Form 6-K North American Energy For: Feb 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of February 2016

Commission File Number 001-33161

NORTH AMERICAN ENERGY PARTNERS INC.

Suite 300, 18817 Stony Plain Road

Edmonton, Alberta T5S 0C2

(780) 960-7171

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Documents Included as Part of this Report

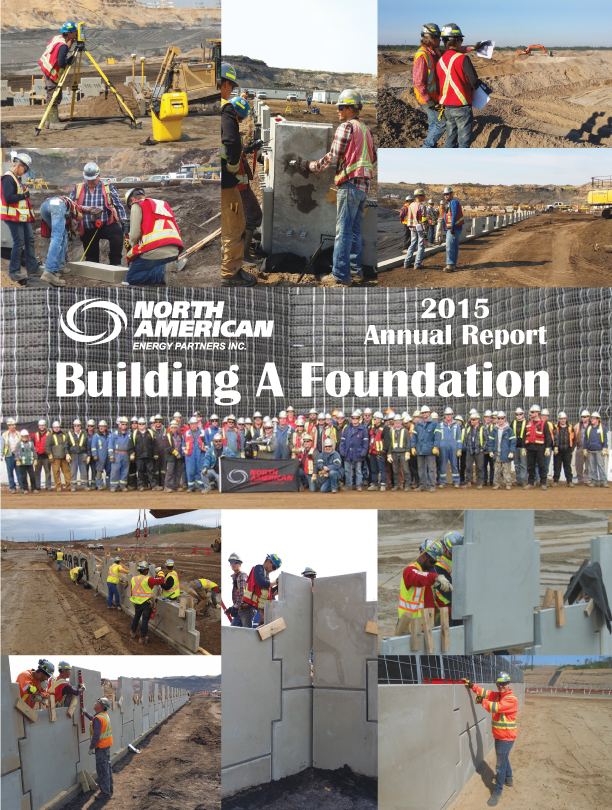

| 1. | 2015 Annual Report to Shareholders |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NORTH AMERICAN ENERGY PARTNERS INC. | ||

| By: | /s/ Martin Ferron | |

| Name: |

Martin Ferron | |

| Title: |

President & Chief Executive Officer | |

Date: February 23, 2016

To Our Shareholders:

NOA

Management’s Discussion and Analysis

For the year ended December 31, 2015

A. EXPLANATORY NOTES

February 16, 2016

The following Management’s Discussion and Analysis (“MD&A”) is as of December 31, 2015 and should be read in conjunction with the attached audited consolidated financial statements for the year ended December 31, 2015 and notes that follow. These statements have been prepared in accordance with United States (“US”) generally accepted accounting principles (“GAAP”). Except where otherwise specifically indicated, all dollar amounts are expressed in Canadian dollars. The audited consolidated financial statements and additional information relating to our business, including our most recent Annual Information Form (“AIF”), are available on the Canadian Securities Administrators’ SEDAR System at www.sedar.com, the Securities and Exchange Commission’s website at www.sec.gov and our company website at www.nacg.ca.

Caution Regarding Forward-Looking Information

Our MD&A is intended to enable readers to gain an understanding of our current results and financial position. To do so, we provide material information and analysis comparing results of operations and financial position for the current period to that of the preceding periods. We also provide analysis and commentary that we believe is necessary to assess our future prospects. Accordingly, certain sections of this report contain forward-looking information that is based on current plans and expectations. This forward-looking information is affected by risks, assumptions and uncertainties that could have a material impact on future prospects. Readers are cautioned that actual events and results may vary from the forward-looking information. We have denoted our forward looking statements with this symbol “¿”. Please refer to “Forward-Looking Information, Assumptions and Risk Factors” for a discussion of the risks, assumptions and uncertainties related to such information. Readers are cautioned that actual events and results may vary from the forward-looking information.

Non-GAAP Financial Measures

A non-GAAP financial measure is generally defined by the Securities and Exchange Commission (“SEC”) and by the Canadian securities regulatory authorities as one that purports to measure historical or future financial performance, financial position or cash flows, but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measures. In our MD&A, we use non-GAAP financial measures such as “gross profit”, “gross profit margin”, EBITDA which is “net income before interest expense, income taxes, depreciation and amortization”, “Consolidated EBITDA” (as defined in our Sixth Amended and Restated Credit Agreement, the “Credit Facility”), “Consolidated EBITDA from Continuing Operations”, “Piling Business EBITDA”, “Total Debt” and “Free Cash Flow”. Where relevant, particularly for earnings-based measures, we provide tables in this document that reconcile non-GAAP measures used to amounts reported on the face of the consolidated financial statements.

Gross profit and Gross profit margin

Gross profit is defined as revenue less: project costs; equipment costs; and depreciation. Gross profit margin is defined as gross profit as a percentage of revenue.

We believe that gross profit is a meaningful measure of our business as it portrays operating profits before general and administrative (“G&A”) overheads costs, amortization of intangible assets and the gain/loss on asset sales. Management reviews gross profit and gross profit margin to determine the profitability of operating activities, including equipment ownership charges and to determine whether resources and equipment are being allocated effectively.

EBITDA and Consolidated EBITDA

Consolidated EBITDA is defined as EBITDA, excluding the effects of unrealized foreign exchange gain or loss, realized and unrealized gain or loss on derivative financial instruments, non-cash stock-based compensation expense, gain or loss on disposal of plant and equipment and certain other non-cash items included in the calculation of net income.

| 2015 Management’s Discussion and Analysis |

1 |

NOA

We believe that EBITDA is a meaningful measure of the performance of our business because it excludes interest, income taxes, depreciation and amortization that are not directly related to the operating performance of our business. Management reviews EBITDA to determine whether plant and equipment are being allocated efficiently. In addition, our Credit Facility requires us to maintain both a fixed charge coverage ratio and a senior leverage ratio, which are calculated using Consolidated EBITDA from continuing operations. Non-compliance with these financial covenants could result in a requirement to immediately repay all amounts outstanding under our credit facility.

As EBITDA and Consolidated EBITDA are non-GAAP financial measures, our computations of EBITDA and Consolidated EBITDA may vary from others in our industry. EBITDA and Consolidated EBITDA should not be considered as alternatives to operating income or net income as measures of operating performance or cash flows as measures of liquidity. EBITDA and Consolidated EBITDA have important limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our results as reported under US GAAP. For example, EBITDA and Consolidated EBITDA do not:

| • | reflect our cash expenditures or requirements for capital expenditures or capital commitments or proceeds from capital disposals; |

| • | reflect changes in our cash requirements for our working capital needs; |

| • | reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

| • | include tax payments or recoveries that represent a reduction or increase in cash available to us; or |

| • | reflect any cash requirements for assets being depreciated and amortized that may have to be replaced in the future. |

Consolidated EBITDA excludes unrealized foreign exchange gains and losses and realized and unrealized gains and losses on derivative financial instruments, which, in the case of unrealized losses may ultimately result in a liability that may need to be paid and in the case of realized losses represents an actual use of cash during the period.

Consolidated EBITDA from Continuing Operations

With the sale of our Pipeline construction related assets (November 22, 2012) and our Piling related assets and liabilities (July 12, 2013) and the exit from both businesses, the results from these businesses are reported as results from “discontinued operations”. We believe that our performance should be measured on our continuing operations and compared against historical results from continuing operations. “Consolidated EBITDA from Continuing Operations” is defined as Consolidated EBITDA excluding results from discontinued operations.

Piling Business EBITDA

As part of the sale of our Piling related assets and liabilities, as discussed in “Financial Results – Contingent Proceeds”, there was the possibility of receiving contingent proceeds based on certain profitability thresholds being achieved from the use of the assets and liabilities sold. The calculation of the actual profitability performance, for the purpose of determining the contingent proceeds that we could receive, is defined in the purchase and sale agreement using substantially our definition of Consolidated EBITDA, as described above, as it applies to the Piling business with a limit placed on incremental corporate general & administrative (“G&A”) costs that can be included in the determination of such EBITDA (the “Piling Business EBITDA”).

Total Debt

Total Debt is defined as the sum of the outstanding principal balance (current and long-term portions) of: (i) capital leases; (ii) borrowings under our Credit Facility; (iii) Series 1 Senior Unsecured Debentures due 2017 (the “Series 1 Debentures”); and (iv) hedges or swap liabilities. Total Debt is used in the pricing grid of our Credit Facility which uses a Total Debt to trailing 12-month Consolidated EBITDA ratio to determine the pricing level for borrowing and standby fees under the facility. We believe Total Debt is a meaningful measure in understanding our complete debt obligations.

