Form 6-K SMART Technologies Inc. For: Jul 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of July 2015

Commission File Number 001-34798

SMART TECHNOLOGIES INC.

3636 Research Road N.W.

Calgary, Alberta

Canada T2L 1Y1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

THIS REPORT ON FORM 6-K SHALL BE DEEMED FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “COMMISSION”) AND INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-181530) OF SMART TECHNOLOGIES INC. FILED WITH THE COMMISSION, AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED TO THE COMMISSION, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS THE REGISTRANT SUBSEQUENTLY FURNISHES TO OR FILES WITH THE COMMISSION.

DOCUMENTS FILED AS PART OF THIS FORM 6-K

The following information filed with this Form 6-K shall be deemed to be incorporated by reference into the registration statement on Form S-8 (File No. 333-181530) of the Registrant filed with the Securities and Exchange Commission (the “Commission”), and to be a part thereof from the date on which this report is furnished to the Commission, to the extent not superseded by documents or reports the Registrant subsequently furnished to or files with the Commission.

| • | Notice and Access Notification to Shareholders, the text of which is attached hereto as Exhibit 99.1; |

| • | Notice of 2015 Annual Meeting and Management Information Circular and Proxy Statement, the text of which is attached hereto as Exhibit 99.2; |

| • | Common Shares Proxy for use at the Annual Meeting of Shareholders, the text of which is attached as Exhibit 99.3; |

| • | Chief Executive Officer’s Letter to Shareholders and Corporate Information Directory, the text of which is attached hereto as Exhibit 99.4; and |

| • | Election Form for Shareholders to request delivery by mail of the Company’s interim and annual financial statements and management’s discussion and analysis (“NI Card”), the text of which is attached as Exhibit 99.5. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SMART TECHNOLOGIES INC. | ||

| By: |

/s/ Jeffrey A. Losch | |

| Name: |

Jeffrey A. Losch | |

| Title: |

Vice President, Legal and General Counsel, and Corporate Secretary | |

Date: July 2, 2015

Exhibit Index

| 99.1 | Notice and Access Notification | |

| 99.2 | Notice of 2015 Annual Meeting and Management Information Circular and Proxy Statement | |

| 99.3 | Common Shares Proxy | |

| 99.4 | Letter to Shareholders and Corporate Information Directory | |

| 99.5 | Form of Shareholder Election (NI Card) | |

2

Exhibit 99.1

SMART TECHNOLOGIES INC.

NOTICE AND ACCESS NOTIFICATION TO SHAREHOLDERS

Notice and Access

You are receiving this notification as SMART Technologies Inc. (“SMART”) has elected to use the notice and access model (“Notice and Access”) for the delivery of meeting materials to its shareholders who do not hold their common shares of SMART (“Common Shares”) in their own name (the “Beneficial Shareholders”) in respect of its annual general meeting of shareholders to be held on August 6, 2015 (the “Meeting”). Under Notice and Access, instead of receiving paper copies of SMART’s management information circular dated June 29, 2015 (the “Circular”), Beneficial Shareholders are receiving this notice with information on how they may access the Circular electronically. SMART is providing this notice to all Beneficial Shareholders who have indicated that they want to receive the Circular. The use of this alternative means of delivery is more environmentally friendly as it will help reduce paper use and it will also reduce SMART’s printing and mailing costs.

MEETING DATE, TIME AND LOCATION:

| WHEN: |

Thursday, August 6, 2015 11:00 a.m. (Mountain Time) |

WHERE: |

3636 Research Road N.W. Calgary, Alberta |

SHAREHOLDERS WILL BE ASKED TO CONSIDER AND VOTE ON THE FOLLOWING MATTERS:

ELECTION OF DIRECTORS: Shareholders will be asked to elect directors to hold office until the next annual meeting. Information respecting the election of directors may be found in the “Particulars of Matters to be Acted Upon – Election of Directors” section of the Circular.

ADOPTION OF EMPLOYEE SHARE OWNERSHIP PLAN: Shareholders will be asked to approve the adoption of an employee share ownership plan. Information respecting the terms and conditions of such plan may be found in the “Particulars of Matters to be Acted Upon – Employee Share Ownership Plan” section of the Circular. The actual text of such plan is included in Appendix B to the Circular.

APPOINTMENT OF AUDITORS: Shareholders will be asked to re-appoint KPMG LLP, Chartered Accountants as SMART’s auditor until the next annual meeting. Information on the appointment of KPMG LLP may be found in the “Particulars of Matters to be Acted Upon – Appointment of Auditors” section of the Circular.

OTHER BUSINESS: Shareholders may be asked to consider other items of business that may be properly brought before the Meeting. Information respecting the use of discretionary authority to vote on any such other business may be found in the “Information Regarding Proxies and Voting at the Meeting” section of the Circular.

SHAREHOLDERS ARE REMINDED TO REVIEW THE CIRCULAR BEFORE VOTING.

WEBSITES WHERE CIRCULAR IS POSTED

The Circular can be viewed online at www.sedar.com or at the following internet address: http://materials.proxyvote.com/83172R

HOW TO OBTAIN PAPER COPIES OF THE CIRCULAR

Beneficial Shareholders may request paper copies of the Circular to be sent to them at no cost to them. Requests may be made up to one year from the date the Circular was filed on SEDAR. Requests may be made by telephone at any time prior to the Meeting at 1-877-907-7643.

Requests should be received at least 5 business days in advance of the proxy deposit date and time set out in the accompanying voting instruction form in order to receive the Circular in advance of such date and the date of the Meeting.

VOTING

Beneficial Shareholders are asked to return their enclosed voting instruction form in accordance with the deadline and instructions noted on the voting instruction form.

Beneficial Shareholders with questions about Notice and Access can call toll free at 1-855-887-2244.

Please Note: You cannot use this notice to vote. If you do request a paper copy of the Circular, you will not receive a new voting instruction form so you should retain the form sent to you in order to vote.

Table of Contents

Exhibit 99.2

SMART Technologies Inc.

NOTICE OF ANNUAL

MEETING TO BE HELD ON

AUGUST 6, 2015

AND

MANAGEMENT INFORMATION CIRCULAR

June 29, 2015

Table of Contents

SMART Technologies Inc.

NOTICE OF ANNUAL MEETING OF THE SHAREHOLDERS

TAKE NOTICE THAT an Annual Meeting (the “Meeting”) of the shareholders (“Shareholders”) of SMART Technologies Inc. (the “Corporation”) will be held at the offices of the Corporation located at 3636 Research Road NW, Calgary, Alberta T2L 1Y1, at 11:00 A.M. (MDT) on Thursday, August 6, 2015 for the following purposes:

| 1. | to receive and consider the financial statements of the Corporation as at and for the fiscal year ended March 31, 2015, together with the report of the auditors thereon; |

| 2. | to elect Neil Gaydon, Robert C. Hagerty, Gary Hughes, Ian McKinnon and Michael J. Mueller as the directors of the Corporation for the ensuing year; |

| 3. | to approve the employee share ownership plan of the Corporation as further described in the Information Circular; |

| 4. | to appoint KPMG LLP, Chartered Accountants as the auditors of the Corporation for the ensuing year and to authorize the directors of the Corporation to determine the remuneration to be paid to the auditors; and |

| 5. | to transact such other business as may properly come before the Meeting. |

Information relating to matters to be acted upon by the Shareholders at the Meeting is set forth in the accompanying Information Circular.

