jones splits of the same original sample that are assayed separately) and 5% reference materials (RMs).

| 1.8 |

Data Verification |

Data verification was undertaken on the data collected at the time as part of third-party prepared prefeasibility and feasibility studies: Bechtel, 1988 (prefeasibility study); MRDI, 1997 (updated prefeasibility study); Minorca, 1998 (feasibility study); Aker Kvaerner, 2001 (updated feasibility study); and Fluor JPS, 2004 (final feasibility study). Vale also commissioned a number of third-party consultants to perform independent audits in support of Mineral Resource and Mineral Reserve estimates as follows: MRDI/AMEC, 1997, 2002, 2004; Pincock, Allen and Holt, 2007 and 2008; Snowden, 2009; and Golder Associates, 2010. Micon Consultants completed review of Mineral Resources and Mineral Reserves in support of a technical report filing n the Salobo Operations for Silver Wheaton in 2013.

In addition, Vale has regularly used various internal procedures to verify data quality.

| March 2016

Project Number:179678 |

Page 1-5 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| 1.9 |

Metallurgical Testwork |

Five distinct phases of testwork have been completed and include CVRD (a predecessor company to Vale, from 1978–1981); CVRD and Anglo American (1986–1987); Salobo Metais S.A. (1993–1998; another Vale predecessor company); CVRD Research Centre (2003–2004 and 2005–2006). Work relevant to current operations included rougher flotation tests, locked cycle tests, modifications to reagent schemes, development of equations for predicting Cu and Au recoveries, evaluations of alternatives to standard semi-autogenous grind (SAG) milling, and assessments of blending requirements for the mixed ore stockpile and transition ore.

Recovery equations are currently used to project copper and gold recoveries in the Mineral Reserve estimate, cutoff grade calculations, and the life-of-mine financial model. These are underlying a fixed target copper grade in concentrate of 38% Cu. Within the 0.6 –1.5% Cu range of the data points retained for a regression analysis, the resulting equations are fairly insensitive to the actual feed grade encountered Some variability in the metallurgical results can be expected as the mixture of lithologies found in the plant feed change. Over monthly periods, the resulting blend is more likely to approach the Mineral Reserves profile and thus mitigate the variability that may be detected on a daily basis, versus projections.

Introduction of mixed material above a proportion of 30% of plant feed has been shown to lead to a degradation of the flotation results. Proper blending of such material, albeit representing only 1% of the Mineral Reserves, will be required.

There are three deleterious elements of potential concern in the copper concentrate, namely fluorine, chlorine and uranium. Of these, fluorine is the most significant. In general, smelters will tend to reject concentrates with high fluorine content due to problems in the smelter’s sulphuric acid plants. Vale has secured contracts with four smelters able to accept the copper concentrate, with an average fluorine content of about 2,000 ppm, and a maximum content of 4,000 ppm. Penalties are charged though starting below the actual content. Vale advised that, since concentrate lots are segregated by grade (lower, medium and high grades) at the Parauapebas transfer shed, blending of out-of-specification concentrate is possible, should it ever be necessary. Therefore, with the potential blending strategy and the securing of contracts with four smelters which accept concentrates with fluorine content of up to 4,000 ppm, the risk of concentrate rejection is significantly reduced. These smelters also placed the maximum acceptable chlorine content at 1,200 ppm but with a penalty drawn at the 550–650 ppm content seen in 2015 shipments. Uranium in the partial set of shipment assays reviewed indicated levels below the rejection threshold of 50 ppm, with values generally in the 25–35 ppm range. No penalties are drawn below the rejection level.

| March 2016

Project Number:179678 |

Page 1-6 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

The targeted operated throughput, set at 3,146 t/h in 2015 and 3,171 t/h thereafter, has been achieved on a daily basis. Reducing the frequency of feed interruptions should help in meeting the monthly throughput targets. The plant operational utilization is meeting expectations, whereas downward pressure on the actual utilization is brought mostly by the availability, which has been below expectations since inception of the operations. Realized modifications and upgrades throughout 2015, especially to some of the material handling equipment, have reduced the number of feed interruptions and unscheduled downtime events. The targeted long-term process plant availability of 88.9% for 2020 may still prove difficult to reach, given the lack of stand-by crushing and screening equipment in the tertiary crushing circuit as well as the reliance upon multiple single-line conveyors.

| 1.10 |

Mineral Resource Estimation |

The Mineral Resource estimate was prepared by Vale. Three-dimensional solid models of the lithology and copper grade shells were constructed using commercially-available Geovia software. The construction date of the resource model is 11 March, 2013. Compositing, exploratory data analysis including variography, interpolation, statistical validation and classification were done using Isatis. Visual validation was performed in Geovia.

