Form 6-K RIO TINTO PLC For: Mar 31

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

|

Commission file number: 001-10533 |

Commission file number: 001-34121 |

|

|

|

|

Rio Tinto plc |

Rio Tinto Limited |

|

|

ABN 96 004 458 404 |

|

(Translation of registrant’s name into English) |

(Translation of registrant’s name into English) |

|

|

|

|

2 Eastbourne Terrace |

Level 33, 120 Collins Street |

|

London, W2 6LG, United Kingdom |

Melbourne, Victoria 3000, Australia |

|

(Address of principal executive offices) |

(Address of principal executive offices) |

Indicate by check mark whether

the registrant files or will file annual reports under cover of

Form 20-F or

Form 40-F:

Form 20-F _X_ Form 40-F ___

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T

Rule 101(b)(1): ___

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T

Rule 101(b)(7): ___

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to

Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___ No _X_

If "Yes" is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82- ________

EXHIBITS

|

99.1 |

6 March 2015 | Increase to Diavik ore reserves |

| 99.2 | 6 March 2015 | Increase to Hail Creek coal reserves |

| 99.3 | 6 March 2015 | Increase to Pilbara ore reserves and mineral resources |

| 99.4 | 16 March 2015 | Rio Tinto paid US$1.7 billion in taxes in 2014 |

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorised.

| Rio Tinto plc |

Rio Tinto Limited |

| (Registrant) |

(Registrant) |

|

|

|

|

|

|

| By /s/ Eleanor Evans | |

| Name Eleanor Evans |

Name Eleanor Evans |

| Title Company Secretary |

Title Joint Company Secretary |

|

|

|

| Date 2 April 2015 |

2 April 2015 |

|

|

|

Media release |

INCREASE TO DIAVIK ORE RESERVES

6 March 2015

To support the annual Mineral Resources and Ore Reserves review process detailed in Rio Tinto’s 2014 Annual report released today, Rio Tinto Diamonds has declared an increase of its Ore Reserves for the Diavik operation in Canada, resulting from the completion of studies and evaluations.

The update is reported under the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 (JORC Code) and ASX Listing Rules, and provides a breakdown of the updated Mineral Resource and Ore Reserve in Table 1 and 2, and a summary of information to support the Ore Reserve increase in Appendix 1.

The update is based on a rigorous examination of the identified resources, mining options and operations planning for Diavik resulting in:

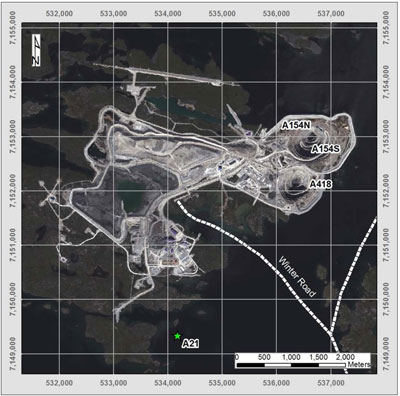

| • | the addition of a new Open Pit mining development from the fourth kimberlite pipe, A21, to be mined with the existing underground production from the A154N, A154S and A418 pipes; and, | |

| • | production from A21 which will bring open pit mining back into the mine plan, adding important incremental production to ongoing underground output to sustain the current total production rate over the existing mine life. |

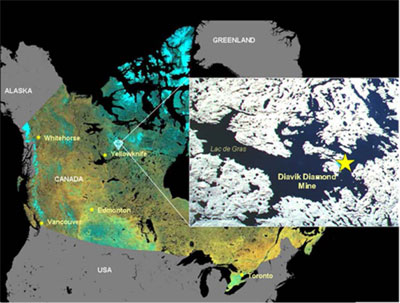

Diavik is a diamond mine operating at a secure remote site in the Northwest Territories, Canada. Access is by air year-round and a seasonal ice road is available for eight to ten weeks each year over which the mine’s annual re-supply of bulk materials and large cargo are transported.

The mine is a joint venture with Rio Tinto holding 60 per cent and serving as the operator and manager. The ownership structure and joint venture arrangements have remained unchanged since commercial production began in 2003.

The updated Ore Reserve and current mine plans indicate production continuing to 2023. Remaining mineral resources are available and are being evaluated, and may have potential to be added to the mine plan in due course.

Diavik’s fourth kimberlite pipe, A21, is located on the mine site near the other three pipes currently in production. During the fourth quarter of 2014, Rio Tinto approved a positive feasibility proposal to add A21 to the existing mine plan. An implementation team is in place and construction activities began immediately. Development includes site preparation, earthworks, water management and pre-production overburden stripping. First ore production from A21 is expected in 2018.

Page 1 of 21

|

|

Summary of Information to Support Mineral Resource Estimates

Mineral Resource Estimate upgrades for the Diavik diamond mine are supported by JORC Table 1 (Section 1 to 3) documents provided in Appendix 1 of this media release and also located at www.riotinto.com/JORC. The following summary of information for Mineral Resource Estimates is provided in accordance with Chapter 5.8 of ASX Listing Rules.

Geology and geological interpretation

The mineral resource for the Diavik mine consists of four diamond-bearing kimberlite pipes located beneath Lac De Gras in Canada’s Northwest Territories. The Diavik kimberlites are Eocene (54–58 Ma) volcanic deposits that intruded Archean (2.5-2.8 Ga) granitoid and metasedimentary rocks of the Slave Craton. The kimberlites and their host rocks were then covered by a Quaternary glacial till which was generally up to 40 metres (m) thick in the immediate vicinity of the pipes. The Diavik Project kimberlites occur as steeply inclined to vertical cone-shaped intrusions, or pipes, within granitoid country rocks. The pipe walls are inclined at angles between 78 and 84 degrees. The Diavik pipes range from 100 m to 150 m in plan and form complex elongated cone shapes to depths approaching 1,000 m below surface. They contain 5 to 20 million tonnes (Mt) of ore with production lives ranging from 5 to 10 years. The kimberlite pipes that underpin the present mining plan are named A154S, A154N and A418 and A21.

Drilling techniques

A total of 95 sampling drill holes have been used for the resource estimate. Core drilling (LDC) represents 25% of the total samples and large diameter reverse circulation (LDRC) drilling 65%. The remaining samples were collected from blasted material during mining. The drill holes are between 15 m and 532 m in length, all of them drilled vertically. A range of bit sizes has been used. The diamond drilling bit size used was 6” for sampling. NQ and HQ core were drilled for delineation and geologic interpretation. LDRC drilling has used scoop tooth, tri-cone and mill tooth bits of 13.75”, 17.5”, 22” and 24” diameters.

A core orientation tool has been used since commencement of diamond core drilling to confirm hole azimuth and dips. During LDRC drilling programs downhole caliper tools are also used to measure hole volumes.

Sampling and sample analysis method

LDC sample holes were drilled vertically, starting with 6” core and stepping down to 3” to 4” core at depths of around 250 m (due to drilling equipment limitations). Samples were recovered in varying lengths (nominally 15 m for 6” core and 25 m for 3” and 4” core) attempting to maintain a constant sample weight and yielding a minimum of around 30 stones per sample.

Large diameter core was logged at site, packed into core boxes and sent for processing. Each sample length was treated separately through the plant, with the circuit flushed and cleaned between the samples. The LDC samples were crushed and then processed through a dense media separation (DMS) circuit to produce a heavy mineral concentrate. The concentrate was then sent through an x-ray diamond sorting machine and hand sorted to recover the diamonds. A nominal lower cut of size of 1 mm square mesh was achieved using slotted screen panels in the DMS circuit. The diamonds recovered were cleaned, sized, weighed and the results reported by size class.

Page 2 of 21

LDRC holes were drilled in all of the project pipes to improve resource definition after the start-up of the mine. Where possible, the drilling was done before mining commenced in the area: A154N and A418 in 2004/2005, and A21 in 2009. These three programs were designed to drill to the bottom of the planned open pits. Once mining was underway, three in-pit programs were conducted: A154S in 2009, and A154N and A418 in 2013. The in-pit programs were planned to drill to the pipe outer walls. All of the LDRC holes were vertical and hole diameters ranged from 13.75” to 24” depending on the grade of the pipe. The samples were planned to coincide with underground mining levels and were collected in 10 m increments along the hole. Chip samples were taken every 3 m and were logged to determine the modeled geologic unit of each sample.

The LDRC samples were sealed at the drill site and transported off-site for processing. The samples were crushed in two stages and treated by dense media separation with a nominal lower cut-off size of 1 mm. Recovery of diamonds from the resulting concentrates was by x-ray sorting and magnetic separation. In some cases caustic fusion of the rejects was done. The +2 mm concentrates were hand-picked directly whereas the –2 mm concentrates were fused in caustic soda prior to diamond extraction by hand. All recovered diamonds were cleaned, sieved, counted and weighed and the results reported by size class.

Criteria used for classification

Classification is based on:

| • | appropriate spatial and geological representivity of samples; | |

| • | sample size effect; | |

| • | complete size/frequency distribution and therefore accurate mean stone size; | |

| • | confidence in diamond quality and value; | |

| • | contact and volume delineation confidence; | |

| • | sample grade and specific gravity estimation uncertainty; | |

| • | reconciliation with production data. |

Estimation methodology

The grade estimation uses unconstrained ordinary kriging of carats per tonne (cpt) in the top portion of the pipes and unconstrained simple kriging of cpt at lower depths in some of the pipes due to a reduced number of samples. As there are sufficient samples at depth in the A154S pipe, simple kriging is not necessary in that pipe. Estimate block size is 15 m, just over half the average drill hole spacing and appropriate for the scale of mining being carried out.