A Shareholder may attend the Meeting in person or may be represented at the Meeting by proxy. Shareholders who are unable to attend the Meeting in person and wish to be represented by proxy are requested to date, sign and return the accompanying instrument of proxy, or other appropriate form of proxy, in accordance with the instructions set forth in the accompanying Information Circular and instrument of proxy. Shareholders who cannot attend the Meeting may vote by mail, by using the internet or by telephone. See the accompanying Information Circular for information on how to vote. An instrument of proxy will not be valid unless it is received by Computershare Trust Company of Canada not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the province of Alberta) before the time of the Meeting, or any adjournment thereof. A person appointed as proxy holder need not be a Shareholder of the Corporation.

Only Shareholders of record as at the close of business on June 19, 2015 are entitled to receive notice of the Meeting.

This year, as described in the notice and access notification mailed to beneficial Shareholders of the Corporation, the Corporation has decided to deliver the Information Circular to beneficial Shareholders by posting the Information Circular on the following website: http://materials.proxyvote.com/83172R. The use of this alternative means of delivery is more environmentally friendly as it will help reduce paper use and it will also reduce the Corporation’s printing and mailing costs. The Information Circular will also be available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. The Information Circular will be mailed to registered Shareholders.

SHAREHOLDERS ARE CAUTIONED THAT THE USE OF THE MAIL TO TRANSMIT PROXIES IS AT EACH SHAREHOLDER’S RISK.

DATED at Calgary, Alberta as of the 29th day of June, 2015.

| BY ORDER OF THE BOARD OF DIRECTORS |

| (signed) “Michael J. Mueller” |

| Chairman |

Table of Contents

SMART Technologies Inc.

Management Information Circular

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| Voting of Proxies and Exercise of Discretion by Proxy Holders |

2 | |||

| 2 | ||||

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED ON |

2 | |||

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES |

2 | |||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

Table of Contents

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

29 | |||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| Consideration of the Representation of Women in the Director Identification and Selection Process |

34 | |||

| Consideration Given to the Representation of Women in Executive Officer Appointments |

34 | |||

| Targets Regarding the Representation of Women on the Board and in Executive Officer Positions |

34 | |||

| Number of Women on the Board and in Executive Officer Positions |

34 | |||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| A-1 | ||||

| A-1 | ||||

| A-1 | ||||

| A-1 | ||||

| A-1 | ||||

| A-1 | ||||

| A-2 | ||||

| A-2 | ||||

| A-3 | ||||

| A-3 | ||||

| A-4 | ||||

| A-4 | ||||

| A-4 | ||||

| A-4 | ||||

| A-5 | ||||

| B-1 | ||||

Table of Contents

SMART Technologies Inc.

Management Information Circular

Dated June 29, 2015

INFORMATION REGARDING PROXIES AND VOTING AT THE MEETING

This management information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies by and on behalf of management of SMART Technologies Inc. (the “Corporation”) for use at the annual meeting (the “Meeting”) of holders (“Shareholders”) of Common Shares (the “Common Shares”) of the Corporation to be held at the offices of the Corporation, 3636 Research Road N.W., Calgary, Alberta T2L 1Y1, at 11:00 A.M. (MDT) on Thursday, August 6, 2015 for the purposes set forth in the notice of annual meeting (the “Notice”) accompanying this Information Circular. Solicitation of proxies will be primarily by mail, but may also be undertaken by way of telephone, facsimile or oral communication by one or more members of the board of directors (the “Board”), officers or regular employees of the Corporation, at no additional compensation. Costs associated with the solicitation of proxies will be borne by the Corporation.

Accompanying this Information Circular is an instrument of proxy (“Instrument of Proxy”) for use at the Meeting. A Shareholder may vote by proxy in one of the following ways:

| (i) | by mailing or delivering the signed Instrument of Proxy to Computershare Trust Company of Canada, Proxy Department at 100 University Avenue – 8th Floor, Toronto, ON M5J 2Y1; |

| (ii) | by using the internet at www.investorvote.com; or |

| (iii) | for Shareholders in Canada and the United States, by calling the following toll-free number: 1-866-732-VOTE (8683). |

In order to be valid, Instruments of Proxy must be received by Computershare Trust Company of Canada not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the province of Alberta) prior to the time set for the Meeting or any adjournment thereof.

The persons designated in the Instrument of Proxy are officers and/or directors of the Corporation. A Shareholder has the right to appoint a person (who need not be a Shareholder) other than the persons designated in the accompanying Instrument of Proxy, to attend at and represent the Shareholder at the Meeting. To exercise this right, a Shareholder should insert the name of the designated representative in the blank space provided on the Instrument of Proxy and strike out the names of management’s nominees. Alternatively, a Shareholder may complete another appropriate Instrument of Proxy.

Signing of the Instrument of Proxy

The Instrument of Proxy must be signed by the Shareholder or the Shareholder’s duly appointed attorney authorized in writing or, if the Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney of the Corporation. An Instrument of Proxy signed by a person acting as attorney or in some other representative capacity (including a representative of a corporate Shareholder) should indicate that person’s capacity (following his or her signature) and should be accompanied by the appropriate instrument evidencing qualification and authority to act (unless such instrument has previously been filed with the Corporation).

1

Table of Contents

A Shareholder who has submitted an Instrument of Proxy may revoke it at any time prior to the exercise thereof. In addition to any manner permitted by law, a proxy may be revoked by instrument in writing executed by the Shareholder or by his or her duly authorized attorney or, if the Shareholder is a corporation, under its corporate seal or executed by a duly authorized officer or attorney of the corporation and deposited either: (i) at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournments thereof, at which the Instrument of Proxy is to be used; or (ii) with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof. In addition, an Instrument of Proxy may be revoked: (i) by the Shareholder personally attending the Meeting and voting the securities represented thereby or, if the Shareholder is a corporation, by a duly authorized representative of the corporation attending at the Meeting and voting such securities; or (ii) in any other manner permitted by law.

Voting of Proxies and Exercise of Discretion by Proxy Holders

All Common Shares represented at the Meeting by properly executed proxies will be voted on any ballot that may be called for and, where a choice with respect to any matter to be acted upon has been specified in the Instrument of Proxy, the Common Shares represented by the Instrument of Proxy will be voted in accordance with such instructions. The management designees named in the accompanying Instrument of Proxy will vote or withhold from voting the Common Shares in respect of which they are appointed in accordance with the direction of the Shareholder appointing him or her on any ballot that may be called for at the Meeting. In the absence of such direction, such Common Shares will be voted “FOR” the proposed resolutions at the Meeting. The accompanying Instrument of Proxy confers discretionary authority upon the persons named therein with respect to amendments of or variations to the matters identified in the accompanying Notice and with respect to other matters that may properly be brought before the Meeting. In the event that amendments or variations to matters identified in the Notice are properly brought before the Meeting or any other business is properly brought before the Meeting, it is the intention of the management designees to vote in accordance with their best judgment on such matters or business. At the time of printing this Information Circular, the management of the Corporation knows of no such amendment, variation or other matter to come before the Meeting other than the matters referred to in the accompanying Notice.

All monetary sums set forth in this Information Circular are in U.S. dollars unless otherwise specified.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED ON

Except as disclosed in this Information Circular, none of the directors or executive officers of the Corporation at any time since the beginning of the Corporation’s last fiscal year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise in any matter to be acted on, other than the election of directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The authorized share capital of the Corporation consists of an unlimited number of Common Shares and an unlimited number of preferred shares (the “Preferred Shares”) issuable in series. The record date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting is June 19, 2015 (the “Record Date”). As at the Record Date, there were 122,429,920 Common Shares and no Preferred Shares issued and outstanding.

2

Table of Contents

Each holder of Common Shares is entitled to receive notice of and attend all meetings of Shareholders, except meetings at which only holders of another particular class or series have the right to vote. At each such meeting, each Common Share entitles its holder to one vote.