The estimated elements are total copper, gold, silver, fluorine, carbon, molybdenum, sulphur, uranium and density. Grade capping was done by shell (high-grade or low-grade) and sector in two steps: top-cut of the original assay values; and high yield restriction on the composites during estimation.

The copper, gold, and density block grade values were interpolated within the grade shells using an ordinary kriging (OK) estimator. Outside the grade shells (waste), blocks were assigned zero copper and gold grades, and the mean bulk density of the corresponding lithology. Silver, fluorine, carbon, molybdenum, sulphur and uranium were also interpolated using an OK estimator.

The Mineral Resource is classified in accordance with the 2014 CIM Definition Standards. In addition to criteria such as sufficient geological continuity, grade continuity, and data integrity, Vale recommends the following benchmark criteria for resource classification:

| • |

Inferred Mineral Resource: a level of confidence of ±15% on the global recoverable metal content, tonnes, and grades | |

|

| ||

| • |

Indicated Mineral Resource: a level of confidence of ±15% on the recoverable metal content, tonnes, and grades over an area or volume corresponding to the footprint of one year of production for a given deposit type in a mine or project |

| March 2016

Project Number:179678 |

Page 1-7 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| • |

Measured Mineral Resource: a level of confidence of ±15% on the recoverable metal content, tonnes, and grades over an area or volume corresponding to the footprint of one quarter of one year of production for a given deposit type in a mine or project. |

Classification was based on the estimation passes used for kriging, followed by some smoothing to reduce classification discontinuities.

Mineral Resources represent sulphide mineralization that is adjacent to the current Mineral Reserve pit plus Inferred Mineral Resources within the Mineral Reserve pit. There are no oxide Mineral Resources. Considerations of reasonable prospects of eventual economic extraction include metal prices; determination of the reasonableness of Mineral Resource pit extents, such as impact on planned mine infrastructure; cutoff grades; preparation of a provisional extension of the life-of-mine (LOM) production schedule to include material above this cutoff grade and demonstration of whether a positive cash flow can be generated; no external dilution or mining losses are included.

| 1.11 |

Mineral Resource Statement |

Mineral Resources considered amenable to open pit mining methods, which are reported exclusive of the Mineral Resources converted to Mineral Reserves, are constrained within a pit shell. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate has an effective date of 31 December 2015. Mineral Resources have been classified using the 2014 CIM Definition Standards.

Estimates were prepared by Mr Joao Dirk V. Reuwsaat, an employee of Vale. Dr Georges Verly, P.Eng., an Amec Foster Wheeler employee, is the Qualified Person (QP) for the estimate. Table 1-2 and Table 1-3 show the estimated sulphide Mineral Resources reported at 0.286% copper equivalent (CuEq) cutoff grade. There are no oxide Mineral Resources.

| March 2016

Project Number:179678 |

Page 1-8 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| Table 1-1: | Salobo Measured and Indicated Mineral Resources |

|

Confidence |

Tonnes | Cu | Au | ||

| Location |

Category |

(Mt) | (%) | (g/t) | |

|

|

|||||

| Adjacent to 2015 LOM |

Measured |

44.1 | 0.83 | 0.48 | |

| Mineral Reserve Pit |

Indicated |

185.0 | 0.72 | 0.37 | |

|

Subtotal Measured |

|||||

|

and Indicated |

229.1 | 0.74 | 0.39 |

| Table 1-2: | Salobo Inferred Mineral Resources |

|

Confidence |

Tonnes | Cu | Au | ||

| Location |

Category |

(Mt) | (%) | (g/t) | |

| Adjacent to 2015 LOM |

|

||||

| Mineral Reserve Pit |

Inferred |

132.7 | 0.6 | 0.3 | |

| Within 2015 LOM |

|

||||

| Mineral Reserve Pit |

Inferred |

16.0 | 0.5 | 0.3 | |

|

Total Inferred |

148.7 | 0.6 | 0.3 |

Notes to accompany Mineral Resource tables:

| 1. |

Mineral Resource estimates were prepared by Mr Joao Dirk V. Reuwsaat, a Vale employee. The Qualified Person for the estimate is Dr Georges Verly, P.Eng., an Amec Foster Wheeler employee. | |