Reasonable prospects for eventual economic extraction

For areas of the geologic resource model not in the Ore Reserves – all of which are underground at depth or beneath a completed open pit – break-even cut-off grades can be calculated based on assumed mining method, costs, and price. For areas having economic potential, a measure of viability is derived from production scheduling and cash flow analysis.

The proposed Mineral Resources are added into the prevailing life-of-mine plan as if they were ‘ore reserves’, which provides an ‘upside’ scenario for comparing against the Ore Reserves-only plan. Where Mineral Resources are extensions of the underground mine and prevailing mining methods are applicable, the same dilution, losses and cost modeling are assumed. Where Mineral Resources would not be mined as extensions of current plans, appropriate assumptions supported by studies-in-progress are applied. Comparing the

Page 3 of 21

resulting cash flows and net present values for the respective scenarios provides a sense of the net business impact of the Mineral Resources that has included assumed mining methods, the anticipated costs, prices over time, capital requirements, tax effects, and any changes in mine closure plan.

Table 1

| Diavik Remaining Mineral Resource Update (100% Joint Venture) | ||||||||||||||||||||||||||||

| Kimberlite Pipe |

Measured Resource |

Indicated Resource |

Inferred Resource |

Total Resource |

Rio Tinto Interest |

|||||||||||||||||||||||

| Mt | ct/t | Mct | Mt | ct/t | Mct | Mt | ct/t | Mct | Mt | ct/t | Mct | |||||||||||||||||

| At End 2014 | ||||||||||||||||||||||||||||

| A154N | --- | --- | --- | --- | --- | --- | 2.0 | 2.5 | 5.0 | 2.0 | 2.5 | 5.0 | ||||||||||||||||

| A154S | --- | --- | --- | --- | --- | --- | 0.1 | 3.8 | 0.3 | 0.1 | 3.8 | 0.3 | ||||||||||||||||

| A418 | --- | --- | --- | --- | --- | --- | 0.3 | 2.4 | 0.7 | 0.3 | 2.4 | 0.7 | ||||||||||||||||

| A21 | --- | --- | --- | 0.4 | 2.6 | 1.0 | 0.8 | 3.0 | 2.3 | 1.1 | 2.9 | 3.3 | ||||||||||||||||

| Totals | --- | --- | --- | 0.4 | 2.6 | 1.0 | 3.1 | 2.6 | 8.3 | 3.5 | 2.6 | 9.3 | 60% | |||||||||||||||

| At End 2013 Totals |

3.6 | 2.8 | 10.0 | 0.4 | 2.6 | 1.0 | 3.3 | 2.7 | 8.8 | 7.3 | 2.7 | 19.8 | 60% | |||||||||||||||

Summary of Information to Support Ore Reserve Estimates

Ore Reserve Estimate upgrades for the Diavik diamond mine are supported by JORC Table 1 (Section 4) documents provided in Appendix 1 of this media release and located at www.riotinto.com/JORC. The following summary of information for Ore Reserve Estimates is provided in accordance with Chapter 5.9 of ASX Listing Rules.

Economic assumptions

Economic viability is indicated by cash flow modeling for the full operation over the life of the mine that shows positive net present value with positive annual cash flows during production years. In some scenarios, cash flows may be negative over short periods when capital investments are planned which lead to increasing the net present value.

Revenues are forecasted from scheduled diamond production, expected prices and anticipated foreign exchange rates. Unlike most commodities, rough diamonds are not homogeneous and have wide ranges of size, colour and quality in infinite combinations. As such, trading prices are neither published nor benchmarked. For planning, aggregate diamond prices for each producing pipe are forecasted by the company’s diamond technical and marketing analysts. Foreign exchange rates are forecasted as well by company economics specialists.

Forecasted costs include mining and processing as well as all aspects of site support and corporate overhead including marketing and mine closure. A schedule of planned capital investment is also included for ongoing mine development and for sustaining the operation and its assets.

Page 4 of 21

Taxation modeling reflects applicable current tax laws including the treatment of capital investment and asset depreciation.

Criteria used for classification

The stated Proved and Probable Ore Reserves directly coincide with the Measured and Indicated Mineral Resources, respectively. There are no Inferred or Unclassified resources included in the stated reserve numbers.

Mining and recovery factors

Three adjacent kimberlite pipes have been in continuous production for a number of years while a fourth kimberlite pipe, A21, is in development toward first production expected by the end of 2018. A21 is reported as Ore Reserve for the first time in this statement.

Mining of the first three pipes was initially by open pit mining. Mining is now entirely from underground, accessed by portals. Two of the pipes are being mined by sub-level retreat. The third is being mined by blast-hole stoping with cemented rockfill. The ore processing plant is fed by mine production from all three pipes concurrently. The fourth kimberlite pipe, A21, will bring open pit mining back into the mine plan, adding important incremental production to ongoing underground output to sustain the current total production rate over the existing mine life.

The Ore Reserves are contained within full working mine designs for the underground operation and the future open pit. The mine designs are engineered for the geotechnical and hydrological conditions at the site and meet all applicable mining codes and regulations.

All of the Ore Reserves are in the life-of-mine production schedule.

Mining dilution and losses associated with each of the different mining methods employed are incorporated into the Ore Reserves. Assessments of mining dilution and losses are ongoing, and the assumptions used in Ore Reserve estimation are reviewed annually.

Cut-off grades

Forecasted costs for the operation along with forecasted prices determine a break-even grade (carats per tonne). For each of the kimberlite pipe deposits in the mine plan, diamond grades throughout the Ore Reserves and as forecasted in the mine plans exceed the break-even grade by generous margins. As such, selective mining is not required and all kimberlite is mined and processed.

Processing

The ore processing plant uses processes and equipment that are common in the diamond mining industry. The plant has operated continuously since mine start-up and is processing a varying blend of hard and soft kimberlites from several geologic units from multiple pipes.

Continuous improvement enabled the plant to exceed its original design throughput and metallurgical recovery early in the mine life. The stated Ore Reserves take into account the metallurgical recovery. Plant performance has been consistent and stable, thus supporting the life-of-mine plan and the economic viability of the Ore Reserves.

Page 5 of 21

Modifying factors

The Diavik diamond mine has met or exceeded operating, environmental, social and commercial expectations since the 2003 mine start-up. Production has been continuous and consistent, with proven mining and processing performance and product recovery.

Reconciliations between forecast model and actual outcomes are performed rigorously and frequently.

Mine designs, detailed working plans and regular updates to production schedules are carried out by staff geoscientists, engineers and metallurgists. Mining and processing are fully supported by requisite site infrastructure, health and safety leadership, environmental stewardship, communities engagement, people management and corporate functions. Business modeling for the full operation reflects favourable economics over the mine life.

The market for rough diamonds has robust fundamentals. Long-term forecasts are favourable based on a view that demand for rough diamonds will outstrip supply. For the Diavik mine, there are no political obstacles in Canada relating to the export of rough diamonds.

Property tenure is secure. All necessary regulatory permits are in place and in good standing.

Initial commissioning of the mine in 2003 as an open pit operation was on-time and within budget. A decade later, transition to the presently all-underground phase was successful. The re-introduction of open pit mining in the near future to complement ongoing underground production is being supported positively by the company and local communities.

Table 2

| Diavik Ore Reserve Update | (100% Joint Venture) | |||||||||||||||||||||||

| Kimberlite Pipe |

Proved Reserve |

Probable Reserve |

Total Reserve |

Rio Tinto Interest |

||||||||||||||||||||

| Mt | ct/t | Mct | Mt | ct/t | Mct | Mt | ct/t | Mct | ||||||||||||||||

| At End 2014 | ||||||||||||||||||||||||

| A154N | Underground | 5.0 | 2.3 | 11.5 | 2.1 | 2.2 | 4.5 | 7.0 | 2.3 | 16.1 | ||||||||||||||

| A154S | Underground | 0.9 | 4.0 | 3.7 | 0.9 | 3.4 | 3.1 | 1.8 | 3.7 | 6.7 | ||||||||||||||

| A418 | Underground | 3.5 | 4.1 | 14.3 | 2.1 | 2.9 | 6.1 | 5.5 | 3.7 | 20.4 | ||||||||||||||

| A21 | Open Pit | 3.7 | 2.7 | 10.0 | --- | --- | --- | 3.7 | 2.7 | 10.0 | ||||||||||||||

| Stockpile | n/a | 0.02 | 3.1 | 0.1 | --- | --- | --- | 0.02 | 3.1 | 0.1 | ||||||||||||||

| Totals | 13.1 | 3.0 | 39.6 | 5.0 | 2.7 | 13.7 | 18.1 | 2.9 | 53.3 | 60% | ||||||||||||||

| At End 2013 | ||||||||||||||||||||||||

| Totals | Underground | 11.1 | 2.9 | 32.0 | 5.3 | 2.8 | 14.9 | 16.4 | 2.9 | 46.8 | 60% | |||||||||||||

| plus Stockpile | ||||||||||||||||||||||||

Page 6 of 21

Competent Persons Statement

The information in this report that relates to Mineral Resources is based on information compiled by Ms. Kari Thompson, a Competent Person who is a Professional Geoscientist with the Northwest Territories Association of Professional Engineers and Geoscientists in Canada. Ms. Thompson is a full-time employee of the company.

