Form 6-K PRIMERO MINING CORP For: Apr 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES

EXCHANGE ACT OF 1934

For the month of April 2016

Commission File No. 001-35278

PRIMERO MINING CORP.

(Translation of registrant's name into English)

Suite 2100, 79 Wellington Street West,

TD South

Tower, P.O Box 139

Toronto, Ontario

M5K 1H1

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

Indicate by check mark whether the registrant, by furnishing the information contained in this Form, is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 4, 2016

PRIMERO MINING CORP.

“Wendy Kaufman”

_______________________

Wendy Kaufman

Chief Financial

Officer

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

AND

INFORMATION CIRCULAR

March 22, 2016

PRIMERO MINING CORP.

Suite 2100, 79 Wellington

Street West, TD South Tower

Toronto, Ontario, Canada M5K 1H1

SHAREHOLDERS OF PRIMERO MINING CORP.: These materials are important and require your immediate attention. They require you to make important decisions. If you are in doubt as to how to make such decisions, please contact your financial, legal, or other professional advisors. If you have any questions or require more information with regard to voting your shares of Primero Mining Corp., please contact Tamara Brown, Vice President, Corporate Development and Investor Relations, at (416) 814-3168.

March 22, 2016

Dear Shareholder:

On behalf of the Board of Directors and management of Primero Mining Corp. (the “Company”), we are pleased to invite you to attend the Company’s Annual General and Special Meeting of Shareholders (the “Meeting”), which will be held at 10:30 a.m. (EDT) on Wednesday, May 4, 2016 at the offices of Stikeman Elliott LLP, 5300 Commerce Court West, 199 Bay Street, Toronto, Ontario.

The Meeting is your opportunity to hear about our past performance and plans for the future and also to consider and vote on a number of important matters. Your participation in voting at the Meeting is very important to us. We encourage you to vote, which can easily be done by following the instructions enclosed with this management information circular (“Information Circular”).

The accompanying Information Circular describes the business to be conducted at the Meeting. The contents and the sending of this Information Circular have been approved by the Board of Directors.

We value your views and encourage you to read the Information Circular in advance of the Meeting. Following the formal portion of the Meeting, management will review the Company’s operational and financial performance during 2015 and provide an outlook for 2016. At the Meeting, members of management and our Board of Directors will be present and you will have the opportunity to ask questions and provide feedback.

If you are unable to attend the Meeting in person, the Meeting will be webcast (live and archived) and also available by conference call. Details will be available on the Company website www.primeromining.com under the News and Events section.

The Board and management look forward to your participation at the Meeting and we thank you for your continued support.

| Sincerely, | ||

| “Wade Nesmith” | “Ernest Mast” | |

| Wade Nesmith | Ernest Mast | |

| Chairman of the Board | President and Chief Executive Officer |

PRIMERO MINING CORP.

Suite 2100, 79 Wellington Street West, TD South Tower

Toronto, Ontario, Canada M5K 1H1

Telephone: (416) 814-3160 / Facsimile:

(416) 814-3170

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TAKE NOTICE that the annual general and special meeting (the “Meeting”) of shareholders of PRIMERO MINING CORP. (the “Company”) will be held at the offices of Stikeman Elliott LLP, 5300 Commerce Court West, 199 Bay Street, Toronto, Ontario, Canada on Wednesday, May 4, 2016, at 10:30 a.m. (Toronto time), for the following purposes:

| 1. |

to place before shareholders the consolidated financial statements of the Company, for the year ended December 31, 2015, including the auditors’ report thereon; |

| 2. |

to elect the Directors of the Company who will serve until the end of the next annual shareholder meeting or until their successors are appointed; |

| 3. |

to appoint the auditors of the Company for the ensuing year and to authorize the Directors to fix the remuneration to be paid to the auditors; |

| 4. |

to consider and, if thought advisable, to pass, with or without variation, an ordinary resolution to authorize, amend and re-approve the stock option plan of the Company, as more particularly described in the Information Circular; |

| 5. |

to consider and, if thought advisable, to pass, with or without variation, an ordinary resolution to authorize, amend and re-approve the 2013 phantom share unit plan of the Company, as more particularly described in the Information Circular; |

| 6. |

to consider and, if thought advisable, to pass, with or without variation, an advisory resolution accepting the approach to executive compensation disclosed in this Information Circular; and |

| 7. |

to transact such further and other business as may properly be brought before the Meeting or any adjournment or postponement thereof. |

An information circular accompanies this Notice. The information circular contains details of matters to be considered at the Meeting.

Regardless of whether a shareholder plans to attend the Meeting in person, we request that each shareholder please complete and deliver the enclosed form of proxy, or follow the other voting procedures, all as set out in the form of proxy and information circular.

Non-registered shareholders who plan to attend the Meeting must follow the instructions set out in the form of proxy or voting instruction form and in the information circular to ensure that their shares will be voted at the Meeting. A shareholder who holds shares in a brokerage account is not a registered shareholder.

DATED at Toronto, Ontario, March 22, 2016.

BY ORDER OF THE BOARD OF DIRECTORS

“Wade Nesmith”

Wade Nesmith

Chairman of the Board

TABLE OF CONTENTS

| SECTION 1: INFORMATION ABOUT VOTING | 1 | |

| Solicitation of Proxies | 1 | |

| Appointment of Proxyholders | 1 | |

| Voting by Proxyholder | 1 | |

| Registered Shareholders | 2 | |

| Beneficial Shareholders | 2 | |

| Processing the Votes | 3 | |

| Notice to Shareholders in the United States | 3 | |

| Revocation of Proxies | 3 | |

| Notice and Access | 3 | |

| Interest of

Certain Persons or Companies in Matters to Be Acted Upon |

4 | |

| Record Date and Voting Securities | 4 | |

| SECTION 2: BUSINESS OF THE MEETING | 4 | |

| Financial Statements | 4 | |

| Election of Directors | 5 | |

| Audit Committee Report and Appointment of Auditor | 16 | |

| Approval of Stock Option Plan | 17 | |

| Approval of the 2013 Phantom Share Unit Plan | 19 | |

| Advisory Vote

on the Company’s Approach to Executive Compensation |

20 | |

| SECTION 3: GOVERNANCE | 21 | |

| Governance and Nominating Committee Report | 21 | |

| Governance Overview | 21 | |

| Corporate Governance Practices | 22 | |

| SECTION 4: COMPENSATION | 32 | |

| Human Resources Committee Report | 32 | |

| Compensation Governance and Overview | 34 | |

| Executive Compensation 2015 | 42 | |

| Incentive Plan Awards | 53 | |

| Executive

Employment Agreements, Termination and Change in Control Provisions |

55 | |

| Director Compensation | 56 | |

| Securities Authorized For

Issuance Under Equity Compensation Plans |

61 | |

| SECTION 5: OTHER INFORMATION | 72 | |

| Indebtedness of Directors and Executive Officers | 72 | |

| Interest of Informed Persons in Material Transactions | 72 | |

| Additional Information | 72 |

| SCHEDULE “A” AMENDED AND RESTATED 2010 STOCK OPTION PLAN DATED FOR REFERENCE MAY 29, 2010 | |

| SCHEDULE “B” 2013 PHANTOM SHARE UNIT PLAN DATED FOR REFERENCE MARCH 28, 2013 | |

| SCHEDULE “C” TERMS OF REFERENCE FOR THE BOARD OF DIRECTORS | |

| SCHEDULE “D” AUDIT COMMITTEE CHARTER |

PRIMERO MINING CORP.