More information regarding the Common Shares and Preferred Shares is disclosed in the Annual Report on Form 20-F of the Corporation for the fiscal year ended March 31, 2015 (the “Annual Report”), which is incorporated by reference into this Information Circular and forms an integral part thereof. The Annual Report is available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and is also available on EDGAR at www.sec.gov. Upon request, the Corporation will promptly provide a copy of the Annual Report free of charge to any Shareholder of the Corporation.

Only Shareholders whose names are entered in the Corporation’s register of shareholders at the close of business on the Record Date and holders of Common Shares issued by the Corporation after the Record Date and prior to the Meeting will be entitled to receive notice of and to vote at the Meeting, provided that, to the extent that: (i) a registered Shareholder has transferred the ownership of any Common Shares subsequent to the Record Date; and (ii) the transferee of those Common Shares produces properly endorsed share certificates, or otherwise establishes that he or she owns the Common Shares and demands, not later than ten days before the Meeting, that his or her name be included on the Shareholder list before the Meeting, in which case the transferee shall be entitled to vote his or her Common Shares at the Meeting.

Voting of Common Shares – Advice to Non-Registered Holders

Only registered holders of Common Shares, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Common Shares beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

| (a) | in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the Common Shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited). |

The Corporation is not forwarding its proxy-related materials directly to non-objecting beneficial holders. In accordance with the requirements of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), the Corporation intends to pay for Intermediaries to forward the proxy-related materials and the voting instruction form to objecting beneficial owners.

Applicable Canadian regulatory policies require Intermediaries to seek voting instructions from Non-Registered Holders in advance of shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Non-Registered Holders in order to ensure that their Common Shares are voted at the Meeting. Often, the voting instruction form supplied to a Non-Registered Holder by its Intermediary (or the agent of the Intermediary) is very similar or even identical to the Instrument of Proxy provided by the Corporation to registered shareholders. However, its purpose is limited to instructing the registered Shareholder (the Intermediary or agent of the Intermediary) how to vote on behalf of the Non-Registered Holder. In Canada, the majority of Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). In most cases, Broadridge mails a scannable voting instruction form in lieu of the Instrument of Proxy provided by the Corporation and asks Non-Registered Holders to return the voting instruction form to Broadridge or otherwise communicate voting instructions to Broadridge (by way of telephone or the Internet, for example). Broadridge then tabulates the

3

Table of Contents

results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. A Non-Registered Holder receiving a proxy or voting instruction form from Broadridge cannot use that form to vote Common Shares directly at the Meeting, rather the form must be returned to Broadridge or, alternatively, instructions must be received by Broadridge well in advance of the Meeting in order to have the Common Shares voted. If you have any questions respecting the voting of your Common Shares held through an Intermediary, please contact that Intermediary for assistance.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies.

Only registered Shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must in sufficient time in advance of the Meeting, arrange for their respective Intermediaries to change their vote and if necessary revoke their proxy in accordance with the revocation procedures set out above.

NI 54-101 and National Instrument 51-102 – Continuous Disclosure Obligations allow for the use of a “notice-and-access” regime for the delivery of proxy-related materials.

Under the notice-and-access regime, reporting issuers are permitted to deliver proxy-related materials by posting them on SEDAR as well as a website other than SEDAR and sending shareholders a notice package that includes: (i) the voting instruction form; (ii) basic information about the meeting and the matters to be voted on; (iii) instructions on how to obtain a paper copy of the materials; and (iv) a plain-language explanation of how the new notice-and-access system operates and how the materials can be accessed online. Where prior consent has been obtained, a reporting issuer can send this notice package to shareholders electronically. This notice package must be mailed to shareholders from whom consent to electronic delivery has not been received.

The Corporation has elected to send its Information Circular to beneficial Shareholders using the notice-and-access regime. Accordingly, the Corporation will send the above-mentioned notice package to beneficial Shareholders which includes instructions on how to access the Corporation’s Information Circular online and how to request a paper copy of the Information Circular. Distribution of the Corporation’s Information Circular pursuant to the notice-and-access regime has the potential to substantially reduce printing and mailing costs and reduce our impact on the environment.

Notwithstanding the notice-and-access regime, Alberta’s Business Corporations Act (“ABCA”) requires the Corporation to: (i) deliver a paper copy of its annual financial statements to a registered Shareholder unless such registered Shareholder informs the Corporation in writing that it does not want a copy of the annual financial statements or provides written consent to electronic delivery; and (ii) deliver a paper copy of the Information Circular to a registered Shareholder unless such Shareholder provides written consent to electronic delivery. In order to ensure compliance with the ABCA, registered Shareholders who have not yet consented to electronic delivery will be mailed a copy of the Information Circular.

4

Table of Contents

The following table sets forth, to the best of the knowledge of the directors and executive officers of the Corporation, as at the Record Date, the only persons, corporations or other entities (other than securities depositories) who beneficially own, directly or indirectly, or exercise control or discretion over voting securities carrying more than 10% of the voting rights attached to the Common Shares of the Corporation.

| Name and Address of Beneficial Owner |

Type of Ownership |

Number of Common Shares |

Percentage of Share Capital |

Percentage of Voting Power |

||||||||||

| Entities related to and Funds advised or managed by Apax Partners(1) |

Direct | 37,658,083 | 30.9 | % | 30.9 | % | ||||||||

| Intel Corporation(2) |

Direct | 17,466,633 | 14.3 | % | 14.3 | % | ||||||||

| David Martin(3) |

Direct and Indirect |

26,982,074 | 22.1 | % | 22.1 | % | ||||||||

| Nancy Knowlton(3) |

Direct and Indirect |

26,981,074 | 22.1 | % | 22.1 | % | ||||||||

NOTES:

| (1) | Represents Common Shares beneficially owned by PCV Belge SCS, which is managed by Apax Guernsey Managers Ltd., Apax US VII, L.P. and Apax Europe V (a collective of nine partnerships comprised of Apax Europe V – A, L.P., Apax Europe V – B, L.P., Apax Europe V C GmbH & Co. KG, Apax Europe V – D, L.P., Apax Europe V – E, L.P., Apax Europe V – F, C.V., Apax Europe V – G, C.V., Apax Europe V – 1, LP and Apax Europe V – 2, LP), which are advised by Apax Partners, LP and Apax Partners LLP. PCV Belge SCS, Apax US VII, L.P. and Apax Europe V each disclaim beneficial ownership of the Common Shares held by the other. The address of Apax Partners LLP is 33 Jermyn Street, London, UK, SW1Y 6DN. |

| (2) | The address of Intel Corporation is 2200 Mission College Boulevard, Santa Clara, California. |

| (3) | 517,440 Common Shares are held directly by Mr. Martin and 516,440 Common Shares are held directly by Ms. Knowlton. 26,464,634 Common Shares are owned by IFF Holdings Inc. (“IFF”), a corporation with respect to which David Martin and Nancy Knowlton own 100% of the securities directly or indirectly. Mr. Martin and Ms. Knowlton are married to each other, and as such Mr. Martin and Ms. Knowlton may each be deemed to be beneficial owners or to have control and direction over all of the Common Shares owned by IFF. The address for Mr. Martin, Ms. Knowlton and IFF is c/o Kymbask Management Inc., 10th floor 1221 8th Street SW Calgary, AB, T2R 0L4. |

PARTICULARS OF MATTERS TO BE ACTED UPON

The audited financial statements for the Corporation for the fiscal year ended March 31, 2015, together with the report of the auditors thereon will be presented to the Shareholders at the Meeting.