The information in this report that relates to Ore Reserves is based on information compiled by Mr. Calvin Yip, a Competent Person who is a Fellow of The Australasian Institute of Mining and Metallurgy. Mr. Yip is a full-time employee of the company.

Ms. Thompson and Mr. Yip have sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as Competent Persons as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Ms. Thompson and Mr. Yip consent to the inclusion in the report of the matters based on the information in the form and context in which it appears.

Page 7 of 21

| Contacts | |

| [email protected] | |

| www.riotinto.com | |

Follow @RioTinto on Twitter Follow @RioTinto on Twitter |

|

| Media Relations, EMEA/Americas | Media Relations, Australia/Asia |

| Illtud Harri | Ben Mitchell |

| T +44 20 7781 1152 | T +61 3 9283 3620 |

| M +44 7920 503 600 | M +61 419 850 212 |

| David Outhwaite | Bruce Tobin |

| T +44 20 7781 1623 | T +61 3 9283 3612 |

| M +44 7787 597 493 | M +61 419 103 454 |

| David Luff | Matthew Klar |

| T + 44 20 7781 7781 | T +61 7 3625 4244 |

| M +44 7780 226 422 | M +61 457 525 578 |

| Investor Relations, EMEA/Americas | Investor Relations, Australia/Asia |

| John Smelt | Rachel Storrs |

| T +44 20 7781 1654 | T +61 3 9283 3628 |

| M +44 7879 642 675 | M +61 417 401 018 |

| David Ovington | Galina Rogova |

| T +44 20 7781 2051 | T +852 2839 9208 |

| M +44 7920 010 978 | M +852 6978 3011 |

| Grant Donald | |

| T +44 20 7781 1262 | |

| M +44 7920 587 805 | |

| Rio Tinto plc | Rio Tinto Limited |

| 2 Eastbourne Terrace | 120 Collins Street |

| London W2 6LG | Melbourne 3000 |

| United Kingdom | Australia |

| T +44 20 7781 2000 | T +61 3 9283 3333 |

| Registered in England | Registered in Australia |

| No. 719885 | ABN 96 004 458 404 |

Page 8 of 21

Appendix 1: Diavik Diamond Mine – Table 1

The following table provides a summary of important assessment and reporting criteria used at the Diavik diamond mine for the reporting of mineral resources and ore reserves in accordance with the Table 1 checklist in The Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code, 2012 Edition). Criteria in each section apply to all preceding and succeeding sections.

SECTION 1 SAMPLING TECHNIQUES AND DATA

| Criteria | Commentary | ||||

| Sampling techniques |

• | Core drilling and reverse circulation (RC) drilling from surface and in-pit have been used for sampling. Core drilling was used early in the project for feasibility work and RC drilling has been used subsequently to deliver a mining model. In-pit level sampling and underground drift sampling has also been used in areas where the drill samples do not provide adequate coverage. | |||

| Drilling techniques |

• | A total of 95 drillholes (1,581 samples) have been used for the resource estimate. In pit/underground sampling represents 10 percent of the total samples, core drilling represents 25 percent of the total samples and RC drilling 65 percent. The drill holes are between 15 metres and 532 metres in length, all of them drilled vertically. | |||

| • | A range of bit sizes has been used. The diamond drilling bit size used was primarily 6”, stepping down to PQ where necessary. RC drilling has used scoop tooth, tri-cone and mill tooth bits of 13.75”, 17.5”, 22” and 24” diameters. | ||||

| • | A core orientation tool has been used since commencement of diamond core drilling. | ||||

| Drill sample | • | Diamond core recovery is recorded by the geologist whilst logging the drill hole. | |||

| recovery | • | RC sample recovery is calculated using down hole caliper surveys for volume and weighing the recovered sample material. | |||

| • | Only material greater than 1 mm is recovered in RC samples as this has been the production stone size cut-off. | ||||

| Logging | • | Quantitative logging for lithology, mineralogy, texture, hardness, magnetic susceptibility and density is conducted using defined material type codes based on characterisation studies and mineralogical assessments. Colour and any additional qualitative comments are also recorded. Everything is logged. | |||

| • | Each tray of core is photographed. | ||||

| Sub-sampling techniques and sample preparation |

• | No sub-sampling is done as the sample size must be as large as possible for statistical reasons and representivity given the type and nature of the mineralisation. | |||

| Quality of assay data and laboratory tests |

• | Diamond sizing results are received electronically from an internally affiliated laboratory located elsewhere in Canada (at Thunder Bay, Ontario). Results are reviewed as they are received from the laboratory. Each individual sample’s stone size frequency distribution (SFD) is plotted alongside the combined results of that drill hole to identify any potential anomalies with the recovery during processing. Any discrepancies observed in the recovered SFD are followed with a third pick of the concentrate and a review of processing data by the laboratory staff. Samples are randomly spiked to check recovery efficiency. Audit samples are regularly collected and sorted from the float and fines. | |||

| Verification of sampling and assaying |

• | All logging is done in pairs. In addition, an external consultancy is engaged for petrographic expertise. | |||

| • | All data transfer is electronic and data are validated prior to uploading into acQuire databases which are managed and access-controlled by the Diavik resource geologists. All core logging data is collected as it is being logged using a front end application designed in MS Access. The Access mdb file is formatted using the acQuire database and all fields and data types in both are identical. As the core is logged, each dataset is entered into the mdb file using a laptop in the core shack. Once logging is complete, the data is added to the database using an import object that contains additional validation and will not import data that is not correctly formatted. | ||||

| • | All sample grades are adjusted to a well-established and historical production size frequency distribution (SFD) used as a reference. | ||||

| • | Twinned holes are not used as sample sizes need to be as large as possible for assessing | ||||

Page 9 of 21

| diamonds deposits. | |||||||

| Location of data points |

• | Land topography was modeled as a gridded surface based on 1:10,000 aerial photos flown in 1995. Data had been provided to Diavik by external contractors in Digital Terrain Model and contour format, and this was rationalised into a grid file in the MEDSYSTEM software. | |||||

| • | To include areas under surrounding lakes, bathymetric contours from survey points at 20 m intervals on 100 m lines were meshed with the topographic data to provide a “top of till” surface. | ||||||

| • | A Diavik-specific mine grid is used, based on the Nad83 UTM projection and datum. | ||||||

| Data spacing and distribution |

• | A154S | probable – 30 m | proven – 25 m | |||

| • | A418 | probable – 35 m | proven – 28 m | ||||

| • | A154N | probable – 40 m | proven – 27 m | ||||

| • | A21 | probable – 40 m | proven – 28 m | ||||

| • | No compositing has been applied. | ||||||

| Orientation of data in relation to geological structure |

• | Bedding is primarily horizontal so vertical drilling was chosen as the most geologically representative method of sampling. | |||||

| Sample security | • | Samples were sealed at the drill site and transported from Diavik (at Lac de Gras, Northwest Territories) to the Rio Tinto Exploration laboratory/processing facility (at Thunder Bay, Ontario) via secure trailer from G& G Expediting in the city of Yellowknife. | |||||

| Audits or reviews |

• | A scheduled independent Resources and Reserves audit in 2012 identified minor matters concerning sampling techniques and data having no material impact on reported figures, and all issues have since been addressed. | |||||

| • | The resources and reserves have been subjected periodically to Rio Tinto and Diavik internal review processes over the years. | ||||||

| • | The A21 project underwent an internal Rio Tinto review in 2014. | ||||||

|

SECTION 2 REPORTING OF EXPLORATION RESULTS |

|||||||

| Criteria | Commentary | ||||||

| Mineral tenement and land tenure status |

• | The Diavik diamond mine is an unincorporated joint venture (JV) arrangement between Rio Tinto holding 60% through its wholly-owned subsidiary Diavik Diamond Mines (2012) Inc. (DDMI) and Dominion Diamond Corporation holding 40% through its wholly-owned subsidiary Dominion Diamond Diavik Limited Partnership. Ownership of the larger exploration property is covered by option agreements with various third parties. | |||||

| • | Details for all 302 currently assigned mining leases can be provided. All are held by DDMI as manager and all are in good standing. | ||||||

| • | The leased tenure is secure for 21 years after the lease application date, at which point it can be renewed for a further 21 years on request as a simple administrative transaction. | ||||||

| • | There are no known impediments to maintaining the existing licences to operate in the area whether regulatory or social. | ||||||

| Exploration done by other parties |

• | No exploration by other parties has been performed on the property in the last 15 years. Any results generated from other companies prior to this have been incorporated into DDMI’s exploration database. | |||||

| Geology | • | The deposit types are all kimberlitic, hosted by typical Canadian Shield craton. | |||||

| Drill hole information |

• | This information has been adequately reported in historical announcements and is available in detail in the annual exploration reports delivered to the territorial government. This material is freely available in the public domain. In terms of assessing developing potential, this mine has been in continuous commercial production for more than a decade. | |||||

| Data aggregation methods |

• | In the diamonds sector, grade interpretation work on exploration pipes is typically not feasible and not attempted for lack of sufficient data during the highly speculative exploration phases of a project. | |||||

| Relationship | • | Information from drilling is reported as down-hole lengths, within sub-vertical kimberlitic | |||||