Suite 2100, 79 Wellington Street West, TD South Tower

Toronto, Ontario, Canada M5K 1H1

Telephone: (416) 814-3160 / Facsimile:

(416) 814-3170

INFORMATION CIRCULAR

(unless otherwise specified,

information is as of March 21, 2016)

This Information Circular is furnished in connection with the solicitation of proxies by the management of Primero Mining Corp. (the “Company” or “Primero”) for use at the annual general and special meeting (the “Meeting”) of its shareholders to be held at the offices of Stikeman Elliott LLP, 5300 Commerce Court West, 199 Bay Street, Toronto, Ontario, Canada on Wednesday, May 4, 2016, at 10:30 a.m. (Toronto time), for the purposes set forth in the accompanying notice of the Meeting.

In this Information Circular, references to “we” and “our” refer to the Company. The “board of directors” or the “Board” refers to the board of directors of the Company. “Common Shares” means common shares without par value in the capital of the Company. “Primero shareholders”, “shareholders”, and “shareholders of the Company” refer to shareholders of the Company. “Beneficial Shareholders” means shareholders of the Company who do not hold Common Shares in their own name and “intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders.

The board of directors has approved the contents and the sending of this Information Circular. All dollar amounts referred to herein are in Canadian currency unless otherwise indicated.

SECTION 1: INFORMATION ABOUT VOTING

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors, officers and regular employees of the Company. The Company will bear all costs of this solicitation. We have arranged for intermediaries to forward the meeting materials to Beneficial Shareholders of the Common Shares held of record by those intermediaries and we may reimburse the intermediaries for their reasonable fees and disbursements in that regard.

Appointment of Proxyholders

Ernest Mast and Wendy Kaufman, the individuals named in the accompanying form of proxy (the “Proxy”), are President and Chief Executive Officer, and Chief Financial Officer, respectively, of the Company. If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than either of the persons designated in the Proxy (who is not required to be a shareholder), to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another suitable form of proxy.

Voting by Proxyholder

The persons named in the Proxy will vote or withhold from voting the Common Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly. The Proxy confers discretionary authority on the persons named therein with respect to:

| (a) | each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors; |

| (b) |

any amendment to or variation of any matter identified therein; and | |

| (c) |

any other matter that properly comes before the Meeting. |

In respect of a matter for which a choice is not specified in the Proxy, the management appointee acting as a proxyholder will vote in accordance with the recommendations set out in the Proxy. However, under New York Stock Exchange (“NYSE”) rules, a broker who has not received specific voting instructions from the beneficial owner may not vote the shares in its discretion on behalf of such beneficial owner on “non-routine” proposals, although such shares will be included in determining the presence of a quorum at the Meeting. Thus, such broker “non-votes” will not be considered votes “cast” for purposes of voting on the election of directors. Broker “non-votes” will be considered as votes “cast” in respect of the ratification of the appointment of the Company’s auditor, which qualifies as a “routine” proposal.

Registered Shareholders

If you are a registered shareholder (a shareholder whose name appears on the records of the Company as the registered holder of Common Shares) of the Company, you may wish to vote by proxy whether or not you are able to attend the Meeting in person. Registered shareholders electing to submit a proxy may do so by:

| (a) |

completing, dating and signing the Proxy and returning it to the Company’s registrar and transfer agent, Computershare Investor Services Inc. (“Computershare”), by fax within North America at 1-866-249-7775, outside North America at 1-416-263-9524, or by mail or hand delivery to 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1; | |

| (b) |

using a touch-tone phone to transmit voting choices to the toll free number given in the Proxy. Registered shareholders who choose this option must follow the instructions of the voice response system and refer to the enclosed Proxy for the toll free number, the holder’s account number and the proxy access number; or | |

| (c) |

using the internet at Computershare’s website, www.investorvote.com. Registered shareholders must follow the instructions that appear on the screen and refer to the enclosed Proxy for the holder’s account number and the proxy access number; in all cases ensuring that the Proxy is received at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment or postponement thereof at which the Proxy is to be used. |

Beneficial Shareholders

The following information is of significant importance to shareholders of the Company who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as set out in the following disclosure.

If Common Shares are listed in an account statement provided to a Company shareholder by a broker, then in almost all cases those Common Shares will not be registered in the shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the names of intermediaries. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms) and, in the United States, under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depository for many U.S. brokerage firms and custodian banks).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of meetings of Company shareholders. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

The Company is relying on the provisions of National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer that permit it to deliver proxy-related materials directly to its beneficial holders. As a result, beneficial holders can expect to receive a scannable voting instruction form (“VIF”) from their broker. Voting can be completed by filling out and signing the VIF and returning it to their broker by telephone, by the Internet or by mail, in each case as set out in the instructions provided on the VIF. These securityholder materials are being sent to both registered and non-registered owners of the Common Shares of the Company. If you are a non-registered owner, and the Company or its agent has sent these materials directly to you, your name and address, and information about your holdings of securities, were obtained in accordance with applicable securities regulatory requirements from the intermediary holding securities on your behalf.

2

By choosing to send these materials to you directly, the Company (and not the intermediary holding securities on your behalf) has assumed responsibility for (a) delivering these materials to you, and (b) carrying out your voting instructions. Please return your VIF as specified in the request for voting instructions sent to you.

Processing the Votes

Our Transfer agent, Computershare, or its authorized agents count and tabulate the votes on the Company’s behalf. We will file the voting results of the Meeting on SEDAR at www.sedar.com, and on the United States Securities and Exchange Commission website at www.sec.gov.

Notice to Shareholders in the United States

This solicitation of proxies involves securities of an issuer located in Canada and is being effected in accordance with the corporate laws of the Province of British Columbia and the securities laws of applicable provinces of Canada. The proxy solicitation rules under the United States Securities Exchange Act of 1934, as amended, are not applicable to the Company or this solicitation, and this solicitation has been prepared in accordance with the disclosure requirements of the securities laws of applicable provinces of Canada. Shareholders should be aware that disclosure requirements under the securities laws of applicable provinces of Canada differ from the disclosure requirements under United States securities laws.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a registered shareholder who has given a proxy may revoke it:

| (a) |

by executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the registered shareholder or the registered shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the proxy bearing a later date to Computershare, or to the Company at the address of the registered office of the Company at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, V6E 4N7, at any time up to and including the last business day before the day of the Meeting or, if the Meeting is adjourned, the last business day before any reconvening thereof, or to the chairman of the Meeting at the Meeting or any reconvening thereof, or in any other manner provided by law; or | |

| (b) |

by personally attending the Meeting and voting the registered shareholder’s Common Shares. |

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

Notice and Access

In lieu of mailing this Notice of Meeting and Information Circular and the Company’s financial statements and management discussion and analysis (“MD&A”), we are using notice-and-access to provide access to an electronic copy of these documents to registered holders and beneficial owners of the Company’s common shares by posting them on the Company’s website (www.primeromining.com). These documents can also be accessed on SEDAR at www.sedar.com and on the United States Securities and Exchange Commission website at www.sec.gov.

Registered shareholders and Beneficial Shareholders who have previously provided standing instructions will receive a paper copy of these documents.