Net Debt

Net Debt is defined as Total Debt less cash recorded on the balance sheet. Net Debt is used by us in assessing our debt repayment requirements after using available cash.

| 2 | 2015 Management’s Discussion and Analysis |

NOA

Free Cash Flow

Free cash flow is defined as cash from operations less cash used in / provided by investing activities (excluding cash used for growth capital expenditures and cash used for / provided by acquisitions). We feel free cash flow is a relevant measure of cash available to service our Total Debt repayment commitments, pay dividends, fund share purchases and fund both growth capital expenditures and potential strategic initiatives.

Backlog and future workload

Backlog is a measure of the amount of secured work a company may have outstanding. As a result, the definition and determination of backlog will vary among different organizations ascribing a value to backlog. We do not believe that backlog is an accurate indicator of the base level of our future revenue potential as a significant portion of our activity is performed under a master services agreement (“MSA”) with each of our key clients. Our clients provide us with work authorizations under the MSAs as our services are required and as we have equipment fleet available to perform the work. In addition, the amount of work performed under our MSAs compared to work performed under contracts varies year-by-year.

| 2015 Management’s Discussion and Analysis |

3 |

NOA

B. SIGNIFICANT BUSINESS EVENTS

2015 economic, industry and oil sands customer events

2015 was a tumultuous year for the economy, for our industry and for our oil sands customers. We entered the year already having experienced a slide both in the WTI price per barrel of oil and the Canadian / US exchange rate from peak numbers in the last three years: WTI crude oil at $108.00 $US/barrel in August 2013; and the exchange rate over par at $1.01 in January 2013. Our customers had already reacted to declining revenues from the lower oil prices, both with investment deferrals in growth capital projects (the majority of these deferrals related to higher operating cost “in situ” extraction method projects) and the implementation of aggressive operating cost reduction plans, which included the dilution of fixed costs through production growth. Oil sands producers re-affirmed their investment commitments to grow production in their longer-life, lower operating cost oil sands mines, including the continued development of the Fort Hills mine1, the ramping up of production at the Kearl mine2 and the expansion of production at the Horizon mine3. Separate from this reaction to the changing oil price, the joint venture owners of the Joslyn mine4 had already suspended their mine development project, citing escalating costs and uncertain economic returns.

Below are some of the economic, political and customer highlights of 2015 that have influenced our business, many of which were not anticipated as we entered 2015:

| • | The Canadian economy continues to experience moderate inflation, with current inflation trends remaining within the Bank of Canada’s target inflation rate of 2%. |

| • | On December 31, 2014 the WTI price per barrel of oil was $60.75 ($US/barrel) and the Canadian / US dollar exchange rate was $0.87. |

| • | On January 2, 2015, under the terms of our long-term overburden removal contract with Canadian Natural5 we completed the buyout of certain contract-specific equipment leases, the sale of contract-specific assets, and the assignment of other contract-specific equipment leases to the customer and received net proceeds of $36.3 million. The long-term contract with Canadian Natural expired on June 30, 2015. |

| • | On June 16, 2015, Imperial Oil6 announced the early start-up of their Kearl mine expansion, adding 110,000 bbl/d to their existing 110,000 bbl/d initial production capacity. |

| • | On June 30, 2015, as anticipated, our 10-year overburden removal contract at the Horizon mine expired. |

| • | On July 1, 2015, the newly elected Alberta provincial government implemented a 20% increase to the provincial corporate tax rate. |

| • | On July 8, 2015, we entered into the Sixth Amended and Restated Credit Agreement with our existing banking syndicate which matures on September 30, 2018, replacing the Fifth Amended and Restated Credit Agreement. The new credit agreement consists of a $70.0 million revolving facility and a $30.0 million term loan. The term loan was used to secure the redemption of $38.8 million million of the Series 1 Debentures. The new credit agreement is expected to provide a lower cost of debt, more flexible terms and an increased borrowing base.¿ |

1 Fort Hills Energy LP (Suncor Fort Hills), a limited partnership between Suncor Energy Inc. (50.8%), Total (29.2%) and Teck Resources Ltd. (20%). Through its affiliate, Suncor Energy Operating Inc. (SEOI), Suncor is the developer and operator of the Fort Hills project via an operating services contract.

2 Kearl Oil Sands project, jointly owned by Imperial (71%) and ExxonMobil Canada (29%).

3 Horizon Oil Sands Project, a wholly owned and operated Canadian Natural Resources Limited project.

4 Joslyn North Mine Project (Joslyn), a joint venture amongst Total E&P Canada (38.25%), Suncor (36.75%), Occidental Petroleum Corporation (15%) and Inpex Corporation (10%). Total is the operator of the oil sands mining and extraction operations of the Joslyn North Mine Project.

5 Canadian Natural Resources Limited (Canadian Natural), owner and operator of the Horizon Oil Sands mine site.

6 Imperial Oil Resources Limited (Imperial Oil).

| 4 | 2015 Management’s Discussion and Analysis |

NOA

| • | On August 29, 2015, Syncrude7 experienced a fire at their Mildred Lake8 upgrading facility which reduced short-term output by upwards of 80%. Syncrude returned to pre-fire production levels at the beginning of October, 2015. |

| • | On September 21, 2015, Suncor9 acquired an additional 10% ownership of the Fort Hills joint venture10 from Total11, bringing their ownership to 50.8% and reducing Total’s ownership to 29.2%. Suncor is the operator of the Fort Hills development project. |

| • | On October 5, 2015, Suncor launched an unsolicited bid to buy all the common shares of Canadian Oil Sands Limited (“COS”)12. COS owns 36.74% of Syncrude Canada Limited, the joint venture owner of the Mildred Lake and Aurora mines13 (Suncor currently owns 12% of Syncrude), operated by Imperial Oil. On February 5, 2016, Suncor announced the successful acquisition of 72.9% of the outstanding common shares of COS, thus assuming majority control. |

| • | On October 20, 2015, a new Canadian federal government was elected on a platform that included promises of increased standards for the environmental review of new and existing pipeline construction projects, more stringent carbon emission standards, a focus on “clean energy” and an economic stimulus plan with an increase in infrastructure spending. |

| • | On November 6, 2015, TransCanada Corporation’s Keystone XL pipeline14 proposal (a pipeline intended to transport Alberta produced crude oil to US refineries in the Gulf of Mexico) was rejected by the administration of the US government, bringing an end to a more than six year environmental review process. |

| • | On November 22, 2015, the Alberta provincial government announced a new climate plan to take effect starting in 2017, which includes a carbon pricing regime coupled with an overall emissions limit for the oil sands. The climate plan places some certainty on the future greenhouse gas (GHG) costs, while the limit on oil sands emissions will force companies to ensure only the most profitable and efficient projects are developed. |

| • | On December 31, 2015 the WTI price per barrel of oil was $37.13 ($US/barrel) and the Canadian / US Exchange rate was $0.72. During 2015, the WTI price of a barrel of oil declined by $16.32 ($US/barrel), a reduction of almost 31%, while the Canadian / US dollar exchange rate declined by $0.14 in the same period, a 16% reduction. The volatility continued into 2016, with the WTI price per barrel of oil dropping to an almost 13-year low point of $26.21 ($US/barrel) on February 11, 2016 and the Canadian / US Exchange rate dropping to a low point of $0.69 on January 19, 2016, before both rebounding, but not to 2015 levels. |

Accomplishments against our 2015 Strategic Priorities

At the start of 2015, we reaffirmed our primary goal for shareholders to grow our shareholder value through being an integrated service provider of choice for the developers and operators of resource-based industries in a broad and often challenging range of environments and to leverage our equipment and expertise to support the development of provincial infrastructure projects across Canada. Our focus was on the following strategic priorities:

| • | Enhance safety culture; |

| • | Increase customer satisfaction; |

| • | Maintain productivity and profitability; |

| • | Improve cash flow; |

| • | Maintain a strong balance sheet; and |

| • | Increase our presence outside the oil sands. |

7 Syncrude Canada Ltd. (Syncrude) - Imperial Oil is the operator of the oil sands mining and extraction operations for the Syncrude Project, a joint venture amongst Suncor Energy Oil and Gas Partnership (49%), Imperial Oil Resources (25%), Sinopec Oil Sands Partnership (9%), Nexen Oil Sands Partnership (7%), Murphy Oil Company Ltd. (5%) and Mocal Energy Limited (5%). - On February 5, 2016, Suncor announced the successful acquisition of 72.9% of the outstanding common shares of Canadian Oil Sands Limited, thus increasing their joint venture ownership from 12% to 49%.

8 Mildred Lake oil sands mine, owned and operated by Syncrude Canada Ltd.

9 Suncor Energy Inc. (Suncor).

10 Fort Hills Energy LP (Suncor Fort Hills), a limited partnership between Suncor Energy Inc. (50.8%), Total (29.2%) and Teck Resources Ltd. (20%). Through its affiliate, Suncor Energy Operating Inc. (SEOI), Suncor is the developer and operator of the Fort Hills project via an operating services contract.