|

| ||

| 2. |

Mineral Resources have an effective date of 31 December 2015. Mineral Resources are reported exclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. | |

|

| ||

| 3. |

Mineral Resources were estimated assuming open pit mining methods and are reported at an approximate cutoff grade of 0.286% copper equivalent (CuEq). The CuEq grade incorporates the following: metal prices of US$3.67/lb Cu, US$1,500/oz Au; process recoveries of -2.3/Cu + 90.23% for Cu and 66% for Au; US$0.40/t mill feed to waste mining cost difference; US$11.48/t process cost; selling costs of US$0.669/lb for Cu and US$0.45/oz for Au; US$2.77/t general and administrative (G&A) and other costs; smelter recovery of 96.7% for Cu and 93.94% for Au; transport loss of 0.5%. | |

|

| ||

| 4. |

The pit shell constraining the estimate used the following assumptions: metal prices of US$3.67/lb Cu, US$1,500/oz Au; process percent recoveries of -2.3/Cu +90.23% for Cu and 2.56*Au + 64.9% for Au; US$3.84/t mining cost plus vertical component per bench of US$0.016/t (> 250 m elevation) and US$0.046/t (<250 m elevation); US$11.48/t process cost; selling costs of $US0.696/lb for Cu and $US0.45/oz for Au; US$2.9/t G&A, logistic and other costs; smelter recovery of 96.7% for Cu and 93.94% for Au; and inter-ramp pit slope angles that ranged from 48–52º. | |

|

| ||

| 5. |

No allowances for mining recovery and external dilution have been applied. Contact dilution between grade shells within 15 m x 15 m x 15 m blocks was considered. | |

|

| ||

| 6. |

Tonnage figures are reported as million metric tonnes (Mt); copper grade figures as percent (%) and gold grade figures as grams per tonne (g/t). | |

|

| ||

| 7. |

Tonnages are rounded to the nearest hundred thousand tonnes; grades are rounded to two decimal places for Measured and Indicated Mineral Resources, and one decimal place for Inferred Mineral Resources. | |

|

| ||

| 8. |

Rounding as required by reporting guidelines may result in apparent summation differences. |

| March 2016

Project Number:179678 |

Page 1-9 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

Factors which may affect the Mineral Resource estimates include changes to the assumptions in the parameters used in the Whittle pit shell design, changes to cutoff grades and CuEq values used to report the estimates, and any changes to the permitting, social, environmental, and political/legal assumptions.

| 1.12 |

Mineral Reserve Estimation |

Open pit optimization was performed using Whittle Four-XTMv4.4 software. A 5%, zero-grade material dilution factor was included and a 100% material recovery was assumed for pit optimization, to account for selectivity when mining at the contacts of the ore body. A mining cost adjustment factor (MCAF) was applied to account for incremental increases in haulage cost with depth. The size of the selective mining unit (SMU) was established as 15 m x 15 m x 15 m.

In addition to the above, a discount factor of 10% per year was included to account for the time value of money, assuming an annual drop-down rate of maximum five benches. Only Measured and Indicated Mineral Resources were used, all Inferred material is considered as waste in pit optimization and subsequently in the LOM planning.

An overall marginal cutoff grade of 0.253% CuEq was calculated.

After completion of the design, the mining phases were transformed into a yearly production plan with a steady production feed of 24 Mt/a to the mill. A stockpiling strategy is practiced, targeting the higher grades to feed the plant in the first years of operation. Initially only high-grade ore (>0.85% CuEq) will be delivered to the plant while medium-grade (0.60 to 0.85% CuEq) and low-grade (0.253 to 0.60% CuEq) ore will be stockpiled for later plant feed.

The open pit mine life spans approximately 29 years, ending in 2044. However, the process plant will continue operating, processing stockpiled material for another 21 years until 2065 (Figure 1-1).

| 1.13 |

Mineral Reserve Statement |

Mineral Reserve estimates were prepared by Mr Wellington F. de Paula, a Vale employee. Mr Gerrit Vos, P.Eng., an Amec Foster Wheeler employee, is the Qualified Person for the estimate.

Mineral Reserves have been classified using the 2014 CIM Definition Standards and have an effective date of 31 December, 2015.

Table 1-3 shows the estimated sulphide Mineral Reserves reported at a 0.253% CuEq cutoff grade. There are no oxide Mineral Reserves.