Page 10 of 21

| between mineralisation widths and intercept lengths |

pipes. | ||||

| Diagrams | Location of the Diavik diamond mine in northern Canada: | ||||

|

|||||

| Site plan showing the location of the four Diavik production kimberlites: |

Page 11 of 21

|

|||||

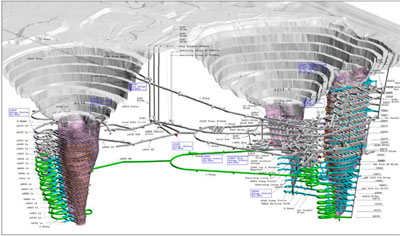

| Cut-away view showing past, existing and planned mine development for the current underground mining: | |||||

|

|||||

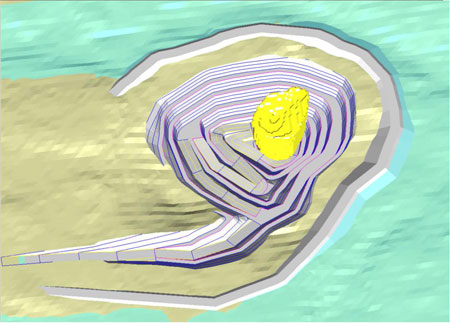

| Illustration of planned dike and open pit design for the fourth kimberlite pipe, A21, currently in development toward production anticipated for late 2018: |

Page 12 of 21

|

|||||

| • | Beyond the current kimberlites in production, none of the new kimberlites discovered to date are currently considered to be significant discoveries. | ||||

| Balanced reporting | • | Estimated sizes of exploration kimberlites are not reported externally. | |||

| Other substantive exploration data | • | Surface geochemical and kimberlitic indicator mineral results, geological mapping and geophysical surveys (gravity, magnetic, frequency and time-domain electromagnetic methods) have been completed and reported to the territorial government as a part of annual work requirements for regulatory purposes and are accessible by the public. No representations to date have been made for investor purposes. | |||

| Further work | • | No further drilling work is planned and exploration has been put on hold for the property. | |||

|

SECTION 3 ESTIMATION AND REPORTING OF MINERAL RESOURCES |

|||||

| Criteria | Commentary | ||||

| Database integrity | • | All data transfer is electronic. All data are validated prior to upload into acQuire databases that are managed and access-controlled by authorised Diavik staff geologists. Core logging data is collected as it is being logged using a laptop with a front end application designed in MS Access. The Access mdb file is formatted to match the acQuire database such that all fields and data types in are identical. When core logging is complete, the new data is added to the database using an import object. This import object contains additional validation and will not import unless the data are formatted correctly. | |||

| • | Diamond stone size analyses are received electronically from an internally affiliated laboratory/processing facility at Thunder Bay, Ontario. Results are reviewed as they are received from the laboratory, whereby each individual sample’s stone size frequency distribution (SFD) is plotted alongside the combined results of the entire drill hole to identify any potential anomalies with processing plant recovery performance, and any discrepancies observed are followed up with a third pick of the concentrate and a review of processing data by the laboratory staff. | ||||

| Site visits | • | The Competent Person (CP) for resource estimation works at site and the CP for ore reserves regularly visits site. | |||

| Geological | • | The grade estimation is unconstrained so internal geology units do not have any effect on the resource. | |||

Page 13 of 21

| interpretation | • | Multiple versions of the model have been run with different assumptions; all have been reconciled with production data to determine the most appropriate method. | |||

| Dimensions | • | The Diavik mineral resource and ore reserve hosts a single mining operation and common facilities, and is comprised of adjacent kimberlite pipes that are considered relatively small by world comparison. Each pipe is carrot-shaped and extends almost to surface with diameters between 100 m to 150 m at the tops and tapering to points at different individual depths currently modelled to between 300 m to more than 500 m below surface. | |||

| • | Production currently comes from three adjacent pipes mined simultaneously by a single crew and feeding a common processing plant, while a fourth pipe is in development for future production to commencing in 2018. | ||||

| • | To maintain accuracy of dimensions, kimberlite/waste contact points are collected both through ongoing drilling and surveying in active mining areas. Volume uncertainty in the proven/probable categories is kept to less than +/-10%. | ||||

| Estimation and modelling techniques |

• | The grade estimation uses unconstrained ordinary kriging (OK) of carats per tonne (cpt or ct/t) in the top portion of the pipes and unconstrained simple kriging (SK) of cpt at lower depths in some of the pipes due to a reduced number of samples. | |||

| • | The estimation uses all samples when estimating blocks within 25 m of a high grade sample but for the estimation of any remaining blocks the grade is decreased. This method better represents the actual variability in grade seen in the mined ore and limits the smearing of high grades into other part of the body. | ||||

| • | Estimate block size is 15 m, just over half the average drill hole spacing and appropriate for the scale of mining being carried out. | ||||

| • | All kimberlite in the reserve is economic and is mined as ore without selectivity and processed as a single blended feed. For model validation, however, production results are reconciled back into separate pipes through back-calculation. | ||||

| • | The validation process includes a visual check of the grade estimation in plan and section views as well as a comparison of average grade /grade distribution between the model and de-clustered sample data. Monthly grade reconciliation is also calculated and reported with periods of anomalous reconciliation for periods of 3 or more months prompting an in-depth investigation. | ||||

| Moisture | • | Core samples are collected at 6 m intervals down hole. A 20 cm piece is wrapped in plastic wrap by the driller’s helper as the core is removed from the core barrel. This piece is retrieved by the logging geologist as part of the logging procedure when the kimberlite is logged. The in-pit samples are collected as the kimberlite is mined. A piece of kimberlite weighing approximately 1 kg is collected at each sample site. Care is taken to choose locations that are as undisturbed as possible so that the geologist is confident that the surveyed coordinates for the sample location reflect true in-situ location. | |||

| • | The procedure for measuring density of the kimberlite is similar for both core and hand samples. The hand sample or core sample is broken into two. One piece is weighed both in air and in water to provide the values necessary to calculate a bulk density. The second piece is weighed in air and then dried in an oven at 110º C for 24 hours. After drying, the sample is weighed in air again which provides the second value needed to calculate a moisture percentage. This moisture percentage is applied to the previously calculated bulk density to provide a dry bulk density which is used for density estimation and reconciliation purposes. | ||||

| Cut-off parameters |

• | Cut-off grade analysis is carried out as part of the reserve/resource definition process for each of the kimberlite pipes that underpin current business plans. Combining modeled grades with modeled cost projections suggests break-even grades for each zone analysed, which modeled grades should exceed in order to be economic. All kimberlite considered for inclusion in mine plans is likely to be economic and, as such, a cut-off grade is not applied. | |||

| Mining factors or assumptions |

• | Since Diavik is a producing mine with an active mining reserve, evaluation of resources outside of reserves is based on assumptions supporting the current mine plan that have been approved and accepted. This is particularly sensible for resources that are extensions of the current mine plan since the likelihood of mining would be under similar conditions. Such assumptions include mining method, mining losses and dilution, plant recovery, prices, and costs (with adjustment for depth/access in relation to current mining). | |||

| • | In the case of resources which would not be mined as straightforward extensions of current mine plans, applicable assumptions supported by studies-in-progress are applied. | ||||

Page 14 of 21

| Metallurgical factors or assumptions |

• | Before running the mineral resource model estimation, metallurgical recoveries are taken into account by adjusting sample grades for production stone size/frequency recovery based on the screen size cut-off in the processing plant. | ||||

| Environmental factors or assumptions |

• | No kimberlite is mined as waste and all is taken to the processing plant. The processing involves gravity, magnetics and x-rays, and no chemical reagents are used whatsoever. The by-product is a non-deleterious processed kimberlite (PK) that is taken to an engineered containment adjacent to the plant. | ||||

| • | Granitic waste rock surrounds the kimberlite pipe. Mining involves the removal of some of this to access the kimberlite. Certain zones of the granitic host rock contain biotite schist which has a sulphur content (low), and so precautions have been taken to segregate and manage this in case there is acid generating potential in the long term. There have been no acid issues to date and the mine closure plan includes permanent safeguards. | |||||

| • | Community leaders, residents and employees are kept updated on environmental impacts and monitoring performance. Community consultation including regular site visits by local elders are part of the evolving mine closure planning efforts, not only for transparency but also to leverage traditional knowledge of the land. | |||||

| Bulk density | • | Kimberlite dry bulk densities are measured from samples taken from the mine and from ongoing delineation programs and a density model is developed using geostatistical methods. | ||||

| Classification | • | Classification is based on: | ||||

| • | appropriate spatial and geological representivity of samples | |||||

| • | sample size effect | |||||

| • | complete size/frequency distribution and therefore accurate mean stone size | |||||

| • | confidence in diamond quality and value | |||||

| • | contact and volume delineation confidence | |||||

| • | sample grade and specific gravity estimation uncertainty | |||||

| • | reconciliation of production data | |||||

| Audits or reviews |

• | An independent Resources and Reserves audit in 2012 identified only minor matters having no material impact on reported figures, and all issues have since been addressed. | ||||