For more information regarding notice-and-access or to obtain a paper copy of these documents, registered shareholders may call toll free, within North America—1-866-962-0498, or outside of North America 514-982-8716 and by entering your control number as indicated on your Proxy; and Beneficial Shareholders may contact 1-877-619-3160. You must call to request a paper copy by April 25, 2016 in order to receive a paper copy prior to 10:00 a.m. (Toronto time) on May 2, 2016, which is the proxy deadline for the submission of your voting instructions. If you have previously provided standing instructions indicating that you wish to receive paper copies of the Notice of Meeting and Circular and Financial Statements and MD&A, you may revoke your instructions by contacting your broker to change the standing instructions on record.

3

Interest of Certain Persons or Companies in Matters to Be Acted Upon

To the best of our knowledge, except as otherwise disclosed herein, no person who has been a director or executive officer of the Company at any time since the beginning of the Company’s last completed financial year, nor any associate or affiliate of the foregoing persons, has any substantial or material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors or the appointment of the auditor.

Record Date and Voting Securities

Record Date

The board of directors has fixed March 21, 2016 as the record date (the “Record Date”) for the determination of persons entitled to receive notice of the Meeting. Only shareholders of record at the close of business on the Record Date who either (a) attend the Meeting personally (b) complete, sign and deliver a form of proxy in the manner and subject to the provisions described above, or (c) vote in one of the manners provided for in the VIF, will be entitled to vote or to have their Common Shares voted at the Meeting.

Voting Securities

Primero’s authorized share capital consists of an unlimited number of Common Shares without par value and an unlimited number of preferred shares without par value. The Common Shares are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “P” and on the NYSE under the symbol “PPP”. In addition, the Company has convertible debentures trading under the symbols “P.DB.U” and “P.DB.V”. As of March 21, 2016, there were 164,648,090 Common Shares issued and outstanding and no preferred shares issued and outstanding.

Holders of Common Shares are entitled to one vote per Common Share at meetings of shareholders. No group of shareholders of the Company has the right to elect a specified number of directors, nor are there cumulative or similar voting rights attached to the Common Shares, other than as described under “Election of Directors – Nominees for Election”.

To the knowledge of the directors and executive officers of the Company, there is no person that beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying more than 10% of the voting rights attached to all outstanding Common Shares.

SECTION 2: BUSINESS OF THE MEETING

Financial Statements

The audited annual consolidated financial statements and MD&A for the year ended December 31, 2015, are available upon request from the Company or they can be found on SEDAR at www.sedar.com, on the United States Securities and Exchange Commission website at www.sec.gov, or on the Company’s website at www.primeromining.com.

The audited consolidated financial statements of the Company for the year ended December 31, 2015, and the report of the auditor thereon, will be placed before the shareholders at the Meeting, but no shareholder vote is required in connection with them.

Election of Directors

Pursuant to the terms of the Company’s articles, the number of directors may be fixed or changed by ordinary resolution, subject to a limited right of the Board to increase the number of directors between shareholder meetings. The number of directors was last fixed by shareholders of the Company at nine.

The term of office of each of the current directors will end immediately before the election of directors at the Meeting. Unless the director’s office is earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia) (“BCA”), each director elected will hold office until immediately before the election of directors at the next annual general meeting of shareholders, or if no director is then elected, until a successor is elected, or until he or she otherwise ceases to hold office under the BCA or the terms of the Company’s articles.

4

Majority Voting for Directors

The Board has adopted a policy stipulating that if the votes in favour of the election of a nominee director at a shareholders’ meeting represent less than a majority of the shares voted and withheld, the nominee will submit his or her resignation promptly after the meeting to the Board, to be effective upon acceptance by the Board. The Governance and Nominating Committee will review the circumstances of the election and make a recommendation to the Board as to whether or not to accept the tendered resignation. The Board will determine whether or not to accept the tendered resignation as soon as reasonably possible and in any event within 90 days of the election. Subject to any corporate law restrictions, the Board may fill any resulting vacancy through the appointment of a new director. The nominee will not participate in any Governance and Nominating Committee or Board deliberations on the offered resignation. This policy does not apply in circumstances involving contested director elections.

Nominees for Election

The nine nominees proposed for election as directors of the Company are set out below, see “Principal Occupation - Business or Employment of Nominees.” All nominees have established their eligibility and willingness to serve as directors and have agreed to stand for election. If, however, one or more of them should become unable to stand for election, it is likely that one or more other persons would be nominated for election at the Meeting.

The following disclosure sets out, as at the date of this Information Circular, the names of management’s nominees for election as directors and their residency, all major offices and positions with the Company each now holds, each nominee’s principal occupation, business or employment, the period of time during which each has been a director of the Company, and the number of Common Shares beneficially owned by each directly or indirectly, or over which each exercised control or direction by the nominees for directors, in part, on information furnished to the Company or has been extracted from insider reports filed by the respective nominees and public available through the Internet at the website for the Canadian System for Electronic Disclosure by Insiders (SEDI) at www.sedi.ca. For the number of options and PSUs (defined under “Compensation – Compensation Governance and Overview – Elements of Executive Compensation”) held by Messrs. Conway and Mast as of December 31, 2015, see “Compensation – Incentive Plan Awards – Outstanding Share-Based and Option-Based Awards.” For the number of options and PSUs held by each of management’s nominees for election as directors other than Messrs. Conway and Mast as of December 31, 2015, see “Compensation – Director Compensation – Incentive Plan Awards – Outstanding Share-Based and Option-Based Awards”.

The information as to principal occupation, business or employment that is not within the knowledge of the management of the Company has been furnished by the respective nominees.

The Board unanimously recommends that shareholders vote FOR the election of each of the director nominees listed in this Information Circular. Unless authority to do so is withheld, the persons designated as proxyholders in the accompanying Proxy or VIF intend to vote the Common Shares represented by such Proxy FOR the election of each of the director nominees listed in this Information Circular.

Primero’s management does not contemplate that any of the nominees will be unable to serve as a director, but if that should occur for any reason before the Meeting, it is intended that discretionary authority will be exercised by the persons named in the accompanying Proxy to vote for the election of any other person or persons in place of any nominee or nominees unable to serve.

5

| Principal Occupation, Business or Employment of Nominees |

| WADE NESMITH |

|

Wade Nesmith – Director and Chairman of the

Board |

| Age: 64 | Areas of Expertise |

| Mining Industry experience | |

British Columbia, Director Since |

Capital Markets and Corporate Finance |

| Legal/Governance | |

| Corporate Development | |

| Principal Occupation | |

| Chairman and Director of the Company |

| Other Public Board | Public Board Interlocks | |

| Directorships | ||

| Silver Wheaton Corp. | Silver Wheaton Corp.(1) |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Chairman of the Board of Directors | 7 of 7 – 100% |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site | Primero Mining Corp. | August 2015 |

| Visit | ||

| Developments in Corporate | CLE BC | November 2015 |

| Governance | ||

| Securities Held As At | Value of At Risk | Minimum Share Ownership | |

| March 21, 2016(2) | Holdings(3) | ||

| Common Shares: | 387,151 | 1,313,021 | Complies. |

| Options: | 100,000 | ||

| PSUs: | 117,857 | ||

| DSUs: | 315,790 |

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 88.25% | 11.75% |

| 2013 | 84.88% | 15.12% |

| (1) | Messrs. Nesmith and Luna are directors of the Company who serve together as directors on the board of Silver Wheaton Corp. Mr. Nesmith is on its Corporate Governance & Nominating and Audit Committees and Mr. Luna has been appointed to its Human Resources Committee. |