11 Total E&P Canada Ltd. (Total), a wholly owned subsidiary of Total SA.

12 Canadian Oil Sands Limited is a joint venture partnership that as of February 5, 2016 is owned 72.9% by Suncor Energy.

13 Aurora Project (Aurora), owned and operated by Syncrude Canada Ltd.

14 TransCanada Corporation (TransCanada)

| 2015 Management’s Discussion and Analysis |

5 |

NOA

As documented above, many of the economic, political and customer changes in 2015 were not anticipated, or we did anticipate the event, but not at the dire levels we experienced during the year. Despite the “worst case” scenarios, we maintained our focus on our strategic priorities, which aided us in maintaining our resilience through a tough economic year.

Our focus on our strategic priorities resulted in the following significant accomplishments for the year ended December 31, 2015:

| • | We continued to elevate the standard of excellence in our safety culture, as reflected by our strong safety record in 2015, which included a significant improvement in our Total Recordable Injury Rate (“TRIR”) of 0.44 down from 0.88 in 2014 and down from 0.97 in 2013. As a reflection of the high safety standards we maintain, we recently celebrated achieving a major safety milestone at the Kearl mine, where we achieved 18 months without a recordable incident. |

| • | As anticipated with the completion of the 10-year overburden removal contract on the Horizon mine and the suspension of the Joslyn mine development project, our revenue was $281.3 million, a drop of $190.5 million from 2014 levels (a 40.4% reduction). However, the continued focus on cost savings initiatives and excellence in project execution mitigated the impact of these lower volumes, resulting in our Gross Profit of $31.9 million, $19.5 million or 38.0% lower than 2014 levels with our gross margin improving by 0.4% from 2014 to 11.3% in 2015. In addition, we finished 2015 with $32.4 million in cash on our balance sheet and we achieved $48.5 million in Consolidated EBITDA for the year, a $15.9 million or 24.7% reduction from 2014 levels, with our Consolidated EBITDA margin improving by 3.6% from 2014 levels to 17.3% from 2014 levels. |

| • | We generated $81.9 million of free cash flow from the aforementioned Canadian Natural equipment sale, better profitability, continued capital discipline and the timely collection of working capital which complements the $24.2 million of free cash flow generated in 2014. |

| • | On August 14, 2015, we redeemed $37.5 million of the Series 1 Debentures on a pro rata basis for 101.52% of the principal amount, plus accrued and unpaid interest. During 2015, we repurchased $1.3 million of the Series 1 Debentures at par, plus accrued and unpaid interest in three separate market transaction. |

| • | On August 14, 2015, we commenced a normal course issuer bid (“NCIB”) in Canada, through the facilities of the Toronto Stock Exchange (“TSX”) to purchase up to 532,520 of our voting common shares which, at the time the NCIB commenced represented approximately 2.3% of the public float (as defined in the TSX Company Manual). As at December 17, 2015, 532,520 voting common shares had been purchased and retired under this bid. |

| • | During 2015, we secured more than $75.0 million of lower cost equipment leasing capacity through our equipment leasing partners (we are limited by the Credit Facility to $75.0 million of outstanding capital equipment leases at any time). |

| • | Between the reduction in Series 1 Debentures in mid-2014 and during 2015, the negotiation of a lower cost credit agreement and the securing lower cost capital lease terms, we reduced total 2015 interest cost by $2.4 million from 2014 levels, while lowering net debt to $78.6 million from $127.4 million in the same period. |

| • | We continued our focus on extending our presence outside the oil sands with work completed on the Highway 63 road building project for the Government of Alberta Ministry of Transport. In addition, we pre-qualified as part of a contractor consortium to bid for the main civil work package associated with the Site C Clean Energy (“Site C”)15 project in British Columbia. The $8.8 billion Site C hydro-electric dam project was sanctioned by the Province of British Columbia on December 16, 2014. While our consortium bid was unsuccessful, we built a strong relationship with our consortium partners and gained significant experience during the bidding process, both of which we hope to leverage in our bidding activities on large infrastructure projects for 2016. |

A complete discussion on our significant business events for the past three years along with our 2016 strategic priorities can be found in our most recent Annual Information Form (“AIF”).

15 Site C Clean Energy (“Site C”) project is a Province of British Columbia approved project operated by BC Hydro.

| 6 | 2015 Management’s Discussion and Analysis |

NOA

C. OUR BUSINESS

Five Year Financial Performance

The table below represents select financial data related to our business performance for the past five years:

| Year ended December 31, |

||||||||||||||||||||||||||||||

| (dollars in thousands except ratios and per share amounts) | 2015 | 2014 | 2013 | 2012 | 2011(1) | |||||||||||||||||||||||||

| Operating Data |

||||||||||||||||||||||||||||||

| Revenue |

$ | 281,282 | $ | 471,777 | $ | 470,484 | $ | 595,422 | $ | 636,101 | ||||||||||||||||||||

| Gross profit |

31,890 | 51,400 | 45,739 | 24,030 | 16,293 | |||||||||||||||||||||||||

| Gross profit margin |

11.3 | % | 10.9 | % | 9.7 | % | 4.0 | % | 2.6 | % | ||||||||||||||||||||

| Operating income (loss) |

2,837 | 11,599 | (2,683 | ) | (23,136 | ) | (31,574 | ) | ||||||||||||||||||||||

| Net income (loss) from continuing operations |

(7,470 | ) | (697 | ) | (18,047 | ) | (32,496 | ) | (35,508 | ) | ||||||||||||||||||||

| Consolidated EBITDA from continuing operations(2) |

48,534 | 64,442 | 43,466 | 28,071 | 55,518 | |||||||||||||||||||||||||

| Consolidated EBITDA margin from continuing operations |

17.3 | % | 13.7 | % | 9.2 | % | 4.7 | % | 8.7 | % | ||||||||||||||||||||

| Net (loss) income(3) |

(7,470 | ) | (1,169 | ) | 69,184 | (13,673 | ) | (34,737 | ) | |||||||||||||||||||||

| Per share information from continuing operations |

||||||||||||||||||||||||||||||

| Net loss – basic & diluted |

$ | (0.23 | ) | $ | (0.02 | ) | $ | (0.50 | ) | $ | (0.90 | ) | $ | (0.98 | ) | |||||||||||||||

| Per share information |

||||||||||||||||||||||||||||||

| Net (loss) income – basic |

$ | (0.23 | ) | $ | (0.03 | ) | $ | 1.91 | $ | (0.38 | ) | $ | (0.96 | ) | ||||||||||||||||

| Net (loss) income – diluted |

$ | (0.23 | ) | $ | (0.03 | ) | $ | 1.89 | $ | (0.38 | ) | $ | (0.96 | ) | ||||||||||||||||

| Balance Sheet Data |

||||||||||||||||||||||||||||||

| Total assets(4) |

$ | 360,694 | $ | 456,581 | $ | 445,641 | $ | 474,749 | $ | 478,671 | ||||||||||||||||||||

| Total debt(4)(5) |

110,942 | 128,324 | 118,295 | 330,729 | 328,959 | |||||||||||||||||||||||||

| Total shareholders’ equity |

171,618 | 189,579 | 191,835 | 143,573 | 143,573 | |||||||||||||||||||||||||

| Debt to shareholders’ equity |

0.6:1 | 0.7:1 | 0.6:1 | 2.5:1 | 2.3:1 | |||||||||||||||||||||||||

| Cash dividend declared per share |

$ | 0.08 | $ | 0.08 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||||||||||||||

| 1 | Financial results for the year ended December 31, 2011 include a $42.5 million revenue write-down on the Canadian Natural overburden removal contract. |

| 2 | For a definition of Consolidated EBITDA and reconciliation to net income see “Non-GAAP Financial Measures” and “Summary of Consolidated Results” in this MD&A. The consolidated EBITDA calculation for the year ended December 31, 2011 excludes the non-cash effect of the $42.5 million revenue write-down on the Canadian Natural contract. |

| 3 | Net (loss) income includes results from discontinued operations. Revenue, gross profit, operating income (loss) and Consolidated EBITDA excludes results from discontinued operations. |

| 4 | Total assets and total debt have been adjusted to only include assets and debt associated with continuing operations for all periods presented. |

| 5 | Total debt is calculated as the addition of Series 1 Debentures, 8 3/4% senior notes, current and non-recurring portion of swap liability, capital lease obligations and credit facilities. Excluded from total debt is debt relating to discontinued operations of $6.1 million and $0.3 million at December 31, 2012 and 2011, respectively. |

Business Overview

We provide a wide range of mining and heavy construction services to customers in the resource development and industrial construction sectors, primarily within Western Canada.