| • | The resources and reserves have been subjected periodically to Rio Tinto and Diavik internal review processes over the years. | |||||

| • | The A21 project underwent an internal Rio Tinto review in 2014. | |||||

| Discussion of relative accuracy/ confidence |

• | Four simulated models are built each year to quantify the uncertainty in value of production and prepare management and sales staff for the variability in production carats that result from using a grade model based on limited numbers of samples. For these models 100 simulations are run, each calculating a single grade variable for each block in the model using ordinary and simple kriging. The kriging parameters used mimic those used in the standard grade estimations at Diavik. The 100 simulated grades are then used to calculate the potential variability in grade which is possible based on the current sample dataset (based on spatial location and variance). | ||||

| • | Grade reconciliation is expected to fall within these calculated uncertainty limits and, if it does not for 3 or more months in a row, an investigation is undertaken. | |||||

| SECTION 4 ESTIMATION AND REPORTING OF ORE RESERVES | ||||||

| Criteria | Commentary | |||||

|

Mineral Resource estimate for conversion to Ore Reserves |

• | Those portions of the mineral resource model that are economically viable after considering the method of mining and associated site-wide operating and capital costs, and after applying reasonable expectations for mining dilution and losses, are converted to Ore Reserves. | ||||

| • | Remaining mineral resources having reasonable likelihood of being mined with economic viability are reported as Mineral Resources in addition to the reported Ore Reserves. | |||||

| Site visits | • | The Competent Person (CP) for resource estimation and the CP for ore reserves are senior professional employees of the mine and undertake site visits as a regular part of their roles. | ||||

| Study status | • | The Ore Reserves underpin a producing mine that has operated continuously and successfully for more than a decade. Initial open pit mine start-up and recent transition to | ||||

Page 15 of 21

| fully underground mining were both supported by bank-approved full/final feasibility studies. An approved full/final feasibility study also supported the addition of the future A21 open pit to the Ore Reserves. | |||||

| Cut-off parameters |

• | Historical and forecasted costs for the operation along with approved price forecasts are used to determine break-even grade. | |||

| • | For the kimberlite pipe deposits in the mine plan, diamond grades throughout the resource/reserve model and forecasted in the mine plans have consistently exceeded the break-even grade by generous margins. As such, selective mining has not been warranted and all kimberlite is sent for processing. | ||||

| Mining factors or assumptions |

• | The selection of underground mining methods has been based on rock strengths and structure, and a requirement for no surface subsidence to maintain the integrity of critical mine site infrastructure. | |||

| • | Mining widths were determined by geo-mechanical analysis during feasibility studies and to date have not been changed materially. | ||||

| • | Access via portals and not by shafts was selected based on the availability of mined-out pits with road/ramp systems in place and a legacy fleet of open pit haulage trucks in good operating order that provide reliable overland ore transport from any of the in-pit portals to the processing plant at an acceptable operating cost and with zero up-front capital cost loading on the UG development funds. | ||||

| • | With no shafts, there is no hoisting option. Given the vertical geometry of the kimberlite pipes being mined, conventional sloped conveyors would provide only limited benefit. Dynamic haulage simulation modeling indicates that the life-of-mine plan can be achieved with manageable UG fleet size and ventilation needs. | ||||

| • | Mining dilution and recovery factors were estimated during the feasibility study based on to-scale stope design drawings, sketches of likely dilution and loss sources, and volume calculations. These have been reviewed and updated on an annual basis as more operating experiences are gained. In general, the feasibility assumptions were conservative as updated factors have generally decreased over time as understanding increases. | ||||

| • | The underground mine is designed to extract the Inferred Resources in each of the three pertinent kimberlite pipes with the expectation that they will be upgraded to Ore Reserves in time. Two versions of a mine plan are produced: a Reserves-only version for reporting purposes and a Reserves-plus-Resources version as an upside and for internal strategic purposes. | ||||

| • | A fourth kimberlite pipe, A21 being reported here for the first time, will bring open pit mining back into the mine plan by the end of 2018. A21 does not extend the mine life but will provide important incremental production alongside ongoing underground output to maintain existing levels of total production over the remaining mine life. | ||||

| • | The A21 open pit has been designed with the same geotechnical and economic rigour used in the mine’s earlier completed open pits. Mining will be carried out using much of the existing equipment from the previous pits and an experienced workforce. Mining dilution and losses are expected to be similar to the outcomes achieved in the earlier pits. | ||||

| Metallurgical factors or assumptions |

• | The ore processing plant was designed by an engineer experienced with diamond kimberlite processing, built by a reputable construction contractor, and began exceeding design capacity and performance expectations early in the mine life. | |||

| • | The plant has been in continuous operation for more than a decade. | ||||

| • | Continuous improvement has been ongoing, resulting in the current plant achieving higher throughput and achieving better diamond recoveries than designed. | ||||

| • | Whilst some plants juggle a trade-off between throughput and recovery, this plant has focused on maximising throughput although the secondary goal of maximising diamond recovery has also been met with notable success. | ||||

| • | Rigorous reconciliation of model to mine to plant is carried out monthly, helping all three areas track performance and calibrate as necessary. | ||||

| • | Ore from all three of the mine’s kimberlite pipes currently in production are processed together, with mine geologist and plant engineer collaborating to optimise the blend from available material on the feed pad for best recovery and throughput. | ||||

| • | Occasionally, mined batches of a particular area or a particular kimberlite type are processed to better understand the performance and/or the product characteristics. | ||||

| • | The stated Ore Reserves take into account the metallurgical recovery. | ||||

Page 16 of 21

| Environmental | • | All necessary permits and licenses have been in place and in good standing since the mine began more than a decade ago. | |||

| • | Ongoing operating activities include regular monitoring of water quality, aquatic effects on fish and roe, air quality and dust loading, wildlife patterns, and land use vis a vis the permit allowances. | ||||

| • | A regulator-approved waste rock management plan is well established. | ||||

| • | Long-term research was initiated early in the mine life in the areas of fish toxicity, effects of ammonia from blasting, effects of chemicals released by mining activity such as phosphates, long-term acid generating potential of waste rock, long-term thermal effects on waste rock dumps and tailings impoundments in the arctic. | ||||

| • | The monitoring and ongoing research has been feeding into the mine closure plan, which is updated approximately every five years. There is regular consultation with local community and aboriginal groups about the mine closure plans, and efforts are made to incorporate Traditional Knowledge to enhance the scientific and social efforts. | ||||

| • | Regulator-approved financial security is in place to cover the current mine closure liability, and the amount of the security is reviewed regularly. | ||||

| Infrastructure | • | The mine site has been fully functional since its start-up more than a decade ago. | |||

| • | The remote site has a federally approved air strip capable of landing 737 jets and C-130 Hercules transports. A modern camp facility provides private rooms and bathrooms to every employee, serves high-quality nutritious meals, has recreation facilities and an adult learning centre offering a range of courses from arts & crafts to university access. The site generates its own electricity from diesel generators and a wind farm. There is bulk fuel storage, wastewater treatment, sewage treatment, waste disposal/incineration, maintenance shops, offices, the ore processing plant, and covered heated pedestrian walkways providing year-round connection to the main facilities protected from the harsh arctic winters. | ||||

| Costs | • | Capital cost assumptions are the prevailing approved capital plan for the mine. | |||

| • | Operating costs are based on area managers’ budget estimates which in many cases are supported by historical costs. Where there is no historical cost, company senior management requires first-principles estimations. | ||||

| • | Approved diamond price assumptions are provided from the product group level, since this is not a listed or a contracted commodity. Diamonds are a pure product; there are no penalties for deleterious co-products. | ||||

| • | Exchange rate forecasts are as prescribed by the corporation. | ||||

| • | Transport charges for rough diamonds are negligible (stones in envelopes carried in a small suitcase), and the security costs are part of operating costs. | ||||

| • | Royalties payable to government as well as private parties are accounted for in the financial modeling. | ||||

| Revenue factors | • | Revenues are based on forecasted carat production after processing and final cleaning, underpinned by mine production forecasts from engineered mine designs and scheduling which in turn are supported by peer- and third-party-reviewed reserve/resource modeling kept up to date with rigorous monthly reconciliation from plant to mine to model. | |||

| • | The calculated estimation uncertainty inherent in the reserve/resource model is carried through the mine plant to the carat production forecast, providing the sales team with expected minimum and upside carat production on either side of a central-case forecast. This helps determine how much product can be locked into sales agreements and what portion should be handled with more flexibility. | ||||

| • | The mine is a joint venture with Rio Tinto holding 60% through a wholly-owned business unit Diavik Diamond Mines (2012) Inc. (“DDMI”). DDMI is the operator and manager of the mine. A 40% share is owned by Dominion Diamond Diavik Limited Partnership, a wholly- owned business unit of Dominion Diamond Corporation headquartered at Yellowknife, Northwest Territories, Canada. | ||||

| • | Rio Tinto’s 60% share of the rough diamonds are sold by DDMI through an agency agreement with the over-arching product group marketing division, and all marketing costs and service fees chargeable to the mine are included as part of DDMI’s operating costs. | ||||

| • | Price assumptions are developed by the marketing division and approved values are passed down to the mine from the product group head. | ||||