Management proposes to nominate at the Meeting the persons whose names are set forth in the table below to serve as directors of the Corporation until the next meeting of Shareholders at which the election of directors is considered, or until their successors are elected or appointed. Unless directed otherwise, the persons named in the accompanying Instrument of Proxy intend to vote FOR the election of such persons at the Meeting. Management does not contemplate that any of the nominees will be unable to serve as a director of the Corporation.

The following table and the notes thereto state the names of all persons proposed by management to be nominated for election as directors of the Corporation at the Meeting, their principal occupation or employment

5

Table of Contents

within the five preceding years, the period during which they have been directors of the Corporation, and their shareholdings, including the number of voting securities of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised by each of them.

In the event that a vacancy occurs because of death or for any reason prior to the Meeting, the proxy shall not be voted with respect to the filling of the vacancy.

| Name and Residence |

Common Shares(1) |

Offices Held and |

Principal Occupation | |||||

| Neil Gaydon Alberta, Canada |

262,551 | President and Chief Executive Officer

Director since February 2013 |

Director and President and Chief Executive Officer of the Corporation; Director and Chief Executive Officer of Pace PLC. | |||||

| Robert C. Hagerty(2) (3) (4) (5) California, U.S.A. |

99,992 | (7) | Director since July 2010 |

Since September 2011, CEO and Director of iControl Networks, Inc. Served at Polycom, Inc. in various executive capacities and as an advisor from 1997 through 2011 including Chairman, Director, President and CEO. | ||||

| Gary Hughes(5) Scotland, UK |

Nil | (8) | Director since December 2013 | Operating Executive, APAX Partners LLP; Corporate Director. | ||||

| Ian McKinnon(2) (3) (4) (5) Ontario, Canada |

59,992 | (9) | Director since August 2013 | Corporate Director. | ||||

| Michael J. Mueller(2) (3) (4) (5) (6) Ontario, Canada |

149,992 | (10) | Director since July 2010 |

Corporate Director. | ||||

NOTES:

| (1) | Includes Common Shares subject to options, restricted share units (“RSUs”) and deferred share units (“DSUs”) granted under the Corporation’s amended and restated equity incentive plan (the “Equity Incentive Plan”) that are vested as of the Record Date. |

| (2) | Member of the Audit Committee. |

| (3) | Member of the Compensation Committee. |

| (4) | Member of the Corporate Governance and Nominating Committee (the “CG&N Committee”). |

| (5) | Independent director. |

| (6) | On May 15, 2014, Mr. Mueller was appointed Chairman of the Board. |

| (7) | Mr. Hagerty has options to acquire 20,000 Common Shares at an exercise price of $17.00 per Common Share. He was awarded 10,000 DSUs on June 22, 2011; 10,000 DSUs on June 18, 2012; 21,250 DSUs on November 7, 2013, 14,742 DSUs on May 15, 2014 and 24,000 DSUs on May 14, 2015. |

| (8) | 37,658,083 Common Shares are beneficially owned by funds advised or managed by Apax Partners LLP and by PCV Belge SCS, an entity related to Apax Partners LLP. Mr. Hughes was appointed a director on December 1, 2013 and is an Operating Executive at Apax Partners LLP but disclaims beneficial ownership of these Common Shares. |

| (9) | Mr. McKinnon became a director on August 26, 2013. He was awarded 21,250 DSUs on November 7, 2013, 14,742 DSUs on May 15, 2014 and 24,000 DSUs on May 14, 2015. |

| (10) | Mr. Mueller has voting and dispositive power over 50,000 Common Shares. He has options to acquire 20,000 Common Shares at an exercise price of $17.00 per Common Share. He was awarded 10,000 DSUs on June 22, 2011; 10,000 DSUs on June 18, 2012; 21,250 DSUs on November 7, 2013, 14,742 DSUs on May 15, 2014 and 24,000 DSUs on May 14, 2015. |

| (11) | Information in the above table is as of the Record Date. |

6

Table of Contents

The information as to voting securities beneficially owned, directly or indirectly, is based upon information furnished by the respective nominees.

Other than disclosed herein, no proposed director is, as at the date of the Information Circular, or has been, within the last 10 years, a director or executive officer of any company (including the Corporation) that: (a) was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days (“Order”) that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; (b) was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or (c) within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Mr. Hughes was a director of Gala Coral Group Limited from October 2008 to October 2011. In May 2010 Gala Coral Group Limited underwent a voluntary creditors’ approved liquidation in the United Kingdom.

Mr. McKinnon was a director of Empirical Inc., a TSX Venture Exchange (“TSXV”) listed company, from December 2007 until 2008. In January 2009, Empirical announced that it had entered into a standstill agreement with its creditors. The company’s assets were sold in February 2009, following which its shares were suspended from trading on the TSXV. Mr. McKinnon was a director and chair of the board of Adeptron Technologies Corporation (“Adeptron”), a TSXV listed company, from August 2011 to March 2012. In October 2011, Adeptron announced that it had entered into a business combination with Artaflex Inc. Following this announcement, the TSXV halted trading of Adeptron’s shares pending receipt and review of acceptable documentation from Adeptron in respect of the transaction. Trading of Adeptron’s shares resumed in February 2012.

No proposed director has within the last 10 years become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

At the Meeting, Shareholders will be asked to consider and approve the adoption of an employee share ownership plan (the “ESOP”) of the Corporation. The complete texts of the ESOP and the U.S. Participant Supplement thereto are set out in Appendix B hereto and a summary of the material terms of the ESOP is provided below. Capitalized terms used in the summary but not defined shall have the meanings given to those terms in the ESOP. The ESOP is intended to enable eligible employees to acquire Common Shares in a convenient and systematic manner, so as to encourage a proprietary interest in the operation, growth and development of the Corporation.

Full-time and part-time employees of the Corporation and its affiliates are eligible to participate in the ESOP, provided that consultants, temporary employees, non-employee directors of the Corporation or any officer of SMART Technologies ULC shall not be eligible to participate in the ESOP, and that such employee must be resident in North America. Participants in the ESOP (“Participants”) accumulate funds for the purchase of Common Shares through payroll deductions. A Participant may elect to contribute an amount during each regular payroll period of not less than 1% of the Participant’s monthly pre-tax base salary earnings (“Eligible Earnings”) and not more than 3% of his Eligible Earnings (a “Personal Contribution”), or such other percentage as the Board may determine. Participants’ employer will make a contribution (an “Employer Contribution”) equal to 100% of the Participant’s Personal Contribution up to a maximum of 3% of the Participant’s Eligible Earnings. On the first trading day following the date on which the Corporation pays its employees (a “Purchase Date”), all Personal Contributions and Employer Contributions received since the last Purchase Date will be used to purchase Common Shares.

7

Table of Contents

Common Shares that are purchasable on a Purchase Date may, at the discretion of the Corporation, be purchased through open market purchases or issued from treasury. If purchased on the open market, the price per share of such Common Shares shall be the volume-weighted average price paid for the Common Shares. If issued from treasury, such Common Shares will be issued for a price per share equal to the volume-weighted average trading price of the Common Shares on the Toronto Stock Exchange (“TSX”) (or on the NASDAQ in the case of U.S. Participants in the ESOP) for the five trading days immediately preceding the Purchase Date.

Subject to the provision for certain adjustments provided for in the ESOP, the number of Common Shares reserved for issuance to Participants from time to time under the ESOP will not exceed 3% of the total number of Common Shares of the Corporation issued and outstanding from time to time. As at the Record Date, the Corporation would be able to issue 3,672,898 Common Shares under the ESOP. Upon the issuance of any Common Shares from treasury pursuant to Personal Contributions and Employer Contributions, such number of Common Shares so issued will be automatically reserved again for future issuance. As a result, the ESOP is considered a “rolling” plan since the Common Shares permitted to be issued pursuant to it will increase as the number of issued and outstanding Common Shares increases.