Our core market is the Canadian oil sands, where we provide construction and operations support services through all stages of an oil sands project’s lifecycle. We have extensive construction experience in both mining and “in situ” oil sands projects and we have been providing operations support services to four producers currently mining bitumen in the oil sands since inception of their respective projects: Syncrude, Suncor, Imperial Oil and Canadian Natural. We focus on building long-term relationships with our customers and in the case of Syncrude and Suncor, these relationships span over 30 years.

We believe that we operate one of the largest fleet of equipment of any contract resource services provider in the oil sands. Our total fleet (owned, leased and rented) includes approximately 382 pieces of diversified heavy construction equipment supported by over 1,752 pieces of ancillary equipment. We have a specific capability operating in the harsh climate and difficult terrain of northern Canada, particularly in the Canadian oil sands.

While our services are primarily focused on the oil sands, we believe that we have demonstrated our ability to successfully leverage our oil sands knowledge and technology and put it to work in other resource development projects. We believe we are positioned to respond to the needs of a wide range of other resource developers and provincial infrastructure projects across Canada. We remain committed to expanding our operations outside of the Canadian oil sands.

| 2015 Management’s Discussion and Analysis |

7 |

NOA

We believe that our excellent safety record, coupled with our significant oil sands knowledge, experience, long-term customer relationships, equipment capacity and scale of operations, differentiate us from our competition and provide significant value to our customers.

Operations Overview

Our services are primarily focused on supporting the construction and operation of surface mines, particularly in the oil sands, with a focus on:

| • | site clearing and access road construction; |

| • | site development and underground utility installation; |

| • | construction and relocation of mine site infrastructure; |

| • | stripping, muskeg removal and overburden removal; |

| • | heavy equipment and labour supply; |

| • | material hauling; and |

| • | mine reclamation and tailings pond construction. |

In addition, we provide site development services for plants and refineries, including in situ oil sands facilities.

We maintain our large diversified fleet of heavy equipment and ancillary equipment from our two significant maintenance and repair centers, one based in Fort McMurray, Alberta on a customer’s mine site and one based near Edmonton, Alberta. In addition, we operate running maintenance and repair facilities at each of our customer’s oil sands mine sites.

We believe our competitive strengths are as follows:

| • | leading market position in contract mining services; |

| • | large, well-maintained equipment fleet; |

| • | broad mining service offering across a project’s lifecycle; |

| • | long-term customer relationships; |

| • | operational flexibility; and |

| • | strong balance sheet to weather the cyclical risks prevalent in the oil sands. |

For a complete discussion of our competitive strengths, see the “Business Overview – Competitive Strengths” section of our Annual Information Form (“AIF”), which section is expressly incorporated by reference into this MD&A.

Revenue by Source and End Market

Our revenue is generated from two main customer demand sources:

| • | operations support services; and |

| • | construction services. |

Our revenue is generated from three main end markets:

| • | Canadian oil sands; |

| • | non-oil sands resource development; and |

| • | provincial infrastructure. |

The flexibility of our equipment fleet and technical expertise is such that we can move people and equipment across revenue sources and markets to support the different types of project’s needs.

For a discussion on our revenue by source and end market see the “Our Business – Revenue by Source and End Market” section of our most recent AIF, which section is expressly incorporated by reference into this MD&A.

Our Strategy

For a discussion on how we will implement our strategy see the “Our Strategy” section of our most recent AIF, which section is expressly incorporated by reference into this MD&A.

| 8 | 2015 Management’s Discussion and Analysis |

NOA

D. FINANCIAL RESULTS

Summary of Consolidated Annual Results

| Year Ended December 31, | ||||||||||||||||||||||||||||||

| (dollars in thousands, except per share amounts) |

2015 | 2014 | 2013 | 2015

vs 2014 Change |

2015

vs 2013 Change |

|||||||||||||||||||||||||

| Revenue |

$ | 281,282 | $ | 471,777 | $ | 470,484 | $ | (190,495 | ) | $ | (189,202 | ) | ||||||||||||||||||

| Project costs |

119,568 | 216,342 | 180,348 | (96,774 | ) | (60,780 | ) | |||||||||||||||||||||||

| Equipment costs |

89,784 | 161,108 | 207,906 | (71,324 | ) | (118,122 | ) | |||||||||||||||||||||||

| Depreciation |

40,040 | 42,927 | 36,491 | (2,887 | ) | 3,549 | ||||||||||||||||||||||||

| Gross profit |

31,890 | 51,400 | 45,739 | (19,510 | ) | (13,849 | ) | |||||||||||||||||||||||

| Gross profit margin |

11.3 | % | 10.9 | % | 9.7 | % | 0.4 | % | 1.6 | % | ||||||||||||||||||||

| Select financial information: |

||||||||||||||||||||||||||||||

| General and administrative expenses (excluding stock-based compensation) |

24,602 | 30,157 | 33,708 | (5,555 | ) | (9,106 | ) | |||||||||||||||||||||||

| Stock-based compensation expense |

1,696 | 3,305 | 6,193 | (1,609 | ) | (4,497 | ) | |||||||||||||||||||||||

| Operating income (loss) |

2,837 | 11,599 | (2,683 | ) | (8,762 | ) | 5,520 | |||||||||||||||||||||||

| Interest expense |

9,880 | 12,235 | 21,697 | (2,355 | ) | (11,817 | ) | |||||||||||||||||||||||

| Net loss from continuing operations |

(7,470 | ) | (697 | ) | (18,047 | ) | (6,773 | ) | 10,577 | |||||||||||||||||||||

| Net loss margin from continuing operations |

(2.7 | )% | (0.1 | )% | (3.8 | )% | (2.6 | )% | 1.1 | % | ||||||||||||||||||||

| Net (loss) income from discontinued operations |

— | (472 | ) | 87,231 | 472 | (87,231 | ) | |||||||||||||||||||||||

| Net (loss) income |

(7,470 | ) | (1,169 | ) | 69,184 | (6,301 | ) | (76,654 | ) | |||||||||||||||||||||

| EBITDA from continuing operations(1) |

$ | 44,326 | $ | 58,082 | $ | 37,315 | $ | (13,756 | ) | $ | 7,011 | |||||||||||||||||||

| Consolidated EBITDA from continuing operations |

$ | 48,534 | $ | 64,442 | $ | 43,466 | $ | (15,908 | ) | $ | 5,068 | |||||||||||||||||||

| Consolidated EBITDA margin from continuing operations |

17.3 | % | 13.7 | % | 9.2 | % | 3.6 | % | 8.1 | % | ||||||||||||||||||||

| Per share information - continuing operations |

||||||||||||||||||||||||||||||

| Net loss - Basic |

$ | (0.23 | ) | $ | (0.02 | ) | $ | (0.50 | ) | $ | (0.21 | ) | $ | 0.27 | ||||||||||||||||

| Net loss - Diluted |

$ | (0.23 | ) | $ | (0.02 | ) | $ | (0.50 | ) | $ | (0.21 | ) | $ | 0.27 | ||||||||||||||||

| Per share information - discontinued operations |

||||||||||||||||||||||||||||||

| Net (loss) income - Basic |

$ | — | $ | (0.01 | ) | $ | 2.41 | $ | 0.01 | $ | (2.41 | ) | ||||||||||||||||||

| Net (loss) income - Diluted |

$ | — | $ | (0.01 | ) | $ | 2.39 | $ | 0.01 | $ | (2.39 | ) | ||||||||||||||||||

| Per share information |

||||||||||||||||||||||||||||||

| Net (loss) income - Basic |

$ | (0.23 | ) | $ | (0.03 | ) | $ | 1.91 | $ | (0.20 | ) | $ | (2.14 | ) | ||||||||||||||||

| Net (loss) income - Diluted |

$ | (0.23 | ) | $ | (0.03 | ) | $ | 1.89 | $ | (0.20 | ) | $ | (2.12 | ) | ||||||||||||||||

| Cash dividend declared per share |

$ | 0.08 | $ | 0.08 | $ | — | $ | — | $ | 0.08 | ||||||||||||||||||||

| (1) | See “Non-GAAP Financial Measures”. A reconciliation of net (loss) income from continuing operations to EBITDA and Consolidated EBITDA is as follows: |