Page 17 of 21

| Market assessment |

• | Supply and demand fundamentals for diamonds are favourable and robust for the foreseeable long term. Consumer demand in established markets remains steady but is increasing in emerging countries, notably China and India. Meanwhile, the availability of new discoveries and pace of new mine development lags far behind demand. | |||

| • | Diavik is a part of Rio Tinto Diamonds, a fully integrated global business with 30 years of history in exploration, mining, marketing and sales. RTD has earned a strong position in the industry and is the world’s third-largest supplier of rough diamonds. RTD’s sales and marketing organisation is well-established with a strong and loyal customer base. | ||||

| • | There are no market constraints. Everything produced is sold. | ||||

| Economic | • | All of the foregoing is accounted for in a full-business life-of-mine discounted cash flow model. | |||

| • | For testing proposed new reserves and resources, the output from an updated mineral resource model that has been at least peer-reviewed and sometimes third-party-reviewed is scheduled with applied mining loss/dilution assumed for the selected mining method. Capital costs developed for the scenario(s) and operating costs including mining, processing, site support and corporate overheads are put into the cash flow model. Costs also include marketing, royalties and mine closure. Revenue is calculated using approved price and exchange rate forecasts. A comprehensive taxation model reflecting current Canadian tax laws including the treatment of capital investment and asset depreciation is then applied. | ||||

| • | Viability is indicated by a positive NPV and positive cash flows during production years, except where injections of capital are made to sustain or expand production. In such cases the investment must increase the NPV (i.e. must test for this). The updated Diavik Ore Reserve including A21 is cash accretive under these scenarios. | ||||

| • | Diamond prices are commercially sensitive information and cannot be disclosed either directly or indirectly. | ||||

| Social | • | The company is party to a binding Socio-Economic Monitoring Agreement (SEMA) between government, aboriginal groups/nations, and the company. The SEMA was signed prior to the construction of the mine more than a decade ago and remains in good standing. Commitments have been met or exceeded every single year. | |||

| • | Also before the mine began, the concept of “impact-benefit agreements” was enhanced to ensure full two-way participation and commitment. Participation Agreements were signed and remain in place and in good standing with five aboriginal groups/nations that are impacted by and benefitting from the mine. | ||||

| • | These agreements have formalised mutual commitments in key areas including supply of local labour and services, provision of jobs and training, support by and support to local businesses, community development and scholarships for youth, collaboration on future mine closure plans, sharing of Traditional Knowledge and knowledge gained from environmental monitoring. These commitments remain strong despite democratic changes in community leaders and band chiefs and turnover of company management. | ||||

| Other | • | All of the kimberlite pipes being mined are under a large lake. Past open pit mining and the current open-stoping methods of underground mining are made possible by engineered water-retention dikes that have been built to hold back the lake water until mining is completed and return of the lake water is possible. Developing A21 will require a new dike to be built at that location and construction is presently underway. The structural integrity of these dikes is of critical importance. Full-time monitoring is aided by several different types of instrumentation and automation systems along with daily survey confirmation and visual inspections and reporting. There have been no incidents of concern during the operating life to date. | |||

| • | There have been no charges under any environmental regulation. | ||||

| • | All regulatory permits and licenses have been in good standing every year; those requiring renewal have been so renewed as required. | ||||

| • | There are no political obstacles relating to the export of rough diamonds. | ||||

| • | All mining claims have been secured by conversion to long-term mineral leases. Should the mine life extend beyond the term of the leases, the renewal procedure is an administrative task in which the incumbent lease holder has first rights and merely needs to opt to continue. | ||||

Page 18 of 21

| Classification | • | Since start-up more than a decade ago, past open pit mining was carried out successfully and the current underground mining is proceeding as planned. There have been no reasons to deviate from the following classification criteria for the current Reserve. | ||||

| • | All Measure Resources are considered to be Proved Reserves. | |||||

| • | All Indicated Resources are considered to be Probable Reserves. | |||||

| Audits or | • | The most recent independent third-party audit of reserves and resources took place from April to June 2012. | ||||

| reviews | • | Based on a scale from Weak → Marginal → Satisfactory → Good: | ||||

| Out of 15 audit components, 10 were Good, 4 were Satisfactory, and only 1 was Marginal. | ||||||

| • | There were twenty Findings requiring action, none urgent. All actions are now completed/closed. | |||||

| Discussion of relative accuracy/ confidence |

• | Uncertainty in the Reserve estimated pertains primarily to the accuracy of predictions that are possible from a diamond deposit. There is low uncertainty about conventional mining and processing methods, the operating environment, or saleability of product. | ||||

| • | Diamond deposits are rare and by their nature highly variable. The occurrence of diamonds within a deposit is very low, in the parts-per-million. The variability of grades (carats per tonne) within a diamond deposit can be in the order or 40% or more. The challenge is to model this variability accurately. Despite high variability, it can be modeled accurately with appropriate sampling and estimation techniques. | |||||

| • | The Diavik kimberlites are considered to be well-sampled and well-modeled. | |||||

| • | For Diavik, confidence in the Proved Reserve is approx. +/-15% (this is excellent for any diamond resource model). | |||||

| • | There remain small uncertainties about volume and density at depth, as the drilling and sampling recovery diminishes. | |||||

| • | Diavik’s Probable Reserves occur at depth, and the uncertainty begins to increase as delineation/volume data weakens and combines with grade uncertainty to give a notably higher overall uncertainty. | |||||

| • | This uncertainty means possible upside and not just downside. While this envelope widens with depth, central-case grade estimates remain reasonably consistent throughout. | |||||

| • | These uncertainties (upside as well as downside) are carried through the production forecasting process to provide marketing staff with upside and downside carat production on either side of a central case. This can help shape sales agreements with customers. | |||||

| SECTION 5 ESTIMATION AND REPORTING OF DIAMONDS AND OTHER GEMSTONES | ||||||

| Criteria | Commentary | |||||

| Indicator minerals |

• | Indicator minerals are neither reported nor applicable in mineral resource modeling and reserve reporting for an established producing diamond mine. | ||||

| Source of diamonds |

• | There are four economic kimberlites at Diavik: A154N, A154S, A418 and A21. | ||||

| • | Diamonds sizes and qualities are categorised by production size stones sets of >100,000 carats in the three production pipes. A21 (in development) has been valued using a smaller bulk sample dataset of ~8,000 carats. | |||||

| Sample collection |

• | Core drilling and reverse circulation (RC) drilling from surface and in-pit have been used. Core drilling was used early on the project for delineation and feasibility work while RC drilling has been used subsequently to support development of a production resource model. In-pit level sampling and underground drift sampling has been used in areas where the drilling does not provide adequate coverage. | ||||

| • | A total of 95 drillholes (1,581 samples) have been used for the resource estimate. In pit/underground sampling represents 10 percent of the total samples, core drilling represents 25 percent of the total samples and RC drilling 65 percent. The drill holes are between 15 metres and 532 metres in length and all were drilled vertically. | |||||

| • | Sample programs are designed to be both geologically and spatially representative. | |||||

| Sample | • | All samples were processed by an internally affiliated processing laboratory in Thunder Bay, Ontario. | ||||

| treatment | • | Bottom screen size was 1 mm. Material was sent through a 10 mm rolls crusher, treated by dense media of this material with the float product re-crushed to 6 mm, followed by dense media separation. This material was then put through x-ray machine sorting. The x-ray | ||||

Page 19 of 21

| accepts are hand sorted. The rejects are further crushed to 4 mm, this material and all floats are sent through magnetic separation and caustically fused to reduce manual sorting time. The rejects and floats are then hand sorted. These sample grades are adjusted back to production using reference size frequency distributions. | ||||||||

| • | Microdiamond analysis has not been used for resource modeling. | |||||||

| Carat | • | Industry standard carat weights are used for all reporting. | ||||||

| Sample grade | • | Sample grades are reported in carats per tonne using the bottom screen size cut-off. | ||||||

| • | Stones per tonne values are calculated but not used in the estimation process. | |||||||

| Reporting of Exploration Results |

• | 1 mm has been the lower cut-off size. Recovered stones are sieved three times in square mesh, diamond sieve and grainer series. | ||||||

| • | All processing data is provided in digital format by the Thunder Bay laboratory including sample weights, concentrate weights, and fraction weights. | |||||||

| • | Sample grades are adjusted to production recoveries using reference size frequency distributions. | |||||||

| • | Core samples are collected at 6 m intervals down hole for density measurements. Densities for large diameter reverse circulation (LDRC) samples are taken from the modeled density for the elevation range that the sample was collected from. | |||||||

| Grade | • | A154S | probable – 30 m | proven – 25 m | ||||

| estimation for | • | A418 | probable – 35 m | proven – 28 m | ||||

| reporting | • | A154N | probable – 40 m | proven – 27 m | ||||

| Mineral | • | A21 | probable – 40 m | proven – 28 m | ||||

| Resources and Ore Reserves |

• | Bedding is primarily horizontal so vertical drilling was chosen as the most geologically representative method of sampling. | ||||||

| • | The sample processing flow sheet is designed to mimic production as closely as possible. Sample grades are adjusted at the coarse and fine end of the size frequency distribution to match production recoveries. | |||||||

|

Value estimation |

• | For A154N, ~15,000 carats from an underground bulk sample have been used to calculate carat value. This sample was run through the production plant at the Diavik mine site; consequently, diamond recovery matches typical production. | ||||||