| (2) |

Mr. Nesmith holds 100,000 options and 315,790 DSUs. The multiple of Cash Retainer calculation does not include Mr. Nesmith’s options and DSU holdings in the Company. |

| (3) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

6

| JOSEPH CONWAY |

|

Joseph Conway – Director and Executive

Vice Chairman Mr. Conway was appointed President and Chief Executive Officer of the Company on June 1, 2010, and has been a director of the Company since June 28, 2010. Mr. Conway ceased to be President of Primero on February 2, 2015, and retired from his position as Chief Executive Officer on January 31, 2016. Effective February 1, 2016, he became Executive Vice Chairman of the Company. He has also been a director of Orezone Gold Corporation since October 2014. Mr. Conway was a non-executive director of Santana Mineral Limited from June 2013 to November 2015. Mr. Conway was a director of Dalradian Resources Inc. from June 2010 to May 2013. He served as President and Chief Executive Officer and a director of IAMGOLD Corporation (“IAMGOLD”) from January 2003 until January 2010 and was a director of IAMGOLD from January 2004 until December 2009. Mr. Conway was President, Chief Executive Officer and a director of Repadre Capital Corporation from September 1995 until January 2003. From 1989 until 1995, he was Vice President and a director of Nesbitt Burns, a Canadian investment dealer. He was a stock analyst with Walwyn Stodgell Cochran and Murray from 1987 to 1989, and a mine and exploration geologist from 1981 to 1985. Mr. Conway has a Bachelor of Science degree from Memorial University and a Master of Business Administration degree from Dalhousie University. |

| Age: 58 | Areas of Expertise |

| Mining Industry experience | |

| Ontario, Canada | Exploration/Geology |

| Status: Not Independent | Capital Markets and Corporate Finance |

| Human Resources and Executive Compensation | |

| Director Since | |

| June 28, 2010 | Principal Occupation |

| Director |

| Other Public Board | Public Board | |

| Directorships | Interlocks | |

| Orezone Gold Corporation | None. |

| Primero’s Board & Committee Participation | Meeting Attendance | |

| Member of the Board of Directors | 7 of 7 – 100% | |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site | Primero Mining Corp. | August 2015 |

| Visit | ||

| Securities Held As At March | Value of At Risk | Minimum Share | |

| 21, 2016(1) | Holdings(2) | Ownership | |

| Common Shares: | 722,068 | 4,959,609 | Complies. |

| Options: | 727,941 | ||

| PSUs: | 1,185,474 | ||

| Convertible Debentures | 300 units |

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 94.90% | 5.10% |

| 2013 | 84.89% | 15.11% |

| (1) |

Mr. Conway holds 727,941 options and 300 units (each US $1000 principal amount) of Primero’s 5.75% convertible unsecured subordinated debentures maturing on February 28, 2020. The multiple of Cash Retainer calculation does not include Mr. Conway’s options and debenture holdings in the Company. |

| (2) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

7

| DAVID DEMERS |

|

David Demers – Director |

| Age: 60 | Areas of Expertise |

| Environment, Safety and Sustainability | |

British Columbia, Director Since |

Capital Markets and Corporate Finance |

| Legal/Governance | |

| Human Resources and Executive Compensation | |

| Corporate Development | |

| Principal Occupation | |

| Chief Executive Officer of Westport Innovations Inc. |

| Other Public Board | Public Board Interlocks | |

| Directorships | ||

| Westport Innovations Inc. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 7 of 7 – 100% |

| Chair of the Human Resources Committee | 5 of 5 – 100% |

| Member of the Governance and Nominating Committee | 2 of 2 – 100% |

| Member of the Audit Committee (until May 5, 2015) | 2 of 21 – 100 % |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site | Primero Mining Corp. | August 2015 |

| Visit | ||

| Securities Held As At | Value of At Risk | Minimum Share Ownership | |

| March 21, 2016 | Holdings(2) | ||

| Common Shares: | 163,102 | 572,887 | Complies. |

| Options: | Nil | ||

| PSUs: | 57,239 | ||

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 68.44% | 31.56% |

| 2013 | 93.59% | 6.41% |

| (1) |

Mr. Demers resigned from the Audit Committee on May 5, 2015. He attended all Audit Committee meetings held while he was on the Audit Committee. |

| (2) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

____________________________

8

| GRANT EDEY |

|

Grant Edey – Director |

| Age: 66 | Areas of Expertise |

| Mining Industry experience | |

| Ontario, Canada | Audit/Finance |

| Status: Independent | Capital Markets and Corporate Finance |

| Corporate Development | |

| Director Since | |

| June 28, 2010 | Principal Occupation |

| Chairman, President and Chief Executive Officer of Khan Resources Inc. |

| Other Public Board | Public Board Interlocks | |

| Directorships | ||

| Khan Resources Inc. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 7 of 7 – 100% |

| Chair of the Governance and Nominating Committee | 2 of 2 – 100% |

| Member of the Audit Committee | 5 of 5 – 100% |

| 2015 Orientation and Continuing | ||

| Education | ||

| Topic | Host Organization | Date(s) |

| Seminar on Cyber Security | PWC | April 2015 |

| Black Fox Complex Site Visit | Primero Mining Corp. | August 2015 |

| Whistleblower Seminar | Ernst & Young LLP | September 2015 |

| Off-Quarter Audit Committee | Primero Mining Corp. | October 2015 |

| Education Seminar | PWC | November 2015 |

| Seminar on Mining Innovation | ||

| Securities Held As At | Value of At Risk | Minimum Share Ownership | |

| March 21, 2016(1) | Holdings(2) | ||

| Common Shares: | 53,394 | 286,936 | Complies. |

| Options: | Nil | ||

| PSUs: | 56,966 | ||

| Convertible Debenture | 50 units |

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 67.64% | 32.36% |

| 2013 | 92.21% | 7.79% |

| (1) |

Mr. Edey has 50 units (each US $1000 principal amount) of Primero’s 5.75% convertible unsecured subordinated debentures maturing on February 28, 2020 held in a spousal RRSP. The multiple of Cash Retainer calculation does not include Mr. Edey’s debenture holdings in the Company. |

| (2) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

9

| EDUARDO LUNA |

|

Eduardo Luna – Director | |

| Age: 70 | Areas of Expertise | |

| Mining Industry experience | Capital Markets and Corporate Finance | |

| Mexico State, Mexico | Exploration/Geology | Human Resources and Executive Compensation |

| Status: Independent | Metallurgy | Corporate Development |

| Environment, Safety and | ||

| Director Since | Sustainability | |

| October 29, 2008 | ||

| Principal Occupation | ||

| President and Chief Executive Officer of Rochester Resources Ltd. | ||

| Other Public Board | Public Board Interlocks | |

| Directorships | ||

| Silver Wheaton Corp. | Silver Wheaton Corp.(1) |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 5(2) of 7 – 71% |

| Member of the Corporate Responsibility Committee | 3 of 3 – 100% |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site Visit | Primero Mining Corp. | August 2015 |

| Securities Held As At March 21, 2016 | Value of At Risk Holdings(3) | Minimum Share Ownership | |

| Common Shares: | 156,620 | 556,036 | Complies. |

| Options: | Nil | ||

| PSUs: | 57,240 | ||

|

Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 97.80% | 2.20% |

| 2013 | 84.24% | 15.76% |

| (1) |

Messrs. Luna and Nesmith are directors of the Company who serve together as directors on the board of Silver Wheaton Corp. Mr. Luna has been appointed to its Human Resources Committee and Mr. Nesmith is on its Corporate Governance & Nominating and Audit Committees. |