Under the ESOP, together with any other security-based compensation arrangements of the Corporation, the aggregate number of Common Shares that may be issuable to insiders of the Corporation may not exceed 10% of the issued and outstanding Common Shares and the aggregate number of Common Shares issued to insiders within a one-year period cannot exceed 5% of the issued and outstanding Common Shares.

A Participant’s participation in the ESOP will terminate if: (a) the Participant ceases to be an Employee for any reason, such termination to be effective as of the date of such cessation; (b) the Participant transfers any right or interest the Participant may have pursuant to the ESOP in a manner not permitted under the ESOP; (c) the Corporation terminates the ESOP or, at the discretion of the Corporation, such Participant’s enrollment in the ESOP. A former Participant whose participation in the ESOP has terminated may deal with the Common Shares in the former Participant’s account by filing a notice with the administrative agent under the ESOP within 60 days after termination of the Participant’s participation in the ESOP requesting that: (a) provided that the number of Common Shares in the Participant’s account (“Standard Account”) that is not a RRSP or a TFSA exceeds 100, all of the Common Shares in such account be transferred to an account outside the ESOP or a share certificate for the Common Shares be issued; (b) all of the Common Shares in the Standard Account be sold and proceeds distributed to the Participant; or (c) with respect to Common Shares held in a RRSP Plan or TFSA Plan, all such Common Shares be transferred to an external RRSP or external TFSA or the cash equivalent for the Common Shares be distributed to the Participant. If no such notice is filed within 60 days after the termination of a Participant’s participation in the ESOP, the former Participant shall be deemed to have elected to: (a) sell all of the Common Shares in the former Participant’s Standard Account on the open market and have the proceeds (net of any applicable brokerage commissions, sales administration fees and withholding tax) distributed to him, and (b) have distributed to him the cash equivalent for any of the Participant’s Common Shares held in a RRSP account or TFSA account based upon the current market price as at the date of settlement.

Any right or any interest that any Participant may have in or pursuant to the ESOP may not be transferred or otherwise disposed of by any Participant in whole or in part except as permitted by the ESOP or as required for normal estate settlement purposes.

The ESOP provides that in the event that the Common Shares are subdivided, consolidated, converted or reclassified by the Corporation or any action of a similar nature affecting such Common Shares is taken by the Corporation, then the Common Shares held under the ESOP shall be appropriately adjusted, as determined in the sole discretion of the Corporation.

Shareholder approval and TSX approval will be required for any amendment to the ESOP that would: (a) increase the fixed maximum percentage of Common Shares which may be reserved for issuance under the ESOP; (b) amend the insider participation limits under the ESOP; (c) amend the persons eligible to participate in the ESOP; (d) permit rights under the Plan (including Common Shares to which a Participant is entitled to under

8

Table of Contents

the Plan) to be transferable or assignable other than for normal estate settlement purposes; or (e) amend the amendment provision of the ESOP to eliminate a matter listed as requiring Shareholder approval. The Board may, in its sole discretion, without obtaining any approval of Shareholders, make any other amendments to the ESOP including, without limitation:

| (a) | amendments of a “housekeeping” nature; |

| (b) | a reduction of the number of Common Shares reserved from time to time for issuance under the ESOP; |

| (c) | such amendments as are necessary for the purpose of complying with any changes in any applicable law, rule, regulation or policy of any securities regulatory authority, stock exchange or other governmental entity having jurisdiction over the Corporation; and |

| (d) | amendments to correct or rectify any ambiguity, defective provision, error or omission in the ESOP. |

At the Meeting, Shareholders will be asked to consider and, if thought advisable, approve an ordinary resolution of Shareholders to adopt the ESOP. The resolution approving the ESOP must be approved by at least a majority of the votes cast thereon.

Provided that the resolution adopting the ESOP is approved by at least a majority of the votes cast thereon, the Board will, at its discretion, determine the date on which the ESOP will be implemented, which will be a date following the Meeting.

Unless directed otherwise, the persons named in the accompanying Instrument of Proxy intend to vote FOR the approval of the ESOP. The text of the ordinary resolution is set out below:

“BE IT RESOLVED as an ordinary resolution of the holders of common shares of SMART Technologies Inc. (the “Corporation”) that:

| 1. | the employee share ownership plan (the “ESOP”), in the form attached as Appendix B to the management information circular of the Corporation dated June 29, 2015, is approved and adopted as the employee share ownership plan of the Corporation; |

| 2. | in accordance with the rules of the Toronto Stock Exchange, the Corporation will have the ability to grant and issue common shares of the Corporation (and such other security as may be substituted for common shares as a result of amendments to the articles of the Corporation) in accordance with the terms of the ESOP, which does not have a fixed maximum number of securities issuable, until August 6, 2018, which is the date that is three years from the date of the shareholder meeting at which shareholder approval of the ESOP is being sought; |

| 3. | any director or officer of the Corporation is authorized and directed, for and in the name of and on behalf of the Corporation, to execute, or cause to be executed, whether under the corporate seal of the Corporation or otherwise, and to deliver or cause to be delivered all such other documents and instruments, and to do or cause to be done all such other acts and things as, in the opinion of such director or officer, may be necessary or desirable in order to carry out the intent of this resolution, the execution of any such document or the doing of any such other act or thing being conclusive evidence of such determination; and |

| 4. | notwithstanding the foregoing, the directors of the Corporation are authorized to revoke this resolution and not proceed with matters herein authorized, without further approval of the shareholders of the Corporation.” |

Management is nominating KPMG LLP, Chartered Accountants, Calgary, Alberta, as auditors, to hold office until the next annual meeting and is requesting authorization for the directors to fix their remuneration. KPMG LLP has been the Corporation’s auditors since 1993 and has been the auditors of the Corporation since it became a public company in July 2010. The persons named in the accompanying Instrument of Proxy intend to vote for the appointment of KPMG LLP and the authorization for the directors to fix their remuneration at the Meeting, unless otherwise directed.

9

Table of Contents

Management knows of no amendment, variation or other matter to come before the Meeting other than the matters identified in the Notice of Meeting. However, if any other matter properly comes before the Meeting or any adjournment or postponement thereof, the Common Shares subject to the Instrument of Proxy solicited hereunder will be voted on such matter in the discretion of and according to the best judgment of the proxyholder unless otherwise indicated on such Instrument of Proxy.

Compensation Discussion and Analysis

The following discussion and analysis examines the compensation earned during the last financial year of the Corporation by the persons who acted as the Corporation’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) for any part of the fiscal year ended March 31, 2015 as well as each of the three other most highly compensated executive officers of the Corporation (collectively, the “NEOs”) each earning more than $150,000 in total compensation for the fiscal year ended March 31, 2015.

Under the guidance of the Compensation Committee of the Board, the Corporation has taken a strategic approach in the design of its compensation program to ensure transparency and alignment with business objectives and performance. The Compensation Committee has adopted a philosophy of transparency in its compensation programs rewarding performance with competitive base salaries, annual performance and success-sharing bonuses and long-term incentive awards including the granting of stock options, RSUs and retirement plans.

Executive Compensation Guiding Principles

The Corporation recognizes that its success is in large part dependent on the Corporation’s ability to attract and retain skilled employees. The Corporation endeavors to create and maintain compensation programs based on performance, teamwork and rapid progress and to align the interests of the executives and Shareholders. The principles and objectives of the compensation and benefits programs for employees generally, and for the NEOs specifically, are to:

| • | attract, motivate and retain highly-skilled individuals who have incentives to achieve the Corporation’s strategic goals; |

| • | closely align compensation with the Corporation’s business and financial objectives and the long-term interests of Shareholders; and |

| • | offer total compensation that is competitive and fair. |

Elements of Executive Compensation

The compensation of the NEOs consists of the following principal components:

| • | base salary; |

| • | performance-based cash bonuses; and |

| • | participation in the Corporation’s Equity Incentive Plan. |

Each compensation element has a role in meeting the above objectives. The mix of compensation components is designed both to reward short-term results and to motivate long-term performance. The compensation level of the NEOs reflects to a significant degree the varying roles and responsibilities of the NEOs.