| • | For A154S, carat value is based on six production valuations with a total of 6.7 million carats (~7 months of production). | |||||||

| • | For A418, diamond size distribution is based on 14 weeks of A418-only production (~2.2 million carats) and diamond quality distribution is based on a single production batch of ~186,000 carats. | |||||||

| • | For A21, ~10,000 carats from large diameter core (LDC) and large diameter reverse circulation (LDRC) drilling programs, along with an underground bulk sample, have been used to calculate carat value. | |||||||

| • | Stones are visually inspected for new breakage as they are sieved at the laboratory. Only one of the 15 sampling programs completed has shown signs of significant breakage. | |||||||

|

Security and integrity |

• | Samples are sealed at the drill site and transported from the Diavik mine (at Lac de Gras, Northwest Territories) to the Rio Tinto Exploration laboratory/processing facility (at Thunder Bay, Ontario) via secure trailer from G& G Expediting in the city of Yellowknife. | ||||||

| • | As an assurance testing exercise for the sample processing, a robust sample spiking program was initiated for the A418 and A154N LDRC sample processing program. Samples were either spiked with +1.70mm, +2.36mm, or +3.35mm faceted Argyle diamond spikes or 2 mm or 4 mm density tracers. Spiking locations were varied and included the feed conveyor, the prep screen and the dense media separation (DMS) feed screen. This spiking continues on all samples programs since that time. | |||||||

| • | Core and mini-bulk samples are weighed both at the mine site and at the laboratory. There is no data available for cross-validation of LDRC sample weights as they are calculated from the hole volume and density and the fines have been screened out. Weighed tonnages at the laboratory are compared to caliper tonnages to see if the ratios are reasonable. | |||||||

| Classification | • | Stone frequency values are not reported; grades are measured and reported as carats per tonne. | ||||||

| • | Classification is based on: | |||||||

| • | appropriate spatial and geological representivity of samples | |||||||

| • | sample size effect | |||||||

Page 20 of 21

| • | complete size/frequency distribution and therefore accurate mean stone size | |||||

| • | confidence in diamond quality and value | |||||

| • | contact and volume delineation confidence | |||||

| • | sample grade and specific gravity estimation uncertainty | |||||

| • | reconciliation of production data | |||||

Page 21 of 21

|

Media release |

INCREASE TO HAIL CREEK COAL RESERVES

6 March 2015

To support the annual Mineral Resources and Ore Reserves review process detailed in Rio Tinto’s 2014 Annual report released today, Rio Tinto Coal Australia has declared an increase of its managed coal reserves for its Hail Creek Mine in Queensland, Australia, resulting from the completion of studies and evaluations.

The updated Hail Creek Ore Reserves and Mineral Resources are reported under the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 (JORC Code) and are set out in the following Tables 1 and 2 and a summary of information, with supporting technical detail in Appendix 1.

Marketable Ore Reserves at Hail Creek have increased by 25 million tonnes (Mt), from 60 Mt to 85 Mt.

| The update is based on a rigorous examination of the mine and operations planning for the Hail Creek project Western Margin including: | |

| • | Reprocessing of a primary coal stream to introduce an additional thermal coal product into the operations and marketing plan. |

| • | Analysing a vast dataset gathered over decades including updates from recent prefeasibility study drilling. |

| • | Transforming the strategic mine planning processes and tools used to estimate Ore Reserves. |

| • | Adopting more efficient Mineral Resource estimation methods. |

The increases to the Hail Creek Ore Reserves have resulted from a broader programme of Orebody Knowledge and Strategic Mine Planning optimisation at Rio Tinto Coal Australia. This process will lead to periodic updates of the Mineral Resources and Ore Reserves for the projects and operations managed by Rio Tinto Coal Australia.

Page 1 of 22

|

Table 1 – Ore Reserves

Ore reserves

| Reserves | Marketable reserves | Marketable reserves | Marketable coal quality |

Average % yield to give marketable reserves |

|||||||||||||||||||||||

| Type of mine (a) |

Coal type (b) | Proved | Probable at end 2014 |

Proved | Probable at end 2014 |

Total 2014 |

Total 2013 |

(c) | (c) | Marketable reserves |

|||||||||||||||||

| COAL (d) | millions of tonnes |

millions of tonnes |

millions of tonnes |

millions of tonnes |

millions of tonnes |

millions of tonnes |

Calorific value MJ/kg |

Sulphur content % |

millions of tonnes |

||||||||||||||||||

| Reserves at operating mines Rio Tinto Coal Australia |

|||||||||||||||||||||||||||

| Hail Creek | O/C | SC + MC | 107 | 20 | 72 | 13 | 85 | 60 | 25.74 | 0.35 | 67 | 82.0 | 70 | ||||||||||||||

Notes

(a) Type of mine: O/P = open pit, O/C = open cut, U/G = underground,

(b) Coal type: SC: steam/thermal coal, MC: metallurgical/coking coal.

(c) Coals have been analysed on an ‘‘air dried’’ moisture basis in accordance with Australian Standards and gross calorific value and sulphur content are reported here on that basis. Marketable Reserves tonnages are reported on a product moisture basis.

(d) For coal, the yield factors shown reflect the impact of further processing, where necessary, to provide marketable coal. Hail Creek Marketable Reserves tonnes increased due to the inclusion of a thermal coal product derived from coarse plant rejects.

Page 2 of 22

Table 2 – Mineral Resources

Mineral resources

| Likely mining method (a) |

Coal type | Coal resources at end 2014 | Total resources 2014 compared with 2013 |

||||||||||||||

| (b) | Measured | Indicated | Inferred | 2014 | 2013 | ||||||||||||

| COAL (c) | millions of tonnes |

millions of tonnes |

millions of tonnes |

millions of tonnes |

millions of tonnes |

||||||||||||

| Rio Tinto Coal Australia | |||||||||||||||||

| Hail Creek | O/C | SC + MC | 60 | 79 | 33 | 172 | 172 | 82.0 | |||||||||

Notes

(a) Likely mining method: O/C = open cut; U/G = underground

(b) Coal type: SC=steam/thermal coal, MC=metallurgical/coking coal.

(c) Rio Tinto reports coal Resources on an in situ moisture basis.

Page 3 of 22

|

Summary of Information to Support Mineral Resource Estimates

Mineral Resource Estimate upgrades for Hail Creek are supported by JORC Table 1 (Section 1 to 3) documents provided in Appendix 1 of this media release and also located at www.riotinto.com/JORC. The following summary of information for Mineral Resource Estimates is provided in accordance with Chapter 5.8 of ASX Listing Rules.