|

|

Year Ended December 31, | |||||||||||||||

| (dollars in thousands) |

2015 | 2014 | 2013 | |||||||||||||

| Net loss from continuing operations |

$ | (7,470 | ) | $ | (697 | ) | $ | (18,047 | ) | |||||||

| Adjustments: |

||||||||||||||||

| Interest expense, net |

9,880 | 12,235 | 21,697 | |||||||||||||

| Income tax benefit |

(114 | ) | (31 | ) | (6,102 | ) | ||||||||||

| Depreciation |

40,040 | 42,927 | 36,491 | |||||||||||||

| Amortization of intangible assets |

1,990 | 3,648 | 3,276 | |||||||||||||

| EBITDA from continuing operations |

$ | 44,326 | $ | 58,082 | $ | 37,315 | ||||||||||

| Adjustments: |

||||||||||||||||

| Unrealized gain on derivative financial instruments |

— | — | (6,551 | ) | ||||||||||||

| Loss on disposal of plant and equipment |

917 | 2,777 | 3,033 | |||||||||||||

| (Gain) loss on disposal of assets held for sale |

(152 | ) | (86 | ) | 2,212 | |||||||||||

| Equity classified stock-based compensation expense |

2,511 | 3,615 | 981 | |||||||||||||

| Equity in earnings of unconsolidated joint venture |

356 | — | — | |||||||||||||

| Loss on debt extinguishment |

576 | 54 | 6,476 | |||||||||||||

| Consolidated EBITDA from continuing operations |

$ | 48,534 | $ | 64,442 | $ | 43,466 | ||||||||||

| Consolidated EBITDA from discontinued operations |

$ | — | $ | (472 | ) | $ | 9,577 | |||||||||

| Consolidated EBITDA |

$ | 48,534 | $ | 63,970 | $ | 53,043 | ||||||||||

| 2015 Management’s Discussion and Analysis |

9 |

NOA

Analysis of Consolidated Annual Results from Continuing Operations

Revenue

At the start of this year as a result of a long standing contract, the owner of the Horizon mine bought out the balance of the contract equipment fleet and assumed responsibility for maintenance activities for overburden removal. The equipment ownership and maintenance costs were recoverable under our contract. While the overburden removal contract expired with this customer on June 30, 2015, we remain active on the Horizon mine performing other mine support and project activities.

For the year ended December 31, 2015, revenue was $281.3 million, down from $471.8 million for the year ended December 31, 2014. Current year revenue benefited from the first quarter completion and the fourth quarter startup of winter works programs at the Millennium mine16, in support of that customer’s Tailings Reduction Operation (“TRO”) initiative. Current year activity was complemented by our ongoing mine support activities at the Mildred Lake and Kearl mines, first quarter muskeg removal and project activities at the Horizon mine along with the final six months of overburden removal activity at the Horizon mine. New activity started in 2015 included summer overburden removal activity at both the Millennium and Steepbank mines, a full year of activity on a new Kearl mine site development project awarded at the end of last year and our return to the Aurora mine. The new activity could not fully replace the prior year overburden removal and equipment cost recovery at the Horizon mine or projects that were completed last year, which included mine development and MSE wall construction projects at the Fort Hills mine and mine site development work at the Joslyn mine, suspended by the owner near the end of last year. Last year’s activity also included higher volumes of project work at the Horizon mine and equipment rental activity at the Mildred Lake mine.

Revenue for the current year was down from $470.5 million for the year ended December 31, 2013. The strong revenue in this prior period benefitted from the wrap-up of the Mildred Lake Mine Relocation (“MLMR”) civil construction project, the start-up of road construction on Highway 63, mine development activities at both the Joslyn and Kearl mines, muskeg removal activity at the Horizon mine and ongoing mine support activities at both the Millennium and Mildred Lake mines. Also contributing to this period’s revenue was ongoing overburden removal activity at the Horizon mine, under the long-term contract with that customer. On January 1, 2014, this customer exercised their rights under this cost reimbursable contract to assume the procurement activities for equipment maintenance parts, thus reducing reimbursable cost related revenue to revenue from equipment maintenance and equipment ownership costs.

Gross profit

For the year ended December 31, 2015, gross profit was $31.9 million or 11.3% of revenue, down from $51.4 million or 10.9% of revenue in the previous year. Current year gross profit benefitted from a strong program of winter work in the first and fourth quarters along with contributions from our site development, mine support and summer overburden activities which helped to mitigate the impact of the completion of a larger volume of project work at higher margins and the contribution from the Horizon mine’s overburden removal activity in the prior period.

Gross profit for the current period was down from $45.7 million or 9.7% of revenue for the year ended December 31, 2013. The stronger prior period results benefitted from the aforementioned volumes of civil construction and mine development activity and the affect of a full year of overburden removal and cost reimbursement from the long-term contract at the Horizon mine.

For the year ended December 31, 2015, equipment cost decreased by $71.3 million and $118.1 million, respectively, compared to the prior two years. The lower costs included a large reduction in operating lease expense in the current period ($1.1 million, down from $15.0 million and $23.0 million, respectively, compared to the last two years). The aforementioned changes to the reimbursable cost structure on the Horizon mine overburden removal contract, which included a large portion of the operating lease expense, accounted for the majority of the equipment cost reduction and caused an erosion of gross profit due to the corresponding loss of related margin on this contract.

16 Millennium mine, owned and operated by Suncor Energy Inc.

| 10 | 2015 Management’s Discussion and Analysis |

NOA

Depreciation for the year ended December 31, 2015 was $40.0 million (14.2% of revenue) down from $42.9 million (9.1% of revenue) and up from $36.5 million (7.8% of revenue) for the years ended December 31, 2014 and 2013, respectively. Excluding prior year depreciation related to Horizon mine equipment ownership costs, depreciation was higher in the current period, primarily as a result of a larger mix of heavy equipment used to support the overburden removal and winter works programs. Current year depreciation included $3.9 million in write-downs of assets held for sale and accelerated depreciation for equipment components that did not achieve estimated lives. Accelerated depreciation for equipment components that did not achieve estimated lives is primarily related to early component failures or damage to the components incurred during operating activities. In the prior years we recorded $5.7 million and $3.4 million, respectively in write-downs and accelerated depreciation.

Operating income (loss)

For the year ended December 31, 2015, operating income was $2.8 million, down from $11.6 million and up from an operating loss of $2.7 million for the years ended December 31, 2014 and 2013, respectively. Mitigating the lower gross profit this year was a reduction in G&A expense (excluding stock-based compensation expense) ($5.6 million and $9.1 million lower than during the respective years ended December 31, 2014 and December 31, 2013) and a $1.6 million decrease in stock-based compensation cost ($1.6 million and $4.5 million lower than the respective years ended December 31, 2014 and December 31, 2013).

G&A expense (excluding stock-based compensation expense) was $24.6 million for the year ended December 31, 2015, down from $30.2 million and $33.7 million, in the years ended December 31, 2014 and 2013, respectively. The current year G&A reflects the benefits gained from restructuring and cost-saving initiatives implemented over the past year, partially offset by $1.4 million of restructuring charges recorded in the first quarter. Stock-based compensation cost decreased compared to the previous two years primarily as a result of the effect of the lower share price on the carrying value of the liability classified award plans and a reduction in plan participation due to the aforementioned restructuring.

During the year ended December 31, 2015 we recorded a $0.8 million loss on the disposal of plant and equipment and assets held for sale as we disposed of certain pieces of our heavy equipment fleet that had passed their useful lives. In addition we recorded $2.0 million of amortization of intangible assets. We recorded loss on disposal of plant and equipment and assets held for sale of $2.7 million and $5.2 million for the years ended December 31, 2014 and 2013, respectively. We recorded amortization of intangible assets of $3.6 million and $3.3 million for the respective years ended December 31, 2014 and 2013.

Net loss from continuing operations

For the year ended December 31, 2015, we recorded a net loss from continuing operations of $7.5 million (basic and diluted loss per share of $0.23), compared to a net loss from continuing operations of $0.7 million (basic and diluted loss per share of $0.02) for the year ended December 31, 2014 and a net loss from continuing operations of $24.1 million (basic and diluted loss per share of $0.50) for the year ended December 31, 2013. The combined income tax benefit in the current period is higher than the previous year combined income tax benefit as a result of the deferred tax benefit associated with the increased loss for the year ended December 31, 2015, offset by the estimated $2.0 M deferred tax expense impact of the province of Alberta’s corporate tax rate increase. Basic and diluted loss per share in the current period was partially affected by the reduction in issued and outstanding common shares (33,150,281 as at December 31, 2015 compared to 34,923,916 and 34,746,236 outstanding voting common shares as at December 31, 2014 and December 31, 2013, respectively). For a full discussion on our capital structure see “Resources and Systems – Securities and Agreements” in this MD&A.