| (2) |

Mr. Luna was unable to attend due to illness. |

| (3) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

10

| BRAD MARCHANT |

|

Brad Marchant – Director | |

| Age: 59 | Areas of Expertise | |

| Mining Industry experience | Human Resources and Executive Compensation | |

British Columbia, Director Since |

Metallurgy | Risk Management |

| Environment, Safety and Sustainability | Corporate Development | |

| Audit/Finance | ||

| Capital Markets and Corporate Finance | ||

| Principal Occupation | ||

| President and Chief Executive Officer of Enterra Feed Corporation | ||

| Other Public Board Directorships | Public Board Interlocks | |

| None. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 7 of 7 – 100% |

| Chair of the Corporate Responsibility Committee (since November ) | 3 of 3 – 100% |

| Member of the Audit Committee (since May 5, 2015) | 4 of 4(1) – 100% |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site Visit | Primero Mining Corp. | August 2015 |

| Off-Quarter Audit Committee Education Seminar | Primero Mining Corp. | October 2015 |

| Audit Committee Course – Toronto | ICD | November 2015 |

| Internal and External Auditor | ICD | November 2015 |

| Relationships – Vancouver | ||

| Securities Held As At March 21, 2016 | Value of At Risk Holdings(2) | Minimum Share Ownership(3) | |

| Common Shares: | 38,891 | 249,938 | Complies. |

| Options: | Nil | ||

| PSUs: | 57,239 | ||

|

Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 99.88% | 0.12% |

| 2013 | 99.88% | 0.12% |

| (1) |

Mr. Marchant was appointed to the Audit Committee on May 5, 2015. He attended all Audit Committee meetings held while he was on the Audit Committee. |

| (2) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

| (3) |

Mr. Marchant joined the board on June, 2013, and has five years from the date of his appointment to establish the required level of shareholding. |

11

| Principal Occupation, Business or Employment of Nominees |

| ERNEST MAST |

|

Ernest Mast – President and Chief Executive

Officer | |

| Age: 52 | Areas of Expertise | |

| Mining Industry experience | Risk Management | |

| Ontario, Canada | Metallurgy | Corporate Development |

| Status: Not Independent | Environment, Safety and Sustainability | |

| Director Since | ||

| January 31, 2016 | Principal Occupation | |

| President and Chief Executive Officer | ||

| Other Public Board Directorships | Public Board Interlocks | |

| None. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance | |

| NA(1) | ||

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site | Primero Mining Corp. | August 2015 |

| Visit | ||

| Securities Held As At March 21, 2016(2) | Value of At Risk Holdings(3) | Minimum Share Ownership(4) | |

| Common Shares: | 38,209 | 811,881 | Complies |

| Options: | 845,588 | ||

| PSUs: | 274,053 | ||

| (1) |

Mr. Mast became a director of the Company effective January 31, 2016. |

| (2) |

Mr. Mast holds 845,588 options. The multiple of Cash Retainer calculation does not include Mr. Mast’s options in the Company. |

| (3) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

| (4) |

Mr. Mast was appointed as President and CEO on January, 2016, and has five years from the date of his appointment to establish the required level of shareholding. |

12

| ROBERT A. QUARTERMAIN |

|

Robert A. Quartermain – Director

|

| Age: 60 | Areas of Expertise |

| Mining Industry experience | |

British Columbia, Director Since |

Exploration/Geology |

| Environment, Safety and Sustainability | |

| Capital Markets and Corporate Finance | |

| Principal Occupation | |

| Chairman and Chief Executive Officer of Pretium Resources Inc. |

| Other Public Board | Public Board | |

| Directorships | Interlocks | |

| Pretium Resources Inc. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 7 of 7 – 100% |

| Member of the Human Resources Committee | 5 of 5 – 100% |

| Member of the Governance and Nominating Committee | 2 of 2 – 100% |

| Member of the Corporate Responsibility Committee (Since November 2, 2015) | 1 of 1(1) – 100% |

| 2015 Orientation and Continuing Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site Visit | Primero Mining Corp. | August 2015 |

| Securities Held As At March 21, 2016 | Value of At Risk Holdings(2) | Minimum Share Ownership | |

| Common Shares: | 30,000 | 226,821 | Complies. |

| Options: | Nil | ||

| PSUs: | 57,239 | ||

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 93.42% | 6.58% |

| 2013 | 93.83% | 6.17% |

| (1) |

Mr. Quartermain was appointed to the Corporate Responsibility Committee on November 2, 2015. He attended all Corporate Responsibility Committee meetings held while he was on the Corporate Responsibility Committee. |

| (2) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

13

| MICHAEL RILEY |

|

Michael Riley – Director | |

| Age: 64 | Areas of Expertise | |

| Mining Industry experience | Human Resources and Executive Compensation | |

British Columbia, Director Since |

Audit/Finance | Risk Management |

| Capital Markets & Corporate Finance | Corporate Development | |

| Legal/Governance | IT project management and oversight | |

| Principal Occupation | ||

| Corporate Director | ||

| Other Public Board | Public Board | |

| Directorships | Interlocks | |

| None. | None. |

| Primero’s Board & Committee Participation | Meeting Attendance |

| Member of the Board of Directors | 7 of 7 – 100% |

| Chair of the Audit Committee | 5 of 5 – 100% |

| Member of the Human Resources Committee | 5 of 5 – 100% |

| 2015 Orientation and Continuing | ||

| Education | ||

| Topic | Host Organization | Date(s) |

| Black Fox Complex Site Visit | Primero Mining Corp. | August 2015 |

| Off-Quarter Audit Committee | Primero Mining Corp. | October 2015 |

| Education Seminar | ||

| Americas Mining Annual Conference | Ernst & Young LLP | September 2015 |

| for Financial Executive and | ||

| Directors – Chicago, Il | CPA Canada | December 2015 |

| Annual Conference for Audit | CPABC, Ernst & Young LLP, | throughout 2015 |

| Committee | KPMG LLP and Deloitte LLP | |

| Various Financial Accounting and | ||

| Reporting Sessions | ||

| Securities Held As At March | Value of At Risk | Minimum Share | |

| 21, 2016 | Holdings(1) | Ownership | |

| Common Shares: | 56,000 | 294,421 | Complies. |

| Options: | Nil | ||

| PSUs: | 57,239 | ||

| Director Election – Voting | ||

| Results | ||

| Year | Votes | Votes |

| For | Withheld | |

| 2014 | 74.09% | 25.91% |

| 2013 | 99.08% | 0.92% |

| (1) |

Value of At Risk Holdings was calculated using the closing price of the Company’s common shares on the TSX on March 21, 2016 of $2.60. |

Cease Trade Orders, Bankruptcies, Penalties and Sanctions

14

No proposed director is, as at the date of this Information Circular, or has been, within the last 10 years before the date of this Information Circular, a director, chief executive officer, or chief financial officer of any company (including Primero) that was:

| (a) |

subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or | |

| (b) |

subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

Except as set out below, no proposed director is, as at the date of this Information Circular, or has been, within 10 years before the date of this Information Circular, a director or executive officer of any company (including Primero) that:

| (a) |

while that person was acting in that capacity, or within a year of ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement, or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets; or | |

| (b) |

became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager, or trustee appointed to hold the assets of the proposed director. |

Audit Committee Report and Appointment of Auditor

Audit Committee Report

The responsibility of Primero's Audit Committee includes oversight of the integrity of the financial reporting process, the performance and independence of the external auditor, the design and implementation and performance of internal controls over financial reporting, disclosure controls and legal and regulatory requirements. For information about the Audit Committee’s charter and membership, See “Governance - Mandate and Charters - Audit Committee”.