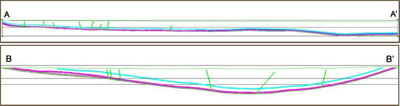

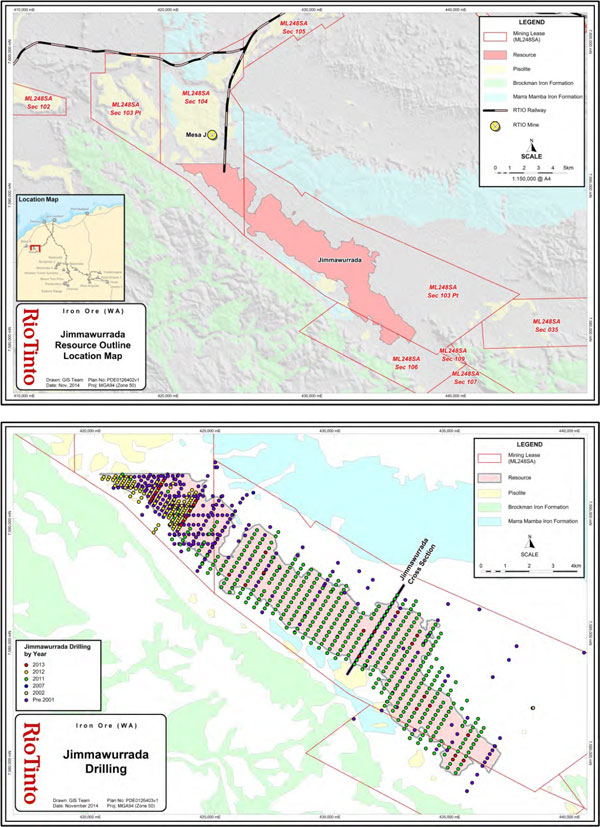

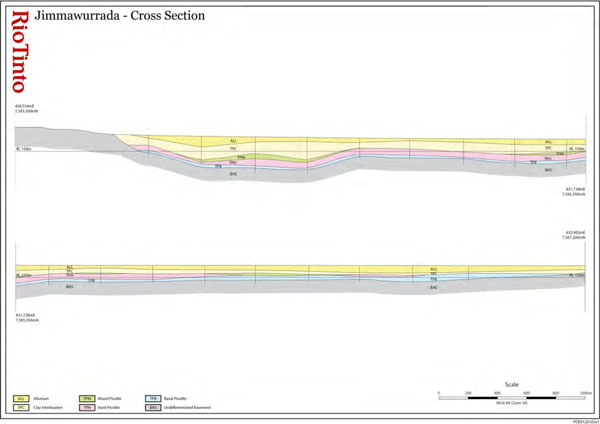

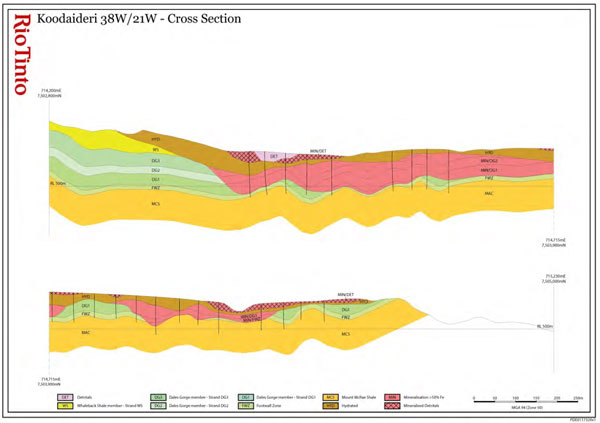

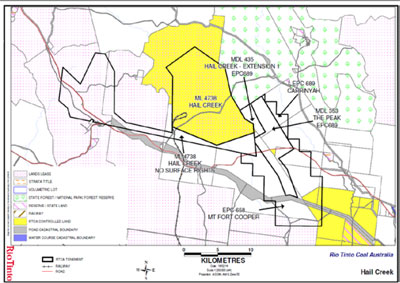

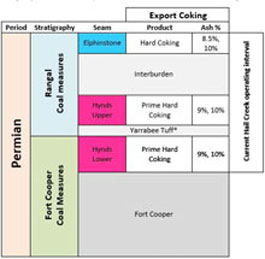

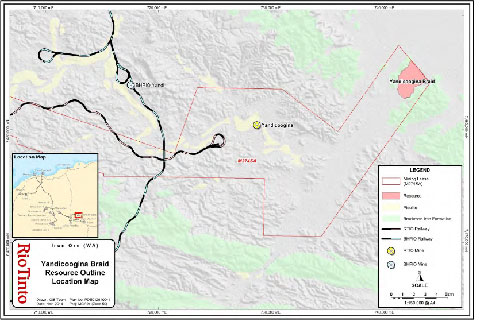

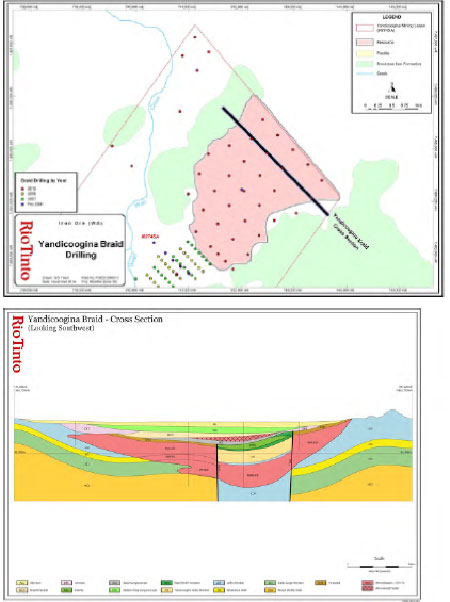

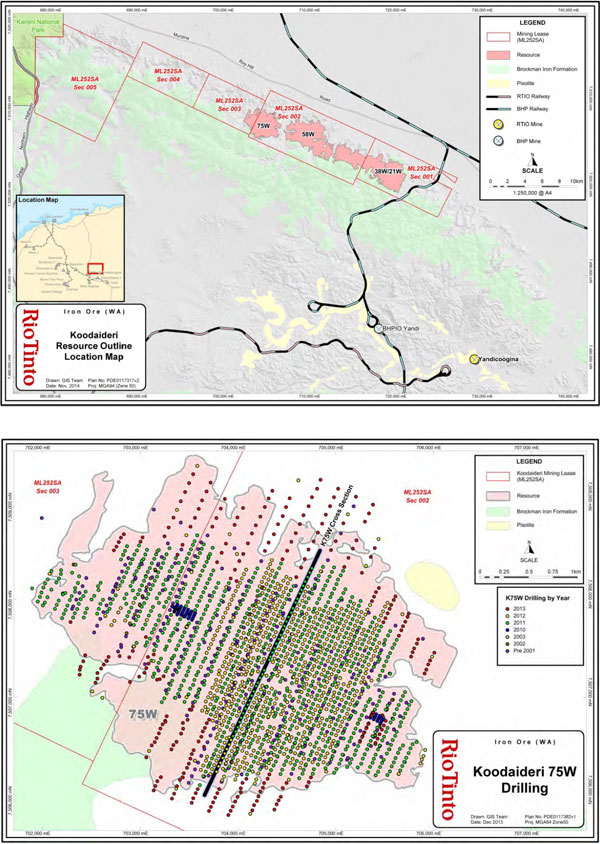

Geology and geological interpretation

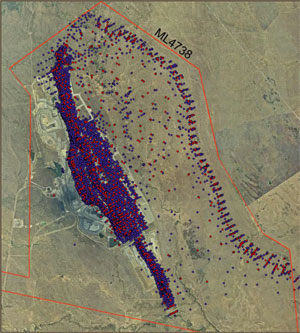

Hail Creek is located in the northern part of the Bowen Basin which contains numerous important coal producing intervals in the Permian stratigraphy. The Late Permian Fort Cooper and Rangal Coal Measures host the coal deposits mined at Hail Creek. The main rock types of these measures are sandstone, siltstone and conglomerate, which occur with coal and tuffaceous claystone. Coal quality and geological structure, including coal seam continuity, faulting, and limits of oxidation, sub-crops and igneous intrusions are well defined. Geologic interpretations are supported by surface mapping of outcrops and mining exposures, geophysics (2D/3D seismic, airborne magnetics) and by a comprehensive database containing structural, coal quality and geotechnical data for 6,058 exploration, evaluation and pre-production drill holes.

Drilling techniques

The Hail Creek deposit has been extensively drilled using a combination of open hole and wireline coring techniques. Open holes comprise approximately 83% of all drilling completed with this method primarily employed for the purpose of coal and waste structure definition. Core drilling (predominantly 4C (100mm) but also HQ3 and PQ3 in size) is primarily employed for the purpose of coal quality (CQ), geotechnical and gas sampling. A limited number of 200mm large diameter holes have been drilled to obtain bulk volume samples for coal sizing and handling characterisation studies. This technique comprises just over 1% of total drilled metres.

Geophysical logging was completed for all drill holes employing a comprehensive suite of down hole tools to collect calliper, gamma, density, neutron and sonic measurements. Acoustic scanner measurements were also routinely completed for cored holes to obtain additional data for geotechnical assessments.

Sampling, sub-sampling method and sample analysis method

Total coal core recovery in drill core was above 95% for all holes. Sampling of drill core at Hail Creek was according to a universal standard set of instructions. Samples were bagged at the drill site and then transported to an external accredited laboratory for analysis. All samples were weighed, air-dried and then re-weighed before being crushed to a 19mm top size. A rotary splitter was used to divide the sample into portions available for further analysis.

Coal quality analysis was by a three-stage method comprising raw analysis for all plies followed by washability and product testing on composite samples. All sample treatment and analysis was conducted according to procedures which adhere to Australian or International equivalent standards in National Association of Testing Authorities certified laboratories.

Page 4 of 22

Criteria used for classification

The classification of Mineral Resources into confidence categories was based on a standard process for all RTCA sites. Drill holes were assessed according to the value and reliability of contained data to contribute a point of observation to Mineral Resource classifications. Structure and coal quality confidence limits were plotted on a seam group basis with classification of coal inventory into areas of low, medium or high confidence. These were combined to delineate areas of Measured, Indicated and Inferred coal inventory as a basis for determining Mineral Resource tonnage estimates.

A range of drill hole spacing limits were defined to reflect the inherent variability of the six seam groups modelled within the deposits. Typical distances for structure confidence classification are 125m to 250m for high, 250m to 500m for medium and 1,500m to 3,000m for low. Typical distances for coal quality confidence classification are 250m to 500m for high, 500m to 1,000m for medium and 1,500m to 3,000m for low.

Estimation methodology

Modelling was completed using standard coal resource modelling software. For structural modelling a Finite Element Method (FEM) interpolator was used and for coal quality an inverse distance squared interpolator was used. All surfaces and coal qualities were interpolated into grids with 20 m2 node spacing. Modelling was completed on an iterative basis by checking cross sections and contours of structural and coal quality attributes. Database values were posted on contours to provide a further check. A volume / tonnage check was completed with predecessor models to provide final validation.

Reasonable prospects for eventual economic extraction

A minimum coal thickness of 0.2m and density of 1.8 g/m3 were applied as cut-off parameters for reporting Mineral Resources. Economic resources were defined by a “break even” ($0 margin) Lerchs-Grossman optimised shell for opencast coal – this effectively sets the maximum depth or lowermost seam to be considered.

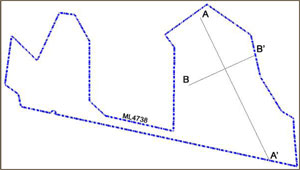

Summary of Information to Support Ore Reserve Estimates

Ore Reserve Estimate upgrades for Hail Creek are supported by JORC Table 1 (Section 4) documents provided in Appendix 1 of this media release and located at www.riotinto.com/JORC. The following summary of information for Ore Reserve Estimates is provided in accordance with Chapter 5.9 of ASX Listing Rules.

Economic assumptions