| 2015 Management’s Discussion and Analysis |

11 |

NOA

Summary of Consolidated Three Month Results

| Three Months Ended December 31, | ||||||||||||||||||

| (dollars in thousands, except per share amounts) | 2015 | 2014 | Change | |||||||||||||||

| Revenue |

$ | 64,994 | $ | 113,179 | $ | (48,185 | ) | |||||||||||

| Project costs |

26,349 | 58,519 | (32,170 | ) | ||||||||||||||

| Equipment costs |

19,346 | 32,599 | (13,253 | ) | ||||||||||||||

| Depreciation |

10,347 | 11,935 | (1,588 | ) | ||||||||||||||

| Gross profit |

8,952 | 10,126 | (1,174 | ) | ||||||||||||||

| Gross profit margin |

13.8 | % | 8.9 | % | 4.8 | % | ||||||||||||

| Select financial information: |

||||||||||||||||||

| General and administrative expenses (excluding stock-based compensation) |

6,123 | 8,055 | (1,932 | ) | ||||||||||||||

| Stock-based compensation expense (recovery) |

615 | (2,183 | ) | 2,798 | ||||||||||||||

| Operating income |

536 | 1,037 | (501 | ) | ||||||||||||||

| Interest expense |

1,558 | 3,218 | (1,660 | ) | ||||||||||||||

| Net loss from continuing operations |

(712 | ) | (1,534 | ) | 822 | |||||||||||||

| Net loss margin from continuing operations |

(1.1 | ) % | (1.4 | ) % | 0.3 | % | ||||||||||||

| Net loss from discontinued operations |

— | (472 | ) | 472 | ||||||||||||||

| Net loss |

(712 | ) | (2,006 | ) | 1,294 | |||||||||||||

| EBITDA from continuing operations(1) |

$ | 11,382 | $ | 14,430 | $ | (3,048 | ) | |||||||||||

| Consolidated EBITDA from continuing operations(1) |

$ | 13,456 | $ | 17,013 | $ | (3,557 | ) | |||||||||||

| Consolidated EBITDA margin from continuing operations |

20.7 | % | 15.0 | % | 5.7 | % | ||||||||||||

| Per share information – continuing operations |

||||||||||||||||||

| Net loss – Basic & Diluted |

$ | (0.02 | ) | $ | (0.04 | ) | $ | 0.02 | ||||||||||

| Per share information – discontinued operations |

||||||||||||||||||

| Net loss – Basic & Diluted |

$ | — | $ | (0.01 | ) | $ | 0.01 | |||||||||||

| Per share information |

||||||||||||||||||

| Net loss – Basic & Diluted |

$ | (0.02 | ) | $ | (0.05 | ) | $ | 0.03 | ||||||||||

| Cash dividend declared per share |

$ | 0.02 | $ | 0.02 | $ | — | ||||||||||||

| (1) | See “Non-GAAP Financial Measures”. A reconciliation of net loss from continuing operations to EBITDA and Consolidated EBITDA is as follows: |

| Three Months Ended December 31, | ||||||||||

| (dollars in thousands) |

2015 | 2014 | ||||||||

| Net loss from continuing operations |

$ | (712 | ) | $ | (1,534 | ) | ||||

| Adjustments: |

||||||||||

| Interest expense |

1,558 | 3,218 | ||||||||

| Income tax benefit |

(320 | ) | (417 | ) | ||||||

| Depreciation |

10,347 | 11,935 | ||||||||

| Amortization of intangible assets |

509 | 1,228 | ||||||||

| EBITDA from continuing operations |

$ | 11,382 | $ | 14,430 | ||||||

| Adjustments: |

||||||||||

| Loss on disposal of property, plant and equipment |

931 | 2,032 | ||||||||

| Loss (gain) on disposal of assets held for sale |

238 | (43 | ) | |||||||

| Equity stock-based compensation expense |

905 | 844 | ||||||||

| Gain on debt extinguishment |

— | (250 | ) | |||||||

| Consolidated EBITDA from continuing operations |

$ | 13,456 | $ | 17,013 | ||||||

| Consolidated EBITDA from discontinued operations |

$ | — | $ | (472 | ) | |||||

| Consolidated EBITDA |

$ | 13,456 | $ | 16,541 | ||||||

| 12 | 2015 Management’s Discussion and Analysis |

NOA

Analysis of Three Month Results from Continuing Operations

Revenue

For the three months ended December 31, 2015, consolidated revenue was $65.0 million, down from $113.2 million in the same period last year. The current quarter revenue was driven by the completion of recent awards of summer overburden removal activity at the Steepbank17 and Millennium mines, the start-up of a significant winter works program at the Millennium mine, site development activity at the Kearl mine and the wrap-up of haul road construction at the Aurora mine which complemented ongoing mine support activity at the Kearl mine. The revenue contribution from the new awards helped to mitigate the drop in revenue as a result of the completion of prior year projects, including mine development and mechanically stabilized earth (“MSE”) wall construction at the Fort Hills mine, Joslyn mine development closeout activities and road construction on the Highway 6318 project. Prior year revenue also included activities related to the long-term Horizon mine contract which expired on June 30, 2015.

Gross profit

For the three months ended December 31, 2015, gross profit was $9.0 million or 13.8% of revenue, down from a gross profit of $10.1 million or 8.9% of revenue during the same period last year. The lower gross profit in the current quarter is primarily a result of the aforementioned drop in volume from the completion of prior year projects, partially mitigated by improved gross profit margins resulting from lower equipment rental costs in the period.

For the three months ended December 31, 2015, equipment cost decreased by $13.3 million compared to the prior year. The lower costs included a notable reduction in operating lease expense in the current quarter ($0.2 million, down from $3.0 million in the same period last year). A significant portion of the equipment cost reduction, including a majority of the lower operating lease expense, resulted from the completion of the Horizon mine contract earlier this year, which included a reimbursable cost structure for equipment maintenance and ownership costs.

For the three months ended December 31, 2015, depreciation was $10.3 million, down from $11.9 million in the same period last year. Current quarter depreciation included $2.2 million in write-downs of assets held for sale and accelerated depreciation for equipment components that did not achieve estimated lives, compared to $1.3 million in write-downs and accelerated depreciation in the prior year.

Operating income

For the three months ended December 31, 2015, operating income was $0.5 million, compared to operating income of $1.0 million during the same period last year. G&A expense (excluding stock-based compensation expense) was $6.1 million for the three months ended December 31, 2015, down from $8.1 million in the same period last year, reflecting the benefits gained from restructuring and cost-saving initiatives implemented over the past year.

Stock-based compensation expense increased $2.8 million compared to the prior year, primarily as a result of the larger benefit recorded to the prior year’s liability classified stock-based compensation cost, driven by a decrease in the share price during that period.

For the three months ended December 31, 2015, we recorded $1.2 million of losses on the disposal of plant and equipment and assets held for sale compared to $2.0 million in the previous period.

Net loss from continuing operations

For the three months ended December 31, 2015, net loss from continuing operations was $0.7 million (basic and diluted loss per share of $0.02), compared to a net loss of $1.5 million from continuing operations (basic and diluted loss per share of $0.04) during the same period last year. The combined income tax benefit recorded in the current period is lower than the same period in the prior year as a result of the deferred tax benefit associated with the loss for the three months ended December 31, 2015 being lower than the deferred tax benefit associated with the comparative loss for the three months ended December 31, 2014.

17 Steepbank mine, owned and operated by Suncor Energy Inc.

18 Alberta Highway 63 project.

| 2015 Management’s Discussion and Analysis |

13 |

NOA

Non-Operating Income and Expense from Continuing Operations

| Three Months Ended December 31, |

Year Ended December 31, |

|||||||||||||||||||||||||||||

| (dollars in thousands) | 2015 | 2014 | 2015 | 2014 | 2013 | |||||||||||||||||||||||||

| Interest expense |

||||||||||||||||||||||||||||||

| Long term debt |

||||||||||||||||||||||||||||||

| Interest on Series 1 Debentures |

$ | 452 | $ | 1,472 | $ | 3,986 | $ | 6,168 | $ | 2,716 | ||||||||||||||||||||

| Interest on Credit Facility |

363 | 446 | 1,031 | 1,268 | 4,326 | |||||||||||||||||||||||||

| Interest on capital lease obligations |

648 | 869 | 3,044 | 3,103 | 2,424 | |||||||||||||||||||||||||

| Amortization of deferred financing costs |

107 | 427 | 1,961 | 1,594 | 12,507 | |||||||||||||||||||||||||

| Interest on long term debt |

$ | 1,570 | $ | 3,214 | $ | 10,022 | $ | 12,133 | $ | 21,973 | ||||||||||||||||||||

| Interest (income) expense |

(12 | ) | 4 | (142 | ) | 102 | (276 | ) | ||||||||||||||||||||||

| Total Interest expense |

$ | 1,558 | $ | 3,218 | $ | 9,880 | $ | 12,235 | $ | 21,697 | ||||||||||||||||||||

| Foreign exchange loss (gain) |

10 | 20 | (35 | ) | 38 | (156 | ) | |||||||||||||||||||||||

| Total unrealized gain on derivative financial instruments |

— | — | — | — | (6,551 | ) | ||||||||||||||||||||||||

| (Gain) loss on debt extinguishment |

— | (250 | ) | 576 | 54 | 6,476 | ||||||||||||||||||||||||

| Income tax benefit |

(320 | ) | (417 | ) | (114 | ) | (31 | ) | (6,102 | ) | ||||||||||||||||||||

Interest expense

Total interest expense was $1.6 million during the three months ended December 31, 2015, down from $3.2 million in the same period last year. In the year ended December 31, 2015, total interest expense was $9.9 million, down from the $12.2 million and $21.7 million for the respective years ended December 31, 2014 and December 31, 2013.