The audit committee’s responsibilities in 2014 and early 2015 were significantly affected by many material changes in Primero’s scope of activities including the Brigus acquisition, the initial adoption of Section 404 of the Sarbanes-Oxley Act (SOX 404), the move of our finance function to Toronto from Vancouver, and the process we undertook which resulted in changing our external auditors for our fiscal 2015 year. By contrast, our 2015 and early 2016 activities have been carried out in a more stable corporate environment as the prior year’s changes have been integrated into our organization and operations. During 2015 the Audit Committee oversaw the quarterly reviews and the initial audit of our consolidated financial statements and systems of internal control by our new external auditors, KPMG LLP.

The Company continued to operate in a difficult commodity price environment in 2015 which focussed management on regular assessments of our operating expenses, capital expenditures and capital structure. We oversaw the issuance and the related accounting and financial reporting of the $75 million convertible debenture issued early in 2015. Management carried out detailed assessments of the carrying values of our significant mineral properties, and consistent with many gold mining companies, these assessments resulted in write downs during the fourth quarter. The Audit Committee oversaw the significant assumptions and estimates underlying these write downs.

In early 2016, the Company’s Advance Pricing Agreement (“APA”) issued in 2012 and affirming the Company’s income tax for the years 2010 to 2014 in relation to its silver sales to Silver Wheaton was challenged by the Mexican tax authorities through the initiation of a legal proceeding. This matter is receiving significant attention by management, and oversight by the Audit Committee and the Board of Primero. Based on the APA, our tax position for our 2010-2014 fiscal years reflected taxation based upon realized revenue. The Company continues to believe that it has filed its tax returns, and paid all applicable taxes, in compliance with Mexican tax laws. The Company is vigorously defending the validity of the APA. This is a very significant development which will be monitored carefully in 2016.

15

Primero’s Board and management are committed to following best practices in financial accounting and reporting standards in our industry. In support of this, the Audit Committee regularly receives reports on evolving standards in IFRS, industry and regulatory issues and governance practices. We held our annual "off quarter" meeting in October 2015 to specifically focus on these matters as they relate to our current and future financial reporting obligations, together with various management initiatives in strengthening our internal controls and resources.

During 2015 Director David Demers rotated off of Audit Committee and was replaced by director Brad Marchant. On behalf of the committee and the Board, I would like to thank Mr. Demers for his valued contributions to our committee which predated our initial public offering in 2010 through to his stepping down during 2015. I would also like to express my thanks and appreciation to my committee members, Messrs. Edey and Marchant, the Board as a whole and our management and auditors who have worked so diligently on behalf of Primero and our Audit Committee over the last year.

Sincerely,

Michael Riley, CPA, CA

Director and Chair of the Audit Committee

Appointment of Auditor

KPMG LLP, an Audit, Tax and Advisory firm, 333 Bay Street, Suite 4600, Bay Adelaide Centre, Toronto, Ontario, will be nominated at the Meeting for reappointment as auditor of the Company to serve until the close of the next annual general meeting of shareholders, at a remuneration to be fixed by the directors. KPMG LLP was first appointed as auditor of the Company on May 6, 2015.

The Board unanimously recommends that shareholders vote FOR the appointment of KPMG LLP as auditor of the Company to serve until the close of the next annual general meeting of shareholders and the authorization of the directors to fix the remuneration of the auditor. Unless authority to do so is withheld, the persons designated as proxyholders in the accompanying Proxy or VIF intend to vote the Common Shares represented by such Proxy FOR the appointment of KPMG LLP as auditor of the Company to serve until the close of the next annual general meeting of shareholders and the authorization of the directors to fix the remuneration of the auditor.

Approval of Stock Option Plan

Under the rules, regulations and policies of the TSX (the “TSX Policies”), listed issuers must obtain shareholder approval for all unallocated options, rights or other entitlements under a security based compensation arrangement. The approval must be obtained every three years.

The Company’s amended and restated 2010 stock option plan dated for reference May 29, 2010 (the “Stock Option Plan”) was approved by shareholders of the Company at the annual and special meeting of shareholders held on June 28, 2010, was implemented upon the Common Shares becoming listed on the TSX on August 19, 2010, and was subsequently approved by shareholders of the Company at the annual and special meeting of shareholders held on May 8, 2013. As three years have passed since the last shareholder approval, in accordance with the TSX Policies, the Company will be seeking approval of the unallocated options under the Stock Option Plan at the Meeting. In connection with such approval, the Company is also seeking to make certain amendments to the Stock Option Plan as described in this Information Circular, along with certain other non-material amendments. Generally, the material amendments have been made to reflect current good governance practices and the TSX Policies and include: eliminating the participation of non-employee directors, adding a more robust definition of a change of control, incorporating a double-trigger for acceleration and vesting of options on a change of control, incorporating a cashless exercise feature (including a stock appreciation component) and amending the amendment provisions of the Stock Option Plan by, among other things, restricting the ability of the Company to re-introduce participation of non-employee directors without shareholder approval. All references in this Information Circular to the Stock Option Plan are references to the Stock Option Plan as proposed to be amended, a complete copy of which is set out in Schedule “A” of this Information Circular.

16

The maximum aggregate number of Common Shares that may be reserved for issuance under all of the Company’s security based compensation plans is 10% of the Company’s issued and outstanding Common Shares (on a non-diluted basis) at the time the Common Shares are reserved for issuance, less any Common Shares reserved for issuance under all other share based compensation arrangements of the Company. As of March 21, 2016, options to purchase an aggregate of 6,424,167 Common Shares (representing approximately 3.9% of the issued and outstanding Common Shares) are outstanding under the Stock Option Plan. The total number of 2013 PSUs (defined herein) awarded under the 2013 PSU Plan (defined herein) is 4,481,917 (representing 2.7% of the outstanding Common Shares). The total number of Directors’ PSUs (defined herein) awarded to non-executive directors under the Directors’ PSU Plan (defined herein) is 211,371 (representing 0.1% of the outstanding Common Shares). The total number of DSUs awarded under the DSU Plan (defined herein) is 315,790 (representing approximately 0.2% of the outstanding Common Shares). Therefore, entitlements to purchase an aggregate of 5,031,564 Common Shares, representing approximately 3.1% of the issued and outstanding Common Shares, remain available for issuance under the Company’s share based compensation plans.

A summary description of the Stock Option Plan can be found under “Compensation – Securities Authorized for Issuance Under Equity Compensation Plans – Stock Option Plan” and the complete copy of the Stock Option Plan is set out in Schedule “A” of this Information Circular.