The 2014 Mineral Reserves were made current by subtracting the forecast production from the 2015 updated five-year mine plan.

| March 2016

Project Number:179678 |

Page 1-10 | |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| March 2016

Project Number:179678 |

Page 1-11 |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

| Table 1-3: | Mineral Reserves Estimate |

| Tonnes | Cu | Au | |||

| Area | Classification | (Mt) | (%) | (g/t) | |

| Salobo Pit Phase 2 | 2.7 | 0.69 | 0.34 | ||

| Salobo Pit Phase 3 | 132.2 | 0.77 | 0.44 | ||

| Salobo Pit Phase 4 | 97.1 | 0.73 | 0.39 | ||

| Salobo Pit Phase 5 | Proven | 94.4 | 0.75 | 0.37 | |

| Salobo Pit Phase 6 | 126.0 | 0.65 | 0.40 | ||

| Salobo Pit Phase 7 | 159.1 | 0.72 | 0.36 | ||

| Stockpiles | 42.9 | 0.48 | 0.24 | ||

| Salobo Pit Phase 2 | 0.326 | 0.62 | 0.21 | ||

| Salobo Pit Phase 3 | 24.0 | 0.57 | 0.28 | ||

| Salobo Pit Phase 4 | 53.1 | 0.60 | 0.30 | ||

| Probable | |||||

| Salobo Pit Phase 5 | 45.8 | 0.56 | 0.24 | ||

| Salobo Pit Phase 6 | 170.9 | 0.61 | 0.34 | ||

| Salobo Pit Phase 7 | 208.2 | 0.64 | 0.30 | ||

| Total Proven and Probable | 1,156.8 | 0.67 | 0.35 | ||

Notes to accompany the Mineral Reserve Table

| 1. |

Mineral Reserve estimates were prepared by Mr Wellington F. de Paula, an employee of Vale. The Qualified Person for the estimate is Mr Gerrit Vos, P.Eng.., an Amec Foster Wheeler employee. | |

| 2. |

Mineral Reserves have an effective date of 31 December 2015. | |

| 3. |

Mineral Reserves are reported within the open pit design based on metal prices of $3.45/lb copper, and $1,250/oz gold, with variable recoveries by grade and ore type. A 5% dilution is included, and ore losses are considered to be 0%. Pit inter-ramp slope angles vary from 48–52º. | |

| 4. |

Mineral Reserves that are classified as amenable to direct processing are defined as mineralization above a lower cutoff grade that varies by year between 0.65–1.03% Cu and 0.36–0.64 g/t Au and represents ore that is to be mined and directly processed. | |

| 5. |

Mineral Reserves noted as “stockpiled” material consists of ore tonnage above 0.253% copper equivalent (CuEq) cutoff grade that was mined and stockpiled before being sent to the mill. This stockpiled tonnage includes ore mined before mill start-up, and lower-grade ore mined during pre-production commercial production phases. Stockpiling of low grade material will continue, but this ore will be fed to the plant at the end of the mine life. | |

| 6. |

Mineral Reserves are reported above a marginal cutoff grade of 0.253% CuEq. The CuEq value used for cutoff grades is based on $3.45/lb copper and $1,250/oz gold and based on the equation: CuEq(%) = Cu(%) + Au(g/t) x 0.40677651 / RecCu (%). | |

| 7. |

Tonnage figures are reported as million metric tonnes (Mt); copper grade figures as percent (%) and gold grade figures as grams per tonne (g/t). | |

| 8. |

Tonnages are rounded to the nearest million tonnes; grades are rounded to two decimal places. | |

| 9. |

Rounding as required by reporting guidelines may result in apparent summation differences. |

| March 2016

Project Number:179678 |

Page 1-12 |

|

Salobo Operations Para State, Brazil NI 43-101 Technical Report |

The following factors may affect the Mineral Reserve estimate: copper and gold price fluctuations, the US dollar exchange rate, the Brazilian inflation rate, geotechnical and hydrogeological assumptions, the ability of the mining operation to meet the annual production rate, process plant recoveries and maintenance of deleterious element levels within life-of-mine plan (LOMP) expectations, ability to meet permitting and environmental licence conditions, and maintain these licences, and the ability to maintain the social licence to operate.

| 1.14 |

Mining Methods |

Mining at the Salobo Operations utilizes standard open pit methods with drilling and blasting, loading and hauling, using 15 m benches in rock and 8 m loading benches in saprolites. Electrical cable shovels with 220 t and 327 t trucks are used for bulk mining, hydraulic shovels, and 220 t trucks are used in the saprolites with soft ground conditions and occasionally at pit bottoms to improve selectivity.