Interest on our Series 1 Debentures dropped to $0.5 million and $4.0 million, respectively, during the three months and year ended December 31, 2015, from $1.5 million and $6.2 million in the respective corresponding period last year and from $12.5 million for the year ended December 31, 2013. The savings on Series 1 Debenture interest expense in the current year is a result of the redemption of $38.8 million of Series 1 Debentures, $16.3 million of redemptions in 2014 and $150.0 million of redemptions in 2013.

Interest on our Credit Facility dropped to $0.4 million and $1.0 million, respectively, during the three months and year ended December 31, 2015, from $0.4 million and $1.3 million during the respective three months and year ended December 31, 2014. Reduced pricing on our Credit Facility executed this year mitigated costs related to the increased borrowing in the current periods. Current year interest expense on our Credit facility is higher than the interest during the year ended December 31, 2013, largely due to the increased borrowing in the current year as compared to 2013 year.

Interest on capital lease obligations of $0.6 million and $3.0 million during the respective three months and year ended December 31, 2015, was slightly lower than the previous periods as improved lease facility pricing offset an increase in equipment secured through capital leases. Current year interest on capital lease obligations is lower than the interest during the year ended December 31, 2013, largely due to the increase in financing of plant and equipment by capital lease. For a discussion on assets under capital lease see “Resources and Systems – Capital Resources and Use of Cash”.

Amortization of deferred financing costs decreased in the three months ended December 31, 2015 to $0.1 million and increased in the year ended December 31, 2015 to $2.0 million, from $0.4 million and $1.6 million, respectively, in the corresponding periods last year. The replacement of the Previous Credit Facility and the partial redemption of Series 1 Debentures resulted in the recording of $nil and $0.7 million in write-offs of deferred financing costs against this expense during the three months and year ended December 31, 2015, respectively, compared to $0.1 million and $0.2 million in deferred financing cost write-offs in the respective corresponding periods last year from partial Series 1 Debenture redemptions. Current year amortization of deferred financing costs is significantly lower than the amount recorded during the year ended December 31, 2013 due to the 2013 partial redemption of $150.0 million in Series 1 Debentures and the expiration of our previous credit facility, which resulted in a $3.1 million write-off of deferred financing costs during the year.

Foreign exchange loss (gain)

The foreign exchange gains and losses relate primarily to the effect of changes in the exchange rate of the Canadian dollar against the US dollar on purchases of equipment and equipment parts. A more detailed discussion about our foreign currency risk can be found under “Risk Factors – Quantitative and Qualitative Disclosures about Market Risk”.

| 14 | 2015 Management’s Discussion and Analysis |

NOA

Loss on debt extinguishment

During the year ended December 31, 2015, we redeemed $38.8 million aggregate principal amount of Series 1 Debentures as part of our debt restructuring and recorded a loss of $0.6 million related to the transactions. The loss on debt extinguishment of $0.1 million and $6.5 million for the years ended December 31, 2014 and 2013, respectively, relate to partial Series 1 Debenture redemptions completed during each year.

A more detailed discussion on the partial redemption of our Series 1 Debentures can be found under “Resources and Systems – Securities and Agreements”.

Income tax benefit

For the three months ended December 31, 2015, we recorded a current income tax expense of $nil and a deferred income tax benefit of $0.3 million, providing a total income tax benefit of $0.3 million. This compares to a combined income tax benefit of $0.4 million for the same period last year.

For the year ended December 31, 2015, we recorded a current income tax expense of $nil and a deferred income tax benefit of $0.1 million for a total income tax benefit of $0.1 million. This compares to a combined income tax benefit of $nil and $6.1 million for the years ended December 31, 2014 and 2013, respectively.

Income tax as a percentage of income before taxes differs from the statutory rates of 26.0% for the three months and year ended December 31, 2015, 25.26% for the three months and year ended December 31, 2014 and 25.12% for the year ended December 31, 2013. The differences in the year ended December 31, 2015 were primarily due the enacted increase of the Alberta provincial corporate tax rates, permanent differences resulting from stock-based compensation expense and other income tax adjustments. The difference from the statutory rates in all other periods is primarily due to permanent differences resulting from stock-based compensation expense and other tax adjustments.

Summary of Consolidated Cash Flows from Continuing Operations

Consolidated cash flows from continuing operations are summarized in the table below:

| Three months ended December 31, |

Year ended December 31, |

|||||||||||||||||||||||||||

| (dollars in thousands) | 2015 | 2014 | 2015 | 2014 | 2013 | |||||||||||||||||||||||

| Cash provided by operating activities |

$ | 12,492 | $ | 12,072 | $ | 77,099 | $ | 41,701 | $ | 57,488 | ||||||||||||||||||

| Cash (used) provided by investing activities |

(4,999) | 7,799 | 4,769 | (19,488) | (27,093) | |||||||||||||||||||||||

| Cash used by financing activities |

(8,333) | (18,946) | (50,473) | (34,527) | (246,148) | |||||||||||||||||||||||

| Net (decrease) increase in cash from continuing operations |

$ | (840) | $ | 925 | $ | 31,395 | $ | (12,314) | $ | (215,753) | ||||||||||||||||||

Operating activities

Cash provided (used) from the net change in non-cash working capital specific to operating activities are summarized in the table below:

| Three months ended December 31, |

Year ended December 31, |

|||||||||||||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2013 | ||||||||||||||||||||||||

| Net change in non-cash working capital |

||||||||||||||||||||||||||||

| Accounts receivable |

$ | 6,726 | $ | (14,187 | ) | $ | 45,367 | $ | 3,674 | $ | 29,765 | |||||||||||||||||

| Unbilled revenue |

1,037 | 24,289 | 26,057 | (11,454 | ) | 30,275 | ||||||||||||||||||||||

| Inventories |

(227 | ) | 304 | 3,746 | (1,542 | ) | (644 | ) | ||||||||||||||||||||

| Prepaid expenses and deposits |

399 | 1,333 | 690 | (780 | ) | 634 | ||||||||||||||||||||||

| Accounts payable |

(1,683 | ) | (4,966 | ) | (29,751 | ) | 9,928 | (31,847 | ) | |||||||||||||||||||

| Accrued liabilities |

(4,272 | ) | (2,163 | ) | (6,892 | ) | (954 | ) | (1,603 | ) | ||||||||||||||||||

| Long term portion of liabilities related to equipment leases |

— | — | — | — | (209 | ) | ||||||||||||||||||||||

| Billings in excess of costs incurred and estimated earnings on uncompleted contracts |

(780 | ) | (3,316 | ) | 457 | (6,357 | ) | (872 | ) | |||||||||||||||||||

| $ | 1,200 | $ | 1,294 | $ | 39,674 | $ | (7,485 | ) | $ | 25,499 | ||||||||||||||||||

During the three months ended December 31, 2015, cash provided in operating activities was $12.5 million, up from $12.1 million provided during the three months ended December 31, 2014. The comparable cash flows between the two periods reflects the similar profitability, adjusted for non-cash items and similar cash provided by working capital in the two periods.

| 2015 Management’s Discussion and Analysis |

15 |

NOA

During the year ended December 31, 2015, cash provided in operating activities was $77.1 million, up from $41.7 million provided during the year ended December 31, 2014 and up from $57.5 million provided during the year ended December 31, 2013. The increased cash flow in the current period is largely a result of $39.7 million contributed from the decrease of working capital, driven primarily by the completion of final project billings and the settlement of related holdbacks for projects completed in the prior year partially offset by the settlement of accounts payable liabilities related to the same projects completed in the prior year. Cash provided by operations during the year ended December 31, 2014 was negatively affected by an increase in working capital from the project closeout billing activity that extended into 2015. Cash provided by operations during the year ended December 31, 2013 was impacted by a net loss, offset by non-cash items and cash provided by working capital.

There are currently no legal or economic restrictions on subsidiaries of NAEPI that could impair the ability to pay dividends and provide loans or advances to NAEPI.

Investing activities

During the three months ended December 31, 2015, cash used by investing activities was $5.0 million, compared to $7.8 million provided by investing activities for the three months ended December 31, 2014. Current period investing activities included $12.6 million for the purchase of plant, equipment and intangible assets, partially offset by $7.6 million received on the disposal of plant, equipment, assets held for sale and the partial settlement of sale and leaseback agreements. Prior year investing activities included $6.6 million for the purchase of plant, equipment and intangible assets, offset by $14.4 million cash received on the disposal of plant, equipment, assets held for sale and settlement of sale and leaseback agreements.