At the Meeting, shareholders will be asked to consider and pass the following ordinary resolution (the “Stock Option Plan Resolution”):

RESOLVED THAT:

| 1. |

the continuation of the Company’s amended and restated 2010 stock option plan dated for reference May 29, 2010 (the “Stock Option Plan”) is hereby approved; | |

| 2. |

the amended Stock Option Plan, in the form set out at Schedule “A” to the Company’s Information Circular dated March 22, 2016, and all amendments reflected therein, are hereby approved; | |

| 3. |

the available and unallocated options issuable pursuant to the Stock Option Plan are hereby approved and authorized for grant until May 4, 2019; and | |

| 4. |

Any director or officer of the Company be and is hereby authorized and directed to take all such action and execute and deliver all such documents as any such director or officer may, in his or her sole discretion, determines are necessary, desirable or useful to implement the foregoing resolutions. |

An ordinary resolution is a resolution passed by a simple majority of the votes cast in person or by proxy. As the Stock Option Plan includes an insider participation limit, insiders of the Company who are entitled to receive a benefit under the Stock Option Plan are eligible, under the TSX Policies, to vote their securities in respect of the Stock Option Plan Resolution. Unless otherwise indicated and subject to NYSE rules, the persons designated as proxyholders in the accompanying Proxy intend to vote the Common Shares represented by each properly executed Proxy FOR the Stock Option Plan Resolution.

The Stock Option Plan benefits the Company’s shareholders by enabling the Company to attract and retain personnel of the highest caliber by rewarding them for their contribution to the generation of shareholder value, and aligning the interests of the Company’s directors and officers with those of the Company’s shareholders. Accordingly, the Board recommends that shareholders vote in favour of the Stock Option Plan Resolution.

All previously allocated options will continue unaffected regardless of the outcome of the vote. However, should the Stock Option Plan Resolution not be approved by the shareholders, the Company will no longer be able to make option grants under the Stock Option Plan, and all allocated options will no longer be available for reallocation if they are cancelled, or expire unexercised. Any future option grants then would require shareholder approval.

Approval of the 2013 Phantom Share Unit Plan

The Company’s 2013 phantom share unit plan dated for reference March 28, 2013 (the “2013 PSU Plan”) was approved by shareholders of the Company at the annual and special meeting of shareholders held on March 8, 2013. As three years have passed since the last shareholder approval, in accordance with TSX Policies, the Company will be seeking the approval of all unallocated entitlements under 2013 PSU Plan at the Meeting. In connection with such approval, the Company is also seeking to make certain amendments to the 2013 PSU Plan as described in this Information Circular, along with certain other non-material amendments. Generally, the material amendments have been made to reflect current good governance practices and the TSX Policies and include: adding directors as eligible persons under the plan to streamline the Company’s plans but limiting the issuance of 2013 PSUs held by non-employee directors to no more than 1% of the Common Shares issued and outstanding from time to time (calculated on a non-diluted basis) and the total annual grant to any one non-employee director to a maximum grant value of $150,000 in total equity, which may include no more than $100,000 of stock options (note, however, that the Company does not grant stock options to non-employee directors), and which limit shall apply across all of the Company’s share based arrangements, adding a more robust definition of a change of control, incorporating a double-trigger for acceleration and vesting on a change of control and amending the amendment provisions of the 2013 PSU Plan by, among other things, restricting the ability of the Company to make any amendments that would increase the number or value of Common Shares that the Company may issue to a non-employee director pursuant to the 2013 PSU Plan or any other amendment that may permit non-employee directors to participate on an unlimited or discretionary basis without shareholder approval. All references in this Information Circular to the 2013 PSU Plan are references to the 2013 PSU Plan as proposed to be amended, a complete copy of which is set out in Schedule “B” of this Information Circular.

17

The 2013 PSU Plan allows the Company to grant phantom share units (“2013 PSUs”) to selected persons who are employees, officers or directors of the Company or of the Company’s subsidiaries (each an “Eligible Person”). The 2013 PSU Plan is intended to promote a greater alignment of interests between the shareholders of the Company and selected Eligible Persons by providing an opportunity to participate in increases in the value of the Company.

Under the 2013 PSU Plan, the aggregate number of Common Shares that may be reserved for issuance pursuant to the settlement of 2013 PSUs, together with the aggregate number of Common Shares issued pursuant to any other share compensation arrangements (including the Stock Option Plan, the Directors’ PSU Plan and the Deferred Share Unit Plan) will not exceed 10% of the outstanding Common Shares at such time on a non-diluted basis (which as at the date hereof, represents 16,464,809 Common Shares). As of March 21, 2016, the total number of 2013 PSUs awarded under the 2013 PSU Plan is 6,214,866. The outstanding 2013 PSUs may be settled for 4,481,917 Common Shares, which represents approximately 2.7% of the issued and outstanding Common Shares as at the date hereof and 39.2% of the Common Shares available to be issued pursuant to all of the share compensation arrangements of the Company (including the 2013 PSU Plan).

A summary description of the 2013 PSU Plan can be found under “Compensation – Securities Authorized for Issuance Under Equity Compensation Plans – 2013 PSU Plan” and the complete copy of the 2013 PSU Plan is set out in Schedule “B” of this Information Circular.

At the Meeting, shareholders will be asked to consider and pass the following ordinary resolution (the “2013 PSU Plan Resolution”):

RESOLVED THAT:

| 1. |

The phantom share unit plan (the “2013 PSU Plan”), as described in the Information Circular, is hereby approved, and the Company is hereby authorized to issue securities pursuant to the 2013 PSU Plan; | |

| 2. |

the amended Company’s 2013 PSU Plan, in the form set out at Schedule “B” to the Company’s Information Circular dated March 22, 2016, and all amendments reflected therein, are hereby approved; | |

| 3. |

The unallocated entitlements under the 2013 PSU Plan are hereby approved until May 4, 2019; and | |

| 4. |

Any director or officer of the Company be and is hereby authorized and directed to take all such action and execute and deliver all such documents as any such director or officer may, in his or her sole discretion, determines are necessary, desirable or useful to implement the foregoing resolutions. |

An ordinary resolution is a resolution passed by a simple majority of the votes cast in person or by proxy. As the 2013 PSU Plan includes an insider participation limit, insiders of the Company who are entitled to receive a benefit under the 2013 PSU Plan are eligible, under the TSX Policies, to vote their securities in respect of the 2013 PSU Plan Resolution. Unless otherwise indicated and subject to NYSE rules, the persons designated as proxyholders in the accompanying Proxy intend to vote the Common Shares represented by each properly executed Proxy FOR the 2013 PSU Plan Resolution.

18

The 2013 PSU Plan will benefit the Company’s shareholders by aligning the interests of the Company’s employees, officers and directors with those of Primero shareholders and providing a long-term incentive to reward employees, officers and directors for their contribution to the generation of shareholder value. Accordingly, the Board recommends that shareholders vote in favour of the 2013 PSU Plan Resolution.

All previously allocated 2013 PSUs will continue unaffected regardless of the outcome of the vote. Pursuant to the policies of the TSX, if the 2013 PSU Plan is approved by the shareholders at the Meeting, such plan will require shareholder approval thereafter at least once every three years.

However, should the 2013 PSU Plan Resolution not be approved by the shareholders, the Company will no longer be able to make 2013 PSU grants under the 2013 PSU Plan, and all allocated 2013 PSUs will no longer be available for reallocation if they are cancelled, or expire unexercised. Any future 2013 PSU grants then would require shareholder approval.

Advisory Vote on the Company’s Approach to Executive Compensation

The Board believes that the Company’s compensation program must be competitive to attract and retain top quality directors and officers, provide a strong incentive to its management to achieve the Company’s goals and align the interests of management with the interests of the Company’s shareholders. A detailed discussion of the Company’s executive compensation program is provided under the heading “Compensation” of this Information Circular. Shareholders are asked to consider that disclosure because the shareholders have a formal opportunity at the Meeting to provide their views on the Company’s approach to executive compensation through the following “Say on Pay” advisory vote:

“BE IT RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in the Company’s Information Circular delivered in advance of the 2016 annual general and special meeting of Shareholders.”