10

Table of Contents

The appropriate level for overall NEOs compensation is determined by the Compensation Committee for all of the NEOs based on: (i) a review of certain available market data including a review of the compensation paid to other named executive officers by a comparison group of companies as set forth below; and (ii) internal equity, length of service, skill level and other factors deemed appropriate.

The Corporation has relied on market survey data for similar positions in other companies to assist in determining compensation levels that are competitive and fair. In addition, the CEO (and with respect to the CEO, the Compensation Committee) reviews the performance of each NEO on an annual basis. Based on this review and the factors described above, such parties made recommendations to the Board as to the executive compensation package for each NEO. This review commences in the last quarter of the fiscal year to which the performance relates and is completed in the first quarter of the subsequent fiscal year.

Competitive Positioning and Compensation Advisors

The Compensation Committee is authorized to retain the services of external executive compensation specialists from time to time, as the committee sees fit, in connection with the establishment of cash and equity compensation and related policies. In January 2011, the Compensation Committee first retained the services of Mercer Canada Limited (“Mercer”), an executive compensation consultant, to assist in establishing and reviewing a comparator group to conduct an analysis to assist in establishing competitive total direct compensation and short-term and long-term incentive targets for the NEOs. For the fiscal year ended March 31, 2015, Mercer provided data and analysis with respect to compensation matters in respect of each NEO as well as providing general salary information that was used by the Corporation for assessing the compensation elements for the general employee population. Prior to January 2011, the Corporation did not engage the services of a compensation consultant.

The Compensation Committee annually reviews the total compensation of the Corporation’s NEOs and compensation practices of the Corporation. In reviewing the total compensation for the NEOs for the fiscal year ended March 31, 2015, the Corporation used data previously collected from a group of five Canadian and 15 U.S. companies (“Comparator Group”) that, with the assistance of Mercer, was aged appropriately in order to be suitable for use in the current fiscal year. The Comparator Group reflects the types of organizations with which the Corporation competes for talent for executives. The Compensation Committee reviewed such data from the Comparator Group targeting total direct compensation at the 50th percentile. The Comparator Group used for the fiscal year ended March 31, 2015 was comprised of the following companies:

| • Aastra Technologies Limited

|

• Netgear Inc. |

• Sierra Wireless, Inc. | ||

| • Arris Group, Inc.

|

• Novatel Wireless Inc. |

• STEC Inc. | ||

| • Constellation Software Inc.

|

• OCZ Technology Group Inc. |

• Super Micro Computer, Inc. | ||

| • Cts Corp.

|

• Open Text Corporation |

• Synaptics Inc. | ||

| • Emulux Corp.

|

• Polycom, Inc. |

• United On Line Inc. | ||

| • Intermec Inc.

|

• QLogic Corp. |

• ViaSat Inc. | ||

| • Macdonald Dettwiler & Associates Ltd. |

• RealNetworks Inc. |

|||

11

Table of Contents

NOTE:

U.S. companies are in italics.

The Corporation benchmarks each named executive position against similar positions in the Comparator Group. Competitive market data on the Comparator Group gives the Compensation Committee and the Board an initial reference point for determining executive compensation. The Comparator Group is used to assess the reasonableness of the Corporation’s compensation and to confirm that compensation is consistent with the Corporation’s desired philosophical positioning. In setting compensation of an executive, the Comparator Group is considered among other factors, including the individual’s contribution, experience, performance and internal equity. The Compensation Committee, in consultation with Mercer, reviews the Comparator Group annually to ensure that it continues to be appropriate. The compensation data previously collected from the Comparator Group, appropriately aged, was used to evaluate executive compensation for the fiscal year ended March 31, 2015. The criteria used for determining the companies included in the Comparator Group include that each company: (i) is autonomous and publicly-traded; (ii) has comparable revenues to that of the Corporation; (iii) is similarly sized considering assets, market capitalization and number of employees; and (iv) has robust compensation data available. The Comparator Group has been chosen by the Compensation Committee as appropriate because it represents a cross-section of companies from different sectors that are similar to the Corporation in terms of size of assets and revenues.

The Corporation believes it has effective risk management and regulatory compliance for its compensation policies. The Corporation has a Compensation Committee to assist the Board in discharging its duties relating to compensation of the Corporation’s directors and executive officers. The Compensation Committee and the Board have structured the executive compensation to ensure that executives are compensated fairly, and in a way that does not incur undue risk to the Corporation or encourage executives to take inappropriate risks. Risks related to compensation are taken into consideration as part of the general review and determination of executive compensation by the Compensation Committee and the Board, including: review of salaries of the Comparator Group, review and approval by the Compensation Committee and recommendation to the Board for approval. Director and executive compensation are reviewed annually, and benchmarked against the Comparator Group to assess competitiveness and fairness. Management will use Mercer to conduct a competitive compensation review for all executive positions as and when appropriate. This independent advice provides the Compensation Committee and the Board with a market reference point when they assess individual performance in the context of overall corporate performance.

Inappropriate and excessive risks by executives are mitigated by regular meetings of the Board, at which activity by the executives must be approved by the Board if such activity is outside or beyond previously Board-approved actions. Through the Audit Committee, the Board also receives regular reports concerning risk management activities as well as management’s compliance with company policies and procedures. Part of the Corporation’s executive compensation consists of grants under the Equity Incentive Plan. Such compensation is long term and, accordingly, is directly linked to the achievement of long term value creation and aligns executives’ interests with those of Shareholders. As the benefits of such compensation, if any, are not realized by the executive until a significant period of time has passed, the ability of executives to take inappropriate or excessive risks that are beneficial to them from the standpoint of their compensation at the expense of the Corporation and its Shareholders is limited.

The other two elements of compensation, base salary and performance-based cash bonuses, represent the remaining portion of an executive’s total compensation. While neither salary nor bonus is long term, these components of compensation represent only a portion of total compensation and as a result it is unlikely that an executive would take inappropriate or excessive risks at the expense of the Corporation and its Shareholders that would be beneficial to them from the standpoint of their short term compensation when their long term compensation might be put at risk from their actions.

12

Table of Contents

For the reasons set forth above, the Compensation Committee has concluded that there are minimal risks arising from the Corporation’s executive compensation policies and practices that are reasonably likely to have a material adverse effect on the Corporation.

Although the Corporation has not adopted a policy forbidding insiders from purchasing financial instruments relating to the Common Shares, the Corporation is not aware of any insider having entered into this type of transaction.

The compensation of the NEOs consists of the following principal components:

| • | base salary; |

| • | performance-based cash bonuses; and |

| • | participation in the Equity Incentive Plan. |

The NEOs’ compensation packages provide a balanced set of elements consistent with the objectives of the Corporation’s compensation strategy. The fixed elements, assessed in their entirety, provide a competitive base of fixed compensation necessary to attract, retain and motivate executives. The variable elements, assessed in their entirety, are reviewed and approved by the Compensation Committee and are designed to balance short-term objectives with the long-term interests of the Corporation, motivate superior performance against both timeframes and reward the attainment of individual and business objectives. The combination of the fixed elements and variable incentive opportunities delivers a competitive compensation package as compared to the peer group used by the Corporation.