During the year ended December 31, 2015, cash provided by investing activities was $4.8 million, compared to $19.5 million and $27.1 million used for investing activities in the respective years ended December 31, 2014 and December 31, 2013. Current period investing activities included cash inflows of $38.0 million for the partial settlement of sale and leaseback agreements and the disposal of plant and equipment and assets held for sale, which was primarily related to the $29.4 million Canadian Natural contract fleet sale. This was partially offset by $33.3 million of plant, equipment and intangible asset purchases which included $5.4 million for the settlement of liabilities related to fourth quarter 2014 plant, equipment and intangible asset purchases and the buyout of $3.0 million of operating leases. Investing activities during the year ended December 31, 2014 included $36.1 million in purchase of plant, equipment and intangible assets, partially offset by $16.6 million in proceeds on the disposal of plant, equipment, assets held for sale and settlement of sale and leaseback agreements. Investing activities during the year ended December 31, 2013 include $34.2 million for the purchase of plant, equipment and intangible assets, offset by $7.1 million in proceeds on disposal of plant and equipment.

Financing activities

Cash used in financing activities during the three months ended December 31, 2015, was $8.3 million driven by $1.1 million in scheduled principal repayments on the Credit Facility term loan, $4.8 million in capital lease obligation repayments and $1.1 million for the purchase and subsequent cancellation of common shares. Cash used in financing activities for the three months ended December 31, 2014 was $18.9 million, primarily from a net $3.9 million repayment to the Previous Credit Facility, $5.2 million in capital lease obligation repayments, the retirement of $6.3 million in Series 1 Debentures, $1.9 million for the purchase and subsequent cancellation of common shares and $1.2 million of treasury share purchases. Cash used in dividend payments during the three months ended December 31, 2015 was $1.3 million and for the three months ended December 31, 2014 was $0.7 million. Cash used in the current period for dividend payments was $0.6 million higher than the prior year, reflecting the change in dividend payment date implemented during the three months ended December 31, 2015.

| 16 | 2015 Management’s Discussion and Analysis |

NOA

For the year ended December 31, 2015, cash used in financing activities was $50.5 million which included $39.4 million used for the redemption and repurchase of Series 1 Debentures primarily funded by $30.0 million in borrowings under the Credit Facility. Current period financing activity also included $5.5 million of Previous Credit Facility repayments, $1.4 million of Credit Facility repayments, $21.7 million in capital lease obligation repayments, $6.2 million for the purchase and subsequent cancellation of common shares and $2.4 million of treasury share purchases. Cash used in financing activities during the year ended December 31, 2014 was $34.5 million, driven by $18.7 million in capital lease obligation repayments, $16.3 million in Series 1 Debenture redemptions, $1.9 million for the purchase and subsequent cancellation of common shares and $3.7 million of treasury share purchase activity, partially offset by a $5.5 million increase in borrowings from the Previous Credit Facility and $2.8 million in proceeds from exercised options. Cash used in financing activities of $246.1 million for the year ended December 31, 2013 included $156.5 million towards the redemption of Series 1 Debentures, a net repayment towards the Previous Credit Facility of $62.3 million, capital lease repayments of $14.0 million and $11.7 million

towards the purchase and subsequent cancellation of common shares. Dividend payment began during the year ended December 31, 2014. The cash used in the current period for dividend payments was $1.2 million higher than the prior year, reflecting the early 2014 implementation of the new dividend policy and the change in dividend payment date implemented this year.

Summary of Consolidated Quarterly Results

A number of factors have the potential to contribute to variations in our quarterly financial results between periods, including:

| • | the timing and size of capital projects undertaken by our customers on large oil sands projects; |

| • | changes in the mix of work from earthworks, with heavy equipment, to more labour intensive, light construction projects; |

| • | seasonal weather and ground conditions; |

| • | certain types of work that can only be performed during cold, winter conditions when the ground is frozen; |

| • | the timing of equipment maintenance and repairs; |

| • | the timing of project ramp-up costs as we move between seasons or types of projects; |

| • | claims and change-orders; |

| • | the level of borrowing under our Series 1 Debentures, Credit Facility and the corresponding interest expense recorded against the outstanding balance of each. |

The table, below, summarizes our consolidated results for the preceding eight quarters for continuing operations:

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (dollars in millions, except per share amounts) | Dec 31, 2015 |

Sep 30, 2015 |

Jun 30, 2015 |

Mar 31, 2015 |

Dec 31, 2014 |

Sep 30, 2014 |

Jun 30, 2014 |

Mar 31, 2014 |

||||||||||||||||||||||||

| Revenue |

$ | 65.0 | $ | 66.8 | $ | 64.4 | $ | 85.1 | $ | 113.2 | $ | 134.7 | $ | 116.2 | $ | 107.7 | ||||||||||||||||

| Gross profit |

9.0 | 7.4 | 4.6 | 11.0 | 10.1 | 16.8 | 9.3 | 15.2 | ||||||||||||||||||||||||

| Operating income (loss) |

0.5 | 1.0 | (0.8 | ) | 2.2 | 1.0 | 9.7 | (2.2 | ) | 3.0 | ||||||||||||||||||||||

| Consolidated EBITDA from continuing operations |

13.5 | 12.2 | 8.1 | 14.8 | 17.0 | 22.0 | 10.2 | 15.2 | ||||||||||||||||||||||||

| Total net (loss) income(i) |

(0.7 | ) | (2.1 | ) | (4.1 | ) | (0.5 | ) | (2.0 | ) | 4.8 | (4.1 | ) | 0.1 | ||||||||||||||||||

| Net (loss) income per share – basic(ii) |

$ | (0.02 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | (0.01 | ) | $ | (0.04 | ) | $ | 0.14 | $ | (0.12 | ) | $ | 0.00 | ||||||||||

| Net (loss) income per shares – diluted(ii) |

$ | (0.02 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | (0.01 | ) | $ | (0.04 | ) | $ | 0.13 | $ | (0.12 | ) | $ | 0.00 | ||||||||||

| Cash dividend declared per share(ii) |

$ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.02 | $ | 0.02 | ||||||||||||||||

| i) | Total net (loss) income includes results from discontinued operations. Revenue, gross profit, operating income (loss) and Consolidated EBITDA excludes results from discontinued operations. |

| ii) | Net income (loss) per share for each quarter has been computed based on the weighted average number of shares issued and outstanding during the respective quarter; therefore, quarterly amounts may not add to the annual total. Per-share calculations are based on full dollar and share amounts. |

| iii) | On February 19, 2014, we announced that as part of the Company’s long term strategy to maximize shareholders’ value and broaden our shareholder base, the Board of Directors approved the implementation of a new dividend policy whereby, we intend to pay an annual aggregate dividend of eight Canadian cents ($0.08) per common share, payable on a quarterly basis. Numbers reported reflect the dividend per share declared at the end of each quarter.¿ |

| 2015 Management’s Discussion and Analysis |

17 |

NOA

We generally experience a decline in our mine site support revenue such as reclamation and muskeg removal services during the three months ended June 30 of each year due to seasonality, as weather conditions make performance of this heavy equipment intensive work in the oil sands difficult during this period. The mine support activity levels in the oil sands decline when frost leaves the ground and access of excavation and dumping areas, as well as associated roads are rendered temporarily incapable of supporting the weight of heavy equipment. The duration of this period, which can vary considerably from year to year, is referred to as “spring breakup” and has a direct impact on our mine support activity levels. All other events being equal, mine support revenue during the December to March time period of each year is traditionally highest as ground conditions are most favourable for work requiring frozen ground access in the oil sands.

Delays in the start of the winter freeze, required to perform this type of work or an abnormal thaw period during the winter months will reduce overall revenues or have an adverse affect on project performance in the winter period. It should be noted that extreme weather conditions during this period, where temperatures dip below minus 30 degrees Celsius, can have an adverse effect on revenue due to lower equipment performance and reliability. In each of the past two years we have experienced either a late winter freeze or an abnormal winter thaw causing results to deviate from the typical winter pattern. In addition, construction project delays have reduced demand for services typically provided during the three months ended March 31 in each of the past two years.

Our civil construction revenue, which usually includes a higher percent of low margin materials revenue, generally ramps up after the “spring breakup”, once ground conditions stabilize. We typically use lower capacity equipment to support civil construction activities during this period resulting in a lower rate of revenue per equipment hour. Civil construction activity continues until the winter freeze at which time we typically demobilize this lower capacity equipment from the sites. The margin and schedule for this type of work is negatively affected by low productivity if weather delays extend beyond seasonal averages for the construction season. These additional delays can push the project completion into the more costly winter season or require us to re-mobilize to the site after the winter season to complete the project.

Overall, full-year results are not likely to be a direct multiple or combination of any one quarter or quarters. In addition to revenue variability, gross margins can be negatively impacted in less active periods because we are likely to incur higher maintenance and repair costs due to our equipment being available for servicing.