Since this vote is advisory, it will not be binding on the Board. The Board remains fully responsible for its compensation decisions and is not relieved of this responsibility. However, the Board and the Human Resources Committee will consider the outcome of the vote, as appropriate, when considering future compensation policies, procedures and decisions, all of which are to be consistent with its pay for performance compensation model (see “Statement of Executive Compensation” for details regarding the compensation philosophy and guidelines of the Board).

The Board unanimously recommends that shareholders vote FOR approval of the non-binding resolution on executive compensation. Unless authority to do so is withheld, the persons designated as proxyholders in the accompanying Proxy or VIF intend to vote the Common Shares represented by such Proxy FOR approval of the non-binding resolution on executive compensation.

19

SECTION 3: GOVERNANCE

Governance and Nominating Committee Report

Primero’s Governance and Nominating Committee is pleased to present the following disclosure of Primero’s corporate governance practices. As a company that is committed to creating sustainable long term value for the benefit of all stakeholders, Primero understands that it must lead with its governance practices. In this spirit, Primero seeks to maintain governance practices that reflect standards that meet or exceed those of its peers, reflect governance best practices for a company such as ours, and establish the foundation to sustain the larger, mature organization that Primero intends to become. We believe that good governance supports more consistent, sustainable, superior performance.

In 2015, the Governance and Nominating Committee focused on governance initiatives not only to maintain compliance with regulatory requirements but also to enhance the Company’s governance practices in line with current market views of best practices and reflecting Primero’s commitment to align with our shareholders’ interests. As standards of good governance are continually evolving, so must our governance practices, and we endeavour to be a leading example of good governance, appropriate to our business and our industry.

Among the committee’s annual responsibilities, we reviewed board structure and composition and considered its independence and effectiveness. To assist the Board in this matter in 2015, an independent governance expert was retained to conduct an assessment and provide a report on various board matters. In general, the expert’s report confirmed Primero’s governance practices to be consistent with best practices for a company such as ours, and his recommendations generated a constructive discussion of governance trends and standards, which supports the Board’s commitment to continual improvement of its performance on behalf of shareholders.

In addition, the committee has extensively considered matters of diversity among executive officers and directors in accordance with the Company’s Diversity Policy. Fifty percent of Primero’s executive officers are women, a fact we believe is unique among our peers. Beyond gender diversity, we have a highly diverse employee base reflecting our constituent communities among other qualities. While we do not yet have female representation on the Board level, during 2015 we worked toward this objective, including considering and interviewing potential director nominees, and we anticipate adding a female director within the next year.

In conjunction with the Human Resources Committee, we considered and made recommendations to the board of directors in respect of director compensation maintaining directors’ compensation without changes in 2015.

In 2015, a year in which Primero addressed many challenges, Primero remained focused on continually improving its governance practices and policies to provide enhanced transparency, integrity, principled action, risk oversight and stakeholder engagement. Primero’s corporate governance practices are described in detail below. The Governance and Nominating Committee believes that Primero’s corporate governance provides a governance framework that provides transparency and confidence to our shareholders.

Sincerely,

Grant Edey,

Chair,

Governance and Nominating Committee

Governance Overview

The board of directors is committed to acting in the best interests of the Company and its stakeholders. The Board fulfills its role directly and through its standing committees which are focused on the performance of the Company and the continued improvement of our corporate governance practices. Detailed information on the Audit, Human Resources, Governance and Nominating and Corporate Responsibility Committees, can be found under the heading “Board Committees” of this Information Circular.

The NYSE rules require the Company to disclose any significant ways in which its corporate governance practices differ from those followed by United States domestic issuers under the NYSE listing standards. The Company believes that there are no significant differences between its corporate governance practices and those required to be followed by United States domestic issuers under the NYSE listing standards.

The following disclosure has been prepared under the direction of the Governance and Nominating Committee and has been approved by the Board. Below is a summary of our corporate governance practices in accordance with the applicable rules and standards of the Canadian Securities Administrators, the TSX and the NYSE.

20

| Governance Practices | |

| Size of Board | 9 |

| Number of Independent Directors (%) | 7/9 (78%) |

| Fully Independent Audit, Human Resources and Governance and Nominating Committees | YES |

| Majority of Independent Directors on All Other Committees | YES |

| Annual Election of Directors | YES |

| Average Tenure of Director Nominees (years) | 5.3 |

| Average Age of Director Nominees | 61 |

| Mandatory Term Limits for Directors | NO |

| Directors Elected Individually (not by slate) | YES |

| Majority Voting Policy for Directors | YES |

| Separate Board Chair & CEO | YES |

| In Camera Sessions of Independent Directors | YES |

| Share Ownership Policies for Directors and Executives, including anti-hedging | YES |

| Board Orientation/Education Program | YES |

| Code of Business Conduct and Ethics | YES |

| Annual Advisory Vote on Executive Compensation | YES |

| Formal Board Evaluation Process | YES |

| Executive Compensation Claw-back Policy | YES |

| Diversity Policy | YES |

Corporate Governance Practices

Board of Directors

The Board facilitates the exercise of independent supervision over management by ensuring representation on the Board by directors who are independent of management. Directors are considered to be independent if they have no direct or indirect material relationship with the Company. A “material relationship” is a relationship which could, in the view of the Company’s Board, be reasonably expected to interfere with the exercise of a director’s independent judgment. For information regarding independence of director nominees, see “Business of the Meeting - Election of Directors”.

Exercise of Independence by the Board

Pursuant to the Company’s governance principles, the Board has followed the practice of meeting in executive session without management present at all scheduled Board meetings. In addition, where a matter under consideration at a Board meeting warrants it and to ensure that free and candid discussions can take place, the Chairman may request one or more members of management or non-independent directors to withdraw during the discussion of that matter. The Chairman may also call meetings of independent directors at the request of any independent director, on his own initiative, or in a situation whereby a conflict of interest arises with any director and such director should abstain from any vote regarding such matter.

The meetings of independent directors are chaired by the Chairman. The meetings provide an opportunity for independent directors to raise issues that they do not wish to discuss in the presence of management. When such meetings are held at the commencement of the meeting, independent directors are able to discuss matters preparatory to the meeting and, when held at the conclusion of the Board meeting, independent directors are able to discuss any issues that may have arisen during the Board meeting. Throughout 2015, all Board meetings included an in camera session of independent directors at the beginning or end of the meeting, and some meetings included in camera sessions both at the beginning and end of the meeting. During 2015, independent directors met without management or non-independent directors present at every Board meeting.

21

The independence of the Board is also fostered in the following ways:

| • |

There are no members of management on the Board (or otherwise non- independent directors) other than the Executive Vice Chairman and the Chief Executive Officer; | |

|

| ||

| • |

Special meetings of the Board may be held at any time at the request of any two directors; | |

|

| ||

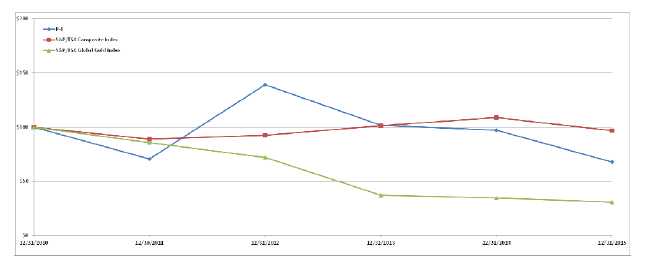

| • |