Below is a description of the total compensation elements of the Corporation as of March 31, 2015, forms of compensation, performance periods and how the amount is determined for each element.

| Type of Compensation |

Form | Performance Period |

How is it determined | |||

| Base salary |

Cash | One year | Reflects consideration of sector market conditions, the role of the executive, individual competency, and attraction and retention considerations. Base salary was benchmarked to the 50th percentile for the selected Comparator Group of companies and adjusted to reflect the NEOs’ experience, responsibilities and performance. | |||

| Short-Term Incentive |

Performance- Based Cash Bonuses |

One year | Focuses on specific annual objectives. Target award is based on market competitiveness. The actual award is based on Corporation performance in the case of the CEO, and on Corporation and individual performance in the case of the other NEOs. | |||

13

Table of Contents

| Type of Compensation |

Form | Performance Period |

How is it determined | |||

| Long-Term Incentive |

Stock options |

Typically, three year cliff vesting and a five year term |

Target award (using an option pricing model to estimate the value) is based on market competitiveness of the long-term incentive package. However, the final realized value is based on the appreciation of the price of the Common Shares. | |||

| RSUs | Typically, three year cliff vesting |

Target award is determined by the Compensation Committee and based on market competitiveness of the aggregate value of all long-term incentives awarded in a particular year. | ||||

| Performance Restricted Share Units (“PSUs”) |

Typically, three year cliff vesting and a three year term |

Target award is determined by the Compensation Committee and is based on the market competitiveness of the aggregate value of all long-term incentives awarded in a particular year. | ||||

| Benefits |

Medical and dental insurance |

Ongoing | Based on historical practices of the Corporation. | |||

| Retirement Plans |

RRSP Contribution 401(k) |

Ongoing | The Corporation matches an employee’s contribution to a maximum of 3.5% of the employee’s annual salary. With respect to 401(k) plans, the Corporation matches an employee’s contribution to a maximum of 3.0% of the employee’s annual salary. | |||

In general, base salaries for the NEOs are initially established through arm’s-length negotiation at the time of hire, taking into account the NEO’s qualifications, experience and prior salary and prevailing market compensation for similar roles in comparable companies. The initial base salaries of the NEOs are then reviewed annually by the Compensation Committee for the CEO and by the CEO and the Compensation Committee for all other NEOs, to determine whether any adjustment is warranted. Base salaries are also reviewed in the case of promotions or other significant changes in responsibility.

In considering a base salary adjustment, the Compensation Committee considers the Corporation’s overall performance, the scope of the NEO’s functional responsibilities, individual contributions, responsibilities and prior experience. The Compensation Committee may also take into account the NEO’s current salary, equity position both vested and unvested, and the amounts paid to the NEO’s peers at the Corporation.

14

Table of Contents

Performance-Based Cash Bonuses

Annual performance-based cash bonuses are intended to reward the NEOs for achieving short-term goals while making progress towards the Corporation’s long-term objectives. The Fiscal 2015 Discretionary Bonus Plan (the “2015 Bonus Plan”) includes target bonus opportunities and target goals. The Compensation Committee reviewed and approved the proposed bonus awards for fiscal 2015 for each of the NEOs that it would recommend to the Board, and the Board approved the awards at the recommended levels.

Each bonus under the 2015 Bonus Plan has two components, as described in greater detail below: (i) a Corporation performance bonus; and (ii) an individual performance bonus. These components are measured as follows:

| • | The Corporation performance bonus is measured by reference to a key performance indicator: “Adjusted EBITDA” as determined by internal management financial statements. The term “Adjusted EBITDA” is defined as net income before interest, income taxes, depreciation and amortization, adjusted for the following items: foreign exchange gains or losses, net change in deferred revenue balances, stock- based compensation, costs of restructuring, impairment of goodwill, impairment of property and equipment, other income, and gains or losses related to the sale of long-lived assets. The Corporation uses this method to assess business performance when evaluating results in comparison to budgets, forecasts, prior-year financial results and the performance of companies in the comparison group of companies used by the Corporation. |

| • | The individual performance bonus is measured by reference to the following factors relating to an individual NEO’s performance: contribution to the Corporation’s strategy, contribution to key issues for the Corporation, attention to values, principles and policies, and delivery against objectives set out in an individual NEO’s annual work plan and as otherwise communicated to the NEOs. |

Each NEO’s target bonus opportunity under the 2015 Bonus Plan was expressed as a percentage of his or her base salary, with individual target award opportunities ranging from 70% to 100% of base salary. There is an additional bonus opportunity for exceptional performance, and another in the event the Corporation attains the Corporation performance targets. The weighting of the bonus for the NEO ranges from 80% to 100% for Corporation performance and 0% to 20% for individual performance. The bonus is weighted towards Corporation performance in accordance with the NEO’s ability to affect overall Corporation performance. The Corporation performance targets for payout under the 2015 Bonus Plan were initially set at amounts the Board reasonably believed to be attainable. The 2015 Bonus Plan contemplates that if the Corporation performance targets are not attained, no individual performance bonuses may be paid. However, the 2015 Bonus Plan provides that the Board can exercise discretion to award bonuses in the absence of attaining Corporation performance targets or can increase or decrease awards on a discretionary basis having regard, in each instance, to the general spirit and intent of the 2015 Bonus Plan. In December 2014 the Board chose to exercise such discretion and reduced the Corporation performance targets such that in the event Adjusted EBITDA for fiscal 2015 was equal to or exceeded $25 million, the Corporation performance factor in the bonus formula would be 50% for all NEOs. As a result, while some bonuses were earned under the 2015 Bonus Plan as so revised, the amounts were substantially lower than would have been the case had the original Corporation performance targets been attained.

For NEOs whose short-term incentive includes an individual performance component, the factors comprising such individual performance include: achieving established in-year objectives, continuing to build the capability, capacity and process improvement of the officer’s functional area(s) of responsibility, and adhering to the established budget of the officer’s functional areas(s) of responsibility.

15

Table of Contents

The Corporation adopted the Equity Incentive Plan in connection with its initial public offering (“IPO”) and has granted equity incentive awards to the NEOs pursuant to the Equity Incentive Plan. Such grants were made with consideration given to the overall compensation of the NEO as well as the number of Common Shares already held.

The Corporation has entered into employment agreements with the NEOs that provide for the payment of certain benefits if the Corporation undergoes a change in control or going private transaction. The Corporation believes that these arrangements effectively allow the NEOs to objectively assess and pursue aggressively any corporate transactions that are in the best interests of Shareholders, without undue concern over the effect of such a transaction on their own personal financial and employment situation. See “— Termination and Change of Control Benefits.”

Perquisites and Other Personal Benefits

The Corporation does not currently utilize perquisites or other personal benefits as a significant element of the compensation program currently provided to NEOs. All future practices regarding these matters will be approved, and subject to periodic review, by the Compensation Committee.

The Corporation has a Compensation Committee that is currently composed of Messrs. Hagerty, Mueller and McKinnon, all of whom are independent within the meaning of National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”).

All members of the Compensation Committee have direct experience in compensation matters as current or former chief executive officers of public companies or chief operating officers of large accounting firms. Collectively, this experience provides the Compensation Committee with the knowledge, skills, experience and background in executive compensation and human resources matters to make decisions on the suitability of the Corporation’s compensation policies and practices. In addition to the collective experience of the Compensation Committee in compensation matters, all of the members stay actively informed of trends and developments in compensation matters and the applicable legal and regulatory frameworks.

The Compensation Committee acts on behalf of the Board in all matters pertaining to the appointment, compensation, benefits and termination of members of the senior management team. The Compensation Committee reviews the goals and objectives relevant to the compensation of the senior management team, as well as the annual salary, bonus, pension, severance and termination arrangements and other benefits, direct and indirect, of the senior management team, and makes recommendations to the Board and/or management, as appropriate.

16

Table of Contents

Specific responsibilities of the Compensation Committee include:

| • | reviewing management succession plans and processes of the CEO, the CFO, the Chief Technology Officer, the President of the Education Business Unit and the President of the Enterprise Business Unit (which, as of April 1, 2015, are now titled the Solutions and kapp Business Units, respectively) and the other executives that report directly to the CEO as well as any other senior employees designated for this purpose by the committee from time to time and making recommendations to the Board and/or management as appropriate (no other senior employees have been so designated by the committee as of March 31, 2015); |

| • | reviewing the annual salary, bonus, pension, severance and termination arrangements and other benefits, direct and indirect, of the executive management team and making recommendations to the Board and/or management as appropriate; |

| • | reviewing and approving (or in the discretion of the Compensation Committee, making recommendation to the Board) recommendations concerning the operation of employee compensation plans, including the terms, eligible participants, vesting, price and incentive targets and the exercise of any discretion provided in these plans; |

| • | providing recommendations to the Board regarding the administering and granting of options, awards or rights pursuant to any stock option, purchase plan or incentive plan; and |

| • | reviewing any proposed disclosure relating to executive compensation. In particular, reviewing, commenting on and approving the statement of Executive Compensation (including the Compensation Discussion and Analysis and related tables) and recommending it to the Board for inclusion in this Information Circular prepared for the annual meeting of Shareholders. |

The Corporation retained Mercer to provide research, advice and recommendations with respect to the compensation of the directors and certain key employees of the Corporation. The services that Mercer has provided to the Corporation include advising on the design of overall compensation packages, reviewing the Corporation’s director compensation program, compiling comparative data with respect to the compensation programs of similar entities, analyzing the Corporation’s executive compensation packages and the individual elements thereof and comparing such compensation packages to those offered by other entities in the Comparator Group. Mercer did not provide any other services to the Corporation, or to any of its directors or members of management, other than or in addition to those compensation services referred to above.

The total compensation paid to Mercer for the fiscal year ending March 31, 2015 for the provision of these services was approximately $54,289 of which approximately $7,849 was related to consulting work related to compensation programs and approximately $46,440 was related to the Corporation’s participation in annual market surveys carried out by Mercer. There have been no fees paid to Mercer other than as provided for herein for the fiscal year ended March 31, 2015.

17

Table of Contents

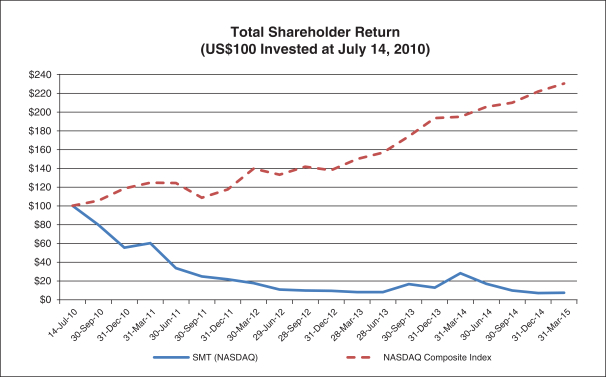

The following chart illustrates the cumulative Total Shareholder Return of $100 invested in the Corporation’s Common Shares on the NASDAQ Global Select Market (the “NASDAQ”) on July 14, 2010 (the Corporation’s first day of public trading) through March 31, 2015. This is compared to the equivalent cumulative value invested in the NASDAQ Composite Index for the same time period.

| Date |

SMT (NASDAQ) |

NASDAQ Composite Index |

||||||

| 14-Jul-10 |

100.00 | 100.00 | ||||||

| 30-Sep-10 |

79.71 | 105.48 | ||||||

| 31-Dec-10 |

55.53 | 118.48 | ||||||

| 31-Mar-11 |

60.06 | 124.46 | ||||||

| 30-Jun-11 |

33.53 | 124.40 | ||||||

| 30-Sep-11 |

24.71 | 108.61 | ||||||

| 31-Dec-11 |

21.71 | 117.50 | ||||||

| 30-Mar-12 |

17.47 | 139.78 | ||||||

| 29-Jun-12 |

10.71 | 133.10 | ||||||

| 28-Sep-12 |

9.59 | 141.76 | ||||||

| 31-Dec-12 |

9.29 | 138.00 | ||||||

| 28-Mar-13 |

8.18 | 149.76 | ||||||

| 28-Jun-13 |

8.00 | 156.54 | ||||||

| 30-Sep-13 |

16.53 | 174.05 | ||||||

| 31-Dec-13 |

12.88 | 193.36 | ||||||

| 31-Mar-14 |

28.12 | 194.96 | ||||||

| 30-Jun-14 |

16.76 | 205.32 | ||||||

| 30-Sep-14 |

9.65 | 209.92 | ||||||

| 31-Dec-14 |

6.94 | 221.88 | ||||||

| 31-Mar-15 |

7.18 | 230.28 | ||||||

18

Table of Contents

As at March 31, 2015, the share price of the Corporation’s Common Shares was approximately 25% of its price one year earlier. Base salaries for the NEOs who were with the Corporation over the past fiscal year remained constant over this time period and the performance based cash bonuses earned in respect of performance for the fiscal year ended March 31, 2015 were significantly lower, reflecting in part the decrease in share price over that period.

The following table sets forth information concerning the total compensation paid or earned by the NEOs for each of the years ended March 31, 2015, 2014 and 2013.

| Name and Principal Position |

Year | Salary($)(1) | Share- based awards ($)(2) |

Option- based awards ($)(3) |

Non-equity incentive plan compensation ($) |

Pension Value ($) |

All other Compensation ($)(1) |

Total Compensation ($)(1) |

||||||||||||||||||||||||||||

| Annual incentive plans(1)(4) |

Long- term incentive plans |

|||||||||||||||||||||||||||||||||||

| Neil Gaydon President & CEO(5) |

2015 | 680,619 | 260,657 | 287,688 | 340,309 | Nil | Nil | 1,031 | (10) | 1,570,304 | ||||||||||||||||||||||||||

| 2014 | 735,643 | 1,000,500 | 81,426 | 1,103,465 | Nil | Nil | 30,514 | 2,951,548 | ||||||||||||||||||||||||||||

| 2013 | 321,569 | 258,000 | 121,580 | 336,456 | Nil | Nil | 100,335 | 1,137,940 | ||||||||||||||||||||||||||||

| Kelly Schmitt Vice President, Finance & CFO(6) |

2015 | 277,821 | 111,517 | 123,081 | 127,964 | Nil | Nil | 10,942 | (11) | 651,325 | ||||||||||||||||||||||||||

| 2014 | 287,520 | 404,000 | Nil | 294,219 | Nil | Nil | 27,258 | 1,012,998 | ||||||||||||||||||||||||||||

| 2013 | 200,625 | 64,100 | 60,790 | 49,945 | Nil | Nil | 26,900 | 402,360 | ||||||||||||||||||||||||||||

| Warren Barkley Chief Technology Officer(7) |

2015 | 351,287 | 111,517 | 123,081 | 216,393 | Nil | Nil | 152,705 | (12) | 954,983 | ||||||||||||||||||||||||||

| 2014 | 380,819 | 463,000 | 54,284 | 560,418 | Nil | Nil | 60,165 | 1,518,685 | ||||||||||||||||||||||||||||

| 2013 | 152,140 | 64,500 | 59,772 | 152,140 | Nil | Nil | 991 | 429,544 | ||||||||||||||||||||||||||||

| Greg Estell President, Education(8) |